PREFACE TO NINTH EDITION

We take immense pleasure in presenting this 9th Edition of Tax Practice Manual.

In this Edition, amendments made by the Finance Act, 2023 are incorporated. The tax department has migrated to a total faceless regime for scrutiny, appeals and penalties (apart from a search and survey cases). However, there are challenges as far as assessee’s right to represent in appeals is considered and it has to pass the test of Constitutional legitimacy which will take shape in the days to come based on the views taken by the Judiciary. The faceless regime requires all the professionals to be more cautious while making online submissions. The Income Tax Act and it provisions are the same and the issues involved shall also remain the same. What has changed is the way a case is represented and therefore the better the replies are drafted the better shall be chances that relief is obtained from the department. This book contains steps for making such online submissions to the department.

Our basic purpose and goal over the years has been to assist the Taxpayers as well as the fraternity of Tax Practitioners. We have updated the relevant provisions and kept the length of the texts to a minimum which is going to benefit the readers in thorough understanding of the Income Tax Laws. We have also endeavoured to highlight the basic principles of law, without proper understanding of which, it will be difficult to apply the relevant provisions of Income Tax Law.

Before we end, we acknowledge the assistance of our team members who have worked hard to enable us to bring this into publication in time.

MAHENDRA B. GABHAWALA

APRAMEYA M. GABHAWALA

I-7

MILINDA A. GABHAWALA

Why this Book ?

1.1 Motivation for writing this book cannot be better expressed than by quoting from preface to “Landmarks In The Law” by Lord Denning: .... I wanted to write .... But what about ? .... In the end I decided to tell of some of those great cases of the past .... They are cases, too, which are full of interest for others. They portray dramatic situations. The characters are real. The scenes are true. The prose is good. ... They are like stones which mark the boundaries of principles. They are lighthouses from which our forefathers have taken their bearings. They have set the course of the law for future generations. That is why I have collected them for you.

1.2 Being a first generation entrepreneur in tax practice, starting from a scratch and slowly and gradually appearing before and interacting with almost all the authorities under the Income-tax Act including CIT (Appeals), Income Tax Appellate Tribunal and Income Tax Settlement Commission. I have had the benefit of coming across defending and winning typical cases. Hard earned realization is that destiny of case can be changed with a little “EXTRA” knowledge, a little “EXTRA” effort and a little “EXTRA” technique. This book is an honest attempt to share that a little “EXTRA”.

Why Taxation ?

2.1 Taxation is not an end in itself. In a Welfare Society, the aim is to meet basic obligations of a State like national security and also to achieve the largest good of common man.

2.2 Why to raise the funds by levy of Tax ? I-9

PRELUDE

a Defence, Courts, Police, Treasury, Foreign Exchange, Atomic Energy.

b Forest, Roads, Railway, Metro, Irrigation, Electricity, Post Office, Tourism.

c

Health, Education, Promotion of Art & Science, Subsidies, Protection of Interest of weaker sections and under-privileged.

2.3 Tax laws are expected to serve like a traditional wife. There is no end to the list of expectations. Their primary purpose was to raise funds for the welfare and State activities. There are ancillary purposes too such as, to reduce income disparity, promotion of savings, development of backward area, promotion of exports, support to handicapped, females and senior citizens and so on.

2.4 Its need and objectivity cannot be better explained than by quoting Justice Holmes as considered by Supreme Court in the backdrop of ground realities obtaining in our country by observing as under:

“It is true that tax avoidance in an underdeveloped or developing economy should not be encouraged on practical as well as ideological grounds. One would wish, as noted by Reddy J., that one could get the enthusiasm of Justice Holmes that taxes are the price of civilization and one would like to pay that price to buy civilization. But the question which many ordinary taxpayers very often, in a country of shortages with ostentatious consumption and deprivation for the large masses, ask is, does he with taxes buy civilization or does he facilitate the waste and ostentation of the few. Unless waste and ostentation in Government spending are avoided or eschewed, no amount of moral sermons would change people’s attitude to tax avoidance.”

CWT Arvind Narottam

History of Income Tax in India

3.1 “It was only for the good of his subjects that the King collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand fold.”

I-10

3.2 The law of Income Tax in India has roots in Gadar of 1857 which is recorded by Britishers as “Sepoy Mutiny” and recognised in Indian history as the 1st Great Liberation Movement. To meet the cost of silencing the Mutiny, Income Tax was imposed for the first time in British India by 1860 Act. It was replaced after 26 years by Income-tax Act, 1886.

3.3 To meet the cost of First World War, Super Tax Act, 1917 was brought in.

3.4 A unified Act was framed as Income-tax Act, 1922.

3.5 Income-tax Act, 1961, the present law, replaced 1922 Act with an objective, “Endless stream of amendments had left the 1922 Act, shapeless and orderless”.

3.6 The present Act of 1961 has been reformed/mutilated over 150 times by Finance Acts, Ordinances and Amendment Acts.

3.7 A new law of Income Tax is being codified to replace the present Income-tax Act, 1961.

The most important word in Tax Laws

4.1 The most important word used in the law of Income Tax is “satisfaction” of the concerned authority. To illustrate -

a Section 145(3) authorising an Assessing Officer to assess income like an order under section 144 if he is not “SATISFIED” about the correctness or completeness of the accounts of the assessee.

b Section 271(1) requiring an assessee to pay penalty in certain circumstances when the Assessing Officer or the CIT (Appeals) or the Commissioner is “SATISFIED” that such assessee has been guilty of specific default.

c Section 12AA(1)( ) empowers Commissioner of Income Tax to register a Charitable Institution under section 12A of the Act if he is “SATISFIED” about the objectives of the institution and genuineness of its activities.

4.2 However, it is easier said than done. It is like the proverbial saying - Belling the Cat. It involves proper understanding of the law, marshalling of all relevant facts, analysing favourable and unfavourable decisions, communication skill (calling in question) jurisdiction, pointing out that the onus lies on the department,

I-11

discharging initial onus and shifting it to the department, requesting for inspection and issuance of certified copy, filing affidavit, requesting to allow cross-examination of departmental witness, requesting the Assessing Officer to make use of his powers under section 131 and/or 133(6) so as to enable the assessee to gather necessary evidence to put up the defence, to explain that various deficiencies pointed out by the Assessing Officer are either incorrect or at least irrelevant, establishing reasonable cause in the matter of levy of penalty, to explain delay if any and seek its condonation are a few of such examples and the art of carrying conviction.

