BY DONNELL SUGGS

With Election Day less than a month away and endorsements from the country’s political, religious, and employment leaders becoming as valuable as any individual vote, a group of Muslim leaders has officially endorsed United States Vice President Kamala Harris for President of the United States.

The Statement is signed by 25 Imams and Muslim leaders, all of whom are based within the United States, with five of the religious leaders being based in Atlanta and metro Atlanta: Imam Rashad Abdul Rahman, Imam Plemon T. El-Amin, Imam Mansoor Sabree, and Soumaya Khalifa.

More than 1.5 million Muslim Americans voted in the 2020 election and there are now 2.5 million Muslim Americans eligible to vote in the upcoming election, according to data from the Council of American-Islamic Relations (CAIR).

“I’m supporting Kamala Harris because I believe without a doubt she’s the best candidate,” Imam El-Amin, former resident Imam of the Atlanta Masjid of Al-Islam, told The Atlanta Voice during an interview on Tuesday, Oct. 8. “In the Muslim community there has been a movement to support a third candidate, but very few Muslims want to support Trump.”

The statement titled, “Muslim Imams and Leaders Letter to the Community on the 2024 Elections,” began with condolences for the lives lost and the lives that have been affected by the war in Gaza and the escalation of that war in Lebanon. The statement went on to assess the two presidential candidates by framing it as “not the lesser of two evils.”

It continued, “For us, as people of faith, specifically as Muslims, it’s the measure or estimate of the harm and the benefit,” the statement read. “When faced with a choice, we are expected to carefully assess the potential benefits and harm involved, prioritizing actions that bring better and minimize negative consequences.”

Imam El-Amin said he “probably wouldn’t have voted for current United States President Joseph R. Biden had remained the Democratic nominee for president, but he wasn’t voting for Trump either. “Kamala Harris is entirely different,” he said.

The war in Gaza and Lebanon concerns Muslims and Muslim voters alike, said Imam El-Amin. “This is upsetting to the Muslim community, and it should be upsetting to everyone,” he said. “I’m hurt by Biden’s response in Gaza.” Along with Imam El-Amin and the other Muslim leaders in Georgia, Imam Talib Shareef, Imam Albert Sabir, Imam Benjamin Abdul Haqq and Commander Lyndon Bilal of Washington, D.C.; Imam John Bilal, Qadir Abdus Salaam, and Imam Bashar Arafat in Maryland and leaders in Baltimore, New Jersey, Oakland (CA), and Dallas, battleground states like North Carolina with religious leaders such as Imam Joel Saahir, Imam Abdul Rahman Shareef, Imam Naim Muhammad and Fleming El-Amin of the Masjid Al-Mu'Minun are also involved. That list also includes Imam Fahad Muhammad in Milwaukee, Wisconsin, Imam Salaam Muhsin and Imam Muhammad Abdul Aleem in Pennsylvania, and Imam Mikail Stewart

“I’m supporting Kamala Harris because I believe without a doubt she’s the best candidate.”

- Imam Plemon T. El-Amin

Saadiq in Detroit, Michigan.

Harris had already been endorsed by the Black Muslim Leadership Council, which is located in Pennsylvania, and Emgage, a Florida-based organization that educates and mobilizes Muslim American voters.

Information for Muslim voters on what to bring to local polling places in order to vote and where polling places, for example, is available on the Georgia Muslim Voter Project website. Imam El-Amin said he can’t go through another

four years of a Trump-led administration, which failed to highlight the positive impact of the Muslim community on the country.

“The impact of Muslims in this country has been immense, especially in urban areas,” Imam El-Amin said. He added that the endorsement is very important, especially in Georgia and in Michigan, which has a large Muslim community.

“Here in Georgia and in Michigan there were small margins of victory,” Imam El-Amin said. “The letter is there to say there’s a large number of Muslims that say we’re not going to sit out of this election and we are supporting Kamala Harris.”

The Harris-Walz campaign has a media campaign targeting Muslim and Arab-American communities in Dearborn, Michigan. Director of Muslim and Arab American Outreach for Harris campaign Nasina Bargzie said in a statement, “The Vice President is committed to work to earn every vote, unite our country, and to be a President for all Americans.”

BY DONNELL SUGGS

On a sunny Sunday morning at the intersection of Piedmont Avenue and 10th Street in Midtown, people laid on the ground for selfies and danced to music being played from speakers on the corner. Normally that wouldn’t be any different from any other weekend near Piedmont Park, but this celebration was about Atlanta’s inclusivity.

The intersection known across the world for its rainbow design was the sight of a new addition to its already colorful seven-year life. Black and brown lines were recently added to better represent the city’s LGBTQIA+ community. The colors of the LGBTQ flag were also added.

Atlanta Mayor Andre Dickens, City of Atlanta Director of LGBTQ Affairs Malik Brown, Atlanta Police Chief Darin Darin Schierbaum, members of the Atlanta City Council, and current and former members of the City’s LGBTQ Advisory Board took part in a ribbon-cutting to celebrate the new look of the crosswalk.

Atlanta Pride kicks off on October 12

The iconic Rainbow Crosswalk in Midtown Atlanta received a

with Black and Brown lines added to

Photo by Kerri Phox/The Atlanta Voice

and the newly painted and more inclusive crosswalk couldn’t have come at a better time, said Dickens.

“This is meaningful, impactful, and necessary to have us here today,” Dickens said.

The City’s 61st mayor said the crosswalk is “a powerful symbol of love, unity, and acceptance” and “Today we proudly celebrate the new design.”

The Atlanta Gay Men’s Chorus kicked things off with a rendition of “Seasons of Love” from the Broadway hit “Rent.” Out Front Theater performer Anna Dvovak sang “Over the Rainbow” for the dozens of men, women, children, and dogs that gathered in the intersection for the ceremony. She was widely applauded for her performance.

A temporary version of the crosswalk was installed in 2016 before a more permanent version was installed in 2017.

Brown shared a story of seeing what looked like teenagers recording TikToks in the intersection. Brown says he remembered the City having to clean up skid marks from street racing and vandalism from people who didn’t believe in the purpose of the Rainbow Crosswalk.

“To so many people it is a symbol of hope and inclusion,” said Brown of the Rainbow Crosswalk, which now includes Black and brown.

“Freedom is never given; it is won.”

BY CHARLENE CROWELL

The nation’s largest corporate landlord for single-family home rentals (last month/recently?)

was fined $48 million by the Federal Trade Commission (FTC) for years-long financial abuses of tenants. The firm, Invitation Homes, also will be required to change its practices, and agree to long-term monitoring of its rental activity.

According to the September 24 settlement, renters who resided in one of Invitation Homes’ over 33,000 properties between 2018 and 2023 will be the beneficiaries. Its rental properties across the nation are located in both cities and suburbs including –but not limited to: Atlanta, Chicago, Dallas, Denver, Houston, Los Angeles, Miami, Minneapolis, and Seattle.

“Invitation Homes, the nation’s largest single-family home landlord, preyed on tenants through a variety of unfair and deceptive tactics, from saddling people with hidden fees and unjustly withholding security deposits to misleading people about eviction policies during the pandemic and even pursuing eviction proceedings after people had moved out,” said FTC Chair Lina M. Khan in a September 24 announcement.

“No American should pay more for rent or be kicked out of their home because of illegal tactics by corporate landlords. The FTC will continue to use all our tools to protect renters from unlawful business practices.”

Founded in 2012, Invitation Homes’ initial public offering (IPO) raised approximately $1.77 billion, making it and is the second- largest real estate investment trust (REIT) IPO in history, according to its website.

Regulators said Invitation Homes was guilty of anti-consumer practices that included:

• D eceiving renters about lease costs including $500 ‘reservation fees’ in addition to

application fees. Since 2019, Invitation Homes has collected more than $18 million in application fees alone for deceptively priced houses;

• Charging undis closed junk fees – costing consumers up to $1,700 per year;

• Failing to inspect homes before residents moved in;

• Unfairly withholding tenants’ security deposits when they moved out; and

• Other misrepresentations including total monthly leasing price, property condition, and availability of emergency maintenance,

In a related consumer alert posted on FTC’s website, Larissa Bungo, a senior attorney, shared more details documenting why the enforcement action is warranted.

