JULY / AUGUST 2023 R39.90 (incl VAT) International R44.50 (excl tax) WOMEN IN MINING Advice for those starting out JUNIOR INDABA Sector bounces back ENERGY Renewable opportunities for juniors Pam du Plessis, Invincible Valves Managing Director 40%: Global manganese ore in SA R88bn: Juniors’ 2022 revenue generated INVINCIBLE VALVES New facility, better service MIN NG READ WHAT REALLY GOES DOWN IN SADC SA www.samining.co.za

Positive signs for junior miners.

IN BRIEF

6 De Beers on pace to deliver on ambitious 2030 sustainability goals.

FEATURES

14 Q&A: Roger Baxter, outgoing CEO of the Minerals Council SA

One of the industry’s most well-known faces and voices, Roger Baxter leaves the MCSA. We ask him to outline both the challenges and positives of his time in charge

16 Junior Indaba Roundup

The Junior Mining Indaba was told that it is imperative to develop an exploration implementation plan, and to implement a functional and transparent cadastral system.

20 Women in Mining

Senior women in the mining sector outline why they think young women should consider mining as a career, and o er their advice to those starting this journey.

22 Energy

As global demand for renewable energy solutions rises, the metals that go into such o erings rise in importance and open opportunities for juniors in SA to exploit.

NEWS IN NUMBERS

16 R88bn: Juniors’ 2022 revenue generated

22 40%: Global manganese ore in SA

REGULARS

4 Out of Africa

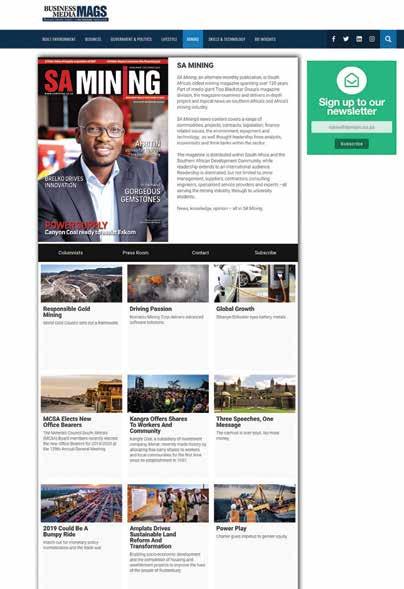

www.samining.co.za or www.businessmediamags.co.za

www.linkedin.com/company/samining/

www.facebook.com/businessmediaMAGS/company/samining/

In our May/June issue, in the story entitled ‘New shasinking method at Venetia and Palabora mines’, we referred to the contractor involved as Murray & Roberts, which is the holding company. The correct entity is Murray & Roberts Cementation.

Business Spotlight – Enaex Africa’s plans to embrace Artificial Intelligence

Gary Alfonso speaks to CEO of Enaex Africa, Francisco Baudrand, about the company’s plans to embrace Artificial Intelligence, while also looking into incorporating sustainability within the organisation’s strategic objective.

https://youtu.be/2U0RMa_6bko

A new machine shop and facility is enabling Invincible

businessmediamags.co.za/mining/sa-mining/subscribe/

JULY / AUGUST 2023 22

CONTENTS

16

WATCH:

How

junior miners can benefit from ‘green’ metals.

Valves to

o er a more a diverse

valves

streamline its operations and

portfolio of

JULY AUGUST WOMEN IN MINING Advice for those starting out JUNIOR INDABA Sector bounces back ENERGY Renewable opportunities for juniors Pam du Plessis, Invincible Valves Managing Director 40%: Global manganese ore in SA R88bn: Juniors’ 2022 revenue generated INVINCIBLE VALVES New facility, better service MIN NG READ WHAT REALLY GOES DOWN IN SADC SA www.samining.co.za COVER STORY: PAGE 8

ERRATA

twitter.com/BMMagazines www.instagram.com/business_media_mags/ To visit our website. SCAN HERE SCAN HERE

JUNIOR MINING IN THE SPOTLIGHT

According to the Minerals Council South Africa, the local junior mining sector currently employs between 33 500 and 40 300 people directly, and probably as many again through fixed-term contracts, making it critical to the success of the overall industry.

A er all, this sector comprises explorers, developers and smaller producers; and exploration, for example, is essential to the long-term survival of mining locally, as finding new deposits is necessary to keep the mining economy afloat.

The Junior Mining Indaba, hosted in Johannesburg, proved a major success. Juniors were told that while the economy may be tough, the long-term focus on clean energy minerals would ultimately benefit them. A er all, as global demand for renewable energy solutions rises, the metals that go into such o erings rise in importance. There is little doubt that this will open opportunities for juniors in SA to exploit.

Two major announcements were also made at the Indaba. The first was that one of the industry’s most well-known faces and voices, Roger Baxter – CEO of the Minerals Council SA – would be leaving the council a er 30 years with the organisation. Before he goes, SA Mining has asked him to outline both the challenges and positives of his time in charge.

The second announcement was that of the launch of a Junior Mining Council (JMC), which will give a greater voice and increased support to this sector of

the industry. The JMC’s new CEO, Fred Arendse, outlines for us the new organisation’s goals, plans and strategy.

August, of course, is Women’s Month, and – as the gender demographics of the mining industry slowly change – we asked some senior women in the sector to o er advice to young women about how best to be successful in this space, and how they can build their careers in the long term. Sustainability is currently a watchword in the mining business, but is not a word that seems compatible with the development and use of explosives – a vital and necessary part of the industry. We speak to several of the main explosives manufacturers in the country to learn exactly how they are working to make this area more sustainable, both in terms of the environment and in terms of its e ect on the surrounding communities, and also safer for mine employees.

Finally, in our cover story, we chat to Invincible Valves to find out how diversification and innovation are paramount in this sector, if an organisation is to remain ahead of the industry curve.

To this end, the company has recently moved towards achieving this level of independence by acquiring a machine shop and an additional facility located in Knights, Germiston. This has enabled the business to streamline its operations and make its entire process more e icient.

Gary Alfonso speaks to CEO of Enaex Africa, Francisco Baudrand, about the company’s plans to embrace Artificial Intelligence, while also looking into incorporating sustainability within the organisation’s strategic objective.

https://youtu.be/2U0RMa_6bko

EDITOR

Rodney Weidemann

Tel: 062 447 7803

Email: rodneyw@samining.co.za

ONLINE EDITOR

Stacey Visser

Email: vissers@businessmediamags.co.za

ART DIRECTOR

Shailendra Bhagwandin

Tel: 011 280 5946

Email: bhagwandinsh@arena.africa

ADVERTISING CONSULTANTS

Ilonka Moolman

Tel: 011 280 3120

Email: moolmani@samining.co.za

Tshepo Monyamane

Tel: 011 280 3110

Email: tshepom@samining.co.za

PRODUCTION CO-ORDINATOR

Neesha Klaaste

Tel: 011 280 5063

Email: neeshak@sahomeowner.co.za

SUB-EDITOR

Andrea Bryce

BUSINESS MANAGER

Claire Morgan

Tel: 011 280 5783

Email: morganc@sahomeowner.co.za

GENERAL MANAGER MAGAZINES

Jocelyne Bayer

SWITCHBOARD

Tel: 011 280 3000

SUBSCRIPTIONS

Neesha Klaaste

Tel: 011 280 5063

Email: neeshak@sahomeowner.co.za

PRINTING

CTP Printers, Cape Town

PUBLISHER

Arena Holdings (Pty) Ltd, PO Box 1746, Saxonwold, 2132

Copyright Arena Holdings (Pty) Ltd. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic or mechanical, without prior written permission. Arena Holdings (Pty) Ltd is not responsible for the views of its contributors.

www.samining.co.za 2 SA MINING JULY / AUGUST 2023 FROM THE EDITOR

© ISTOCK –Barraud MIN NG READ WHAT REALLY GOES DOWN IN SADC SA www.samining.co.za

Rodney Weidemann

WATCH: Business Spotlight – Enaex Africa’s plans to embrace Artificial Intelligence

SCAN HERE

Expect more at every stage of tyre life

Making tyre management safer and more productive. Reducing total cost of ownership and putting ESG at the core of our o ering

By delivering more than what is expected, we help make a di erence every day.

Kaltiremining.com

UNLOCKING BOTSWANA’S MINING POTENTIAL WITH EPCM EXPERTISE

In the pursuit of economic prosperity, Botswana stands as a shining example for South Africa in its e orts to harness its abundant mineral resources to drive growth. Yet achieving broad-based, future-proof economic growth in the country calls for professional engineering expertise and investment to enhance the sector’s development and workforce skills.

The mining and quarrying industry emerged once again as the major contributor to Botswana’s economy in 2022, accounting for 24.6% of its GDP, as per Statistics Botswana’s Gross Domestic Product: Fourth Quarter of 2022 report. Notably, the real value added by the coal, soda ash, and diamond industries grew by 21.8%, 8.9%, and 7% respectively, underlining the sector’s dynamic diversity and growth potential.

James Othapile, Erudite Botswana’s managing director, notes that the key in meeting this potential and ensuring the country’s longterm mining growth lies in optimising the country’s operations.

