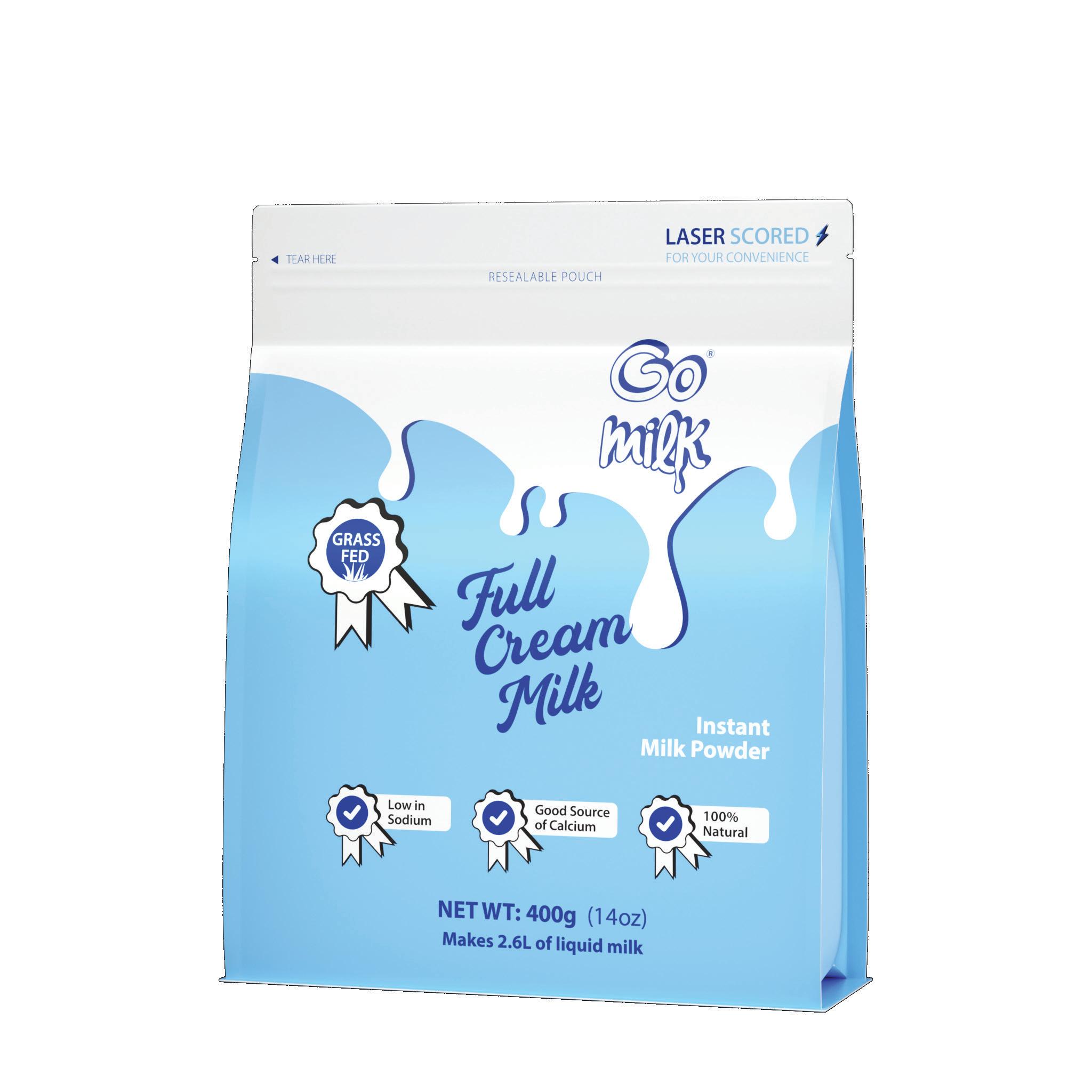

Full Cream and Skim Milk Powder Available in PAK'nSAVE and Woolworths Nationwide

Tania Walters | Publisher

As we close out 2024 and move into 2025, the challenges of 2024 remain firmly in place, with cautious consumer spending and rising costs continuing to set out a tough operating environment. Generating revenue will require sharper strategies, greater efficiency, and a commitment to innovation as suppliers navigate increasing pressure on margins.

New Zealand’s economic landscape mirrors these challenges. Productivity growth has stagnated at just 0.2% annually over the past decade, highlighting the need for a shift in how we approach business. For retailers and suppliers, the question isn’t just about keeping costs down but about asking, “How can we improve productivity across our operations?”

All year I've been saying that business this year is the hardest ever - and I've been through a few recessions. To finally hear that it is the worst recession in 40 years is at least an honest starting point for 2025, and reflects what business owners have been saying all year and that pundits and experts have been denying. So we will come back

in 2025 ready for the challenge. Being proactive, adopting smarter processes, and focusing on value-driven decisions - this guide is here to support you in making those decisions. From exploring new NPD to efficient supply chain solutions to adopting sustainable practices and investing in technology, this resource is tailored to present the options, helping you adapt and thrive in 2025’s demanding market.

From our team to yours wishing you a happy holiday season, and we look forward to working with you next year.n

Food and Grocery Council is an industry association for grocery suppliers providing members networking, events, industry information and strong advocacy. Contact us for information on the benefits of membership: raewyn.bleakley@fgc.org.nz

