GST Refunds & Amendments

with practical examples and Case studies

CA AANCHAL KAPOOR 9988692699 2

RULES

NOTIFICATIONS AND CIRCULARS

Sec. 54-58

Chapter XI

Rule 89-97A

Forms RFD-01 to RFD-11

Circular 125/2019, 135/2020, 137/2020 and other circulars

Legal

ACT

Provisions relating to refund

CA AANCHAL KAPOOR 9988692699 3

OLD CIRCULARS

Old Circulars

• Circular No. 17/17/2017- GST dated 15.11.2017

• Circular No. 24/24/2017- GST dated 21.12.2017

• Circular No. 37/11/2018- GST dated 15.03.2018

• Circular No. 45/19/2018- GST dated 30.05.2018

• Circular No. 59/33/2018- GST dated 04.09.2018

• Circular No. 70/44/2018- GST dated 26.10.2018

• Circular No. 79/53/2018- GST dated 31.12.2018

• Circular No. 94/13/2019- GST dated 28.03.2019

CA AANCHAL KAPOOR 9988692699 4

Definition of Refund

CA AANCHAL KAPOOR 9988692699 5

Explanation 1 to section 54 "refund"

1. Refund of excess balance in the electronic cash ledger;( Sec. 49(6))

includes refund of tax paid on zero-rated on inputs or input services refund of tax on the refund of unutilised

2. Refund of excess payment of tax;

3. Refund of tax paid on intra-State supply which is subsequently held to be interState supply and vice versa;( Sec. 77)

4. Refund on account of assessment/provisional assessment/appeal/any other order;`

As per Sec 54(8) & Circular 125/44/2019

SEC. 54 (REFUND OF TAX)

CA AANCHAL KAPOOR 9988692699 6

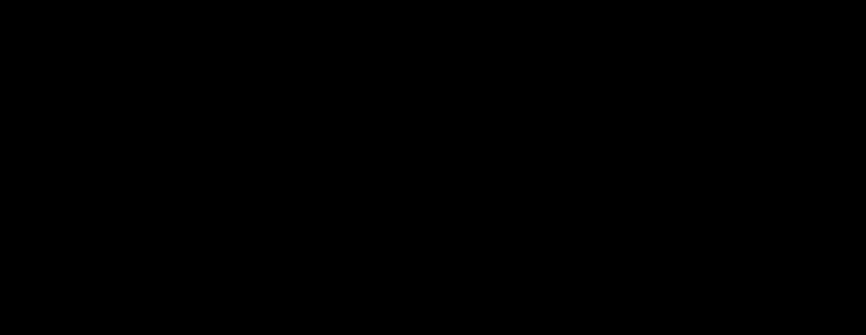

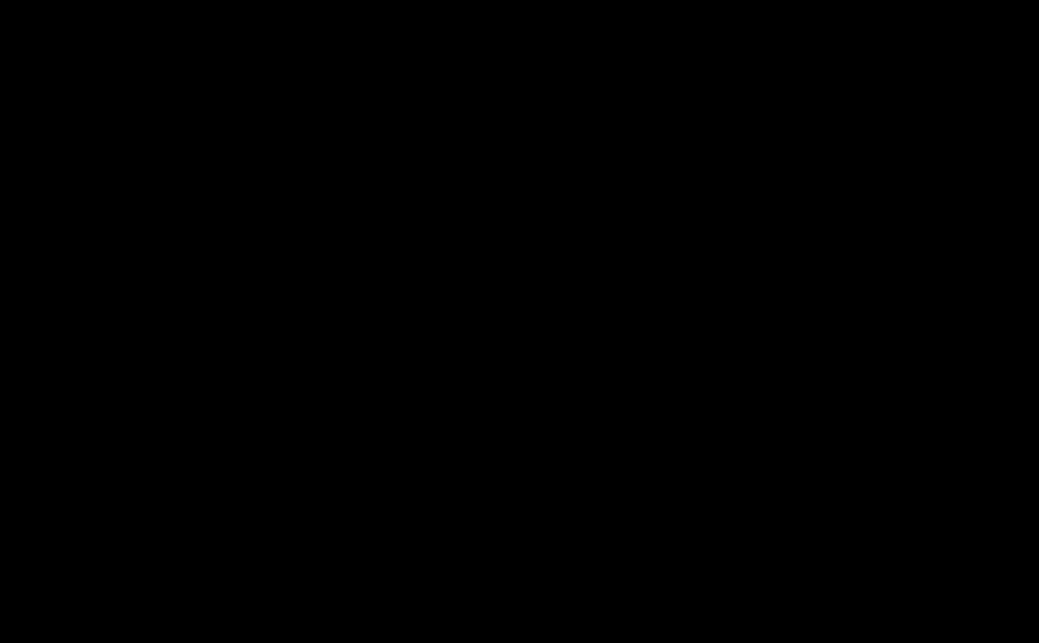

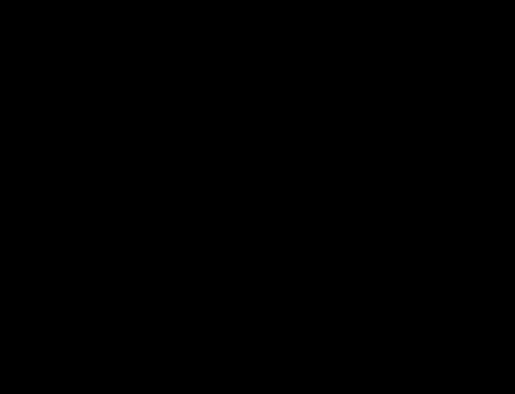

Type of Refund

CA AANCHAL KAPOOR 9988692699 7

Exports

Supplies to SEZ Unit/ SEZ Developer

Without payment of tax

with payment of tax;

Without payment of tax

with payment of tax;

Refund of unutilized ITC on account of accumulation due to inverted tax structure;

Refund of excess payment of tax;

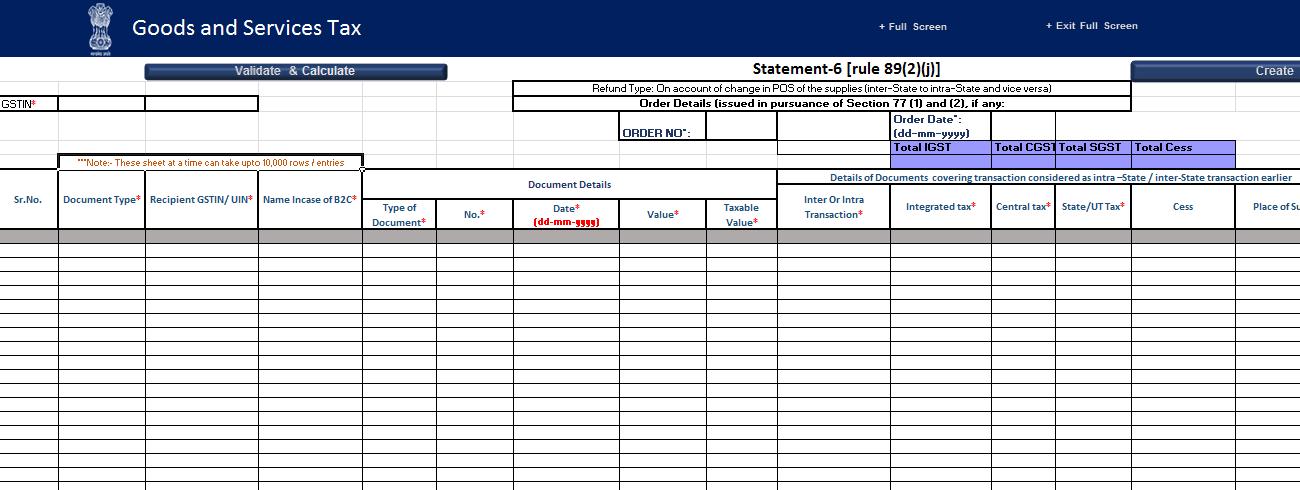

Refund of tax paid on intra-State supply which is subsequently held to be inter-State supply and vice versa;

CG, IS partly

Wrong Payment of Taxes, Sec 77

Deemed Exports

Refund on account of assessment/ provisional assessment/ appeal/any other order;

Refund of excess balance in the electro nic cash ledger; (Sec. 49(6)) 1

Refund of unutilized input tax credit (ITC)of Input or input services on account of exports.

Same as Exports

a)Goods

b) Services

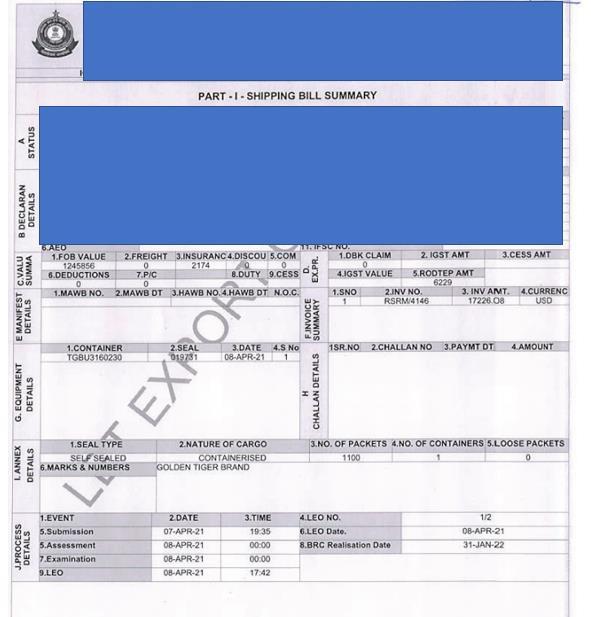

Rule 96The shipping bill filed by an exporter of goods shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India. No Separate Application Required.

Refund to supplier of tax paid on deemed export supplies;

Refund to recipient of tax paid on deemed export supplies;

per ACT & CIRCULAR

Types of refund (As

125)

