18 minute read

Kal Tire at the forefront of innovation

KAL TIRE

at the forefront of customer service and innovation

By Nelendhre Moodley

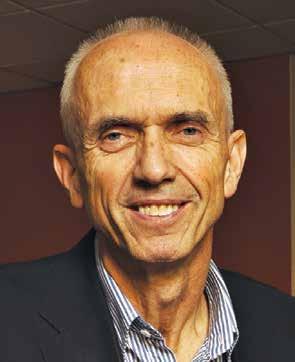

Health, safety and environmental issues continue to take front and centre stage at boardrooms and mine sites across the globe. As such, the tyre market is evolving in line with customer needs and industry requirements, says Kal Tire’s Mining Tire

Group, VP Southern Africa, John Martin.

SA Mining recently caught up with Martin to chat about the key elements driving industry change.

THE TYRE MARKET IS ESSENTIAL IN DRIVING THE GLOBAL ECONOMY. WHAT ARE SOME OF THE KEY GLOBAL AND LOCAL FACTORS IMPACTING THE SECTOR?

We have a sense from our customers that environmental stewardship and corporate social responsibility are gaining a great deal of attention – both in boardrooms and at the mine locations. Although mines have always had a key focus on safety, this notion of widening that attention is quite evident.

We see for example some customers focusing more on environmental, social and governance, which drives investment and development of new technology or innovations. This is not only to make jobs and tasks easier and safer, but to support our customers’ commitment to the environment, complement their social standing with mining communities and underpin their organisational governance.

HOW IS THE SECTOR RESPONDING TO EXTERNAL IMPACTS, AND WHAT MEASURES HAVE BEEN PUT IN PLACE?

We see tyre manufacturers – who normally work closely with original equipment manufacturers’ (OEMs) product portfolios – work on ways they can change the tyre construction or performance to match the new demands of automated or electrified fleets.

Stresses and wear characteristics will undoubtedly change the dynamics of tyre wear and performance, and the tyre itself needs to be able to be matched to the duty cycles.

Additionally, we are seeing more of a holistic approach to linking things together from a data collection perspective. So the machine sends data through sensors, and we include information from the tyre (heat, temperature, pressure) and add details about locations (GPS tracking) and even operating context (weather patterns, etc.).

Taken all in combination, we can learn things about relationships that were di icult to determine before.

For ourselves, we are keeping abreast of technological changes and innovations on a regular basis. We are having more involvement with OEMs and even third party data collection sources or aggregators. An organisation – even a tyre service provider – that is not taking notice of this fundamental shi from reactive service to predicative analytics will find themselves minimising their impact on the value chain over time. It is not easy, and it is quite new for us, but we feel it is well worth the e orts.

John Martin.

HOW DID THE TYRE MARKET PERFORM IN 2020 AND UP TO MAY 2021?

Tyre manufacturers have for the most part performed reasonably well over the 2020/21 period. COVID has unfortunately forced a slump in the sale of light vehicles. However the demand for mining tyres has remained relatively robust, stemming primarily from increased mining activity in the face of favourable pricing development in global commodities. >

The tyre industry is however not without its challenges. It’s currently under severe pricing pressure through the unprecedented increases in the pricing of tyre products, as well as the fourfold increases in ocean-going freight.

Kal Tire’s performance through 2020 and year to date 2021 has been strong and favourable, due to our very close alignment to the mining industry and its principal players, as well as the close cooperation with our selected manufacturing partners.

While we have been warned of potential supply constraints for giant o -the-road (OTR) tyres, fortunately that has not materialised to a ect the industry.

WHAT NEW DEVELOPMENTS ARE UNDER WAY AT KAL TIRE TO ENSURE THAT INDUSTRY REMAINS PRODUCTIVE AND TICKING?

The core principle behind all Kal Tire’s innovations is that what we develop should have a twofold e ect on operations. The innovation should reduce risk and improve the operational e iciency.

Our award-winning Gravity Assist System (GAS) is a prime example of this philosophy. It is designed in a manner that allows the technician to e ortlessly handle and use very heavy torque tools, while further reducing health and safety risks, such as pinched hands and fingers, general fatigue, and muscle strain.

Kal Tire will continue to innovate new and value-generating solutions, as part of our core competencies and functions. New riskreducing and productivity-enhancing tools will be released to the market in September 2021.