“Landlords must truthfully advertise the prices and services they’re offering, said Bungo.

“The FTC says Invitation Homes advertised an overall “worry-free leasing lifestyle” and promised pre-inspected homes before move-in and “24/7 emergency maintenance” for any issues, but failed to deliver.”

“Instead, new residents faced major issues like sewage backup, broken appliances, and visible rodent feces,” continued Bungo. “The promises didn’t live up to the hype and, to add insult to injury, according to the FTC, Invitation Homes wrongly withheld some or all of renters’ security deposits for things like normal wear and tear or damage that was already there before renters moved in. Which is also illegal.”

The fall settlement also marks a milestone victory for consumer advocates that in recent years have urged federal regulatory agencies to adopt and enforce rules to better protect consumers from an array of junk fees.

For example, in 2022, four national consumer advocates –Americans for Financial Reform, the Consumer Federation of America, the National Consumer Law Center, and the Center for Responsible Lending (CRL), jointly urged the Consumer Financial Protection Bureau (CFPB), to enact junk fee rules.

“Hidden fees and costs strip wealth from the most vulnerable consumers who are struggling to make ends meet,” wrote the

advocates. “The most impacted consumers often come from communities of color already burdened by other predatory practices, further exacerbating racial inequities… Disclosure is intended to give consumers an opportunity “know before they owe.” But that knowledge is worthless if charges are imposed under circumstances that most consumers would not expect even if, with hindsight, the fees were disclosed.”

By early February 2023, junk fee advocacy grew to involve more than 40 national and state consumer advocates who together appealed to the FTC for its own agency rules and actions.

Created in 1915, the FTC has two primary missions: protecting competition and protecting consumers. It is empowered to investigate as well as prevent unfair methods of competition, and unfair or deceptive acts or practices affecting commerce.

Consumers who suspect a company may be engaging in fraud, scams or bad business practices can share their concerns at https://reportfraud.ftc. gov/.

FOUNDED May 11, 1966 FOUNDER/EDITOR

Ed Clayton Immortalis Memoria

PUBLISHER/EDITOR

J. Lowell Ware Immortalis Memoria

The Atlanta Voice honors the life of J. Lowell Ware.

PUBLISHER

Janis Ware

PRESIDENT/

GENERAL MANAGER

James A. Washington 2018-2024

EXECUTIVE ASSISTANT TO PUBLISHER

Chia Suggs csuggs@theatlantavoice.com

EDITOR IN CHIEF Donnell Suggs editor@theatlantavoice.com

GENERAL ASSIGNMENT REPORTERS

Isaiah Singleton isingleton@theatlantavoice.com

Laura Nwogu lnwogu@theatlantavoice.com

EDITOR AT LARGE

Stan Washington swashington@theatlantavoice.com

MANAGING EDITOR, DIGITAL Itoro Umontuen iumontuen@theatlantavoice.com

ADVERTISING, SALES & CIRCULATION

ADVERTISING ADMINISTRATOR

Chia Suggs advertising@theatlantavoice.com

CIRCULATION MANAGER

Terry Milliner

SALES

R.D.W. Jackson rdwadman@gmail.com

SUBMISSIONS editor@theatlantavoice.com

DIRECTOR OF PUBLIC RELATIONS

Martel Sharpe msharpe@theatlantavoice.com

CONTACT INFORMATION 633 Pryor Street, S.W. Atlanta, GA 30312 Office: 404-524-6426 info@theatlantavoice.com

BY JAMES A. WASHINGTON

They tell me that ignorance of the law is not supposed to be an excuse for breaking the law. So, if you ever find yourself in court, telling the judge you didn’t know, that, by itself, won’t get you off the hook. Depending on the conviction of the presiding judge, however, might get you a lighter sentence. I believe when it comes to your and my spiritual existence, Jesus represents the kind of forgiveness that only occurs in Family Court. The more I read scripture, the more I understand our wonderful relationship with the Almighty and the extraordinary power of His love for you and me, as demonstrated by my relationship with His only son, my Lord and Savior, Jesus Christ. That blood thing is what I’m referring to. If you would allow me to use two examples to illustrate my point, let me give for your review Christ on the cross and Simon Peter’s denial of Jesus as the cock crowed. All of us know that Peter did in fact deny Jesus as predicted. We also know that Peter “wept bitterly” because of it. Now, one very good example of God’s great ca-

“Repent, be baptized, every one of you, in the name of Jesus Christ for the forgiveness of your sins. And you will receive the gift of the Holy Spirit” Acts 2:38

pacity to love His children is that this same Peter, once afraid and fearful for his own life, came to witness for the Lord with no fear about his new life whatsoever. It was Peter, who, when the day of Pentecost came, and he was filled with the Holy Spirit, spoke boldly and without fear of reprisal about the blood-bought forgiveness of sins because Christ’s death made us eternal members of God’s family. You see, Jesus is our access.

He is our entrée, court-appointed attorney, and intercessor to our Father, the ultimate Judge. Peter acknowledges this when he says, “Repent, be baptized, every one of you, in the name of Jesus Christ for the forgiveness of your sins. And you will receive the gift of the Holy Spirit” Acts 2:38.

You see, what the Holy Spirit did for

Peter is what the Holy Spirit will do for you. The key is weeping bitterly. Peter had to first accept and acknowledge his shortcomings. He had to empty himself to make room for the Holy Spirit. Those who recognize this and understand the premise know firsthand that they are truly family members, and ignorance is but a poor excuse for the ultimate acceptance of Christ as Lord. In Luke 23:24, Jesus says, “Father, forgive them, for they know not what they do.” From the Master’s own lips, we know even His captors and persecutors were in line for forgiveness. All anyone has to do is plead ignorance, repent, and turn to the Lord. Ain’t that something? Blood bought forgiveness, and no one, particularly God, expects you to be perfect. The expectation is that you’ll be righteous

in your acceptance of Jesus and sincere in your repentance. Remember, your court-appointed attorney has already won your case. But you do have to show up in court, listen, and acknowledge that the changes are true. Your Honor, yes, I denied Him. Yes, I committed the sin. Yes, I was wrong. Guilty as charged will be the verdict. And as Jesus told the adulteress, “Go and sin no more.” He tells us that each and every day. May you and I hear and obey. May you come to understand that the shedding of Christ’s blood made you His blood brother, so to speak, and yes, God is your Father, too. That means the court convenes in the living room. What a blessing! In the meantime, may you never live in ignorance again, and may God bless and keep you always.

This column is from James Washington’s Spiritually Speaking: Reflections for and from a New Christian. You can purchase this enlightening book on Amazon and start your journey toward spiritual enlightenment.

