the Westgold Infused Butter Collection November 2022 • Vol. 15 No. 11 $ 10.95 Wholesale/Outlet grocery (see page 30)

Introducing

The Food and Grocery Council is an industry association for grocery suppliers providing members networking, events, industry information and strong advocacy.

The NEW ZEALAND BEVERAGE COUNCIL is an industry association whose members cover all aspects of the non-alcoholic beverage market both in New Zealand and the export markets.

The Council members are spread throughout New Zealand and come together annually for a conference that covers industry issues and is addressed by international speakers. The organisation monitors product quality, sets standards for the industry and runs national competitions and awards.

THE NEW ZEALAND BEVERAGE COUNCIL (NZBC) P.O. Box 47, AUCKLAND 1140, New Zealand. Email: info@nzbc.nz Phone: +64 9 309 6100 DDI: +64 9 302 9932

2 I supermarketnews.co.nz

contents PUBLISHER Tania Walters GENERAL MANAGER Kieran Mitchell EDITORIAL DIRECTOR Sarah Mitchell EDITOR Caitlan Mitchell ADVERTISING SALES Felicity-Anne Flack, Caroline Boe EDITORIAL ASSOCIATE Sabrina Snoad SENIOR DESIGNER Raymund Sarmiento GRAPHIC DESIGNER Debby Wei ISSN 1173-3365 (Print) ISSN 2744-595X (Online) Retail 6, Heards Building, 2 Ruskin Street, Parnell, Auckland. PO Box 37140 Parnell, Auckland Call: (09) 3040142 | Email: edit@reviewmags.com ATTENTION GROCERY SUPPLIERS

Contact

•

•

•

•

www.fgc.org.nz food grocery & COUNCIL NEW ZEALAND food grocery & COUNCIL 4 9 18 20 28 14 This magazine is published monthly under license. Please direct all enquiries and correspondence to Review Publishing Co Ltd. This magazine is a platform for the industry and may include content that expresses views and opinions by contributing writers. Content is attributed to the author, and these opinions and the view/s are those of the author/s. They do not necessarily reflect the official policy or position of any other agency, organisation, employer or company. The opinions and material published in this edition are not necessarily those of the publishers unless expressly stated. All material appearing in the magazine, website and social media platforms is copyright and may only be reproduced with the written consent of the publisher. Copyright 2022 42 31 35

us for information on the benefits of membership: katherine.rich@fgc.org.nz

Networking • Industry Updates

Conference and Events

Education and Training

Advocacy and Law Reform

FACING THE MUSIC: Inflation, Staffing and Consumer Spending

With inflationary pressures expected to worsen over the coming year, brands are looking at ways to reduce costs, but there is likely no end in sight. Across various surveys, business confidence is low globally, with around 80 percent of businesses expecting worse to come in 2023.

Rising costs will mean consumers will continue to feel the pinch point at the checkout. Retail NZ's latest survey has found retail businesses in this country expect prices to increase on average by another five percent in the next quarter, after a six percent increase in the previous quarter.

Staffing remains the number one concern; the upheavals we've seen in the job market this year have impacted businesses struggling to keep a full complement of staff. With staffing shortages comes wage increases as each company tries to woo new staff onto its team.

As consumers push back against price hikes, suppliers are working hard to keep consumers engaged. Already we see some activity across innovation, with new variants coming online to excite weary consumers and repackaging and shrinkflation across many brands. Product downsizing, or "shrinkflation," has happened before during times of high inflation because brands are also paying more for raw materials, production and distribution.

As we race towards the end of 2022, most will be happy to say goodbye to what has been a shocking year for business in many sectors. Grocery will not be immune

as we enter the new year. Consumers will feel the impact of higher interest rates, with many fixed mortgages coming off low rates. Consumers are likely to shift spending away from discretionary purchases because it's taking more to cover the essentials.

All eyes will remain on the consumer and their spending habits. While consumers are dealing with inflation by using credit cards more, saving less and drawing on their pandemic savings, consumer stamina will be the big question. We can expect a much smaller shopping basket in 2023, with intense competition for the consumer dollar.

November 2022 I 3 publisher'snote

Tania Walters Publisher

tania@reviewmags.com

New Zealand Food and Grocery 2022 Conference

4 I supermarketnews.co.nz

The New Zealand Food and Grocery Council’s annual conference took place in Queenstown from 5 pm on November 2nd until 2 pm on November 4th. The busy schedule of events kept the industry informed and entertained. Held at the Millenium Hotel, industry speakers included Miek Pretty, Ceri Evans, Petra Bagust, John Kirwan, Cam Calkoen, Saskia Van Der Geest and Theresa Gattung.

November 2022 I 5

FIRST COLUMN AND CONFERENCE

AS CHIEF EXECUTIVE

I didn’t go into my first Food & Grocery Council conference this month with any doubts about the passion and knowledge members have for their work and the greater good they are involved in, but if I had any, they would have been well and truly dispelled. Beyond all shadow of a doubt.

and how sustainability is such a big thing for consumers “it’s critical industry starts to own this.” I’m aware FGC members look forward to the type of information gleaned from such presentations, and we’ll see if we can amp them up at future conferences.

RAEWYN BLEAKLEY CEO, NZ Food & Grocery Council

What has struck me since meeting members in my time with FGC, and was strongly confirmed as I met and got to know members at conference, is their single-mindedness and focus on the job at hand, be it bringing me up to speed on the issues of the day – the Grocery Market Study, the status of sustainability progress, supply chain – or making sure I’m across aspects of the industry. It was great to be among people who care so much about what they do – to put the best products on supermarket shelves and at fair prices for consumers. The networking opportunities and breakout sessions being a neverending feast of great discussion, and the camaraderie in the industry is palpable and clearly enduring through the slings and arrows of recent tough times.

OneVoice was the theme, and it was very apparent everyone was indeed aligned about wanting to make the industry better, so all players benefit and get a fair go, be it suppliers, retailers or consumers. One of our speakers used the phrase “make a decent profit - decently”, which originates from the founding mission of Harvard Business School back in 1908. There was some lightheartedness about business school graduates, but this mission for the leaders Harvard trains really resonated, given the big issues of the day.

The 200 or so who attended were treated to a mix of entertainment, advice, and usable

industry information they could take back to their workplace. It’s a mix I intend to keep and to even improve on, if that’s possible, at forthcoming conferences. Cerebral palsy sufferer and international speaker Cam Calkoen set the scene with an inspiring, tearinducingly poignant and funny presentation. Then there were the tales of entrepreneurship marked by persistence and perseverance by 42 Below, Ecoya, and Trilogy founders Geoff Ross and Justine Troy; Nick Ashill’s story of incredible endurance and overcoming the odds to run across the US; Sacha Coburn’s delightful and deeply wise takes on leadership potential and extreme ownership; and Theresa Gattung’s invaluable tips on business innovation and governance.

It was great to have two of the three supermarkets thereafter another eventful year. Foodstuffs couldn’t make it due to a number of existing commitments but wished FGC all the best for the conference, while Countdown and Costco gave delegates some great insights. Jody Farrell gave a rundown on Costco’s operation, and she and Anton Ramshak gave delegates guidance at one of the breakout workshops on how to present them with new products. I think with their big splash in Auckland and their expansion plans, we can start talking about Costco as a third player.

Countdown’s Steve Mills and Pieter De Wet took us through their thinking around interactions with suppliers, emphasising they want to be much more responsive and how their future focus will be on digital transformation and sustainability. They said they would follow parent Woolworths Australia in changing their product review process to take in an entire department or portfolio, allowing them to focus on what is on-trend with customers and resulting in leveraging shelf space more effectively. This would give them more opportunity for product ranging to vary from store to store. No doubt members will be watching this with interest.

Data company IRI gave an exciting preview of their upcoming State of the Industry update, with Craig Irwin and Debbie Simpson-Pudney running delegates through how the surge in online spending since Covid has taken online forward five years,

Similarly for FGC’s breakout sessions, which are always among the most popular on the programme, no matter the subject. This year was all about industry relations, where members had the chance to discuss with our Industry Relationships Working Group what they would like the focus to be on with each retailer. It’s the sort of feedback FGC needs to help us advance some of these issues and work in the best interests of members.

Another popular session was an update by MBIE’s Deputy Chief Executive Paul Stocks on the Code of Conduct and Grocery Commissioner, both of which are contained in the Grocery Industry Competition Bill to be introduced to Parliament next month. The Q&A session that followed and the informal discussions Paul had over morning tea were also extremely insightful to members, and I’m confident left him appreciating the strength of feeling in the industry about these measures being effective.

Conferences are all about members, and because I’m new and still getting to know most of them, FGC Chair Mike Pretty and I decided we needed a way for them to get to know me better. We wanted them to feel at ease approaching me with issues and also to get a feel for my background and motivation for taking this role. It’s a priority for us that members keep me as informed as possible.

So, Mike took on the role of interviewer, and I sat in the hot seat. I emphasised that understanding what members wanted and how they work is key. I also shared I’m keen to look at how we do our work at FGC, including how we communicate with members, what services we offer, and whether we should widen or refine what the working groups are doing. But I want to do this in a considered way after I’ve deepened my understanding of the industry and got to know members better. I also spoke about how impressed I’ve been with how FGC has been operating and how genuine members are to find good outcomes around sustainability and consumers getting fairer prices. Our challenge is to get across these things and to represent them really well. The real exciting challenge for me is working with the membership, the Board, and the Government to make sure the market changes will be truly effective – for everyone.

