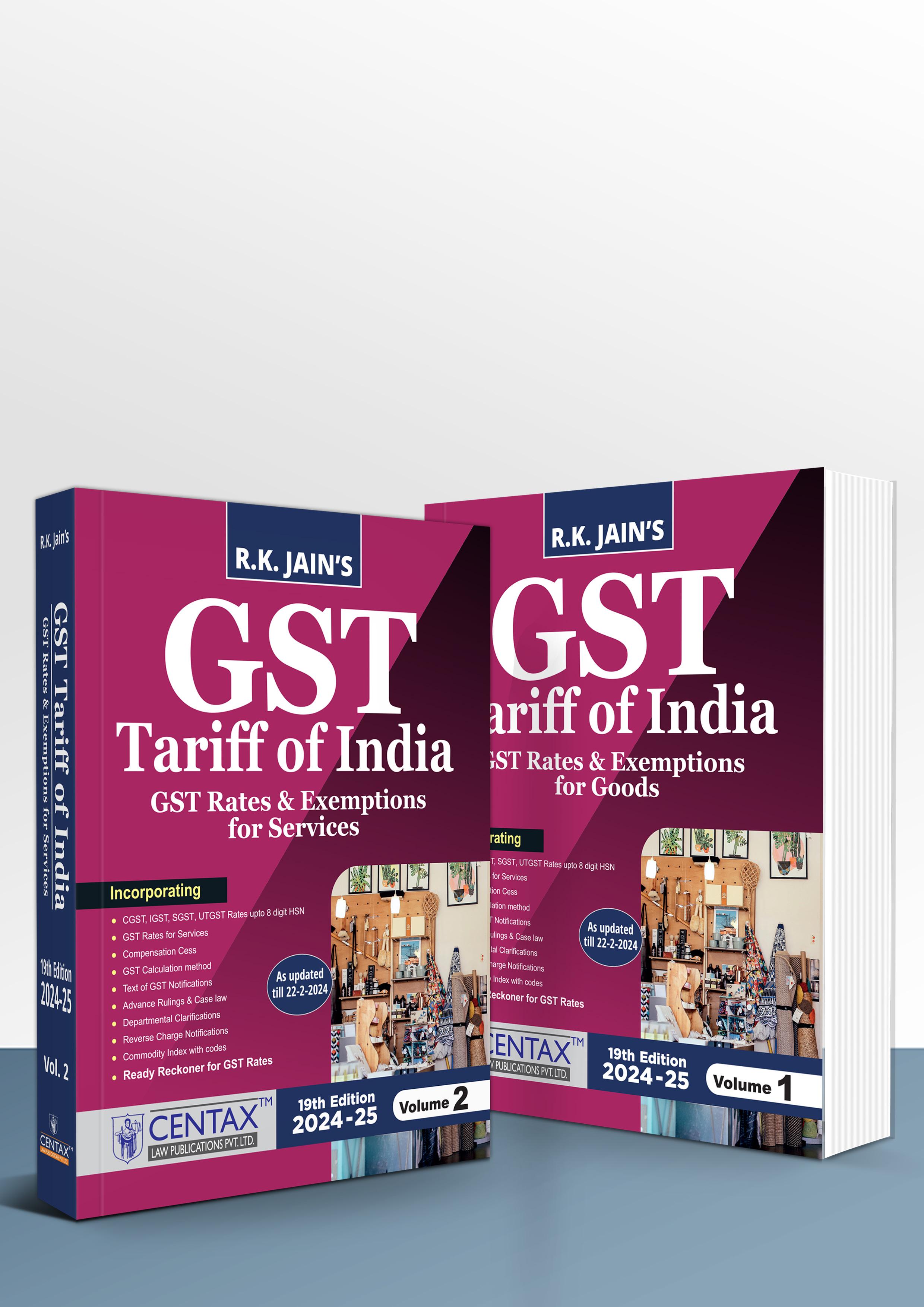

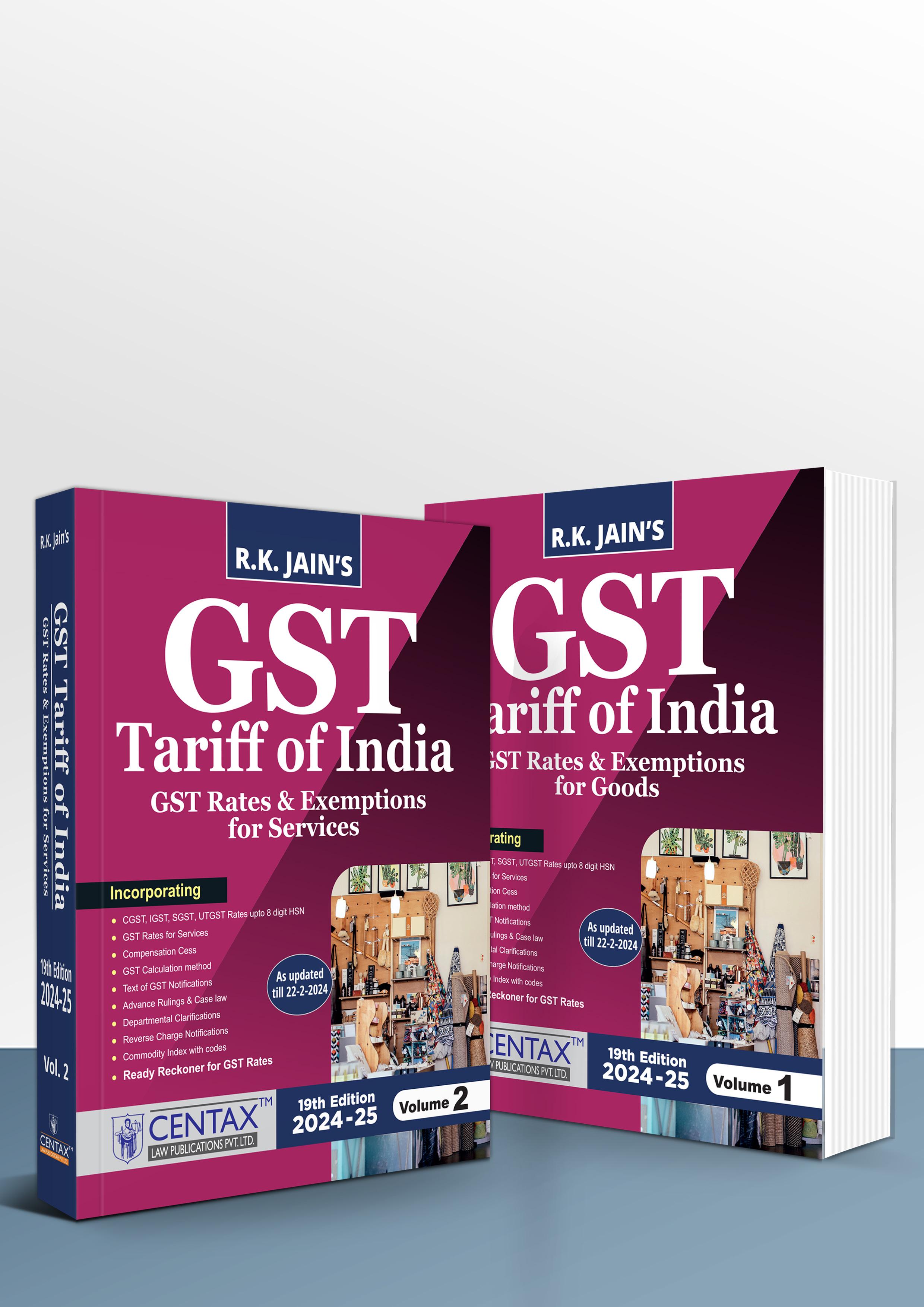

Published by : CENTAXTM LAW PUBLICATIONS PVT. LTD.

59/32, New Rohtak Road, New Delhi-110 005 INDIA

Tel. : 011-40749999, E-mail : sales@centax.co.in

Website : centaxonline.com © CENTAXTM

[

Price : ` 3595/(for a set of two vols.)

ISBN : 978-93-91055-67-7

Printed at :

Tan Prints (India) Pvt. Ltd.

