It gives me immense pleasure to place this book at the hands of the readers. The present book is the result of the co-operative and cumulative effort of two of the outstanding officers - Shri Bidyut Kumar Banerjee and Shri Srinivasan Gopal - from the apex intelligence and investigative agency viz. DRI, which, inter alia, deals not only with the matters relating to violations under the Customs Act, 1962 but also plays a vital role in interdicting persons involved in illicit trafficking in narcotics, psychotropic and controlled substances, busting of illegal/illicit clandestine labs and factories and prosecuting them under the provisions of Narcotic Drugs and Psychotropic Substances Act, 1985.

The drug menace is a global issue. It is a serious evil not only for the individual but also for the society. The illicit traffic in narcotic drugs and psychotropic substances poses a serious threat to the health and welfare of human beings especially the youth and adversely affects the economic, cultural and political foundation of society.

In India, a comprehensive legislation, viz. the Narcotic Drugs and Psychotropic Substances Act, 1985 was enacted to strengthen the control measures over drug trafficking and for deterrent punishment for drug trafficking offences.

The Narcotic Drugs and Psychotropic Substances Act, 1985 prohibits the following activities :

Cultivation of any coca plant or gathering any portion of coca plant;

Cultivation of the opium poppy or any cannabis plant;

Production, manufacture, possession, sale, purchase, transportation, warehousing, use or consumption, import inter-state, export inter-state, import into India, export from India or transshipment of narcotic drugs or psychotropic substances except for medical or scientific purposes in accordance with the terms and conditions of licence, permit or authorisation granted under the rules or orders made under the Act;

Dealing in any activities in narcotic drugs or psychotropic substances other than those activities referred above;

Handling or letting out any premises for the carrying on of any of the prohibited activities, including dealing, referred above;

Financing directly or indirectly, any of the aforementioned prohibited activities;

Abetting or conspiring in the furtherance of or in support of doing any of the aforementioned prohibited activities; I-5

Harbouring persons engaged in any of the aforementioned prohibited activities; External dealings in narcotic drugs and psychotropic substances; Acquiring any property by means of any income or earnings attributable to contravention of any provisions of the Act or holding such illegally acquired property; Certain activities relating to property derived from an offence committed under the Act or under any other corresponding law of any other country.

To combat illicit trafficking in narcotic drugs and psychotropic substances, the Enforcement Agencies have been entrusted with enormous responsibilities of not only detecting the case of illicit traffic but also to ensure that the offender is punished and does not go scot free due to the ignorance or negligence of the Enforcement Officers in proper implementation of the provisions of the Act which are scrutinised by the courts. As a result of non-compliance and non-adherence of settled procedures of law, in many cases, the accused even a king pin who masterminds such illicit trafficking is acquitted by the Courts on the ground of ‘benefit of doubt’. The procedures prescribed are to be complied with in entirety and they are so sacrosanct that any violations or non-compliance, irrespective of the quantity seized, is bound to vitiate the trial.

Under the Act, the power of enforcement of the laws towards the prohibited activities (illicit traffic and illicit trade) has been allocated to various Central and State law enforcement agencies. Several departments and organisations of the Central Government viz. Narcotics Control Bureau (NCB), Central Bureau of Narcotics (CBN), Directorate of Revenue Intelligence (DRI), Commissionerates of Customs, Commissionerates of Central Excise (now Commissionerate of Central Tax and Central Excise), Railway Protection Force, Indian Coast Guard, Border Security Force, Sashastra Seema Bal, National Investigation Agency and State Police, State Excise Officers of the State Government are designated as Drug Law Enforcement Agencies (DLEA). The Act empowers an officer superior in rank to a peon, sepoy or constable of the Central and State Government departments to enter, search, seize and arrest without warrant or authorisation even between sunset and sunrise. The empowered law enforcement agencies, thus, play a vital role in curbing the drug menace. They need to take special care towards, compliance of the provisions of the Act and procedures, while enforcing the law.

It is in this context apt to recollect the observation of the then Chief Justice of India

Shri Y.K. Sabharwal on the issue of low conviction rate in drugs cases at the National Seminar on Narcotic Drugs and Psychotropic Substances wherein he stated that “the rate of acquittals is a matter of great concern as it elucidates the gap between the investigation and the law.

……….Justice can be delivered only when there is total support by an effective and efficient investigation and administration. ………..we need to take multi dimensional steps to improve the quality of investigation as well as increase effectiveness of criminal justice delivery system.”

It is also a matter of record that while passing the orders of acquittals various courts have observed adversely about the shortcomings of the prosecution case in proper implementation of the provisions of the Act.

The cases under the Act are booked by the enforcement agencies as a result of dedicated and sincere efforts of the officers who participate at different stages of collection of specific and accurate information on illicit trafficking, search, seizure, arrest, investigation etc. Acquittal of offender(s) due to inadequacies and procedural lapses during the searches, seizures and investigation is not only a failure on the part of the individual officer and the organisation towards elimination of crime but also a continuing threat to the society as the person is in all likelihood likely to continue in such criminal acts. On the other hand joint efforts of all the officers at every stage and proper observance of legal and procedural requirements lead to conviction.

The legal and procedural requirements as pronounced by trial courts, High Courts and the Hon’ble Supreme Court are simple and are in the nature of primary requirements which are expected to be in the knowledge of any law enforcement officer, irrespective of his/her rank. However, it is also a fact that the events in each case do not occur in straightjacket pattern. Each case has its own peculiar facts and circumstances which also demands compliance of legal and procedural requirements. The field officers in many such cases commit unwarranted and unintentional mistakes which sometimes become one of the vital cause leading to acquittal.

In view of above, exhaustive study has been made to identify various circumstances where the courts have pointed out the failure of the officers towards non-compliance of provisions, which are mandatory & not directive and non-compliance of requirements laid down under the legal framework for investigation of the offences.

Keeping the aforesaid in view, an attempt has been made in this book to compile such different and peculiar circumstances with practical guide as to how the enforcement officers can comply with the legal requirements in each step of the proceedings from recording of information to filing of prosecution charge sheet/complaint before the designated court and steps required to be taken by all prosecution witnesses for tendering evidences before the trial court.

