CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES

Learning Objectives

LO1: To highlight the concept of a central bank and the characterizing roles performed by it

LO2: To explain the concept, the relevance and tools of monetary policy

LO3: To describe the purpose and functioning of each monetary policy instrument

LO4: To discuss the money market forces and role of interest rates

LO5: To deliberate on central banking in Indian context and its linkages with economic activities

11.1 INTRODUCTION

You must have come across headlines like ‘RBI hikes repo rate by 50 basis points. RBI adopts a tight monetary stance amid inflationary pressures.’ ‘Sensex tanks 1000 points, amid fears of Fed rate increase.’ The above statements refer to the monetary policy of a central bank— Reserve Bank of India (RBI) is the Central Bank of India—via effecting a change in the interest rate.1 Each country has its own Central Bank like the U.S. Federal Reserve System, Bank of England, Bank of France etc. A Central Bank (e.g., RBI) is different from a commercial bank like State Bank of India or Axis Bank. It plays an important role in the macroeconomic management of a country in terms of monetary policy.2

In some countries, the central bank has emerged out of the process of evolution in the same way as commercial banks did. For example, the Bank of England was established in the late 17th century but it was not the central bank of the U.K. at that time. Over the years, it gradually occupied this status. In many countries, the central bank has been established by a statutory process. The RBI was set up in 1935 and was nationalised in 1949. Unlike the Bank of England, which evolved into a central bank, RBI was designated as the Central Bank of India right from its inception.

1. As we will learn soon, the repo rate is an interest rate.

2. Incidentally, there is a public-sector commercial bank in India named Central Bank of India. Please do not confuse it with the term ‘central bank’ as we use in this chapter. India’s central bank is the RBI.

11 CHAPTER

271

In this chapter we learn central banking, monetary policy—how it is executed—and interest rates. Just as fiscal policy impacts on a macroeconomy by affecting aggregate demand, monetary policy does so by affecting the interest rate. It will be convenient to begin with knowing about various types of interest rates.

It should be kept in mind at the outset that we do not consider in this chapter (a) how monetary policy affects output and employment and (b) the full impact of monetary policy on the interest rate after taking into consideration how other macro variables are affected. Thus, it is not a chapter on the determination of output, employment or interest rate. These issues will be analysed in Chapter 12. In this chapter, we will understand the effect of monetary policy on the interest rate in a very short run, defining the execution of monetary policy so to speak.

11.2 INTEREST RATE

Interest rate is simply the charge or a fee for using someone else’s money over a specified period of time. As you step out of college to accept a well-paying position in an established firm, you may want to buy a car (you fancied in your teen years) before you have enough savings out of your forthcoming income stream. How? By taking a loan from a local bank and paying the bank the principal and the interest in terms of EMI, equated monthly instalment. You are paying interest because you are using the bank’s money for a period of time. The entity who provides money or cash is the lender (the local bank in the example) and the entity who accepts money with a promise to repay is the borrower (yourself). Not just individuals, businesses, private and public institutions including central and local governments also need to borrow funds. From whom? The household sector, the business sector and the governments. Borrowing and lending activities at some aggregate level like the domestic economy or the international economy are collectively referred to as the loan, the credit or the debt market

11.2.1 A Classification of Loan Markets and Interest Rates

There are various types of loan markets and interest rates that coexist in an economy. Figure 11.1 presents a classification. Loan markets can be informal or formal, depending on whether or not the loans are legally recorded. Whether informal or formal, loans can be short-term and long-term loans. Accordingly, there are short-term interest rates and long-term interest rates. Typically, loans up to one year are considered short-term and those maturing after one year are called long-term loans. In the formal (legally recorded) loan market, we talk about gross or before-tax interest rate and net or after-tax interest rate. The term TDS (Tax Deducted at Source) must be familiar to most of you.3

3. Also, there is simple versus compound interest rate, which applies to any loan with an interest. The difference between the two is left as an exercise at the back of the chapter.

RATES 272

Para 11.2 CENTRAL BANKING, MONETARY POLICY AND INTEREST

Informal (not recorded legally)

Interest Rates

Short Run and Long Run Village Money Lenders, Family Loans, Mafia etc.

Formal (legally recorded)

Short Run and Long Run; Gross and Net

Savings and Time Deposits, Fixed Deposits, Interest on Credit Cards, Interest on Personal and Business Loans, LIBOR and SOFR, Bank Rate, Repo Rate, Marginal Standing Facility (MSF) Rate, Federal Funds Rate, Interest Rate in the Bond Market etc.

The informal loan market includes private money lenders in rural and urban areas, loans from family and friends, and those from the ‘underground world.’ Imagine a poor farmer needing money for some urgent purpose approaches a village money lender who lends money at a very high interest rate along with the farmer’s land as collateral. You know the rest of the story to come. Such money lenders are pictured as villains of society. Earning interest from such loans is seen as a sin. Clip 11.1, which is partly informative, is a narrative that you may enjoy reading.4

CLIP 11.1 INDICTMENT SURROUNDING INTEREST EARNINGS

The very mention of the word interest rate must be bringing to your mind several Bollywood movies depicting the blood-sucking, cruel, ruthless village moneylenders harassing the poor yet adorable heroes and heroines. In your childhood and early youth, you must have developed a hatred for actors like Kanahiyalal, Prem Chopra, Om Prakash, Gulshan Kumar, and Amrish Puri who often played the role of money lenders in several movies. You must have seen the Nargis-Sunil Dutt starrer ‘Mother India’, so well depicting the problem of rural credit and its sole source of availability in those times. In medieval Europe, money lending business was largely controlled by the Jews, and, for this reason, the Jews were held in contempt among Christians for this reason. Remember the well-known play ‘The Merchant of Venice’ written by William Shakespeare.

