© All rights reserved

Price : ` 795

Published by : Taxmann Publications (P.) Ltd.

Sales & Marketing :

59/32, New Rohtak Road, New Delhi-110 005 India

Phone : +91-11-45562222

Website : www.taxmann.com

E-mail : sales@taxmann.com

Regd. Office :

21/35, West Punjabi Bagh, New Delhi-110 026 India

Printed at :

Tan Prints (India) Pvt. Ltd.

44 Km. Mile Stone, National Highway, Rohtak Road Village Rohad, Distt. Jhajjar (Haryana) India

E-mail : sales@tanprints.com

Disclaimer

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. It is notified that neither the publisher nor the author or seller will be responsible for any damage or loss of action to any one, of any kind, in any manner, therefrom. This book should not be considered as professional advice on the HR policies/ Taxation/Accounting/any such matters as it is purely for easier understanding. Authors are not technical experts but rather consultants and the solution depends upon situations which may be unique to each person.

The authors, contributors and publishers in this book shall bear no responsibility for the actions and inactions made based upon the information contained in this book. No part of this book may be reproduced or copied in any form or by any means [graphic, electronic or mechanical, including photocopying, recording, taping, or information retrieval systems] or reproduced on any disc, tape, perforated media or other information storage device, etc., without the written permission of the publishers. Breach of this condition is liable for legal action.

For binding mistake, misprints or for missing pages, etc., the publisher’s liability is limited to replacement within seven days of purchase by similar edition. All expenses in this connection are to be borne by the purchaser. All disputes are subject to Delhi jurisdiction only.

ABOUT THE AUTHOR

i ii iii iv I-7

Ravi Mamodiya

CONTENTS PAGE Foreword I-5 About the Author I-7 Preface I-9 Acknowledgement I-11 Prologue I-13 PART I SUCCESSION INITIATION Chapter 1 Succession Foundation 3 Chapter 2 Types of Succession Planning 5 Chapter 3 Myths vs. Facts 7 Chapter 4 Succession Planning according to SEBI 11 Chapter 5 The Great Indian Family Business: Benefits and Challenges 14 I-15

Chapter 6 Conflicts of Interest in Family Business Management 20 Chapter 7 Breaking the Glass Ceiling: Overcoming Gender Bias in Succession Planning 24 Chapter 8 From Founder to Successor: Navigating Succession Planning for Female Entrepreneurs 27 Chapter 9 Passing the Torch: Succession for Startups 29 Chapter 10 The Life Cycle of Succession 34 PART II SUCCESSION PREPARATION/REHEARSAL Chapter 11 Garud View vs. Sarp View 41 Chapter 12 As Clear as Crystal 43 Chapter 13 Guiding Principles for Succeeding with Succession 45 Chapter 14 Strategies and Approach to Succession Planning 50 PAGE I-16

Chapter 15 The Wheel of Succession 57 PART III OWNER’S VISION Chapter 16 Visualising the Vision-Internal 63 Chapter 17 Visualising the Vision-External 68 PART IV THE FAMILY CONSTITUTION Chapter 18 The Purpose of a Family Constitution 77 Chapter 19 A Step Before Family Constitution 82 Chapter 20 The Family Constitution: A Tool for Family Governance 84 Chapter 21 Steps for Building the Family Constitution 91 Chapter 22 Drafting the Family Constitution 95 Chapter 23 Challenges in Constitution Building 98 PAGE I-17

PART

ALIGNING THE FAMILY AND THE BUSINESS Chapter 24 The Three Circle Model 107 Chapter 25 Parallel Planning Process 111 Chapter 26 Guiding Principles for Family Succession Planning 114 Chapter 27 Contingency Plan 121 PART VI SUCCESSOR IDENTIFICATION AND GROOMING Chapter 28 Identifying the Leader 131 Chapter 29 The Three-step Model: Assessment, Management and Grooming (AMG) 137 Chapter 30 AMG - Step 1: Assessment 139 Chapter 31 AMG - Step 2: Management 144 Chapter 32 AMG - Step 3: Grooming 147 PAGE I-18

