THE TO POWER MOVE YOU

Great news! This issue of our magazine is packed with exciting and informative articles on real estate. Whether you’re a buyer, seller, or simply interested in the market, there’s something for everyone in this issue.

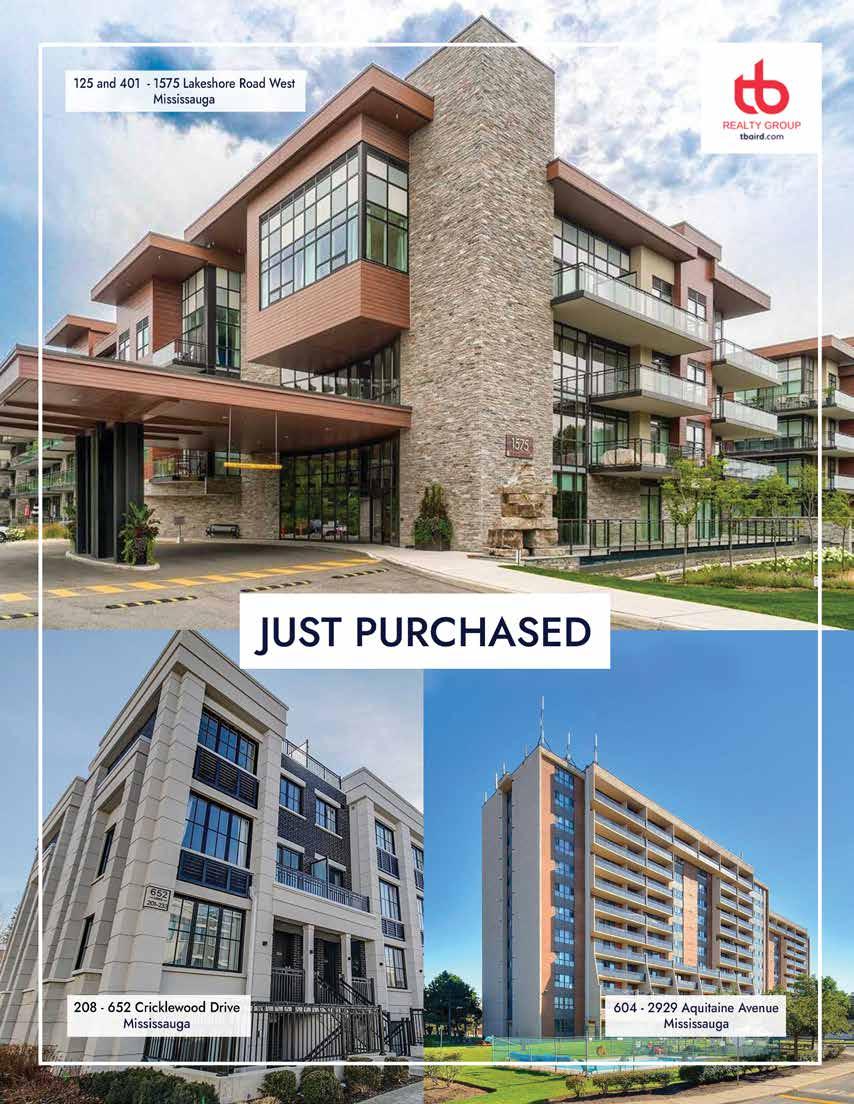

Get ready to dive into valuable insights on the Canadian housing market, with a lead feature on the recent Bank of Canada rate pause and what it means for homebuyers. You’ll also find a range of spectacular featured listings, showcasing unique and beautiful homes for sale across Canada and the United States. From a modern and playful retreat that has undergone a complete landscaping makeover, to a luxurious Florida home in a sought-after location, you’ll be inspired by the variety of properties offered for sale.

In addition to the exciting features, the magazine includes an All About Real Estate section. This covers everything from an overview of the February 2023 TRREB report to our team testimonial page, which highlights a few of the reviews that our clients have provided recently. You’ll also find helpful advice on increasing your credit score to buy a home, and supporting your sense of wellbeing while working from home. This section is a must-read for anyone looking to stay up-to-date on the latest trends and insights in the real estate industry. So sit back, relax, and enjoy all the engaging and informative articles we’ve assembled for this months issue.

Theresa is thrilled to announce to her clients that she has attained the Accredited Real Estate Negotiator (AREN) Certification. This esteemed certification is granted to individuals who have completed either the Master Certified Negotiation Expert (NCNE) or the Certified Negotiation Expert Course (CNE), in addition to a recent Dealmaking course with The Nature of Real Estate Company. Furthermore, Theresa is a valued member of multiple recognized programs, certified by CREA (Canadian Real Estate Association) and NAR (National Association of Realtors US).

For more information on these designations and how Theresa and her team can help you buy, sell or invest in local, national and international real estate properties, visit http://www.tbrealtygroup.ca Power

Discover the exquisite Terra Model home crafted by Empire Homes. Renovated just 5 years ago, this exceptional residence boasts elevated main and upper levels that exude sophistication and style. As you step inside and experience the open spaces that are perfect for family living, this turn-key home beckons the next happy homeowner to make it their own. Take a moment to immerse yourself in the virtual tour or book a private showing to experience the grandeur of this ideal home firsthand.

Wednesday marked the second Bank of Canada (Bank of Canada) interest rate announcement of the year. The overarching takeaway: the bank made good on its promise to hold the benchmark rate steady… for the time being, at least.

