About the Author I-5

Preface to Seventh Edition I-7 Acknowledgement I-9 About the Book I-11 Chapter Heads I-15 “WHAT’S IN A FACE?” (A Poetic Tribute to the New Era of Faceless Assessments) 1

CHAPTER 1

FACELESS ASSESSMENTS GOT A NEW LEASE OF LIFE

1.0 Epilogue: Faceless assessments got a new lease of life 3

1.1 Problematic issues to be addressed for the Faceless Assessments tax reform clock not to be turned back 3

1.2 Prologue: Metamorphosis of Faceless Assessment regime 8

1.3 Key Characteristics of New Faceless Regime of assessments 12

1.4 Difference between conventional E-Proceedings assessments & new faceless assessments u/s 144B of Income-tax Act 13

1.5 Key de nitions 18

1.6 Infographic presentation of new prescribed procedure of Faceless assessments in substituted section 144B 22

1.7 Faceless assessments: Our own AI & ML based GPT 23

1.8 Time for some lighter moments 23

CHAPTER 2

2.0

2.1

2.2

2.3

2.4

2.5

2.6

2.7

2.11

2.12

2.13

CHAPTER 3

FAQs ON STANDARD OPERATING PROCEDURES (SOPs) FOR FACELESS ASSESSMENT PROCEEDINGS U/S 144B OF THE

3.0 FAQs on Standard Operating Procedures (SOPs) to be Adhered by Assessment Units (AUs) in the conduct of Faceless assessment proceedings u/s 144B

3.1 Which category of cases are to be assigned to an Assessment Unit (AU) in a faceless hierarchy?

3.2

3.3 How is it ensured that cases excluded u/s 144B(2) are not being assigned to AU?

3.4 In reopened cases, what is to be done by AU on assignment of such case?

3.5 When initial scrutiny questionnaire is to be issued by AU?

3.6 Before issuing initial questionnaire, which considerations AU must bear in mind?

3.7 Which queries should ideally be included by AU in the initial questionnaire?

3.8 What is the process for issuance of notice u/s 142(1) of the Act?

3.9 How much time AU must give the assessee to respond to a notice?

3.10 What is to be done by AU where there is no response from the assessee to the initial notice u/s 142(1), within the compliance date?

3.11 What are the prescribed timelines for grant of adjournment to the assessee by AU?

3.12 What is the procedure to be followed by AU on receipt of reply to the initial notice u/s 142(1) by the assessee?

3.13 What is to be done by AU if the assessee doesn’t respond to notice u/s 142(1) even after the lapse of adjourned time limit?

3.14 What is the assessment procedure in case of non-compliance of notice u/s 142(1) and passing of best judgment assessment u/s 144 of the Act in a fair & reasonable manner?

3.15 In which circumstances, AU may make a reference to the Technical Unit (TU)?

3.16 What is the procedure to be followed by AU for making a reference to VU?

3.17 What is to be done by AU where the assessee seeks cross examination of witness not having any digital footprint?

3.18 What is the procedure to be followed by AU for making a reference to Technical Unit (TU)?

3.19 Under what circumstances AU can make a reference to NaFAC for special audit u/s 144B(7)?

3.20 How AU shall proceed for making a reference to NaFAC for Special Audit u/s 144B(7)?

3.21 What is the procedure to be followed by AU for issuance of Show Cause Notice (SCN) to the assessee?

3.22 What is the procedure to be followed by AU for Granting personal hearing in respect of the SCN to the assessee?

3.23 What is the procedure to be followed by AU for Preparation of Income & Loss Determination Proposal (ILDP)?

3.24 What is the procedure to be followed by AU on receipt of report of RU, in cases where ILDP prepared by it has been referred by NaFAC to RU for review?