“Multinational Engineering, Procurement, Construction Management organisations (EPCMs) have primarily been serving the local mining industry, but this approach has brought little to no substantial local empowerment to the local engineering sector in which they operate. This creates a significant advantage when partnering with more localised, African-based EPCMs – their commitment to local ownership and skills development.”

He notes that there are two key benefits. Firstly, by subcontracting local companies, EPCM firms directly facilitate the growth of the local economy, creating jobs and driving income growth. This approach goes a long way in supporting the growth of local enterprises, o ering them lucrative opportunities to participate in significant projects and gain exposure to the industry.

Secondly, these firms deploy comprehensive training programmes designed to enhance the professional capabilities of local workforces. This helps raise the skill levels within their immediate teams and contributes to a broader ecosystem of well-trained professionals. The long-term impact of such initiatives is substantial, equipping workforces in countries such as Botswana with the expertise needed to lead future projects and drive innovation in the sector.

“Sustained investment in local subcontracting and training forms an integral part of EPCMs’ strategies. By committing to these initiatives, they can nurture an ecosystem of skilled professionals and robust enterprises. As we’ve seen in Botswana, the ripple e ects of such an ecosystem are substantial, with potential to contribute significantly to economic growth well beyond the completion of initial projects,” says Othapile.

RENEWABLE ENERGY

CAN SAVE WEST AFRICA HUNDREDS OF MILLIONS OF DOLLARS

At the recent West Africa Energy Transition Forum in Dakar, key energy decision makers from Wärtsilä shared insights on the impact renewables will have on power system cost, flexibility, and stability in West Africa.

They presented the results of their latest study which investigates Senegal’s optimal power system expansion. The study reveals that the scenario featuring a greater deployment of renewable energy in the power system will, by far, be the most a ordable and sustainable option. Paired with energy storage and flexible engine power plants to maintain a constant and stable power supply, a larger share of renewable energy will reduce carbon emissions by 30% by 2030 and generate total system savings of $700 million by 2035.

The fuel savings are the main factor in reducing the total cost of the system since renewable energy will partially remove the need to operate thermal power plants at full load to satisfy demand.

“Our study shows very clearly that maximising low-cost renewable energy is in Senegal’s best interest, both economically and environmentally,” says Kenneth Engblom, VP, Africa and Europe, Wärtsilä Energy. “We would almost certainly reach the same results, albeit of varying scales, if we were to analyse Guinea, Ivory Coast, or Mauritania’s power systems in similar depth. Price alone is converting the world to renewable energy.”

www.samining.co.za 4 SA MINING JULY / AUGUST 2023 OUT OF AFRICA

© ISTOCK –MichaelUtech © ISTOCK –CandyRetriever

Kenneth Engblom.

Unlimited

Scenarios

choices and self-customized products for a variety of needs. Our new range now includes solar PTZ and ANPR camera’s. Flexible Deployment Convenient and flexible deployment via all-in-one design Solar-Powered Products

Abundant

battery life and sturdy performance to withstand inclement weather Flexible Security, Unlimited Power Hikvision South Africa(Pty) Ltd 9 Eden Road, Waverly O ce park, Building 2, Bramley, Johannesburg, 2090, South Africa @HikvisionSouthAfrica Call Centre: +27 (0)10 085 8300 Website: www.hikvision.com

Reliable Performance Long

DE BEERS

ON

PACE TO DELIVER ON AMBITIOUS 2030 SUSTAINABILITY GOALS

Sustainability report highlights milestones in climate ambition and ethical leadership of the diamond industry.

De Beers Group has provided an update on progress towards its 2030 Building Forever sustainability goals. The goals, which were set in 2020, are De Beers’ blueprint for creating a positive and sustainable impact in its host countries and throughout the diamond value chain.

They span four pillars: leading ethical practices; partnering for thriving communities; protecting the natural world; and accelerating equal opportunity. During 2022, De Beers saw advances across all four pillars and all 12 goals, which includes reductions in water use and energy intensity, innovations in diamond tracing technology, increased representation of women in senior leadership, and progress towards its climate commitments.

A notable milestone was setting emission reduction targets across Scopes 1, 2 and 3, which have been validated by the Science Based Targets initiative (SBTi). In setting the targets across all three scopes, the company is extending its climate ambition over and above its existing commitment to be carbonneutral across Scope 1 and 2 emissions by 2030. The SBTi-validated targets represent the reductions required by the organisation to align with the goals of the Paris Agreement on climate change.

However, under its existing carbonneutral commitment and with the implementation of its Reduce and Replace strategy, De Beers expects to exceed its SBTivalidated targets for reducing Scope 1 and 2 emissions by 2030. De Beers also accelerated the pace of innovation and investment in its blockchain provenance platform, Tracr.

De Beers’ global production by value is now being registered on Tracr, which was recently named by Forbes as one of the world’s 50 leading blockchains for the third time.

“De Beers has a simple belief that informs everything we do: the diamonds we discover belong to the communities and countries in which they are found. We are inspired by the beauty and rarity of natural diamonds and the natural world, and we know how precious diamonds are – not only for the people who wear them, but for all those they touch along the way,” says Al Cook, CEO, De Beers Group.

“Building Forever is about taking a long-term view. We work hand in hand with the communities in which we live and work to shape a better future. Our actions range from addressing the climate crisis to growing prosperity wherever we operate. And by using our proprietary technologies, we can now connect our customers to the origin, impact and stories of their diamonds. Building Forever will continue to guide every decision De Beers makes and touch every diamond we discover.”

The platform was deployed at scale in 2022 and enables participants to provide assurance of a diamond’s source as it travels through the value chain. More than half of

The 2022 sustainability report, which is now available, provides a detailed overview of the Building Forever pillars and goals, along with key progress made towards each of these.

www.samining.co.za 6 SA MINING JULY / AUGUST 2023 IN BRIEF

© ISTOCK –RHJ

Building Forever is about taking a longterm view. We work hand in hand with the communities in which we live and work to shape a better future.

“ “

WE CAN HANDLE THE PRESSURE. GUARANTEED.

