10 minute read

Geoff Shoji and Lisa Bridal

Meet Geoff Shoji

At the Green Mortgage Team, we are kicking off the new year in a big way by welcoming mortgage underwriting expert, Geoff Shoji to our team as our new Underwriting Manager.

Advertisement

Our General Manager, Max Jurock sat down with Geoff to learn a little more about him and his experience in the industry.

Max: Hi Geoff! Let me get started by saying welcome to the team!

Geoff: I am very excited to be part of this amazing team, and I look forward to working with each and every team member at DLC Homeline Mortgages - The Green Mortgage Team, as well as, our lending partners and our new one existing customers to achieve all of our goals for 2021!

Max: How many years have you been in the industry and what does that experience bring to the team?

Geoff: I have been a registered Mortgage Professional since 2007. Over the past 14 years, I have worked in both the banking and broker channel sides of the business. Having this experience has helped me develop a wellrounded perspective of the mortgage and financing industry, as well as, helped develop solid relationships with all industry partners.

Max: What are some of the roles you have held over the past 14 years and how will that experience benefit the Green Mortgage Team and our clients?

Geoff: I have held senior underwriting and leadership positions with some of the top mortgage brokerages in Canada. Over the last 14 years, I have built solid relationships with industry partners and have developed exceptional experience with lender guidelines and policies. I am considered an expert in underwriting conventional, alternative and private residential mortgages. I love what I do and find that helping people enter one of their biggest investments of home ownership to be most rewarding.

Max: When you are not busy being an expert in the field, what keeps you busy?

Geoff: [Laughter] Well, when I am not busy working with the talented underwriters and account managers at the Green Mortgage Team, I enjoy spending my free time at the ice rink or soccer pitch, either playing or cheering on my two lovely daughters. I also enjoy spending quality time with my wife and good friends over a nice dinner and some tasty beverages. I look forward to returning to these activities when the pandemic is over!

Celebrating Lisa Bridal

The year of 2020 was certainly full of ups and downs. However, there was one consistently shining star among our staff and that was our fantastic documents manager, Lisa Bridal. Lisa joined the Green Mortgage Team halfway through 2020 and has been an invaluable part of our team ever since.

Near the end of last year, “in an effort to celebrate the unsung heroes of the industry”, Newton Connectivity Systems partnered with I Love Mortgage Brokering to nominate Canada’s Top Mortgage Assistant.

Over 150 mortgage assistants were nominated and while there were countless deserving candidates, ultimately the team at Newton went through the submissions and had to make the tough decision to select three standout nominees. We are so proud to share that Lisa was

nominated as one of the Top 3 Mortgage Assistants in Canada!

Max: Thank you for taking the time out of your very busy schedule for me. I know you have lots to do! You joined our team last year in the middle of a global pandemic – how has your first year been working here, especially under the unique circumstances?

Lisa: It has been amazing! I have a lot of great mentors within our team. As the owner, Kyle is the most supportive manager. He wants me to be a part of everything and gives me the guidance and tools to succeed. My team, I love them! I can reach out to literally anyone and they will respond quickly and offer help in any way they can. My position gives me the opportunity to have a positive impact in helping clients with their mortgages and making a difference in their lives. Joining the Green Mortgage Team and family has been a game changer in my career.

Max: Could you tell us more about the recognition you received at the end of 2020 and what being named a Top 3 Mortgage Assistant in Canada means to you?

Canada was an amazing honour for me! I was pleased and very grateful to be nominated by my fellow co-workers and previous co-workers within the industry. I strive to be the best that I can be every day. I love helping our clients – building relationships is the foundation of a successful business. I understand how challenging it can be to provide the required documents and I do my best to help ease the pressure off our clients. I have to say, we do have some of the most amazing clients ever!

Max: When you are not busy being one of the best mortgage assistants in the country for our team and clients, what keeps you busy?

Lisa: Well... with the current pandemic, having fun with friends and family has been challenging. I do enjoy camping, hiking and playing golf. I am a loyal Canucks fan and I am looking forward to this interesting hockey season.

Chief Economist, Dominion Lending Centres

Sherry is an award-winning authority on finance and economics with over 30 years of bringing economic insights and clarity to Canadians.

