Grocery retail is continuously evolving, adapting to thrive in an ever-changing global economy. Emerging trends, new technologies, and listening to consumer demands remain the pillars driving all other responses.

Continuous improvement and innovation are essential; longevity is not a given, even if you have been in the market for decades.

In this global edition, we have looked at retailer and supplier operations, trends, innovations, and how the world of NPD is shrinking. We also asked some industry experts to share their thoughts on what the drivers are for today's suppliers and retailers and how emerging suppliers and independent retailers are challenging the bigger players.

Technology has fundamentally altered the way we shop. E-commerce, mobile apps, and online delivery services have changed the grocery game. E-commerce is how emerging suppliers try to break into the market, using tech, innovative brand advertising and marketing to reach consumers and

encourage direct engagement with their brands. It has rapidly become essential to global retail, transforming how goods are bought and sold and with over five billion internet users worldwide, online shopping continues to grow steadily. In 2024, retail e-commerce sales are projected to surpass $6.3 trillion, with the growth trend set to continue.

DTC offerings are still growing steadily. In some countries, few majors are dabbling in this offering and have yet to launch hard advertising and marketing campaigns to drive the concept. This holdback may be because they have the tech ready but are unwilling to drive hard in this area, particularly if they have

strong retail brands on shelf. Two categories that globally are doing well in offering DTC subscription services are baby food and pet food. Looking at pet food DTC subscriptions, it is a thriving category. Consumers choose the products they need and the delivery cycle; the choice online far outweighs anything a supermarket offers. Personalisation also helps, as each delivery can be addressed to the pet with owners setting up a pet profile, listing favourite foods and additional treat items.

If you haven't hopped on the DTC subscription bandwagon yet, you're missing out on the opportunity to enjoy monthly recurring revenue and the chance to build a fantastic customer base. For brick-and-mortar locations, in-store subscriptions are probably the number one growth revenue opportunity for their business — whether they know it or not. For brand owners, it is an opportunity to build brand support and customer engagement and to develop additional products only available through the DTC option.

Consumers are stressed in a fast-paced world, dealing with financial challenges many have not seen before. They value convenience and time-saving more than ever. Also, the joy of receiving a parcel each monthit is almost a gift!

Demographics play a significant role in the grocery industry. We've seen changes in consumer preferences, such as the demand for organic, locally sourced, and sustainable products. Retailers are leveraging this by building close relationships with local suppliers. Being agile and responsive to a community's tastes can be advantageous, particularly to smaller independents.

The grocery industry relies heavily on global supply chains, and geopolitical tensions and trade disputes can disrupt these chains. Operators dealing with product shortages and price fluctuations may find the answer is to look local.

Diversifying suppliers and having contingency plans for emergencies can help mitigate geopolitical risks.

The pandemic accelerated the popularity of food delivery and prepared meals. Tapping into this trend is a wave of ready meals, from budget to gourmet. Suppliers are expanding into this category to increase sales, offering ready-to-eat meals to meal kits, partnering with food delivery services, or collaborating with other brands.

It's all social platforms, as brands try to build brand awareness; however, social platforms do not deliver customer loyalty. As the global economy transforms, community engagement remains a powerful tool. Retailers and suppliers who are building their community of loyal customers are using a variety of tools to engage and convert.

Consumers want to shop where they feel connected and buy brands that anchor that connection. n

Food and Grocery Council is an industry association for grocery suppliers providing members networking, events, industry information and strong advocacy. Contact us for information on the benefits of membership: raewyn.bleakley@fgc.org.nz

Networking • Industry Updates

Conference and Events

Education and Training

PUBLISHER Tania Walters

EDITORIAL DIRECTOR Sarah Mitchell

EDITOR-IN-CHIEF Caitlan Mitchell

EDITORIAL

Sam Francks, Jenelle Sequeira SENIOR

Andrew Hayward is Four Square Red Beach's new owner and operator.

Two Bay of Plenty food rescue organisations, Chrome Collective and Good Neighbour, have received a $10,000 donation from Foodstuffs North Island.

According to Love Food Hate Waste NZ, over 12,901 tonnes of perfectly good-to-eat leftovers, including roast chicken, rice, and wilted green vegetables, end up in households' bins every year.

Online shopping has firmly established its place in Australian and New Zealand retail.

After one of the strongest starts to the 2024 season, Zespri is now in the midst of the summer fruit season, which traditionally sees more competition.

The Wellington High Court has penalised Foodstuffs North Island NZD $3.25 million for lodging anti-competitive land covenants with the purpose of blocking competitors.

Te Mata Exports, a leading New Zealand fresh produce export business, today announced the retirement of its founding director, Murray Tait.

The Infometrics-Foodstuffs New Zealand Grocery Supplier Cost Index has indicated an increase of 2.4 percent.

Justice Radich released the reasons for his decision in the case brought by the Commerce Commission against Foodstuffs.

Major supermarket chains across New Zealand have been challenged by the Grocery Commission to improve refund policies.

Granarolo New Zealand Ltd

6 Farmhouse Lane, St Johns, Auckland 1072 09 551 7410

info@granarolo.co.nz

New Zealand Food Safety (NZFS) has supported The Little Bone Broth Company in recalling all batches and dates of its bone broths.

Braedan and Rebecca Trompetter have been settling into life in Invercargill after taking over as the new owner and operator of New World Elles Road.

Meadow Mushrooms

Meadow Mushrooms is rolling out new premium packs for its grocery range that provide greater protection for the mushrooms as well as being more sustainable.

The new 200g and 400g eco punnets are made from 100% rPET plastic that are recyclable in New Zealand via kerbside recycling. The peelable lid of the smaller SKUs and flow-wrap of the larger SKUs are both recyclable via soft plastic recycling at participating stores.

The more robust and protective packaging format replaces the old 200g cardboard trays that were wrapped in cling film and the 400g bags, ensuring greater product quality for the mushrooms. The freshness protection also means there is less food waste.

“We have been trialing our new packaging format over the past two years and well as carrying out a full life cycle assessment of all potential options,” says Meadow Mushrooms CEO Todd Grave.

“We are proud that the new format we have landed on delivers a 20% lower carbon emission profile and better circularity than all alternatives we looked at, including the old cardboard trays. No longer using the trays means we no longer need to use cling film, which complies with the PVC film ban

Introducing our latest seasoning from the Rum and Que kitchen – Homegrown. Crafted from native herbs and spices from Aotearoa. This seasoning is a blend of premium herbs and spices, that will elevate any dish. Backed with a heavy hitting seasoning blend, we have incorporated Horopito, Kawakawa, Thyme and Rosemary to bring this herbaceous blend to life. We have carefully selected each ingredient to ensure a perfect balance of smoky, savoury, and aromatic notes.

This product also profiles each of our 7 National Butchery team members from The Hellers Sharp Blacks. These are a collectable set with 7 in the series. If anyone collects all 7 cans, they simply go to our website: www.rumandque.com and enter the unique codes on each can for their chance to win over $5000 worth of prizes delivered to their door early next year. 100% of proceeds go directly to the team so they can compete in Paris next year.

coming into place next year.”

The new packs have the added benefit of better in-store presentation, which is important for grocery retailers.

Trials of the new packaging took place in 2022 and 2023 and with successful results, the new formats are now rolling out in stores nationwide.

Meadow Mushrooms is a familyowned business which has proudly grown mushrooms for more than 50 years. Specialist growers, harvesters and packers work year-round to produce the freshest, highest quality mushrooms from its vertical farming system based in Christchurch's Hornby and second location in Dunsandel.

Sustainably farmed, and with a 5-star health rating, Meadow Mushrooms are naturally packed full of B vitamins and selenium to help boost immunity and energy, as well as support growth and brain function.

Quick and easy to add taste and texture to a range of dishes, mushrooms are also a value-for-money option to make meals go further or as an alternative to meat.

"We're feeling really excited about bringing a higher level of quality and a higher level of sustainability to our consumers and for Kiwis to continue to enjoy all the wonderful benefits of our mushrooms,” says Grave.

Hooleys

Hooleys has launched waves in three new flavours, original salted, salt and vinegar and barbecue. These Hooleys Waves are light and crunchy with bold, exciting flavours.

Alderson NZ

Aldersons NZ's new hot sauce line was successfully launched recently. Its Blueberry Reaper sauce had a particularly effective production run, and other exciting new varieties in the pipeline. Many may recall that Aldersons NZ's acclaimed Blueberry and Carolina Reaper sauce has received numerous inquiries and requests. In response to customer feedback and demand, the brand has announced rereleasing this sought-after product.

Pams

Pams Hollandaise Sauce has been a staple in New Zealand kitchens for more than 80 years, making it a trusted choice for high-quality products at affordable prices. One of the key highlights of Pam's Hollandaise Sauce is that it contains no artificial colours or flavours, ensuring a more natural and authentic taste.

