8 minute read

AM AND THE YEAR AHEAD

WORDS: Laura Griffiths

AM AND THE YEAR AHEAD

Head of Content Laura Griffi ths asks AM experts what’s in store for 2022.

Personal resolutions, however ambitious or misguided, are standard for a January. Mine was to read a new book every week (don’t be too impressed, the second was ticked off by Britney Spears’ unoffi cial biography). For industry, however, January tends to be about predicting trends for the coming year, and after the two we’ve all just had, it’s good to look to the future with a big dollop of optimism.

If there’s one topic that has reigned supreme following accelerated conversations throughout 2020, it’s supply chain. After AM vendors and end-users rushed to answer calls around PPE shortages and other pandemicimpacted supplies, the question since has been whether AM’s role in alleviating those problems would just be another short-lived spike on the 3D printing hype cycle or if the goodwill earned by the technology during those times of crisis would have a long-term impact.

“In the second stage of the pandemic, and now in 2022, society has become more aware of the enormous social contribution of our technology - industries have seen how we can improve processes and reduce costs with our 3D printers in production lines,” Xavier Martínez Faneca, CEO at BCN3D told TCT. “I think this situation is exceptional and transitory, and through this experience, we have all realized that it does not make sense to be producing in distant locations but that local manufacturing should instead become the norm.”

Recent fi gures from market intelligence company CONTEXT suggest that this renewed interest in 3D printing is here to stay. Figures show a tangible impact on machine orders, and CONTEXT reports that “almost all major vendors” at last year’s Formnext said “new and renewed interest in 3D printing was a consequence of global supply-chain problems.” While work from home scenarios saw a surge in desktop machine purchases in 2020, one machine segment that has remained strong throughout is the Professional class (categorized as those priced between $2,500-$20,000). Shipments were up not only on the previous year but +13% higher than in the same period pre-Covid, which CONTEXT believes has been driven by the launch of new products, namely lower-cost SLS machines like Formlabs’ Fuse 1.

Kathy Bui, Product Lead, Engineering Business at Formlabs, commented: “In 2022, we will continue to see AM play a role in the supply chain with 3D printers becoming a manufacturer’s Swiss army knife, an adaptable tool that can keep production lines running. With in-house industrial grade 3D printers, manufacturers can fortify their business against supply chain challenges and mitigate risk rather than replacing traditional manufacturing processes. 3D printers will be used as a risk mitigation tool rather than replacing traditional manufacturing processes.”

That said, the same report cautions while 3D printer shipments are on the up, the industry’s own production lines have been thwarted by the very supply chain disruptions it aims to solve. Order rates show demand is there but due to shortages in certain printer components, like many in-demand consumer-facing items from cars to PlayStation 5s, the supply chain can’t keep up.

But that doesn’t mean AM can’t be an asset elsewhere as Oliver Smith, Founder and Principal Consultant at Rethink Additive, commented: “For every story of 3D printed rockets, there are a thousand examples of 3D printing producing the “boring” stuff that keeps a line moving, an operator comfortable or a parts bin stocked.

“Going into 2022 and beyond, expect a shift in messaging from vendors and enquiries by users from 3D printing as a production solution, towards 3D printing as a productions support solution, able to rapidly provide the “boring” components and widgets needed to keep your operations and shop fl oor processes moving. COVID has made “boring” cool.”

That AM can’t solve all supply chain problems, not even its own, emphasizes how AM adoption needs the right applications. 3D Systems, for example, has been exploring AM’s role in semiconductor capital equipment, an area the company’s CEO Dr Jeff rey Graves believes AM’s ability to facilitate “exotic machine components” will help “improve effi ciencies by simultaneously producing numerous unique, end-use parts.”

Likewise, Don Xu, Deputy General Manager and Global Business Group Director at Farsoon Technologies, which announced sales totalling more than $15 million during November 2021 with over 40 machines sold, believes while AM trends in supply chain will continue this year “to an extent and in certain applications,” for the vast majority of supply chain issues, we won’t see much change. Although, Xu does believe that “larger, more productionoriented applications will be a key growth area for additive in 2022.”

Avi Reichental, CEO, Chairman, and Co-Founder of Nexa3D, which recently introduced a new SLS system that decouples 3D printing and cooling processes to maximize productivity, says the lean towards production will lead to further micro-trends too: “The last two years have exposed a highly complex and brittle supply chain, which is top of mind for most product companies and driving CEOs to accelerate the digitization and localization of their supply chain with AM playing a central role with emphasis on speed, throughput, cost, and sustainability.

“With more companies transitioning to volume additive production, we will experience stronger demand for larger build formats, functional materials, scaled post-processing, and full factory automation solutions that are anchored by advanced and adaptive machine learning and vision technologies for greater production consistency and yields.”

Throughout each of these conversations, it became clear that if there’s an AM segment that holds the most promise and is set to be the biggest driver in said production applications, it’s material innovation, as Bui posited: “In 2022, 3D printing will grow as more innovative materials come to market to serve a variety of industries such as healthcare, dental, manufacturing, engineering, education, jewelry, audio and entertainment. In addition to evolving the existing materials to advance their aff ordability, functionality, and effi ciency, advancements in material production will open up new markets while enabling manufacturers to reduce wasted materials and lower costs.”

