30 minute read

Central Copper Resources advances Mbamba Kilenda

MBAMBA KILENDA

A copper producer within a year of approval?

By Nelendhre Moodley

New kid on the block Central Copper Resources Plc (CCR) is perched on the sweet spot as it progresses its flagship Mbamba Kilenda copper project, aiming to be a producer within a year of project approval, COO Kevin van Wouw tells SA

Mining. With a widening supply-demand gap in the copper space currently playing out, the soon-to-be copper producer is set to reap some handsome rewards in the near future. “Due to the regulatory uncertainty of the timing of the issue of the mining exploitation licence, CCR has withdrawn its intention to list on London’s AIM market,” says Van Wouw.

London-based CCR is instead busy advancing its portfolio of exploration and development projects in Zambia and the Democratic Republic of the Congo (DRC), with the Mbamba Kilenda project being its most advanced project. “We will complete the definitive feasibility study of phase 1 of the project in the first half of 2022, and then subject to issue of the already approved licence, can proceed with implementation.”

MBAMBA KILENDA

The Mbamba Kilenda project located 70km south of Kinshasa in the DRC sits on the west copper belt which extends over 1 400km from Angola, the DRC, Congo Republic to Gabon. PROGRESSING MBAMBA KILENDA

The copper exploitation and development company is in the process of finalising the feasibility study for the Mbamba Kilenda project and has engaged various parties for the supply of key equipment and services. The copper developer completed its pre-feasibility work in 2020, and with a completed definitive feasibility study can resolve the finances for project development.

“This step is of major importance for CCR as it allows the company to commence its project in a phased way, building financial capacity and skills as we transition from explorer/developer into an operator,” says Van Wouw.

He says as a result of the high-grade nature of the Mbamba Kilenda resource, a direct shippable ore-type concentrate will be generated, running at around 20% Cu, making the project extremely cash flowpositive from the implementation of the first phase.

“This will not only assist with completion of the feasibility study of the subsequent phases, but will also aid in paying for the implementation of the major expansion of the project.”

According to the pre-feasibility study, a total capital commitment of $230-million has been identified for the first module. Of that amount, $46.7m has been earmarked to progress the first phase of the project.

“At current copper prices, no further capital will be required. Once we have completed the feasibility study, we will seek to finalise the reduced finance requirement as a mixture of equity/o balance sheet debt and normal debt as appropriate for a company of our size.”

Mbamba Kilenda is a shallow, high-grade resource with significant expansion potential to both the east and west and containing an “ultra” high-grade zone. The high-grade zone has a copper grade greater than 18% Cu and has been identified as a direct shipping ore product.

The mine, which has a 12-year life of mine in the current resource, will be a 30 000tpa copper producer. An induced polarisation geophysical investigation conducted in late 2021 has shown significant resource expansion potential within an additional 5km of strike length to the current resource. “As we expand this resource, we will increase the life of mine and add additional production modules.”

Added to this, the various new targets within the same 85km belt along strike within the licence package covering the geophysical feature hosting the mineralisation will allow it to develop new

Mbamba Kilenda project.

Mbamba Kilenda is a shallow, high-grade resource with significant expansion potential. “ “ – Van Wouw

projects in a pipeline development regional (belt) scale potential.

“When we stopped drilling in 2017, in order to secure the balance of the licence packages, we stopped in mineralisation to the east and west of the resource. We are currently running orientation geophysics both east and west of the resource to help identify the mineralised extensions. These will be followed up with further drilling.

“With mineralised evidence along the entire 85km strike length, we are confident that this low-risk approach will more than double our current resource, adding both life and project scalability and new development projects over time.”

CCR’S EXPLORATION PORTFOLIO

The company’s Zambian project is the Lunga Basin project situated adjacent to the operating Chifumpa Mine, which is bestowed with grades of over 4% copper. In 2020, significant anomalism was identified on the property, which will be tested at depth by reverse circulation drilling and then diamond drilling.

Also located in the DRC is CCR’s 78% owned Titan Kayeye Project – touted as having world-class copper discovery potential.

“The Titan Kayeye Project lies next to the world’s second largest new copper discovery by grade and tonnage – Ivanhoe’s flagship copper project, Kamoa-Kakula,” says Van Wouw, who is hopeful that the Kayeye Project will be just as attractive as the Kamoa-Kakula project.