3.25 What is the procedure to be followed by AU for preparation of Draft order?

3.26 What is the procedure to be followed by AU for preparation of Final Assessment Order?

3.27 What all considerations are to be kept in mind by AU in passing the nal assessment order? 61

3.28 How AU shall proceed with the PAN marked as fraud by ITBA?

3.29 What is the role of AU with reference to withholding of assessee’s refund u/s 241A?

3.30 What is the role of AU with reference to provisional attachment of assessee’s immovable property u/s 281B?

CHAPTER 4

PRACTICAL GUIDE TO e-PROCEEDINGS

4.1 Launch of New Income-tax ‘E- ling portal’ & New ‘E-Proceedings’ utility 64

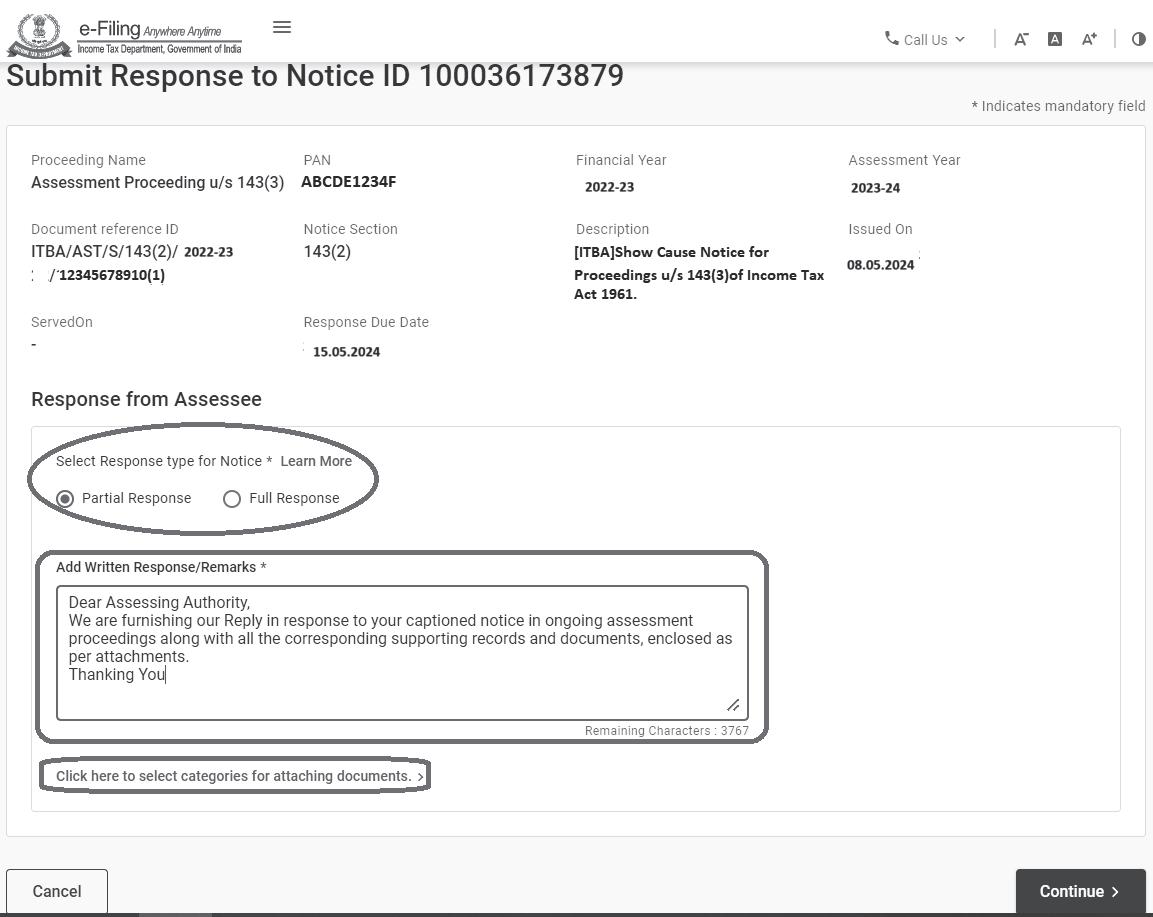

4.2 Step-by-step Guide to ‘Faceless Assessment Proceedings’ under sections 143(3), 144 and 147/143(1)

4.3 Other sections 88

CHAPTER 5

CRITICALITY OF PRINCIPLE OF NATURAL JUSTICE IN FACELESS ASSESSMENTS

5.0 Meaning of principle of Natural Justice 89

5.1 Signi cance of principle of natural justice in faceless assessments 89

5.2 Legislative provisions ensuring adherence to the Principle of Natural Justice in faceless assessments 90

5.3 Omission of sub-section (9) of section 144B: Set Back to the Principle of Natural Justice 92

5.4 Principle of Natural Justice not adhered to in Faceless Assessment: Writ or regular appeal? 94

CHAPTER 6

PRACTICAL GUIDE TO PRINCIPLE OF NATURAL JUSTICE IN FACELESS ASSESSMENTS

6.1 Recent judicial precedents Highlighting the criticality of the adherence of the Principle of Natural Justice in Faceless Assessments 95

6.2 Omission of section 144B(9) will not make faceless assessments made in contravention of Principle of Natural Justice, Immune/Faceless assessment order made in contravention of Principle of Natural Justice remitted back to AO & not quashed 95

6.3 Faceless assessments made in contravention of principle of natural justice quashed & not just set aside [SLP of assessee admitted by Supreme Court] 96

6.4 Faceless Assessment order passed without considering reply of assessee violates section 144B(1)(xiv) [Now substituted with section 144B(1)(xv)] of the Income-tax Act

6.5 Faceless assessment order without passing Draft assessment order & without serving income & loss determination proposal set aside 97

6.6 Faceless assessment order passed without giving adequate time to reply set aside 98

