TAHOE MOUNTAIN REPORT

TAHOE-TRUCKEE MARKET OVERVIEW

Mid-Year Report

Tahoe-Truckee

Market Overview

Resort Communities

Tahoe Mountain Realty is a team of seasoned professionals specializing in luxury resort real estate, dedicated to providing unparalleled insight and guidance across Truckee and North Lake Tahoe. Armed with cutting-edge tools and a deep understanding of the region’s unique market dynamics, we are committed to delivering exceptional results for our clients.

Our team’s expertise is rooted in decades of experience in developing, positioning, and marketing premier properties within these exclusive communities. This extensive background allows us to approach each client interaction with a distinctive perspective, ensuring a personalized experience that consistently achieves optimal outcomes. outcomes.

TAHOE - TRUCKEE MID-YEAR REPORT | 2024

The first half of 2024 has delivered a complicated set of results for Tahoe Truckee real estate indicative of a market seeking identity. Following a year of stagnation in 2023 characterized by declining sales amidst resilient prices and constrained inventory, 2024 has brought about a notable increase in residential transactions, signaling a potential turn in market sentiment.

Thus far, 2024 has delivered 10% more residential sales year-over-year while average and median price are flanking the results of 2023. To date, median price, indicative of the majority of homes sales, has risen by 7% to $1,100,000; the highest number on record for this metric. Conversely, average price, which is typically pulled upward based upon premium sales many times greater than the median, has drifted downwardly by 4%.

The gap between average and median prices has narrowed to just 32%, the lowest since 2011. The tightening suggests a higher floor for entry-level home prices, where demand still far outpaces supply. Conversely, the ceiling for high-end properties has lowered, as evidenced by fewer hyper-premium sales. While inventory has accumulated to levels higher than in recent years, sellers have not shown interest in cutting prices dramatically in the absence of distress or outside pressures to find liquidity.

Economic conditions, including interest rates, homeowners’ insurance, and inflation, have proven stubborn headwinds to a market that has shown signs of wanting to break out of its slump.

Moreover, the reduced number of hyper-premium sales points to a possible saturation or cooling off in the luxury segment. The prestige of ultra-high-end properties in Lake Tahoe and Martis Camp may have peaked, and the pool of buyers willing to spend on these homes might be smaller than in previous years. This shift has led to a more balanced market, where the influence of a few ultra-luxury sales is less pronounced.

Sales greater than $1,000,000 have constituted 54% of all year-to-date sales, equal to the highest amount ever yet transactions above $5,000,000 have dipped to the lowest proportion since 2020.

While still constrained by historical standards, the number of available listings is currently at the highest number in more than 4 years. This is 25% more than one year ago and nearly double the amount available in 2022.

Seasonal considerations indicate that market activity will accelerate over the next 3-4 months before tapering in Q4. Typically, the second half of any given year will deliver double the number of transactions as the first, projecting a year-end total around 1,200 residential sales. While this number would underperform historical average by 20% it would absorb most of this standing inventory and likely result in a second year of generally balanced pricing.

As we navigate through the complexities of the Tahoe Truckee real estate market, we remain committed to providing insightful analysis and strategic guidance. The evolving dynamics observed in 2024 underscore both challenges and opportunities for prospective buyers and sellers alike. We look forward to keeping you informed as market conditions continue to evolve.

TAHOE - TRUCKEE 6MO

6MO MARKET OVERVIEW

12385 Caleb Drive | Sold 12778 Caleb Drive

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Old Greenwood saw a 9% increase in median home prices to $1,665,000 and a slight rise in median price per square foot to $761, despite a decrease in transactions.

