Bought To You By themoonmag.com

Halving mania is about to hit its peak frenzy as the countdown to the halving event ticks away, now standing at a mere 12 days from the release of this edition of Moon Mag As miners prepare for the impending reduction in block rewards, the question looms large: will this pivotal moment catalyse significant shifts in the cryptocurrency market?

Amidst the anticipation and uncertainty, it's crucial for investors to assess their positions and strategies. Hence, we delve into the timely article titled "SHOULD I SELL MY BAGS?" This insightful piece (written by me) explores the nuanced considerations surrounding selling decisions in the lead-up to and aftermath of the halving, offering valuable insights to navigate this volatile period.

But that's not all - this edition of Moon Mag offers much more to satiate your crypto appetite.

Learn how to track whales, gaining invaluable insights into the movements of influential market players. Delve into the psychology of trading like a whale, honing your strategies to align with theirs.

Additionally, explore the world of launchpads, discovering new opportunities to participate in promising projects. With a mag packed full of content awaiting your perusal, Josh and I are thrilled to present this month's edition of Moon Mag

We hope you find it as enjoyable and informative as we do Happy reading!

Lisa xx

di

E

t orial A note from Lisa

It's meme coin mania at the moment in the Market, and while the Moon Mag loves to focus on crypto with utility, that's not to say that meme coins don't have their place! It's very easy to be selective when picking and choosing your focus in crypto, but it's the opposite way of thinking that often leads to great opportunities. We address this idea further in our two whale articles in this issue, where you can learn how to both track whales and think like a whale when trading crypto.

We are also at a very pivotal part of the Market where Bitcoin has reached its all-time high and is deciding where to go next....up, down or sideways! One of the most common questions at this time is what to do with our crypto bags. Do we hodl or sell? Luckily, our resident trading expert, Lisa, is here to help us figure out what to do in this situation.

Overall, we have a super interesting issue this month, designed to help you make the most of the crypto market. Do get in touch and let us know what you love about the Moon Mag. Do you want to see more gems? More education articles? Or do you love it just the way it is!? Thanks for reading, and enjoy!

A note from Josh

A note from Josh

SUMMARY TRADERS PERSPECTIVE Should I Sell My Bags? 9 Diving Into Crypto Launchpads 16 How To Find & Track Profitable Whales 30

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. Think & Trade Like A Crypto Whale 46 Using Liquid Restaking Effectively 52 Jupiter $JUP 66

SPONSORS

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

CONTRIBUTORS

Daniel

Daniel has been a blockchain technologyevangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies MDC writer since 2018, currently writer for CryptoTrendencia.

Chrom

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades Been working as a DAO contributor, start-up advisor & research leader Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

BUY Lisa N Edwards’ Best Selling NEW Book OUT NOW!

written by Lisa N. Edwards

Should I Sell My Bags?

PERSPECTIVE

TRADERS

Let’s Look at your Trading Strategies and potential Tax Considerations.

At this point in the market, we need to access our long-term goals and move into the BULL RUN. Trading can be exhilarating, giving us a shot of adrenaline more than a Red Bull drink can offer, but when the market turns red, the negativity creeps in, and so does the stress of losing all those hard-earned profits.

We need to look at long-term or short-term strategies that offer opportunities for profit and growth. However, in times like these, we often face the critical decision of selling our trades. This decision hinges on various factors, including our trading strategies, long-term and short-term goals, and the oftenoverlooked aspect of tax implications.

Understanding Different Trading Strategies

Before diving into whether to sell your trades, it's essential to understand the different trading strategies that guide your investment decisions. Here are a few common strategies:

▪ Day Trading: Day traders aim to capitalise on short-term market fluctuations, typically holding positions for a few hours or even minutes. Their primary goal is to profit from intraday price movements.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

▪ Swing Trading: Swing traders hold positions for a few days to weeks, aiming to capture short- to medium-term gains. They analyse technical indicators and market trends to enter and exit trades at opportune moments.

▪ Long-Term Investing: Long-term investors take a more passive approach, focusing on the fundamentals of companies or assets. They aim to hold investments for years or even decades, banking on the potential for substantial growth over time.

Considering Long-Term and Short-Term Goals

The decision to sell your trades should align with your overarching financial goals, whether they're short-term or long-term. Here's how different goals might influence your selling decisions:

1. Short-Term Goals: To generate quick profits or meet immediate financial needs, consider selling trades more frequently, especially if they've reached your target price or if market conditions indicate a downturn.

2. Long-Term Goals: Selling trades might occur less frequently for investors (HODLers) with a long-term outlook. Instead, you may opt to hold onto investments through market fluctuations, allowing them to compound over time and potentially achieve significant gains.

Factoring in Tax Implications

Taxes play a crucial role in determining when to sell your trades and how much of your profits you get to keep. Here are a few key considerations:

1. Short-Term vs. Long-Term Capital Gains: In many jurisdictions, the tax rate on short-term capital gains (profits from assets held for one year or less) is higher than that on long-term capital gains (profits from assets held for more than one year). Consider the tax implications of holding onto trades for different periods before making selling decisions. This can also come down to your job title or hobbies you list on your tax return. If you are classed as a trader in your everyday work or your main hobby is trading, this will also alter how tax is calculated.

2. Offsetting Gains with Losses: If you have losing trades in your portfolio, selling them at a loss can help offset taxes on your gains. This strategy, known as taxloss harvesting, can reduce your overall tax burden. This strategy becomes particularly valuable when certain assets may underperform or become obsolete during bear markets. In such scenarios, selling these "dead coins" or underperforming assets frees up capital and allows for tax-loss harvesting. Moreover, tax-loss harvesting from bear markets offers an opportunity to rebalance portfolios and reallocate resources into more promising assets. It's a proactive approach to managing investments during market downturns, potentially mitigating losses and positioning oneself for future growth opportunities. This is why sometimes it is better to cut a losing trade, especially when you have factored in your overall goal.

3. Tax-Efficient Trading: Some trading strategies are inherently more tax-efficient than others. For example, long-term investing typically incurs fewer taxes than frequent trading due to lower tax rates on long-term gains. When trading becomes your profession or a significant hobby, the tax implications can become more complex and substantial. Here's a breakdown of key considerations:

▪ Tax Classification: The tax treatment of trading income depends on whether it's classified as capital gains or business income. Traders who engage in frequent buying and selling with the intention of making a profit may be classified as traders in securities by tax authorities, leading to different tax treatment than investors.

▪ Business Income vs. Capital Gains: If your trading activity is considered a business, profits are typically taxed as ordinary income rather than capital gains. This means you're subject to your regular income tax rate, potentially resulting in higher taxes compared to the lower rates for long-term capital gains.

▪ Mark-to-Market Accounting: Some jurisdictions allow traders to use mark-to-market accounting, where they're required to report gains and losses at the end of each tax year based on the market value of their positions. This can simplify tax reporting and may allow for deductions on trading expenses.

▪ Deductions and Expenses: Traders may be eligible to deduct certain expenses related to their trading activities, such as platform fees, data subscriptions, research materials, and home office expenses. These deductions help offset trading income and reduce taxable liability. YOUR, GSIC LISATBOT TTMBOT, could all be valued TAX DEDUCTIONS! You can find your subscription receipts for your claims in YOUR ACCOUNT in the GSIC Menu.

▪ Estimated Taxes: Unlike traditional employees who have taxes withheld from their wages, traders are generally responsible for making estimated tax payments throughout the year. Failure to pay estimated taxes on time can result in penalties and interest charges.

▪ Wash Sale Rules: Traders need to be mindful of wash sale rules, which disallow the deduction of losses from the sale of securities if substantially identical securities are purchased within a short period before or after the sale. Violating these rules can impact your tax liability.

▪ State and Local Taxes: Trading-related tax implications can vary significantly depending on your jurisdiction's tax laws. Some states or countries may have different tax rates or rules regarding trading income, so it's essential to understand the specific regulations in your area.

▪ Record-Keeping: Keeping detailed records of your trades, including dates, purchase prices, sale prices, and expenses, is crucial for accurate tax reporting. Good record-keeping ensures compliance with tax laws and helps maximise deductions and errors. Using a tax calculation like https://cryptotaxcalculator.io/ or https://www.cointracker.io/

Conclusion

In summary, trading as a profession or hobby introduces a range of tax considerations that can significantly impact your financial outcomes. Understanding these implications, consulting with tax professionals, and maintaining meticulous records are essential for managing your tax obligations effectively and optimising profits.

Deciding whether to sell your trades is a nuanced process that requires careful consideration of your trading strategy, financial goals, and tax implications. While short-term traders may prioritise locking in profits and reacting to market movements, long-term investors often benefit from a patient approach that allows investments to grow over time. This is why I say you have 80% of your crypto locked into a long-term portfolio and only 20% actively traded. This will need rebalancing from time to time as your trading bags potentially grow.

Regardless of your trading style, factoring in the tax consequences of selling trades is essential. By understanding how taxes impact your profits and implementing tax-efficient strategies, you can maximise your returns and achieve your financial objectives more effectively. Ultimately, the decision to sell should be guided by a thorough assessment of your individual circumstances and goals.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The Top 5 Crypto Launchpads

Discover the best launchpad platforms with MoonMag’s comprehensive review to find your next crypto project.

written by Chris

Crypto launchpads are platforms that help Web3 projects raise capital while offering investors early access to promising new tokens. Think of them as a bridge between exciting projects and a community eager to support them.

These are the different types of launchpads:

▪ Initial Coin Offering (ICOs)

▪ Initial DEX Offering (IDOs)

▪ Initial NFT Offering (INOs)

▪ Initial Game Offering (IGOs)

▪ Initial Exchange Offering (IEOs)

In this article, we'll dive into the different types of launchpads, their benefits, potential drawbacks, and how to choose the right one for you. The highlight is near the end, as we take a closer look at the top 5 launchpads in crypto right now.

What is a Crypto Launchpad?

Think of a launchpad as a marketplace for exciting new projects. It's where their promising ideas meet a community of investors hungry to back the next big thing. These platforms usually offer a win-win scenario for everyone involved.

What's in it for Projects?

▪ Funding: Launchpads help projects secure the money they need to fuel their vision and mission.

▪ Community Building: Getting in front of passionate early adopters can be a game-changer, creating a loyal following right out of the gate.

▪ Affordability: Launches can be expensive. Launchpads offer a more budget-friendly option compared to traditional fundraising routes.

What’s in it for Investors?

▪ Early Opportunity: Participants get the chance to invest in tokens before they hit significant exchanges, potentially leading to some serious returns.

▪ Democratisation: Launchpads often try to make things fairer for the average investor, aiming to curb the dominance of big-money players.

Of course, it's important to remember that launchpads often carefully vet projects (and potential investors!) to ensure quality and security.

Who should use these Launchpads?

Truth be told, anyone can use them, but for conciseness:

▪ Web3 Projects: Launchpads offer a lifeline if you're building the next big Web3 project. They can help secure that crucial early funding, build buzz, and connect you with a supportive community of enthusiasts excited about your vision.

▪ Crypto Investors: Seasoned investors know that getting in on the ground floor of a promising project can lead to significant gains. Launchpads offer that opportunity, providing early access to tokens with colossal potential.

To top it all off, most major launchpads do their due diligence in assessing tokenomics, whitepaper, the reliability of the project, and so on. While we recommend ALWAYS doing your due diligence and research yourself, it's good to have everything in one place.

How to Use a Launchpad?

While the exact process can vary between platforms, here are some basic steps to follow:

1. Find Your Launchpad: Do some research and choose a launchpad that aligns with your interests and has a good reputation. (We’ll provide our top 5 further below)

2. Set Up Your Account: Most launchpads will require you to create an account by connecting a crypto wallet or using your email.

3. Get Verified: KYC checks are standard practice for security and transparency.

4. Load Up Your Wallet: Make sure you have enough of the required currency (often USDT or USDC) to participate in upcoming token sales.

5. Find Your Project: Explore the launchpad's offerings. Look for projects that excite you and fit your investment strategy. Be sure to do your research!

6. Get on the List: Many launchpads use whitelists or lottery systems to determine who gets to purchase tokens. Sign up early for the projects that interest you.

Types of Crypto Launchpads

Let's explore the different types of launchpads because picking the right one matters!

Initial Coin Offering (ICO) launchpads

ICOs are the OG of crypto fundraising. With an ICO, investors buy a project's newly minted utility token directly. Think of it as getting super early access in hopes the project takes off and the token's value skyrockets. ICOs are known for their simplicity, but they've also gained a reputation for scams and regulatory issues, so tread carefully!

Pros:

▪ Quick and easy for projects to launch

▪ Potential for enormous returns for investors

Cons:

▪ Lack of security or strong vetting

▪ History of fraudulent projects

▪ Grey regulations over crypto ICOs

Initial Exchange Offering (IEO) launchpads

IEOs attempt to address the trust issues of ICOs by having a centralised exchange (like Binance) act as a middleman. The exchange vets the project and handles the token sale. This adds a layer of legitimacy but comes at a cost for projects. Think of listing fees and giving the exchange a cut of the tokens.

Pros:

▪ Backing of a reputable exchange

▪ Increased security for investors

Cons:

▪ High cost for projects to list

▪ Centralised nature goes against some crypto ideals

Initial DEX Offering (IDO) launchpads

IDOs can be particularly appealing to those DeFi natives. Projects list their tokens directly on a decentralised exchange (DEX). This approach means no single entity controls the process, and investors often have immediate access to trade the new tokens. IDOs are all about transparency and fairness!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Pros:

▪ Quick liquidity for projects

▪ Democratised access for investors

▪ Avoids centralised control

Cons:

▪ Investors need to be savvy in assessing projects themselves

▪ Prices can be highly volatile

Initial NFT Offering (INO) launchpads

Got a thing for NFTs? INO launchpads are your jam. Instead of buying a project's token, you can buy NFTs that represent in-game items, exclusive artwork, or even a stake in the project itself. It's a way to combine different investing strategies, especially if you are an NFT enthusiast.

Pros:

▪ Unique assets that can have real utility

▪ Potential for appreciation in NFT value

▪ Creates a sense of ownership for investors

Cons:

▪ NFT markets can be unpredictable

▪ Even harder to assess project quality than standard tokens

Initial Game Offering (IGO) launchpads

If you are a gamer, then this is for you! IGO launchpads cater specifically to blockchain-based game projects. You can get early access to in-game NFTs (characters, weapons, land, etc.), boosting the game's development. Think of IGOs as fueling a community of passionate players who also have a financial stake in the game's success. While this type has yet to become that popular, we might see more adoption as the GameFI narrative grows.

Pros:

▪ Taps into a highly engaged audience

▪ A fun way to support game development

▪ Potential for valuable in-game assets

Cons:

▪ Game projects can be high-risk

▪ Success hinges on the game itself being a hit

Factors to Consider –

Choosing a Launchpad

Picking a suitable launchpad is essential, so take into account the following considerations:

Security and Reliability

Safety first! Look for launchpads with strict security measures like encryption, multifactor authentication, and proper KYC procedures. A reputable launchpad should also have a solid track record and a team you can trust.

Project Selection

Does the launchpad carefully vet the projects it promotes? Check their history and see if past projects have delivered on their promises. Ideally, they should be selective, focusing on truly innovative ideas with real potential.

Token Distribution

How are tokens allocated to investors? Fair methods like lotteries or ‘’first-come-firstserved’’ mechanisms help to level the playing field. Red flags go up if the launchpad seems to favour large investors or insiders.

Lockup Periods

A longer lockup period (during which tokens can't be immediately sold) is a good sign for new project tokens. It shows a commitment to the long haul and can deter early sell-offs that destabilise the price.

Liquidity and Listings

Can you easily buy and sell the Launchpad tokens? This is key! Additionally, a platform with a history of getting tokens listed on major exchanges is a bonus, as it adds credibility and opens up a wider market for the projects they support.

Benefits of Crypto Launchpads

You are all aware that launchpads offer exciting opportunities for Web3 projects and potential investors. But what are the actual benefits?

▪ Community Power: Launchpads excel at creating buzz around new projects and attracting a dedicated community of early supporters. This can be invaluable for projects, offering feedback, connections, and support from day one.

▪ Get in Early: For investors, it's the chance to get your hands on tokens of promising projects before they hit the big exchanges. This could lead to huge returns down the line if the project thrives.

▪ Increased Trust: Reputable launchpads carefully vet the projects they list. While not foolproof, this helps filter out scams and gives investors more peace of mind.