44 Km. Mile Stone, National Highway, Rohtak Road

Village Rohad, Distt. Jhajjar (Haryana) India

E-mail : sales@tanprints.com

Disclaimer

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. It is

be responsible for any damage or loss of action to any one, of any kind, in any manner, therefrom. It is suggested that to avoid any doubt the reader should cross-check all the facts, law and contents of the publication with original Government

No part of this book may be reproduced or copied in any form or by any means [graphic, electronic or mechanical, including photocopying, recording, taping, or information retrieval systems] or reproduced on any disc, tape, perforated media or other information storage device, etc., without the written permission of the publishers. Breach of this condition is liable for legal action.

For binding mistake, misprints or for missing pages, etc., the publisher’s liability is limited to replacement within seven days of purchase by similar edition. All expenses in this connection are to be borne by the purchaser.

All disputes are subject to Delhi jurisdiction only.

As updated

] First Edition 2017 (June) 2nd Edition 2017 (July) 3rd Edition 2017 (Aug.) 4th Edition 2018 (Feb.) 5th Edition 2018 (May) 6th Edition 2018 (July) (Leap Ed.) 7th Edition 2018 (Aug.) 8th Edition 2019 (Feb.) 9th Edition 2019 (Apr.) 10th Edition 2019 (July) Reprint 2019 (July) 11th Edition 2019 (Sept.) Reprint 2019 (Oct.) 12th Edition 2020 (Feb.) Reprint 2020 (Feb.) 13th Edition 2021 (Feb.) 14th Edition 2021 (June) 15th Edition 2022 (Feb.) 16th Edition 2022 (Aug.) 17th Edition 2023 (Feb.) 18th Edition 2023 (June) Reprint 2023 (Aug.) 19th Edition 2024 (March)

till 22-2-2024

CONTENTS OF GST TARIFF (GOODS) — GST RATES & EXEMPTIONS 1. Live animals .......................................................................................................................................................................................... 71 2. Meat and edible meat offal ................................................................................................................................................................... 77 3. Fish and crustaceans, molluscs and other aquatic invertebrates .................................................................................................... 88 ........... 107 ................................................................................................... 115 ..................................................... 123 7. Edible vegetables and certain roots and tubers ............................................................................................................................... 127 8. Edible fruit and nuts; peel of citrus fruit or melons ........................................................................................................................ 137 9. Coffee, tea, mate and spices ................................................................................................................................................................ 149 10. Cereals ……… ...................................................................................................................................................................................... 161 11. Products of the milling industry; malt; starches; inulin; wheat gluten ........................................................................................ 168 12. Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodder … ........................................................................................................................................................................................ 176 13. Lac; gums, resins and other vegetable saps and extracts ............................................................................................................... 191 ........................................................... 197 15. Animal, vegetable or Microbial fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes..................................................................................................................................................................................................... 202 ...................................... 217 17. Sugars and sugar confectionery ......................................................................................................................................................... 223 18. Cocoa and cocoa preparations ........................................................................................................................................................... 230

.......................................................................................... 234 20. Preparations of vegetables, fruit, nuts or other parts of plants ..................................................................................................... 242 21. Miscellaneous edible preparations .................................................................................................................................................... 252 22. Beverages, spirits and vinegar ........................................................................................................................................................... 265 23. Residues and waste from the food industries; prepared animal fodder ..................................................................................... 274 24. Tobacco and manufactured tobacco substitutes; products, whether or not containing nicotine, intended for inhalation without combustion; other nicotine containing products intended for the intake of nicotine into the human body .......... 285 25. Salt; sulphur; earths and stone; plastering materials, lime and cement....................................................................................... 293 26. Ores, slag and ash ................................................................................................................................................................................ 308 27. Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes.................................. 317 28. Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, of radioactive elements or of isotopes ....................................................................................................................................................................... 333 29. Organic chemicals ................................................................................................................................................................................ 353 30. Pharmaceutical products .................................................................................................................................................................... 395 31. Fertilisers …… ...................................................................................................................................................................................... 419 32. Tanning or dyeing extracts; tannins and their derivatives; dyes, pigments and other colouring matter; paints and varnishes; putty and other mastics; inks .......................................................................................................................................... 427 33. Essential oils and resinoids; perfumery, cosmetic or toilet preparations .................................................................................... 445 waxes, polishing or scouring preparations, candles and similar articles, modelling pastes, “dental waxes” and dental preparations with a basis of plaster. ..................................................................................................................................... 457 ..................................................................................................... 466 36. Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations ........................................ 472 37. Photographic or cinematographic goods ......................................................................................................................................... 477 38. Miscellaneous chemical products ...................................................................................................................................................... 486 39. Plastics and articles thereof ................................................................................................................................................................ 506 40. Rubber and articles thereof................................................................................................................................................................. 534 41. Raw hides and skins (other than furskins) and leather. ................................................................................................................. 550

