EXTERNAL COMMERCIAL BORROWINGS (ECB)

JULY 20, 2023

FEMA Advisory I Registered Valuer

Mobile No.-9930547923

Presented by

CA. Niki Darshak Shah

Presented by

CA. Niki Darshak Shah

JULY 20, 2023

FEMA Advisory I Registered Valuer

Mobile No.-9930547923

Presented by

CA. Niki Darshak Shah

Presented by

CA. Niki Darshak Shah

RBI/FED/2018-19/67 FED Master Direction No.5/2018-19 on ‘External Commercial Borrowings, Trade Credits and Structured Obligations’

Foreign Exchange Management (Borrowing and Lending) Regulations, 2018

notified vide Notification No. FEMA 3R/2018-RB dated December 17, 2018, as amended from time to time

Foreign Exchange Management (Guarantees) Regulations, 2000, notified vide Notification No. FEMA 8/2000-RB dated May 03, 2000, as amended from time to time.

Business

Owner’s Capital

Equity / Preference / Debt

Borrowed Capital Funds

Borrowed from India

ECB – Funds

Borrowed from Outside India

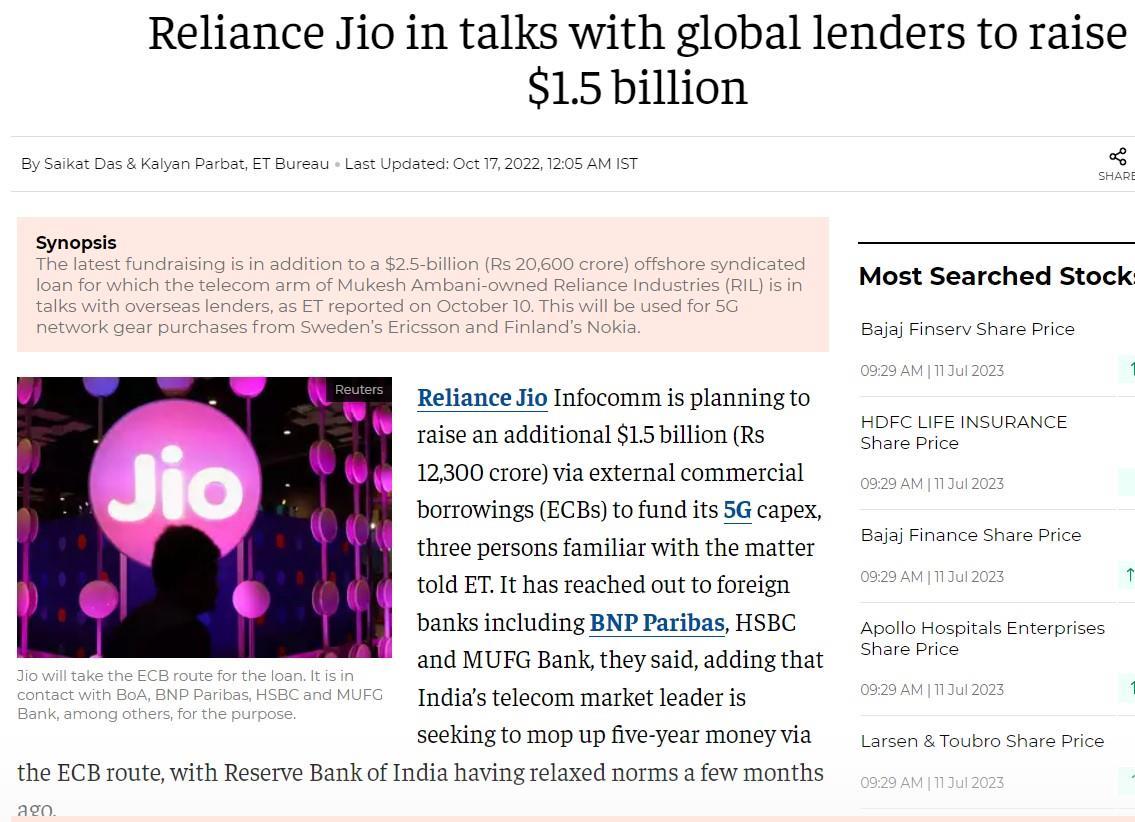

• On an Average around 1000 ECBs are raised every year

• In April 2022, the ECBs had dropped sharply since interest rates increased in global economies

• On 1 August 2022, liberalization measures were announced to the ECB policy

o Increase automatic route limit from USD 750 million to USD 1.5 billion

o Increase the all-in-cost ceiling for ECBs, by 100 bps available only to eligible borrowers of investment grade rating from Indian Credit Rating Agencies

o Available for ECBs to be raised till December 31, 2022

• Due to liberalization August and September 2022, more than USD 5.2 Billion was raised as ECB

• In November 2022, USD 5.2 Billion was raised as ECB

• 3.63 times of October 2022 of 1.43 Billion

The liberalisation was till 31st December and has not been extended

Borrowings 2022-23 (In USD MN)

Source: CEIC Data I RBI

External Commercial Borrowings for Various Purpose

• 3 months data of shows the Working Capital shows the highest ECB that has been borrowed by Indian Entity.

