19 minute read

Hard Data

UK market – no clear 2020 vision

The CEA’s market analyst, Paul Lyons, provides his insight into what is happening in and around the construction equipment market…

Advertisement

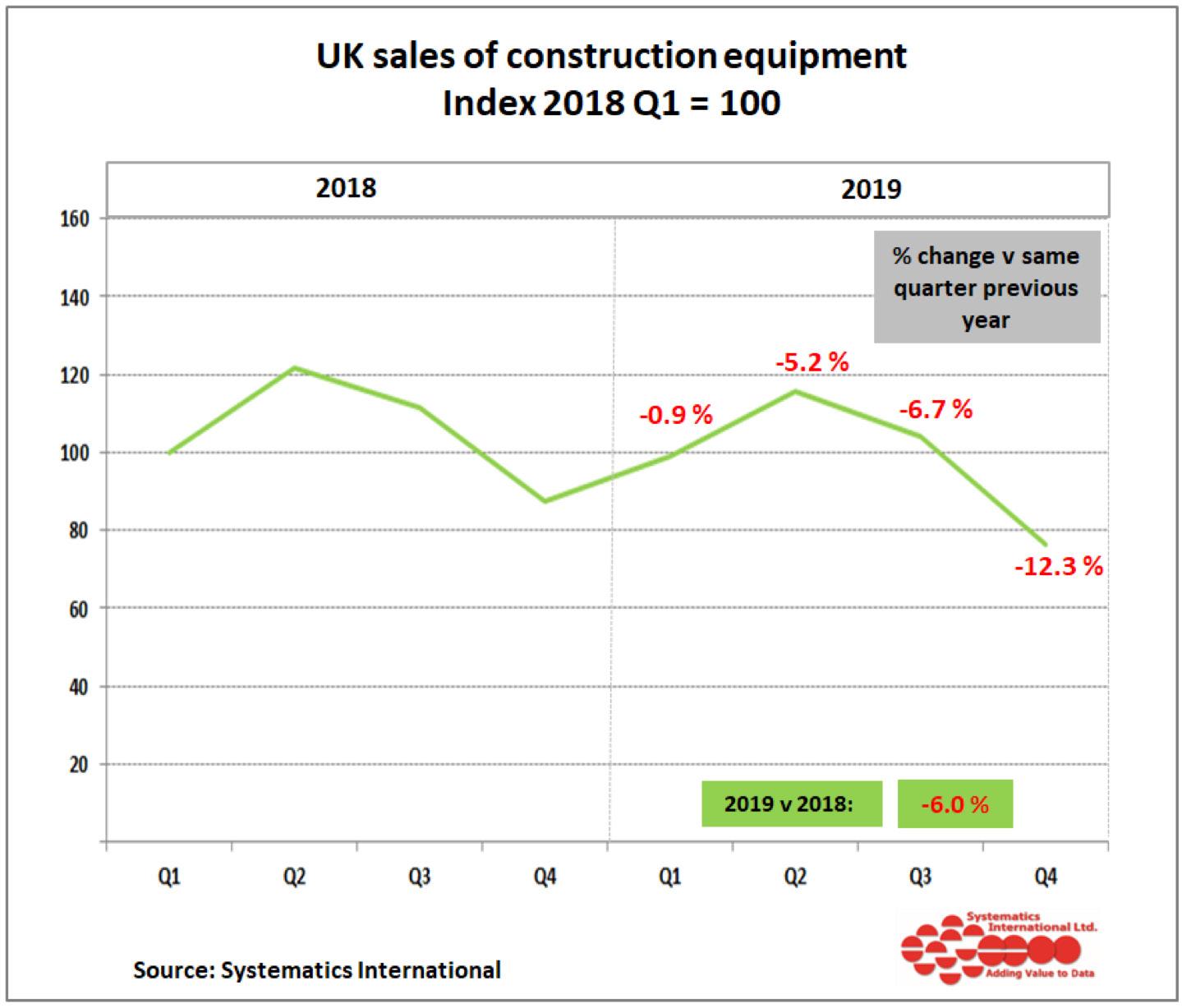

Construction equipment sales fell by 6% in 2019 Retail sales of construction and earthmoving equipment in the UK market fell by 12% in the last quarter of the year, compared with the same quarter in 2018. This continued the trend during 2019 of quarterly sales declining at increasing rates through the year compared with 2018. This significant fall in sales in the final quarter of the year resulted in sales for the whole of 2019 showing a 6% reduction on 2018 levels, reaching just over 32,000 units. A decline in sales in 2019 had been expected for some time, after reaching peak levels in 2018 following a number of years of growth. However, the downward path expected in 2019 was added to by the uncertainty caused by Brexit, and also uncertainty regarding the future of some major infrastructure projects, particularly HS2.