V

Chapter 33 Selecting the Successor 152 PART VII OWNERSHIP TRANSFER & ESTATE PLANNING Chapter 34 Mapping Out Estate Planning 163 Chapter 35 Type of Estate Succession 165 Chapter 36 Intestate Succession in Hindus: One Without a Will 167 Chapter 37 Intestate Succession in Muslims: One Without a Will 179 Chapter 38 Intestate Succession in Parsi: One Without a Will 185 Chapter 39 Intestate Succession in Christians and Others: One Without a Will 191 Chapter 40 Intestate Succession Process and Role of Domicile 202 Chapter 41 Succession Certificate 207 Chapter 42 Testamentary Succession: One with a Will 211 PAGE I-19

Chapter 43 Taxation of Intestate & Testamentary Succession 219 Chapter 44 Private Trust 222 Chapter 45 Hindu Undivided Family 247 Chapter 46 Breaking Some Other Myths 253 PART VIII SUCCESSION IN THE SERVICE INDUSTRY Chapter 47 Definition and Difference between Service and Business 261 Chapter 48 Next Steps for Successful Succession Planning 266 Chapter 49 5-step Approach for Succession in the Service Industry 268 Chapter 50 Succession in Corporate Practice vs. SME Practice 271 PART IX EXIT STRATEGIES & LEGACY PLANNING Chapter 51 Exit Strategies 277 PAGE I-20

52 Role of Family Business in the Growth of India 282 Chapter 53 Understanding Gen Z Mindset 285 Chapter 54 The Crucial Role of Liquidity Management in Family Businesses During Transitions 287 Chapter 55 Family Office - A Tool to Continue the Legacy 294 PART X CASE STUDIES & FAQs 301 318 ANNEXURES Annexure 1: 343 Annexure 2: 352 Annexure 3: 353 AFTERWORD 357 PAGE I-21