6.7 Where SCN suffered from vice of pre-determination, faceless assessment order stood vitiated 99

6.8 Faceless assessment order made with additions not show caused in draft assessment order quashed 99

6.9 Omission of section 144B(9) by Finance Act, 2022, not unconstitutional 100

6.10 Faceless assessment order passed without responding to assessee’s adjournment request set aside

6.11 Where response page got closed due to technical glitch in IT Portal, revenue directed to open response window

6.12 Non-speaking faceless assessment order without considering reply of assessee set aside

6.13 No infringement of principles of Natural Justice if assessee utilised the short time period opportunity to reply

6.14 Faceless assessment order passed by simply cut copy pasting draft assessment order, without considering reply of assessee, set aside

6.15 High pitched faceless assessment order passed rejecting Documentary evidence furnished in regional language remanded back to AO

6.16 Faceless assessment order passed not considering assessee’s objections led with DRP u/s 144C(2) set aside

6.17 Faceless assessment order passed in gross violation of principles of Natural Justice ignoring Standard Operating Procedure (SOP) quashed

6.18 Faceless assessment order passed without considering assessee’s reply as evidenced by system generated acknowledgement set aside

CHAPTER 7

7.0 Vested right of personal hearing through video conferencing in faceless assessments

7.1 Amendment brought by Finance Act, 2022, vesting the right of personal hearing through video conferencing to assessees, in faceless assessments

7.2 Rationale for bringing in the amendment

7.3 Step-by-step guide to avail opportunity of personal hearing through video conferencing

7.4 Personal hearing through video conferencing not granted: writ or regular appeal?

CHAPTER 8

LEGAL JURISPRUDENCE IN PERSONAL HEARING THROUGH VIDEO CONFERENCING IN FACELESS ASSESSMENTS

8.1 Understanding practical aspects of the vested opportunity of personal hearing through video conferencing in faceless assessments through case laws

8.2 Whether non-granting of personal hearing through video conferencing will fall foul of Principle of Natural Justice?

8.3 Whether personal hearing through video conferencingA vested right of assessee?

8.4 Whether denial of personal hearing through video conferencing is violative of provisions of section 144B(6)(vii)/(viii) of the Income-tax Act?