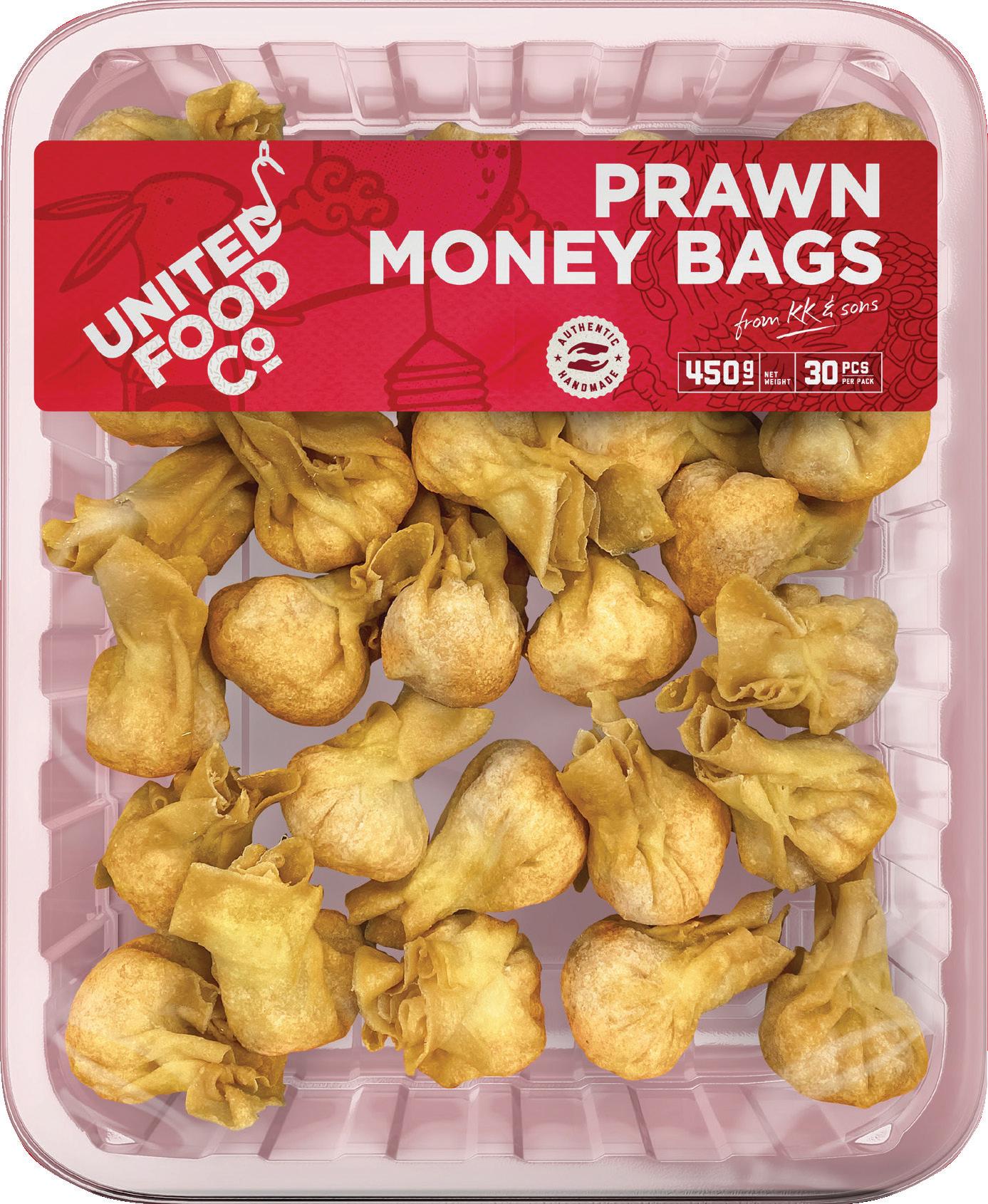

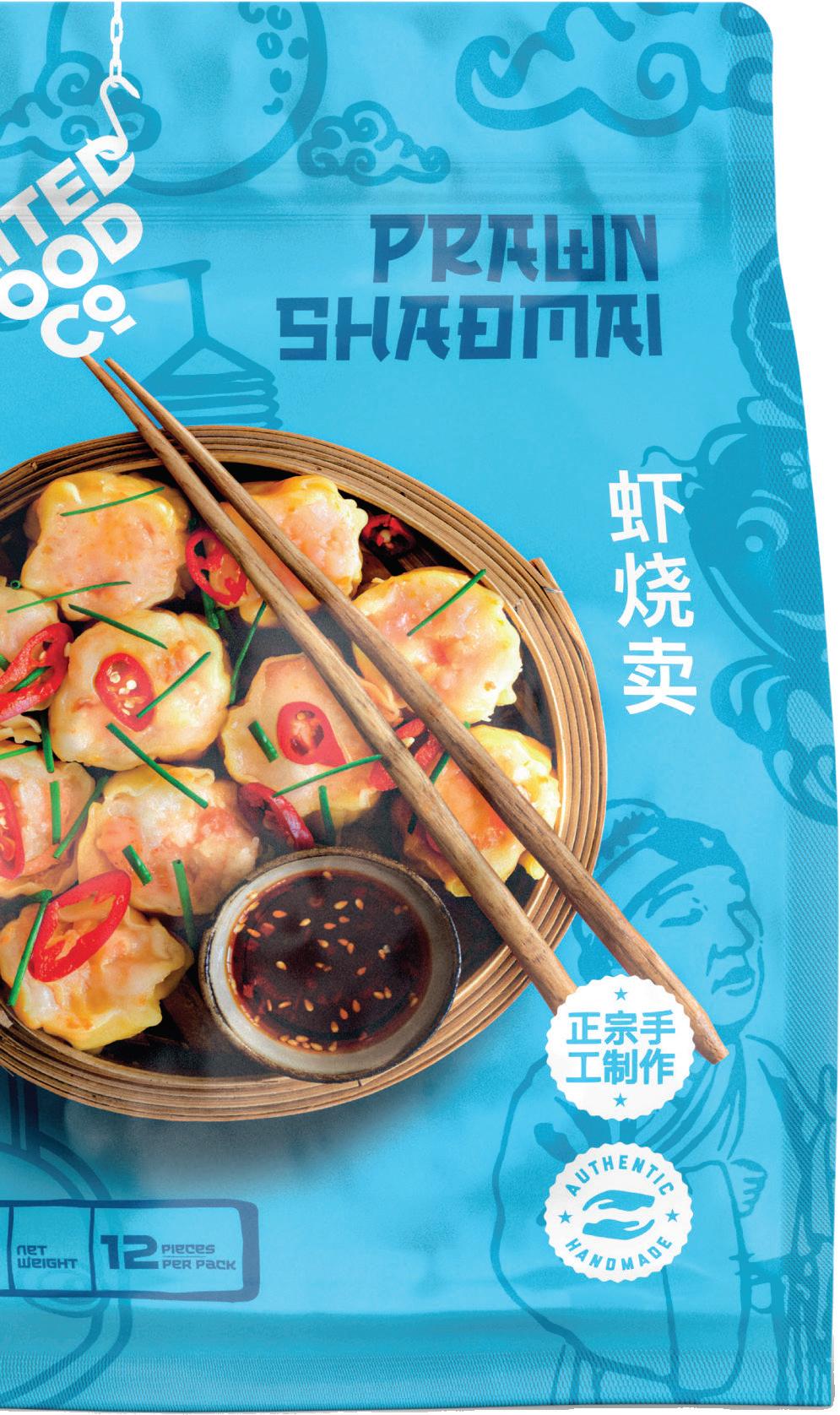

Using the finest ingredients, our authentic, handmade foods world are designed to go from the freezer to your table

foods from around the in under 15 minutes

mail@unitedfisheries.co.nz

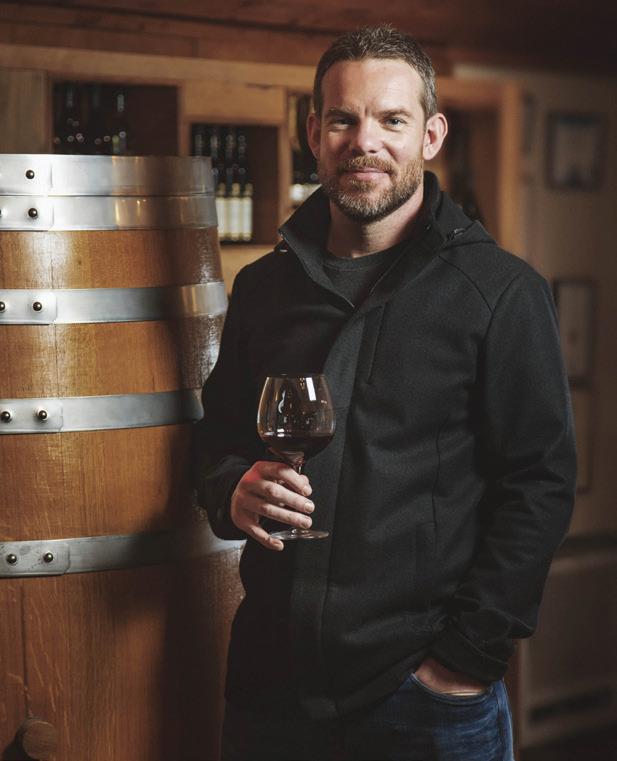

Sadly, worldwide consumption of wine is on the decline. After 13 years of relative stability in volume sales, worldwide sales of wine declined by over six percent in 2023. Take inflation into consideration, and this equates to an even larger decrease in sales value.

Among these, there are, however, stories of success. Perhaps none more so than the NOLO category.

In the USA, the total sales volume of zero-alcohol wine has increased by 18 percent over the past 12 months, an even more impressive growth of 27 percent by value. Importantly, this is not growth from an insignificant base value; it is represented by total sales value growth from USD 64M to over USD 81M over a 12-month period.

We can confidently say that consumers are embracing zero-alcohol wines. On average, they spend more per bottle, and importantly, they are repeat buying. Zeroalcohol wine is officially a thing.

So what’s behind all of this? Who’s drinking NOLO wine, and why? Specifically, what is happening in the grocery industry here in New Zealand, and what can we expect to see over the next 12 months?

The category of low-alcohol wine is being driven by moderators, people who are looking for ways to decrease their total alcohol intake without compromising social and lifestyle choices. Interestingly, zeroalcohol wine is the same.

According to the data sources, 78 to 95 percent of people who buy zero-alcohol

wine also drink full-alcohol wine. While the category's most significant growth is among millennials specifically, it is growing across all age groups of legal drinking age.

So, the people embracing zero-alcohol wine are, above all, regular wine drinkers. They are looking for something that can bring at least some of the pleasure of drinking a nice glass of wine with food and friends but without alcohol.

Part of a wine drinker’s journey to embrace zero-alcohol wine in their lifestyle requires a level of acceptance. Accept that it will not taste exactly the same as regular wine. Without alcohol, it simply cannot. However, does it bring some other qualities, such as balance, structure, dryness and complex flavour? Essentially, is it a refreshing drink that matches well with food and has layers of aroma and flavour that make it an adult drinking experience?

Where the answer to this question is yes, producers are seeing success. There is now significant choice available to consumers in this space. Subsequently, brand recognition and trust are becoming increasingly critical to success, as is out-and-out quality. The excellent news for consumers is that quality is increasing and will continue as technical knowledge builds in the industry.

New Zealand is certainly not bucking the global growth trend in the NOLO wine category. The Moving Annual Total to the end of June 2024 shows 19 percent growth in zero-alcohol wine sales in NZ grocery stores, both in volume and value.

While total sales of non-alcoholic wine in grocery are still only a fraction of total alcoholic wine, the gap is closing. As a standalone category, zero-alcohol wine has overtaken Riesling's total sales volume in NZ grocery. Along with the growth in sales volume, the choice of NOLO wines available to consumers in supermarkets has also seen significant growth over the past year, and of

course, the two go hand in hand.

Consumers who want lower- or nonalcoholic wine alternatives have always existed, but the quality and choice perhaps have not. Now that this is changing, we see more people embrace the category.

So, what can we expect over the coming year? Well, there will be more growth, both in sales of low- and non-alcoholic wines and, very importantly, product innovation.

Successful producers will continue to push the boundaries of what’s possible in this category in terms of product quality, product style, and new product development. This will especially be the case in low-alcohol alternatives. After all, moderators, not abstainers, drive category growth, and lowalcohol wines often offer significantly higher quality and flavour concentration than nonalcoholic alternatives.

NOLO wine has certainly not been embraced by everyone, and I can see why. Wine is an incredible drink that’s been part of human culture for thousands of years and can offer levels of texture, flavour, and aroma complexity that NOLO wine will most likely never achieve.

However, what NOLO wine can do is bring at least some of that experience to people’s lives without the impact of alcohol. Above all, what NOLO wine offers is choice, and for the consumer, this can only be a good thing. For trade, what the category can offer is a great opportunity. n

year

what it means for brands competing for consumer attention

This year, AI has taken centre stage with innovations that just a few short years ago would have seemed like science fiction. From creating content in seconds to algorithms that predict purchasing behaviour down to an individual level, AI has fundamentally reshaped how businesses operate.

Brands and supermarkets competing in an increasingly saturated market are asking: How can we leverage technology to anticipate and meet consumers' needs faster and better than ever before?

Here’s a look at some of the major shifts happening in the world of consumer insights and how brands are transforming to not only ‘keep up’ but ‘stay ahead’ of consumer expectations.

SHIFT: From surveys to realtime data: knowing what consumers want right now Traditionally, brands have relied on detailed (and expensive) surveys and periodic reports to understand consumer preferences. The problem with these is that they report on what has already taken place - often months ago - by which time the market (and consumer) has moved on. Today, businesses can access data in realtime, capturing up-to-the-minute trends

that allow them to adapt instantly. Platforms like Appetise Insights are leading the charge here, providing detailed information about what Kiwis are adding to their festive shopping lists as early as Halloween— months before Christmas arrives.

