POWER MOVE

Our Canadian Thanksgiving and the whole month of October is a time to remember, a time to share and a time to show gratitude.

We have a tremendous amount of beauty in our fall season, our country is rich and bountiful and we have so many opportunities granted to us that are denied to other countries around the world. We should take this time to think and reflect on how fortunate we all are.

Our team at The TB Realty Group and Keller Williams Real Estate Associates are full of gratitude:

• for the loyalty of our clients

• for the trust they give us to help find or sell their homes

• for giving recommendations to others about all of the services we provide

• for inspiring us to continue working at our highest level

For these and many others, we are truly thankful. As always, we will continue to follow our vision. Our promise is our pleasure. Nothing else will do.

Wishing you and your family a very happy fall.

Sincerely,

Theresa Baird Broker

KW Real Estate Associates Inc., Brokerage

Lakeshore Road East, Mississauga

| tbaird@tbaird.com

Prep time: 20 minutes

3 nectarines , quartered

3 large tomatoes , sliced

Portion size: 4 servings

1 1/2 cup cherry tomatoes or miniature pear tomatoes, halved

1/2 cup crumbled feta cheese

2 tablespoons small fresh oregano leaves

1/2 teaspoon fleur de sel

1/4 teaspoon pepper

Vinaigrette:

1/4 cup olive oil

2 tablespoons lemon juice

2 teaspoons grated lemon zest salt and pepper

On large serving platter, arrange nectarines, sliced tomatoes and cherry tomatoes.

Vinaigrette:

In small bowl, whisk together olive oil, lemon juice and zest; season with salt and pepper. Drizzle vinaigrette over salad. Scatter feta cheese and oregano over top. Season with fleur de sel and pepper.

Photography by Tango | Food Styling: Denyse Roussin | Prop

Styling: Caroline Simon

Canadianliving.com

In talks of the Canadian real estate market, multi-property home ownership remains a hot topic, as fingers point to investors as contributors to the country’s housing crisis. But speculation may not be as big of an issue as it is made out to be - not in Ontario at least - according to new research.

The latest Market Insight Report from Teranet continues its focus on multi-property ownership profiles in Ontario. In its last market report, the registry solu tions company reported that as of April 2022, just under 25% of all residential properties in Ontario are owned by multi-property owners. Out of those properties, over 53% are owned by those with only two properties in their portfolio.

Additionally, their analysis suggests that the majority of multi-property owners are purchasing for long-term holding and value, with only a small fraction demonstrating high rates of turnover and shorter hold ing periods in their property portfolios that’s indicative of speculative activity.

In the latest report, Teranet data scientists ana lyze how people are purchasing, what they are purchas ing, and how they are financing such purchases. The re port subsequently offers new insights into the real estate market in Ontario derived through the team’s analysis of sales registration activity in the Ontario Land Registry.

The findings reveal that the majority of multi-prop erty owners purchase in groups of two, with an average age between the two parties of six years, suggesting that these owners are couples. Analysts observed that, of the Ontario home purchases by multi-property owners since 2011, approximately 60% are purchased by par ties of two, and 30% by those purchased individually. Not surprisingly, the proportion of multi-property pur chases made by a single owner is steadily decreasing, from 36% in 2011 to 27% year-to-date in 2022. As the report highlights, this emerging trend is likely indicative of the erosion in housing affordability observed in On tario during the period.

Most multi-property owners have just two prop erties in their portfolio. As of July 31, 2022, 53% of properties owned by multi-property owners are by those who own two properties, 18% owned by those with three properties, 8% by those with four properties, and the remaining 21% by those who own five or more proper ties. Of those owners with two properties, many have a

Source: Storey.com

preference towards GTA properties that are not Toron to condos. Based on sales activities from 2011 to July 2022, of those multi-property owners with two prop erties in their portfolio 25% are fully comprised of properties within the GTA excluding Toronto condos, 21% are fully comprised of Ontario properties that are outside the real estate hotbeds of the GTA, Ottawa, University towns, and cottage country, and lastly that 17% are comprised of one Toronto condo and another property within the GTA.

Data scientists observed differing trends amongst multi-property owners with five or more properties in their portfolios. They found that 25% of multi-property owners with five or more properties are fully comprised of Ontario properties that are outside the real estate hotbeds of the GTA, Ottawa, university towns, and cottage country. Addi tionally, 19% are comprised of at least one Toronto condo and other properties within the GTA. Lastly, 11% are com prised of at least one GTA property and other properties outside of the widely held real estate hotspots of the GTA, Ottawa, university towns, and cottage country.

“In summary, contrary to popular belief, we observe that multi-property owners with two properties have a preference for GTA properties that are not Toron to condos,” reads the report. “When looking at the port folios of multi-property owners, it appears that despite the number of properties in their profile, this segment tend to have similar weightings in Toronto condo prop erties, which supports the perceived appeal of this kind of property. Across all multi-property owners, an unex pected trend has emerged in which a quarter have all holdings outside of the real estate hotspots of the GTA, Ottawa, cottage country, and university towns.”