8.5 Whether faceless assessment order passed without granting meaningful personal hearing to be set aside?

8.6 Whether grant of personal hearing through video conferencing with technical glitches - A reasonable opportunity of being heard?

8.7 Whether personal hearing through video conferencing to be granted to assessee only if the assessee asks for it?

8.8 Whether assessee can ask for physical hearing in place of virtual hearing?

8.9 Where link for virtual hearing was not provided even when the assessee opted for the same, faceless assessment order passed after one month, to be set aside

CHAPTER 9

PRACTICAL GUIDE TO ISSUANCE & SERVICE OF NOTICE & ORDER IN FACELESS ASSESSMENTS

9.1 What constitutes a valid ‘issue’, ‘dispatch’ & ‘service’ of notice & order under faceless assessments regime?

9.2 Whether the date of digitally signing the notice or order is to be considered as the date of issuance and service of such notice or order?

9.3 Understanding practical aspects of the ‘issuance’ & ‘service’ of notice & order in faceless assessments through Case Laws

CHAPTER 10

PRACTICAL GUIDE TO OVERCOME SPACE CONSTRAINT LIMITATIONS IN UPLOADING SUPPORTING DOCUMENTS IN FACELESS ASSESSMENTS

10.0 Practical limitations in uploading supporting attachments and les along with a response in faceless assessment proceedings

10.1 Practical tips to overcome space constraints in ling effective responses/submissions to scrutiny notice under section 143(2)/142(1)/SCNs and other requisitions

10.2 Recent case laws addressing the space constraint limitations in uploading supporting attachments along with replies in faceless assessment proceedings

10.3 Suggestive solutions to IT Portal’s restrictions qua number of attachments & le uploading size

CHAPTER 11

MISCELLANEOUS CRITICALITIES IN FACELESS ASSESSMENTS

11.0 Addressing miscellaneous criticalities in faceless assessments in light of recent case laws

11.1 Reconsideration of exercise of revisionary powers of PCIT u/s 263/264 in faceless assessments regime

11.2 Validity of frequent transfer of faceless assessments & penalty cases, from faceless hierarchy to jurisdictional AO

11.3 Legality of closing response window before the completion of time barring limitation period of faceless assessments

CHAPTER 12

FACELESS REASSESSMENT UNDER NEW REGIME

12.1 Introduction of faceless Reassessment under New Regime

12.2 Substitution of “Reason to Believe” by “Information in Possession”

12.3 Meaning of the term “Information” as per Finance Act, 2021 143

12.4 Expansion in scope of the term “Information” by Finance Act, 2022 143

12.5 Conducting enquiry, providing opportunity before issue of Notice u/s 148 [Section 148A, applicable w.e.f. 1.4.2021]

12.6 Limitation period for issuance of notice u/s 148 [Section 149 as amended by Finance Act, 2021] 144

12.7 Amendments made by Finance (No. 2) Act, 2024 in New Reassessment Regime 145

12.8 Legislative Intent v. Ground Level Implementation 148

12.9 Circumvention of the reduced limitation period of 3 years 150

12.10 What is the meaning of ‘risk management strategy of CBDT’? 150

12.11 Concluding remarks 151

CHAPTER 13

PRACTICAL GUIDE TO FACELESS REASSESSMENT UNDER NEW REGIME

13.0 Emerging legal jurisprudence on New Faceless Reassessment Regime 153

13.1 SCN u/s 148A(b) & Order u/s 148A(d) & Notice u/s 148 to be issued by Faceless Assessing Of cer (FAO) & not by Jurisdictional Assessing Of cer (JAO)

13.2 Reopening Notice u/s 148 for AYs 2013-14 & 2014-15, issued under old reassessment regime and deemed as SCN u/s 148A(b), by revenue relying upon Ashish Aggarwal judgment of SC, are barred by limitation, based on rst proviso to section 149, as fth proviso will not apply