▪ Accessibility: Unlike traditional fundraising, launchpads often have minimal barriers to entry, making participation more accessible for the average investor.

Drawbacks of Crypto Launchpads

It's equally important to be aware of the potential downsides too:

▪ High Risk: Even with the best intentions, early-stage projects carry inherent risks. Price volatility, lack of regulation, and, yes, even the occasional scam are realities of the crypto space.

▪ Not All Are Equal: While top-tier launchpads prioritise quality projects, some may be less selective. It's always wise to do your own research on both the project and the launchpad itself.

▪ Tiered Systems: Some launchpads use allocation tiers based on how many of their tokens you hold. This can create imbalances and leave smaller investors with less access.

▪ Redemption Times: There can sometimes be delays before tokens purchased on a launchpad become tradable on major exchanges. This temporary lack of liquidity should be factored in.

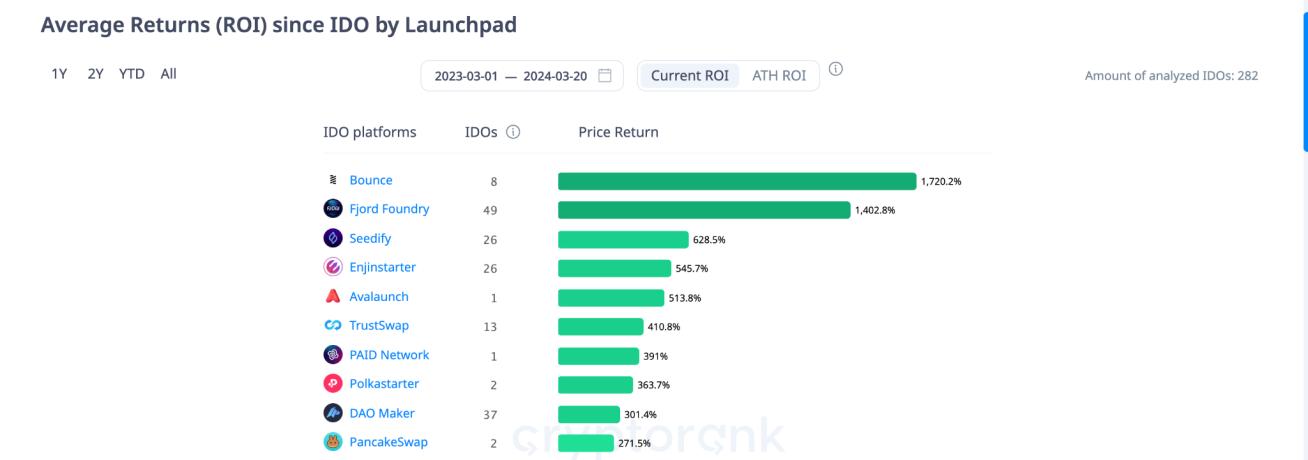

Top 5 Crypto Launchpads (2024)

1. Binance Launchpad

Binance Launchpad is a cornerstone of the crypto fundraising landscape. It offers a secure, streamlined platform where transformative blockchain projects and passionate early adopters can meet.

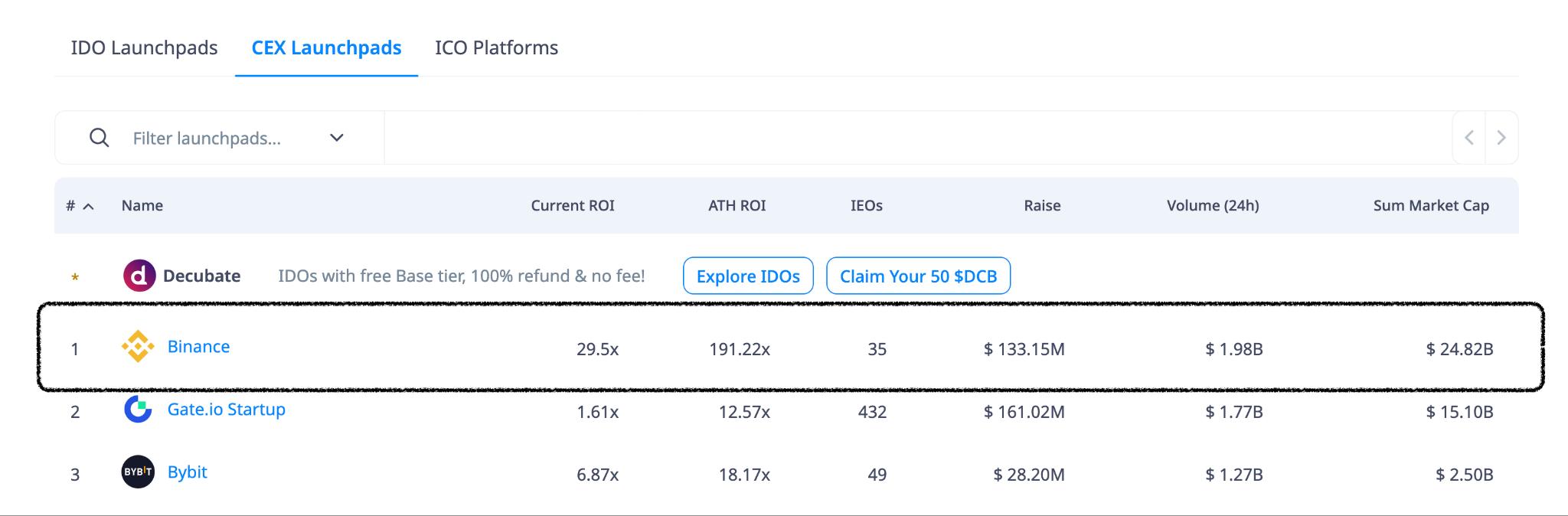

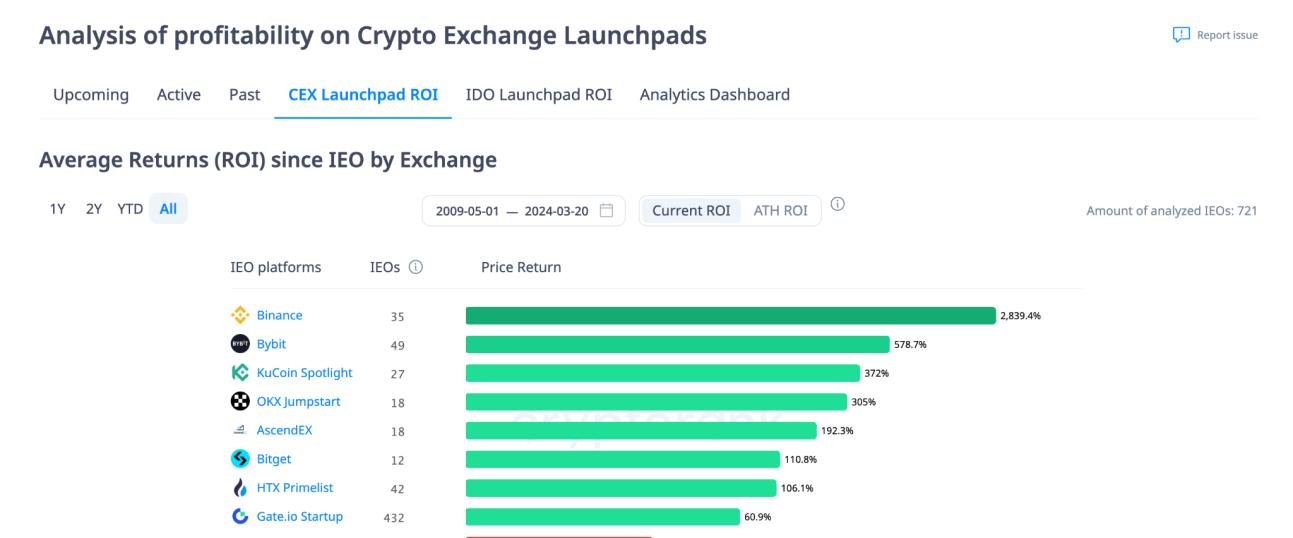

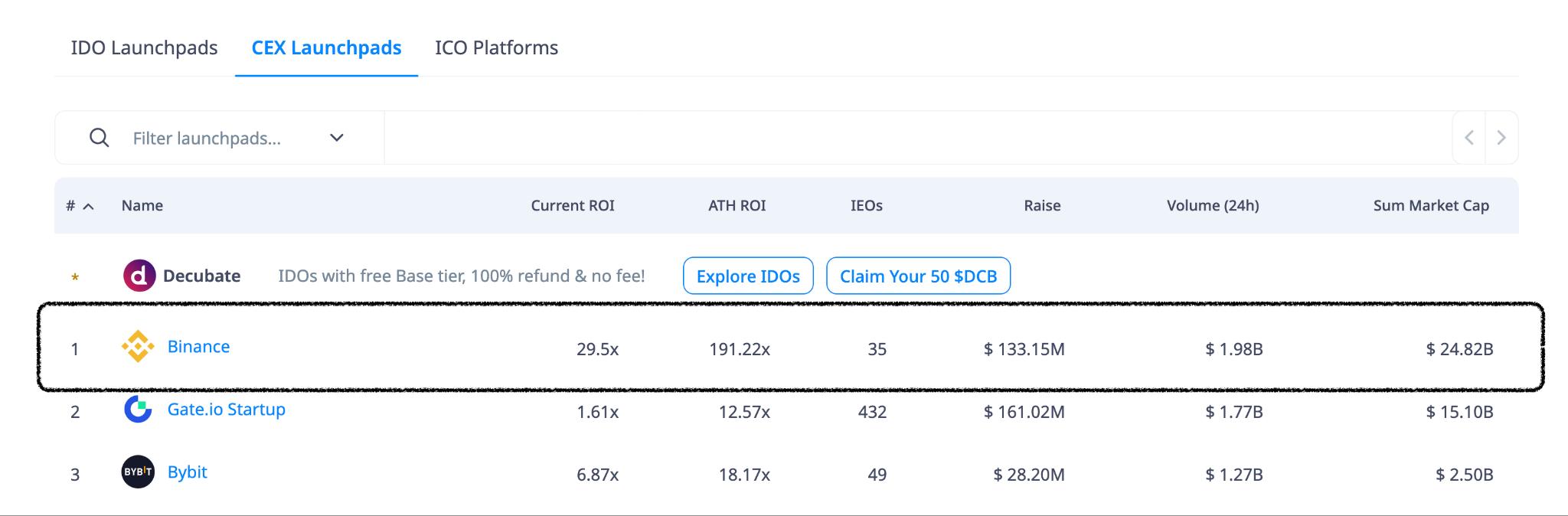

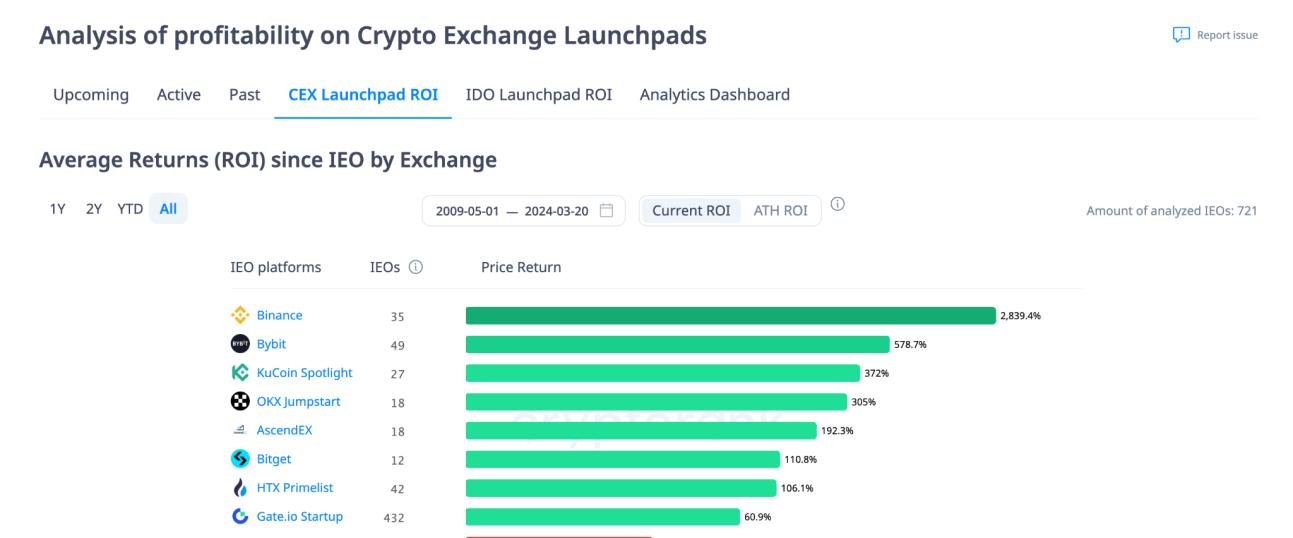

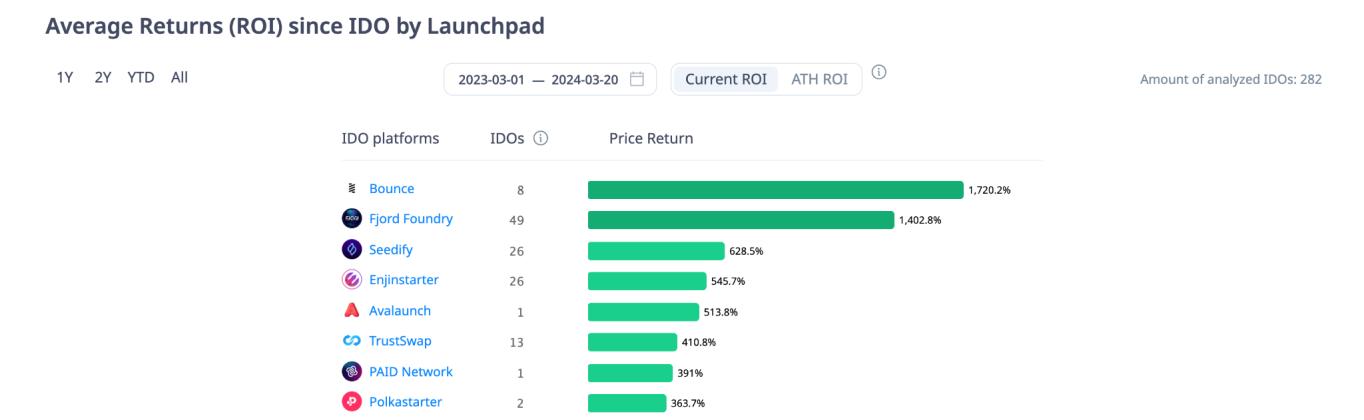

According to cryptorank, as of March ‘24, Binance Launchpad is the first largest CEX launchpad. So far, it has raised over $133 million in investments and has an ATH ROI of 191x.

Key Features

▪ Binance prioritises security and user protection throughout the launch process.

▪ Projects and protocols gain immediate access to Binance's vast user base, ensuring strong liquidity and global exposure.

▪ Binance doesn't just facilitate fundraising; it provides ongoing guidance and resources to help projects thrive.

Statistics and Performance

▪ Binance Launchpad revolutionised crypto crowdfunding, spearheading the shift towards Initial Exchange Offerings (IEOs).

▪ Launchpad has helped propel projects like Polygon (MATIC), Axie Infinity (AXS), and The Sandbox (SAND) into the spotlight.

▪ Binance continues to add new features and opportunities to its Launchpad program.

Tier System and Participation

Binance Launchpad uses a lottery system to ensure fairness and accommodate its growing user base:

▪ A snapshot of your BNB holdings over a set period leading up to the IEO determines your eligibility and potential allocation.

▪ After the holding period, you can claim lottery tickets based on your BNB balance.

▪ Winning tickets are drawn, and holders can then participate in the IEO using their BNB through a lottery system.

Launchpad vs. Launchpool

While both aim to support exciting new projects, Launchpad and Launchpool operate differently:

Launchpad:

▪ Launchpad focuses on IEOs, where you can buy tokens of a new project.

▪ Token allocation is determined via a lottery system after a BNB holding period.

Launchpool:

▪ Launchpool allows you to stake your crypto assets to earn rewards in the form of new tokens.

▪ You can harvest your rewards and unstake your assets at any time.

How to Participate in a Binance IEO

Binance Launchpad uses a subscription-based model:

1. Hold BNB: You'll need to hold a sufficient amount of BNB tokens in your Binance wallet to participate in a token sale.

