VIEW FROM THE TOP CEO Scott Strazik on GE Vernova’s bold path to energy transformation

VIEW FROM THE TOP CEO Scott Strazik on GE Vernova’s bold path to energy transformation

NUCLEAR

UK’s US$140bn nuclear pipeline: Opportunities, challenges and SMRs

Bertling – where excellent operational performance speaks for itself. Stay informed about your carbon footprint and take proactive measures to reduce and offset emissions with our comprehensive transport tracking solution. Join us today on our Road to Zero!

Visit www.bertling.com/sustainability to find out more.

10 News and events

12 The big question Is the supply chain being listened to?

14 Special report EIC Manifesto 2024: Tom Wadlow on EIC’s call for collaboration on energy policy

20 Perspective: IndustriALL Europe

General Secretary Judith Kirton-Darling on green steel in Europe

21 Perspective: British Chambers of Commerce

Director General Shevaun Haviland on navigating the North Sea transition

34 My business Laura Hughes, Costain

Should

28 A balancing act: Oil, gas and energy transition

Mahmoud Habboush, Communications Adviser, EIC

30 Urgent upgrades needed for UK power grid

Mahmoud Habboush, Communications Adviser, EIC

32 Accelerating the UK’s nuclear future

Mahmoud Habboush, Communications Adviser, EIC

THURSDAY 10 OCTOBER 2024

CEO

From the Chief Executive: EIC has just published its first-ever manifesto – calling for transformative policy change in the energy industry, and suggesting four pillars through which it might be carried out

This July, EIC published its first manifesto. The fact that we had not yet released one in our more than 80 years of history only highlights the significance of doing so now. Not only is our data more comprehensive than ever, supporting the asks made in the manifesto, but the challenges faced by both industry and government have grown significantly in past decades. The threat of climate change and the urgency of energy transition pose unprecedent challenges for us all.

For the thousands of companies in the supply chain, one such challenge is simply being heard by government officials and institutions – hence the dynamic between the elephant and the mouse on the cover of this issue. This results in continuous and damaging mismatches between business needs and policy reality.

This is something EIC addresses in the manifesto through four pillars: the integrated energy supply chain, not to be siloed by technology; a detailed roadmap to energy transition, including project timelines and improved financial access; improved access to export finance and international trade support; and a cross-party approach to energy policy that recognises and respects the importance of the UK’s world-leading energy supply chain, both domestically and on the world stage.

There is room for improvement, felt even by the larger supply chain companies such as GE Vernova, an EIC member and this issue’s View from the Top interviewee. In this highly recommended read, CEO Scott Strazik tells us about the importance of policies that are based on partnership with and empowerment of the private sector, in order to accelerate technology, job generation and manufacturing.

Timing is crucial, as 49% of the world’s electorate will go to the polls in 2024. Many elections, such as those in the UK, have already been completed, and many are still to come –most notably in the US. Uncertainty surrounds

the global energy landscape, and it’s the time for EIC to shout louder on behalf of our members and fill this lack of solid propositions with new ones that align with the reality of the supply chain. Our manifesto is a contribution to this effort.

In the past year, through our publications, events and presentations, we have frequently referenced the final investment decision (FID) data gathered by our market intelligence teams worldwide. We have repeatedly shown that FIDs are concentrated in upstream oil and gas projects (according to the latest figures, more than 33% of FIDs are in this area) and large nuclear, while energy transition technologies such as hydrogen and floating offshore flounder at 5% or lower. Energy policy and industrial strategy does not currently reflect the reality of what thousands of supply chain companies face every day, as they try to invest in an embattled and uncertain trading environment that threatens their survival, risks them uprooting to outside the UK and further delays progress towards legally binding net-zero commitments.

EIC wants to be part of the solution, and we are not stopping at the manifesto. We have recently launched Bankable Energies, the latest of our large events. Scheduled for 26-27 February 2025 in London, it will bring together leaders from industry, policy, investment and innovation to debate the direction of sustainable energy investments and to contribute to the acceleration of the transition.

I’m confident that EIC has a key role to play, one of advocacy based upon a global, energy agnostic, heavy-lifting, data-centred argument.

Stuart Broadley Chief Executive Officer, Energy Industries Council stuart.broadley @the-eic.com

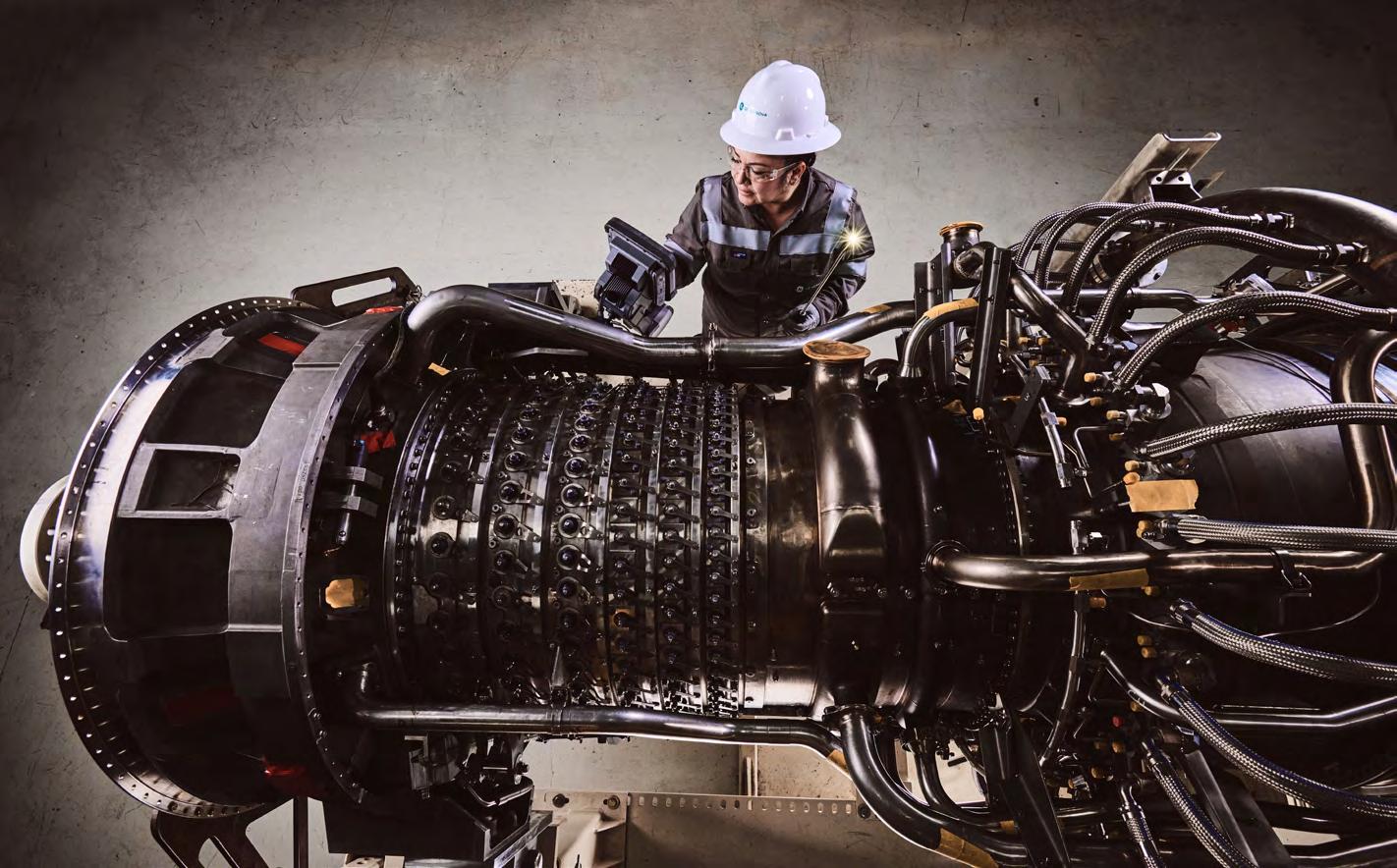

Scott Strazik , CEO of GE Vernova

Our responsibility is to be the architects, engineers and builders of a sustainable energy future

Scott Strazik talks to Energy Focus about the company’s strategies and innovations driving the global energy transition, emphasising the need for urgent action, collaboration and technological diversity

GE Vernova is at the forefront of the energy transition. What are the key pillars of its vision for a sustainable and resilient energy future?