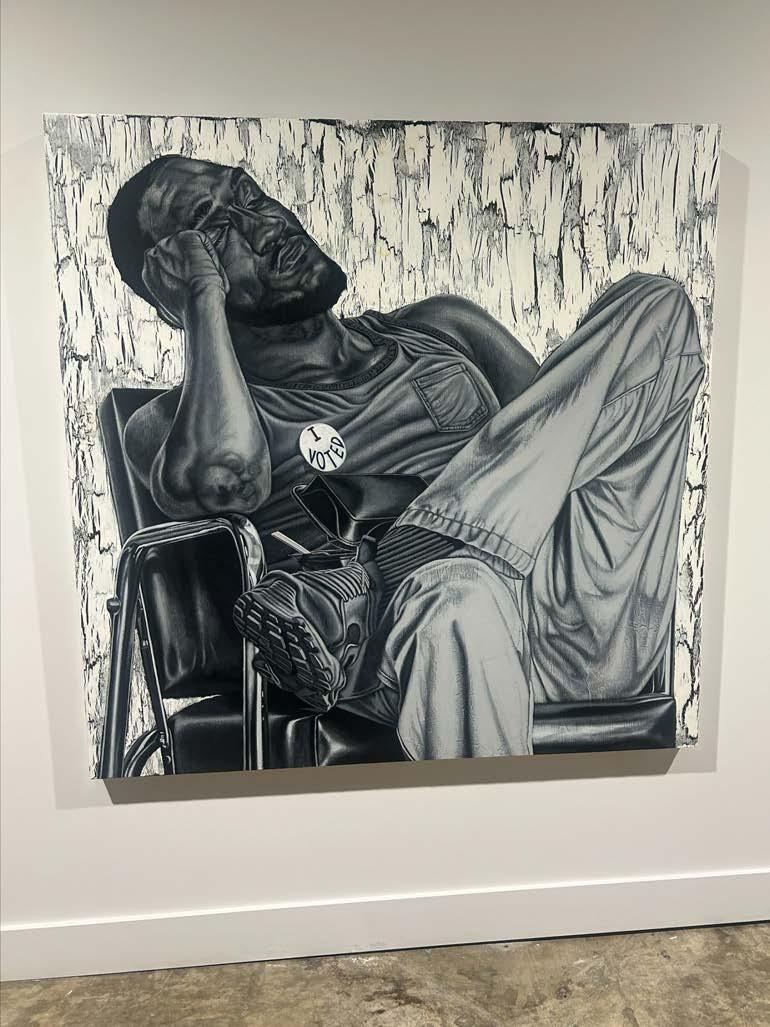

BY ISAIAH SINGLETON

The Atlanta Community Food Bank, one of the nation’s leading food banks fighting hunger, calls for action within Metro Atlanta to support the Commodity Supplemental Food Program (CSFP).

To address this issue, ACFB hosted a “Community Conversation Cooking Class with Mayor Andre Dickens.” CSFP provides seniors with healthy foods through free monthly food boxes as part of the current farm bill. As critical pandemic-era benefits expire, many seniors on fixed incomes struggle to afford rising food, housing, and medical costs.

The event included discussions on food insecurity affecting Atlanta’s senior community and Dickens’ commitment to supporting and strengthening CSFP. Seniors could share their experiences and hear firsthand about the city’s efforts to address food insecurity.

“We are always thankful for the diligence and hard work the Atlanta Community Food Bank’s great leadership puts into every community across Georgia that needs food whether that’s in our youth, our families, and today is all about our seniors,” Dickens said. “We’re teaching them how to eat healthy and we’re going to make some meals.”

Dickens said the event was meant to ensure seniors had healthy food options and enjoyed life in Atlanta.

“We want to ensure our seniors have food options, whether it's through the Senior Box the community food bank provides or if you’re in need of the SNAP program or assisted food to be able to take care of them and get the food they need,” he said.

President & CEO of the Atlanta Community Food Bank Kyle Waide says food insecurity has increased dramatically over the last two years. He also said the need right now is “tremendous” and has worsened since the damaging effects of Hurricane Helene.

“Inflation has had such a massive impact across our region and the country. We’re serving 66% more people today than we did just two years ago, which is being felt by families, children, and low-income seniors,” he said.

Waide says they are proud to partner with the city and other community organizations to deliver high-quality, nutritionally dense food boxes to low-income seniors every month.

“We’re really proud to be able to support our seniors with great high-quality nutrition education resources so they can prepare healthy meals with the food provided,” he said.

Furthermore, Waide said ACFB looks forward to continuing to work on ensuring

everyone across Atlanta has the food they need and deserve to live a healthy life in the coming months and years.

Also, seniors were given recipes to try at home. They tried Beef Lentil Soup with low-sodium options, vegetarian options, and Pumpkin/Sweet Potato Biscuits.

Emmanuel Lutheran Church seniors, including Atlanta resident Deborah Clarkson, were among the attendees. She said she appreciated the Atlanta Community Food Bank for holding this event for seniors only.

“Groceries, food, and everything else has gotten entirely too expensive for many people and me at age 65,” she said. “It has be -

come a task to budget on my income for everything, and I’m just so grateful for Mayor Dickens and the Atlanta Community Food Bank for looking out for us old folk; it means a lot.”

Senior Darrell Simms said he enjoyed the cooking lesson provided and appreciates the efforts of all parties involved.

“Eating healthy has gotten hard for me because I can’t afford most things, as most can’t these days, but I’m on a fixed income, so things have been tough,” he said. “I appreciate the mayor and the community food bank so much because this helps out more than people realize.”

While cooking, Dickens also spoke to everyone about initiatives for senior citizens in Atlanta, including establishing a senior center at John A. White Park with amenities like a fitness center, kitchen, dining hall, and event spaces.

The center will cater to seniors and will take 18 months to construct.

Additionally, there are plans to build 20,000 units of affordable housing for seniors and a rehabilitation program for senior homeowners to help with necessary repairs.

Dickens also discussed the annual senior ball and emphasized public safety, with police officers now allowed to take their cars home to deter crime. The mayor and local police officials expressed commitment to these programs and their impact on the community.

In partnership with Invest Atlanta, Dickens also discussed an owner-occupied rehab program, the Atlanta Heritage Owner-Occupied Rehab Program. The program is designed to help senior citizens get rehabilitation services for free.

“Your roof may cost $25,000 - $30,000 to replace it, and a lot of times seniors and a lot of people in general don’t have that kind of cash running around,” he said. “Replace a roof or an air conditioning unit, or if you bought a house when you were 35 or 45 and now, you’re 67 years old, so you need handlebars in the bathroom and the shower.”

For more information on how to get involved with the ACFB, visit https://www. acfb.org/volunteer/.

BY LAURA NWOGU

Caring for Others, an Atlanta-based nonprofit on a mission to eradicate poverty, activated an "All Hands Mission" on Thursday in partnership with Convoy of Care to provide relief efforts and supplies for residents affected by Hurricane Helene. Parts of the Southeast are still dealing with the devastating effects of the hurricane that made landfall in Florida a week ago and swept through the Southeast, killing more than 200 people, leaving millions without power, and toppling trees and buildings.

According to Georgia Gov. Brian Kemp, 33 people have been reported dead in Georgia. The team at Caring for Others left Atlanta Thursday morning with a plan to help victims in Augusta, Valdosta, Nashville, and Sandersville, Georgia, as well as those in North Carolina. The nonprofit hopes to assist agencies already on the ground in providing supplies and nonperishable food to feed those struggling to afford groceries or those who have had to toss out spoiled items due to the loss of power impacting Georgia residents.

Eslene Richmond-Shockley, CEO and founder of Caring For Others, said there is a high need for basic cleanup supplies and water.

“Our goal is always to provide solutions to those experiencing food insecurity or the impact of disasters like Hurricane Helene,”

Shockley said. “We are very blessed that the community is rallying behind us daily.”

Caring for Others provided a list of supplies that are needed:

• Tarps

• Generators

• Bottled Water (palletized is best)

• Toilet Paper

• Personal Care

• Hygiene Kits

• Toothpaste, toothbrush, bar soap, shampoo/conditioner

• Personal Wipes

• First-Aid Kits

• Feminine Hygiene Items

• Cleaning Supplies

• Laundry Detergent

• Cleaners/Disinfectants/Sanitizers

• Bleach

• Cleaning Rag/Towels/Wipes

• Sponges

• Gloves

• Buckets/Pails

• Mops/Brooms/Pans

• Trash Bags (kitchen and heavy duty)

• Disposables

• Plates

• Bowls

• Cups

• Plasticware Forks/Spoons/Knives

• Paper Towels

Donations to assist in purchasing these items and aiding families with rebuilding and cleanup can refer to caring4others.org/ hurricane-helene/

BY LAURA NWOGU

Ghanaian skincare brand R&R made its U.S. debut during Atlanta’s Fashion Week. CEO and founder Valerie Obaze hopes to connect people to the African super ingredients that fuel and nourish healthy skin with a line of products that include shea body oil, whipped shea butter, and pure black soap. For Obaze, that mission began at home.

After giving birth to her daughter, Obaze and her husband moved from London to his birthplace of Nigeria. When searching the stores for natural and local skin products, she noticed that no African brands were being sold; the shelves were filled with international brands that weren’t selling shea butter in its pure form.

“I definitely saw that there was a gap there. And so, it was a mixed show of need, and also seeing a gap in the market that created the brand for me,” Obaze said during an Atlanta Fashion Week mixer.