2. Subscription Period: Commit your BNB tokens to the project's crowdfunding event during the designated timeframe.

3. Allocation: Your final token allocation is determined based on your BNB commitment compared to the total pool.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

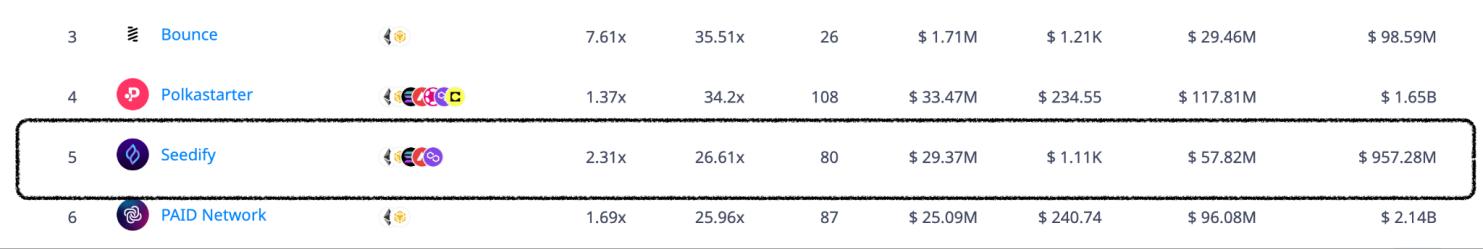

2. Polkastarter Launchpad

Polkastarter is a decentralised launchpad with a focus on cross-chain capabilities and supporting highquality projects.

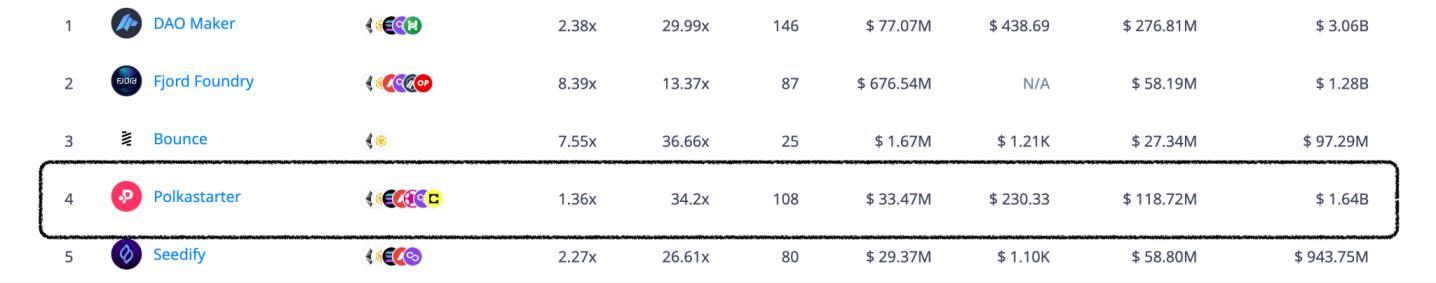

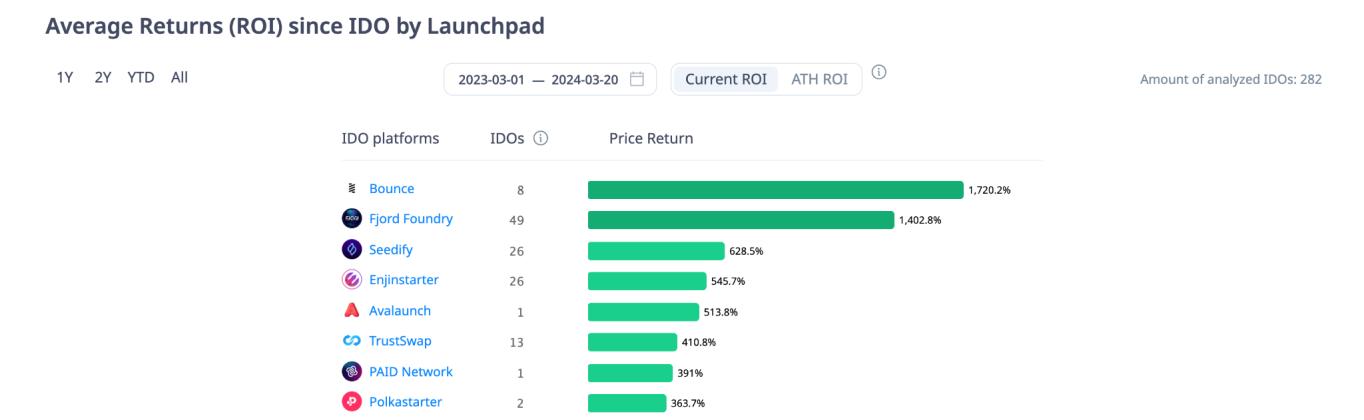

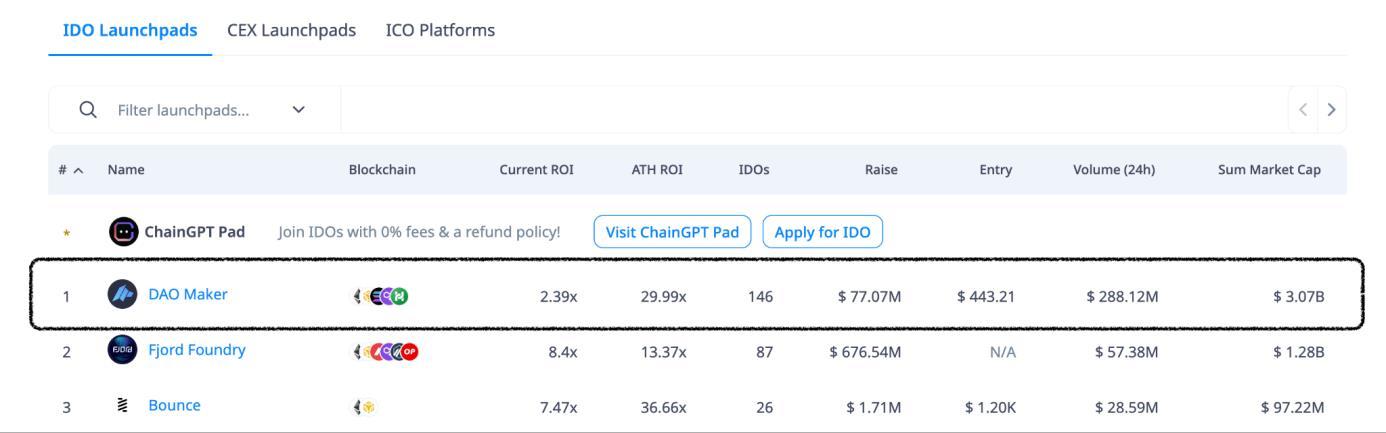

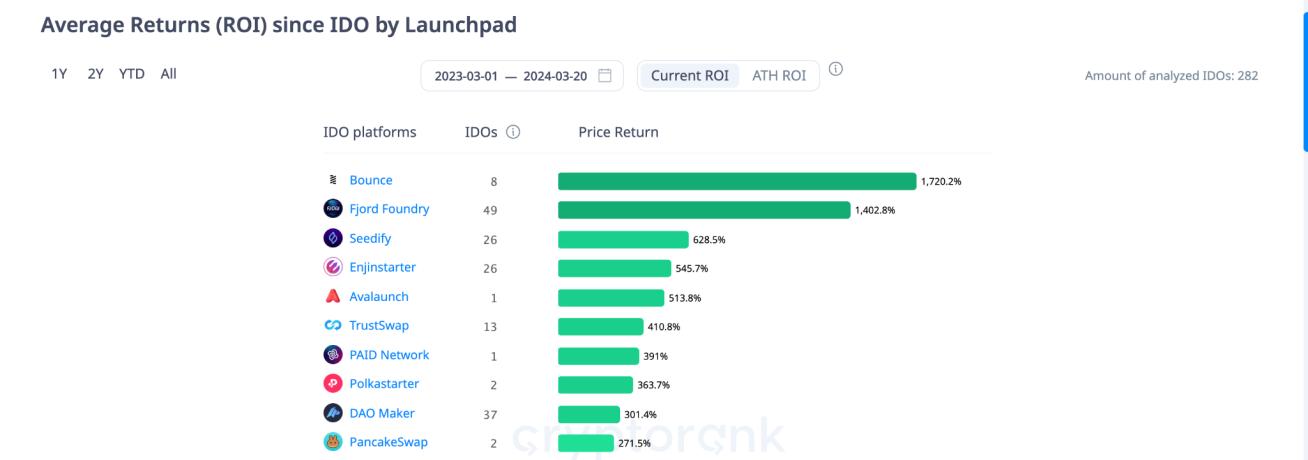

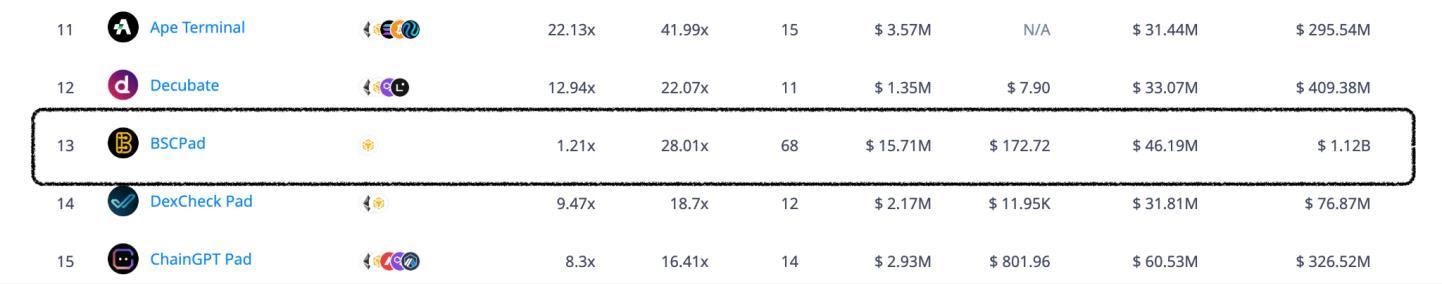

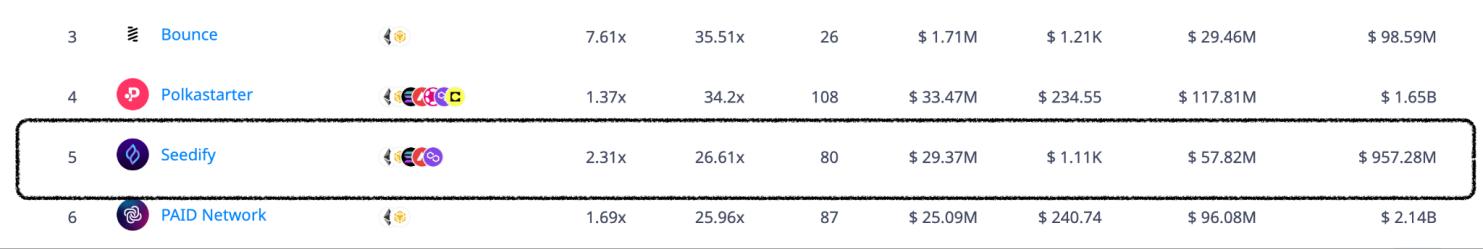

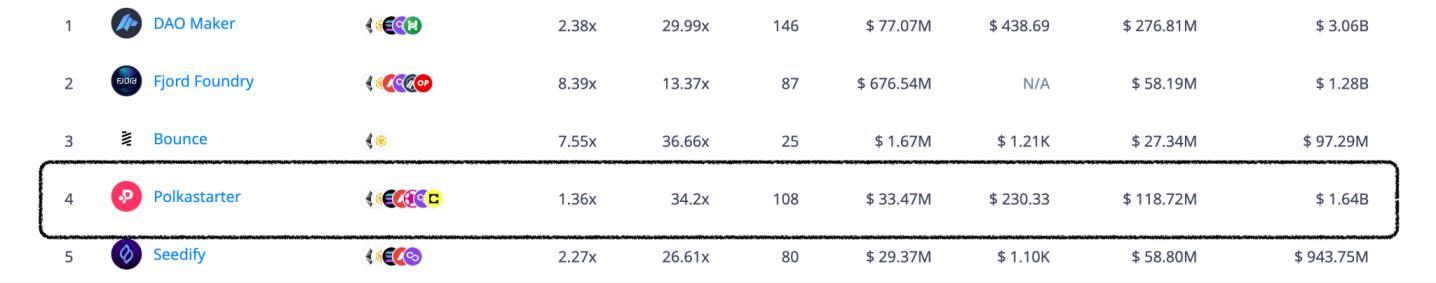

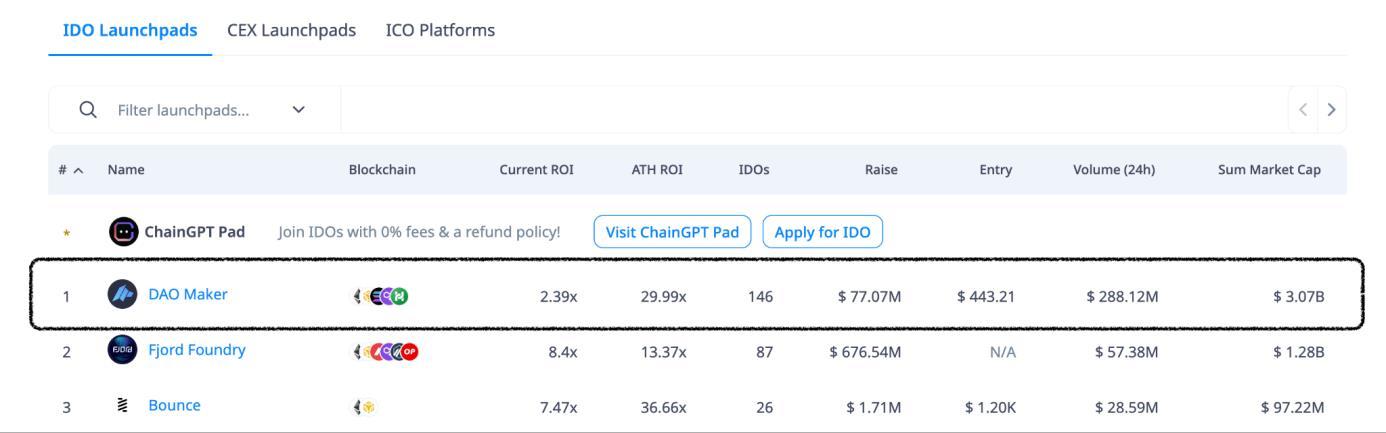

According to cryptorank as of March ‘24, Polkastarter is the 4th largest launchpad. So far, it has raised over $33 million in investments with an ATH ROI of 34.2x.

Key Features

▪ Polkastarter supports launches on Ethereum, Binance Smart Chain, Polygon, and more, giving projects access to a broader market.

▪ Polkastarter prioritises careful project selection, aiming to reduce the risk for investors.

▪ The fixed swap pools help to stabilise token prices during the launch, preventing volatility and potential price manipulation.

Statistics and Performance

▪ Polkastarter consistently ranks among the top launchpads. Although there weren’t many IDOs launched in the last year.

▪ Polkastarter has a strong track record, with many projects showing impressive ROI for investors.

▪ Over 40 successful launches have taken place on Polkastarter since its inception.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Tier System and Participation

Polkastarter uses a combination of whitelisting and a POLS system to determine allocations:

▪ Holding POLS tokens grants you ‘’POLS Power,’’ which increases your chances of getting whitelisted. Social media engagement can also boost your POLS Power.

▪ Tiered Allocation: Higher POLS Power levels increase your potential allocation size.

▪ Cooldown Period: After winning an allocation, there's usually a 7-day cooldown period before you can participate in another IDO (unless you reach the highest tier).

How to Participate in a Polkastarter IDO

1. Connect a compatible crypto wallet

2. Purchase and hold/stake POLS tokens to gain POLS Power

3. Complete KYC verification

4. Apply for the whitelist of your desired project

5. If selected, participate in the IDO according to the project's rules

3. DAOMaker Launchpad

DAO Maker provides a suite of tools and services designed to help early-stage crypto projects thrive. Its primary feature is the DAO Launchpad, where holders of the DAO token can invest in promising new projects.

According to cryptorank as of March ‘24, DAOMaker is the 1st largest launchpad. So far, it has raised over $77 million in investments with an ATH ROI of 30x.

Key Features

▪ DAO Maker offers guidance, resources, and operational support to nurture selected startups.

