The author is a member of the Institute of Chartered Accountants of India, Institute of Cost and Works Accountants of India and the Institute of Company Secretaries of India. The academic record right from the college days was excellent. The author has received various scholarships and prizes from Institutions like JRD Tata Merit Scholarship, Narsee Monjee College Merit Scholarship, Sydnam Golden Jubilee’s Scholarship etc.

Before commencement of practice, the author has served in industry for six years in the field of indirect taxation. Since 1988 the author is practising in the field of indirect taxation only.

The author has contributed extensively in the field of indirect taxation in various seminars/lectures. The author is also faculty member in the colleges/institution for teaching the indirect taxation and is associated with various social organisations. The author has also written book on “Service Tax - How to Meet Your Obligations and GST on services,” which is very widely referred by Trade and Industry.

All staff members particularly CA Darshna Jani, Mrs. Shraddha Nikam and Mr. Bhavin Dubli of the author have provided immense help in writing of the book.

CHAPTER 39

CHAPTER 40

CHAPTER 41

CHAPTER 42

CONDITIONS, TIME LIMIT AND DOCUMENTS FOR AVAILMENT OF CREDIT

CHAPTER 43

COMMON INPUTS AND INPUT SERVICES FOR EXEMPTED AND TAXABLE SUPPLIES

CHAPTER 44

REMOVAL OF INPUT, CAPITAL GOODS AND WASTE INCLUDING FOR JOB-WORK

CHAPTER 45

*

PROCEDURES AND RECORDS FOR INPUT TAX CREDIT 2481*

CHAPTER 46

INPUT SERVICE DISTRIBUTOR

*See Volume 2.

*

i see para 41.3

ii see para 41.4

iii see para 41.5

iv see para 41.6

v see para 41.7

vi see para 41.8

vii see para 41.9

viii see para 41.10

ix para 41.11

x para 41.12

41.4-4a

Sequence of utilization

41.4-5 Manner of utilization of credit vide

i Disputed credit carried forward

ii Non-transition of blocked credit

2391

41.4-6 IGST to be utilized first vide vide

Para 41.4

Input tax Credit on account of Output liability Output liability on account of Central tax

Output liability on account of State tax/ Union Territory tax

(III) Input tax Credit on account of Integrated tax to be completely exhausted mandatorily -

Head

Input tax Credit on account of

Discharge of output liability on account of Integrated tax

Output Liability Input tax Credit

Discharge of output liability on account of Central tax

Discharge of output liability on account of State tax/Union Territory tax

Balance of Input Tax Credit

Input tax Credit on account of Integrated tax has been completely exhausted

Para 41.5

Input tax Credit on account of

Discharge of output liability on account of Integrated tax

Discharge of output liability on account of Central tax

Discharge of output liability on account of State tax/Union Territory tax

2392

Balance of Input Tax Credit

-

Input tax Credit on account of

Discharge of output liability on account of Integrated tax

Discharge of output liability on account of Central tax

Discharge of output liability on account of State tax/Union Territory tax

Balance of Input Tax Credit

Input tax Credit on account of Integrated tax has been completely exhausted

Para 41.6

41.6 One-to-One correlation not necessary

2394

41.6-1 No correlation with particular output required

Ichi Karkaria Ltd.

Bombay Dyeing ‘

CCE Dai

CCE

Kisan Products Ltd. CCE Bajaj Sevashram Ltd. CCE Nisha Conductors Collector and Rama Cables and Wires Ltd. Collector Pratap

Steels Ltd. CCE Bajaj Tempo Ltd.

CCE HMT CCECCE Motherson Sumi Electric Wires Shri Dnyaneshwar SSK CCE

PSL Corrosion Control CCE -

Indian Aluminium CCE

CCE National Trading Co

CCE Bajaj Tempo Ltd. ‘ ’ ‘ ’

vide viii -

Credit by assessee who is manufacturer as well as service provider

2395

Nahar Industrial Enterprises Ltd.