Selaks

In August the newest Selaks Origins Breeze 5% offering will hit the shelves. It combines a fusion of tradition and innovation by embracing the Piquette method of rescuing already pressed winemaking grapes, and caters to those seeking lower-alcohol options. The result is smooth-drinking, bursting with flavour and, at 5% ABV, there are just 3 standard drinks in a 750ml bottle.

Selaks' winemakers have masterfully crafted each bottle to ensure that the vibrant flavours associated with the brand remain. The range includes a crisp Piquette from Marlborough Sauvignon Blanc, a summer berry-infused Piquette Rosé, and a vibrant Piquette from Pinot Gris.

Selaks | Devoted To Taste www.selaks.co.nz 0800 662 456 @selakswinesnz facebook.com/SelaksWines

Powerade

A limited-edition sports drink collaboration with this year’s Olympic Games, Powerade ION4 Gold Crush is scientifically formulated to replace electrolytes lost in sweat. It contains ION4 electrolytes: Sodium, Potassium, Calcium, and Magnesium.

Moana New Zealand

Discover our high-protein ready-to-eat meals! With five tasty flavours to choose from, these meals are ready in just 3 minutes and require no refrigeration. Each pouch is packed with meat, sauce, vegetables, and carbohydrates, making it the perfect solution for a quick, nutritious lunch or dinner. Ideal for busy students, professionals, or anyone needing a fast, healthy meal on the move. For more information please contact Nicola Frampton nicola.frampton@moana.co.nz or 027 880 4211.

NESCAFÉ ® Espresso Concentrates

Love café-style iced coffees? Discover new iced coffee combinations at home with NESCAFÉ® Espresso Concentrates.

NESCAFÉ® Espresso Concentrates are created with a rich Arabica blend that is concentrated under pressure at a high temperature, to naturally lock-in the same great taste, that you love about freshly made coffee from a café. They are highly versatile, convenient, and easy to use as they dissolve in cold liquid in seconds.

Coffee lovers can customise their drinks at home by simply adding a shot of NESCAFÉ® Espresso Concentrate to their preferred milk to create a creamy iced latte, mixing it with hot water for a robust long black, or combining it with lemonade or tonic for a refreshing twist.

To make a delicious iced coffee pour 250ml of cold milk into a glass, shake bottle well, add 2-3 tablespoons (50ml) of concentrate to the milk, stir, add ice and enjoy.

No fancy machines or barista skills required so you can unleash your inner barista at home.

Kellanova

Kellanova is launching a NEW proteinpacked cereal, Kellogg’s® Nutri-Grain® High Protein Crunch Choc Malt flavour. The delicious new addition to the range mixes the iconic Kellogg’s® Nutri-Grain® cereal with high protein choc balls, creating a delicious Choc Malt flavour everyone will love.

With 12.7g of protein per serving, Kellogg’s® Nutri-Grain® High Protein Crunch delivers a protein hit, providing 25% of the recommended daily protein intake in a single bowl.

The launch of Kellogg’s® NutriGrain® High Protein Crunch reflects the increasing consumer demand for protein-rich foods, with 7 in 10 (72%) shoppers believing high protein is important when choosing a breakfast food*. The new cereal is designed with extra protein to support lean muscle

growth and development, and essential nutrients to help unlock and release energy. A high protein breakfast is also proven to help Kiwis feel fuller.

Dr Gina Levy, Senior Nutrition Manager, Kellanova ANZ, explains: “A nutritious breakfast sets us up for a positive start to the day, but breakfast is the meal where people generally don’t get enough protein. By opting for a protein-rich breakfast, like Kellogg’s® Nutri-Grain® High Protein Crunch, Kiwis can ensure they are getting the benefits of protein early in the day. Protein is important for appetite control, building and maintaining lean muscle and supporting healthy bones.”

Robert Saunders, Marketing Manager, Kellanova NZ, adds: “As New Zealanders increasingly prioritise protein-rich choices to power their mornings,

Kellanova has created Kellogg’s® NutriGrain® High Protein Crunch, extending our protein proposition. The new addition to the Kellogg’s® Nutri-Grain® range is perfect for active Kiwis looking for a nutritious choice to fuel them through their busy mornings.”

Kellogg’s® Nutri-Grain® High Protein Crunch will be hitting shelves in New Worlds and Pak N Saves from the end of August with a RRP of $11.50 for a 500g pack.

*Research source: Kellanova, Breakfast Usage & Attitude Study, IMI (2023)

Ceres Organics

There are two new varieties of Ceres Organics Coconut Bites: White Choc Mocha and Mint Chocolate. Crafted from freshly cold-pressed coconut cream and stuffed with smooth white chocolate and a touch of espresso, these Coconut Bites will transport you to a serene tropical setting, as if you are right under a coconut tree, with its soothing aromas.

Similarly, the Organic Coconut Bites, Mint Chocolate have been created from freshly cold-pressed coconut cream and packed with mint chocolate.

XO COCOA CRUNCH

Freedom Foods

A new and improved plant-based recipe, Freedom Foods XO Cocoa Crunch is filled with crunchy cocoa goodness without compromising health. Perfect for breakfast or even a delicious snack straight out of the box, it has been made with sustainably sourced cocoa—UTZ certified and farmed using good agricultural practices. With less of the stuff you don't need, these cereals are bursting with flavours and wholesome ingredients.

Bootleg Jerky Co.

Bootleg Jerky Co. has created three unique flavours of beef jerky. The Manukayaki is a teriyaki-flavoured jerky made from New Zealand beef, Japanese soy sauce, Manuka honey, and other ingredients.

The Hot Shot, packed with succulent chillies and New Zealand apple cider vinegar, is a bold and adventurous choice for those who crave a spicy kick.

The O.G. is the original beef jerky, made with simple yet savoury ingredients such as onion, garlic, black pepper, and hickory smoke.

Each jerky flavour offers a distinct and mouthwatering taste experience, perfectly complementing different preferences.

Discover new co ee combinations at home with NESCAFÉ® Espresso Concentrates. Created with an Arabica blend to deliver a rich and smooth café-quality co ee taste.

NESCAFÉ® Espresso Concentrates dissolve in seconds in cold milk so you can create a creamy iced latte easily at home.

Mix with hot water for a rich long black. Or pair with lemonade for a refreshing twist. No barista skills required so you can unleash your inner barista.

Pour It, Mix It, Hack It

In an ever-evolving New Zealand market, Selaks proudly introduces their first-to-market 5% alcohol fruit wine to their lineup: Selaks Origins Breeze 5%, a crisp, and refreshing fruit wine that is lower* in alcohol and poised for success. *Lower than a standard 12.5% wine.

This innovative offering comes at a time when lower alcohol consumption is not just a preference but a growing trend among consumers seeking healthier lifestyle choices without compromising on flavour.

consumers driving market changes

Research is clear: demand for lower alcohol beverages is growing. Consumers are increasingly mindful of their alcohol intake and are actively seeking options that allow them to enjoy wine in moderation. This shift reflects a broader cultural movement in New Zealand towards more responsible drinking habits.

“Drinking responsibly is essential, drinking mindfully is the evolution we are now embracing” Stephanie Shennan | Senior Brand Manager, Constellation Brands

Giving grapes a second squeeze.

The Selaks Origins Breeze range introduces a fusion of tradition and innovation. At the heart of the Origins Breeze range is the innovative use of the

Piquette method, a traditional winemaking technique originating from France. Piquette is made by rescuing already pressed winemaking grapes, and giving them a second squeeze. More taste & less waste!

“In a world where we are striving for better food utilisation, this product redirects grape juice that would otherwise have been wasted” David Edmonds | Chief Winemaker

Our NEW 5% range replaces our current 8% offering

Why is the taste so much better?

Piquette is a 5% ABV, product relying on natural fruit flavours. With no need to remove any alcohol through industrial methods, Piquette remains bright and fresh.

What makes it a better consumer offering?

At 5% ABV there are just 3 standard drinks in a 750ml.

“We have worked hard to produce a product with all natural fruit flavours, a product that speaks of the bright fresh

characters of the fruit from which it is made that can be enjoyed by a broad range of consumers” David Edmonds | Chief Winemaker

As we launch Selaks Origins Breeze 5%, we invite our supermarket partners to join us in catering to this growing market segment. n

www.selaks.co.nz

@selakswinesnz

facebook.com/SelaksWines

This year, comfort snacking has become a global trend driven by increases in stress and anxiety, mainly due to the cost-of-living crisis.

t's not just Millennials and Gen Zs; older adults are also turning to snacks not just to satisfy hunger but to find comfort and alleviate emotional distress. Snacks' immediate gratification and soothing effects, often rich in sugar, salt, or fat, trigger neurotransmitters like dopamine and serotonin, offering a brief respite from daily pressures. The convenience and accessibility of snacks further fuel this habit, making them a go-to solution for quick stress relief.