▪ The DAO Launchpad leverages the network to raise funds and build community for emerging projects.

▪ DAO Maker incentivises community engagement and growth through its social mining system.

● DAO Maker has backed the development of successful projects such as My Neighbor Alice (ALICE) and Orion Protocol (ORN).

● You can find more details on DAO Maker's project history and performance on their website

Tier System and Participation

DAO Maker uses a combination of token staking and randomisation (SHOs) for IDO participation:

▪ Public SHO: Open to anyone holding at least $500 in supported crypto assets. Social media engagement boosts your chance to win an allocation.

▪ Private SHO: Requires staking a minimum of 250 DAO tokens. Higher tiers based on staking amount mean larger guaranteed allocations.

How to Participate in a DAOMaker IDO

1. Register an account on the DAO Maker website

2. Complete KYC verification

3. Connect a compatible crypto wallet (MetaMask recommended)

4. Purchase and stake DAO tokens (minimum 250 for Private SHO participation)

5. Deposit DAO tokens into the DAO Vault to enter IDOs (SHOs)

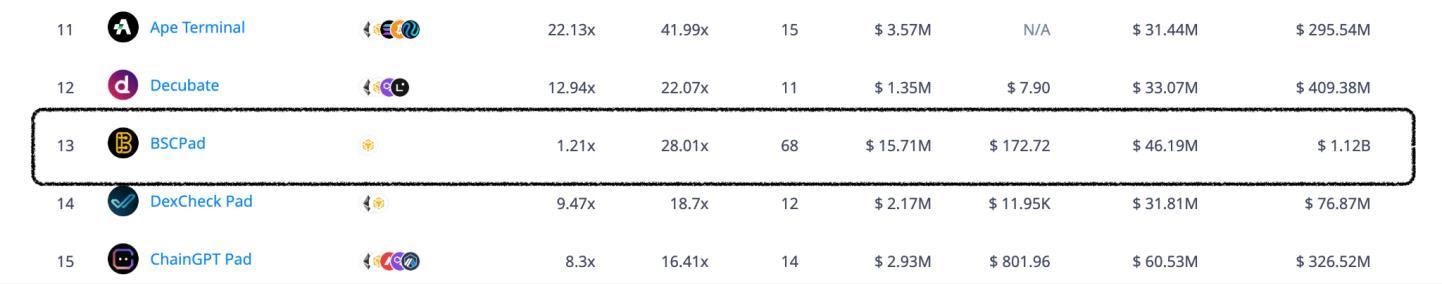

4. BSC LaunchPad

BSCPad is a launchpad built specifically for projects within the Binance Smart Chain ecosystem. It stands out by aiming to give retail investors a fairer shot at getting involved in promising early-stage projects.

According to cryptorank, as of March ‘24, BSCPad is the 13th largest launchpad. So far, it has raised over $15 million in investments and has an ATH ROI of 28.01x.

Statistics and Performance

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Key Features

▪ BSCPad caters to the growing number of projects choosing to build on the BSC network.

▪ BSCPad combines a lottery system (for smaller investors) with guaranteed allocations (for higher tiers) to help ensure broader participation.

▪ Compared to some launchpads, the staking requirements to participate in BSCPad IDOs are relatively accessible.

Statistics and Performance

▪ BSCPad currently ranks among the top launchpads in terms of activity and funds raised.

▪ While returns can vary significantly from project to project, BSCPad's track record shows potential for investors to see strong returns.

▪ BSCPad is known for its high volume of launches, giving investors a more comprehensive selection of projects to choose from.

Tier System and Participation

BSCPad uses a six-tier system based on how many BSCPAD tokens you stake:

▪ Lottery Tiers (Bronze, Silver, Gold): Offer chances to win allocation spots through a lottery.

▪ Guaranteed Tiers (Platinum, Diamond, Blue Diamond): Provide guaranteed token allocation, with increasing amounts based on your tier.

How to Participate in a BSCPad IDO

1. Connect a compatible crypto wallet (make sure you have BNB for fees)

2. Purchase and stake the required amount of BSCPAD tokens

3. Pass KYC verification

4. Select your desired project and participate in the IDO according to your tier

5. Seedify Launchpad

Seedify specialises in supporting blockchain gaming projects. It offers a launchpad, incubator, and a system designed to reward early investors with access to exciting project features.

According to cryptorank as of March ‘24, Seedify is the 5th largest IDO launchpad. So far, it has raised over $29 million in investments with an ATH ROI of 26.60x.

Key Features

▪ Seedify caters specifically to the booming blockchain gaming sector.

▪ Multi-Tier System: Seedify uses a unique allocation system designed to promote fairness and broader participation.

▪ Along with launch support, Seedify provides guidance and resources to help incubated projects succeed post-launch.

Statistics and Performance

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

▪ Over 80 projects have successfully launched so far with an average 2x ROI.

▪ If you are in the GameFI sector looking for your next adventure, Seedify will cover it.

▪ Seedify has also expanded its tier system to accommodate the growing demand, indicating platform growth.

Tier System and Participation

Seedify's allocation system balances lottery draws with guaranteed allotments:

▪ Tiers: There are 9 tiers based on staked SFUND tokens. Higher tiers offer greater pool weights and increase allocation sizes.

▪ Lottery vs. Guaranteed: The lowest tier uses a lottery for allocation fairness, while higher tiers receive guaranteed allocations based on their pool weight.

▪ Private Allocations: Higher tiers can also access private token allocations.

How to Participate in a Seedify IGO

1. Connect a compatible wallet (MetaMask, Trust Wallet, etc.)

2. Complete KYC verification

3. Purchase SFUND tokens on a supported exchange

4. Stake your SFUND tokens (choose a lock-in period)

5. Select your desired project and participate in the IGO

Conclusion

Crypto launchpads represent a shift in how innovative web3 projects reach the world. By prioritising security, fairness, and community building, launchpads are helping to foster a more inclusive ecosystem.

As launchpads gain popularity and refine their offerings, we can expect a few key trends:

▪ Increased Trust: By carefully vetting projects, launchpads can combat scams and provide a safer environment for investors, building confidence in the crypto landscape as a whole.

▪ Democratised Investment: No longer restricted to venture capitalists, promising crypto projects will tap into a wider pool of support through retail investors.

▪ Widespread Innovation: With more accessible funding, a new wave of transformative Web3 projects will emerge.

The future is bright for both crypto startups and enthusiasts. Launchpads are poised to drive innovation, broaden the investor base, and ultimately push blockchain technology further into the mainstream.

Step-by-step guide on how to find and track profitable whales

written by Daniel

Given the volatile tendencies of the cryptocurrency world, it is vital to seize the information available on the blockchain, especially the one associated with cryptowhale activities.

Knowledge is power in crypto, and understanding how the market works can be the key to making a difference in your journey through this fascinating decentralised world.

Understanding and monitoring trades and transactions of one of the key players in the industry, such as crypto whales, can help you refine your trading strategies and become an early adopter of promising projects that can make you a good profit.

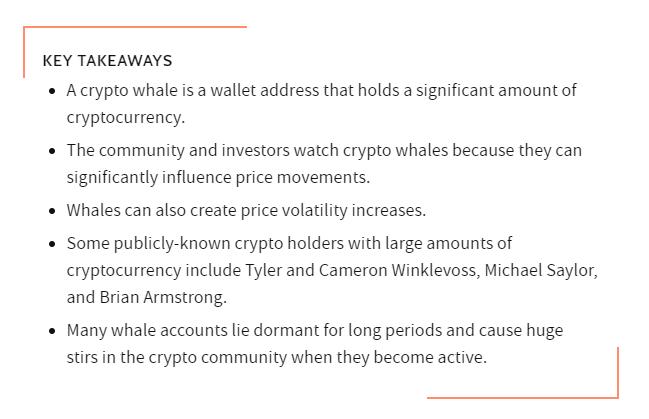

What are crypto whales?

Cryptocurrencies have a heap of exciting and unusual terms. While it's normal to use animal-related terms to highlight the market trend (bear or bull, for example) or point to a relevant player in the ecosystem, such as crypto 'whales'.'.

While this terminology is not unique to the crypto space and has been used long before in traditional trading associated with the forex market, the association of certain types of animals in the financial markets, in general, relates to the representation that they can perfectly resemble certain actors in the exchange or trading of cryptocurrencies.

Thus, bulls represent bullish buyers, bears represent bullish sellers and bearishness, and whales are generally associated with those large investors capable of manipulating the market with a significant buy and sell order on a particular asset.

In simple terms, crypto whales are web entities, individuals, or organisations that hold a significant amount of the circulating supply of a particular token or cryptocurrency in their wallet.

While there is no fixed number to signal whether a holder of X token is a whale, they may coin this term if they own a significant percentage of the token supply, which can cause price volatility and impact price movements.

Typically, crypto whales accumulate extensive holdings by buying a crypto asset early, mining, or having enough capital to invest in a cryptocurrency.

Why track crypto whales?

As cryptocurrency trading becomes increasingly popular, tracking and finding profitable crypto whales is essential for intelligent investing. Due to cryptocurrencies' volatility, crypto whales can drastically influence the price behaviour of the assets they hold in their portfolio.

In addition, their actions influence the decisionmaking of other market participants, especially small investors.

Studying the movements of crypto whales and receiving early warnings of their transactions can be advantageous when searching for your next profitable trade. Although challenging, fortunately, there are increasingly sophisticated tools for on-chain analysis, essential for identifying potential market trends and defining successful investment strategies.

However, keep in mind that there are crypto whales that make incredible returns on what they buy and others that make decisions that do not always end well in terms of performance. The first segment of whales are the so-called intelligent money whales, which should be your target group in your study and analysis of money movement in the crypto market.

Finding whales with an outstanding history of profitable trades is a privileged insight that can give you clear signals and consistent patterns to more easily understand their strategies.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

As an investor, this allows you to make informed decisions or duplicate strategies with a high probability of success.

Underestimating the whales and failing to understand their movements to anticipate them in the market can mean missed opportunities to generate substantial profits as a trader and investor

How to find crypto whales?

In this section, we will provide you with an instructional guide on how to "track and observe" crypto whale movements with the knowledge at your fingertips so that you can maximise your investment by potentially benefiting from their movements.

We will use blockchain tools that allow traders and investors to track crypto whales' movements and spend their cryptocurrencies in the market.

Step 1: Find the crypto whale wallet

Like the rest of the entities that make life in the crypto 'ocean', crypto whales have an identifier, and it is our goal to search for information on their activities to find their wallet address.

The wallet address of a crypto whale allows the individual or entity behind important cryptographic transactions to per its uniqueness.

To identify a crypto whale wallet, use some on-chain tools (freemium or premium), search for a token or cryptocurrency of your interest, and f break down the different relevant transactions on the chain, taking notice of those entities with large movements.

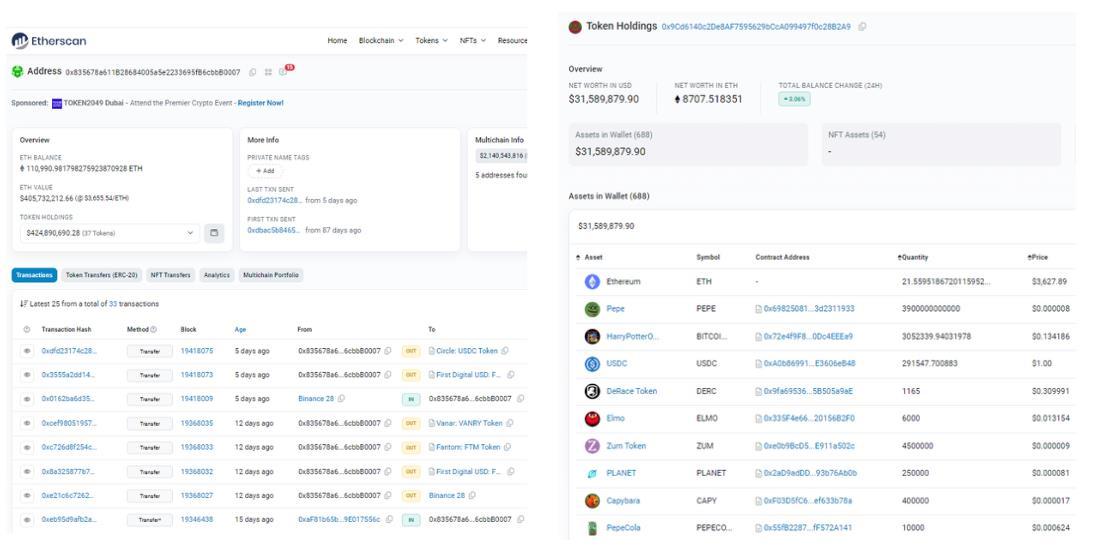

You can use free tools, such as the block explorers of various blockchain networks, like Etherscan, Solscan, Polyscan, and others, to identify the 'Top Holders' of a project in particular.