We think about the energy transition as a period similar to the industrial and digital revolutions in terms of global importance and impact – a multi-decade supercycle of huge transformation and growth. Our mission is focused on building a more sustainable electric power system, meaning we must urgently grow and transform an infrastructure that has been built up over a century, using the technology of today while developing the breakthrough technologies of tomorrow. As demand for electricity increases, it offers an opportunity to sustainably rewire the global economy – and we are ready to deliver.

Our Sustainability Framework includes four pillars; GE Vernova is the only company to include Electrification as part of its framework, as well as Decarbonise, Conserve and Thrive. Our leadership position in providing equipment and services that can deliver on the energy transition is one we take seriously in terms of conserving the planet’s resources and ensuring an equitable future. Around 750 million people lack electricity today, and not much can happen without it: healthcare, education, sustainable growth.

Can you outline the key strategies your company is employing to manage and accelerate the energy transition across different sectors?

We believe in an ‘all-of-the-above’ technology approach, which can balance the energy trilemma – to provide reliable, affordable, sustainable and secure electricity. GE Vernova provides essential products and solutions for the world’s electricity systems across our three segments: power, wind and electrification. The businesses in these segments allow us to help generate, transfer, orchestrate, convert, and store electricity with the scope and scale needed to lead the energy

transition. With global electricity demand expected to double by 2040, the breadth of our portfolio means we are positioned to provide an enormous impact. Many of the world’s leading utilities, developers, governments and large industrial electricity users rely on our installed base today, which generate approximately 25% of the world’s electricity.

How is GE Vernova integrating renewable energy sources into traditional energy systems? Renewable energy technologies such as wind and solar, and other zero emissions technologies such as nuclear, have an important role to play both today and tomorrow in helping us to decarbonise the electric power system, and we are deeply committed as a leading provider of renewable energy technologies. More broadly, though, the focus across our portfolio is to help customers meet their growing demand for electricity generation as sustainably as possible, with technologies that help them avoid, reduce or capture greenhouse gas emissions when generating electricity.

What are some of the most significant technological innovations GE Vernova is developing or implementing to support the transition to cleaner energy?

We continue to build on a rich heritage of technology leadership and innovation, dating back to Thomas Edison’s first commercial power plant in the US in 1882. Today we invest around US$1bn annually in R&D, often with partners or other third parties. These efforts drive breakthroughs across a range of technologies, such as energy storage, hydrogen, carbon capture, the BWRX-300 (a small modular nuclear reactor) and electricity software. Our role is to deliver state-of-the-art technology across the energy mix, enabling customers to meet their long-term sustainability goals.

Scott Strazik is CEO of GE Vernova. He has more than 20 years of finance, operations and leadership experience with GE, including more than eight years in the company’s power businesses. Before joining GE Power, Mr Strazik held various senior roles, including as CFO of GE Aviation’s Commercial Engine Operations and CFO of Gas Power Systems. He was also instrumental in the launch of GE’s HA gas turbine – one of its most successful new product introductions.

Mr Strazik became an officer of the General Electric Company in 2015 and served as President and CEO of its Power Services business in 2017. Having been appointed CEO of Gas Power in 2018, he expanded his role to leading GE Power businesses from 2021.

Mr Strazik holds a BA in Industrial Labour Relations from Cornell University, and a master’s from Columbia University’s School of International and Public Affairs in Economics and Public Policy.

Could you share some specific sustainability goals GE Vernova has set, and the progress made towards achieving them?

We announced our Sustainability Framework earlier this year, and in the autumn we’re launching GE Vernova’s first Sustainability Report, detailing our progress, goals and commitments towards building a more sustainable power system. Our focus is on being a leader in providing electricity generation, enabling decarbonisation of the electric system (while growing capacity), and making progress on our pledge to achieve carbon neutrality for our Scope 1 and 2 emissions by 2030. We’ve also developed a product stewardship and circularity strategy, known as our 4R circularity framework, and our goal is for it to cover 90% of our top products (by sales) by 2030. Finally, we focus on people, with goals for safety, inclusion, ethics and human rights.

The recent spin-off from GE is a significant milestone for GE Vernova. How has it impacted operations, and what new opportunities does it present for the company?

GE Vernova is a purpose-built energy technology company focused on accelerating electrification and decarbonisation. We’re excited by our progress since our April 2024 spin-off, and for the opportunity ahead. Our portfolio

gives us unique scope and scale and better positions us to collectively accelerate the energy transition. We have more than 75,000 employees across over 100 countries with the sole focus of serving customers and helping them navigate the challenges of maintaining more secure, sustainable, reliable and affordable power systems.

As an independent company, this focus has increased our agility so we can respond better to industry dynamics and the increasing demand for power generation, driven by several factors and market dynamics across the world – including manufacturing growth, industrial electrification, electric vehicles, emerging data centre needs, and secure and reliable grid infrastructure. Our purpose is not just transforming the power and energy sectors, but enabling the energy-reliant industries of tomorrow to grow and innovate.

What roles do partnerships and collaborations play in GE Vernova’s strategy for managing the energy transition?

No single company can drive or deliver the massive scale of what the energy transition will require. We see ourselves as a leading entity at the centre of this transformation, collaborating with customers, universities, policymakers, smaller startups and venture capital to drive the critical breakthroughs in the energy transition that smaller organisations cannot. We have the scale and

industrial footprint to help innovate, develop and scale the products and solutions required to electrify and decarbonise the world today and tomorrow. We’ve located our global headquarters in Cambridge, Massachusetts, in a hub of talent, technology and innovation, and we’re dedicated to unlocking growth in collaboration with all our stakeholders.

How is GE Vernova engaging with policymakers and regulatory bodies to support the transition? We work closely with governments around the world on their unique needs and believe public-private partnerships are essential to the transition – we’ve been proud to be at the centre of private sector engagement from COP28 to the successful implementation of clean energy tax credits in the US. We also want to focus on meeting the requirements of emerging economies, which have different needs to those with more fully developed energy infrastructures. From working with the Ministry of Energy in Ukraine on its short and long-term needs, to helping fortify the grid among huge electrification demands in Africa, to accelerating coal-to-gas switching in southeast Asia, we are providing expertise and technology around the globe. As the private and public sectors look for more partnership opportunities throughout the energy transition, I’m confident we will see a force multiplier that accelerates the work to electrify the world while decarbonising it.

What changes in regulations or policies do you believe are necessary to accelerate the transition to sustainable energy?

We support recent policy trends focused on partnership and empowerment with the private sector. These approaches have accelerated not just technology deployment, but also jobs and manufacturing. This is a good start, but we have work to do on driving policy certainty by making these goals of electrification and decarbonisation apolitical, and pursuing permitting and infrastructure reform that ensure we can realise the full potential. Permitting reform and the ability to move projects forward more efficiently is important, as are policies that encourage innovation, such as further development of alternative fuels, building the grid of the future, or dozens of other R&D projects we are working on at our Global Research Centers and other facilities around the world.

How is GE Vernova preparing its workforce for the new skills required in a transitioning energy landscape?

Our team of more than 75,000 employees is our greatest asset and we’re dedicated to investing in their skills and abilities as we lead the energy transition. The GE Vernova Way, the principles we run our company on, prioritises Safety, Quality, Delivery and Cost

– with safety coming first – for employees, contractors, customers and other stakeholders. We see the GE Vernova Way as a potential differentiator, as it ensures we deliver effective, measurable and sustainably successful outcomes for customers, employees and other stakeholders.