4.3 Apart from learning, delearning and relearning the law of income tax, the real mind boggling task was to invent and discover mode and form of written communication to describe and highlight peculiar facts of cases before various income tax authorities with the following objectives :

a To clear the clouds of confusion created by the department;

b To explain and prove the case of an assessee that he is either entitled for a relief or not liable for damage; and

c Various deficiencies pointed out by the department are not relevant or immaterial.

Written Communication

5.1 There is a proverbial saying “Writing makes a man perfect”.

5.2 Drafting of written submissions, explanation, petition, objections, statement of facts and grounds of appeal, etc., before any incometax authority is essentially an art of communication. It is very basic and ultimate too. It is an unenviable task and to accomplish it, many qualities are required, such as -

Clarity of thinking

Grass-root grasp of most minute facts with accuracy

Harmonising facts, dates and figures

Forensic skill to thrash out finer issues

Macro as well as micro viewing of things

Being merciful to the absurdity and ridicule

Mirror looking of the things to evaluate a submission from view point of the opposite side

I-12

Craft of making big points against one to look small and making small points in one’s favour appear big and unassailable

Lucidity and elegance of expression

Courtesy, modesty and humbleness

Urge to excel more and more Spirit to give up ? No, Nay, Never.

5.3 Writing is a muscle which requires exercise. However, it is only a perfect writing which can ultimately come to the rescue of a taxpayer. As long as everything sails smooth and fine, the strength or weakness of the written communication is not of any impact or consequence. But at times, each and every word in a particular written communication comes under microscopic examination. Many a good case is lost for a small and inadvertent lapses here and there.

Commercial v. Legal Drafting

6.1 In commercial correspondence, the writer of a letter and its recipient are of equal status and the things are settled by normal, natural and commercial principles. On the other hand, in legal correspondence or drafting, it is between the State and its subject.

6.2 We have inherited the luxury of language by way of British legacy. Even after over half a century of independence, we still continue to follow the theme, texture and terminology so inherited.

6.3 Between commercial correspondence and legal drafting, the tone and tenor are quite different. When an income-tax authority writes something to a taxpayer, it is called a ‘Notice’ or ‘Order’. When the taxpayer answers or writes something, it is termed as a ‘petition’ or ‘submission’ or ‘appeal’. In commercial correspondence, in the recent past, there is a visible change in trend from formal correspondence to informal correspondence.

6.4 To demonstrate the difference between a commercial correspondence and legal correspondence, a comparative picture is given below :

I-13

Fabrics Ltd.

Awarded Best Exporter 2019-20

COMMERCIAL CORRESPONDENCE LEGAL CORRESPONDENCE

Dear Ms. Jenny PAN cum

PRAYER I-14

Dynamics of Change

7.1 Perhaps, there was a time when there were a few laws with plenty of time at the disposal of public at large. Present generation is sandwiched between the slowest life of the last generation and the fastest life of the succeeding generation. The enormous amount of voluminous changes which are being witnessed by the present generation, neither the past 100 generations did nor the future generation will face. In this milieu, what has remained unchanged is two certainties of life - Death and Taxes.

7.2 Over course of time, expectations from professionals have seen myriad changes. This may be expressed by way of evolution of a saying as given below : Day before yesterday ............................................ To err is human. Yesterday ................................. To err is human, to forgive is divine. Today ........................ To err is human, but not to err is professional.

7.3 This book narrates and illustrates in a concise but succinct manner, the guiding principles, tips and traps, drafts of petitions, submissions, explanations, affidavits, statement of facts, grounds of appeal and other drafting which would be of immense guidance in real life situations.

Tips and Traps

Nothing succeeds like success (but sooner the better)

There is no short cut to success

Slow but steady wins

Make hay when the sun shines

A stitch in time, saves nine

Courtesy pays

Alert averts accident

More one sweats in leisure, less one bleeds in war

For effective results in tax practice, it is necessary for the taxpayers as well as for the consultants that they are aware of their rights, duties, obligations as well as those of the departmental authorities.

The procedural aspects are assuming greater importance and, the Income Tax Department as well as the departmental officials view various deadlines with rigidity.

I-15

Nearly 99% of the cases are decided on facts of the respective cases. For mistakes of fact, ITAT being the final facts finding authority, very little remedy is available for redressal. Facts are to be stated in a clear and crispy manner and have also to be proved by laying evidence on record.

Many a time, a good case is lost because the full facts are not placed before the authority. Further, when a clear strategy is not formulated at the earliest opportune, it may tempt the department to discard a good argument by labelling the same as afterthought.

The most valuable right of an assessee during the course of assessment proceedings is to place any amount of evidence on record. Similarly, in an appeal before the Commissioner (Appeals) or before ITAT, the most valuable right is to challenge an order by raising various grounds of appeal on questions of law as well as on question of facts. If appropriate ground is not taken, one may have to exert and remain at the mercy of the appellate forum for admission of additional evidence or for admission of additional grounds of appeal.

In the context of proceedings before appellate authorities, one must exactly know what relief one wants to seek. He is expected to visualise what objections will be raised against him by the other side, for which he must prepare himself in advance for all such issues whether factual or legal.

A taxpayer should not pre-empt a decision in his favour on any technical ground. In other words, he should also either keep open the proceedings or submit alternative pleas.

A mirror silently tells the facts of your face. Similarly, the best way to evaluate strength or weakness of a defence or an argument is to place yourself into the shoes of the Assessing Officer as only the wearer knows where they pinch.

Configuration of this book

9.1 This book is broadly divided as under.

9.2 Firstly, the reader may refer to the “Prelude” meant to introduce this book to its readers and to set their mood and mental frame to enjoy the orchestra of this composition.