In a bid to unlock further upside, the company is advancing a drilling programme at Titan’s Kayeye Project. “Our teams have already proved geological continuity and the presence of mineralisation, with follow-up drilling at identified drill-ready targets.

“In the next two to three years we plan to be developing another two to three projects on a similar scale to that of the Mbamba Kilenda project. At Lunga we expect to be completed with our resource development work on the shallow high-grade oxides and moving to a production decision.

“Any success at Titan will fundamentally change our company. Further to this, we will continue to identify opportunities that suit our business model – by then we hope to have added another few licences to our portfolio.” ■

WHY COPPER AND WHY NOW?

The supply-demand deficit that is developing and driving copper prices higher is being a ected by two main situations. These are the continued demand for electrification across the world, and the commitment to infrastructure development by governments globally, which has yet to be implemented.

“Meeting the soaring demand for electrification is more important than carbon replacement commitments or green revolutions that constitute more of the hype around copper consumption. Together, these factors are driving demand for copper from current levels of 20mtpa to beyond 30mtpa. On the supply side, very little investment has been made in copper exploration over the past 20 years and coupled with the fact that existing copper operations are aging and becoming ever lower in grade (0.58% average) makes for an attractive demand/supply situation for developers of copper projects. As such, we expect to see supply taper as mines reach end of life and new projects are yet to come online or be confirmed to replace the loss of capacity. CCR has been developing new copper over the past eight years, with $27-million invested in its projects to date,” says Van Wouw.

Bonginkosi Sithole.

ENERGY CRISIS

Impact on the economy and what to expect in 2022

By Bonginkosi Sithole: MD of Rand Heavy Industries, a clean energy solutions provider in Africa

Power outages have pitched millions of South Africa’s homes into darkness, and disrupted the economic growth recovery from the residue le by COVID-19. In the last quarter of 2021, load shedding became intensified with stage 2 (Figure 1) guaranteeing a minimum of two hours of no power and for some, four hours, per day.

Multiply that by six days and it makes it unviable to run basic business operations. No sector seems to escape the adverse impact of persistent power cuts.

Manufacturing, which is one of the largest contributors to the country’s GDP, is burdened with production halts, losing time and e iciencies. Production factories are compelled to invest in commercial generators; however the frequency of the outages means more litres of fuel to sustain the generator threaten the fuel cost e iciencies of operating the generators. Small, medium and micro enterprises (SMMEs) declined by 11% in 2020 due to

COVID-19 (SEDA – SMME Quarterly Update). Once considered the beacon of hope of unemployment alleviation, SMMEs are forced to sit this one out during the power outages due to lack of a ordability for alternative energy – generators or back-up batteries. Even the telecommunications industry, which is a vital force in business operations, has been hammered. Cellphone towers run on electricity, paired with back-up batteries.

Prolonged power cuts mean insu icient network coverage; fibre provision is also compromised. The result is limited or no internet. Modern business has been wired to rely on network connectivity. Outages disrupt communication, making it counterproductive for employees whose employers have opted for the “working from home” model. The average worker does not have access to solar power or inverter batteries; consequently a four-hour or more power outage results in compromised output.

Another utility a ected is water, which requires electricity to pump water from reservoirs into towers. In food and leisure, some fast-food and sit-down restaurants must shut their doors during load shedding due to a lack of back-up energy to fire up their cooking platforms. Not only do they lose customers who may never return, but raw material (non-cooked food) can spoil.

In mining, operations are interrupted in order to preserve power and for the safety of miners.

In a country already weighed down by a high unemployment rate of 34.4% (QLFS 2nd Quarter 2021), load shedding further resulted in job losses of around 350 000 in 2021. GDP growth reduced by 3.0 percentage points (South Africa Economic Outlook 2021 – PwC). This a ects investor confidence. The South African Reserve Bank has kept its growth predictions modest for 2022 and 2023, at 1.7% and 1.8% respectively, according to Investec’s monetary policy update.

R229.1-billion

Mining’s contribution to government revenue

Economically the mining sector’s performance resulted in a 38% growth year on year (June 2020 to June 2021), providing a healthy contribution of 7.6% to South Africa’s GDP in the financial year 2021. It created and sustained approximately 2 300 000 direct and indirect jobs on average and contributed around R229.1-billion to total government revenue, says SA Mine 2021 – PwC.

The impact of mining on the economy is paradoxical in nature. Although we see a positive economic contribution, mining remains an accomplice to negative environmental impact. Mining operations result in high CO2 emissions, high electricity and water usage, and contribute to pollution.

