ENERGY & GREEN ECONOMY

Portugal is building a hugely ambitious floating wind farm set to come online in 2019.

IT, TELECOMS & MEDIA Europe’s hottest annual tech conference has chosen to relocate from Dublin to Lisbon.

TOURISM Portugal continues to improve ranking in WEF’s Travel & Tourism Competitiveness Index.

PORTUGAL 2019

“Microsoft has been present in Portugal for over 28 years and has over 650 people working to live up to our goal of empowering every person and every organization on the planet.”

PAULA PANARRA Country Manager, Microsoft

“Portugal has a trifecta of highly valued assets, such as the sea, sun, and wind, and I would risk a fourth, which is skill.”

JOÃO PEDRO SOEIRO DE MATOS FERNANDES Minister for the Environment and Energy Transition

“In 2017, we registered growth of 9% in terms of tourism arrivals, breaking the 20-million mark.”

LUÍS ARAÚJO President, Portuguese National Tourism Authority

43

151

77

Insurance Brokerage Employee Benefits and Health Management Personal Lines Property & Casualty Financial Lines A nity Risk Consulting Enterprise Risk Management Risk Analysis Loss Control Business Continuity Reinsurance & Wholesale Alternative Risk Transfer & Captive Solutions mdsinsure.com We will be there. MDS - Corretor de Seguros, S.A., Insurance intermediary registered, on 27/01/2007, with the ASF - Autoridade de Supervisão de S eguros e Fundos de Pensões in the category of Insurance Broker, under no. 607095560/3, with authorization for Life and Non-Life Branch es, verifiable at www.asf.com.pt.

THE BUSINESS YEAR: PORTUGAL 2019

Regional Director

Paul Loomis

Country Managers

Carlos Martínez, Suzanna Howse

Country Editors Peti Lipták, Miguel Artacho

Project Assistant

Amabyli Sousa

Chief Executive Officer

Ayşe Valentin

Editorial Director Peter Howson

Senior Editor Terry Whitlam

Writer/Editor Evan Pheiffer

Associate Editor Liz Colavita

Sub-Editors

Shireen Nisha, Kabir Ahmad, Kevin Mataraci

Editorial Coordinator

Belemir Ece Çolak

Web Editor

Aidan McMahon

Web Assistant & Social Media Coordinator

Ahsen Durukan

Web Developer

Volkan Görmüş

Analytics Assistant

Sena Özcanlı

Art Director Emily Zier-Ünlü

Senior Motion Graphic Designer Serkan Yıldırım

Motion Graphic Designer Yiğit Yeşillik

Senior Graphic Designers Bilge Saka, Şule Kocakavak

For this, our first edition on the Portuguese economy, we conducted over 130 interviews with key policymakers and top executives from all kind of sectors. With the support of our partner, the Confederação Empresarial de Portugal, we created a deep analysis of Portugal’s economy, highlighting its remaining challenges after the hit of a crisis, but also several great opportunities for the coming years.

Portugal’s government, elected on a wave of anti-austerity sentiment, has succeeded in returning the country to fiscal health and barnstorming economic dynamism following the European sovereign debt crisis. As of late 2014, Portugal had borrowed EUR79 billion from the IMF, EFSM, and EFSF in order to prevent insolvency, with strict conditions imposed on public-sector wages, working hours, holidays, and state pensions. Prime Minister António Costa owes his favorable public opinion to the fact that he has rolled back public spending cuts to return to pre-bailout levels in these areas.

Portugal’s economy continues to be buoyed by tourism, a sector that we covered in deep. Although if one sector stands out from the rest, that is ICT. We had a strong focus on how prepared is Portugal to be one of the first countries

adapting the 5G technology, meeting key players such the Minister of Science and Technology, the regulators, main operators, and multinationals that are taking part in this shift.