“We can see that the interest rate increases we’ve undertaken to date are already working. Higher rates are slowing household spending, and inflation is coming down,” Bank of Canada Governor, Tiff Macklem, said in a statement in January. “We expect to pause rate hikes while we assess the impacts of the substantial monetary policy tightening already undertaken. To be clear, this is a conditional pause - it is conditional on economic developments evolving broadly in line with our MPR outlook. If we need to do more to get inflation to the 2% target, we will.”

After eight consecutive rate hikes over the span of a year, industry experts agree that Wednesday’s announcement is a bright spot for Canadian consumers. It may even bode well for the housing market this spring.

Moshe Lander, Senior Economics Lecturer at Concordia

University, says “nothing has really happened” between the January and March decisions to necessitate another rate hike. In fact, the Consumer Price Index has come down for two months in a row, dipping to 6.3% in December and to 5.9% in January. These are signs that the rate hikes are working their way through the economy the way they are designed to.

“Because there hasn’t been any smoking gun, the Bank of Canada had to keep things on pause to maintain a certain element of credibility,” he continues. “Just imagine a parent says to their child, ‘I want you to go to bed at 10:00.’ Then 10:00 comes, and they say, ‘make it 10:15.’ The kid’s going to say, ‘I thought I had until 10:00.’ Credibility comes from when you say something, standing behind it unless there’s evidence to suggest that you need to change your position.”

If the Band of Canada had in fact raised the rate, Lander

Written by Zakiya KassamSource: https://storeys.com/boc-rate-pause-signals-strong-spring-market/?ct=t(EMAIL_CAMPAIGN_3_24_2021_13_32_COPY_15)

adds, it would only frustrate and confuse Canadians and implicate the efficacy of the bank’s forward guidance. “That could make it harder for expectations to be met in the future.”

“I think the pause is a much-needed sigh of relief for would-be homebuyers,” says Christopher Alexander, President at RE/MAX Canada. Where consumer confidence has dwindled over the past year, he’s now observing some semblance of rebound. “What I’m hearing, at least from a good segment of agents, is that their customers are understanding that rates are where they’re at, and they’re probably going to be where they are for the foreseeable future.”

Alexander’s observation is well-supported. In January, insurance comparison platform RATESDOTCA revealed that mortgage renewal quotes were up by 107% and purchase quotes by close to 92% month over month. Year over year, renewal and purchase

quotes were up 49% and 48%, respectively, indicative of “a new wave of interested buyers.”

More recently, the latest Bloomberg Nanos Canadian Confidence Index showed that consumer confidence hit a six-month high in February, attributed to “improving views on real estate.”

“Consumer confidence rose to the highest level since the end of September as more Canadians see real estate values rebounding after the central bank conditionally halted its interest-rate hikes,” wrote Randy Thanthong-Knight in a post for Bloomberg News. “Improvements in sentiment point to expectations of an imminent recovery [in] Canada’s housing market, which saw benchmark real estate prices plunge 15% from last year’s peak as higher rates squeezed buyers. More than a quarter of respondents now expect prices to rise in the next six months, the highest proportion since September - though still below historical averages.”

Alexander notes that prices will likely continue to find support in the coming months due to chronically low supply.

“It’s very fascinating because, outside of Calgary and a little bit of Edmonton, the story is the same across Canada, which is very low inventory, homes that come to market are selling pretty quickly and oftentimes in competition or in multiple offers.”

While conditions in the housing market are nowhere near the pandemic frenzy, Alexander says that the home-buying desire is certainly there.

“There’s a lot of pent-up demand,” he says. “Consumers have to make buying and selling decisions, so they’re going to make them in the next several months. I think we’re going to get some balance, we’re probably going to get back to the normal real estate cycle.” And this may even translate into some reprieve for the rental market.

In January, the annual rate of rent inflation in Canada remained in the double-digits for the ninth consecutive month, rising 10.7% to $1,996, according to the latest national rent report from Rentals.ca.

“We were on the verge of renting being more expensive than buying,” says Alexander. However, the rate pause may very well entice Canadians to reevaluate their home-buying plans. Alexander says he’s seen this happen in the past. “You might get people jumping back into purchasing, jumping back into homeownership.”

Whether or not the Band of Canada will raise the rate further remains to be seen. The consensus amongst industry experts seems to be that we haven’t seen the last of rate hikes.

“The major risk this year with respect to Band of Canada rate policy is that the central bank will have to reverse course and lift the policy rate further,” says Joe Brusuelas, Chief Economist with consulting firm, RSM. In a report from February, RSM forecasted that the Bank of Canada will raise its policy rate to a peak of 4.75% by the middle of this year. Brusuelas also cautions that activity from the US Federal Reserve stands to have a major influence over the Bank of Canada’s next moves.

“Following Federal Reserve Chair Jerome Powell’s testimony to Congress this week, it’s highly likely that the American policy rate will move to a minimum of 5.5% and quite possibly 6% in the near term,” he says. “Given that the current Bank of Canada policy rate stands at 4.5%, that creates quite a large differential which will result in capital flowing into the US and depreciation of the Canadian dollar against the greenback.”

Protecting the value of Canadian currency “may lead the Band of Canada to reconsider its strategic pause later this year,” adds Brusuelas.

Speculation aside, Lander says that consumers can expect the Bank to “start to make noises” ahead of a prospective rate increase. “And that makes it a lot easier than for people to stomach because they would see it coming then.”