Coal remains a contentious commodity. There is an immediate pressure from the globe for SA, which ranks as the 12th biggest source of greenhouse gas emissions. Certainly, it has a responsibility to reduce the use of fossil fuels, but this move must be strategic. Coal is one of the key mining commodities. It is a major source of energy in the production of electrical power, it’s versatile, with positive performance and contributions to the economy in the production of steel and a key source of energy in aluminium and cement production.

Socioeconomically, 335 000 people in SA’s coal mining communities are dependent on coal for income, says PwC’s SA Mine 2021.

Mineral Resources and Energy Minister Gwede Mantashe has called on African nations to form a united front to resist this global pressure to rapidly abandon fossil fuels, arguing that Africa is the least polluting

continent in the world.

Mantashe further says the intra-African trade of fossil fuels should be prioritised, and that countries should work to establish an African finance arm to raise capital for investments in oil and gas on the continent.

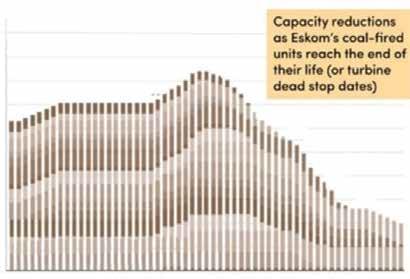

Realistically, the decommissioning will not happen at the pace that’s expected. Eskom expects decommissioning of approximately 24.1GW of coal-fired power plants in the period beyond 2030 to 2050, according to Auctusmetals.com.

Eskom indicates that despite decommissioning of old power plants and preference for renewables and gas, coal remains dominant in the energy mix for the planning period up to 2030.

Renewable energy in business is gaining momentum. Government’s approval for companies to generate up to 100MW for own needs is welcomed by all, especially the mining sectors, as demonstrated by Anglo American Platinum awarding the Pele Green Energy and EDF Renewables as their supplier

2021

2020

YEAR 2019

2018

2015

0 200 400 600 800 1000 1200 1400 HOURS OF LOAD SHEDDING

Load shedding hours. (18 November 2021 – EskomSePush notifier app insights)

350

300

250

200

150

100

50

0

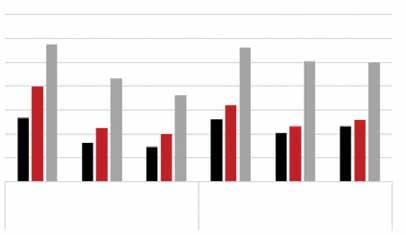

Mining’s contribution to government in South Africa

Coal Gold Iron Ore Coal Gold Iron Ore

FY2020 FY2021

■ Mining sales, (Rbn) ■ Total impact on GDP (Rbn) ■ Total impact on jobs (number)

Coal gold and iron ore’s contribution to SA economy.

Load shedding resulted in job losses of around 350 000 in 2021.

60

50

40 Installed Capacity (GW) Capacity reductions as Eskom’s coal-fired units reach the end of their life (or turbine dead stop dates)

1995 2000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050

Capacity reduction of Eskom coal-fired units.

of choice to build a 100MW solar photovoltaic (PV) plant in Limpopo.

Retail giant Shoprite announced its plans to power 25% of its operations with renewable energy with the addition of 22 new PV sites to double its solar capacity. South African Breweries will now produce Castle Lite using renewable electricity, reducing electricity from the grid and decreasing interruptions to production.

Property developers are now planning to incorporate renewable products in their building and construction plans as buildings generate nearly 40% of annual global CO2 emissions.

The energy transition is a larger mission, and mining will play an imperative role in this transition. There is a surge of alternative energy technologies – inverters, lithium batteries, wind turbines, electric vehicles and their battery chargers; even solar panels are being upgraded for faster storage from the sun.

These technologies will bring a complete evolution of the mining mix to incorporate the sourcing of raw materials required for the structural development of renewable energy products. Lithium, cobalt, zinc, chromium, aluminium, copper, iron, concrete, steel, plastic, glass, iron, chromium, copper, aluminium, manganese and nickel are among the list of demanded minerals for solar, wind and types of battery storages.

The demand for these products will not only impact the mining sector, but also open doors for new professions in the renewable energy space, even bringing about change on the academic curriculum front, reigniting interest in minerals and chemistry. It is also an open gate for infrastructure and skills development, which may just ease unemployment through new industries.