In short, marketing strategies no longer have to be reactive, missing the mark only to realise too late that consumers aren’t responding. Real-time insights empower brands to fine-tune their campaigns from the outset, ensuring they align perfectly with consumer sentiment.

This year, for example, data showed a clear shift from turkey to chicken as Kiwis' go-to holiday protein due to budget constraints and rising food prices. Knowing this, supermarkets could plan targeted advertising campaigns around chicken and other budget-friendly options rather than spending on promoting turkey.

SHIFT: From responding to predicting: forecasting what will sell

Using these advanced, AI-driven insights, brands can move from simply responding to trends to predicting them before they take hold. This shift from historical to predictive data is crucial. It’s no longer about looking back at past holidays to realise that people spent less; brands now have the foresight to recognise these patterns in advance and know that Kiwis will prioritise cost-effective solutions, given the high volume of the search term ‘cost-effective’, supermarkets and suppliers can market their value propositions upfront, competing more effectively in a season when shoppers may be curtailing their budgets. Using a data-backed approach, brands can craft messages that hit home, capturing attention in a timely and relevant way for price-conscious shoppers.

SHIFT: From relying on inhouse data to partnering with tech innovators: gaining a holistic view

There has also been a marked shift away from relying on ‘in-house’ data only, with brands realising that tapping into innovative tech platforms to broaden their consumer insights and gain a more holistic view is the smart cut to success. Rather than piecing together fragmented information, partnerships can help brands move beyond their own data silos to reveal detailed consumer preferences across specific demographics and regions in an everchanging market.

This collaborative approach is powerful and can highlightessentialt consumer shifts, such as a growing interest in Asianinspired meals among Kiwis. Knowing that dishes featuring fresh, bold flavours and ingredients like gochujang and yuzu can help brands refine their product lines, experimenting with flavours that might resonate with consumers looking for something unique yet accessible.

Ultimately, consumer attention is earned by those who can deliver value at the moment and anticipate needs before they even arise. In this AI-powered era, those who leverage the right insights at the right time will come out on top.

For more insights into shifting consumer trends and how brands can respond effectively, stay tuned to Appetise Insights. n

Sustainability remains a top consumer priority, but it must be practical. The Eco-Logical trend showcases the need for eco-friendly products that integrate seamlessly into daily life without compromising affordability or convenience. Retailers in Australia and New Zealand must make sustainable choices compelling and credible.

The past years have seen consumers recalibrating their priorities amid economic uncertainties, increasing sustainability awareness, and a proactive approach to health and well-being.

As we head into 2025, these shifting behaviours continue to shape the retail landscape, creating both challenges and opportunities for supermarkets and FMCG brands across Australia and New Zealand.

Drawing from Euromonitor International’s 2025 Global Consumer Trends report, we identify three critical trends shaping future shopping behaviours in Australia and New Zealand: Wiser

Wallets, Eco-Logical, and Healthspan Plans. These insights offer valuable guidance for retail professionals aiming to align with evolving consumer expectations.

Wiser Wallets: Strategic Spending Becomes the Norm

Economic pressures have fundamentally changed how consumers think about spending. Shoppers are no longer just looking for bargains or making impulse purchases.

According to Euromonitor International Voice of the Consumer: Lifestyles Survey 2024, only 18 percent of global consumers said they often made impulse purchases in 2024. In New Zealand, 36.8 percent said they like to browse in stores even if they don’t need to buy anything, compared to 43 percent in 2019.

* fielded January to February 2024 (n=40,236–global, n=1,001- New Zealand) Instead, consumers are taking a strategic approach, carefully evaluating the value of their purchases against their priorities. The Wiser Wallets trend reflects this shift toward investing in products and services that deliver immediate value alongside long-term benefits. One example of this trend is Woolworths’ new marketplace initiative, which expands its online offerings by partnering with a wide range of sellers. By creating a onestop platform, Woolworths enhances convenience and competitive pricing, appealing to cost-conscious shoppers who

value efficiency and variety. This approach supports long-term purchasing habits by making strategic shopping easier. Similarly, Marquise Baby’s launch of on-the-go nappies available at BP and 7-Eleven outlets addresses the needs of busy parents seeking quality and convenience. By providing accessible, reliable products, the brand meets immediate demands while reinforcing long-term trust and loyalty. Loyalty programmes are also evolving. Kathmandu’s Out There Rewards programme, popular in both Australia and New Zealand, rewards members not only for purchases but also for engaging in outdoor activities like hiking. This strategy aligns rewards with consumer lifestyles, fostering deeper connections and enhancing brand affinity through meaningful, experience-based incentives.

Eco Logical: Beauty and personal care brands have made a marked effort to enhance offers

Sustainability remains a top consumer priority, but it must be practical. The EcoLogical trend showcases the need for ecofriendly products that integrate seamlessly into daily life without compromising affordability or convenience. Retailers in Australia and New Zealand must make sustainable choices compelling and credible. It is undoubtedly that the beauty and personal care industry is on the frontline of

the eco-logical movement in the consumer spending goods industry. Forty-six percent of online beauty and personal care products used a sustainability claim in 2023 - the highest share of the digital shelf among categories, data analysis by Euromonitor’s Passport Sustainability.

Beauty and personal care brands have made a marked effort to enhance offers in this space, where products with sustainability claims generated more than USD120 billion in 2023—the highest industry by sales.

Australia and New Zealand are a part of this trend. In New Zealand, Solid's rollout of eco-friendly oral care products exemplifies this trend. Offering plasticfree, refillable solutions, Solid integrates sustainability into everyday habits without sacrificing convenience. Retailers can adopt similar approaches, such as introducing refill stations or reusable packaging, to appeal to eco-conscious shoppers.

Other sectors have seen an acceleration in demand alongside sales of green alternatives. Through its partnership with Gander, SPAR Chevron in Australia uses technology to provide real-time updates on near-expiry, marked-down products. This initiative reduces food waste and delivers cost savings, proving that eco-friendly practices can be economically advantageous while boosting consumer engagement.

New Zealand’s pre-loved fashion platform, now expanding into Australia, exemplifies the growing interest in second-hand shopping as part of a sustainable lifestyle. By promoting circular fashion, this initiative connects with

consumers who prioritise reducing waste and environmental impact. Retailers can explore partnerships with similar platforms to align with consumer values.

Healthspan Plans: Let’s not just live longer; take a longevity journey

Health and wellness are evolving into a more proactive, long-term focus. People don’t just want to live longer (lifespan); they want to feel better for longer (healthspan). And a majority of consumers believe they’ll be healthier in the next few years than they are now.

Their desire for longevity shapes their current wellness choices. That’s prompting a bigger shift towards preventative, specialised solutions in combination with reactive treatments.

Vitamins and supplements are one example; global retail sales have recorded steady growth in recent years and are expected to hit USD 139.9 billion in 2025. In Australasia, vitamin and supplement retail sales are set to reach USD 2 billion in 2025, compared to a 2021 market size of USD 1.6 billion.

In Australia, brands like Gevity Rx are addressing the demand for functional foods with products such as bone broth concentrates that support gut health. These convenient solutions align with consumers' preference for products that can be easily incorporated into daily routines, supporting wellness at every life stage. Retailers can feature such products to emphasise their role in fostering proactive health management.

In New Zealand, a new brain drink range developed by a local food tech company targets cognitive health. This innovative product reflects consumers’ growing awareness of mental wellness and the demand for functional beverages that support brain health. Retailers can promote similar offerings with educational content that underscores their benefits.

Rebel Bakehouse’s Happy Gut Wraps, designed to improve digestive health, also illustrate the importance of accessible functional foods. By simplifying healthy eating, these products make wellness attainable for everyday consumers. Retailers can leverage this by featuring healthboosting products prominently and using in-store promotions to educate shoppers.

The Healthspan Plans trend captures the growing consumer demand for products that promote well-being at every life stage. Retailers should emphasise evidence-based solutions that support overall health and longevity.

Consumer expectations are becoming more strategic and values-driven, whether in spending, sustainability, or wellness. For retailers across Australia and New Zealand, this means rethinking loyalty programmes to offer experiences and community engagement, adopting credible sustainability practices that do not compromise practicality, and investing in health products backed by research and measurable benefits. Businesses that stay agile and responsive to these shifts while maintaining their core values will be better positioned to connect with mindful consumers and drive longterm success. n

In today’s challenging economic climate, New Zealand businesses face a storm of rising costs, declining GDP, and increasing customer price sensitivity.

Peter Kendall CEO Extolla

Supply chains are under relentless pressure to perform in an environment riddled with disruptions — flooding, Cook Strait ferry disruptions, geopolitical conflict, and even significant supply chain blockages like the Suez Canal incident.

Gartner research reveals that 68 percent of supply chain executives have dealt with highimpact disruptions consistently over the last three years, often without sufficient recovery time before the next disruption occurs.

Building a resilient, cost-effective, and high-performing supply chain is no longer a luxury—it is a necessity. Whether you’re a retailer, manufacturer, 3PL, or distributor, the steps outlined below can transform your supply chain into a competitive advantage, driving customer satisfaction and long-term profitability.

Effective inventory management is critical to resilience. By leveraging machine learning (ML) and artificial intelligence

(AI), businesses can position inventory close to customer demand while minimising working capital costs.

Predictive fulfilment methods use advanced data analytics to forecast demand, ensure inventory availability, and maintain optimal service levels. This approach reduces lost sales, balances inventory costs, and helps fulfil customer promises.