Check out this amazing bungalow on a huge, irregularly shaped lot filled with mature trees and beautiful gardens. It’s perfect for enjoying as a family or hosting parties. You’re also a stones throw from Forster Park, top-notch schools, and vibrant downtown Oakville.

This could be your new home! Contact us to book a showing or visit our website for more information.

While the U.S. real estate market is experiencing supply shortages and corresponding price increases, Canadians are still investing in U.S. real estate, making up the largest share of foreign buyers.

For nearly 19 months, the Canada-U.S. land border was closed to non-essential travel. In November 2021, fully vaccinated travelers were once again allowed to enter the U.S., and travel began to pick up immediately. As of February 2022, the largest increase in arrivals into the U.S. was among Canadians.

Just as they enthusiastically traveled back to the U.S., Canadians began investing in U.S. real estate again. In fact, Canadians made up the largest share of foreign U.S. property buyers at 11% of total foreign buyers. Based on the 2022 International Transactions in U.S. Residential Real Estate report published by the National Association of REALTORS, Canadians spent $5.5 billion on U.S. real estate purchases last year.

Florida has long been a prime destination for Canadian travelers as short-term vacationers and snowbirds who enjoy an extended winter stay. As temperatures dip north of the border, the Sunshine State’s warm weather broadens its appeal to Canadians. So when it comes to purchasing real estate, it’s not surprising that Florida is again top of the list. According to a National Association of Realtors® 2022 study, for U.S. real estate property purchases by Canadians:

• 45% were in Florida

• 23% were in Arizona

• 12% were in California

Beyond weather considerations, one of the reasons Florida remains so attractive to Canadian buyers is its affordability - particularly in Orlando and Central Florida. 72 million people visit Orlando each year - and all throughout the year, not just in summer or winter. This reality, combined with the considerable short- term rental zoning in Orlando, makes the area particularly appealing for those looking to purchase investment properties. For buyers interested in purchasing a short-term rental, just be sure to advise that they confirm the terms with the Homeowners Association, as they can vary across properties.

In Arizona, cities on the west side of the Valley of the Sun are ones to watch. There’s a lot of construction happening in that region, and it is one of the more affordable areas for buyers in that state.

According to the same NAR study, 44% of all foreign buyers of U.S. real estate purchase a property for use as a vacation home, rental home or both. Comparatively, 58% of Canadians are more likely than the average foreign buyer to buy U.S. real estate for vacations.

Source: https://discover.rbcroyalbank.com/canadians-are-back-to-buying-u-s-real-estate/

While most Canadian buyers purchase detached single -family homes in the U.S., they are also the most likely to purchase condominiums. This is likely due to the fact that their properties are primarily used for vacations.

The rate of home sales in the U.S. began to slow in early 2022, falling nearly 6% compared to the same period the year before - likely in response to rising mortgage rates. Even so, there is more demand than supply in the U.S. real estate market, so home prices have continued to rise. The median sales price for an existing home reached $391,200 USD in April 2022, up almost 15% over last year. In the first quarter of 2022, 70% of 185 metro areas had double-digit price increases.

And although rising interest rates have restricted purchasing power for buyers across North America, the housing market is complex. While some buyers adopted a ‘wait and see’ approach in the late fall of 2022, the pull back of mortgage rates in 2023 is likely to mean that home sales will quickly pick back up in the months ahead. Canadian buyers are especially likely to look south of the border for their vacation properties. This is partially because these “higher rates” in the U.S. - which are still far lower than the current rates in Canada - have led to a cooling of U.S.

home prices. Still, the prices for single family homes in the U.S. remain more affordable than the cost of property in Canada. For example, according to the Global Property Guide for prices in global cities, the median price of a home is $530,000 USD in the Miami/Fort Lauderdale/ West Palm Beach region - or $3,170 per square meter. In Toronto, the median price per square meter is $10,947 USD. So far, in 2022, Canadians are paying an average of $485,000 for their U.S. properties.

As Realtors are well aware, the real estate market both north and south of the border is complicated and trends are difficult to predict. While interest rates, home prices, inflation and other broad economic conditions may have thrown a wrench into some buyers’ plans, others have found opportunities. Plus, those looking to realize longheld dreams of U.S. homeownership have taken action in the wake of the pandemic. The bottom line is that Canadians are back to buying U.S. real estate - they just need some guidance from experienced Realtors who can partner with them through their exciting journey ahead.

Theresa is a Certified International Property Specialist (CIPS) and a member of the National Association of Realtors® (NAR) USA. If you’re considering buying a vacation home in the US, give her a call. She has the expertise and contacts to make it an easy and stress free experience.

Fractional ownership in real estate is when individuals own a percentage of a property and share usage rights. Fractional ownership splits the cost of an expensive purchase among several people.

Fractional ownership is commonly used for buying vacation homes or luxury items like boats or planes, but is also used for other types of assets such as art, stock and fashion items. Owners are issued a deed representing their fraction of the property.

Fractional owners also take on the benefits and losses that come with ownership: If a vacation home grows in value over 10 years, individual shares appreciate, too. Co-owners share usage rights, income and access to their shared property proportionate to the percentage of the asset they own. Unlike a timeshare, fractional ownership means you own part of the second home itself, not just the time you can use it.

There are a few common fractional ownership structures that we’ll dive into later. One is called tenancy in common and another is via an entity, like an LLC.

