As a little girl the smells of hairspray, deep conditioner and hot flat irons filling the air were part of a weekend routine. The hair salon was more than a place to get your hair done, it was a way to connect to your community, get the hottest gossip and everything else in between. Today, that community has seemed to dissipate and shift into more stylists and beauticians going solo, redefining what we knew as Black hair culture.

In the 90’s and early 2000’s, Black-owned hair culture was a huge staple in the Black community; it was the first nudge at Blackowned businesses and ownership. We had a place that was for us, by us and we used it to uplift and support each other in many ways.

Atlanta, specifically, has always been known as one of the world-renowned Black hair capitals. With the Freaknik aesthetic trends taking off, the Bronner Bros. annual hair shows that are hosted downtown and the longevity of local Black-owned salons, Atlanta’s Black hair community has always had a strong, positive presence. Today, the number of brick and mortar Black-owned hair salons have dwindled and beauticians are going the entrepreneurial route for many reasons.

Like many other ventures, Black business owners typically receive less capital than their non-Black counterparts. According to a McKinsey & Co. report in 2020, Black business owners start with loans that are roughly $35,000 in contrast to the roughly $107,000 white business owners start with. The study also touches on the wage and representation disparity between Black and non-Black business owners. Those disparities result in lower revenues and earnings than white businesses, even with minor efforts from the SBA and the ongoing trend of outside business loans and assistance for Black female entrepreneurs. Due to these business trends and the ways of the hair and beauty industry, many beauticians explored different routes to still accomplishing their goals within their profession.

Aisha Amos is the owner and sole stylist of Hair Beat Salon in Atlanta’s Little Five Points neighborhood. She’s been a self-taught braider since the age of seven and a licensed beautician since 2014. Amos, a native of Baltimore, Maryland, currently rents a suite at Salon Lofts, a suite rental business for independent beauty professionals, and enjoys it

more than the traditional salon setting.

“At the time, they were building a Salon Lofts by our cosmetology school,” said Amos, 46. “And for a field trip one night, our instructor took us over to look at them and I was like ‘yeah, I think I want to do something like this.’”

Amos’ thought process during that decision was rooted in her want to help people and the attitudes of her fellow associates in cosmetology school. She was lucky to find her friend and business associate, Traci Burton, owner of Crimson Beauty Salon in Edgewood, but Amos and Burton agreed that a significant portion of their peers didn’t take the profession as seriously.

“I can’t be in a shop,” says Amos. “I like it and you know, the comradery and being around other stylists but I couldn’t see myself paying the same booth rent or the same amount of money and not having any control, it just wasn’t adding up.”

Salon Lofts gave Amos and Burton that

flexibility to control their own schedule, balance their earnings and still build that community for themselves. Salon Lofts offer stylists their individual suite that they rent weekly and still have that traditional salon-like feeling looming through the halls. This is one of the biggest alternatives that stylists and beauticians have taken to become individual businesses.

With this shift into the rise of individual businesses come some obstacles. Today, “Atlanta stylists” and “Atlanta braiders” are trending topics on social media and not for the best reasons. The viral topic includes commentary from displeased customers about professionalism, pricing, rules and quality.

“There’s these stereotypes that come with the craft now that I’m trying to step away from,” said Chiynah Town, owner of CT Hair Hu$tle, LLC.

Town also believes that people are not looking beyond the stereotypes and come

with preconceived notions that every stylist they come across is rude, late and expensive. One way that Town dispels those stereotypes is by letting her accredited work and bubbly personality do it for her. Although she’s doing business out of her home, she has everything else necessary to become the successful stylist she is and she’s still learning.

“They don’t teach you the business side of cosmetology so much,” said Town. “So trying to get into a salon is a lot harder than people think... it’s hard and competitive and you’re not making the money you’re supposed to be making.”

Stylists like Amos, Burton and Town are the ones spearheading this shift in Black hair culture and while it comes with many ups and downs, the reward of seeing your work flourish and still building that community makes it worthwhile. The shifts and changes we’re seeing aren’t all bad and continue to nod at the stylists and businesses that came before us and sculpted this culture.

The water services have been restored at Tara Woods Apartments tonight. The property owners, Red Apple Investments, paid 75% of the $98,000 water bill, according to Michelle Matich, assistant to the property's owner.

"We paid the bill this morning," said Matich, who was dressed in a black cap and workout gear as she had to come from her home to the apartments to take care of the matter. "This was very embarrassing. We care very much about our tenants and I am so thankful we have gotten this taken care of."

Matich said there is still over $200,000 in delinquent rent that is owed, but the most important thing was to get the water back on.

What a start to a Monday morning

With residents looking on from second floor balconies and from their ground floor apartment doorways, the water services at the Tara Woods Apartments were cut off Monday morning.

Clayton County Water Authority (CCWA) staffers were escorted to the Jonesboro-based apartments by Clayton County Police, Clayton County Code Enforcement officers and Clayton County Fire Scene Investigations officials. Hundreds of residents will be immediately effected by the disruption of service.

With less than a month before the school year begins at dozens of nearby Clayton County Schools, the apartment complex owners, Red Apple Investments, have reported $225,000 in delinquent rent and a $98,000 account balance with CCWA. Signage informing residents about the stoppage in water service was posted outside the entrance to Tara Woods Apartments Friday, July 7. Less than an hour after the water service was stopped, Clayton County Code Enforcement began going door-to-door informing residents that they would have to evacuate the premises by 5 p.m.

A number of residents were crying

as they learned about the evacuation, others were packing their children and personal items into cars and leaving the apartments.

Red Apple Investments, LLC, has been contacted for comment but has not returned our calls and emails. Tara Woods Apartments is located at 661 Sherwood Drive.

Sheltering Arms, one of Georgia’s largest nonprofit early education and childcare organizations, will host its signature hiring event to fill teacher, food service, and other positions for all 13 locations in the metropolitan Atlanta area.

The event will take place Saturday, July 15 from 8 a.m. to 3 p.m., at the Educare Atlanta Center, located at 404 Fulton Street, SE, Atlanta.

Sheltering Arms is seeking qualified candidates for lead teachers, full-time and part-time assistant teachers, substitute teachers, food service managers and more. Candidates will be taken through every stage of the application and interview process, and the organization will make on-the-spot job offers with up to $5,500 in signing bonuses.

In addition, they will be providing a supervised play area for the candidate’s children on the day of the event.

“When you work with young people, there’s

an awesome responsibility in that because it could be life-changing,” said Blythe Keeler Robinson, President and CEO, Sheltering Arms.

“We are looking for potential team members who are just as passionate as we are about providing quality early education to our community’s little ones while supporting their families with the resources and tools, they need to create a legacy of economic stability and growth.”

Sheltering Arms offers excellent benefits to employees, which includes free healthcare, dental and vision, life and disability insurance,

matching 401K, paid vacation, and sick days, and paid federal holidays.

Interested candidates should arrive in professional business attire with the following items:

•A valid state ID or driver’s license

•A copy of their resume

•A copy of all college transcripts and educational certifications or high school diploma/ GED, if available

More information about the event can be found at: www.shelteringarmscareers.com.v

In light of the recent Supreme Court ruling eliminating the use of race in college admissions, there has been a growing conversation about the role of Historically Black Colleges and Universities (HBCUs) in higher education.

While encouraging scholars to consider HBCUs is a valid idea, it is essential to recognize that these institutions may require time and strategic planning to accommodate a significant increase in student enrollment. Greater investment in various aspects of HBCUs — such as housing, classrooms, food services, and administrative support — is critical to the long-term success of the students and the institution.

However, there is an opportunity to support HBCUs, elevate their status, increase revenues, and attract students who might otherwise be attracted to larger colleges and universities across the country. This can be achieved by focusing on bringing top athletes to HBCUs. Although this transition will not happen overnight, it is worth pursuing.

Student-athletes are often drawn to renowned college programs due to factors such as excellent facilities, access to exceptional coaches, state-of-the-art resources, media exposure, and the potential to become professional athletes. However, many HBCUs currently do not meet these standards across the board.

Now is the time to invest in HBCU athletic programs, enabling them to compete for and attract top football and basketball recruits, many of whom happen to be African American.

I have had many conver-

sations with a friend involved in college athletics that has shed some light on the requirements for small schools to consistently compete at a national level. Upgrading facilities and maintaining an annual department budget ranging from $25 million to $50 million are necessary steps. While these numbers may seem daunting, the process can be done gradually with both short-term and longterm benchmarks. Starting with basketball, a sport with fewer players, allows for a manageable investment

that can yield significant returns through effective national marketing.

Imagine if 10 HBCUs could successfully recruit top basketball talents, competing head-to-head with powerhouse programs like Duke, North Carolina, UCLA, Kentucky, and Michigan. Envision these HBCUs contending for Sweet 16 berths and championships during March Madness. With only 12 to 13 players required on a basketball roster, these schools could transition from merely celebrating participation when

they make it to the “Big Dance” to expecting success every year.

To build a successful basketball program, an annual investment of around $15 million, in addition to facility upgrades (workout facilities, gymnasiums, housing, etc.), can quickly change the plight of the program.

Read this full Op-Ed online at www.wordinblack. com

FOUNDED

May 11, 1966

FOUNDER/EDITOR

Ed Clayton Immortalis Memoria

PUBLISHER/EDITOR

J. Lowell Ware Immortalis Memoria

The Atlanta Voice honors the life of J. Lowell Ware.