Outside of our company, the new GE Vernova Foundation is committed to developing the workforce of the future to support the energy transition. Its programmes will invest in both the future and the present, encouraging young people

to pursue STEM and skilled trade careers, and provide reskilling and upskilling support to ensure no worker is left behind during the transition. The foundation’s investments will help to bridge the global skills gap to ensure a sustainable transition.

What emerging trends or technologies do you believe will have the most significant impact on the energy transition in the next decade? And how does GE Vernova plan to stay ahead of these trends and continue to lead in the energy sector?

We have more work to do on driving policy certainty by making these goals of electrification and decarbonisation apolitical and pursuing permitting and infrastructure reform

First, we need to act with urgency. We need to use today’s technology to drive action and meaningful change. But we’re just as focused on developing and commercialising the breakthrough energy technologies of tomorrow, including energy storage, hydrogen, carbon capture, small modular nuclear reactors, advanced wind turbines and electricity software. We don’t think there is a single ‘silver bullet’ technology; we believe in an ‘all-of-the-above’ approach, prioritising a diverse set of technologies that suit global customer requirements while balancing the energy trilemma.

We see the technology developments in the electric power industry as an incredibly exciting place to play; our responsibility is to be the architects, engineers and builders of a sustainable energy future.

Date:October–November 2024

Established in 1943, the EIC is the leading trade association for companies working in the global energy industries.

Our member companies, who supply goods and services across the oil and gas, power, nuclear and renewables sectors, have the experience and expertise that operators and contractors require. As a not-for-profit organisation with offices in key international locations, the EIC’s role is to help members maximise commercial opportunities worldwide.

Following the release of the Survive & Thrive VIII Insight Report, EIC is gearing up for EIC Awards 2024. Scheduled to take place across five global offices, the awards will celebrate the standout companies featured in the report. EIC is also proud to host the UK Pavilion at ADIPEC again, showcasing UK energy sector excellence. And another dynamic trade delegation to Guyana is planned, offering networking and business opportunities.

This is just a snapshot of the events we have planned. For a full schedule, including upcoming webinars and more, visit the-eic.com/events/calendar. Stay tuned for more updates and opportunities to engage with the EIC community!

Location:UK, UAE, US, Brazil, Malaysia Whyattend?Since 2005, EIC has been recognising and celebrating companies that are transforming the energy industry and advancing the global energy supply chain through its awards programme. This inclusive initiative considers businesses of all sizes for their innovative contributions. Last year, EIC Awards events held in Dubai, Houston, Kuala Lumpur, London and Rio de Janeiro brought together nearly 700 industry professionals to honour their achievements.

EIC extends a warm invitation to stakeholders, authorities, the media and all members to join us for a series of evening events to celebrate the achievements of the global supply chain. We are thrilled to announce that the 2024 UK National Awards Dinner will be hosted by actor and presenter Richard E. Grant

If you are interested in attending or learning more about EIC Awards 2024, visit www.the-eic.com/Events/ EICAwards2024

Date: 4–7 November 2024

Location: Abu Dhabi, UAE Whyattend?EIC is thrilled to announce its return to ADIPEC to host the UK Pavilion. With a rich history of more than 20 years at the event, EIC has seen it evolve into one of the world’s most influential energy gatherings.

ADIPEC is a crucial hub for industry professionals, offering a platform to explore emerging opportunities and navigate the dynamic energy landscape.

80% of attendees holding decisionmaking, purchasing or influential roles. This presents an unparalleled chance for businesses to connect with existing and potential clients, while showcasing products and services designed to enhance performance, improve efficiencies and optimise costs.

EIC’s continued presence at ADIPEC underscores its commitment to facilitating valuable industry connections and driving innovation within the sector. To exhibit with EIC or learn more, visit the-eic.com/ Events/Exhibitions/ADIPEC24

Date: 3–6 September 2024

Location: Georgetown, Guyana Why attend? The EIC is planning another trade delegation to Guyana, in collaboration with Aberdeen International Associates. Delegates will be able to attend organised group meetings with key local players, attend briefing meetings led by qualified professionals with in-market experience, and engage with local companies. Crucial networking opportunities will also be available.

If you are interested in joining the delegation or need more

information, visit the-eic.com/ Events/Overseas Delegations/Trade Delegationto

GuyanaDecember 2024

EIC has unveiled a manifesto calling for a unified energy policy, clear project pipelines, enhanced international trade support, and recognition of an integrated supply chain to drive the UK’s energy transition. It aims to unite diverse stakeholders, foster innovation and ensure equitable opportunities across the supply chain.

The manifesto offers several recommendations to accelerate the UK’s energy transition and strengthen its global market position. It is based on extensive EIC data, including a thorough analysis of energy projects and supply chain capabilities. It also incorporates insights from numerous industry reports and interviews with energy sector leaders.

The eighth edition of EIC’s Survive & Thrive Insight Report series is now available, featuring insights from 134 companies (up 40% from last year) and highlighting the ongoing challenges faced by the global energy supply chain.

Commenting on the findings, EIC CEO Stuart Broadley said: “2024 sees a shift from boom times to an environment filled with uncertainty, as companies grapple with increased policy and geopolitical challenges,”

The report notes that the development of new export or international regions remains the least used growth strategy, with only 7% of companies venturing into new markets. High costs and insufficient government support are major deterrents. Developing client-facing services and solutions has emerged as the most popular growth strategy, with 82% of supply chain companies now working directly with operators rather than contracting via tier 1 EPC contractors.

Read the full report at the-eic. com/MediaCentre/Publications/ SurviveandThrive

Rebecca Groundwater, Head of External Affairs at EIC, said: “Policymakers must ensure that all relevant groups and stakeholders are involved at the appropriate stages. The current fragmented system hinders the supply chain’s ability to deliver and expand. Our recommendations aim to streamline processes and create a favourable environment for investment and

Join EIC in shaping a sustainable, inclusive energy future, where every voice counts and progress benefits all. Read the manifesto at the-eic. com/MediaCentre/ Publications/ EICManifesto

Brazil shines as a global leader in clean energy, boasting one of the world’s most sustainable electricity mixes.

As of May 2024, it has achieved a total installed capacity of 204GW, with 84% coming from renewable sources – and it remains a prime destination for foreign investment in the renewable sector.

Following the February 2022 edition, read this new report to see how Brazil’s renewable journey has evolved. Gain insights into opportunities across the wind, solar, hydropower, biomass and conventional power sectors tracked on EICDataStream.

To access this report and other market intelligence publications from EIC, please visit the-eic.com/MediaCentre/ Publications/Reports

Do you feel you have the ear of policymakers, and what are the consequences if not?

Policymakers’ decisions shape the energy sector’s future, but without industry input, policies can hinder innovation and competitiveness. From Brazil’s economic challenges to the UK’s low-carbon tech ambitions, the lack of dialogue with the supply chain poses critical risks. Is the energy supply chain being listened to?

Product Director at Crowcon

Detection Instruments

Ultimately, we do not have the ear of policymakers. This disconnect has significant consequences for the energy market. Governments and policymakers miss out on critical expertise that could guide more effective policies. Without industry insight, policies and regulations often become overly stringent or misaligned with industry realities, stifling innovation. This misalignment results in unnecessary red tape, driving up costs for manufacturers and diverting resources away from research and development.

Smaller players in the industry are also disproportionately affected, as they lack the resources to manage complex regulatory requirements, making it harder for them to

compete and thrive. This creates an uneven playing field, reducing diversity and innovation within the market.

Additionally, the lack of industry input can lead to policies that do not adequately address the practical challenges faced by the energy sector. As a result, there is a risk of implementing measures that are either too conservative or too aggressive, neither of which foster a healthy market environment.

This absence of a collaborative dialogue means missed opportunities for developing more sustainable and efficient energy solutions. The energy market evolves rapidly, and without the engagement of industry experts, policymakers may fail to anticipate future trends and needs. Ultimately, not being listened to by policymakers hinders the development of a dynamic, efficient and competitive energy sector, affecting everyone from large corporations to small innovators and consumers.