The ongoing evolution of Kal Tire’s proprietary Tire Operations Management System (TOMS) continues to deliver new functionality. TOMS is the most advanced management system for OTR tyres that positively impacts productivity, tyre life and safety.

Focused on fleet productivity and accessible, near-live reports, TOMS gives the visibility for planned and predictive maintenance and thus enables informed, real-time decisions. With instant, visual communication between the entire fleet planning team, more tyre work can be performed while trucks are simultaneously down for maintenance.

Kal Tire continues to deliver strong performance.

Tyre manufacturers are aligning tyre“ “ construction to new demands of automated or electrified fleets. – Martin

HOW IS THE INDUSTRY HANDLING THE DISPOSAL OF WASTE TYRES?

One of the biggest environmental challenges South Africa has been grappling with for many years, and which remains a significant challenge and concern, is the ethical disposal of waste tyres. Mining customers are desperate to roll out their environmental stewardship obligations . However a fully functional waste tyre management plan is urgently needed, to allow our mine owners to exercise their obligations.

An e ective tyre abatement plan that serves all industries that generate waste tyres, and more specifically for the mining industry, is urgently needed. No facilities are currently available in South Africa that can e ectively and ethically recycle the large stockpiles of waste mining tyres that the industry has generated over many years of stockpiling.

Kal Tire has invested heavily in OTR recycling technology, which we call thermal conversion, which is specifically designed to cater for the recycling of ultra-large mining tyres. A proven and functional recycling facility is already installed in the La Negra district of Chile, which by design returns waste tyres into the original basic components used for tyre manufacturing, fully supporting the development of a circular economy, in the most environmentally friendly manner possible.

Existing technology of this nature can do extremely well for many of the established mining locations around South Africa, to reduce the many stockpiles of mining tyres that are causing ongoing environmental, health and safety risks.

THE MINING SECTOR IN AFRICA AND SOUTH AFRICA SEEMS TO BE BENEFITING FROM HIGH COMMODITY PRICES. HAS THIS IN ANY WAY TRANSLATED TO INCREASED BUSINESS FROM THE MINING SECTOR FOR KAL TIRE?

Africa remains the one continent that is relatively unexplored, and continues to deliver several world-class mining projects, as exploration continues to grow on the continent. We are experiencing some consolidation of mining operations, as mining houses look to take advantage of the buoyant commodity prices.

Growth opportunities certainly exist on the continent, in both brownfield and greenfield expansions, which is driving demand for additional services and products. The buoyant market has certainly brought about some stability into a market that was threatened by COVID-induced uncertainties a year ago.

Kal Tire will continue to leverage our regional infrastructure as well as our broad width of services and product o erings to serve our existing customer base, and be well placed to expand into the greenfield and brownfield expansions.

These growth opportunities are necessitating new investment in additional infrastructure and service capacity, in locations that place Kal Tire’s service capabilities geographically closer to any new operations. ■

If its not INVAL, it’s not Invincible

© ISTOCK – michaeljung

The gradual increase of women in the maritime logistics sector has seen just over 1 300 more women joining Transnet Port Terminals (TPT) in the past six years alone. Predominantly a male-dominated industry, the rise in woman engineers, artisans and operators places the representation of women at 31% of the total employee population, which is currently at 9 735, the company says.

“We have passed the age of ring-fencing so er positions for women because women have proven competent enough to land positions across business disciplines and trades based on acquired skills and merit – and despite presenting challenges, they have performed exceptionally,” says general manager of people management at TPT Caroline Mayeza.

With a cumulative spend of R263-million on women’s development programmes over the same six-year period, TPT has been implementing seven development initiatives including two with international immersion.

According to Mayeza, this is to ensure that there is a pipeline of woman leaders in the business across technical, operations, support functions and leadership. The overall TPT target for women’s representation is 35%, a figure that Mayeza believes will ensure the success of the transformational agenda.