9.3 Then please refer Book One : Law Relating to Tax Procedures.

I-16

I-17

9.4 Then refer Book Two : Tax Practice.

9.5 Finally, the reader may refer to “Case Studies” - Chapters 26-60.

Annexures to this Chapter

For better comprehension as well as for convenience of reference, three Annexures are added to this Chapter as under :-

Annexure I : Abbreviations

Annexure II :Words and Phrases

Annexure III : Legal Maxims

ANNEXURE I - TO PRELUDE ABBREVIATIONS

I-18

A B C

D E F G

I I-19

H

J L M N O P R S I-20

T U V W I-21

ANNEXURE II - TO PRELUDE

WORDS AND PHRASES

a fortiori a posteriori a priori ab initio ad valorem benami bona fide bona fides caveat certiorari ceteris paribus consensus ad idem corpus de facto de novo ejusdem generis ex gratia ex officio ex parte ex tempore

I-22

I-23

facto habeas corpus id est/i.e. in absentia in camera in forma pauperis in limine in pari materia in praesenti in re : in rem : in status quo in toto infra

inter alia inter se inter vivos

interim intra vires ipse dixit

ipso facto jus in personam just in re/rem lis pendens lis sub judice locus standi

mala fide mens rea modus operandi

mutatis mutandis

non obstante obiter dictum

pari passu per per annum per contra per incuriam

Per mensem

prima facie

pro rata

puisne

Qua

Quasi

re. res. judicata

shebait

sic simpliciter

sine die status quo

sub judice

suo motu

supra

ubi supra/u.s.

ultra vires

verbatim versus/vs./v.

viz.

Vis-a-vis’

I-24

ANNEXURE III - TO PRELUDE

LEGAL MAXIMS

NATURAL JUSTICE, EQUITY AND GOOD CONSCIENCE : audi alteram partem -

circulus in probando -

injuria non excusat injuriam -

justitia nemini neganda est -

justitia non est neganda non differenda -

lex non cogit ad impossibilia -

necessitas non habet legem -

necessitas publica major est quam privata -

memo agit in seipsum -

nemo contra factum suum proprium venire potest -

nemo debet bis puniri pro uno delicto -

I-25

nemo debet esse judex in propria qusa -

nemo esta supra leges -

nemo tenetur ad impossiblesuppressio veri, expression/suggestion falsie -

INTERPRETATION OF STATUTES

generalia specialibus non derogant -

generalibus specialia derogant -

ignorantia legis jurisneminem excusat -

injure alterius -

in jure, non remota causa sed proxima spectatur -

noscitur a sociis -

optima legume interpres est consuetodo -

optimus interpres rerum usus -

ubi jus, ibi officium -

Ubi jus, ibi remedium -

ubi jus incertum, ibi jus nullum -

ubi remebium ibi jus -

I-26

ui res magis valeat quam pereat -

INTERPRETATION OF DEEDS

Contemporanea exposition est optima et fortissima in lege -

expressum facit cessare tacitum -

locus contractus regit actum -

nemo dat qui/quod non habet -

non dat qui non habet -

pacta dant legem contractui -

qui facit per alium facit per se -

qui tacet cosentire videtur -

CAUSE OF ACTION, GRIEVANCE

actus non facit reum nisi mens est/sit rea -

ex pacto illicito non oritur action -

Jus ex injuria non Oritur -

I-27

I-29 PAGE About the Author I-5 Preface to Ninth Edition I-7 Prelude I-9 Book One : Law Relating to Tax Procedures Division One Tax Practice 1.1 Tax Practice 4 1.2 Tax Practitioner 15 1.3 Tax Engagements 26 1.4 Relationship with client 28 1.5 48 Division Two Pre-assessment Procedures 2.1 Advance Tax & Self Assessment Tax 80 2.2 Return of Income 86 2.3 PAN - Permanent Account Number TAN - Tax Deduction and Collection Account Number 107 Contents

I-30 PAGE Division Three Assessment 3.0 120 3.1 Assessment - Principles & Issues 134 3.2 Summary Assessment 208 3.3 Scrutiny Assessment 211 3.4 Post-Search Assessment 217 3.5 Best Judgment Assessment 223 3.6 Assessment Order 227 3.7 Re-opening of Assessment 230 3.8 242 3.9 Revision 251 Division Four Appeals 4.1 Appeals to JT. CIT (Appeals)/CIT (Appeals) 272 4.2 Appeals to ITAT/High Court/Supreme Court 295 Division Five Interest, Fees, Penalty and Prosecution 5.1 Interest Payable by Assessee 325 5.2 Fees Payable by Assessee 332 5.3 Penalties 335 5.4 Waiver of Interest and Penalty 382 5.5 Prosecution 389 Division Six Refunds 6.1 Necessity 409 6.2 Relevant provisions 410 6.3 Claim of refund 410

I-31 PAGE 6.4 Withholding of refund u/s 241A 410 6.5 Interest payable by the department 411 6.6 Condonation of delay for claiming refund 412 6.7 Income Declaration Scheme (IDS) 414 6.8 Set off and Withholding of Refunds in certain cases (Sec. 245) (w.e.f. 01.04.2023) 414 Division Seven Settlement Commission - ITSC, Interim Board & Dispute Resolution Committee (DRC) 7.1 Background 416 7.2 Recent changes 417 7.3 417 7.4 Computation of additional tax 418 7.5 418 7.6 Admission of application 418 7.7 Calling report from CIT 419 7.8 Declaring application as invalid 419 7.9 Enquiry by ITSC 419 7.10 420 7.11 Organisational structure 420 7.12 Additional income 423 7.13 Fast track arrangements 423 7.14 Powers of ITSC 424 7.15 Immunity from prosecution and penalty - Sec. 245H(1) 425 7.16 Bar on subsequent application 426 7.17 New abatement provisions 426 7.18 427 7.19 Finance Act, 2021 - Paradigm shift in the provisions relating to Income Tax Settlement Commission Discontinuation of ITSC 427 7.20 Interim Board for Settlement 428 7.21 Dispute Resolution Committee 432

I-32 PAGE Division Eight Summons, Survey, Search 8.1 Summons 437 8.2 Calling Information 442 8.3 Survey 447 8.4 Search & Seizure 456 Division Nine TDS and TCS 9.1 TDS - Deduction of Tax at Source 493 9.2 Tax Collection at Source - TCS 536 Division Ten Recovery of Tax 10.1 Recovery of tax - General 546 10.2 Stay of Demand 550 10.3 Recovery 558 Division Eleven Special Procedures 11.1 SFTRA - Statement of Financial Transaction or Reportable Account 563 11.2 AAR - Authority for Advance Ruling 569 11.3 A&D - Amalgamation and Demerger 575 11.4 AOP - Association of Persons 582 11.5 Firm 585 11.6 LLP - Limited Liability Partnership 594 11.7 610 11.8 HUF - Hindu Undivided Family 657 11.9 NR - Non-Resident 676 11.10 Transfer Pricing 687 11.11 DRP - Dispute Resolution Panel 697