Meal-time fragmentation is also rising globally, with more consumers skipping structured meals, particularly breakfast. This shift towards informal eating patterns throughout the day often leads to increased snacking or grazing.

Despite being told they are a "sometimes treat", indulgent snacks like chocolate and potato chips remain popular among consumers. The preference for these

treats underscores a broader trend where snacking is driven more by emotional indulgence than nutritional considerations. Consumers often seek snacks as a form of escapism from the uncertainties and stresses of daily life, prioritising emotional comfort over health benefits.

The trend of comfort snacking is projected to persist as consumers navigate through periods of heightened stress and seek solace in familiar and easily accessible snack options. This ongoing behaviour underscores the complex relationship between food, emotions, and coping mechanisms in today's fast-paced and challenging world.

By understanding this trend, retailers can offer a broader range of healthier options, and brand owners can innovate to offer consumers more variety, healthier choices, and smaller pack sizes so that snacking remains affordable. n

At the 2024 National Confectioners Association's Sweets and Snacks Expo, several key trends emerged amidst the launch of innovative new products and educational sessions. According to Euromonitor, three trends stood out:

"Toyification" of Snacks Marketing: Traditionally, the marketing cycles of the toys and games industry have aligned with entertainment franchises and film releases. However, this approach now influences snack marketing, where brands increasingly license popular characters from video games and films to boost sales. Brands like Mario Kart, Minecraft, Barbie, and Harry Potter were prominently featured at the expo. This trend, while carrying a high upfront cost, aims to capitalise on the release of these franchises by offering limited-edition SKUs that hit shelves exactly on launch day.

Innovation in flavours is becoming crucial to maintain consumer interest. The number of new snack product launches in the US increased by 27 percent in Q1 2024 compared to the same period in 2023. According to Euromonitor's Voice of the Consumer: Health and Nutrition Survey, 38.6 percent of Americans enjoy trying new taste combinations, such as "swicy" (sweet and spicy). The Sweets and Snacks Expo highlighted the importance of connecting cultural significance and emotions with flavours. This trend is partly driven by the need to engage consumers using GLP-1 drugs, which suppress appetite. By linking flavours with emotions—like nostalgia, delight, or energy—brands hope to retain these consumers even if their consumption volume decreases.

Confectionery sales have traditionally peaked during core holidays like Halloween, Christmas, Valentine's Day, and Easter. However, the industry is now looking to expand beyond these periods by promoting snacks for smaller holidays and creating new celebratory occasions.

These trends highlight the snack industry's response to current challenges, including inflation. Through strategies like "toyificated" marketing, emoting flavours, and expanding snack occasions, the industry aims to meet consumers' evolving social, emotional, and taste needs. Additionally, the industry is seeing increased M&A activities, innovation in flavours and formats, a focus on healthier products, and a growing presence in the premium space. Most importantly, the industry's commitment to sustainability is a beacon of hope for the future as companies adapt to changing consumer preferences. n

Coca-Cola and OREO have launched their first-ever campaign as “besties” to launch two exclusive and limited-edition products.

The OREO Coca-Cola Sandwich Cookie and Coca-Cola OREO Zero Sugar Limited Edition were inspired by “besties” worldwide to celebrate friendship while enjoying these products.

Best friends often combine their very best traits, making each other even better, which this new partnership has brought to life for Australian and New Zealand consumers.

The new launch will only be available for a limited time and will offer unique experiences celebrating the magic of teaming up with a best friend.

“Coca-Cola Creations is all about infusing the iconic Coca-Cola brand with new expressions of creativity, allowing Australian and New Zealand fans to experience the Real Magic of Coca-Cola,” said Kate Miller, Senior Marketing Director at Coca-Cola South Pacific.

“Coca-Cola OREO Zero Sugar Limited Edition perfectly aligns with this, tapping into emerging technologies, collaborating with brands, artists and designers to create new flavours, designs and unexpected experiences.”

The campaign has created an immersive digital experience, inviting Australian and New Zealand fans to activate the ‘Bestie Mode’.

Created in partnership with Spotify, the OREO and Coca-Cola brands unveiled the ‘Bestie Mode Digital Experience,’ an exclusive platform and first-of-its-kind musical experience designed for besties to merge music tastes and enjoy together.

“At OREO, we pride ourselves on taking our customers on a delightful journey by bringing innovation and playfulness into our delicious cookies,” said Ben Wicks, Vice President of Marketing – Australia, New Zealand.

“We are excited to unveil our latest innovation, OREO Coca-Cola Sandwich Cookie, which results from an exciting collaboration that pushes the boundaries of flavour innovation to captivate consumers' taste buds and imagination.”

By scanning Coca-Cola and the OREO brand products, fans can follow the steps to explore ‘Bestie Mode’ and sync up music preferences. Spotify Free users can also access the experience via on-platform promotion.

Once connected to a Spotify account, fans will be prompted with questions to see how their taste in music stacks up against their best friends. A playlist will be generated with combined music preferences for them to enjoy.

Both products feature a captivating design and sleek packaging, adorned with distinctive OREO cookie embossments and stacked Coca-Cola bottles. With each sip of the Coca-Cola OREO Zero Sugar Limited Edition, fans can savour a refreshing CocaCola taste with flavourful hints inspired by OREO cookies.

The Limited-Edition OREO Coca-Cola flavoured Sandwich Cookies have been embossed with Coca-Cola cookie designs, including red sprinkles in the creme filling.

The OREO Coca-Cola Sandwich Cookie and Coca-Cola OREO Zero Sugar Limited Edition will be available this September across major and independent retailers in Australia and New Zealand.

The frozen variation of Coca-Cola OREO Limited Edition will also be available in Australia at participating Macca’s restaurants and via the MyMacca’s app. n

Cheese Crisps are a gamechanging snack crafted with care in Italy using only 100% Italian-aged cheese.

This innovative, oven-baked treat has quickly become a favourite among snack lovers. It offers a deliciously crispy bite that satisfies any craving while aligning with the healthy snacking trend consumers demand.

What sets Cheese Crisps apart is the premium Italian aged cheese; these crisps are naturally rich in calcium and phosphorus, essential nutrients for maintaining strong bones and overall health. Unlike many other snacks, Cheese Crisps contain no

preservatives, ensuring an enjoyable snack that's as wholesome as it is tasty.

Cheese Crisps are perfect for those with dietary restrictions or simply looking to make healthier choices. They're lactose-free and gluten-free, making them a tasty snack for all consumers. Additionally, thanks to microbial rennet, Cheese Crisps are suitable for vegetarians, allowing everyone to indulge in this guilt-free snack.

The versatility of Cheese Crisps makes them an ideal companion for various

occasions. Whether it's a quick snack during a busy day, an afternoon treat, or a creative way to garnish salads and soups, Cheese Crisps fit the bill. Their crunchy texture and rich flavour also make them an excellent addition to any finger food platter, elevating entertaining with a touch of Italian flair. These crisps don't require refrigeration, making them a perfect on-the-go snack. The consumer trend for healthy snack options makes Cheese Crisps a delicious, nutritious, and versatile choice. n

Following on from Alliance Trading’s massive Meat snacking success with the original Mr Hamfrey’s brand of Pork crackle, Bacon Bites and Bacon Jerky’s ,in all FMCG and Fuel accounts.

Mr Hamfreys has recently launched the new Smokey bacon flavoured Pork crackle in the ever-popular 75gm and 25gm packs.

Based on consumer feedback at food shows ,in store tastings, and current in store sales, Alliance Trading Company Director Paul Kenny believes the Smokey Bacon flavour will be as popular as the current original Himalayan sea salt and will once again continue to stimulate profitable growth in the meat snacks category. In February Alliance Trading under its healthy eating Brand Be Right launched their Gluten free, Organic ,Vegan Coconut rolls in the Big Value 285gm and ever popular 100gm bag.

Ceres Organics has been observing a recent increase in ‘healthy’ snacking and ‘permissible indulgence’. Consumers are unwilling to compromise on small moments of indulgence while still looking for products made with clean ingredients.

Keeping up with this evolving consumer need, the brand launched New Zealand-made Organic Wholefood Fudgy Bites, which is perfectly positioned to meet this need. With their simple whole-food ingredients list and luscious fudge centre, these decadent

Paul explained after seeing the success internationally of coconut rolls he recognised

individually wrapped balls are the perfect afternoon pick-me-up. Recent in-store sampling has confirmed that they are hitting the spot with shoppers.

“Wonderful products, buy them all the time. Appreciate good quality products that are not only good for the environment but good for you”; “These are going back on the shelf; yours are much better,” said some of the shoppers.