According to the report, the larger the portfolio of a multi-property owner, the more likely it is they will use a variety of lenders to fund portfolio purchases, and the less likely it is they will use a Big 5 bank exclusively for financing. Over 70% of multi-property owners with five or more properties chose different lenders for the properties within their portfolios. “Across all portfolio

sizes, there has been an increasing trend since 2011 to use different lenders to finance purchases, likely in dicative of the heightened level of competition between mortgage lenders,” reads the report.

While the majority of multi-property owners with two properties still tend to borrow exclusively from the Big 5 banks (at 54%, this preference declines with more properties in the multi-property owner portfolio). Amongst multi-property owners with five or more prop erties, only 38% finance their purchases exclusively with the Big 5 banks, while the remainder choose smaller lenders or combinations thereof, according to Teranet.

Tellingly, less than 30% of multi-property owner purchases are made within one year of a refinance of another property in the portfolio, which contradicts a widely-held belief that this segment habitually refinances other properties in their portfolio in order to fund new properties. There is an increasing trend to refinance other properties in the portfolio since 2019, coinciding with the significant increase in home prices.

“As expected, the bigger the property portfo lio, the higher the propensity to refinance properties in the portfolio to fund new purchases,” reads the report. “Only 17% of purchases by multi-property owners with two properties saw a refinance of the existing property within a year while those with five or more properties are twice as likely to do so, at 34%.”

Lastly, Corporations own less than 4% of resi dential properties in Ontario. Amongst Corporations that own multiple properties, the London area is most popular, and 73% of said owners have ten or more properties in their portfolio. “This is illustrative of the likely nature of property ownership for income-generat ing purposes, where the portfolio of properties is held in the same region for ease of maintenance,” highlights the report.

So, the reality is that some multi-property own ers may indeed be in the market purely for investment or income generating purposes. But many others clearly are not.

New York’s Hudson River Valley is the Empire State’s gem escape. With the Hudson River etching through the ten-coun ty region from Westchester County to Albany, the Valley not only inspires with its natural beauty, but also its bounties. From the Catskill Mountains and Shawangunk Mountain Ridge to vineyards and sustainable farms, this is the place to savor your time in the outdoors as well as a farm-to-table meal paired with your choice of local wine, craft brews, and/ or cider. Discover why others have chosen to vacation in the Hudson River Valley and why you should too!

Explore the Natural Beauties. Whether you en joy hiking, bicycling, or watersports, the Hudson River Valley area has experiences for all ages and abilities. Head to Minnewaska State Park Preserve for scenic hikes or bike rides on the Shawangunk Mountain Ridge. Nick named “The Gunks” by locals, this is where visitors can witness waterfalls, lakes, hardwood forests, and sheer cliffs with spectacular views along nearly fifty miles of footpaths and thirty-five miles of carriage roads. Another beautiful walk or bike ride is the Walkway Over the Hudson State Historic Park. Stroll or ride across this rail-totrail bridge from Poughkeepsie to Highland. Take in the sights from the walkway, including the FDR Mid-Hudson Bridge and the Culinary Institute of America (CIA). No trip to the Hudson River Valley would be complete with out an experience on the river for which it’s named. Try a kayak day trip or a relaxing cruise out of Kingston.

For history buffs, a drive to Hyde Park to tour the Franklin D. Roosevelt Historic Site and the Vander bilt Mansion is just the ticket. It’s no secret that many of the historically wealthy have vacationed in Hudson

River Valley to recharge their batteries. Because of this, there is a strong health and wellness focus, including the world-renowned Omega Institute for Holistic Studies located outside Rhinebeck.

Indulge in the Bounties. Stone Barns Center for Food and Agriculture and Blue Hill at Stone Barns locat ed on eighty acres of a former Rockefeller Estate in Pocanito Hills. Not only is Stone Barns a sustainable farm and not-for-profit educational center, but also a place where all can sample the fruits of the farm’s labor in the Blue Hill cafeteria.

For those wanting to experiment with delicacies from the crème de la crème of cooking schools, navi gate to the Culinary Institute of America (CIA) campus with a reservation in one of its four restaurants.

The Hudson River Valley is a wine lover’s des tination; so take the opportunity to swirl, sniff, and sip. A favorite multi-stop wine experience is the Dutchess Wine Trail, which includes three award-winning winer ies: Clinton Vineyards, Milea Estate Vineyard, and Mill brook Vineyards & Winery.

Written by Heidi Siefkas / Photography by Getty Images Source: HomesbyDesign.comIf craft brews or ciders are more your fancy, there is an array to pick from. Plan Bee Farm Brewery in Poughkeepsie is a true field-to-glass brewery. The brewers source 100 percent of all ingredients from New York, many of which come from the farm itself. For cider, Kings Highway Cider Shack at McEnroe Organic Farm in Millerton is a local hotspot. Enjoy seasonal ci ders as well as burgers, lobster rolls, and other delish delights.

With the natural beauty and tasty bounties of the Hudson River Valley, a trip to Upstate New York is calling you. Whether you fancy history, outdoor ad ventures, culinary stops, wine tastings, craft brews, or a combination of it all, Hudson River Valley has you covered. Take the time to escape, recharge, and in dulge in the Hudson River Valley.

Relocation companies are still looking for great rental opportunities and this condo happened to be one of them. If you’re a landlord with a property to lease and are looking for a corporate tenant reach out.