The pharmaceutical companies are also engaged in various activities in relation to narcotic drugs, psychotropic substances and controlled substances for medical and therapeutic purposes and such companies are required to be extra vigilant and strictly adhere to the requirements of procedure prescribed under various provisions of laws. A section of the book deals with various requirements under the Drugs and Cosmetics Rules, 1945 made under the Drugs and Cosmetics Act, 1940 and the Narcotic Drugs and Psychotropic Substances Rules, 1985, made by the Central Government under section 9 read with section 76 of the Act. NDPS Rules made by the State Government under section 10 of the Act and the Narcotic Drugs and Psychotropic Substances (Regulation of Controlled Substances) Order, 2013 made by the Central Government under section 9A of the Act, as failure to comply with the provisions of these Rules and Order amount to an offence under the Act and is punishable under various sections of the Act.

The book not only provides step- by- step guidance to field officers as the case progresses from information stage to filing of charge sheet/complaint before the trial court, detailed discussion on each topic with latest case laws relevant to enforcement provisions under the Act including the topics on academic interest dealt separately under the heading

‘Knowledge Enhancement Topics’ shall provide vital background towards proper implementation of the provisions of the Act by the enforcement officers. This book is of great help to officials to adhere to the letter and spirit of the law. It is expected that this book shall cater to the needs of field officers in day-to-day discharge of their duties and the endeavour of the authors in bringing out this book shall be appreciated by the readers by suggesting and pointing out correction(s), if any. Needless to mention, law on the subject is extremely dynamic in nature and accordingly the readers are advised to have a proactive role in updating their knowledge, based on the judgments rendered by the Hon’ble Supreme Court and various Hon’ble High Courts.

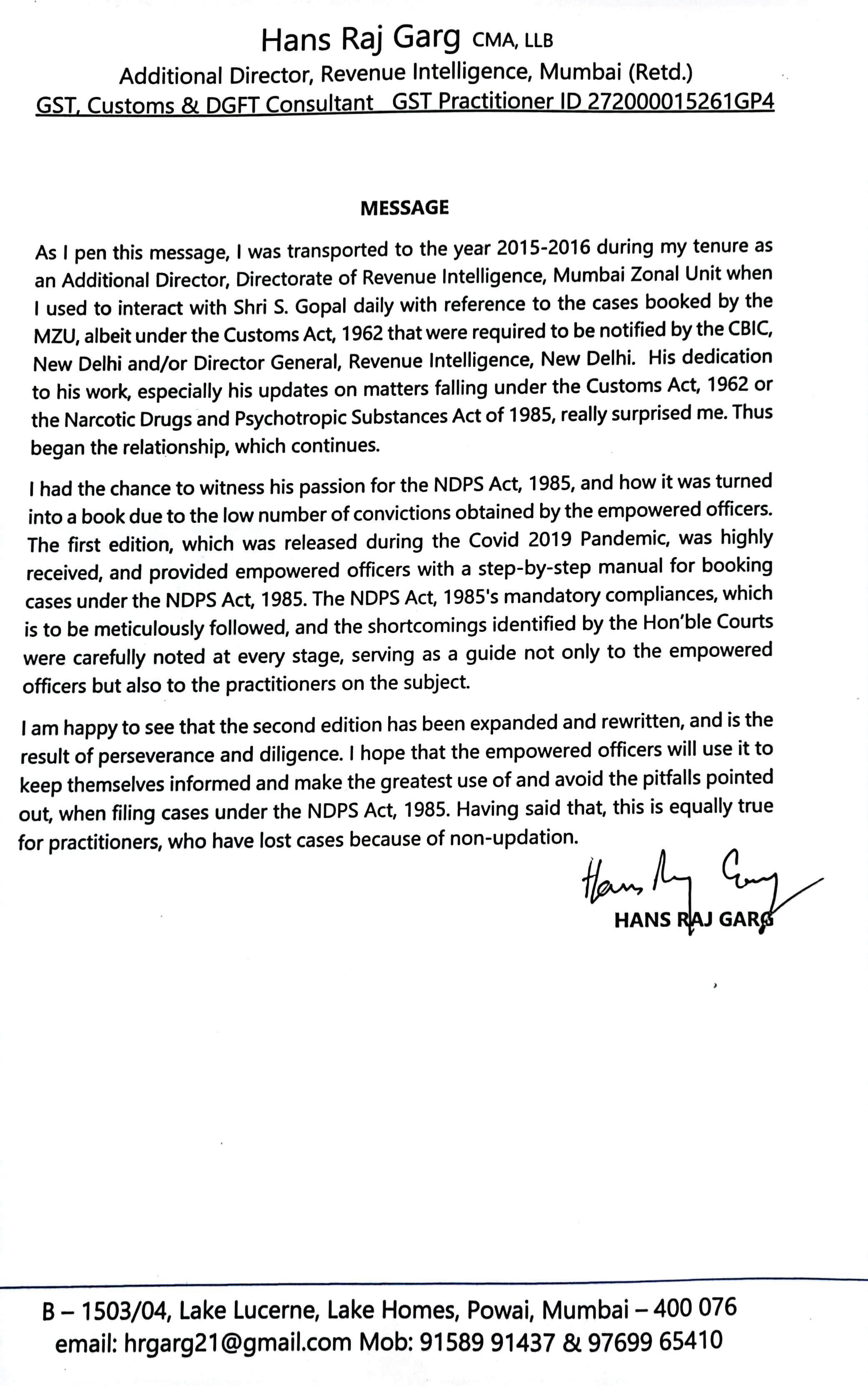

I offer my congratulations to Shri S. Gopal on the publication of the second edition of his book and convey to him my best wishes.