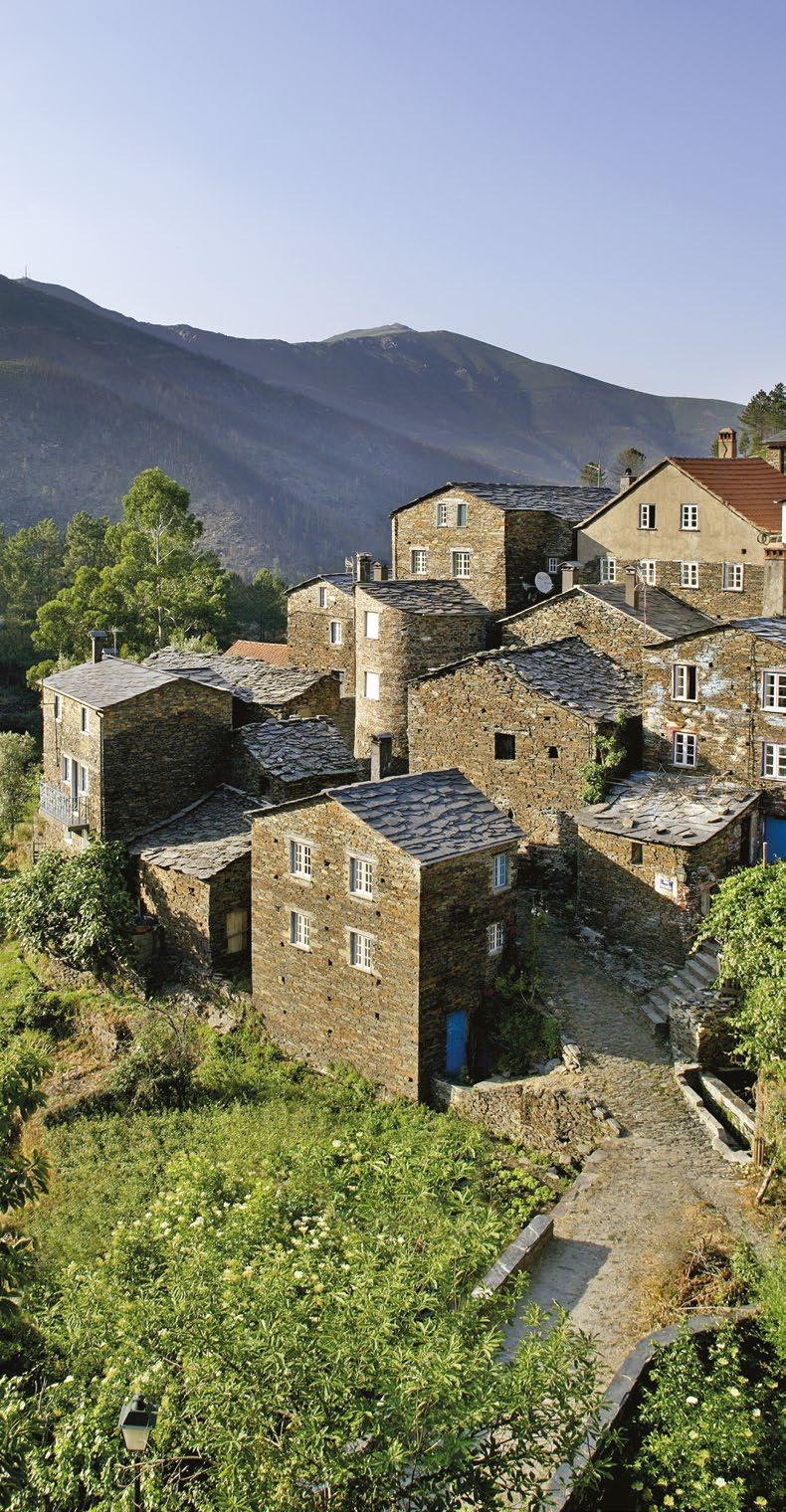

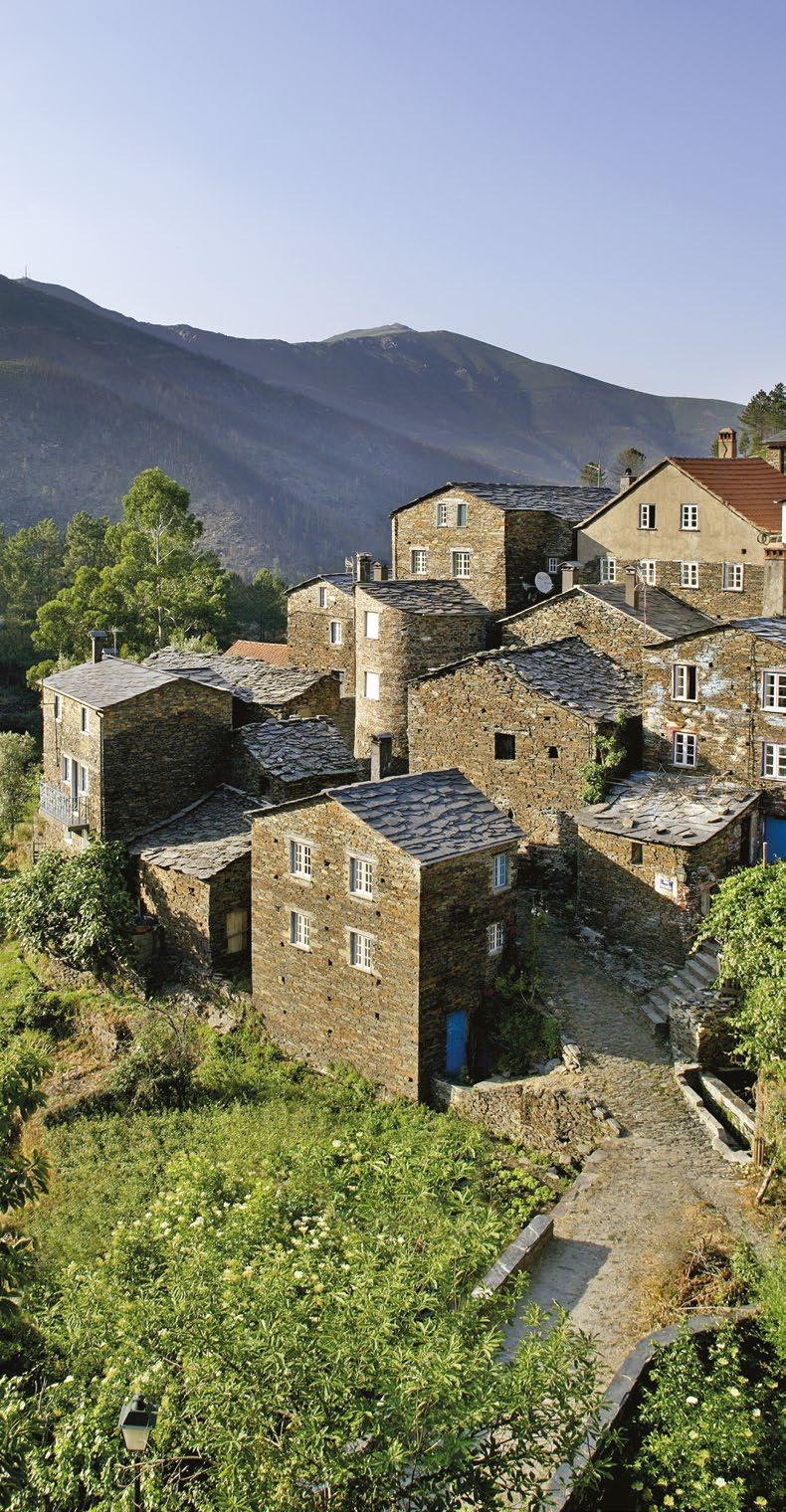

Portugal, for our readers, is well known, not only for its beautiful landscapes, delicious food, and secure business environment, but also its high level of human talent. Portuguese students have access to world-class level universities; all of them are fluent in several languages and with a broad and international mind that can nourish any business. For this reason, our Education chapter gathers the voices of decision makers that make this possible, from local primary schools to universities, as well as business schools.

The Business Year will help to introduce the people and ideas that are reinventing Portugal and its economy as it looks to play a greater role in the EU and beyond.

The result of this in-country project is the hard work of a team based in Portugal for 10 months, meeting face-to-face the players that have led Portugal out of a crisis, from north to south, from Madeira to the Azores, and not forgetting the interior of the country, where the opportunities are brighter than ever. ✖

Graphic Designer Arzu Çimen

Contributors

Babak Babali, Mark Szawlowski, João Marques

Transcribers

Jason Shaw, Emily Damgalı, Heather Conover, Gillian Docherty, Cain Day, Susan Barrett, Adrian Espallargas, Jeffrey Rogers, Alejandro Bautista, Michael Mariaud, Rewordist

HR Executive

Merve Yıldırım

PR Executive

Şölen Cenberoğlu

Operations Manager

Öznur Yıldız

Operations Assistant Can Ünsan

Office Coordinator

Gamze Zorlu

Finance Director

Serpil Yaltalıer

Accounting Manager

Quenie Ann Gonzales

ISBN 978-1-912498-22-2

www.thebusinessyear.com

3 FROM THE EDITOR'S DESK

Contents $60

In cooperation with:

11

17 ECONOMY

17 Everything’s gonna be alright

• Chapter summary

18 Manuel Caldeira Cabral, Former Minister of Economy • Interview

19 Upward growth trajectory

• Spotlight feature: The public sector and associations

23 Fiscal health check • Focus: Stability program

24 António Saravia, President, Confederation of Portuguese Industries (CIP) • Interview

25 Jorge Portugal, General Manager, COTEC Portugal • Interview

DIPLOMACY

13

14 Making an impact • Focus: Community of Portuguese Language Speaking Countries

33 ENERGY & GREEN ECONOMY

33 Earning its green • Chapter summary

34 João Pedro Soeiro de Matos Fernandes, Minister for the Environment and Energy Transition

• Interview

35 António Sá da Costa, President, Association of Renewable Energy (APREN) • Interview

36 Miguel Pernes, Country Managing Director, ABB Portugal • Interview

38 A green and pleasant land

• Focus: Renewables

26 Jorge Marques dos Santos, Former President, Portuguese Agency for Competitiveness and Innovation (IAPMEI) • Interview

27 João Castello Branco, CEO, Semapa • Interview

28 The right goals • Focus: Ease of doing business

29 Chambers • Forum

30 Eliana Bessada, Manager, I&F Portugal Bureau Veritas • Interview

31 Accountancy

• B2B

40 João Manso Neto, CEO, EDP Renewables • Interview

41 António José Nunes de Almeida Sarmento, President, WavEC Offshore Renewables • Interview

42 Duarte José Botelho da Ponte, President, Electricidad dos Açores (EDA) • Interview

43 Harnessing the ocean sky

• Focus: Offshore wind energy

44 Go with the flow • Focus: Wind energy

45 Conventional energy • B2B

3 From the editor's desk

7 Executive summary 9 Timeline 11

Old & wise • Chapter summary

12 Marcelo Nuno Duarte Rebelo de Sousa, President, Portugal • Inside perspective

António Costa, Prime Minister, Portugal • Inside perspective

PORTUGAL

44 24 27

2019

47 FINANCE

47 In the money • Chapter summary

48 Carlos da Silva Costa, Governor, the Bank of Portugal • Interview

49 Don’t mind the disruption

• Focus: Fintech

50 Nuno Amado, Chairman, Millennium bcp • Interview

51 Voices from the sector

52 Madalena Cascais Tomé, CEO, SIBS • Interview

53 Carlos Alberto Silva, Executive Board Member & CFO, SONAE IM

• Interview

54 Chinese policy • Focus: Chinese investment in the insurance sector

55 José Manuel Dias da Fonseca, Global CEO, MDS Founder and Chairman, Brokerslink • Interview

56 David Legrant, CEO, MEDICARE

• Interview

57 Insurance • B2B

59 INDUSTRY

59 Make it • Chapter summary

60 António Braz Costa, General Manager, Portuguese Technological Centre for the Textile & Clothing Industries (CITEVE) • Interview

61 Mário Jorge Silva, CEO, and Ricardo Silva, Head of Operations, Tintex Textiles • Interview

62 Textiles • Forum

65 Tech-stiles • Focus: Textiles

66 Voices from the sector: Textiles

68 Rise and shine • Focus: Automotive industry

69 José Couto, President, Mobinov & Board Member, Microplasticos

• Interview

70 Fabrice Crevola, CEO Portugal, Groupe Renault • Interview

71 Francisco Geraldes, Managing Director, Mitsubishi Motors

• Interview

72 José Cordeiro, President, and Dr. João Romana, General Director, AED Portugal • Interview

73 Celia Reis, CEO, Altran

• Interview

74 Voices from the sector: Industry

77 IT, TELECOMS & MEDIA

77 Summit to see • Chapter summary

78 Manuel Heito, Minister, Science, Technology, and Higher Education

• Interview

80 Rogério Carapuça, President, Portuguese Association for the Development of Communications (APDC) • Interview

81 Alexandre Fonseca, CEO, Altice

• Interview

82 Chris Lu, CEO, Huawei

• Interview

83 IT leaders • Forum

84 Interconnected • Focus: Web Summit in Lisbon

87 Pedro Afonso, CEO, Axians Portugal & Board Member, Vinci Energies Portugal • Interview

88 Carlos Leite, Managing Director, Hewlett Packard Enterprise (HPE) Portugal • Interview

89 José Gonçalves, Country Managing Director, Accenture Portugal • Interview

90 Voices from the sector

92 Leading solutions • B2B

93 Daniel Araújo, CEO, Asseco PST

• Interview

94 AI • Forum

95 Francisco Pedro Balsemão, CEO, Grupo Impresa • Interview

96 Media Forum

97 Consultancy

• B2B

81

99 TRANSPORT & LOGISTICS

99 Port, oh! • Chapter summary

100 Miguel Frasquilho, Chairman of the board, TAP Air Portugal

• Interview

101 Marta de la Rocha, Regional Vice President for Southern Europe, Netjets • Interview

102 Right time to seize missed opportunities • Focus: New airport

104 Logistics • Forum

105 José António Reis, Managing Director, DHL Express Portugal • Interview

106 Richard Mitchell, Regional General Manager, Yilport Iberia

• Interview

107 Filipa Ferreira Mendes, Country General Manager, CHEPa Brambles Company • Interview

108 Voices from the sector

5 65 50

78

Contents

111 CONSTRUCTION & REAL ESTATE

111 High stakes • Chapter summary

112 Rita Moura, President, Plataforma Tecnológica Portuguesa da Construçao (PTPC) and Cluster AEC & Head, R&D Teixeira Duarte Engenharia e Construçoes, S.A