Are interest earners sinners? Is it unethical to charge interest? Keeping aside the economic rationale for the time being, there is a social stigma attached to the interest earners. They are seen to

4. Of course, not all in informal lending is a bad thing. If your friend needs urgent money to meet some family emergency and you lend him/her some amount, this is obviously a good thing.

FIGURE 11.1: VARIOUS KINDS OF INTEREST RATES

273 INTEREST RATE Para 11.2

be enjoying while doing nothing. It is regarded as an unearned income. In Islam, charging of interest is prohibited. It is ‘haraam’ (unislamic) to charge interest. A devout Muslim should, therefore, not charge interest and should also have no dealings with people who do so. However, the Shariya (Islamic Law) permits ‘profit sharing’ with the person from whom you have borrowed. There are several Islamic banks that carry out their commercial banking in accordance with the Shariya. For example, they would not lend money to liquor producers and dealers or to casinos. They wouldn’t buy or hold shares of such mutual funds whose holding includes the shares of such companies. It creates problems for such banks to deal with other commercial banks who do not have such taboos. In recent times, Middle-East Asia (which is largely Islamic) has emerged as a major economic power. This makes the study of Islamic banking even more relevant and challengin1g.

11.2.2 Different Interest Rates in the Formal Loan Market

Macro management deals mostly with the formal loan market. Depending on who the lenders and borrowers are, the maturity period of the loan etc., a number of interest rates prevail in an economy.

Interest on savings and time deposits: This is all too familiar with us.

Fixed deposits: This should also be quite familiar with you. Generally, the fixed deposits pay a higher interest rate than a savings or time deposit, because the money is locked in. In the U.S., it is called the certificates of deposit. These are available for different durations like three months, six months, one year, two years etc.

Interest on credit card: Any purchase with a credit card is a loan with the proviso that if you pay back an amount no later than the due date, the interest rate is zero. Otherwise, the outstanding amount entails a hefty interest rate. This is how the credit card companies make their money.

Interest on personal and business loans: Banks and other financial institutions loan funds to individuals and businesses. Interest rates vary, depending on the trust or credit worthiness of individuals, assessed viability of businesses etc.

LIBOR and SOFR: Banks lend each other on a short-term basis depending on their needs. LIBOR stands for the London Interbank Offered Rate. It is the average interbank interest rate at which the banks in the London money market lend to one another. In 2023 it was replaced by Secured Overnight Financing Rate (SOFR). LIBOR/SOFR serves as a global benchmark for setting interest rates on corporate debt, mortgages etc.

Bank Rate: Any business faces cash-flow problems periodically. It includes commercial banks, who borrow from different sources. Bank Rate is the rate of interest at which the central bank lends money to commercial banks.

Repo rate: It is the rate at which the central bank provides loans to the commercial banks. Thus, the bank rate and then repo rate are almost the same. The only difference is that in case of bank rate, the lending facility is available without any collateral, while repo rate refers to

Para 11.2 CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES 274

the situation where the central bank gives loans to commercial banks against some securities which the commercial bank must sell to the central bank with a repurchase option (repo).5

A change in the bank/repo rate is typically expressed in what is called basis points (bps). One basis point is equal to one-hundredth of one per cent. For example, an increase in the bank rate by 75 basis points from say 5% means an increase from 5% to 5.75%.

As will be discussed later, the bank rate or the repo rate serves as the “bench-mark” interest rate in a country in that it acts as a signal to commercial banks with which they can read the policy stance of the central bank.

Marginal Standing Facility (MSF) rate: It was introduced in India in 2011. It is the rate at which commercial banks can borrow overnight (in an emergency situation) from the RBI against approved government securities.6

Federal Funds Rate: In the U.S., the federal funds rate is the interest rate at which depository institutions like commercial banks, credit unions etc. lend their overnight excess reserves to one another. This is the U.S. equivalent of the bank/repo rate of India, in the sense that the U.S. Fed adjusts the money supply so that the actual funds rate moves toward the target interest rate by the Fed.7

Interest Rates in the Bond Market: Corporate businesses and the governments—central/federal, state and local—borrow from the public regularly by issuing bonds, respectively called corporate and government bonds. A bond is essentially an ownership certificate issued by the borrowing party to the lender, stating the amount lent and coupon payments, from which one can deduce the interest rate. We will not get into details, except to note that different bonds are issued with different maturity periods like three months, one year, five years, ten years etc. and they carry different interest rates.8 For instance, RBI issues saving bonds with a maturity period of seven years. There are several bonds floated by corporate houses like Reliance Industries, Kotak, ICICI, L&T among many, many others. Bonds issued by the Government of India and State Governments are referred to as “G-sec.” The maturity period of G-sec varies from three months to well over thirty years.9, 10

5. In other words, the rate charged by the central bank from commercial banks on loans against no security is the bank rate.

6. As of September 2022, the bank rate and the MSF were both 5.65%, while the repo rate was 5.4%.

7. Commercial banks in the U.S. can borrow from the Fed at an interest rate, called the discount rate, which is typically 100 basis points (1%) higher than the federal funds rate. It is because the Fed prefers that the commercial banks borrow from each other while monitoring each other with regard to liquidity and risk.