In a world that may seems designed for the young, getting older can feel like you’re becoming invisible. But, of course, you don’t simply stop having fun as you age. Here are some tips to help keep you on your toes to take advantage of the best years of your life.

1. Make a bucket list. Though it may be a bit cliché, making a list of things you want to accomplish in the remainder of your life can be a great exercise to understand your priorities, and your desired retirement style. Even if you don’t draft a detailed list, give it some thought: Do you crave adventure and new activities, or are you looking forward to slowing down and relaxing? Maybe a bit of both? Recognizing these broad goals can help you realize what will bring you the most fun and enjoyment as you’re making plans.

2. Find fun fitness. Physical activity is crucial to your overall health and wellness, and it is never too late to get started. In fact, in retirement you may be able to devote more time to activity than you ever did in the past. Whether you walk just half the golf course, dance in the kitchen or join a traditional fitness class, the key is to try out different activities to find one you enjoy. Don’t be afraid to make modifications for ability if you’re wor ried about injuries.

3. Get connected online. If you’re not totally com fortable on the internet, you’re not alone. But it can be a great resource to enrich your social life and help maintain your independence. Try getting your grandkids to teach you their favourite online video games; join social media and participate in groups and forums and reconnect with family and friends you normally call once a year. Just be sure to take the time to brush up on how stay cyber safe. Scammers often target older adults assuming they are more vulnerable. So, prove them wrong, and watch out for red flags like strange or threatening requests. Don’t give out personal information like your address, social insurance number or mother’s maiden name and never send money to someone you’ve only met online. Some scammers will target seniors pretending to be a family member. So if you get an urgent message from a relative in need, reach out to them through another means like by telephone to verify it’s really them. If anyone requests something sensitive, block them and report them to the platform you’re on.

Canada’s housing market is constantly surprising both buyers and sellers.

If you’ve been interested in buying a home in Canada, you’ve seen super high prices, and lately, you might have noticed a “correction” in the cost of homes. So, is it possible at all to plan for the coming year when the price of a house seems things can change so quickly?

We sat down with real estate agent Trish MacKen zie to get her forecast on what the upcoming 12 months in the world of Canadian real estate are going to look like. Simply put, MacKenzie said that understanding the hous ing market is “everyone’s favourite puzzle to try to solve.” But, there are a few things we can start thinking about pre paring for in the next 12 months, according to MacKenzie.

“As always, supply is going to be a major factor in the home prices we see,” said MacKenzie. “With sellers nervous about the return they will see in their asset, many will hold off listing their homes if they can,” she continued.

Homeowners don’t want to sell in a low market, even though tons want to buy under those conditions. That would be a reverse of what we saw in February of this year when people who sold in a high market also had to buy in a high market. This will mean that while we have generally low housing prices across Canada, we could see a major hit to the supply. “But the quantity of supply isn’t the only factor - so is the quality,” MacKenzie noted.

“With many of my first-time buyers, I am feeling their frustration that there are opportunities available to them, but the quality of the inventory is still not up to par.”

Potential new homeowners are facing the fact that a lot of houses going onto the market will have had the same owners for 30 or 40 years, which means their budget could disappear when renovations are included.

“They find an option that on first impression seems great,” explained MacKenzie. “But the work re quired makes it even more difficult to find a lender who will finance and insure the property.” On the flip side, if you’re a seller, you might simply just be thinking “not my problem.” That is until no one buys your property.

MacKenzie said that how we think about home ownership could likely change in the next 12 months. “We may see a shift in what it means to own property as an individual or family as one generation (baby boomers) sell off their assets, and a new generation (millennials and younger) take action towards homeownership.”

Of course, she’s quick to mention that there is no “perfect time to make a move in our housing market.” For sellers, she suggested that you “work with an agent who can help you put together a strategy for bringing your home to market.” This includes “giving you a clear vision in the values in your area and barriers buyers are facing” to make your property more desirable for buyers and lenders.

As for buyers, she recommended getting “a strong support team” and staying on top of the latest ben efits and changes to the economy. “Look for solutions on how to make your money work best for you,” she advised.

“The best time to buy or sell, to make any kind of moves in our market, is when it makes sense for you and your lifestyle.”

Written by Tristan Wheeler - Staff writer Source: Narcity.com

Attention golfers! Here is a beautiful turn-key home that includes full golf membership. Skip the line and start to play the moment you arrive. Fully furnished with a heated pool and spa. Become part of the Shadow Wood Country Club and enjoy 54 holes of golf, 9 tennis courts, bocce ball, pickleball and more.

Start living your best life now, call Theresa for more information.