13.3 Reopening Notice issued under old section 148 for AYs 2016-17 & 2017-18, deemed as SCN u/s 148A(b), as per Ashish Aggarwal judgment of SC, are invalid if approval u/s 151 not obtained from PCCIT

13.4 Order passed u/s 148A(d) and reopening notice issued u/s 148 under the new reassessment regime unsustainable if passed merely on the basis of change of opinion

13.5 Where JAO has not applied an independent application of mind on information received from investigation authority, impugned reassessment notice set aside

13.6 Order Passed u/s 148A(d) without dealing with assessee’s reply in response to notice u/s 148A(b) remanded back

13.7 Where reason for issuance of notice u/s 148A(b) was itself de hors available record, such SCN issued u/s 148A(b) and order passed u/s 148A(d) were liable to be set aside

13.8 Invocation of extended period of limitation of 10 years for reopening of assessments as per section 149(1)(b) on assumption basis by AO, in contradiction to the actual escapement of income of less than ` 50 lacs, invalidates the reassessment proceedings

CHAPTER 14

GUIDELINES FOR COMPULSORY SELECTION OF CASES FOR COMPLETE SCRUTINY IN FY 2024-25 IN FACELESS REGIME

14.1 Guidelines for compulsory selection of cases for complete scrutiny in FY 2024-25 in Faceless Regime

CHAPTER 15

PRACTICAL CASE STUDY ON ADDITION BASED ON DENIAL OF BENEFIT OF NEW PERSONAL TAX REGIME IN FACELESS ASSESSMENT

15.0 Legislative provisions w.r.t. introduction of New/Alternate Personal Tax Regime 167

15.1 Break-even point analysis to make an informed choice between the Old & the New Personal Tax Regime 168

15.2 Recent case laws on denial of bene t of new Regime for delayed ling of Form 10-IE

15.3 Case Study on addition on account of denial of the bene t of reduced tax rates of the new personal tax regime

CHAPTER 16

PRACTICAL CASE STUDY ON DISALLOWANCE OF BROUGHT FORWARD BUSINESS LOSSES PURSUANT TO DEMERGER/AMALGAMATION IN FACELESS ASSESSMENT

16.1 Allowability of carry forward & set-off of accumulated business loss & unabsorbed depreciation in amalgamation

16.2 Allowability of carry forward & set-off of accumulated Business loss & unabsorbed depreciation in demerger

16.3 Legislative provisions of carry forward & set-off of business loss & unabsorbed depreciation in amalgamation & demerger

16.4 Allowability of the brought forward capital losses & mat Credit of amalgamating/demerged entity in the hands of the amalgamated/resulting entity

16.5 Recent case laws on allowability of brought forward business losses & unabsorbed depreciation in amalgamation/ demerger

16.6 Case Study on disallowance of brought forward business losses pursuant to demerger/amalgamation

CHAPTER 17

PRACTICAL CASE STUDY ON ADDITION BASED ON AIS INFORMATION IN FACELESS ASSESSMENT

17.1 Reporting of Speci ed Financial Transactions (SFTs) in Annual Information Return (AIR) by speci ed entities

17.2 New functionality in AIS rolled out displaying status of information con rmation

17.3 Use of AI & ML tools by Indian Tax Administration to process AIS based information

17.4 Case Study on addition based on AIS information of purchase of time/ xed deposits with Bank

CHAPTER 18

PRACTICAL CASE STUDY ON ADDITION BASED ON PURCHASE OF IMMOVABLE PROPERTY IN FACELESS ASSESSMENT

18.1 Case Study on addition of unexplained expenditure u/s 69C on account of purchase of immovable property 194

CHAPTER 19

PRACTICAL CASE STUDY ON ADDITION BASED ON DIFFERENT REVENUE RECOGNITION CRITERIA IN REAL ESTATE BUSINESS IN FACELESS ASSESSMENT