Today’s consumers also want to enjoy ‘treats’ such as the traditional chip but don’t

an opportunity to develop this market in NZ into a significant snack food line .

Retailer and consumer support for the Brand of this unique product have seen the coconut rolls distribution roll out into to every major retailer in the country.

Paul said the amazing feedback he has received from online advertising and from consumers at Food shows has vindicated his decision to develop this segment of the snacking category .

Paul quotes “as tiring as the food shows can be I love hearing the unfiltered feedback and ideas”, such as the number of consumers telling me they use the coconut rolls as an alternative to breakfast cereals ,or on cheese boards ,school lunch box treats ,after school snacks ,or his personal favourite snacking on a 100gm bag with a few beers watching the rugby. n

want to feel guilty about it. This has driven a move towards alternative bases, such as legumes, which appeal as a ‘better-for-you’ offer.

Ceres Organics Pea Chips launched last year and has quickly become a consumer favourite, growing 60 percent in the latest quarter vs the same period last year**.

Organically grown peas are gently popped into a light and crunchy chip, then sprinkled with seasoning to deliver a delicious snacking masterPEAs. These bags are full of hap-PEAness and have a lot to offer.

They have a clean label, with at least 50 percent less fat than regular potato chips, no MSG added, lower calories and sugars than similar products, and are proudly certified organic. Made here in New Zealand, these unique chips are small in ingredients but massive in taste.

Consumers want to know what is in their snacks, how they are prepared, where they come from, and the environmental and social consequences of their production. Certified organic products address many of these concerns.

*Ceres Organics instore Sampling Campaign Consumer Feedback June 2024 ** Circana Total NZ Grocery, QTR to 040824. n

At AraBello®, we believe in creating small pieces of everyday joy. After years of sharing our handcrafted chocolate with family and friends, we're now inviting everyone to taste the magical moment that occurs when simple ingredients are perfectly combined.

The appreciation for detail is evident in every piece of AraBello® chocolate. This is the result of years of perfecting the combination of ingredients. Each portion is handmade, hand-cut and hand-packaged. The unique, sustainable packaging is both elegant and eye- catching.

As a New Zealand-based brand, AraBello® is dedicated to producing exceptional flavour combinations, artisanal quality, and sustainable practices. Our eco-friendly

approach resonates with environmentallyconscious consumers increasingly seeking ethically produced and responsible products. By emphasising eco-friendly packaging, responsible sourcing of ingredients, and waste reduction, AraBello® chocolate sets itself apart as a purpose-driven brand with a genuine commitment to the environment and society.

We offer two award-winning flavours:

• Original Peanut Marble: A swirl of white and dark chocolate with crushed roasted peanuts.

• Raspberry Marble: The same delightful white and dark chocolate swirl with crushed dried raspberries.

Our products are packaged in two convenient sizes:

• 26g Squares: The peanut marble is wrapped in gold foil and the Raspberry Marble is wrapped in light raspberrycoloured foil. Labels can be custom-designed for special events and requirements.

• 52g Bars: Containing 2 x 26g squares of either the Peanut or Raspberry Marble.

Our mission is to reach the hearts of many people who deserve that 'magical moment'. Especially in these global challenging times, there's a need for hope and moments of special indulgence.

Whether you're enjoying a moment of relaxation at home or looking for a pickme-up during a busy day, our chocolate provides a luxurious snacking experience. We can't wait to share AraBello® chocolate with you. Happy snacking! n

Heartland Potato Chips is a Kiwi success story fuelled by passion, innovation, and a commitment to quality. Founded by Raymond and Adrienne Bowan, who have been farming potatoes at Fallgate Farm in South Canterbury since 1975, Heartland’s journey began in 2009 with a bold move. When the Bluebird chips site in Timaru closed, the Bowans seized the opportunity to create something special. They purchased the facility and, through tireless effort, transformed it into a stateof-the-art production site. In October 2010, Heartland became New Zealand’s only Kiwi-owned and operated potato chip brand.

From the beginning, Heartland has been dedicated to delivering chips that Kiwis

love. By sourcing all their potatoes from their own farm and using the finest oils and flavours, the Bowans have crafted a product that deeply resonates with consumers. This commitment has driven tremendous growth, with Heartland doubling in size over the last three years.

One of Heartland's standout offerings is the Old Fashioned Wave Cut range, which has seen a remarkable 13.7% growth in the past 12 months—nearly double the category's 7.4% growth. This surge reflects a shift toward value-driven choices for everyday snacking. Despite this trend, Heartland’s premium ranges, like Kettle Cooked and Extreme Crunch, have remained steady, showcasing the brand’s broad appeal and consumers’ willingness to

A key factor in Heartland’s success is its flavour innovation. The Bowans have consistently introduced unique flavours that capture the Kiwi palate, such as the Tokyo Tang Wasabi Mayonnaise, a gamechanger that secured placement in all FSNI Pak 'n Save stores in the latest category review due to it being highly incremental to the category. Limited edition offerings, like the Smokey T's collabs and Kiwi Favs range, have also contributed to the brand’s momentum.

Now available in all major supermarkets across New Zealand, Heartland Potato Chips continues to soar. With family values at its core and a commitment to innovation, the brand is poised for even greater heights. n

The Fresh Market, Ellerslie, was formed in early 2023 by Nathan Royce, John Backman and Jasmine Taylor, who were relatively old school but had some new ideas.

Royce (also known as Banana Man) began working at 16, selling and auctioning produce at Bray Frampton Auction Market in the South Island. Throughout his career, Royce has worked in the produce industry, spending several years overseas.

He also worked in the airline and hotel industries before returning to New Zealand’s produce industry in 1998 with Auckland’s MG Marketing. He later opened and operated four retail wholesale stores with the iconic 1971 Morris Van (banana car) Fresh Market brand. His experience has also

assisted him in purchasing daily products from markets and growers.

Also starting at a young age was John Backman, aka Jonny Rotten, who worked in the produce department of a Paraparaumu supermarket. He has worked in many areas of produce and owned and operated a successful produce wholesale business for several years, gaining the title of an ‘old school produce specialist.’

Offering a wide range of knowledge and expertise, Backman’s experience has included fantastic marketing concepts and presentation skills for The Fresh Market

Ellerslie. He has also cultivated valuable, longstanding relationships within New Zealand’s wholesale sector and with industry growers and suppliers.

Returning from Australia two years ago, Jasmine Taylor (Bob) started her career in the produce industry, working for the renowned industry figure Jack Lum. Her father, Tony Teau, has been a respected figure in the industry, having worked for Turners & Growers Produce Market for over 40 years.

She gained valuable experience working in the industry in Queensland. She and

her sister Nadine have offered exceptional customer service and know all the regular customers by name.

The Fresh Market has been a familyrun enterprise, with all shareholders having family members working within the business. Rooted in quality fruit and vegetables, the business has offered an extensive range, including frozen and ready meals, gluten-free options, natural fruit ice cream, great coffee, and freshly made gourmet food for the café area, catering to retail and wholesale customers.

“We firmly believe that quality and customer service are crucial to achieving success, and our prices reflect this, as we are highly competitive with supermarkets and other market players,” said Royce.

“Quality takes care of price. By visiting the markets every morning around 4:30 am, we secure the best opportunities for quality produce and competitive prices. Receiving deliveries six days a week from markets and growers gives us the advantage of stocking fresh produce for our retail and wholesale customers daily.”

By following this practice, The Fresh Market has eliminated the need to rely on a distribution centre that could add two to three days of shelf life to fresh produce. This means that customers benefit from an extended life for their produce. It has also helped minimise wastage and associated costs, as the team has worked efficiently to utilise all products within the business.

"We procure from the local big three produce markets daily and have a selected group of local suppliers who supply us directly. We have local growers throughout the North Island, including spray-free, organic, hydroponic, and conventional

growers and suppliers.”

Royce also mentioned that customer feedback, both in-store and online, has been precious as it has allowed business growth and built vital relationships.

“We take pride in our old-school customer service, whether carrying your bags to the car or allowing you to pay next time when you've forgotten your card. Trust and relationships are important to us, and our customers often feel like family and friends; many visit us just for a coffee and a chat.”

The Fresh Market has a deep appreciation and respect for the surrounding community, which has dramatically valued the business

and its location, especially after previous options had closed down.

Their relationships with markets, growers, and wholesale customers have spanned over 30 years, which has been crucial to the business's longevity, sustainability, and success.

At present, The Fresh Market has been focused on developing the website and introducing a home delivery aspect to the business after receiving inquiries from outside its usual demographic.