2020 Was a Blockbuster Year for Housing

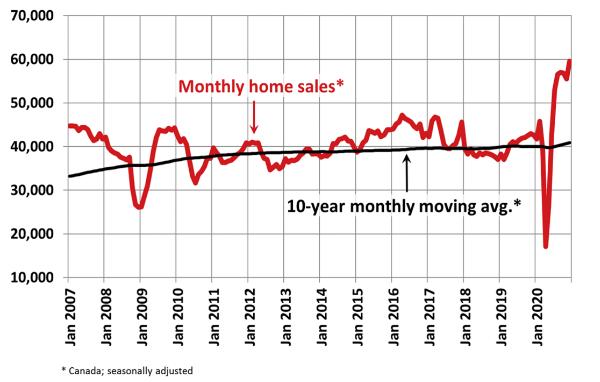

Despite the fears leading into the pandemic last Spring, 2020 marked a record number of home resales as new listings lagged and prices climbed. December housing data released by the Canadian Real Estate Association (CREA) January shows national home sales surged 7.2% month-over-month (m-o-m) at a time of the year when housing is normally slow. The chart below shows that resales were impressively above their 10-year average. The seasonally adjusted activity was running at an annualized 714,516-unit pace in December 2020 – the first time on record that monthly sales (at seasonally adjusted annual rates) have ever topped the 700,000 mark. It was a new record for December by a margin of more than 12,000 transactions. For the sixth straight month, sales activity was up in almost all Canadian housing markets compared to the same month in 2019. The increase in national sales activity from November to December was driven by gains of more than 20% in the Greater Toronto Area (GTA) and Greater Vancouver.

On a year-over-year basis (y-o-y), activity rocketed upward by 47.2% as interest rates hit record lows, housing needs changed owing to the pandemic, and supply was insufficient to meet demand. The housing boom occurred despite the fall in population growth, reflecting the dearth of new immigration. The yearly change in population growth in Canada nosedived in 2020 after climbing powerfully in the prior four years.

Despite this headwind, for 2020 as a whole, 551,392 homes traded hands over Canadian MLS® Systems – a new annual record. This is an increase of 12.6% from 2019 and stood 2.3% above the previous record set in 2016.

New Listings

“The stat to watch in 2021 will be new listings, particularly in the spring – how many existing owners will put their homes up for sale?” said Shaun Cathcart, CREA’s Senior Economist. “We already have record-setting sales, but we know demand is much stronger than those numbers suggest because we see can see it impacting prices. On New Year’s Day, there were fewer than

100,000 residential listings on all Canadian MLS® Systems, the lowest ever based on records going

back three decades. Compare that to five years ago, when there was a quarter of a million listings available for sale. So we have record-high demand and recordlow supply to start the year. How that plays out in the sales and price data will depend on how many homes become available to buy in the months ahead. Ideally, we’d like for households to be able to find and acquire the homes that best suit their needs and for housing to remain affordable, but the fact is we’re facing a major supply problem in 2021.”

The number of newly listed homes climbed by 3.4% in December, led by more new listings in the GTA and B.C. Lower Mainland, the same parts of Canada that saw the biggest sales gains in December.

With sales up by more than new supply in December, the national sales-to-new listings ratio tightened to 77.4% – among the highest levels on record for the measure. The long-term average for the national sales-to-new listings ratio is 54.2%.

Based on a comparison of sales-to-new listings ratio with long-term averages, only about 30% of all local markets were in balanced market territory in December, measured as being within one standard deviation of their long-term average. The other 70% of markets were above long-term norms, in many cases well above.

There were just 2.1 months of inventory on a national basis at the end of December 2020 – the lowest reading on record for this measure. At the local market level, 29 Ontario markets were under one month of inventory at the end of December.

Home Prices

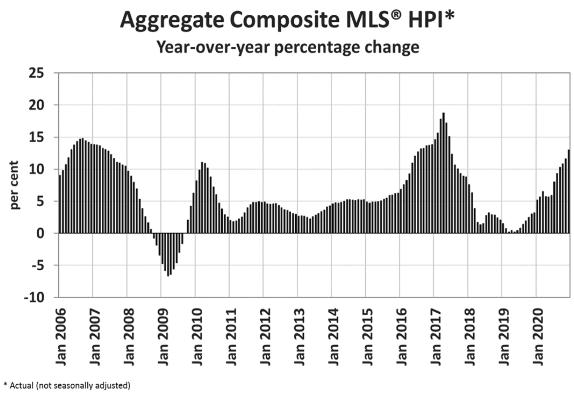

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose by 1.5% m-o-m in December 2020. Of the 40 markets now tracked by the index, only one was down between November and December.

