13 minute read

REGULATION... Why Bother?

We live in a world where each aspect of our daily lives seems to be subject to more and more regulations, more bureaucracy, more control. This is particularly true in the case of the financial world. When we open a bank account and we are required to produce documents proving who we say we are. When we pay money into that account, we may be required to show where the money comes from.

It is even more onerous for fmancial firms themselves. They must comply with a series of regulations concerning the way they do busi ness; they are required to make regular returns to the regulator and are subject to regulatory inspec tions of their premises. What is more they must pay for the "privi lege" of this. Often the cost is ulti mately bom by the consumer.

So why bother?

Financial transactions are based upon trust. Indeed trust is vital to the financial system as a whole. Trust that the money you place in the bank will be available to you when you need it. Trust that the insurance you take will pay out if the insured event occurs.Trust that the financial advice you get is suit able for your circumstances.

Without that trust the system breaks down. People keep their money under the mattress and the banks have nothing to lend. If peo ple do not trust the advice they get and so do notinvest in shares,com panies cannot raise capital and therefore have difficulty in getting the cash they need for expansion.

Trust was easier when you knew the provider. However we live in a global financial community,where consumerssimply cannotapply the personal trust test they once could. To even attempt to achieve the same result would now require an amount oftime and cost beyond the means of most people.

Regulation has now stepped in to provide a replacement. Regula-

Gibraltar's Financial Services Commissioner, Marcus Killick tion allows the consumer to use fi nancial firms they do not know per sonally because the regulator has tory requirements that the firm does so, and regulatory sanctions if it does not. In effect the regulator saves consumers money as it pro vides an economy ofscale in moni toring because it is cheaper for a single regulator to do it than for every consumer to do it for them selves.

Without regulation, consumers are faced with limited information; they have limited opportunitiesfor assessing quality and have limited chance of assessing the safety and soundness of the provider

Therefore without regulation to give consumers some independent assurance about the terms on which they will be doing business, the safety of money and other assets which they entrust to the financial firm, and the quality of advice re ceived,saving and investment may be discouraged, with damaging economic consequences. However,itmustbe emphasised that regulation does not provide a guarantee. It can help reduce risk.

Regulation allows the consumer to use financial firms they do not know personally because the regulator has done the checking for them done the checking for them. Trust in the firm itself is replaced with reliance upon the regulator.Instead of trusting that you will be told the risks of an investment, consumers rely upon the existence of regula- by vetting those who wish to sell financial ser\'ices and products and by setting rules of behaviour (such as requiring that the adviser as sesses the suitability of a product before recommending it to a cus tomer). However,there will always be risk,and regulation is an aid to, not a replacement for common sense. Regulation also performs other fimctions. For example, with some financial institutions, particularly banks,the collapse of one may lead to the collapse of others. Such sys temic risk cannot be analysed by in dividual consumers,indeed it often cannot be assessed by single regu lators. Rather the risk to which a multinational bank is exposed has to be looked at on a global level. This can only be achieved through international cooperation between the regulators in those jurisdictions where that bank is located.

Turning to the issue of customer identification. We need to make sure criminals cannot use our finan cial institutions to launder money or, worse, use them to facilitate the financing of terrorism, Part of the way we prevent this is by making sure a firm knows who its custom ers are and then makes sure the business they conduct with that customer is in line with what is ex pected and investigate when it is not.

Such an approach has proved, time and time again,to be an effec tive way of catching drug traffick ers and others. If we can use this method to help get drugs off our streets and to catch other criminals many would say it is worth the in convenience. Some compare it to the security checks at the airport, inconvenient, but acceptable be-

Gibraltar's leading suppliers ofcomputer & general stationery,office products&furniture.

Next day delivery of stock items, free furniture delivery (t assembfc^talogue order service cause of the protection it brings.

The issue is therefore not the need for regulation but its scale and application. It is too easy for some regulators,in an attempt to reduce risk to a minimum,to over regulate and stifle legitimate business. It is too easy for some consumers to let a regulatory structure replace their own common sense. It is too easy

Gibraltar Asset Management Limited

Member of the London Stock Exchange

Solutions for Private Clients

Solutions for Company Managers

Solutions for Accountants

Solutions for Solicitors

Solutions for Professional Intermediaries

• Equities •Fixed Interest •Traded Options

Ultimately effective regulation is . a partnership between regulator, consumer and the finance sector it self. The consumer must exercise common sense and report a concern as soon as they become aware of it.