Investors and local financial institutions must help create capabilities committed to expanding renewable energy financing and aiding customers, regulators and all other stakeholders in e orts to transform the country’s energy mix. ■

AFRICAN OIL AND GAS

NOT DEAD YET

By Ogi Williams: director of strategy and consul ting at In On Africa

Over the past two years the global oil and gas market has seen significant fluctuations in the price per barrel of crude. At the onset of the COVID-19 pandemic, the futures cost of West Texas

Intermediate fell in the negatives as demand dried up globally amid lockdown restrictions.

Subsequent months saw a gradual uptick as economic activity began to return, but with much speculation on when this would come back to pre-COVID levels.

The gradual rollout of vaccines across the world in late 2020 and early 2021 was able to provide some confidence to global markets, but not without concerns of a resurgence in infections amid breakthrough cases as well as the evolution of the virus and how this would impact demand going forward.

Since mid-2021 the cost of crude has been gradually climbing, hitting record highs in

October 2021 for the first time since 2014 to reach above $80 per barrel, something not seen in years as global markets were flooded with supply.

Demand has grown to such an extent to warrant intervention from US President Joe

Biden in pleading with OPEC+ members to increase supply, which even if they wanted to, cannot, given their own existing capacity limitations, but something they have also turned down regardless in keeping prices higher. Output stagnation is set to last until

April 2022, according to the group.

The e ects on natural gas prices were more limited over 2020, but have started to gradually see the same trends as oil.

Price fluctuations in the crude space have gradually begun to push investors to alternatives, including gas, which too has now seen a significant surge in cost over the course of 2021. Similar to oil, natural gas prices have increased to highs not seen since 2014.

The prospects of gas as an alternative option will probably see power generators in particular start to make longer-term moves to switch to the cleaner fuel in weaning o oil, while also capitalising on current prices ahead of further surges in demand as household consumption is set to rise over the 2021/2022 winter months in Europe and the US.

“Price fluctuations in the crude space have gradually begun to push investors to alternatives, including gas. – Williams “

HOW AFRICA STANDS TO CAPITALISE

All things considered, the gradual bounceback of global economic activity and the subsequent rise in prices for both oil and gas will bode well for African producers that have had to place projects on hold or cancel them entirely over 2020 as investment dried up amid global uncertainty.

With the trend in demand gradually reversing, key projects have restarted across the continent, with a number of positive developments on the go.

The largest motion made was the conclusion of the final investment decision on the East African Crude Oil Pipeline stretching from the Lake Albert basin in Uganda through to the Tanzanian port of Tanga in April 2021, which will see the

$4.8-billion

Value of the Grand Tortue Ahmeyim LNG project

latter secure a viable route for export of its crude reserves to Asian markets. In tandem, Uganda is also set to develop its first refinery as a way to increase value, with both components being developed in partnership with French energy giant TotalEnergies.

On the west coast Angola and Gabon have both moved to ease up on regulatory red tape in driving additional investor interest. They’ve sought to open up additional o shore fields for development as well as look for further avenues to drive value-addition, including increased refinery capacity, setting up innovation centres, and looking to focus on other downstream product development.

Though nascent by comparison with other markets, o shore projects in Senegal, including the Sangomar Field Development driven by BP and Kosmos Energy, will probably see final investment decision by 2022 and production begin by 2023.

On the gas front the $20-billion Mozambican liquefied natural gas project spearheaded by TotalEnergies is the largest continental prospect, but has stalled as of April 2021 due to militant activity. Despite the current situation and military involvement from a number of Southern African states, African Development Bank President Akinwumi Adesina is confident that development can get back on track by the end of 2022.

The $4.8-billion Grand Tortue Ahmeyim field o shore Mauritania and Senegal is another major venture that will see additional development in 2022. South Africa is the latest to get on board in exploiting its own gas potential following the significant discoveries by TotalEnergies in 2019 and 2021 at the Brulpadda and Luiperd o shore fields, respectively.

Though progress is slow in the continent’s second largest economy, given environmental concerns, the potential is sizeable and could bode well for South Africa, which is currently knee-deep in a power supply crisis. This amid deteriorating infrastructure and international pressure to begin moving away from coal as part of its energy agenda.

Fuel costs are an important consideration in mining.

The cost of crude hit record highs of above $80 per barrel.