19.1 Case Study on addition based on different revenue recognition criteria in real estate business

CHAPTER 20

PRACTICAL CASE STUDY ON ADDITION OF UNDISCLOSED INCOME IN FACELESS ASSESSMENT

20.0 Legislative scheme for taxation of undisclosed income 204

20.1 How to handle taxability of share capital receipts as unexplained cash credits u/s 68?

20.2 Case Study on addition of share capital money/premium Receipts as unexplained cash credit u/s 68

CHAPTER 21

PRACTICAL CASE STUDY ON ADDITION OF CASH DEPOSITS BASED ON AUDIT OBJECTION IN NEW REASSESSMENTS REGIME

21.1 Whether cash deposits made out of regular cash sales recorded in the books of account, be treated as unexplained cash credits u/s 68?

21.2 Case Study on addition of cash deposits in bank as unexplained cash credit u/s 68 in faceless reassessment based on audit objection

CHAPTER 22

PRACTICAL CASE STUDY ON ADDITION OF LONGTERM CAPITAL GAIN ON PENNY STOCKS IN FACELESS ASSESSMENT

22.1 How to handle issue of addition of Long-Term Capital Gain on Penny Stocks? 231

22.2 Recent case law on Addition of Long-Term Capital Gain on Penny Stock 232

22.3 Case Study on addition of Long-Term Capital Gain on Penny Stocks 233

CHAPTER 23

PRACTICAL CASE STUDY ON DISALLOWANCE OF RELATED PARTY EXPENDITURE IN FACELESS ASSESSMENT

23.1 Case Study on disallowance of interest paid to sister concern u/s 36(1)(iii) 241

CHAPTER 24

PRACTICAL CASE STUDY ON IND AS ADJUSTMENTS IN FACELESS ASSESSMENT

24.1 Case Study on Ind AS adjustments in income 248

CHAPTER 25

PRACTICAL CASE STUDY ON DISALLOWANCE U/S 14A & RULE 8D IN FACELESS ASSESSMENT

25.1 Case Study on disallowance u/s 14A read with rule 8D 254

CHAPTER 26

PRACTICAL CASE STUDY ON DISALLOWANCE OF PRE-COMMENCEMENT BUSINESS EXPENDITURE IN FACELESS ASSESSMENTS

26.1 Case Study on issue of disallowance of pre-commencement business expenditure 262

CHAPTER 27

PRACTICAL CASE STUDY ON ADDITION OF COMPENSATION RECEIVED UNDER RFCTLARR ACT, 2013 IN FACELESS ASSESSMENTS

27.1 Case Study on issue of addition of compensation received towards compulsory acquisition of land under Right to Fair Compensation & Transparency in Land Acquisition, Rehabilitation & Resettlement Act, 2013 (RFCTLARR Act)

CHAPTER 28

PRACTICAL CASE STUDY ON ADDITION BASED UPON ANNUAL INFORMATION RETURN (AIR) INFORMATION

28.1 Case Study on additions based upon Annual Information Return (AIR) Information

CHAPTER 29

PRACTICAL CASE STUDY ON REVENUE RECOGNITION & EXPENDITURE BOOKING IN REAL ESTATE BUSINESS IN FACELESS ASSESSMENTS

29.1 Case Study on issue of accounting for revenue recognition & expenditure booking in real estate business

CHAPTER 30

FACELESS APPEALS IN ITS NEW AVATAR

30.1 Catching up on all signi cant developments in Faceless Appeal Regime

30.2 Difference between conventional appeals before CIT (Appeals) & Faceless Appeals under the newly substituted faceless appeal scheme, 2021