I-33 PAGE Division Twelve Approvals 12.1 703 12.2 Purpose 704 12.3 Administrative or Internal Approvals 704 12.4 Approvals by Central Government etc. 707 12.5 Other Approvals 711 Division Thirteen STT, Deemed Dividend, Tax on Liquidation, Reduction and Buy Back, MAT, AMT 13.1 Securities Transaction Tax - STT, Commodities Transaction Tax - CTT 715 13.2 Deemed Dividend 722 13.3 Tax on Liquidation, Reduction and buy back 724 13.4 728 13.5 735 Division Fourteen RTI, Ombudsman 14.1 RTI - Right to Information 739 14.2 Ombudsman 748 Division Fifteen Drafting of Deeds 15.1 Introduction 758 15.2 Document 759 15.3 Deeds poll and indenture 759 15.4 Stages in business contracts 759 15.5 Simple words 759 15.6 Figures and words 760 15.7 Components or parts of a document 760

I-34 PAGE 15.8 Non-operative parts of a deed 760 15.9 Operative parts of a deed 763 15.10 Stamp duty 765 15.11 Registration 766 15.12 Precautions 767 Division Sixteen Agreement, MOU 16.1 769 16.2 When agreement deemed to be void 769 16.3 Who can sign an agreement 769 16.4 An agreement does not require attestation 770 16.5 Stamp duty on agreement differs from State-to-State 770 16.6 Registration in case of Immovable property worth Rs.100 or more is compulsory 770 16.7 770 Division Seventeen Gift, Wills, Family Arrangements 17.1 Gift 772 17.2 Wills 777 17.3 Family Arrangements 784 Division Eighteen Power of Attorney etc. 18.1 Power of Attorney 788 18.2 Indemnity and Guarantee 790 Division Nineteen Lease, Rent, License etc. 19.1 Lease 793 19.2 Rent 793 19.3 Leave & license 794

I-35 PAGE 19.4 Lease v. License 794 19.5 Advantages of lease 795 Division Twenty Sale/Transfer of Properties 20.1 797 20.2 Immovable Property 800 20.3 Taxation of Immovable Property Transactions 809 Division Twenty One Tax Audit 21.1 830 21.2 Objective 831 21.3 Applicability of tax Audit (Section 44AB) 831 21.4 833 21.5 Reporting 833 21.6 Due dates of tax audit 834 21.7 Penalty for non-compliance (Section 271B) 834 21.8 Tax audit checklist for professionals 834 21.9 Documentation for tax audit 835 21.10 Compliance with standards of auditing in tax audit 836 Division Twenty Two Income Computation & Disclosure Standards 22.1 Why ICDS? 841 22.2 Applicability 841 22.3 Computation and Disclosure Standards 841 22.4 843 22.5 Income Computation and Disclosure Standard I: Accounting Policies 844 22.6 Income Computation and Disclosure Standard II: Valuation of Inventories 845

I-36 PAGE 22.7 Income Computation and Disclosure Standard III: Construction Contracts 848 22.8 Income Computation and Disclosure Standard IV: Revenue Recognition 851 22.9 Income Computation and Disclosure Standard V: Tangible Fixed Assets 852 22.10 Income Computation and Disclosure Standard VI: Effect of change in Foreign Exchange Rates 854 22.11 Income Computation and Disclosure Standard VII: Government Grants 857 22.12 Income Computation and Disclosure Standard VIII: Securities 859 22.13 Income Computation and Disclosure Standard IX: Borrowing Cost 861 22.14 Income Computation and Disclosure Standard X: Provisions, Contingent Liabilities and Contingent Assets 863 Division Twenty Three Virtual Digital Assets 23.1 Background 867 23.2 Recent developments 868 23.3 869 23.4 Tax on income from virtual digital assets 869 23.5 Tax Deduction At Source – Section 194S 870 23.6 Gifting of Virtual Digital Assets 870 23.7 Conclusion 871 Division Twenty Four 872 Division Twenty Five Prohibition of Benami Property Transactions Act, 1988 25.1 Introduction 888 25.2 Key Definitions 888 25.3 Prohibitions under Benami Act 891

Book Two : Case Studies

Division Twenty Six

I-37 PAGE 25.4 Authorities and Jurisdiction 892 25.5 Notice and attachment of property involved in benami transaction 894 25.6 895 25.7 Adjudication of Benami property 895 25.8 Confiscation of Benami Property 897 25.9 898 25.10 Procedure and Powers of Appellate Tribunal 898 25.11 Appeals to Appellate Tribunal 898 25.12 Rectification of mistakes 899 25.13 Right to Representation 900 25.14 Appeal to High Court 900 25.15 Penalties under Benami Act 901 25.16 Proof of entries in records or documents and Previous Sanction 901 25.17 Certain Transfers to be null and void 902 25.18 Offences by Companies 902 25.19 Notice not to be invalid on certain grounds 903 25.20 Prosecution of action taken in good faith 903 25.21 Proceeding against legal representative 903 25.22 Act to have overriding effect 903

Tax Practice 26.1 Form 39 909 26.2 911 26.3 912 26.4 Form 40 913 26.5 Form 38 914 26.6 Letter of engagement (from client to the tax practitioner) 915

Division Twenty Seven

I-38 PAGE 26.7 Schedule of recommended fees by ICAI (The Institute of Chartered Accountants of India) 918 26.8 Power of attorney : General 929 26.9 931 26.10 Vakalatnama 933 26.11 Time sheet 935 26.12 936 26.13 938 26.14 939 26.15 941 26.16 Case diary 942 26.17 943 26.18 Daily report 944 26.19 Dispatch register 945 26.20 Inward register 946 26.21 Due date register 947 26.22 948 26.23 950 26.24 952