THE LONG-TERM POTENTIAL IS THERE, BUT SWIFT ACTION IS NEEDED

Without decisive motions across the board in all markets and the fast-tracking of regulatory bottlenecks, African hydrocarbon potential will be lost as the world begins to adjust towards cleaner and greener fuels.

Though analysts speculate that high prices of oil and gas seen in the early 2010s are a thing of the past, the impact of COVID-19 on global demand has a number of complexities that will keep the price buoyant for at least another five years.

This transition period is a key time for African states to act quickly and decisively in positioning to capture on the price increases that are set to drive further investment in the sector despite international motions towards the opposite in the long term.

Moving up the value chain is also key in eking out additional revenue considering that prices may come down abruptly as they have in the past 24 months.

The most important consideration is one of moving quickly in decision making, lest the opportunity of the rebound in prices be missed as it was during the 2000s when China was investing in African oil and gas to meet its own energy needs.

Limited supply by OPEC+ to counterbalance US influence and production output – in both oil and gas – is something to keep an eye on going forward, while the shi towards gas in China is another area to monitor along the way. ■

LOAD SHEDDING

NO END IN SIGHT

Load shedding is here to stay – for the next few years, at least – and its impact on business will continue to be devastating. SA Mining recently caught up with Afriforesight’s deputy chief economist and head of energy commodities, Vinesh Chetty, to chat about the cost of load shedding to the mining industry.

HOW ARE THE CONTINUED ENERGY CONSTRAINTS AND LOAD SHEDDING IMPACTING THE MINING SECTOR?

Load shedding has forced some of South Africa’s energy-intensive heavy industries to curb operations or delay potential expansions, with multiple SA chrome and manganese smelters having reduced output or closed in recent years.

While high prices can make it uneconomical to smelt in South Africa, lack of electricity security makes investing in smelting operations even less likely.

Underground mining can also be particularly hard hit during the more severe stages of load shedding, when mines can be asked not to send sta underground.

While the full e ect of load shedding on the industry is di icult to quantify, one measure would be the lower output at smelters.

Smelting activity has been in decline for the past three years as load shedding became more frequent and tari s increased. In the 12 months ended July 2021, South Africa smelted only 2.9mnt of chrome, just over 50% of its 5.6mntpa capacity.

25

22

SA electricity production - TWh

19

16

13

10

Jan 00 Feb 01 Mar 02 Apr 03 May 04 Jun 05 Jul 06 Aug 07 Sep 08 Oct 09 Nov 10 Dec 11 Jan 13 Feb 14

■ ESKOM ■ OTHERS

Mar 15 Apr 16 May 17 Jun 18 Jul 19 Aug 20 Sep 21

Source: StatsSA

Vinesh Chetty.

THE PRICE OF ELECTRICITY CONTINUES TO RISE. HOW IS THIS IMPACTING BUSINESSES, ESPECIALLY MINERS AND THE MANUFACTURING SECTOR?

The sharp rises in electricity costs seen in recent years have become an increasingly concerning burden for businesses to bear. From 2007 to 2021, tari s for mining customers increased by an average of 15% per year, well above inflation, resulting in electricity costing almost 700% more in 2021 than it did in 2007.

As noted above, energy-intensive heavy industries are hit most directly and most companies are looking to limit costs from rising electricity tari s. Where higher e iciency machinery is available, this is o en used to replace older, more electricity-hungry equipment. Mine designs in South Africa may be more likely to use diesel than mines in other countries, due to relative stability compared to rapidly rising electricity prices.

WHAT IS THE MINING INDUSTRY’S APPETITE AND RESPONSE TO BEING ALLOWED TO PRODUCE UP TO 100MW OF RENEWABLE ENERGY WITHOUT THE NEED FOR LICENCES?

There is already a large appetite for selfgenerating electricity at mines. The Minerals Council South Africa expects its members to invest R60-billion to develop up to 3.9GW of electricity capacity and storage.

Due to government raising the self-generation limit to 100MW, Minerals Council members increased their planned generation construction by almost 150%. Ferrochrome smelters alone plan to add 750MW of capacity to assist their struggling operations.

WHAT MEASURES ARE MINERS AND RELATED BUSINESS PUTTING IN PLACE TO REDUCE THEIR FOOTPRINT?

There is a strong push by miners to reduce their carbon footprint. Companies are doing so both due to investor pressure and rising demand for “carbon-neutral” commodities, which are

R60-billion

© ISTOCK – TomasSereda

o en sold at a premium to products without carbon certification.