Refund of tax paid on export

CG

2

3 4 5 6 7 8 9 11 12 Any

10 CA AANCHAL KAPOOR 9988692699 8

other

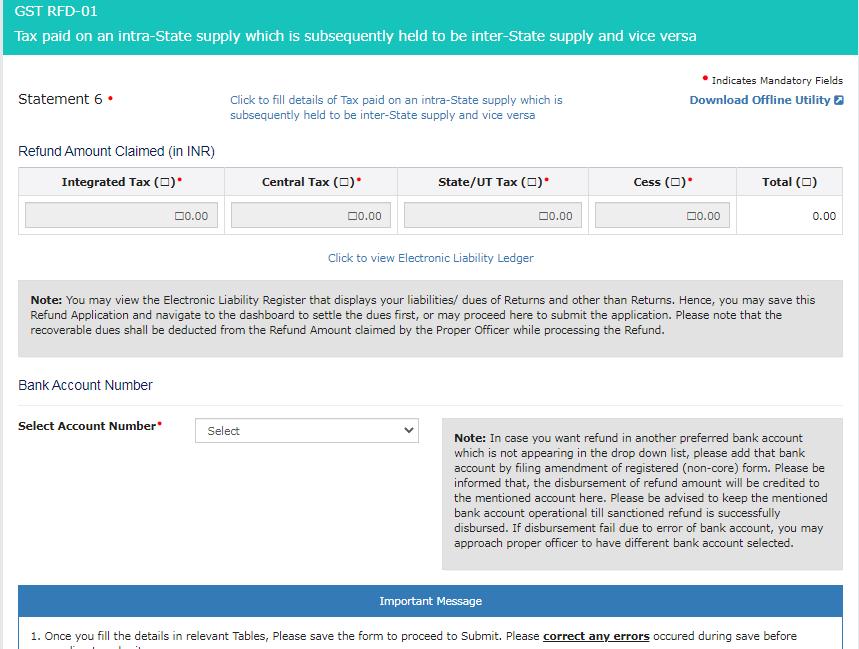

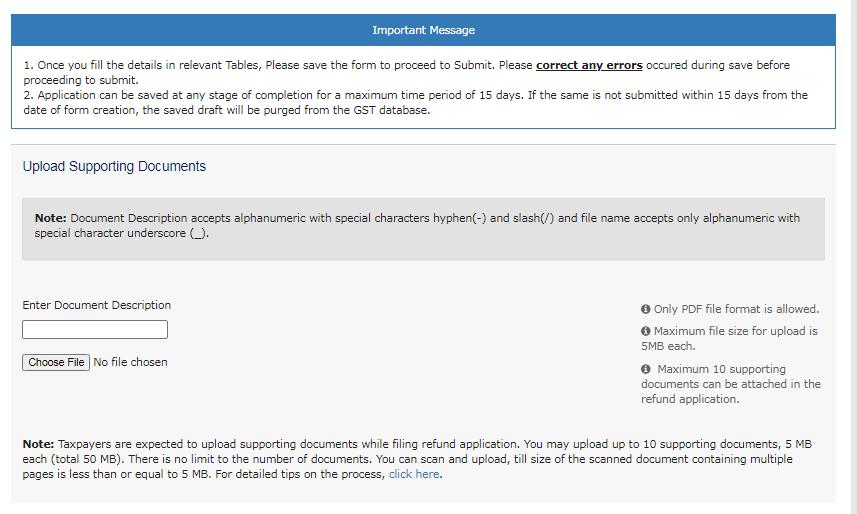

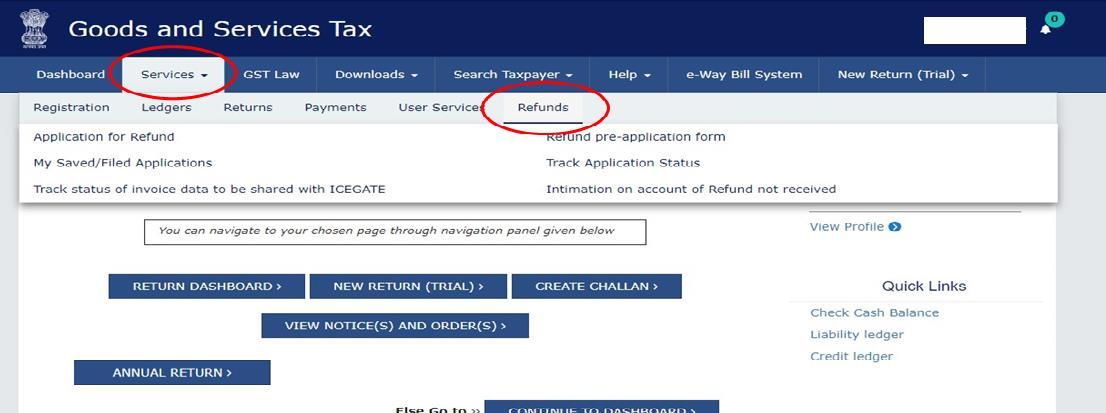

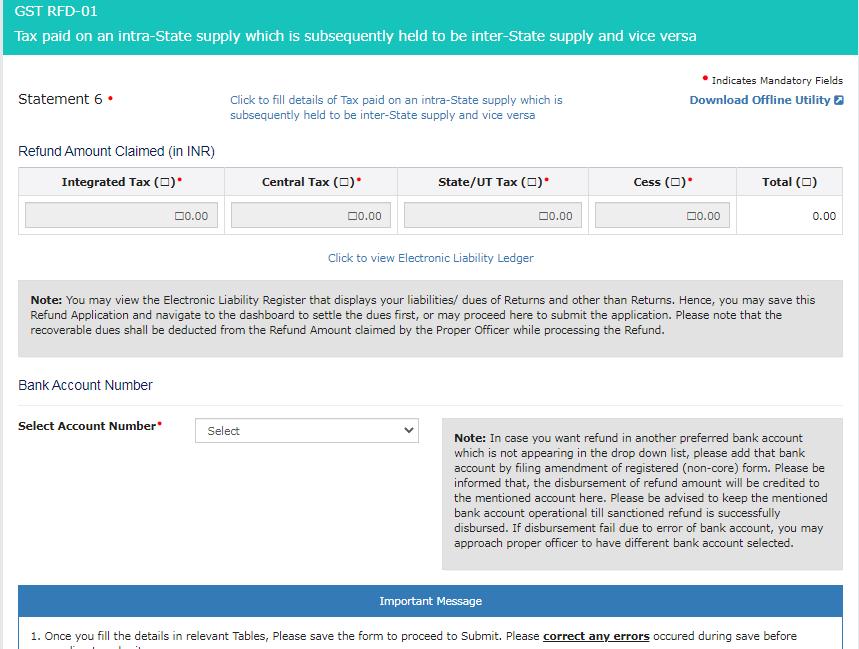

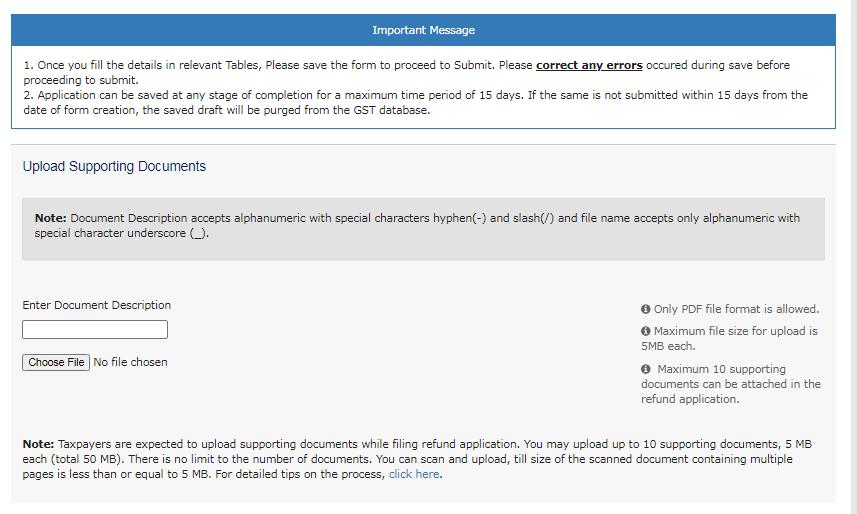

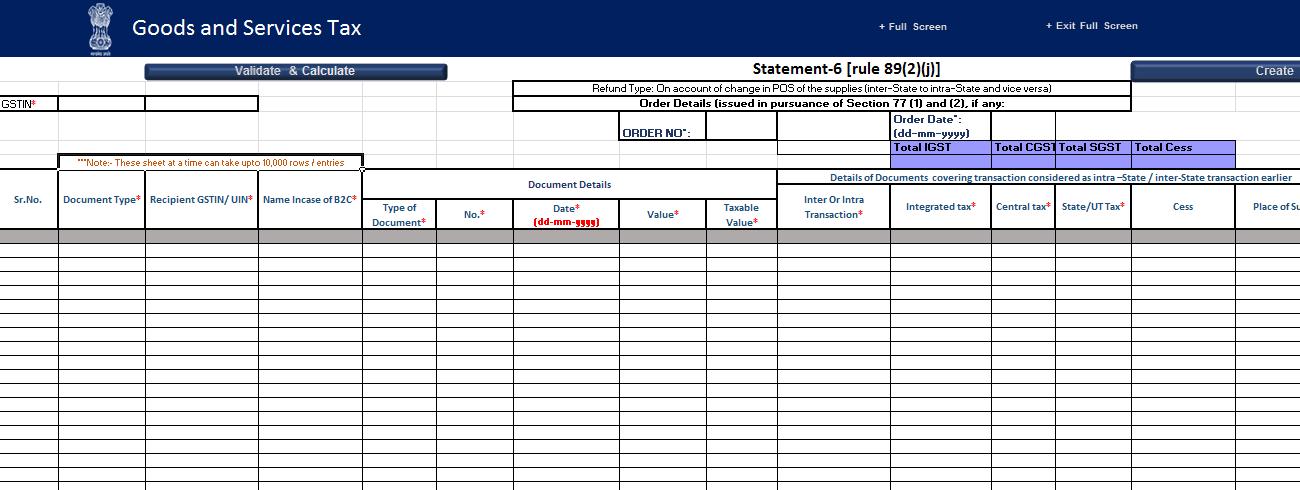

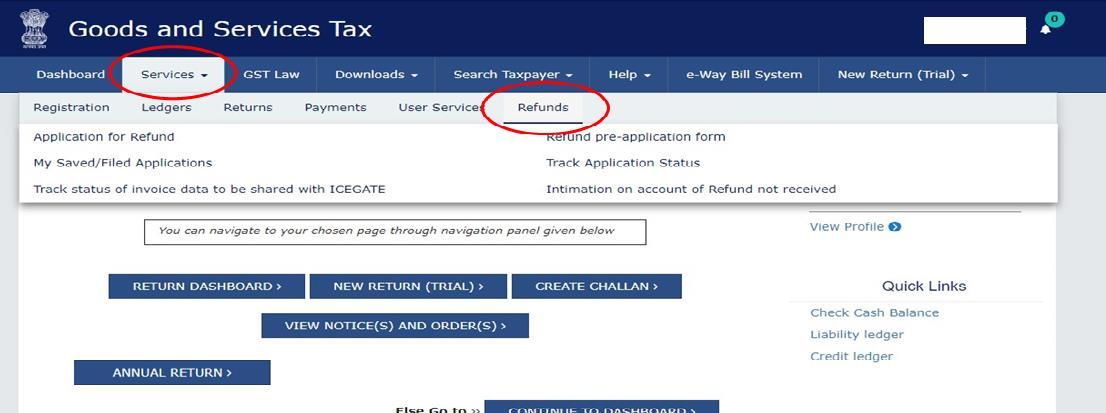

of Refund Window Fully Electronic Process for applications filed after 26.09.19 CA AANCHAL KAPOOR 9988692699 9

Screen Shot

1 2 3 4 5 6 7 8 9 10 11 12 CA AANCHAL KAPOOR 9988692699 10

Sec. 54

CA AANCHAL KAPOOR 9988692699 11

54(1) Any person claiming refund of any tax and interest, if any, paid on such tax or any other amount paid by him, may make an application before the expiry of two years from the relevant date in such form and manner as may

Form GST RFD-01

Any Person means either buyer or seller can make application of refund.

Any other Amount:- Eg. Pre deposit of appeal, penalty, Fee.

Provided that a registered person the electronic cash ledger in accordance provisions subsection (6) of section 49, may claim such refund in the return furnished under section 39 in such manner as may be prescribed.

Rule 89

(2) A specialised agency of the United Nations Organisation or any Multilateral Financial Institution and Organisation notified under the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947), Consulate or Embassy of foreign countries or any other person or class of persons, as notified under section 55, entitled to a refund of tax paid by it on inward supplies of goods or services or both, may make an application for such refund, in such form and manner as may be prescribed, before the expiry of six months from the last day of the quarter in which such supply was received.

Relevant Date:- As per explanation 2 to sec. 54

Sec. 49(6):- The balance in the electronic cash ledger or electronic credit ledger after payment of tax, interest, penalty, fee or any other amount payable under this Act or the rules made thereunder may be refunded in accordance with the provisions of section 54

Relevant Date in this case is not as per

Explanation 2 to section 54

Time period extended by 18 months in N.N. 20/2018

SEC. 54 (REFUND OF TAX)

RFD 10, Rule 95

Form GST

CA AANCHAL KAPOOR 9988692699 12

(3) Subject to the provisions of sub-section (10), a registered person may claim refund of any unutilised input tax credit at the end of any tax period.

54(10) relates to deduction from refund for unpaid amount or withhold refund until the return furnished

Provided that no refund of unutilised input tax credit allowed in cases other than—

I. zero-rated supplies made without II. where the credit has accumulated inputs being higher than (other than nil rated or fully goods or services or both as may be notified by the Government on the recommendations of the Council:

i.e. Export/ Supply to SEZ under Bond/ LUT

N.N. 5/2017 for goods

N.N. 15/2017 for services(Services as specified in 5(b) of schedule II)( construction)

Sec. 2(106) "tax period" means the period for which the return is required to be furnished;

Provided further that no refund of unutilised input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty:

Provided also that no refund of input tax credit shall be allowed, if the supplier of goods or services or both avails of drawback in respect of central tax or claims refund of the integrated tax paid on such supplies

2(62) & 2(63) Para

This point is relevant, as in case of exports the period of two years is to be checked from relevant date INDIVIDUALLY and when the two or more relevant dates fall under same tax period then the relevant date from latter should be considered, as there can be SINGLE application for a Tax period. As per Law applicant can file refund application at the end of Tax Period only, and the situation is beyond his control. But in this artificial bunching should be avoided to extend the period of Limitation and minimum tax period for which refund can be applied should be considered.