The graph below shows quarterly sales of equipment on an index basis from the construction equipment statistics exchange *, using Q1 2018 as 100. The fall in sales during 2019 was mainly driven by two of the most popular machine types, mini/midi excavators and

crawler excavators (over 10 tonnes), which showed reductions in sales of 11% and 4.5%, respectively. Strongest sales amongst the high volume equipment types has been experienced by telehandlers (to the construction industry), which showed a 7% increase in 2019. This was a result of very strong sales in the middle two quarters of the year. Analysis of sales by region in the UK market in 2019 showed a very distinctive pattern. Compared with 2018, growth in sales was focused in Scotland, Northern Ireland, Wales and the North East of England. In contrast, most other regions in the south and east of England recorded declining sales. This was particularly the case in London, recording close to a 25% decline in equipment sales compared with 2018.

Off-Highway Research will be publishing an updated forecast for equipment sales in the UK market in the coming months. The last forecast published in 2019, anticipated that sales would show a further fall in 2020, with a forecast of a 6% reduction. At this stage, it seems likely that recovery from Brexit/election uncertainty, and a clear outcome for the HS2 project review might not provide any improvement in the equipment market until the second half of the year.

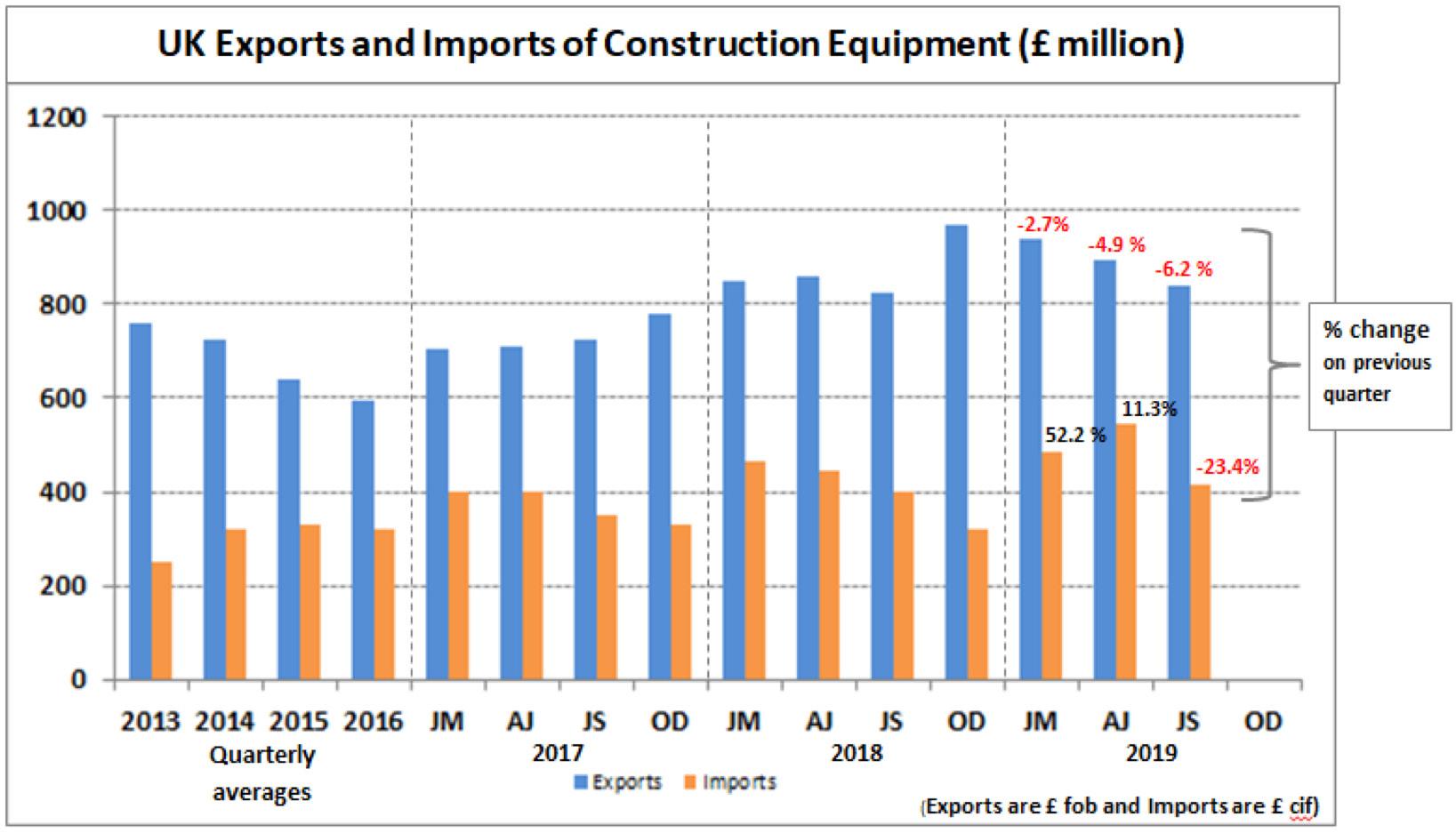

UK exports remained strong in 2019, but beginning to ease back UK exports of construction and earthmoving equipment showed a modest declining trend in the first three quarters of 2019, after peaking in the last quarter of 2018. Despite this, exports in the first nine months of the year were still 6% ahead of 2018 levels, during the same time period, at £2,678 million. A declining trend for exports is consistent with reports of demand falling in many of the major overseas markets last year, after peaking in 2018.

The USA remained the top destination for UK exports in the first three quarters of 2019, accounting for 29% of total exports at £767 million. This represented a 3% increase on 2018 levels, when share of exports to the