Crowcon

is a global manufacturer of gas detectors and air quality monitors that protect people and places so that operations run efficiently and safely. The company has been aiming to make the world safer, cleaner and healthier by detecting gas and saving lives since 1970, with high quality fixed and portable gas detectors and air quality monitors that provide protection and process insights.

Commercial Manager at EquipSea

Policymakers hold the power to make decisions that can either foster growth or hinder the progress of the regions they govern. This influence is particularly evident in the energy sector, where decisions carry national significance.

Brazil currently faces significant opportunities for policymakers to enhance

the country’s competitiveness on the global stage. However, without tax reductions, exemptions or drawbacks, Brazilian companies are struggling to compete effectively in the international market. This challenge is closely tied to the ‘Brazil Cost’ – a term referring to the high operational costs that diminish Brazilian businesses’ global competitiveness.

We believe that the supply chain can play a crucial role in helping policymakers to strike the right balance between tax revenue collection and maintaining the strength of Brazilian companies in global markets. Achieving this balance is essential. By accepting slightly lower taxes on individual items, the government could potentially see a larger total revenue due to enhanced business competitiveness.

While local content policies offer some degree of protection within the domestic market, comprehensive reforms are necessary to secure and boost Brazil’s competitiveness both at home and abroad – without relying on protectionist measures

About EquipSea EquipSea is a Brazilian manufacturer of welded, machined and coated parts, as well as turnkey tested sets, including seals, hydraulic and electrical components. Serving global clients such as OneSubsea, Aker Solutions and Subsea 7, EquipSea delivers high-precision parts in carbon, alloy and stainless steels and high-nickel alloys up to 40 tonnes, offering Inconel cladding, high-precision machining and hydrostatic testing up to 30kpsi within a dedicated test bunker.

John Hartley

CEO of Levidian

From a standing start, Levidian has had success engaging with policymakers, and has grown to become an increasingly wellregarded voice within the low-carbon tech revolution. With a new government in the UK, we’re identifying opportunities to gain the

Policymakers must actively engage with the industry, leveraging supply chain expertise to create ambitious and achievable policies

ear of influential policymakers to help ensure that R&D and homegrown clean tech are recognised as important priorities in the journey to net zero.

With high emitters and hard-to-abate sectors contributing around two-thirds of global emissions, there is an urgent need to support businesses that rely on carbonintensive processes or produce methane as a by-product. However, this challenge presents an opportunity within the net-zero transition that has not yet been fully realised by policymakers – that businesses can remain commercially competitive by turning carbon into valuable, versatile materials as part of a circular economy model.

This is the solution that Levidian offers through its LOOP technology, which can easily be retrofitted to existing infrastructure. This can help to decarbonise some of the world’s hardest-to-abate sectors, such as agriculture, gas, concrete, cement and steel – securing their future in a net-zero economy.

It is imperative that policymakers listen to companies like Levidian that are already pushing the boundaries of decarbonisation to ensure the UK capitalises on this opportunity, and uses climate tech as an engine of our country’s future growth.

About Levidian Levidian is a British climate tech company on a mission to decarbonise carbon-intensive industries. By converting carbon liabilities into competitive advantages, it aims to solve the decarbonisation/business performance dilemma. Its LOOP technology captures carbon from methane before combustion, converting it into clean hydrogen and high-quality net-zero graphene, a highperformance additive that can be used to enhance the intrinsic characteristics of products in major global industries.

Subsurface Director at THREE60 Energy Collaboration between policymakers and the energy industry is essential for shared success. When it falters, there are severe consequences.

In environments such as New Zealand and the UK, a lack of consistent oil and gas sector policy, conflicting messages and inadequate industry consultation have led to a loss of investor confidence. This impacts the entire supply chain as participants shift focus elsewhere, risking areas such as late-life asset management and decommissioning. This reinforces the need for aligned government and industry decision-making.

Conversely, successful collaborations have yielded positive outcomes. The US and Malaysia’s ‘rig-to-reef’ programme for decommissioning, and the evolution of production sharing contract models across Southeast Asia, such as Indonesia’s gross split in 2017 and the Malaysian Small Field Agreement in 2021, show the benefits of industry–government cooperation.

However, key challenges remain. The development of carbon capture, utilisation and storage regulations is one area where closer collaboration could accelerate progress. Additionally, AI regulation requires careful consideration and input from policymakers and industry experts.

To ensure a sustainable energy future, policymakers must actively engage with the industry, leveraging supply chain expertise to create policies that are both ambitious and practically achievable.

About THREE60 Energy THREE60 Energy is a lifecycle solutions and engineering technology company with more than 40 years of experience. Serving oil and gas, wind, carbon capture and storage, marine, nuclear and defence, it offers integrated services from development to decommissioning. With a global team of more than 1,000, THREE60 Energy excels in technical competency and client collaboration, emphasising safety and core values of integrity, collaboration, challenge, and ownership through its ‘Better Energy Together’ approach.

EIC’s first-ever manifesto: A call for an integrated and supported energy supply chain to be recognised

Despite the evolution of the UK energy sector, the supply chain remains unheard and undersupported, with critical gaps in policy and investment. This is causing significant disruption and missed opportunities for the sector as it transitions to a sustainable and integrated energy future – a reality that EIC’s new manifesto seeks to address, writes Tom Wadlow

EIC has represented energy companies’ interests for more than 80 years. As the UK and global energy sectors have expanded and evolved to embrace new technologies and solutions, the need for a strong and coordinated supply chain has intensified – as has the need for it to be treated as such.

Every time the energy industry transitions, so do its members. Today, EIC continues to advocate for member companies as the voice of the energy supply chain – across all energy technologies and in all regions of the UK. What has become clear, however, is that the supply chain is not being listened to.

The message from our members is clear and has to be heard. We have the knowledge and technological solutions to support the energy transition, but current policies are holding us back

Rebecca Groundwater, EIC Head of External Affairs

“Our Survive & Thrive series has taught us a lot about the amazing capabilities and pain points of companies up and down the energy value chain in the UK,” says EIC CEO Stuart Broadley. “A lot of firms are doing brilliant things but are in trouble and receiving no help.

“The other source of fuel for this manifesto is final investment decision data, which shows a stark gap between net-zero ambition and reality. It is difficult for politicians and the media to hear, but this is non-partisan, non-biased information that should be underpinning decision-making. At the moment, they are not listening.”

The supply chain is struggling to be heard because the UK has an extremely disjointed system when it comes to setting and implementing energy policy. Various levels of government have different powers over energy policy, leading to slow and fragmented implementation. This, coupled with frequent ministerial changes, has created instability and deterred investment.

While high-level decisions are made, there is often limited engagement with the numerous SMEs and larger organisations that comprise the supply chain. Policies that favour the major energy players do not

typically benefit the majority of the supply chain, or the innovators.

While they are aspirational, UK content mandates lack accountability, and innovation funding often ends after the initial trials. SMEs struggle to navigate complex funding landscapes, while growing companies are excluded from opportunities because of financial policies.

And what’s more, UK policy has largely ceased supporting hydrocarbonrelated businesses domestically and abroad since 2020, despite ongoing global crises and uncertainties. Companies struggle to access capital and funding for growth and innovation because their primary revenue still comes from oil and gas. This persists even when they seek to diversify into renewables or decarbonisation projects, as their current profit sources overshadow these efforts.

The four pillars of the EIC manifesto

This is a heady mix of challenges, explored in further detail in the manifesto itself. But the problem is clear. Because enterprises in the supply chain see insufficient domestic opportunities and lack affordable access to global projects, they are abandoning the energy sector.

“The message from our members is clear and has to be heard,” says Rebecca Groundwater, EIC Head of External Affairs.

“We have the knowledge and technological solutions to support the energy transition, but the way companies are categorised into siloes is holding us back.

