6 minute read

Education feature by The Good Schools Guide

through the door

Schools 47

Advertisement

Whether you’re looking for a day nursery, boarding school or sixth form, finding the school that is right for your child means lots of homework for parents. For most parents the school search starts with a browse through websites. Educational marketing is highly professional these days so be prepared for buildings that look like country house hotels, acres of playing fields, perpetual sunshine, high-tech laboratories, professional standard theatres and many, many grand pianos. After a while you may start to feel as though you have been assaulted, in the nicest possible way, by a combination of Downton Abbey, Enid Blyton, Child Genius and the Olympics. Some parents try reverse engineering to help them choose a school, starting with top universities and working backwards. They identify schools that send a large proportion of leavers to Oxbridge or Ivy League colleges and then register their child at linked or ‘feeder’ preps. It’s not uncommon for spreadsheets to be drawn up with every detail of a child’s educational future specified. Of course there’s nothing wrong with forward planning, but where’s the contingency? The plan B? After all, the baby whose future is being mapped out so meticulously may not have got the Oxbridge memo. Parents’ educational experience, good or bad, will be hugely influential on any decision. Try writing down the things you liked and disliked most about the schools you attended and then think about these in the context of what you want for your child. You also need to think about whether you want co-ed or single sex education, any religious preferences and, for day schools, chapter and verse on bus routes and realistic travel times. Look beyond league tables Many parents say they don’t want their child to go to an academic ‘hot house’. What they want is for their Choosing the best school for your child Advice from Janita Gray at The Good Schools Guide

48 Schools

child to enjoy learning in an unpressurised environment. Oh, and by the way, they also want their child to get in to Oxford. Good Schools Guide advice is to ignore league tables and look at trends in exam results over a few years. If most of the children are getting A/A* with only a few Cs and Ds, think about how the child who got the C might feel. Open days An open day is often the first contact parents have with a school in which they are seriously interested. There’s no substitute for setting foot in a school –you may find that a place that looks perfect on paper just ‘feels’ wrong and you shouldn’t ignore this. Try and attend the head’s talk. Prep school heads have your child’s future in their hands –you’re paying them to know your child, advise on the best senior schools and, if necessary, intervene on your child’s behalf if an entrance exam doesn’t go to plan. In senior schools the head may be more of a figure head and most of your day to day dealings will be with tutors or housemasters, but the leadership of the school is still key to its ethos. If you’re considering boarding for your child make sure you get a good look round. The norm is cabin beds, shared rooms until GCSEs, empty noticeboards in boys’ dorms and lots of bunting in girls’ dorms. Ask how many children stay in school after matches on Saturday. If nearly everyone else is going home it’s not much fun to be left behind –even if the school does lay on trips.

If you think you’ve found the perfect school then get yourself in the system as early as you can. Make sure you visit, register and pay the deposit in good time –for popular schools that can be several years in advance. You also need a back-up school (but don’t tell your child that this is what you’re calling it). You should also be prepared for change. A new head or move from single sex to co-ed can have profound effects. And last but by no means least, there’s your child. He or she may turn out to have very different plans from the ones you have drawn up.

For more information, advice and school reviews visit: www.goodschoolsguide.co.uk