By 2026, Gartner predicts more than 50 percent of supply chain organisations will use ML to augment decision-making capabilities. To unlock this potential, businesses must invest in the right talent, such as data scientists and business intelligence specialists, to take advantage of the technology benefits available.

Labour shortages and rising wages are ongoing challenges that require innovative solutions. Improving operational productivity isn’t just about offering higher pay and equipping employees with the tools and support they need to succeed.

Labour Management Systems (LMS)

incorporating gamification and coaching can rapidly boost worker productivity. Engaged employees, clear expectations, effective coaching, and proper training foster a motivated workforce that drives efficiency. Treating employees well while setting them up for success is a critical investment in any supply chain operation.

The robotics and automation revolution has become more accessible, with costs for equipment like AMRs and AGVs dropping significantly while labour and warehouse rents continue to escalate. Robotics-as-aservice (RaaS) models now allow businesses to shift from capital expenditure (CAPEX) to operational expenditure (OPEX), flexibly scaling automation as demand fluctuates. Automation isn’t just a contingency for labour shortages—it improves scalability, reduces errors, enhances safety and boosts efficiency. By conducting a robotics assessment, businesses can quickly determine the best solutions for their needs and remain competitive in a rapidly evolving market.

Effective planning is a cornerstone of supply chain resilience. When businesses align their planning processes through disciplined S&OP and IBP practices, they minimise variability, optimise resources, and drive performance.

These processes must start with customer demand and work backwards, aligning cross-functional teams - sales, marketing, finance, and IT - towards shared objectives. Companies that excel in planning achieve higher returns on invested capital, better inventory performance, and significantly reduced lost sales. The key is to ensure that planning is not just a financial exercise but a holistic, demand-driven strategy.

Sustainability has become a vital component of supply chain strategy. Customers are increasingly making purchasing decisions based on a company’s environmental credentials, and supply chain leaders must now tackle carbon emissions reduction alongside traditional goals like cost savings.

A well-executed sustainability strategy reduces emissions and costs, particularly in transport and DC operations. Businesses should map their requirements, identify impactful opportunities, and treat sustainability as an integral part of their operations rather than a separate initiative. Acting can transform carbon reduction from a compliance requirement into a competitive advantage.

Too often, supply chains are treated as cost centres rather than as investments in customer satisfaction and resilience. This mindset results in a lack of investment that stifles efficiency and effectiveness. While

cost savings are important, the ultimate goal should be enhancing the customer experience and creating long-term value. Businesses attempting to “squeeze” more from their supply chains without investment are missing opportunities. Supply chains are not deserts to be drained of resources; they are fertile grounds that require constant nurturing to yield better performance, reduced costs, and improved customer outcomes.

In an era of frequent disruptions and economic uncertainty, nurturing your supply chain is essential. By investing in advanced inventory forecasting, labour productivity, automation, integrated planning, and sustainability, businesses can build resilient supply chains that are both cost-effective and customer-centric.

This isn’t just theory—it’s reality. Businesses that embrace these steps will see rapid returns on their investments and build supply chains that are ready to thrive in the face of uncertainty. Now is the time to treat your supply chain as a strategic asset, not a cost centre.

With thoughtful investment and the right strategies, your supply chain can become your greatest competitive advantage. www.extolla.com. n

Eating the right food is one of the most important parts of healthy living and is vital for people living with coeliac disease or gluten intolerance.

Adapting to a strict gluten-free (GF) lifestyle can be difficult for some people and adds a significant burden to everyday life.

As the GF diet is the only treatment for people diagnosed with coeliac disease, being able to access a range of GF products in supermarkets, whether that is packaged goods, delicatessen, or ready-to-eat meals, is essential to enable them to stick to the diet.

Gluten is a protein found in many grains such as wheat, barley, rye, and avenin in oats. The Coeliac New Zealand Medical Advisory Panel advises people with coeliac disease to avoid oats due to the risk of crosscontamination.

Four groups of foods are suitable for those on a gluten-free diet: naturally gluten-free food, products labelled gluten-free, products without gluten-derived ingredients, and products endorsed by the Crossed Grain Logo administered by Coeliac New Zealand. For people with coeliac disease, there are several risks associated with not following the GF diet because, as well as the usual coeliac symptoms occurring, it can cause long-term health complications such as Type 1 diabetes, osteoporosis, and fertility issues. This is because the disease affects the absorption of important nutrients, including iron, folic acid, calcium, and fatsoluble vitamins.

As demand for gluten-free products has increased recently, supermarkets must cater to this growing market segment. Educating staff about GF food safety and ensuring the proper handling and labelling of GF products will help customers and build their trust and loyalty.

Food Standards Australia New Zealand (FSANZ) requires that a product to make a gluten-free claim must not have any presence of barley, wheat, rye, or oats. Every ingredient derived from wheat, rye, barley, or oats should be declared in bold in the statement of ingredients. These grains are traditionally used to make bread, pasta, and cereals and are unsuitable for people on a GF diet.

Under new Plain English Allergen Labelling (PEAL) requirements, specific terminology used in the ingredient list and allergen summary statements are now mandatory. Allergens must be declared both in the statement of ingredients and in the adjacent and distinctly separate summary statement. It’s a decision affecting some 55,000 product SKUs with a total value of NZD 130 billion, per FSANZ data.

Mandatory summary statements provide a summary of the allergens (including gluten) present in the ingredients of a product. Summary statements help identify which allergens are present in a product; the source ingredient of any allergen will also always be listed in the statement of ingredients. Summary statements will appear as ‘Contains’:

The food code requires the terms ‘gluten’ and ‘wheat’ to be used and declared separately in the allergen summary statement. This makes labelling clear and helpful for people with coeliac disease and wheat allergies.

Contains: Wheat, Gluten - Gluten and wheat must be declared separately in the allergen summary statement. Including gluten in the allergen summary statement indicates that gluten is present. These products are not suitable for a gluten-free diet.

Contains: Gluten—If an ingredient in the product contains gluten, ‘gluten’ will be listed in the Allergen Summary Statement: ‘Contains: Gluten’. These products are unsuitable for a gluten-free diet.

Contains: Wheat - This indicates that the product contains a wheat-derived ingredient but that the wheat-derived ingredient does NOT contain gluten. If you see a declaration of

‘Contains: Wheat’ (in the absence of ‘Contains: Gluten’), the product is suitable for the gluten-free diet. This declaration may also appear on products labelled ‘gluten-free’.

Some highly processed wheat-derived ingredients are suitable for a gluten-free diet. Common examples include glucose derived from wheat, Caramel colour (150) from wheat, and Dextrose from wheat. In these instances, the gluten-free claim overrides the wheat claim and is suitable for someone with coeliac disease.

While some additives can be sourced from wheat or barley, most remain suitable. The only additives that should be avoided if derived from barley or wheat are 234 (Barley) and 1400 - 1450 (Wheat). Numbers without barley or wheat after them have been derived from another GF source and are suitable for the gluten-free diet.

To get your products Crossed Grain Logo accredited, or to find out about the GF diet and access the Gluten Free Food Safety Training visit coeliac.org.nz n

This year has been a whirlwind for the independent retail produce industry. Abundant sunshine, perfectly calibrated rain, and ideal temperatures have produced a bumper crop on a number of produce lines, a boon for consumers struggling with rising costs—a helping hand against inflation, CPI growth, and soaring mortgage rates.

At Fruit World, we have made changes throughout the year, starting with the rebranding of our remaining Supa Fruit Mart stores to the Fruit World brand. Outdated stores were closed and replaced by new, strategically located outlets in more appealing areas.

Work has been completed on store refreshing, improving a few stores that could do better, updating the grocery range, developing new marketing concepts, and updating the online platform, which now has a much-needed facelift offering a more comprehensive range of produce and a more seamless customer experience. These changes were driven by a constant focus on the customer, a devotion at the heart of Fruit World's success.

The backbone of Fruit World has always been its store owners - hardworking mums and dads dedicated to providing the best quality produce at the best price. Their unwavering commitment to freshness and

value is a testament to the brand's ethos. It's a business built on a foundation of fundamental principles that continue to resonate with consumers.

As produce specialists, Fruit World prioritises:

Freshness and Quality: Four experienced buyers, each with over 25 years in the industry, work tirelessly from early mornings to late evenings, navigating markets and meticulously selecting the freshest produce. We don't import directly, preferring to work with trusted agents and ensure that only the highest-quality fruits and vegetables reach the stores. Fruit World only buys what it needs on the day, guaranteeing freshness. This is a testament to a commitment to quality.

Specialists in Produce, with a Wider Range:

Produce is the heart of Fruit World, and the stores offer a diverse selection of sizes

and formats, catering to every need, from the most significant and most premium to budget-friendly options. They also offer a curated range of essentials and other products, complementing the shopping experience.

Quick and Easy Shopping:

are continuing to explore partnerships with complementary businesses.

The focus, however, remains unwavering: upholding the brand values and maintaining the highest-quality produce at the best possible price.

their unwavering commitment to freshness and value is a testament to the brand's ethos. it's a business built on a foundation of fundamental principles that continue to resonate with customers.

Convenience is paramount. Fruit World stores are designed for swift and effortless shopping. Produce is organised for easy access, and friendly staff are always on hand to assist.

Nimbleness and Agility:

Fruit World's short supply chain—from fields to markets to stores—allows it to capitalise on fleeting opportunities, quickly offering seasonal produce flushes that bigger chains may miss. The nimble approach extends to weekly promotions, set incredibly late to maximise freshness and value.