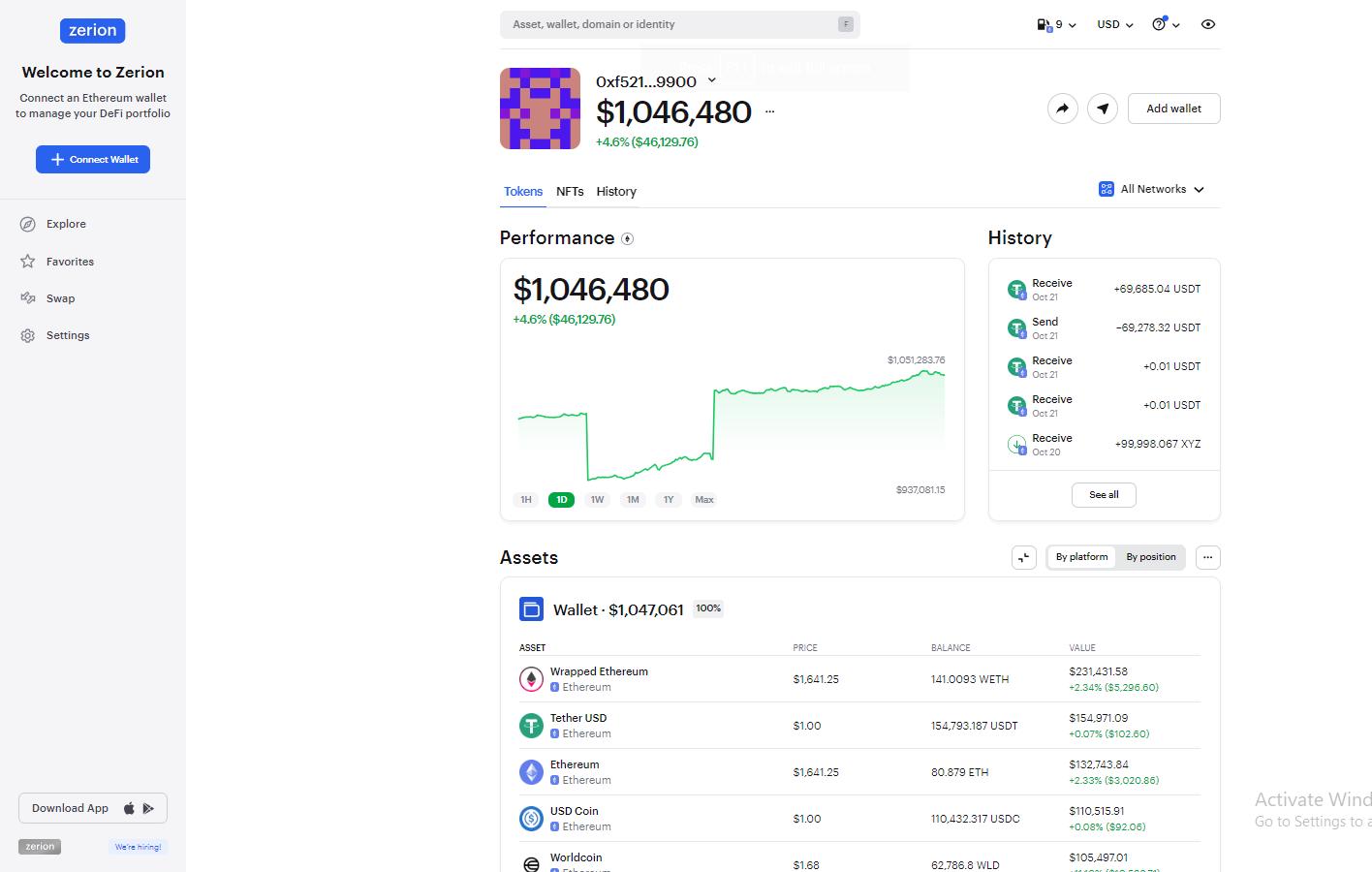

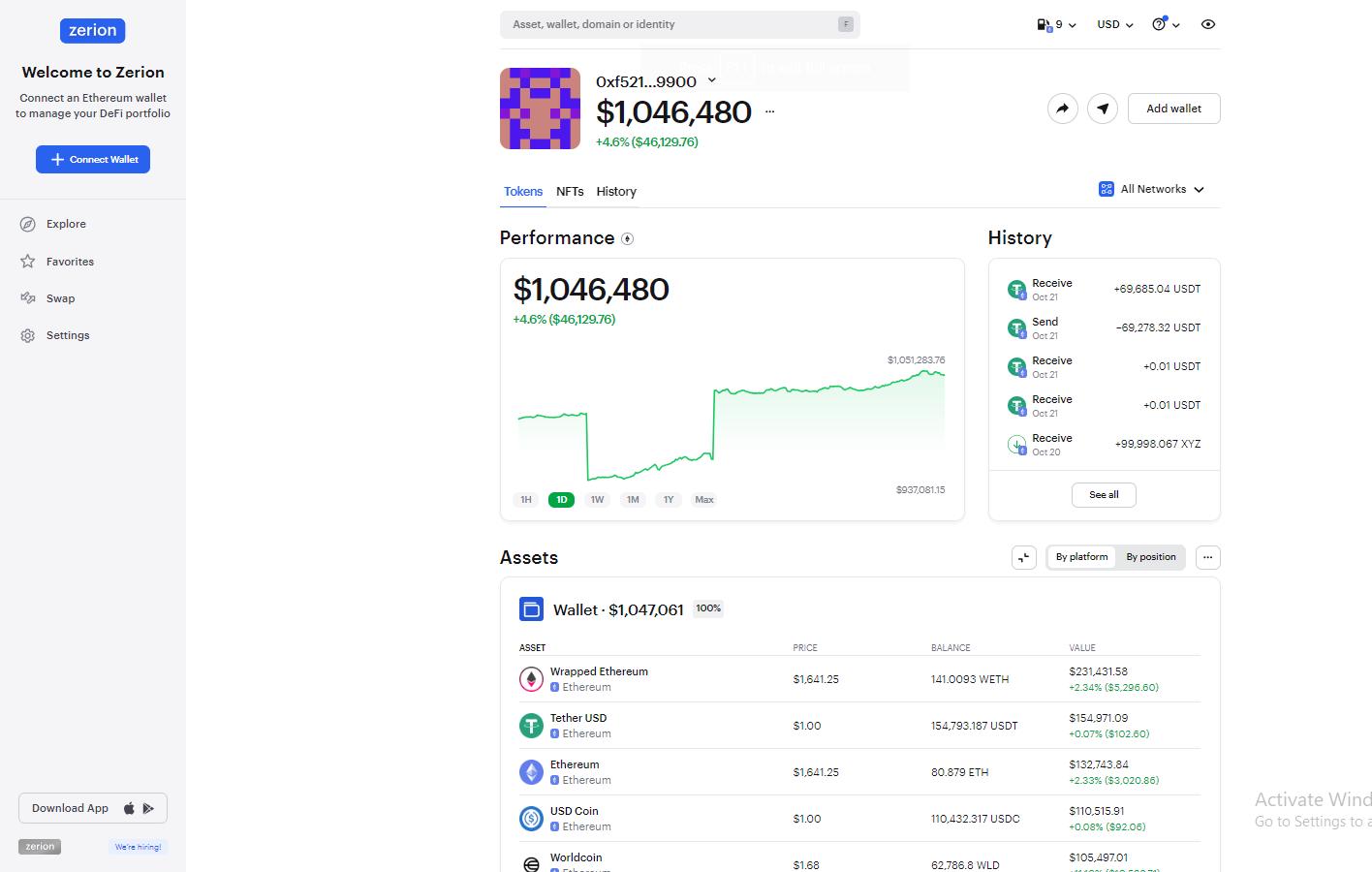

If you want more intuitive information, on-chain analytics platforms such as Arkham Intelligence, Dex Screener, Zerion, Nansen, Bubblemaps or DeBank can help you visualise all transactions executed by large entities in a particular cryptocurrency.

Let's see how this search works with an example:

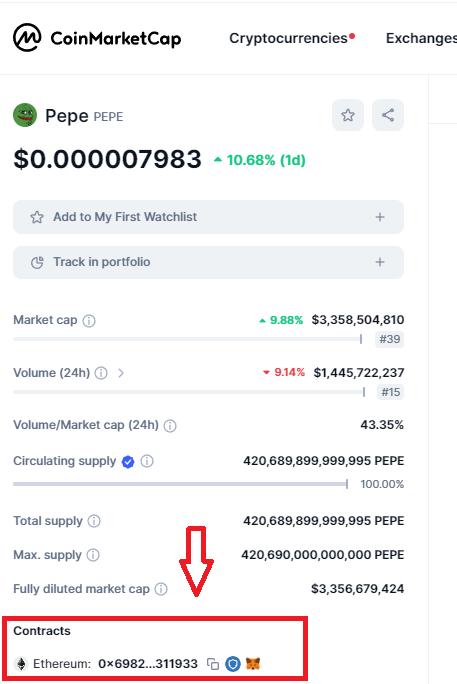

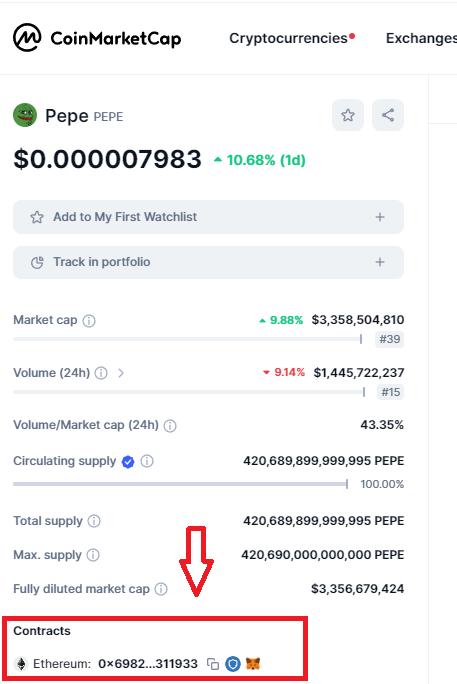

1.- Select a recently successful token that has generated a lot of good profits: PEPE. Go to a market price aggregator like Coinmarketcap and copy its contract address.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