I’d like to thank members for their warm welcome and their generosity of time and expertise. I look forward to working with them to take this great industry on to even greater things and to make sure FGC is the most valuable support to them and their businesses it possibly can be. n

6 I supermarketnews.co.nz FGC

Authentic

Supplying quality Italian smallgoods to New Zealand supermarkets, hospitality trade and delicatessen wholesalers. Call us now for authentic quality Italian smallgoods. Granarolo New Zealand Ltd 337 High St, Boulcott, Lower Hutt 5010, New Zealand +64 (0)9 551 7410

Italian Delicacies

Bread Given a New Life at Countdown

The Rescued range of upcycled products is now available for customers to buy at select Countdown stores. Rescued takes leftover bread from Countdown bakeries and turns it into easy-to-make vanilla, chocolate, lemon and gin botanicals and savoury baking mixes. It also produces plain and herb breadcrumbs. “When we first began our journey to tackle food waste in Aotearoa through upcycling, one of our biggest goals was to be selling our products in the same place we’re rescuing from - and we’ve done it,” said Diane Stanbra, Rescued Founder.

Read more here

Changes to Health Star Rating

The Health Star Rating system has received an upgrade that is tougher on sugar and salt. The system was first introduced in 2014, and the changes have been made based on a 2019 review. Products with high levels of sugar and salt will receive lower ratings, including breakfast cereals and fruit juices. Minimally processed fruit and vegetables will automatically receive a five-star rating. “We know people lead busy lives, and it can be difficult to make good choices at the supermarket. The Health Star Rating has been designed by nutritionists and health experts to cut through the confusion and give people nutritional information at a glance. We heard some people had issues with rating discrepancies, and we’ve listened to their concerns. By using the best and latest science from a range of experts and getting tougher on sugar and salt, those issues have been addressed, and the system is more robust,” said Vincent Arbuckle, New Zealand Food Safety’s deputy director-general.

Read more here

Curious AF Bottle Shop

Curious AF, the drink brand founded by Lisa King, is set to open the country’s first alcohol-free brick-and-mortar bottle shop. The store opens on November 18 in Ponsonby, Auckland, on November 18, following the success of a pop-up store in July. “Earlier this year, we opened a pop-up alcohol-free bottle shop for the month of July and were blown away by its success. Across just a few short weeks, some 2000 people walked through our beautiful art gallery-inspired installation to discover what the Curious AF movement had to offer. And it didn’t disappoint. In the first few weeks, we sold out of many product lines and received an overwhelming number of requests to make the pop-up permanent. Four months later, here we are,” said King.

Read more here

Empowering Employees to Support Local Charities

Support My Cause, Coca-Cola Europacific Partners New Zealand’s (CCEP NZ) new community-focused programme has donated $30,000 to local charities. Employees are able to nominate a charity that is meaningful to them and vote on the organisations that will receive donations. The first round of support recipients are Awhitu Landcare, nominated by Luke Graham (Business Manager – Foodstuffs North Island), Auckland Women’s Refuge, nominated by Brendan Podayko (Information Assurance Manager) and Bellyful West Auckland, nominated by Richard Davis (Customer Business Manager). “The Support My Cause initiative is designed to support local charities, community organisations, or good causes that are meaningful to our people and support our communities in which we operate. We’re delighted we can support and provide immediate relief to those smaller causes delivering such important work for our communities,” said Chris Litchfield, Managing Director of New Zealand and Fiji at CCEP NZ.

Read more here

most read on web 8 I supermarketnews.co.nz

Wonky Fruit and Vege Box Continues Expansion

Off the tail of its Auckland expansion, the Wonky Box is headed to customers closer to home. Kiwis in the Wairarapa and Palmerston North now have access to the delivery service. “This is a big deal for Wonky! Palmy and the Wairarapa are home to many of our growers who were willing to give us a chance in our early days. It’s so satisfying to know we can now service the local community that helped us kick start. As a regional business, we are able to ensure that the box contents haven’t travelled thousands of miles, and customers should know that they are eating produce from farmers just down the road. It’s a great way to reduce your carbon footprint, which a lot of our customers are keen on,” said Angus Simms, Co-Founder.

Read more here

First in Sustainable Trade Index

New Zealand was ranked first of 30 economies in the Sustainable Trade Index by Hinrich Foundation and the International Institute for Management and Development. The United Kingdom followed in Second place, Hong Kong in third and Japan and Singapore in fourth and fifth, respectively. The economies are judged in economic, societal and environmental pillars. “We have placed trade at the centre of our economic recovery, successfully securing four FTAs in the past five years. Our standard of living depends on our ability to trade and that in turn depends on adapting to changing markets. This ranking is a strong validation of our approach and goes to the heart of our global brand. New Zealand being ranked first in the Sustainable Trade Index is an excellent endorsement of our Trade for All agenda and our successes in economic growth, environmental protection, and societal development,” said Damien O’Connor, Minister for Trade and Export Growth.

Read more here

Foodstuffs Commitment to More Social Supermarkets

As a part of Foodstuffs ‘Here for New Zealand Pledge,’ the cooperative has announced plans to open social supermarkets across the North Island in partnership with local community organisations. The success of the Wellington, Kaitaia, Tokoroa, Whangarei and Otumoetai offerings have been seen through giving Kiwis dignity in choice for their food support. “I’m announcing our commitment to open social supermarkets right across the motu, providing a more dignified and respectful way to access food when times are tough. Rising inflation and cost of living pressure means budgets are being stretched more than ever, and many hard-working Kiwis are really struggling. Since partnering with the Wellington City Mission to open New Zealand’s first social supermarket 18 months ago, we’ve been humbled by the response and see social supermarkets as being an important way we can help everyday New Zealanders get access to the groceries they need with dignity,” said Chris Quin, Foodstuffs North Island Chief Executive.

Read more here

Wine Label Wins Five Trophies in One Week

Giesen won five awards across the New Zealand International Wine Show, the Marlborough Wine Show and the National Wine Awards of Aotearoa New Zealand, in one week. “It’s not every day you win awards, let alone four on the same day and then five in one week, across three different varietals. It speaks to the diversity of quality we offer at Giesen – something our team works hard to achieve,” said Duncan Shouler, Chief Winemaker.

Read more here

November 2022 I 9

functional food&drink

FAVOURING FUNCTIONAL FOODS

The global functional food market was worth $482.6 billion at the end of 2021 and is expected to grow to $909.5 billion by 2028. The CAGR for that time period is 9.5 percent. The trend saw a rise in mid-2020, growing by 11 percent as consumers became increasingly aware of personal health and wellness because of the pandemic. This appreciation is set to continue with consumers as ageing populations, highly processed diets, time scarcity, and financial stresses create a need for innovative health solutions.

Hot topics in the functional food market are relaxation, sleep, mood, mind, energy and immunity, alongside the health concerns of obesity, diabetes, gut health and cardiovascular diseases. Popular ingredients at the moment include magnesium, botanicals, protein, vitamin D, collagen, hemp and CBD. However, functional dairy products have the market lead, specifically those containing prebiotics, probiotics and high protein levels.

The Asia Pacific region holds the highest market share for the industry, with supermarkets and hypermarkets as the leading distribution channels - consumers appreciate the convenience of functional foods being in their major retailers.

In a very similar market to New Zealand’s, Australia is seeing growth in functional beverages and snacks. High-fibre, Kombucha, nootropics, plant-based and weight-loss drinks are all seeing an increase in consumer

interest. Fermented drinks are expected to show the strongest category growth. Functional snacks remain competitive, with probiotic and prebiotic grocery sales increasing 50 percent yearly. The proteinenriched product market is currently seeing some oversaturation.

It is important to remember that not all functional foods are created equal, and as some consumers start to look for food as medicine, there needs to be transparency in the functional claims. Marketing strategies

can include providing recommendations for the product from doctors, nutritionists and other health experts. These claims need to be relevant and accurate.

Taste is also a critical factor in the functional foods market, where added extracts, herbs, or botanicals often drastically change the taste. Counteracting the usual bitterness, off taste, and undesirable flavours are imperative to consumer buying decisions. For example, citrus flavours often work well to mask antioxidant supplements. n

10 I supermarketnews.co.nz

Food is no longer just a source of nourishment; the need for functional foods means products must extend beyond their basic nutritional value.

PRODUCER PERSPECTIVE

Producers in the functional food and drink sector are noticing the increase in demand for science-backed natural nutrition.

Larger producers such as Fonterra are beginning to catch on, the company announced the launch of its cognitive supplement brand, BioKodeLab, at the end of September. Unilever and Nestle have also been making moves among international supplements and vitamins. But it is the small growing producers that have fostered the sector.

Trends noticed by those in the game are adaptogens, immune support, gut health, mushrooms and natural sugars. When utilising these ingredients, or creating a claim, scientifc evidence is the most important factor.

“From the day we started Ārepa, our goal was to create a scientifically proven brain drink. Before we were on the shelves, we engaged with one of the world’s top neuroscientists Professor Andrew Scholey to help us create our patented formula which actually works,” said the team at Ārepa.

“We’re actually one of the only beverage companies in the southern hemisphere who have undertaken clinical research of a finished product in humans, and we’re proud to put our product on the line to prove that it does what it says it does… We see continued and sustained growth in the industry as

the science will only get stronger and more compelling. We are expecting to publish two more studies in early 2023 and have another seven clinical trials across leading universities in NZ and AU.”

Similarly, Vicki Brannagan from Wise Foods saw a gap in the everyday healthy snacking space and has produced a healthy, allergenfriendly cookie in multiple flavours alongside plant-based and collagen-infused variants. She also noted that the functional food and drink industry is about staying true to claims.