*The UK construction equipment statistics exchange is operated by Systematics International Ltd. This scheme is run in partnership with the CEA, and allows publication of quarterly bulletins on equipment sales in the UK market.

THE ONE LAS VEGAS SHOW YOU NEED TO SEE

NORTH AMERICA’S LARGEST CONSTRUCTION TRADE SHOW CONEXPOCONAGG.COM MARCH 10-14, 2020 | LAS VEGAS, USA

USA was 26%. Exports to EU28 countries have shown a 9% increase in the first nine months of 2019, compared with the same period in 2018, reaching £1,239 million. This took the share of overall exports to over 46.5% for EU28 counties, compared with 44.5% for the whole of 2018.

UK imports dip in Q3 after showing strong growth in the first half of 2019

Imports of equipment fell back in Q3, after being at their highest levels for at least six years in the first half of the year. At £1,444 million, imports in the first three quarters of the year were 10% above 2018 levels, during the same time period.

Japan remained the leading source of imports in the first nine months of 2019 at £295 million, accounting for 20% of total imports, a similar share to 2018. Imports from EU28 countries showed significant increases in the first three quarters of the year, reaching £939 million, and accounted for 65% of total imports. This was 3% higher than the share achieved in 2018. Germany remains the leading EU28 import source, and is second only to Japan as the leading country, and accounted for over 17% of total imports in the first nine months of the year. Construction orders showing a downward trend in 2019 The latest data from the Office for National Statistics (ONS) for new orders in the construction sector shows a 1.6% decline in the first three quarters of 2019, compared with the same period in 2018. Only the civil engineering sector showed an increase (+16.1%), with most other sectors showing a decline. In spite of this, construction output has been relatively stable in 2019, and showed modest growth. In the period from January to November 2019, output was 2.2% higher than the same eleven months in 2018. Within this, output for new work showed a 3.1% increase, while repair and maintenance work was only up 0.4%. Infrastructure (+6.0%) and housing (+5.7%) were the strongest sectors for new work.