Example: Sophie lives in Detroit, Michigan, and wants to buy a second home so she can winter on the West Coast. Her budget is $110,000, so she’s able to become a 1/4 fractional owner of a beach house valued at $440,000. The home has two other owners: James, who owns 1/4 and the Jones family who own 1/2 of the property shares. A local management company facilitates their renovations and property maintenance.

TAKEAWAYS

Fractional ownership is:

A more accessible way to buy and own than purchasing alone

When the cost of an asset is divided into percentage shares

Property that’s owned and shared by multiple unrelated parties

Written by Kayla Moss. Images from www.pacaso.comSource: https://www.pacaso.com/blog/what-is-fractional-ownership

The pros include each owner has express ownership of part of the property. Your capital goes further as a part of a collective buying power. You have greater control over when and how you stay than a timeshare and there are typically fewer owners to share with than a timeshare. You can sell your shares in the property whenever you want and your shares can appreciate over time.

The cons are that you aren’t the sole owner of the property. You pay management fees, if you choose an external manager. Your shares can depreciate over time and it can be difficult to sell shares versus a whole property.

With tenancy in common (TIC), each tenant holds an individual deed for a fraction or percentage of a commercial or residential property. There is one key difference between tenancy in common and fractional ownership: No one person or company is in charge. To be a

TIC, individuals must own different percentages of the property while sharing the whole and managing it themselves.

Some properties split ownership via a structural entity like an LLC (limited liability company) or LLP (limited liability partnership). Since a separate legal entity defines the ownership, it’s no longer a tenancy in common. It’s not necessary to have an LLC to make a fractional owner ship purchase.

Many major purchases can be purchased via fractional ownership: luxury cars, yachts and boats, aircraft, recreational vehicles and, of course, real estate.

Yes, you can finance fractional ownership of a property,

but it’s less common than paying in cash. Fractional mortgages come with their own restrictions and are issued less often by lenders.

Fractional ownership differs from timeshares because you own a portion of the property. For the majority of timeshares, you only own time to use the property. Timeshares are also shared by many more families than homes owned via fractional ownership. A timeshare might have 50 or more families staying per year, while fractionally owned properties can have as few as two simultaneous owners.

Maintenance of fractionally owned properties typically falls to a third-party management company. If the property you share is recognized as a tenancy in common, the owners might take a more casual approach and assign property management tasks to individuals in the group.

Pacaso offers fully managed LLC co-ownership of a second home. Owners purchase from 1/8 to 1/2 of the property and share the rest anonymously with their fellow owners. From there, Pacaso handles all the maintenance, management and ongoing updates to the home. Ownership is easy and straightforward to ensure you spend time enjoying your second home, not managing it. Learn more about our residential listings, and see how easy it is to own a second home by talking with Theresa Baird and her team. Theresa is an authorized Pacaso Realtor® and can answer all your questions.

Soak up desert views in this gated mountaintop retreat with a wrap-around balcony and walls of glass. Sleek, contemporary architecture creates seamless indoor-outdoor living, starting in the spacious great room.

The gourmet kitchen has stainless steel appliances and a quartz waterfall island. The dining table and executive bar make entertaining easy, as does the cooled whiskey and wine room.

The primary suite features a fireplace, wine fridge and doors to the patio. The ensuite bathroom has a soaker tub, tiled shower, dual sinks and a makeup vanity. An office and game room opens to the infinity pool and patio. The home, which includes an elevator, comes fully furnished and professionally decorated. If you’re tired of the cold and want a beautiful retreat to get away from it all, this is for you.

For Bianca Bodley, owner and principal designer of Biophilia Design Collective, landscaping is all about harmony. Her Victoria, British Columbia - based firm specializes in both landscape design and project management for residential and commercial properties.

“When I look at a landscape - whether it is a small urban garden like this one or rural acreage - I see it as pared back to the original form as possible and build forward from that in my mind,” she says. “We treat the land, the existing flora, and the overall site context as equal stakeholders in the design process. If the design we achieve honors both the land and the client, then we have succeeded.”

In the case of this home, nestled in the tree-shaded neighborhood of Fairfield, creating a cohesive transition from the indoor to outdoor spaces was paramount. Bodley and her team worked previously with both the homeowners and the on-board architect, D’Arcy Jones. Collaborating closely with Jones, Bodley and her team crafted a retreat that honored existing tenets of the landscape - like the stately Garry oak and cedar trees - while matching the fresh, modern aesthetic of the renovation.

Whenever possible, Bodley incorporated existing plants and native species to keep the garden rooted in place. “Using indigenous plants, for me, is all about restoration and giving back to the land,” she explains. “They also provide food for people and birds, and they just feel grounded. I like to use them en masse just as they are found in nature, in beautiful swaths.”

In the front garden, native ferns and rhododendrons complement a hedge of English laurels offering structure and privacy. An existing boxwood hedge in the back garden serves as a natural frame for focal pieces like the clients’ art installation and blooming roses. The woodier elements help demarcate spaces, creating a flow and organization akin to interior rooms.

“The evergreen backdrop was the anchor in both the front and the back gardens,” explains Bodley. In many

Written by Victoria Hittner / Photography by James Jones Source: https://article.homebydesign.com/pages/article/HBD_FEB_23_04/275454/index.html#pockets of the design, texture plays a greater role than color. For depth and visual interest when revitalizing a landscape, the designer recommends investing in mature trees and shrubs and filling in with smaller, faster -growing perennials and grasses.