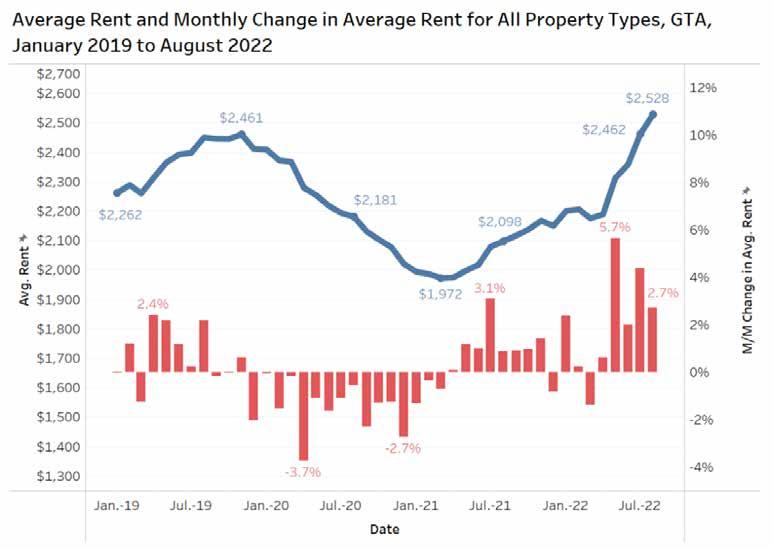

Thanks to a number of compounding factors, rents in the GTA are continuing to be pushed upwards. This is accord ing to a new Toronto GTA Rent Report by Rentals.ca and Bullpen Research & Consulting, which showed that rents for all property types in the GTA have increased 21% since this time last year. In August 2021, the regional average was $2,098. Last month, that same figure climbed to $2,528.

August’s rent was also up on a monthly basis, rising 2.7% since July. This is now a trend; rental rates in the GTA have risen by 2% or more for the past four consecutive months, following a rise of 5.7% in May, which was a multi-year high.

Rental rates as we’re seeing them today have now risen 28.2% past the COVID lows of early 2021, and this upward trajectory can be largely chalked up to the Bank of Canada’s interest rate hikes, “which has made owning a home more expensive and resulted in a swift decline in prices in the resale market,” reads the report.

The report goes on to say that, with future rent hikes most likely looming, rental demand isn’t expected to relent any time soon.

“From May to August, the Greater Toronto Area rental market has experienced four significant monthly

rent increases, as tenant demand has skyrocketed due to interest rate changes, a resale house price correction, and the typical seasonal fall uptick,” says Ben Myers, President of Bullpen Research & Consulting. “Pageviews per listing on TorontoRentals.com hit a multi-year high in August, rising 106% annually and 166% from the pan demic-impacted August 2020. Prospective tenants are seeing limited vacancies due to an extreme imbalance between supply and demand, with year-to-date new housing completions down 22 per cent annually in the metro area per CMHC.”

In central Toronto, the average monthly rent climbed 30.7% between Q3 2022 and Q1 2021, reach ing $2,533. On a quarterly basis, the Q3 figure has increased 13.8%.

The average rent also increased by 10.1% in North York, 9.4% in Scarborough, 5.7% in Etobicoke,

Written by Zakiya Kassam Source: Storeys.comand 5.1% in Mississauga between the second and third quarters of this year.

Condominium apartments in Toronto saw an increase to $2,963 in August, marking a 43% increase from a COVID-related low point of $2,100 in early 2021. August’s average was also 9.1% higher than the pre-pandemic high of $2,715 in August 2019.

Meanwhile, the average rent for a condo in Scarbor ough reached $2,494 in August, up 20% from August 2019, while Mississauga’s rose to $2,767 (up 13%), and Etobicoke’s rose to $2,723 (up 9.7%).

Additionally, certain neighbourhoods in the GTA saw more rent growth than others. Yonge-St.Clair, Casa Loma, Bay Street Corridor, and Little Portugal had some of the highest rents, although this differed by unit type. The area with the highest average across all property

types was the Bay Street Corridor, at $2,779. Conversely, Kensington-Chinatown and O’Con nor-Parkview had the most reasonable rents in the GTA. In particular, rental rates in O’Connor-Parkview were about $1,000 less per month compared to the Bay Street Corridor.

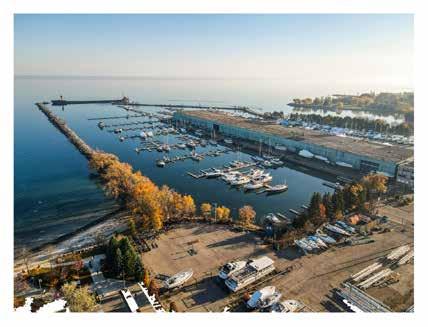

Classic living at its finest with modern amenities, great location and access to great cultural events that take place every year in Port Credit Village. Discover entertainment, shopping and tasty restaurants all within easy walking distance. Stroll along the waterfront trails and experience the best Mississauga has to offer. Reach out to Theresa or Lindsay to see this off-market property.

While spooky decor and classic costumes are the usual symbols of Halloween, you can’t forget about the iconic jack-o’-lantern. Picking out pumpkins and deciding how to decorate them is one of the most en joyable traditions of the Halloween season. That’s why we’re sharing our best pumpkin carving tips from the pros to help you and your family create your own All Hallows’ Eve staple.

Carving a pumpkin is a lot harder than it looks - no matter how much of a beginner or skilled crafter you may be. So we gathered insight from experts to find out their go-to carving tips to bring your creepy creations to life - from the standard triangular eyes and toothy grin to a glittery masterpiece and carved-out black cat. And if you want to stray from the traditional route, check out these no-carve pumpkins and painted pumpkin ideas instead.

Step 1. Begin with the right pumpkin. Choose one that’s fresh, with a sturdy stem, no bruises and a flat bottom so it won’t roll while you carve.