TRANSNET INCREASES UPTAKE OF WOMEN SANDVIK RELOCATES TO NEW FACILITIES Engineering group Sandvik Mining and Rock Solutions has moved its South African headquarters to new, purposedesigned premises in Kempton Park near Johannesburg. According to Simon Andrews, managing director at Sandvik South Africa, the state-of-the-art Khomanani facility includes three large workshop areas and o ice space on a 62 000m2 site. “The technical synergies of the workshops add to our commitment and capacity for local production that meets global quality requirements.” Two of the workshops are dedicated to refurbishment and rebuilding of local equipment for the Southern African region – mainly Botswana, Namibia and South Africa. This is where new standard-format equipment is configured for local use – typically including features like safety systems, lighting, toe-hitches and decals to customer specifications. “Our remanufacturing facility allows us to completely rebuild machines to original equipment manufacturer standards, including the sub-assembly refurbishments on transmissions, axles, di erential and pump motors,” he says.

O ering more drive options to meet the global mining industry’s needs, the new Cat 6040 Hydraulic Mining Shovel features an added engine configuration that meets US EPA Tier 4 Final and EU Stage V emission standards.

The new configuration includes two fuel-e icient Cat C32 engines, o ering a total gross power rating of 1 550kW (2 079hp).

Optimising machine uptime and lowering operating costs, the engine package includes maintenance-free diesel oxidation catalysts (DOC) and does not require diesel exhaust fluid (DEF)/ AdBlue or diesel particulate filters (DPF), says the company.

NOW CARBON NEUTRAL THROUGH ENERGY EFFICIENT MANUFACTURING, SUSTAINABLE PACKAGING AND NATURE-BASED CARBON CREDITS.

SOUTH AFRICAN MINING

AND COMMODITY PRICE REVIEW

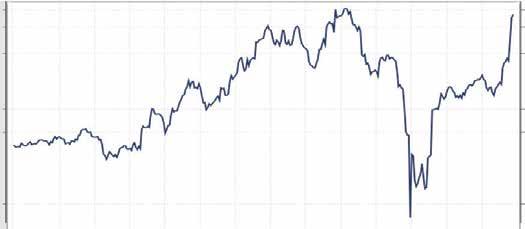

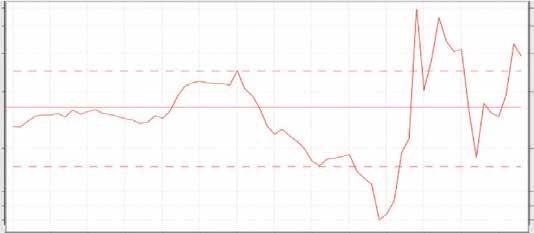

Eight months into 2021 – the year of fabulous commodity prices for South African mining companies – and with just four months remaining, what can mining investors and participants look forward to for the rest of the year? Mining companies the world over seldom have had it this good. Earnings per share in dollars for the South African Resource Index (RESI 10), which tracks the market cap of the resource companies listed on the JSE, are now at all-time highs in nominal terms, as are South Africa’s receipts for commodity export earnings (which could be as high as $55-billion in 2021). Interestingly, the RESI 10 share prices are not at all-time highs; not even close. In 2007, 2008 and 2011 South African mining companies’ share prices were 60% higher on the same earnings they have today. And for once we can’t blame all of that poor valuation on South

Africa alone, because most of the RESI 10 companies now operate outside of SA. Still – crime, corruption, mayhem and service collapse in the country are as bad as ever, and yes, the Department of

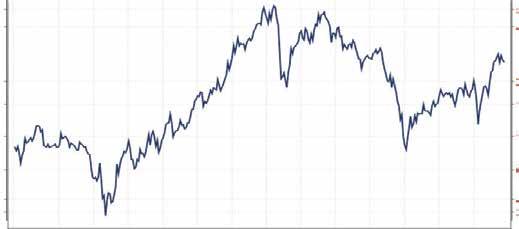

Mineral Resources and Energy (DMRE) and the government in general are as di icult and dysfunctional as ever. (Although we may be finally getting to a sustainable bottom on those last two, with some flickers of light now visible in the 20-year tunnel of darkness.) Commodity prices today, on the whole, do seem to have finally le their insane (in many cases) price levels behind them. Iron ore is now $145/tonne, down from $235/t in early May.