Reducing their carbon footprints would also allow miners to lower their expenses under South Africa’s carbon tax.

The Minerals Council has estimated a 2023 carbon tax bill of R3.8bn to R4.6bn (about 1% of mining revenue) which would increase the mining sector’s tax bill by about 20%.

Operations are generally more energye icient than before, due to the use of better technologies and building designs. Anglo American plans to be carbon-neutral (on scope 1 and 2 emissions) by 2040 while halving its scope 3 emissions.

Glencore intends to reduce emissions (on scope 1, 2 and 3) by 40% by 2035 and be carbon-neutral by 2050. While it no longer operates in South Africa, BHP also envisions being carbon-neutral by 2050.

kt 500

400

300

200

100

0

Nov 17 Feb 18 May 18 South Africa’s smelting production

Aug 18 Nov 18 Feb 19 May 19 Aug 19 Nov 19 Feb 20 May 20 Aug 20 Nov 20

■ FERROCHROME (le axis) ■ FERROMANGANESE (right axis)

Feb 21 May 21

kt 50

40

30

20

10

0 Source: DMRE

THE CALL FOR CLEAN COAL TECHNOLOGIES CONTINUES TO GROW LOUDER. IS THE SECTOR LOCALLY AND GLOBALLY WORKING TO SPEEDILY DEVELOP SUCH TECHNOLOGIES?

Globally most new coal-fired power stations are built to more e icient standards and more are being built with “scrubbers” to reduce sulphur dioxide emissions. While Eskom has been reducing its emissions over the past decade, it still produces about 40% of the country’s CO2. Eskom has mainly reduced ash emissions, but has lagged at reducing sulphur dioxide and nitrogen oxides.

While South African power stations were meant to meet stricter emission standards from 2020, only one has fully complied, due to funding challenges.

Australia and the UK are considering Allam-Fetvedt Cycle power stations. These are super-critical power stations designed to reduce emissions by burning coal or natural gas in oxygen (not normal air) and high pressures, capturing gases that would otherwise be released. The process could be used to produce hydrogen, an even cleaner fuel.

ANY OTHER INFORMATION YOU WISH TO IMPART?

While high electricity costs in South Africa are a constraint, load shedding seems to be the larger issue. When businesses are unsure of electricity supply, it makes operating extremely di icult. When high energy costs must be factored into operating plans, South Africa’s erratic electricity supply is almost impossible to work around.

It is interesting to note that South Africa generated less electricity in 2021 than it did in 2017, even as private producers ramped up output.

Electricity generation increased steadily until 2007, but has slowly trended downwards since. The decline comes from lower Eskom output, as private producers have ramped up generation over the same period. ■

MULTI-STAKEHOLDER COLLABORATION AROUND BATTERIES

Benedikt Sobotka.

Key to powering a brighter future

By Benedikt Sobotka, CEO of Eurasian Resources Group and co-chair of the Global Battery Alliance

The digital revolution, low-carbon transition and future energy security have led to an exponential global demand for batteries to power mobile devices, electric vehicles and renewable energy systems. But meeting the growing battery demand in a sustainable and responsible way requires that stakeholders all along the battery’s lifecycle – from the extraction of raw materials to production, use and recycling – work together to drive transparency and accountability across the battery value chain.

In 2016, the Paris Agreement identified that 100 million electric vehicles needed to be added to roads by 2030 to reduce carbon emissions and keep global warming below 1.5°C. More recently the International Energy Agency projected that electric vehicles (across all transport modes) would expand to almost 145 million by 2030 – an annual average growth rate of nearly 30%.

Since the lithium-ion batteries that power electric vehicles depend on lithium, nickel and cobalt as key components, the extractive industry is facing its biggest purchase order to date and, with it, the challenge of meeting the skyrocketing demand for battery metals in a sustainable manner.

For cobalt, two thirds of the world’s known resources are found in the Democratic Republic of the Congo, leaving few viable alternative markets from which to obtain this metal. And although much of the cobalt in the country is formally mined, there is a significant segment of the industry that has been linked with informal and unregulated artisanal and small-scale mining, unsafe working conditions, environmental degradation and child labour, among other risks.

In addition to its involvement in social and sustainable development initiatives that directly address these risks, Eurasian Resources Group (ERG) – which operates Metalkol RTR, the world’s second largest standalone cobalt producing entity – is working with other industry players to

145-million by 2030

Projected number of electric vehicles on the road

improve traceability and provide assurance that the cobalt contained in batteries is responsibly sourced and produced.