Pre-Assessment Procedures 27.1 Proforma of Notice u/s 210(3) 953 27.2 Draft Reply to Notice issued u/s 210(3) after the last day of February 955 27.3 Draft Reply to Notice issued u/s 210(3) and advance tax paid 957 27.4 PAN Application - Instructions 958 27.5 TAN Application - Instructions 964 27.6 Correction/change in PAN data or surrender of PAN 965 27.7 Correction/change in TAN data or surrender of TAN 970 27.8 Notice u/s 272B for having Duplicate PAN 971 27.9 Reply to Notice issued u/s 272B 972

I-39 PAGE Division Twenty Eight Assessment - Principles and Issues 28.1 Basics - Assessment Procedure 976 28.2 Scrutiny Assessment - Tools 1020 28.3 Scrutiny Assessment - Issues 1063 28.4 Re-opening of Assessment 1196 28.5 Post-Search Assessment 1222 Division Twenty Nine 29.1 prescribed Income Tax authority 1261 29.2 Credit not allowed for TDS in intimation u/s 143(1) 1266 29.3 Interest wrongly charged u/s. 234B/234C 1268 29.4 Error of principle - Same income considered twice 1270 29.5 1272 29.6 claimed in the return of income with reference to business income as assessed 1274 29.7 Set off not allowed for brought forward losses in the past 1276 Division Thirty Revision 30.1 Ad hoc appeal has expired 1279 30.2 Disallowance out of expenses - Deduction u/s 80HHC not increased correspondingly 1285 30.3 Addition for low withdrawals and deduction u/ss 80TTA and 80G not granted 1289 30.4 Revision Petition to challenge 1292 30.5 44AF - Ad hoc disallowance out of expenses 1295 30.6 Explanation offered on FDR of ` 1 Crore 1298

Division Thirty One

I-40 PAGE 30.7 1300 30.8 iii) cannot be attracted where own surplus fund has been utilised to give interest free loans to its sister concern 1307

Appeals to JT. CIT(Appeals)/CIT(Appeals) 31.1 Reconciliation of Income Returned and Assessed 1314 31.2 Filing an Appeal to JT. CIT (Appeals)/CIT (Appeals) in response of an order u/s. 143(3) under the new Faceless Appeal Scheme, 2021 1316 31.3 Ad hoc disallowances out of manufacturing and before JT. CIT (Appeals)/CIT(Appeals) 1321 31.4 Surrender of ` 15,00,000 during search retractedappeal 1330 31.5 Assessment reopened - Income of Benamidar included in reassessment - Filing of Appeal 1333 31.6 Books of account rejected and income estimated by invoking sec. 145 read with sec. 144 - Routine disallow-ance of expenses - Filing of appeal before JT. CIT (Appeals)/ CIT(Appeals) 1337 31.7 1341 31.8 Condonation of delay 1342 31.9 Additional grounds of appeal before JT. CIT (Appeals)/ CIT(Appeals) 1344 31.10 1346 31.11 Ad hoc 1348 31.12 Written submissions before JT. CIT (Appeals)/CIT(Appeals) 1350 31.13 Routine disallowance out of expenses on ground of 1354 31.14 Petition to grant stay of demand 1357 31.15 Disallowances and Addition for low withdrawals - Draft of First Appeal 1359 31.16 Power of Attorney to argue before JT. CIT (Appeals)/ CIT(Appeals) 1363

Division Thirty Two

I-41 PAGE 31.17 opportunity to the assessee 1365 31.18 Disputes in the Directors of the Company - Inability to produce record before AO 1367 31.19 Withdrawal of appeal before JT. CIT (Appeals)/CIT(Appeals) 1370 31.20 Order by JT. CIT (Appeals)/CIT(Appeals) granting withdrawal of appeal 1371 31.21 The authorities have to be guided by the legal evidence and not on general observations based on statements, reports from investigation wing probabilities, human behaviour, modus operandi etc. 1372

Appeals to - ITAT - High Court - Supreme Court 32.1 Appellate Tribunal Check List - Proforma 1377 32.2 Appellate Tribunal Check List - Filled in 1379 32.3 Filing an appeal before ITAT 1380 32.4 before ITAT 1384 32.5 Power of Attorney to argue ITAT appeal 1386 32.6 Paper Book Index 1388 32.7 Filing Cross Objections to ITAT 1390 32.8 Petition for delay condonation 1393 32.9 Stay Petition before Appellate Tribunal 1395 32.10 Additional grounds of appeal and additional evidence 1398 32.11 1401 32.12 Written Submissions before ITAT 1404 32.13 Objections to departmental Paper Book 1412 32.14 of relevant documents 1415 32.15 Request for preponement 1418 32.16 Compilation of decisions relied upon 1419 32.17 Another Compilation - Additional evidence 1421 32.18 Effect to ITAT Order 1422 32.19 Effect to ITAT Order - Response to outstanding demand 1425

I-42 PAGE 32.20 Appeal to High Court against ITAT Order 1429 32.21 SLP - Settlement Commission could not dispose of by the cut off date - Abatement of the proceedings to AO as per sec. 245HA - High Court declined to interfere 1432 Division Thirty Three Interest payable by assessee 33.1 Interest payable by assessee 1437 Division Thirty Four Penalties 34.1 Keeping penalty proceedings in abeyance : Brief Petition 1442 34.2 Keeping penalty proceedings in abeyance : Detailed Petition 1444 34.3 Routine Disallowances out of Expenses - Concealment 1447 34.4 Penalty u/s 271(1)(c) - Explanation 1448 34.5 c)Addition because method of accounting is changed by the 1452 34.6 First Appeal partly allowed - Both the assessee and pending decision - Explanation on merits 1454 34.7 Concealment penalty - Addition of ` 2 Lac on agreed basis 1462 34.8 Loss reduced on assessment - Old decisions in favour amendment in Explanation 4 to sec. 271(1)(c) w.e.f. 1.4.2003 - Whether applicable to assessment year 2002-03 1464 34.9 Dropping the penalty proceedings u/s 271AAC as addition 1466 34.10 Application to grant immunity from imposition of penalty u/s 270A 1469 34.11 from imposition of penalty under section 270A and from 1471

Division

Division

Division Thirty Seven

Dispute

PAGE

I-43

Prosecution 35.1 Hearing opportunity by CIT before launching prosecution - Filing of petition 1473 35.2 1476 35.3 Compounding Petition 1477