8. A textbook on finance would explain terms like coupon payments and how to calculate the interest rate from the coupon payments and face value of a bond. The bond certificates exist in terms of electronic accounts, called “demat”. Some decades ago, they were physical, a piece of paper stating the borrower’s name, the lender’s name, the amount of the principal and the coupon payments.

9. The RBI website, https://www.rbi.org.in/commonperson/English/Scripts/FAQs.aspx?Id=711 (accessed on July 2, 2023), provides a primer on G-sec.

10. Debentures are loan instruments very similar to bonds. The usage of the term ‘debenture’ varies somewhat between countries, but generally they mean unsecured loans that do not involve a collateral.

275 INTEREST RATE Para 11.2

11.2.3 Marketability of Bonds and the Link Between the Interest Rate and the Price of Bonds

Unlike other interest-bearing assets like a savings or fixed deposit with a bank, the distinguishing feature of bonds are that many (not all) are marketable, in the sense that if you have a bond with a maturity date, say one year from now, within this period you can sell this bond just like shares or stocks of public limited companies. For instance, you hold five government bonds, each with a face value of ` 20,000 (meaning a certificate with a principal amount of ` 20,000) and you need cash now. You can sell one, some or all of the bonds you have in the bond market. Once you do it, someone else becomes the owner of that pre-existing bond. However, it is very important to know that when you sell the bond, its price will most likely be different from ` 20,000. Why? Suppose that your bond offers an 8% interest rate annually. This is fixed. Now when you sell it, suppose that new government bonds of the same duration are offering 10% interest rate. (Interest rates change over time and we will see why). If so, no one would buy your bond that gives 8% interest for the same amount of the principal, because the option of buying a bond offering a higher (10%) interest rate is available. Therefore, your bond will be priced less than ` 20,000 at a level which brings an equivalence between an existing bond and a new bond. It follows that an increase in the interest rate lowers the price of existing marketable bonds. Likewise, a decrease in the interest rate implies a higher price of the same. See Appendix 11-A for details on how interest rate changes and bond prices are related.

You should know that bonds are rated according to how safe or reliable they are in terms of the servicing of the interest payments and return of the principal upon maturity.11

11.2.4 Nominal Versus Real Interest Rate

For analytical purposes, we differentiate between the nominal interest rate and what is called the real interest rate. Nominal interest rate is the rate specified on or implied from a bond instrument, e.g., 8% for a fixed deposit of 3-year duration or 6% for a 2-year government bond or whatever. The real interest rate accounts for the expected rate of inflation and is defined as:

Real interest rate = Nominal interest rate—Expected rate of inflation. (11.1)

Suppose you buy or an agent for you buys a government bond that gives 4% interest at the end of one year and experts are saying that the inflation rate will be 2.5% during the forthcoming year. In this example, the nominal interest rate is 4%, the expected inflation rate is 2.5% and thus the real interest rate is 4–2.5 = 1.5%. This is your expected return from investing in the government bond in real terms. Note that:

(

a) Real interest rates can be negative. In our example if the expected rate of inflation was, say, 5%, the real interest rate would have been –1%.

11. In the U.S., there are three main bond rating agencies: Standard & Poor’s, Moody’s and Fitch. Prominent credit rating agencies in India include, among others, CRISIL (Credit Rating Information Services of India, Ltd.), ICRA (Investment Information and Credit Rating Agency), CARE (Credit Analysis and Research Ltd.) and India Ratings and Research Pvt. Ltd.

Para 11.2 CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES 276

(b) Real interest rate is a hypothetical (yet very useful) concept in the sense that expected inflation refers to the future which no one can predict with certainty. This is why it is expected in the first place, not actual. However, sometimes, in reference to the past, “real interest rate” is interpreted as the difference between nominal rate and the observed inflation rate. This is, strictly speaking, not the real interest rate. More appropriately, it is the realized real interest rate. But the word “realized” is kept silent.

11.2.5 Interrelationships Between Various Types of Interest Rates and the Interest Rate Linked Directly to Monetary Policy

Are various types of interest rates unrelated? No. In fact, they are closely related since they all involve time, and a longer time interval is cumulative of shorter time periods. In normal times, the family of interest rates moves in tandem. For example, there are theories on how interest rates of different maturity durations may be related. This is known as the term structure of interest rate, which is beyond our scope of analysis in this book.

You can also imagine that if the cost of—that is, interest charge on—borrowing by the commercial banks from other commercial banks or the central bank increases, the (profit maximizing) commercial banks will charge a higher interest for loans that they offer to their customers.12 Therefore, the bank/repo rate and interest on personal and business loans are positively and strongly correlated.

In general, given that various interest rates are closely related, for analytical simplicity, we will assume a single loan/bond market, and therefore, a single interest rate. We will understand in this chapter how a central bank’s monetary policy directly impacts on the shortterm interest rate like the bank rate, repo rate or the federal funds rate — with the implicit understanding that changes in these interest rates have a ripple effect on other interest rates in the economy that affect macroeconomic variables like investment, output and employment.

11.3 FUNCTIONS OF A CENTRAL BANK

We will understand what a central bank of a country is by understanding what it does. Traditionally, there are seven standard functions of a central bank: 1. Bank of Issue, 2. Banker, Agent and Advisor to the government, 3. Custodian of cash reserves of commercial banks, 4. Custodian of a nation’s reserves of international currencies, 5. Lender of the last resort, 6. Clearing house and 7. Controller of credit.