“We need policymakers to help us export UK skills, to create certainty and to develop a joined up industrial plan that stretches beyond a single political cycle. With a new government in place, now is the ideal opportunity to properly engage ministers

and ensure the supply chain is properly represented.”

EIC’s manifesto sets out a vision and a series of proposals across four broad themes.

The first, and arguably the most significant, calls for the energy supply chain to be treated as an integrated whole.

According to the latest EIC data, 82.9% of the UK’s energy supply chain is reliant on oil and gas. Of that oil and gas supply chain, 44.7% is diversified into renewables and net-zero technologies; only 15.1% of the UK renewables and net-zero supply chain grew out of non-oil and gas capabilities.

“This equates to thousands of companies servicing customers across all energy sectors – making policy for technologies in siloes causes problems for the supply chain where there are competing pulls on regions, available funding and growth,” says Broadley.

The second pillar concerns energy transition. While EIC members are eager to diversify into all areas of the energy transition, they routinely report that the pipeline of domestic projects, in all energy sectors, is unclear and faltering.

“The oil and gas industry operates with clear approvals processes and regulations,” says Groundwater. “Its economics, risks and rewards are wellunderstood, and that allows investors to assess project viability from the start. Unfortunately, this expertise hasn’t been effectively transferred to emerging technologies in the energy sector, and that has left a significant knowledge gap.”

The EIC Manifesto urges the creation of a detailed energy roadmap, collaborating with industry stakeholders to outline project timelines across technologies and regions. It also calls for a reassessment of financial access, supporting businesses transitioning to green

energy and growing companies, to ensure fair opportunities throughout the supply chain and promote sustainable development.

This feeds into the third and fourth pillars, which cover exporting and international trade, and the UK’s place on the global stage. UK companies face a plethora of challenges when doing business with international markets, with many of these arising from regulatory constraints, costs and lack of support. To overcome these barriers, EIC is calling for much-improved access to export finance and on-the-ground, practical assistance.

Broadley says: “The UK is already a global leader in its net-zero commitments and decarbonisation progress, and that is testament to the strength of the energy supply chain.

“We need to respect the work that’s been done and be proud of this strength. All too often politicians and the media fall into the trap of talking about the supply chain in such simplistic terms –that oil and gas is bad, and renewables are good.

“A shared sense of urgency also needs to return. During the Covid pandemic, there was a joined-up attitude of ‘anything is possible’ – that has now gone, and we are back to being put into siloes.”

The manifesto also looks ahead to future energy policy and stability. In recent years, we have seen the opposite of this.

Energy needs to become a toptable topic, with EIC as the authoritative, non-partisan voice representing the UK-wide value chain with data at its core

Stuart Broadley

Frequent leadership changes and the lack of a clear 2050 industrial strategy have hindered UK industry investment and focus.

Moving forwards, a unified approach is crucial, with policy focusing on viable projects and clear five to 10-year timelines. The supply chain needs collaborative, holistic frameworks that transcend party politics and withstand changes in government. EU regulations should also

EIC Manifesto 2024: a roadmap to a sustainable and integrated energy future EIC calls for an integrated and supported energy supply chain to be recognised. Fragmented policies and insufficient backing are leading to disruptions and lost opportunities. The EIC Manifesto tackles these issues by advocating for a unified, holistic approach to energy policy.

Treat the energy supply chain as an integrated whole, not siloed by technology, to ensure sustainable and cohesive growth across all energy sectors

Collaborate on a detailed energy roadmap with clear project timelines and improved financial access for transitioning companies

Reform UK Export Finance to improve access to finance and simplify European trade regulations to boost competitiveness

Unlock global energy markets, boost supply chain access, reinstate on-the-ground support, and foster international collaboration for a net-zero future

Integrating all supply chains into one strategy aligns with ABB’s approach to providing integrated operations across the entire energy industry.

Our technology solutions serve all areas, and the more cross-sector collaboration there is, the more impact you make on energy efficiency – and therefore emissions.

The bigger picture is how an integrated supply chain will benefit society. First, it will encourage a more balanced energy mix, improving energy security. A diverse energy mix is vital to balancing supply and demand and making our energy infrastructure more sustainable. At ABB we call this “net additions AND lower emissions”, a two-fold focus to grow and integrate lower carbon energy systems while diversifying and optimising existing systems.

Breaking down siloes will also breed collaboration and innovation – crucial to a successful energy transition. While technology is an enabler, it is not a silver bullet, and it is only effective when deployed in conjunction with expertise from partners across the board.

ABB is working in this way through partnerships in carbon capture and storage, green hydrogen and offshore wind with Pace CCS, CMG and Coolbrook, bringing different energy streams together to optimise industrial processes.

A single strategy will also impact the UK economy, because clear and consistent policies are more likely to attract investments in energy infrastructure and technology. More streamlined regulations reduce administrative costs and improve operational efficiency, which will encourage more projects to come online.

Since 2007, AIS has been continuously innovating its existing products and investing in the research and development of new products.

Throughout the years, we have consistently found the funding application process to be complex and the processing of funding applications to be exceedingly protracted.

The administrative burden often hinders growth opportunities rather than accelerating them. Energy is a fast-paced industry, so it is crucial for UK companies to keep up if they want to remain competitive. Unfortunately, development projects can be stunted by the funding difficulties caused by bureaucratic hurdles – undermining the UK’s reputation for innovation.

We need policymakers to help us export UK skills, create certainty, and develop a joinedup industrial plan that stretches beyond a single political cycle

Rebecca Groundwater, EIC Head of External Affairs

be considered to streamline processes for UK businesses. Meanwhile, urgent attention to domestic grid capacity is needed while the supply chain eyes opportunities in more stable markets abroad.

Trust and trade are critical to competitive supply chains

Make no mistake, the challenges ahead of the UK’s energy sector are enormous.

As the voice of the supply chain, EIC is clear in its call to policymakers and other industry stakeholders: start listening to the thousands of companies that operate up and down the country and will, ultimately, determine the success of the UK’s energy transition.

Bringing an innovative solution from conception to market is challenging and time-consuming. By simplifying funding access, UK companies could compete more effectively and evolve at the same pace as, if not faster than, the global market.

While the new manifesto sets out numerous policy proposals, the first pillar or step is a prerequisite to tangible progress. The supply chain must be treated as an integrated, moving whole and not categorised into siloes, which polarises debate and fails to acknowledge the reality of how the energy sector actually works.

LISTEN to the supply chain: The UK energy sector needs to be heard. Policymakers must start listening to the thousands of companies across the UK’s energy value chain

An integrated approach to energy policy

“We need that holistic mindset and approach to energy policy. Once this starts to happen, what we have set out in the manifesto is actually a series of relatively small, logical tweaks – we are not asking for anything radical,” says Groundwater.

Broadley adds: “There are two outcomes I would like to see. First, energy needs to become a top-table topic, with EIC as the authoritative, non-partisan voice representing the UK-wide value chain with data at its core.

“The UK must respect the worldleading capabilities we have and treat our energy value chain as one integrated ecosystem. Without this, it will be very difficult to advance towards net zero”

Stuart Broadley

RESPECT the energy value chain: Policymakers must treat the UK’s energy value chain as an integrated ecosystem, recognising its world-leading capabilities

“I also want to come back to respect. The UK must respect the world-leading capabilities we have and treat our energy value chain as one integrated ecosystem. Without this, it will be very difficult to advance towards net zero.” Join EIC in shaping a sustainable and inclusive energy future, where every voice counts, and progress benefits all. To read the EIC Manifesto 2024 visit the-eic.com/ MediaCentre/ Publications/ EICManifesto

European

On 21 March, green smoke rose from the blast furnace at Tata Steel in IJmuiden, the Netherlands, as steelworkers across Europe mobilised to demand a just transition to green steel.

Steel is a strategic sector for Europe, at the root of the energy, construction, automotive and defence industries, and employing 300,000 workers. A strategy for green steel is not only urgent for the climate, but also to stimulate investment and innovation to keep European manufacturing competitive, maintaining and creating good industrial jobs. In a volatile geopolitical context, strategic autonomy in the steel supply is crucial.