I had the privilege of regularly interacting with him on various aspects of NDPS Act, 1985 and related issues while holding different assignments with the GovSouth Asia. I have found him to be exceptionally passionate about his academic interests, and the National Academy of Indirect Taxes, Customs and Narcotics, Faridabad, and its Zonal Units, as well as other empowered departments, are making full use of his insights into the provisions of the NDPS Act, 1985.

implementing the provisions of the NDPS Act, 1985. In the recent past, we have departments, and that too in substantial quantities. This is a matter of serious concern for all of us. It is in this context that the current publication offers a from investigation to prosecution as they register the cases under the NDPS Act, 1985. The book also encourages readers to stay informed about both - the modus operandi used, and the decisions made by the various Hon’ble Courts. Having said that, it also in no way lessens the value of the book for the legaledition, which has been expanded and revised, is also a result of assiduous study by the author and has been brought out in a record time.

JAYANT MISRA Former Director General, DRI and Chairman, Settlement Commission

JAYANT MISRA Former Director General, DRI and Chairman, Settlement Commission

Former Director General, National Academy of Customs Indirect Taxes & Narcotics, & Multi - Discriplinary School of Economic Intelligence, India & + 91 98101 44308 ) shreemenon48@gmail.com

Bidyut Kumar Banerjee, recipient of Presidential Award for ‘Specially Distinguished Record of Service’ joined the service in the year 1978 and retired on superannuation as Assistant Director, DRI (HQ.), New Delhi in the year 2016. He served more than 25 years in premier intelligence agencies viz. Directorate of Revenue Intelligence, Directorate General of Central Excise Intelligence (now Directorate General of Goods and Services Tax Intelligence) and Central Economic Intelligence Bureau.

seminar on ‘Planning Meeting of Storm Enforcement Network on Medical Product Counterfeiting and Pharmaceutical Crime’ at Singapore, organised by INTERPOL. He attended the ‘International Border Interdiction Training’ in U.S. organised by

organised by Department of Energy, National Nuclear Security Administration, U.S.A. His knowledge and teaching experiences are marked by his addresses to the Special Judges (NDPS) and Public Prosecutors at Delhi Judicial Academy on Investigation Challenges in relation to Illicit Drug Trade, Financial Investigation etc. He is associated with National Academy of Customs, Indirect Taxes & Narcotics and Central Detective Training Institute as guest faculty for delivering

NDPS Act, 1985.

Srinivasan Gopal is a graduate from the University of Madras. He did his law from the University of Delhi. He regularly teaches at the National Academy of Customs, Indirect Taxes and Narcotics (NACIN), Faridabad, for Indian

variety of topics related to the NDPS Act, 1985, Customs Act, of various formations of the Central Board of Indirect Taxes and Customs at NACIN, Zonal Training Institutes located at Bhopal, Chandigarh, Hyderabad, Jaipur, Mumbai, New Delhi and Ranchi.

Guard, Shashtra Seema Bal, DRI, Lucknow Zonal Unit, and NCB, New Delhi. He

Commissionerate in India, on various topics under the CGST Act, 2017. He also participated in the National Consultation on Synthetic Drugs held on 3-5 August, 2022 and made a presentation on “Seizure, Modus Operandi

the NDPS Act, 1985, New Psychoactive Substances and Precursor Control and Its Regulations: Indian Context.

He is also the content provider for the Mobile App “Indian Customs Traveller

was also co-opted as a Member by the Additional Director General, DRI, Chennai Zonal Unit for iGOT- Mission Karmayogi on “Prosecution under the provisions

No. 67/2022-Cus(NT), dated 8th August, 2022.

Following the release of the first edition, there have been numerous drug seizures along all the traffickers’ routes, and the pattern of illicit drug trafficking has changed noticeably. The quantity of drugs that is being pushed into our country and the increase in consumption are concerning.

The first edition of this book needed to be updated due to the rapidly changing developments and the numerous judgments coming from the Hon’ble Supreme Court, the Hon’ble High Courts, and Ld. Trial Courts.

It is a pleasure to present the second edition of this book to the esteemed empowered officers of various empowered departments, legal luminaries, practising advocates and law students intending to practise and hone their skills in this field of law.

The book is a tutorial for empowered officials, as its title suggests, but it also points out the misses that Ld. Counsels have made when presenting their cases that could have affected the cases they handled and titled the decisions in their favour.

If the need ever arises, I would be more than pleased to aid the empowered officers in developing their talents in any way.

Both suggestions and criticism are always welcome. I genuinely hope that the book will be useful to all the readers.

Srinivasan Gopal srinivasangopal.book@gmail.comDuring the course of the analysis of the conviction secured vis-a-vis the cases booked by the empowered departments, the results were shocking. The impact analysis of the judgments rendered by the Hon’ble Supreme Court and the Hon’ble High Courts on various issues led to the irresistible conclusion that the empowered officers require proper guidance at every stage of the case until the charge sheet or complaint, as the case may be, came to be filed before the Trial Courts.

Keeping in view the situation the empowered officers were placed, the authors, as Drug Law Enforcement Officers, while handling the cases booked under the NDPS Act, 1985 realised the need of a practical guide book on enforcement operations under the Act. Therefore, an attempt has been made to make a simple version on practical aspects of implementation of various provisions of the Act by the enforcement officers based on up-to-date judgments of the Hon’ble Supreme Court, High Courts and Trial Courts.

To provide a clear, simple and authentic meanings and explanation of various terms and expressions used in the Act, which were brought from the International Conventions on drugs and substances India being signatory to the conventions, the authors have extensively relied upon various publications of the UN, UNODC and WHO viz. the Multilingual Dictionary of Narcotic Drugs and Psychotropic Substances under International Control, Commentary on the Single Convention on Narcotic Drugs, 1961, Commentary on the United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988, Terminology and Information on Drugs, Extracts and Tinctures of Cannabis, Cannabis Plant and Resin, World Drug Reports, etc.

The current issues on legalization of cultivation of cannabis plant in India, steps taken by the government permitting various institution to cultivate cannabis plant for R & D in medical and scientific fields, industrial and horticultural purposes, the legal status of cannabis related products viz. CBD Oil, Hemp Seed Oil, etc. and interpretation of WHO’s recommendation on re-scheduling of cannabis

I-19

and cannabis resin have been incorporated in the book with the aim to provide not only the empowered officers but also the practitioners/legal fraternity an up-to-date knowledge on various aspects of drugs law envisaged under the Act.