“Texture is important as it allows you to create mood,” says the designer. “The structure of evergreens allows you to define a space and draw the eye, [giving] you the feeling of privacy and enclosure. Soft and movable plants such as grasses and bamboo offer a sense of peace and interactivity, as they respond to their changing environment.”

Come autumn, the grasses also bring a touch of honeyed color to the garden. Flowering perennials add further seasonal splashes in pinks, purples, and whites. Keeping the color scheme of the vegetation simple allowed Bodley and her team to play with starker contrasts in the landscaping.

“The color palette of the house inside and out, as designed by [architect] D’Arcy Jones, is a bold and clean, white aesthetic. This extended to the decking that was stained white and leads the eye seamlessly between the inside living room to the outside living space. We wanted to continue this bold and clean approach to our material and color selections for the exterior . . . but in a contrasting tonality of dark against the white.”

For the main patio, Bodley chose charcoal pavers, while smooth concrete and pea gravel form the main pathways connecting the front and back gardens. Junctures and stairs are punctuated with flagstone and black basalt. At night, uplighting illuminates the front garden path, as well as natural focal points like the large oak tree in front and bamboo in the back garden.

One of Bodley’s favourite aspects of the design is the sleek, white planters. The powder-coated metal pieces can be found on the deck, throughout the back garden, and inside the home. “For me,” notes Bodley, “it was like taking the white, art-gallery feel of their interior outside to allow the plants in the garden to be displayed in their own room . . . I feel like [the planters] are a strong connecting art element between the house and the landscape.”

The tidy pathways and multiple seating areas invite continuous exploration and enjoyment, balancing just the right amount of modern intrigue with the more traditional aspects of a garden retreat.

“The clients love art and color, but they also wanted a serene space that complemented their beautiful home,” says Bodley. “This garden, for me, is a reflection of the spirit of my clients; it’s really important to me that the gardens I design have this connection.”

This Port Credit waterfront community offers unparalleled lakeside living and a coveted carefree lifestyle. Awaken to breathtaking sunrises and relish in the tranquil beauty of Lake Ontario from the second floor of this exquisite suite, where panoramic lake views abound. Step inside and be captivated by the open concept layout, perfectly suited for the contemporary urbanite.

With just one call, this masterpiece can be yours to treasure for a lifetime.

Being self-employed has many benefits, such as flexibility, independence, and potential for higher earnings. However, it can also bring some challenges, especially when it comes to securing a mortgage.

There were 2.7 million self-employed Canadians in 2021. In this large market, many people are searching for a new home, and they would also be in need of a good mortgage. Self-employed people can get a mortgage from A Lenders, B Lenders, and private mortgage lenders.

To qualify for a self-employed mortgage, borrowers will need to have at least two years of consistent income from their occupation or business. Lenders may require up to three years of income history in some cases.

Though requirements may vary per lender, here are four key documents that lenders usually require when applying for a self-employed mortgage:

If your credit history isn’t good enough, you may need to pay higher minimum down payment of at least 10%, as opposed to the standard 5%.

STEP 1: Prepare your financial documents ahead of time, including bank statements and a profit and loss statement for your business.

STEP 2: Lower your debt-to-income ratio by paying down debts or increasing your income to make you a less risky borrower.

STEP 3: Improve your credit score by making consistent on-time payments and lastly,

STEP 4: Consider making a larger down payment.

STEP 5: Get a mortgage pre-approval to determine your price range and show sellers that you’re a serious buyer.

Tip: Working with a mortgage broker who specializes in self-employed mortgages can be a great way to navigate the requirements and find the right lender for your needs.