PUBLISHER Janis Ware jlware@theatlantavoice.com

PRESIDENT/ GENERAL MANAGER James A. Washington jaws@theatlantavoice.com

EXECUTIVE ASSISTANT TO PUBLISHER

Chia Suggs csuggs@theatlantavoice.com

DIRECTOR OF PUBLIC RELATIONS

Martel Sharpe msharpe@theatlantavoice.com

EDITOR IN CHIEF

Donnell Suggs editor@theatlantavoice.com

GENERAL ASSIGNMENT REPORTER

Janelle Ward jward@theatlantavoice.com

GENERAL ASSIGNMENT REPORTER Isaiah Singleton isingleton@theatlantavoice.com

GENERAL ASSIGNMENT REPORTER Noah Washington nwashington@theatlantavoice.com

MANAGING EDITOR, DIGITAL Itoro Umontuen iumontuen@theatlantavoice.com

ADVERTISING, SALES & CIRCULATION

ADVERTISING ADMINISTRATOR

Chia Suggs advertising@theatlantavoice.com

CIRCULATION MANAGER

Terry Milliner SALES

R.D.W. Jackson rdwadman@gmail.com

SUBMISSIONS editor@theatlantavoice.com

CONTACT INFORMATION 633 Pryor Street, S.W. Atlanta, GA 30312 Office: 404-524-6426 info@theatlantavoice.com

“When I liberate myself, I liberate others. If you don’t speak out ain’t nobody going to speak out for you.”

— Fannie Lou Hammer

Iam told that an alcoholic, a person with an addiction, has to admit that he or she has a problem before they have any chance of overcoming it. Real rehabilitation starts with this simple acknowledgment, “I have a problem.”

How many times have you heard the addicted person say over and over again, that they don’t have a problem? They can handle it. They even claim the ability to ‘quit whenever they want to.”

Now if the truth be told, most times tragedy of some sort has to befall this person before their can turns into can’t and they end up begging for help.

There are times now when I think that coming to the Lord for many is eerily similar. People like me and maybe you too, are or have been sick from ignorance of the gospel and don’t realize, like the addiction, that this illness is killing us day by day.

We didn’t, or don’t, have the knowledge or faith required to diagnose our problem. Or, like the alcoholic, we don’t realize we have one.

We simply continue to engage in spiritually self-destructive behavior not recognizing that while ruining our own lives, we also take others along for the ride through our personal nightmare.

Ironically, after salvation, the same people will testify that indeed, they were, shall we say, sick?

Not until we are faced down in the dirt of life, are we then able to see the light and somehow recognize then, the road to spiritual rehab was there all the time. And just like that of the addict, this rehab road to spiritual health and wellness can be long and arduous; forever fulfilling and full or reward.

But following Christ is neither easy nor comfortable. This is indeed another version of the yellow brick road in Oz. My bible says that the cost of following Christ is an all or nothing proposition. Once an addict, always an addict. Once a Christian, always a Christian. Once

saved, always saved.

Those who follow the Lord’s way do not necessarily have it easy. On the contrary, the Christian life can be very hard. Persecution from “haters” who refuse to accept you as a new Christian is the same as the person who offers an alcoholic a drink and can’t understand why the alcoholic says no.

One gets it. The other doesn’t. “Jesus replied, Foxes have holes and birds of the air have nests, but the Son of Man has no place to lay His head.” Luke 9:58.

Our responsibility then is to first and foremost understand and admit we are helpless against our addiction, our illness. We are not in control. Submission, in this case, is our admission that God is in charge and not us. Our life belongs to Him. Now we can begin serious spiritual rehab.

Being faced down in the dirt

can now be replaced with being faced down in prayer. There’s a big difference in perspective if you get my meaning.

I submit to you that once you understand the scope of this struggle and the lengths to which God will go to save you, then you have an excellent chance of claiming your redemption.

As long as we know that we are at the mercy of so many things that we have no control over, we will continue to find the answers and solutions we need, our medicine, in our very own clinic built and fortified by Christ Himself. Therein lays the light in all this darkness.

God loves us more than we can possibly comprehend; so much so He provided us with the prescription for our illness. However, it is still up to us to get that prescription filled. It starts with a trip to the Dr.’s office and our honest answer to His question, “Now what’s the problem?” If that answer is “I’m sick and I cannot save myself,” then you’re cured.

May God bless and keep you always.

Tuesday, Georgia State Rep. Meisha Mainor, D-Atlanta, announced her intentions to leave the Democratic Party with immediate effect. She made the announcement on social media:

“My name is Rep. Meisha Mainor and today I made the decision to leave the Democrat Party. I represent a blue district in the city of Atlanta so this wasn’t a political decision for me. It was a MORAL one. I will NEVER apologize for being a black woman with a mind of my own.”

Mainor also said “left-wing radicalism, lawlessness, and putting the interests of illegal aliens over the interest of Americans,” were additional reasons why she believed the Democratic Party “left her” and not the other way around.

Mainor was elected to the Georgia House of Representatives in 2021, in House District 56, a Democratic stronghold that stretches from Atlantic Station to Westview. During the 2023 Legislative Session, there were Democrats calling for a primary opponent to challenge Mainor for her seat. State Senator Josh McLaurin, D-Sandy Springs, tweeted a blank check for $1,000 saying

‘all I need is a name,’ putting out a clarion call for any Democrat willing to challenge Mainor.

Mainor raised the ire of her Democratic Party colleagues after she showed support for a school choice bill, Senate Bill 233, according to reports. That bill would have created “Promise Scholarship Accounts,” which the State of Georgia will give each student a $6,500.00 subsidy per school year to pay for student expenses related to homeschooling and private schools.

“When I decided to stand up on behalf of disadvantaged children in support of school choice, my Democrat colleagues didn’t stand by me,” Mainor told Fox News. “They crucified me. When I decided to stand up in support of safe communities and refused to support efforts to defund the police, they didn’t back me. They abandoned me.”

U.S. Rep. Nikema Williams, chair of the Democratic Party of Georgia, assailed Mainor’s switch as a “stinging betrayal” of her Democratic constituents.

“House District 56 deserves a representative who will do the job they were elected to do, including fighting for high-quality public education,”

Williams said in a statement.

Mainor’s shift increases the Republican majority in the Georgia House to 102 over the Democratic Party’s 78.

“For far too long, the Democrat Party has gotten away with using and abusing the Black community,” Mainor added. “For decades, the Democrat Party has received the support of more than 90% of the black community. And what do we have to show for it? I represent a solidly blue district in the city of Atlanta. This isn’t a political decision for me. It’s a moral one.”

Mainor has already been welcomed by high-powered Republicans. U.S. Senator Kelly Loeffler congratulated Mainor for joining the Republican Party.

“[Mainor was] attacked the moment she spoke out for law enforcement and educational freedom. Grateful for her conviction, and her willingness to serve our state – as Georgia’s newest Republican,” said Loeffler.

Additionally, House Speaker Jon Burns, a Republican from Newington, said in a statement that Mainor is “joining the party of opportunity.

Additionally, Governor Brian P. Kemp has also welcomed Mainor to the Republican Party. “We welcome Representative Mainor to our party and look forward to working with her on issues for the benefit of hardworking Georgians,” said Governor Kemp in a tweet.

“Jesus replied, Foxes have holes and birds of the air have nests, but the Son of Man has no place to lay His head.” Luke 9:58.

The 2023 ESSENCE Festival of Culture features fashion, beauty, food, music and loads of fun. However, the Festival is also a place for poignant conversation. A deep conversation was held at the Mayor’s Forum which was part of the larger Global Black Economic Forum inside the Ernest N. Morial Convention Center. America’s leading Black mayors from top cities participated as they discussed the biggest issues in each city and the political effects from their decisions.

The participants were Atlanta Mayor Andre Dickens, Cleveland (Ohio) Mayor Justin M. Bibb, New Orleans Mayor LaToya Cantrell, Los Angeles Mayor Karen Bass, New York City Mayor Eric Adams, The Reverend Al Sharpton and Chair of the National Urban League, Marc H. Morial participated on the panel. Mayor Cantrell served as the moderator.

“We have just raised $250 million in the city of Atlanta to be able to do more affordable housing,” said Mayor Dickens. “We have a goal of 20,000 units. So we’re well on our way we’re building as fast as we can. We’ve got Black developers, we’ve got nonprofit developers, we’ve got churches.”

Dickens also added that inequity is the issue that keeps him up at night. The median home price in Atlanta was $350,000 in January 2023, according to the U.S. News Housing Market Index, which is based on Redfin data. That’s a 1.5% increase from one year ago. By comparison, the national median existing-home sale price in January, which was $359,000, according to the National Association of Realtors. That’s a 1.3% uptick year over year.

“I see a train that’s steadily coming where people are, again, being priced out,” Mayor Dickens said. “Yes, we have upward mobility that’s happening and all this great new development in our city. We also have individuals who have been living on the margins and now I’m trying to make sure we have balanced growth. So every day I think about how I can make sure Miss Jones has been living in that house for 40 years, to make sure that she can stay in that house and still be able to benefit from this growth. The challenge is to have balanced growth all across the city and still be able to have legacy residents benefit from this great growth.”

The Mayor’s Forum looked ahead at the potential obstacles coming down the road for each city’s top leader. Each leader expects attacks from those saying they didn’t do enough to combat any particular issue: like homelessness, the asylum seeker crisis, education, various forms of inequality, or being in favor of defunding the police (for the record, none of the mayors on stage are in favor of defunding the police). Former Mayor of New

Orleans and current leader of the National Urban League, Marc H. Morial, says there will be what he describes as a “pernicious effort to undermine our electoral success by using legislatures and federal policies and rhetoric from newspapers and pencil

Morial, the son of Ernest Nathan (who was New Orleans’s first Black mayor and whom the city’s Convention Center bears his name), discussed the ways state legislatures sought to cripple the

we need to be aware that behind a curtain somewhere in this country, there are people plotting to undermine the leadership of these mayors and of American cities. First thing for us to do is to be aware, and I’ll say yes, woke, be woke. Because if you’re not ‘woke’, you’re asleep. And we can’t [fall] asleep.”

Mayor Adams and Mayor Bass each said homelessness and the asylum crisis are two of the biggest issues threatening not only their cities but all of America.

“And all mayors must come up with a clear urban agenda on how we ensure that the resources that are coming to the states find their way into the cities. That’s so important, this migrant asylum seeker issue. Every mayor should lift their voice,” said Mayor Adams.