Thirty Five

Thirty Six Refunds 36.1 Revalidation of Refund Voucher 1481 36.2 Proforma of Indemnity Bond 1482 36.3 Letter of Grievance 1483 36.4 Refund due to Order of JT. CIT (Appeals) or CIT(Appeals) 1484 36.5 Refund Voucher lost by bank 1485 36.6 Indemnity Bond - Refund Voucher lost by bank 1487 36.7 Petition for fresh refund in case of deceased 1488 36.8 Indemnity Bond by Legal Heir 1490 36.9 1491 36.10 Refund - Due to claim of advance tax challan not taken on Return of Income 1493

Resolution

37.1 Filing objections against the draft order of Dispute No. 35A. 1495 37.2 Filing Application for resolution of dispute before the Dispute Resolution Committee under Rule 44DAB. 1497

Panel

Survey 38.1 Survey u/s 133A - Books of account and other documents impounded - Statements recorded - Inspection, photocopy 1501

Division Thirty Eight

Division Thirty Nine

I-44 PAGE 38.2 Survey u/s 133A - No proceeding pending - Release of impounded books etc. 1504 38.3 Books of account etc. impounded u/s 133A 1506 38.4 Actual release of books of account etc. u/s 133A by 1507

Search & Seizure 39.1 Departmental Rules for Searches and Seizures 1510 39.2 Seizure of Ornaments - CBDT Circular 1514 39.3 Performa of Search Warrant 1515 39.4 Preliminary Statement of person searched before actual commencement of search 1518 39.5 Language in which statement can be recorded 1519 39.6 Search party asking for some minute details towards the close of the search when the person is exhausted 1520 39.7 Unlikeable situation may surface such as incomplete cash book 1521 39.8 Requisition of books of account of earlier years 1522 39.9 Incomplete and haphazard data on computer 1523 39.10 Purchase of immovable property 1525 39.11 Enquiry about jewellery - Whether new? 1526 39.12 Purchase of agricultural land by minors, gift received and gift given 1528 39.13 An irrelevant question by the search party 1529 39.14 Surrender of income to seek immunity from penalty for concealment in the case of a search 1530 39.15 Surrender of income to seek immunity from penalty for concealment in the case of a search by harmonizing various items 1531 39.16 Panchnama - Search & Seizure action u/s 132 1533 39.17 1537 39.18 Annexure for Books of Account etc. 1539 39.19 Annexure for Bullion/Jewellery 1540

I-45 PAGE 39.20 Annexure for Cash 1541 39.21 Annexure for Other Assets 1542 39.22 Annexure for Stock 1543 39.23 copy of statements recorded 1544 39.24 Restraint Order u/s 132(3) - Proforma 1546 39.25 Life of Restraint Order u/s 132(3) 1548 39.26 insists for its formal recall for payment of maturity value of NSCs 1550 39.27 Omnibus or highly generalised restraint order to bank 1552 39.28 Restraint order for bank account of persons not searched, etc. 1555 39.29 Restraint order issued for disclosed bank accounts 1557 39.30 year 1559 39.31 Restraint order issued for stock-in-trade and sealing of warehouses 1562 39.32 Restraint order issued for residential house and its sealing 1565 39.33 Revoking Restraint order u/s 132(3) 1568 39.34 Search and Seizure - Cash Seized - Release for adjustment tax liabilities 1570 39.35 Request for release of assets seized for payment of tax 1572 39.36 Release of Jewellery against Bank Guarantee 1574 39.37 Request for release of seized valuables - All assessments completed - Due taxes paid 1576 39.38 Interest u/s 244A on cash kept deposited in PD Account 1578 39.39 Requisition u/s 132A - Proforma of Warrant 1580 39.40 Proforma of notice u/s 153A(a) 1582 39.41 Objection to notice u/s 153A(a) and request for inspection, copy etc. 1584 39.42 Formal compliance of notice u/s 153A 1587 39.43 Assessee not aware of requisition u/s 132A - Notice from 1589

I-46 PAGE 39.44 Requisition u/s 132A - Cash seized by police handed over in supurdagi of Court - Objections before Court 1591 Division Forty Tax Deduction at Source 40.1 Proforma of Notice u/s 201(1) 1598 40.2 Proforma of Report of Short Deduction/Collection 1601 40.3 Proforma of Report for Challans mismatch 1603 40.4 Reply to the Notice u/s 201(1) 1604 40.5 Proforma of Order u/s 201(1) 1606 40.6 Shortfall in deduction of TDS due to wrong disallowance u/s 40(a)(ia) 1608 40.7 appropriate proportion of sum (other than Salary), payable to non-resident, chargeable to tax in case of the recipients 1611 Division Forty One Recovery of Tax 41.1 CIT(Appeals) 1622 41.2 Stay of concealment penalty when its quantum appeal is 1625 41.3 years - Stay of Demand 1627 41.4 1630 41.5 1632 Division Forty Two Trust, Mutuality, Charity 42.1 Charitable Trust Deed 1633 42.2 Corpus Donation Letter 1643 42.3 Form 10A 1644 42.4 Form 10AB 1655

I-47 PAGE

Firm 43.1 Simple Partnership Deed 1664 43.2 Partnership Deed for a new Firm 1667 43.3 Partnership Deed upon conversion of proprietary business into a partnership 1674 43.4 Covering letter to Client 1680 43.5 Deed of Retirement 1682 43.6 Partnership Deed for recording change in constitution on account of simultaneous admission and retirement of partners 1686 43.7 1694 43.8 Public Notice of Dissolution 1695 43.9 Dissolution Deed of a Partnership Firm 1696 Division Forty Four LLP - Limited Liability Partnership 44.1 Simple LLP Agreement 1701 44.2 LLP Agreement for a new LLP 1711 44.3 LLP Agreement on conversion 1723 44.4 Covering letter to client 1733 44.5 Consent letter of partner being an individual 1735 44.6 Consent letter of designated partner being an individual 1736 44.7 Consent letter of partner in capacity of a nominee of a body corporate 1737 44.8 Consent letter of designated partner in capacity of a nominee of a body corporate 1738 44.9 Resolution by company to become partner and appoint nominee 1739 44.10 1740 44.11 Resolution to ratify the LLP Agreement 1742 44.12 Subscriber Sheet 1743