Bidyut Kumar Banerjee

bidyutbanerjee56@gmail.com

Srinivasan Gopal

srinivasangopal.book@gmail.com

1. The Narcotic Drugs and Psychotropic Substances (Seizure, Storage, Sampling been framed by the Central Government in exercise of powers conferred under section 76 read with section 52A of the Act.

1.1 The 2022 Rules supersedes the Standing Order No. 1/88, dated 5-03-1988, Standing Order No. 2/88, dated 11-04-1988, both issued by the Narcotics Control Bureau, Standing Order No. 1/89, dated 13-06-1989 issued by the Government of India, Ministry of Finance (Department of Revenue), and the notification dated 10-05-2007 and 16-01-2015, both issued by the Government of India, Ministry of Finance (Department of Revenue).

1.2 With the issuance of the 2022 Rules, the same has come into force with effect from 22.12.2022.

2.2022 Rules have been divided into 5 chapters (Chapter V has been erroneously numbered as Chapter IV).

3. Chapter I deals with the Preliminary while that of Chapter II deals with Classification of seized material. Rules 3 to 8 fall under Chapter II while Rules 9 to 15 fall under Chapter III, which deals with Sampling. Chapter IV containing Rules 16 to 28 deal with disposal of the seized substances. Rule 29 under Chapter V (wrongly mentioned as Chapter IV) deals with repealing and saving clauses.

4. The salient features of the 2022 Rules are under:

physical properties and results of the drug detection kit, if any, and shall be weighed separately.

The detailed inventory of the packages, containers, conveyances and other seized articles shall be prepared and annexed to the panchnama drawn on the spot.

The designation of godown under Rule 4 of Chapter II of Rules, 2022

DRUGS

PSYCHOTROPIC SUBSTANCES (SEIZURE, STORAGE, SAMPLING AND DISPOSAL) RULES, 2022

the department and agencies of the Central Government whose police station under section 53 of the Act; and the State Police and the department and agencies of the State

The seized substances under the Act shall be deposited by the seizing hours from the time of seizure alongwith a forwarding memorandum in Form-1 and an acknowledgement obtained in Form-2.

shall record his remarks in the godown register in Form-3 with respect to security, safety and early disposal of the seized material. Preparation of an inventory of the seized material in Form-4 shall be made as prescribed and the same is as under:

earliest, under sub-section (2) of section 52A of the Act is prescribed and the same shall be done in Form-5.

Rule 11 prescribes that in cases of opium, ganja and charas (hashish) a quantity of not less than twenty-four grams shall be drawn for each sample.

In all other cases (other than opium, ganja and charas (hashish) not quantity shall be taken for the duplicate sample.

Rule 11(3) categorically prescribes that in case where seized quantities are less than that required for sampling, the whole of the seized quantity is to be sent.

Rule 12 states that each sample shall be kept in heat-sealed plastic bags or heat-resistant glass bottle or apparatus, which shall be kept in a paper envelope, sealed properly and marked as original or duplicate, as the case may be. The paper envelope shall also bear the respective serial number of the package or container from which the sample had been drawn. The envelope containing the duplicate sample shall also have reference of the test memo and shall be kept in another

envelope, sealed and marked ‘Secret-drug sample/Test memo’, to be sent to the designated laboratory for chemical analysis.

trate shall be sent directly to any one of the jurisdictional laboratories of Central Revenue Control Laboratory (CRCL), Central Forensic Science Laboratory (CFSL) or State Forensic Science Laboratory (SFCL), as the case may be, for chemical analysis without any delay under the cover of the Test Memo, which shall be prepared in triplicate, in Form-6. the original and duplicate of the Test Memo shall be sent to the jurisdictional laboratory alongwith the samples; and

The time line of 15 days has been laid down for submission of the report in terms of Rule 14. The CRCL/CFSL/SFCL, as the case may be, has been mandated to submit its report to the court of Magistrate

date of receipt of the sample. Proviso to Rule 14 provides that where quantitative analysis requires longer time, the results of the qualitative test shall be dispatched to the court of Magistrate with a copy to

test shall also be indicated on the duplicate Test Memo and sent to

The functions of the Drug Disposal Committee (DDC) has been stated in Rule 20 and has been vested with powers, in supersession of the

terials, the details of which are as under: Sl. No.

1

4

5

6

7

8

9

In the event that the consignments are larger in quantity or of higher value than those indicated in the above Table, the DDC shall send its

recommendations to the Head of the Department who shall order their disposal by a high-level Drug Disposal Committee constituted for this purpose.

The Head of the Department of each Central DLEA and State DLEA shall constitute one or more Drug Disposal Committees comprising Superintendent of Police or Joint Commissioner of Customs and Central Goods and Services Tax, Joint Director of Directorate of Revenue shall be directly responsible to the Head of the Department.

Note Behind:

(

i

) While the DDC and the high-level DDC have been vested with the power to auction the seized conveyance and be sold by way of tender or auction as may be determined by the Drug Disposal Committee under section 60(3) of the Act.

(ii) The power to DDC or high-level DDC to act as per (i) above does not diminish the power of the Hon’ble Courts to entertain the Writ Petitions and Order dated 01-10-2022 of the Hon’ble Supreme Court in Special Leave Petition (Crl.) 2745 of 2002 in the case of Sunder Bhai Ambalal Desai v. State of Gujarat is still a valid.

(iii) It is required to be noted at this stage that the power under section 451 of the Cr. P.C., 1973 is not inconsistent with provisions of the Act and the same can be pressed into service by virtue of section 51 of the Act. Hence, the decisions quoted from page 974 to 977 of this

(iv) Methaqualone is better known by its brand name mandrax.