42. Articles of leather; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silk-worm gut). ................................................................................................................................................................ 557 ............................................................................................................................ 564 44. Wood and articles of wood; wood charcoal ..................................................................................................................................... 569 45. Cork and articles of cork ..................................................................................................................................................................... 588 46. Manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork ............................................. 591 ............................. 595 48. Paper and paperboard; articles of paper pulp, of paper or of paperboard ................................................................................. 600 49. Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans…… ....................................................................................................................................................................................... 621 50. Silk………….. ........................................................................................................................................................................................ 636 ............................................................................................ 641 52. Cotton……… ........................................................................................................................................................................................ 650 ............................................................................. 670 ..................................................................................... 678 ....................................................................................................................................................................... 692 56. Wadding, felt and non-wovens; special yarns; twine, cordage, ropes and cables and articles thereof ................................. 705 ........... 713 58. Special woven fabrics; tufted textile fabrics; lace; tapestries; trimmings; embroidery .............................................................. 720 59. Impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use .................. 729 60. Knitted or crocheted fabrics ............................................................................................................................................................... 739 61. Articles of apparel and clothing accessories, knitted or crocheted........................................................................................ 745 62. Articles of apparel and clothing accessories, not knitted or crocheted. ....................................................................................... 761 63. Other made up textile articles; sets; worn clothing and worn textile articles; rags ................................................................... 780

64. Footwear, gaiters and the like; parts of such articles ...................................................................................................................... 792 65. Headgear and parts thereof ................................................................................................................................................................ 800 66. Umbrellas, sun umbrellas, walking-sticks, seat-sticks, whips, riding-crops and parts thereof ............................................... 805 .............. 809 68. Articles of stone, plaster, cement, asbestos, mica or similar materials ........................................................................................ 814 69. Ceramic products ................................................................................................................................................................................. 825 70. Glass and glassware............................................................................................................................................................................. 834 71. Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin .................................................................................................................................. 846 72. Iron and steel ........................................................................................................................................................................................ 862 73. Articles of iron or steel ........................................................................................................................................................................ 891 74. Copper and articles thereof ................................................................................................................................................................ 911 75. Nickel and articles thereof .................................................................................................................................................................. 922 76. Aluminium and articles thereof ......................................................................................................................................................... 928 77. (Reserved for possible future use in the Harmonized System) 78. Lead and articles thereof ..................................................................................................................................................................... 940 79. Zinc and articles thereof ...................................................................................................................................................................... 945 80. Tin and articles thereof .........................................................................................................................................................................950 81. Other base metals; cermets; articles thereof ..................................................................................................................................... 954 82. Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal ....................................................... 963 83. Miscellaneous articles of base metal ................................................................................................................................................. 973

84. Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof ....................................................................... 982 85. Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles ......................................................................... 1065 ............................ 1117 87. Vehicles other than railway or tramway rolling-stock, and parts and accessories thereof. ................................................... 1125 88. Aircraft, spacecraft, and parts thereof............................................................................................................................................. 1153 .................. 1159 90. Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof ........................................................................................................................................ 1167 91. Clocks and watches and parts thereof ............................................................................................................................................ 1196 92. Musical instruments; parts and accessories of such articles ........................................................................................................ 1204 93. Arms and ammunition; parts and accessories thereof ................................................................................................................. 1211 94. Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; luminaires and like; prefabricated buildings ............................................................................................................................................................. 1216 95. Toys, games and sports requisites; parts and accessories thereof .............................................................................................. 1226 96. Miscellaneous manufactured articles .............................................................................................................................................. 1235 97. Works of art, collectors’ pieces and antiques ................................................................................................................................. 1247 98. Project imports; laboratory chemicals; passengers’ baggage, personal importations by air or post; ship stores; actionable claims ................................................................................................................................................................................ 1253 98A. Miscellaneous goods falling under all or any chapter of GST Tariff..........................................................................................1259