Named after her daughter, R&R’s focus is clean and high-quality skincare that not only benefits people but also uplifts them. Shea nuts are a key economic crop for over 470,000 women farmers in Northern Ghana. Despite the opportunities offered through Ghana being the fourth largest shea kernel-producing country in the world, Obaze noted

that the fortunes of the rural women still weren’t changing after decades of big pharmaceutical brands purchasing shea from them. So, she created the Women of The Savannah Development Project (WSDP), an initiative where Obaze and her team reinvest in the community by conscientiously sourcing raw materials from the Northern Ghanaian women and allowing them to be their own bosses.

“We have to empower women. I'm a woman. I have three

daughters, and definitely the women are the leaders of the future, and I'm just glad to be a part of that and just building the economy on the continent.”

As a Black, female entrepreneur, Obaze is no stranger to the fact that women are sorely underrepresented in manufacturing, especially in Ghana and Nigeria, causing her to face challenges with funding. Fortunately, with building her own supply chain and securing funds focused on women and women of color, she’s been able to build on her goal of expanding R&R to all parts of the world. The brand has three flagship locations, two in Accra, Ghana, and one in Lagos, Nigeria, and is hoping to open locations in the U.S. and Europe. These pop-ups are just the next step in getting the products into as many hands as possible and bringing Ghana to the World.

“I think for the longest time, people have thought everything from Africa is insubstantial. Everything that comes out of Africa is not good. And I think we've proven otherwise with music, fashion, and film.

“Now I think it's beauty’s time to have its moment and for people to see that good things come out of Africa. You can have luxury, and you can have great packaging. You can have a great finished product that you can bring from the continent, and we just want to change people's perception.”

BY KEVIN REEN

The hardest part of any journey is the first step. It’s true in life and it’s particularly true when it comes to purchasing a home. The lack of funds for a down payment remains one of the largest barriers to homeownership most people face. That’s especially true for traditionally underserved minority homebuyers.

And yet, consider how important that first step is. Homeownership is one of the most effective ways families can build intergenerational wealth. Typically, homeowners build equity over time and are able to take advantage of tax deductions. In addition to these financial bene-

fits, homeownership brings substantial societal benefits for families and the communities they live in. However, we know that traditionally underserved communities continue to face significant challenges when it comes to purchasing a home.

Wells Fargo is focused on strengthening underserved communities and advancing racial equity in homeownership. While we continue to pursue multiple efforts to address a broader variety of factors driving the homeownership gap, we’ve found that providing down payment assistance can make a significant difference for many potential homebuyers. As such, in 2023 Wells Fargo launched our Homebuyer Access grant, a program that provides $10,000 toward

the down payment for eligible homebuyers who currently live in or are purchasing homes in certain underserved communities.

The Homebuyer Access Grant program is currently available in select communities in eight Metropolitan Statistical Areas (MSAs) and additional areas in New Jersey. Eligible homebuyers can also combine the grant with other programs for which they may qualify, allowing them to maximize the support available to them. This flexibility ensures that we are providing comprehensive assistance to help first-time homebuyers succeed.

Potential homebuyers looking to purchase a home in any of the eligible areas and those who current-

ly live in those areas can find out more about the program, including how to contact a local Wells Fargo Home Lending office in their area, at https://wellsfargo.com/homegrant I have seen firsthand the impact that this program can have. It is heartening to hear stories from individuals who, with the help of the Homebuyer Access Grant, have been able to achieve their dream of owning a home. Sometimes all you need is a little help with that first step.

Kevin Reen is the head of Wells Fargo Home Lending

Women-owned businesses continue to fuel the economy, representing 39.1% of all businesses – over 14 million – employing 12.2 million workers, and generating $2.7 trillion in revenue. According to the 2024 Wells Fargo Impact of Women-Owned Business Report, in partnership with Ventureneer, CoreWoman, and Women Impacting Public Policy (WIPP), the number of women-owned businesses between 2019 and 2023 increased at nearly double the rate of those owned by men; and from 2022 to 2023, the rate of growth increased to 4.5 times.

Whether it was during COVID-19 lockdowns in 2020 or supply chain disruptions throughout the pandemic, women business owners are driving economic growth:

During the onset of the pandemic in 2020, despite business closures, women launched more businesses than they closed, while the number of men-owned businesses declined. Women-owned businesses also grew their workforces and increased their revenue while men’s numbers shrank.

From 2019 to 2023, women-owned businesses’ growth rate outpaced the rate of men’s 94.3% for number of firms, 252.8% for employment, and 82.0% for revenue.

During the pandemic, women-owned businesses added 1.4 million jobs and $579.6 billion in revenue to the economy.

Nearly half a million women-owned businesses with revenues between $250,000 and $999,999 grew their aggregate revenues by about 30%, illustrating their ambition, grit, and readiness to cross the $1 million revenue threshold.

“The impact that women-owned businesses make on the economy is undeniable. Even more impressive is that growth in women entrepreneurship – whether it was their workforce or revenue – grew during an extremely

difficult time,” said Wells Fargo Women’s Segment Lead for Small Business, Val Jones.

“From the trillions in revenue they contribute to the economy to the millions in jobs, women-owned businesses are coming out of the pandemic stronger than they went into the pandemic and many are thriving. It’s a testament to their resiliency and the breadth and depth of support they’ve received from government entities, banks, corporations, and philanthropic organizations that must be sustained.”

Also, during the COVID-19 pandemic and the transition to the post-pandemic period, Black/African American and Hispanic/Latino women-owned businesses increased at a much higher rate than all women-owned businesses. Between 2019 and 2023, Black/ African American women-owned businesses saw average revenues increase 32.7% and Hispanic/Latino women-owned businesses 17.1% compared to all women-owned businesses' 12.1% rise.

Further, women-owned businesses with 50 or more employees account for nearly half of women-owned businesses’ employment and revenues. Currently, women-owned busi-

nesses with 50 or more employees average $31.8 million in revenue generating $1.3 trillion in aggregate revenue. If they achieved the average revenue of men-owned businesses with 50 or more employees, they would add $1.2 trillion in revenue to the U.S. economy.

“The surge in growth rates of women-owned firms with more than 50 employees proves their strength and adaptability during and post the pandemic era,” said Wells Fargo Women's Segment Lead for Commercial Banking, Judith Goldkrand. “To sustain the growth and close the gaps, it’s important that we continue to create opportunities that help these businesses flourish, including removing barriers to capital, providing technical assistance, and offering support with business certification.”

Industry trends

More than a decade ago, women-owned businesses were concentrated in just three industries. Now, half of all women-owned businesses (50%) are concentrated in these four industries:

Other services (hair and nail salons, pet care, laundries, and dry cleaners): In 2023, women owned 2,267,000 other services

companies, accounting for 16.2% of all women-owned businesses.

Professional, scientific, and technical services (legal, bookkeeping, and consulting businesses): In 2023, women owned 2,017,000 businesses in this category, accounting for 14.4% of all women-owned businesses.

Administrative, support and waste management, and remediation services (office administration, staffing agencies, and security and surveillance services): In 2023, women owned 1,671,000 businesses of this type, accounting for 11.9% of all women-owned businesses.

Healthcare and social assistance (child day care and homecare providers, mental health practitioners, and physicians): In 2023, women owned 1,588,000 healthcare and social assistance companies, accounting for 11.3% of all women-owned businesses.

While these industries have the most women-owned businesses, between 2019 and 2023, the sectors that saw the most significant growth (50%) were in finance, insurance firms, real estate, transportation, and the warehouse industry.

Women-owned businesses could make a greater impact

While women business owners represent 39.1% of U.S. firms, they only account for 9.2% of the workforce and 5.8% of revenue. Closing the gap in average revenues for those ethnically or racially diverse has the potential to generate $667 billion in additional revenue, while closing the gap in average revenues between womenand men-owned businesses has the potential of generating $7.9 trillion in additional revenue to the nation’s economy.

Wayne Anderson, Mortgage Executive

BY WAYNE ANDERSON Mortgage Executive

Purchasing a home is one of the most important financial decisions a person makes in their lifetime, and there is much more to selecting a mortgage lender than ensuring you are getting the best rate. With so much at stake, it is important to pick a lender who can provide you with the best experience and loan for you. Here are a few compelling reasons to consider working with a local lender.