11.3.1 Bank of Issue

The central bank is the sole authority of issuing the currency of a nation, including coins and notes. In India, coins are minted by the Government of India and issued by the RBI. As you know, the currency notes of ` 500 and ` 1,000 denominations ceased to be the legal tender (legally acceptable currency) following demonetization in November 2016. Thereafter, the RBI issued fresh currency notes of ` 500 and ` 2,000 denominations along with new currency notes of ` 200, ` 100, ` 50, ` 20, ` 10 and ` 5 denominations. In 2023, the RBI

12. More will be said on this later.

277 FUNCTIONS OF A CENTRAL BANK Para 11.3

withdrew the 2000-rupee notes and directed the public to get these notes exchanged for some other currency notes.

Das, Goyal & Kakar

Figure 11.2 shows the value of the RBI issued banknotes in circulation in all denominations for the year 2022. Notice that ` 500 notes (bills) constitute nearly 3/4th of the total value of all bills. Coins of ` 1, ` 2, ` 5, ` 10 and ` 20 denominations also circulate. As of early 2020s, the coins in fractional denominations in India have gone out of circulation almost entirely.

Some countries have fractional components in their currencies, like cent in US and pence in UK while in other countries there is no fractional component, e.g., yen of Japan.

Source: Reserve Bank of India, Database on the Indian Economy, rbi.org.in/DBIE/dbie.rbi?site=statistics

After the demonetization of 2016, the currency in circulation in India went down from roughly ` 17 trillion (` 17 lakh crore) in 2016 to ` 13.5 trillion (` 13.5 lakh crore) in 2017. However, in the next four years it increased rapidly and more than doubled, reaching ` 28 trillion or ` 28 lakh crore in 2021. This happened despite constant efforts of the government to reduce the use of currency money and move towards digital modes of payment.

have fractional components in their currencies, like cent in US and pence in UK while in other countries there is no fractional component, e.g., yen of Japan.

Being the bank of issue provides status and superiority to the central bank. In many developed countries, this function is losing its importance because of the growing and widespread use of a digital currency. There are multiple ways in which transactions of any magnitude and denominations can be carried out without using notes and the problem of small change does not arise. However, we are still far away from a situation where the role of currency as a medium of exchange will become insignificant or redundant.

After the demonetization of 2016, the currency in circulation in India went down from roughly 17 trillion ( 17 lakh crore) in 2016 to 13.5 trillion ( 13.5 lakh crore) in 2017. However, in the next four years it increased rapidly and more than doubled, reaching 28 trillion or 28 lakh crore in 2021. This happened despite constant efforts of the government to reduce the use of currency money and move towards digital modes of payment.

Being the bank of issue provides status and superiority to the central bank. In many developed countries, this function is losing its importance because of the growing and widespread use of a digital currency. There are multiple ways in which transactions of any magnitude and denominations can be carried out without using notes and the problem of small change does not arise. However, we are still far away from a situation where the role of currency as a medium of exchange will become insignificant or redundant.

Page 9

Figure 11-2: Banknotes (Currency Notes) in Circulation, India, 2022

Para 11.3 CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES 278

11.3.2 Banker, Agent and Advisor to the Government

The central bank maintains the accounts of all State Governments and Central Governments. As an advisor, the central-bank officials and policy makers are always available to the government on matters of economic management. On its own as well, the central bank publishes periodical reports on the state of the economy and its policy stance. As an agent, the central bank floats and manages all types of loans which the government plans to issue. The government borrowings can be domestic as well as international, and they have different maturity periods in the form of treasury bills and bonds. Treasury bills normally have a short maturity date of six months or less. Bonds are the long-term borrowing instruments of the government. The maturity date of bonds ranges from one year to well over thirty years.13 Sometimes the bonds have no maturity date. These bonds, called perpetuities, simply carry a fixed rate of annual return which the holder gets. As borrowing by the government is considered very safe, government bonds are termed as gilt-edged securities.14

In the Indian framework, RBI is constitutionally obligated to undertake the receipts and payments of the Central Government and carry out the exchange, remittance and other banking operations, including the management of public debt. State Government transactions are carried out by RBI as per the terms of agreement with the State Governments.

RBI carries out the banking business through its own offices and via commercial banks appointed as its agents. It can appoint scheduled commercial banks as agents for specified purposes. RBI maintains the Principal Accounts of central and State Governments at its Central Accounts Section, Nagpur. A well-structured arrangement exists for revenue collection as well as payments on behalf of the government across the country.

11.3.3 Custodian of Cash Reserves and Banker to Commercial Banks

Please recall the dilemma of a commercial bank arising out its conflicting objectives of profitability and security. If an overenthusiastic bank chases the profitability motive too far, it must keep less cash (low CRR). But this endangers it to a default on depositors’ withdrawals and hence carries the risk of losing public trust. As the apex regulatory body, the central bank cannot allow this situation to occur. It mandates the commercial banks to keep a certain minimum portion of their deposits with the central bank. This is CRR, the cash reserve ratio. For instance, if the CRR is 4.5 per cent, then all commercial banks must keep at least ` 4.50 with the RBI for every ` 100 deposit with them. The central bank acts as a custodian of this cash reserve.

RBI acts as a common banker to all banks and for this purpose, the banks maintain current accounts with it. As per the guidelines of the Department of Government and Bank Accounts, the current accounts of individual banks are opened in e-Kuber (Core Banking System of RBI) by Banking Departments of the regional offices. RBI-stipulated minimum balance must be maintained by banks in these accounts, which enables participation in payment systems, inter-bank settlements, sale/purchase of securities and foreign currencies, etc.