GST TARIFF SERVICES CONTENTS (A) 1433 (B) ............................................. 1485 — 1485 — ...................................................... 1522 or services 1550 — Refund of unutilized input tax supply credit of services not permissible for goods of construction of a complex, building or a part thereof, intended for sale to a buyer, wholly or partly, where the amount charged from the recipient of service includes the value of land or undivided share of land under CGST Act ...................... 1551 — Exemption to goods and services supplied to specialized agency of UNO, Embassies and other ............................ 1551 — Electronic Commerce Operator notify to pay tax for the services provided for transportation of passengers by Radio taxi, Motor Cab, Maxi Cab, Motor cycle or any other motor vehicle except omnibus, an omnibus except where person supplying such service through electronic commerce operator is a company, services of providing accommodation in hotels, Guest houses, Clubs, Campsites and other commercial places, etc. services by way of house-keeping, i.e. plumbing, carpentering, etc. and restaurant services other than services supplied by restaurant, eating joints etc., except where the person supplying such service is liable for registration under CGST 1552 — Exemption from CGST to intra-State supplies of goods and services received by a TDS deductor from any supplier who is not registered 1552 — Exemption to intra-State supply of heavy water and nuclear fuels by deptt. of Atomic Energy to NPCIL — ........................... 1552 — Special procedure for payment of CGST for construction under transfer of development rights — 1553 mine Petroleum Crude or Natural Gas — 1553 — ` ` 1553 1554 — 1556 1591 — Exemption to inter-State supply of services by small taxpayers with Annual All India turnover up to ` ` 1623 or services under IGST 1623

— Refund of unutilized input tax supply credit of services not permissible for goods of construction of a complex, building or a part thereof, intended for sale to a buyer, wholly or partly, where the amount charged from the recipient of service includes the value of land or undivided share of land under IGST Act

— Electronic Commerce Operator notify to pay tax for the services provided for transportation of passengers by Radio taxi, Motor Cab, Maxi Cab, Motor cycle or any other motor vehicle except omnibus, an omnibus except where person supplying such service through electronic commerce operator is a company, services of providing accommodation in hotels, Guest houses, Clubs, Campsites and other commercial places, etc. services by way of house-keeping, i.e. plumbing, carpentering, etc. and restaurant services other than services supplied by restaurant, eating joints etc., except where the person supplying such service is liable for registration under IGST

..................... 1623

.......................................... 1623 authorised operation from IGST 1624 — Special procedure for payment of IGST for construction under transfer of development rights — 1624 mine petroleum crude or natural gas — 1625 — Exemption from IGST to Royalty and Licence fee included in transaction value under Rule 10(1)(c) of Customs Valuation Rules — ............ 1625 1625 1626 (C) 1629 (D) ......... 1703 — FAQs (Short) on Services — 1703 — FAQs on Health Services — 1704 — FAQs on GST Services and ITC — 1705 — FAQs on Accommodation services, betting and gambling in casinos, horse racing, admission to cinema, homestays, printing, legal services, etc. — 1706 — FAQs on Transport & Logistics Services — 1709 — FAQs on bus body building, tyre retreading services, PSLCs’ recovery services under State Electricity Act and guarantee commission paid for guarantee provided by State Government to State owned companies services as per GST Council meeting held on 9th, 10th & 13th Janu1711 — FAQs on Banking, Insurance and Stock Brokers Sector — 1712 — FAQs on levy of GST on Supply of Services to Co-operative Society — 1730 ping) or otherwise - Exemption from GST ...................................... 1731 — Ambulance services provided to Government by private service providers under the National Health Mission (NHM) exempt from GST 1731 — Asian Development Bank (ADB) and International Finance Corporation (IFC) 1731