• Followed by New project and Modernisation

• It is beneficial to borrow ECB for Import of Capital Goods

• NBFCs are also using ECB for On-Lending and Sublending purpose

Source: RBI

LENDERS PROVIDING ECB

Lenders Providing ECB to Indian Entity

• Highest number of contributor contributing ECB are Foreign Collaborator/ Foreign Equity Holder

others 20%

Multilateral Financial Institution

4%

• Other Commercial Bank shows the highest amount of ECB contribution

• Multilateral Financial Institution, Leasing Company, Government Owned Development Financial Institution and others are also part of ECB contribution.

Other Commercial Banks

9%

Foreign Collaborator / Foreign Equity Holder

67%

Source: RBI

Economic Sectors of Borrowers

• Major borrowing happening through ECB is for Financial Service Activities

• Followed by Manufacturing sector for different products

• Other Sectors like Information Services, Warehousing, Air transport, Electricity, etc. also shows the major ECB borrowings

Financial Services Activities

Manufacturing

Information Services

Warehousing and Support

Air transport

Electricity, gas, etc

Wholesale trade

Head Office

Computer programming

Wholesale and retail

Source: RBI

1. Definition: ECBs are commercial loans raised by eligible resident entities from recognized non-resident entities.

2. Parameters: ECBs should conform to parameters such as minimum maturity, permitted and non-permitted end uses, maximum all-incost ceiling, etc.

3. The parameters given apply in totality and not on a standalone basis.

4. Route: ECB can be raised under Automatic route or under approval route

5. Approval route: prospective borrowers send their request to RBI through AD category- I Bank

Loans including bank loans

Loans including bank loans

Floating/ fixed rate notes/ bonds/ debentures (other than fully and compulsorily convertible instruments);

Floating/ fixed rate notes/bonds/ debentures/ preference shares (other than fully and compulsorily convertible instruments);

Trade credits beyond 3 years; Financial Lease Trade credits beyond 3 years; Financial Lease

FCCBs; FCEBs.

Plain vanilla Rupee denominated bonds issued overseas, which can be either placed privately or listed on exchanges as per host country regulations.

FCY denominated ECB

INR denominated ECB

FCY denominated ECB

INR denominated ECB

• All entities eligible to receive FDI

The following entities are also eligible to raise ECB Registered entities engaged in micro-finance activities,

i. Port Trusts;

ii. Units in SEZ;

iii. SIDBI; and

iv. EXIM Bank of India.

INR denominated ECB

All entities eligible to raise FCY ECB

i. Registered Not for Profit companies

ii. Registered societies/ trusts/ cooperatives

iii. Non-Government Organisations

• Registered FPI investing in Non-Convertible Debentures- ECB framework is not applicable

Note: RBI FAQ Qn 5 - LLPs are not eligible borroweras not eligible to receive FDI (LLP eligible to receive Foreign Investment under FEMA NDI [earlier FEMA 20(R)]

The lender should be resident of FATF or IOSCO compliant country, including on transfer of ECB. However,

• Multilateral and Regional Financial Institutions where India is a member country.

• Individuals can only be permitted if they are foreign equity holders

• Foreign branches / subsidiaries of Indian banks only for FCY ECB (except FCCBs and FCEBs),

• For subscription to bonds/debentures listed abroad

• Can participate as arrangers/underwriters/ market-makers/ traders for Rupee denominated Bonds issued overseas

• Underwriting by foreign branches/ subsidiaries of Indian banks for issuances by Indian banks will not be allowed.

FATF: A country that is a member of Financial Action Task Force (FATF)

IOSCO: A country whose securities market regulator is a signatory to the International Organization of Securities Commission's (IOSCO’s)

Direct foreign equity holder with minimum 25% direct equity holding in the borrowing entity

Indirect equity holder with minimum indirect equity holding of 51% Group company with common overseas parent

Disposal of shareholding not allowed during tenure of the loan

A (Foreign Resident)

Is Mr. A permitted to provide ECB directly to the Indian Co.?