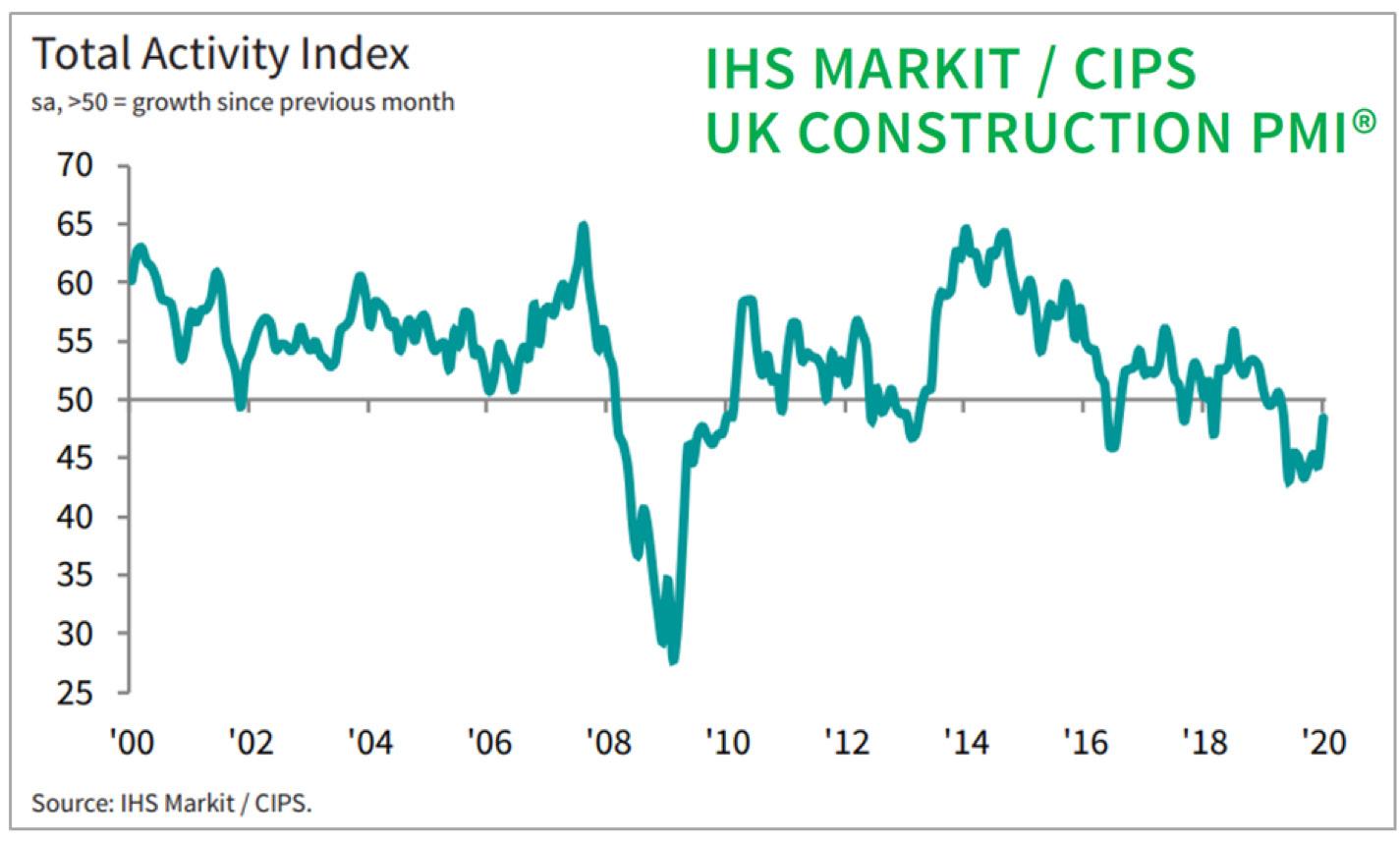

The latest UK construction Purchasing Managers Index (PMI) published by IHS Markit in February is shown below. This shows that the index in January recovered to 48.4, after reaching 44.4 in December. While the index remained below the 50.0 “no change” level, this was the best result for the survey for eight months, since May 2019. Respondents to the survey commented on how demand from clients was showing signs of improvement, after political uncertainty was receding. House building was the strongest performing sector in the survey, and civil engineering was the weakest in January. Looking

ahead, the survey suggested that construction companies are now the most optimistic about their growth prospects since April 2018. A number of firms noted that clients' willingness to spend had picked up after the general election, which should translate into rising workloads over the course of 2020.

Glenigan published their latest forecast for the UK construction market in December. This measures market activity in terms of the value of new project starts. The latest update shows that new project starts fared better than anticipated in 2019, showing a 1% increase on 2018 levels. This was a welcome stabilisation in demand after project starts had shown 8% declines for the two previous years. The latest forecast for 2020 is for further modest improvement in the market, and anticipates a 2% increase in project starts. The strongest sectors in 2020 are expected

to be private housing and civil engineering, with the latter being the strongest sector in 2019. Further growth in civil engineering activity is expected in 2020 as road rail and water investments gather momentum. Existing major infrastructure schemes are also forecast to lift activity, with the main uncertainty remaining over HS2, until the Government review is complete. Overall, weak economic growth is forecast to constrain construction activity in 2020 and 2021. Manufacturing activity in particular, is under pressure from weak domestic demand and uncertain export prospects until the Brexit agreement is completed. (www.glenigan.com). ■

Are you reaping the full benefits of CEA Membership? Obtain discounted rates for advertising in the next Construction Worx Email angela.spink@thecea.org to request your 2020 media pack.