Chapter

-CHAPTER 14 Strategies and Approach to Succession Planning 50

Figure-2

FIVE-STEP APPROACH TOWARDS FAMILY SUCCESSION PLANNING

Vision

51

Family Constitution

Aligning the business & family strategies

Identifying & Preparing successors and Leadership transition

Estate Planning

52

THREE-STEP

Identifying & Preparing Successors for Leadership

Figure-3

BUSINESS SUCCESSION PLANNING Vision -

APPROACH TOWARDS

53

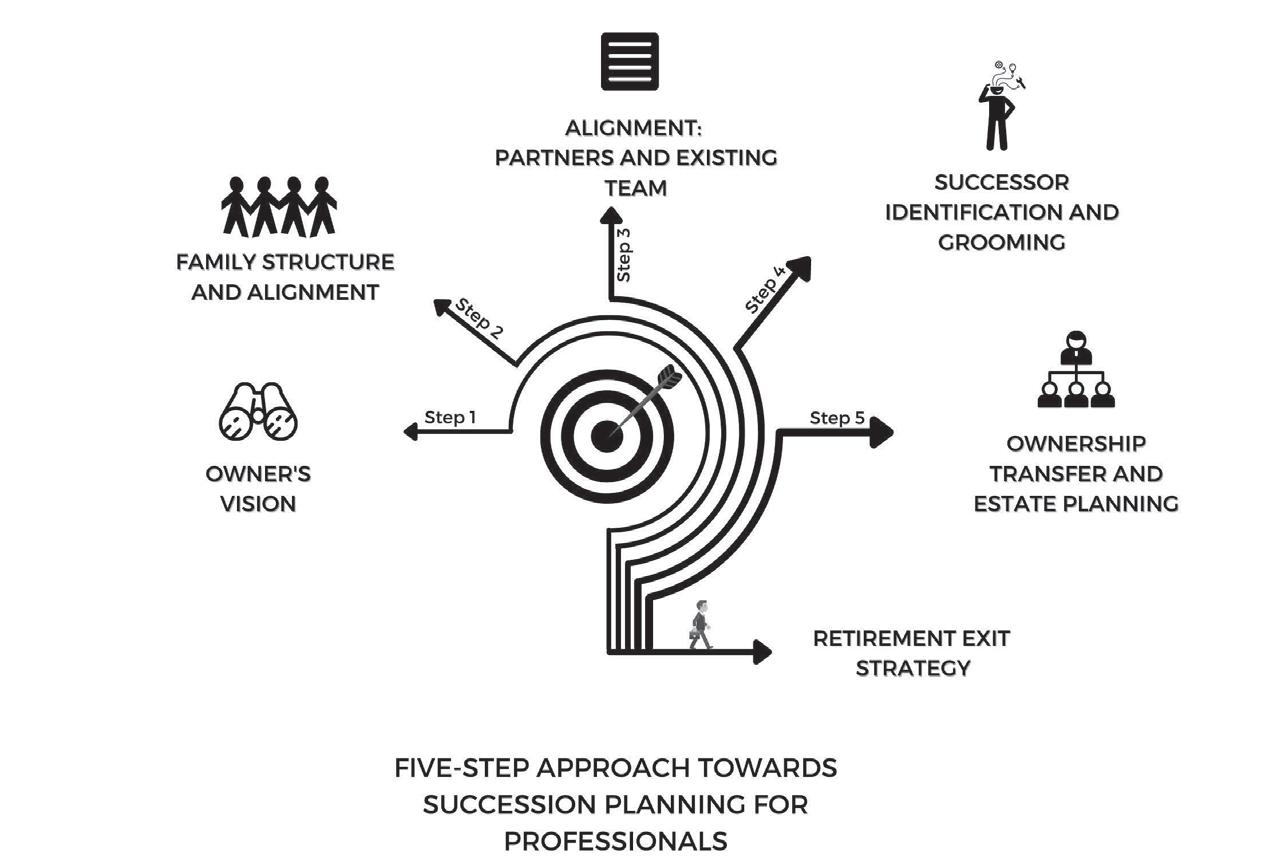

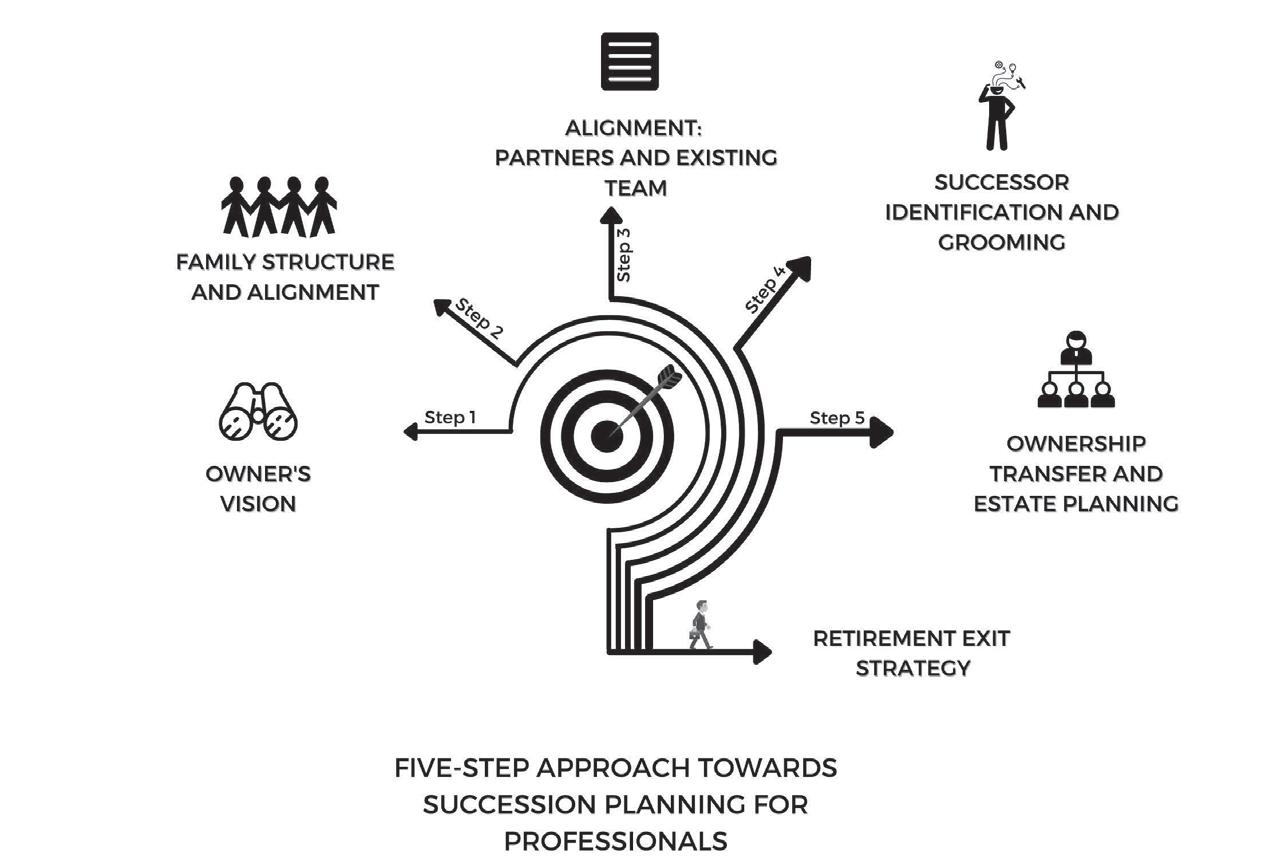

FIVE-STEP APPROACH TOWARDS SUCCESSION PLANNING FOR PROFESSIONALS

Estate Planning

Figure-3A

54

Vision -

Alignment with the Partners and the Existing Team

-

Family Structure and Alignment

-

Estate

55

Successor Identification and Grooming

Planning and Exit Strategy

56

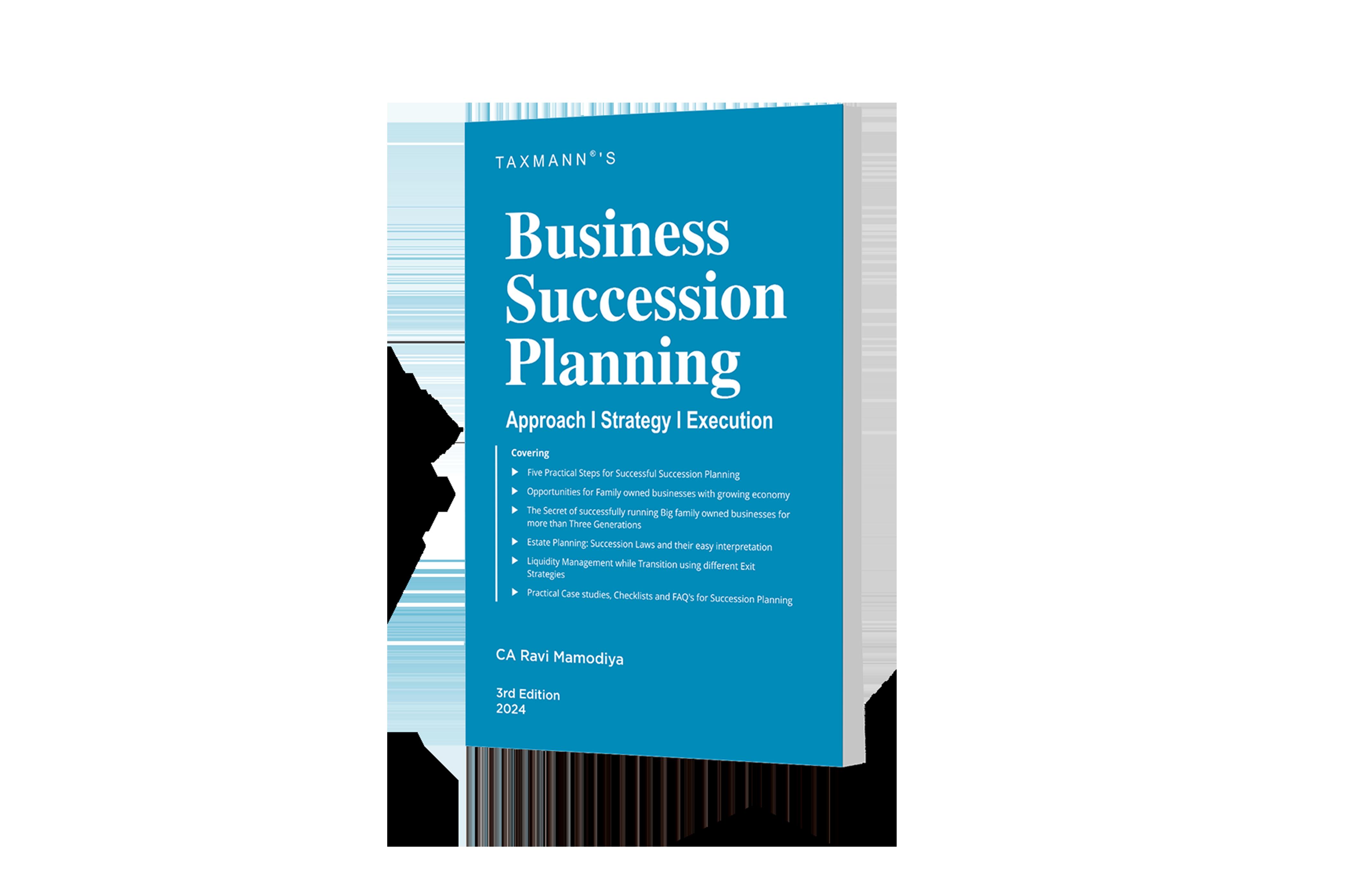

Business Succession Planning

AUTHOR : RAVI MAMODIYA

PUBLISHER : TAXMANN

DATE OF PUBLICATION : APRIL 2024

EDITION : 3rd Edition

ISBN NO : 9789357788632

NO. OF PAGES : 384

BINDING TYPE : PAPERBACK

DESCRIPTION

This book provides answers to the readers' primary questions about succession, i.e.

• Where to begin?

• The ways to implement

Rs. 795 | USD 11