Innovation and Exploration:

Fruit World has always been a testing ground for new concepts, whether new produce varieties or retail strategies. Our agility allows innovations in a single store or across a network of 18 stores. In support of the butchery sector, in the coming weeks, we are set to launch a combined Butchery/ Produce offering partnering with Prime Range Fresh in Ponsonby.

Looking towards the future, we may see a shift in consumer spending as discretionary income increases. We plan to expand cautiously; opening new stores beyond Auckland is a possibility, and we

Ultimately, Fruit World's success hinges on the continued support of its customers. Their patronage of independent fruit stores and businesses is critical to maintaining a dynamic, competitive market that benefits everyone.

In an ever-changing retail world, Fruit World remains steadfast in its commitment to providing fresh, high-quality produce at affordable prices. This is a testament to the power of simplicity, quality, and a genuine passion for fresh food. n

Potatoes have long been a staple in diets across the globe. With their versatility, affordability, and impressive nutritional profile, potatoes are a must-have for any menu. Whether served as the star of the dish or a reliable side, potatoes bring value and satisfaction to the table like no other ingredient.

The Nutritional Edge

Contrary to their reputation as a simple starch, potatoes are packed with nutrients. A medium-sized potato provides:

• Carbohydrates: The main energy source for our body, but should be taken in moderation. The good news is fresh potatoes contain 50% less carbs than rice and 25% less carbs than pasta.

• Vitamin C: An antioxidant that helps slow down or prevent cell damage and protects us from infection. Because our bodies don’t store vitamin C we need to get a regular intake. And with more vitamin C than blueberries, potatoes are great way to get it every day.

• Potassium: An essential dietary mineral and electrolyte that is stored in our body cells. It helps build muscle, regulates

blood pressure and helps our heart and kidneys to function properly.

• Fibre: With 20% more fibre than pasta and more than double the fibre of rice, a daily serve of potatoes keeps your body running like clockwork.

• B Vitamins: There are eight B-group vitamins and each one has an important function for our bodies, from strengthening our muscles, joints and ligaments, to anti swelling and nutrient absorption.

• Iron: Essential because it helps transport oxygen throughout our bodies. Lack of iron in your diet can cause fatigue. Most kids won’t eat broccoli once a day but they won’t say no to a potato.

• Moreover, potatoes are naturally fat-free, gluten-free, and low in sodium, making them an ideal option for health-conscious diners and those with dietary restrictions.

From upscale dining to casual eateries, potatoes can adapt to any culinary context. Their versatility is unparalleled, with preparation methods ranging from roasting and frying to boiling and baking. Potatoes absorb and enhance flavours, making them the perfect canvas for creative chefs.

Here are a few ideas for incorporating potatoes into your menu:

• Artisan Fries: Elevate fries with truffle oil, Parmesan, or unique dipping sauces.

• Stuffed Creations: Load baked potatoes with gourmet toppings like smoked salmon, crème fraiche, and herbs.

• Global Dishes: Feature potatoes in curries, gnocchi, or as a base for Spanish-style patatas bravas.

• Breakfast Boosters: Highlight hash browns, potato pancakes, or skillet potatoes in your brunch offerings.

For businesses committed to sustainability, potatoes are a win. They are one of the most resource-efficient crops to grow, requiring less water and energy than many alternatives. Additionally, their long shelf

life helps minimise food waste, a critical consideration for both the environment and your bottom line.

Thanks to potatoes affordability and comfort-food appeal, they allow you to deliver hearty, satisfying portions without breaking the bank. Potatoes remain a costeffective option for supermarket customers.

When sourcing potatoes, look for suppliers who prioritise quality and freshness. Explore different varieties. Collaborating with local farmers can also add a farm-to-table appeal to your dishes.

Potatoes are more than just a side dish— they’re a versatile, nutritious, and sustainable ingredient that deserves a starring role on the menu. By embracing the humble potato, supermarkets can deliver value, innovation, and satisfaction to your customers, proving that sometimes, the simplest ingredients are the most impactful.

So, let’s raise a fork to the mighty potato—a true gem of the culinary world. For more information, visit us at www.potatoesnz.co.nz n

Environmental and geopolitical turbulence is impacting the continuity of food/drink supply on our supermarket shelves. Picture this: meat cultivated in cutting-edge labs rather than raised in sprawling fields, and vegetables jetting in from distant lands instead of growing in the nearby countryside—all designed to keep shelves stocked and choices available.

Cormac Henry Associate Director

Mintel Food and Drink Australia

In the often-polarised cultural landscape of 2025. It's easy to assume that consumers would take a firm stand, rallying strongly for the hyper-local rather than the imported alternative. But that's not the full story. Humans, with their nuanced needs, defy simple categorisation. Their food and drink preferences shift and flex depending on context and cravings, juggling practicality and passion.

Mintel’s 2025 Food & Drink Trends, Chain Reaction and Hybrid Harvests reveal how brands can resonate with consumers as these tensions ripple through global supply chains.

Chain Reaction: exciting consumers with local and imported varieties

In Australia, 46 percent of consumers aim to buy locally grown produce whenever they can according to Mintel research. In

New Zealand, 55 percent consumers would like stores to offer food/drink that comes from different places around the world. This duality—passion for the homegrown mixed with curiosity for the global—offers an opportunity for supermarkets and brands alike to offer greater variety to consumers.

To win their hearts (and carts), brands should spotlight the tangible benefits local and imported products bring, from irresistible flavors to health-boosting qualities.

For example, while most coffee in Australia is currently imported, Hunt & Brew’s RTD Atherton Coffee is said to have been sourced after the brand hunted the globe for the finest single origin beans which they found in Atherton, Queensland where the high altitude region makes for the perfect coffee terroir providing unique taste notes.

The blending of local and global offerings also opens doors to connect with increasingly multicultural shopper bases across Australia

and New Zealand. Imported products can help immigrants immerse themselves in cherished tastes of home and offer new taste horizons for non-immigrants. In India, 82 percent of consumers agree that food is the main way they stay connected to their culture/heritage.

Hybrid Harvests: bridging technology and tradition

In New Zealand, 37 percent of consumers agree genetically modified food (GMO) is a good solution to global hunger. Technological breakthroughs promise to safeguard our food supply, but consuming their creations often sparks hesitation. What seems ideal in theory can feel less appetising in reality: just 11 percent of New Zealand consumers agree they would try food grown from cells in a laboratory.

The challenge for brands lies in easing this transition by reframing the narrative.

Consumers are far more likely to accept new technologies when they’re reminded of how previous so-called “radical” techniques have become everyday occurrences. For example, O’Driscoll’s Sweetest Batch berries in the US are produced through cross-pollination. Cross-pollination naturally occurs in the wild too. The berries are said to boast unrivalled sweetness and juiciness. It’s a perfect example of how science and tradition can intertwine to elevate food quality.

Transparency is the bridge that connects consumers to these advancements. By clearly communicating how their products are made—whether through advanced technology or heritage practices—brands empower consumers to make choices that align with their values or simply curiosity.

Through balancing new technology adoption with an honest narrative, food brands have the power to reshape

perceptions. They can turn apprehension into excitement, proving that when tradition and technology coexist, consumers gain not just new options on the supermarket shelves but a deeper trust in what they choose to eat.

By responding creatively to supply chain challenges across the board, the payoff isn’t just stocked shelves—it’s a deeper, richer relationship with consumers.

Note: Consumer data cited are from Mintel Global Consumer research. n

Matthew Lane, General Manager of Night ’n Day Foodstores in New Zealand, shared his perspective on the state of the convenience retail market—a sector that has demonstrated remarkable resilience and adaptability despite ongoing challenges.

to keep pace with rising consumer expectations,” Lane remarked, noting that failing to adapt could leave businesses lagging behind competitors.

Food-to-go options and delivery services have emerged as significant drivers of growth in the sector. Platforms like Uber Eats and DoorDash have made it easier for consumers to access ready-to-eat meals and everyday essentials, creating new opportunities for convenience retailers.

"Delivery is now a significant driver, bringing convenience items directly into homes," Lane added, highlighting how these services have transformed customer expectations around accessibility and convenience.

Lane pointed to regulatory changes as one of the most significant challenges for the sector.

Stricter rules on products like tobacco and vapes have forced retailers to adapt quickly, ensuring compliance while continuing to serve their customers effectively.

"Adapting to regulatory shifts is essential to maintaining a competitive edge," he explained, emphasising the need for proactive strategies to address these changes.

customers but also makes it easier for staff and suppliers to work effectively,” Lane said.

While urban centres have traditionally driven growth in convenience retail, regional New Zealand is an area that may see growth in the coming years. Strong performance in the South Island markets and untapped potential in rural North Island towns offer exciting opportunities for expansion.

Lane noted that renewed certainty in the market has boosted confidence in investing in these areas, supporting the broader growth of the sector.

As the convenience market continues to evolve, its resilience underscores the importance of adaptability, innovation, and a customer-first approach. Investments in modernisation and diversification will remain critical to meeting consumer needs and capturing new opportunities.

"Consumers are seeking fast, affordable, and high-quality solutions more than ever,” Lane noted, reflecting on the ongoing evolution of the sector.

their busy lifestyles.

"Stores need to evolve continuously

Technology has also played a pivotal role in helping businesses navigate these challenges. From self-service kiosks to loyalty apps and enhanced supply chain systems, advancements in technology have improved both customer experiences and operational efficiency.

"Streamlining processes not only benefits

By staying ahead of trends and embracing change, convenience retailers can continue to thrive in an ever-shifting landscape.

Looking ahead, the convenience sector is well-positioned to capitalise on emerging trends, including delivery services, digital integration, and regional growth opportunities. n

A whole array of businesses of different sizes and focus are benefitting from the many advantages associated with New Zealand Beverage Council (NZBC) membership.