SEC. 54 (REFUND OF TAX)

125/44/2019

40 of circular

CA AANCHAL KAPOOR 9988692699 13

SEC. 2(62) Input Tax

“Input tax" in relation to a registered person, means the central tax, State tax, integrated tax or Union territory tax charged on any supply of goods or services or both made to him and includes—

a) the integrated goods and services tax charged on import of goods;

b) the tax payable under the provisions of sub-sections (3) and (4) of section 9;

c) the tax payable under the provisions of sub-sections (3) and (4) of section 5 of the Integrated Goods and Services Tax Act;

d) the tax payable under the provisions of sub-sections (3) and (4) of section 9 of the respective State Goods and Services Tax Act; or

e) the tax payable under the provisions of sub-sections (3) and (4) of section 7 of the Union Territory Goods and Services TaxAct, but does not include the tax paid under the composition levy;

SEC. 2(63) (Input Tax Credit)

“Input tax credit” means the credit of input tax

CA AANCHAL KAPOOR 9988692699 14

(4) The application shall be accompanied by—

a) such documentary evidence as may be prescribed to establish that a refund is due to the applicant; and

b) such documentary or other evidence (including the documents referred to in section 33) as the applicant may furnish to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which such refund is claimed was collected from, or paid by, him and the incidence of such tax and interest had not been passed on to any other person:

Provided that where the amount claimed as refund is less than lakh rupees, it shall not be necessary for the applicant to furnish any documentary and other evidences but he may file a declaration, based on the documentary or other evidences available with him, certifying that the incidence of such tax and interest had not been passed on to any other person.

(5) If, on receipt of any such application, the proper officer is satisfied that the whole or part of the amount claimed as refund is refundable, he may make an order accordingly and the amount so determined shall be credited to the Fund referred to in section 57.

SEC. 54 (REFUND OF TAX)

CA AANCHAL KAPOOR 9988692699 15

Eg. Export

Invoice Rule 89(2) Sec. 57 Consumer Welfare Fund Refund Order Concept of unjust enrichment

(6) Notwithstanding anything contained in sub-section (5), the proper officer may, in the case of any claim for refund on account of zerorated supply of goods or services or both made by registered persons, other than such category of registered persons as may be notified by the Government on the recommendations of the Council, refund on a provisional basis, ninety per cent of the total amount so claimed, excluding the amount of input tax credit provisionally accepted, in such manner and subject to such conditions, limitations safeguards as may be prescribed52 and thereafter make under sub- section (5) for final settlement of the refund due verification of documents furnished by the applicant

Sec. 16 of IGST Act,” Zero rated supply" means any of the following supplies of goods or services or both, namely:—

a) export of goods or services or both; or

b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit

2) Subject to the provisions of sub-section (5) of section 17 of the Central Goods and Services Tax Act, credit of input tax may be availed for making zero-rated supplies, notwithstanding that such supply may be an exempt supply

(3) A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely:

a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit; or

(7) The proper officer shall issue the order under sub within sixty days from the date of receipt of application all

b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.

Rule 91

Interest from 61st day. The amount must be credited in bank account in 60 days

SEC. 54 (REFUND OF TAX)

of Circular Generation of ARN is taken

Para 13 to 17 of Circular Para 34

CA AANCHAL KAPOOR 9988692699 16

(8) Notwithstanding anything contained in sub-section (5), the refundable amount shall, instead of being credited to the Fund, be paid to the applicant, if such amount is relatable to—

a) refund of tax paid on 53[export] of goods or services or both or on inputs or input services used in making such 53[exports];

b) refund of unutilised input tax credit under sub-section (3);

c) refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued, or where a refund voucher has been issued;

d) refund of tax in pursuance of section 77;

e) the tax and interest, if any, or any other amount paid by the applicant, if he had not passed on the incidence of such tax and interest to any other person; or

f) the tax or interest borne by such other class of applicants as the Government may, on the recommendations of the Council, by notification, specify

(8A) The Government may disburse the refund of the State tax in such manner as may be prescribed.

SEC. 54 (REFUND OF TAX)

w.e.f 01.09.2019 by FA(2), 2019 CA AANCHAL KAPOOR 9988692699 17

Export under bond/ LUT

(9) Notwithstanding anything to the contrary contained in any judgment, decree, order or direction of the Appellate Tribunal or any court or in any other provisions of this Act or the rules made thereunder or in any other law for the time being in force, no refund shall be made except in accordance with the provisions of subsection (8).

(10) Where any refund is due under sub-section (3) to a registered person who has defaulted in furnishing any return or who is required to pay any tax, interest or penalty, which has not been stayed by any court, Tribunal or Appellate Authority by the specified date, the proper officer may—

a) withhold payment of refund due until the said person has furnished the return or paid the tax, interest or penalty, as the case may be;

b) deduct from the refund due, any tax, interest, penalty, fee or any other amount which the taxable person is liable to pay but which remains unpaid under this Act or under the existing law.

Explanation.—For the purposes of this sub-section, the expression "specified date" shall mean the last date for filing an appeal under this Act.

SEC. 54 (REFUND OF TAX)

CA AANCHAL KAPOOR 9988692699 18

(11) Where an order giving rise to a refund is the subject matter of an appeal or further proceedings or where any other proceedings under this Act is pending and the Commissioner is of the opinion that grant of such refund is likely to adversely affect the revenue in the said appeal or other proceedings on account of malfeasance or fraud committed, he may, after giving the taxable person an opportunity of being heard, withhold the refund till such time as he may determine.

(12) Where a refund is withheld under sub-section (11), the taxable shall, notwithstanding anything contained in section 56, be interest at such rate not exceeding six per cent as may be notified recommendations of the Council, if as a result of the appeal proceedings he becomes entitled to refund.

(13) Notwithstanding anything to the contrary contained in this section, the amount of advance tax deposited by a casual taxable person or a nonresident taxable person under sub-section (2) of section 27, shall not be refunded unless such person has, in respect of the entire period for which the certificate of registration granted to him had remained in force, furnished all the returns required under section 39.

Not. 13/2017 @ 6% Provision relating to CTP/NRTP. Can claim

(14) Notwithstanding anything contained in this section, no refund under sub-section (5) or sub-section (6) shall be paid to an applicant, if the amount is less than one thousand rupees

SEC. 54 (REFUND OF TAX)

Limit of Rs. 1000 is to be checked for each tax head separately and not cumulatively para 6 of circular 125/44/2019 CA AANCHAL KAPOOR 9988692699 19

(a) in the case of goods exported out of India where a refund of tax paid available of goods themselves or, as the case may be, the inputs or input services used in such goods,

7a & 2 for goods

I. if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India; or

II. if the goods are exported by land, the date on which such goods pass the frontier; or

III. if the goods are exported by post the date of despatch of goods by the Post Office concerned to a place outside India;

(b) in the case of supply of goods regarded as deemed exports where a refund tax paid is available in respect of the goods,

the date on which the return relating to such deemed exports is furnished;

(c) in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of

7b & 2 for Services

I) where the supply of services had been completed prior to the receipt of payment; (Payment After Completion)

receipt of payment in convertible foreign exchange [or in Indian rupees wherever permitted by the Reserve Bank of India],

II) where payment for the services had been received in advance prior to the date of issue of the invoice; (Payment Before Completion) issue of invoice,

(d) in case where the tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court,

the date of communication of such judgment, decree, order or direction;

(e)in the case of refund of unutilised input tax credit under clause (ii) the first proviso to sub-section (3),

the due date for furnishing of return under section 39 for the period in which such claim for refund arises;

(f) in the case where tax is paid provisionally under this Act or the rules made thereunder, the date of adjustment of tax after the final assessment thereof;

(g) in the case of a person, other than the supplier, the date of receipt of goods or services or both by such person; and

(h) in any other case, the date of payment of tax.

Note 4: A Refund application filed after correction of deficiency is treated as a fresh refund application, such a rectified refund application, submitted after correction of deficiencies, shall also have to be submitted within 2 years of the relevant date. Para 12 Circular 125/44/2019.

Explanation 2 to sec. 54:- “relevant date" means

4 12 12

9

CA AANCHAL KAPOOR 9988692699 20

1,8,10 & 11 5

CA AANCHAL KAPOOR 9988692699 21 Amendment Aug. 2017 Before Amendment 31.3.2018 + 2 Years 31.03.2020 After Amendment 20.09.2017 + 2 years 20.09.2019 CGST Amendment ACT, 2018 Inverted Duty Structure Export 1 Exports Export 2 08.08.2017 28.08.2017 + 2 years + 2 years 07.08.2019 28.08.2019 20.08.2019 Refund Applied Whether both eligible?

Bunching of refund claims across Financial Years

The said restriction on the clubbing of tax periods across financial years for claiming refund thus has been continued vide Paragraph 8 of the Circular No. 125/44/2019-GST dated 18.11.2019, which is reproduced as under:

• “8. The applicant, at his option, may file a refund claim for a tax period or by clubbing successive tax periods. The period for which refund claim has been filed, however, cannot spread across different financial years. Registered persons having aggregate turnover of up to Rs. 1.5 crore in the preceding financial year or the current financial year opting to file FORM GSTR-1 on quarterly basis, can only apply for refund on a quarterly basis or clubbing successive quarter…………….. ”

• Hon’ble Delhi High Court in Order dated 21.01.2020, in the case of M/s Pitambra Books Pvt Ltd., vide para 13 of the said order has stayed the rigour of paragraph 8 of Circular No. 125/44/2019-GST dated 18.11.2019 and has also directed the Government to either open the online portal so as to enable the petitioner to file the tax refund electronically, or to accept the same manually within 4 weeks from the Order. Hon’ble Delhi High Court vide para 12 of the aforesaid Order has observed that the Circulars can supplant but not supplement the law. Circulars might mitigate rigours of law by granting administrative relief beyond relevant provisions of the statute, however, Central Government is not empowered to withdraw benefits or impose stricter conditions than postulated by the law. No Restriction u/s 16(3) of IGST and 54(3) of CGST,2017

• Further, same issue has been raised in various other representations also, especially those received from the merchant exporters wherein merchant exporters have received the supplies of goods in the last quarter of a Financial Year and have made exports in the next Financial Year i.e. from April onwards. The restriction imposed vide para 8 of the master refund circular prohibits the refund of ITC accrued in such cases as well.

Note:- Bunching of GST refund claim is now allowed on the portal also.

CIRCULAR 135/05/2020 dated 31-03-2020

BEFORE

Particulars March April Purchase Input 100000 0 Export 0 1200000 Refund 0 0 After

March- April Purchase Input 100000 Export 1200000 Refund 100000

AMENDMENT

Amendment

Sec. 55

CA Aanchal Kapoor 24

The Government may, on the recommendations of the Council, by notifi- cation, specify any specialised agency of the United Nations Organisation or any Multilateral Financial Institution and Organisation notified under the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947), Consulate or Embassy of foreign countries and any other person or class of persons as may be specified in this behalf, who shall, subject to such conditions refund of taxes paid on the notified59 supplies of goods or services

Not. 6/2017 –CSD-50% of CGST

Not. 11/2019- International Airport

Rule 95:- Refund of tax to certain persons

Retail Outlets Tax Free Shops

[(1) Any person eligible to claim refund of tax paid by him on his inward supplies as per notification issued under section 55 shall apply for refund in FORM GST RFD-10 once in every quarter, electronically on the common portal or otherwise, either directly or through a Facilitation Centre notified by the Commissioner, along with a statement of the inward supplies of goods or services or both in FORM GSTR-11.]

(2) An acknowledgement for the receipt of the application for refund shall be issued in FORM GST RFD-02.

(3) The refund of tax paid by the applicant shall be available if

a) the inward supplies of goods or services or both were received from a registered person against a tax invoice; ]

b) name and Goods and Services Tax Identification Number or Unique Identity Number of the applicant is mentioned in the tax invoice; and

c) such other restrictions or conditions as may be specified in the notification are satisfied.