T H E S P E C I A L I S T S I N G L O B A L C O N S T R U C T I O N E Q U I P M E N T RESEARCH

Off-Highway Research specialises in the research and analysis of international construction and agricultural equipment markets. Since 1981 clients have leveraged our reports, databases and expertise to understand global markets, identify trends & opportunities, analyse the competitive landscape and grow their businesses profitably.

With an emphasis on primary research and with five offices on three continents, we can provide unrivalled insights to clients anywhere in the world.

3897 Construction Worx Spring20 Advert.indd 1 16/01/2020 17:48:43 The CEA represents over 140 companies in the construction equipment industry... Recognised by Government, Valued by our Members

ARE YOU A MEMBER? If you are not already a member of the CEA and are interested in finding out more about the benefits of becoming a member, then contact us by email at info@thecea.org.uk

Growing Asian market

It may not be the first market to spring to mind in South East Asia, but the Philippines has seen good growth in equipment sales over the last three years. According to Off-Highway Research, commitments on infrastructure spending could see demand rise further… after a few bumps in the road.

The last two or three years has seen an expansion of the Filipino economy including long overdue infrastructure and construction investment. This has helped lift construction equipment sales.

Despite a slowdown in 2019 caused by delays in approving the country’s budget, an issue which was only resolved in mid-April, the appetite for equipment remains high, as does the realisation that the country requires an enormous amount of construction work if it is to maximise its economic growth potential.

The main beneficiary of this expansion has been the crawler excavator, which accounts for nearly 50 per cent of sales in unit terms. Major gains have also been registered by other equipment associated with infrastructure work in general and road building in particular, such as compaction equipment, crawler dozers, motor graders and wheeled loaders.

One of the most salient features of the last five years has been the trend towards the purchase of new machines in preference to used equipment imported from Japan. In the wheeled loader and mobile crane sectors, in particular, much of the growth in sales is the result of the influx of much cheaper new machines from China, coupled with the declining availability and rising prices of used Japanese equipment. Some tender contracts under the current government’s ‘Build, Build, Build’ investment plan also make the use of new machinery a pre-requisite.

The ongoing policy of funding a vast array of infrastructure projects would suggest a bright outlook for sales of construction equipment. Indeed, if the recent approach is enshrined in a law to ensure a minimum proportion of GDP is invested in infrastructure on an annual basis as planned, the industry could enjoy a period of sustained growth and stability. Another encouraging sign that the current administration has been successful in translating grand promises into action through its ‘Build, Build, Build’ mantra. That said, the political volatility that could yet undermine the recent good work never seems too distant. The delay in approving the budget for 2019, only resolved in mid-April this year, is evidence of how such disagreements can undermine market investment and confidence.

Further ahead, the Presidential elections scheduled for 2022 are likely to have an impact on investment certainty and therefore machinery sales.

CONSTRUCTION The construction market in The Philippines is experiencing a considerable boom. According to the Philippine Statistics Authority, average annual growth in the sector for the four years to 2017 was 9.6%. Impressive though this is, it was outdone by expansion in 2018 of the order of 15.9%. Overall, the value of the industry rose from an estimated $38.5 billion to $44.3 billion.

The main catalyst for this rapid expansion has been the increase in government infrastructure spending. This rose 49.7% in 2018, a clear manifestation of the ‘Build, Build, Build’ mantra of the Duterte administration. Through this scheme, the government intends to invest PHP 8 trillion (US$ 155 billion) in infrastructure up to 2022, the year of the next Presidential election.

In tandem with the government’s spending plans, the Construction Industry Authority of the Philippines (CIAP) has recently launched a 10-year road map, detailing investment plans of PHP 40 trillion (US$ 780 billion) from 2020.

