Shivram Sethuraman (PGDM IIM Lucknow)

Founder – Vtransform Consulting

Independent Director – Apollo Home Healthcare Ltd.

Ex-Director - Deloitte Human Capital Advisory Services

Shivram Sethuraman (PGDM IIM Lucknow)

Founder – Vtransform Consulting

Independent Director – Apollo Home Healthcare Ltd.

Ex-Director - Deloitte Human Capital Advisory Services

After 10 years of being a Chartered Accountant, there was only so much in accounts and taxation that I could handle. But, I did begin to notice a shift inside me that was influenced by a series of events outside my area of work. One question gripped me strongly and pushed me to chase towards a deeper meaning: What is beyond Success?

Helping entrepreneurs and large corporate companies to acquire success has always been my core strength. However, after a certain point, every business owner is troubled by family disputes regarding ancestral properties or handing over the reins to the right person. I was approached to address such problems, or I may have started noticing them more prominently at the time. This was a similar problem that I faced when my father passed away and left his estate and financial belongings to my mother and siblings. I knew I had to dig deeper into this.

Talking about death is not easy as people try to avoid talking about it to the maximum possible extent. But for me, this wasn’t the case. I think that death is the ultimate reality. When I started to draw the reverse map of life, I found my Life’s Values, Principles and Non-negotiable values. It was only a matter of time when and how I would want to pass on my legacy post my demise.

I started looking for books that could help me simplify or understand this daunting process. Search engines

filled their result pages with miles of information about succession. I began gathering more information by talking to people. That’s when I took notes and tried correlating these insights with succession. I looked forward to gaining more knowledge on the Succession and Business Continuity Planning process.

The truth is, the consequences of the sole businessman or breadwinner passing away is nothing short of a tragedy if you depend on them. Nothing lasts forever. Change will and must occur. With proper planning one can adapt to change.

Unless we do not hand over the reins to another in a planned manner, we will stagnate moving forward only because circumstances beyond our control force us to.

This book will hopefully help you understand the benefits and consequences of succession planning, and what you need to do to secure the reins of your empire to the right descendant.

Ravi Mamodiya

Aligning the business & family strategies

Identifying & Preparing successors and Leadership transition

Estate Planning

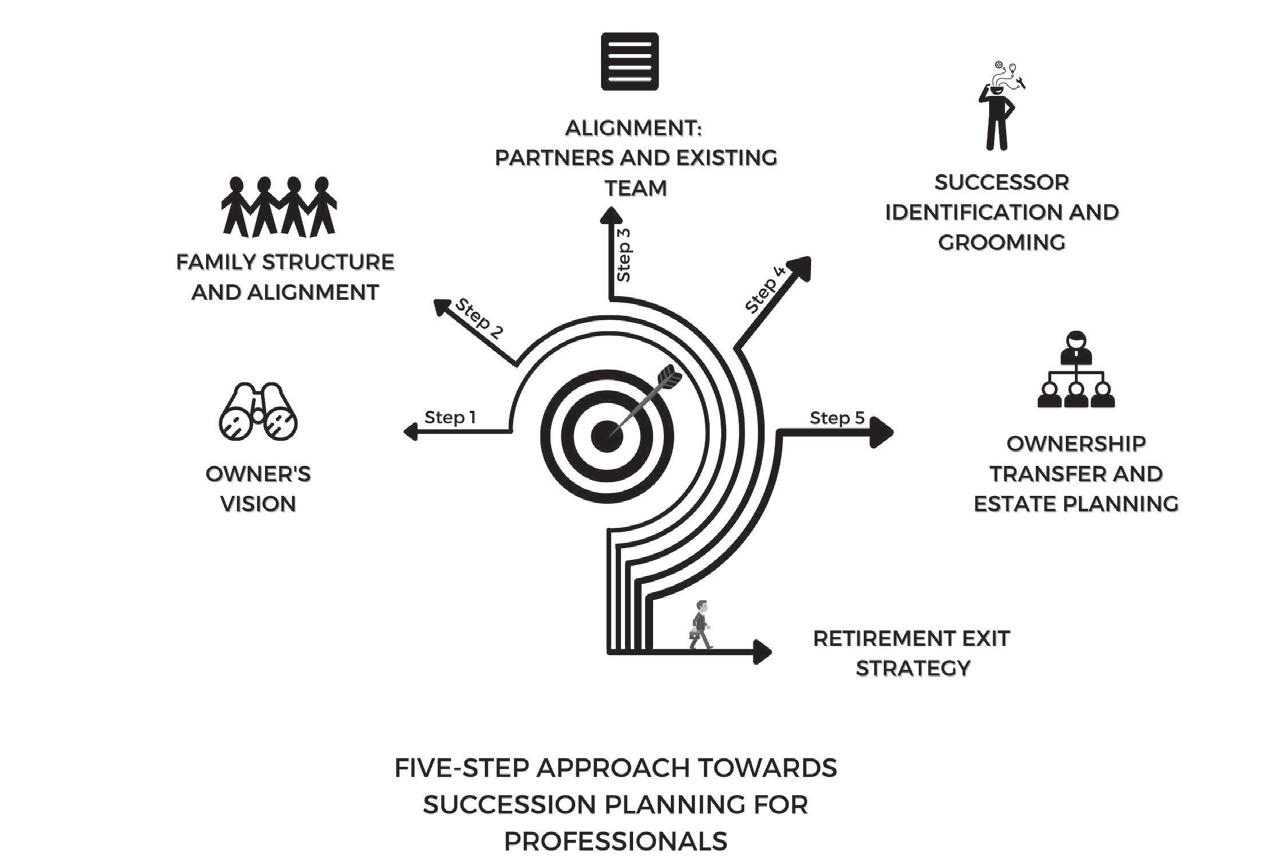

FIVE-STEP APPROACH TOWARDS SUCCESSION PLANNING FOR PROFESSIONALS

Vision

Figure-3A

Figure-3A

AUTHOR : RAVI MAMODIYA

PUBLISHER : TAXMANN

DATE OF PUBLICATION : APRIL 2023

EDITION : 2nd Edition

ISBN NO : 9789356227507

NO. OF PAGES : 344

BINDING TYPE : PAPERBACK

This book provides answers to the readers' primary questions about succession, i.e.

• Where to begin?

• The ways to implement

The sole purpose is to help the reader understand the basics of succession in a simplified manner. It will be helpful for professionals and business owners to understand the critical aspects of succession planning and create strategies for better business continuity planning.

The Present Publication is the 2nd Edition, authored by CA Ravi Mamodiya, with the following noteworthy features:

• [Five-Step Approach] to handle the wheel of succession to plan, manage and see the expectations

• [Technicalities explained in a Simple Manner] To avoid getting caught in the web of laws & rules, the author has presented the technicalities suited for a layperson too

• [Diagrams, Charts, Case Studies & FAQs] are embedded in the book to help the reader to gain better insights into the topic

• [Summaries] Each chapter consists of key takeaways to revisit the learnings and remember the important points to solve the readers' doubts and provide clarity

• [Authors' Personal Experience] with different clients, including those faced amongst family, friends, and relatives, are included in the book to help the reader grasp the practicalities and realities of day-to-day life

• [Discussion on Estate Planning] which includes:

o Indian Succession Act

o Hindu Succession Act

o Shariat Law

o Private Trust and its Law, along with the applicability of the Income-tax Act in different situations

o Creation of HUF & its Taxation

ORDER NOW

Rs. 750 | USD 38