ECB proceeds cannot be utilised for-

a) Real estate activities

b) Investment in capital market

c) Equity investment. (domestic)

d) Working capital purposes except from foreign equity holder.

e) General corporate purposes except from foreign equity holder.

f) Repayment of Rupee loans except from foreign equity holder.

g) On-lending to entities for the above activities, except in case of ECB raised by NBFCs

Note: RBI FAQs No. 23 - The reimbursement of expenditure incurred in the past is not a permissible end-use under the ECB framework

• Refinancing of existing ECB by raising fresh ECB is permitted provided:

‒ No reduction in outstanding maturity of the original borrowing;

‒ all-in-cost of fresh ECB to be lower than all-in-cost of existing ECB

‒ Multiple borrowings: weighted outstanding maturity / weighted average costs

• Refinancing of ECBs raised under previous ECB framework – permitted subject to Borrower being an Eligible Borrower under extant framework

• Fresh ECB is not availed from overseas branches / Subsidiaries of Indian banks except for highly rated corporates (AAA) and Maharatna / Navratna PSUs

Note: RBI FAQs No. 26 - Refinancing of INR ECB with FCY ECB is not permitted

• Allows to borrow a large volume of funds for the long term

• Cost of funds is usually cheaper if borrowed from economies with a lower rate of interest

• It allow borrowers to diversify the investor base

• Execute the plan for expansion of business

• Acquisition of assets or repayment of existing debt

MAMP for ECB will be 3 years. Call and put options, if any, shall not be exercisable prior to completion of minimum average maturity.

(a) Manufacturing Companies Upto USD 50 million or its equivalent per FY

(b) Foreign equity holder

a. Working capital purposes or general corporate purposes

b. Repayment of rupee loans

(C) Eligible Lender except foreign branches/ subsidiaries of Indian banks

a. Working capital purposes or general corporate purposes

b. on-lending by NBFCs for working capital purposes or general corporate purposes

1 Year

5 Year

10 Year

(d) Eligible Lender except foreign branches/ subsidiaries of Indian banks

a. Repayment of Rupee loans availed domestically for capital expenditure

b. On-lending by NBFCs for the same purposes

7 Year

(e) Eligible Lender except foreign branches/ subsidiaries of Indian banks

a. Repayment of Rupee loans availed domestically for purposes other than capital expenditure

b. On-lending by NBFCs for the same purposes

Note: RBI FAQs No. 14 - Repayment of principal of ECB can start before the completion of MAMP

10 Year

Sr. No. Raised by Raised upto/for MAMP• Benchmark rate plus 550 bps spread – For existing ECBs linked to LIBOR whose benchmarks are changed toARR

• Benchmark rate plus 500 bps spread – For new ECBs

• Benchmark rate plus 450 bps spread

Others

• Prepayment charge/ Penal interest, if any, for default or breach of covenants, should not be more than 2 per cent over and above the contracted rate of interest on the outstanding principal amount and will be outside the all-in-cost ceiling

Note: RBI FAQs No. 21 - All-in-cost should be within the applicable ceiling at all times, e.g., breach of all-in-cost ceiling in the first year and a much lower all-in-cost in the second year so as to comply on an average, is not permitted.

All eligible borrowers can raise ECB up to USD 750 million or equivalent per financial year under the automatic route

In case of FCY denominated ECB raised from direct foreign equity holder, ECB liability-equity ratio under the automatic route cannot exceed 7:1

This ratio will not be applicable if the outstanding amount of all ECB, including the proposed one, is up to USD 5 million or its equivalent

The borrowing entities will also be governed by the guidelines on debt equity ratio, issued, if any, by the sectoral or prudential regulator concerned.

ECB Amount

Includes all outstanding amount of all ECBs (other than INR denominated)

And The proposed one (only outstanding ECB amounts in case of refinancing)

Includes the paid-up capital and free reserves (including the share premium received in foreign currency) as per the latest audited balance sheet.

ECB and EQUITY

Amounts will be calculated with respect to the foreign equity holder.

MORE THAN ONE FOREIGN EQUITY HOLDERS

In the borrowing companythe portion of the share premium in foreign currency brought in by the lender(s) concerned shall only be considered for calculating the ratio

Note: RBI FAQs No. 18 - Any debit balance in the profit and loss account as per the latest audited balance sheet of the Eligible Borrower should be deducted from the equity

Form ECB: Borrower is required to submit Form ECB in duplicate with AD Bank. AD Bank will forward one copy to the Director, Balance of payments statistics division, Department of Statistics and Information Management, RBI

Loan Registration Number (LRN)

• Any draw-down in respect of ECB as well as payment of any fee / charges for ECB should happen only after obtaining LRN from RBI.

Changes in terms and conditions of ECB

• Revised Form ECB should be submitted with RBI DSIM in any case not later than 7 days of such changes

Monthly Reporting of actual transactions

• The borrowers are required to report actual ECB transactions through Form ECB 2 Return through the AD Category I bank on monthly basis so as to reach DSIM within seven working days from the close of month to which it relates.

• Changes, if any, in ECB parameters should also be incorporated in Form ECB 2 Return.

Delay in reporting of drawdown of ECB proceeds before obtaining LRN or delay in submission of Form ECB 2 returns can be regularized by payment of LSF as under:

Where:

‘A’ = Amount involved in the delayed reporting.