The non-seasonally adjusted Aggregate Composite MLS® HPI was up 13% on a y-o-y basis in December – the biggest gain since June 2017 (see chart). Home price activity largely reflected the desire of home purchasers to move away from city centres to a greener, less-expensive suburbs and exurbs now that telecommuting appears to be a sustainable option, at least part-time.

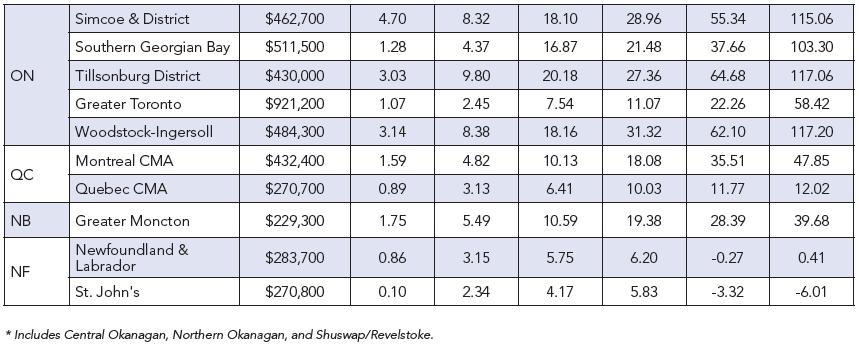

The largest y-o-y gains – above 30% – were recorded in Quinte & District, Simcoe & District, Woodstock-Ingersoll and the Lakelands region of the Ontario cottage country (see table on the next page for details).

Y-o-y price increases in the 25-30% range were seen in Bancroft and Area, Grey Bruce Owen Sound, Kawartha Lakes, North Bay, Northumberland Hills and Tillsonburg District.

This was followed by y-o-y price gains in the range of 20-25% in Barrie, Hamilton, Niagara, Brantford, Cambridge, Huron Perth, Kitchener-Waterloo, London & St. Thomas, Southern Georgian Bay and Ottawa.

Prices were up in the 15-20% range compared to last December in Oakville-Milton, Peterborough and the Kawarthas, Montreal and Greater Moncton.

Meanwhile, y-o-y price gains were in the 10-15% range in the GTA and Mississauga, Quebec City, and the 5-10% range across B.C., and in Regina, Saskatoon, Winnipeg and St. John’s NL.

Alberta still lagged owing to the still-negative oil market scene, where home prices were up only 1.5% and 2.7% in Calgary and Edmonton, respectively.

The MLS® HPI provides the best way to gauge price trends because averages are strongly distorted by changes in sales activity mix from one month to the next.

The actual (not seasonally adjusted) national average home price was a record $607,280 in December 2020, up 17.1% from the same month last year.

Housing strength is largely attributable to record-low mortgage rates and strong demand for more spacious accommodation by households that have maintained their income level during the pandemic. The hardest-hit households are low-wage earners in the accommodation, food services, non-essential retail and tourism-related sectors. These are the folks that can least afford it and typically are not homeowners.

We end 2020 with the national average home price up 17.1% — a dramatic surge rather than the 9-18% decline forecast by CMHC last March. Moreover, 2021 is likely to be another strong year for housing. It would not surprise me if annual sales reached a new high in 2021, especially in the first half of the year. There will, however, be cooling signs as the year progresses and especially into 2022. Firstly, supply constraints are a major factor as new listings remain low relative to demand. As well, the pandemic-induced changes in housing needs will have a waning effect over time. As vaccine injections rise across the country and we return to a new normal, interest rates will creep up moderately. This along with higher home prices will slow the pace of activity as affordability erodes.

There will be mitigating factors in 2022: the number of new immigrants is slated to rise to roughly 500,000 that year and demand for short-term Airbnb rentals will rise sharply as tourism revives.