(4) The provisions of rule 92 shall, mutatis mutandis, apply for the sanction and payment of refund under this rule

(5) Where an express provision in a treaty or other international agreement, to which the President or the Government of India is a party, is inconsistent with the provisions of this Chapter, such treaty or international agreement shall prevail.

Sec. 55:- Refund

in certain cases.

CA Aanchal Kapoor 25

Sec. 56

CA Aanchal Kapoor 26

Sec. 56:-Interest on delayed refunds.

If any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under sub-section (1) of that section, interest at such rate not exceeding six per cent as may be specified in the notification63 issued by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said sub-section till the date of refund of such tax:

Provided that where any claim of refund arises from an order passed by an adjudicating authority or Appellate Authority or Appellate Tribunal or court which has attained finality and the same is not refunded within sixty days from the date of receipt of application filed consequent to such order, interest at such rate not exceeding nine per cent as may be notified63 by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application till the date of refund.

Explanation. —For the purposes of this section, where any order of refund is made by an Appellate Authority, Appellate Tribunal or any court against an order of the proper officer under sub-section (5) of section 54, the order passed by the Appellate Authority, Appellate Tribunal or by the court shall be deemed to be an order passed under the said sub-section (5).

Not. 13/2017 CT & 6/2017 IT CA Aanchal Kapoor 27

Facts of the case

•Petitioner Stated that in accordance with section 54(6) read with rule 91 of CGST Rules 2017 , Proper officer was required to refund at least 90% of the refund claimed on account of zero rated supply of goods or services or both made by registered persons within 7 days from the date of acknowledgment issued under Rule 90.

• He stated that despite the period of 15 days from the date of filing of the refund application having expired, the respondent had till that date neither pointed out any deficiency/discrepancy in FORM GST RFD-03 nor it had issued any acknowledgement in FORM GST RFD-02

Held

•HC found that Rules 90 and 91 of the CGST Rules provide a complete code with regard to acknowledgement, scrutiny and grant of refund. The said Rules also provide a strict time line for carrying out the aforesaid activities.

•Rules 90 states that within 15 days from the date of filing of the refund application, the respondent has to either point out discrepancy/deficiency in FORM GST RFD-03 or acknowledge the refund application in FORM GST RFD-02.

•In the event deficiencies are noted and communicated to the applicant, then the applicant would have to file a fresh refund application after rectifying the deficiencies.

•In the event default or inaction to carry out the said activities within the stipulated period, consequences like payment of interest are stipulated in Section 56 of CGST Act.

•Admittedly, till the date of the Court hearing, the petitioner’s refund application had not been processed.

• Also neither any acknowledgment in FORM GST RFD-02 had been issued nor any deficiency memo had been issued in RFD-03 within 15 days

CA Aanchal Kapoor 28 JIAN INTERNATIONAL versus COMMISSIONER OF DELHI GOODS AND SERVICES TAX

•Therefore, the refund application would be presumed to be complete in all respects in accordance with Rule 89 of CGST Rules.

•To allow the respondent to issue a deficiency memo today would amount to enabling the Respondent to process the refund application beyond the statutory timelines as provided under Rule 90.

•This could also be construed as rejection of the petitioner’s initial application for refund as the petitioner would thereafter have to file a fresh refund application after rectifying the alleged deficiencies.

•This would not only delay the petitioner’s right to seek refund, but also impair petitioner’s right to claim interest from the relevant date of filing of the original application for refund as provided under the Rules.

•Also, the respondent’s prayer to raise a deficiency memo is a hyper-technical plea as admittedly, all the relevant documents have been annexed with the present writ petition and the respondent is satisfied about their authenticity. Consequently, High Court was of the view that the respondent had lost the right to point out any deficiency, in the petitioner’s refund application , at this belated stage . Accordingly , the court directed the respondent to pay the petitioner the refund along with interest in accordance with law within two weeks

CA Aanchal Kapoor 29 Held

Sec. 57

CA Aanchal Kapoor 30

The Government shall constitute a Fund, to be called the Consumer Welfare Fund and there shall be credited to the Fund,—

a) the amount referred to in sub-section (5) of section 54;

b) any income from investment of the amount credited to the Fund; and

c) such other monies received by it, in such manner as may be prescribed

Rule 97

Sec 58:- Utilisation of Fund.

(1) All sums credited to the Fund shall be utilised by the Government for the welfare of the consumers in such manner as may be prescribed.

Rule 97

(2) The Government or the authority specified by it shall maintain proper and separate account and other relevant records in relation to the Fund and prepare an annual statement of accounts in such form as may be prescribed in consultation with the Comptroller and Auditor General of India.

Sec 57:- Consumer Welfare

Fund

CA Aanchal Kapoor 31

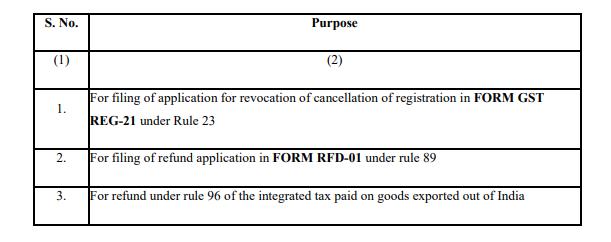

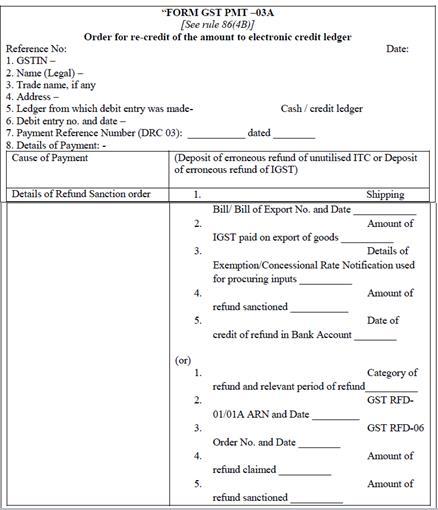

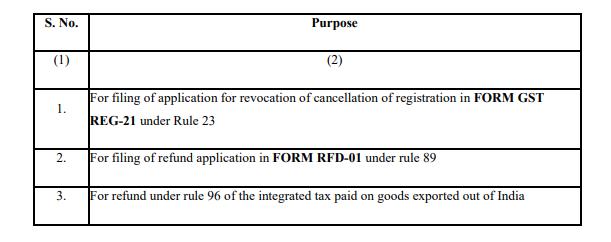

Change in manner of refund of tax paid on supplies other than zero rated supplies

Circular No. 125/44/2019-GST dated 18.11.2019, in para 3, categorizes the refund applications to be filed in FORM GST RFD-01 as under:

a) Refund of unutilized input tax credit (ITC) on account of exports without payment of tax;

b) Refund of tax paid on export of services with payment of tax; .

c) Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax;

d) Refund of tax paid on supplies made to SEZ Unit/SEZ Developer with payment of tax;

e) Refund of unutilized ITC on account of accumulation due to inverted tax structure;

f) Refund to supplier of tax paid on deemed export supplies;

g) Refund to recipient of tax paid on deemed export supplies;

h) Refund of excess balance in the electronic cash ledger;

i) Refund of excess payment of tax;

j) Refund of tax paid on intra-State supply which is subsequently held to be inter State supply and vice versa;

k) Refund on account of assessment/provisional assessment/appeal/any other order;

l) Refund on account of “any other” ground or reason.

For the refund of tax paid falling in categories specified at S. No. (i) to (l) above i.e. refund claims on supplies other than zero rated supplies, no separate debit of ITC from electronic credit ledger is required to be made by the applicant at the time of filing refund claim, being claim of tax already paid. However, the total tax would have been normally paid by the applicant by debiting tax amount from both electronic credit ledger and electronic cash ledger. At present, in these cases, the amount of admissible refund, is paid in cash even when such payment of tax or any part thereof, has been made through ITC.

CA Aanchal Kapoor 32

Amount CGST SGST Actual Sales 100000 2500 2500 Sales entered in 3B 100000 5000 5000 10000 Paid Through Balance in ledger 7000 3000 (Credit ledger) (Cash Ledger) Excess Paid 2500 2500 Refund Applied Rs. 5000 Old Law RFD-06 Rs. 5000 cash (Encashment of credit ledger of Rs. 2000) New Law Cash Credit RFD-06 = Rs. 1500 Rs. 3500 in Credit ledger through (3000/10000*5000) PMT-03 (7000/10000*5000) CA Aanchal Kapoor 33

RFD-06=Rs.4000( 5000-1000)cash

(Encashment

Rs. 2000)

(

3500

SGST Actual Sales 100000 2500 2500 Sales entered in 3B 100000 5000 5000 10000 Paid Through Balance in ledger 7000 3000 (Credit ledger) (Cash Ledger) Excess Paid 2500 2500 Refund Applied Rs. 5000 Outstanding dues Rs. 1000 Old Law

Amount CGST

New Law

liability =Rs.

Rs.

= Rs.

(PMT-03)

of credit ledger of

If

1000 Cash

1500-1000= Rs. 500(RFD-06) Credit

Entire

CA Aanchal Kapoor 34

liability adjusted from Cash)

a Glance] Issuance of deficiency memo RFD-03 Issuance of acknowledgement RFD-02 Issuance of payment advice RFD-05 SCN RFD-08 Reply to SCN RFD-09 Issuance of adjustment advice RFD-07 Provisional Refund In case of exportsRFD-04 Within 7 days of RFD02 Within 60 days of RFD-01 Within 15 days of Refund application RFD-01 Within 15 days of RFD-01 In Case of DM , Amount is Reccredited in ECrL & Fresh Application to be made within 2 years Issuance of refund order Rejection Order RFD-06 Amount Recredited after taking Undertaking that no appeal will be filed thru PMT-03 CA Aanchal Kapoor 35 Amended to provide 15 days /Time Taken

Refund Process [At

If the bank account details mentioned by an applicant in the refund application submitted in FORM GST RFD-01 are invalidated, an error message shall be transmitted by PFMS* to the common portal electronically and the common portal shall make the error message available to the applicant and the refund officers on their dashboards. On receiving such an error message, an applicant can:

(a) rectify the invalidated bank account details by filing a non-core amendment in FORM GST REG-14; or

(b) add a new bank account by filing a non-core amendment in FORM GST REG-14

*PUBLIC FUND MANAGEMENT SYSTEM

•

CA Aanchal Kapoor 36

BANK VALIDATION

Inverted Duty structure

54(3) (Subject to the provisions of sub-section (10), a registered person may claim refund of any unutilised input tax credit at the end of any tax period: Provided that no refund of unutilised input tax credit shall be allowed in cases other than''

ii) Where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council:

ITC rate on inputs

CG, IS partly

IS GREATER THAN

Rate of tax on output supplies

Output can have both goods or services

i)

-----ZERO RATED-----

>

CA Aanchal Kapoor 37

Refund of accumulated input tax credit (ITC) on account of reduction in GST Rate

It has been brought to the notice of the Board that some of the applicants are seeking refund of unutilized ITC on account of inverted duty structure where the inversion is due to change in the GST rate on the same goods. This can be explained through an illustration. An applicant trading in goods has purchased, say goods “X” attracting 18% GST. However, subsequently, the rate of GST on “X” has been reduced to, say 12%. It is being claimed that accumulation of ITC in such a case is also covered as accumulation on account of inverted duty structure and such applicants have sought refund of accumulated ITC under clause (ii) of sub-section (3) of section 54 of the CGST Act.

It may be noted that refund of accumulated ITC in terms clause (ii) of sub-section (3) of section 54 of the CGST Act is available where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies. It is noteworthy that, the input and output being the same in such cases, though attracting different tax rates at different points in time, do not get covered under the provisions of clause (ii) of sub-section (3) of section 54 of the CGST Act. It is hereby clarified that refund of accumulated ITC under clause (ii) of sub-section (3) of section 54 of the CGST Act would not be applicable in cases where the input and the output supplies are the same.