As its members appreciate, the NZBC is the trusted voice for NZ’s non-alcoholic beverage sector, providing its members with strong and credible representation. It’s a professional body that has the respect and confidence of decision-makers, stakeholders and consumers.

The council’s members represent more than 75 percent of non-alcoholic ready-todrink beverages sold in retail across NZ.

Members range from large multinational brands and local NZ producers to those who provide a wide range of goods and services to those companies. Brand owners, manufacturers, bottlers, and suppliers of NZ juice, carbonated drinks, flavoured dairy, and bottled water make up the membership of this valuable organisation.

NZBC co-chair Grant Jeffrey said the NZBC is proud of the work its members undertake.

“And we, as a council, are committed to providing them with a strong and united voice, as well as working with our members to create the conditions that will allow our sector to prosper.”

He said regardless of business size, members see value in belonging to the NZBC with its focus on uniting, advocating, supporting and informing.

Members enjoy “fantastic” events throughout the year, with networking opportunities a big drawcard. The events

provide a forum for members to develop new contacts, learn from each other and discuss common issues, opportunities and the direction of the industry.

The NZBC, as an industry association, also plays a vital role when it comes to advocacy and dealing with regulatory bodies.

“We proudly represent and advocate for our members – working constructively with our partners, regulators and decision-makers to ensure the right settings are in place to allow those in our industry to succeed,” said Jeffrey.

“We are committed to providing our members with a strong and united voice so as to create an environment in which our members thrive, and consumers have a choice.”

On the regulatory front, for example, he said that NZBC’s technical committee provides an excellent forum for managing the many submissions to Food Standards Australia New Zealand (FSANZ) and other regulatory bodies.

The hugely successful 2024 NZBC annual conference is an example of an event carrying multiple benefits for members. An impressive lineup of speakers delivered informative sessions focused on an area front of mind to most members—building a healthy beverage industry during economic uncertainty. The need for adaptability, optimisation, and innovation was well covered.

He said the wide-ranging experience NZBC members bring to the table is exciting.

Building on that experience is essential, and a collective approach is beneficial.

“It is our collective responsibility, as NZBC members, to face up to industry challenges and create new opportunities through innovation and adaptability. All this while pursuing a culture of resilience and passion to take the industry forward into the future,” he said.

“We believe the non-alcoholic beverage industry has the potential to play an increasingly important role in New Zealand’s economic future – creating jobs, strengthening our manufacturing base, supporting the regions and growing the country’s export earnings.”

Not yet a NZBC member? Rest assured, there’s a place for your business.

The NZBC welcomes new members keen to unlock the full potential of their company and interested in tapping into exclusive resources to fuel their growth and success. Contact: www.nzbeveragecouncil.org.nz or info@nzbeveragecouncil.org.nz. n

As we enter 2025, the local industry faces persistent global challenges, ranging from political instability at origin and climate change to ongoing supply chain hurdles, rising production costs, and heightened consumer demand for sustainable practices. These factors all play a part in shaping your cup of coffee,

Our principle remains the same: the New Zealand Specialty Coffee Association (NZSCA) emphasises the importance of understanding the value behind your daily cup.

Beyond a caffeine boost, your coffee purchase reflects an investment in quality, sustainability, and ethical practices. It’s your daily affordable luxury.

The journey of coffee from origin to cup has continued to rise. To minimise delays and costs, importers are responding by optimising container usage and sourcing beans from regions closer to New Zealand, such as Southeast Asia and the Pacific.

Exciting news closer to home sees the New Zealand Coffee Producers Association gather momentum as acres of coffee trees are planted in Northland. In the future, those import costs may be internal, and we will patiently wait to taste the crops grown in Te Tai Tokorau.

From raw materials and transportation to wages and overheads, every part of the coffee production chain has continued to feel the pinch of inflation and increased costs.

Businesses face a challenging balancing act: maintaining high-quality offerings without sacrificing sustainability or profitability. Instead of engaging in a “race to the bottom” on price, the industry remains focused on integrity, fair compensation, and ethical sourcing.

Creativity has flourished under pressure, with more cafés investing in premium, ergonomic machinery and refining their product offerings to meet consumer expectations. Many businesses have sold, bringing new challenges and investment to long-held favourite consumer brands. We expect business acquisitions to continue as the new normal.

New Zealand consumers continue to shape industry trends, focusing on health, social responsibility, and unique experiences. Plant-based milk options, particularly oat

milk, have cemented their place on café menus, with some cafés reporting a nearequal split in demand between dairy and dairy-free options.

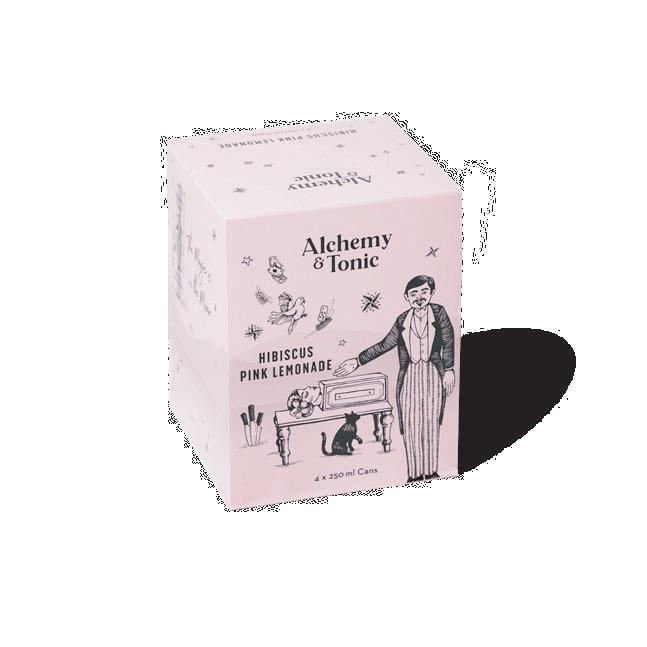

Alongside this, interest in low-sugar, specialty drinks, and sustainably packaged products is on the rise. The canned drink option continues to rise in popularity, flavours and availability, notably at petrol and convenience stores. Many new places are highly influenced by overseas and are given a Kiwi twist with our high-quality roasting, products and manaakitanga.

Sustainability as a Core Value

Sustainability remains at the heart of New Zealand’s coffee culture. Paying a little extra for your coffee supports eco-conscious practices, such as responsibly sourced beans, recyclable packaging, or energy-efficient brewing methods.

The NZSCA has been on an incredible journey with EECA to decarbonise the roasting arm of production and now sees cafés as a way to invest in best-practice carbon-offset energy-saving programs.

The specialty coffee industry in New Zealand is poised for growth despite its challenges. Businesses can thrive in the face of adversity by adopting new technologies, embracing sustainable practices, and staying aligned with evolving consumer values. The cream will always rise to the top.

In summary, paying a premium for your coffee in New Zealand in 2025 supports a unique experience—one brewed with care, committed to sustainability, and rooted in New Zealand community connection. n

Seafood New Zealand Chief Executive Lisa Futschek explains why consumers can feel good about enjoying New Zealand seafood.

Lisa Futschek Chief Executive Seafood New Zealand

Some of you may recall the popular slogan, “Enjoy fish, the family dish,” used in the 1960s and 70s by the New Zealand Fishing Industry Board, an early predecessor of Seafood New Zealand. While this catchy campaign is a thing of the past, its message still resonates today: fish is still the family dish, and so much more.

You can feel good about eating New Zealand seafood When it comes to protecting our oceans, the fishing industry is on board because sustainable fisheries rely on healthy and functioning marine ecosystems. It’s that simple.

These days, consumers can feel confident when purchasing Kiwi kaimoana thanks to New Zealand’s Quota Management System which carefully limits how many fish can be caught. There is extensive ongoing scientific research that underpins this system, which means that consumers can trust their seafood has been harvested sustainably. Fishers and seafood businesses are also committed to having as little impact on our moana and marine wildlife as possible. We have countless examples of fishers going above and beyond – from two fishers in the north who have helped to design and trial a new weighted hook to reduce seabird captures, through to a much bigger seafood company reducing seal captures by around

a third in the last year by trialling and implementing new mitigation methods.

And, recently we received the great news that our largest Jack mackerel fishery, off the west coast of the North and South Islands, achieved zero protected species bycatch. That means no dolphins, no seals, no seabirds were accidentally captured the entire year. The three companies who operate in this fishery made this happen by working together to trial new tools and implement new processes.

Health benefits for all ages

Fish remains a great dish for families and people of all ages and stages as it is a highly nutritious food. Seafood is a great source of protein, many species are low in saturated fat and a number of them are a good source of Omega 3.

Below is a glimpse of the health benefits of several Kiwi favourites:

• Snapper is a good source of selenium which is necessary for a normal immune system and also contributes to healthy hair and nails. It is also a good source of vitamin B12 which is necessary for brain function, energy metabolism and contributes to growth and development in children.

• Gurnard is a good source of vitamin D which is necessary for normal bone structure, and it contributes to the maintenance of teeth. It is also a source of potassium which contributes to the functioning of the nervous system and to normal muscle function.

• Trevally is a good source of niacin (vitamin B3) which is necessary for the normal structure and function of the skin and it contributes to the reduction of tiredness and fatigue.

And we’re learning more all the time about just how good seafood is for us.

Earlier this year, the Food and Agriculture Organisation of the United Nations (FAO) and the World Health Organisation (WHO) released their Background Document on the Risks and Benefits of Fish Consumption which concludes that consuming fish provides energy, protein and a range of other nutrients important for health.