“Our marketing strategy as a functional product is to stay true to label, and true to the claims criteria in the Foods Standards Code. We’re very particular about avoiding the more spurious style of claims that are common in this space. Our key messages are less about cookies, and more about innovative flavours and simple label claims, at the convergence between genuinely healthier snacks and indulgence.”

Even though scientific claims are increidbly important, regulation within the industry does not make things easy for producers.

“Development of the functional food sector here in New Zealand is, unfortunately, hampered by a regulatory environment which some would argue is not fit for

purpose. Key to this is the definition of what a nutritive substance is. Nutritive substances are closely tied to novel foods in the FSANZ Code. The current definition is sufficiently ambiguous so that many ingredients used in normal practice would and could be captured as being ‘nutritive substances,’ leaving a substantial grey area about what is or isn’t permitted. As a result, this was tested in Australian courts in 2007. The outcome forced FSANZ (then ANZFA) to initiate a review of novel foods and nutritive substances. The original proposal for the review was initiated in 2012. Ten years later, there has been no resolution,” said Martyn Atack, Technical Director of Cogito Food and Beverage.

“We have the Supplemented Food Regulations, intended to fill the gap in the interim. However, the two most important categories that would benefit from allowing supplementation are Formulated Meal Replacements and Formulated Supplementary Foods, which are specifically excluded from being further supplemented with additional nutritive substances. We also have the Dietary Supplement Regulations 1985 administered by Medsafe. The date on these regulations is a clue to just how fit for purpose these 20thcentury regulations actually are.”

Regardless the common theme from the producers remains to be evidence and integrity, which provides an obvious marketing pathway for any product in the market. n

November 2022 I 11

Kiwi Brook Kirk was drawn to the beverage industry as something new and exciting. He considers the industry to be at a crossroads at the moment, and the need for affordable sugar-free and low-sugar products is more important than ever.

As the new CEO of Kiwi Beverages Sugar-Free, Kirk is enjoying the challenge of elevating the company brands to an international level and utilising his background in exporting to complement what the local sales team are already doing.

“The drinks we make here at Kiwi Beverages Sugar-Free are helping to show both buyers and consumers that there are alternatives to the mainstream sugar-loaded options that have been around for years. The development and ingredients that go into our beverages are providing worldclass options in the fruit drink and energy categories,” said Kirk.

Kirk is an Auckland local, attending Sacred Heart College and completing a Bakery apprenticeship in St Heliers and Che Lui in Howick. He and his brothers purchased what was then the Meadowbank Continental Bakery and made many changes to the business over 13 years, including changing its name to the one it

still holds today - Meadowbake.

Kirk was at Progressive Enterprises (now Woolworths NZ), running the in-store Bakery Division for 14 years and in the Service Deli for a further year. He had a two-year stint as Operations Manager in Brisbane’s large artisanal bakery, Wilbreads, then returned to NZ to work with Lowe Corp. When Covid hit, and travel stopped, the program shut down, leaving Kirk time to enjoy the first lockdown looking for something new.

“The answer came quite left of field when I was offered a GM Business Development role with the Clear Protect Group. CPG are New Zealand’s preeminent antimicrobial and pathogen specialists for the food industry. This was fantastic as it meant I could take my manufacturing knowledge and apply it to solutions for some of New Zealand’s biggest and most iconic brands.”

Now at Kiwi Beverages, Kirk has so far enjoyed the passion that David, Amanda, the rest of the Directors, and the team have for the industry and business. The company’s best-selling product would have to be the entire Frutee range, and Kirk’s new passion showed when describing the Strawberries and Cream flavour.

“It’s especially good, If you haven’t tried it yet, you’ll understand once you have.”

The biggest challenges the company faces right now are supply and logistics. A massive amount of focus is needed from the entire team at Kiwi Beverages to ensure they stay on top of delays and shortages.

To ensure the fridge or chiller is fully stocked with sugar-free and low-sugar drinks, Kiwi beverages are the team to talk to. Kirk left with some advice for innovation in FMCG: Understand your market and the retailer’s needs and make sure you work towards them. n

BROOK KIRK CEO, KIWI BEVERAGES SUGAR FREE

20

minutes with

12 I supermarketnews.co.nz

The drinks we make here at Kiwi Beverages Sugar-Free are helping to show both buyers and consumers that there are alternatives to the mainstream sugar-loaded options that have been around for years.

Free Call 0508 474 663, mobile 021 310 821 or email dave@pioneergroup.co.nz www.pioneergroup.co.nz Contact Key Account Manager DAVE MORELLO to request a quote for your area. Excludes GST and Freight. Limited balers in stock. Subject to availability at time of order. Christmas Supermarket Baler 860HD CHRISTMAS CARD BALER BUNDLE • 1 x HSM V-Press 860 Plus Baler at Supermarket Special Pricing • FREE 10 x bundles (250kg) of Baler Wire (Value $1252.50) • Extended Warranty to 24 months – With Purchase of Annual Service Agreement 605ECO PLASTICS BALER BONUS BUNDLE (Valid with purchase of 860HD Christmas Baler Bundle) • 1 x HSM V-Press 605 ECO Plastics Baler at Supermarket Special Pricing • Free Installation and Training (Value $627.00) • Free Box of Plastic Strapping • Free Annual Service Agreement (With valid 860 Service Agreement) • Extended Warranty to 24 months

store of the month KUMEU PRODUCE MARKET

SANDY CHENG STORE OWNER

SANDY CHENG STORE OWNER

Sandy Cheng and her husband Jerome manage Kumeu Produce Market, located at 407 State Highway 16. Before moving to New Zealand, the couple lived in Taiwan, where Sandy worked in Finance and Jerome in business. Shortly after getting married, they picked up everything they had and immigrated.

Upon arrival in New Zealand, the couple studied at a polytechnic and started working at their local greengrocer on Hobsonville Road.

After the birth of their two sons, an opportunity to own and operate the Lincoln Fresh greengrocer presented itself, and the couple became owneroperators for the first time.

Cheng noted that owning their first business was challenging, but she felt lucky to supply to her community. The couple opened their second store, Kumeu Produce Market, in search of a new challenge 12 years ago. They have since passed on Lincoln Fresh, so their

sole efforts can go into the Kumeu store.

“What drew us into being greengrocers was that we found it important and necessary that people could get quality and nutritious produce at reasonable prices.

We have maintained our passion by supporting the local and wider Auckland community with quality produce; we also like to support local growers and farmers.

From locally grown tomatoes, strawberries and other organic products, we also deliver to several businesses, cafes, and restaurants daily,” said Cheng.

For Cheng’s husband, Jerome, the typical day starts at 3am. He can be

14 I supermarketnews.co.nz

found at the markets sourcing fresh produce for the store, and she credits this dedication to their ability to maintain quality and rage - “As they say, the early bird gets the worm.”

The store has a strong team of ten. Cheng and some of her staff will set up the shopfront between 6am and 7am, restocking, helping early customers and picking produce for the local business delivery run.

Throughout the day, operations run smoothly and involve bagging fruit and washing and trimming vegetables. Part-time staff take over in the afternoon while Cheng and her husband prepare for evening deliveries.

As a small family business, Cheng values communication. There is so much going on in the store that asking each other for help makes things more enjoyable and helps the team better serve customers.

“I recall a time when we still owned both businesses. A customer came to Lincoln Fresh and mentioned they liked our Gold Kumara and asked to purchase a box. They said they usually go to a store in Kumeu for their Gold Kumara, but they had just sold out for the day. When the customer found out that we managed both stores, they were not surprised and noticed the similar qualities our stores displayed.”

She is also incredibly proud of her store’s history of supporting local, small and growing businesses, knowing firsthand how hard it can be to establish a brand in a competitive market. Just the other day, two small business owners mentioned to Cheng that Kumeu Produce Market was the first

store they had been stocked in, and she was incredibly proud to give them the opportunity.

Besides seasonal fruit and vegetables, locally sourced foods and organics are the bestsellers in the store. In the summertime, strawberries and stone fruit varieties are popular, and Cheng takes pride in the store’s offering of local freerange eggs.

The specials are displayed on traditional black signage boards, and information occasionally goes into local print media. The staff are very diligent with social media, posting on the store’s Facebook page and local community groups.

“We haven’t been able to expand our digital marketing and online presence. It has certainly been a challenge.

I imagine it is the same with many other small businesses that have operated for many years and may not have the resources or expertise to pivot to an online business to do home deliveries like supermarkets.”

Despite this, Kumeu Produce Market has flourished thanks to the support of the local community and Sandy and Jerome’s commitment to sustainable and quality organic produce. n

November 2022 I 15

GETTING TO KNOW LIAM CRAUSE

Learn more about the Senior Marketing Manager at Cartology NZ, his role, what differentiates Cartology and what clients can expect over the next 12 months.

multiple projects, everything from creating the website, arranging a launch event, determining the brand position and customer value proposition to gathering and translating customer data into insights to support the sales team.

its infancy but is sharply on the rise, and Cartology are right at the forefront. They have a vast omnichannel media ecosystem with unrivalled access to first party data.

lot since Cartology’s inception, and is constantly looking to international markets that are more mature than NZ to give a glimpse into what the future holds.

LIAM CRAUSE Senior Marketing Manager, Cartology NZ

The Role

Crause has the privilege of setting the marketing strategy for Cartology that covers four key areas of the plan; Brand, Communication, Insights and GTM. Having previously worked in Brand and Shopper Marketing roles for the likes of Diageo, GSK and Lion, he is very familiar with retail media networks. Using that experience, he can apply a client lens to all the marketing activity run at Cartology.