• Interview

113 Esteban Adolfo Trouet, CEO, Odebrecht Portugal

• Interview

131 HEALTH & EDUCATION

131 The doctor will see you now

• Chapter summary: Health

132 Marta Temido, Minister of Health

• Interview

134 The PPP regime • Focus: Excellence in healthcare

136 Germano de Sousa, President, Grupo Germano de Sousa

• Interview

144 Business schools • B2B

145 Arlindo Oliveira, President, Instituto Superior Técnico • Interview

146 An age-old problem • Focus: Public teaching staff

148 Voices from the sector: Education

151 TOURISM

151 Packed to the rafters • Chapter summary

114 Changing places

• Focus: Parque das Nações

115 Reshaping • Forum

116 Vasco Pereira Coutinho, CEO/ President of the Board, Temple Global and Lince Capital

• Interview

123 AGRICULTURE

123 Shifting tastes • Chapter summary

125 Pedro Queiroz, General Manager, Federation of the Portuguese Agri-Food Industry (FIPA) • Interview

137 Sérgio Reis Soares, Director, and Samuel dos Santos-Ribeiro, Scientific Coordinator, IVI Lisbon

• Interview

138 Voices from the sector: Health

140 Chapter summary: Education

141 Isabel Capeloa Gil, Rector, Universidade Católica

• Interview

152 Luís Araújo, President, Portuguese National Tourism Authority • Interview

153 Pedro Manuel Monteiro Machado, President, Turismo Centro de Portugal • Interview

154 A feast for more than the eyes

• Photo essay: Azores

117 Developers • B2B

118 Fast-track to residency • Focus: Golden Visa

119 Eric van Leuven, Head of Portugal, Cushman & Wakefield

• Interview

121 Real estate • Forum

126 Paolo Fagnoni, CEO, Nestlé Portugal • Interview

127 Jorge de Melo, CEO, Sovena Group • Interview

128 A nice tipple • Focus: Portugese wine & cork

142 João Sàágua, Rector, Nova University

• Interview

143 Carlos Guillén Gestoso, President, Escola Universitária de Ciências Empresariais, Saúde, Tecnologias e Engenharia, & President, Atlantica University

• Interview

156 The more things change...

• Focus: Sustainability

157 Thomas Schoen, General Manager, Pine Cliffs, A Luxury Collection Resort • Interview

159 Spotlight: Portugal • Focus: International fairs and events

160 TBY recommends

Read more at thebusinessyear.com/portugal

stored in a retrievable system, or transmitted in any form or by any means, electronic, mechanical, photocopied, recorded, or otherwise without prior permission of The Business Year International Inc. The Business Year International Inc. has made every effort to ensure that the content of this publication is accurate at the time of printing. The Business Year International Inc. makes no warranty, representation, or undertaking, whether expressed or implied, nor does it assume any legal liability, direct or indirect, or responsibility for the accuracy, completeness, or usefulness of any information contained in this publication. The paper used in the production of this publication comes from sustainable sources.

thebusinessyear thebusinessyear TBYupdates

6 Portugal 2019 118

The Business Year is published by The Business Year International, Trident Chambers, P.O. Box 146, Road Town, Tortola, British Virgin Islands. Printed by Uniprint Basım San. Tic. A.Ş., Ömerli Mah. Hadımköy - İstanbul Cad. No:159 Hadımköy Arnavutköy 34555 İstanbul/Türkiye. The Business Year is a registered trademark of The Business Year International, Copyright The Business Year International Inc. 2018. All rights reserved. No part of this publication may be reproduced,

thebusinessyear

136 132 119

EXECUTIVE SUMMARY

DESPITE A ROUGH DECADE, with stark comparisons drawn between the country and Greece, Portugal today is on solid footing. Having escaped recession, the Iberian nation is set to grow between 2.3 and 2.7% this year.

We spoke to dozens of top business figures in preparation for this publication, gathering information that will be invaluable for potential investors. Among headline developments are the country’s early exit from its EU-IMF bailout and a robust 7% increase in exports over the last year, boosting the economy as demand increases.

THE DIPLOMATIC DANCE

On the global stage, Portugal remains a key member of NATO, the EU, and the Community of Portuguese Language Countries, and recent visits provide some hints to the country’s priorities— high-profile visitors have included King Philippe of Belgium, Chinese President Xi Jinping, Angolan President João Lourenço, German Chancellor Angela Merkel, and Queen Maxima of the Netherlands. And given that the current head of the UN is Portuguese politician António Manuel de Oliveira Guterres, the country has never before held such significant international clout.

Portugal is at the forefront of Europe’s green revolution, as outlined in our chapter on energy and the green economy. While the EU aims to derive 20% of its final energy consumption from renewable sources by 2020, Portugal currently produces more than half of its energy needs from clean sources. For this publication, we set out to explore the solar, wind, and hydro energy sectors, with Portugal also looking to exploit opportunities across the border in Spain. We spoke with João Pedro Matos Fernandes, Minister of Environment, about the role of the private sector in advancing Portugal’s agenda in this respect, and he expressed his delight that “more industries in Portugal [are] placing decarbonization and circular economy at front and center in their business models.”

Part of this drive comes in the form of batteries, with R&D activity abuzz around the topic of lithium-based solutions for industrial-sized energy storage. And with Portugal joining the exclusive club of countries that have run, at least temporarily, entirely on renewable sources—in this case thanks to a high number of sunny yet windy days in 1Q2019—finding a battery solution has become more pertinent than ever.

7

MEAN GREEN

Portugal has come a long way since the dark days of the financial crisis, having defied expectations to return to growth.

EXECUTIVE SUMMARY Contents

Image: Peti Lipták

TRYING TO MAKE IT

Portugal’s industry matrix also came under the microscope for this publication. While textiles remains the largest of its industries, representing 10% of all exports, new synergies emerging between universities and business are helping to move production up the value chain across a number of areas. Alongside automotive production, which has a long history in the country, Portugal is becoming a growing producer of higher technologies, including computer software, pharmaceuticals, biotechnology, and aerospace solutions.

BUILDING UP

While a concise summary of each chapter cannot be offered here, one sector that always stands out as a bellweather of overall economic health is real estate and construction. The Portuguese real estate and construction sector is a hive of activity, with stable economic indicators and increased in-

GDP PER CAPITA (2017)

SOURCE: WORLD BANK

USD21,136

INFLATION (2018)

SOURCE: STATISTA 1.75%

TRADE BALANCE (USD BN)

SOURCE: STATISTA

ward investment driving demand.

Construction activity grew 3.5% in 2018, and a figure of 5% is expected in 2019, pushed along by 7% growth in the residential area and 2.8% in the non-residential segment. The sector is also a significant employer, providing work for 300,000 people, or 6.4% of the total workforce. The sector contributes 7% to GDP. By talking to a series of top construction and real estate players, we hope to offer the reader a complete picture of this complex, yet telling sector.

During our time in Portugal, our editors and analysts felt a sense of optimism in the business community, and while many are perhaps wary of repeating past mistakes, there is a general feeling that Portugal, as an integral part of the EU, is on an upward trajectory. More popular with investors than ever, there has never been a better time to learn more about this robust Iberian economy.

GDP (IN USD BILLIONS)

SOURCE:THE WORLD BANK

8 Portugal 2019

-8 -10 -12 -14 -16 2013 2014 2015 2016 2017

✖ 300 250 200 150 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17

Image: ARPT –Porto and the North

NATO Secretary General Jens Stoltenberg visits the Joint Analysis and Lessons Learned Centre, NATO’s lead agency for the analysis of operations and training for the organization, in Monsanto.

MARCH 2018

Portugal doubles down on cork after demand for traditionally bottled wine booms. The world’s biggest exporter of cork products calls for more oak plantations across the country.

MAY 2018

Eurovision Song Contest 2018, the European song contest, is held in Lisbon’s modern quarter, Parque das Nações.

APRIL 2018

Portugal’s parliament ratifies a new legal gender change law making it easier for people to change their legal gender.

JUNE 2018

Portugal’s parliament overwhelmingly approves a bill to legalize cannabis-based medicines, after rejecting earlier proposals to allow patients to grow the drug at home.

JULY 2018

France, Portugal, and Spain agree to build an undersea power line in the Bay of Biscay with the aim of integrating electricity links between the Iberian Peninsula and Europe.

SEPTEMBER 2018

A centuries-old shipwreck is found off Portugal’s coast. Archaeologists discovered peppercorns, fragments of Chinese porcelain, and bronze cannons among the sunken remains of a 400-year-old ship that once sailed the spice route between Europe and India.

DECEMBER 2018

Chinese President Xi Jinping visits Portugal. The two countries discuss opportunities surrounding Belt and Road, an initiative that offers loans to build railways, roads, and ports across Asia, Europe, and Africa.

NOVEMBER 2018

CEOs and founders of tech start-ups together with members of the global IT industry gather in Lisbon for Web Summit 2018, an annual gathering on the latest technology and innovation.