Only Reduction of Rate of Goods Circular 135/05/2020 CA Aanchal Kapoor 38

No. 14/2022-CT

173/02/2022 &

Clarification on issue of claiming refund under inverted duty structure where the supplier is supplying goods under some concessional notification

Vide circular, para 3.2 of Circular No. 135/05/2020-GST dated 31.03.2020 stands SUBSTITUTED as under:

3.2 It may be noted that refund of accumulated ITC in terms of clause (ii) of the first proviso to sub-section (3) of section 54 of the CGST Act is available where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies.

“

It is noteworthy that, the input and output being the same in such cases, though attracting different tax rates at different points in time, do not get covered under the provisions of clause (ii) of the first proviso to sub-section (3) of section 54 of the CGST Act.”

Notification

Circular No.

Notification No. 14/2022-CT

Circular No. 173/02/2022 & Vide circular, para 3.3 of Circular No. 135/05/2020-GST

dated 31.03.2020 stands SUBSTITUTED as under:

3.3 There may, however, be cases where although inputs and output goods are the same, the output supplies are made under a concessional notification due to which the rate of tax on output supplies is less than the rate of tax on inputs.

In such cases, as the rate of tax of output supply is less than the rate of tax on inputs at the same point of time due to the supply of goods by the supplier under such concessional notification, the credit accumulated on account of the same is admissible for refund under the provisions of clause (ii) of the first proviso to sub-section (3) of section 54 of the CGST Act, other than the cases where output supply is either Nil rated or fully exempted, and also provided that supply of such goods or services are not notified by the Government for their exclusion from the refund of accumulated ITC under the said clause.”

“

Clarification on issue of claiming refund under inverted duty structure where the supplier is supplying goods under some concessional notification

INTERPRETATION

The refund is admissible in cases where inputs and output goods are same but the output supplies are made under a concessional notification due to which the rate of tax on output supplies is less than the rate of tax on inputs.

EXAMPLES:

a) Where the inputs are taxable at 18% and outward supply also taxable at 18%, however under a concessional notification provides for reduced rate in special circumstances. Example could be the supply made to Public funded research institution under NN 47/2017-ITR at concession rate of 5% – IDS refund is admissible.

b) An applicant trading in goods has purchased, say goods “X” attracting 18% GST. However, subsequently, the rate of GST on “X” has been reduced to, say 12%. -IDS refund is not admissible as per para 3.2 of circular No. 135/05/2020-GST dated 31.03.2020.

Notification

14/2022-CT Circular No. 173/02/2022 &

No.

[2021] 130 taxmann.com 182 (Gauhati)

HIGH COURT OF GAUHATI

BMG Informatics (P.) Ltd. v. Union of India

GST : Provisions of paragraph 3.2 of Circular No. 135/05/2020-GST dated 31-3-2020 providing that even though different tax rate may be attracted at different point of time, but refund of accumulated unutilized tax credit will not be available under section 54(3)(ii) in cases where input and output supplies are same, would have to be ignored

[2022] 140 taxmann.com 326 (Rajasthan)

HIGH COURT OF RAJASTHAN Baker Hughes Asia Pacific Ltd. v. Union of India

GST : Circular No.135/05/2020-GST, dated 31-3-2020 which stipulates that refund under inverted duty structure in terms of section 54(3)(ii) would not be available where input and output supplies are same is repugnant and conflicting to parent legislation i.e. section 54(3)(ii)

HIGH COURT OF CALCUTTA

Shivaco Associates v.

Joint Commissioner of State Tax, Directorate of Commercial Taxes

AMRITA SINHA, J. WPA NO. 54 OF 2022

MARCH 11, 2022

Refund - Unutilized ITC - Petitioners were engaged in business of purchasing Liquefied Petroleum Gas (LPG) in bulk quantity and thereafter same was refilled in small bottles/cylinders and then sold to commercial and domestic consumers

- Rate of tax on input supply (LPG in bulk) is 18 per cent and rate of on output supply (LPG in small containers for domestic consumers) is 5 per cent - Adjudicating authority by an order rejected petitioner's claim of refund by relying on Circular No. 135/05/2020-GST, dated 31-3-2020 wherein it has been mentioned that taxpayers cannot claim refund in terms of clause (ii) of section 54(3) in cases where input and output supplies remain same - HELD : Refund of unutilized input tax credit was to be allowed under section 54 where credit accumulated on account of rate on inputs was higher than rate of tax on output supplies - Act does not restrict refund only in respect of supplies which are different at input and output stage - However, by way of above circular, Board was curtailing said benefit and making refund only if input and output supplies are different, which amounted to overreaching provisions as laid down in Act - Thus, refund of accumulated input tax credit was admissible [Section 54 of the Central Goods and Services Tax Act, 2017/ West Bengal Goods and Services Tax Act, 2017] [Paras 26 to 29] [In favour of assessee]

[2022] 137 taxmann.com 213 (Calcutta)

Amendment in formula prescribed in Rule 89(5) of CGST Rules, 2017 for calculation of refund of unutilized Input Tax Credit on account of inverted rated structure

Maximum Refund Amount

{(Turnover of inverted rated supply of goods and services) × Net ITC ÷ Adjusted Total Turnover} – tax payable on such inverted rated supply of goods and services

Maximum Refund Amount {(Turnover of inverted rated supply of goods and services) × Net ITC ÷ Adjusted Total Turnover} –[{tax payable on such inverted rated supply of goods and services × (Net ITC ÷ ITC availed on inputs and input services)}]

Net ITC shall mean input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rule (4A) or (4B) or both;

EARLIER

NEW

MAXIMUM Refund amount calculation (Rule 89(5))

Input tax credit availed on inputs during the relevant period other than the input tax credit availed for which refund is claimed under sub-rule (4A) or (4B) or both

Net ITC

In next Slide

Adjusted Total Turnover

*[{tax payable on such inverted rated supply of goods and services × (Net ITC ÷ ITC availed on inputs and input services)}]

Illustration

1. ITC on inputs = Rs. 18,000/-

2. Total Turnover = Rs 1,00,000/- (Assuming the entire turnover is in relation toinverted duty structure)

3. Tax on Turnover = Rs 5,000/-

4. Total Output Tax = 5000 will be paid through ITC of Rs. 18000. Therefore the balance available in credit ledger will be Rs 13,000/-

5. Maximum Refund Amount = [(100000 X 18000)/100000]-5000=Rs. 13,000/-

Turnover of inverted duty Structure Tax payable on such inverted rate of supply * CA Aanchal Kapoor 45

Maximum Refund Amount

• Total Turnover = Rs 1 Crore --Inverted Duty (taxable @ 5%) = Rs 50 lakhs

--Other (taxable @ 18%) = Rs 50 Lakhs

• Total ITC availed = Rs 8 Lakhs --on goods = Rs 6 lakhs

--on services = Rs 2 lakhs

• Total Tax paid = Rs 11.5 Lakhs -- Inverted Duty = Rs 2.5 Lakhs

-- Other = Rs 9 lakhs

= 1.125 lakhs

It reduces the tax paid in proportionate to ITC of goods only. Hence, the refund amount is higher Change in formula owing to SC judgement in case of VKC Footsteps

{(50 l) × 6 l ÷ 1 crore}

2.5 L

{ (50 l) × 6 l ÷ 1 crore}–[{2.5 l × (6 l ÷8 l)}]

EARLIER

EXAMPLE Maximum Refund Amount

–

= 0.5 lakhs Maximum Refund Amount

NEW

Turnover of Zero Rated Services in terms of clause (D) + Non Zero Rated

LESS THEN ADD, BECOZ ZERO RATED VALUE TO BE CALCULATED AS MENTIONED IN CLAUSE D of 89(4)

Exempt Supplies Reduced as Got added in 2(112). Logic- ITC does not belong to Exempt Supplies so deduced

Turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both

Adjusted Total Turnover Turnover in State as per Sec.

All Taxable Turnover of Goods & Services Exempt Supplies Export of

&

(All without Tax) Less Turnover of

Refund amount calculation (Rule 89(5))

2(112)