“I have been with the business since it launched in February 2021 and over the past 18 months I have worked across

It sounds like such a cliche but no two days for me are ever the same. One day I am setting the strategy, the next day I am activating that strategy across owned, earned and paid channels. I also get to lead a very talented Assistant Marketing Manager, Cassandra, and together we share the workload of spreading awareness of the Cartology brand.

More recently, I have started writing thought leadership articles about the rise of retail media and even had the opportunity to speak about it at The Future of Retail Marketing conference.”

Partnering With Cartology

The Cartology North Star is to shape the future of retail media through trusted partnerships with the Woolworths Group ecosystem and brands. Retail media in New Zealand is still in

“When we combine those two together, we are able to drive real customer impact to help grow brands. Brands that sell through retail platforms want to influence customers not just at the point of purchase but throughout their entire shopping journey. Cartology Retail media enables brands to build better connections with customers instore and online.

Our retail media proposition starts with customers, our role is to ensure that we are creating accretive experiences for customers that are contextual and a seamless extension of their shopping experience.

Activating campaigns that are hyper relevant to those customers is the next component, whether they are in our network or off network and lastly and most importantly is our ability to measure the effectiveness of these campaigns through closed-loop reporting.”

The Next 12 Months

There are three key areas of focus for the marketing team over the next 12 months: Literacy, insights and Proof, and the Cartology proposition. As retail media gathers more momentum, Cartology’s mission is to grow the awareness and the opportunities it presents for brands.

Literacy on the topic in NZ is scarce, but Crause has learned a

“Closer to home, we are sharing our own learnings and insights from the vast array of campaigns we have run and using that knowledge by sharing it with our clients on how to effectively use retail media networks, especially as we continue to grow the Cartology media channel offering.

We all know the value of insights and given our unique access to real shoppers; we are going to be running research to fully understand the everchanging shopper journey. That research will form the basis of a series of Playbooks to help our clients fully unlock the value of retail media by effectively activating along that shopper journey.”

Personal Shopping List

Crause’s family shopping list sees milk, coffee, carrots, yoghurt and beer.

“Milk ...litres of it. My kids are at that age where they want to pour the milk themselves and let’s just say more ends up on the floor than in the cup.

Coffee. Carrots - our Beagle called Molly eats them as a treat. The Collective Greek YoghurtI recently discovered the coffee cacao flavour…delish! Anything from the beer chiller - the style depends on the occasion.” n

16 I supermarketnews.co.nz

column

November 2022 I 17 2023 buyer's guide 2023 buyer's guide BOOK YOUR SPOT NOW! BOOK YOUR SPOT NOW! email sales@reviewmags.com

As Seen at Go Green

Go Green is New Zealand’s largest green living and sustainable lifestyle show. The expo features a selection of diverse brands and companies that favour the environment and healthy living.

With a number of dates across the country in 2022 and 2023, companies and brands look to transform customers’ way of life. Categories include Food and beverage, beauty and personal care, household products, eco home and building, home and lifestyle and health and wellness.

“Go Green Expos continue to get better every year, with strong, effective advertising and marketing ensuring the right crowds attend, and all exhibitors have a good experience,” said Julena from Hunter Gatherer.

The Expo expects between 7,000 and 11,000 visitors depending on the location and offers goodie bags, professional speakers and influencers, free yoga classes, live seminars and demos, a show prize and a networking event for exhibitors.

2022 & 2023 EXPOS:

• Auckland, November 12 & 13, 2022

• Tauranga, November 19 & 20, 2022

• Christchurch, August 5 & 6, 2023

• Hawke’s Bay, October 14 & 15, 2023

• Wellington, November 4 & 5, 2023

18 I supermarketnews.co.nz go green

Better Better Noodles …

“We had an amazing response (at the expo) as people really appreciate having a Healthy Noodle Option available. A meal, not a snack. Probably the busiest stand, we sold about 800 boxes and could hardly keep up,” said WhatIF. The noodles have vibrant colours and awesome flavours to brighten up any meal. But that’s not all! 17g of protein per bowl, making up to 25 percent of the daily requirement of protein (equivalent to two eggs). Three times more dietary fibre than conventional ramen - great for a healthy gut and keeping you fuller and satisfied for longer. With the in-house patented air-frying technology, the fat content is reduced by 60 percent versus a typical deep-fried instant ramen. And no Palm oil ever.

To order contact 09 820 7800

Angel Food

“Go Green Wellington was a success for us, reconnecting with lots of existing customers and meeting lots of potential new customers who had seen our products instore but been hesitant to purchase an unfamiliar product. Feedback on the products was very positive - especially the two recipes we showcased using our plant-based cream cheese - a rich dark chocolate cheesecake and marinated cream cheese cubes. The top products were our cream cheese and the grated. People love the convenience,” said Alice Shopland, Founder and Managing Director.

To order contact 09 3764623

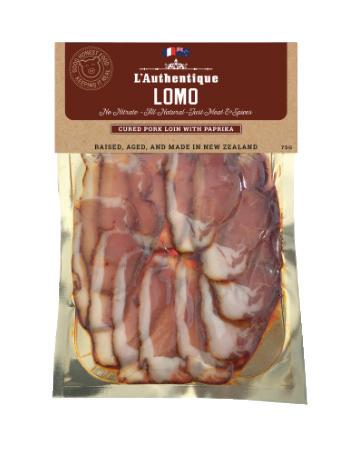

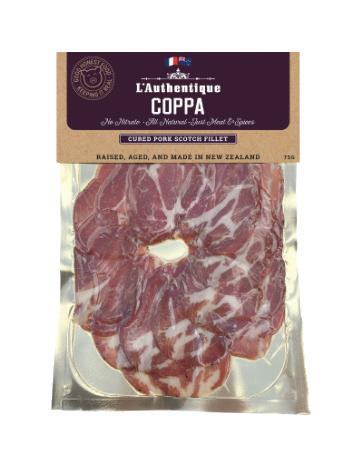

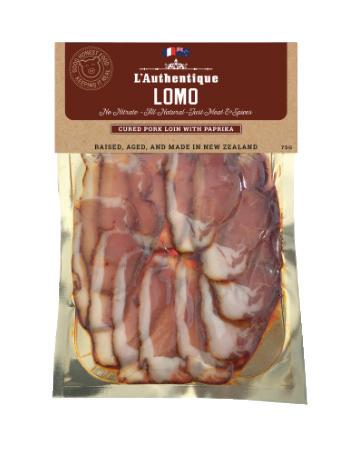

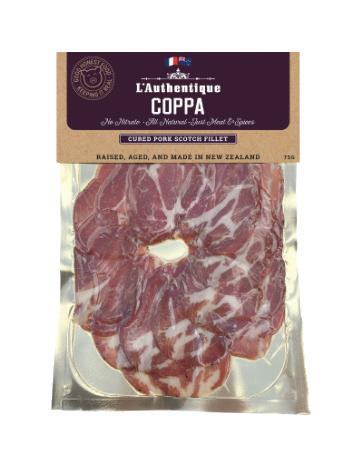

L'Authentique

The Go Green expos were a solid opportunity for L’Authentique to showcase their products, reconnect with existing customers and have new conversations with customers looking for keto, dairy-free and all-natural meals or the entertaining solutions range. As well as their popular favourites; the sausages, parfaits and go-to terrines, they also highlighted the new range of cured, slow-aged meat. Cured without nitrate or chemicals, using traditional Mediterranean preservation methods, the ingredients list for L’Authentique range is wonderfully short and local, and the price point is reasonable: something the Go Green attendees loved. With summer entertaining around the corner, this long-life local range is perfect in the deli. Contact Wade on 021 613939 to order.

From One (Taste) Bud to Another

Face to face with the people who are their biggest critics and biggest advocates - that is the joy of the Go Green shows, and nothing beats it. “This year, we found lots more people know and love the Food Nation brand. The understanding of the environmental and health benefits has grown enormously and was clearly on people’s minds, and we got huge kudos for the added vitamin B12 and D. Possibly most exciting was the response to our new Spanish Chorizo Super Sausie. It’s only our second sausage in the range and has taken us two years to get one we really thought was a winner on taste and texture. The crew at Go Green pretty much told us it was a slam dunk winner on both fronts. Both the saussies in the range flew off the shelves this time round. We’re coming into summer and sausie season so looking forward to feeding the nation,” said Food Nation.

To order contact 027 474 1019

November 2022 I 19

Fighting Modern Slavery

27seconds, the North Canterbury wine label that donates 100 percent of its profits to helping end modern-day slavery, is preparing its big donation goal for the next holiday season.

Last year, the company sold 15,000 bottles over the Christmas period, which allowed their donations to total $147,000. This year it hopes to sell 17,000 bottles.

“People often think it’s a crazy concept to give away the profits. We’re like any business and have costs to cover, though some folks in our supply chain are amazing and give us a discount/donate to contribute to the cause,” said Alanna Chapman, Co-founder.

On Christmas eve in Kolkata, India, in 2012, Alanna and Pete Chapman were visiting friends who run Freeset, a business that offers alternative employment to women in prostitution. When visiting one of the women they had met, an alleyway shortcut had the pair encounter a group of teenage girls that looked distinctly different. They were then told the young girls had been trafficked from Nepal and sold into prostitution.

The injustice of modern-day slavery hit the couple hard. More people are in slavery today than ever before, it is estimated the figure currently sits between 21 and 40.3 million people.

Pete is the manager for his family vineyard, Terrace Edge, and in 2017, that is where the idea originates: a wine label that donates 100 percent of its profits to charity, or more specifically, to help end slavery. The first year saw 9000 bottles produced, with the Rose and Savignon selling within four months.