CHAPTER-HEADS

Topic 5

Topic 6

Vexatious entry, search, seizure or arrest - Free and fair investigationProtection of action taken in good faith-interdependence thereof -

Topic 7 Controlled delivery

Topic 8

Offences by companies

Topic 9

Commission of offence under the Act by juvenile

Topic 10

Use of animals as courier of drugs or for concealment of drugs

Topic 11

The Repatriation of Prisoners Act, 2003 read with Transfer of Prisoners (Republic of India) Regulations, 2006 in drugs cases

Topic 12

Inter play amongst the provisions of (i) the Foreign Trade (Development and Regulation) Act, 1992 & Foreign Trade Policy 2015-20 framed thereunder, (ii) Drugs and Cosmetics Act, 1940 & the rules made thereunder, (iii) the NDPS Act, 1985 & the rules made thereunder and (iv) the Customs Act, 1962 956

Topic 13

Procuring independent witnesses – How to overcome by using the provisions of section 56 of the Act

Topic 14

Pre-trial disposal of conveyance

Topic 15

The Challenges

Glossary

Whether the Passports Act, 1967 is applicable to Foreign Nationals and accordingly whether it would also include within its domain the impounding

cancellation of such passports?

How to overcome the provision of section 25 of the Indian Evidence Act, 1872 while recording a statement of a person accused of an offence under section 67 of the NDPS Act, 1985?

Can summons issued under section 67(c) to a person be quashed by a High Court ?

Interplay of the provisions of Customs Transit Declaration (CTD) issued under the provisions of the Customs Act, 1962 for goods destined to Nepal with the provisions of the NDPS Act, 1985 and maintainability of the writ petition for release of the trailer(vehicle) to the hirer

this book, the usage of the phrase ‘police empowered basically are responsible for maintaining law, public order from the other empowered departments such as NCB, DRI, State Excise, Customs, etc., who have been referred to as

Discrepancies in the prosecution’s case, prosecution unable to connect the evidence available to the guilt of the accusedEffect of the same 570

Can an appeal against conviction could be treated as infructuous merely for the reason that the convicted appellant had served out the sentence awarded by the trial court?

Guidelines in compliance with the directions of the Hon’ble Supreme Court in ‘D.K. Basu v. State of W.B.’

terms of section 3(a)(i) and (ii) of the Cr.P.C., 1973, the term magistrate shall be construed in relation to an area outside a metropolitan area, to a judicial magistrate and in relation to a metropolitan area, as

Whether an anticipatory bail application would be maintainable by an accused who is already arrested and is in magisterial custody in relation to another crime?

Whether parity can be pressed into service as a sole ground for grant of bail under the NDPS Act, 1985?

Whether the report of Public Prosecutor (PP) should be submitted before the expiry of 180 days seeking extension of detention under proviso to section 36A(4) of the Act?

Whether government holidays are to be excluded for the sheet/challan?

Whether a person accused of an offence under the Act having waived of his right to seek default bail and his application for bail being rejected on merits, can he seek default bail belatedly? Alternatively, whether a person his bail application which came to be decided on merits, default bail belatedly?

Non-service of notice to the person accused of an offence

The manner of conducting trial, as has been brought out herein above in para 22.1 gets buttressed with the judgment of the Hon’ble High Court of Delhi in the case of Nafe

original petition before the Hon’ble High Court under section 482 of the Cr.P.C., 1973

section 200 of Cr.P.C., 1973 on account of the fact that some other persons who might have committed the offences, but were not arrayed as accused and were not charge sheeted?

Rights of an accused to defend himself in a court of law by using the provisions of section 91 of Cr.P.C., 1973

Whether the accused has right to seek production of documents, under section 91 of the Cr.P.C., 1973 at the stage of framing charge, which are in custody of investiwith the report?

of CDR along with tower location of raiding

entry, search, seizure or arrest - Free and fair investigation-protection of action taken in good faith-interdependence thereof -

TOPIC 12 Inter play amongst the provisions of (i) the Foreign Trade (Development and Regulation) Act, 1992 & Foreign Trade Policy 2015-20 framed thereunder, (ii) Drugs and Cosmetics Act, 1940 & the Rules made thereunder, (iii) the NDPS Act, 1985 & the Rules made thereunder and (iv

The Narcotic Drugs and Psychotropic Substances Act, 1985 (61 of 1985), (herein referred to as the ‘Act’) was enacted by Parliament on 16th September, 1985. It is also popularly known by its shorter version viz. The NDPS Act, 1985. It was brought into force on 14th November, 1985.

3.1.1 Narcotic drugs have unique place in medical science. Since ages narcotic drugs have being used for relief of pain, suppression of cough and as an anesthetic. Some of the narcotic drugs also cause euphoria, a state of intense feelings of well-being and happiness. These drugs are addictive and destructive in character, when misused or abused for euphoric sense of mind. The addictive character of narcotic drugs, their availability, huge monetary gain from illicit trafficking leading to accumulation of black money and their uses in other organised criminal activities, including narco-terrorism, are various causes, among others, responsible for spreading drug abuse and illicit drug trade world-wide. The magnitude of drug abuse and illicit drug trade reached so high during the early 20th century, the international community soon became conscious of the threat caused by the illicit traffic of narcotic drugs to the health and welfare of the mankind. At the same time, while recognizing that the medical use of narcotic drugs continues to be indispensable for the relief of pain and suffering and that adequate provision must be made to ensure the availability of narcotic drugs for medical and scientific purposes it was also realised that the menace of illicit trafficking of narcotic drugs needs to be combated, through concerted international policy, particularly by co-ordinated and universal action towards adopting multi-national agreements and conventions.

3.1.2 The first such international co-operation was initiated in the year 1909, followed by 4 conventions, 3 agreements and 2 protocols till 1953. However, the most effective and successful international policy was adopted by ‘The

Single Convention on Narcotic Drugs, 1961’, which was further widened and strengthened by the 1972 Protocol Amending the Single Convention on Narcotic Drugs, 1961. The Single Convention covers only opioid drugs, cocaine and cannabis depending on their potential for abuse as well as their medical benefit.

3.1.3 The international community and the World Health Organization (WHO), thereafter recognized that many psychotropic substances like amphetamines, LSD etc. having the capacity to produce a state of dependence and central nervous system stimulation or depression, resulting in hallucinations or disturbances in motor function or thinking or behaviour or perception or mood with abuse potential are not under any international control. Accordingly, the Convention on Psychotropic Substances, 1971 was adopted with the identical objectives and aims of the Single Convention. Both the Conventions are based on the following concepts:

must be protected;

Their abuse gives rise to public health, social and economic problems; Vigorous measures are necessary to restrict their use to legitimate purposes; Effective measures require international co-operation in co-ordinated and universal action.