Goods

Services

Services

Less

IST

Less CA Aanchal Kapoor 47

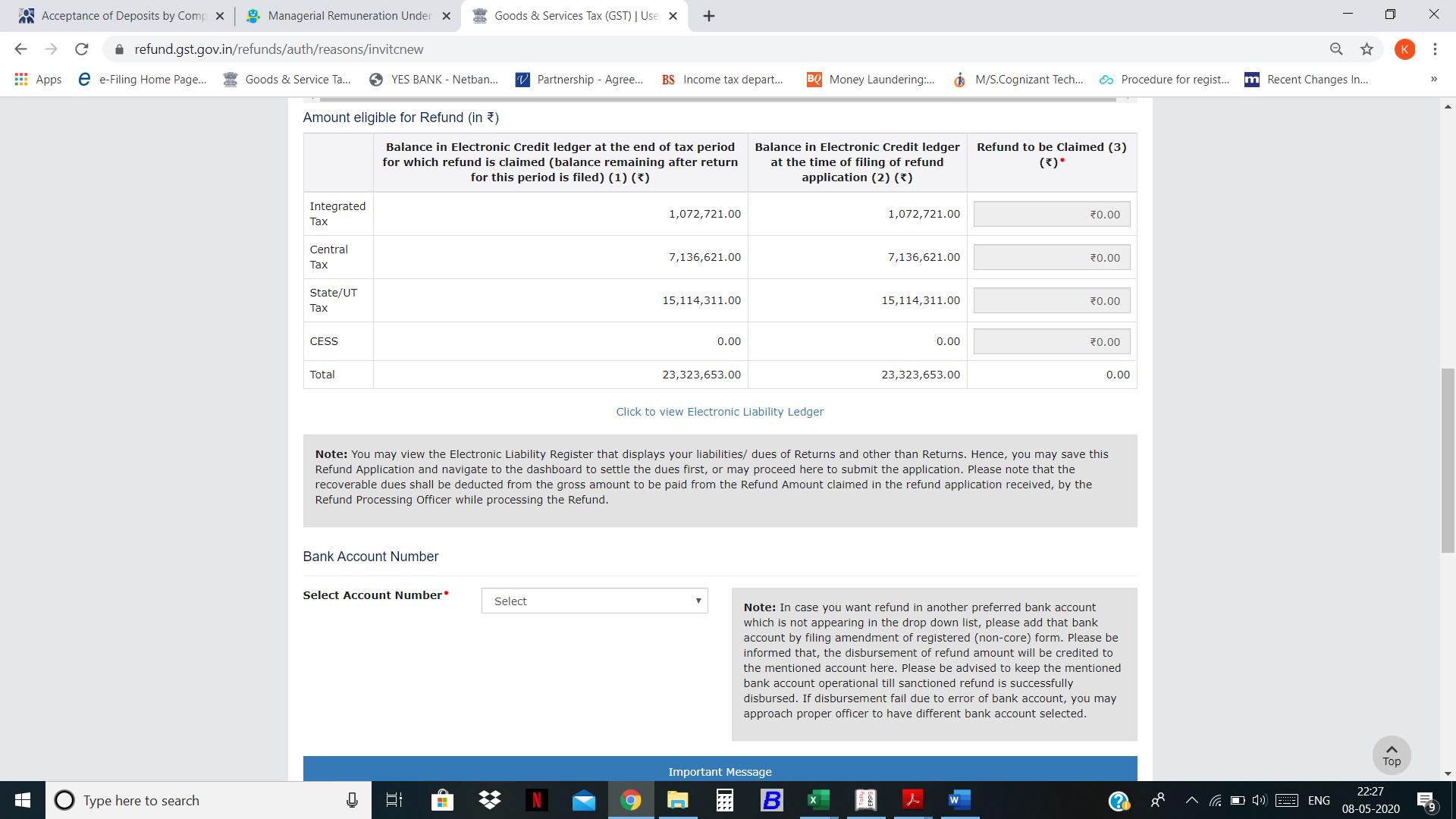

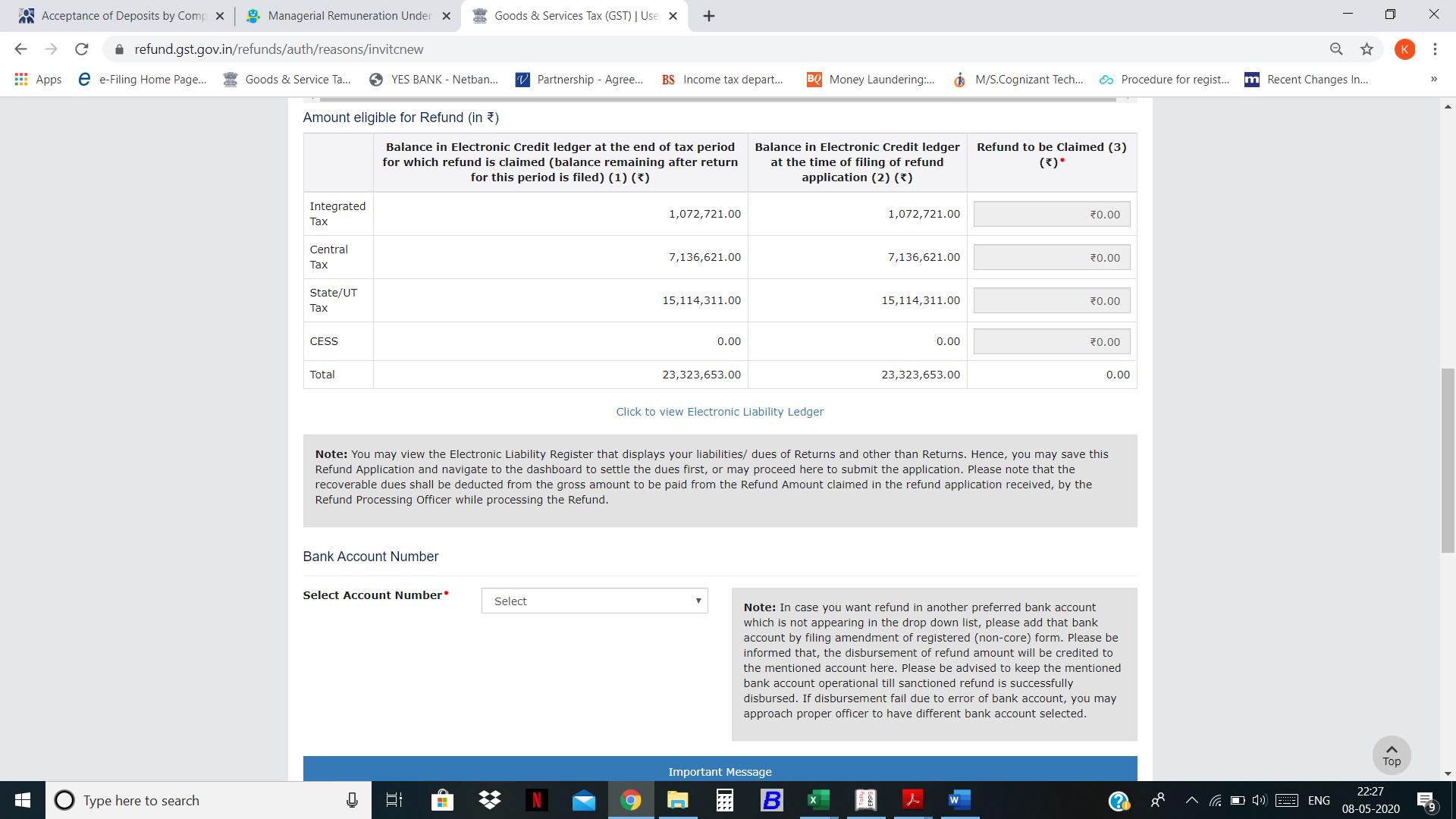

Refund Amount TO BE ALLOWED (Para 37 of Circular 125)

BALANCE CHECKS

1. Least of the following amounts:

a) Maximum refund amount as per the formula (CONSOLIDATED FOR ALL HEADS)

a) The balance in the electronic credit ledger at the end of the tax period for which the refundclaim is being filed

c) The balance in the electronic credit ledger at the time of filing the refundapplication.

2. After calculating the least of the three amounts, the amount is divided in Heads as per following sequence

a)Integrated tax, to the extent of balance available;

a)Central tax and State tax/Union Territory tax, to the extent of balance available and in the event of a shortfall in the balance available in a particular electronic credit ledger , the differential amount is to be debited from the other electronic credit ledger

1 2 CA Aanchal Kapoor 48

CA Aanchal Kapoor 49

A. Amount calculated as per Formula

B. Credit Balance at end of Refund Period

C. Credit Balance at end of Filling Refund Application

50000

30000

28000

EXAMPLE of Refund Amount TO BE ALLOWED

Rs.

Rs.

Rs.

ELIGIBLE REFUND Rs. 28000/CA Aanchal Kapoor 50 First IGST Then CGST SGST equally To the extent available If shortfall in one head then recover from other

1. Total Output Tax of Rs 360/- will be paid through ITC of Rs 385. Therefore the balance available in credit ledger will be Rs 25/-

2. Maximum Refund Amount = [(3000 X 385)/3000]-360 = Rs 25/-

Input A Input B Output Y GST Rate 5% GST Rate 18% GST Rate 12% Purchase = 500 Input on A = 25 Purchase = 2000 Input on B = 360 Sale = 3000 Output = 360

Illustration

amount calculation

54 of

CA Aanchal Kapoor 51

Refund

(Para

Circular 125)

Input A Input Service B Output Y GST Rate 12% GST Rate 18% GST Rate 12% Purchase = 500 Input on A = 60 Purchase = 2000 Input on B = 360 Sale = 3000 Output on Y = 360 Illustration

Not a Case of Inverted Duty CA Aanchal Kapoor 52

Refund Issues

1.

2.

will be Rs. 13/- (985-972).

3. Refund amount to be allowed Rs. 4.81/-.

Input B Output Y GST Rate 5% GST Rate 18% GST Rate 12% Purchase = 500 Input on A = 25 Purchase = 2000 Input on B = 360 Illustration Total Turnover of assessee Rs. 8100 Sale = 3000 Output on Y = 360 TRADING

OF INVERTED DUTY TURNOVER (Mixed Turnover) Input X GST Rate 12% Purchase = 5000 Input on X = 600 Output X GST Rate 12% Sale = 5100 Output on X = 612 MANUFACTURIN G

CONCEPT

from input of

ledger

Total Output Tax of Rs. 972/- (360+612) will be paid

Rs. 985/(25+360+600).Balance in credit

Maximum Refund Amount = [(3000 X 985)/8100]-360 = Rs. 4.81/-

CA Aanchal Kapoor 53

• Yes, under different categories. E.g Refund of Cash Balance and Refund on Account of Exports.

• Can Refund of Inverted Duty and Exports be made simultaneously for same period for same invoices?

• No, Inverted Duty and Exports with Payment of Taxes for same invoices cannot be applied simultaneously .(2nd Proviso to Section 53(3). However, if one has domestic and Exports both then for domestic covered by Inverted Duty application can be made under Inverted duty & for Export invoices a separate application will be made for same period.

Example: Inverted Duty + Exports

Refund

Purchase= 100 @ 18% Export Sales= 120 @ 10%

ITC =18

Output Tax =12

Export --Refund on payment of taxes= Rs. 12

Refund ( say product is exempt..eg. Rice unbranded)

Purchase= 100 @ 18% Export Sales= 120 @ 10%

ITC =18

Output Tax =0

Export --Refund under Bond/ LUT, ITC= Rs. 18

One refund application---category----ITC on Exports = Refund Rs. 18

CAN TWO REFUND APPLICATIONS BE MADE FOR SAME PERIOD

With payment of tax Without payment of tax

LOSS TO ASSESSEE CA Aanchal Kapoor 54

OTHER Provisions

Whether Input used directly or indirectly considered in ITC:-

All input ITC, whether directly or indirectly used.

Hence ITC of Stores and spares, packing material, materials purchased for machinery repairs, printing & stationery Items, as part of net ITC ( Stores and spares the expenditure of which is charged as revenue expenditure cannot be held as capital goods.)

•

•

CA Aanchal Kapoor 55

a Certificate in Annexure 2 of FORM GST RFD-01 issued by a chartered accountant or a cost accountant to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed exceeds two lakh rupees: Provided that a certificate is not required to be furnished in respect of cases covered under clause (a) or clause (b) or clause (c) or clause (d) or clause (f) of sub-section (8) of section 54;

Self-Declaration or CA Certificate for non-passing on of incidence of tax, interest or any other amount is not required in following cases:

1. Refund of tax paid on account of export of goods or services

2. Refund of unutilized ITC for export of goods or inverted duty rate structure.

3. Refund of tax paid on a supply which has not been provided.

4. Refund of CGST and SGST HELD to be IGST or vice versa

5. Refund of Tax or Interest borne by notified applicants.

CA AANCHAL KAPOOR 9988692699 56

RULE 89(2)(m)

Not. 5/2017-CT (R)

S. No. Tariff item, heading, sub-heading or Chapter

No Refund u/s 54(3)(ii) of following HSN

1. 5007 Woven fabrics of silk or of silk waste

2. 5111 to 5113 Woven fabrics of wool or of animal hair

3. 5208 to 5212 Woven fabrics of cotton

4. 5309 to 5311 Woven fabrics of other vegetable textile fibres, paper yarn

5. 5407, 5408 Woven fabrics of manmade textile materials

6. 5512 to 5516 Woven fabrics of manmade staple fibres

Description of Goods

Processing Houses Eligible for Refund since Beginning

Not. 20/2018-CT (R) & Circular

56/30/2018

Refund eligible after 01.08.2018 on Reversing of Credit till 31.07.2018 u/s 54(3)(ii) of following HSN

6A# 5608 Knotted netting of twine, cordage or rope; made up fishing nets and other made up nets, of textile materials

6B* 5801 Corduroy fabrics

6C# 5806 Narrow woven fabrics, other than goods of heading 5807; narrow fabrics consisting of warp without weft assembled by means of an adhesive

7. 60 Knitted or crocheted fabrics [All goods]

8. 8601 Rail locomotives powered from an external source of electricity or by electric accumulators

9. 8602 Other rail locomotives; locomotive tenders; such as Diesel-electric locomotives, Steam locomotives and tenders thereof 10 8603

Self-propelled railway or tramway coaches, vans and trucks, other than those of heading 8604 11 8604 Railway or tramway maintenance or service vehicles, whether or not self-propelled (for example, workshops, cranes, ballast tampers, trackliners, testing coaches and track inspection vehicles)

8605

Railway or tramway passenger coaches, not self-propelled; luggage vans, post office coaches and other special purpose railway or tramway coaches, not self-propelled (excluding those of heading 8604) 13 8606

Railway or tramway goods vans and wagons, not self-propelled

Parts of railway or tramway locomotives or rolling-stock; such as Bogies, bissel-bogies, axles and wheels, and parts thereof 15 8608

8607

Railway or tramway track fixtures and fittings; mechanical (including electro-mechanical) signalling, safety or traffic control equipment for railways, tramways, roads, inland waterways, parking facilities, port installations or airfields; parts of the foregoing

CA Aanchal Kapoor

Refund of unutilized input tax credit w.r.t Not. 20/2018-CT(R)& Circular 56/30/2018

12

14

57

Issues in Refund of unutilized input tax credit

Now many more issues will arise if we strictly analyses the language of the notification. According to the notification, only input tax credit accumulated of in respect of goods is eligible for refund. According to this notification, what happens to excess credit accumulated on account of services or capital goods or ITC accumulated on account of stock- in- trade. Credit accumulated up to 31st July shall lapse but according to Sec 54(3), a registered person is restricted only to claim refund. It is nowhere mentioned in the law that excess duty will lapse.

Calculation of Net ITC Total ITC from 01-07-2017 to 31-07-2017 XXXXX Less:- XXXXX ITC for supplies received @ 0.01% [40/2017-CTR 7 41/2017-ITR] XXXXX ITC on capital Goods XXXXX ITC on services XXXXX ITC on stock as on 31-07-2018 XXXXX ITC on other inputs and input services used in making zero rated supplies where supplies has claimed benefit of deemed exports/advance authorization on one part of inputs XXXXX Net ITC XXXXX

CA Aanchal Kapoor 58

GST: In absence of express provision in section 54(3) empowering Central Government to provide for lapsing of unutilised ITC, Notifications and Circulars, prescribing for lapsing of ITC were to be quashed and set aside and assessees would be entitled to unutilised ITC accumulated on account of rate of tax on inputs being higher than rate of tax on output.