The name 27seconds comes from the Unicef statistic that estimates one child every 27 seconds is sold into slavery, or 1.2

million children every year. The brand’s range includes a Riesling, Sav Blanc, Pinot Gris, Rose and Pinot Noir. It also offers wine-tasting party boxes.

All profits from the wine go to charity partner Hagar, which provides recovery care for survivors of slavery, trafficking and severe abuse in Cambodia, Vietnam and Afghanistan. This includes trauma and recovery care, access to education, economic empowerment and systemic change. Hagar recently named 27seconds as one of its two ‘mega donors.’

“We really feel that the name ‘mega donor’ belongs to the collective community of people who choose to buy 27seconds. Yes, we make the wine, but without people purchasing it, there would be no donation to give. So it’s our consumers who are the true heroes.” n

20 I supermarketnews.co.nz go green

THE DESIGN AGENCY

WHERE ‘WORK THAT WORKS’ IS ALWAYS ON THE MENU

Specialising in packaged-goods design and strategy, Brother Design has shaped many of New Zealand’s best-loved brands. This is how they do it.

When Brother Design set up shop fifteen years ago, its purpose was clear: to raise the bar in design for the whole FMCG sector. A look around New Zealand’s retail stores would seem to prove that mission was accomplished. From private labels to brand leaders and new entrants, high standards prevail. But the Auckland-based agency isn’t sitting on its laurels.

“Succeeding in the packaged goods sector is harder than ever,” said Brother’s Business Development Director, Jennifer McMillan. “In a way, we’ve made our own job more difficult because we effectively pioneered a new standard in retail packaging design. We’ve just become better at it over time, as bottom-line results for our clients show.”

Typically, McMillan chooses returns as a measure of success, even though Brother has been showered with New Zealand and international design awards over the years. “It’s great to impress your peers. But at Brother, the reason clients seek us out and stay with us so long is our commitment to work that works–on shelf, in the market, where it matters,” she said.

THE SECRET SAUCE

With a client list that comprises many of New Zealand’s best-known grocery brands, clearly, a lot of companies like what Brother Design has to offer. But what is that, exactly? Why would it be better than another design solution? “It’s two things,” said McMillan. “Talent and methodology. And one without the other just won’t achieve the same results.” McMillan contends that subjectivity has led some potentially-successful FMCG brands to underperform. “At Brother, we have a seriously talented and experienced team. But it’s our proprietary design approach that ensures such potential delivers real success.”

It’s an approach that puts context at the heart of everything, from initial review through to testing and refining the final designs. And it has quite the track record.

“Countless times we’ve produced design that–without anything else in the marketing mix changing–increases sales, trial, market share, category growth, you name it, literally overnight.”

Visit brotherdesign.co.nz or email jenny@brotherdesign.co.nz or call 021 1932141 to find out more. n

Brother_Supermarket News_HalfPage_210x150mm_October v1.indd 1 19/10/22 3:33 PM November 2022 I 21

IT’S GETTING HOT IN HERE. MORE ACTION; LESS TALK

Sustainability - We’ve all heard the harrowing statistics, we know it’s an important consumer hot button, and we don’t want to continue to contribute to the problem. So why are businesses so slow to get on board with tackling sustainability? Why is something so important to long term brand relevance and business success so difficult to get off the ground and implement?

of those surveyed reported a willingness to take a pay cut to gain employment at these organizations.

Supermarket News Buyer's Guide 2023

So why is implementing this very necessary shift so difficult for businesses?

sustainability goals. Executives that view sustainability as an opportunity and incorporate these goals into border strategic objectives will be sure to see the returned business value.

2. Harness the power of technology: Digital technology can give leaders a foot up in their quest for sustainability. Technologies such as the cloud, AI and blockchain can provide usable data and insights that would help businesses set, track and manage improved, sustainable operations.

3. Set measurable (and achievable) targets: Sustainable targets should be embedded into the business strategy and understood by stakeholders. If the leaders of a business don’t know their targets or they’ve created targets that aren’t achievable, they may struggle to make changes that inspire others and move the needle.

FIONA KERR Head of Brand and Customer Experience, VAPO

The case for companies championing sustainability is strong! And the numbers stack up. Let’s look at some data from the IBM Institute for Business Value (IBV) who undertake a number of research projects across consumers, CEO’s and employees each year.

IBV Consumer research conducted in 2022 revealed that consumers are changing their habits to reduce their environmental impact. Almost 2 in 3 (64 percent) say products branded as environmentally sustainable or socially responsible made up at least half of their last purchase. And roughly half (49 percent) of consumers say they paid an average premium of 59 percent for products branded as sustainable or socially responsible vs 12 months ago.

Business leaders are also under pressure, IBV’s 2022 CEO study revealed that almost four in ten (39 percent) executives said that environmental sustainability is a top priority for them today, and more than half (53 percent) said it would be a top priority in three years.

• Fear of greenwashing: Businesses may be fearful of criticism or backlash if they don’t get sustainability and the reporting perfect or if they perhaps fail to deliver on a specific goal.

Be Featured in this Vital Industr y Resource

• Fundamental change requires collective action: Sustainability does not fit neatly into the modern business model because it requires multiple departments, multiple inputs and multiple levels. Therefore, it is often difficult to drive sustained engagement and action.

4. Share the load: Sustainability needs to be embraced and activated across the whole business. No one department or individual can make the significant changes required. It starts at the top and should form part of every level of the business. Incentivising this change in behaviour may help employees adopt ‘green habits’ faster.

Listings Closing Soon! CLICK HERE

5. All in this together: No single organization can curb climate change on its own. We need to work together with our partners and suppliers to create meaningful and sustainable change. Transparency and collaboration is key. Organizations should work together with other businesses to achieve set targets, reduce risk and boost efficiencies.

An IBV Employee satisfaction study found that over 70 percent of surveyed employees and job seekers believe “environmentally sustainable companies are more attractive employers.” And almost half

• Profits (generally) rewarded over business change: Traditionally, the C-suite hasn’t been tasked with delivering sustainability as a measure of success. Bonus structures and rewards systems are usually linked to commercial achievements and profit, possibly with some softer people metrics such as engagement scores built-in for ‘balance’.

• What should be measured, by when and by whom: Things that affect people and society at a macro level may be more difficult to gain clear-cut data, and their impacts are not always immediately obvious. Sometimes the plethora of choice creates inaction and confusion. Not to mention who should be measuring and juggling the required multiple data sources.

The sobering reality is that we won’t solve this issue in my lifetime, but if we continue to do nothing, there won’t be much of a planet left. A report by The World Bank estimates that by 2050 the world will generate 3.4 billion tonnes of waste annually, and unchecked CO2 emissions will contribute to a temperature increase of two degrees Celsius - making life on this planet almost intolerable.

OPENING SOON YOU ARE INVITED!

Now is the time for businesses to step up and become part of the solution, cut down on emissions and waste, invest in their people as finite resources, change behaviours and contribute to stopping the damage (as much as we can). n

Here

are five ways to accelerate sustainable adoption within your business:

1. Start seeing sustainability as an opportunity: It’s a myth that businesses have to sacrifice results to reach their

22 I supermarketnews.co.nz

column

BE FEATURED IN THIS SOON! VITAL INDUSTRY RESOURCE LISTINGS CLOSING

RAW KANUKA HONEY 500G

Manawa’s Raw Kānuka Honey, with its delightful, the natural creamed texture is an international award winner, and its also got health-giving properties that hark back to its cousin Mānuka. Raw means not filtered, not heat-treated and not pasteurised. In sum, this is an extraordinary honey from the rhythms of the ancient forest, Te Urewera. Launch Special Price will expire in two weeks, so don’t hesitate to get one now. Learn more at www.manawahoney.co.nz/productpage/raw-kanuka-honey-500g/

TASTE NATURE’S BEST, MADE EVEN BETTER

They’ve taken the delicious Westgold butter and infused it with favourite herbs and spices – which means less time chopping and mixing and more time spreading and eating! The Garlic & Parsley Infused Butter will rival the juiciest of jus, while the Chilli & Garlic Butter will see your sweet chilli sauce banished to the back of the pantry. Check out www.westgold.com/nz/recipes/ category/infused-butter for inspiration and fresh ideas on how to use Westgold Infused Butter. 100g butter sticks are available now in Countdown nationwide and New World in the North Island.

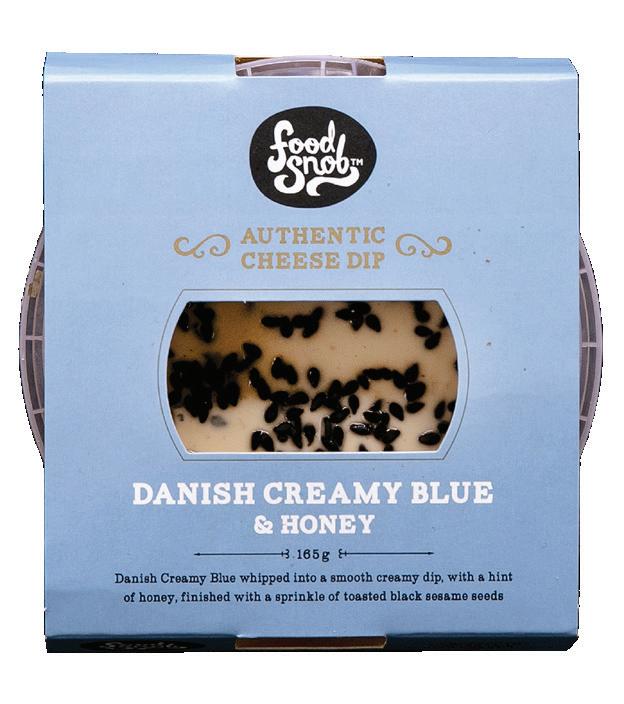

CHEESY DIPS

Introducing Food Snob’s new Authentic Cheese Dip Range. Crafted in New Zealand using Food Snob’s favourite cheeses, whipped into a smooth, creamy dip. Three flavours to try: Smoked Danish Havarti & Black Pepper, Aged English Cheddar & Jalapeno and Danish Creamy Blue & Honey. Perfect for sharing on platters or pairing with favourite chips. Available in most Countdown, New World & PAK’nSAVE stores in the Dip’s Chiller.