3.1.4 India, being geographically sandwiched between the two major sources of opium producing regions in the world namely ‘the Golden Triangle’ [border regions between Thailand, Burma (now Myanmar) and Laos] and ‘the Golden Crescent’ [space overlapping three nations, Afghanistan, Iran and Pakistan], faced serious problem of transit traffic in illicit drugs and psychotropic substances. With the passing of time, India also faced additional major problems of abuse and addiction of narcotic drugs and psychotropic substances caused by the spill-over of such transit traffic. At that stage, in India cultivation of opium poppy, manufacture of opium and possession, sale, purchase, transport, import or export of opium were regulated by the Opium Act, 1857 and the Opium Act, 1878 respectively. The Dangerous Drugs Act, 1930 was enacted with an aim to suppress the contraband traffic in and abuse of Dangerous Drugs especially those derived from opium, Indian hemp (cannabis) and coca leaf. Psychotropic substances were not covered under these Acts. The magnitude of illicit trafficking in narcotic drugs and psychotropic substances at national and international level reached so high that it was soon realised that the scheme of penalties under these Central Acts was not sufficiently deterrent to combat the menace of drug trafficking. This necessitated and led to the enactment of a comprehensive legislation namely the Act by Parliament to strengthen the control measures over illicit drug trafficking and for deterrent punishment for illicit drug trafficking

CH. 3 : AN OVERVIEW OF THE NDPS ACT, 1985 47

offences in accordance with the provisions of the International Convention on Narcotic Drugs and Psychotropic Substances, India being a signatory to the Convention.

3.1.5 The Golden Triangle and Golden Crescent are depicted in the map as under:

3.1.6 In view of the resolutions adopted by the United Nations Convention Against Illicit Traffic In Narcotic Drugs and Psychotropic Substances, 1988, the Act was amended in the year 1989. The Act has undergone further amendments in the years 2001 and 2014.

Consequent to the judgment and order dated 04.06.2021 passed by the Hon’ble High Court of Tripura, vide NDPS (Amendment) Ordinance, 2021 (8 of 2021), in section 27A of NDPS Act, 1985, for the words, brackets, letters and figures “clause (viiia) of section 2”, the words, brackets, letters and figures “clause (viiib) of section 2” was substituted. It was promulgated on 30th September, 2021 as The Narcotic Drugs and Psychotropic Substances (Amendment) Ordinance, 2021 (No. 8 of 2021).

The Narcotics Drugs and Psychotropic Substances (Amendment) Bill, 2021 after being passed by the Parliament received the assent of the President on the 29th December, 2021 and was notified on 30th December, 2021 as Narcotic Drugs and Psychotropic Substances (Amendment) Act, 2021. See full details at pages 983-984.

3.2 JURISDICTION OF THE ACT

3.2.1 The Act extends to the whole of India.**

** In terms of explanation after clause (xxv) of section 2 of the Act, “India” includes the territorial waters* of India.

*Territorial waters extends up to 12 nautical miles i.e. 22.2 km from the nearest point measured from the appropriate baseline [of coastal state].

Image Credit: swarjayamag.com

Image Credit: swarjayamag.com

[Sub-section (2) of section 3 of the Territorial Waters, Continental Shelf, Exclusive Economic Zone and Other Maritime Zones Act, 1976]

3.2.2 Thus, on a plain reading it transpires that the provisions of the Act are applicable up to 22.2 km into the sea from the point of the appropriate baseline of coastal state.

3.2.2.1 However, a moot question that follows is the applicability of the provisions of the Act when the person(s) on ship is/are a foreigner(s) and the ship (vessel) is not registered in India and foreign vessel is found to contain narcotic drugs or psychotropic substances on it.

3.2.2.2 In this situation, whether a search and seizure operation under the provisions of Act read in conjunction with the provisions of Customs Act, 1962 can be conducted by the Indian Coast Guard Officers is the question that is being explored herein.

3.2.2.3 Before addressing the issue, it is imperative to quote from a report from News 18 dated 5.12.2019:

”the Coast Guard used provisions of the Customs Act and the Narcotic Drugs and Psychotropic Substances Act and other relevant acts to board and seize vessels in the EEZ. However, it did not have the necessary legal backing and many cases would fall flat in the court, officials said.”

3.2.2.4 A careful analysis of the above statement reveals that the Indian Coast Guard used the provisions of the Customs Act, 1962 and the Act to board and seize vessels in the EEZ. In this context, it is necessary to refer to the Customs Notification empowering the Indian Coast Guard Officers with powers.

3.2.2.5 In terms of Notification No. 12-Cus dated 14.2.1981, the Officers of Coast Guard were given power of officers of Customs under sections 37, 38, 100 to 104, 106, 107 and 110 of the Customs Act, 1962, within the Indian Customs Waters.

3.2.2.6 At the time of issuance of Notification dated 14.2.1981, section 2(28) of the Customs Act, 1962 defined “Indian Customs Waters’’ as ‘waters extending into the sea up the limit of contiguous zone of India under section 5 of the Territorial Waters Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976 (80 of 1976) and includes any bay, gulf, harbour, creek or tidal river;’. Vide section 58(iii) by Finance Act, 2018 (13 of 2018) with effect from 29.3.2018, the definition underwent a substitution and the substituted definition of ‘’Indian Customs Waters’’ read as ‘’the waters extending into the sea up to the limit of Exclusive Economic Zone under section 7 of the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976 (80 of 1976) and includes any bay, gulf, harbour, creek or tidal river;’’. Accordingly, it emerges that the Indian Customs Water, with effect from 29.3.2018 extends up to the

CH. 3 : AN OVERVIEW OF THE NDPS ACT, 1985 49

Exclusive Economic Zone. A deemed fiction has been created to include up to 200 nautical miles (up to EEZ) as part of physical mass of India.

3.2.2.7 In this context, it is apt to note that the Central Government issued Notification No. S.O. 429(E) dated 18.7.1986 under section 6(5)(a) and section 7(6)(a) of the Territorial Waters, Continental Shelf, Exclusive Economic Zone and Other Maritime Zones Act, 1976 by which certain areas were identified as designated areas. The ‘’designated areas’’ are more than 12 nautical miles away from the shore and are outside the territorial waters of India.