Rhodium is $17 300/oz a er being nearly $30 000/oz from

March through to May. Palladium and platinum are currently at $2 400/oz and $1 000/oz respectively a er hitting $3 000/oz and $1 300/ oz in May. But like gold today at 3 $1 830/oz (down from $2 050 a year ago), these are all still great prices for local producers. And South Africa’s nonferrous bulk commodities – coal, heavy mineral sands and base metals – seem to be holding at their current “decadehigh” price levels. Export coal is over $100/t, copper at $9 400/t and tin at $34 300/t. Ilmenite is at $380/t and zircon and rutile are both over $2 000/t. Fantastic prices indeed. So while share prices are discounting falling metal prices, the fact that SA’s producers are still on 10-year-high margins bodes well for dividend receipts for investors, rising co ers for company balance sheets and great revenue and tax receipts for South Africa’s greatly in-

need government and economy. Unfortunately, it is South Africa Inc that is mainly responsible for revenue flows being far less than they should be for all these commodities and others. Coal exports alone are $1bn less than they would © Robert Tshabalala @ Financial Mail have been under normal rail conditions. Iron ore receipts are more than $1bn less than they should have been and manganese and chrome are less too. But the fact is South Africa’s decrepit, underinvested, under-maintained and constantly undersiege infrastructure is now a serious bottleneck on the whole country – and not just the mining companies. Only belatedly is government waking Peter Major up to this fact. The worry is it will probably be years before government has an implementable solution Mergence Corporate – which is way too late for most mining company Solutions Director: Mining investors, and too late for much of South Africa’s very needy population. Shortfalls due to degraded and under-siege railroad capacity of up to 10mt of export coal at $100/t and +5mt of iron ore at $200/t are leaving huge gaps in companies and South Africa’s income statement. Iron ore prices for South Africa have averaged over $200/t this year compared to $85/t in real terms Iron Ore $ ton real 62% Fe fines for the past 65 years. What a 240 MEAN = 84.9055 Std.Dev. = 39.5124 240 waste! 200 200 These are once-in-a-century 150 150 missed opportunities that South 100 100 Africa is not able to capitalise on, to its own detriment (and to its 55 55 competitors’ advantage). Platinum/PGM producers don’t 35 30 35 30 have the logistical constraints of 26 iron ore, coal, manganese and chrome producers. But they are 5 000 4 000 RESI in $ 5 000 4 000 constrained by Eskom’s power shortages and regular community and literal gang and mafiosi 2 000 2 000 groups and demands. 1 500 1 500 Eskom is a serious constraint 1 000 1 000 on all local mining and logistics; but especially for the precious 650 650 metal mines: Eskom is their heart 450 380 450 and lungs. Electricity constraints ‘95 equal mining and refining 3.9 RESI eps in $ US 3.9 constraints, and days and revenue lost. These can never be 3 regained. 2 2 South Africa and South African mining were horribly hit by the 0.85 0.85 COVID virus and subsequent 0.6 0.6 lockdowns and greatly reduced economic activity. But the sky0.2 0.2 high metal prices and demand that followed in April 2020, ‘95 and are continuing today, have provided a hugely unexpected, large and welcome bonanza. Government, especially the DMRE, should realise this is just a temporary reprieve for South Africa’s beleaguered mining industry. They must use this rare opportunity to devise and implement some mining investor-friendly policies, before all these commodity prices return to their long-term averages and lower. ■

‘97 ‘97 ‘99 ‘99 ‘01 ‘01 ‘03 ‘03 ‘05 ‘05 ‘07 ‘07 ‘09 ‘09 ‘11 ‘11 ‘13 ‘13 ‘15 ‘15 ‘17 ‘17 ‘19 ‘19 ‘21 ‘21

‘58 ‘63 ‘68 ‘73 ‘78 ‘83 ‘88 ‘93 ‘98 ‘03 ‘08 ‘13 ‘18 380

26

TO ADVERTISE IN www.samining.co.za SAMIN NG MIN NG

READ WHAT REALLY GOES DOWN IN SADC

CONTACT

ADVERTISING Ilonka Moolman 011 280 3120 moolmani@samining.co.za

INDEX TO ADVERTISERS

AECI Mining Explosives ................................................................. OBC Air Liquide Industries ......................................................................... 35 Bara Consulting ................................................................................. 19 BLC Plant Company ........................................................................ IBC Bosch Diesel Service ....................................................................... IFC Brelko Conveyor Systems ................................................................. 43 Gates SARL .......................................................................................... 7 Hikvision ............................................................................................. 31 Invincible Valves................................................................................. 39 Kal Tire ............................................................................................... 37 Keller Netherlands ............................................................................... 3 Komatsu Mining ................................................................................. 11 NSDV .................................................................................................. 25 Rand Merchant Bank ........................................................................... 5 Shell Lubricants ................................................................................. 41 Thungela Resources .....................................................................12-14 UMS .................................................................................................... 21 Vendel Equipment Sales .................................................................... 44