TAMCO CONDIMENTS

The tangy taste of tamarillo complements a variety of foods, and its versatility to blend with other foods appeals to customers who want to boost the taste experience. The unique gourmet products use a specific variety of tamarillo grown by the NZ Tamarillo Cooperative, a small group of specialist Northland orchardists and marketed under the brand For the love of Tams. All products are gluten and dairy free. No added preservatives or colour.

TAMARILLO RELISH

The Tamarillo Relish has a rich, tangy, genuine taste of tamarillo. Because of its versatility, it’s delicious on cheese and crackers, hot scones or as a compliment to chicken, fish, vegetarian dishes, pies, etc. Delicious with sour cream as a delicious dip with corn chips and tacos, superb served with meats, salads and cold cuts, spread on pizza base as a sauce, or added to meatloaf mixes or casseroles.

TAMARILLO VINAIGERETTE

The Tamarillo Vinaigerette has the wow factor with a unique sweet, tangy taste – superb drizzled over salads, meats, seafood or sprinkled on vegetables, blended into marinades and dressings, whisked with olive oil and served as a dip with crusty bread or even sprinkled over strawberries and served with whipped cream. Whisk with olive oil and serve as a dip with crusty bread, sprinkle over strawberries and serve with whipped cream, steep with beetroot, cucumber or tomatoes.

24 I supermarketnews.co.nz

LOS BROS

Lo Bros proudly present Not Soda, well, not soda like you know it. Lo Bros are on a mission to free the oceans of plastic bottles and hydrate soda lovers with damn tasty, better-for-us drinks that will leave taste buds tingling for more. For every can sold, Lo Bros Not Soda along with their partners, Seven Clean Seas, clean-up two plastic bottles from oceans and waterways (the equivalent weight of two plastic bottles to be exact). Are they excited to be doin’ good within the soda industry? Fizz yeah! Available in four hit flavours Raspberry, Orange, Pink Grapefruit and Lemon. Learn more about this sea-sational movement at lobros.co

FORTUNE FLAVOURS THE BOLD: NEW

HI-CHEW MIX BAGS

Hi-Chew is well-known as sensationally chewy candy bursting with flavour, and Kiwi consumers can look forward to trying out the two latest additions to the extensive range this spring. Superfruit Mix features a delicious range of tangy, tropical flavours: Dragon Fruit, Acai and Passionfruit. Made up of two distinctive layers, each sweet treat packs a punch of real fruit flavour with every bite. PlusFruit Mix features a seamless pairing of delicious flavours: Orange & Tangerine and Red Apple & Strawberry, treating fans with the added fun of REAL fruit pieces inside for an extra chewy experience - a first in HiChew’s innovative candy-making history. Rolling out now to leading supermarkets and retailers nationwide. For more information or to become a stockist, contact Tokyo Food Retail Manager - Mark Whiteman, info@tokyofood.co.nz

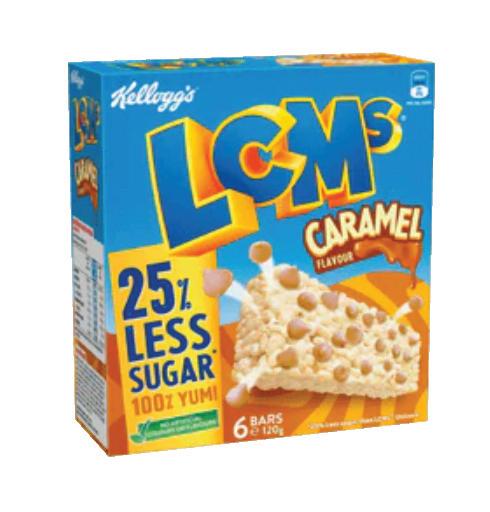

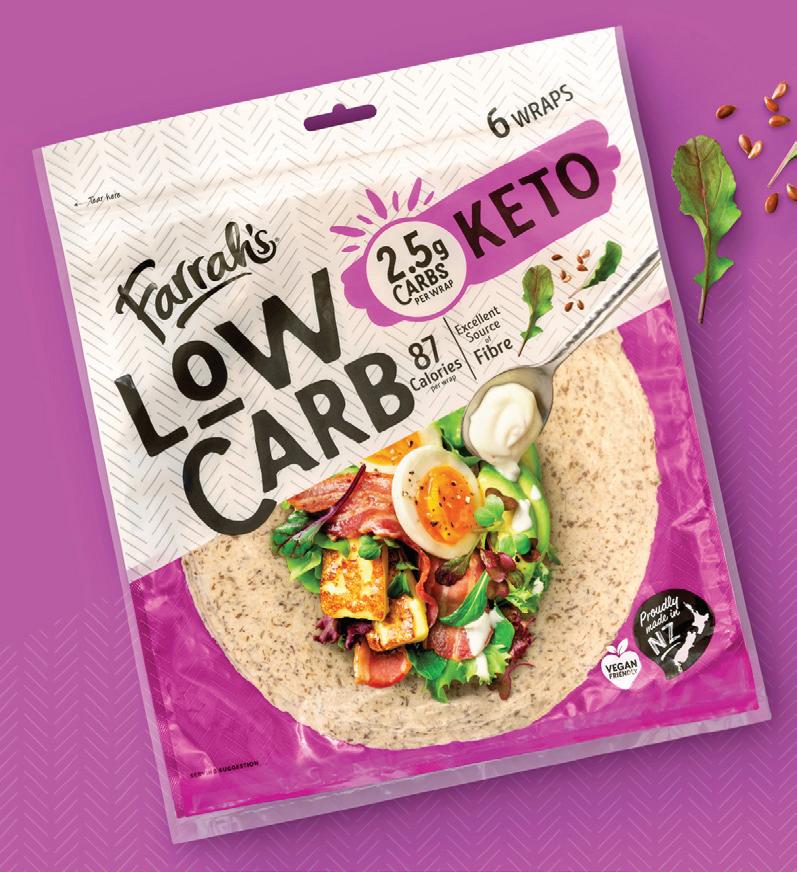

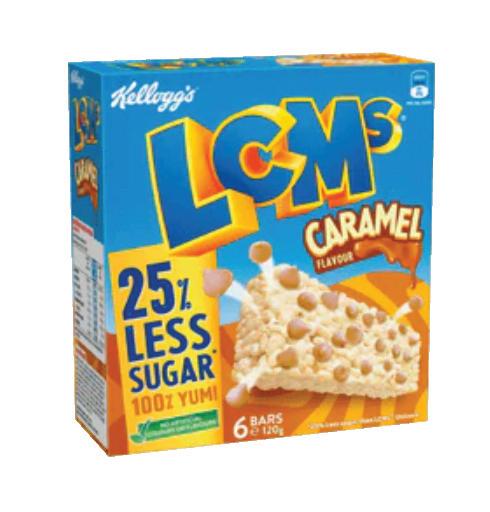

KELLOGG’S AUSTRALIA LAUNCHES A NEW REDUCED SUGAR LCMS RANGE

Kellogg’s Australia has rolled out a new range of its iconic lunch box brand, LCMs – the snack bar kids love. The new range contains 25 percent less sugar than comparable LCM bars and are available in two new delicious flavours. Choc Strawberry combines the sweet taste of chocolate with a burst of strawberry flavour. The Caramel variant compliments the crispy marshmallow base with delicious caramel toppers. Made from the same puffed rice used in Kellogg’s Rice Bubbles the range is also free from artificial colours and flavours. The new LCMs bars are now available in PAK’nSAVE and New World stores in North Island.

L’AUTHENTIQUE

Kiwis will be rustling up platters as summer entertaining gets underway. L’Authentique, the award-winning New Zealand sausage maker, has launched a range of cured, slow-aged meat using traditional Mediterranean preservation methods. Cured without nitrate or chemicals, the ingredients list is wonderfully short. Air-dried and sliced delicately paper thin, the Lonza, Lomo and Coppa can be served on or beside a baguette lathered with butter which will cut through the textural profile of the dry-cured meat. A Filet Mignon - French for cute fillet - is aged and cured eye fillet sold in unsliced 100g lengths and comes in three spice variations: Natural, Garlic and Mild Paprika. L’Authentique cured meat is available now in addition to the deli range, contact Wade Lewis 021 613939.

November 2022 I 25

KAI COMMITMENT LAUNCH

On November 2nd, New Zealand’s largest food businesses joined the Kai Commitment - a voluntary initiative to reduce food waste and emissions. The Kai Commitment is led by the New Zealand Food Waste Champions, a charitable organisation established to progress UN Sustainable Development Goal 12.3, reducing food waste by 50 percent by 2030. Fonterra,

Countdown, Goodman Fielder, Silver Fern Farms, Foodstuffs and Nestle are the first organisations to join the commitment.

