4 minute read

LEEDS & HOLBECK — ONE YEAR ON

Leeds & Holbeck Building Society, which opened its first branch outside Britain in Gibraltar last November is on track to announce a successful first year's trading on the Rock,and to celebrate has expanded its lending operation to include Spain's Costa del Sol,according to Sally Butcher, manger of the local branch. Up to now the Gibraltar arm of the society has concentrated on providing loans on Gibraltar properties.

However, at the beginning of October it launched three types of locally-available loans for anyone looking to purchase either a home to live in or a holiday home in the popular Spanish coastal region. They are also available for anyone looking to re-mortgage.TTie loans are available to EU(including UK) nationals permanently residing in Spain,Gibraltar or the UK and to UK expatriates resident in Gibral tar or Spain.

The loans include a five-year fixed rale deal at 5.75 per cent and a three-year tracker based on the UK base rate plus0.95 per cent(at the current Bank of England rate of 3.5 per cent this would be an attractive 4.45per cent)with up to £1,000 cash-back. There is also an Espafia Variable Rate loan, which tracks the Bank of England Base Rate plus 2.00 per cent(currently equivalent to 5.50 per cent) and has unlimited capital repay ments.

Highlights of the five-year fixed rate deal include a maxi mum loan value of 66 per cent and a tapered early repayment charge of six months interest in the first year reducing to reduc ing to four months in year five. There are no extended "lock ins" and there is an application fee of £199.

As well as a 1 per cent cash-

e/gt

and tapered early repayment charges.

The Espaha Variable Rate deal provides for unlimited capital re payments — on which there is no early repayment charge at any time. Maximum loan value is capped at66 per cent and here, too,there is no application fee.

back up to £1,000, there is no ap plication fee for first tracker deal which also provides for a maxi mum loan value of 66 per cent

"This is an exciting develop ment for the Society and a great way to celebrate the first birth day of the branch on the Rock," Butcher said. "The range has something for everyone and will suit UK residents or ex-pats who are thinking of moving or want ing a second home on the Costa del Sol. The venture follows our rapid growth into the savings and investment market in Spain and Gibraltar and is a great com mitment to the future of Gibral tar."