NEW PRODUCT

BRELKO NIP GUARD SAFETY DEVICE

PATENTED

APPLICATIONS • Nip Guards improve worker safety around head, tail, and drive pulleys and prevents worker exposure to conveyor pulley nip points and pinch point hazards.

BRELKO

CONVEYOR PRODUCTS

FEATURES • Easy installation. • Low maintenance. • Simple design. • Operates in all conditions. • Manufactured according to SABS, CEMA,

Australian and PROK mounting standards. • Unique adjustable guard maintains a constant gap between the conveyor belt and guard, even when the conveyor belt is tensioned. • Robust construction for longer life. • Can be installed on bi-directional conveyor belts.

VENDEL EQUIPMENT SALES (PTY) LTD T/A ASSOCIATED EQUIPMENT

PO BOX 3716, HONEYDEW, 2040 TELEPHONE: +27(11) 801 4911/2 REG. NO: 2013/000179/07 E-MAIL: vendels@mweb.co.za ANTON - CELL +27 (0) 082 923 5397 OFFICE – CELL +27(0) 83 626 5588 JAAP - CELL +27 (0)82 892 1327 LORAINE - CELL +27 (0)76 021 4344

Plot 92 Indaba Lane – Off Beyers Naude, Rietfontein, Roodepoort FAX: +27 (0)11 801 4914 E-MAIL: associatedloraine@xnet.co.za

We are buyers for your good Running Redundant Equipment

1 x 2013 Caterpillar 950H FEL 2 x 2014 Sem 668C Front end loaders 1 x 2013 JCB 456 ZX Front end Loader 1 x 2011 Bell 1806E Front end loader

1 x 2016 Doosan DX62R-3 Mini Excavator 1 x 2013 Wacker 50Z3 Mini Excavator

2 x 2014,2016 Hamm 3520 SDR 2 x 2018 Hamm 3411 SDR’S 1 x Hamm HD120 SD Roller

Ham HD120 Smooth Drum Roller

3 x 2013/2014/2015 Volvo A40F ADT’S 2 x Cat 140H Motor Grader with Ripper 1 x Caterpillar 140G Motor Grader 1 x Komatsu GD650 Grader with ripper 1 x Cheng Gong MG2320B Grader with ripper and cat 3306 engine

5 x 2021 New / Unused Case 851EX 4x4 Magnum TLB ‘s

1 X Etnyre K Chip Spreader’s Refurbished, mechanical 1 x Gallion 10 Ton Crane

1 x 2017 Case 570T 4x4 TLB

1 x Caterpillar 725 Water Tanker– 23000 LT 3 x 2021 New / Unused Cat 323D3 Excavators 1 x 2016 Doosan DX62R-3 1 x 2013 Wacker Neuson 50Z3

1 x 2018 Kamaz 65222 6x6 15M³ Tipper 1 x 2016 F. A. W 10M³ Truck 1 x 2004 Terex TA30 6x6 Dumptruck

1 x Dynapac R 3 Point Steel Rolle-13 Ton 1 x Bomag BW212 Smooth drum Roller

1 x 2010 Cat 336D Excavator

1 x Scania P380 Water Tanker – 16000 LT 1 x2016 JCB 540-140 Telehandler 1 x 2015 JCB 535-140 Telehandler 1 x 2014 JCB 535-125 Telehandler 2x 2010/11 JCB 535-140 Telelhandelers

2 X 2008 Hamm GRW18 PTR’s 1 x Caterpillar PF300C 7 PTR 1 x Hamm GRW15 Pneumatic Roller 1 x Ingersoll Rand –PTR 27 Ton

2 x 2021 New / Unused Cat 320D3 Excavators

1 x Tata 813 EX2 Truck

1 X Broce Broom