Step 2. Start cutting from the bottom, not the top. Michael Natiello, pumpkin carving pro and creative di rector for The Great Jack-o’-Lantern Blaze, says cutting your “lid” from the bottom of the pumpkin helps prevent the sides from caving in later.

Step 3. If you do carve from the top, cut out the lid on an angle.

This way it won’t drop inside the pumpkin when you put it back on top, like it would with a straight up-and-down cut. A boning knife should work well for this.

Step 4. Scoop out all the pulp (and then some). You can buy a special “claw” for pumpkin gutting, but an ice cream scoop will do just fine. Thin the inner wall of the “face” area to 1¼-inch thick, so it will be easier to pierce the shell.

Step 5. Sketch out your design on paper first. If you draw your jack-o’-lantern face to size, Natiello says you can use it as a pattern: Just tape it to the front of your pumpkin and use a fork or pencil to poke holes along the lines you want to carve. (Or save yourself

Written by Liz Borod, Heather Finn & Marigah Thomas Source: Goodhousekeeping.comfrom creative blocks by getting a pumpkin carving kit, complete with a marker, scraper, cutting tools and premade patterns.)

Step 6. Hold the pumpkin in your lap. It’s easier to create features when the face is gazing up at you. Natiello suggests using a serrated kitchen knife or an X-Acto knife for carving, but to make intricate de signs, you could try using a small saw. Just don’t cut on a slant — clean up-and-down slices look best.

Step 7. Start by making simple rough cuts. If you get the big pieces of pumpkin out of the way first, you can go back and clean up the edges of your design later.

Step 8. Use your scraps creatively. Make a tongue, pipe or hair accessories out of a dis carded piece of pumpkin shell, for example.

Step 9. Keep your pumpkin fresh. Natiello recommends spreading petroleum jelly on the cut edges to seal in moisture. If your pumpkin still shriv els a few days later, you can revive it with a facedown

soak in cold water for up to eight hours.

Step 10. Light it up.

Place your candle (or candles) into your pumpkin before lighting. If you don’t want to use votives, try Christmas lights, especially those that blink for a spooky appear ance. Or, save yourself the stress and go with battery-op erated votives instead.

Step 11. Create a chimney. First, leave the lid on for a few minutes while the candle burns. Then make a small hole where the lid has black ened.

Step 12. Sprinkle cinnamon inside the lid. That way, when you light the candle, your jack-o’-lantern will smell like a pumpkin pie. Yum.