“We're not striving to conquer the world or mimic our competitors. We aim to improve our work and allow more people to experience our passion, products, and service. We are incredibly proud of what we have achieved and dedicated to our passion, products, and customers.” n

www.grocerycharityball.nz

Meetings, Incentives, Conferences, and Exhibitions are essential for connecting professionals, fostering collaboration, and driving innovation across industries. These events provide unique opportunities for companies and brands to build partnerships, share ideas, and explore new growth avenues. At the heart of successful MICE events is the venue itself. Whether it's a large

conference, a focused workshop, or a corporate retreat, the right setting can elevate the experience, enhance engagement, and help achieve strategic goals.

In this editorial series, we delve into the top conference spaces designed to inspire and facilitate meaningful connections. Discover how choosing the right venue can transform your next event into a catalyst for business growth and success. n

Kauri Bay Boomrock is a premier destination that excels in delivering an unparalleled experience through its distincive blend of amenities, services, and natural beauty.

s Auckland's Ultimate Experience Venue for functions and events, it is situated on a stunning private 500-acre Clevedon property with expansive coastal views over the Hauraki Gulf and towards Coromandel Peninsula. This venue stands out for its commitment to offering exceptional quality and personalised service. Whether you're planning a corporate event, product launch, private gathering or a wedding, the picturesque setting and modern facilities provide an ideal environment for both relaxation and celebration.

Escape the busy pace of life and host your next event with us. With three individually designed facilities; The Lodge, The Bunkers

and The Quails Nest there is the perfect venue to select from for your event.

The Lodge has the ability to host from 10 - 250 guests in a warm and relaxed atmosphere. It is the complete venue to entertain guests for corporate entertainment and meetings to wedding celebrations, international incentives, private functions and product launches.

The Bunkers has established a special purpose-built claybird shooting facility. This venue offers the ultimate day out for both private and corporate entertainment experiences. This specialised venue caters for up to 50 guests and is the ideal setting for your unique day out with multiple activity options.

The Quails Nest was built as one of our

shooting stands and a venue for smaller events that want a shooting fuelled morning or afternoon. Guests will be entertained for hours enjoying the adrenaline-filled activity of Claybird Shooting and Claybird Shooting Flurries, with Extreme Hole-In-One Golf and darts available as well. The venue hosts up to 15 guests with light catering options available.

With a strong focus on outstanding New Zealand cuisine, wine and service, we believe in showcasing the finest products available. We have a selection of menus to cater to every event requirement; everything from relaxed cocktail style canapes and plates, shared family-style platter menus, to multiple course degustations.

If you are looking for something a little

different, you can chat with one of our Event Coordinators to help elevate your event to experience something new.

A site visit or pre-event meeting is always a great idea to visualise and discuss all that we have to offer. Otherwise if this option isn't for you, sit back, relax and let us take care of you. n

We had a wonderful time thanks, and we were so lucky with the weather. The food was outstanding. Everyone commented on how delicious it was, and the beef and fish were perfectly cooked. Please pass on our compliments to the chef(s).

Hopefully we can have another event there soon.

-Beth Morrison, Mercedes-Benz

Lab5 by ISM will be located next year to further strengthen the synergies between ISM and ProSweets Cologne during Sweet Week. The exhibition area is in Hall 10.1, right next to Entrance East.

In addition to new products and trend snacks, Lab5 by ISM will present startups, scale-ups and small handicraft businesses. The relocation to Hall 10.1 and the segmentation according to theme worlds will significantly increase the quality of the experience and the possibilities for a professional exchange.

Sweet Week has created the ideal conditions for effective networking thanks to its spatial and thematic proximity to the Raw Materials & Ingredients and Packaging sections. Visitors can seamlessly track all of the process steps, from the presentation of the raw materials to the final packing.

Special attention will be placed on the sustainability of packaging and ingredients, opening up new business opportunities for producers and suppliers.

Visitors can look forward to trusted

attractions and exciting new formats, which will impress the industry. The 'Finest Creations' has become a popular crowdpuller, presenting the art of confectionery and cake-making up close.

The ‘Live Sweets Creation' lets visitors experience the production of exquisite treats live. The newly introduced Scale-up Area has explicitly targeted companies that have been operating on the market for between five and ten years.

These sections offer young, innovative companies the opportunity to present their products and ideas to a broad trade audience.

Trend Snacks, traditionally replacing meals more frequently, are true crowdpullers. From smoothies and muesli bars in the morning to dried fruit and nuts as an in-between snack, the assortment at ISM satisfies the highest quality demands.

The GISMO Bar also has an inviting atmosphere, where visitors can relax while enjoying coffee and refreshing beverages. The daily DJ's live music creates the right environment for stimulating networking and casual exchange.

The experience is enhanced by the 'New Product Showcase', which grants insights into the industry's latest products.

“The Sweet Week has become an indispensable meeting point for the confectionery and snack industry,” said Sabine Schommer, Director of ISM.

“As the ideal supplement to the ProSweets sections, Ingredients and Packaging, Lab5 by ISM creates new cooperation opportunities between the manufacturers of ISM and supplier companies. Young visionaries and established brands meet up here – innovation and tradition at eye level.” n

The leading global trade fair for sweets and snacks, ISM, has announced a positive development after the early bird phase. 85 percent of the overall space of ISM 2024 has already been booked again by exhibitors from over 60 countries.

Compared to the number of applications received by the end of the early bird phase of ISM 2024, Koelnmesse has registered an eight percent increase.

As the leading trade fair for the sweets and snacks industry, ISM will once again offer a platform for innovations, networking, numerous entertainment offers, and business opportunities.

The upcoming ISM is being co-located with the supplier fair ProSweets Cologne in February 2025.

"We are delighted to have recorded seven percent more exhibitors and an eight percent increase in space compared to ISM 2024. That is remarkable, especially since the early bird phase didn't end until May last year - but it also underlines the

significance of ISM as the indispensable highlight of the annual event calendar of the sweets and snacks industry,” said Sabine Schommer, ISM Director.

The applications from Germany include companies like Katjes, Krüger, Lambertz, Ragolds, Riegelein, Rübezahl, Trolli and WAWI. Dietrich Borggreve, Genuport, IBIS, Kuchenmeister, Piasten, Schluckwerder, Conrad Schulte, Tri d’Aix, Top Sweets, and Wicklein have also confirmed their participation in 2025.

"For our exhibitors, participating in the trade fair means more than just booking a stand area. They profit from unprecedented visibility within the industry, access to buyers of global importance, and a comprehensive presence in the national and international media,” said Bastian Mingers, Vice President of Trade Fair Management Food at Koelnmesse GmbH.

“Beyond this, we enable first-class networking within the industry as well as with the exhibitors of ProSweets, the experts for the production of sweets and packaging technology, ingredients and packaging material.”

There is also a strong participation of international players. Baronie (Belgium), Cloetta Holland (the Netherlands), Elvan (Turkey), Fazer (Finland), Fini (Spain), ICAM (Italy), Kambly (Switzerland), Kervan (Turkey), Kras (Croatia), Loacker (Italy), Manner (Austria), Millenium (Ukraine), Natra (Spain), Nestlé Italiana (Italy), Sölen (Turkey), Toms (Denmark), Valor (Spain), Vidal (Spain), Wawel (Poland) have already registered.

After over 20 years, the Japanese company Morinaga, one of the leading global sweets manufacturers, has booked a stand and is returning to ISM.

In addition to existing regular exhibitors, ISM has also welcomed numerous new exhibitors again in 2025, including 1701 Nougat & Luxury Hampers Pty Ltd from South Africa, the manufacturers of hand-made luxury nougat; Amalfi Foods from Bahrain that specialises in bakery products and cakes; Hacks Sang Udom Confectionery, one of the leading Thai sweets companies for confectionery, popcorn and rice snacks; Lyra, the manufacturers of speciality chocolate from Slovakia; Savoria Kreasi Rasa with fruit, mint and coffee sweets, pastry and wheat snacks from Indonesia, Star Foodstuff (VAE) that produces among other things snack items made from potatoes, maize or that are tapioca or plantain-based as well as nuts, pistachios and sweets and the company Zuru from New Zealand that has combined confectionery with toys.

ISM unites companies from all over the globe across digital channels under the hashtag #ISMfamily. n

New Zealand, July 15, 2024 –Coca-Cola Europacific Partners New Zealand has been named in the 2024 Randstad Employer Brand Research as one of New Zealand’s Top Ten most attractive employers, coming in at 7th place in 2024. The company was also the best-performing organisation in the fastmoving consumer goods (FMCG) category.

The research also revealed employee sentiment about the attractive qualities in a job. Coca-Cola Europacific Partners New Zealand was recognised for its financial health, long-term job security and career progression opportunities.

Coca-Cola Europacific Partners New Zealand Managing Director, Wendy Rayner says “this recognition is a testament to our ways of working and acknowledges the

foundation of our success is the strength of the culture our people have built and will continue to build on moving forward”.