To coin a new phrase

So, if we were to come up with a slogan for 2025, it would probably be something like this, “Enjoy fish, the sustainable, protein and nutrient rich, caught with care, simply delicious dish”. Hmm, perhaps a little wordy – but it’s all true. n

• Global fishery and aquaculture production are at a record high, and the sector will play an increasingly important role in providing food and nutrition into the future (FAO, 2022).

• Global fish consumption has more than doubled in the last 50 years, and annual per capita consumption reached more than 20 kg in 2020 (FAO, 2022).

• New Zealand has one of the largest Exclusive Economic Zones (EEZ) in the world. Our marine area is 15 times the size of New Zealand’s land mass.

• New Zealand’s seafood sector is worth just over $2 billion in export revenue. Government projections show that demand is forecast to remain strong in the 2024/25 year and that this should boost export revenue to $2.5 billion (figures from MPI's SOPI report).

Strawberry volumes are recovering after a couple of difficult seasons in the aftermath of cyclones Hale and Gabrielle.

The 2024 season offers large, sweet berries with superior fresh quality compared to overseas-sourced fruit. The industry body “mystery-shops” strawberries to monitor colour, appearance, brix, weight, traceability, microbial and residue levels, packaging, and price.

Early season results are great and have continued an upward trend over the past few seasons to better quality, greatly assisted by retailers' efforts to store and handle berries carefully, particularly the trend towards retailing from chill zones.

“Growers really appreciate the efforts of retailers to preserve that ‘just-picked’ quality. The combination of improved cultivation techniques and supply chain

improvements creates a win-win for customers with beautiful fruit,” said Sally King, Executive Manager of SGNZ.

There has been strong momentum towards covered crops, which remove some of the growing risk factors and provide a very reliable supply. The industry is seeing increasing consolidation, with over 50 percent of the volume now produced by less than ten growers nationally.

In line with consumer trends, strawberry growers are adopting integrated pest management, using biological controls and significantly reducing the use of sprays for pests and diseases.

“Some growers are now at the point of no sprays other than foliar feeding, which is a major shift. Strawberries are fragile fruits, so the evolution from chemical approaches to agroecology has been an area of significant investment for the industry,” added King.

“It has been challenging, but we are seeing real progress. We have a research programme with partners such as Plant and Food and A Lighter Touch, working with our research lead, Berry World. We are confident we can meet the consumer demand for pesticide-free fruit that consumers see as healthier, more natural, trustworthy, and environmentally friendly”.

Plant variety research is another significant investment for the sector. Getting the right combination of taste, berry size, yield, disease resistance, and tolerance to New Zealand weather conditions is a very exacting science.

Over the past 30 years, more than 100 varieties have been trialled to bring the best varieties to New Zealand tables.

“There are some very promising new berries coming to commercial production soon. Look out for Moxie, Royal Royce, and Valiant. These will offer consumers new choices such as 100-gram berries or supersweet flavours.”

Spring promotions are underway to support retailers via the 5+ A Day promotional programme, social media, and public relations activity.

“We do get great coverage from mainstream media. Before Christmas, there’s a burst of inquiries regarding the availability of these quintessential menu items. I’m throwing no shade, but kiwifruit just doesn’t cut it on the Christmas pavlova. Strawberries all the way.” n

Circana released new Circana Compass insights, providing a comprehensive update on the global retail food and beverage (F&B) industry's performance in 2024 and an outlook for 2025.

Following Circana’s forecast for 2024 from a year ago and the recent midyear update, the market has mainly trended as predicted. As expected, price/mix growth in 2024 fell below historical averages as modest increases in base prices continued, countered by increasing promotion rates.

Further contributing to average price changes, the mix of F&B products shifts as consumers trade down among existing products while many also gravitate to more premium innovation in new items. Retail volumes grew as the post-pandemic wind-down stabilised, and rising prices when eating out prompted consumers to shift some volume back to at-home consumption.

Circana Compass: Growth Opportunities

While market volumes improved in 2024 versus 2023, and consumers remain tethered to more at-home spending, dynamics within retail F&B are challenging and will continue to moderate overall growth ahead.

“Consumers are driven by a demand for value, impacting both volume and price/mix growth. We’re noticing that channels offering everyday value have become more influential. E-commerce solutions also are increasing convenience and price transparency, with online transactions now driving 35 percent of food and beverage dollar sales growth, despite holding only a 10 percent market share. We expect consumers to continue leaning into private labels, which saw a three percent

volume increase over last year versus a one percent decline from mainstream brands as they selectively choose premium brands that deliver the right value,” said Sally Lyons Wyatt, global executive vice president and chief advisor at Circana.

“At the same time, unscripted consumer behaviours add complexity to the market dynamics. We’re seeing a shift from out-ofhome dining, where traffic has fallen by two percent, to in-home meals, which rose by one percent in volume. Shopping patterns are also changing, with consumers making more trips, up 8.9 percent, but buying fewer items per trip — as much as an 11 percent decline — and shopping more perimeter categories versus centre-store.”

As consumers adopt more selective buying habits, they purchase and stock up on some products less often, delay certain purchases, and switch to alternatives as they reassess spending from necessity and make more room for discretionary items.

Circana Compass: 2025 Predictions

Circana anticipates the F&B industry will see an increase between two percent and

four percent in dollar sales in 2025. Price/ mix will grow, reflecting continued modest base price inflation, stabilising promotion levels, and ongoing demand for value, including more premium benefits at the right price.

Uncertainty around potential new government policies introduces a broader range of possible effects on industry costs and requires careful monitoring to plan accordingly. Retailers and manufacturers face stressed margins and increased public scrutiny on grocery prices, requiring them to balance value and incremental offerings.

Volume sales growth will likely range between zero and one percent as the market continues to strengthen for at-home occasions and improve food service traffic. Ongoing channel migration and the shift in shopping behaviours with a value mindset will likely continue shifting the location of the volume growth opportunity.

Circana’s outlook, based on consensus from macroeconomists, assumes a moderate slowdown in economic conditions. This includes softer growth in 2025 than in 2024 for gross domestic product (GDP) and disposable income, a slightly weakening job

market, and stable consumer confidence.

If economic conditions outperform expectations, volume growth may decrease as consumers dine out more, coupled with a stronger price/mix driven by demand for premium experiences. Conversely, weakerthan-expected conditions could reinforce in-home meal preferences but reduce willingness to pay for premium products.

Circana expects F&B value sales across the EMEA region to continue growing around 4 percent in 2025, following a similar trend in 2024. An important trend in EMEA is the expanding presence of generic and private-label brands, which now account for 39 percent of F&B sales, up from 37 percent four years ago.

In the APAC region, Circana projects unit sales to trend upward by 1.6 percent, following a flat performance in 2024. This increase, combined with slowing price/mix trends, will drive four percent value growth in 2025, reflecting a positive outlook for consumer confidence, driven by anticipated interest rate cuts and a gradual shift in spending from food service to retail.

Circana’s F&B outlook is developed using econometric demand models leveraging Circana’s Demand Forecasting Platform. Over 100 variables are analysed to test hypotheses for each model, supported by a machine-learning algorithm and over 500 random forest models to determine the most important causal factors.

Forward-looking input variable assumptions are developed using historical trends and insight from industry experts. This platform allows Circana to run scenarios and estimate future sales, breaking them down by their driving factors. n

According to the latest consumer trends research by Innova Market Insights, 58 percent of consumers worldwide have prioritised quality in ingredients and products when making food and beverage purchases.

As the demand for added value has become the norm, brands must elevate quality beyond ingredients to thrive in 2025.

Innova’s research highlighted key trend drivers for 2025, including personalised nutrition, a renewed focus on gut health, naturalness in plant-based products, flavour mashups, and the tangible effects of climate change on the F&B industry and consumer choices.

Every year, Innova’s direct consumer trends research has identified shifts in behaviour and preference, product launches, and on-pack information from the market.

Trend 1: Ingredients and Beyond

Lu Ann Williams, Global Insights Director at Innova, emphasised the critical role of ingredient quality in consumer purchasing decisions.

“Our top trend for 2025, ‘Ingredients and Beyond,’ underscored the necessity for companies to captivate consumers by enhancing the quality attributes of their ingredients,” said Williams.

“Freshness, nutrition, health benefits, and ingredient sourcing are paramount to consumers. Brands can distinguish themselves in the market by offering superior quality ingredients.”

Williams also noted the positive consumer perception of store brands, highlighting the impact of increased private label focus on ingredient quality.

Trend 2: Health – Precision Wellness

Nearly 60 percent of consumers said they were proactive about their health, with over half planning their nutrition intake based on health issues.

Innova’s #2 trend, ‘Health – Precision Wellness,’ described consumers seeking balanced nutrition through easy-to-consume functional food and beverage products

tailored to their life stage, lifestyle, and health needs.

Personalised nutrition plans, with key focus areas including women’s health, weight management, mood, and performance, have been seen as more effective.

Creativity and excitement in product innovation have taken centre stage with the #3 trend, ‘Flavours – Wildly Inventive.’ Consumers have become more eager to explore unexpected flavours, fusion cuisines, cobranding, unusual formats, cross-category mashups, and limited editions.

Over half of the global consumers have become interested in flavour fusions, and 37 percent followed viral food and beverage trends on social media. In a crowded market, brands can stand out by delivering the “wow” factor and surprising consumers with fun and indulgent experiences.

Trend 4: Gut Health – Flourish from Within

There has been a renewed focus on gut health post-pandemic. Innova’s #4 trend, ‘Gut Health—Flourish from Within,’ highlighted the growing consumer interest in digestive health, driven by key ingredients like fibre and probiotics.