; Thefinance sector must abide by the spirit as well as the letter of the regulations and deal with their cus tomer as they themselves would

The regulator must listen as well as regulate and make sure it does not fall in to the trap of regulation for regulations sake for a finance sector firm to apply regulations blindly without consid ering their intent. expect to be dealt with. The regula tor must listen as well as regulate and make sure it does not fall in to the trap of regulation for regulations sake. It must be prepared for, en courage and welcome constructive challenge.

Financial services regulation will not prevent all instances of crime or incompetence. It can, however, help in preventing the criminal or incompetentfrom rurming a finan cial institution or assist in their prompt detection.

One Irish Place POBox 166 Gibraltar

T; + 35075181 E: gam@gam.gi W: www.gam.gi

Authorised and Regulated by the Financial Services Commission

Member of the Gibraltar Association of Stockbrokers and Investment Managers

Member of the Association of Private Client Investment Managers and Stockbrokers

We offer a full range of Courier, Mali, and Freight Services in Gibraltar and on the Costa Del Sol

* UK Parcel Collection Service, offering 24/48 hour delivery. You can now order UK Collections Online

* Easimail - a cost effective alternative to Courier for non-urgent Documentation, Brochures, Samples etc..

* Worldwide Courier and Parcel Service

Budhrani & Co. Barristers-at-Law

General Legal Practice

INCLUDING company formation AND corporate services

Through such a partnership, all parties can benefit, without it all will suffer. V^UOHRANl

Suite 1 , 62 Main Street, Gibraltar. TEL:(350)73521 FAX:(350)79895 e-mail: budlaw@gibnynex-gi

* Mailboxes and Onforwarding

For our latest tariffs and Services Information, visit our website: www.offexspain.com

Qlbrattar-Tel;(9567)77176 Fex:47128

Spain •Tai; 952 599 254 Fax:952 599 245 agnail: infoQoffaxapain.eofn

MASBRO INSURANCE BROKERS

Wv ciffer full insurance with annual gteen cards on UK registered motorcars

SuiU:' 1A, 14J Main Strofl, PC) Box GlfiRAIJAR Tel: 7(-.4'i4 Fax: 7(i741

THE GIBRALTAR FINANCIAL SERVICES HANDBOOK IniiTfTiJUon tm Ihc Rixks otT-short* yJviinia^cs in Td\'.\umi. Utw. Biinkiny. Company Si Tnisi Formaiion, In^ur iiJKi:, Hnsincss, Properly and Finant iul .Services.

Coinrrehensivi' A-/ IndcK lor ilic visiung prt)fesMond) i liusiiiessnian atiJ die Jisccrnini: invesier.

Deuilcd jppendlees on relcvaniClihraliiirCovemnwni ivljlion

On sale JL htKikshops and newsagenls in Oihraliar ui II accountants

Wi>ildv.ide airmiol order service dl£25 steillng orctjuiv lent irom (il SH. TO Box 555. GibraJlar.