Many people think they don’t have what is needed to purchase a home, but what you think you need and what you actually need may be very different. You may be able to buy sooner than you think, or if you need time to prepare, an experienced lender can provide strategies to help you plan for a future purchase such as how to overcome any issues with your debt-to-income ratio, how to pay off debt, save, or tap into other investments to secure a down payment.

A local lender will get to know you, your unique financial situation, and goals. They will guide you through the process each step of the way and have access to a variety of loan options to fit your needs and budget as well as their own custom products. At Southern First, for example, we offer our Dream Mortgage, which offers up to 100% financing with no down payment or mortgage insurance required.*

3. Local Market Knowledge & Relationships

Local lenders that live and work in your area will be familiar with the neighborhood you’re purchasing in and local market trends. They are typically involved in their communities and well-connected with local Realtors®. These relationships can help. When the Realtors® that are a part of your deal have a relationship with your lender, they know they can count on a smooth and timely closing.

Using a local lender gives you direct access to get your questions answered quickly. Our Mortgage Executives are available when you need them and have a full team behind them to assist you. The underwriter and processor working on your loan are right here and able to help answer questions.

At Southern First, our team is passionate about helping people achieve their dreams of homeownership. We offer competitive rates and a variety of products including low down payment options such as FHA, VA, and USDA loans. Reach out today to get started at 877-679-9646 or southernfirst. com/mortgage.

Member FDIC and Equal Housing Lender. // *Loan originations are subject to underwriting and credit approval. Other terms, conditions, and certain fees may apply. The Dream Mortgage Program is a Special Purpose Credit Program designed to expand access to credit for underserved borrowers (low to moderate income and minorities) or locations, which are subject to change without notification. Applications are subject to underwriting and credit approval; additional terms and conditions may apply. Not all applicants will qualify.

Choose from no or low down payment options with competitive interest rates and terms

Multiple loan options to choose from including conventional, FHA, VA, and USDA loans

Providing personalized guidance to help you find the right mortgage to fit your budget * *

*Loan originations are subject to underwriting and credit approval. Other terms, conditions and certain fees may apply.

Scan to get started

Starting a business is a challenging task that requires a certain optimism, imagination, and perseverance. If you’re looking to start your own business, here are some important initial steps to consider:

• Know the business in and out. Whether you want to sell homemade sauces, open a place that serves coffee or offer Artificial Intelligence services, you should know your product or service, the market you have and the competitors. Briefly and simply describe what your business consists of, what need or market it serves and who your potential clients are.

• Create a Business Plan. A guide or roadmap focused on your business idea, the market and

how you plan to reach your objectives, will not only help you open and face the challenges that exist in a business but also maintain it. Additionally, it will allow you to focus on your idea, see the path ahead and communicate it to potential investors. Agile start-ups only need the description of the proposal, what is needed, finances and potential clients.

• Assess the need for financing and look for it. The business plan you created will help you. Many entrepreneurs initially use their personal credit card to fund a business, but there are actually business credit cards, like Chase’s Ink Business Cash Card, that can help meet your needs while earning rewards like cash back on business purchases. If you’re looking to obtain a business loan, you can work with a bank or

through the Small Business Administration. Alternatively, there may be public and foundation subsidies where you can do crowdfunding.

• Determine the legal structure and register your company. This affects your tax obligations and legal liability. Some options include sole proprietorship, or Unipersonal Company — one owner is responsible for the debts; partnership –if there are more than two people; corporation — to separate personal responsibility from that of the business; LLC — or Limited Liability (the most common). Seek legal assistance to determine what structure is best for you and your business.

• Register with the IRS. Consider whether you should have an employer identifier number among other things to keep tax obligations sep-

arate.

For more information and tips on how to start and manage a business, visit chase. com/business

For informational/educational purposes only: Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy.

SUBMITTED BY WELLS FARGO

Game Plan – the comprehensive intuitive mobile-first learning management system built by student-athletes for student-athletes – announced an expanded sponsorship with Wells Fargo – its exclusive provider of financial education curriculum since 2015. Through this expanded sponsorship, Game Plan will be offering free financial education to all 1,200 collegiate athletic departments – including those at 107 HBCUs, courtesy of Wells Fargo. This announcement came ahead of August 2024, when the NCAA board of directors began requiring all Division 1 colleges to provide student-athletes with life skills development, including financial education, and ensures that collegiate athletic departments can help student-athletes navigate the Name, Image and Likeness (NIL) era. As a part of this expansion, Wells Fargo is investing in updating its current financial education program avail-

able on the Game Plan app with engaging courses on budgeting & saving, credit management, planning for the future, and more, along with offering one-on-one advice and planning sessions with bankers to empower collegiate student-athletes to capitalize on their NIL earning potential.

“The financial expertise that Wells Fargo has brought to university athletic departments and student-athletes through our platform for more than eight years now has been invaluable,” said Mike Banville, CEO at Game Plan. “With the NCAA life skills mandate implemented in August and at a time when student-athletes stand to gain more than ever through NIL, this is the perfect time to offer this enhanced financial education program.”

Gigi Dixon, head of External Engagement for Diverse Segments, Representation, and Inclusion at Wells Fargo, added, “Empowering financial success is core to who we are at Wells Fargo as The Bank of Doing. Stu-

dent-athletes are expected to juggle classes, games, practices, meetings, and other commitments. The greatest advantage Game Plan provides is housing all of the content critical to their life skills development in one easy-to-access efficient digital platform. We’re looking forward to updating our financial education curriculum and meeting university athletic departments and student-athletes where they are to ensure that higher education institutions meet guidelines and individuals can navigate this increasingly complex landscape to its maximum benefit.”

Harry Stinson III, MS-SA, Interim Vice President of Institutional Advancement & Executive Director of the Lincoln University Foundation, Director of Athletic & Recreational Services at Lincoln University, offered, “Wells Fargo has provided our students with financial education workshops that have elevated their ability to manage their finances in a new way. The workshops

are short, yet detailed, and provide insight into the complexity of managing finances and prepares our students for their future success. From learning about taxes, owning your own business, renting versus buying, and understanding credit, our students are in position to think critically and strategically regarding their future and this program within the Game Plan platform is a game changer for us.”

To-date, more than 875 athletic organizations have placed their trust in Game Plan, and within the duration of the Wells Fargo sponsorship, student-athletes on the Game Plan platform have successfully finished over 48,000 Wells Fargo Financial Education courses.

BY DR. JAMES BRIDGEFORTH

In the intricate tapestry of the American economy, one thread stands out not only for its resilience but also for its potential to drive significant economic growth and social change. That thread is the African American economy — a force that not only supports its community but also bolsters the broader economic fabric of the United States.

The narrative of African American economic power is often overlooked or underestimated, overshadowed by persistent disparities and historical injustices. However, to truly grasp the impact and potential of this economic force, one must recognize its depth and breadth across various sectors — from entrepreneurship and consumer spending to workforce participation and investment.

African Americans represent a substantial consumer base in the United States, wielding immense purchasing power that influences industries ranging from fashion and entertainment to technology and healthcare. According to a report by Nielsen, Black consumers collectively have a buying power projected to reach $1.8 trillion by the end of 2024. This economic influence extends beyond mere consumption; it shapes market trends, influences product development, and drives innovation.

Moreover, the entrepreneurial spirit within the African American community is a cornerstone of economic vitality. Historically, Black-owned businesses have played a pivotal role in local economies, fostering job creation, community development, and economic empowerment.

Today, Black entrepreneurs continue to launch enterprises at a higher rate than the national average, contributing to economic diversity and resilience. Investments in education and skills development further amplify the economic impact of African Americans.

As more individuals from this community pursue higher education and specialized training, African Americans contribute to a skilled workforce that drives productivity and innovation across industries. The growing African American presence in professions such as law, medicine, academia, and technology

not only enhance these fields but also advance the nation’s overall economic competitiveness.