The urgency has been intensified by Covid-19, war in Ukraine, and rising energy and raw material prices. Europe’s steel production has plummeted to 2009 levels, with market share lost to imports from third countries resulting in the loss of more than 25% of direct steel jobs since the financial crisis in 2008–09. This is staggering given that one direct job in the industry brings in six indirect jobs.

However, the situation is different elsewhere. Steel overcapacity had increased to around 2.5bn tonnes by the end of 2023, according to the OECD. China has increased production capacity by 2.2%, India by 7.5%.

And more than half of new capacities (2024–26) will be based on traditional blast

furnaces. European steel is decarbonising in a hostile environment.

We are at a critical juncture. Half of Europe’s blast furnaces will need to be replaced before 2030 due to their age. Investment decisions are needed in the coming months, but the current scale of industrial ambition risks deindustrialisation in Europe. Based on public data from the Green Steel Tracker and the Global Energy Monitor, complete decarbonisation projects from European steel companies (announced, and representing an industrial transformation, regardless of their status) currently represent a total capacity of 54 million tonnes (mt) annually. Meanwhile, Europe has existing nominal capacities of 97.5mt in primary steel production and 86mt in iron. Relatively few of these green steel projects have reached final investment decisions, and investment uncertainty is increasing anxiety among steelworkers.

Governments have a crucial role to play in securing the framework conditions for these investments and security for workers in transition. Strategic autonomy will come at a price, but deindustrialisation costs more. According to the European Steel Platform, “new, low-CO2 steel production technologies will require an investment of approximately €50–60bn, with €80–120bn/yr capital and

operating cost”. Electricity consumption is set to rise by 60% between now and 2030 (notably in sectors such as the steel industry), and the European Commission (EC) estimates that €584bn of investment will be needed this decade to modernise grids. Austerity measures could exacerbate the risk of deindustrialisation in Europe.

We need a coordinated industrial policy to drive green steel demand (through public procurement and lead market initiatives), secure raw materials and ramp up the circular economy, and deliver infrastructure to ensure abundant affordable energy. Trade policies must ensure a level playing field during the transition. Public support and funding will be key, but there need to be social strings attached to deliver a just transition for workers, promoting collective bargaining, worker participation and job guarantees. This would provide a ‘return for taxpayers’ in good jobs and community investment. IndustriALL Europe and Eurofer have advocated for this.

In response to these concerns, EC President Ursula von der Leyen committed to a Clean Industrial Deal in the first 100 days of the new EC mandate. As steelworkers across Europe have been saying, “steel needs Europe, and Europe needs steel!”. We have a short window in which to get this right.

The North Sea has been a crucial asset to the UK for decades. It provides oil and gas to meet our own energy needs, and also exports, contributing significantly to our economy. With around 200,000 jobs tied to the industry, both directly and indirectly, its impact extends far beyond the energy sector. As we look to the future of the UK’s energy landscape, the North Sea’s role remains pivotal, and it must continue to be part of any conversation around its future.

We all recognise the real and urgent threat that climate change poses globally. It is clear we need to move away from oil and gas production and accelerate our shift to renewable energy. But at the same time, we must also balance the diversity of our power supplies to ensure that the UK’s energy security remains strong. This transition offers an incredible opportunity to unlock economic benefits – if we get the pace right, we can help workers in the oil and gas industry successfully switch their skills to the low-carbon sector, avoiding significant job losses and creating a stronger, greener economy.

Discussions on the future of the North Sea are becoming increasingly contentious, with ongoing debates surrounding licensing, decommissioning, governance and the fiscal regime around it. While transitioning to net zero is necessary, we must also ensure that critical investment in the sector is not lost. It is in everyone’s best interest to get round the table and find pragmatic, long-term solutions to the North Sea and the UK’s energy transition.

This is why an independent taskforce is so important. We need to bring industry experts, economists, environmentalists, academia and politicians together to find the right pathway to net zero. We need to ensure there is a long-term, holistic plan for the North Sea. We also need a strategic approach to decision-making around both the immediate management of the North

An independent taskforce in the North Sea is critical to navigating the energy transition, says Shevaun Haviland, Director General of the British Chambers of Commerce

Sea, as well as the longer-term transition of the industry to net zero. A collaborative partnership with all involved is the way we can achieve this.

The taskforce needs to produce recommendations to the government on how we can safeguard jobs and skills to support the UK’s energy security. Crucially, it must also examine the fiscal regime in the industry, especially in light of recent announcements including the Energy Profits Levy and investment allowances. Plans to reduce investment allowances risk undermining business confidence in the sector, potentially leading to reduced investment, underdelivered production and revenues from the North Sea, all of which could jeopardise a smooth and successful transition in the energy sector.

The work of the taskforce will be essential in providing the certainty and confidence to the workforce, to businesses and unions. It can help create a

plan to safeguard jobs, investment and energy security.

Seizing the opportunity for a greener future

The UK can lead the world in renewable energy if we navigate the North Sea energy transition with care and collaboration. By working together and ensuring no one is left behind, we can protect jobs, drive innovation, and set the stage for a brighter, greener future. Let’s turn our ambitions into reality!

The message from EIC members is clear: reaching net-zero targets hinges on having consistent and supportive policies, well-designed financial incentives and a skilled workforce, says Mahmoud Habboush at EIC

Achieving net zero requires more than ambition; it demands a supportive environment for innovation, investment and skilled labour. EIC research, featured in its annual Survive and Thrive and Net Zero Jeopardy reports, reveals that energy leaders believe a supportive and stable policy environment, targeted financial incentives and a skilled workforce are crucial to reach net-zero targets. A disciplined and well-executed approach is essential to navigate the energy transition successfully. EIC has identified several key areas as critical to this process.

A stable and supportive policy environment is crucial. Governments must provide clear, consistent guidelines and long-term political agreements to encourage long-term investment in energy transition projects. Without a coherent and consistent policy framework, investors tend to be hesitant and cautious, undermining progress.

need

Better access to funding and financial support is a critical concern that is repeatedly highlighted by businesses in discussions with EIC. Many of these companies grapple with high operational costs and navigate complex regulatory landscapes, while existing financial incentives fall short of being truly effective.

To meet net-zero goals, it is essential for governments to offer tailored financial incentives, grants and subsidies that cater to the unique needs of specific sectors, including carbon capture and nuclear energy.

A crucial aspect of both financing and supply chain considerations is recognising that there is one integrated supply chain

in the energy industry, working across the various sectors.

EIC data shows that the bulk of this supply chain remains rooted in oil and gas, and relies on revenue from hydrocarbons to finance energy transition activities. Specifically, 82.9% of the UK’s energy supply chain relies on oil and gas, with 44.7% of that oil and gas supply chain also diversified into renewables and net-zero technologies.

For companies operating internationally, navigating different regulatory environments poses a major challenge. The complexity and variation in different countries’ regulations and support for the oil and gas sector can make it difficult for companies to access export finance support. Harmonising regulatory frameworks and providing clear, consistent guidelines could significantly reduce compliance burdens and operational costs.

EIC research also shows that building robust international partnerships and leveraging diplomatic networks could provide crucial support for businesses expanding internationally. Specifically, companies have called for more free trade agreements to lower barriers, reduce tariffs and facilitate smoother export processes. Relatedly, companies see maintaining strong relationships with key economies as a route toward overcoming protectionist policies that restrict competition and threaten free trade.

Governments must provide clear, consistent guidelines and long-term political agreements to encourage longterm investment in energy transition projects

Innovation is essential for the energy transition, but it requires substantial investment and time. Companies need funding for both early-stage technology development and commercialisation. Government commitment to supporting research and development initiatives aimed at enhancing competitiveness and innovation is essential.

Stronger political will is needed

Greg Arnold, Technology Director, Whessoe Engineering Ltd.

The drive for energy transition stems from five key pressures: social, political, economic, commercial and environmental.