Division Forty Three

I-48 PAGE

Forty Five Right to Information - RTI 45.1 Form of Application 1744 45.2 Intimation for deposit of further fee 1749 45.3 Form of Notice to third party 1750 45.4 Transfer of application to other State Public Information 1751 45.5 Forwarding of Application/Appeal 1753 45.6 Form of supply of information to the applicant 1755 45.7 Rejection Order 1757 45.8 Appeal under section 19 of the Right to Information Act, 2005 1758

Forty Six Agreement, MOU 46.1 Awarding Contract by Government Corporation 1761 46.2 Selling Agency Agreement 1770 46.3 Agreement between a company and its director to be appointed as an employee to create employer-employee relationship 1773 46.4 1776 46.5Organisation through grant 1779 Division Forty Seven AOP - Association of Persons 47.1 Formation of Association of Persons (AOP) 1782 Division Forty Eight HUF - Hindu Undivided Family 48.1 1788 48.2 Petition u/s 171 1792

Division

Division

I-49 PAGE 48.3 enquiry of claim of partition of the HUF 1794 48.4 Compliance to Notice u/s 171(2) by members of HUF 1796 48.5 Order u/s 171 1798 48.6 1799 Division Forty Nine GIFT 49.1 1801 49.2 1803 49.3 1805 49.4 1806 49.5 1808 49.6 Gift Deed for Gift to sister by Cheque 1810 49.7 1812 49.8 gave gift without any occasion 1814 Division Fifty Wills 50.1 Simple Will – Giving entire Estate to wife 1816 50.2 Legacy in favour of various family members 1817 50.3 Joint Will of husband and wife 1819 Division Fifty One Family Arrangements 51.1 Separate Families 1821 51.2 Partnership - Family Arrangement for immovable property 1825 Division Fifty Two Power of Attorney 52.1 General Power of Attorney by a lady proprietress 1829 52.2 Power of Attorney by Karta of HUF 1832

I-50 PAGE 52.3 Special Power of Attorney 1835 52.4 General Power of Attorney by a Firm to its employee 1837 52.5 Special Power of Attorney to execute a Sale Deed 1840 Division Fifty Three Indemnity and Guarantee 53.1 Indemnity Bond for Refunds due (Apart from Interest) 1842 53.2 Indemnity by a Partner Retaining Assets and Liabilities to 1844 53.3 Indemnity to Bank 1846 Division Fifty Four Lease, Rent, Leave and License 54.1 Letting out premises with processing equipments 1848 54.2 Leave and License Agreement 1851 Division Fifty Five Sale/Transfer of Properties 55.1 Draft letter for Sale of Vehicle 1854 55.2 Assignment of certain business assets 1856 55.3 Assignment of partnership business to a Private Limited Company as a going concern 1858 55.4 Agreement to Sell – Land/House 1860 55.5 Special Power of Attorney to present a sale deed before Sub-Registrar 1863 55.6 Sale deed - Flat 1865 55.7 Developer Agreement 1868 55.8 LLP - Contribution of immovable property 1872 55.9 Family Arrangement for immovable property contributed by Partners to the Partnership Firm 1873

Division

56.1 Audit Engagement Letter for pre-deciding the terms and scope before entering into an audit engagement with an entity