Source: Moe Hasham of Mortgage Leaders

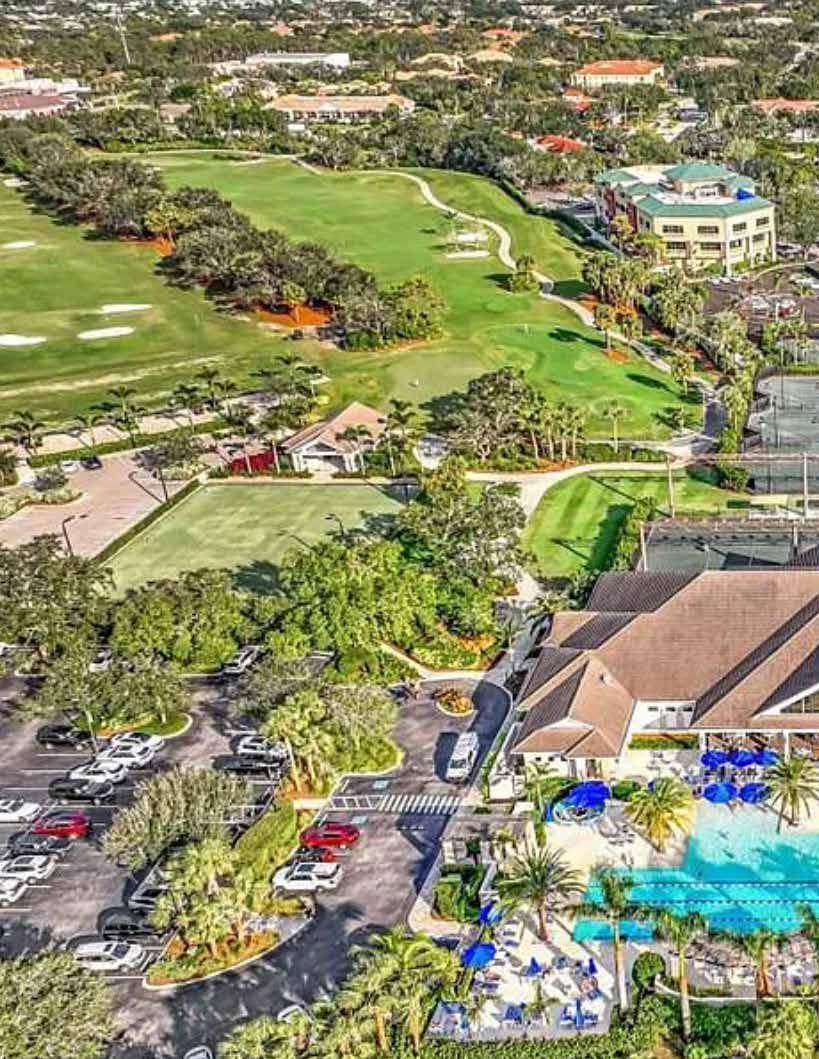

As you enter this beautiful estate home, the open floor plan unfolds throughout the rear of the house and welcomes you to a spectacular golf course view. Enjoy the spacious outside lounging deck complete with beautiful pool and spa which is overlooking the 13th green! This is one you don’t want to miss. Reach out to our team and make your dreams a reality.

Canada’s foreign homebuyer ban may have unintended consequences that could harm the real estate market and beyond, warns Benjamin Tal, managing director and deputy chief economist for CIBC Capital Markets Inc.

The “Prohibition on the Purchase of Residential Property by Non-Canadians Act,” which came into effect on January 1st, prohibits non-Canadians from purchasing residential property for two years. The goal was to take pressure off the price of housing and improve affordability.

However, in a weekly memo, Tal highlights that the language of the legislation has created ambiguity and confusion, leading to unintended consequences.

The economist writes, “The language of the Act appears straightforward until you show it to a lawyer,” Tal explains that the definition of “residential property” is broader than most people would expect. It includes any developed or vacant land that does not contain a habitable dwelling, is zoned for residential or mixeduse, and is located within a census metropolitan area.

This means legislation includes commercial real estate assets on land zoned for residential or mixeduse, encompassing the entire downtown Toronto area. Additionally, based on the language, it prohibits non-Canadians from purchasing farmland located within a census metropolitan area, which may not have been the intended target.

The economist writes, “While real estate lawyers are smiling, the rest of the industry is not. We have been in contact with many real estate players in recent weeks. The damage is real.”

The unintended consequences of the foreign homebuyer ban have already been felt, with many commercial real estate deals being canceled or placed on hold, even those unrelated to residential housing, writes Tal.

Source: https://realestatemagazine.ca/the-unintended-consequences-of-canadas-foreign-homebuyer-ban/

Developers that are partly foreign-owned or rely on foreign equity are unable to proceed with purpose -built developments, which Tal argues are the most effective tool to tackle Canada’s housing affordability crisis. The Act is also having a negative impact on REITs, which Taj says are “by far the most capable and motivated potential builder of purpose-built units.”

The economist believes the legislation may harm not only the real estate market but also other industries, such as private equity funds with minority foreign

investors trying to acquire shares in a manufacturing or pipeline business located on land zoned as residential or mixed-use.

Tal is calling on the government to make changes, writing, “Policymakers should immediately take another look and amend the Act in a way that is consistent with what it was intended to achieve - focusing only on single units being purchased by foreigners while exempting development of new supply from the impact of the new legislation.”

Have you been renting and thinking about buying a home? The benefits of owning a home go beyond having something to call your own! Typically considered one of the safest investments a person can make, there are several other benefits of homeownership. If you’re feeling financially secure, the time to act is now.

In Canada, first time buyer incentives are making homeownership more attainable, getting people out of rentals and into a home of their own. Here’s what it looks like when you rent vs own.

1) When you rent your a paying the landlords mortgage and making them richer. Owning your own home increases your wealth.

2) Monthly payments are subject to increases year-to-year but a fixed mortgage keeps your monthly payments constant during your term.

3) When you rent, you pay a constant amount that never goes away but with ownership you have the option to prepay your mortgage, if your bank allows it.

4) With a rental you always know the space you live in belongs to someone else. A home is yours to customize and design however you want.

5) As a renter you are subject to the will of the landlord who may decide to make changes or updates at their convenience. As a homeowner, you are your own landlord.

The amount of Canadian non-homeowners who plan to buy within the next two years nearly doubled in 2020. Many of these folks aspire to purchase a nice home with more room in an affordable area. There are a few other benefits as well. Homeownership provides a place to call your own. Your home creates a sense

Article written by and images provided by Buffini & Company.

Source: http://buffinico.blob.core.windows.net/downloads/documents/resources/The_Magic_of_Owning_a_ Home_Full_CANADA.pdf

of security and belonging in your community, knowing that you have a piece of the neighbourhood that’s all yours. Whenever you walk through the front door, you are reminded of the effort that went into obtaining that home in the first place and achieving that goal.

The financial benefits of Homeownership:

1) Grow your personal fortune. Owning your home boosts your own net worth and lets you accumulate more wealth over time

2) Get more tax benefits. Depending on your circumstances, you can gain access to various tax credits and deductions as a homeowner, which could save you money come tax time.