9 TIMELINE

JANUARY 2018

Contents

Portugal 2019

The Monastery of Alcobaça is a Roman Catholic monastic complex located in the town of Alcobaça, in central Portugal

BREAKDOWN OF PORTUGUESE DIPLOMATIC MISSIONS ABROAD SOURCE: 2017 LOWY INSTITUTE GLOBAL DIPLOMACY INDEX 57% Embassies/High commissions 36% Consulates/Consulate generals 6% Permanent missions 1% Other representations NET OFFICIAL DEVELOPMENT ASSISTANCE (% OF GNI) SOURCE: OECD 55 50 45 40 '10 '11 '12 '13 '14 '15 '16 '17 GENERAL GOVERNMENT REVENUE VS. EXPENDITURE (% OF GDP) SOURCE: THE OECD Revenue Expenditure 0.4 0.3 0.2 0.1 0 '10 '11 '12 '13 '14 '15 '16 '17

Image: Francisco Carvalho-Amatar

OLD & WISE

Despite a rough decade, Portugal is today well positioned in southeastern Europe and enjoys huge popularity with tourists from around the world. It is also, according to the Global Peace Index 2018, one of the most peaceful places to live in the world.

Founded in the 12th century, it is also one of the world’s oldest states and is filled to the brim with history and tradition. Thanks to its location, it played a major role in the age of discovery, establishing far-flung colonies as far away as the Americas, Africa, and Asia.

During its long history, Portugal stands out as having been relatively peaceful. This has allowed it to forge strong alliances and trading relationships, with one such alliance, with the UK, dating back to 1386.

Today, the country is a member of NATO, the EU, and the Community of Portuguese Language Countries, a collection of nations from around the world made up mostly of former colonies of the Portuguese Empire.

The current President of the Republic is Marcelo Nuno Duarte Rebelo de Sousa, who was elected for his first five-year term in 2016, having previously served as a minister and whose background is as a law professor, journalist, and political analyst.

As with most former empires, the country also has ties to a number of autonomous regions, including Maderia and the Azores, which both

have regional presidents.

António Costa, the 119th and current Prime Minister of Portugal, in office since 2015, has overseen a recent cabinet reshuffle, the impact of which will be covered later in this publication. Portugal 2020, a priority vision for the Prime Minister and his team, permeates all areas of the economy and is the blueprint for the country’s commercial future.

On the diplomatic front, Portugal has been no less busy. In recent years, Portugal has hosted world leaders including King Philippe of Belgium, Chinese President Xi Jinping, Angolan President João Lourenço, German Chancellor Angela Merkel, and Queen Maxima of the Netherlands. Pope Francis also visited the country to celebrate the anniversary of a religious apparition.

And no summary of Portugal’s diplomatic endeavours could be complete without mention of António Manuel de Oliveira Guterres, the Portuguese politician and diplomat currently serving as the ninth Secretary General of the United Nations. We are thrilled to fea ture his words in this chapter.

Across the world, Portugal is opening embassies and promoting its food, culture, and products at an unprecedented rate. Brand Portugal is strong, and the country looks set to put the concerns of the past behind it as it continues to strengthen in the wider EU. ✖

11 Diplomacy CHAPTER SUMMARY Diplomacy

BIO

Marcelo Nuno Duarte Rebelo de Sousa is a Portuguese politician serving as the 20th and current President of Portugal since March 9, 2016. Previously, he was a government minister and member of parliament, a law professor, journalist, political analyst, and pundit. Born in Lisbon, Rebelo de Sousa is a university graduate, Doctorate, Professor, and publicist specializing in constitutional law and administrative law from the faculty of law of the University of Lisbon, where he taught law.

The reform of the UN requires the commitment of all member states. Maintaining the status quo is a way of gutting multilateralism and multiplying risks, conflicts without prevention, underdevelopment, and the violation of human rights and human dignity. Not reforming the Security Council with a broad-based consensus is to ignore the geopolitics of the 21st century, which requires, at the very least, the presence of the African continent, Brazil, and India.

Our view of the world situation and of the role of the UN explains our positions on so-called regional questions, but which are global in scope. Let me now dwell on some that are of special relevance to Portugal: The strengthening of the Community of Portuguese Language Countries (CPLP), currently presided by Cabo Verde, to be followed by Angola, whose contributions to stability and development I wish to highlight. CPLP enjoys magnificent cooperation with the UN and pursues the goal of seeing the Portuguese language—one of the most widely spoken in the world—adopted as an official language of the UN; the steps taken in Guinea-Bissau in preparation for elections in November; the growing importance of the African Union, its key uniting role for peace and sustainable development, the intensification of the partnership with the UN and the historic step of the “Joint Declaration of Peace and Friendship” between Ethiopia and Eritrea. Our wish is for the elections in the Democratic Republic of Congo to be held in a safe, free, and fair manner and that the results will be respected by all; the important developments on the Korean Peninsula opening positive prospects for complete, verifiable and irreversible denuclearization and demonstrating the commitment and courage of the parties involved; and the signing of the Maritime Boundary Treaty between Australia and Timor-Leste under the auspices of the Secretary-General of the UN.

Unfortunately, certain parts of the Middle East and the Maghreb continue to show signs of permanent political, social and economic instability. In Libya, the international community must unite

Marcelo Nuno Duarte Rebelo de Sousa PRESIDENT, PORTUGAL

GLOBAL peace

Portugal believes that multilateral action, political dialogue, and diplomatic wisdom are the only possible route to harmonious coexistence between nations and peoples.

to assist with the humanitarian and security situation and the creation of a solid state. Yemen remains the scene of one of the greatest humanitarian crises today, especially affecting the most vulnerable, women and children. Only negotiated political solutions, through the mediation of the UN and respect for international humanitarian law, will be able to reverse this increasingly tragic situation. Equally tragic is the humanitarian crisis in Syria, with one of the largest flows of refugees within and out of the region.

Here, also, only a substantive, inclusive and UN-mediated political solution will tend to ensure effective and broad-based international support for reconstruction, in the absence of which there will be apparent, sporadic and transitory agreements, but not the lasting peace. In any case, stabilization and peace in the Middle East will only be possible with the resolution of the Israeli-Palestinian conflict. Common sense demands the resumption of a credible negotiation process, addressing all the final status issues, including the question of Jerusalem, and leading to a practicable two-state solution based on coexistence by Israel and Palestine in peace and security.

As mentioned by Secretary-General António Guterres, true patriotism is only complete with cosmopolitanism. Portugal believes that multilateral action, political dialogue, and diplomatic wisdom are the only possible route to harmonious coexistence between nations and peoples. A short-term view or views, however appealing they may appear to be, are just a flash in the pan, which does not last, will not last, and will not solve the world’s true problems: development, justice, security, and effective respect for the rights of those who are the reason for our mandate and our presence in this General Assembly.

As Nelson Mandela said: “A fundamental concern for others in our individual and community lives would go a long way in making the world the better place we so passionately dreamt of.” This is the noble mission of this institution; it is also the reason for Portugal’s deep commitment to the UN. ✖

12 Portugal 2019

INSIDE PERSPECTIVE

Address made at the 73rd Session of the UN General Assembly

you’ve got A FRIEND

The oldest diplomatic alliance in the world, Portugal and the UK continue to nurture their strong ties in the pursuit of common opportunities.

It has become somewhat of a cliché, but a necessary one, to recall the Treaty of Windsor of 1386, which makes the Portugal-UK relationship thelongest-standing diplomatic alliance in existence between two countries in the world. More importantly, the relationship is still strong and vibrant. The ties between our countries are deeply rooted in culture and anchored in the vivid and growing communities of Portuguese here in the UK and British expats in Portugal.

As we prepare for Brexit, I want to recognize the invaluable contributions both communities provide to their country of residence. Both must be respected. Those who moved on the premise of freedom of movement should not be uprooted by Brexit. We must turn Brexit into an opportunity for both our countries to deepen our special relationship both politically and economically.

The important thing now is to minimize the negative consequences of Brexit and develop a relationship as close as possible with the UK. The European project is one of peace and progress, but also of opportunity. And it will continue to be. British businesses will continue to cross the Channel in search of profit, as will our own. Portugal has for centuries been a preferred destination of the British on the Old Continent. The UK is our largest source of tourists, our fourth-largest export market, and our fourth-largest source of FDI. That preference continues to this day. British investment in Portugal grew at a faster pace than EU investment in Portugal over the past two years. And over the last year, it multiplied by five. In the wake of Brexit, many companies have chosen Portugal to be their second home in Europe.

These are the dividends of a special relationship nurtured over centuries, and they pay both ways.

Today the opportunities for investing in Portugal are even greater because we are committed to the European project and are a living symbol of recovery from economic, financial, and social crises. Portugal is growing faster than Europe. Employment and investment growth are double the average of the EU and unemployment is falling faster than in any other eurozone country.

GDP grew by 2.7% in 2017. This growth allowed for a 0.9% public deficit, the lowest in our democratic history. Primary surplus was 3% and public debt fell more than 4 percentage points of GDP. We have left the excessive deficits procedure, and our sovereign debt is no longer junk-rated. Our current account balance is in surplus. Stabilizing the financial sector was a key priority for this government. Today, confidence and resilience are back to the financial sector and country.

In innovation, we are going above and beyond. Through December 2017, we approved support for almost 3,000 collaborative innovation projects worth almost EUR600 million. Recently, we launched six collaborative labs that bring together businesses and researchers to set priorities for the research agenda. We also issued new funding for sector-level technological centers, which have been the driving force behind innovation and entrepreneurship in traditional sectors.