“I loved being in Congress, but the reason why I wanted to be mayor is because I am very worried about us repeating something that happened in the 90s, and that is the criminalization of Black folk. In the 90s, folks were criminalized because of crack, my worry now is that people will be criminalized because they’re living on the streets,” added Mayor Bass.

Meanwhile, Mayor Bibb of Cleveland, Ohio discussed the challenges and opportunities facing Cleveland and marginalized communities in urban spaces across the nation. He spoke especially to the increasing problems with violence prevention and gun control in the city.

“We have to change the culture of how we think about guns in this country. And we need to make sure we do everything to vote in 2024 to make sure we put people in DC and in our legislatures to pass common sense gun reform. I get those calls on a weekly basis about people dying in my city. I pray that we find a way to change how we think about guns and gun violence in our country. We all have a role to play to make that change happen in this nation.” said Bibb.

Reverend Al Sharpton emphasized the importance of gathering Black leaders together in conversation.

“One of the reasons it is so important that we hear from these mayors is that never in a time in American history have we seen the mayors of every major city, just about, Black and from our community,” said Sharpton.

pushers and so-called good government groups to undermine power.”

“What we are going to witness in the next 18 months is an orchestrated effort to point the finger at American cities and their challenges and their problems to try to undermine the credibility of Black leadership of American cities,” Morial said. “We need to be aware, and we need to say

power that these Black mayors soon amassed, even though their cities are their state’s primary economic engine.

“You did not do a damn thing about homelessness,” exclaimed Morial, directing his ire at the panel’s collective political opponents. “You didn’t do a damn thing about education. You didn’t do a damn thing to try to sustain American cities. So

As the ESSENCE Festival of Culture drew to a close, it was clear for these five mayors that in the midst of fun, there remains a lot of work to be done. Just like Dave Dinkins passed it to Eric Adams, Maynard Jackson ultimately to Andre Dickens, Tom Bradley ultimately to Karen Bass and so on, there is a standard these Black mayors must continue to uphold, which is ensuring they leave their city better than they found it when they arrived. The good thing is, the concerned public and the voters are watching every step they

Coca-Cola believes partnership with the ESSENCE Festival is about uplifting Black culture. Read online at www.theatlantavoice.com

The loan a person takes out to to buy real estate such as a house or condominium is called a mortgage and requires monthly payments. In Georgia, if the property owner falls behind in making those payments, the lender, such as a bank, can sell the property at auction to settle the debt. Doing so is known as foreclosing on a property.

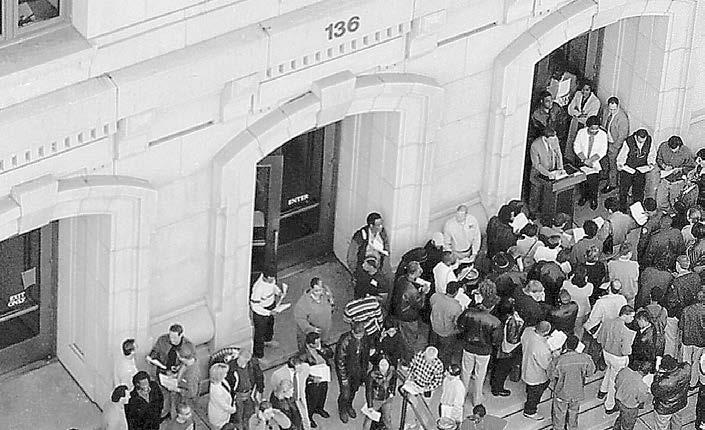

These auctions take place the first Tuesday of every month (or the first Wednesday if the first Tuesday falls on a holiday) between 10 a.m. and 4 p.m. on the steps of the county courthouse. The auction of properties in Fulton County takes place in downtown Atlanta on the front steps of the Fulton County Courthouse at 136 Pryor St.

Georgia law allows lenders to conduct an auction without going before a judge on one condition: The lender must give the borrower—and the public—proper, legal notice of its plans to foreclose. Proper notification means advertising in the county’s official legal newspaper. In Fulton County, that official newspaper is the Daily Report. The lender must advertise its intent to foreclose once a week for the four consecutive weeks leading up to the “first Tuesday” sale date. To auction off a property the first Tuesday of March, for example, a lender must have published a foreclosure notice during each of the four weeks of February.

During the weeks leading up to the auction date, many property owners are able to work things out with their lenders, seek bankruptcy protection or line up other arrangements to prevent the bank from selling off their homes. If your lender has started foreclosure proceedings against your property, these listings provide you with an extra alert— over and above the official notice published in full in the Daily Report—to take action.

See MORTGAGE, Page 2

Introduction from the publisher

Get behind on your mortgage, and you could lose your home. Don’t pay your property taxes, and you might similarly find your house auctioned off on the courthouse steps. Both types of forced sale, known as foreclosure, involve complicated legal procedures. We’ve designed FCDR ConsumeR AleRts to take some of the mystery out of the process and to alert consumers to how and when to take action.

We can provide this service because, by law, no foreclosure can occur unless properly announced in the official legal newspaper of the county. That’s required for the benefit of the property owner but also for the community at large. The publication requirement is founded upon the same notions of due process, open government and community awareness that underlie American democracy, and it’s a practice at least as old as the country itself.

Since 1890, the Fulton County DAily RepoRt has served as Fulton County’s newspaper of record for public notices. Each day, important public information courses through our pages in the form of hundreds and hundreds of official notices. We’ve designed FCDR ConsumeR AleRts to present that information in

an easy-to-understand and easy-touse format.

Thanks to a partnership between the Fulton County DAily RepoRt and the AtlAntA VoiCe, FCDR ConsumeR AleRts will reach tens of thousands of county readers each month. We’ve also made a database of the information available on the Internet, expanding the utility and reach of county information even further. At www.fcdr.com, members of the public can make intelligent searches and link to the full text of official public notices as originally published in the DAily RepoRt

On the following pages you’ll find this month’s FCDR ConsumeR AleRts, along with user’s guides that help explain the legal procedures at work, the different forms of public notice, and how to make the most of the information.

As always, we welcome your thoughts. If you have any suggestions or comments about how we can improve FCDR ConsumeR AleRts, please don’t hesitate to contact me at the address below.

Fulton County Daily RepoRt 136 Pryor St, CB14, Atlanta, GA 30303 (404) 521-1227

User’s Guide:

Local government runs on property taxes. That’s why Georgia law imposes severe penalties for failing to pay them. If left unresolved, a bad situation easily can become worse, forcing a homeowner in arrears to choose between paying a small fortune or losing the family homestead.

It doesn’t have to come to that. And in fact, there are several opportunities throughout the property tax collection process that allow the homeowner to come current and avoid the worst. We’ve designed our tax sale listings to make sure homeowners don’t miss those opportunities.

We’re able to provide this service because the Daily Report is the official newspaper of the Fulton County courts. Throughout the process in Fulton County, the law requires the various collection participants to publish several different forms of notice in the Daily Report Those notices form the basis for the listings below.

Our tax sale listings represents a compilation of information from the following types of public notices:

• Non-Judicial Tax Sale

• Redemption Rights Deadline

• Judicial Tax Hearing

• Judicial Tax Sale

• Quiet Title

Here’s how the tax collection process works, what the different notices mean, and when they come into play.

Your obligation to pay property taxes is backed by the property itself. Fail to pay, and the county tax commissioner

See TAX, Page 6

Neither the Daily Report nor The Atlanta Voice is responsible for any errors or omissions in the FCDR Consumer Alerts listings. The information is neither official nor complete, but merely an abstract of the first-run public notices appearing in the Daily Report . For the complete and official public notice, consult the printed Daily Report. Information in the official notices comes directly from the advertisers with no independent verification. These listings do not include any subsequent cancellations or subsequent corrections advertisers may have made to their notices.

Just because a property is advertised for foreclosure does not necessarily mean it is in foreclosure or that the owner is in arrears. Some notices result from misunderstandings. Oftentimes matters are worked out (or halted) well in advance of the auction date but after the notice has been submitted for publication. Just because a property isn’t listed here doesn’t mean it’s not in foreclosure. Again, these listings are by no means the official notice.

The person listed as owner may not necessarily be the present title holder. Indeed, your property may well be listed under the name of a prior owner. Mortgage value information merely reflects the amount of the original loan amount as listed in the foreclosure notice, not the balance due and not the value of the property.

Neither the Daily Report nor The Atlanta Voice is responsible for any investment decisions based on this information. Neither do they make any representations regarding title or the existence of any liens or encumbrances. Readers of this report should do their own research and consult a real estate, legal or investment professional.

This report is the exclusive copyrighted property of the Fulton County Daily Report ALM© 2013. All rights reserved.

Daily Report

www.dailyreportonline.com

260 Peachtree Street N.W. Suite 1900, Atlanta, GA 30303 Call (404) 419-2871 to subscribe.

MORTGAGE, from page 1

• Neighbors: Know What ’ s Going On

Use these listings to stay informed about your neighborhood. By law, and for important reasons of public policy, foreclosure notices are for the public. They can tell you whether you have a neighbor in need. They can help answer questions you might have about abandoned or poorly maintained property near you. They can give you insight into property values in your neighborhood. Indeed, a foreclosure taking place in your neighborhood can affect your own property values.

• Homebuyers, Investors: Find a Bargain Foreclosure notices provide valuable

330 CROOKED STICK DR Orig. mort.: $861,250.00

Deed Book: 60256, Page 342

Mort. Holder: Michel Njem

Firm Contact: 888-8186032

770 ANNA LN Orig. mort.: $50,000.00

Deed Book: 40199, Page 455,

Mort. Holder: Frederick Waterman and Judith J.