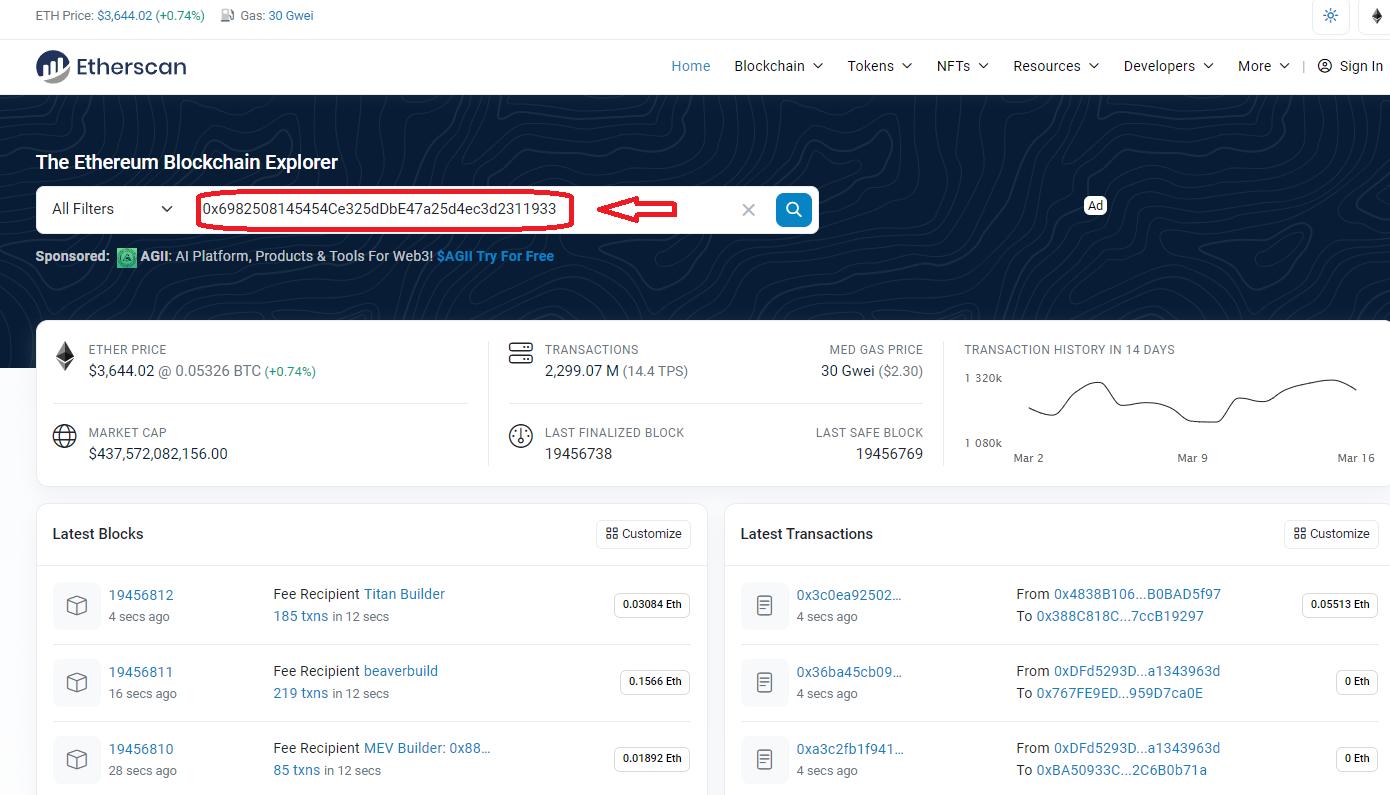

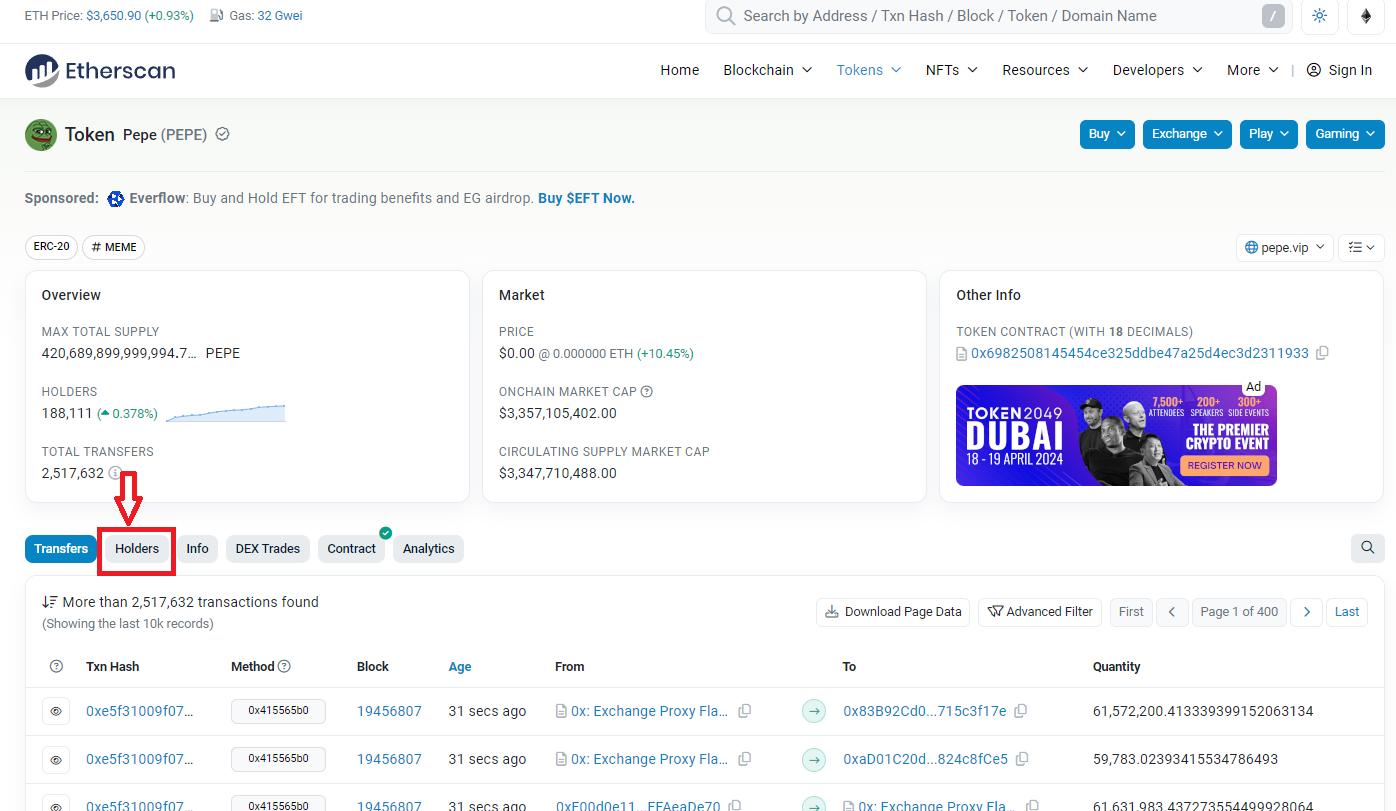

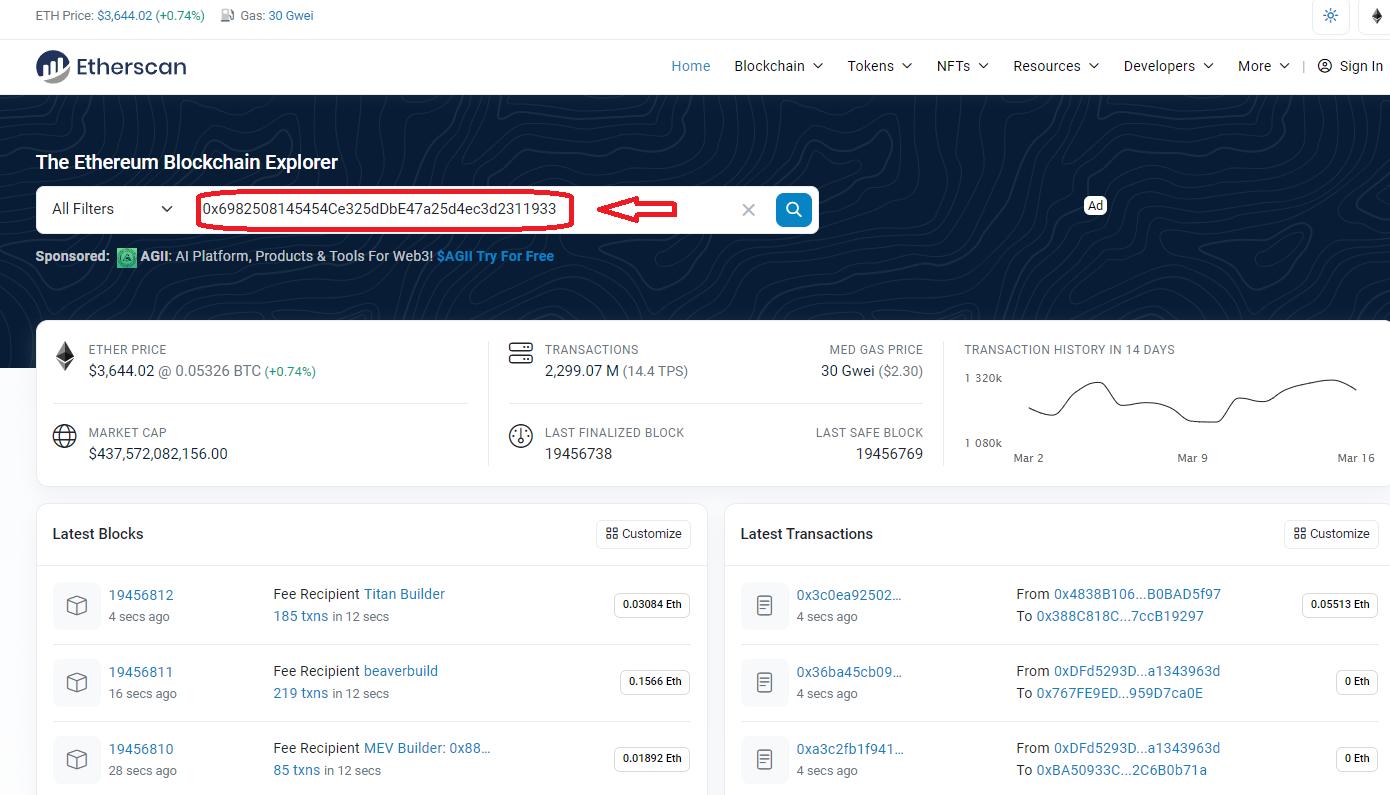

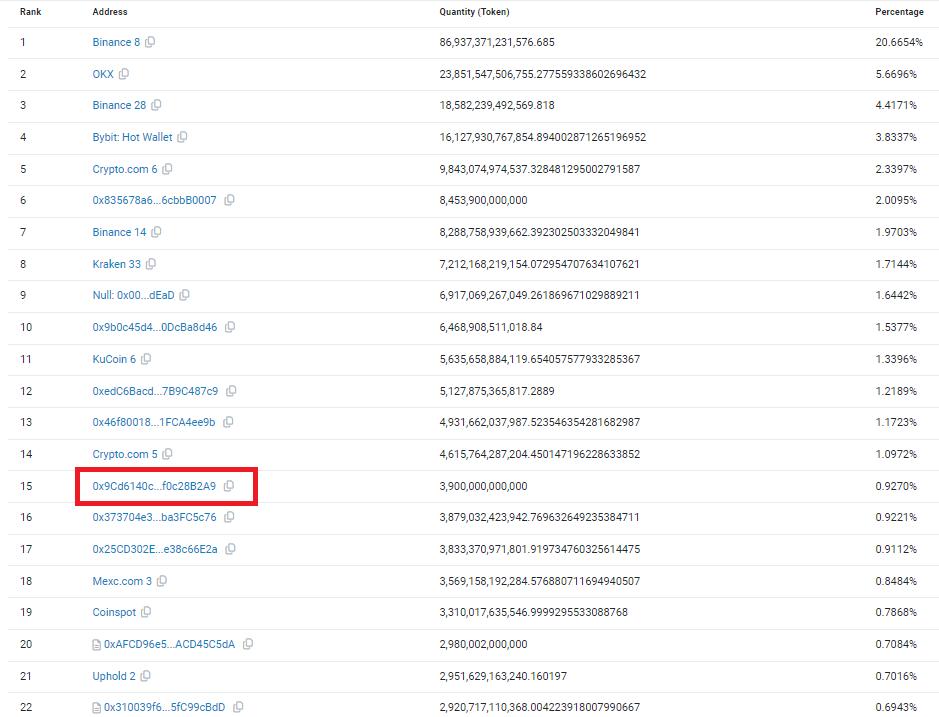

2.- To visualise the top holders, use a tool such as chain scanners or intuitive platforms. If you are using Etherscan, paste the contract address copied in the previous step into the browser's search engine.

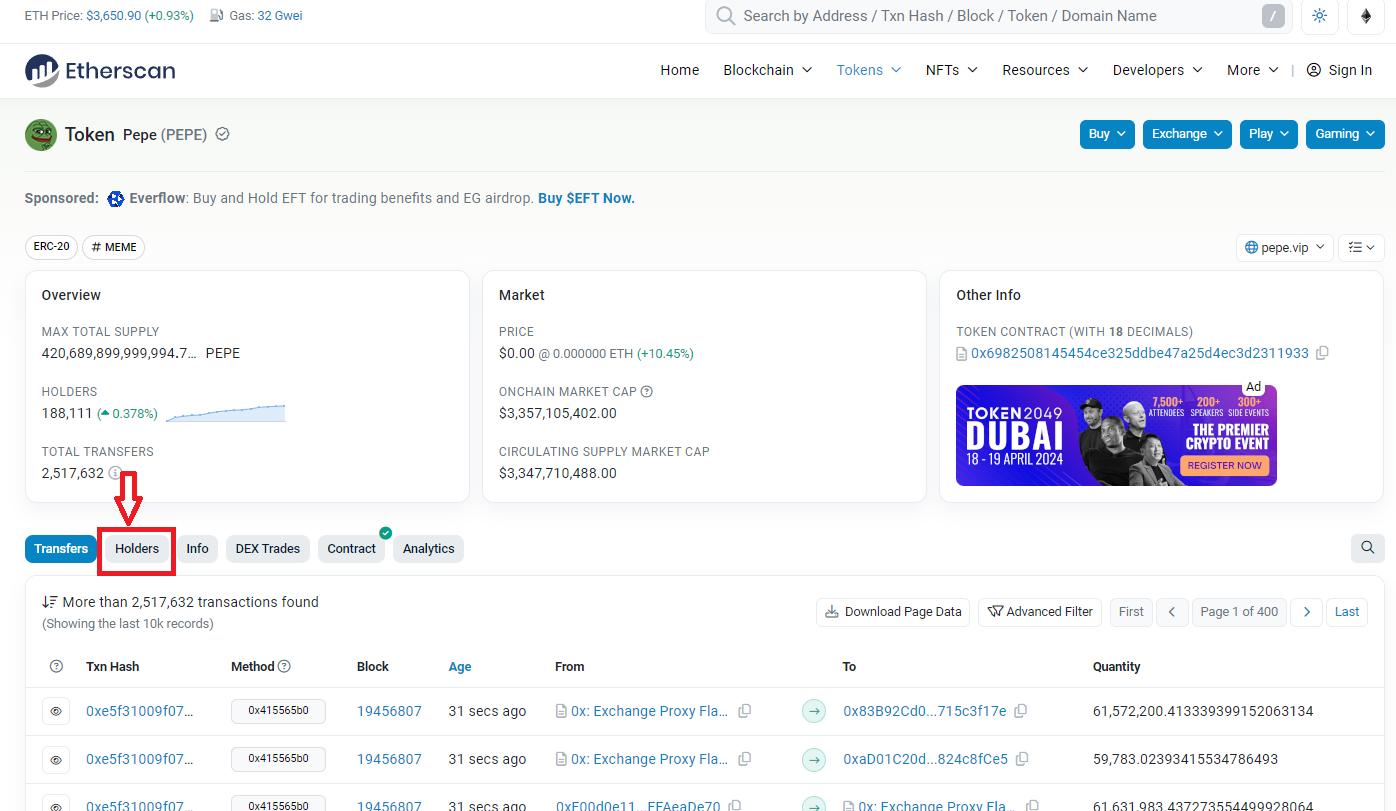

3.- Go to the 'holders' section to get the large entities holding the example token.

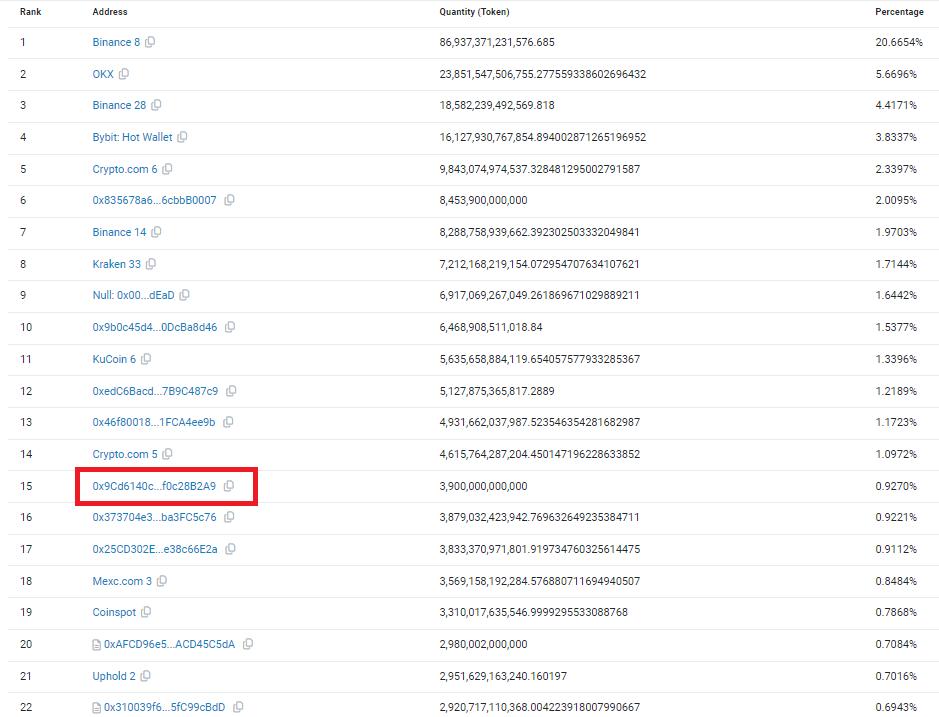

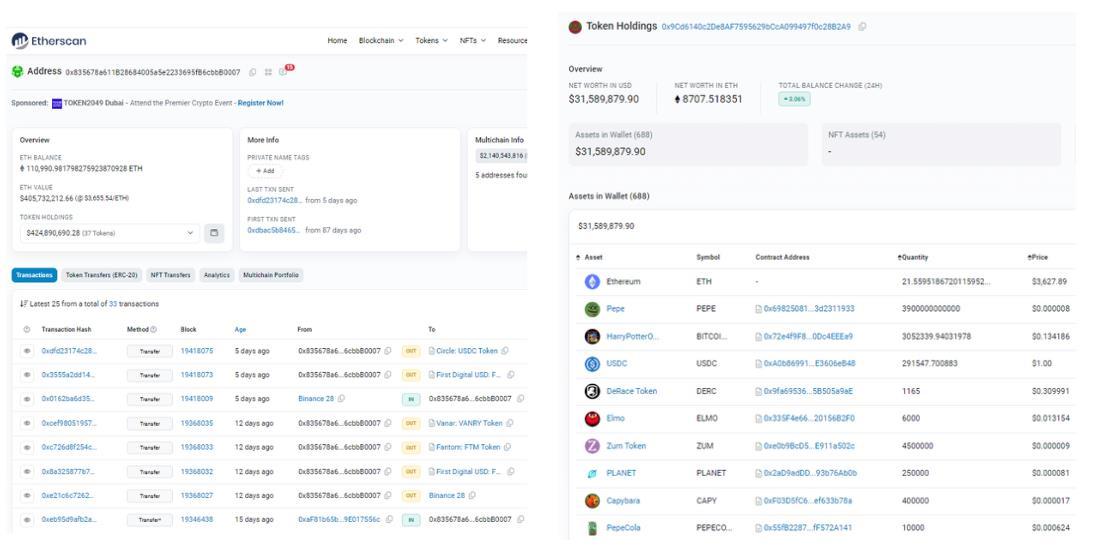

4.- Select a top holder and copy its wallet address. Please ignore the exchanges, as your holdings belong to your clients.

One of the significant limitations of block explorers when analysing information is the lack of a simple and powerful interface that allows tags to visualise a considerable amount of information in less time. This is a strong point that on-chain analysis platforms such as Arkham, DeBank, or Nansen have in their favour.

You will not be able to determine if, in the Top Holders list, the first individual or entity that does not belong to a CEX or DEX is outside the top ten PEPE token holders, even with Etherscan

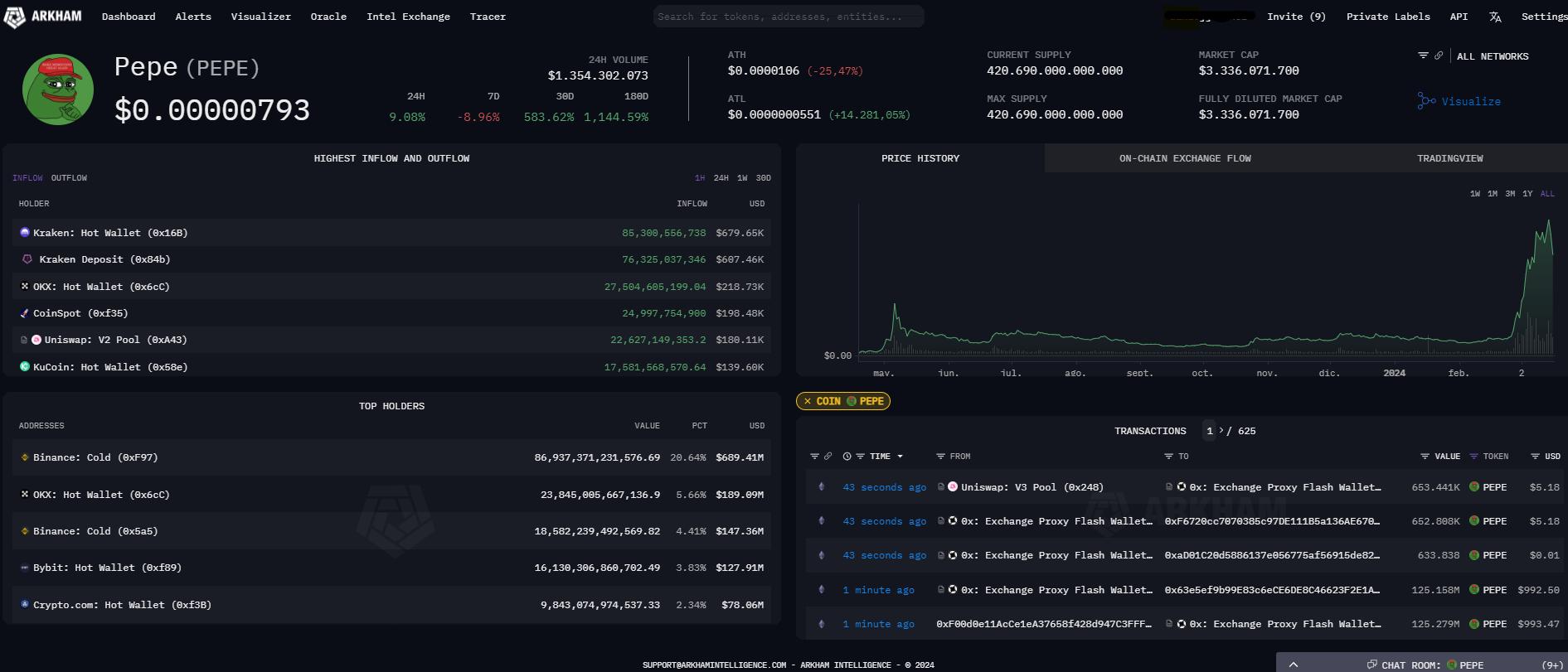

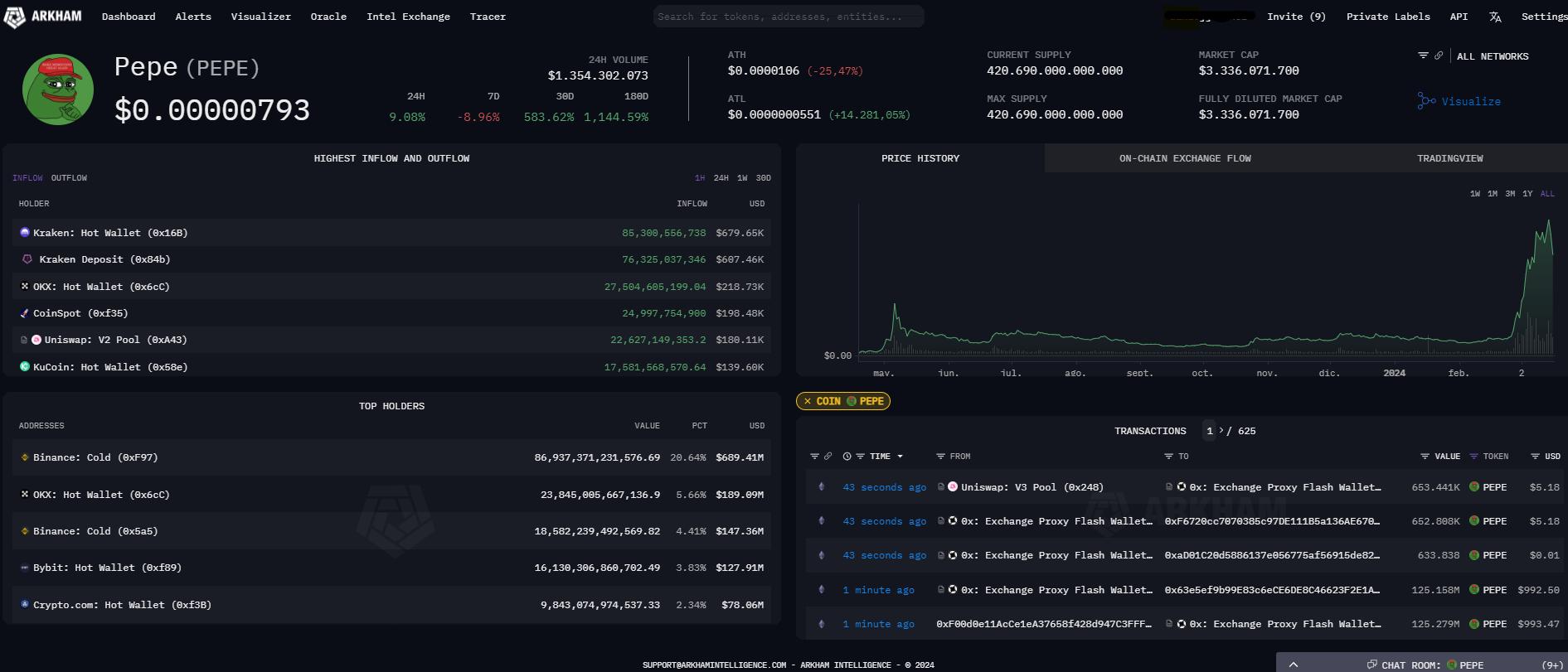

If we repeat the whole process but use a tool like Arkham, we could have more data that can give us a better perspective of the information we are analysing to make a better decision on whether or not to invest in the selected token.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