3) Secure an investment that isn’t going anywhere. Whether you fix it up, rent it out or re-sell it, real estate’s value tends to increase the longer you have it, and are often less volatile than stock investments.

Not only does homeownership benefit you, but it also

impacts the world around you and it can creates stronger families. When you have a home base that’s all yours, studies show that emotional stability increases among family members.

Kids perform better in school. Children raised in a home that’s owned by the family find more success in math and reading and have fewer behavioral problems.

Homeownership can crate a stronger sense of community. People who own homes are more active in their community, doing more to ensure that their property remains in a neighbourhood that is supportive, safe and beautiful.

The magic of homeownership affects your dreams, wealth and family life. Investing in a home is a smart decision for anyone looking to increase their net worth and become more active in their community.

Call the TB Realty Group today to get started on your journey to homeownership!

Crisp asparagus pairs beautifully with salmon in this one pan wonder, which is fitting for a weeknight dinner or an elegant gathering.

Preparation time: 15 minutes Total time: 25 minutes Portion: 4 serving

Photography by Maya Visnyei

Source: https://www.canadianliving.com/food/lunch-and-dinner/recipe/garlicky-parmesan-salmon-asparagus

3 tablespoons olive oil

2 cloves garlic, minced

1 teaspoon lemon zest

2 tablespoons lemon juice

3/4 teaspoons salt, divided

1/2 teaspoon pepper, divided

4 salmon fillets (about 800 g total)

1/2 cup finely grated Parmesan cheese, divided

1 bunch asparagus (about 450 g), trimmed

1/4 cup finely chopped chives

Preheat oven to 425°F. Line baking sheet with parchment paper. In small bowl, whisk together oil, garlic, lemon zest, lemon juice, 1/2 tsp of the salt and 1/4 tsp of the pepper.

Place fish in centre of prepared pan; sprinkle with remaining 1/4 tsp each salt and pepper. Brush with half of the garlic mixture; sprinkle with 1/4 cup of the Parmesan. Bake for 5 minutes. Remove from oven.

Add asparagus to pan; brush with remaining garlic mixture. Sprinkle with remaining 1/4 cup Parmesan. Return to oven; bake until fish flakes easily when tested, 5 to 7 minutes. Sprinkle with chives.

When you are buying a home and getting a mortgage, the purchase price isn’t really what you are paying. The actual cost of the house is how much you pay in interest to the mortgage lender. If you get a better interest rate from the lender, your payments will be less. Those who have the best credit get the most favorable loan terms.

So improving your credit score before buying a home is essential. It is not so much what credit score is necessary to buy a house but what scores will give you the best terms and conditions.

There are a few things you can do to improve your credit score in order to qualify for a loan to buy a house. By following these simple steps, you can increase your credit score by up to 50 points in a relatively short time. Let’s dive in and take a look.

When your credit score is low you may not be able to procure a mortgage. The majority of all lenders will not give you a loan when your score is lower than 620. If you are lucky, you may be able to get a traditional FHA loan or FHA 203 k with a score less than 620. So, in order to increase your loan options it becomes crucial

to work on improving your scores. Your credit score is an important factor in determining your mortgage rate. The better it is, the lower your interest rate and monthly mortgage payments will be.

If your credit score is lower than average, increasing it can help you save money on interest rates. But even if your score is good, increasing it could still save you thousands of dollars in interest payments over the life of the loan.

By increasing your credit score by just 50-60 points you could save tens of thousands over your mortgage term. Credit scores become especially important when you are buying a home a lower income.

What do lenders and credit institutions consider a good credit score? The majority of lenders will look at

Written by Bill Gassett. Source: https://www.rismedia.com/2022/09/27/how-increase-your-credit-score-buy-house/a borrower more favorably when their credit is above 670. If you can get your scores above 740, your credit score is considered very good. Anything above 800 is exceptional. Each step up the credit ladder will help you lower the interest rate a lender is willing to give you.

Everyone is entitled to check their credit score once a year for free. Each of the three major credit bureaus including, Experian, Equifax, and Transunion will provide you with a free credit report. You just need to ask them to send it to you by going to their respective websites.

It is vital that you look over your credit reports yearly to ensure there are no mistakes. Credit reporting mistakes can bring down your scores. Many people have credit errors and don’t even know it.

These are all the things you can do to improve your credit scores to be able to buy a house with more favorable terms.

1) Fix credit reporting errors

As previously mentioned, check over your credit report for any errors and get them fixed.

2) Avoid late payments

One of the most vital factors that influences your credit

scores is paying your bills before they are due. Late payments can have a detrimental effect on your credit scores. If you find that you’re having problems making timely payments, consider getting auto payments set up.

3) Keep credit utilization low

Another important factor when improving a credit score is the percentage of your total available credit that you use. Keeping your credit utilization below 30% of your total credit line is important to maintain a good credit score.

4) Sign up for credit karma or credit sesame

Two of the best companies out there to help improve your credit history are Credit Karma and Credit Sesame. Their services tell you exactly what you need to do to increase your scores and the service is free.

Your credit score is one factor that lenders use when considering what interest rate you qualify for on a mortgage. It is certainly a factor that is in your control. If you put the time and effort in, it will improve. If your credit score is below-average, you may be charged more in interest over the life of your loan than someone with a better credit score.

To improve your credit score quickly, you should focus on reducing your debt, limiting your spending, and paying bills on time.