Firm: LEFKOFF, RUBIN, GLEASON, & RUSSO,

leads to prospective homebuyers and real estate investors. Houses facing foreclosure often go for bargain prices. These listings, organized by zip code and street address, can help you spot those potential bargains. The summary information, of course, is just a starting point—a lead to initiate your own research. In addition to bidding for a house on the courthouse steps, there are ways to buy the property in advance of foreclosure by dealing directly with the lender’s attorney or the property owner, both generally listed below. But be warned: Buying a house facing foreclosure is not for the faint of heart. In general, you must buy the property as is, without an opportunity for inspection. You have to pay with cash or certified check. And

all sales are final. To say the least, make sure you do your homework, do a complete title search, consult with a professional and, above all else, think twice.

• Lenders: Protect Your Interests

Many properties are subject to more than one loan, such as a home equity loan or second mortgage. If the lender holding the first mortgage sells the property off at foreclosure, the rights of the secondary lenders may be wiped out. If you have lent someone money against his or her property, or if you hold a lien, these listings provide you with an alert—in addition to the official notice published in full in the Daily Report —so that you can take action to protect your interests.

Firm: BROCK & SCOTT PLLC

Firm Contact: 404-7892661

420 PECAN WOOD CIR Orig. mort.: $159,065.00

Deed Book: 58688 Page 658

Mort. Holder: Callie Rumph and Ronald Sloan Jr

Firm Contact: 404-9947400

6094 ALLPOINT WAY Orig. mort.: $135,200.00

Deed Book: 44399 Page

Firm Contact: 866-2586572

4701 FLAT SHOALS RD, UNIT 34A Orig. mort.: $171,500.00

Deed Book: 65209, Page

553

Mort. Holder:

Holder: Scott W. Anderson and Deborah A. Bernstein-Anderson

MCMICHAEL

GRAY LAW GA

CT Orig. mort.: $70,900.00 Deed Book: 58200

5078

419 ELDER ST Orig. mort.: $100,328.00

Deed Book: 47540 Page

549

Mort. Holder: Howard L. Hagood

SAINT DAVID STREET

mort.: $176,739.00 Deed Book: 57866, Page

BUTNER RD

mort.: $127,645.00

Deed Book: 58961, Page 339

Mort. Holder: Victor Wilborn Firm: MK CONSULTANTS, INC.

Firm Contact: 888-4034115

7546 SAINT DAVID STREET Orig. mort.: $184,900.00

Deed Book: 58342, Page 328

Mort. Holder: Kannon T Parker

Firm: MANER, RICHARD

Firm Contact: 404-789-

2661

452 WOODLAWN AVE

Orig. mort.: $231,396.00

Deed Book: 61824, Page 666 Mort. Holder: Thomas Henry

Firm Contact: 734-8057125

482 PARK VALLEY DRIVE NW Orig. mort.: $175,000.00

Deed Book: 65959, Page 45

Mort. Holder: GA Real Estate Acquisitions, LLC

Firm: MANER, RICHARD B. PC Firm Contact: 404.252.6385

557 CHAPPELL ROAD NW Orig. mort.: $35,000.00

Deed Book: 44502 Page 520

Mort. Holder: Martha A Tuggle

Firm Contact: 404-9947400

716 CEDAR AVE NW Orig. mort.: $39,100.00

Deed Book: 24121, Page 168

Mort. Holder: Willie Whitfield and Alford

Malcolm

Firm: BROCK & SCOTT

PLLC

Firm Contact: 404-7892661

882 HALL ST NW Orig. mort.: $90,000.00

Deed Book: 64033, Page 400

Mort. Holder: Melba Miles and Michael Miles

Firm Contact: 800-3066059

2009 ARLINGTON CIRCLE NW

Orig. mort.: $0.00

Deed Book: 61357, beginning at page 239

Mort. Holder: Aubrey B. Carter

Firm: CAMPBELL & BRANNON LLC

Firm Contact: 770-3920041

431 LANIER ST, NW Orig. mort.: $180,000.00

Deed Book: 66068, Page 62

Mort. Holder: Palm Coast Georgia, LLC

Firm: MCCALLA RAYMER LEIBERT PIERCE, LLC

Firm Contact: 678-281-

578 BROADVIEW PLACE NE Orig. mort.: $484,350.00

Deed Book: 60871, Page 354

Mort. Holder: Mauricio Lopez Firm Contact: 888-4802432

626 E MORNINGSIDE DR. NE

Orig. mort.: $904,687.00

Deed Book: 65713, Page 217

Mort. Holder: LI VAUGHAN EQUITY PARTNERS, LLC

Firm:

65664, Page

Mort. Holder: D.A.T. Contracting, LLC

Firm Contact: 404-233-

390 WEST LAKE AVENUE, UNITS A6, A9, B5, B8, AND B9, Orig. mort.: $905,000.00

Deed Book: 66268, Page

Mort. Holder: D.A.T.

6503

991 WESCOTT LN Orig. mort.: $484,000.00

Deed Book: 46717, Page

632

Mort. Holder: Matthew Greco and Juliet C. Greco

Firm: BROCK & SCOTT PLLC

mort.: $187,018.00

Deed Book: 46305, Page

376

Mort. Holder: ANTONIO WALKER AND TIERRA M.

WALKER

Firm: SOLOMON BAGGETT LLC

Firm Contact: 678-2432515

4840 WEST PARK CIR

Orig. mort.: $210,123.00

Deed Book: 65543, Page 250

Mort. Holder: Stephanie

M Tatum

Firm Contact: 404-679-

4908/-3133

5053 LICHEN TRAIL

Orig. mort.: $210,798.00

Deed Book: 45135, Page

354,

Mort. Holder: Camille S. Williams

Firm: BROCK & SCOTT

PLLC

Firm Contact: 404-789-

2661

5835 VERNIER DR

Orig. mort.: $89,915.00

Deed Book: 49131, Page

271

Mort. Holder: Arnold

G. Huston and Earlene

Parker Huston

Firm: BROCK & SCOTT

PLLC

Firm Contact: 404-789-

2661

5850 BUTNER RD

Orig. mort.: $50,000.00

Deed Book: 42393 and Page No. 395

Mort. Holder: ELIZABETH

TAYLOR & ANTHONY RAY TAYLOR.

Firm: BARRETT DAFFIN

FAPPIER LEVIN

Firm Contact: 972-341

5398

6166 LAMP POST PLACE

Orig. mort.: $129,750.00

Deed Book: 43109 Page 247 Mort. Holder: Antonio Mathis

Firm Contact: 404-9947400

3537 FORREST PARK ROAD SE

Orig. mort.: $93,263.00

Deed Book: 36360, Page 272

Mort. Holder: Cassandra Thomas and Miriam Smith

Firm Contact: 800-6544566

451 TUFTON TRAIL SE

Orig. mort.: $75,295.00

Deed Book: 57293, Page 508

Mort. Holder: Jade Norwood

Firm: PUBLICATION POINT

Firm Contact: 850-422-

2520

580 HUTCHENS RD

Orig. mort.: $50,000.00

Deed Book: 46348, Page

462

Mort. Holder: Helen S.

Van Wyck

Firm: LEFKOFF, RUBIN, GLEASON, & RUSSO, P.C.

Firm Contact: 404)8696900

5128 LOWER ELM ST Orig. mort.: $205,405.00

Deed Book: 63551 at Page 552

Mort. Holder: Candice Graham

Firm: SERVICELINK AGENCY SALES AND POSTIN

Firm Contact: 770-3734242

Orig. mort.: $95,000.00

Deed Book: 59298, Page 483

Mort. Holder: DAVANTE BROWN

Firm: SELLERS & WARREN. P.C.

Firm Contact: 770-9249366

Orig. mort.: $229,000.00

Deed Book: 53867,

can sell the real estate to raise the amount due in back taxes. It’s an awesome power, and it takes the form of a lien.

Think of a lien as a parking boot the county clamps on your property. As with that more physical form of restraint, a lien against your property can stop you cold. It can interfere with your ability to transfer the property or even to borrow against it. If you do manage to sell the property, the lien sticks to it, interfering with the next owner’s title.

By law, the county tax commissioner automatically gains a lien against property the first day property taxes come due, Jan. 1 of each year. Once the owner pays the taxes, the lien dissolves.

When the property taxes become past due, the tax collector can proceed in one of two ways- Non-Judicial Tax Sale which doesn’t involve going to court, and Judicial Tax Sale , which must. Both types of proceedings rely upon the sheriff to conduct the sale. Each has its own purpose and its own advantages to the tax collector. More important to the homeowner, each has its own set of procedures and its own types of public notice.

Non-judicial tax sale is the most common route for the tax commissioner to take. After the payment deadline passes, and after providing the owner with written notice, the tax commissioner turns the matter over to the sheriff by issuing what’s called a tax fi. fa. or writ of execution.

Fi. fa. is the abbreviation of a Latin term meaning “cause it to be done,” and the writ, in this case, formally commands the sheriff to sell the property at auction to the highest bidder. The sheriff has no choice in the matter. The ensuing process is known as sheriff’s levy and sale.

As a first step, the sheriff must send out written notice and also publish a Notice of Sheriff’s Sale in the Daily Report. Those notices, grouped under the heading NonJudicial Tax Sales , are generally the first form of notice to hit the Daily Report and therefore usually represent the first alert appearing in the listings below.

If you see a property in which you have an interest listed as the subject of a Non-Judicial Tax Sale, you need to contact the sheriff ’s office and the county tax authorities.

If the notice lists a private investor, that means the county has transferred the tax lien on your property (explained below), and you should contact that party.

After meeting the law’s notification requirements, the sheriff auctions the property to the highest bidder on the steps of the Fulton County Courthouse in downtown Atlanta at 136 Pryor St. S.W., the first Tuesday of the month. The money raised goes toward the back taxes, and the bidder now takes ownership to the property.

The original homeowner still has a way to get the house back (explained below, under Redemption), but it’s now a matter between old owner and new; the county is out of the picture.