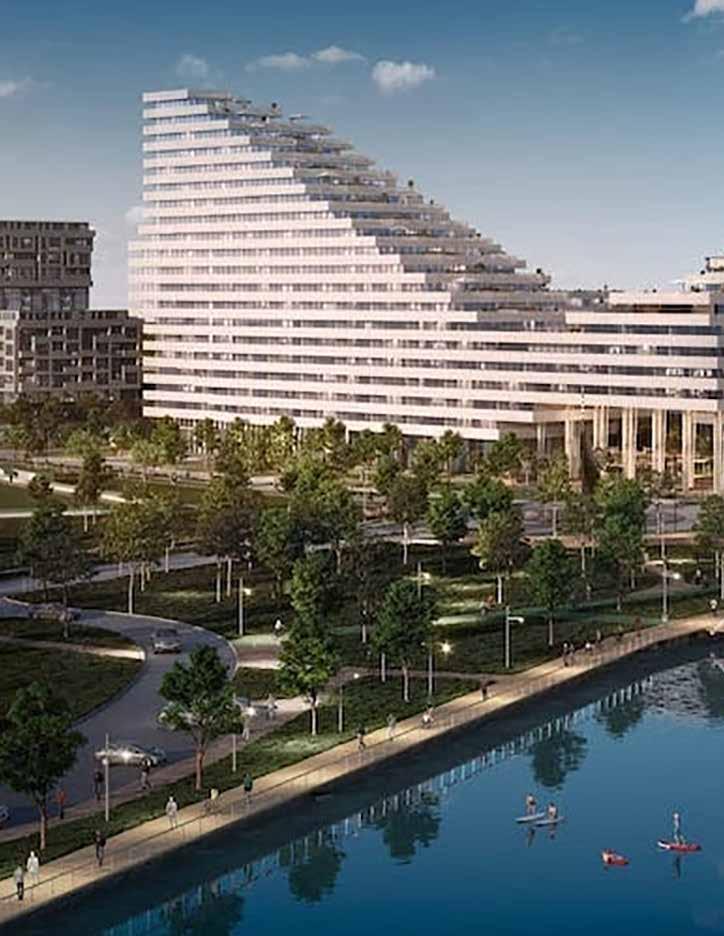

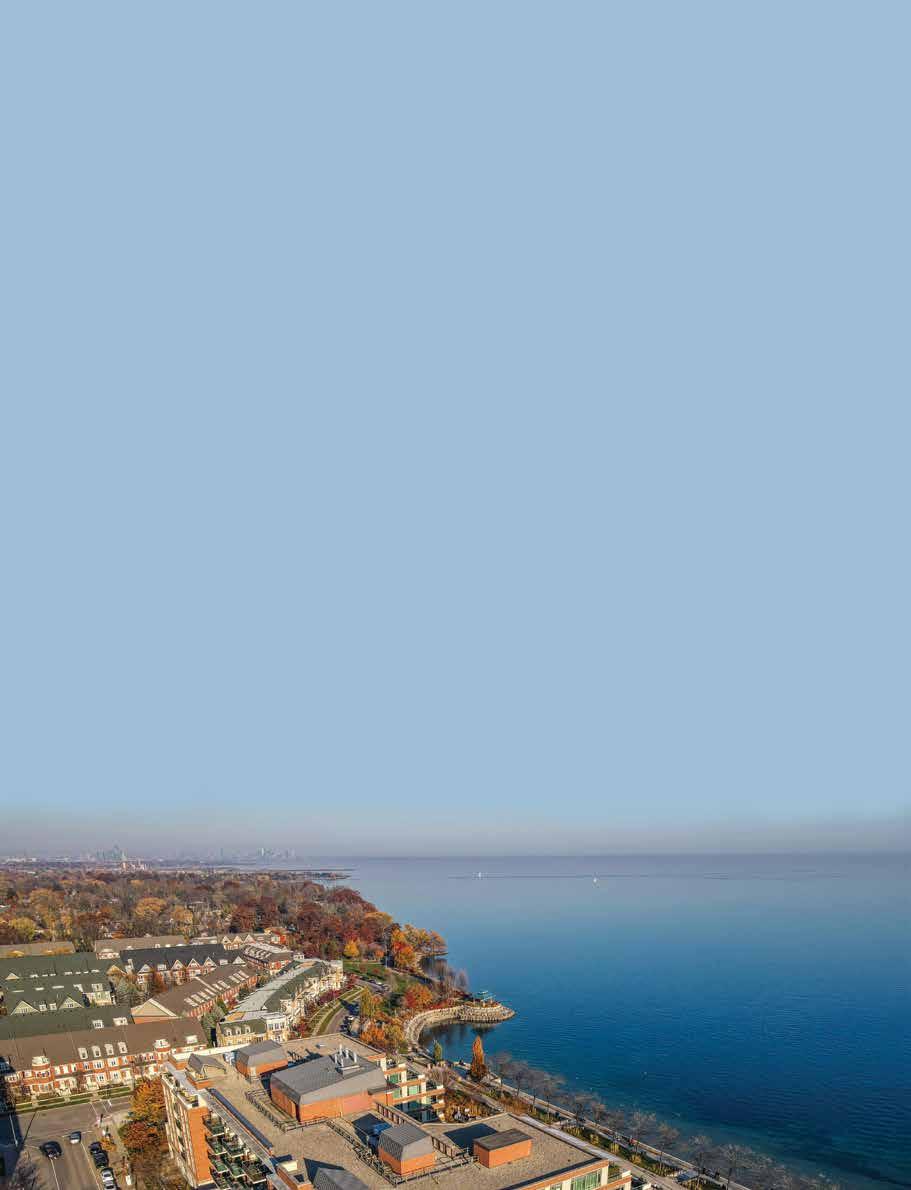

On 177 acres Lakeview Village is a newly built sustainable community, perfectly situated within easy walking distance to the waterfront, woodland and local dynamic districts.

Harbourwalk’s interconnected towers set an all new standard of luxurious waterfront living.

Don’t miss out on this fantastic opportunity. Contact Theresa and start living.

The district of Chelsea in London has been the epicentre of cultural and class in the heart of the United Kingdom.

Located on a quiet side street in one of the most desirable neighbourhoods of London and just a short walk to all the shopping, dining, pubs and galleries of the King’s Road.

Waiting for an opportunity to discover all England has to offer? Reach out to Theresa to begin your adventure.

If you’re considering a second home purchase, you probably want to know the bottom line. Sure, it’s more fun to browse listings and imagine yourself poolside at your new home, looking out at the ocean waves or rolling hills. But cost is part of the equation, and Pacaso is committed to full transparency. We want to make sure buyers understand the cost breakdown upfront, so there are no surprises later on.

Once you find a home you love, a Crew member will walk you through the costs associated with the list ing. In the meantime, if you’re trying to understand the whole financial picture, our pricing model covers three main areas:

• Share price

• Monthly owner expenses Pacaso’s program management fee

• Here’s how we approach each cost area.

• Determining the share price

When you browse Pacaso listings, the sale price reflects the cost to purchase ⅛ ownership of the home. If you want more ownership, multiply that price by the number of shares you wish to purchase, up to four (½ ownership of the home). We determine the sale price of a share by adding these costs:

Whole home purchase price. This one is selfexplanatory - it’s the amount Pacaso paid to acquire the home on the open market.

Home upgrades and closing. We give each home a design makeover to create livable luxury - a beautifully and comfortably designed home, with all the amenities you need to enjoy your stay. This includes big-ticket items, like high-end furnishings and state-ofthe-art appliances, and small details, like board games and handy kitchen gadgets. Our professional interior designers customize each home, and we install the lat est home technology and smart home features. We also calculate the real estate transaction costs (agent commis sions, inspections and closing costs).

Pacaso service fee. This one-time fee covers the costs of buyer aggregation (finding and vetting qualified owners) and LLC formation (including legal fees). Financing. For buyers who choose to finance up to 70% of their purchase through Pacaso’s banking partners, a financing fee will be assessed at closing.