CEA MEMBERSHIP LIST

A & Y Equipment Ltd www.aandygroup.com Adams Cundell Engineers Ltd (ACE Plant) www.aceplant.co.uk Advanté Ltd www.advante.co.uk Airboss Ltd www.airbosstyre.com Air-Seal Products Ltd www.air-sealproducts.com Amber Valley Developments LLP www.amber-valley.com AMI Group Ltd www.amigroup.co.uk Armcon Ltd www.armcon-online.com Ashtree Vision & Safety Ltd www.avsuk.co ATG Ltd www.atg-global.com ATP Industries Group Ltd www.atp-group.com AVID Technology Ltd www.avidtp.com BAV Crushers Ltd www.bavcrushers.co.uk Beckers Industrial Coatings Ltd www.beckers-group.com Becool Radiators / Gallay Ltd www.gallay.co.uk Bergstrom Europe Ltd www.bergstromeurope.com BKT Europe SRL www.bkt-tires.com Blackwood Engineering www.blackwoodengineering.co.uk Bobcat Company www.bobcat.com Bomag (GB) Ltd www.bomag.com Brendon Powerwashers www.powerwashers.co.uk Brigade Electronics Group Plc brigade-electronics.com British Steel Britishsteel.co.uk BSP International Foundations Ltd www.bsp-if.com Cab Glazing Services LLP www.cabglazing.com Cabcare Products Ltd www.cabcare.com Caepro Ltd www.caepro.co.uk Caldervale Group Ltd www.caldervalegroup.com CanTrack Global Ltd www.cantrack.com Caterpillar (UK) Ltd www.cat.com Charles & Dean Ltd www.charlesanddean.com CLM Construction Supplies Ltd www.clm-supplies.com CNH UK Ltd www.cnhindustrial.com Confi git Ltd confi git.com Con Mech Engineers Ltd www.conmecheng.com Cummins Engine Co Ltd www.cummins.com Darchem Engineering Ltd www.darchem.co.uk Dawson Construction Plant Ltd www.dcpuk.com Deutz AG – UK & Ireland www.deutzuk.co.uk DF Capital www.dfcapital.co.uk Digbits Ltd www.digbits.co.uk Doosan International UK Ltd www.doosanequipment.eu Echo Barrier Ltd www.echobarrier.com elobau UK Ltd www.elobau.com Eminox Ltd www.eminox.com Engcon Ltd www.engcon.com Enigma Telematics www.enigmatelematics.com Fablink UK Ltd www.fablink.co.uk Fozmula Ltd www.fozmula.com Friction Marketing Co Ltd www.frictionmarketing.co.uk FuelActive Ltd www.fuelactive.com Fuelwood Ltd www.fuelwood.co.uk G&M Radiator Manufacturing Co Ltd www.gm-radiator.com Gate7 Ltd www.gate7.co.uk Geith International Ltd www.geith.com Giant Crushing Ltd www.giantcrusher.com GKD Technik Ltd www.gkdtechnik.com Gomaco International Ltd www.gomaco.com Gordon Equipments Ltd (Durite) www.durite.co.uk Hewitt Robins International Ltd www.hewittrobins.com Hill Engineering Ltd www.hillattach.com Hitachi Construction Machinery (Europe) NV www.hcme.com Holmbury Ltd Holmbury.com Husco International Ltd www.huscointl.com Hydreco Hydraulics Ltd www.hydreco.com Hydrema (UK) Ltd www.hydrema.co.uk Hydrema Denmark A/S www.hydrema.com HYTORC Industrial Bolting Systems hytorc.com Hyundai Construction Equipment Europe UK www.hyundai.eu

"Recognised by Government, Valued by our Members" The CEA represents over 140 companies in the construction equipment industry...