Until May 2002, Georgia law let the county turn matters over to the private sector even sooner. Instead of pursuing the non-judicial sale procedures itself, the county could sell off its tax liens to private investors. The investors paid off the back taxes and then handled the rest, including having the sheriff conduct a non-judicial sale. Although the Georgia Legislature halted the practice during its 2002 session, enough transferred liens remain outstanding that homeowners need to know about them.

For one thing, a transferred tax lien can lie dormant for a few years and thus catch the homeowner unawares when the private investor finally decides to execute on it. That’s because the purchaser of a tax lien does not have to demand a sheriff’s sale of the property right away. Some transferees hold on to the lien without taking any action for a couple of years, thus allowing the interest and penalties—the value of their investment—to grow. As the penalties compound, it becomes harder and harder to get one’s property out of hock.

Once the property is sold on the courthouse steps, the former owner still has the chance to rescue the property through a process called redemption. To regain good title to the property, the homeowner must reimburse the purchaser the amount paid at auction, plus penalties, interest and, sometimes, costs.

An owner has the opportunity to redeem as a matter of right for 12 months following the sale. But the window to redeem actually may stay open longer, depending on when the tax-sale purchaser takes action to cut off the owner’s right of redemption.

That action is technically known as foreclosing the right to redeem. The term “barment” has also come into parlance to describe the procedure for cutting off the owner’s right to redeem. By whatever

name, it has the effect of giving the taxsale purchaser title to the land (subject to other possible liens).

Twelve months after the sale, the purchaser can send out notice to the homeowner giving the person a deadline to pay up and reclaim the property or lose all rights to it. The tax-sale purchaser gives notice by mail and also by publishing in the Daily Report a Notice to Foreclose the Right of Redemption, a form of public notice we group under the heading Redemption Rights Deadline

If your property appears in the listings below as subject to a Redemption Rights Deadline, you can rescue the property by contacting the purchaser and tendering the full redemption amount before the announced cutoff date.

The second and less common means of property tax collection is judicial tax foreclosure sale. When the tax authorities take that route, they have to wait a little longer to act, and they have to go to court, but it’s ultimately a more decisive process. In general, the county avails itself of this process as a way to put abandoned and blighted property in better hands.

Twelve months after the property taxes first become due on Jan. 1, the tax collector can file a petition in Fulton County Superior Court to conduct a foreclosure sale on the property in arrears.

Note, the legal action is filed not against an individual, such as the owner of record, but against the land itself, a procedure in law known as an action “in rem.”

The first published notice announces a hearing in Superior Court on whether a tax foreclosure sale should be permitted. Notice to the property owner of the county’s intent to foreclose on the land includes mailed notice and the publication of a Notice of Judicial In Rem Hearing, grouped in the Daily Report under the heading Judicial Tax Hearing

If you see your property listed below as subject to a Judicial Tax Hearing, you need to contact the county tax commissioner and attend the scheduled hearing in Superior Court, but consult a lawyer.

Once satisfied that the tax collector has met the law’s notice and other procedural requirements, a judge issues an order allowing a foreclosure sale of the property.

With that order in hand, the tax collector then must publish in the Daily Report a Notice of Judicial In Rem Foreclosure Sale, which we’ve organized under the heading Judicial Tax Sale

If you see your property listed below as subject to an impending Judicial Tax Sale, you need to contact the tax commissioner ’s office and make arrangements to settle your tax delinquency and stop the sale.

The property owner has the right to redeem the property up to the moment of sale, which generally takes place the first Tuesday of the month following the published notice.

The law gives the owner one last chance at redemption. For 60 days after the sale, the owner can pay the redemption amount, which now includes not just the back taxes and penalties but also the amount paid for the property at auction. If the owner misses that opportunity, then title to the property passes to the purchaser at auction.

Title to property bought at tax foreclosure sales, particularly non-judicial sales, is generally considered clouded. That can cause complications when the new owner decides to sell or finance the property. To fix that, most purchasers undertake Quiet Title proceedings, seeking a declaration that they own the real estate free and clear. The process involves filing a petition with the Superior Court, mailing out notice, and publishing a Notice to Quiet Title in the Daily Report

If you see your property listed as subject to Quiet Title proceedings, you may be able to file pleadings in Superior Court to intervene. Consult a lawyer.

Suffice it to say, it’s a complicated sequence of events, and one that rapidly gets more expensive and harder to control as time passes. For help and more information, here are some suggested Fulton County contact numbers:

• Tax Commissioner (404) 612-6440

• Sheriff ’s Property Tax Unit (404) 730-6595

• Superior Court Clerk (404) 730-5313

• Atlanta Bar Association Lawyer Referral Service (404) 521-0777

The Daily Report gratefully acknowledges the advice and insight of Emory University School of Law Professor Frank S. Alexander and his authoritative book on the subject, “Georgia Real Estate Finance and Foreclosure Law with Forms” (Harrison Co. 3d ed. 1999 & supp. 2001).

1 LAMAR AVENUE NW.

Owner: CLINTON CURRY ESTATE

Amount Due: $8,806.00

Tax Parcel ID: 14-0180-0012-013-2

1103 SIMS STREET SW.

Owner: TRIROSE DIVERSIFIED INC

Amount Due: $7,688.00

Tax Parcel ID: 14-0087-0008-031-4

114 HEMPHILL SCHOOL RD #REAR.

Owner: HARPAGON MO LLC

Amount Due: $12,166.00

Tax Parcel ID: 14-0243-0007-023-3

1155 SIMS STREET SW.

Owner: BAKARY DOUMBIAD

Amount Due: $22,922.00

Tax Parcel ID: 14-0087-0008-112-2

1290 WALKER AVENUE.

Owner: CAROLYN S MCKINNEY

Amount Due: $7,571.00

Tax Parcel ID: 14-0130-0006-013-1

132 GRAVES STREET NW.

Owner: VINE CITY PLAZA II LLC

Amount Due: $7,872.00

Tax Parcel ID: 14-0083-0004-063-5

133 VINE STREET NW.

Owner: VINE CITY PLAZA II LLC

Amount Due: $7,377.00

Tax Parcel ID: 14-0083-0004-066-8

1335 ANDREWS STREET NW

Owner: THE LEGACY OVER CURRENCY TRUST

Amount Due: $21,698.00

Tax Parcel ID: 14-0142-0005-032-8

135 JOSEPH E LOWERY BLVD NW.

Owner: ELLIOTT CHEELY, GREATER MACEDONIA

CHURCH

Amount Due: $26,338.00

Tax Parcel ID: 14-0110-0007-015-9

14-0114-0007-039-5

Owner: PROCTOR LAND HOLDINGS LLC, K C MARKS

ESTATE

Amount Due: $4,194.00

Tax Parcel ID: 14-0114-0007-039-5

1483 ARTHUR LANGFORD PLACE SW.

Owner: B & R APARTMENTS LLC

Amount Due: $65,186.00

Tax Parcel ID: 14-0089-0003-025-9

1512 HARBIN ROAD SW.

Owner: MUSA CONSTRUCTION LLC

Amount Due: $8,583.00

Tax Parcel ID: 14-0217-LL-047-2

1563 RALPH D ABERNATHY BLVD SW.

Owner: LNK HOME LLC

Amount Due: $13,298.00

Tax Parcel ID: 14-0149-0002-056-3

1837 STANTON ROAD.

Owner: THE HOUSING AUTHORITY OF THE CITY OF

EAST POINT

Amount Due: $449,026.00

Tax Parcel ID: 14-0166-0004-084-1

2044 WILSON AVENUE NW.

Owner: ARTHUR BURTON

Amount Due: $2,853.00

Tax Parcel ID: 14-0180-0013-014-9

2099 JONESBORO ROAD SE.

Owner: ABEBE VENTURES LLC

Amount Due: $107,036.00

Tax Parcel ID: 14-0038-0002-047-6

2398 HERRING ROAD SW.

Owner: CASCADE EQUITY PARTNERS LLC

Amount Due: $5,984.00

Tax Parcel ID: 14-0183-0005-008-8 2530 HOGAN ROAD.