PAUL E. DODWELL fca

Chartered Accountant

Suite B, Ground Floor, Regal House Queensway, Gibraltar

Tel;(350)43808

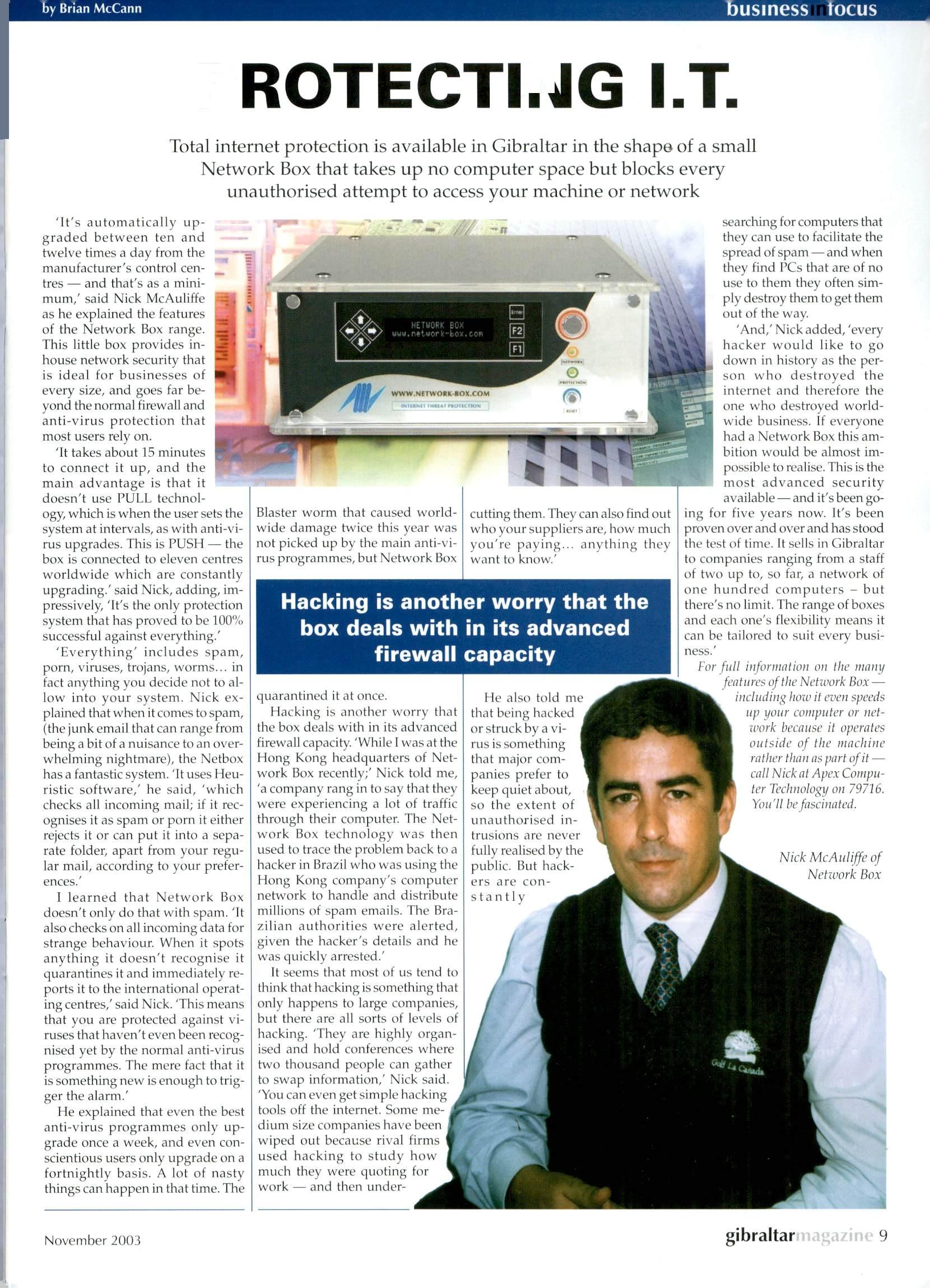

Total internet protection is available in Gibraltar in the shape of a small Network Box that takes up no computer space but blocks every unauthorised attempt to access your machine or network

'It's automatically up graded between ten and twelve times a day from the manufacturer's control cen tres — and that's as a mini mum/ said Nick McAuliffe as he explained the features of the Network Box range. This little box provides inhouse network security that is ideal for businesses of every size, and goes far be yond the normal firewall and anti-virus protection that most users rely on.

'It takes about 15 minutes to connect it up, and the main advantage is that it doesn't use PULL technol ogy,which is when the user sets the system at intervals, as with anti-vi rus upgrades. This is PUSH — the box is connected to eleven centres worldwide which are constantly upgrading.'said Nick,adding,im pressively,'It's the only protection system that has proved to be 100% successful against everything.'