Section 54 of the Central Goods and Services Tax Act, 2017/Section 54 of the Gujarat Goods and Services Tax Act 2017 - Refund - Tax

- Whether there being no express provision in section 54(3) empowering Central Government to provide for lapsing of unutilised ITC, assessees would have a vested right to unutilised ITC accumulated on account of rate of tax on inputs being higher than rate of tax on output supplies (inverted rate structure) - Held, yes - Whether by prescribing for lapsing of ITC, Central Government had exceeded power delegated under section 54(3)(ii) - Held, yes - Whether therefore, Notification No.05/2017-C.T. (Rate), dated 28-6-2017, as amended by Notification No.20/2018-C.T. (Rate), dated 26-7-2018 and Circular No. 56/30/2018-GST, dated 24-8-2018 to extent they provide that input tax credit lying unutilized in balance, after payment of tax for and upto month of July, 2018, on inward supplies received upto 31-7-2018, shall lapse, are quashed and set aside and declared as ultra vires and beyond scope of section 54(3)(ii)Held, yes [Paras 6 and 27][In favour of assessee]

Shabnam

Petrofils (P.) Ltd v. Union of India* ([2019] 108 taxmann.com 15 (Gujarat))

59

CA Aanchal Kapoor

Without payment of tax

Refund of unutilized input tax credit (ITC)of Input or input services on account of exports.

With payment of tax;

Refund of tax paid on export

Goods

CG

Rule 96The shipping bill filed by an exporter of goods shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India. No Separate Application Required. Services CA Aanchal Kapoor 60

Without Payment of Tax under Bond/LUT

54(3) Subject to the provisions of sub-section (10), a registered person may claim refund of any unutilised input tax credit at the end of any tax period:

Provided that no refund of unutilised input tax credit shall be allowed in cases other than''

Zero rated supplies made without payment of taxes

Duty-------------------

Provided further that no refund of unutilised input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty:

Provided also that no refund of input tax credit shall be allowed, if the supplier of goods or services or both avails of drawback in respect of central tax or claims refund of the integrated tax paid on such supplies.

i)

ii) -----------Inverted

CA Aanchal Kapoor 61

Maximum

Refund

Amount

Turnover of zero-rated supply of goods means

Turnover of Zero rated supply Net ITC

Credit availed on inputs and inputservices

All turnover except Exempt Turnover

• the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking or

• the value which is 1.5 times the value of like goods domestically supplied by the same or, similarly placed, supplier, as declared by the supplier,

• whichever is less

Turnover of zero-rated supply of services means

• Payments received during the tax period

• Add: Services completed in current tax period for which advance was received in previous tax periods

• Less: Advance received

Note: Balance Checks in calculating refund amount are same as in REFUND

Rule 89(4) Refund amount calculation

Adjusted Total Turnover

UNTILISED ITC ON ACCOUNT OF INVERTED DUTY

OF

CA Aanchal Kapoor 62

Rule 89(4)(c) Substituted:- ( Refund on Zero Rated Supply Without Tax under Bond)

“Turnover of zero-rated supply of goods" means

the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking or

the value which is 1.5 times the value of like goods domestically supplied by the same or, similarly placed, supplier, as declared by the supplier, whichever is less, other than the turnover of supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or both;‟ .

High Court of Karnataka (WP No. 13185 of 2020) M/s

Tonbo Imaging India Pvt. Ltd. quashes Rule being ultravires and violative of Article 14 of Constitution

63

CA Aanchal Kapoor

Particulars Before amendment After amendment Zero Rated (10000 Kg @8036/100kg) 803600 787500 Domestic (2000Kg @ 5250/100kg ) 105000 105000 Total Sales 908600 892500 ITC 100000 100000 Refund= ITC* Turnover of Zero Rated Supply Adjusted total Turnover 100000*803600/908600 100000*787500/892500 Turnover of Zero Rated Supply 803600 803600 or 10000*5250/100*1.5= 787500 Whichever is less i.e 787500 Refund 88443 88235 Adjusted Total Turnover 105000+803600= 908600 105000+787500=892500 Circular 147/02/2021

Rule 89(4)

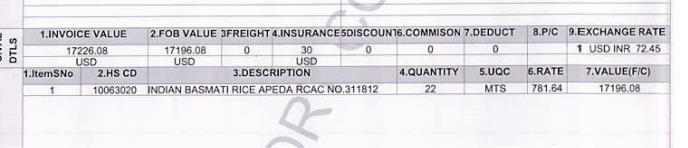

In the case of zero-rated supply of goods or services or both without payment of tax under bond or letter of undertaking in accordance with the provisions of sub-section (3) of section 16 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), refund of input tax credit shall be granted as per the following formula

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) × Net ITC ÷ Adjusted

Total Turnover

Explanation inserted – For REFUND the value of goods exported out of India shall be taken as –

(i) the Free on Board (FOB) value declared in the Shipping Bill or Bill of Export form, as the case may be, as per the Shipping Bill and Bill of Export (Forms) Regulations, 2017; or

(ii) the value declared in tax invoice or bill of supply, Whichever is less

The GST invoice is based on Transaction value and it is CIF including goods and freight. So invoice will include both value of goods and freight. But shipping bill is based upon FOB value. And as per circular 125 para 47 in case of unutilised ITC , refund is processed on basis of lower of two values of Gst Invoice and SB. Moreover, even in case of non payment of tax , shipping bill is the deemed application. So refund restricted to shipping bill value in both cases. Moreover supply of services associated with transit cargo to Nepal is exempt by 9B of 12/2017

Export freight is also exempt.

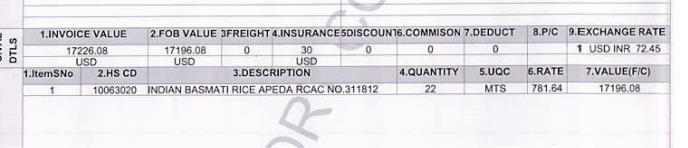

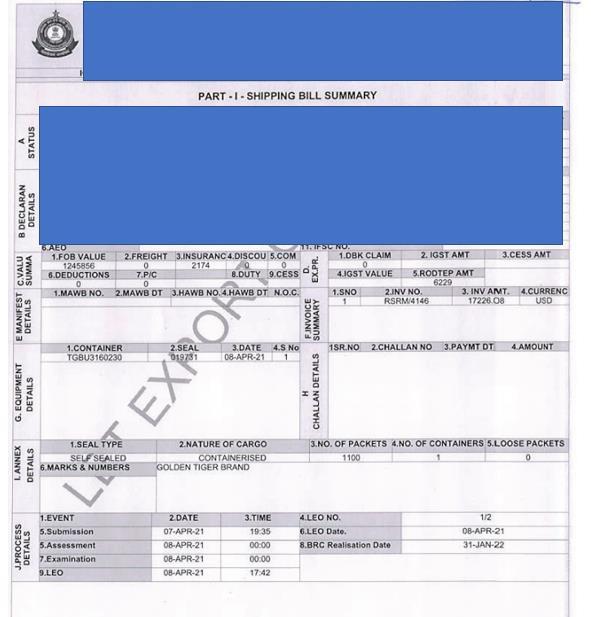

SPECIMEN OF THE INVOICE (without freight)

Containing FOB + Insurance Charges= CIF

SPECIMEN OF THE SHIPPING BILL

VALUEOF REFUND =LOWER 17196/-

Option Comparison When Capital Goods are Involved

Exported goods worth Rs 100000/- chargeable to GST @ 12%=Rs. 12000

Option 1

Without payment of tax

LUT should be furnished

No output tax will be payable.

Refund of Inputs Tax Credit Rs 3000 and Input services Rs 2000.

No refund of Rs 5000 of ITC on capital goods

Option 2

With payment of tax

IGST of Rs 12000/- shall be payable as exports are with payment of taxes.

Rs. 12000 paid 10000 thru Credit Ledger & 2000 in cash

Refund amount Rs. 12000 and there is no fund blockage.

Easier to get Refund

Illustration

S . N o Type of ITC CGST SGST IGST Total 1 Inputs 1000 1000 1000 3000 2 Input Services 500 500 1000 2000 3 Capital Goods 5000 5000 Total 1500 1500 7000 10000

OUTPUT

CA Aanchal Kapoor 67

INPUTS

Option Comparison When Input Tax Credit has CESS

LUT should be furnished

No output tax will be payable.

Refund of Inputs Rs 4500 (including cess) and Input services Rs 2000. Total

Without payment of tax Option 2

With payment of tax

IGST of Rs 5000/- is payable as exports are with payment of taxes.

Rs. 5000 will be adjusted from C,S,I

Cess cannot be used for payment above IGST and will not be available as refund.

Illustration Exported goods worth Rs 100000/- chargeable to GST @ 5%=Rs. 5000 S. No Type of ITC CGST SGST IGST Cess Total 1 Inputs 1000 1000 1000 1500 4500 2 Input Services 500 500 1000 0 2000 3 Capital Goods 0 0 0 Total 1500 1500 2000 1500 6500

1

Option

6500/-

Rs

INPUTS CA Aanchal Kapoor 68

OUTPUT

Option 1

Without payment of tax

LUT should be furnished

No output tax will be payable.

Refund of Inputs Rs 30000 and Input services Rs 2000. Total Rs 32000/-

Option 2

With payment of tax

IGST of Rs 5000/- is payable as exports are with payment of taxes.

Rs. 5000 will be adjusted from C,S,I

Refund of Tax Paid Rs. 5000/-

Illustration Exported goods worth Rs 100000/- chargeable to GST @ 5%=Rs. 5000 S. No Type of ITC CGST SGST IGST Cess Total 1 Inputs 10000 10000 10000 0 30000 2 Input Services 500 500 1000 0 2000 3 Capital Goods 0 0 0 Total 10500 10500 11000 0 32000

OUTPUT INPUTS CA Aanchal Kapoor 69

Option Comparison When Stock Held Inside

IMPORT /EXPORT CASE STUDIES

CASE

A gave order to B for supply of Goods to C

Whether supply of goods qualify as exports

Ans:- Since the goods do not move outside the territory of India. So it cannot be termed as exports

Whether C will be eligible for ITC?

Ans:- No Import for C. C will get invoice from Mr. A. C will not be eligible for credit as tax paying document is in favour of Mr. A in USA.

to in India

Mr. A in Canada

Mr. B in Kerala

Mr. C in Punjab

Invoice By B to A

Mr. A in Canada

Mr. B in Kerala

Mr. C in Punjab

Invoice By B to A

studies Bill to Ouside India Ship

CASE studies

A gave order to B for supply of Goods

Order required development of new Tools (Moulds) to be retained in India by Mr. B

Mr. A in Canada

Whether supply of goods qualify as exports

Ans:- Since the goods do not move outside the territory of India. So it cannot be termed as exports

Goods Retained and Not delivered

Mr. B in Kerala

Mr. B in Kerala

CASE studies

Export of goods

Return of goods by Mr. A to Mr. B

Duties payable on return

No Use old shipping bill

Mr. A in Canada

Mr. B in Kerala

Mr. A in Canada

Mr. B in Kerala

M/s ABC of India

Case Studies

No tax invoices required to be issued in this case but the specified goods shall be accompanied with delivery challan issued in accordance with the provisions contained in rule 55 of the CGST rules

M/s ABC sends 100 units of specified goods out of India

In case the entire quantity of specified goods is brought back within the period of 6 months from the date of removal , no tax invoice is required to be issued as no supply has taken place in such a case

Mr. C staying outside India

In case ,the entire quantity of specified goods is neither sold nor brought back within 6 months from the date of removal, a tax invoice would be required to be issued for entire 100 units as per provisions contained sec 12 and sec 31 of CGST act.