Furthermore, the economic influence of African Americans extends beyond domestic borders. In an increasingly globalized economy, cultural exports from the Black community — including music, art, fashion, and entertainment — have garnered international acclaim and economic success. These exports not only generate revenue but also promote American cultural influence worldwide, further solidifying the economic footprint of African Americans.

Despite these achievements, challenges persist. Structural barriers, systemic inequalities, and disparities in access to capital continue to hinder the full realization of African American economic potential. Addressing these challenges requires concerted efforts from policymakers, business leaders, and the

broader community to foster an inclusive economy where all individuals can thrive.

To harness the full economic power of the African American community, strategic initiatives are essential. These include: Promoting Entrepreneurship and Business Development: Enhancing access to capital, mentorship programs, and networking opportunities for Black entrepreneurs can foster a thriving ecosystem of businesses that drive economic growth and job creation.

Investing in Education and Skills Training: Increasing access to quality education, vocational training, and STEM programs can equip African Americans with the skills needed to excel in a rapidly evolving economy and fill critical gaps in the labor market.

Advancing Financial Inclusion and Wealth Building: Encouraging financial literacy, homeownership programs, and

equitable access to banking and investment services can empower African Americans to build generational wealth and economic stability.

Fostering Inclusive Corporate Practices: Promoting diversity, equity, and inclusion within corporate environments can create pathways for African Americans to advance professionally, contribute to innovation, and drive corporate profitability.

Supporting Cultural and Creative Industries: Investing in Black-owned media, arts, and entertainment ventures can amplify diverse voices, celebrate cultural heritage, and stimulate economic growth through creative expression.

In conclusion, the economic power of the African American community is a formidable force that secures the financial outlook for the nation. Moreover, by leveraging this power through strategic investments, inclusive policies, and collective action,

we can unleash untapped potential, drive sustainable economic growth, and create a more prosperous future for all Americans.

As we celebrate our achievements of African Americans and honor the many contributions to the nation’s economic landscape, let us also commit to building a more equitable and inclusive society—one where every individual, regardless of race or background, has the opportunity to thrive and contribute to the collective prosperity of our great nation.

By embracing diversity and harnessing the economic power of the African American community, we not only strengthen our economy but also uphold the principles of justice, equality, and opportunity upon which America was founded. Together, let us forge a path towards a brighter, more inclusive future where every individual has the chance to achieve the American dream.

BY ASWAD WALKER

If one of the greatest, most influential Black organizations of the past 100 years can fade into oblivion, how can others avoid that same fate?

That’s what happened to the Universal Negro Improvement Association, arguably the largest and most impactful Black organization in history. It once boasted a membership in the millions in the 1920s, with chapters on nearly every continent. And though the organization still exists in name, it is a shell of its former self.

But at least it’s a shell. There are countless other Black organizations and businesses that had huge impacts on Black people and Black life, yet they are now gone, existing only in the history books and the memories of elders.

Yet, some organizations have stood the test of time, existing over 100 years. What is their secret? What’s the difference? What do they have to teach today’s Black organizations and businesses that seek long-term staying power?

Succession planning.

“You build up your company through blood, sweat, and tears. It’s a success. One day, however, you will need, or choose, to turn over the reins to someone else. Whether by simply appointing your successor or by selling the company outright, the transition to new leadership can be tricky, even painful,” wrote Business Consultant Frank Williamson in his article, “Why Succession Planning Is a Must For Black-Owned Businesses.”

Williamson’s words apply to organizations, as well. Including the Black Church.

Recently, Dr. Ralph Hughes and leadership subject matter expert Dr. Khandicia Randolph led an online conversation about the critical role of organizational succession planning, particularly within the Black church.

The conversation produced the usual takeaways from conversations and studies on the topic: succession plans are crucial for organizations to ensure smooth leadership transitions and creating a leadership culture is key to meeting succession planning challenges.

It also pointed out that the Black church faces unique challenges in succession planning due to the cultural significance of the pastor’s role and the lack of preparation for leadership transitions. The resulting assignment: make sure to address specific deficiencies within the church/organization to improve the chances of creating and successfully implementing a succession plan.

Locally, the NAACP Houston Branch seems to have created that “leadership culture” stressed by Hughes and Randolph.

NAACP Houston’s Executive Director, Yolanda Smith, applauds the national

NAACP for its commitment to bringing on new leaders, pointing specifically to the organization’s ACT-SO program.

ACT-SO (Afro-Academic, Cultural, Technological and Scientific Olympics), informally called the “Olympics of the Mind,” is the NAACP’s youth program “designed to recruit, stimulate, improve and encourage high academic and cultural achievement among African American high school students.”

“It’s a 50-year-old program founded by legendary journalist Vernon Jarrett and has produced alums like Kanye West, Jada Pinkett Smith, Niecy Nash and Anthony Anderson who participated in ACT-SO in their youth and who regularly attend ACT-SO events currently,” said Smith, who connects ACT-SO activities with the NAACP’s commitment to succession planning.

“Our national and local offices train our youth to be new leaders. Our Houston Branch Youth Council is the number one youth council in the nation, winning the most awards of any unit. They are mini-units of NAACP branches. They have their own president, VP, secretary, etc., all training to

be the next leaders. That’s our succession plan,” Smith added.

Smith contends NAACP youth will be the next presidents and leaders because of ACTSO, the youth unit configurations and the organization’s “robust mentorship program.”

“We have about 20 advocacy committees where all of the work of the NAACP is done. And the youth have their own advocacy committees and initiatives that they do, with mentors assisting them. They enlist judges to put on moot courts, head environmental justice initiatives, learning about STEM and entrepreneurship. Our youth are involved in various activities and areas where they’ll eventually become adult leaders,” shared Smith, who credits Avalina Homles, the youth advisor and Summer Thompson, the co-advisor, for the success of local NAACP youth.

Smith counts NAACP youth as children “from birth to 21.” NAACP Houston has chapters on several Houston-area college campuses, including TSU, UH, Rice and Sam Houston State. Ms..

“Succession planning is vital for the longevity and sustainability of the Hon-

ey Brown Hope Foundation,” said Tammie Lang Campbell, the organization’s executive director since its inception in 1991. “While I’m not planning to retire anytime soon, succession planning is a strategic investment in protecting our organization’s legacy and ensuring that our community will continue to have access to the vital resources and support we offer.”

Campbell explained that the foundation’s plan is not about a pre-selection, but instead preparation for when she retires.

“We’re not just picking a successor –we’re preparing a leader who has been working with the organization since she was a teenager. She has the compassion and desire to serve others, which is a necessity for advocacy work. I am blessed and honored to be passing the torch to my daughter, Shar-day Campbell, upon my retirement. She has been involved with the Foundation since she was a teenager by not only addressing initiatives that align with the organization’s mission but honing her skills and designing initiatives that will take the organization to the next level for generations to come.”

BY TASHI MCQUEEN

The expanding role of artificial intelligence in modern life has been the subject of much discussion and some controversy in recent months. Therefore, it was no surprise the topic was featured on the first day of the 2024 Congressional Black Caucus Foundation’s Annual Legislative Conference, which kicked off Sept. 11 in Washington, D.C.

A group of panelists, including Tracy Owens, director of U.S. public affairs at Sage; Aaron Harris, chief technology officer at Sage; Dona Franklin, owner of Turnkey Solutions; and Georgia State Sen. Jason Esteves (D-Dist. 6), discussed how small businesses can maximize the use of AI.

The conversation featured Sage, a software company that provides human resources services to small and medium businesses, and how it has incorporated AI into its business. The company is particularly aiming to use AI in ways that can serve their clients.

“With the help of AI, we can capture all business activity in real time and account for that business activity,” said Harris. “We pair continuous assurance for continuous accounting to create trust in that data. Small business leaders and owners need to move very fast to compete, and our objective is to give them technology that enables them to [do just that].”

Franklin described how she has used ChatGPT, an AI chatbot, in her business to save time on everyday tasks.

“AI has literally revolutionized our business in the past couple of years,” she said. “I looked at ChatGPT as a fun thing when I first discovered it. But what has happened over the past two years is we found that it can make mundane, everyday tasks so much easier, and it provides such tremendous productivity.”

Franklin said she has used ChatGPT to create documents based on presentation slides and develop training videos.