‘A’ = for any ECB-2 return will be the gross inflow or outflow (including interest and other charges), whichever is more ‘n’ = number of years of delay in submission rounded upward to the nearest month (up to 2 Decimal).

Note: RBI FAQs No. 39 & 40 - The facility for opting for LSF shall be available up to three years from the due date of reporting/ submission. Also, LSF is applicable for non-submission of each Form ECB 2, including Nil returns

Permitted subject to:

• Activity of borrowing company covered under automatic routeor required government approval is obtained for FDI;

• Conversion not to breach applicable sectoral cap under FDI policy;

• Compliance with pricing guidelines (FV on date of conversion);

• Consent of other lenders;

• Full / part conversion of ECB permitted

• Conversion at exchange rate on the date of agreement or any lesser rate with mutual consent

• If Borrowerhas other credit facilities in India, guidelines of RBI to be complied with

Eligibility

• An entity recognised as a Startup by the Central Government as on date of raising ECB

Amount, Average Maturity & All-in-costs

• Amount - USD three million or equivalent per financial year either in INR or any other convertible foreign currency or a combination of both

• Ratio - Leverage ratio and ECB Liability –Equity Ratio is not applicable.

• Maturity - Minimum average maturity period of 3 years

• All-in-cost - Mutually agreed between the borrower and lender

Recognised Lender

• Lender / investor to be a resident of FATF compliant country

• Not permissible from Overseas branches / subsidiaries of Indian banks or overseas WOS / JV of an Indian company

• Form - Loans or non-convertible or optionally convertible or partially convertible preference shares.

• End Use - For any expenditure in connection with the business of borrower

• Denominated in any freely convertible currency or in INR or a combination thereof (Hedging recommended but not mandatory)

• Conversion of ECB into equity is freely permitted –rate as per date of agreement

• Security = movable, immovable, intangible assets (including patents, IPRs), financial securities, etc.

• Issuance of corporate or personal guarantee is allowed. NR guarantee only if Eligible Lender as above. Banks / FIs / NBFCs cannot issue any guarantee, LoC, etc.

• Other provisions of ECB continue to apply and start-ups not eligible as above can choose normal ECB route as well. Start-up to have appropriate risk management policy for FX exposure arising from FCY ECB.

TC refer to credits extended directly by the overseas supplier, bank, financial institutions and other permitted recognised lenders for imports of capital/non-capital goods.

Sr. No. Parameters

(a) Forms of TC Buyers’ Credit and Suppliers’ Credit

(b) Eligible borrower Person resident in India acting as an importer

(C) Amount under automatic route

a. Up to USD 150 million or equivalent per import transaction for oil/gas refining & marketing, airline and shipping companies

b. For others, up to USD 50 million or equivalent per import transaction

a. For suppliers’ credit: Supplier of goods located outside India.

(d) Recognised lenders

b. For buyers’ credit: Banks, financial institutions, foreign equity holder(s) located outside India and financial institutions in IFSCs located in India.

a. Reckoned from the date of shipment, shall be up to 3 years for import of capital goods

(e) Period of TC

b. For non-capital goods, this period shall be up to 1 year or the operating cycle whichever is less.

c. For shipyards / shipbuilders, the period of TC for import of non-capital goods can be up to 3 years.

(f) All-in-cost ceiling per annum

a. Benchmark Rate plus 350 bps spread: For existing TCs linked to LIBOR whose benchmarks are changed to ARR.

b. Benchmark rate plus 300 bps spread: For new TCs

Benchmark rate plus 250 bps spread

Change of currency of FCY TC into INR TC can be at the exchange rate prevailing on the date of the agreement between the parties concerned for such change or at an exchange rate, which is less than the rate prevailing on the date of agreement, if consented to by the TC lender.

For conversion to Rupee, exchange rate shall be the rate prevailing on the date of settlement.

Change of currency of TC from one freely convertible foreign currency to any other freely convertible foreign currency as well as to INR is freely permitted.

Change of currency from INR to any freely convertible foreign currency is not permitted.

Trade Credits scheme for SEZ / FTWZ / DTA:

(i) TC can be raised by unit or developer in SEZ including FTWZ for purchase of capital /non-capital goods within SEZ including FTWZ or different SEZ including FTWZ;

(ii) DTA unit is also allowed to raise Trade Credit for purchase of capital /non-capital goods from a unit or a Developer of SEZ including FTWZ

FAQ:

• An Indian Shipping Company purchased a ship on suppliers credit of 3 years. The Company was not able to repay the suppliers credit within 3 years. Can the Company apply for an extension of the trade credit for 2 years?

Extension of trade credit is not allowed

Application to convert to ECB

Approval needed from the RBI through the AD Bank, it Could take 6 months

Form ECB

Form ECB-2 from the date of the trade credit

Lenders consent and other documents