CCE Vardhman Spinning

S. S. Engineers CCE

CCE

Jyoti Structures Ltd CCE

Fragmentation of credit not required

Para 41.7 CCE

Forbes Marshall

Vardhman Spinning CCE

only if

Same principle applies to State Vat Hindustan Unilever Ltd State of Andhra Pradesh

Maxwroth Plywoods AC(CT)

41.7-1 Full credit of duty is available to recipient, even if less duty is paid or no duty is paid by supplier [this principle will not be applicable in GST, in view of provision in section 16(2)]

CCE Advance Diesels Engines

Amul Industries

Amul Industries

Para 41.7 2396

’

Kerala State Electronic Corpn CCE

Tirupati Cigarettes CCE

Eveready Industries CCE

Raj Kesari Electrodes CCE

Jollyboard Ltd CC&CE

CCE UP State Sugar Corporation Ltd.

CCE Synmedic Laboratories

YG1 Industries CCE

CCE GKW Ltd

MDS Switchgear CCE -

CCE MDS Switchgear Ltd

UP State Sugar Corporation CCE ’

CCE Anant Commodities

Eveready Industries CCE

Ruptex Mineral CCE Shakun Polymers CCE CCE Gwalior Chemical Industries

CCE Sterlite IndustriesKerala State Electronic Corporation CCE International Tractors CCE CCE Neel Metal Products Cipla Ltd. CCE CCE Kitchen Appliances

Racold Thermo CCE -

CCE Aggarwal Iron Industries

CCE Pawan Ispat Udyog

2397

Para 41.7

Racold Thermo CCE Cummins Diesel Sales and Services India Ltd. CCE

41.7-2 Full Cenvat credit of duty paid available even if seller gave trade discount or price reduction later

’ CCE Tirumala Fine Texturiser P. Ltd

Evergreen Engineering Co. CCE Brown Kraft Indus. Ltd CCE Sri Balaji Industries CCE ACS Hydraulics CCE Advance Detergents CCE

Srinivasa Chemical Enterprises CCE Force Motors CCE ‘ ’

‘ ’ Mahaveer Surfectants CCE CCE Toyo Springs CCE Toyo Springs Pawan Alloys CCE

Creative Polypack Ltd CCE CCE Trinetra Texturisers

Para 41.7 2398

Ltd Bajaj Auto Ltd. CCE -

MRF Ltd. CCE ’

Business Combine Ltd. CCE

No reduction in Cenvat even if price reduced due to quality difference -

CCE J L Morison

Credit even if duty paid at higher rate

Nahar Industrial

Enterprises CCE CCE Jai

Mata Alloys

CCE Pirity Flexpack ’

Credit even if duty is paid under protest CCE Sterlite Industries

Memories Photography Studio CCE

User cannot be penalised for fault of supplier J K Industries Ltd UOI

Malhotra Cables CCE

Hind Alloys CCE

2399

Overseas CCE

Para 41.7

Karishma

41.7-3 Buyer can avail Cenvat credit, if supplier paid duty, even though not payable

CCE CEGAT ‘ ’ ‘

‘ ’ CCE Ranbaxy Labs Ltd.

Manaksia Ltd CCE

Savera Pharmaceuticals CCE

Divya Pharma CCE Manikgarh Cement

CCE

V G Steel Industry CCE

Sterlite Industries CCE

Natco Pharma CCE

Uniworth Ltd CCE

CCE Nahar Granites

Hindustan Coca Cola Beverages CCE

Balakrishna Industries CCE Neuland Laboratories CCE Kohinoor Printers

CCE CCE Kohinoor Printers

Oboi Laboratories CCE

Neuland Laboratories CCE

CCE Sundaram Auto Components

BCL Springs CCE

CCE Nagappa Springs

V G Steel Industry CCE

CCE Pirity Flexpack

Brakes India CCE

Spic (HCD) Ltd. CCE

Para 41.7 2400

Kerala State Electronic Corporation CCE

Owens Bilt CCE

CCE Hogans India

CCE DIL Ltd. Koch-Glitsch

India CCE CCE Laxmi Metal Pressing Works

Sundaram Auto Components CCE

CCE Sundaram Auto Components

Owens Bilt Ltd. CCE

Goa Industrial Products CCE

Nav Bharat Tubes CCE -

CCE Nestle India

CCE Nestle India

Shree Shyam Filaments CCE -

Sanjivani SSK Ltd. CCE -

Cenvat credit of duty paid on inputs as well as duty paid by job worker on entire value