13. For instance, in 2023 the RBI announced, among other bonds, an auction of central government bonds that would mature in 2062.

14. Sometimes, the bonds issued by big, reputed companies are also called gilt-edged for their security and safety.

279 FUNCTIONS OF A CENTRAL BANK Para 11.3

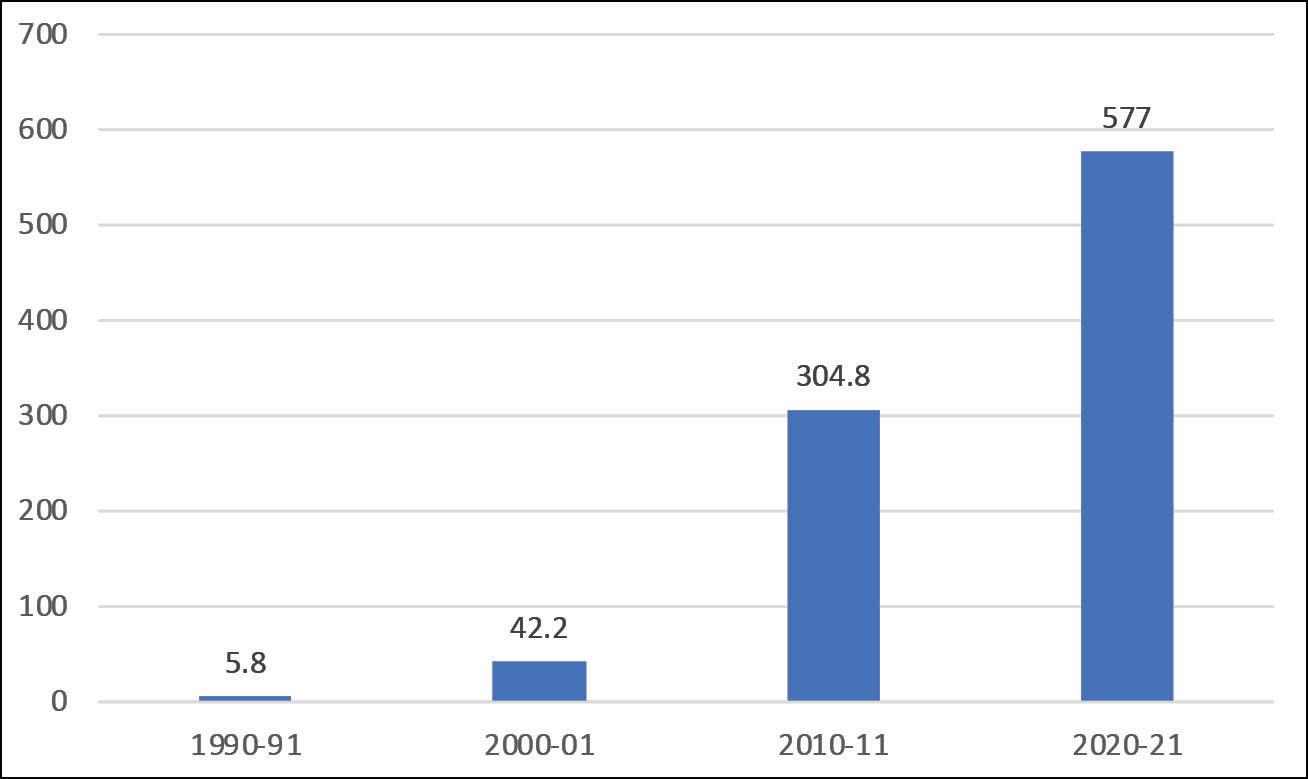

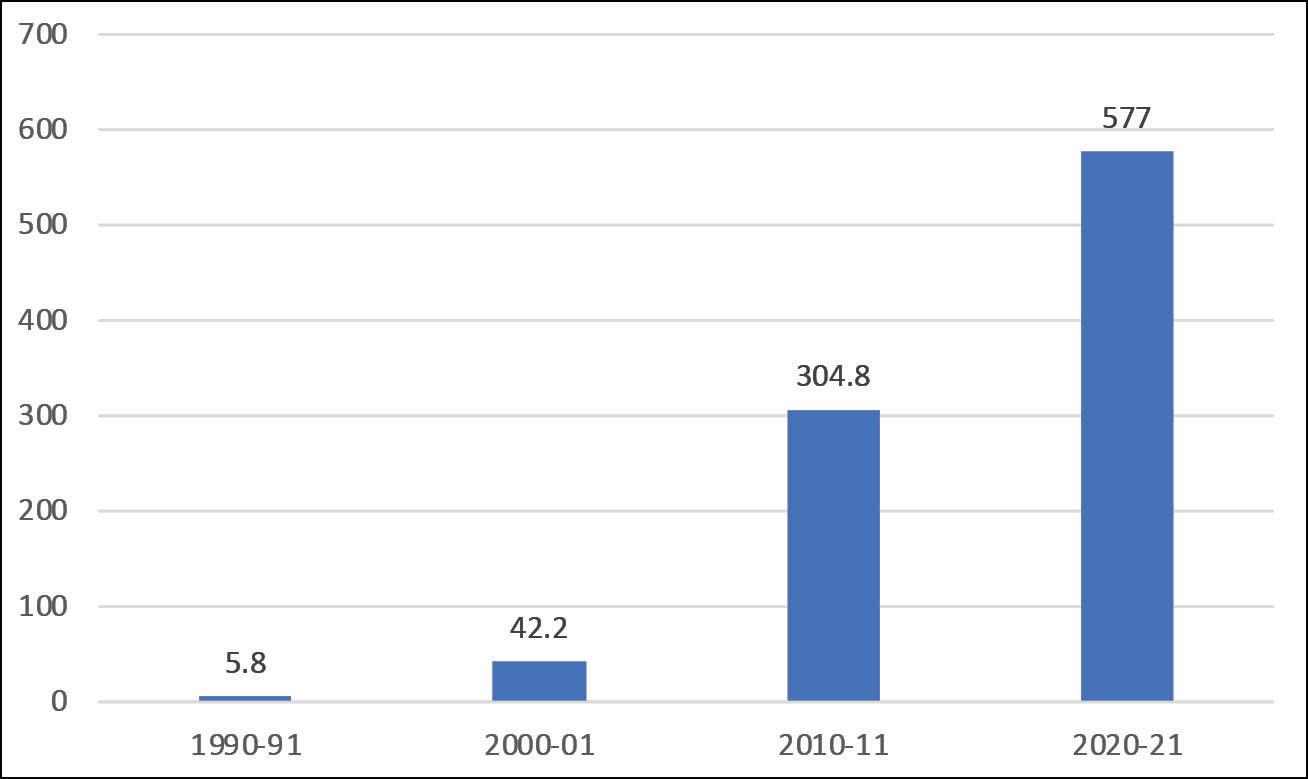

11.3.4 Custodian of Nation’s Reserves of International Currencies

The central bank keeps foreign currencies as reserves, called forex reserves. They are used in order to intervene in the forex market if the value of the domestic currency starts falling sharply, particularly due to speculative pressures. This is done by selling the forex reserves and buying domestic currency, which tends to halt the downward pressure on the value/price of the domestic currency in the forex (foreign exchange) market. This means a depletion of forex reserves. For example, between January and August in 2022, the RBI intervened repeatedly to stop a sharp decline in the value of Indian rupee. In the process, the forex reserves fell from nearly 600 billion USD to 530 billion USD during the same period. Typically, such intervention by the central bank has limited success. The RBI failed to stop the declining rupee as the dollar- rupee exchange rate rose from $1 = ` 75 in January 2022 to more than $1 = ` 82 in October 2022. Figure 11.3 illustrates impressive growth in India’s forex position over the decades. A central bank may also intervene in the forex market to reduce the value of its own currency if it rises sharply. This is done by selling their own currency and buying foreign currencies, which tends to increase foreign reserves.

Source: Reserve Bank of India, Database on Indian Economy, rbi.org.in/DBIE/dbie.rbi?site=statistics

A large amount of forex reserves is an important indicator to the rest of the world that the nation is not going to default on its international payments obligations.15 Overall, a central bank’s policies for foreign exchange reserves management are guided by safety, liquidity and returns.

11.3.5 Lender of the Last Resort

The central bank does not provide any lending facility to commercial banks in normal times. It periodically advises and sometimes cautions the commercial banks to keep enough liquid assets with themselves to meet depositors’ demands. On its part, the central bank keeps a 15. For example, in September 2022, RBI’s forex reserves were enough to finance nearly eight months of imports.

Para 11.3

CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES

close watch on the liquidity position of the banks and issues warnings to those who either flout its directive and/or are too tight on their liquidity fronts. The erring commercial bank soon falls in line for fear of losing its association with the apex bank.