In Portugal, you will always find a friend of Britain and British businesses, not to mention a safe harbor and fertile ground for your investment. Indeed, to British businesses I say—by opening in Portugal you can have a two-in-one; Brexit in the UK and Remain in the EU by investing in Portugal. Just as history proved before there even was an EU, and just as we will prove together after Brexit, Britain and Portugal can grow together. ✖

Address made at the Portugal-UK Economic Forum, April 2018

BIO

António Costa holds a degree in legal and political sciences from the faculty of law of the Universidade Clássica de Lisboa and a post-graduate degree in European studies from the Catholic University of Lisbon. He is a lawyer. He was Deputy to the Assembly of the Republic between 1991 and 2004. For more than 10 years, he was a member of the Lisbon Municipal Assembly and served as a councilor at the Loures City Hall. He served as Secretary of State for Parliamentary Affairs in the XIII Constitutional Government and Minister for Parliamentary Affairs. He was Minister of Justice between 1999 and 2002 and Minister of State and of the Internal Administration from 20052007. He was Mayor of Lisbon from 2007-2015.

13 Diplomacy INSIDE PERSPECTIVE

António Costa PRIME MINISTER, PORTUGAL

MAKING AN IMPACT

Established in 1996, the Community of Portuguese Language Speaking Countries (CPLP) is a mechanism geared at linking and sharing the experience of Lusophone countries. Besides Portugal, this includes Brazil, Portugal, Cape Verde, Angola, Mozambique, Guinea-Bissau, and São Tomé and Príncipe.

BRAZIL BOASTS LATIN AMERICA’S LARGEST START-UP ECOSYSTEM,

while Portugal itself has a vibrant tech sector, and the CPLP is working hard to realize the potential of its African counterparts. Enabling cooperation across key areas, ranging from science and technology to culture, communication, and administration, impact investment capable of giving direction and depth to the respective economies of Lusophone Africa and fostering broader social welfare is hugely important. At the heart of such investment is the capacity to fuel startups and incubators, sectors that cause competition to flourish.

UNDERSTANDING THE CHALLENGES

The language barrier is a challenge, as many firms from the continent, as well as from Asia and Europe, opt to locate to neighboring English-speaking countries from which they service Lusophones. Moreover, much, if not all, of the literature in the technology sector is published in English, though mitigating initiatives have included certain developers in Mozambique publishing in Portuguese. Then there's the commercial environment, where FDI is put off by structural problems in certain nations such as exchange regimes curbing repatriation of capital, an investment staple worldwide.

SMALL STEPS TOWARD A LARGER ECOSYSTEM

Orange Corners is a pan-African program funded by the Dutch government that supports entrepreneurship through a knowledge program and networking facilities to bridge start-ups and funding. Other notable developments thus far are Angola's first incubator, KiandaHub, and Acelera Angola, a news portal dedicated to entrepreneurship. In 2017, the start-up studio Bantu Makers set up shop to assist young enterprises. In Mozambique, the Maputo-based consultancy IdeiaLab is another ecosystem catalyst for local SMEs, while Cape Verde hosted Startup Weekend to galvanize interested start-ups. Two examples are the local taxi app Taxi Already and Ifome, a food delivery service. In 2013, Cape Verde also factored entrepreneurship into its education system. Though the country has suffered from brain drain, one young star who has stayed behind is Pedro Lopes, who organized the nation's first TEDx talk and went on to establish the youth organization Geração B-Bright to nurture entrepreneurial skills. In 2018, he was appointed the state secretary of innovation and technical training.

That same year, Guinea Bissau’s entrepreneurial ecosystem gained fame as the country hosted the global start-up competition of Switzerland-based Seedstars, where agri-tech startup ‘Bandim Online’ went home with the prize.

AID TO GROWTH

Lateral thinking has proposed an “if you can spend it, it must be cash” approach in Mozambique. Given the name “donor up” by a start-up called UX Information Technologies, the idea was to channel donor money into start-ups. If this sounds familiar, it is. It's the old “teach a man to fish” in action, and was floated at the Seedstars Africa Summit in Mozambique in 2017.

Unemployment is substantial in Mozambique, and UX saw potential in establishing the job portal emprego.co.mz, which leveraged the state policy of providing jobs first to locals in order to promote fairer access to a limited pool of around 750,000 jobs. In Cape Verde, a green energy policy pledges to generate 100% of electricity from renewable resources by 2025. The “Climate Launchpad” has thus far resulted in four start-ups.

IN THE PIPELINE

As the year closed, the Lusophone countries appeared poised for a pipeline of USD5 billion in both private sector and private-public partnership (PPP) projects to stimulate economic growth. Meanwhile, a development finance compact between the African Development Bank, Portugal, and the Lusophone six was signed at the African Investment Forum in Johannesburg in November. It was noted that Lusophone countries were home to 267 million people worldwide and possessed substantial natural resources including oil and gas. These have not been exploited due to the lack of infrastructure that forthcoming investment could now reverse. The African Development Bank pledged financing guarantees to support projects also supported by Portugal, while Portuguese Development Finance Institution SOFID also pledged EUR20 million in credit lines for related projects. While the early shoots of entrepreneurial initiative are visible, forming development ecosystems will prove a long road for the Lusophone nations. One factor to watch is the policy of Brazil’s new president-elect Jair Bolsonaro toward his linguistic African compatriots. ✖

14

FOCUS Community of Portuguese Language Speaking Countries Portugal 2019

15 Diplomacy

Image: Francisco Carvalho-Amatar

The Ponte de Barcelos bridge crosses the Cávado River in Braga

Portugal 2019

Lisbon, the capital of Portugal, remains a key commercial center, popular with businesses and tourists alike

Image: Alexandre Rotenberg

GOODS

SOURCE: STATISTICS PORTUGAL 100 80 60 SHARE OF REAL VALUE ADDED TO GDP, 2017 SOURCE: OECD Trade, repairs, transport, accomm., food services 25% Public admin., defense, education, health, social work 19.2% Industry including energy 18.4% Real estate 12.1% Professional, scientific, support services 7.6% Finance and insurance 4.9% Construction 4% Information, communication 3.5% Other services 2.9% Agriculture, forestry, fishing 2.3% IMPORTS VS EXPORT OF GOODS AND SERVICES (BILLION USD) SOURCE: THE WORLD BANK '10 '11 '12 '13 '14 '15 '16 '17 Exports Imports EXPORTS IMPORTS Spain 25.2% Spain 32.3% France 12.5% Germany 13.7% Germany 11.4% France 7.3% UK 6.6% Italy 5.4% US 5.2% Netherlands 5.4% Netherlands 4% China 3% Italy 3.5% Belgium 2.8% Angola 3.2% UK 2.7% Belgium 2.3% Russia 2.3% Brazil 1.7% Brazil 1.8% Others 24.3% Others 23.4%

EXPORTS AND IMPORTS OF

BY MAIN PARTNER COUNTRIES, 2017

EVERYTHING’S GONNA BE ALRIGHT

It is no secret that Portugal has had a rough decade. But against all odds, the Iberian nation has achieved something remarkable, escaping recession and turning risks into opportunities. While others still struggle today, Portugal has experienced moderate growth over the last three to four years, and despite the slow growth outlook, unemployment is down, the deficit is narrower, and debt has decreased.

Having spoken to dozens of top business leaders in the preparation of this publication, we discovered that while imbalances are being gradually corrected in the economy, growth is indeed slowing, and more moderate figures are likely this year and next. For this year, growth estimates hover between 2.3% and 2.7%. The OECD is the least optimistic when it comes to growth predictions. But while the majority of our interviewees believe a slowdown is more likely, the government believes it can maintain the growth levels of 2018.

The current economic and labour market momentum allows institutions to anticipate progress on the budget front. This year, both the public and private sectors expect an improvement over 2018 and that the unemployment rate will come in

somewhere around 6%. In this regard, the finance minister is still considering a slightly more modest unemployment rate of 7.2% next year.Everyone expects the deficit and debt to fall.

Last year also presented a big milestone, as the county made an early exit from the EU-IMF bailout, our interviewee, Carlos da Silva Costa, the governor of the Bank of Portugal, explained in an interview for this publication. It is also worth mentioning that the growth figure for 2018, released by Banco de Portugal, came in at 2%, above the EU projection and eurozone forecast. Growth was helped along by a robust 7% increase in the exports of goods and services, which should continue to boost the economy as global demand increases further.

Diversification in exports has also played an important role in stabilizing the economy. Services around tourism offer up huge potential, while sectors as diverse as pulp and paper create significant export power. We believe this chapter, featuring a range of big names from across the public and private sectors, will help readers gain a comprehensive picture of the state of play in the Portuguese economy in 2019. ✖

17 Economy CHAPTER SUMMARY Economy

13% growth in investment in 2017

11.9% increase in exports in 2017

Portugal’s economy has seen five years of unprecedented growth. How has an anti-austerity policy mix contributed to this?

The government used anti-austerity measures to unleash society’s existing growth potential by following responsible and moderate policies. The first major impact of this was to boost citizen and consumer confidence, which was also reflected in the confidence of investors. These generated an atmosphere of certainty and led to an acceleration of this growth, far above the EU average. Our investment grew by 13% in 2017, the biggest increase in 18 years, mostly in private investment, both Portuguese and FDI. Second, we instilled stability into the public accounts. With more growth, we have more revenue and reduced unemployment, which reduces the costs of unemployment benefits and social security. We also sent a clear message about fiscal stability in our three approved budgets: we have no need to drum up revenue by hiking taxes. We succeeded through better management and by harnessing the opportunities created by economic growth to reduce the debt burden, while maintaining fiscal stability. This reduction of the deficit—to 1.3% in 2017, well below our ambitious targets— works as a guarantee of our ability to retain this fiscal stability, as we will not have more urgent needs in the short or medium term.