James Fisher Prolec www.prolec.co.uk JCB Sales Ltd www.jcb.co.uk John Deere, Worldwide Construction and Forestry Division www.deere.com KAB Seating Ltd www.kabseating.com Kawasaki Precision Machinery (UK) Ltd www.kpm-eu.com Kay-Dee Engineering Plastics Ltd www.kaylan.co.uk KHL Group www.khl.com Knibb, Gormezano and Partners www.kgpauto.com Kocurek Excavators Ltd www.kocurek.com Komatsu UK Ltd www.komatsu.com Kubota UK Ltd www.kubota.co.uk Leica Geosystems Ltd www.leica-geosystems.co.uk Linde Hydraulics Ltd www.lindehydraulics.co.uk LiuGong Machinery Europe www.liugong-europe.com Manitou UK Ltd www.uk.manitou.com McCloskey International Ltd www.mccloskeyinternational.com Mecalac Construction Equipment UK Ltd www.mecalac.com Merlo UK Ltd www.merlo.co.uk Miller UK Ltd www.millergroundbreaking.com Molson Equipment Services Ltd www.molsongroup.co.uk Morris Site Machinery Ltd www.morrismachinery.co.uk MP Filtri UK Ltd www.mpfi ltri.co.uk National Fluid Power Centre Ltd www.nfpc.co.uk NC Engineering www.nc-engineering.com Nylacast Ltd www.nylacast.com/construction Off-Highway Research Ltd www.offhighway.co.uk OnGrade Ltd www.ongrade.com Parker Hannifi n - ECBU (Sweden) www.parker.com PEI-Genesis www.peigenesis.com Perkins Engine Co Ltd www.perkins.com Phoenix Engineering Co Ltd www.phoenixeng.co.uk Rayco-Wylie Systems www.raycowylie.com Red Dot Europe Ltd www.reddoteurope.com Red Rhino Crushers (UK) Ltd www.redrhinocrushers.com Ricardo plc www.ricardo.com Rima UK Ltd www.rima-uk.com Route One Publishing Ltd www.ropl.com RSP UK Suction Excavators Ltd www.rsp-uk.co.uk Rubbernek Fittings Ltd www.rubbernek.co.uk Sandhills East www.resaleweekly.com Sandvik Construction www.construction.sandvik.com Screen Services (NE) Ltd www.screenservices.co.uk Selwood Ltd www.selwood.co.uk SKM Asset Finance Ltd www.skmassetfi nance.co.uk SMT GB www.volvoce.com Southco Manufacturing Ltd www.southco.com Steelwrist UK Ltd www.agcon.co.uk Strickland MFG Ltd www.stricklanduk.com Syncron UK Ltd www.syncron.com Takeuchi MFG (UK) Ltd www.takeuchi-mfg.co.uk Tata Steel Europe Ltd www.tatasteeleurope.com Taylor Construction Plant www.tcp.eu.com Taylor’s Trailers Ltd www.taylors-trailers.com Technical Services (UK) Ltd www.technical-services.co.uk Telestack Ltd www.telestack.com TeletracNavman (UK) Ltd www.teletracnavman.com Terex Materials Processing www.terex.com/en/materials-processing/ Terex Trucks www.terextrucks.com Thwaites Ltd www.thwaitesdumpers.co.uk Topcon Technology Ltd www.topconpositioning.com Total UK Ltd – Lubricants Division www.total.co.uk TriMark Europe Ltd www.trimarkeu.com Veethree Technologies www.veethree.co.uk Webster Technologies Ltd www.websterequipment.com Webtec Products Ltd www.webtec.co.uk Weston Body Hardware www.westonbodyhardware.com Wightman Stewart Waterjet Ltd www.wightmanstewart.com Winget Ltd www.winget.co.uk WWL ALS Ltd www.abnormal-loads.com

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Sales Forecast Crawler dozers 4% Wheeled excavators 3%

Motor graders 6%

Ride-on compaction equipment 12% Others 9%

Wheeled loaders… Crawler excavators 48%

Contributed by Chris Sleight, managing director Off-Highway Research who generously make their reports and market information available to the CEA. Indeed, the CIAP is also pushing for legislation to enshrine the proportion of the country’s budget spent on infrastructure, both to underpin private investment plans and to prevent a hiatus as every new administration re-appraises previously announced projects, or swaps to its own pet schemes.

As is so often the case, the confidence engendered by government plans to invest in infrastructure has prompted strong growth from the private sector. In particular, residential and commercial projects have proliferated, and investment in educational facilities has also followed suit. In 2018 residential construction was the largest single component of construction activity, accounting for 33.3 % of investment.

Unsurprisingly, infrastructure investment came next, accounting for 21.5 %. If this is combined with the 15.6 % of investment made in the energy and utilities sector, the combined total under a broader definition of infrastructure would by 37.1 %. Commercial building accounted for 17.5 % of the total, with the remainder made up of institutional building work (7.0 %) and industrial construction (5.2 %).

It is also worth noting a shift away from the previous preference for funding schemes via the Public-Private Partnership (PPP) model. Instead, the Official Development Assistance (ODA) mechanism is now being more widely adopted, as a means to gain access to cheaper loans and overcome some of the delays reported in previous PPP schemes.

Within this shift, however, there has also been an acknowledgement of the importance of foreign direct investment by contractors. Accordingly, the proportion of project ownership available to foreign contractors has increased from 25 to 40%.

The recent peak in construction equipment sales was just over 7,500 units sold in 2018. Although there was a dip last year due to issues around approval of the national budget, sales stayed above 7,000 machines. Off-Highway Research forecasts that sales should rise above 8,000 machines this year, with further growth in 2021. ■ NEW REPORT Off-Highway Research’s 156-page report on the construction equipment industry in The Philippines is now available to buy from www.offhighway-store.com The study includes coverage of 14 equipment types and discusses the market size, market shares, distribution, machine population and models available in The Philippines, as well as providing five-year sales forecasts.