“An activity that might have taken me an

hour and a half [to] two hours literally took 10 minutes,” she said. “If you think about the time you spend doing those things, it translates directly into money.”

With the plethora of issues Black small businesses already face such as high interest rates, AI could provide that much-needed relief.

“Just this morning, I gave a speech to an association not too far from here, and prior to finalizing that speech, I ran the text through ChatGPT,” said Esteves. “I said ‘Give me your thoughts on the speech. How long is it? How long will it take me, and do you have any recommendations on what I had?’”

“It did a lot for me in [those] 30 seconds that it took to spit out the information,” he continued. “I was able to add more to my speech.”

Though only 3.8 percent of American businesses were using AI in 2023, Owens insists that it will continue to expand rapidly and urged small business owners to take part in the conversation.

“Small businesses, medium-sized businesses are going to be in the mix for all of this,” said Owens.

He said small business owners should ensure “investments are being made” and have conversations with government officials and larger businesses about how they can best assist small business owners’ AI endeavors.

“There’s room for all of us,” said Owens.

In a related event, Sen. Laphonza Butler (D-Calif.) led a discussion about ways African Americans can use AI to empower the Black community.

Butler emphasized the importance of this conversation and briefly discussed legislation she was planning to introduce.

“This is legislation that is directed towards traditionally marginalized communities,” she said.

Butler said it would set aside $250 million to invest in upskilling students, educators and employers in industries that will potentially be impacted by artificial intelligence.

Building communities, one home at a time

At Wells Fargo, we believe that strong communities start with stable homes. That’s why we’ve pledged our support to help grow homeownership in diverse communities across the country.

Through our investments in affordable housing initiatives and financial education programs, we’re working to make homeownership accessible to everyone

Join us in building a brighter future for our communities, one home at a time.

Ready to be a part of something bigger? Learn more about Wells Fargo’s commitment to homeownership and how you can get involved in building stronger communities

BY STACY M. BROWN

Color of Change, the nation’s largest online racial justice organization, and Americans for Tax Fairness released a damning report Thursday exposing the deep racial inequities entrenched in the U.S. tax system.

The issue brief “How Tax Fairness Can Promote Racial Equity,” written by Color of Change Managing Director Portia Allen-Kyle and Americans for Tax Fairness Executive Director David Kass, exposes the systemic flaws in tax policy that have widened the racial wealth gap and prevented economic mobility for Black, brown, and Indigenous communities.

The report urgently calls for sweeping reforms to stop the flow of tax benefits to the wealthiest Americans — who are overwhelmingly white — while offering concrete solutions to make the tax code work for everyone, not just the top 1%.

“An equitable tax system does two things,” Allen-Kyle asserted. “It narrows the racial wealth gap from the bottom up and spurs economic mobility for Black, brown, and Indigenous individuals and families. Our current tax code fails on both accounts. It’s a prime example of how so-called ‘colorblind’ systems actively prevent Black families from building generational wealth and economic security.”

The brief pulls no punches in describing how current tax policies disproportionately benefit wealthy white families, further deepening racial inequalities. By giving preferential treatment to wealth over work, the system locks in economic advantages for white households while leaving communities of color to bear the brunt of these inequities.

“Our tax system is not only failing to address racial wealth inequality, it’s exacerbating it,” Kass warns in the report. “We privilege wealth over work, fail to adequately tax our richest households and corporations, and allow inherited fortunes to compound unchecked by taxation. This perpetuates a legacy of racial inequality.”

The racial wealth gap has exploded in recent years, with the median wealth gap between Black and white households jumping from $172,000 in 2019 to over $214,000 in 2022. Economic crises such as the Great Recession and the COVID-19 pandemic further entrenched these divides, benefiting the already wealthy, while leaving Black, brown and Indigenous communities further behind.

The Racial Wealth Gap and Homeownership Homeownership, long touted as a primary means of building wealth in America, has failed to deliver for Black families. The report points to factors such as biased home

Color of Change and Americans for Tax Fairness have released a report exposing the racial inequities in the U.S. tax system and calling for reforms to narrow the racial wealth gap and promote economic mobility for Black, Brown, and Indigenous communities. Photo Credit:iStock.com/ktsimage

appraisals and a regressive property tax system as key reasons why Black homeowners have been unable to accumulate wealth at the same rate as their white counterparts.

As the brief notes, with critical provisions of the Tax Cuts and Jobs Act (TCJA)set to expire, now is a pivotal moment for tax reform.

“We have a once-in-a-generation opportunity to reform our tax system to address racial inequality,” the report states, comparing recent monumental legislation like the Bipartisan Infrastructure Law and the Inflation Reduction Act.

The report lays out three central reforms aimed at curbing the wealth concentration among the ultra-rich and dismantling the racial inequities baked into the tax code:

1. Taxing Wealth Fairly: The report calls for equalizing the tax rates on wealth and work. Currently, capital gains — profits from investments — are taxed at a far lower rate than wages earned by working people, a disparity that overwhelmingly benefits white households. The vast majority of capital gains income flows to white families, who comprise only two-thirds of taxpayers but receive 92% of the benefits from lower tax rates on investment income.

2. Strengthening the Estate Tax: The estate tax, which is supposed to curb the accumulation of dynastic wealth, has been weakened over time, allowing large for-

tunes — primarily held by white families — to grow even larger across generations. The report calls for stronger enforcement of the estate tax to prevent the further entrenchment of wealth and power within a small, overwhelmingly white elite.

3. Targeting Tax Deductions to Benefit Lower-Income Households: Deductions for mortgage interest, college savings, and retirement accounts disproportionately benefit wealthier, predominantly white households. In order to prevent lower-income and minority households from falling behind due to policies that are currently biased in favor of the wealthy, the brief advocates for restructuring these deductions.

Both the Biden-Harris administration and Senate Finance Committee Chairman Ron Wyden have proposed addressing the racial wealth gap.

The Billionaire Minimum Income Tax (BMIT) and the Billionaire Income Tax (BIT) would ensure that the wealthiest Americans — who often go years without paying taxes — contribute their fair share. These proposals would raise over $500 billion in revenue over the next decade, which could be reinvested in healthcare, education, and housing for communities of color.

As the report points out, our current tax system is skewed in favor of the ultrawealthy. It allows the rich to avoid paying taxes on the

increased value of their investments unless they sell them. They often borrow against these growing fortunes, further delaying taxation, which allows white billionaires to accumulate vast wealth while paying a fraction of what working families pay in taxes.

The report also highlights the critical need to defend IRS funding, restored under the Inflation Reduction Act, which is essential for cracking down on wealthy tax cheats.

Contrary to Republican claims, this funding will not increase tax enforcement on households earning less than $400,000. Instead, it will improve customer service and expand the Direct File program, saving taxpayers significant time and money.

The Biden administration’s restored IRS funding is expected to raise an additional $100 billion over the next decade by ensuring the wealthiest Americans and corporations pay what they legally owe.

The message from Color of Change and Americans for Tax Fairness is clear: America’s tax system is broken, and without immediate reforms, the racial wealth gap will continue to widen.

“Addressing the insidious racial preferences in our tax code is one of the most direct ways we can not only help Black communities grow here and now but for generations to come,” Allen-Kyle concludes.

SUBMITTED BY WELLS FARGO

Alife of hard work and sacrifice offers the opportunity to leave a legacy that that lifts up not only your family, but your community. There are important considerations as you approach financial planning to transfer wealth to future generations.

Creating an estate plan is a foundational step. While it can seem intimidating, a team of trusted professionals, including a financial advisor, estate planning attorney, and accountant, can ask the right questions and help you avoid potential pitfalls.

“Developing an estate plan is about taking control. You are directing how the assets you have accumulated over your lifetime are passed on to the people and organizations that you care about,” says John Ripoll, Senior Vice President for Wells Fargo Advisors.

Your situation’s complexity will determine which documents your plan requires; however, these five are often included in an estate plan:

A will provides instructions for distributing your assets to your beneficiaries when you die. In it, you name a personal representative (executor) to pay final expenses and taxes and distribute your remaining assets.

A durable power of attorney lets you give a trusted individual management power over your assets if you can’t manage them yourself. This document is effective only while you’re alive.