30.3 Key de nitions

30.4 Pictorial presentation of modi ed procedure of conduct of faceless appeals

CHAPTER 31

DECODING FACELESS APPEAL SCHEME, 2021

31.0 Threadbare analysis of amendments brought in by legislature in the substituted ‘Faceless Appeal Scheme, 2021’

31.1 Scope and coverage of Faceless Appeal Scheme, 2021

31.2 The New Faceless Appeals Hierarchy

31.3 Procedure of Conduct of Faceless Appeals

31.4 Exchange of Communication Exclusively by Electronic Mode: For the purposes of this Scheme

31.5 Authentication of Electronic Record: For the purposes of this Scheme, an electronic record shall be Authenticated

31.6 Delivery of electronic record

31.7 No Personal appearance in the appeal centres or units & vested right of personal hearing through video conferencing

31.8 Penalty proceedings

31.9 Recti cation proceedings

31.10 Appellate proceedings

31.11 Power to specify format, mode, procedure and processes

31.12 Comparison Between Faceless Appeal Scheme, 2020 & Faceless Appeal Scheme, 2021 310

CHAPTER 32

PRACTICAL GUIDE TO FACELESS APPEALS

32.1 Step-By-Step Guide to File E-Appeal in Online Form 35 through E-Filing Portal

CHAPTER 33

PRACTICAL CASE STUDY ON DISALLOWANCE OF PURCHASES TREATING THEM AS BOGUS IN FACELESS APPEALS

33.1 Case Study on Appeal Representation w.r.t. disallowance of purchases treating them as bogus

33.2 Recent case law on disallowance of bogus purchases

CHAPTER 34

PRACTICAL CASE STUDY ON DISALLOWANCE OF DEDUCTION U/S 35D IN FACELESS APPEALS

34.1 Case Study on appeal representation w.r.t. disallowance of deduction u/s 35D of the Income-tax Act

CHAPTER 35

PRACTICAL CASE STUDY ON ADDITION OF FOREIGN BANK ACCOUNT IN FACELESS APPEALS

35.1 Case Study on appeal representation in respect of addition of foreign bank account balance

CHAPTER 36

PRACTICAL CASE STUDY ON RENTAL BUSINESS INCOME TREATED AS INCOME FROM HOUSE PROPERTY IN FACELESS APPEALS

36.1 Case Study on appeal representation in respect of rental business income treated as income from house property

CHAPTER 37

PRACTICAL CASE STUDY ON CAPITAL GAIN ON SALE OF BUILDING COMPRISED IN BLOCK OF ASSETS TREATED AS CAPITAL GAIN ON LAND IN FACELESS APPEALS

37.1 Case Study on capital gain on sale of building comprised in block of asset treated as capital gain on sale of land

CHAPTER 38

PRACTICAL CASE STUDY ON APPEAL AGAINST ORDER U/S 201(1)/(1A) FOR NON-DEDUCTION OF TDS ON YEAR END EXPENDITURE PROVISIONS IN FACELESS APPEALS

38.1 Case Study on appeal representation w.r.t. Order u/s 201(1)/ (1A) for non-deduction of TDS on year end expenditure provisions

348

355

364

369

CHAPTER

39

DECODING THE NEW RULES OF PENALTY SHOOTOUT: FACELESS PENALTY SCHEME

39.1 Learning the New Rules of the Penalty Shoot-Out Game 387

39.2 Faceless Penalty Scheme Decoded 387

39.3 Launch of Faceless Penalty Scheme, 2021 388

39.4 Key De nitions 388

39.5 Faceless Penalty (Amendment) Scheme, 2022 391

39.6 Scope of Faceless Penalty Scheme 391

39.7 Authorities to conduct the Faceless Penalty Proceedings 392

39.8 Procedure to conduct Faceless Penalty Proceedings 393

39.9 Transfer of case 396

39.10 Electronic Records 397

39.11 Personal appearance at the centre and units 398

CHAPTER 40

PENALTY FOR UNDER REPORTING & MISREPORTING OF INCOME IN FACELESS REGIME

40.1 Penalty for under reporting & misreporting of income in Faceless Regime 400

40.2 Illustrative List of Under Reporting of Income v. Misreporting of Income Circulated By Income Tax Department For Faceless Assessment [Penalty] Of cers 401