What if a commercial bank (unexpectedly) faces a liquidity crunch due to sudden and massive withdrawal requests of the depositors? The central bank comes to the rescue by providing short term loans to the commercial bank to tide over the crisis. The central bank is thus a lender to the commercial banks of the last resort. Before granting the temporary loan facility however, the central bank ensures that the liquidity crisis in the commercial bank had occurred not due to the latter’s negligence or laxity but because of circumstances which were normally beyond its control. Moreover, this short-term loan facility is not free: there is an interest charge.

11.3.6 Clearing House

As you all know, we accept cheques of other banks (in which we do not have our account) as payments because we can easily deposit the cheque of the other banks in our account which is in a different bank. It leads to a situation where commercial banks have claims over one another. The central bank acts as a clearing house for settling the interbank claims. When these claims were in paper form, the representatives of all the banks would literally assemble and settle accounts at periodic intervals. In modern times, information technology does it all. In this context, National Payments Corporation of India (NPCI) was set up in 2008 by RBI (as a specialized division) for operating retail payments and settlement systems in India through a digital mode. In its wide portfolio of services, among others, are the Cheque Truncation System (CTS) and the National Automated Clearing House (NACH). Digitization has made it possible to stop the movement of physical cheques (known as cheque truncation). Instead, its electronic image is transmitted along with related information.16 In 2021, RBI announced its intention of bringing all bank branches under the system and consolidating multiple clearing locations managed by different banks with service variations into a nationwide standard clearing system. Another significant service of the NCPI is NACH — a centralised clearing service for high-volume and low-value interbank transactions, that are repetitive and periodic in nature. Clearly, information and communication technologies have made money transfer services much faster and at a lower cost than earlier.

In 2009, RBI mandated upper limits to cheque clearance for local/state capitals or major cities/ other locations at one-to-seven and ten-to-fourteen days respectively. From 2021 onwards, the nationwide coverage of CTS combined with speed clearing has drastically lessened the time involved.17 Also, there are no collection charges on cheques drawn on a bank located within the CTS defined grid.