While there is broad support for transitioning to cleaner energy to combat climate change, many people are unwilling to pay significantly higher costs – two, three, or four times more than fossil fuels – without strong legislative measures. Politically, few governments are prepared to impose higher costs on their economies unilaterally.

Consequently, energy transition projects often progress slowly, moving through each engineering phase with great caution. Most projects are incremental, localised and relatively small-scale, with only a few large-scale global initiatives making headlines.

To accelerate the transition, it is crucial to economically support mid-scale projects. Such support would help align with government strategies and achieve progress. The burden of transition cannot rest solely on industry; stronger political will is needed to address the economic challenges.

The slow road to energy transition

The lack of FID in renewable and net-zero technologies underscores the fact that we lack the business case and the regulated processes to drive growth and demand

EIC final investment decision (FID) data reveals that, globally, oil and gas and large new nuclear projects, both fully regulated and mature industries, have the best FID rates, at 33.7% for upstream oil and gas, 20% for midstream and downstream oil and gas, and 39% for nuclear new build. This compares to only 5% for fixed offshore wind, 6% for carbon capture, 4% for hydrogen and 0.1% for floating offshore wind. FID data is powerful, as it represents the threshold at which the supply chain can and will invest. Without FID, the many project announcements, net-zero ambitions and policy pledges are not bankable for the supply chain.

Carbon capture

354 projects (US$189.5bn) 7.06% reached FID (US$11.1bn)

In some regions, particularly the UK, Europe and the US, there is a pressing need for skilled labour to build energy transition projects. Many companies are establishing internal academies and training programmes to develop the capabilities. Government support in the form of subsidies for training programmes and initiatives to attract and retain talent will be crucial in meeting the increasing demands of the energy transition. Although some skills-related challenges may not yet be apparent, they are likely to become significant as more announced projects reach the final investment decision stage.

Biofuel/sustainable aviation fuel

313 projects (US$131.3bn) 35.46% reached FID (US$22.6bn)

projects (US$623.7bn) 1.67% reached FID (US$592m)

Hydrogen

902 projects (US$1,055bn) 7.65% reached FID (US$38.9bn)

All of this is irrelevant to supply chain businesses if no work comes their way. A steady pipeline of projects is essential for these companies to continue to thrive and play their part in the energy transition. However, there are significant uncertainties around project timelines. Some of these uncertainties are directly related to delays in final investment decisions, while others stem from unpredictable policy shifts. Many companies are overextending themselves in anticipation of promised net-zero projects that either fail to materialise or are less profitable and smaller in scale than expected.

A successful net-zero transition requires a multifaceted approach, including the right policies, financial support and international collaboration. By addressing these key areas, the energy industry’s supply chain can thrive and drive the global transition towards a sustainable energy future.

By Mahmoud Habboush, Communications Adviser, EIC

•

•

•

•

Stable government support and industry collaboration are crucial to driving innovation and growth in renewable energy, says Mahmoud Habboush at EIC

The success of the renewable energy sector relies on stable and consistent government policies, a principle that holds for all sectors. In its Manifesto 2024, the EIC advocates for clear, long-term objectives that remain steadfast despite political changes. It calls on governments to enact legislation that ensures compliance and provides a reliable framework for the industry. Such policy consistency is crucial for building investor confidence and driving sustained growth in renewable energy projects.

A robust supply chain is critical to supporting the growing demands of the renewable sector. This includes developing the necessary infrastructure –such as national grids capable of handling increased capacity and advanced energy storage solutions – to deal with the intermittent nature of renewables (for example storing excess power from wind turbines

when winds are strong).

Addressing supply chain limitations will be crucial in accelerating the deployment of renewable energy systems. Currently, supply chain constraints are often blamed for delays in net-zero projects. However, EIC research detailed in the Survive and Thrive VI Insight Report shows that the supply chain, while busy, is not at full capacity and requires expansion. This growth can be achieved through sustained and predictable project pipelines, the enhancement of local manufacturing capabilities (such as building more wind turbine factories in the UK) and the development of a skilled workforce that is capable of handling the anticipated surge in renewable projects. These improvements will be essential as nations push for faster implementation to meet net-zero goals and energy demands.

In the UK, investments in renewable energy are set to dominate up to 2030, with ambitious targets to treble solar capacity to 48GW and double

onshore wind capacity to 30GW. Offshore wind aims for 55GW by 2030, with 14.6GW already operational. Indeed, the latest Contracts for Difference (CfD) auction round 6 secured 131 new projects capable of generating 9.6GW of green energy. However, challenges still need to be addressed, particularly around grid connectivity and slow project approval processes. These bottlenecks highlight the need for the UK to accelerate project construction and leverage its expertise in wind power to maintain a global leadership position in renewable energy.

EIC’s member companies have provided valuable feedback on the practical steps needed to enhance the renewable energy sector. Their insights reflect the on-the-ground realities and underscore the importance of targeted policies and support. Innovation is the lifeblood of the renewable energy sector, and companies interviewed by EIC stress the need for policies that incentivise investment in new technologies and foster a culture

of continuous improvement. Such incentives can drive the development of cutting-edge solutions that enhance renewable energy systems’ efficiency and effectiveness.

Speeding up the deployment of renewable projects requires stable policy. Now that the UK has a new government, there is optimism that policy will be more predictable. However, conversations with companies around the globe indicate that policymakers should adopt a long-term, non-partisan approach to achieve net-zero targets. Consistent regulations are necessary to provide the predictability needed for substantial investments in renewable energy.

Small and medium-sized enterprises (SMEs) are crucial players in the renewable energy supply chain. Simplifying access to funding and creating supportive policies for SMEs can drive innovation and help such companies scale. Smaller companies often face difficulties in securing loans and other financing options. However, at the Energy Exports Conference in Aberdeen in June 2024, a Santander banker told the audience that funding for renewables projects is available, with banks eager to provide

funding to the right projects. To secure financing, energy companies – including those in the supply chain – are encouraged to have solid financial records and thoroughly risk-assessed projects. While some conference participants suggested that insurance companies could mitigate some of this risk, others argued that government intervention – such as offering loan guarantees for certain sectors –might be a more effective solution.

While financial incentives are key to SMEs and larger businesses, companies working in renewable energy stress the need for collaboration among industry players, supply chain partners and governments. By working together, stakeholders – businesses and governments – can share knowledge, pool resources, and drive innovation, leading to more effective and scalable solutions.

It is clear that the renewable energy sector is marked by numerous challenges and opportunities. By implementing stable policies, offering financial incentives, and fostering collaboration, we can create a robust framework that supports innovation and sustainability.

By Mahmoud Habboush, Communications Adviser, EIC

UK CfD auction round

6 results: 131 projects = 9.6GW

Offshore wind

10 projects: 9 fixed-bottom (4.9GW) and 1 floating (400MW) = 5.3GW

Onshore wind

22 projects = 990MW (909MW in Scotland)

Solar

93 projects = 3.3GW (under 2.9GW in England)

Tidal

6 contracts = 28MW (5 in Scotland)

Fragmented policies

Need for consistent long-term policies to attract and sustain investment

Infrastructure bottlenecks

Investment needed in grid connectivity, ports, vessels and transport equipment

Lengthy approval processes

Complex and time-consuming project approval procedures

Financial incentives

Support mechanisms to make projects financially viable and reduce financial barriers

Collaboration

Partnerships between government, industry players and supply chain partners to drive joint efforts and shared success

Standardisation

Adoption of uniform standards to streamline processes, improve efficiency and lower costs

To support offshore wind, the logistics industry must invest heavily in ports, vessels, transport equipment and related infrastructure before projects are confirmed. A major challenge is the constant delays in the project pipeline, resulting in reluctance to make investments.

Policymakers must understand that the focus shouldn’t just be on the number of projects or megawatts; location is equally important.

Politicians and industry must work together on permitting, infrastructure development, legislation and financing. This collaboration will build confidence in the logistics and offshore wind industries that projects will actually materialise, thereby attracting essential investments for their successful installation.