The sole purpose is to help the reader understand the basics of succession in a simplified manner. It will be helpful for professionals and business owners to understand the critical aspects of succession planning and create strategies for better business continuity planning.

The Present Publication is the 3rd Edition, authored by CA Ravi Mamodiya, with the following noteworthy features:

• [Five-Step Approach] to handle the wheel of succession to plan, manage and see the expectations

• [Technicalities explained in a Simple Manner] To avoid getting caught in the web of laws & rules, the author has presented the technicalities suited for a layperson, too

• [Diagrams, Charts, Case Studies & FAQs] are embedded in the book to help the reader to gain better insights on the topic

• [Summaries] Each chapter consists of key takeaways to revisit the learnings and remember the important points to solve the readers' doubts and provide clarity

• [Authors' Personal Experience] with different clients, including those faced amongst family, friends, and relatives, are included in the book to help the reader grasp the practicalities and realities of day-to-day life

• [Discussion on Estate Planning] which includes:

o Indian Succession Act

o Hindu Succession Act

o Shariat Law

o Private Trust and its Law, along with the applicability of the Income-tax Act in different situations

o Creation of HUF & its Taxation

• [Liquidity Management] This book covers the cruciality of liquidity management during the transition of generation and adoption of various exit strategies. It provides practically implementable tools to continue the legacy. It clears out the basic queries through FAQs and checklists to help the reader summarize and understand the succession in the best possible ways.

Reviews

Shivram Sethuraman | PGDM IIM Lucknow

Independent Director Apollo Home Healthcare Ltd. | Ex-Director – Deloitte Human Capital Advisory Services

"I found this book fruitful for all business owners to help them create a roadmap for a smooth transition of power from one generation to the next.

The simplicity of this book allows any kind of business owner to create a succession plan and, most importantly, guides towards how to execute such a plan practically.

The author explained the concepts very well with relatable practical examples.

The 'Five Steps' approach, which he discusses in the book, brings absolute clarity on the continuity process and draws out a clear pathway for succession."

BUY NOW