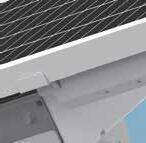

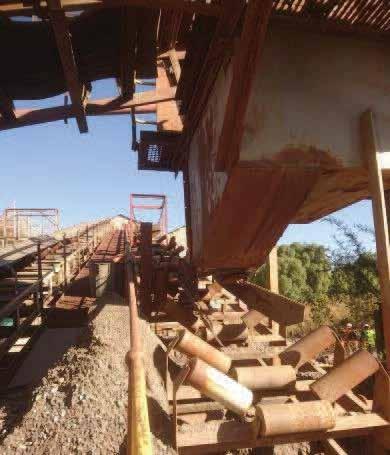

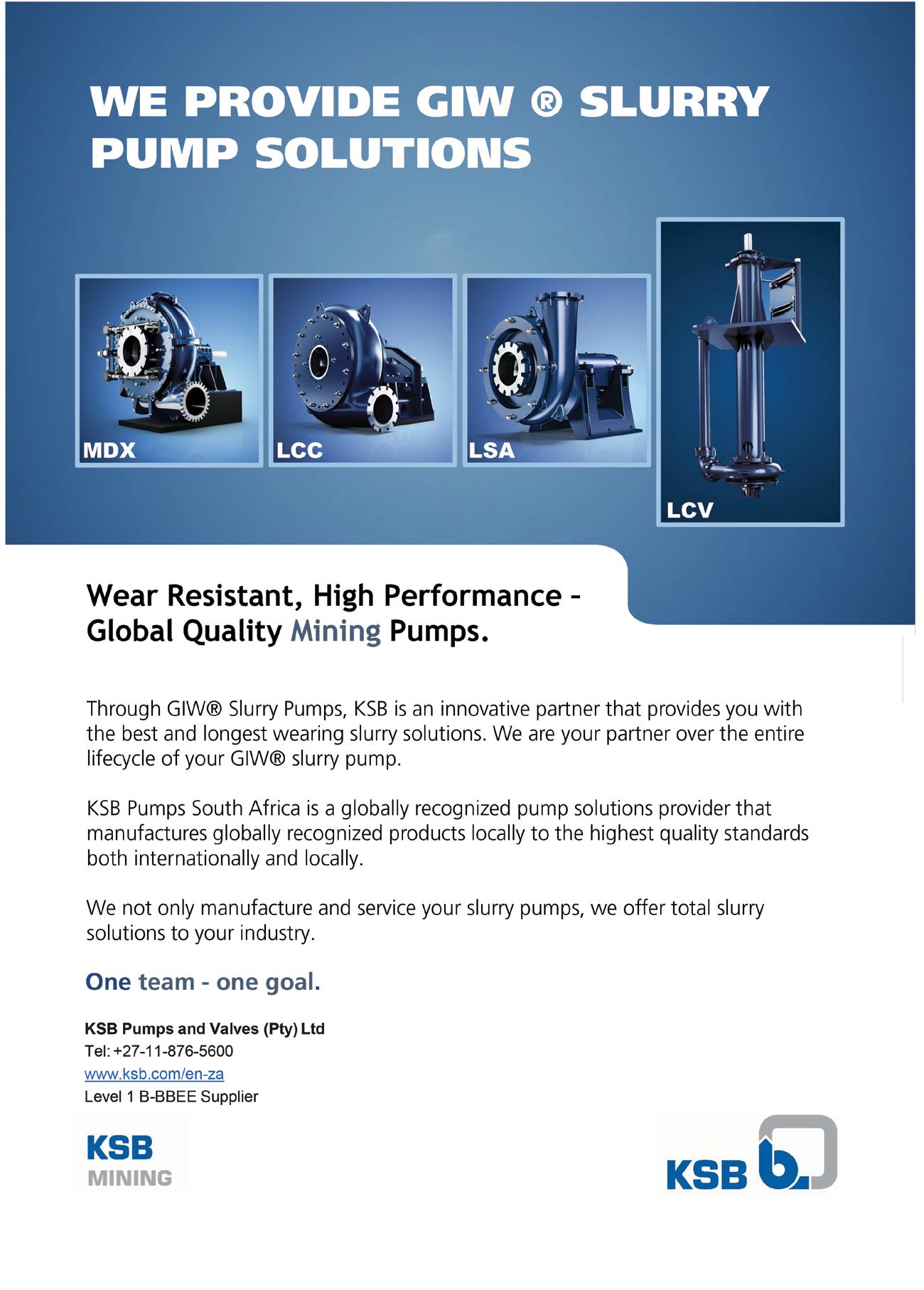

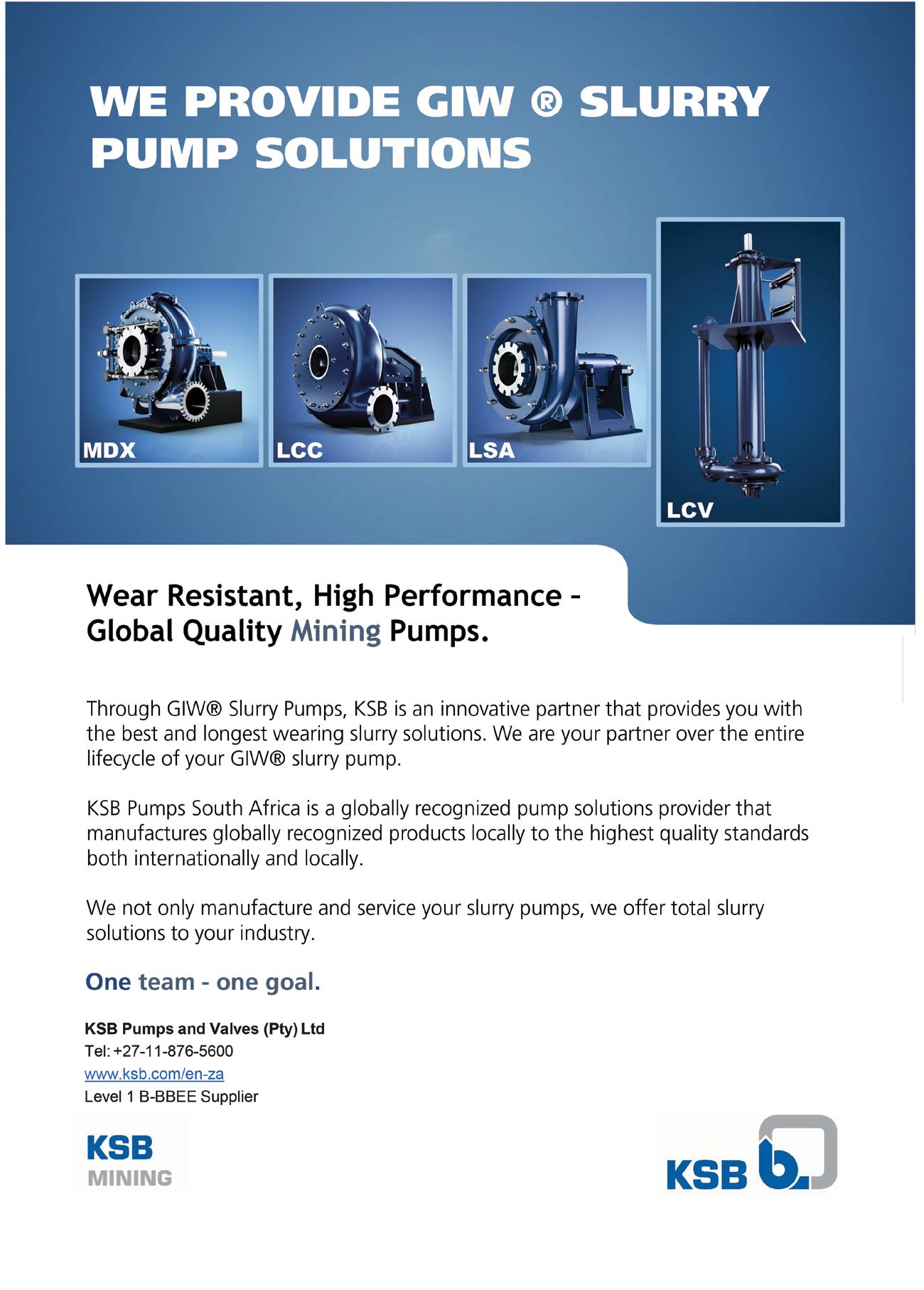

NEW FACILITY STREAMLINES INVINCIBLE VALVES’ OPERATIONS

By Rodney Weidemann

By Rodney Weidemann

While the manufacture of valves may not be viewed with the same excitement as, for example, mining diamonds or gold might, the fact remains that diversification and innovation are paramount in this sector, if an organisation is to remain ahead of the industry curve.

So says Invincible Valves MD Pam du Plessis, who points out that the company has evolved significantly since it launched in 1982 as a reconditioning business, growing into a leading supplier of local and imported valves and accessories for multiple sectors.

She suggests that such evolution is constantly required, in order to keep the company ahead of its competition. To this end, it has taken the bold step to eliminate reliance on third parties and pave the way for long-term business growth.

“We are pleased to announce that we have recently moved towards this level of independence by acquiring a machine shop and an additional facility located in Knights, Germiston. The new factory has proved to be a boon, allowing us to streamline our operations and make our entire process more e icient,” she says.

“At Invincible Valves, we like to say that there is always something happening, and this latest move is critical for the future of

the company. We have built a very strong foundation for our business, so it only made sense that we continue to develop and grow this even more.”

Having experienced unprecedented growth in recent times, Invincible was steadily expanding when the COVID pandemic happened. Rising to this new challenge that was presented, she notes, the company opted to forge ahead, rather than shelve its existing plans to upgrade and expand the facilities.

“While the pandemic did slow down the process ever so slightly, the purchase of a new facility in the same street as our existing works has finally been registered, which has given us the opportunity to revamp the site and create a workflow area that suits both the way we operate and our business needs.

“Following the renovation, the facility now boasts an increased range of capabilities, including the addition of a separate rubber lining division, an entire paint bay, and a shot blasting bay. Furthermore, we have invested in a 10m autoclave and are in the process of purchasing a machine shop.”

This new machine shop, says Du Plessis, is set to be equipped with state-of-the-art computer numerical control equipment. Operated by a computer, these machines provide a level of e iciency, accuracy and consistency that would be impossible to achieve through a manual process.

“This complete set-up is crucial, as it helps to lay the groundwork for enhanced production e iciency, and increased control over the reconditioning and manufacturing process,” she adds.

EXPANSION AND DIVERSIFICATION

As with any sector, it is important to follow new technologies and trends that have the potential to make a huge di erence in the industry.

She notes that if one considers the startling impact of a technology like 3D printing within the manufacturing world, the realisation dawns very quickly just how important it is to apply your mind to change, whether doing so is comfortable or not.

“We focus on being extremely forwardthinking, as we feel this is critical to ensuring the sustainability of the business. It goes

www.samining.co.za 8 SA MINING JULY / AUGUST 2023 PUMPS, PIPES & VALVES COVER STORY

Streamlined operations and a diverse portfolio of valves is now enabling the company to cater to a broader customer base, while also more easily adapting to shifting market dynamics.

©

ISTOCK –Nostal6ie

without saying that diversification is of utmost importance for valve manufacturing companies. Therefore, by expanding our product range and venturing into different sectors, we reduce our reliance on a single market or industry.

“Purchasing the machine shop plays into this strategy, as we see it as a strategic move that not only spreads the risk, but also opens doors to new opportunities and revenue streams. In an ever-changing business landscape, where market demands and technologies evolve rapidly, diversification like this allows us to stay ahead of the curve.”

Moreover, says Du Plessis, by offering a diverse portfolio of valves that are tailored to various applications, it becomes possible to cater to a broader customer base and adapt to shifting market dynamics. Ultimately, undertaking diversification like this enhances the business’s resilience, competitiveness, and long-term sustainability, while ensuring its continued growth and success.

“Invincible Valves’ decision to establish self-sufficiency is driven by the desire to grow the business and provide long-term benefits to its clients. Over the past 15 years,

the company has experienced exponential growth, and its commitment to reinvesting in the industry has paid off,” she says.

“Naturally, the aim now is to master the new machine shop before launching our next expansion stage. Growing the business will remain an ongoing goal, but we nonetheless believe in taking our time with the process. After all, in business the old adage of ‘never biting off more than you can chew’ continues to hold true.”