For workforce development, the biggest challenge is in adopting a common standard for training and competency. The renewable sector is newer in the US market, so there aren’t as defined regulations and industry guidelines for management systems. These would include guidance for training and competence programmes, safety programmes and auditing good practices. It’s currently left up to the operators, project management and service providers.

Government, accrediting bodies, industry and training providers can collaborate to define baseline standards for the various positions and site types. Lessons from other energy sectors and similarly regulated industries, such as manufacturing, could be valuable.

Oil and gas are pivotal to the UK’s energy transition, but current policies limit their potential to support net-zero goals. Balancing support for conventional and emerging technologies is essential for a successful transition, says Mahmoud Habboush at EIC

The crucial role of oil and gas in the UK’s energy transition and supply chain cannot be overstated. Around 83% of the country’s energy supply chain relies on oil and gas, but a sizeable portion of these companies – around 45% – have diversified into renewables and net-zero technologies. This trend highlights the critical role oil and gas plays in supporting the transition to a greener energy future. It also reveals an important and rarely acknowledged reality: there is, in fact, one integrated supply chain serving the entire energy industry. Understanding this interplay is crucial for both policymakers and industry stakeholders as they navigate the complex path toward sustainability.

Despite the increasing focus on cleaner energy, hydrogen and carbon capture are still in their infancy. EIC data reveals that only 3.5% and 2.7% of supply chain companies are currently involved in these sectors, respectively. This suggests substantial potential for growth in these areas. However, the supply chain’s capacity and capability are under strain, with delays in net-zero projects more often linked to policy and funding gaps than to inherent constraints. Oil and gas companies, armed with transferable expertise and financial resources, can and already are playing a significant role in advancing these emerging sectors.

The skills and capability developed within the oil and gas sector are indispensable for the advancing of new energy technologies. It is clear that the energy sector cannot successfully deliver innovative technologies without the foundational support provided by the oil and gas industry. Rather than demonising the oil and gas sector, governments, particularly in the UK, should explore how these businesses can be harnessed to accelerate the journey towards net-zero targets. However, EIC observes that oil and gas supply chain companies are, to some extent, being penalised as they make efforts to diversify into cleantech.

A key issue seems to be one of semantics. The Oxford Dictionary defines “transition” as “the process or a period of changing from one state or condition to another”. The reality is that businesses cannot immediately abandon their legacy operations. EIC members realise they need to undertake this transition all the way to net zero and are working towards that goal, but they will need all available support during the process.

Globally, oil and gas remains a robust sector. EIC data on final investment decisions (FIDs) reveals a stark contrast between oil and gas projects and newer renewable technologies. As previously mentioned in this magazine, upstream oil and gas projects have an FID rate of 33.7%, compared to 4% for hydrogen projects and 0.1% for floating offshore wind. However, UK policies have left domestic oil and gas supply chain companies without sufficient opportunities at home, and they are unable to capture global opportunities due to a lack of government support.

An integrated approach to policy is essential to enable the oil and gas supply chain to seize opportunities across different energy sectors in the UK. There are currently 1,344

energy projects in progress, with an estimated CAPEX of US$686bn across all sectors. Most investments based on commissioning up to 2030 are in renewables. However, the UK’s upstream oil and gas sector is facing challenges. As of July 2024, EIC data shows there are only 58 upstream projects in the UK, the lowest number ever recorded, with US$7.5bn having reached FID and US$26bn worth of projects under development. Notably, no new upstream projects were announced in 2024.

It is crucial to allow supply chain companies to operate across both conventional and non-conventional energy sectors. If these companies are unable to take on oil and gas projects domestically or benefit from government support for international projects, many will face the stark choice of relocating or shutting down.

Recognising the ongoing importance of oil and gas while supporting the transition to renewable energy sources ensures that the supply chain can not only survive but thrive, contributing substantially to a sustainable global energy future.

By Mahmoud Habboush, Communications Adviser, EIC

We have seen companies struggle to access working capital, innovation and growthrelated funding because, for the most part, their main business streams are still oil and gas. It does not matter that the projects they are seeking to diversify into, by investing and exporting, may be linked to renewables, decarbonisation or newer energy transition technologies; it matters only that their profits, or the profits of their customers, currently largely come from oil and gas – EIC Manifesto 2024

John Roy, Director, Norco

We are committed to ensuring that our expansion is not only profitable in the short term but also resilient and sustainable in the long run. Our people are our greatest asset, and their expertise is crucial to our success. We are committed to attracting, retaining and developing top talent in our specialist field. The oil and gas market is highly volatile, and our ability to adapt quickly to changing market conditions is a key factor in ensuring sustainable growth, along with diversifying our energy portfolio. While our core focus remains on critical power support for oil and gas, we are actively moving into supporting renewable energy projects such as solar and large-scale battery storage systems along with providing operation and maintenance services for hydrogen generation plants.

Policy instability is a significant contributor to delays in electrification in the North Sea, which poses a huge opportunity in terms of emissions reduction. However, we cannot just sit back and blame policy. At ABB we believe that while it is essential to work closely with government, it must be businesses that drive the energy transition. The scale of the challenge is enormous, and far too large for governments to tackle successfully on their own. We each have a role to play, small or large, to collectively drive progress towards achieving our energy transition goals.

Like many others worldwide, the UK’s power sector is grappling with the complexities of integrating a surge of new cleantech power sources, including wind and solar, into the national grid. With the government targeting more than 50GW of new capacity by 2030, including the recently announced 9.6GW of renewable power across 131 projects in its flagship auction, the need for a strategic and coordinated approach to grid expansion and modernisation is more urgent than ever.

Grid capacity strainss

One of the most pressing challenges facing the power sector is that of capacity. In 2022 alone, 2,882 projects were added to EICDataStream globally, marking an increase from 2,529 projects in

2021. Notably, renewables constitute 48% of these new projects, rising to 54% when offshore wind is included. This trend, mirrored in the UK, highlights a critical need for substantial grid upgrades. The current infrastructure is inadequate to support the influx of new projects, and the shortage of substations further compounds the issue. These substations, crucial for managing voltage levels, must be expanded to facilitate efficient electricity distribution across the country.

The UK power sector faces urgent challenges in integrating renewable energy into the grid. With more than 50GW of new capacity targeted by 2030, major grid upgrades and energy storage investments are essential, says Mahmoud Habboush at EIC

Beyond expanding grid capacity, the sector requires significant investments in energy storage solutions to manage the intermittent nature of renewable energy. These storage systems are essential for balancing supply and demand, ensuring a reliable and stable power supply as renewables become a larger share of the energy mix.

A call for immediate action

EIC has emphasised the urgency of addressing these issues in its recent manifesto, which states: “We need to look at the grid as a matter of urgency and ensure that we have the capacity and capability to deliver at pace while our supply chain has one eye on international markets which are more politically stable and financially secure.” EIC is calling for a clear energy roadmap and consistent policies to drive growth and demand in the power sector.

As the global shift towards renewable energy accelerates, particularly with the growth of offshore wind projects, the future of the power sector will depend heavily on the successful integration of these sources into existing energy systems. Key to this transition will be the expansion of grid capacity and the advancing of energy storage technologies. For the UK and other nations, overcoming these challenges will require significant investments in both infrastructure and innovation. By addressing these needs, countries can build resilient and adaptable national grids capable of supporting a diverse array of renewable energy projects, paving the way for a stable, sustainable and low-carbon energy future

By Mahmoud Habboush, Communications Adviser, EIC

The world’s creaking grid At a glance

3,700 GW

In 2023 global new capacity increased by 50% from 2022 to 51GW, taking installed capacity to 3,700GW

11,000 GW

To reach the 2030 goal agreed at COP 28, at least 11,000GW will be required

7,300 GW

Global renewables capacity is forecast to grow to 7,300GW by 2028

Ann Moore, Industry Principal – Power & Utilities, AVEVA