A summary of these costs can be accessed via the listing details for any available Pacaso. Prospect list ings are whole homes under consideration for purchase; we use the same criteria to estimate the share price for a

Written by Amie Fisher Source: Pacaso.comProspect, but the price may change slightly if the home becomes available for co-ownership. For example, we would determine the exact cost of upgrades once we walked through the home with our design team.

Keeping the lights on. As with any home, there are utilities and other ongoing expenses associated with Pacaso ownership. These costs ensure your home is well-maintained and ready for your next stay. Because Pacaso manages the home, you don’t have to worry about any of the usual homeowner details or hassleswe take care of the bills, cleaning and maintenance, and we even handle the property tax payments.

We budget for owner expenses annually and break the cost into 12 fixed monthly payments. Costs are passed through to owners, with no markup, based on the number of shares they own. Monthly payments are deposited into the LLC account, and Pacaso uses the funds to cover these expenses as needed:

Preventive and routine maintenance. Depending on the property, this may include landscaping, pool mainte nance, snow removal, HVAC servicing, gutter cleaning and more.

Property management. Pacaso provides inhouse property management services in most regions, and elsewhere we work with experienced local property management companies who take care of the day-today needs of the home. We ensure communication is streamlined and the quality of service is exceptional.

Cleaning. Each home is thoroughly cleaned and inspected after each owner’s stay, and consumable sup plies, such as paper goods, are replenished.

Utilities. This includes gas, electric, water, sewer, garbage and internet/TV — the basics to keep your home functional.

Taxes and insurance. Pacaso manages the pay ments for property taxes and homeowners insurance premiums when due. We’ll provide an annual K-1 tax

form for each owner. Learn more about ownership and tax reporting in a multi-member LLC.

Reserve fund. As any homeowner knows, things break or wear out, so Pacaso maintains reserves in the LLC to cover those unforeseeable or longer-term expens es, such as a roof replacement.

We will only increase monthly owner expenses if it’s needed to cover increases in actual costs of the home, such as insurance, taxes or other increased rates. Any necessary adjustments are made annually, and all cost statements are available to owners upon request.

Providing a fully managed experience. For many people considering a second home purchase, one of the biggest downsides is the burden of owning anoth er property. If you only expect to use your second home a few weeks or months a year, you may decide to rent it out - and deal with the headaches of vacation rental management - or struggle to find reliable local vendors to help with maintenance issues, especially if problems arise while you’re away from the property.

Pacaso relieves you of these worries and has sles by managing all aspects of homeownership. We charge a program management fee of $99 per share, per month, which covers a range of services, including:

• Aggregating and managing the monthly owner expenses and taxes

Maintaining the LLC and resolving any disputes between owners or the municipality Continually innovating and improving the Pacaso app and other digital technology

• Providing dedicated owner support

The monthly program management fee is fixed and will not increase annually. Pacaso is dedicated to transparency in pricing, and we believe our co-owner ship model offers an equitable and cost-efficient way for more people to experience the joy of owning a second home.

This master-planned community will ul timately consist of over 2,500 condos, 400 townhomes and over 300,00 sq ft of commercial and retail space. Now is the perfect time to get in on this great opportunity. Reserve your new home by contacting the Realty Group today.

Oakville’s newest luxury waterfront residence is now available for you to purchase. Well-appointed suites, hotel-inspired amenities and much more all in the heart of Oakville’s Bronte Village. Don’t delay, you can choose your perfect suite now by calling the Realty Group today.

During the summer of 2021, I became increas ingly concerned about the effects of climate change. Saskatchewan’s typical summer weather seemed to be slipping away, and instead, many days were insufferably hot and smoky, as wildfire smoke blew in from fires both in and out of province. In late June of that same year, the entire village of Lytton, B.C., was wiped out by a wild fire after it reached 49.6 degrees Celsius - the hottest temperature ever recorded in Canada. Elsewhere in the world, severe heat brought more raging wildfires, while other places saw devastating hurricanes and floods. Ev ery time I scrolled through the news, I felt a growing sense of dread—it seemed like climate disasters and ex treme weather events were happening everywhere. And climate experts have said that this is just the beginning. That sense of dread, it turns out, has a nameecological anxiety, or eco-anxiety. Defined by the Ameri can Psychological Association as “a chronic fear of envi ronmental doom,” eco-anxiety can involve a wide range of emotions, from anxiety, stress and fear to guilt, anger and hopelessness.

“Eco-anxiety is a rational response to what’s happening in the world,” says Nancy Blair, a registered counselling therapist in Dartmouth, N.S., and the Atlan tic Canada regional representative for the Climate Psy chology Alliance North America (CPA-NA). “Research about eco-anxiety [...] is kind of evolving, but one thing that’s important is that it is not defined as a mental ill ness. It’s a rational, healthy response, no matter how aw ful it feels.”

Blair notes one of the most common things she hears from her clients is a general sense of fear and anx iety for what the future will look like and how we will be affected. These fears impact people of all generations but are increasingly common among young people. A 2021 study from the University of Bath in the United King dom surveyed 10,000 people between the ages of 16 and 25 in 10 countries and found that 59 percent were either very worried or extremely worried about climate change, with 84 percent at least moderately worried.