BUILDING FOR FUTURE SUCCESS

Du Plessis points out that the manufacturing sector remains under pressure, describing it as “operating in challenging times”.

“It is with this in mind that we remain determined to achieve self-sufficiency. In doing so, we address some of our biggest challenges. One ongoing challenge for the manufacturing sector is that of load shedding. Power interruptions and load curtailment disrupt production schedules, leading to increased costs and productivity losses.

“To combat these challenges, Invincible has explored several alternative energy

sources, including generators and renewable power. The company has also implemented a range of contingency plans to minimise downtime,” she says.

One truism she completely agrees with is that the most significant and crucial aspect of a business is its people.

“It is imperative to acknowledge the skills shortage in the industry. It is therefore critical that organisations such as Invincible actively invest in training and skills development programmes, as a way to retain and nurture talent. Only by prioritising the wellbeing and growth of employees can we ensure a robust foundation for future success.

“Despite the challenges and the current global economic uncertainty, we remain optimistic. After all, mining operations continue to expand worldwide, and this should result in higher demand for our products.

“With this growing demand, we have no doubt that as long as we continue leveraging technological advancements, Invincible Valves will be able to navigate any challenges that come our way, as we continue to skill our people and grow the business.”

www.samining.co.za SA MINING JULY / AUGUST 2023 9

We have recently moved towards a new level of independence by acquiring a machine shop and an additional facility located in Knights, Germiston.

“ “

– Du Plessis

© ISTOCK –Petrenko

Q&A WITH FRED ARENDSE, FOUNDING PRESIDENT OF THE JUNIOR MINING COUNCIL

Q: WHY DID YOU FEEL THE NEED TO LAUNCH AN ORGANISATION LIKE THIS, WHEN THE MINERALS COUNCIL SOUTH AFRICA ALREADY EXISTS?

A: The objective of the Junior Mining Council (JMC) is not to compete with, but to cooperate with and complement, other industry bodies. To put matters into perspective, although the Minerals Council South Africa (MCSA) has a Junior Mining Help Desk, it also has 77 members representing 90% of SA’s mineral production, which by implication are the major mining companies.

The JMC will have a focused approach to the unique needs of the junior mining sector and members, which is a very diverse group, ranging from artisanal miners to producers with an annual turnover of less than R500-million. It includes mines, natural brickfields, stone quarries, mine suppliers, explorers, contractors, etc. These companies are largely unrepresented, without a voice and support.

Q: WHAT ARE THE CHIEF GOALS AND FOCUSES OF THIS ORGANISATION?

A: The main goal is to address junior issues in a way that these companies can mature and grow for the benefit of the industry and SA as a whole.

The JMC’s key purpose is to represent the interests of the junior mining industry in the mainstream economy through the following:

Uniting all emerging and junior miners, relevant suppliers, contractors, explorers and quarries behind a common purpose and vision for the sector.

To develop and drive relevant programmes of action that position the junior mining sector at the centre of economic growth and participation in SA.

Q: WHAT SORT OF RECEPTION HAVE YOU RECEIVED, AND HOW DO YOU SEE THE JMC ASSISTING JUNIORS, MOVING FORWARD?

A: Following our introduction at the Junior Indaba this year, we found instant support for the establishment of a new voice for the junior mining sector. Without exception the reception has been very positive, to the extent that a number of companies signed up to become members on the spot, while several more expressed interest.

As for assistance, among our objectives are:

■ Attracting and facilitating investment funding for members.

■ Lobbying and improving communication with media, communities, organised labour, government and all relevant stakeholders.

■ Collaborating with government, relevant departments, state-owned enterprises and other professional bodies to advance the junior mining sector in SA.

■ Enhancing and leveraging on available skills and resources, and providing a platform to grow skills and relevant competencies.

■ Providing a platform to enrich and action key policy debates, and creating capacity and capability relevant to the junior mining sector.

Q: WHAT IS YOUR VIEW OF THE CURRENT STATE OF THE JUNIOR INDUSTRY – SPECIFICALLY, THE IMPACTS, THINGS LIKE SUSTAINABILITY, RENEWABLE ENERGY, WORKER SAFETY AND CURRENT GEOPOLITICAL CONCERNS, ARE HAVING ON IT?

A: The junior mining sector sees environmental, social and governance (ESG) issues as something that needs to be addressed, with the JMC providing guidance in this regard. Worker safety is a primary concern and the smaller the operation the bigger the concern.

New legislation specifically addresses artisanal and illegal mining, the latter of which I also see as a form of artisanal mining. The poor safety records of these are especially disturbing and it is an area where I foresee that the JMC can, through third party intervention, play an important role.

As far as geopolitical uncertainty is concerned, risks o en create opportunities – such as the fact that coal exports have increased by 700% since the Russia-Ukraine war, and the majority of the coal mining companies falls within the junior mining category.

Q: ALTHOUGH YOU HAVE JUST LAUNCHED, CAN YOU GIVE US AN IDEA OF YOUR LONGER-TERM PLANS FOR THE JMC?

A: My vision for the JMC is to develop and grow it into a reputable and respected institution, which will stand as a beacon on the global stage in terms of junior mining representation and support.

www.samining.co.za 10 SA MINING JULY / AUGUST 2023 JUNIOR MINING

Introduced to the industry at the recent Junior Mining Indaba, the soon-to-be launched Junior Mining Council’s founding president outlines the role of the organisation.

© ISTOCK –Shevchuk

Fred Arendse.

Know harm done

Get a comprehensive Environmental Legal Compliance Audit

Through no fault of their own, a lot of mining outfits just don’t know what they don’t know about what’s required from an ELC perspective. But (you guessed it!) we do… And that’s just as well – because unlike the friendliness and warmth your banking app’s chatbot exudes, penalties for having done work on a mine without the right license/s are 100% real. Yip: non-compliance can see a fine of up to R10 000 000 coming your way (and you can get fined more than once) – or even a 10-year prison sentence. Sjoe.

But all’s not lost. No indeed. Our expert Environmental Assessment Practitioners and lawyers would just luuurve to perform ELC audits for you ASAP, so you can avoid fines – or find out exactly what you may’ve missed permission-wise so you can act pre-emptively. In fact, we can get your compliance issues sorted in a single day.

To keep your mining operation compliant – and avoid getting into a hole of another sort – get in touch. We’re a message away.

ESG(REENWASHING)

WHAT CAN WE LEARN FROM ABROAD?

By Dominic Varrie (Candidate Attorney), Nicole Sebanz (Associate), and Minnette Le Roux (Environmental Specialist) at NSDV

As environmental, social, and governance (ESG) disclosures become increasingly important to all stakeholders, greenwashing – tactics organisations use to exaggerate, mislead, or falsify their sustainability claims and credentials on their impact on the environment – becomes more pervasive.

Greenwashing in the context of ESG disclosures includes organisations “tweaking” their environmental disclosures in order to be perceived by the public as a more environmentally conscious organisation than they factually are.

The measures that have been implemented abroad in order to address greenwashing and facilitate accountability for ESG disclosures will certainly inform developments to the relevant South African regulatory framework in the future.

GREENWASHING RISKS IN THE ESG CONTEXT

According to a recent report published by PricewaterhouseCoopers titled PwC’s Asset and Wealth Management Revolution 2022, consumers and investors alike

have developed a massive interest in sustainability-focused companies. In this regard, the PwC report projects that ESGfocused institutional investments will soar by 84%, and asset managers globally are expected to increase their ESG-related assets under management to US$33.9 trillion by 2026.

ESG investing will be astronomical. Greenwashing liability will be too.

With the ever-increasing global focus on sustainability and the significant interest in ESG-focused investments, it is highly likely that greenwashing allegations will increase and continue to garner mainstream attention. It’s very important that organisations implement measures to avoid greenwashing and ensure that ESG disclosures are accurate and transparent, in order to protect their investors, mitigate their ESG risks, and create value for all stakeholders.

In June 2022, the Johannesburg Stock Exchange Limited (JSE) released a document titled JSE Sustainability Disclosure Guidance that aims to “enable more useful, consistent, and comparable sustainability disclosure to inform better decision-making and action”.

It’s intended to be used as a guide for JSE-listed companies on best practice with respect to ESG disclosures.

It is evident from the JSE guidance document that South Africa has begun to reflect an awareness of the need to regulate greenwashing and improve the accuracy and accountability of ESG disclosures. However, despite these progressive steps, it is worth noting that South Africa does not currently have any legislative provisions in place that specifically address greenwashing.

Despite the above, greenwashing in South Africa is not without its risks, and organisations found to be engaging in greenwashing may incur liability regarding fraud; misleading or deceptive representations resulting in an infringement of consumer protection laws; the violation of competition laws; an array of possible regulatory complaints; and liability for directors failing to act in the best interest of the company.

Greenwashing may also result in pressure from the shareholders of an organisation in the form of shareholder activism, or even in the form of shareholder

www.samining.co.za 12 SA MINING JULY / AUGUST 2023 FINANCE & LEGAL CORPORATE PROFILE

class actions. In light of this, greenwashing allegations can ultimately be incredibly damaging to an organisation’s reputation, and in turn, to its bottom line.