July

Due: $9,343.00

Tax Parcel ID: 14-0114-0005-006-6

5400 CASCADE ROAD.

Owner: THE ESTATES AT WEST CASCADE LLC

Amount Due: $7,540.00

Tax Parcel ID: 14F-0109-LL-007-1

561 HARPER ROAD SE.

Owner: ABEBE VENTURES LLC

Amount Due: $17,876.00

Tax Parcel ID: 14-0038-0002-043-5

607 MAGNOLIA STREET NW

Owner: VINE CITY PLAZA II LLC

Amount Due: $76,642.00

Tax Parcel ID: 14-0083-0004-064-3

643 ETHERIDGE STREET NW.

Owner: DAVID J HUGHES III

Amount Due: $10,871.00

Tax Parcel ID: 14-0113-0006-039-7

838 WINDSOR STREET SW.

Owner: JAMES O GREASON

Amount Due: $8,250.00

Tax Parcel ID: 14-0075-0008-022-7

871 REGINA DRIVE NW.

Owner: GREEN PARTS INTERNATIONAL INC

Amount Due: $146,251.00

Tax Parcel ID: 14-0208-0001-067-9

878 SLOAN CIRCLE SE.

Owner: JPMORGAN CHASE BANK TRUSTEE

Amount Due: $28,712.00

Tax Parcel ID: 14-0024-0003-008-3

915 HOLLYWOOD RD NW.

Owner: UNITED UNIVERSAL FELLOWSHIP OF FAITH

Amount Due: $32,010.00

Tax Parcel ID: 17-0226-0005-022-1

950 FAIR STREET SW.

Owner: KEEPING IT REALTY LLC

Amount Due: $18,968.00

Tax Parcel ID: 14-0116-0009-115-9

LAND BEING IN LAND LOT 100, 9F DISTRICT

Owner: SOUTHERN TRANSFER & RECYCLING LLC

Amount Due: $2,840.00

Tax Parcel ID: 09F-2202-0100-022-0

LAND BEING IN LAND LOT 100, 9F DISTRICT

Owner: SOUTHERN TRANSFER & RECYCLING LLC

Amount Due: $2,686.00

Tax Parcel ID: 09F-2202-0100-016-2

LAND BEING IN LAND LOT 105, 14TH DISTRICT

Owner: CORLIS STEPHENS

Amount Due: $21,290.00

Tax Parcel ID: 14-0105-0006-040-5

LAND BEING IN LAND LOT 108, 17TH DISTRICT

Owner: TXO INVESTMENT GROUP LLC

Amount Due: $8,585.00

Tax Parcel ID: 17-0108-0008-508-9

LAND BEING IN LAND LOT 108, 17TH DISTRICT

Owner: TXO INVESTMENT GROUP LLC

Amount Due: $8,585.00

Tax Parcel ID: 17-0108-0008-512-1

LAND BEING IN LAND LOT 108, 17TH DISTRICT

Owner: TXO INVESTMENT GROUP PLLC

Amount Due: $8,853.00

Tax Parcel ID: 17-0108-0008-511-3

LAND BEING IN LAND LOT 108, 17TH DISTRICT

Owner: TXO INVESTMENT GROUP LLC

Amount Due: $8,853.00

Tax Parcel ID: 17-0108-0008-510-5

LAND BEING IN LAND LOT 108, 17TH DISTRICT

Owner: TXO INVESTMENT GROUP LLC

Amount Due: $8,585.00

Tax Parcel ID: 17-0108-0008-509-7

LAND BEING IN LAND LOT 109, 14TH DISTRICT, FULTON COUNTY

Owner: L D LATIMER AKA LARRY DARNELL LATIMER

Amount Due: $6,461.00

Tax Parcel ID: 14-0109-0001-089-3

LAND BEING IN LAND LOT 110, 14TH DISTRICT,

Owner: EMELIZE WOOD ESTATE

Amount Due: $6,954.00

Tax Parcel ID: 14-0110-0010-008-9

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: CANOPY DEVELOPMENT GROUP LLC

Amount Due: $3,972.00

Tax Parcel ID: 14-0114-0007-122-9

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: BELFARE LLC

Amount Due: $7,064.00

Tax Parcel ID: 14-0114-0007-013-0

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: NORTHERN INVESTMENTS LLC

Amount Due: $7,857.00

Tax Parcel ID: 14-0114-0007-063-5

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: PROCTOR LAND HOLDINGS LLC, K C MARKS ESTATE

Amount Due: $4,194.00

Tax Parcel ID: 14-0114-0007-044-5

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: CANOPY DEVELOPMENT GROUP LLC