A health care power of attorney lets you choose someone to make medical decisions for you if you are unable to com-

John Ripoll, Senior Financial Advisor

municate your wishes, or don’t have legal capacity to make treatment decisions for yourself.

A living will expresses your intentions regarding the use of life-sustaining measures if you are terminally ill. It doesn’t give anyone the authority to speak for you.

By transferring assets to a revocable living trust, you can provide for continued management of your assets during your lifetime and after your death — possibly for generations to come.

Establishing a plan is only the beginning. Significant life events are likely to call for changes to your plan.

Ripoll explains, “It’s important to regularly review your plan to ensure it continues to meet your needs. You want to consider whether your estate planning documents, asset titling, and beneficiary designations have been coordinated to allow your assets to be distributed according to your wishes. A regular review of who you have named as agent, executor, guardian for minor children, and trustee is important to ensure those named are still willing and able to serve when needed.”

Investment and Insurance Products are:

• Not Insured by the FDIC or Any Federal Government Agency

• Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

• Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. ©2019-2023 Wells Fargo Clearing Services, LLC. All rights reserved.

When Black homeownership rates increase, more Black households gain access to a proven way to build personal and intergenerational wealth.

Markets change but that does not mean buying a home is out of reach. At Wells Fargo, we can help you navigate the home buying journey during all types of economic cycles.

Our mortgage affordability calculator1 at wellsfargo.com helps you determine which mortgage options best align with your financial goals.

When you are ready to talk, our Home Mortgage Consultants are here to help you create a plan to optimize the benefits of homeownership now and over time.

The Black homeownership rate rose throughout 2022 even in the face of rising mortgage rates, hitting 45.2% in the third quarter - up from 42.7% in 2019. This is the largest point increase of any racial or ethnic

SPONSORED BY JPMORGANCHASE

Having a plan for your money is crucial to building a solid financial foundation. If you’re just getting started on your financial journey, the 50-30-20 rule can help you spend and save your money wisely.

By distributing your dollars into three main categories or buckets: needs, wants and savings, the idea is to limit fixed expenses (or needs) to 50% of your after-tax income and discretionary expenses (or wants) to 30%, leaving 20% for savings.

The 50-30-20 rule isn’t a requirement but can be a great starting point to help you take control of your finances, plan your spending and progress towards your financial goals.

50: What are your needs?

In this bucket, half of your funds go toward paying expenses you can’t avoid. We all need food, housing and healthcare, and other needs could include transportation, clothing and utilities. Regular debt payments, like monthly credit card minimums and loan payments, would also be considered a need because you have a deadline to pay them each month.

What makes something a “need” versus a “want” depends on your lifestyle. Transportation is typically considered a need, but the type of transportation you select might vary depending on where you live.

Having a vehicle may be a legitimate need to get to work and earn money to pay bills, but consider whether you need a luxury car, or if something less expensive would work.

We also need food and clothing, but funds spent on these two categories can flow into the “wants” bucket depending on your choices, such as dining out versus cooking at home or wearing designer gear versus department store basics.

30: What do you want?

Everyone should be able to enjoy life’s simple pleasures, and maybe a few extravagant ones as well. Put aside 30% of your funds for these “wants,” which can include entertainment, cable/streaming services, dining out, fitness memberships, travel, hobbies, personal care beyond the basics and a cell phone beyond the basic plan. Overspending can be common in this category since it’s fun to spend money on things we enjoy. Take time to prioritize your most important wants and desires

and cut back if you find your spending here going over 30%.

20: Save for the future

This category is all about what you want to do with the money in the future. Do you want to travel the world? Retire early? Help your children pay for college? Once your essential needs and more immediate wants are handled, you can put the rest of your funds — 20% — toward achieving your long-term goals.

If you want to pay off debt more quickly, beyond making your ongoing required payments, you can use money from this bucket to help speed up your plan as well.

Once you’ve given this rule a try for a few months, you might notice your spending and savings habits fall well outside of the 50-30-20 guideline. That’s when it’s time to make some tradeoffs.

Be honest about whether the items you’re putting in the needs category are vital to your life or if you could classify some or all those expenses as a want. It’s OK to spend more on housing if having a more expensive place is important to you; it just means you spend less on a car to balance

things out.

If your wants are way beyond 30%, consider scaling back and contributing more to saving for long-term goals. In the same vein, if you don’t have 20% leftover after spending on needs and wants, consider making some adjustments in your other buckets so you have enough for savings.

The 50-30-20 rule can help you allocate your money to needs, wants and savings and offer insights into where you may need to cut back. Use it to help you on your journey to financial success.

For more saving tips, visit chase.com/ personal/financial-goals.

For informational/educational purposes only: Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorganChase or its affiliates and/or subsidiaries do not warrant its completeness or accuracy.

SPONSORED BY JPMORGANCHASE

Homeownership is more than just a lofty American dream—it’s how many can build generational wealth. For the Black community, 90% of wealth gains come from homeownership, meaning that owning a home continues to be a crucial method for Black households to build and accumulate wealth.

And while the Atlanta housing market has been very competitive – the home prices have gone down 2.7% since last year, according to Redfin – home buyers who have been waiting on the sidelines for prices to become more affordable might see some relief soon. The Federal Reserve (the Fed), the U.S.’ central bank that dictates interest rates, continues to indicate that a potential rate cut is on the horizon. Not only can this impact affordability for prospective buyers, but it could be advantageous for current homeowners that are locked into higher interest rates. But, what does this all mean? Corey Mason, Chase Home Lending Advisor in Atlanta answers some of your questions as it relates to prospective homebuyers and homeowners:

What role do interest rates play in buying a home?

Mortgages respond to market conditions, including the Fed's monetary policy. As interest rates climb, so do the interest on new mortgages and mortgage payments. Conversely, if rates fall, so does the interest on mortgages. So, buying at a lower rate can save you money in mortgage payments.

Should I wait to buy a home once interest rates fall?

Timing the market perfectly is not only challenging, but near impossible to do. While we hope the Fed will cut rates this year, it’s never guaranteed. Lower interest rates can save you money, but they’re not the only factor affecting affordability. So, instead of focusing on perfectly timing the market, we recommend leaning into what you can control: being financially prepared to buy a home.

Outside of readying your fi-

nances for homeownership, you can look for options that can lower costs and promote savings such as low down payment mortgages, down payment assistance programs and grants. And don’t forget you always can buy a home now and refinance in the future once rates drop.

How do I prepare myself to buy a home in this current environment?

We not only want consumers to attain homeownership but to sustain it. That’s why it’s important to understand what exactly you can afford before getting into the market. There are a variety of resources to help you prepare financially for buying a home to see how much you can afford in the areas you’re looking to buy, compare loan options and obtain a free credit score. You’ll also want to start compiling all of your necessary documents for pre-approval, such as W2s, bank statements, income documentation, etc.

What about the down payment? Do I need to have 20% of

the home cost saved up?

Most first-time home buyers are singularly focused on saving for a down payment. However, long gone are the days of putting down 20% of the purchase price – low down payment loan options are available with some requiring as low as 3% down. Plus, there are a variety of incentives and grants that can lower your costs. For instance, Chase offers a homebuyer grant of up to $7,500, where eligible, to help with the interest rate, closing costs, and the down payment. These grants are offered in low- to moderate-income communities and neighborhoods that are designated by the U.S. Census as majority-Black, Hispanic and/or Latino.

Should I only work with one lender for my mortgage?

Studies show that 45% of borrowers who shopped around for mortgages received lower offers. Make lenders compete for your business – many have varying fees and closing costs that can add up. Also, interest rates can fluctuate daily, so lock in your rate with your lender if they offer that op -

tion for extra peace of mind.

I’m an existing homebuyer. How does a rate cut impact my situation?

It can be a good time to refinance when interest rates are going down, especially for those with rates above or at 7%. For current homeowners looking to refinance, we advise them to keep their end goal in mind as they consider whether refinancing makes sense for their personal situation. Work with your local advisor or using a Refinance Savings Calculator to understand when it makes sense for your specific situation to refinance.

Why should I refinance when rates are lower?