OLD GREENWOOD

Median Price by Year

11454 Henness Road

Village at Gray’s Crossing 11761 Bottcher Loop

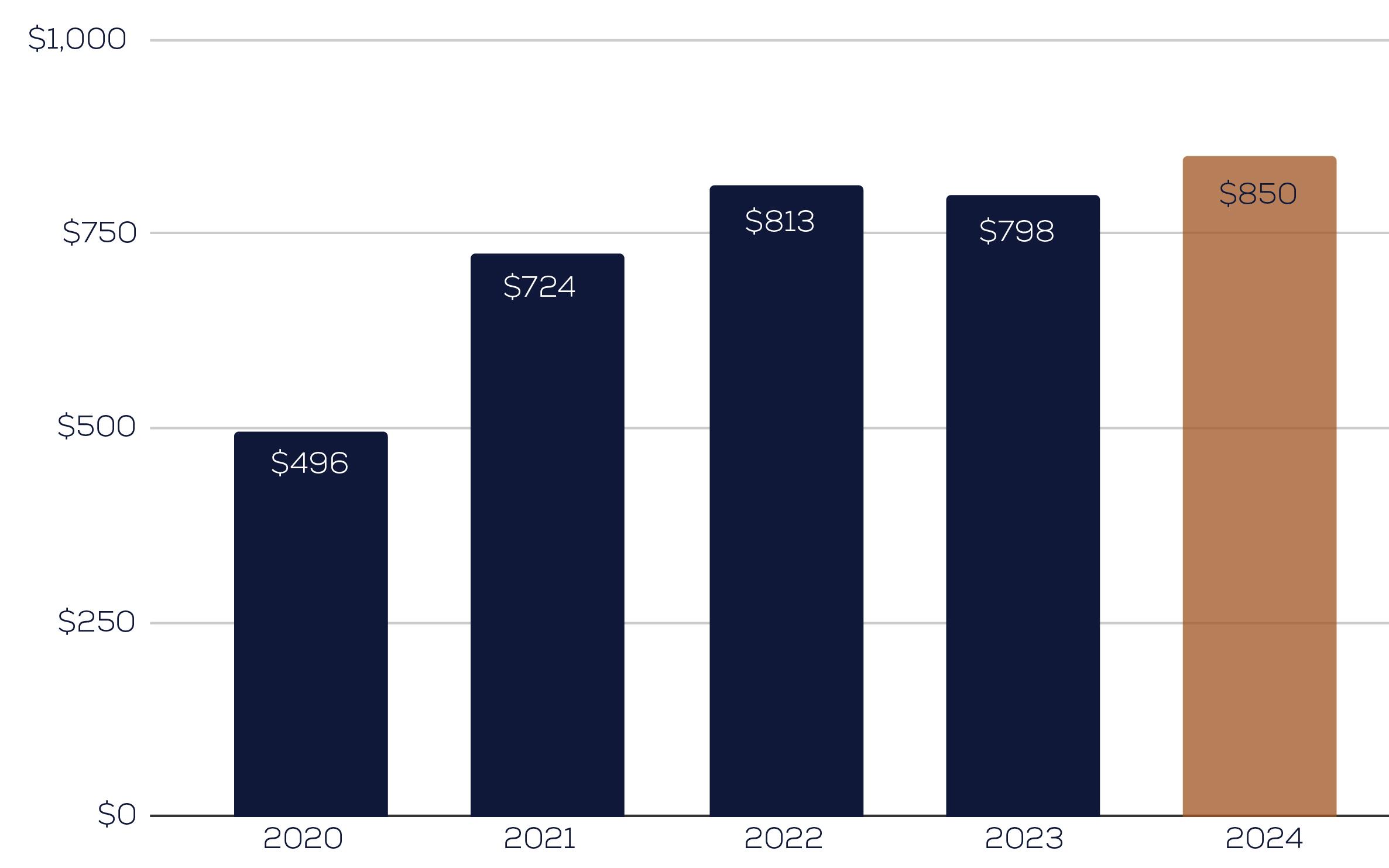

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Gray’s Crossing saw a 6.3% increase in median price per square foot to $850 and homes selling closer to asking price, despite a drop in transactions.

GRAY’S CROSSING

Median Price per Sq.Ft. by Year

8800 George Whittell

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Lahontan saw a slight rise in median home prices to $3,925,000 and homes selling faster, despite a decrease in transactions and a modest dip in median price per square foot.

LAHONTAN

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Schaffer’s Mill saw a 4% increase in median home prices to $2,850,000 and a slight rise in median price per square foot to $940, despite fewer transactions. Homes are selling faster and closer to the asking price, indicating strong demand.

Median Price by Year

SCHAFFER’S MILL

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Martis Camp experienced a 15% decrease in median home prices to $7,150,000 and a slight dip in median price per square foot to $1,680, with fewer transactions.

Median Price by Year

MARTIS CAMP

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Northstar saw a 5% increase in median home prices to $1,717,000 and a rise in average prices to $2,110,000, despite a decrease in the number of transactions. This reflects continued demand for homes in this sought-after mountain community.

NORTHSTAR

Average Price by Year

970 Paint Brush Hill | Sold

Sugar Bowl Road | Sold

In the first half of 2024, where the Tahoe-Truckee market saw a potential signaling of turn in market sentiment, Sugar Bowl experienced a resurgence in median home prices, rising to $2,812,000, while the average price per square foot decreased to $648. Despite these shifts, the market remains active, with homes staying on the market longer and selling slightly below asking price.

SUGAR BOWL

Median Price by Year

SUGAR BOWL HOME S