INTERNATIONAL APPROACH TO GREENWASHING

A big focus in ESG reporting globally is on responsible energy and water usage, when considering climate change and resource optimisation as the key disclosure areas.

Greenwashing-related litigation has therefore recently become prominent in relation to these disclosure areas. A research report from 2022 called ClimateWashing Litigation: Legal Liability for Misleading Climate Communications, by the Grantham Research Institute on Climate Change and the Environment and the Climate Social Science Network, says it’s estimated that since 2016 there have been at least 20 cases filed before courts in the United States (US), Australia, France, and the Netherlands regarding climate-washing (a type of climate change-related greenwashing).

It’s estimated that since 2008, at least

27 administrative complaints regarding climate-washing have been filed before oversight bodies in the United Kingdom, Australia, Italy, New Zealand, Denmark, the US, and South Korea. It’s evident that globally, organisations are increasingly being held accountable for greenwashing.

On a global scale, the International Sustainability Standards Board (ISSB) has confirmed that they will be issuing their first two finalised frameworks, IFRS S1 and IFRS S2, by the end of June.

IFRS S1 is designed to apply globally to corporates in all sectors and attempts to unify disclosure on factors such as waste and emissions, as well as on how to disclose all material sustainability-related risks and opportunities.

IFRS S2 will focus on specific topics, particularly on climate mitigation and climate adaptation. ISSB chair Emmanuel Faber says, “Companies already reporting under GRI won’t be able to simply cut and paste swathes of disclosures, because they will need to apply the ISSB’s investorfocused materiality lens. For companies reporting under multiple frameworks, this will make reporting less challenging.”

INTERNATIONAL SUSTAINABILITY STANDARDS BOARD (ISSB) FRAMEWORKS

■ IFRS S1: designed to apply globally to corporates in all sectors and attempts to unify disclosure on factors such as waste and emissions

■ IFRS S2: focuses on specific topics, particularly on climate mitigation and climate adaptation

WHAT ABOUT SOUTH AFRICA?

South Africa has traditionally followed the lead from abroad when it comes to ESG regulatory developments. It’s significant to note that one of the purported benefits of the JSE guidance document is to support the convergence of global reporting standards.

The adoption of the Corporate Sustainability Reporting Directive in the European Union, the rules proposed by the Securities and Exchange Commission in the US, the standards to be issued by the ISSB, the standard issued by the Canadian government, and the laws to be released in South Korea on greenwashing should inspire companies to question their ESG reporting and potential for greenwashing.

Ultimately, it appears that the best way to stay ahead of the curve in Africa is to develop a business-specific ESG scorecard, avoid greenwashing and facilitate accountability for ESG disclosures.

www.samining.co.za SA MINING JULY / AUGUST 2023 13

© ISTOCK –phototrip

© ISTOCK –Stavnikov

With the everincreasing global focus on sustainability and the significant interest in ESG-focused investments, it is highly likely that greenwashing allegations will increase and continue to garner mainstream attention.

“ “

– NSDV

Dominic Varrie.

Nicole Sebanz. Minnette Le Roux.

Q&A WITH OUTGOING MINERALS COUNCIL SOUTH AFRICA CEO ROGER BAXTER

One of the industry’s most well-known faces and voices, Roger Baxter leaves his role as CEO of the Minerals Council SA after 30 years with the organisation. We asked him to outline both the challenges and positives of his time in charge.

Q: WHAT ARE SOME OF THE BIGGEST CHALLENGES YOU’VE FACED DURING YOUR TIME AS CEO OF THE MINERALS COUNCIL?

A: In 1992 I joined the then Chamber of Mines as a junior economist. The Chamber was an organisation of more than 600 people and the sector was pretty much pale and male, a very hierarchical, patriarchal sort of industry. In fact, the Minerals Council SA (MCSA) appointed a woman as president for the first time in its more than 130 years of history when Nolitha Fakude, Anglo American South Africa chairwoman, was appointed in the role in 2021.

The period when I joined witnessed a huge amount of distrust, when the ANC was unbanned, about the Chamber of Mines and what it stood for. We have done an extraordinary amount of work to address that. Today, the Minerals Council is seen as one of the most e ective business advocacy and representative organisations in South Africa.

One of the biggest recent challenges and frustrations has been the deterioration in energy security and the enormous potential it has cost not just mining but the economy. This is made worse when one considers the Energy Policy White Paper that was negotiated in 1998. I was one of the four business negotiators on the team who negotiated a pragmatic, globally acceptable energy policy white paper. Had that been implemented, South Africa wouldn’t be in the position it’s in now from a load shedding point of view.

Another challenge and frustration is the declining performance of rail transport of minerals. We have forfeited tens of billions of rand in revenue and critically needed taxes in recent years.

Q: WHAT WOULD YOU SAY HAS BEEN THE DEFINING MINING ISSUE DURING YOUR TENURE, AND WHAT ROLE DID THE COUNCIL PLAY IN SOLVING/ MITIGATING IT?

A: Safety and health have been, and remain, the key issue in mining. The industry is committed to achieving zero harm, and half our annual budget is spent on health and safety. When I joined the MCSA in 1992, the industry had 551 fatalities that year. If we look at 2022, the industry had the lowest number of fatalities on record with 49 deaths.

working hard to develop and share industry best practices, encouraging our members to adopt them. We have certainly seen step changes in safety performances and the work that the Minerals Council will continue to drive.

Q: WHAT ARE YOUR PLANS FOR THE FUTURE – CAN WE STILL EXPECT TO SEE YOU IN THE MINING SECTOR, AND IF SO, DOING WHAT?

A: I’ve worked consistently for 32 years without a real break. So it’s time to be with my family and take a bit of a sabbatical. I played rugby in my youth so if I can give the analogy of being a Springbok supporter all your life, it’s not easy to support anyone else. I’ve been in the mining industry all my working life, so it’s fair to say it’s in my blood. I have a decade of work life ahead of me, so I’ll be back in the future, but in what shape or form, I’m not saying just yet. Watch this space.

Q: AS YOU LEAVE THE MCSA, HAVING BEEN ITS RECOGNISABLE FACE FOR SO LONG, DO YOU HAVE ANY FINAL WORDS OR MESSAGES FOR THE LOCAL MINING SECTOR?

A: I’m confident the MCSA is in safe hands. The new Minerals Council CEO, Mzila Mthenjane, from Exxaro, is very experienced in industry issues. I have no doubt he’ll make his own positive and indelible footprint on the organisation.

Roger Baxter.

We have made significant progress in addressing underlying safety issues, but we have more to do. At the MCSA, we are

I also have no doubt the MCSA and its leadership will keep on pushing the positive reform agenda, and being the change that they want to see. I’m a firm believer that with them, we will achieve the aim of #MakingMiningMatter.

www.samining.co.za 14 SA MINING JULY / AUGUST 2023 INDUSTRY BODIES

© ISTOCK –jasonbennee

85 YEARS OF SOLUTIONS.

Since 1937, Fletcher has been answering some of underground mining’s toughest questions. At Fletcher we provide more than solutions, we provide an atmosphere for an open dialogue with customers to ensure their operations are reaching maximum efficiency. Fletcher provides lifetime support through an experienced, knowledgable team of sales staff, engineers and field service technicans. Is your operation facing obstacles that mass produced equipment isn’t addressing? Get your custom solution started today. Learn more at www.jhfletcher.com

J.H. Fletcher & Co. cannot anticipate every mine hazard that may develop during use of these products. Follow your mine plan and/or roof control plan prior to use of the product. Proper use, maintenance and continued use of (OEM) original equipment parts will be essential for maximum operating results. 2022 J.H. Fletcher & Co. All Rights reserved.

304.525.7811 800.543.5431 MANUFACTURED IN WEST VIRGINIA, USA Built on Answers. ® FOLLOW OUR SOCIALS: @FLETCHERMININGEQUIPMENT

POSITIVE SIGNS FOR JUNIOR MINERS

In 2022, junior miners generated some R88-billion in revenue, up from R54bn in 2018. This means that proportionally, the junior mining sector output increased more than that of the overall mining industry during this period, Minerals Council South Africa (MCSA) CEO Roger Baxter told the Junior Mining Indaba in Johannesburg. He says with this sector, every R1bn spent on exploration can potentially contribute around R1.2bn to the country’s gross domestic product – through direct, indirect and induced impacts.

KEY PRIORITIES FOR THE DMRE

■ The implementation of an online mining licensing system.

■ Elimination of the mining licensing backlog.

■ Supporting artisanal and smallscale miners.

■ Supporting exploration by junior emerging miners.

■ The development of a critical mineral strategy for South Africa.

“Research conducted by the Minerals Council indicates that a majority of mining and prospecting rights are currently held by junior and emerging companies. With this in mind, the council has held substantive engagements with the Department of Minerals and Energy (DMRE) and the Council for Geoscience to develop an Exploration Implementation Plan,” he says.

“This has resulted in an acceptable dra document, replacing the internationally accepted ‘first applicant’ principle in granting exploration rights with a ‘meritocratic’ system instead.”

Baxter notes that a proper audit is also needed regarding dormant rights, and more needs to be done about the inadequate time frames for exploration rights – given complex geological settings and di iculties in securing financial backing.