Speaking in a recent column for TCT, Markus Glasser, Senior Vice President EMEA at EOS, concurred: “Where historically there has been a focus on strength, production consistency and supporting a wide range of polymer and metal applications, sustainability is now the driving force for innovation. New materials are already bringing about production effi ciencies in terms of the amount of material needed for an application, or production steps that require less energy. This, alongside improved material and fi nished product recycling will help enable companies to achieve their sustainability goals and support the global drive to a more sustainable world.”

Commenting on where such materials innovations may come from, Smith added: “Counter to the perception of 3D printing as a futuristic technology, there in actual fact has been progressively less and less blockbuster innovations year-on-year. While some interesting start-ups are refi ning aspects of the technology for niche applications and markets, more broad advancements in 3D printing processes have become incremental. Going forward into 2022 and beyond, the enabling and diff erentiating innovation in the space will be centered around materials, which in turn will drive the application space, with these materials advancements not coming from 3DP vendors, but established and specialist chemistry and metallurgy companies.”

Further to that, Laura Ely, Director of Programs at The Barnes Global Advisors, says we’ll likely see more emphasis on the minutia of materials: “We also see an increased focus on what makes a good powder and how best to analyze materials. New processes to create powders are coming onto the market; for example, Metal Powder Works and their system to turn bar stock into powders without the use of gas atomization. We’re also intrigued by a new system for solid material characterization coming out from Exum and tools from Granutools that give new insights to solid material characteristics like fl owability.”

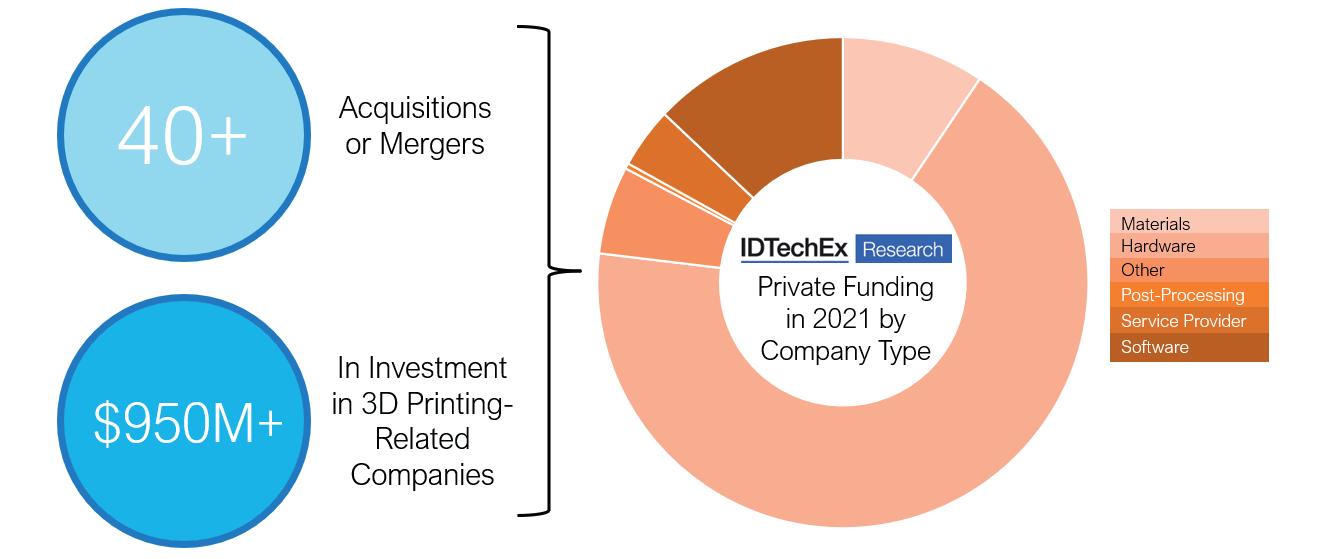

When we can start using the term “post-pandemic” with any sort of confi dence remains to be seen but there are reasons to be cautiously optimistic. In 2021, it seemed barely a week went by without news of a major AM acquisition or SPAC [Our Senior Content Producer Sam Davies has those covered over the page]. A month into 2022 and investment news remains quiet, but Smith thinks SPAC announcements will continue to be “top of the newsfeed” this year, adding that “2022 will be a good indicator for how SPACs could infl uence our industry long-term.”

It's a similar story of pragmatism in supply chain as Cynthia Rogers, Communications ADDvisor at The Barnes Global Advisors, notes: “The noise surrounding 3D printing as the saviour of the supply chain will die down. While impactful in some areas during the pandemic, the simple reality exists that there are a set of requirements that must be met for any use case.”

Ely added: “Some realism will set in. While AM can be a tremendous stop gap to address critical supply chain shortages during crisis situations, it is not the magic pill for all manufacturing scenarios. However, we still see great opportunity; the hard work will continue to put the processes in place to use AM for spares and repairs, for expeditionary manufacturing – think 3D printing on the battlefi eld – and for other areas where point of use manufacturing makes good business sense.”

And there are, of course, always more challenges to be solved, as Glasser noted, emphasising a topic that has seen greater attention, and action, in recent years: “In 2022, AM will become more dominant as a key route to achieving sustainability thanks to the new opportunities it creates for organizations across the design and manufacturing workfl ow, and the innovations that will allow it to replace more traditional production techniques.”

2022, for AM, looks set to be about incremental but impactful developments, putting what we’ve learned over the last two years into practice, and reinforcing that realism to further meaningful applications.