'Everything' includes spam, porn, viruses, trojans, worms... in fact anything you decide not to al low into your system. Nick ex plained that when itcomes to spam, (the junk email that can range from being a bit of a nuisance to an over whelming nightmare), the Netbox has a fantastic system.'It uses Heu ristic software,' he said, 'which checks all incoming mail; if it rec ognises it as spam or porn it either rejects it or can put it into a sepa rate folder, apart from your regu lar mail, according to your prefer ences.'

I learned that Network Box doesn't only do that with spam.'It also checks on all incoming data for strange behaviour. When it spots anything it doesn't recognise it quarantines it and immediately re ports it to the international operat ing centres,'said Nick.'This means that you are protected against vi ruses that haven't even been recog nised yet by the normal anti-virus programmes. The mere fact that it is something new is enough to trig ger the alarm.'

He explained that even the best anti-virus programmes only up grade once a week, and even con scientious users only upgrade on a fortnightly basis. A lot of nasty things can happen in that time.The

Blaster worm that caused world wide damage twice this year was not picked up by the main anti-vi rus programmes,but Network Box cutting them.They can also find out who your suppliers are,how much you're paying... anything they want to know.'

Hacking is another worry that the box deals with in its advanced firewall capacity

quarantined it at once.

Hacking is another worry that the box deals with in its advanced firewall capacity.'While 1 was at the Hong Kong headquarters of Net work Box recently;' Nick told me, 'a company rang in to say that they were experiencing a lot of traffic through their computer. The Net work Box technology was then used to trace the problem back to a hacker in Brazil who was using the Hong Kong company's computer network to handle and distribute millions of spam emails. TTie Bra zilian authorities were alerted, given the hacker's details and he was quickly arrested.'

It seems that most of us tend to think that hacking is something that only happens to large companies, but there are all sorts of levels of hacking. 'They are highly organ ised and hold conferences where two thousand people can gather to swap information,' Nick said. 'You can even getsimple hacking tools off the internet. Some me dium size companies have been wiped out because rival firms used hacking to study how much they were quoting for work — and then under-

He also told me that being hacked or struck by a vi rus is something that major com panies prefer to keep quiet about, so the extent of unauthorised in trusions are never fully realised by the public. But hack ers are con stantly searching for computers that they can use to facilitate the spread ofspam—and when they find PCs that are of no use to them they often sim ply destroy them to get them out of the way.

'And,'Nick added,'every hacker would like to go down in history as the per son who destroyed the internet and therefore the one who destroyed world wide business. If everyone had a Network Box this am bition would be almost im possible to realise. This is the most advanced security available—and it's been go ing for five years now. It's been proven over and over and hasstood the test of time. It sells in Gibraltar to companies ranging from a staff of two up to, so far, a network of one hundred computers - but there's no limit. The range of boxes and each one's flexibility means it can be tailored to suit every busi ness.'

For full infonnatum on the mani/ features ofthe Network Box including how it even speeds up pour computer or net work because it operates outside of the machine rather than as part ofit call Nick at Apex Compu ter Technology on 79716. Y(n('II befascinated.

Though the global banking industry had a bumpy ride last year - and there are strong indications that in Britain, particularly, the massive accumulation of personal and household debt promises more problems for lenders in the medium term - Gibraltar has weathered the storm better than many other off-shore(and smaller on-shore)jurisdictions.

And while there have been a handful of local job losses in the sector in the wake of the with drawal of two banks from the Gi braltar market,banking on the Rock continues to grow.

In practical terms, the past year hasseen the level offunds managed by banks on behalf of customers fall, however, the numbers of cli ents using the Rock's banks to man age their investments has risen by nearly 15 per cent. As at the end of March, 2003, their combined de posit base stood at £2.6 billion, ac cording to the recently published

«

•

•

•

« annual report of the Financial Serv ices Commission.

"Our bankers continue to be verv positive about the immediate, me- as the "Costas" increasingly be come the Florida of Europe, more opportunities are created for ser\'icing an affluent customer base," he dium and long term future for busi ness development," the FSC's head of banking supervision, David Parody, writes in the report."And, adds.