3.2.2.8 The Central Government by Notification No. 11/87-CUSTOMS dated 14.1.1987 issued under section 6(6)(a) and section 7(7)(a) of the Maritime Zones Act, 1976 extended the Customs Act and the Customs Tariff Act, 1975 to the designated areas.

3.2.2.9 The Central Government by Notification No. S.O. 643 (E) dated 19.9.1996, in exercise of its powers under section 6(5)(a) and section 7(6)(a) of the Maritime Zones Act, 1976, further declared certain areas in the continental shelf and the exclusive economic zone where the installations, structures and platforms were located as ‘’designated areas’’.

3.2.2.10 In term of a subsequent Notification No. S.O. 189 (E) dated 11.2.2002, the Central Government in exercise of its power under section 6(5)(a) and section 7(6)(a) of the Maritime Zones Act, 1976, extended the Customs Act, 1962 and Customs Tariff Act, 1975 to the continental shelf of India and the exclusive economic zone of India with effect from the date of publication of the Notification in the Official Gazette for the following purposes, viz. :-

(

a) the prospecting for extraction for production of mineral oils in the continent shelf of India or the exclusive economic zone of India and

(

b

Customs Act, 1962 in connection with any of the activities referred to in clause (a).

3.2.2.11 It is in this context the interception of vessels (ships, etc.) for contraband under the Customs Act, 1962 or the Act has to be seen and the news quoted in para supra assumes significance because of the absence of a proper legal backing.

3.2.2.12 Addressing the legal lacunae and simultaneously empowering the Indian Coast Guard Officers, the Ministry of Defence has issued a Notification S.R.O. 16(E) dated 5.12.2019 from file F. No. 5(4)/2017-D(N-II/OPS)/862 giving the Indian Coast Guard Officers the legal backing it deserves and vide this Notification dated 5.12.20191, issued by the Ministry of Defence in exercise

of powers conferred by sub-section (3) of section 121 of the Coast Guard Act, 1978 (30 of 1978), the Central Government has authorized every member of the Coast Guard, to visit, board, search and seize vessel, or arrest any person, or seize any artificial island or any floating or moored object or any under water object including any maritime property involved or suspected to be used or likely to be used in the commission of any offence punishable under any of the Central Acts, including the Acts specified in clause (i) of sub-section (1) of section 121 of the said Act (Customs Act, 1962 is specified herein), within the area of maritime zone of India extending up to exclusive economic zone as defined under section 2(m) of the Indian Coast Guard Act, 1978.

3.2.2.13 The effect of the Notification dated 5.12.2019 is that the Indian Coast Guard has been conferred powers from this date formally for all the Central Acts and hence, despite the definitions in the Act, as it stands today, the Indian Coast Guard officers have the power to intercept a foreign vessel containing illicitly trafficked drugs (under NDPS cases) or contraband (under Customs Act, 1962) under the Indian Coast Guard Act, 1978 and proceed accordingly.

3.3.1 The Act also applies to all Indian citizens outside India and all persons on ships and aircrafts registered in India, wherever they may be.

[Sub-section (2) of section 1 of the Act]

3.3.2 The Act, also extends the criminal jurisdiction over a person of Indian citizen residing in India, engaged in or control any trade in narcotic drugs or psychotropic substances in an unauthorized manner outside India1. It means, if the said person is engaged in or control any trade whereby a narcotic drug or psychotropic substance is obtained outside India (say Mexico) and supplied to any person outside India (say the UK) without previous authorisation of the Central Government and fulfilment of conditions as may be imposed by that Government in this behalf, the said person shall be liable for punishment under the Act. It also extends the criminal jurisdiction over a foreign citizen, if the foreign citizen is physically present in India and is engaged in or control any trade whereby a narcotic drug or psychotropic substance is obtained outside India and supplied to any person outside India without previous authorisation of the Central Government and fulfilment of conditions as may be imposed by that Government in this behalf.

3.3.3 The Act, further provides that if a person (both Indian citizen and foreign citizen), abets, or is a party to a criminal conspiracy to commit an offence, within the meaning of the Act, either by physically present in India or anywhere shall also be punished under the provisions of the Act.

[Sub-section (2) of section 29 of the Act]

The officers implementing the provisions of the Act are called empowered officers. Readers may note that empowered officers are from various agencies of the Central Government and State Governments. Government of India, Ministry of Finance vide S.O. 3901(E) dated 30.10.2019 empowered the officers of and above the rank of sub-inspector in Central Bureau of Narcotic and Junior Intelligence Officer in Narcotics Control Bureau and of and above the rank of inspectors in the Central Board of Indirect Taxes and Customs, Directorate of Revenue Intelligence, Central Economic Intelligence Bureau to exercise the powers and perform the duties specified in section 42 of the Act within the area of their respective jurisdiction and also authorised the said officers to exercise the powers conferred upon them under section 67 of the Act. Vide S.O. 3899 (E) dated 30.10.2019, the Government of India, Ministry of Finance has also invested the officers of and above the rank of inspectors in the Central Board of Indirect Taxes and Customs, Central Bureau of Narcotics, Directorate of Revenue Intelligence, Central Economic Intelligence Bureau and of and above the rank of Junior Intelligence Officer in Narcotics Control Bureau with the powers specified in section 53(1) of the Act. The Central Government, in exercise of the powers conferred by section 36A(1) (d) of the Act vide Notification S.O. 3900(E) dated 30.10.2019, authorised the officers of and above the rank of Inspectors in the Central Board of Indirect Taxes and Customs, Central Bureau of Narcotics, Directorate of Revenue Intelligence, Central Economic Intelligence Bureau and of and above the rank of Junior Intelligence Officer in Narcotics Control Bureau for filling of complaints relating to an offences under the Act before Special Court.

Officers from certain other agencies such as Border Security Force, Indian Coast Guard, Railway Protection Force, National Investigation Agency, Assam Rifles, etc. have also been made empowered officers.