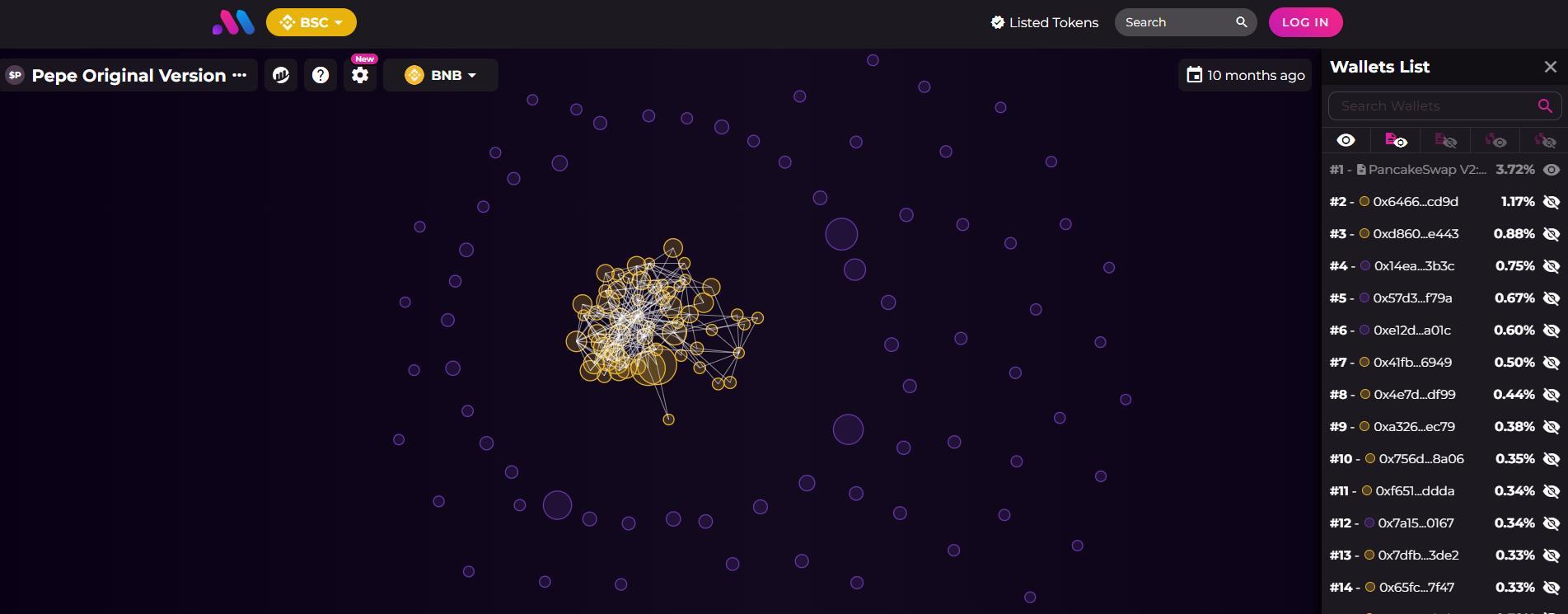

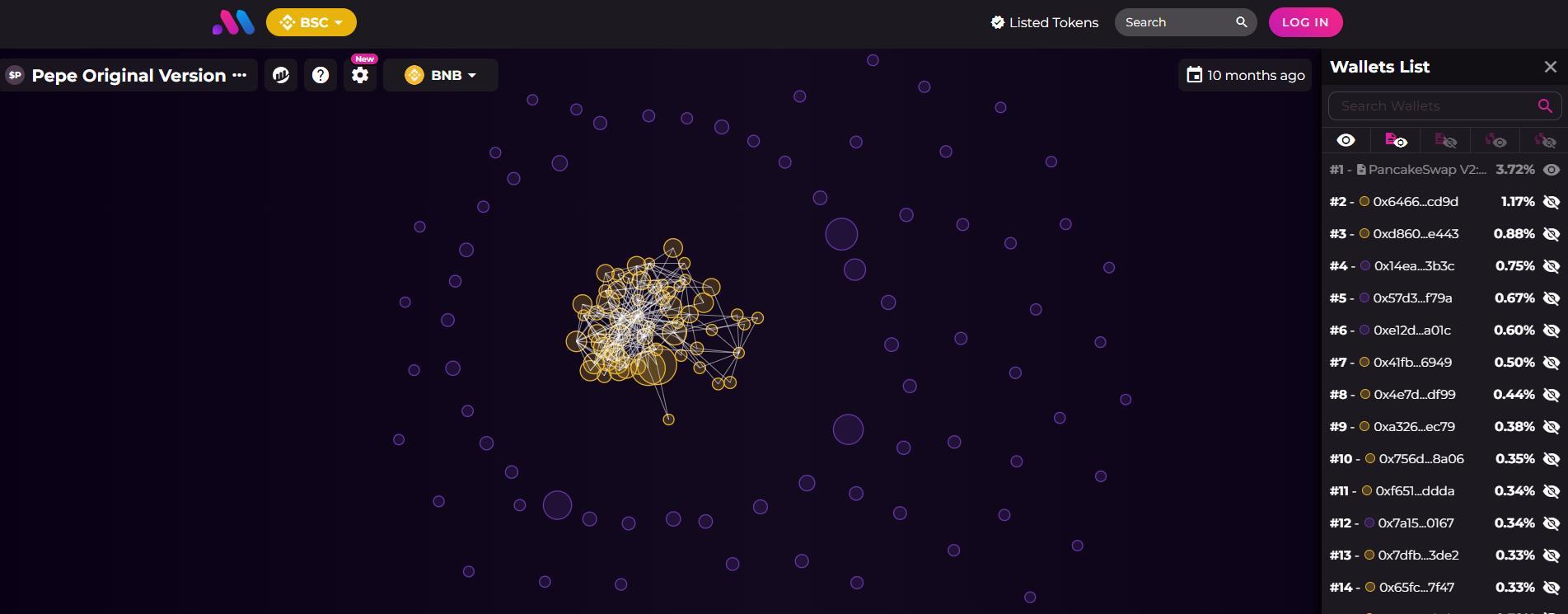

It is even advisable to visualise the tokenomics of the project in the form of bubbles to see the impact of the holdings of the entities or individual Top Holders of the selected token.

When interconnected wallets with a considerable token amount interact, a small group of people control the token, and it's probably a scam.

Bubblemaps is an excellent on-chain tool for comparing a suspicious token distribution with a healthy one. If the selected token has a concentrated distribution in a few hands, don't risk it unless you are a crypto investor.

But if you are looking for a crypto whale that moves within the decentralised exchanges (DEX), the Dex Screener tool can help, especially in catching some emerging meme-coin in the market.

Consider the following recommendations:

▪ Choose new pairs, gainers or a chain

▪ Explore any interesting pairs (check out tokens which were pumped on 500-1,000%)

▪ Click on the pair, copy the token address

Suspicious token distribution - Source: Bubblemaps

Suspicious token distribution - Source: Bubblemaps

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

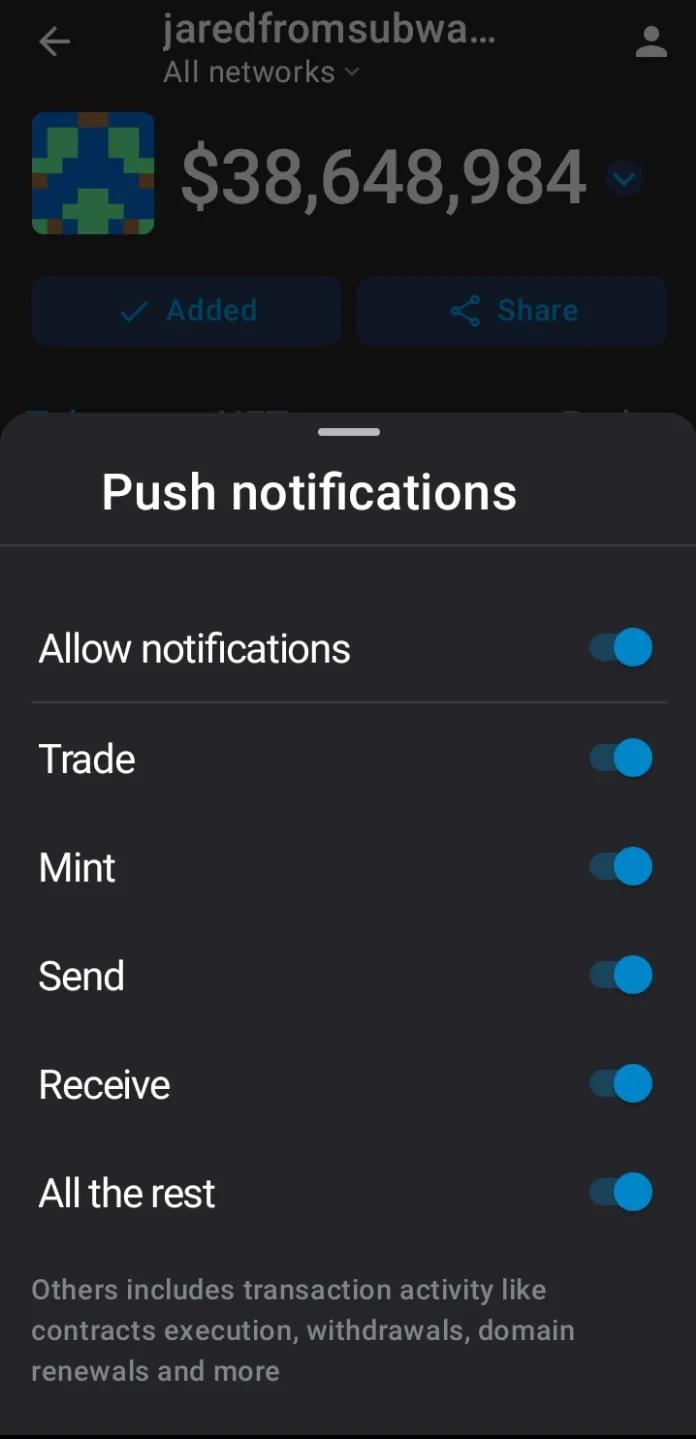

Pro-tips: DeBank offers a section called "Whales", which can function as a starting point if you don't get a crypto whale wallet. Remember to filter out wallets belonging to centralised exchanges or decentralised protocols that hold client funds.

Second step: track your favourite whales

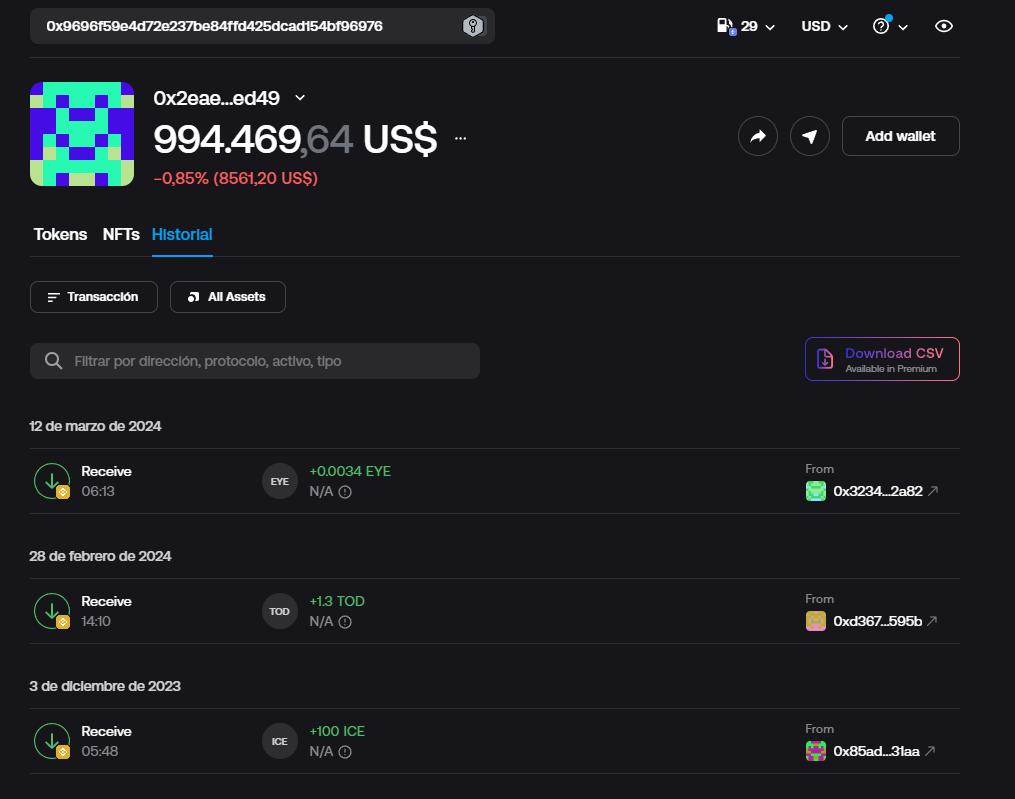

You can view your portfolio in the same block explorer as your transaction history by selecting your target crypto whale.