Thermax Ltd. CCE

Job worker can pay service tax and principal manufacturer can avail Cenvat credit

Federal Mogul Goetze India CCE

CCE Federal Mogul TPR India

No Cenvat credit to assessee or the customer if assessee pays duty on unconditionally exempted goods

Para 41.8

Entire Cenvat credit even if duty payable on final product lower than input credit available

CCE Camphor Allied Products

41.7-4 Accounting entries not relevant for eligibility of Cenvat credit -

Shree Rama Multitech CCE

41.7-5 No reversal if supplier gives reduction in price after clearance

MRF Ltd. CCE

CCE Kinetic Engg. ’ ’

Full credit available even if price subsequently reducedCCE Trinetra

Texturisers

MRF Ltd. CCE

41.8-1 Decisions under Cenvat Credit Rules, 2004

mPortal India Wireless Solutions P. Ltd.

41.8-2 Ratio of judgment will apply

mPortal India Wireless Solutions P. Ltd.

41.8-3 Credit is tax paid in advance on output supply

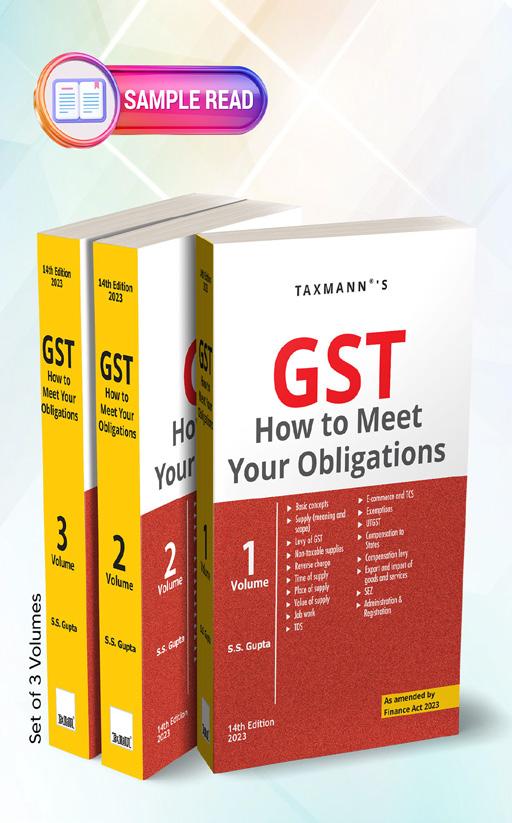

AUTHOR : S.S.

GUPTAPUBLISHER : TAXMANN

DATE OF PUBLICATION : APRIL 2023

EDITION : 14th Edition

ISBN NO : 9789357782425

NO. OF PAGES : 4344

BINDING TYPE : PAPERBACK

Description:

This book is Taxmann's bestselling flagship commentary explaining every concept of GST lucidly. The noteworthy features of this book are as follows:

[Exhaustive GST Commentary] The various provisions contained in different statutes are discussed in sixty chapters [Interlinking all Statutory Contents] Provides the scope of provisions of sections, rules, etc. [Case Laws] Supported by judgements or orders of various Tribunals, High Courts and the Supreme Court. [Illustrations/Examples] The provisions are also explained in different places by way of giving examples [Simple & Lucid Language] The thirst of the book is to explain the provisions in layman's language so that it is understood very easily

This book is trusted by all business people & employees and has been regularly used by departmental officers & courts for several years.

This book is divided into three volumes with the following coverage:

Volumes 1 & 2 covers a 2,700+ page commentary on GST

Volume 3 covers the statutory portion of the GST

The Present Publication is the 14th Edition and has been updated till 31st March 2023. This book is authored by S.S. Gupta & is divided into seven divisions, namely:

Basic Concepts

Exemption & Other Levies

Export & Import of Goods and Services Procedures

Input Tax Credit Appeals

Acts/Rules/Notifications/Circulars & Clarifications