To illustrate in the case of National Investigation Agency, the Central Government, after consultation with the State Governments, has invested the officers of and above the rank of Inspectors in the National Investigation Agency constituted under the National Investigation Agency Act, 2008 (34 of 2008) to exercise the powers and perform duties specified in section 53(1) of the Act within the area of their jurisdiction. It naturally follows from the above that section 53 of the Act

invested the designated officers with all the powers of an ‘officer-in-charge of a police station for the process of investigation, which would begin after information collected by a section 42 officer is handed over to the officer designated under section 53 of the Act.

Moving further, we find that the officers of the State Government in the State Excise and Police are also empowered officers. It is to be noted that in most of the States, the State Governments have, inter alia, empowered the officers of the rank of Head Constable in the Police Force and above to be empowered officers and hence the officers below the rank of Head Constable not being empowered cannot utilise the power so conferred on an empowered officer the right to enter premises, search, seize and arrest without an authorisation under section 42 of the Act.

A statement under section 67 of the Act by two different empowered officers of two different empowered agencies requires a proper analysis. In a situation where a statement is recorded by an investigating officer of the rank of Superintendent/Inspector of Customs under the provisions of section 67 of the Act, it was held admissible as the officer was not a police officer and consequently the statement was not hit by section 25 of the Indian Evidence Act, 1872. Readers may note that the Hon’ble Supreme Court had held in the case of Romesh Chandra Mehta v. State of West Bengal - [1969] 2 SCR 461 (and followed subsequently in a catena of cases) customs officer is not a police officer. This was held in the context of the Customs Act, 1962 being a Revenue Act. This judgment and the subsequent judgments were used to buttress the point that a statement recorded under section 67 of the Act by an officer of Customs is not hit by section 25 of the Indian Evidence Act, 1872 and this proposition of law was upheld by the Hon’ble Supreme Court in the case of Raj Kumar Karwal v. Union of India - [1990]

2 SCC 409 where the Hon’ble Supreme Court deciding the question of police officer in the context of the Act

Directorate of Revenue Intelligence officers (who are basically officers of Customs) are not police officers for the purpose of section 25 of the Evidence Act, 1872. It needs no emphasis at this point of time that in the same case, had the statement being recorded at the material time by an empowered police officer, say an Assistant Commissioner of Police, then the same would have been hit by section 25 of the Indian Evidence Act, 1872. Such was the position until the Larger Bench of the Hon’ble Supreme Court in the case of Tofan Singh v. State of Tamil Nadu

- 2020-TIOL-171-SC-NDPS-LB held by a 2:1 majority that officers invested with powers to investigate offences under the Act are ‘Police Officers’ within the meaning of section 25 of the Indian Evidence Act and therefore a confession made by an accused under section 67 of the Act before such

officer/s was inadmissible in evidence, resulting in parity. While arriving at such finding it was observed as under:

“Even if the NDPS Act is to be construed as a statute which regulates and exercises control over narcotic drugs and psychotropic substances, the prevention, detection and punishment of crimes related thereto cannot be said to be ancillary to such object, but is the single most important and effective means of achieving such object. This is unlike the revenue statutes where the main object was the due realisation of customs duties and the consequent ancillary checking of smuggling of goods (as in the Land Customs Act, 1924, the Sea Customs Act, 1878 and the Customs Act, 1962); the levy and collection of excise duties (as in the Central Excise Act, 1944); or as in the Railway Property (Unlawful Possession Act), 1966, the better protection and security of Railway property. Second, unlike the revenue statutes and the Railway Act, all the offences to be investigated by the officers under the NDPS Act are cognizable. Third, that section 53 of the NDPS Act, unlike the aforesaid statutes, does not prescribe any limitation upon the powers of the officer to investigate an offence under the Act, and therefore, it is clear that all the investigative powers vested in an officer in charge of a police station under the CrPC - including the power to file a charge-sheet - are vested in these officers when dealing with an offence under the NDPS Act. Thus, to arrive at the conclusion that a confessional statement made before an officer designated under section 42 or section 53 can be the basis to convict a person under the NDPS Act, without any non obstante clause doing away without any safeguards, would be a direct infringement of the constitutional guarantees contained in Articles 14, 20(3) and 21 of the Constitution of India”

At this stage, the interplay of section 67 vis à vis section 53 and section 53A of Act and their effect on one another requires to be noted. The Hon’ble Supreme Court considered the word ‘enquiry’ finding place in section 67 of Act and held that information gathered at antecedent stage prior to commencement of investigation is distinct from the enquiry under section 53A of Act, which happens during the course of investigation of offences. Therefore, a statement under section 67 vis a vis section 53 and section 53A of Act operates on different footing.

The question of whether statements given by the accused under Section 67 of the Act has any evidentiary value and whether they can be relied upon to deny an application for bail. As already stated, in Tofan Singh v. State of Tamil Nadu - 2020-TIOL-171-SC-NDPS-LB - by 2:1 majority, it was held that officers of the Central and State agencies appointed under Act are ‘police officers’ within the meaning of section 25 of the Indian Evidence Act, 1872 as a result of which any confessional statement made to them would be barred under section 25 of the

AUTHOR : BIDYUT KUMAR BANERJEE

SRINIVASAN GOPAL

PUBLISHER : TAXMANN

DATE OF PUBLICATION : JANUARY 2023

EDITION : 2nd Edition

ISBN NO : 9789356225503

NO.OF PAGES : 1122

BINDING TYPE : HARDBOUND

Rs.2395 USD 69

This book presents practical aspects of implementing the Narcotic Drugs & Psychotropic Substances Act, 1985 (NDPS Act) by the enforcement officers based on up-to-date 750+ Judgements of the Hon’ble Supreme Court, High Courts & Trial Courts. It also features a step-by-step practical guide for enforcement officers to comply with the legal requirements in each step of the proceedings. Lastly, it features the application of the NDPS Act to the pharmaceutical industries. This book will be helpful for field officers/empowered officers of the empowered departments, NDPS Practitioners, and members of Bar & Bench. This book is divided into five parts:

• Preview

• General

• Enforcement

• Pharmaceutical Industries

• Knowledge Enhancement Topics

ORDER NOW