There is also a distributor profile section, covering the major participants in the industry, along with background information on the economy and its growth drivers.

All sections included detailed data tables and indepth analysis of trends. The report is in .pdf format, with all data tables provided in Excel format.

An update on Off-Highway Research’s best-selling 2014 study on The Philippines, this latest report is believed to be the most extensive and in-depth study ever produced on the country’s construction equipment industry. The Construction Equipment Industry in The Philippines can help OEMs, component suppliers and aftermarket participants alike identify growth opportunities for the profitable expansion of their businesses. Crawler excavators 48% Wheeled loaders… Ride-on compaction equipment 12% Motor graders 6% Crawler dozers 4% Wheeled excavators 3%

Others 9%

CEA and the Brexit transition period

Now Brexit has finally happened, the CEA acts as a conduit between Government departments, industry bodies and our members to facilitate consultation opportunities, ensuring the sector’s voice is heard.

CEA members report drowning under a sea of post Brexit consultation requests. The CEA is sifting out the essential information from the irrelevant, sending regular communications so you don’t miss important deadlines. The CEA’s Brexit Portal, https://www.thecea.org.uk/brexit/ hosts key information helping your business navigate the UK’s transition from the EU.

The CEA is represented on many consultation groups including: ● •Automotive Brexit & Trade Sector Panel (BEIS ((Department for Business, Energy and Industrial Strategy), DExEU and DIT). ● •BEIS Business Readiness Team (SED) ● •BEIS Automotive Unit regulatory and technical consultation ● •Department for International Trade (DIT) UK: US Free Trade Agreement consultation. ● •DIT Global Tariffs consultation ● •DIT Freeport consultation ● •Make UK Chief Executives’ Group ● •Manufacturing Alliance Brexit Task Force

2020 CABINET RESHUFFLE SEES NEW MINISTERS FOR THE CEA The CEA welcomes the appointment of the Rt Hon. Rishi Sunak MP as Chancellor or the Exchequer. It’s a case of local boy made good in that Rishi is the MP for the constituency of Richmond North Yorkshire which includes Northallerton, where the CEA’s head office is located. Rishi is known to several members of our team and we congratulate him on his meteoric rise to high office. We very much hope that he follows the government agenda in regards to the infrastructure plan.” Rob Oliver, Chief Executive.

The CEA’s sponsoring department in government is BEIS (Business Energy and Industrial Strategy) who see a new Secretary of State, Alok Sharma MP. Alok’s brief also includes heading up the COP 26 UN Climate Change Conference in November so he will certainly have very full portfolio. Alok should have some understanding of our sector having been the Prime Minister's Infrastructure Envoy to India and Minister of State for the Department for Communities and Local Government with responsibility for housing. Other roles were Minister of State for Employment and Secretary of State for International Development. We expect some positive ministerial engagement in the months to come.

UPDATE; US TRADE TARIFF MEASURES BOEING V AIRBUS The USA won a WTO ruling in October 2, 2019 when it was authorized to take countermeasures on $7.5 billion in goods after a victory in its unfair trade practices case against the European Union, France, Germany, Spain, and the United Kingdom.

Although the dispute was between aircraft manufacturers, some of the countermeasures were applied to certain types of construction equipment. In particular, tariffs on imports from the United Kingdom and Germany falling under the Harmonized Tariff Schedule of the United States (HTSUS) subheading 8429.52.50, “Self-propelled machinery with a 360 degree revolving superstructure, other than backhoes, shovels, clamshells and draglines” and subheading 8429.52.10, “Self-propelled backhoes, shovels, clamshells and draglines with a 360 degree revolving superstructure” The CEA has been making representations through its membership of CECE who issued a joint statement with AEM, the American trade association asking for the removal of tariffs on all listed equipment used in construction, mining and agriculture.

On 18 March 2020, the WTO have authorised an increase in tariffs on aircraft to 15%, but have not altered tariffs on construction equipment. The next scheduled tariff review is 180 days from 18 March. The EU will review increasing their countermeasure sanctions in June.

CEA members are asked to contact the DIT Trade disputes team with examples of how the tariffs are negatively impacting our trade. Especially important is evidence of how the tariffs are affecting our US counterparts which is thought to have a greater impact on the US negotiators. Send to tradedisputes@trade.gov.uk and copy in paul.lyons@thecea.org. ■