Digestive health has been the top physical health aspect for which consumers purchase functional food and beverages, with an eight percent year-over-year growth in products with digestive health claims. Consumers increasingly seek fibre and probiotics to optimise their microbiome for better gut health.

Trend 5: Plant-based –Rethinking Plants

Innova’s #5 trend, ‘Plant-based –Rethinking Plants,’ reflected the evolving landscape of plant-based products.

Companies have focused on improving taste and texture while meeting consumer demands for naturalness, health, and environmental benefits.

With a 23 percent average annual growth in vegan/plant-based products with natural claims over the past five years, 55 percent of consumers believed plant-based products should be standalone rather than meat and dairy alternatives.

Addressing concerns about ultraprocessing, natural standalone could appeal to the 25 percent of consumers hesitant to buy overly processed plant-based products.

Trend 6: Sustainability –Climate Adaption

Sustainability has also remained a key focus for consumers and the industry alike. Innova’s #6 trend, ‘Sustainability – Climate Adaptation,’ showcased how the industry has responded to climate change impacts and consumer sentiment.

Nearly half of global consumers were aware of climate change’s effects on F&B, with increased prices being the most noticeable impact. This climate uncertainty has presented opportunities for innovation, such as developing alternatives to climate-sensitive crops like cocoa, coffee, and olive oil.

The final four trends in Innova’s Top Ten for 2025 include Beauty Food – Taste the Glow, Food Culture – Tradition Reinvented, Mood Food – Mindful Choices and AI – Bytes to Bites. n

In this 10th annual report from the world's leading natural and organic foods retailer, industry experts share the trends set to transform our plates.

Whole Foods Market’s Trends Council unveiled their top 10 anticipated food trends for 2025 in the retailer’s 10th annual Trends Predictions report. Whole Foods Market predicts a boom in hydrating ready-to-drink beverages, a new wave of aquatic ingredients, added crunch to every meal, and fusion snack foods with international appeal — these and more are set to influence the food landscape in the coming year.

The Whole Foods Market Trends Council—a collective of more than 50 Whole Foods Market team members ranging from foragers and buyers to culinary experts— develops these trend predictions each year through a combination of deep industry experience, keen observation of consumer preferences, and collaborative sessions with emerging and established brands.

“Our tenth anniversary of trend forecasting marks an important milestone for us, reflecting a decade of sharing innovation and culinary exploration that crosses every aisle,” said Sonya Gafsi Oblisk, Chief Merchandising and Marketing Officer at Whole Foods Market.

“This year, we’re especially excited to celebrate how far we’ve come by spotlighting trends for 2025 that not only reflect growing consumer preferences and push the boundaries of what’s possible for the world of food. We’re eager to see these trends take shape and inspire our customers in the year ahead.”

“Whole Foods Market has been keeping an eye on trends and spotlighting innovation in food and beverage from the beginning,” said Cathy Strange, Ambassador of Food Culture for Whole Foods Market

and member of the Trends Council.

“From important food movements around animal welfare, climate, and transparency to the evolving tastes and preferences of consumers, trends in food end up driving our dinner table conversations for years to come and help spark some of the best ideas and solutions for the future.”

Whole Foods Market’s top 10 food trend predictions for 2025 include:

International Snacking

The snack aisle is a perfect place for disruption, with brands taking on salty snacks like popcorn and adding global flavours to create fusion foods that have mass appeal and entice consumers to try something new. On the packaging, brands can tell their snack story by sharing their cultural roots and nostalgic childhood food memories.

Products in this trend introduce consumers to different parts of the world through a mix of traditional international snacks like chamoy candy and new combinations like mango sticky rice chips or a chilli crunch oil edamame and nut mix.

Dumplings are dough pockets with a savoury filling, usually cooked by boiling, steaming or pan frying. Also known as pocket foods, they appear in multiple aisles, including frozen and shelf-stable single-serve formats. These products hit on a few trends — many are authentic to a founder’s cultural roots and ripe for fusion and unexpected mash-ups, which have continued popularity on TikTok and

restaurant menus. Dumplings are longstanding staples in cuisines across the globe, making them a trend everyone can feel involved in and get excited about.

From crispy grains and granola to sprouted and fermented nuts to roasted chickpeas and mushroom chips — consumers are increasingly reaching for these items to enhance meals and add texture to breakfast, lunch and dinner. Brands are creating crunchier versions of the ever-popular chilli crisp, while new seasonings marketed for their texture are stars of salads and roasted veggies. Dehydrated fruits and candy are taking over social media, with consumers seeking that light, airy crunch. This trending texture can also be seen in beverages and desserts, like crème brûlée espresso martinis or pistachiotopped pastries.

Reusable water bottle culture is upon us, but consumers want more from their H2O, seeking added electrolytes and hydration in more innovative forms. It’s impossible to ignore the trend at food and beverage trade shows, where you’ll find popsicles with electrolytes, sparkling coconut water, chlorophyll water, and protein water.

New players are emerging in the space, like cactus waters that contain antioxidants and electrolytes and better-for-you competitors to sugary and artificially coloured sports drinks. Even kids can get in on this trend with new and tasty beverages in fun formats like pouches and mini coconuts.

Tea’s Time

From important food movements around animal welfare, climate, and transparency to the evolving tastes and preferences of consumers, trends in food end up driving our dinner table conversations for years to come and help spark some of the best ideas and solutions for the future.

There’s tea talk everywhere you turn — both in flavour popularity for food like desserts and granola (chai, Earl Grey, London fog), new steeping formats (tea strips, cold-brew bags for water bottles and powders) and a wave of new hot products like plant-based milk teas and sparkling teas. Vintage-inspired adult tea parties are poised to replace happy hour as customers looking for function can seek out brews with added adaptogens and benefits. This new trend follows past predictions like “New Brew: Yaupon” and “A Better Boost.”

Next-Level Compostable

Products that aren’t ditching packaging completely are going the compostable route, making some or all elements of their packaging compostable. Some brands, like Compostic, are even entering new territory with home-compostable products, meaning all components can be composted in a home bin versus requiring a commercial process. In the produce world, Rainer Fruit is working on commercially compostable produce stickers.

More-Sustainable Sips

Forward-thinking boozy brands are working to reduce their environmental footprints. Natural and organic wines may not be new, but brands are taking things a step further by embracing regenerative practices and lower-impact packaging. For example, the Sustainable Wine Roundtable (of which Whole Foods Market is a founding member) has a goal to drop bottle weights by 25 percent by 2026. Meanwhile, beer and whiskey brands are embracing

ingredients like drought-resistant fonio or regeneratively farmed kernza.

Sourdough Stepped Up

During the pandemic, we saw a sourdough resurgence with at-home bakers trying their hand at the classic fermented bread. Now we’re seeing this trend move into grocery aisles in both traditional and innovative ways — pizza crusts, flatbreads, brownies, crackers, chocolate and more — with customers looking for the benefits and flavour that sourdough offers without spending hours in the kitchen. There’s also a variety of innovative sourdough bread launching at Whole Foods Market Bakery, including pumpkin turmeric.

With the continued popularity of seaweed and the increasing interest in harvesting readily available aquatic plants for more sustainable sources of protein and nutrients, the tide is turning toward foods made with more sea and freshwater greens. Sea moss, in particular, has been making a splash as a buzzy wellness ingredient — especially touted for its iron, magnesium and iodine content — in formats such as beverages and gummies. Duckweed, or water lentils, is in the early stages of emerging on the scene and boasts a higher protein content than other leafy greens, and agar-agar (a plant-based gelatin alternative that comes from red algae) is primarily fibre-based and promoted for digestive support.

Consumers are looking to incorporate

more protein in their diet beyond traditional powders and bars, with an emphasis on ramping up protein consumption at meal times and with “whole food” snacking. Recipes incorporating cottage cheese (still the “it girl” in dairy) may have kick-started customers’ desires to seek out protein in whole food sources, with consumers now prioritising animal protein.

Organ meats are being touted as a superfood providing significant protein, vitamins and minerals, leading shoppers to seek meat blends that combine traditional muscle meat like ground beef with organ meats and making it easier to enjoy the nutritional benefits without having to learn how to prepare liver, kidney or heart. n

Founded in 1980, Austin-based Whole Foods Market is the world’s leading natural and organic foods retailer and the first certified organic national grocer in the United States.

Works harder, so you don’t have to

27E Smales Road, East Tamaki, Auckland, New Zealand

Contact: Elliot Keys

T: +64 27 704 7719

E: elliot@acorngroup.co.nz www.acorngroup.co.nz

Categories: Beverage, Confectionery/ Snack Foods, Dry Grocery, Free From/ Organic/Gluten & Allergy

Brands: Clif, ENSO, Exotic Food, Flying Goose, Goodness Me, Got Rice, Jarritos, Nairn’s, Natvia, Oatly, Qetoe, San-J

10 Hutt Road, Petone, Lower Hutt, Wellington, New Zealand

Contact: Glen McCraken T: +64 9 525 1880

E: glenn@acton.co.nz www.acton.co.nz

Categories: Dry Grocery, Sauces/ Dressing/Condiments/Marinades/Oils

Brands: Indomie, Lee Kum Kee, Silk, Golden Sun, Spring Fresh, O’Canada, Fia Fia, Bow Wow, Mouth Fresh, Freeze Pops, Sunshine Pegs, Pagoda Lungkow, Lorea, Ocean Catch

AFT Pharmaceuticals, L1 129 Hurstmere Road, Takapuna, Auckland, New Zealand

Contact: Scott Porter T: +64 27 224 0233

E: scott.porter@aftpharm.com www.aftpharm.com

Categories: Health/Beauty