CHAPTER 41

PRACTICAL CASE STUDY ON PENALTY U/S 270A ON DISALLOWANCE U/S 14A READ WITH RULE 8D IN FACELESS PENALTY

41.1 Case Study on Penalty u/s 270A on disallowance u/s 14A read with rule 8D 408

CHAPTER 42

MISCELLANEOUS FACELESS SCHEMES UNDER THE INCOME TAX ACT, 1961

42.0 Miscellaneous Faceless Schemes under the Income-tax Act, 1961

42.1 e-Assessment of income Escaping Assessment Scheme, 2022 (CBDT Noti cation No. 18/2022, dated 29-3-2022)

42.2 Faceless Jurisdiction of Income-Tax Authorities Scheme, 2022 (CBDT Noti cation No. 15/2022, dated 28-3-2022)

42.3 e-Advance Rulings Scheme, 2022 (CBDT Noti cation No. 07/2022, dated 18-01-2022)

42.4 e-Verification Scheme, 2021 (CBDT Notification No. 137/2021, dated 13-12-2021)

42.5 e-Settlement Scheme, 2021 (CBDT Noti cation No. 129/2021, dated 1-11-2021) 416

42.6 Faceless Scheme for determination of Arm’s Length Price [Section 92CA]

42.7 Faceless Scheme for making of reference to Dispute Resolution Panel [Section 144C]

42.8 Scheme for Faceless Appeal to Appellate Tribunal [Section 253]

42.9 Procedure for Faceless Appeal to Appellate Tribunal [Section 255]

42.10 Extended Limitation dates for issuing Directions for the Faceless Schemes under sections 92CA, 144C, 253 and 255 as per Finance (No. 2) Act, 2024

42.11 Faceless enquiry or Valuation Scheme, 2022 (CBDT Notication No. 19/2022, dated 30-3-2022)

42.12 e-Dispute Resolution Scheme, 2022 (CBDT Noti cation No. 26/2022, dated 4-4-2022)

CHAPTER 43

PRACTICAL GUIDE TO E-FILING OF RECTIFICATION APPLICATION & RESPONSE TO OUTSTANDING DEMAND

43.1 Reconciliation between returned income & return processed under section 143(1) 423

CHAPTER 44

INTERNATIONAL BEST PRACTICES & INDIAN TAX ADMINISTRATION

44.1 The Changing Landscape of tax administration: Global Trends 436

44.2 Digital transformation of tax administrations World-Wide 438

44.3 International best practices concerning digital transformation of the tax administrations 439

44.4 Country speci c international best practices in tax administration 440

44.5 Digitalisation of Indian Tax Administration 445

CHAPTER 45

FAQs ON FACELESS REGIME

45.1 ‘Frequently Asked Questions’ (FAQs) on ‘Faceless Regime’ 452

45.2 FAQs on response to outstanding demand 457

45.3 FAQs on recti cation applications u/s 154 458

45.4 FAQs on authenticating notices issued by Income Tax Department 463

APPENDICES

CLARIFICATIONS UNDER SECTION 144B [FACELESS ASSESSMENT] 506

FACELESS APPEAL SCHEME, 2021 534

FACELESS PENALTY SCHEME, 2021 547

DIRECTIONS TO GIVE EFFECT TO FACELESS PENALTY SCHEME, 2021 560

CLARIFICATION AND GUIDANCE UNDER FACELESS PENALTY SCHEME 569

e-ADVANCE RULINGS SCHEME, 2022 577

e-SETTLEMENT SCHEME, 2021 587

e-VERIFICATION SCHEME, 2021 593

FACELESS JURISDICTION OF INCOME TAX AUTHORITIES SCHEME, 2022 600

e-ASSESSMENT OF INCOME ESCAPING ASSESSMENT SCHEME, 2022 602

FACELESS INQUIRY OR VALUATION SCHEME, 2022 603

e-DISPUTE RESOLUTION SCHEME, 2022 604 e-APPEALS SCHEME, 2023 613