74 CIRCULAR NO. 108/27/2019-GST

M/s ABC of India

Case Studies

No tax invoices required to be issued in this case but the specified goods shall be accompanied with delivery Challan issued in accordance with the provisions contained in rule 55 of the CGST rules

M/s ABC sends 100 units of specified goods out of India

Mr. C staying outside India

If the remaining 40 units are not brought back within 6 months from the date removal, a tax invoice would be required to be issued for such 40 units as per provision of sec 12 & sec 31 of the CGST Act

A tax invoice would required to be issued for such 60 units at the time of each of such sale as per provision of sec 12 & sec 31 of the CGST Act

75

Mr. B

CIRCULAR NO. 108/27/2019-GST

Whether e-way bill is required in the following cases-

Where goods transit through another State while moving from one area in a State to another area in the same State.

It may be noted that e-way bill generation is not dependent on whether a supply is inter State or not, but on whether the movement of goods is inter-State or not. Therefore, if the goods transit through a second State while moving from one place in a State to another place in the same State, an e-way bill is required to be generated.

Where goods move from a DTA unit to a SEZ unit or vice versa located in the same State.

Where goods move from a DTA unit to a SEZ unit or vice versa located in the same State, there is no requirement to generate an e-way bill, if the same has been exempted under rule 138(14)(d) of the CGST Rules.

76 CIRCULAR NO.47/21/2018-GST

(1) The shipping bill filed by 1a[an exporter of goods] shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India and such application shall be deemed to have been filed only when:-

a) the person in charge of the conveyance carrying the export goods duly files 36a[a departure manifest or] an export manifest or an export report covering the number and the date of shipping bills or bills of export; and

b) the applicant has furnished a valid return in FORM GSTR-3 2[or FORM GSTR-3B, as the case may be].

(2) The details of the 1[relevant export invoices in respect of export of goods] contained in FORM GSTR-1 shall be transmitted electronically by the common portal to the system designated by the Customs and the said system shall electronically transmit to the common portal, a confirmation that the goods covered by the said invoices have been exported out of India:

[Provided that where the date for furnishing the details of outward supplies in FORM GSTR-1 for a tax period has been extended in exercise of the powers conferred under section 37 of the Act, the supplier shall furnish the information relating to exports as specified in Table 6A of FORM GSTR1 after the return in FORM GSTR-3B has been furnished and the same shall be transmitted electronically by the common portal to the system designated by the Customs:

Provided further that the information in Table 6A furnished under the first proviso shall be auto-drafted in FORM GSTR-1 for the said tax period. ]

(3) Upon the receipt of the information regarding the furnishing of a valid return in FORM GSTR-32[or FORM GSTR-3B, as the case may be] from the common portal, 4[the system designated by the Customs or the proper officer of Customs, as the case may be, shall process the claim of refund in respect of export of goods] and an amount equal to the integrated tax paid in respect of each shipping bill or bill of export shall be electronically credited to the bank account of the applicant mentioned in his registration particulars and as intimated to the Customs authorities.

(4) The claim for refund shall be withheld where,-

a) a request has been received from the jurisdictional Commissioner of central tax, State tax or Union territory tax to withhold the payment of refund due to the person claiming refund in accordance with the provisions of sub-section (10) or sub-section (11) of section 54; or

b) the proper officer of Customs determines that the goods were exported in violation of the provisions of the Customs Act, 1962.

Rule 96:- Refund of integrated tax paid on goods or services exported out of India

with payment of tax)

(

CA Aanchal Kapoor 77

Rule 96:- Refund of integrated tax paid on goods or services exported out of India

(5) Where refund is withheld in accordance with the provisions of clause (a) of sub-rule (4), the proper officer of integrated tax at the Customs station shall intimate the applicant and the jurisdictional Commissioner of central tax, State tax or Union territory tax, as the case may be, and a copy of such intimation shall be transmitted to the common portal.

(6) Upon transmission of the intimation under sub-rule (5), the proper officer of central tax or State tax or Union territory tax, as the case may be, shall pass an order in Part B of FORM GST RFD-07.

(7) Where the applicant becomes entitled to refund of the amount withheld under clause (a) of sub-rule (4), the concerned jurisdictional officer of central tax, State tax or Union territory tax, as the case may be, shall proceed to refund the amount after passing an order in FORM GST RFD-06.

(8) The Central Government may pay refund of the integrated tax to the Government of Bhutan on the exports to Bhutan for such class of goods as may be notified in this behalf and where such refund is paid to the Government of Bhutan, the exporter shall not be paid any refund of the integrated tax.

1 [ (9) The application for refund of integrated tax paid on the services exported out of India shall be filed in FORM GST RFD-01 and shall be dealt with in accordance with the provisions of rule 89.

2 [ (10) The persons claiming refund of integrated tax paid on exports of goods or services should not have -

a) received supplies on which the benefit of the Government of India, Ministry of Finance notification No. 48/2017-Central Tax, dated the 18th October, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1305 (E), dated the 18th October, 2017 except so far it relates to receipt of capital goods by such person against Export Promotion Capital Goods Scheme or notification No. 40/2017 - Central Tax (Rate), dated the 23rd October, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1320(E), dated the 23rd October, 2017 or notification No. 41/2017-Integrated Tax (Rate), dated the 23rd October, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1321 (E), dated the 23rd October, 2017 has been availed; or

b) availed the benefit under notification No. 78/2017-Customs, dated the 13th October, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1272(E), dated the 13th October, 2017 or notification No. 79/2017-Customs, dated the 13th October, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1299 (E), dated the 13th October, 2017 except so far it relates to receipt of capital goods by such person against Export Promotion Capital Goods Scheme.]

CA Aanchal Kapoor 78

SB001 Invalid SB details

Reason: Due to wrong shipping bill number furnished in GSTR 1/Table 6A.

Solution: Rectify details by making amendments in GSTR 1 by using Form 9A. Form 9A has been made available by GSTN w.e.f. 15.12.2017 in exporter’s login at the GST common portal.

SB002 EGM not filed

Solution: Exporter should approach their

• shipping line; or

• airline/carrier; to file the EGM immediately.

SB003 GSTIN Mismatch

Reason: GSTIN declared in the Shipping Bill does not match with the GSTIN mentioned in the corresponding GST return.

Solution: In this case too, the exporter has to make necessary changes in GSTR 1 by use of amendment Form 9A. Exporters should note that there is no provision of amendment in the shipping bill once the EGM is filed.

Error

Error

Error

Errors in case of Refund of export of goods with Payment

Code

Description

Reason and Solution

CA Aanchal Kapoor 79

SB004 Record already received and validated

This error occurs due to duplicate/ repeat transmission of shipping bill-invoice record from GSTN. The previous transmission would have already been validated for IGST refund by ICES.

SB005 Invalid invoice number

Reason: Mis-match of invoice number as declared in the invoice table of the shipping bill and that declared in the GSTR 1 for the same supply. This can happen due to:

• Typographical mistake while entering data in GSTR 1 or the

•The exporter uses two sets of invoices, one invoice for GST and another invoice for exports resulting in mismatch of invoice numbers.

Solution: It was conveyed and reiterated that there should not be any difference between commercial invoice and GST invoice after implementation of GST since as per the GST law, IGST is to be paid on the actual transaction value of the supply between the exporter and the consignee, which should be the same as the one declared In the commercial invoice. If SB005 is due to a data entry mistake in GSTR 1, it can be amended in Form 9A. But any mistake in the SB cannot be amended in Form 9A. But any mistake in the SB cannot be amended once EGM is filed. Also, if the exporter has used a separate invoice in the SB, he cannot include that in his GSTR 1 in lieu of his GST invoice. Thus, SB005 error, as of now, cannot be corrected by any amendment either in GSTR-1 or in the Shipping Bill. For these cases a mechanism is being considered by the Board to make the requisite corrections manually in line with the recent amendments in Rule 96 of the CGST Rules, 2017. The said mechanism is expected to be available shortly. It may, however be noted that these Interim workarounds shall only be available as a one time measure for the past SBs. It is advised that the exporters should take care so as not to repeat such mistakes in future and ensure that the same GST compliant export invoice is declared at both ends.

CA Aanchal Kapoor 80

SB006

Gateway EGM not available

In cases of exports through ICDs, if the gateway EGM is not filed electronically or it contains some error, response code SB006 appears. It is noticed that gateway EGM In case of many ICD shipping bills have been manually filed, leading to such refunds not being processed. While the Customs at gateway ports are pursuing this matter with the shipping lines, the exporters can also approach their shipping line to file the EGMs electronically.

SB000 Successfully validated

SB000 (Successfully Validated) is the response code which comes when all the decided parameters like GSTIN, SB number, invoice number etc. match between GSTN and Customs database. This code implies that the SB is ready for inclusion in the IGST refund scroll. However, it might happen that even with SB000, the SB does not appear in the refund scroll. This could be due to

(i) The exports might have been made under bond or LUT, hence not eligible for refund.

(ii)If a shipping bill covers multiple invoices, few of the Invoices might have been successfully validated with code SB000 whereas other invoices might be containing other types of error/s

(iii)Composite rate of drawback has been claimed For that SB during the transitional period between 01.07.2017 to 09.2017, thus making the SB ineligible for IGST refund.

(iv) Where the IGST claimed amount is less than Rs. 1000/-.

In all the above cases, the scroll amount shall automatically become zero and the SBs shall not be included in the refund scroll.

There are two more reasons where the SBs will figure in the temporary IGST scroll but not in the final scroll. This could happen if there is an alert/suspension on the IEC in ICES or if the account of the IEC is not validated by PFMS.

CA Aanchal Kapoor 81

Export of goods or services

96A. Export

of

goods

or

services

under

bond

or Letter of Undertaking(1) Any registered person availing the option to supply goods or services for export without payment of integrated tax shall furnish, prior to export, a bond or a Letter of Undertaking in FORM GST RFD-11 to the jurisdictional Commissioner, binding himself to pay the tax due along with the interest specified under sub-section (1) of section 50 within a period of—

a) fifteen days after the expiry of three months 3[, or such further period as may be allowed by the Commissioner,] from the date of issue of the invoice for export, if the goods are not exported out of India; or

b) fifteen days after the expiry of one year, or such further period as may be allowed by the Commissioner, from the date of issue of the invoice for export, if the payment of such services is not received by the exporter in (Convertible Foreign Exchange) 3a[or in Indian rupees, wherever permitted by the Reserve Bank of India]

CA Aanchal Kapoor 82

Export of goods or services

96A. Export of goods or services under bond or Letter of Undertaking

(3)Where the goods are not exported within the time specified in sub-rule (1) and the registered person fails to pay the amount mentioned in the said sub-rule, the export as allowed under bond or Letter of Undertaking shall be withdrawn forthwith and the said amount shall be recovered from the registered person in accordance with the provisions of section79.

(4) The export as allowed under bond or Letter of Undertaking withdrawn in terms of sub-rule (3) shall be restored immediately when the registered person pays the amountdue.

(5)The Board, by way of notification, may specify the conditions and safeguards under which a Letter of Undertaking may be furnished in place of abond.

(6)The provisions of sub rule (1) shall apply, mutatis mutandis, in respect of zero-rated supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit without payment of integrated tax.

For Services Restoration Law is Silent CA Aanchal Kapoor 83

New Rule 96B Inserted:-

“96B. Recovery of refund of unutilised input tax credit or integrated tax paid on export of goods where export proceeds not realised.

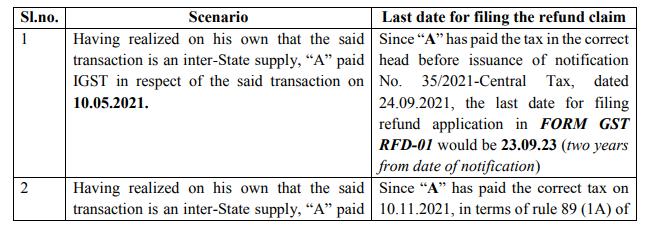

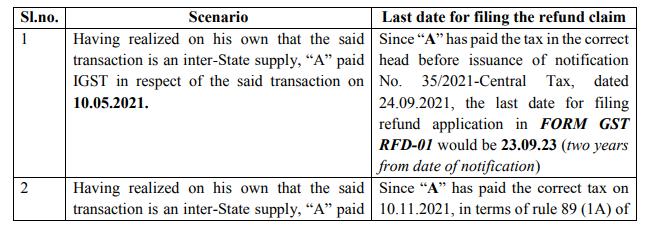

–