Currently 18 banks operate on the Rock. Ten of these are incorpo rated in Gibraltar and are licemsed bv the Commission. There are also seven branches of EEA-authorised banks as well as a branch of a nonEEA authorised bank from jersey, licensed by the Commission. "Gibraltar continues to be an at tractive location from which to con duct banking business," Parody says. "Its ability to tap freely into the entire European market through passporting is probably the biggest attraction for any poten tial newcomer, offering as it does competitive advantages over cither financial centres outside the Euro pean Union. An established and proven regulatory system which is open and transparent adds to the jurisdiction's attractiveness."

Gibraltar's regulatory mecha nisms drew plaudits from the IMF in a report released last year and Parody refers to two specific recom mendations it made in relation to banking supervision - both of which were accepted by the FSC. One has already been acted on by the Commission, while the second (related to a loan classification re gime)will be put in place when ac counting standards in this area are finalised. The FSC "sees no risk to financial stability in the interim, un til the regime is put in place," Parody points out.

"Perhaps the greatest change to the supervisory processes for banks during the year was the move away from a largely desk-based super\'ision to a risk-based approach which includes on-site work by the bank ing division," he con tinues. "This is part of the on-going de velopment within the Commission as it seeks to make better use of its resources through its impact on banking and other services-industry opera tions," Collins writes.

"Gibraltar's ability to match UK standards of insurance regulation was recognised officially by the United Kingdom on 11th June 1997. This, in turn, placed Gibraltar on a par with all other EU jurisdictions. Consequently, insurance institu tions regulated by the Commission are permitted under EU law to 'passport'throughout the EU with out seeking a separate licence in each jurisdiction to do so.

"Undoubtedly the industry's ef forts — combined with Gibraltar's ties to Britain, the marketing work of the Government of Gibraltar and the stable political environmenthave played a significant role in this growth," he adds."Equally the ex istence of a skilled infrastructure of insurance managers, audit firms and the legal profession has con tributed to this growth. Two of the three leading global insurance manage ment companies now have a presence on the Rock.

Barristers-at-Law & Commissionersfor Oaths

Commercial Department

Property

Mortgages

Banking (Onshore and Offshore)

Business Law

Offshore Department

Trust

Company Formation

Ship Registration

Financial Services

Spanish Conveyancing by identifying areas of risk within individual banks • and then mitigating these. The Commission sees this as being of real benefit to the^ Industry and is grateful for the banks' co-operation.

"Work on rolling out the risk framework across the entire bank ing sector will continue during 2003."

Similar optimism is reflected in the comments by Chris Collins the FSC's Head of hjsurance Supervi sion He reports that insurance "has become the fastest growing sector of Gibraltar's financial services" and in the past year ten new li cences were issued, bringing to 31 the number ofcompanies operating on the Rock by the end of March this year.

Of the ten, six were granted to 'open market' insurers and four to captive insurers. The captives in cluded Gibraltar's first Protected Cell Companv (FCC), established under legislation introduced in 2001 and which at the end of 2002 had six cells doing insurance busi ness. "Such growth not only pro vides additional employment but contributes a valuable multiplier effect to the general economy

In the continuing global debate amongst regulators ' and the industry over the r adequacy of solvency marSn gins,no one view or method of assessment enjoys consen sus, Collins adds. "While Gi braltar complies with EU legisla tion and UK practice,the Commis sion also tries to assess the risks in herent in any business plans pre sented to it. Accordingly, where the business being written warrants it — and taking into account the li censee's other risk exposures as well as the economic and business environment at the time — the Commission will always impose higher requirements than the EU minimum.

"Insurance company solvency needs to be monitored not only in retrospect but also going forward. Consequently the Division intends to introduce annual budget and business plan monitoring on a for ward-looking basis for the year 2004 in respect of all'open market' insurers. This will allow the divi sion to carry out limited stress test ing of different market and eco nomic scenarios and,together with on-site inspections, will enhance the Division's overall capabilities."

Litigation Department

Admiralty

General Commercial Litigation

Insolvency and Bankruptcy

International Disputes and Arbitration

J^ttias

Barristcrs-at-Lcm 6c Commissionersfor Oaths Suite 5, 39 Irish Town PO Box 466, Gibraltar

Tel:(350) 72150

Fax:(350) 74686

E-mail: attlev(®gibraltar.gi

Web address: wwu'.attiaslevy.gi