Is fintech becoming a priority area for the government, and how do you envisage technology-based economic development in the long term?

We see technology as a key factor for the evolution of the country. In terms of innovation, we have launched three different programs. One of these was Startup Portugal, which streamlined fiscal rules and instruments of venture capital, matched funds to co-invest with foreign investors in technology firms and created a network of incubators. In terms of fintech, we see many start-ups going from strength to strength, with some firms already securing significant investment. The latest example was Finzay, a leading firm in cybersecurity that won an injection of EUR50 million. Another development is that fintech has allowed banks and financial organizations

KEYS TO success

After recording several years of economic growth above the EU average, Portugal is now set to go beyond and focus on up-and-coming sectors.

Manuel Caldeira Cabral FORMER MINISTER OF ECONOMY

to reorganize their production and services all over the world. Certain large financial institutions are moving key departments, such as cybersecurity or application development, to Portugal. We see two forms of movement: new firms experiencing rapid growth and investors and incumbents eyeing the market with interest. The Web Summit, held in Lisbon, helped to considerably draw attention to the Portuguese ecosystem.

How will Portugal capitalize on its image as an attractive hub for relocating companies?

We see many businesses moving to Portugal in different areas. There are new investments in terms of industry, namely in machinery, aeronautics, and the automotive industry, coming mainly from France, Germany, India, China, and the US. We have several banks creating large pockets of jobs in shared services in Portugal; there are engineering companies that have built R&D centers and many software companies investing here and growing fast. This has translated into an almost 11.9% increase in our exports in 2017 and a strengthening of our industrial capability because of nearshoring. One of the main attractions of opening shop in Portugal is our robust and diverse talent pool. It is a great opportunity to find engineers, software developers, people who speak different languages, people from the finance sector, managers, and people with different competencies.

What impact has qualified labor had on Portugal’s export mix?

We have seen considerable diversification. This used to be more centered on traditional sectors such as footwear, textiles, and clothing, though we have since seen a shift toward the machinery, automobile, aeronautics, and pharmaceutical industries. Even traditional sectors have become more focused on high quality with flexible production: producing more value with less people. Parallel to this, there has been a significant increase in technological services. 10-15 years ago, there were half a dozen software firms exporting; however, today the market has blossomed. ✖

18 Portugal 2019 INTERVIEW

UPWARD GROWTH TRAJECTORY

Formidable relationships with key countries across all continents and a business environment that thrives on disruptive technologies are just two reasons why Portugal is set to reach new highs.

With its economy expanding continuously since 2014, unemployment falling faster than any other eurozone country, a positive current account balance, investment growth double the average of the EU, and its universities delivering increasingly highly qualified professionals to the labor market, Portugal and its leaders have much to be proud of. However, the public sector and industry associations are not resting on their laurels and seek further successes. The country has identified key initiatives in all sectors moving forward. Public sector officials and the relevant associations target the development of digital skills amongst Portuguese to further the country’s development, a creative mix of financing instruments to encourage entrepreneurship, connecting educational institutions and research centers with businesses to further innovation, and more industries placing sustainability at the center of their business models in the coming years.

Marcelo Rebelo de Sousa PRESIDENT, PORTUGAL

António Sá da Costa PRESIDENT, ASSOCIATION OF RENEWABLE ENERGY (APREN)

Manuel Heitor MINISTER FOR SCIENCE, TECHNOLOGY, AND HIGHER EDUCATION

António Costa PRIME MINISTER, PORTUGAL

Manuel Caldeira Cabral FORMER MINISTER OF ECONOMY

Joã o Pedro Matos Fernandes MINISTER OF ENVIRONMENT AND ENERGY TRANSITION

Rogério Carapuça PRESIDENT, PORTUGUESE ASSOCIATION FOR THE DEVELOPMENT OF COMMUNICATIONS (APDC)

António Saravia PRESIDENT, CONFEDERATION OF PORTUGUESE INDUSTRIES (CIP)

Marta Temido MINISTER OF HEALTH

19 Economy SPOTLIGHT FEATURE The public sector and associations

SPOTLIGHT FEATURE

Image: Peti Lipták

THERE ARE TWO DIFFERENT VIEWS OF the world. One, short-term, is unilateral or monoliteral, protectionist, with domestic populist discourse, minimizing multilateralism in anything to do with sustainable development, prone to climate change denial, opposed to global pacts on migration and refugees, and only interested in conflict prevention and peacekeeping where and when, occasionally, it matters. The other, opposing, view, which we share, is multilateral, open, and favorable to the search for global governance, committed to sustainable development regarding international law, the charter, and human rights as values and principles, and never as means or conveniences. We are confident that, in the medium to long term, this view will prevail, as it has prevailed in the EU, which has given Europe the longest period of peace in living memory and the highest levels of welfare and social protection. Our view of the world situation and of the role of the UN explains our positions on so-called regional questions that are global in scope. Portugal believes multilateral action, political dialogue, and diplomatic wisdom are the only possible route to harmonious coexistence between nations and peoples.

IT HAS BECOME SOMEWHAT OF A CLICHÉ, but a necessary one, to recall the Treaty of Windsor of 1386, which makes the Portugal-UK relationship the longest-standing diplomatic alliance in existence between two countries in the world. The ties between our countries are deeply rooted in culture and anchored in the vivid and growing communities of Portuguese in the UK and British expats in Portugal. The important thing now is to minimize the negative consequences of Brexit and develop a relationship as close as possible with the UK. British businesses will continue to cross the Channel in search of custom and profit, as will our own. The UK is our largest source of tourists, our fourth-largest export market, and our fourth-largest source of FDI. That preference continues to this day. British investment in Portugal grew at a faster pace than EU investment in Portugal did over the past two years. And over the last year, it multiplied by five. These are the dividends of a special relationship nurtured over centuries, and they pay both ways.

Manuel Caldeira Cabral FORMER MINISTER OF ECONOMY

Manuel Caldeira Cabral FORMER MINISTER OF ECONOMY

THE GOVERNMENT HAS USED anti-austerity measures to unleash society’s existing growth potential. The first major impact of this was to boost citizen and consumer confidence, and this was also reflected in the confidence of investors. Paired together, these trends generated an atmosphere of certainty and led to not just a continuation but an acceleration of growth, far above the EU average. Our investment grew by 13% in 2017, the biggest increase in 18 years, mostly in private investment, both Portuguese and FDI. The signals we gave off were, first, that we are an open economy for trade, investment, and visitors. Second, we instilled stability into the public accounts. With more growth, we have more revenues and less people in unemployment, which reduces the costs of unemployment benefit and social security. We also sent a clear message about fiscal stability in our three already approved budgets; we have no need to drum up revenue by hiking taxes. We managed through better management and harnessing of the opportunities created by economic growth to reduce the debt burden, while maintaining fiscal stability.

20 Portugal 2019 SPOTLIGHT FEATURE SPOTLIGHT FEATURE

António Costa PRIME MINISTER, PORTUGAL

Marcelo Rebelo de Sousa PRESIDENT, PORTUGAL

WHEN WE ESTABLISHED this association 30 years ago, our objective was shaped by the fact that all electrical business production, transport, and distribution was owned by the state through EDP since 1976. The sector was subsequently opened to private investment. The role of the association remains essential to unify the different investors in the system for the production of electricity. We want Portugal to have a higher share of renewable electricity in order to support the reduction of CO2 emissions and fight climate change. The companies that are members of APREN represent 93% of all renewable power installed in Portugal and on average produce a little more than half of the electricity consumed throughout the country. We work to find solutions for our sector; we address either technical or fiscal problems, those concerning the environment, as well as ways to interact with the remuneration of the sector for electricity production. We started from a system that basically involved feed-in tariffs and transitioned gradually to one determined by the market.

PORTUGAL HAS A TRIFECTA OF highly valued assets, such as the sea, sun, and wind, and I would risk a fourth: skill. When we think of the green energy sector, we tend to focus on the big projects: windmill, solar, and water. It is a fact that we have an extremely high-value industry both in hardware and software. It is not by chance that we attract companies such as Siemens, which may come to benefit of experienced Portuguese companies like A. Silva Matos and others; however, the green energy sector is also made of smaller projects. Take bio-economy, for example, in which we have an enormous potential for development, not only on the “blue” side—seas and rivers—but also on the “green” side— forests and agriculture—combining the cascading of value extraction from natural biomass with energy production. And in that context, we certainly have a solid and growing pool of companies and competences, from north to south of the country such as CIIMAR in Leixões, BLC3 in Oliveira do Hospital, Católica School in Porto, and companies like SilicoLife and A4F.

PORTUGAL IS A SMALL BUT OPEN ECONOMY. It has had throughout its history a differentiation: its relationship with both Africa and the Americas. We have a virtuous triangle: Europe, Africa, and the Americas. Through its history, culture, and relationships with countries that speak Portuguese as an official language, Portugal can help the EU face the challenge of globalization. Our privileged relationships can bring greater synergies to Europe and simultaneously allow Africa and the Americas to see Portugal as the gateway to Europe. However, Europe also has challenges, its biggest being dissolution. It is not just Brexit, but also Catalonia and the autonomous movements in Spain. We also have to consider how Brexit reflects on the reality of the UK. These are challenges that are beginning to undermine European cohesion. If we start thinking about the future, we will have not one Europe but 27 states with distinct realities. Portugal through its historical relationship with the world has a great power of knowledge and this rich history can be utilized by Europe.