“In New Zealand, landfilled food waste contributes four percent of our total emissions and represents a lost economic opportunity of up to $2 billion per year. What’s more tragic than the numbers is that one in five Kiwi kids live in constant hunger. Through the Kai Commitment, we hope to

collectively work on developing a food system in Aotearoa New Zealand, that values every piece of food we produce,” said Kaitlin Dawson, Executive Director of New Zealand Food Waste Champions.

“We’ve seen globally that voluntary agreements make a meaningful impact on reducing food waste. The UK’s equivalent agreement, the Courtauld Commitment, contributed to the UK reducing food waste by

28 percent nationally in the last decade and being on track to meet the UNSDG12.3 goal.

“Reducing food waste also makes good business sense. Global studies show that for every $1 investment in reducing food waste, there can be a return of $14.”

“I’d like to thank our first four signatories, the founding signatories, Countdown, Goodman Fielder, Fonterra and Silver Fern Farms who have supported the design and development of this initiative over the last year. Building Kai Commitment with businesses, for business, was very important to us. We thank them for their insight, leadership and commitment to reducing food waste in their organisations and supply chains.

“Additionally, I want to acknowledge the organisations that invested in the establishment of this project including, AGMARDT, Whakatupu Aotearoa Foundation, Countdown, Goodman Fielder, and the Ministry for the Environment. It has been a team effort.” n

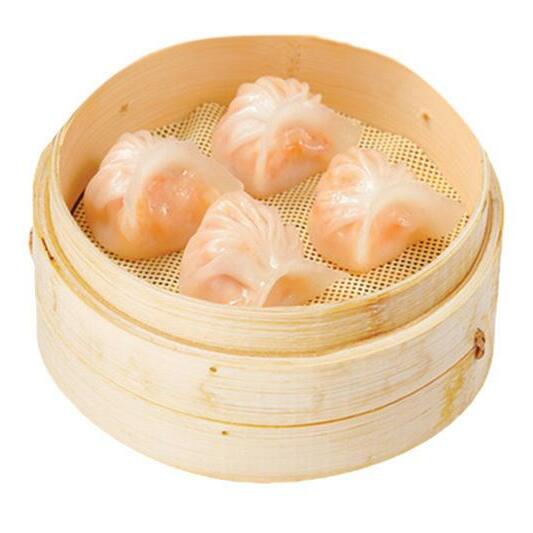

26 I supermarketnews.co.nz Your Asian Food Specialist Contact T: 0800 10 33 05 E: nzenquiries @oriental.com.au Valcom authentic Thai coconut milk and cream.

news

With temperatures heating up and BBQs being dusted off, shoppers this month are looking for the fresh flavours of summer dining, and the new season potatoes arriving are the perfect addition to the trolley. Retailers throughout New Zealand should be preparing room for this Kiwi favourite.

It’s certainly the happiest time of year for spud lovers and the busiest time of year for New Zealand’s growers, located throughout the country in Northland, Pukekohe, Manawatu and Canterbury.

2022 has seen the New Zealand potato industry navigate a return to some kind of normal after the pandemic years, with all yields remaining as expected across the industry’s three sectors: seed potato, fresh/ table potato and processing varieties.

New potatoes are in store from late October onwards, with the annual harvest drawing to a close in February. Handle the incoming baby potatoes gently as their skins are delicate.

Top tips from the team at Potatoes NZ to build the best instore displays of spuds is to make it clear what the variety is, rather than just saying ‘white/yellow/ red’. Consumers are becoming increasingly savvy regarding their choice of variety and, as they get to know and love a specific potato, they’ll seek it out and retailers can expect sales to increase.

As the potato industry increases its marketing presence, it’s looking to honour the identity of individual growers, a developing trend amongst consumers who want to know who produced their food.

Retailers are also advised to label each variety of potato with recommendations for use, such as ‘Great for baking/boiling/ salads/mashing/roasting’, to assist shoppers in selecting the correct spud for their needs.

New Zealand’s $1 billion potato industry supplies the most loved staple vegetable amongst Kiwi consumers, with around 20 percent eating them every day. And not only do the nation’s growers supply the highest quality produce, but they’re also farming in a sustainable way, with strategic targets of net zero emissions by 2035.

The biggest challenge for the industry is how to both adapt to the climate crisis and mitigate any threats from it, such as extreme weather events and the changing climate.

Potatoes will play a major role in helping

sustainably feed Aotearoa and the world, as our growers demonstrate how to use less resources, thus requiring less land.

In addition to these significant changes, the industry also needs to navigate the multiplicity of changing regulations and most especially those that are climate related.

With these increasing demands on the potato industry, it’s important that retailers take this evolving environment into consideration and communicate the high cost of producing fresh produce in New Zealand to consumers where possible.

While costs are rising, the importance of the nutritional boost that potatoes give to such a large percentage of the population must also be considered.

Many shoppers are surprised to learn about the valuable nutrients contained within the humble spud. Just one serving contains 47 percent of the recommended dietary intake (RDI) of Vitamin C, and potatoes also contain folate, thiamine, niacin, pantothenic acid, and potassium and are a source of dietary fibre.

Potatoes are very much a key part of a healthy diet and can be enjoyed in a variety of ways, with recipes spanning cultures and loved through the generations. The smart retailer will be planning a dedicated space to feature these nutritional powerhouses and reaping the result as Kiwi consumers demonstrate their love of the spud. n

MAKE ROOM IN YOUR RETAIL SPACE THIS SUMMER FOR NEW POTATOES November 2022 I 27 column

We’re coming up alarmingly fast on Christmas, and while that may bring a welcome break for many, it’s often the opposite for retailers and particularly the food and beverage sector.

28 I supermarketnews.co.nz column

RAYGUN Retail Decoded

JOHN-DANIEL TRASK

Co-Founder/CEO,

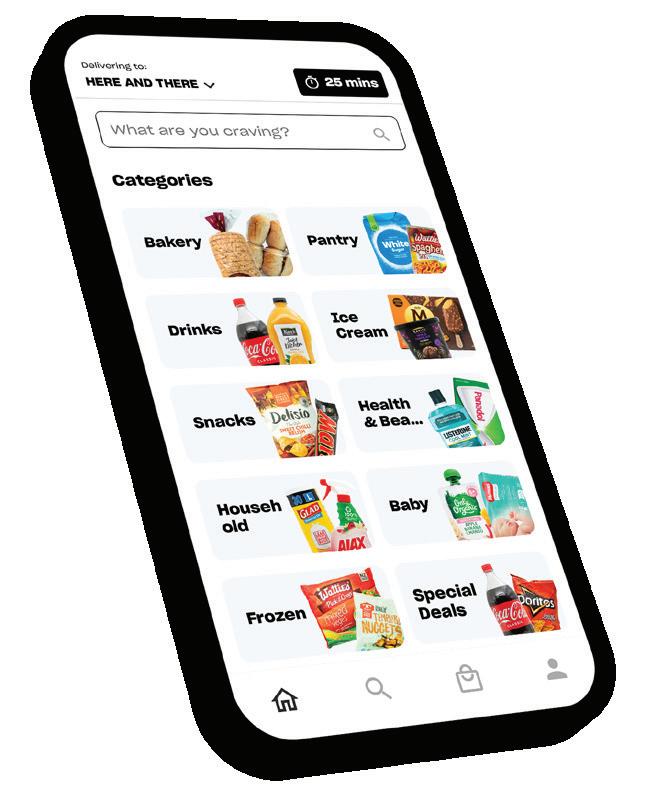

At Raygun, we look after a lot of customers in the US, and as I write this, we’ve been helping them gear up for the Black Friday/Cyber Monday period. Though these sale days aren’t quite as show-stopping in New Zealand as they are offshore, they can still put a lot of pressure on e-commerce systems, and the Christmas period will bring even bigger surges.

When it comes to preparing for massive shopping periods, seasoned business owners will have an established checklist; staff to cover additional shifts, ordering extra stock, prepping promotional material, and so on. But with digital sales ramping up year-onyear, it’s equally important to make sure your website is robust enough to withstand peak periods.

Even world-leading retailers can fall victim to preventable performance issues, and we’ve all heard horror stories about outages caused by traffic surges. In 2021, Office Depot went down for hours on Cyber Monday, while other massive brands like Walmart and GameStop also reported extended outages.

One particularly eye-watering statistic from the Consortium for Information and Software Quality tells us that in 2020, operational software failures cost $1.56 trillion in the US alone, which is ten times more expensive than finding and fixing issues before releasing software into operation.

So today, I thought I’d talk about preventing the tech mishaps that can wreak havoc during your holiday surges. Smart planning and stable technology choices can help you catch issues before they become disasters and save damage to your reputation, relationships, and revenue.

DON’T MAKE ANY CHANGES IMMEDIATELY BEFORE OR DURING BUSY PERIODS

That may be stating the obvious, but it might also be tempting to add a festive animation to your homepage, try out a new third-party extension on your site to help with issuing gift vouchers, or any number of other extras to make the most of the silly season.

These seemingly harmless or helpful changes might cause your site to slow right down or break something entirely. If you’re going to do something different, make sure you’ve tested it carefully, well in advance.

MAKE SURE YOU CAN TRUST YOUR SYSTEMS

Are you using a Content Management System like WordPress, Wix, or Squarespace? How is your website hosted? Do you use external servers? Check with your developers or IT provider that your systems are scalable and have the capacity to handle a significant increase in traffic.

MOBILE MATTERS

2021 was the first year that mobile surpassed desktop on Black Friday, with 54 percent of purchases occurring on mobile devices. Mobile can no longer be an afterthought. To make sure your website is mobile-optimised, drop your URL into Google’s mobile-friendliness checking tool. I’ve talked in previous columns about using the Google customer experience score to assess the quality of your website, and this system is also focused primarily on mobile. Enter your website URL in PageSpeed Insights and toggle to the mobile view to produce a list of suggestions on how to optimise your site for visitors on mobile devices.