“What we’re seeing is that eco-anxiety is emerg ing in popular discourses and mainstream media, while

Written by Naomi Hansen. Illustration from istockphoto Source: Canadianliving.com

before, it was mostly a nameless grief,” says Sarah West, an environmental arts therapist and consultant at Earth en Vision Therapeutic Arts & Consulting in Nelson, B.C. “It’s only been in the last few years that these intense changes in our climate are right in all of our faces, and we cannot ignore them.”

West is also a member of the CPA-NA and through her practice, she runs workshops to help par ticipants cope with ecological grief. She says eco-grief and eco-anxiety are very similar and can often co-exist in those affected.

“Grief is an experience of mourning, and anx iety can be a result of experiencing eco-grief,” West says. “Eco-grief is an expression of love. We grieve be cause we love ourselves and our lives and our planet, and it means that we care. When we care about some thing or someone, we may want to do what we can to help or support.”

Because eco-anxiety and eco-grief are natural re sponses to climate change, they can manifest in many different ways. West notes they can have an impact on both mental and physical health, and that it’s important to honour these feelings when they do come up.

“Shutting it out or shutting it down hurts us in the long run because it numbs us and creates a disconnect between us and nature,” says West.

Dealing with those feelings can look different for everyone, but Blair says a good starting point is using strategies that help alleviate anxiety, like practicing med itation and mindfulness, exercising, spending time in na ture, limiting time scrolling online and talking to other people who share your concerns.

“Get out every tool you have for dealing with anx iety, and if you don’t have any, you may want to develop them,” says Blair. “And then if you decide you want to do something about climate change, really do it. I’ve found that if you take action, that process will alleviate some of the anxiety.”

For Melina Laboucan-Massimo, a Lubicon Cree activist for climate justice and Indigenous rights, work ing through feelings of eco-anxiety and eco-grief has helped her become active.

“Some days it’s sitting through that grief and sad ness and allowing yourself to process it. And then for me, on other days—most days—it’s responding to it,” she says. “I think a lot of the time people think of this as an individual issue, but it’s not, it’s a collective issue. For me, being a part of climate justice movements, [I’ve seen how

Melina Laboucan-Massimo’s organization Sacred Earth Solar brings renewable energy to Indigenous communities.

it] brings together people from all walks of life who care about these issues collectively.”

Laboucan-Massimo has been at the forefront of climate activism in Canada for years—she’s the founder of Sacred Earth Solar, co-founder of Indigenous Climate Action and the host of Power to the People, a documen tary series focused on how Indigenous communities are leading Canada’s clean energy revolution—and she says many environmental activists have been dealing with eco-anxiety for decades.

“Find ways that you can be active and do your part to address climate change,” says Laboucan-Massimo. “[Ac tion] can look like many things to many people, depending on each person’s skill set and passion. And we need all types of skill sets working toward climate action.” Although climate change is a global issue, Laboucan-Massimo rec ommends starting locally. Taking action could mean joining a local group or movement, or it can also involve making personal changes toward living more sustainability. Either way, says Blair, we have to remember to find or generate hope in our lives, which can help us navigate eco-anxiety and eco-grief. “We’re in an extraor dinarily difficult time right now [...] and that’s why I think it’s really important to look for what’s hopeful,” she says. “It’s not over yet, and there are things we can do. You may have to look for it, but it’s really important for us all to have hope that there’s a future worth fighting for, and that we can do something to make it happen.”

The Resort and Second-Home Property Specialist (RSPS) is an o cial certification of the National Association of REALTORS®. That means I uphold a strict Code of Ethics and always work in your best interest.

As an RSPS, I have the certified knowledge and experience to help you buy or sell:

New property developments

Homes in a resort or vacation destination

I’m a Local Expert

Get all the right info about the area—popular attractions to hidden treasures, high season to low, and trends that impact your investment.

I’ve Got the Right Connections

Tap into my vast network of property managers, tradespeople, clients, and professionals who provide specialized services.

Whether you want an investment to retire in or a place you can get away to every now and then, we'll make your dream a reality.

TB Realty

I would like to thank Lindsay and Theresa for their outstanding service. Their handling of my Real Estate transaction was done in a most professional way, and to my fullest satisfaction. I would not hesitate to recommend them to anyone. I wish you both a successful future and thank you again for your help and service.

- Theo Theresa Baird and Lindsay Meadwell recently assisted us with the sale of our Port Credit condo. We had the pleasure of working with them previously, and had every confidence that this time would be no different. From our initial contact, to informing us of current market conditions and trends, preparing our place for sale with expert staging, marketing, through to managing showings and offers, they were attentive, professional, and a pleasure to work with every step of the way. We highly recommend Theresa and Lindsay to anyone looking for real estate agents who go above and beyond to get the job done, efficiently and professionally. Thanks for making our sale a success!

- Michael & RandyWow! Theresa and her team managed to set a new record! I have been working with Theresa’s team for a few years now. They were able to secure a tenant for my rental property within 24 hours! The previous record they held was 48 hours for reference. I’m always super happy with her communication and recommendations. Her advice is always on trend with the ever changing market situations. I look forward to working with her team for years to come!

- Marc