16. The CTS was started in 2008 in New Delhi, and it has gradually extended to the rest of India.

17. State Bank of India’s cheque collection policy among other things states: “Cheques deposited at branch counters and Cheques deposited in the drop-box within the branch premises, before the specified cut-off time, will be sent for clearance on same day, for which the clearance period will be T+1 working day. Cheques deposited after this cut off time will be sent for clearing on next day, for which clearance period will be T+2 working days”.

281 FUNCTIONS OF A CENTRAL BANK Para 11.3

11.3.7 Credit Regulation

The total money supply is composed of currency money and bank deposits. The currency component in the total money supply is rather small. Thus, if monetary management requires a reduction or an expansion of money supply, it is more effective to do so by reducing or expanding bank money. As explained in Chapter 9, commercial banks create money supply via credit creation. The central bank acts as a regulator of this credit money, which is discussed next.

11.4 MEANS OF CREDIT CONTROL

There are several ways in which a central bank can regulate the credit creation process of the commercial banks. The word ‘regulate’ means both reduction and expansion in credit money. To avoid confusion, let us stick to one aspect, that is, reduction of credit. We can easily understand what to do if an expansion is required. Thus, from now, let credit control mean a reduction in money supply.

The central bank must address the following questions before implementing any technique.

(a) What should be the magnitude of credit control? It is a ‘how much’ question.

(b) If a single technique is to be adopted, then which one and why?

(c) If two or more techniques are to be adopted, then which ones, in what order and to what extent?

(d) What if credit control is required for a particular bank or a group of banks, not the entire banking system?

The techniques of credit control are grouped into two broad categories: selective and quantitative. Selective techniques, as the name suggests, affect only a particular bank or banks, while quantitative techniques are those which affect the credit creation capacity of all banks. Needless to say, the latter is more effective and is normally used to regulate money supply.

11.4.1 Selective Techniques

Methods like rationing of credit, changes in margin requirements, moral persuasion and direct action come under the category of selective methods. Rationing of credit simply implies that the central bank would set an upper limit to how much credit the erring bank can create. It may also entail restricting the access of bank credit to certain sectors. For example, the central bank can prohibit a commercial bank from extending, beyond a certain limit, loan facility to industries producing luxuries.

Margin requirements are related to the collateral. The banks demand and keep some assets of the borrowers as collateral which acts as an insurance against default. The collateral can be in physical or in financial forms. Normally, the banks do not give loans equal to the (then) value (price) of the asset given as collateral. It is because the price of the collateral may fall, which may induce the borrower to default and get the collateral confiscated rather than paying back the loan. It is unlikely as it may erode the borrower’s reputation, yet the possibility remains. Therefore, the banks typically keep a margin as a cushion against price

11.4 CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES 282

Para

reduction of the collateral. If the margin requirement of a particular form of collateral is 20%, then for ` 100 worth of collateral, the bank will advance ` 80 as loan at the most. The margin requirements for various forms of collateral differ depending upon their nature and price fluctuations. Clip 11.2 is a brief write-up on the link between the collateral and the Great Recession and how that didn’t apply to India.

The Great Recession of 2008 was triggered by the large-scale default on housing loans which the banks had given to people with dubious credit-worthiness in the U.S. and Europe. (Remember the term, NINJA, no income no job American!) Banks had advanced these loans to these people keeping their apartments as collateral. When large scale default occurred, these apartments were confiscated and offered for sale. This resulted in a massive decline in property prices leading to poor loan recovery as the value of the ‘collateral’ was not enough to cover even the principal. Ever wondered why such a thing never happens in India in case of loans advanced against house/real estate as collateral? You will be surprised to note the credit for this (ironically) goes to the prevalence of large-scale use of black money in property related transactions (see Clip 5.2 in Chapter 5, titled ‘Fools build houses, the wise live in them’). In India if a house is sold/purchased for, say, ` 1 crore, it is likely that 60 per cent of this amount, (` 60 lakhs) will be paid in ‘white’ while the rest in ‘black’. Now suppose the buyer approaches a bank for loan and offers his house as collateral and the bank finds this person credit-worthy. If the margin requirement is, say, 25%, the maximum amount of loan granted by the bank will be 75% of ` 60 lakh, that is, ` 45 lakh. In such a case even if the value of collateral declines sharply, the bank will still be safe. Remember! The de facto value of the collateral is ` 1 crore. What an irony! Black money saved Indian banks.

To regulate credit, the central bank can increase the margin requirement in case of a few commodities and for a particular bank or a group of banks. The central bank may also exert moral pressure on a particular bank through oral and/or written communication. The erring bank is expected to fall in line for fear of stricter actions. If a bank ignores the moral persuasion of the central bank, it can be subjected to a more direct and unpalatable action from the central bank. An extreme, albeit rather rare, example will be to withdraw the recognition of the bank by de-scheduling it, if it happens to be a scheduled commercial bank. A scheduled commercial bank is one which is listed In Schedule II of the RBI Act. Scheduled commercial banks enjoy a greater degree of trust of the depositors. Next time you happen to go to a bank branch just check whether it is a scheduled commercial bank or not.

11.4.2 Quantitative techniques

The quantitative techniques are used for comprehensive control of money supply. They include 1. Changes in Bank Rate, 2. Variations in Cash and Liquidity Reserve Requirements and 3. Open Market Operations.