The 2024 Randstad Employer Brand Research explores the evolving trends and influences shaping employer and employee attitudes towards work in New Zealand and globally. It offers employers crucial insights into the changing preferences and priorities of more than 3,800 Kiwi workers. The study also outlines how these insights can be leveraged to enhance talent attraction and retention strategies, strengthening and diversifying their employer brand.

Randstad New Zealand’s Country Director, Richard Kennedy comments, “Congratulations to Coca-Cola Europacific Partners New Zealand, who was acknowledged as the seventh most attractive employer in 2024. New Zealand is facing a perfect storm of economic challenges and job uncertainties. It is more important than ever for companies to manage their employer brand which will help elevate their reputation, ensuring they continue to attract and retain talent. The achievement of CocaCola Europacific Partners New Zealand in being named one of New Zealand’s most attractive employers this year reinforces how an authentic and consistent approach can help an organisation gain a competitive advantage during challenging times.”

Randstad Employer Brand Research Insights

According to Randstad’s research, worklife balance (1), attractive salary and benefits (2), and good training (3) remain the key drivers that employees are seeking when choosing where to work.

What makes a jobseeker choose one workplace over another in terms of attractiveness remains largely consistent with last year’s findings. However, the exception has been the emergence of “equity” as a notable newcomer, replacing “strong management” in fourth place. According to Randstad, workers want to work for organisations whose values align with theirs, and in today’s market drivers like equity are now seen as a non-negotiable when seeking a new employer. n

Unilever just announced the results for the first half of 2024. Hein Schumacher, CEO, said Unilever was focused on driving high-quality sales growth and gross margin expansion, led by its Power Brands.

The EU AI Act, the first comprehensive AI regulation, will come into force on the 1st of August, 2024 to govern the risks of AI systems and protect the fundamental rights of EU citizens.

Mondelez and Saica have joined forces to launch paper-based multipack bags for Cadbury biscuits in the UK.

Sainsbury’s has chosen NCR Voyix, a global leader in digital commerce solutions, to help transform its shopping experience.

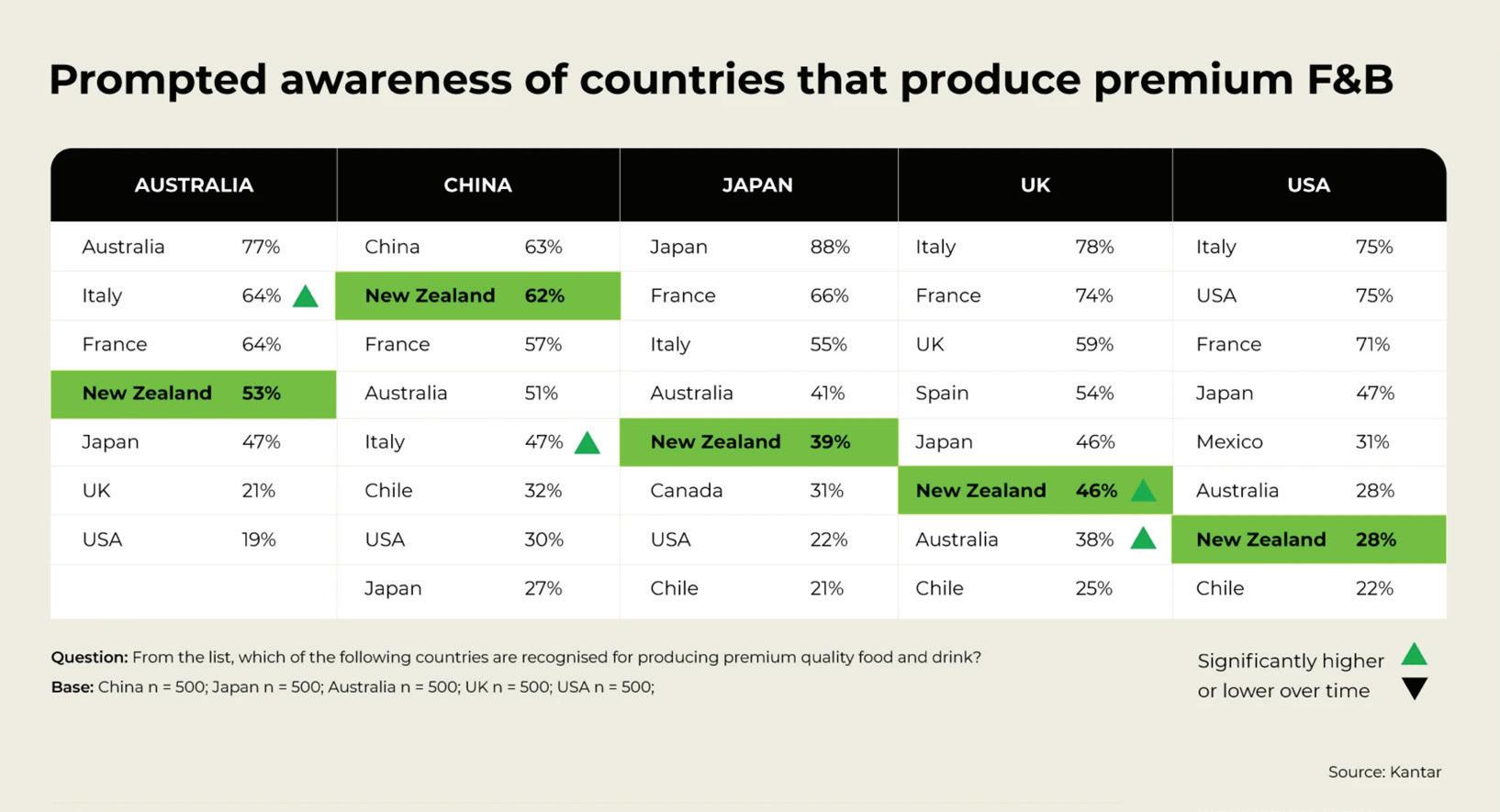

What does it take for a supplier of food or grocery products to go from local to global? Luck? Grit? Sheer determination? It’s a perennial question, and one asked during our dynamic trade session at NZFGC’s annual conference last year.

Moderated by Sarah Salmond from Minters Ellison Rudd Watts, the panel included NZFGC Chair Mike Pretty, board member Matt Donn, NZTE’s Glen Murphy, and NZIBF’s Stephen Jacobi – all to say, between these five experts we had global reach, wherewithal, connections, and realworld experience – like how to take a small snack startup such as Tom & Luke and expand into the US, UK, Japan, Singapore and grow through most major retailers in Australia.

opportunities across the ditch and beyond

The starting point for the discussion was Australia a major export market for New Zealand’s food and grocery exporters. Our panellists noted the country’s close proximity, cultural similarities, regulatory alignment with New Zealand and tarifffree access, make Australia a natural and logical entry point for many Kiwi exporters. Australia is our largest ‘processed food and other’ market, a diverse category that includes cereals, chocolate, honey, and beverages, and accounts for 39% of exports to Australia, China 13% and the United States 12% respectively.

Since the signing of our free trade agreement in 2008, we have been exporting ever-increasing volumes of food and grocery products to China. Some of our key exports include dairy products, meat, seafood, wine, honey, fruit, cereals and grains, processed foods, snack foods, organic and speciality foods. With several Kiwi food exporters

Raewyn Bleakley Chief Executive, New Zealand Food & Grocery Council

having landed lucrative distribution contracts with US retailers in recent years, the assistance of agencies like NZTE, ExportNZ, NZ Export Credit Office, the Kea Network, and others were pointed to by our panel as ways of getting boots on the ground.

As part of its campaign commitments the National Party set India in its trade sights as an important market to build, and there’s already been significant engagement. It’s this sort of relationship building that can clear the way for greater trade. Negotiations have also commenced with the United Arab Emirates on a Comprehensive Economic Partnership Agreement to further unlock further commercial opportunities for exporters. With the quick confirmation of the EU FTA, all signs point towards regulatory settings better enabling growth from local to global.

The Government has coined its own local to global challenge, to be “relentlessly focused on growing New Zealand’s economy, with an aspirational target of doubling exports by value in ten years.”