Amount Due: $7,247.00

Tax Parcel ID: 14-0114-0005-108-0

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: PROCTOR LAND HOLDINGS LLC & NORTHERN INVESTMENTS LLC

Amount Due: $4,227.00

Tax Parcel ID: 14-0114-0007-036-1

LAND BEING IN LAND LOT 114, 14TH DISTRICT

Owner: BELFARE LLC

Amount Due: $6,672.00

Tax Parcel ID: 14-0114-0007-014-8

LAND BEING IN LAND LOT 114, 14TH DISTRICT,

Owner: PROCTOR LAND HOLDINGS LLC, K C MARKS ESTATE

Amount Due: $4,855.00

Tax Parcel ID: 14-0114-0007-041-1

LAND BEING IN LAND LOT 114, 14TH DISTRICT,

Owner: LEXIA FUNDING LLC

Amount Due: $10,431.00

Tax Parcel ID: 14-0114-0005-028-0

LAND BEING IN LAND LOT 115, 14TH DISTRICT

Owner: MICHAEL STEPHENS

Amount Due: $5,268.00

Tax Parcel ID: 14-0142-0014-065-7

LAND BEING IN LAND LOT 116, 14TH DISTRICT

Owner: BOLDEN CAPITAL GROUP LLC

Amount Due: $6,635.00

Tax Parcel ID: 14-0116-0007-061-7

LAND BEING IN LAND LOT 116, 14TH DISTRICT,

Owner: THUY NGUYEN VI & TRUONG D TRAN

Amount Due: $18,579.00

Tax Parcel ID: 14-0116-0009-122-5

LAND BEING IN LAND LOT 119, 14TH DISTRICT

Owner: BERNARD GALES

Amount Due: $28,491.00

Tax Parcel ID: 14-0119-0005-100-2

LAND BEING IN LAND LOT 1222, 2ND DISTRICT

Owner: ALBERT G BIEHL JR

Amount Due: $1,709.00

Tax Parcel ID: 22-3331-1222-011-5

LAND BEING IN LAND LOT 1227, 2ND DISTRICT

Owner: THE BELTEM TRUST

Amount Due: $2,000.00

Tax Parcel ID: 22-3341-1227-207-2

LAND BEING IN LAND LOT 1227, 2ND DISTRICT

Owner: THE BELTEM TRUST

Amount Due: $2,000.00

Tax Parcel ID: 22-3341-1227-206-4

LAND BEING IN LAND LOT 1227, 2ND DISTRICT

Owner: THE BELTEM TRUST

8 July 14 - July 20, 2023

Tax Parcel ID: 22-3341-1227-192-6

LAND BEING IN LAND LOT 1227, 2ND DISTRICT

Owner: THE BELTEM TRUST

Amount Due: $2,000.00

Tax Parcel ID: 22-3341-1227-193-4

LAND BEING IN LAND LOT 125, 14TH DISTRICT

Owner: KADAN CORP

Amount Due: $4,930.00

Tax Parcel ID: 14-0125-0008-004-5

LAND BEING IN LAND LOT 125, 14TH DISTRICT

Owner: HASAN KHAAFID ESTATE

Amount Due: $7,307.00

Tax Parcel ID: 14-0125-0011-057-8

LAND BEING IN LAND LOT 132, 14TH DISTRICT

Owner: AGUSTIN D BROWN

Amount Due: $11,450.00

Tax Parcel ID: 14-0132-0014-095-6

LAND BEING IN LAND LOT 133, 14TH DISTRICT

Owner: MACKAY LLC & ANTOINE MCNEAL

Amount Due: $18,357.00

Tax Parcel ID: 14-0133-0002-008-2

LAND BEING IN LAND LOT 134, 14TH DISTRICT

Owner: FARRIS GENE WELCH & PATTY J WELCH

Amount Due: $7,547.00

Tax Parcel ID: 14-0134-0002-040-4

LAND BEING IN LAND LOT 134, 14TH DISTRICT

Owner: FARRIS GENE WELCH & PATTY J WELCH

Amount Due: $10,153.00

Tax Parcel ID: 14-0134-0002-041-2

LAND BEING IN LAND LOT 137, 14TH DISTRICT

Owner: QUANDA HILL

Amount Due: $16,806.00

Tax Parcel ID: 14-0137-0006-015-9

LAND BEING IN LAND LOT 140, 14TH DISTRICT

Owner: MATTIE MARY MARKS ESTATE

Amount Due: $10,404.00

Tax Parcel ID: 14-0140-0009-085-4

LAND BEING IN LAND LOT 141, 14TH DISTRICT

Owner: MICHAEL FOSTER

Amount Due: $9,885.00

Tax Parcel ID: 14-0141-0003-104-8

LAND BEING IN LAND LOT 141, 14TH DISTRICT

Owner: CASSANDRA H ALLEN & DARRYL G ALLEN

Amount Due: $9,223.00

Tax Parcel ID: 14-0141-0006-036-9

LAND BEING IN LAND LOT 141, 14TH DISTRICT

Owner: CASSANDRA H ALLEN & DARRYL G ALLEN

Amount Due: $8,781.00

Tax Parcel ID: 14-0141-0006-037-7

LAND BEING IN LAND LOT 142, 14TH DISTRICT

Owner: ELNORA JOHNSON ESTATE AND ALL HEIRS

KNOWN AND UNKNOWN

Amount Due: $9,235.00

Tax Parcel ID: 14-0142-0017-023-3

LAND BEING IN LAND LOT 142, 14TH DISTRICT

Owner: STEFEN LEE & JENNIFER SLOAN

Amount Due: $10,503.00

Tax Parcel ID: 14-0142-0001-022-3

LAND BEING IN LAND LOT 142, 14TH DISTRICT

Owner: RANDOLE WILSON

Amount Due: $4,930.00

Tax Parcel ID: 14-0142-0001-043-9

LAND BEING IN LAND LOT 144, 7TH DISTRICT

Owner: JONES ROAD LLC

Amount Due: $8,190.00

Tax Parcel ID: 09F-3100-0144-238-1

LAND BEING IN LAND LOT 146, 14TH DISTRICT

Owner: RUBY P WALKER

Amount Due: $6,700.00

Tax Parcel ID: 14-0146-0005-050-6

LAND BEING IN LAND LOT 146, 14TH DISTRICT

Owner: CITIZENS TRUST CO

Amount Due: $6,642.00

Tax Parcel ID: 14-0146-0014-056-2

LAND BEING IN LAND LOT 149, 14TH DISTRICT

Owner: DARRYL L ALLEN & TERRIE ALLEN & DR

NORMAN R HAYES

Amount Due: $7,272.00

Tax Parcel ID: 14-0149-0001-061-4

LAND BEING IN LAND LOT 151, 17TH DISTRICT

Owner: 647 REAL PROP HOLD LLC

Due: $1,481.00 Tax Parcel ID: 17-0151-LL-049-9

LAND BEING IN LAND LOT 152, 14TH DISTRICT

Owner: GENESIS CONSTRUCTION & CONSULTING

Parcel ID: 14-0152-0012-034-2 LAND BEING IN LAND LOT 157, 14TH DISTRICT

ADVANTA IRA ADMINISTRATION LLC FBO

WILBURN IRA #1521194

Due: $9,123.00

Parcel ID: 14-0157-0015-021-1

BEING IN LAND LOT 158, 9F DISTRICT

MARTHA GOOSBY WARD ESTATE

Amount Due: $6,858.00

Tax Parcel ID: 14-0186-LL-187-3

LAND BEING IN LAND LOT 194, 14TH DISTRICT

Owner: SUEAEN DALY & SNEED DALY

Amount Due: $10,333.00

Tax Parcel ID: 14-0194-0001-022-0

LAND BEING IN LAND LOT 197, 14TH DISTRICT

Owner: JAMES CRAIG EVANS

Amount Due: $11,939.00

Tax Parcel ID: 14-0197-0002-007-7

LAND BEING IN LAND LOT 202, 14TH DISTRICT

Owner: 2680 BENJAMIN E MAYS LLC

Amount Due: $4,453.00

Tax Parcel ID: 14-0202-0001-029-5

LAND BEING IN LAND LOT 206, 14TH DISTRICT

Owner: MELVIN R GREEN & MARY A GLOVER

ESTATE

Amount Due: $2,008.00

Tax Parcel ID: 14-0206-0007-021-2

LAND BEING IN LAND LOT 207, 14TH DISTRICT

Owner: TEMPRO FINANCE LLC

Amount Due: $5,768.00

Tax Parcel ID: 14-0207-0003-020-7

LAND BEING IN LAND LOT 211, 14TH DISTRICT

Owner: RICHARD L MORTON

Amount Due: $3,686.00

Tax Parcel ID: 14-0211-0005-043-1

LAND BEING IN LAND LOT 212, 14TH DISTRICT

Owner: QUINCY D JORDAN & TAMEIKA W JORDAN

Amount Due: $10,127.00

Tax Parcel ID: 14-0212-0002-036-7

LAND BEING IN LAND LOT 212, 14TH DISTRICT

Owner: F O E REALITY LLC & JONNIKA AKA JOHNIKA

HART

Amount Due: $11,817.00

Tax Parcel ID: 14-0212-LL-077-4

LAND BEING IN LAND LOT 212, 14TH DISTRICT

Owner: QUINCY D JORDAN & TAMEIKA W JORDAN

Amount Due: $8,203.00

Tax Parcel ID: 14-0212-0002-048-2

LAND BEING IN LAND LOT 212, 14TH DISTRICT

Owner: QUINCY D JORDAN & TAMEIKA W JORDAN

Amount Due: $8,864.00

Tax Parcel ID: 14-0212-0002-047-4

LAND BEING IN LAND LOT 219, 14TH DISTRICT

Owner: ODA BELL LLC

Amount Due: $18,960.00

Tax Parcel ID: 14-0219-0002-071-7

LAND BEING IN LAND LOT 226, 17TH DISTRICT

Owner: MARVIN TILLER

Amount Due: $4,905.00

Tax Parcel ID: 17-0226-0011-029-8

LAND BEING IN LAND LOT 226, 17TH DISTRICT

Owner: MARVIN TILLER

Amount Due: $4,905.00

Tax Parcel ID: 17-0226-0011-030-6

LAND BEING IN LAND LOT 226, 17TH DISTRICT

Owner: AFFORDABLE HOUSING ENTERPRISES INC & 23 JOHNSON RD NW LLC (

Amount Due: $9,266.00

Tax Parcel ID: 17-0226-0005-052-8

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,271.00

Tax Parcel ID: 14-0230-0007-048-5

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,135.00

Tax Parcel ID: 14-0230-0007-057-6

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,779.00

Tax Parcel ID: 14-0230-0007-051-9

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,014.00

Tax Parcel ID: 14-0230-0007-056-8

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,639.00

Tax Parcel ID: 14-0230-0007-049-3

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,384.00

Tax Parcel ID: 14-0230-0007-050-1

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,850.00

Tax Parcel ID: 14-0230-0007-046-9

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,202.00

Tax Parcel ID: 14-0230-0007-047-7

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: ANNIE DELLE GEORGE WILLIAMS ESTATE