“Of critical importance too is the implementation of a functional and transparent cadastral system. Here, the council has been encouraged by Minister [Gwede] Mantashe’s assertion that SAMRAD [the SA Mineral Resources Administration System] is a failed system.”

He says the Minerals Council has instead “advocated for the deployment of a commercially available, transparent, proven, online cadastral system, one that is widely used in Africa and in other mining jurisdictions”.

“This is crucial, as an e icient, corruption-free cadastral system is critical to unblock the rights backlog,” he says, adding that the latest data from the DMRE indicates a substantial backlog in mineral rights, currently topping 5 000.

South Africa is also rich in clean energy minerals, he says, pointing to platinum group metals, vanadium, copper, manganese, chromium, cobalt, nickel, titanium, tungsten and zinc.

“Remember that the model used by exploration companies is to find and rapidly prove deposits that can be sold to bigger miners. Therefore, making exploration easier will bring in new participants and provide a pipeline of minerals to mine for generations.

“When one considers the potential job creation tie to mining, processing and manufacturing opportunities, along with the boost this will provide to South Africa’s export earnings, taxes, royalties and overall fiscus, easing the process makes perfect sense. Unfortunately, there is currently no South African government support for critical minerals exploration and mining,” says Baxter.

DMRE OUTLINES INDUSTRY CHALLENGES

According to Jacob Mbele, Director General at the DMRE, when one looks at the performance of the local mining sector, there are several international and domestic factors negatively a ecting both production and mineral sales.

“We all are aware that of these, the international factors include soaring energy prices due to the ongoing geopolitical dynamics in Europe. On the other hand, domestic factors include the continuous power supply disruptions, and logistical bottlenecks due to ine iciencies in our rail network and our ports,” he says.

“Analysis of production data reveals that mining production in the country shrank by about 2.6%, year on year, in March 2023. This was following a 7.6% slump in the prior month. This has ultimately marked the 14th consecutive month of contraction in mining activity.”

www.samining.co.za 16 SA MINING JULY / AUGUST 2023 JUNIOR MINING

Despite certain local and international factors impacting the sector, word from the Junior Mining Indaba is that the long-term focus on clean energy minerals will benefi t juniors.

© ISTOCK –mnbb © ISTOCK –jasonbennee

He notes that it has been estimated that the lost opportunities and costs resulting from logistical bottlenecks are around R50bn a year, based on delivered tonnage measured against targeted tonnage.

“The areas that need the most focus in support of junior and emerging miners inlcude the turnaround times for both prospecting and mining applications, as well as exploration support, access to finance and access to the logistics network.

“From the DMRE’s specific point of view, we have embarked on a process to eradicate the backlog in applications for prospecting and mining rights.”

Mbele is quick to add that over the past nearly two-year period, the DMRE has managed to reduce this backlog by about 50%. He says it is now directing its e orts and resources towards tackling the backlog in those regions with the highest volumes of applications, namely Mpumalanga and the Northern Cape.

“We believe the implementation of the cadastral system, which is currently in the process of being procured, will help us

– Baxter

WHAT DO VENTURE CAPITAL-FUNDED JUNIORS NEED TO BE SUCCESSFUL IN SA?

■ A predictable and competitive policy and legislative framework that is much more business-friendly and in tune with the business models of small venture capital-funded juniors.

■ A transparent, e icient and online o -the-shelf cadastral system to enable pre-competitive exploration information to be available online to juniors locally and abroad.

■ A regulatory system that is much more globally competitive, with prospecting rights and renewals issued within three months by the

sustain this intervention going forward, as well as provide the transparency necessary for ongoing investment.”

Furthermore, he says, “We have agreed to work together with the MCSA to ensure we improve South Africa’s standing as a mining investment destination. The DMRE would like to give assurance about

DMRE (the current year is far too long).

■ A taxation system that encourages some extra venture capital investment in exploration by individuals or companies using the flow through share scheme methodology.

■ Extra incentives to explore for critical minerals.

■ A workable artisanal and small-scale mining policy and legislation.

■ Support and mentoring programmes from the MCSA for juniors.

its commitment to supporting junior and emerging miners.

“This commitment will be visible in the streamlining and strengthening of administrative capacity to ensure transparency, shortened turnaround times, and more e icient processing of mining and prospecting licences.”

Of critical importance too is the implementation of a functional and transparent cadastral system.

“ “

AFRICA’S RACE TO THE SUN (AND OTHER ALTERNATIVES)

There are many plans in place to see African countries succeed, but which of the resource-rich countries are in the running for global capital to see their plans come online fi rst?

One of the most emotive subjects in Africa currently is the energy transition from fossil fuels to cleaner energy, with the mining and resources sectors at the sharp end of the debate.

Consider for a moment that South Africa is light years ahead of the rest of the continent in terms of its energy infrastructure and Renewable Energy Independent Power Producer Programme (REIPPP) which has rolled out over 100 viable energy projects. This is undeniably a success story.

At the same time, businesses are coming to a standstill with rolling blackouts of multiple hours, while some power projects from Bid Window 5 are still trying to reach financial close. On top of this, we are facing very real constraints within the transmission and distribution networks, thus indicating that despite the aspiration to succeed, the implementation of solutions is falling short and this needs to be rectified.

Shirley Webber

Coverage Head: Resources and Energy, Absa CIB

The Integrated Resource Plan 2019 by the Department of Mineral Resources and Energy is being implemented, albeit slowly, and there are exciting new initiatives under way, such as the energy storage and gas to power programmes. We believe great strides have been made, and we should focus on the positive impact that the renewable programme actually makes.

While SA is, for now, the most advanced economy in Africa, it’s important to understand that the broader African continent is seeing potential for the clean energy transition and making itself attractive to foreign investors, who are key to funding the renewable drive and energy changing market.

Our research confirms there are many plans in place to see African countries succeed, and this begs the question: Which of the resourcerich countries are in the running for global capital to see their plans come online first? We are looking forward to supporting some of the projects that are on the horizon.

While Egypt’s growth rate is expected to slow from 6.6% in 2022 to 3.4% in 2023, it still compares favourably to SA, which the International Monetary Fund forecasts to grow at 1% while some of the more pessimistic analysts believe it could be even less. On the electricity front, there are some similarities between SA and Egypt, where the Egyptian Electricity Holding Company still dominates the market.

Currently 22% of the electricity supplied is via renewables and this is expected to grow to 42% by 2035. There is also significant investment in a nuclear plant and green hydrogen project with a target of 18GW of

power to be added by 2032.

Mozambique is a fascinating market to consider. While it holds an electrification rate of just 30%, it has the second highest available capacity a er SA as an exporter in the South African Power Pool. On the other hand, it is set to have the fastest growth in natural gas production in Africa over the coming decade. This will create a strong foundation for gasfired power projects that are in the pipeline.

Zambia is mineral-rich and can expect to see significant investment in the coming years with electricity consumption forecast to grow at 3.9% year on year between 2022 and 2030. The primary risk for Zambia is its significant reliance on hydropower, which has been vulnerable during times of rain and drought.

Its rich-resource base means that Zambia will attract foreign investment, and this should be supported by additional captive power projects. This will be critical as the mining sector currently consumes over 50% of the generation capacity.

Ghana’s solar market is already competitive, and it exports electricity into the rest of Africa – both of which can be attributed to policy reforms in the 1980s which drove IPP activity. Given the good potential for clean captive power in commercial and industrial facilities in Ghana, and the relative lack of accessible bank financing, private specialised captive solar PV financing firms have recently entered the market.

Tanzania is the third largest producer of gold on the continent, and it constitutes 50% of the nation’s exports. Of recent interest is that the country has been identified as a potential key player in the global graphite market. With demand for lithium iron ore batteries on the rise, graphite remains a key component. To support this investment opportunity, the under-developed Tanzanian market is expected to add 6GW of renewable energy power by 2025 – this will be a gamechanger for the economy.

Africa has the means to start implementing a successful Just Energy Transition over the next decade. There are myriad plans in execution to reach this goal, but the question remains: Are there adequate resources and expertise to implement them timeously?

Absa is ready to identify hurdles in their race and combine experience and expertise to create an enabling environment for the resource operators in all of Africa to succeed. When we get this right, this becomes a win-win situation for all stakeholders and a success story for the whole continent.

www.samining.co.za 18 SA MINING JULY / AUGUST 2023 COLUMN ENERGY The

© ISTOCK –MichaelUtech

views expressed are the author’s own and do not necessarily reflect SA Mining’s editorial policy.

WE CAN HANDLE THE PRESSURE. GUARANTEED.

WHY MORE WOMEN SHOULD CHOOSE MINING

Mining is one of the bread-andbutter industries of the South African economy, and women have long been the breadand-butter providers for their families. So it only seems logical to encourage them to participate more deeply in both this industry and the economy as a whole.

With August being Women’s Month, SA Mining asked several senior women in the industry why they think girls should consider mining as a career, and their best advice for those starting out.

Rosebella Osei, head of strategy for Women in Mining, points out that by considering a career in the mining sector, young women planning or starting out in the working world can contribute their skills and perspectives to an industry that is evolving and becoming more inclusive.

“The mining industry o ers opportunities for personal and professional growth, as it o ers a wide range of opportunities for career growth and advancement. From entry-level positions, to specialised roles in engineering, geology, environmental science, and management, there are various paths to explore and progress in the industry,” she says.