— Business Facilitator (BF) services or Business Correspondent (BC) services to Banking Company 1731 — Car servicing - Taxability under GST 1732 — Composite supply and Mixed supply under GST 1732 PMAY, RAY, etc. - Effective rate of GST ....................................... 1732 — 1732 — Co-operative Housing Societies Services under GST 1734 — Educational Institutions providing food and beverage services 1734 — Education Services under GST 1734 1734 — Food and beverage services by educational institution .................................. 1734 1735 — Goods Transport Agency (GTA) under GST ........................................ 1735 — Hotel Accommodation - GST Rates for Room Tariff also applicable to Five Star Hotels 1735 — Hostel (College) Mess Fees .................................................. 1735 — Hostel - Lodging in Hostels fully exempted 1735 — IIMs programmes and Courses - Taxability under GST ................................. 1736 — Industrial Training Institutes (ITI) - Taxability of ITI services under GST 1737 — Input Service Distributor (ISD) under GST ........................................ 1737 1737 — Job work under GST ..................................................... 1741 — Joint Venture - Taxable services between the Joint Venture (JV) and its members or inter se 1741 — Legal Services by Advocates including Senior Advocates under Reverse Charge - No change due to GST 1742 — Legal services - Reverse Charge Mechanism 1742 — Online Information Database Access and Retrieval (OIDAR) under GST 1742 — Plantation Services - GST rate on services rendered by way of plantation activities 1742 1743 1743 — Printing of pictures services 1743 — Railways Catering services - Uniform GST rate of 5% on all catering services in trains or on platforms. ......................................................... 1743 — Railways - GST rates for supplies made to the Indian Railways 1744 — Railways - GST impact on works contracts awarded by Railways before implementation of GST ......... 1744 — Religious and Charitable Trusts - GST on Residential programmes or camps meant for advancement of religion, spirituality or yoga by religious and charitable trusts 1745 — Satellite Launch Services 1745 of Elephant, Camel, Rickshaw and Boat, (iii) Rental Services of self-propelled access paid to them, (v) Charges for food supplied to patients, (vi) Fee to Consumer Dispute Redressal Commission, and (vii) Production sharing contract - Taxability under GST 1745 Charitable Institutions 1748 1748vices, Hotel and Accommodation services, consumables, (3) Job work for Textile - Refund of unutilized ITC - Independent fabric processors (job workers) in textile 1749 — Tenancy rights and vacation of rented premises on pagadi - Taxability under GST .................. 1751

— Warehouse - Supply of warehouse goods before clearance for home consumption not a supply 1751 — Works contract under GST 1751 — Support services to exploration, mining or drilling of petroleum crude or natural gas or both........................................................................................................................................................................1751 — Supply of securities under Securities Lending Scheme, 1997 - Taxability ........................................................................1753 — Exemption to DG Shipping approved maritime courses conducted by Maritime Training Institutes of India .....................................................................................................................................................................................1753 — Construction Services - Activities or transactions undertaken by Government and Local Authority are excluded from term ‘business’ ..................................................................................................................................1753 .......................................................................................................................1754 — Reverse Charge Mechanism (RCM) on Renting of motor vehicle .....................................................................................1754 .............................................................1754 .......1755 — Exemption on the upfront amount payable in instalments for long term lease of plots ................................................1755 ..........................................1755 — Levy of GST on the service of display of name or placing of name plates of the donor in the premises of charitable organisations receiving donation or gifts from individual donors ....................................1756 ....................................................................................................................1757 ......................................1757 considerations are received in deferred payment (annuity) .......................................................................................1757 National Board of Examination) .....................................................................................................................................1757 Entity, in relation to construction such as of a Ropeway on turnkey basis ..............................................................1757 ................1758 — GST on service supplied by State Govt. to their undertakings or PSUs by way of guaranteeing loans taken by them ..........................................................................................................................................................1758 .........................................................................................................................1758 — Supply of ice cream by ice cream parlours ............................................................................................................................1758 — Coaching services supplied by coaching institutions and NGOs under the central sector scheme of “Scholarships for students with Disabilities” ...........................................................................................................1758 — Satellite launch services provided by NSIL ...........................................................................................................................1758 — GST on overloading charges at toll plaza ..............................................................................................................................1758 — Renting of vehicles to State Transport Undertakings and Local Authorities...................................................................1758 — Services by way of grant of mineral exploration and mining rights .................................................................................1758 — Admission to indoor amusement parks having rides etc. ..................................................................................................1758 — Services supplied by contract manufacturers to brand owners for manufacture of alcoholic .........1759 — Case Laws. ...............................................................................................................................................................................1759.3 (E) 1761 (F) 1781

The Calculation of actual amount of tax payable under GST is based on two factors. Firstly, the rate of tax and secondly, value of supply (Goods or Services). The rate of tax multiplied by the value of supply, divided by 100, is the amount of the tax payable under the GST, of course subject to Compensation Cess, if applicable.