Amount Due: $8,377.00

Tax Parcel ID: 14-0230-0001-017-6

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,193.00

Tax Parcel ID: 14-0230-0007-054-3

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,138.00

Tax Parcel ID: 14-0230-0007-055-0

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,440.00

Tax Parcel ID: 14-0230-0007-053-5

LAND BEING IN LAND LOT 231, 14TH DISTRICT

Owner: CASCADE PARC PROPERTY OWNERS ASSOCIATION INC

Amount Due: $4,333.00

Tax Parcel ID: 14-0231-LL-487-2

LAND BEING IN LAND LOT 232, 14TH DISTRICT

Owner: HENRY LEE PINCKNEY ESTATE

Amount Due: $10,873.00

Tax Parcel ID: 14-0232-LL-085-3

LAND BEING IN LAND LOT 237, 14TH DISTRICT

Owner: JOHNGALT HOLDINGS LLC

Amount Due: $6,640.00

Tax Parcel ID: 14-0237-0004-009-3

LAND BEING IN LAND LOT 237, 14TH DISTRICT

Owner: JH3212 LLC

Amount Due: $20,020.00

Tax Parcel ID: 14-0237-0001-027-8

LAND BEING IN LAND LOT 237, 14TH DISTRICT

Owner: JOHNGALT HOLDINGS LLC

Amount Due: $8,238.00

Tax Parcel ID: 14-0237-0004-008-5

LAND BEING IN LAND LOT 238, 14TH DISTRICT

Owner: ALVIN M FLETCHER & MARTHA FLETCHER ESTATE AND ALL HEIRS KNOWN AND UNKNOWN

Amount Due: $13,877.00

Tax Parcel ID: 14-0238-0003-025-9

LAND BEING IN LAND LOT 238, 14TH DISTRICT

Owner: WARREN G PARSONS ESTATE & RUBYE P PARSONS ESTATE

Amount Due: $19,379.00

Tax Parcel ID: 14-0238-0003-061-4

LAND BEING IN LAND LOT 24, 14TH DISTRICT

Owner: SK CONSTRUCTION AND CONSULTING INC

Amount Due: $6,270.00

Tax Parcel ID: 14-0024-0005-053-7

CARDINAL FLEET CLEANING SERVICES LLC & INFINITE VISION PROPERTIES LLC

Amount Due: $5,646.00

Tax Parcel ID: 14-0184-0014-033-4

LAND BEING IN LAND LOT 186, 14TH DISTRICT

Owner: A N D K WEALTH MANAGEMENT LTD

LAND BEING IN LAND LOT 230, 14TH DISTRICT

Owner: IVY PROPERTY MANAGEMENT LLC

Amount Due: $6,750.00

Tax Parcel ID: 14-0230-0007-052-7

LAND BEING IN LAND LOT 230, 14TH DISTRICT

LAND BEING IN LAND LOT 240, 14TH DISTRICT

Owner: CORA OGLETREE ESTATE

Amount Due: $10,967.00

Tax Parcel ID: 14-0240-0007-018-6

LAND BEING IN LAND LOT 246, 17TH DISTRICT

Owner: WEST MIDTOWN LLC

Atlanta Voice

Amount Due: $14,708.00

Tax Parcel ID: 17-0246-LL-037-1

LAND BEING IN LAND LOT 247, 17TH DISTRICT

Owner: LULA MAE DALE ESTATE

Amount Due: $5,003.00

Tax Parcel ID: 17-0247-0002-040-1

LAND BEING IN LAND LOT 248, 14TH DISTRICT

Owner: CASCADE ACQUISITION PARTNERS LLC

Amount Due: $4,353.00

Tax Parcel ID: 14-0248-LL-033-5

LAND BEING IN LAND LOT 248, 17TH DISTRICT

Owner: HOLLOWAYS INVESTMENT GROUP LLC

Amount Due: $11,371.00

Tax Parcel ID: 17-0248-0002-029-3

LAND BEING IN LAND LOT 249, 17TH DISTRICT

Owner: KATHERINE E CARTER

Amount Due: $7,015.00

Tax Parcel ID: 17-0249-0002-028-4

LAND BEING IN LAND LOT 25, 14TH DISTRICT

Owner: JACKSON N JOHNSON ESTATE & ZONA H

JOHNSON ESTATE

Amount Due: $7,430.00

Tax Parcel ID: 14-0025-0003-032-2

LAND BEING IN LAND LOT 25, 7TH DISTRICT,

Owner: LEMMA LLC

Amount Due: $1,852.00

Tax Parcel ID: 07-2201-0025-019-9

LAND BEING IN LAND LOT 251, 14TH DISTRICT

Owner: RIVERVIEW PROPERTY MANAGEMENT LLC

Amount Due: $2,555.00

Tax Parcel ID: 14-0251-0005-001-0

LAND BEING IN LAND LOT 257, 17TH DISTRICT

Owner: BDRD LLC

Amount Due: $6,695.00

Tax Parcel ID: 17-0257-0003-086-0

LAND BEING IN LAND LOT 257, 17TH DISTRICT,

Owner: MARVIN TILLER

Amount Due: $12,219.00

Tax Parcel ID: 17-0257-0002-001-0

LAND BEING IN LAND LOT 258, 17TH DISTRICT

Owner: LINDA M BRACKINS ESTATE

Amount Due: $3,706.00

Tax Parcel ID: 17-0258-0004-055-3

LAND BEING IN LAND LOT 27, 14TH DISTRICT

Owner: ABEBE VENTURES LLC

Amount Due: $6,123.00

Tax Parcel ID: 14-0027-0001-005-8

LAND BEING IN LAND LOT 27, 14TH DISTRICT

Owner: ABEBE VENTURES LLC

Amount Due: $6,112.00

Tax Parcel ID: 14-0027-0001-006-6

LAND BEING IN LAND LOT 37, 7TH DISTRICT

Owner: FGMS HOLDINGS LLC

Amount Due: $7,204.00

Tax Parcel ID: 07-3200-0037-111-9

LAND BEING IN LAND LOT 38, 14TH DISTRICT

Owner: ABEBE VENTURES LLC

Amount Due: $12,589.00

Tax Parcel ID: 14-0038-0002-041-9

LAND BEING IN LAND LOT 38, 14TH DISTRICT

Owner: ABEBE VENTURES LLC

Amount Due: $11,203.00

Tax Parcel ID: 14-0038-0002-046-8

LAND BEING IN LAND LOT 39, 14TH DISTRICT

Owner: JAMES T JONES

Amount Due: $11,083.00

Tax Parcel ID: 14-0039-0006-005-9

LAND BEING IN LAND LOT 47, 7TH DISTRICT

Owner: JOSE SERVIN DE LA MORA

Amount Due: $4,523.00

Tax Parcel ID: 07-0200-0047-108-9

LAND BEING IN LAND LOT 49, 17TH DISTRICT

Owner: MEGA OUTPUT LLC (

Amount Due: $20,838.00

Tax Parcel ID: 17-0049-0001-071-7

LAND BEING IN LAND LOT 53, 14TH DISTRICT

Owner: MARTIN ESTATES LLC

Amount Due: $1,548.00

Tax Parcel ID: 14-0053-0005-124-0

LAND BEING IN LAND LOT 56, 14TH DISTRICT

Owner: MICHAEL BERNARD GOOLSBY ESTATE Amount Due: $18,172.00

Tax Parcel ID: 14-0056-0008-085-7

LAND BEING IN LAND LOT 57, 14TH DISTRICT

Owner: ROBERT L FREEMAN III ESTATE Amount Due: $8,615.00 Tax Parcel ID: 14-0057-0002-057-1

LAND BEING IN LAND LOT 58, 14TH DISTRICT

Owner: CITIGROUP GLOBAL MARKETS REALTY

Tax Parcel ID: 17-0096-0001-013-1

LAND BEING IN LAND LOT 96, 17TH DISTRICT

Owner: CLAIRE V PINKERTON & MICHAEL R

PINKERTON

Amount Due: $65,079.00

Tax Parcel ID: 17-0096-0006-005-2

LAND BEING IN LAND LOTS 107 & 108, 14TH

DISTRICT, FULTON COUNTY

Owner: DAVID GORDON

Amount Due: $8,400.00

Tax Parcel ID: 14-0108-LL-216-5

LAND BEING IN LAND LOTS 107 & 108, 14TH

DISTRICT, FULTON COUNTY

Owner: GO TIME INVESTMENTS LLC

Amount Due: $22,471.00

Tax Parcel ID: 14-0108-LL-091-2

LAND BEING IN LAND LOTS 108 & 148, 17TH

DISTRICT

Owner: JAMES A CLAUSELL

Amount Due: $38,275.00

Tax Parcel ID: 17-0108-0001-717-3

LAND BEING IN LAND LOTS 1104, 1119, 1120, 1169 & 1170, 2ND DISTRICT,

Owner: ARDSLEY PARK LLC

Amount Due: $12,406.00

Tax Parcel ID: 21-5610-1119-187-8

LAND BEING IN LAND LOTS 143 & 144, 14TH

DISTRICT Owner: CROSSSTONE MANAGEMENT LLC

Amount Due: $8,405.00

Tax Parcel ID: 14-0143-0003-016-2

LAND BEING IN LAND LOTS 16 & 17, 14TH DISTRICT

Owner: XENOS 20 LLC

Amount Due: $8,202.00

Tax Parcel ID: 14F-0016-0001-049-3

LAND BEING IN LAND LOTS 168 & 169, 14TH

DISTRICT

Owner: JAMAL RENFROE & CHERLETTA FREEMAN

Amount Due: $5,329.00

Tax Parcel ID: 14-0168-0003-008-9

LAND BEING IN LAND LOTS 28 & 37, 14TH DISTRICT

Owner: LIB PROPERTIES LTD

Amount Due: $52,527.00

Tax Parcel ID: 14-0028-LL-204-8

LAND BEING IN LAND LOTS 41 & 56, 14TH DISTRICT

Owner: DAVID COHEN ESTATE

Amount Due: $7,773.00

Tax Parcel ID: 14-0056-0006-021-4

LAND BEING IN LAND LOTS 42 & 66, 14TH DISTRICT

Owner: MAVELENE B JONES AKA MARVELENE

BERRY JONES ESTATE

Amount Due: $11,040.00

Tax Parcel ID: 14F-0042-0002-001-1

LAND BEING IN THE CITY OF FAIRBURN

Owner: FORREST WILCOXSON, EVERNELL WILCOXSON, Amount Due: $20,448.00

Tax Parcel ID: 09F-1005-0052-003-9

OF LAND BEING IN LAND LOT 121, 14TH DISTRICT

Owner: MRS C D CREEL AKA ANNIE MAUDE CREEL

ESTATE

Amount Due: $5,140.00

Tax Parcel ID: 14-0120-0007-042-1

TRACT OF LAND

Owner: JH3212 LLC

Amount Due: $18,512.00

Tax Parcel ID: 14-0237-0001-012-0

Owner: Tax Parcel ID:

0 JOHNSON ROAD N.W.,

Owner: PACIFICA PROPERTIES, LLC, Tax Parcel ID: 17 -0226-0007-011-2

ORCHARD DRIVE

Owner:

Parcel ID: 09F -3601-0129-114-7

LANE Owner:

WEST ANTHONY ST Owner:

Parcel ID:

WASHINGTON PLACE S.W.

Owner: Tax Parcel ID: 14-0116-0003-057-9

1095 SELLS AVENUE S.W.

Owner: Tax Parcel ID: 14-0117-0001-177-6

1107 FOURTH STREET

Owner: Tax Parcel ID: 17 024900070586

125 RED HAWK DRIVE

Owner: JACQUELINE MCKNIGHT Tax Parcel ID: 0111D 125

145 BROWNLEE ROAD

Owner: Tax Parcel ID:

2320 PARK AVENUE S.W.

Owner: Tax Parcel ID: 14 -0070-0004-022-6

2459 MACON DRIVE S.W.,

Owner: QUEST ASSETS, LLC Tax Parcel ID: 14 -0069-0001-021-4

2507 MACON DR

Owner: Tax Parcel ID:

2628 JAMES JACKSON PARKWAY NW

Owner: Tax Parcel ID: 312 & 315 KIMBERLY CT

Owner: Tax Parcel ID:

3394 ADKINS

Owner: Tax Parcel ID:

3482 THOMPSON DR

Owner: Tax Parcel ID:

672 COMMERCIAL AVE

Owner: Tax Parcel ID:

897 SIMS STREET

Owner: Tax Parcel ID:

LAND LOT 180 OF THE 14TH DISTRICT

14-0087-0005-036-6

LAND BEING IN LAND LOT 90, 14TH DISTRICT

Owner: KEEPING IT REALTY LLC Amount Due: $54,361.00 Tax Parcel ID: 14-0090-0006-065-9

LAND BEING IN LAND LOT 94, 14TH DISTRICT

Owner: ALGENIUS GROUP LLC Amount Due: $5,053.00 Tax Parcel ID: 14-0094-0003-003-9

LAND BEING IN LAND LOT 96, 17TH DISTRICT Owner: ALEXANDER B ODOM & AMY O ODOM

Amount Due: $14,612.00

Owner: DG Union City LLC, et al.

Tax Parcel ID: 13 -0097- LL-055-2

Owner: Skatt Investments, LLC, et al.

Tax Parcel ID: 09F-2215-0100-037-3

0 BRYAN ST

Owner:

Tax Parcel ID:

0 HILL ST

Owner: Tax Parcel ID:

LAND LOT 78, DISTRICT 9F

Owner: Tax Parcel ID: 09F-1504-0078-084-5

LAND LOT 8 OF THE 14TH DISTRICT

Owner: Tax Parcel ID:

LAND LOT 8 OF THE 14TH DISTRICT

Owner: Tax Parcel ID:

Hearing is one of the five senses we all possess but may take for granted. According to the American Academy of Audiology, the average person doesn’t start to lose their hearing until 65. That may vary based on how much sound we expose our ears to daily. Erica Walker and her team at the Community Noise Lab are bringing awareness to matters related to sound overexposure, called Noise Pollution. Walker is an RGSS assistant professor of epidemiology at the Brown University School of Public Health. Her research reveals how this affects your overall health and why we must take this subject seriously.

“Noise pollution isn’t just a first-world problem. It is a significant environmental stressor that’s negatively impacting the health and well-being of all of us,” said Walker.

Noise pollution is any unwanted sound that persists in our environment. Items under this umbrella are the sounds that come from major highways, construction sites, travel hubs or any sound that is deemed unwanted. This becomes a concern when too much noise pollution affects sleep quality, mood disruption, and hearing loss. Walker explains that noise is unwanted sound. When we are exposed to unwanted sound, it activates the body’s stress response. Overstimulation of the stress response causes cardiovascular and mental health issues to arise.

“Your stress response triggers the body into flight or fight mode. Imagine if you were walking down a dark alley, and suddenly, a pit bull jumped out and attacked you. Your body is ready to flee or fight in that scenario. At that moment, your heart begins to beat faster and releases stress hormones. Constant stimulation of that flight or fight response over time can lead to severe health impacts,” said Walker.

The research done by Walker and the Community Noise Lab reveals people with lower economic status are affected the most by Noise pollution. The professor elaborates that people living near train stations, airports, transportation hubs, or anything with urban activity would be affected. The research uncovers that bad urban planning contributes to placing Black and brown communities in those areas. Houses and apartments closer to highways, airports, and train stations are cheaper than other areas. This problem trickles down to children as kids exposed to too much noise pollution nega-

tively affect their cognitive development.

What legitimized Walker and the Noise Lab’s work were the stories of those living in these areas. One of the most compelling stories Walker encountered involved a woman told by her city that their tourism dollars matter more than her peace.

“A lady lived in a very touristy part of the