21 Economy SPOTLIGHT FEATURE

António Saravia PRESIDENT, CONFEDERATION OF PORTUGUESE INDUSTRIES (CIP)

Joã o Pedro Matos Fernandes MINISTER OF ENVIRONMENT AND ENERGY TRANSITION

António Sá da Costa PRESIDENT, ASSOCIATION OF RENEWABLE ENERGY (APREN)

NATIONAL SHORT-, MEDIUM- AND LONGTERM STRATEGIES FOR the development of digital skills were set out through the National Digital Skills Initiative (INCoDe2030), so that by 2030 approximately nine out of 10 citizens are frequent users of the internet, and we increased by 50% the number of IT experts in companies. The strategies include, among other aspects, providing support to creative communities in the area of inclusion and at a local and decentralized level throughout the country in close interaction with the local/regional administrations; supporting teachers in the progressive and systematic modernization of the education system working closely with the Minister of Education and related central and regional administrations; establishing regional networks of qualification and digital specialization, namely through partnerships between polytechnics, local administration, and companies namely in the regions of West-Leiria, Cavado and Ave, Nordeste Transmontano-Bragança, Castelo Branco, and Setúbal-Palmela; the establishment of a national AI strategy, with the specific involvement of the public administration, R&D centers, and companies and in close European interaction; and the development of advanced forms of computing, including the creation of the Minho Advanced Computing Center-MACC.

THE IT AND ICT SECTORS ARE REVOLUTIONIZING AND DISRUPTING ALL INDUSTRIES. The question is not if ICT will disrupt business, but when and how much it will change some particulars of the market. For example, in the last seven to eight years, the media and entertainment sector in Portugal lost 40% of its advertising revenues. Digitization is basically a revolution; if we talk solely about technology-related transformations, we had the agricultural, the industrial, and now the digital revolution. The difference is that the digital revolution transforms business and society in a much shorter timeframe than previous revolutions, which took hundreds of years. The first part of the digital revolution was the appearance of computers that could take over support functions for businesses. However, the real revolution started in the last 20 years when businesses were completely transformed due to the exponential growth of several variables that has been maintained from 1958 to date. Things that were impossible 20 or 30 years ago are now easy as a result of the computing power to do them.

IN PORTUGAL, THE PRIVATE SECTOR ALWAYS played a role in the provision of healthcare services in specific areas. The relationship between the public and private areas is of complementarity though also to some effect competitive; in fact, the Basic Law of 1990 envisaged a competitive relationship between both sectors. Traditionally, the private sector provides care in some of the most lucrative areas and where the public sector fails to provide full or timely coverage, as is the case of medical specialist appointments, elective surgery, and medical exams. In the last two decades, the provision of healthcare services by the private sector has shifted from small medical cabinets, geographically spread, and more abundant in urban areas to variable size, well-equipped, high-quality clinics, and small hospitals where medical specialists are concentrated and specialized, and medical exams are readily available. This happened alongside the increase in the percentage of the population covered by a voluntary health insurance, estimated to be 20% in 2014. There are great examples of the relationship between the private and public sectors in the provision of care, such as the dental voucher, where the government contracts with private providers for specific oral care screenings and treatments for vulnerable groups of the population, or the provision of specific services in community pharmacies that are privately owned and well spread throughout the country.

22 Portugal 2019 SPOTLIGHT FEATURE SPOTLIGHT FEATURE

Rogério Carapuça PRESIDENT, PORTUGUESE ASSOCIATION FOR THE DEVELOPMENT OF COMMUNICATIONS (APDC)

Manuel Heitor MINISTER OF SCIENCE, TECHNOLOGY & HIGHER EDUCATION

Marta Temido MINISTER OF HEALTH

FISCAL HEALTH CHECK

Having emerged from a debilitating crisis, the Portuguese economy, though still susceptible to externalities, is being shored up internally to grow at sustainable rates.

BACK IN APRIL OF 2018, PORTUGAL submitted its 2018 Stability Programme for the 2018-2022 period. The country remains subject to the preventive mechanism of the EU's Stability and Growth Pact (SGP). With this cautionary position, it aims to keep the economy on an even keel and meet the Medium-Term Budgetary Objective (MTO) of the European Commission (EC). MTOs, which function as a check on fiscal health, acknowledge a member country's need to ensure sustainable debt levels, giving governments sufficient leeway to adjust to prevailing conditions while setting a margin against breaking the bloc's fiscal rules.

Because of runaway public spending, budget deficits have long plagued the Iberian nation, which had a debt ratio of 129.9% of GDP in 2016. That year Lisbon undertook remedial efforts that by 2020 could meet EU stipulations, and a fiscal surplus of 0.7% is forecast for that year. The structural balance, forecast at 0.7% of GDP for 2018, is expected to have a surplus for 2020 and hit 0.2% in the parliamentary election year of 2019. In short, the government wants the political term to end with a bang, on virtually a zero deficit level. The public debt goal for 2018 is 122% of GDP (a downward revision of the government's original forecast of 123.5%) and 118% for 2019. The official forecast for public debt in 2022, the end of the forecast period, is 102% of GDP.

MEASURED EC APPRAISAL

The EC has cautiously recognized “fiscal improvement.” GDP grew 2.8% in 2017 to USD217.6 billion. The EC forecasts growth of 2.2%, 1.8%, and 1.7% for 2018, 2019, and 2020, respectively. Yet the Stability Programme sets real GDP growth at 2.3% per year for 20182020, with a slight dip to 2.1% in 2022. Its take on the 2018 Stability Programme, which it issued in May, observed that in 2017, Portugal had seen an improvement in its structural balance of 0.9% of GDP, in compliance with the MTO. However, in cautionary tones it noted that the pace of growth in government spending, net of discretionary revenue measures and one-offs, had overshot, resulting in a negative deviation of 0.5% of GDP in the base fiscal position. In general terms, the EC sees the potential for deviation from set targets in both 2018 and 2019.

TRANSMITTING THE RIGHT SIGNALS

On November 29, 2018 Portugal revealed plans to repay its outstanding debt to the IMF in 2018, having begun repayments in 2015. Post-crisis, it had secured a financial rescue package from a troika including the Fund and the EU. Of the EUR78-billion package, EUR26.3 billion was from the IMF. According to the Portuguese Treasury and Debt Management Agency (IGCP), as of the end of October, EUR4.7 billion was outstanding, some 17%. The sooner the debt is repaid, the sooner Portugal frees itself of its Post-Program Monitoring status, a solid indicator for would-be investors and capital markets. Meanwhile, its public debt maturity profile remains key to shaping international perceptions.

Meanwhile, the deceleration in GDP reflects a loss of momentum in exports and investment, though the job market has continued to improve, with unemployment falling from 7.9% in December 2017 to 6.6% in September 2018, driven by broad-based employment growth.

RECOMMENDATIONS

That being said, banks should still ensure buffers against potential economic headwinds in light of recent rising demand for property and higher prices. Continuing ongoing efforts to strengthen the legal and institutional framework for debt enforcement and insolvency are necessary to support a more productive allocation of economic resources. Keeping labor markets flexible is important for Portugal’s ability to process adverse shocks, and maintaining competitiveness requires wage growth consistent with developments in productivity.

EXTERNAL BALANCE WORSENS

The external balance has deteriorated somewhat since the start of the year, influenced by weaker-than-expected exports of goods and a slowdown in tourism. Oil prices have also adversely affected terms of trade and thus the nominal trade balance. Imports are set to continue outperforming exports, resulting in some deterioration in the current account balance. Larger dividend payments to foreign shareholders put additional pressure on the current account, while the projected increase in absorption of EU structural funds and lower interest costs for domestic borrowers are having a positive impact. ✖

Economy 23

FOCUS Stability program

António Saravia PRESIDENT, CONFEDERATION

VOICE OF experience

How do you define CIP’s role in the context of business in Portugal?

The global economy is going through a series of rapid changes, demanding that organizations adapt to new challenges in the business context. CIP interprets these challenges and finds the best solutions, thus acting as a beacon that guides companies. CIP must focus on finding the answers to these new challenges. We represent 140,000 Portuguese companies and are the largest employers’ confederation among 70 associations. The diversity of the companies we represent provides us with a deep knowledge of the day-to-day activities and needs of our companies, replicating best practices that have worked for other companies in need.

What are Portugal’s current competitive factors, and what needs to be done to improve them?

We have an excellent communication network, great highways, and young people who are highly qualified. However, we still need to improve the qualification of our human resources, because it is through knowledge that differentiation among countries will prevail. Incorporating knowledge to create innovation will allow us to differentiate ourselves in the highly competitive global economy. In addition, more structural reforms are needed. The wealth of the country does not support the dimension of the state we currently have. Portugal must improve the qualification of its human resources and free the state from activities that consume a great deal of the wealth generated in order to transfer the surplus to the economy. We must stimulate the improvement of competitiveness factors by reforming tax and reducing bureaucracy so it is less stifling. If the state manages these points, then companies will be able to perform their roles far better.