Learn wherever it is possible, and absorb whatever you can during this process

“Furthermore, the mining sector operates on a global scale, providing opportunities to work in di erent countries and experience diverse cultures. This can be particularly appealing to young women who have an interest in travel and exploring new environments.”

In addition, says Osei, the mining sector o ers competitive salaries and benefits, the result of which is that pursuing a career in mining can provide them with the financial stability to support their personal and professional goals.

“Two other good reasons also stand out. The mining industry is embracing technological advancements to improve

e iciency, safety, and sustainability. This presents opportunities for young women to work with cutting-edge technologies such as automation, robotics, remote sensing, and data analytics.

“Secondly, the industry has also recognised the need for greater diversity and inclusion. Most companies are actively working towards increasing the representation of women in their workforce, creating supportive work environments, and promoting equal opportunities for career advancement. These initiatives promise a more balanced and sustainable workplace in the near future,” she says.

www.samining.co.za 20 SA MINING JULY / AUGUST 2023 WOMEN IN MINING

Long perceived as maledominated, the mining sector is slowly changing its gender attitudes. But convincing more women to join the industry remains diffi cult.

By Rodney Weidemann

Keele Letsipa.

Lydia Carroll.

Rosebella Osei.

. –

“ “ ©

–

Carroll

ISTOCK

heyjojo19

ALTERNATIVE PERSPECTIVES

Lydia Carroll, a professional quantity surveyor with 36 years of experience, and currently director for Capital Projects and Infrastructure at PwC Advisory, says it’s important to have more women in this sector, because of the fresh or different perspectives they can bring to a maledominated industry.

“Women, in my view, are definitely more detail-oriented and like to stick to rules. We want to do everything right with no compromise. Women are also more peopleoriented and bring in a softer approach to the working environment,” says Carroll.

She adds that this is important because mining in general is driven by production and the importance of bottom-line revenue, and there are certain instances where the people factor, life/work balance, or even certain rules can easily be compromised.

“Remember that as mothers, sisters, and daughters, family life remains very important, and thus women can add another dimension to the above-mentioned factors. At the same time, don’t be fooled, women are also strong enough to work in diverse teams in the underground, surface infrastructure, maintenance, or other mining environments.”

Keele Letsipa, group manager for Safety, Health and Corporate Facilities at Exxaro Resources, points out that she comes from a mining family and was adamant, after her

family’s experiences, that she would never join the industry. While that vow did not hold, she suggests that one thing helped her achieve the position she now holds.

“For me, mentoring is absolutely critical, and my success I attribute to having three very different mentors, and I would advise young women to follow a similar path. My one mentor was a senior man in the mining sector, who was able to provide me with a male perspective.

“My second mentor was a woman who had succeeded in the industry, which provided me with an example to aspire to and advice on how to achieve this, as she had already made the journey I was on. Finally, my last mentor was actually a peer who I was able to bounce ideas off, the way one might with a big sister,” she says.

PARTING ADVICE

Finally, we asked each for the parting words of advice they would give to those young women who had decided to pursue a career in this industry. Osei says as women, it is important to remember that the journey in the mining industry may have its unique challenges, but also offers incredible opportunities for growth, impact, and fulfilment.

“We therefore have to be confident and stay true to ourselves. We also have to be persistent, and believe in our abilities to make a difference. We should further

embrace diversity and inclusion, to advocate for ourselves and other women and also strive for a healthy work-life balance to ensure that we are building personal relationships, and pursuing interests outside of work that will promote and maintain longterm career satisfaction.”

Carroll says whatever you choose to do as you move forward, the key is to take responsibility for your own career.

“This means learning wherever it is possible, and absorbing whatever you can during this process. Most importantly, always remember to enjoy the road you are travelling, and that small steps ultimately lead to big changes,” she says.

Letsipa says it’s imperative that women wanting to join an industry that has always been dominated by men come to the realisation that career has no gender.

“In other words, you can do whatever you set your mind to, but never apologise for being women. For us to achieve equal and active participation in the economy, it is vital that women play their part in developing this critical sector.

“However, remember to always also be proud of who you are. Working in this industry does not mean you cannot have children or raise a family, and it doesn’t mean you should ever have to apologise for looking beautiful when going to work. You can be a woman and a miner at the same time,” she says.

www.samining.co.za SA MINING JULY / AUGUST 2023 21

©

©

Career has no gender. You can do whatever you set your mind to. – Letsipa –

“ “

ISTOCK –claffra

ISTOCK

Kardasov

HOW JUNIOR MINERS CAN BENEFIT FROM ‘GREEN’ METALS

By Rodney Weidemann

By Rodney Weidemann

The growing climate crisis is driving a rapidly increasing demand for “green” metals, many of which can be found in great quantities across Africa. In fact, ratings agency Standard & Poor’s (S&P) Global indicates that moving forward, many commodity-exporting economies on the continent will see increased demand for minerals such as copper, magnesium, lithium, cobalt, graphite, and rare earth elements.

This surge is to be expected, given the importance of these minerals in lowcarbon energy generation, as well as in the production of electric vehicles (EVs). Clearly, this is a market that presents new opportunities for those junior explorers that are ready to act.

Jason Brewer, CEO of Marula Mining, a junior miner focused on the battery metals space, told delegates at the recent Junior Mining Indaba that there had been tremendous growth in demand for Africa’s “green” commodities.

LARGE LOCAL RESOURCES

“Globally, demand for battery metals is increasing, as the adoption of EVs and renewable energy solutions rises. These metals are essential for the production of rechargeable batteries, which are one

of the vital components of the developing renewable energy system,” he says.

“The availability of these metals will therefore play a major role in shaping the future global economy, and we plan to be part of this. Graphite, copper and lithium are the key components of our focus.”

Brewer points out that Africa’s resources in this respect are large, noting that “when we explore for these commodities, we find them”. He suggests that East and Southern Africa are among the best areas to explore.

He suggests there are tremendous opportunities for juniors on the continent, if they simply focus on grasping the opportunities presented by the current green environment in which we find ourselves.

Explaining how Marula Mining has done it, he points to three particular projects. The first is the Blesberg lithium mine in SA. He says there’s a lot of associated tantalum found here, while the company is also reprocessing existing waste stockpiles for high-grade lithium-bearing spodumene.

“Then, in Tanzania, there is the Kinusi copper mine, where we have found high-grade copper at the surface, with samples sent for analysis. We also have the Nyorinyori graphite mine, where jumbo graphite flakes have been observed, and up to 100% total graphite content is suspected, to be determined by samples that have been sent for analysis.

“In South Africa, there are around 6 000 closed mines that could easily be restarted by juniors and quickly create employment and produce significant earnings for the country. In fact, if such mines existed in Australia, the junior miners there would have already begun reopening and reworking these with new technologies.”

“At the same time, we are also focused on adding value, rather than merely producing a raw product. To this end, we are looking to produce an intermediate product, in the form of lithium carbonate. Marula hopes to produce around 1 000 tonnes of this per year, which sells for around $40 000 per tonne, meaning our annual production run could be worth some $40-million – quite a substantial turnover for a junior.”

www.samining.co.za 22 SA MINING JULY / AUGUST 2023 ENERGY

As global demand for renewable energy solutions rises, the metals that go into such offerings increase in importance and open opportunities for juniors in SA to exploit.

market value of 30 000 tonnes of manganese sulphate

$75-million

THE BENEFICIATION CONUNDRUM

There is another school of thought that suggests junior miners should consider looking at the battery and green energy metals space not just as a mining opportunity, but as a chance to move their own product up the value chain.

A er all, as Brewer points out, you can sell refined product for greater margins than you can with unrefined metal. If a junior undertakes some form of beneficiation of the product they mine, instantly they become part of the broader green economy debate.

Louis Nel, CEO of junior miner the Manganese Metal Company (MMC), told the Indaba that his company was making e orts to beneficiate the manganese it mines, by turning it into high-purity manganese sulphate. He says this is because demand for it is expected to grow exponentially in the coming years, as the need for EV batteries increases.

“So we are expecting a high demand for manganese sulphate going forward, but currently, China dominates the refining capacity in this space. This has led to concerns around a scarcity of this metal in the West, and is why we see a strong future for these high manganese formulations going forward,” he explains.

“A er all, EV and battery manufacturers clearly need certainty of supply, so providing

an alternative, non-China supply of highpurity manganese will help avoid any dependency on a single country. It is worth noting that there are currently only three international producers outside of China – one in the European Union (EU), one in Japan, and our project at MMC.”

He adds that as far as global manganese ore production goes, SA has around 40% of these resources. Thus it is a no-brainer to not only mine and produce manganese, but also to beneficiate it.

“To achieve beneficiation, a plant that can produce around 30 000 tonnes per annum is required. To give an indication of the benefits of improving our mined manganese, 30 000 tonnes of the mined ore generates around $6m in revenue, whereas if the ore is processed into manganese metal, the 10 000 tonnes generated are worth around $42m. This is further dwarfed by the equivalent price of sulphate, which is nearly doubled, at around $75m.”