ENSURING THE RIGHT RE|SOURCE

Re|Source is a platform born from ERG’s collaboration with leading industry players, among them miners Glencore and China Molybdenum Co., as well as Umicore, who produces cathode materials used in electric vehicle batteries, and renowned electric vehicle pioneer Tesla.

Its development is further supported by pilot partners across a growing number of industry associates, including Norilsk Nickel and Johnson Matthey, and organisations such as the Responsible Minerals Initiative and Cobalt Institute are providing guidance on implementing best practices across the solution.

The Re|Source solution uses blockchain technology – the same technology that powers cryptocurrencies like Bitcoin – to verify adherence to sustainability standards and prove provenance. Similar to a secure ledger, Re|Source gives a view of the material’s journey along the supply chain, >

The Battery “ Passport aims to act

providing assurance that the cobalt used in end products is in line with leading industrial sustainable mining and sourcing standards and frameworks.

This collaboration not only links supply chain players to each other but can also feed into broader initiatives – like the Global Battery Alliance’s (GBA) Battery Passport – and due to its scalability, can be applied to other critical battery materials in the future.

CIRCULAR ECONOMY

In a world faced with the growing threat of climate change, sustainability remains a critical issue. For example, a GBA report indicates that demand for lithium-ion batteries is set to increase by up to 19 times between 2019 and 2030. The significance of the impact becomes apparent when one considers that by that point, up to 11 million tonnes of such batteries would already have reached their end of life.

Lithium-ion battery recycling in the developed world is currently at less than 5%, and if left unchecked, could create a significant waste issue with adverse economic and environmental consequences.

This shifts circularity into focus. Essentially, a circular economy involves composting biodegradable waste, and in those cases – such as with batteries – where the waste is non-biodegradable, it relies on reusing, re-manufacturing and finally recycling.

While the battery’s role in supporting the transition to renewable energy and the decarbonisation of transportation is clear, it can only be recognised as a sustainable solution if its entire lifecycle – from mining through to disposal – is rooted in sustainable practices.

Therefore industry players, governments and NGOs must work together to support this circular economy and find ways to improve and prove a battery’s comprehensive footprint.

PASSPORT TO SUSTAINABILITY

As a founding member of the GBA – a publicprivate collaboration platform – ERG is working alongside members such as Audi, LG Chem, BASF, the World Resources Institute and United Nations Children’s Fund (UNICEF) on developing the Battery Passport.

The Battery Passport aims to act as a form of quality seal, plotting the battery’s impact and performance along a host of environmental, social and governance and lifecycle markers that are benchmarked against accepted standards of what a sustainable and responsible battery is. Essentially, it is a digital representation of its bearer and tells the full story of its journey along the value chain to assure that batteries are sourced, produced, and recycled responsibly and sustainably.

It is this assurance, which can only be achieved through collective and transparent action from all stakeholders, that will secure batteries’ long-term potential to support future technological progress, carbon neutrality and the widespread application of battery storage. n

SA

www.samining.co.za

MIN NG

READ WHAT REALLY GOES DOWN IN SADC

WHY ADVERTISE ONLINE

● ADDED VALUE/EXPOSURE TO YOUR BUSINESS VIA

ONLINE CONTENT.

● Help build/strengthen your company’s brand. ● DRIVE TRAFFIC TO YOUR COMPANY’S WEBSITE.

● Expand your reach with various packaged o erings suited to your company’s needs, such as bundling your advertising with news/corporate pro les and/or a video online.

SA Mining, South Africa’s oldest mining magazine, has been providing insight into the local, Southern African and African mining space for 125 years.

COMBINE DIGITAL WITH PRINT FOR GREAT SAVINGS!

We are now giving our readers and clients an opportunity to take their news and advertising online in real time through www.samining.co.za

Banner 728 x 90 px

Island / Medium Rectangle 300 x 250 px YOUR ADS HERE

businessmediamags.co.za/mining/sa-mining/subscribe/

www.linkedin.com/company/samining/

www.facebook.com/businessmediaMAGS/company/samining/

SCANHERE

To visit our website.

twitter.com/BMMagazines

www.instagram.com/business_media_mags/

ADVERTISING: Ilonka Moolman 011 280 3120 moolmani@samining.co.za Tshepo Monyamane +27 62 239 3538 Tshepom@samining.co.za