As we find ourselves in an unprecedented time, there really isn’t a manual or a “how to” guide for finding and maintaining wellness and an overall sense of health amidst the pandemic. Most of us have been sent home from our work places to work from home. Now that we are settling in to our sixth week of working from home, the reality that this pandemic has forever changed our world is becoming more real as each day goes by.

Working from home sounds like a great idea. No commuting expenses, home cooked lunch, and zero travel time are some of the reasons why working from home was enticing to me; however, after five weeks, I’m beginning to feel a little frazzled. I miss my co-workers, I miss the peer workers I support, and with no end in sight, I am beginning to worry that working from home is something that I need to accept as my new reality.

I have been experiencing a shift in the way I think about work. I begin my day with breakfast and then head upstairs to a make shift office where I spend the next 8 hours – minus the hour for lunch where I head downstairs and cook a nice lunch because I now have time to do that! At the end of my day, I head downstairs but it doesn’t really feel like I have left work. Because I don’t have any commuting time, I haven’t really transitioned from my work

persona to my personal life persona. I still feel like I am switched on and in work mode.

As a team, one of the ways we have adapted is by connecting each morning to check-in with each other and exchange ideas and trouble shoot any issues or concerns that have come up. During this morning huddle, I asked my team if they could relate to my dilemma. We discussed the importance of having a work persona and referred to it as a force field. My team mates are truly the best, so naturally I wanted to share their insights into how they maintain their sense of wellness and manage work/life balance during the pandemic and this new landscape of working from home.

Source: https://cmhawwselfhelp.ca/news/supporting-your-sense-of-wellbeing-while-working-from-home/

We are on a mission to raise $10,000 for CAMH (Centre For Addiction And Mental Health) and CADDAC (Centre For ADHD Awareness Canada). It is without a doubt that ADHD and mental health issues are common in our community and continue to be a contributing cause of death around the world.

The Centre for Addiction and Mental Health is a psychiatric teaching hospital located in Toronto and ten community locations throughout the province of Ontario. At CAMH, it’s their goal to provide hope and a path toward recovery from mental illness and substance use for anyone in need.

There are approximately 2 million individuals affected by ADHD in Canada. Individuals, families, and parents with children are left scrambling to cope, figuring out how and where to get support for their ADHD. As well, they are trying to figure out how to pay for expensive programs.

Our families have been directly affected by ADHD and Mental Health issues so in hopes that one day no one else will have to experience the angst of dealing with ADHD or any kind of addiction or depression, we have chosen to donate a portion of our professional fees to these charities. As well, when you refer a friend or family member to our team not only will they receive award-winning service, but they will also be contributing to these extremely worthy causes. Together we can help calm minds and ensure that everyone gets the support they need.

We encourage you to visit both of their websites at www.camh.ca and www.caddac.ca and check out the incredible work they are doing in our community and beyond!

Knowledgeable, current, and quick to respond - what more you want when hiring a real estate agent and broker? Collectively they have years of experience and the right connections to boot. Every step of the process was enjoyable, collaborative and transparent. Bonus points for the Matterpoint edge which makes virtual viewings easy! Two houses sold and one bought with the help of their solid guidance. We are thankful for Lindsay and Theresa and look forward to moving into our new home and community.

- Rob and JenWe just wanted to send a huge thank you to Theresa and her team, with a special shout out to Lindsay. We were guided through the sale process every step of the way. Our condo looked unbelievably great once it was staged and when it hit the market it sold in under a week for an amazing price. We were totally wowed. After looking after us through the sale, they then found us the ideal rental property and helped us with all the mountains of paperwork involved, something we didn't even realize they could help with. We couldn't have done it without them, they definitely went above and beyond, and they will be the team we call for our next home purchase. With their dedication to helping us and making sure we were ok during this stressful time, we would highly recommend the TB Realty Group to buy, sell or rent.

- Sarah and JimWe had the pleasure of working with Theresa and Samantha for the sale of my mother's home. The entire transaction from our initial meeting to the closing was very smooth and personable. They had great ideas for virtual staging and suggestions for improvements that would have the most impact. Theresa was always available to speak to and provided a wonderful advertising campaign, maximizing the number of potential buyers. We were able to sell the home quickly, above the asking price, with multiple offers. All in all, it was an easy and pleasurable process, mostly as a result of their vast experience and professionalism, we highly recommend working with Theresa and Samantha. Thanks again!

- Aida and RulaOn behalf of The TB Realty Group, we would like to express our sincere gratitude for the trust and support you have given our team over the years. We are thrilled to announce that we received the Platinum Award at the Keller Williams Real Estate Associates 2022 Annual Awards Ceremony. This achievement would not have been possible without you. Your decision to entrust us with your real estate needs, whether it was to sell your home, buy a new property, or find your dream vacation home, has been a great honour for us. It has been an absolute pleasure to serve you, and we are grateful for the opportunity to help you achieve your real estate goals.

To those who referred us to their family and friends, we cannot thank you enough. Your referrals are the highest compliment we can receive. We will continue to work hard to provide exceptional service and exceed your expectations. Once again, thank you for your continued support and for making The TB Realty Group a part of your real estate journey.

Sincerely,

S����tha McG��th Real Estate Agent Real Estate Agent Lindsay Meadwell

Julia Baird-Oryschak Real Estate Agent

S����tha McG��th Real Estate Agent Real Estate Agent Lindsay Meadwell

Julia Baird-Oryschak Real Estate Agent