It should be clear, he explains, that the case for beneficiation is huge, and there are a number of juniors in this space who are looking to set up such plants. There are additional good reasons for SA to undertake such a process, as both the EU and United States have policies focused on resource autonomy, as they seek to be less dependent on China.

In addition, in these regions, permitting can be a long and time-consuming process, while their citizens’ mindset of “not in my backyard” can further complicate project implementation. Finally, he notes that local opposition and environmental issues can further complicate and delay such projects, while increasing costs even more.

“This is why MMC has chosen a route to high-purity manganese sulphate that is lowrisk, while providing an alternative to China. We have begun the process and are busy with the detailed design for a small, brownfields plant at our existing Nelspruit site.

“We are working on getting the chemistry right, and will then start feasibility studies, with a view to beginning work later this year, and having a completed beneficiation facility by some time next year,” he says.

www.samining.co.za SA MINING JULY / AUGUST 2023 23

market value of mined ore when converted to manganese metal

$42-million

© ISTOCK –Kerkez © ISTOCK –mady70

© ISTOCK –artiemedvedev

Demand for battery metals is increasing.

SUSTAINABILITY AND SAFETY IN THE EXPLOSIVES INDUSTRY

Explosives remain important components of day-to-day mining practices, as they have been for decades. However, in a world where the commitment to environmental, social and governance (ESG) practices is more crucial than ever, explosives manufacturers are now seeking more sustainable ways of conducting their business.

According to Enaex Africa’s CEO Francisco Baudrand, the Enaex Group has always maintained a focus on the principle of “safety first”. He says the Chilean-based group has 100 years of history, and is the third largest explosives group in the world – with Enaex Africa considered an important subsidiary.

“Safety first is built into the culture of the organisation, and is key to our focus on humanising mining. To this end, we have developed tele-operated mobile mixing units (MMUs) for opencast mining.

“Remember that when we talk sustainability, we understand that safety is a critical part of this. Thus these tele-operated

units help us to remove people from the danger zone and improve their quality of life through better working conditions,” he says.

He notes that the company’s “safety first” culture goes beyond the norm, as Enaex Africa drives the message home to sta that safety is not only about being careful in the workplace, but also about being conscious and always considering safety at home.

“It is about inculcating a safety culture so that it becomes part of what you do and is habitual. This creates a successful culture and encourages safety as standard practice in all aspects of our people’s lives.”

The other benefit of such an approach, he says, is that by implementing the teleoperation of MMUs, “our employees then also have to be upskilled, so not only are they being made safer, but they are also improving their capabilities”.

Baudrand says the company has also undertaken successful trials of 100% teleoperated blasts in an underground context. This can be challenging in SA, where many mineral seams are “narrow reefs”.

Conditions in these unusual geological occurrences can be especially tough and unsafe. This is why Enaex has partnered with a local university to develop robotics specifically for dealing with narrow reefs.

TECHNOLOGY, COMPLIANCE AND ACCOUNTABILITY

“We have also introduced a locally produced electronic detonator system that enables users to programme blasting sequences in a way that minimises vibrations. Once again, this has a positive impact on the surrounding communities, which are o en negatively a ected by such vibrations. In addition, it increases both the reliability of the blasting and the quality of the rock fragmentation,” he says.

“Predictability is very important in blasting, as this provides an assurance of safety, as well as accurately executed operations. We use innovation – in the form of our MMUs – and robotics to enable this level of predictability. In the future, we aim to leverage autonomous vehicles and artificial

www.samining.co.za 24 SA MINING JULY / AUGUST 2023 EXPLOSIVES CORPORATE PROFILE

Enaex Africa believes that safety and sustainability are vital for an industry that can have such a massive impact on the communities surrounding mines where its products are used.

Enaex has started its own bulk emulsion plant in Secunda for a secure supply chain.

intelligence to improve predictability even further.”

With higher levels of predictability, you are able to determine your blasting times and patterns more accurately, he explains, adding that Enaex wants to create a system that is 100% smart in this regard.

“Another solution we have introduced is known as plasma technology, which is a nonexplosive product designed to deliver a blast in a niche area. So, for example, if a blast is required close to the processing plant, you would use plasma, as it creates almost no vibration, and the required safe distance is only 50m, compared to the standard 500m for regular explosives.”

He notes that since this is a highly regulated industry, compliance is critical. To this end, Enaex utilises a safety, health and environment team to ensure that all operations are driven forward with absolute excellence – both in the mine environment and in the actual production of the explosives.

“Enaex doesn’t only want to implement

Gary Alfonso speaks to CEO of Enaex Africa, Francisco Baudrand about the company’s plans to embrace Artificial Intelligence, while also looking into incorporating sustainability within the organisation’s strategic objective. https://youtu.be/2U0RMa_6bko

sustainable practices, but to continuously improve on them as it conducts operations, production and training.” He adds that they monitor and measure key performance indicators to further ensure accountability.

“We use the Dow Jones Sustainability Index as our benchmark, and have done so since 2016. Enaex is ranked in the top 10% of chemical industries globally, and since the index focuses on accurate reporting and good practices, it clearly demonstrates our considerable sustainability credentials,” he notes.

Through the company’s awareness, and implementation, of the correct processes, it has been able to lower the instances of danger from its products. Crucial to this is the joint venture between Enaex and Sasol – Enaex has acquired 51% of the Sasol explosives business – that allows the company to blend the best of both organisations’ approaches and processes to achieve superior levels of safety.

“The JV with Sasol has been in place since July 2020, and in April this year we obtained

CSI EQUALS SUSTAINABILITY

Baudrand says Enaex Africa has three strong pillars to its corporate social investment (CSI) programme.

“Firstly, we collaborate and work in the communities where our production facilities are situated. Secondly, we look a er the communities that surround our customers, since many of them work in the mines themselves.”

He suggests that the third component of this strategy goes beyond traditional CSI. Here, Enaex has placed a key focus on education and early childhood development.

The company targets those communities that are not supported by other industries.

“For example, we have identified an early childhood development centre in Limpopo with 90 children aged between 10 months and five years, and aim to ensure they have the right levels of nutrition and learning opportunities to enable them to grow and develop properly.

“In addition, we have improved the infrastructure – upgrading it from pit toilets – as well as doubling its capacity, implementing solar energy and borehole water to get them o the grid, and even a playground for the children.

“This project includes upskilling the teachers and delivering some technology to the centre. The impact this has had is enormously positive on the children, the school, and the surrounding community. For us, this is just as crucial as any other work we do, as this focus is all about building an educated and skilled population for the future.”

our BBBEE Level 2 compliance certification. This, we feel, is a true reflection of the transversal and transparent manner in which we are working to benefit the nation, its people, and the industry, and demonstrates our true commitment to sustainability in SA,” says Baudrand.

www.samining.co.za SA MINING JULY / AUGUST 2023 25

“ “

It is about inculcating a safety culture so that it becomes part of what you do and is habitual

.

Francisco Baudrand.

Enaex completed the initiative of building and supporting an early childhood development school.

Business Spotlight – Enaex Africa’s plans to embrace Artificial Intelligence

Enaex’s plasma technology is nonexplosive, safe and sustainable.

WATCH:

SCAN HERE

BOOSTING THE DOWNSTREAM

By Rodney Weidemann

ISTOCK

There is little doubt that the digitisation of the mining industry is delivering huge benefits to the industry. New digital tools and quality electronics are making mining, in particular the blasting and explosives arena, more e icient and less carbon-intensive.

More e icient, higher quality blasts ensure better fragmentation, so that less energy is consumed in downstream stages like loading, hauling, crushing and milling. More crucially, less energy directly results in lower carbon emissions when coal- or dieselfired electricity is used. At the same time, larger blasts mean fewer mine stoppages, allowing a more streamlined mining process.

According to Ralf Hennecke, managing director at explosives manufacturer BME, one of the challenges, in terms of negative impacts, of blasting in opencast mines and quarries are ground vibrations coupled to the risk of fly-rock, not to mention noise and dust creation.

“Fortunately, blasting technology has evolved considerably in recent decades, allowing blasting to be much more controlled. BME’s sustainability contribution takes place on various levels.

“In the manufacture, transport, storage, and application of our explosives, we follow strict environmental policies that ensure no negative impacts in our supply chain. Even

in our production facilities, we are moving towards renewable energy to lower the carbon footprint of our operations,” he says.

“Perhaps the most important impact, though, is reducing the energy requirements of our customers – the mines themselves. By facilitating quality blasts, we streamline the loading, hauling and processing phases of mines, through achieving the right fragmentation of rock. This cuts energy consumption and hence carbon emissions at mine level, a growing strategic imperative for the sector.”

GREEN EMULSIONS

Hennecke notes that blasting is a fundamental part of the mining process, and a quality blast will generate predictable consistency, muck piles, and dilution. This makes everything easier, from digging to crushing. In contrast, a poor blast generates pain points throughout the production chain.

“An important innovation in BME’s emulsion explosives is the incorporation of used oil as a fuel agent, which makes for a greener product and protects the natural environment from contamination. Used oil presents a risk to both water and land, if it is not disposed of in a responsible way,” he says.

BME has developed not only the technology to use this waste product in its explosives, continues Hennecke, but also

provides a valuable and highly controlled used oil collection service for its customers and other oil users.