56.2 Simple management represent letter for tax audit by a company

Division

be applied retrospectively

57.2 What are the principles governing determination of question whether transfer is a Benami transaction or not?

57.3 Burden of proof is on the person who alleges it to be a Benami transaction

on application of mind before passing an order

I-51 PAGE

Tax Audit

Fifty Six

1874

1878 56.3 SA-700 1880 56.4 1885 56.5 1886

1887

Fifty Seven Prohibition of Benami Property Transactions Act, 1988 57.1 cannot

1909

1913

1913

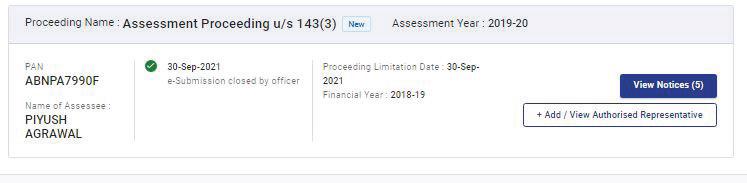

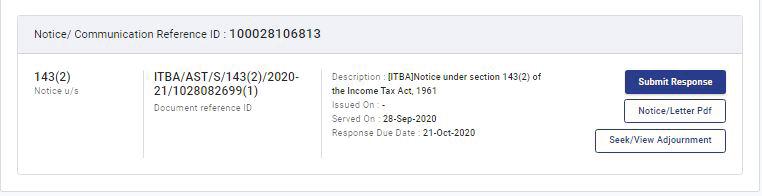

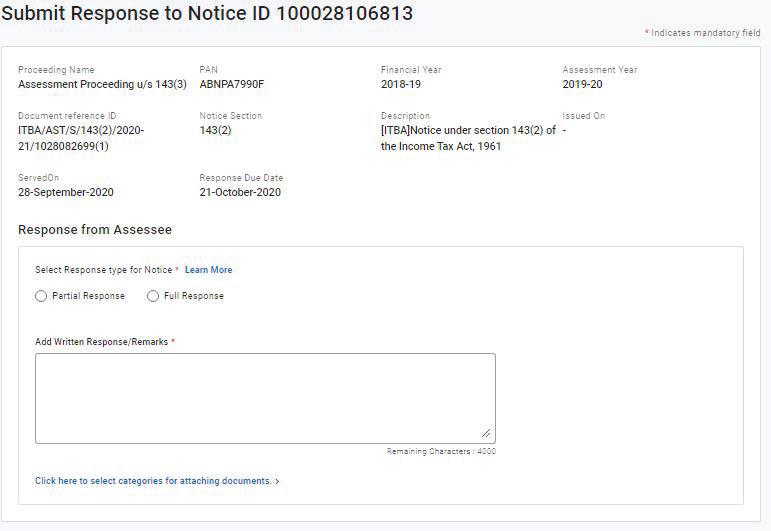

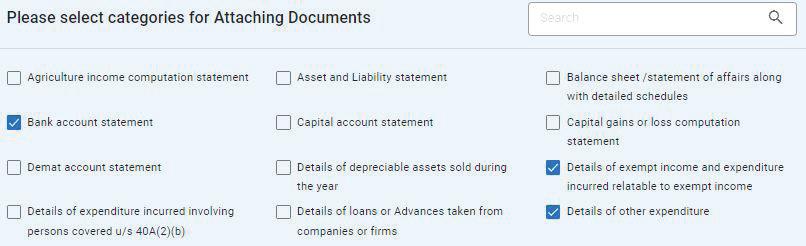

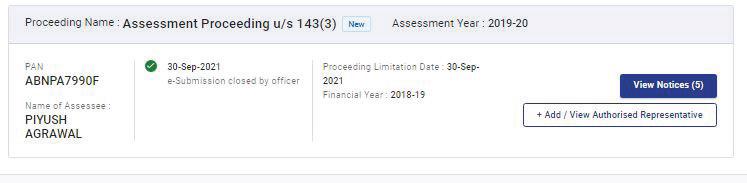

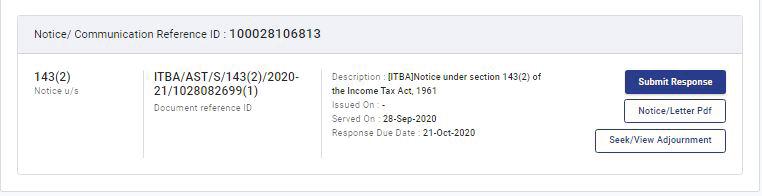

CASE STUDY # 28.1.1.I

Gist Response to notice and requisition issued u/s. 143(2)/142(1)

Step-1 Step-2 Step-3Step-4 -

997 C.S. 28.1.1

Facts

Step-5

Step-6 Step-7Step-8

C.S. 28.1.1 998

Step-9 Step-10

Step-11

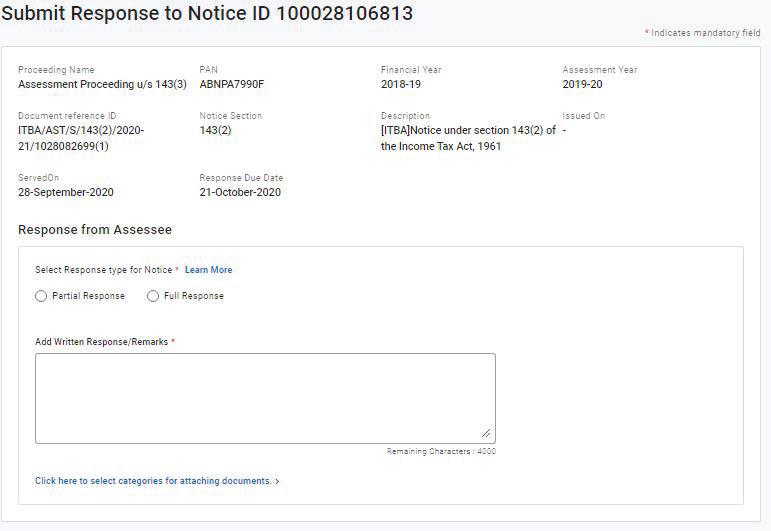

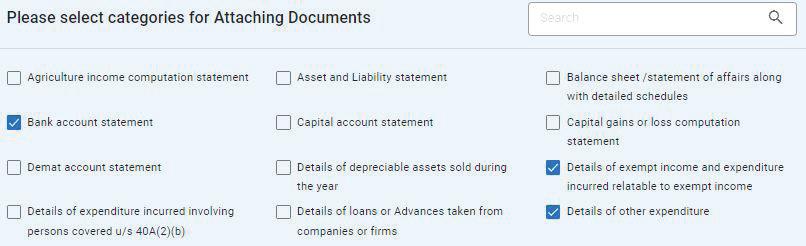

The Specimen of an ideal ‘e-response’ to the Scrutiny Notice/Requisition under section 143(2)/142(1) of the Act, on the issue of disallowance of expenses incurred for earning exempt income and of squared up loans is reproduced below for the ready reference of the worthy readers.

SUBMISSIONS

Most respectfully, we submit as under:Source of fund utilized for making advance to two directors and Simti Industries Ltd.

non-interest bearing funds

ABC Private Limited

999 C.S. 28.1.1

non-interest bearing funds

Reasons

S. No. Particulars Amount (` ) Amount (` )

CIT v. H.R. Sugar Factory (P) Ltd. [1990] 53 TAXMAN 63 (ALL)

Total : 30,90,07,343

C.S. 28.1.1 1000

for increase in Payment of interest to bank:

Particulars A.Y. 2014-15 A.Y. 2015-16 Remarks ` ` Bank of India CC A/c. 690330110000095 Date Particulars Payment Nature of Payment 1001 C.S. 28.1.1

a When Sufficient interest free funds available :-

Bank of India CC A/c. 690330110000095 Date Particulars Payment Nature of Payment

C.S. 28.1.1 1002

CIT Radico Khaitan Ltd. - Annexures 1-10

b When Sufficient interest free funds available: -

CIT Prem Heavy Engineering Works P. Ltd. - Annexures 11-13

c When Sufficient interest free funds available:

iii

Malwa Cotton Spinning Mills ACIT

d No disallowance u/s.36(1)(iii)

“… Where assessee had utilized its own surplus funds to give interest free loans to its sister concern, disallowance of interest

` ` iii

-

1003 C.S. 28.1.1

1004

payment made by Assessing Officer under section 36(1)(iii) was to be deleted.”

ACIT Apollo Hospital Enterprise Ltd.

- Annexures 14-18

e No Nexus between loans advances and Bank Interest:-

CIT India Carbons Ltd.

Annexures 19-24

a -

CIT Reliance Industries Ltd.

CIT. Reliance Industries Ltd.

Annexures 25-29

b Woolcombers of India Ltd. CIT

Annexures 30-39

c -

C.S. 28.1.1

Yours faithfully,

` ` P.CIT. JSB Securities Ltd. Annexures 40-42 d CIT. Harrisons Malayalam Ltd. Annexures 43-51 ``

1005 C.S. 28.1.1