through the door

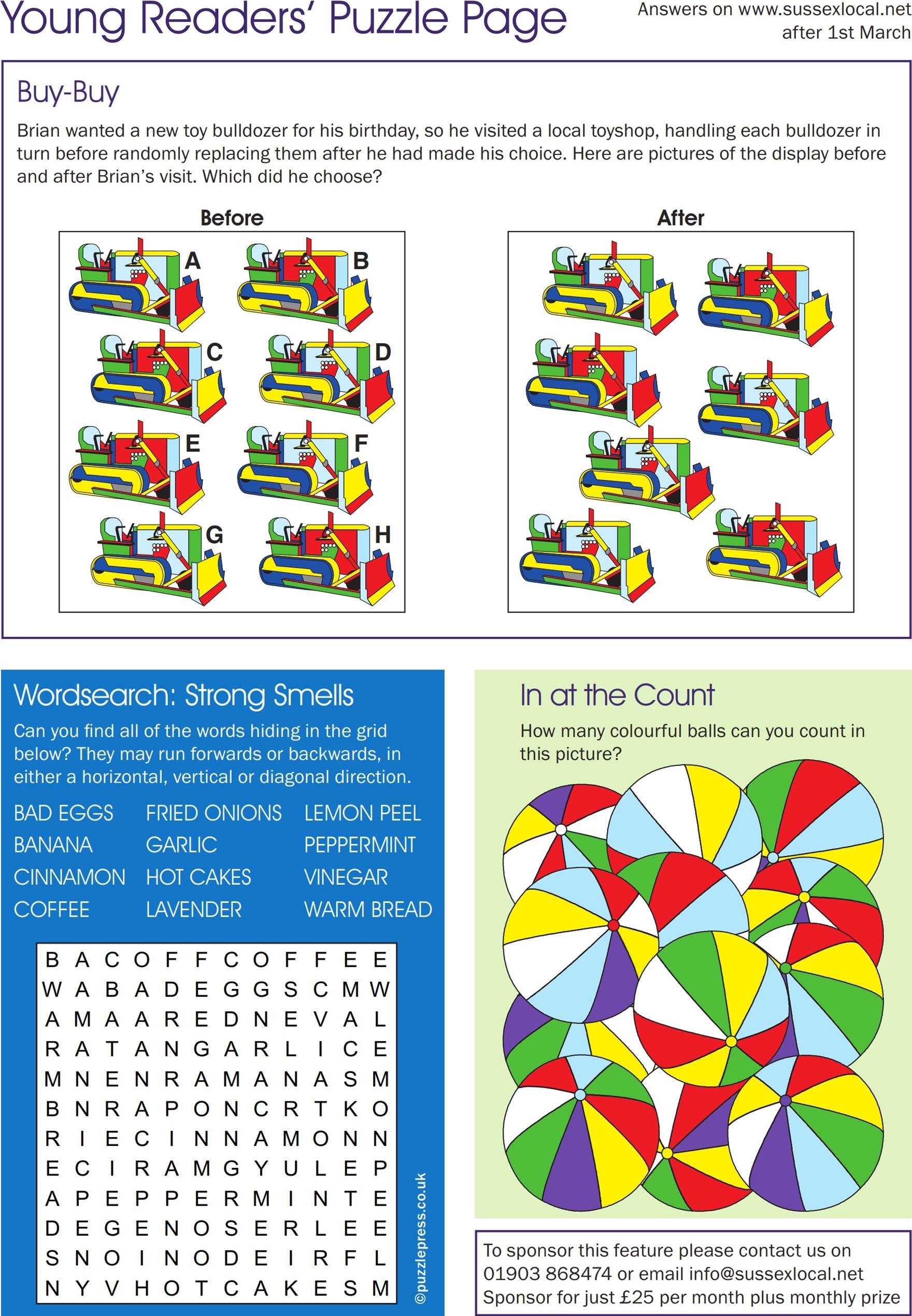

Puzzles 49

50 Finance

Fund Your Future

Life after work

By Ivan Lyons, MD Investment Solutions, Worthing Unlock value from your home and finance those retirement goals Most of us look forward to retirement, but financial worries can cast a shadow over later life. You may be concerned you don’t have enough money to do everything you’ve planned, or that something unexpected, such as redundancy, or ill health, could make life difficult. These anxieties can be hugely frustrating, because while you may live in a valuable property, you might be short of accessible savings. A later life mortgage range could be the answer for you. What are later life mortgages? There are a range of mortgages designed to help those aged 55 and over release some of the equity in their home. You can stay living in the home you love (after all you’re still the owner) but unlock some of its value, offering you a source of money during retirement. Why do people take out later life mortgages? Some release equity to pay for the trip of a lifetime, make home improvements or see their inheritance in action –helping children with university tuition fees, perhaps, or a deposit for a first home. Others use the cash to live more comfortably when pensions or savings aren’t quite enough. The money can also help deal with the unexpected, such as the cost of care. How much will these loans cost? Generally, nothing upfront. We can offer free advice to help you decide whether a later life mortgage is right for you. The lender will also value your home, normally free of charge. Once you take out a later life mortgage, you will pay a competitive rate of interest on the sum borrowed. When do I make repayments? It’s your choice. With a retirement capital and interest mortgage, you would make monthly repayments over the term of the mortgage, much like a traditional home loan. But with the retirement interest-only mortgage, you would only pay interest charges each month, as the money borrowed is usually repaid using the proceeds from the sale of the property –after the last borrower passes away or moves into long term care. With a lifetime mortgage, you will pay nothing during your retirement, unless you want to. The sum released and the interest are usually repaid using the proceeds when the last borrower passes away or moves into long term care. Don’t forget a final check… Think carefully before securing a mortgage against your home as, of course, not keeping up payments could put it at risk. And you will want to check the mortgage meets your needs if you want to move or sell your home or want your family to inherit it. This is a lifetime mortgage. To understand features and risks, please ask for a personalised illustration. Investment Solutions, Grafton House, 26 Grafton Road, Worthing, BN11 1QT. Tel: 01903 214640 email Ivan at: ilyons@graftonhouse.net or visit our website www.investment-solutions.co.uk for more information. ‘Investment Solutions’ is the trading name of Investment Solutions Wealth Management Ltd who are authorised and regulated by the Financial Conduct Authority.

through the door