Bank rate or the repo rate

Recall that the bank/repo rate is the rate of interest at which the central bank lends money to commercial banks. It serves as the representative rate among all the rates of short-term lending by a central bank. It is, in fact, much more than a short-term interest rate: it acts as

283 MEANS OF CREDIT CONTROL Para 11.4

a signal to commercial banks with which they can read the policy stance of the central bank. The lending rates of the commercial banks are normally fixed in tune with the bank rate — which is why it is a technique of credit control. You must have understood the mechanism by now. For instance, if the central bank decides to reduce money supply (same as controlling credit), it would increase the bank rate, signalling to the commercial banks that in case of a liquidity crunch the central bank’s lending facility will be available at a higher cost.

There could be a two-fold impact on commercial banks. First, the banks could follow suit and increase the lending rate accordingly. An increase in lending rate will dampen the borrowing plans of firms and households, resulting in a reduction in borrowing from commercial banks. This would reduce the credit creation capacity of the banks. Clip 11.3 provides two examples illustrating the link between RBI’s change in the repo rate and the change in lending rates by commercial banks.

CLIP 11.3: REPO RATE CHANGES TRANSMITTING INTO BANK LENDING RATE CHANGES

June 2022: A week after RBI’s Monetary Policy Committee increased the repo rate by 50 bps, the State Bank of India, the country’s largest lender, increased its marginal cost of funds-based lending rate (MCLR) by 20 bps across all tenors with immediate effect. Other major players in banking sector too followed similarly. SBI also raised its external benchmark-based and repo-linked lending rates by 50 bps.

August 2022: SBI again raised its Marginal Cost of Lending Rate (MCLR) on loans by 20 basis points with effect from August 15, 2022. This was a reaction to RBI’s raising of the repo rate by a sharp 50 basis points. It prompted many banks to hike various kinds of lending rates they charge on borrowers.

Source: https://www.livemint.com/money/personal-finance/sbi-hikes-mclr-on-loans-emis-to-goup-11660540445161.html

https://www.business-standard.com/article/finance/sbi-raises-lending-rates-hdfc-bank-and-bob-increase-deposit-rates-122061501085_1.html

Second, what if a commercial bank has a comfortable liquidity position in its own asset structure and does not foresee any compulsion to seek central bank’s loan in the near future? It would be least worried about an increase in the bank rate. Theoretically, a commercial bank need not restrict its credit creation. Does it then mean that the bank rate policy is of limited use as a technique of credit control? To an extent, the answer is yes. As a matter of fact, large commercial banks normally have comfortable liquidity positions and do not seek the central bank’s lending facility. However, the utility of the bank rate policy lies in that it acts as a warning signal. An increase in the bank rate is an advance signal to commercial banks who would understand that the central bank wants to restrict credit. If the commercial banks do not control credit on their own, the central bank may follow suit with more comprehensive techniques.

Thus, the bank rate or the repo rate serves as the “bench-mark” interest rate in a country. In India, it is determined by the Monetary Policy Committee consisting of six members (three from within the Reserve Bank of India and three outside experts who are nominated) plus the Governor of the RBI as the ex officio chairman.

11.4 CENTRAL BANKING, MONETARY POLICY AND INTEREST RATES 284

Para

BUSINESS ENVIRONMENT –THE ESSENTIAL ECONOMIC ECOSYSTEM

AUTHOR : SATYA P. DAS, J.K. GOYAL, DEEPTI KAKAR

PUBLISHER : TAXMANN

DATE OF PUBLICATION : MARCH 2024

EDITION : 2024 Edition

ISBN NO : 9789357788069

NO. OF PAGES : 416

BINDING TYPE : PAPERBACK

DESCRIPTION

The textbook covers core subjects in managerial programs, focusing on Managerial Economics and the Business Environment, which are fundamental for understanding macro-economic analysis. This book discusses the multifaceted aspects of the business environment, with a special focus on the economic ecosystem. By integrating fundamental concepts with practical examples and exercises, it aims to facilitate comprehension, provide realistic insights, and offer practice opportunities for concept recall. This comprehensive textbook is designed to be an invaluable resource for B-school students at both postgraduate and graduate levels, pursuing managerial programs. It is equally beneficial for traditional degree programs incorporating macroeconomics courses. The book caters to a diverse student body, including those from engineering, science, and liberal arts backgrounds, making complex economic principles accessible to all. The Present Publication is the Latest Edition, authored by Prof. (Dr.) Satya P. Das, Prof. (Dr.) J.K. Goyal, and Prof. (Dr.) Deepti Kakar. The noteworthy features of this book are as follows:

• [Comprehensive Coverage] The book spans crucial topics from getting started with economic basics to in-depth analyses of fiscal and monetary policies, inflation, central banking, and macroeconomic management in an open economy

• [Accessible to All Backgrounds] Tailored to demystify economic concepts for students irrespective of their academic past, ensuring a deep understanding of managerial economics and the business environment

• [Structured Learning Path] The contents are strategically aligned with the academic structure of two-year full-time management programs, covering core papers on managerial and macro-economic analysis

• [Engaging and Informative] Unique conversational writing style, managerial implications for each topic, and various exercises, including descriptive questions, numerical problems, quizzes, and crosswords

• [Versatile Content] Incorporates essential subject matter relevant across various B-schools, regardless of course title differences such as Macro-economic Management or Economic Environment of Business.

• [Rich in Examples] This book offers an abundance of real-world and scriptural examples within the text to enhance learning and relevance

The book is structured into thirteen comprehensive chapters, each concluding with exercises to reinforce the concepts covered. Additionally, it includes answers to selected questions at the end.

Rs. 595 | USD 8

Buy Now