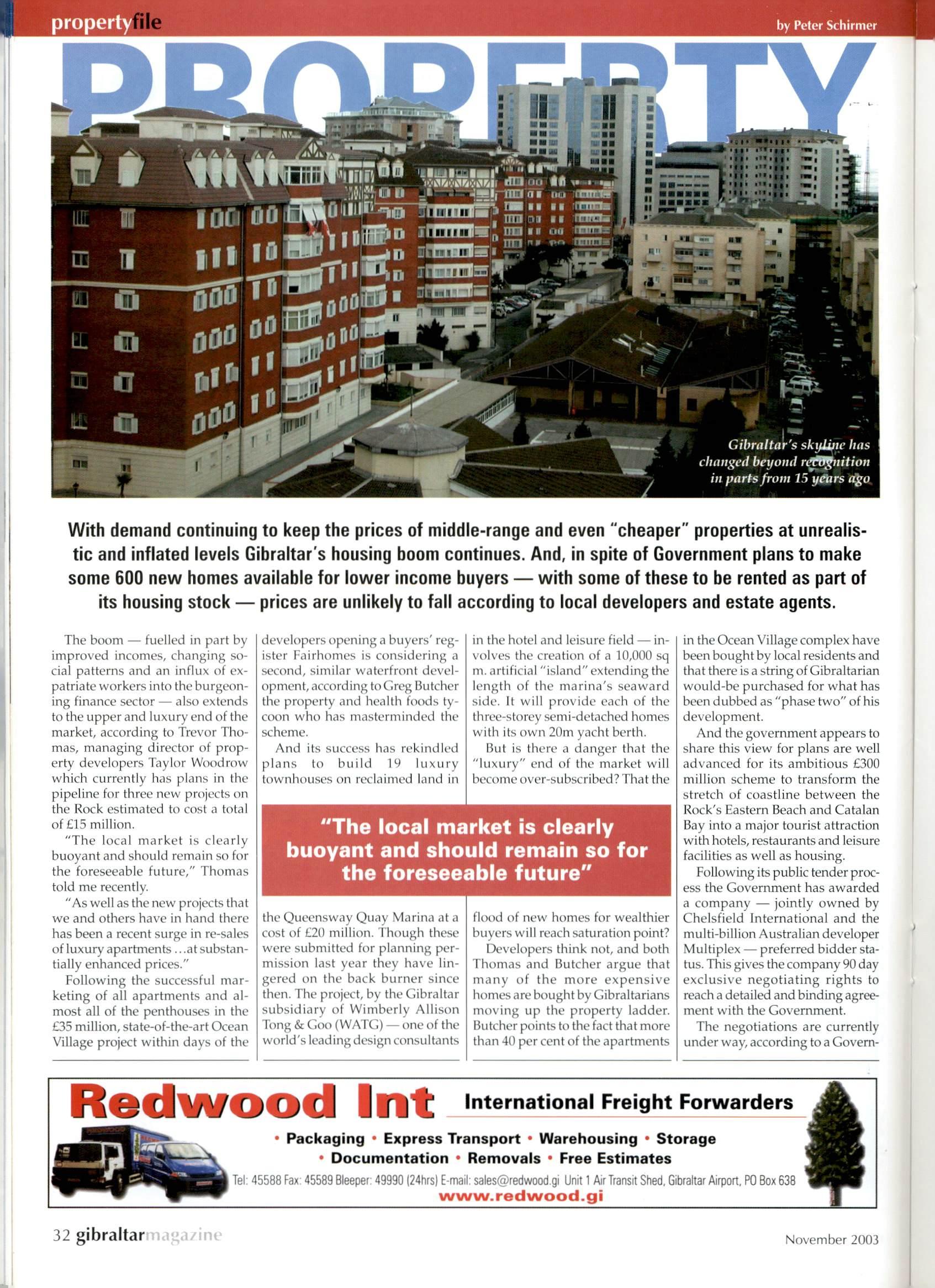

Gibraltar's skifUfte has changed beyond ri^B^iition in partsfrom 15 y^brs(&o

With demand continuing to keep the prices of middle-range and even "cheaper" properties at unrealis tic and inflated levels Gibraltar's housing boom continues. And, in spite of Government plans to make some 600 new homes available for lower income buyers — with some of these to be rented as part of its housing stock — prices are unlikely to fall according to local developers and estate agents.

The boom — fuelled in part by improved incomes, changing so cial patterns and an influx of ex patriate workers into the burgeon ing finance sector — also extends to the upper and luxury end of the market, according to Trevor Tho mas, managing director of prop erty developers Taylor Woodrow which currently has plans in the pipeline for three new projects on the Rock estimated to cost a total of £15 million.

"The local market is clearly buoyant and should remain so for the foreseeable future," Thomas told me recently.

"As well as the new projects that we and others have in hand there has been a recent surge in re-sales ofluxury apartments...at substan tially enhanced prices."

Following the successful mar keting of all apartments and al most all of the penthouses in the £35 million,state-of-the-art Ocean Village project within days of the developers opening a buyers' reg ister Fairhomes is considering a second, similar waterfront devel opment,according to Greg Butcher the property and health foods ty coon who has masterminded the scheme.

And its success has rekindled plans to build 19 luxury townhouses on reclaimed land in in the hotel and leisure field — in volves the creation of a 10,000 sq m.artificial "island"extending the length of the marina's seaward side. It will provide each of the three-storey semi-detached homes with its own 20m yacht berth.

But is there a danger that the "luxury" end of the market will become over-subscribed? That the in the Ocean Village complex have been bought by local residents and that there is a string of Gibraltarian would-be purchased for what has been dubbed as"phase two"of his development. the Queensway Quay Marina at a cost of £20 million. Though these ' were submitted for planning per mission last year they have lin gered on the back burner since then. The project, by the Gibraltar subsidiary of Wimberly Allison Tong & Goo(WATG)— one of the world's leading design consultants flood of new homes for wealthier buyers will reach saturation point?

And the government appears to share this view for plans are well advanced for its ambitious £300 million scheme to transform the stretch of coastline between the Rock's Eastern Beach and Catalan Bay into a major tourist attraction with hotels,restaurants and leisure facilities as well as housing.

Developers think not, and both Thomas and Butcher argue that many of the more expensive homes are bought by Gibraltarians moving up the property ladder. Butcher points to the fact that more than 40 per cent of the apartments

Following its public tender proc ess the Government has awarded a company — jointly owned by Chelsfield International and the multi-billion Australian developer Multiplex — preferred bidder sta tus.This gives the company 90day exclusive negotiating rights to reach a detailed and binding agree ment with the Government.

The negotiations are currently under way,according to a Govern-