SUPPORT

If you’re selling to an international market, or even dealing with last-minute, late-night shoppers at home, you’ll likely see support requests coming through at odd times. You’ve probably already thought about having somebody available outside normal business hours to answer general support calls, but consider adding somebody who can help with technical support and troubleshooting during periods of high traffic.

A fast and functional website is indispensable to take advantage of holiday shopping activity, especially as postpandemic e-commerce sales remain at historic highs. If you’re looking to grow your business and maintain full confidence in the stability and speed of your site all year round, it’s worth looking into a monitoring solution that will detect any errors or abnormalities in your software and alert your team before your customers are impacted.

A few simple preventative steps can protect your profits during the most important retail periods of the year, and there’s still time to health-check your digital store and take a few precautionary measures.

I’ve touched on a few technical concepts in this piece, so if you’d like a bit more detail or have follow-up questions, I’m always available to share answers. Reach out to jdtrask@raygun.com. n

November 2022 I 29

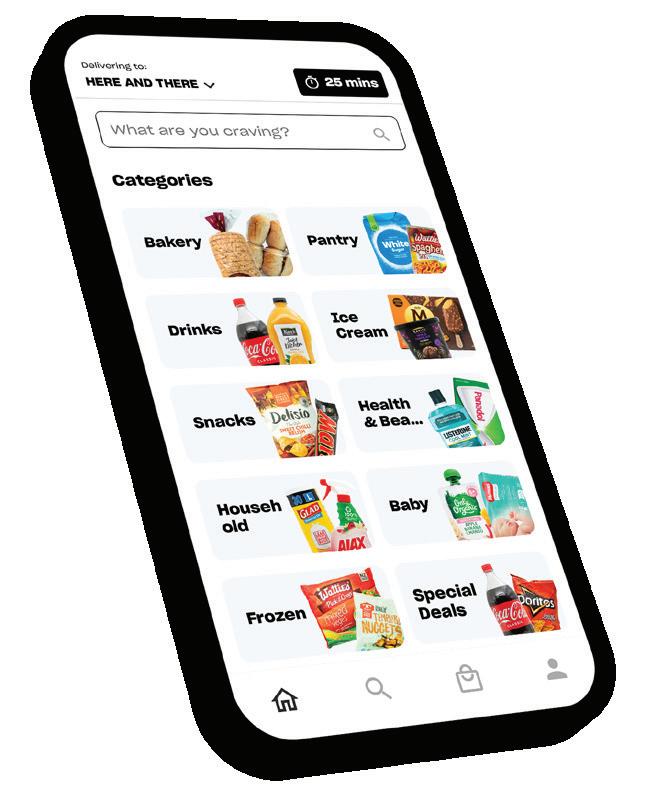

CHANGING GROCERY SHOPPING

The arrival of Costco on New Zealand shores has meant wholesale is no longer left to the producers. While it might feel like homes are becoming the warehouse, the costeffectiveness of bulk buying is something consumers are currently enjoying. The novelty of an international brand on local soil is yet to wear off as customers continue to flock to the store.

Grocery outlets are the next best option for consumers who cannot afford bulk buying. Home to end-of-life and end-of-line products or whatever suppliers need to rid themselves of, they also provide consumers

with FMCG that is easier on the wallet. These stores have also recently increased in popularity as shoppers look around for a bargain. Known as salvage grocery in the USA, the country’s biggest retailer is called Grocery Outlet. These supermarkets are less popular in the UK; approved Food, Discount Food Stores and Clearance XL are the most known stores. On home soil, there is an increasing number of outlet grocers appearing. SupermarketNews spoke to Reduced To Clear, BargainMe and Chilly Box about their stores.

The holidays are around the corner, so every cent counts and businesses need to

look for ways to show customers they are doing everything they can in these trying times to keep on top of inflation and provide the best product value.

The big stores continue the promotion of their low-price initiatives; New World’s Every Day Low Prices, PAK’nSAVE’s Extra Low $5 Deals and Countdown’s Great Price ranges. Own brand offerings have seen a recent increase in demand as consumers seek less product innovation and more original value; demand is highest in Europe, where private label makes up 35 percent of total FMCG sales. n

NEWS

Grocery Outlet Expansion

Grocery Outlet is the fastest-growing discount supermarket on the USA’s West Coast. Its most recent expansion saw the second store opening in Allentown, Pennsylvania, bringing 35 new jobs and discounted food products to the area. Read more here

Retail Giant Catapults

Cookie Brand

Cookie Time is revelling in the “Costco effect” and has increased its sales by more than $1 million since the retail giant opened its first Auckland store in September. Read more here

30 I supermarketnews.co.nz

wholesale & outlet

With living costs on the rise, and inflation affecting what consumers are willing to spend, Kiwis are changing their shopping habits to better meet personal grocery needs.

COSTCO’S KIWI FAN CLUB

Costco opened its doors to kiwis on September 28. The West Auckland store saw between 5,000 and 6,000 customers on average each day in its first month and an average of 7,000 new members each week. While things have steadied, the store’s popularity does not appear to be declining anytime soon.

“W

e’re delighted how quickly New Zealanders have taken to the Costco concept. Our strong membership sign-up and daily foot traffic tells us that our merchandise and pricing is resonating with the people of Auckland,” said Patrick Noone, Managing Director of Costco New Zealand.

Fresh produce is among the most popular categories in store, with meat and bakery also doing well - the big Costco muffins have been flying out the door. Crabs, rotisserie chickens, chips, chocolates and sugar candies are all popular, Noone noted a real sweet tooth among kiwi customers.

“Our merchandise is a mix of locallysourced products and the best of international brands – including items our New Zealander members have been asking for. At Costco, we refer to our merchandising strategy as a treasure hunt of value. What this means is that no two shopping trips should ever be exactly the same.

We hope that members are surprised and delighted every time they visit, discovering

new favourites as well as trusted highquality brands. We’re proud to stock locallyowned brands, particularly across our fresh food categories, and we’d love to hear from more suppliers based in New Zealand.”

Like the rest of the world, New Zealand has made the most of Costco’s Facebook fan clubs, which already have over 200,000 collective members. With the success of the first store, rumours about the next location have been flying

“We are always on the lookout for new warehouse locations. While we can’t confirm any sites yet, Wellington and Christchurch are definitely areas we’re interested in. However, it is a lengthy process to find the right site. Our warehouses are quite sizable in order to be able to house our comprehensive range of goods and specialty department services.

Our focus is always to find the right location to meet our specifications so that we can ensure every warehouse is comprehensively stocked, offering a wide range of products and services of the best quality at the best possible price,” finished Noone.

THE NUMBERS

“To continually provide our members with quality goods and services at the lowest possible prices,” is the business mission.

Costco’s Q4 2022 report saw the company as the third-largest global retailer, the 11th largest in Fortune 500, with a $236 Billion market cap. There are 840 warehouses worldwide, 578 in the USA, 107 in Canada, 40 in Mexico, 29 in the UK and Japan, 17 in Korea, 14 in Taiwan, 13 in Australia, four in Spain, two in China and France, and one in each of Iceland, New Zealand and Sweden.

Globally the retailer has around 118.9 million cardholders, with a 92.6 percent membership renewal rate in the USA and Canada. The in-store merchandising strategy is based on limited SKUs, between 3,400 and 4,000, across a wide range of product categories. Four-way shoppable pallets are used in-store to ensure the product can be reached from every angle and provide prime graphics and branding capabilities. n

November 2022 I 31

Reduced To Clear - North Island

Sean Hills opened his first Reduced To Clear store in Manuka after noticing how much food was being unnecessarily wasted in FMCG. He had worked at Davis Trading and Prolife Foods, dealing with supermarkets in multiple capacities, when the idea to make the most of shortdated, end-of-line, factory seconds or cancelled export orders was born. “I would be helping suppliers move the product and get some recovery for it instead of dumping it. On the other side of the equation, I could help the public by offering them heavily discounted products.”

Hills grew up in Hamilton and attended Hillcrest High before moving to Auckland in his early 20s. He and his wife have two daughters and live on Auckland’s North Shore. Since its inception in 2008, Reduced To Clear has grown to 11 retail offerings throughout the North Island, offering products between 50 and 80 percent off the recommended retail price.

In the beginning, Hills spent many years cold-calling suppliers to see if they had any clearance products they wanted to move, and he often had to explain his business’s goal. These days Reduced To Clear is reasonably well-known within the industry, and new suppliers tend to come to them. The company has a great range of local and international suppliers.

“We are problem solvers to an extent. All suppliers have the odd issue around stock, so we take it, and it becomes our issue to deal with - we’re here to help them.”

Reduced To Clear stocks all kinds of products, snacks, treats, health foods, gluten-free products, cheese, and yoghurts are all requested daily. Chocolate is a customer favourite, and Cadbury has been a big supporter of the store since the beginning.

Read more here

BargainMe - Christchurch

BargainMe is the Christchurch discount food store that opened in March of 2022. Shawn Thomas opened the Linwood store after seeing just how much short-dated, dated, and end-of-line food was being wasted by suppliers. “We wanted to create an alternative for people to shop smarter and add value to their pantry. Short-dated or dated means it’s still good to eat, and that is the knowledge we wanted to increase within the community,” said Thomas.

Thomas moved to New Zealand from Mumbai, India, with his mum and dad at age eight. He grew up in Christchurch and completed a bachelor’s degree in psychology and Postgraduate study in child and family psychology.

Chilly Box - Palmerston North