For computing the amount of tax under GST, the following 6 steps are required to be taken :

— Find the HSN code for goods as given in the Commodity Index (Page 2069) and locate the applicable rate of GST from the seven sched-

Service Codes (SAC) for supply of services, see the list of Service Codes given in Part 3 of this Tariff.

— There are four types of GST which are leviable on goods and services. On supplies of goods and services,

supplies of goods and services, you have to pay a single tax, i.e., IGST. In addition,

(1) In case, supply of your goods is exempted from CGST as per schedule ofspective authorities. Similarly, if your annual turnover is below ` exemption.

(2) Threshold Exemption — There is a threshold limit of ` ` ` 10 lakhs as the case may be below which GST on supply of goods or services or both is neither payable nor any registration is required.

(3) Composition Scheme — If you are working under composition scheme for Intra-State supplyplying alcoholic liquor) where the rate of composition levy is 2½% CGST and 2½% SGST. Composition

SGST) having an Annual Turnover in the preceding Financial Year up to ` 50 lakhs. This scheme is not applicable on Inter-State supplies.

— On the basis of the HSN code and Service Code (SAC), the actual rate at which GST is payable may be worked out, for different types of transactions, in the following manner :

(a) Intra-State (within State) supply of Goods. — For other taxable supplies of goods, GST has to be paid on making supply. For intra-State supplies, you have to pay two types of GST viz.

(b) Inter-State (Outside State) supply of Goods. — For Inter-State supply of goods, only one GST, i.e., IGST has to be paid. For rates please see seven Schedules with IGST rate of 5%, 12%, the applicable rate against description of goods supplied by you. Goods which are neither

(c) Cess on Goods. — For Compensation Cess on some goods viz. Pan Masala, aerated water, CGST or SGST as the case may be.

(d) Intra-State (within State) supply of services. — For Intra-State supply of services rates of-

(e) Inter-State (Outside State) supply of services. — For Inter-State supply of services, only one -

(f) Cess on services. — Compensation Cess is also payable on services of transfer of rights in CGST as the case may be.

— As per the provisions of the value on the basis of which the GST is payable.

(2) Inclusions in Transaction Value — Broadly, transaction value will include all taxes, duties, cess, fees and charges levied under any act, except GST law (including compensation cess); any incidental pay which has been incurred by the recipient and is not included in the price like freight; subsidies linked

(3) Exclusion from Transaction Valuecluded from transaction value.

— The value of supply of goods -

Based on above position of law, the illustration below will make the concept very clear :

9.Compensation Cess @ 12% (S. No. 2 of Schedule to ` 135.60 ` 135.60

10.ter-State]

(a) If discount is not known at the time of supply, no deduction thereof will be permitted from assessable value at the time of supply.

(b) Incidental expenses include all expenses connected with supply viz. packing, commission, loading, unloading, insurance, etc.

1.Transaction value of an item say aerated water ` 1000 ` 1000 2. ` 50 ` 50 3. ` 150 ` 150 ` 30 ` 30 5. ` 1130 ` 1130 6. ` NA ` NA NA `

` `

— Tariff is the backbone of any tax law inasmuch as it gives the description of taxable items in detail on which tax is leviable. The importance of descriptive tariff becomes more prominent when multiple rates of taxation are prescribed for various items under relevant tax laws. The Government has avoidable litigation.

i.e., except of negative list of services, all other services were levi-

— In view of aforesaid and to avoid clas-

turnover is above ` ` turnover is ` ` is up to ` `

-

--

-

in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons].

— These are the supplies which have been declared as non-supplies of supply. These activities are :-

ibid

commencement of this clause.

goods entering in India.

goods have been dispatched from the port of origin located outside India but before clearance for home consumption.

refund of such tax paid on goods or services or both. Vide

-

-

— While negative and zero-rated supplies are those which are -