What is the importance of strategy in terms of Portugal’s efforts to change its industrial profile theme?

The country cannot be based on services alone; we must also have an industrial base. The weight

of industry in the economy must increase, and this can be reached with a well-defined strategy. Portugal must bet on sectors such as aeronautics or the maritime sector. The country must also look to traditional industries such as footwear and textiles, where we have excellent examples. Portugal must define its strategy and business model to diversify and improve. The country must know what it wants and what it can do; we have excellent examples in the metallurgical and metal-mechanics industry, where we are increasing sales and exports. There are great successes in the aeronautics industry, where Embraer and other companies have come to Portugal. Then, there is the automotive industry, where we are attracting companies through clusters that provide components to the sector. Portugal must define industries and, within these, aggregate and develop strategies, promote reforms, and fiscally encourage possible ways to invest. We must attract productive investment and bring more national and foreign investments that will bet on internal production, substituting imports for internal manufacturing, and developing more industry than what we currently have. The weight of industry in Portugal’s GDP has fallen in the last 20 years, and we must return industry to the center of our economy.

What are the priorities for CIP in the coming year?

We will continue to demand that the government look at our internal politics and our role in Europe and the world. We want the government to promote reforms that must be undertaken. We need fiscal stability, and our fiscal policy must be more predictable. We cannot change the fiscal framework every year; there must be an attractive fiscal policy toward investment. It must allow predictability for investors and ensure that taxes will not change in the next five or eight years. The reform of the state must allow the economy to set itself free and entice stimulus so that it can benefit. We need a more efficient legal system with less bureaucracy in order to benefit economic agents. ✖

24 Portugal 2019 INTERVIEW

BIO António Saraiva has been President of CIP since 2011. He was formerly its president between 2010 and 2011. He has been the director of Metalúrgica Luso-Italiana since 1989 and an administrator since 1992. He acquired the company from the Mello Group in 1996 and is currently chairman of the board of directors.

Part of CIP’s focus is advising the government on reforms that stimulate the economy and attract greater investment.

OF PORTUGUESE INDUSTRIES (CIP)

TBY ANALYTICS PORTUGAL 2019

111 interviews were conducted for The Business Year: Portugal 2019 Analytics.

BUSINESS CONFIDENCE INDEX

How confident are you about the outlook for business in Portugal this year (1-5)?

ADVANTAGES & CHALLENGES

What are the most commonly mentioned advantages and challenges of doing business in Portugal?

ADVANTAGES

Dynamic and innovative market

Considerable potential for export

Advanced levels of digitization

High quality of life

Educated young generation

Bilingual population

Developing tourism sector

CHALLENGES

Need for structural reform

Long bureaucratic procedures

Ageing demography

High taxation and unfair labor laws for foreign investors

Limited supply market

Shortage of human resources

SECTORS

AVERAGE

3.3 3.2 ECONOMY 3.5 GREEN ECONOMY 4 FINANCE 3 ENERGY 3.2 INDUSTRY 3.5 IT & TELECOMS 3 AGRICULTURE 3 TRANSPORT 3.2 TOURISM 3 HEALTH & EDUCATION 3 CONSTRUCTION & REAL ESTATE

TO WATCH

RATING

IT & TELECOMS

What are Portugal’s top-5 advantages as an IT hub?

With which sectors are you collaborating?

Top-5 technologies in which interviewees are investing:

Sub-sectoral breakdown of our interviewees in the industry sector:

52% Textiles 20% Automotive 12% Aerospace 16% Other 46% Various (fashion, sport, tactical, etc.) Fashion 39% 15% Home

INDUSTRY

HIGHLIGHTED

of interviewees Good pilot country Growing market & dynamic sector Technological education Human resources IT infrastructure 53% 29% 29% 24% 18% What

IT sector? HIGHLIGHTED

50% of interviewees Lack of funding Supplydemand gap for human resources Talent retention 71% 12% 12% HIGHLIGHTED

interviewees

BY 60.71%

are the current limitations of the country’s

BY

BY 64.29% of

AI & machine learning Internet of Things Network infrastructure (fiber & 5G) Cloud Blockchain 78% 50% 28% 28% 17% Other

Robotics • Virtual reality • 3D printing • Data storage

mentioned technologies:

HIGHLIGHTED

of interviewees Finance Tourism Industry Energy Agriculture Green economy Transport Health & education 53 % 42 % 26 % 26 % 21 % 11 % 5 % 5 %

BY 67.86%

Overall, do you find your location in Europe advantageous or disadvantageous? HIGHLIGHTED BY 68%

What are the competitive advantages of Portugal’s industrial sector?

HIGHLIGHTED BY 80% of interviewees

EDUCATION

Who are your key partners, and which partnerships are you looking to expand?

Most mentioned advantages:

87% Proximitytomarkets

27% Knowledgeexchange

13% Prioritizationonsustainability

50% 45% Innovation and R&D Emphasis on sustainability Value-added products

Interviewees who mentioned the importance of internationalization for Portugal’s education institutions

73% YES

27% N/A

What does internationalization include?

1 Diverse student populations

2 Increased offerings in English

3 Utilization of foreign curricula, such as IB

4 Partnerships and programs with other universities and education institutions

Which countries are you partnering and/or looking to partner with?

What investments are you making to improve the university?

95%

of interviewees Advantageous 88% Disadvantageous 12%

Portugal International

HIGHLIGHTED BY 90.91% of interviewees

54.55% 36.36% 36.36% 27.27% 27.27% 9.09% EUROPE • UK • Poland • Austria NORTH AMERICA • US PORTUGUESE-SPEAKING COUNTRIES • Angola • Brazil Cape Verde • Mozambique LATIN AMERICA AFRICA • Tanzania • Gambia ASIA • China • India INDUSTRY Private sector Other educational institutions 45.45% 18.18% 27.27% 81.83%

Workforce

72.73% Digitalization & advanced technologies 36.36% R&D 27.27% Renewable energy &

sustainability efforts 18.18% Infrastructure 18.18%

skill development

other

BREXIT

What will be the impact of Brexit on business in Portugal?

Many companies are worried about the negative impact Brexit will have on their business. We certainly heard of people leaving the UK before Brexit and that many more have left, especially in the last couple of months. These are individuals who are very apprehensive about Brexit and see Portugal as a good option for relocation.

Education sector interviewees with strong and/or developing relations with education institutions in the UK:

ENERGY & GREEN ECONOMY

Which energy sources, both conventional and renewable, have the most potential in Portugal?

HIGHLIGHTED BY 87.5% of interviewees

Which trends do you see developing in terms of energy and electrification?

HIGHLIGHTED BY 87.5% of interviewees

38%

N/A

Positive 62%

Chris Baton CEO, BRITISH PORTUGUESE CHAMBER OF COMMERCE

36% Yes 64% N/A

NATURAL GAS 25% SOLAR WIND 37.5% 37.5% HYDRO BIOMASS GEOTHERMAL 12.5% 12.5% 12.5%

Conventional Renewable

Updating technology Decentralizing the power sector Electrifying transport Developing energy storage 50% 37.5% 25% 25%

innovation-based ECONOMY

What are COTEC’s key objectives?

For us, one of the key aims is to generate open innovation and collaborative networks. COTEC is a network that brings companies together. We are not focused on any one sector or specific level of company development. From the outset, we looked to create synergies between SMEs and large companies as a key mechanism to promote economic growth. We now see a growing interest from larger companies to address the innovation problems they need to solve, and they believe interaction with SMEs with specific skills from other sectors may bring in additional expertise that can help. Working with the government also plays a major role, and Industry 4.0 is a great example of identifying innovation barriers to be overcome.

To what extent can a culture of innovation act as a catalyst for job creation, and what impact can it have on supporting SME development?

Our growth potential is in moving SMEs to different stages of scale and impact in terms of turnover or employment. From that perspective, we demonstrated a strong correlation between innovation and the ability to manage these processes with a proprietary maturity framework called Innovation Scoring. We also demonstrated the growth potential of SME companies. This would have a growth impact on the national economy of 0.5% of GDP. Innovative SMEs create more and better-paying jobs and play an important social role since they distribute more profit across society. This growth model supported by innovative SMEs is a sustainable one, both in terms of business growth and achieving quali-

ty employment. SMEs in the COTEC network are on average smaller and stuck in that trap between size, scale, and level of innovation. They have many opportunities to grow but simply do not have the resources or financial capital to address those opportunities.

What initiatives have been the most effective in achieving COTEC’s core objectives?

For example, Portugal’s aerospace cluster has been evolving for 100 years. During this time, a number of companies active in maintenance, transport, injection-molding, and metals have entered the market, and it has grown a great deal over the past decade. For this cluster of activities, Portugal is in an extremely selective club of aeronautic manufacturers. There are almost 200 companies in Portugal working in some way; however, this is just one example, and there are many more. We need to stimulate a cluster of activities in order to extract the growth potential because most are highly capital- and knowledge-intensive and able to provide quality employment. We can identify several clusters, including food, the agro and pulp and paper industry, tourism, and health as having excellent prospects for new growth and investment.

What image you would like the international investment community to have about Portuguese innovation?

In the last 25 years, we have been building an international case to have the appropriate talents and capabilities in different areas. We have well-positioned universities that are training researchers and professionals in management