The latest data points to further growth, with food and fibre export revenue tipped to reach $54.6 billion this year and to hit a record $66.6 billion in 2028. Over the last 10 years, food and fibre exports have grown on average by 3.6% per year whereas other merchandise exports have grown by just 1.6%. Despite our size, our plucky

little nation has a lot going for it – perhaps the only barrier that casts doubt on our international credibility is the PM’s current aircraft options!

the quality of our regulations does matter

Increasingly, how the product is made and the country’s regulatory settings are key determinants of success. For our various trade agreements, there’s the need to ensure compliance with the proliferation of Environmental Social and Governance (ESG) laws in the EU, UK and US. This has been expertly covered by Sarah Salmond in a recent article - from greater environmental regulations and labour rights to governance requirements for transparency and ethical practices. In some markets, we are seeing ESG requirements through commercial supply agreements, practices that go beyond regulatory settings, requiring suppliers to give supply chain assurances, such as renewable energy use and commitments to modern slavery eradication. Later this year NZFGC will be again hosting a trade panel at the 2024 Conference in Wellington, where we will further explore these evolving export considerations – and hope you join us! n

15-17/8/2024

Hong Kong Convention and Exhibition Centre 8-24/8/2024

Click2Match (Online)

HKTDC Food Expo PRO provides a one-stop business platform for F&B industry buyers to satisfy their appetites for opportunities and building business connections. The 2023 edition gathered more than 20,100 buyers from 69 countries and regions*

*Include Food Expo PRO & Tea Fair

Register now for FREE admission badge!

Wednesday 2nd October 2024

18th September 2024

Wednesday 3rd July - 18th September 2024 2024 AWARDS ANNOUNCED Wednesday 6th November 2024

Wednesday 16th October 2024

Newflands is founded on the simple philosophy of delivering products and supporting pet owners to give their pets the best possible quality of life.

"Healthy pets, happy people," said CEO and founder Fiona Robertson.

Robertson said she would never forget the day her Newfoundland was diagnosed with a terminal heart condition. As a qualified veterinary nurse, she researched the benefits of Hoki and started trials using humangrade products on her precious pets. The results were spectacular, and Newflands was launched so other pet owners could do their best for their pets.

"All pets are individuals like us and must be treated as such. Our products are all designed from one animal's need and then taken to market."

Wherever possible, Newflands uses New Zealand Natural resources that are environmentally friendly. The Hoki range uses the whole fish, the first MSC-certified fish as a species, so nothing goes to waste.

With every product and service, Newflands is helping pets globally have a substantially better quality of life while being sustainable. Newfland's products are made from human-grade ingredients but are designed to be safe for all family members.

Included in Newfland's inventory is a lovely range of freeze-dried treats, toppers, gravy, and oil supplements, along with its ice cream that uses a combination of New Zealand natural ingredients, including medicinal grade Manuka honey, Astaxanthin, beef and lamb with a separate range of fish (hoki) products.

All products are made in export-certified factories and have New Zealand and international audit systems carried out regularly.

Newflands can ship trial quantities by air using dry ice to most destinations with pre-customs clearance and direct flights from New Zealand. For larger orders, the company utilises temperature-controlled containers via sea. n

For more information, please contact Fiona Robertson at fiona@newflands.co.nz or +6427 288 5358.

New Zealand brand By Nature Skincare, a leading brand in Walmart, has announced its By Nature Beauties Ambassador Program, designed to empower women nationwide to stand up, be seen, and feel great through the power of natural skincare.

Founded in 2012, By Nature's mission has remained unchanged: to create natural skincare that is both luxurious and on-trend. The brand believes everyone deserves fresher, healthier-looking skin that boosts confidence and empowers them.

Ambassadors will gain exclusive access to the brand's latest product releases, opportunities to earn commission, exclusive access to sales, and expert skincare tips.

"Since the beginning, we've been focused on providing honest, clean, and functional skincare. It is our passion to offer highquality, affordable skincare solutions that help women feel empowered and confident in their skin,” said By Nature Beauties Ambassador Program, By Nature's Managing Director, Tim McIver.

"It's an incredible privilege to be part of someone's skincare routine. We are excited to connect with passionate individuals who share our love for natural skincare and are eager to share their experiences with their communities."

To celebrate the launch of the By Nature Beauties Ambassador Program, By Nature From New Zealand has invited skincare enthusiasts across the United States to apply.

By Nature From New Zealand is a trusted skincare brand committed to providing everyone with natural, affordable solutions. The brand's products promote healthier skin, boost confidence, and enhance natural beauty. By Nature's products are available throughout the US, Europe, the United Kingdom, Australia, and New Zealand. n

Mauka Health, a global leader in premium manuka honey products, has announced three new skincare products. The brand is known for harnessing the power of natural ingredients. These products add to its current wellness collections, which comprise both ingestible and skincare categories.

The new products are designed to elevate daily beauty routines further, offering enhanced hydration, improved skin resilience, a radiant glow, and healthier skin overall.

"We are excited to introduce this next wave of products that harness the extraordinary benefits of mānuka honey," said Graham Ritchie, Chief Marketing Officer.

"This expansion exemplifies Mānuka Health's commitment to crafting premium offerings that blend the essence of New Zealand's Mānuka tree and the honeybee, fusing cutting-edge science with nature's finest."

The first release of products launched in the Spring of 2024, and the brand unveiled

the next wave of products, including Eternal Renewal Regenerating Eye Serum, Eternal Renewal Regenerating Face Serum, and Pro Vitality Daily Restorative Face Serum.

Pro Vitality Daily Restorative Face Serum includes propolis, which protects, fortifies, repairs, and replenishes. Together with vitamin C and MGO 400+ mānuka honey, this high-potency serum strengthens the skin's natural barrier, supporting overall skin resilience.

With high-grade MGO 800+ mānuka honey and bee venom, the Eternal Renewal Regenerating Eye Serum nourishes and renews the delicate skin around the eye, while the royal jelly, bee venom and high-grade MGO 800+ mānuka honey

perfectly harmonise the Eternal Renewal Regenerating Face Serum.

All products have been subjected to Mānuka Health's stringent quality testing and standardisation processes, guaranteeing that customers receive the same high potency and effectiveness with every purchase.

Products will be available globally on the website this August and in-store at Rennaï in Montreal beginning September. n

Beverage brand Sidekick Soda has taken the approach of utilising locally sourced ingredients as much as possible.

Except for mango, the brand’s fruit has been cultivated in New Zealand, the ACV has been supplied by the renowned Goulter family in Nelson, and the honey comes from the South Island.

The brand will begin bottling again in a few weeks and launch a new Central Otago Cherry flavour, which it has been highly enthusiastic about. The cherries used in this flavour have been sourced from the Cherry Rescue Project in alignment with the brand’s sustainability strategy.

“We are particularly keen on procuring substantial quantities of locally grown fruit. Sustainability is crucial in our ingredient sourcing, so we are thrilled to collaborate with The Cherry Rescue Project in Central Otago.”

Another topic of sustainability debate has been the usage of glass packaging. While the brand believes that glass is one of the most sustainable options in the long run (a

glass bottle can be reused up to 100 times before needing recycling), as a country, New Zealand lacks the necessary resources to support this. Therefore, the most significant change for Sidekick Soda will be the introduction of cans to the product line.

“It's evident that the local market has faced some challenging times, but I firmly believe we are heading in the right direction.”

In terms of consumer trends, Sidekick Soda has observed that many people have sought a flavourful beverage as an alcohol alternative and options with lower sugar content.

The new iteration of its sodas contains less than 3.5g of sugar per 100g, as the sugars have been derived from the fruit and honey.

“We switched to lower sugars to meet consumer demands and facilitate our bottling process. Utilising fruit purees has posed a challenge for our bottling plant due to the high fibre content, which has led to blockages in the filters and fillers.”

Other brand packaging has been crafted from recycled cards, and the bottles manufactured by Visy in Auckland use recycled glass. The new range of cans has also been produced locally.

“We are very excited to introduce our new range of lower-sugar Sidekick Soda made in New Zealand to the market, both in New Zealand and the USA.” n

Nestlé

Nestlé is committed to developing affordable foods and beverages that include nutritious plant-based proteins, helping people achieve adequate and balanced diets.

In line with this, Nestlé has developed Maggi Rindecarne—a tasty, plant-based meat alternative. The mix of soy and spices allows consumers to prepare a dish combining meat and plant-based proteins, doubling the amount of servings at an affordable price.

Aldi

Aldi will introduce Kewpie Mayonnaise in its stores this July.

This Japanese Kewpie mayonnaise, which has gained immense popularity on TikTok with over 94 million posts featuring the product, will now be available at Aldi.

Aldi's decision to offer Kewpie Mayonnaise has reflected its commitment to catering to diverse culinary preferences. Made with egg yolks, this mayonnaise offers a rich, indulgent flavour and a velvety consistency.

Fonterra

Fonterra Oceania has launched the Mainland Sweet Cinnamon Spreadable Butter across Australia.

The new FMCG product landed on supermarket shelves last month and has since garnered social media popularity, increasing sales.

Nestlé

While global coffee demand has continued to rise, recent climate change modelling has suggested that land suitable for growing Arabica coffee might be reduced by over 50 percent by 2050. To mitigate the impact of these changes on the coffee supply chain and to ensure that sustainably grown coffee is available to future generations, Nestlé has harnessed its agricultural sciences capabilities.

Claussen x Baked by Melissa

Claussen, the 150-year-old brand known for its signature refrigerated pickles, has partnered with New York-based bite-size dessert company Baked by Melissa to create a first-ofits-kind pickle cupcake.

Over the past year, pickle products have continued to trend, with 73 percent of Americans reporting that they enjoyed the taste of pickles. To give the fans what they wanted, Claussen entered the beverage space for the first time last year, launching a sparkling wine cocktail, and this year, it’s all about desserts.

Coveris

Coveris has introduced a range of fibre-based hot-to-go packs, leading the way in sustainable packaging.

These packs, designed to meet the rising demand for hot food, stand out with their unique recyclable ‘heat in pack, eat in pack’ feature, reducing waste and enhancing the consumer experience.

Jubi Brands

Jubi Brands, a company in the botanical extracts sector, has announced the launch of its exciting new line of Plant-Based Shots.

These innovative shots have enhanced energy, promoted relaxation, and improved focus. Each Plant-Based Shot has been meticulously crafted with premium ingredients to cater to various lifestyle needs, ensuring that consumers receive the maximum benefits from each sip.

Babish x Old Pal

With the idea that nothing brings people together like food and cannabis, the OG YouTuber chef Andrew Rea, aka Binging With Babish, has announced his latest collaboration, The Babish Culinary Universe: Babish x Old Pal THC-infused Sugar.

Being accessible and approachable has been a central part of their shared ethos, leading to the infusion of a pantry staple that will unlock unlimited possibilities for classic, shareable moments.

Ore-Ida x GoodPop

LOCK'DIN

Labor Smart, Inc., through its wholly-owned subsidiary, Next Gen Beverages, maker of performance drink brand LOCK'DIN, has announced its launch of a YOUTH Hydrogen Water to boost performance and recovery. This product was specifically designed for young athletes aged 9 to 18 years engaged in training for various individual and team sports.

LOCK'DIN has been committed to providing products that enhance performance without compromising health. As YOUTH Sports reached unprecedented participation levels, the prevalence of potentially harmful drinks has posed a significant threat to a young athlete's well-being.

LOCK'DIN has responded boldly, offering a safe and potent solution: hydrogen water with 45mg of Organic Vitamin C. This innovative product has been designed to bolster immune health and aid in swift recovery, ensuring the safety and well-being of aspiring athletes.

Inspired by this, the Ore-Ida and GoodPop brands have launched the Fudge n’ Vanilla French Fry Pop. Fudge n’ Vanilla French Fry Pop is a first-of-its-kind frozen treat that offers the iconic sweet and salty combination fans crave. It wraps a vanilla oat milk frozen base in a rich, chocolate fudge shell rolled in real, crispy potato bits. The collaboration has created an all-in-one, mess-free offering to delight French fry and ice cream lovers.

Wild Roots Spirits

Wild Roots Spirits has announced the launch of its Wild Roots Handcrafted Wines. Inspired by its roots, these wines have been made with grapes from the Pacific Northwest, celebrating its distinct terroir. Consumers have been encouraged to explore the brand’s new Pinot Gris, Rosé, Chardonnay, Pinot Noir, and Cabernet Sauvignon exclusively. These wines will soon be available at tasting rooms and bottle shops in Portland, Sisters, Washington Square Mall, and select local retailers.

Yumi's

The Yumi’s Veggie Burger range is dairy— and gluten-free and proudly made in Australia with the natural goodness of real vegetables and spices. Once fully cooked, it can be simply heated and served for a super convenient meal.

Featuring veggies everyone loves, the new burger Sweet Potato Burgers with Carrot & Cauliflower is a real crowd-pleaser, while the new Green Goddess burgers are simply divine. With delicious spinach, zucchini, and garden peas seasoned with chilli and garlic, they're packed with delicious flavour.

KRAFT x Nintendo

For over thirty years, fan-favourite KRAFT Mac & Cheese shapes have delighted fans of all generations. KRAFT has partnered with Nintendo to launch KRAFT Mac & Cheese Super Mario Power-Up Shapes. Featuring Fire Flower, Super Star, and Super Mushroom shapes, this was inspired by iconic elements of the Super Mario universe that power up Mario, Luigi, Princess Peach and others in the games.

Made For Drink

Made For Drink has launched some limited edition snacks to be paired with Brancott Estate’s Sauvignon Blanc wines. These crisps are available in two flavours, Pickled Onion and Chilli & Lemon.

Brancott Estate Chilli and Lemon Crisps have a subtle spice to them whereas the Brancott Estate Pickled Onion Crisps are tangy and bold.

ORIGINAL

Downy

For long-lasting freshness, Downy Unstopables InWash Scent Booster Tide

Original Scent is safe to use on all fabrics, even activewear. The fragrance lasts up to 12 weeks from wash until wear. It is easy to use and also ideal for sheets and towels. It provides extra freshness in every load and odour protection for all your clothes, sheets, towels, and other favourites.

Sunny Queen Farms

Sunny Queen Farms’ Liquid Egg Range offers the same farm-fresh goodness and quality expected from the brand but in a liquid form that simplifies the cooking and baking experience.

No mess, no waste—these new Odd Eggs Ready-to-Pour Mix are available in the chilled health aisle at Coles. The convenient pouch was created to repurpose eggs, like those that don’t fit into a carton, so no egg goes to waste.

The Wessex Oat Company

Framptons has launched its latest product line, The Wessex Oat Company.

The Wessex Oat Company is a new range of Britishfarmed oat drinks designed to meet the growing demand for sustainable, locally sourced plant-based beverages.

As the UK’s leading independent plant-based drinks company, Framptons has brought out various delicious, eco-friendly options that support British farming and reduce food miles.

Grace Foods UK

Grace Jamaican Honey Jerk Seasoning is made with real honey in Jamaica. It can be used on meat, chicken, seafood, and even vegetables.

After marinating for roughly an hour, these can be cooked on the grill for the most authentic taste or on the stovetop and oven, depending on preference.

Serving quality since 1922, Grace Jamaican Honey Jerk Seasoning is available at Tesco.

Nestlé

To celebrate the launch of the limited-edition choc bar

Milkybar Biscoff, Watsons Bay Milk Bar, one of Sydney’s few remaining milk bars, has created treats inspired by the iconic flavour combination.

The new Milkybar Biscoff bar has combined the iconic creamy, white chocolate of Milkybar with the crunchy caramelised biscuit of Lotus Biscoff, creating a cool twist on two old favourites.

Cookie Man

Cookieman Loaded Cookie Share Packs are now available at Woolworths. These loaded cookies come in two flavour variants: Red Velvet Cheesecake Filled Cookies and Snickerdoodle Loaded Cookies.

The Snickerdoodle Cookie is a blend of two popular flavours. These golden-brown cookies have been coated with a delicate layer of aromatic cinnamon, infusing them with a warm and comforting essence.

The crisp outer shell gives way to a soft, chewy centre, revealing the rich Biscoff spread that oozes out.

The Red Velvet Cheesecake Cookies have been generously filled with rich couverture white chocolate chunks. Each morsel of white chocolate delivers a burst of creamy and velvety sweetness, perfectly complementing the moist red velvet cake base.

Fonterra

Fonterra Oceania has launched a new range of snacking products under the Australian cheese brand Bega. The new range has paired Bega cheese with crackers in three varieties: Tasty, Vintage, and Colby. This has expanded Bega’s presence in the snacking category.

Fonterra Oceania Marketing Manager— Bega Cheese, Bianca Di Donato, said snacking products have been increasingly in demand in Australia and overseas, presenting an opportunity to champion cheese as a healthier snacking option.

Kraft Heinz

Kraft Heinz has introduced pancake-inspired IHOP syrups, making breakfast as delicious as dining out at home.

The classic combination of IHOP pancakes and syrup has long been a favourite among breakfast lovers, with IHOP selling more than 400 million pancakes annually.

With the introduction of the Original and Butter shelves, it’s easier to bring the flavours from IHOP

Allen's

Allen’s has introduced an exciting twist on a beloved classic with the Allen’s Sweet & Sour Killer Pythons.

Slithering in six new flavours, raspberry, Cola, Creaming Soda, Sour Grape, Sour Watermelon, and Sour Lemon, the team behind Allen’s has been on a mission to make life a little less sour.

Every bite of the new Allen’s Sweet & Sour Killer Pythons differs from the last.

“We know lolly lovers are looking for more taste sensations with sour lollies becoming more popular, but super sour lollies aren’t for everyone,” said Nestlé Head of Marketing Confectionery Melanie Chen.

“With Sweet & Sour Killer Pythons, we’ve hit the sweet spot to give Aussies a juicier, more flavoursome experience. A personal favourite of mine, we’re excited to share with Australia.”

The realisation of the EDEKA Future Market project in Nauen, Germany, EDEKA Minden-Hannover and Schweitzer marks another significant milestone in their history.