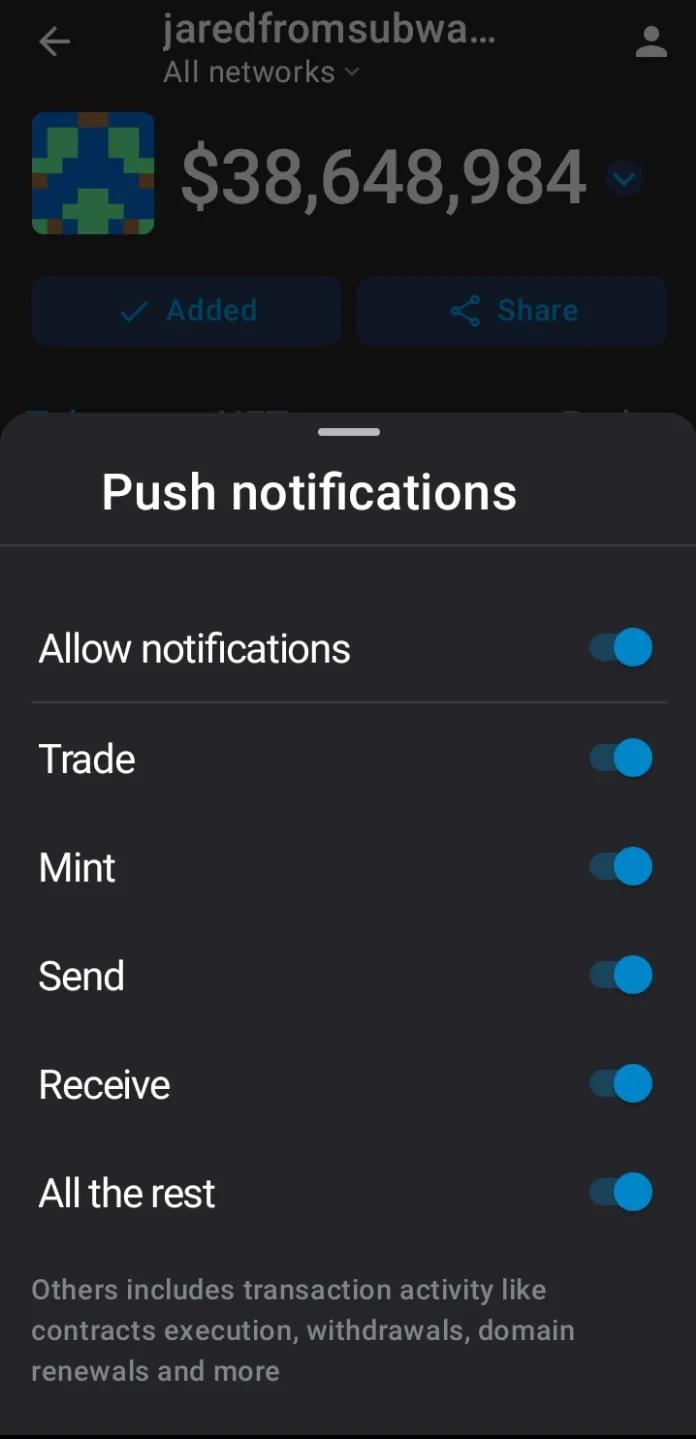

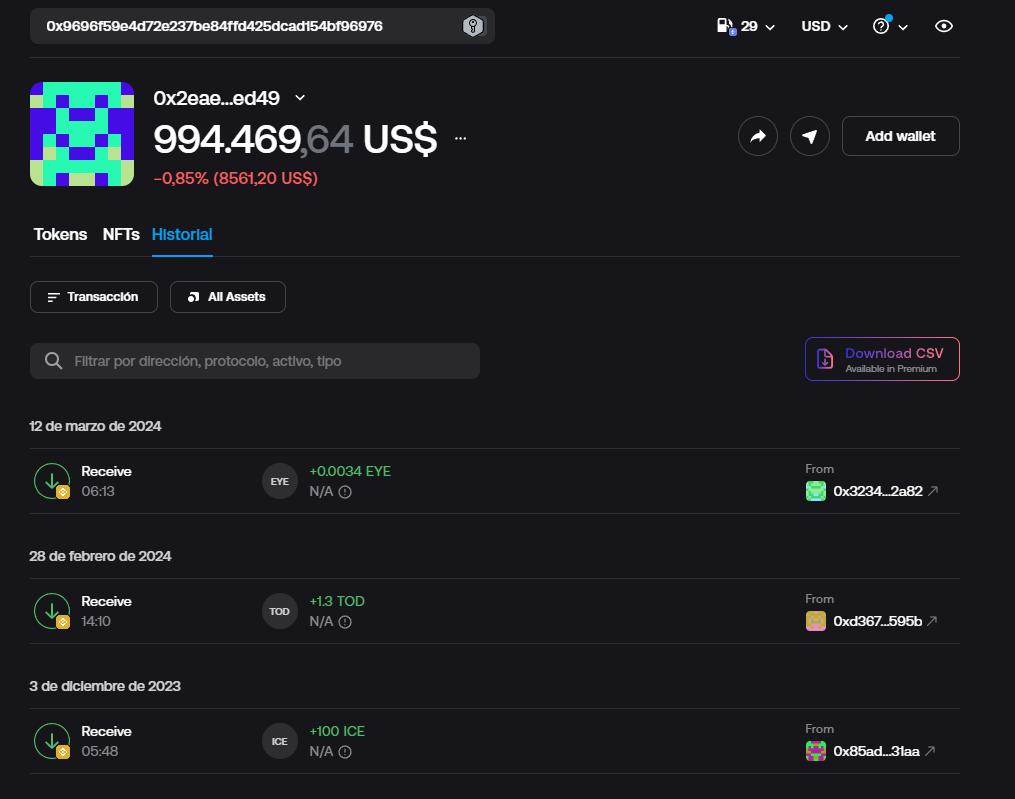

As convenient as block explorers can be, once you have your list of crypto whales to follow and monitor their movements, it is advisable to use more powerful tools such as Nansen, Arkham, DeBank, or Zerion. These tools offer an easy-going real-time interface to your transactions. This way, you can see which tokens these wallets buy, sell, or transfer on-chain and when the activity occurred.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Of course, the wallet activity should be analysed to verify that they are crypto whales that have been profitable in their recent purchases. Once you have a list of profitable whales, follow their daily activity to see which new tokens they're accumulating.

By doing so, you will receive real-time alerts when your tracked whales make any transactions, enabling you to stay updated and respond promptly to market movements.

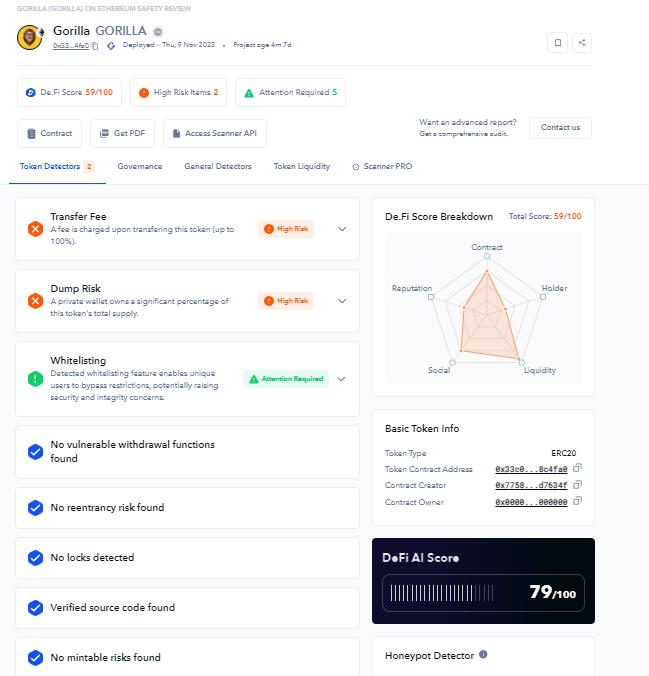

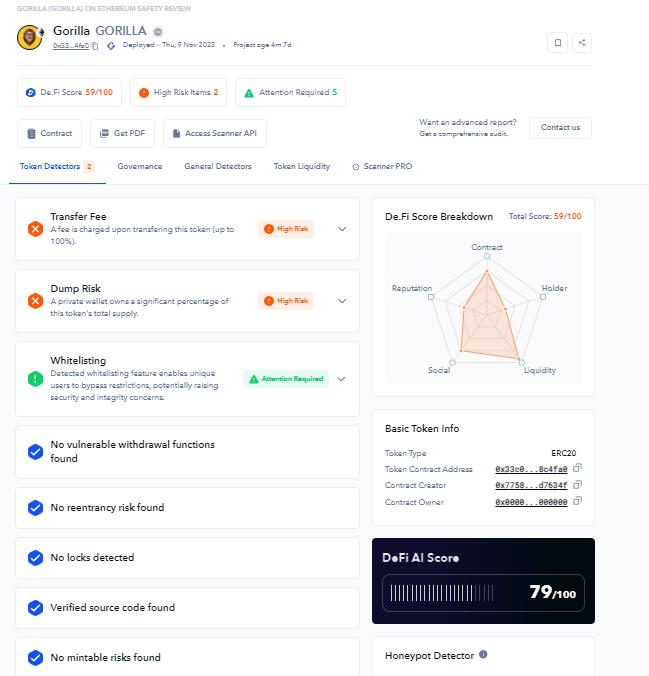

Third step: Find scams and avoid honeypot scams

Due to the number of scam projects flooding the market and the actions of bad actors in this industry, it is imperative to always rely on security-focused on-chain analysis tools.

In this case, we rely on tools such as De.Fi because of their reliability in detecting all honey pots. Make the following checklist and make sure that your target token meets the acceptable conditions recommended by the tool:

▪ Liquidity

▪ Token Distribution

▪ Honey pots and so on

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

To avoid honeypot scams, try to comply with some basic rules, like tokens that entities buy in small amounts, which is nothing for whales and can be simple bait.

On the other hand, avoid 'received' tokens in the transaction history of crypto whales, as they may be just OTC offers. Last but not least, DYOR every token.

You can rely on analytics platforms such as Zerion to achieve the above.

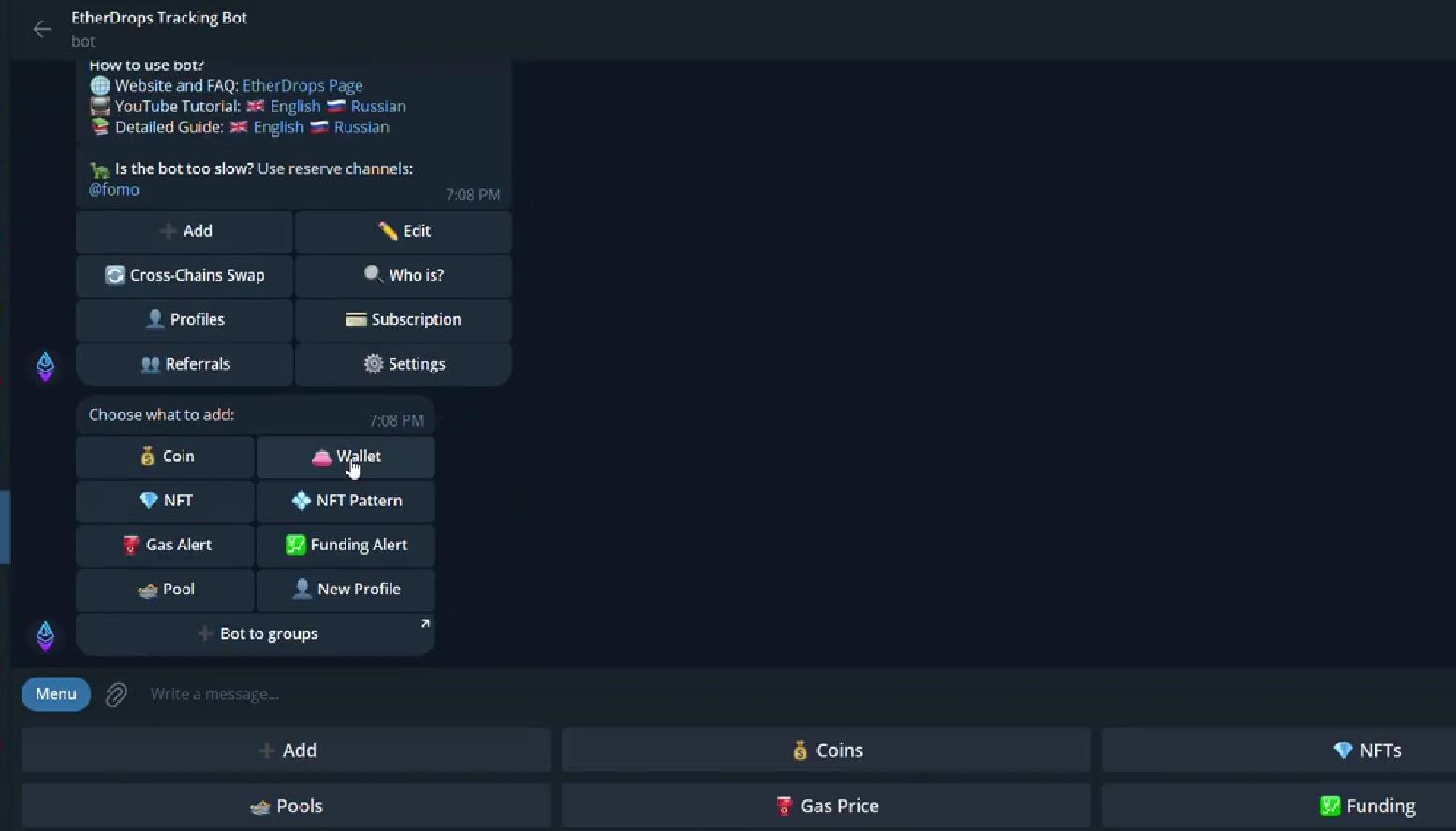

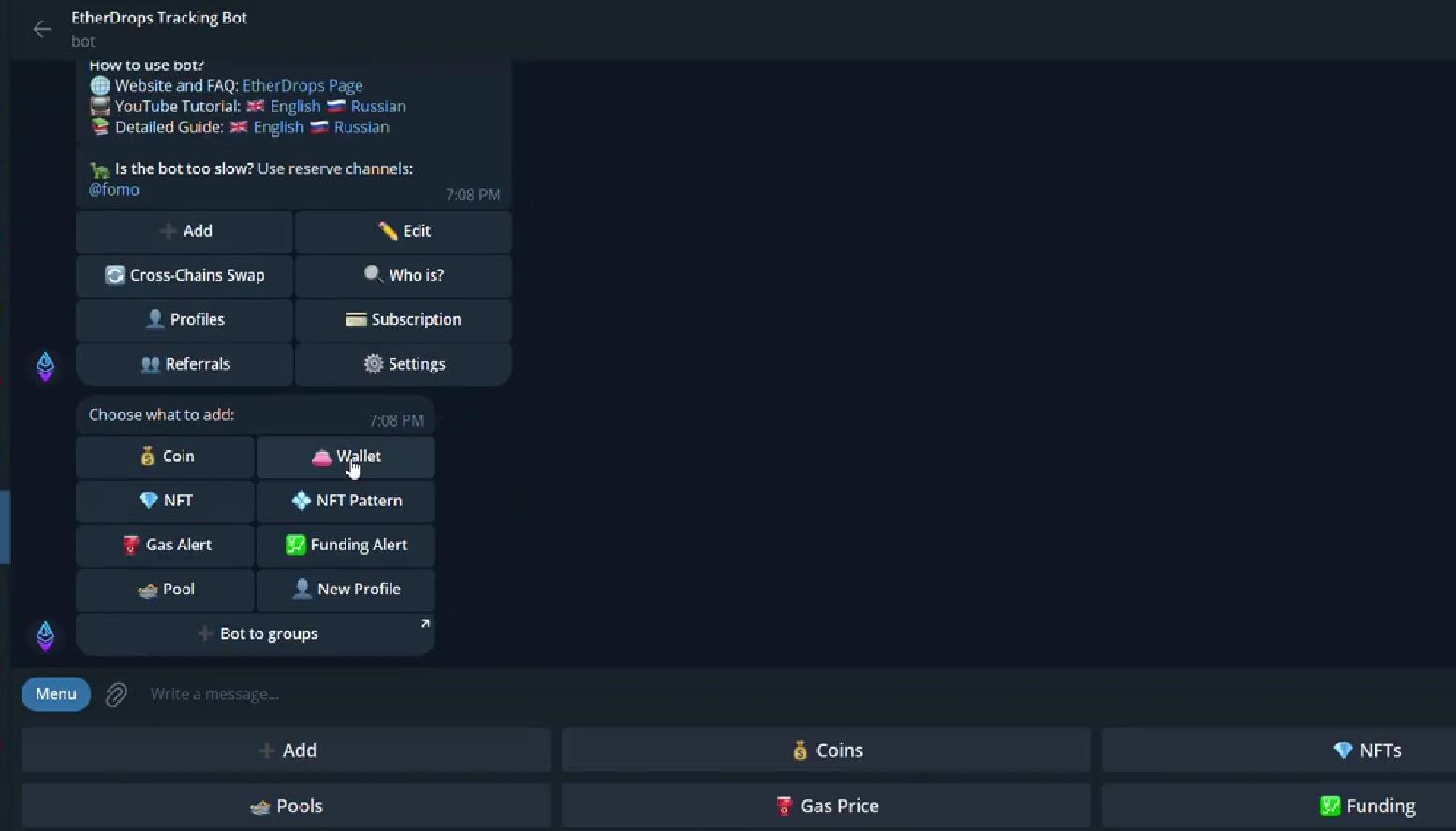

Bonus Tip: Use Whale Alerts on Social Media

In addition to the on-chain analytics platforms that abound in the industry every day, consider getting up to speed with social media platforms, such as Telegram, to set up alerts on the movement of whales.

The rise of Telegram bots allows the average investor to have real-time alerts from the wallets of their choice at their fingertips practically and intuitively, which was unthinkable a decade ago.

Examples of Telegram bots that track crypto whales are Whale Alerts, WhaleBot Alert, and Etherdrops_bot.

Its configuration is simple. You only need to enter the wallet address you want to track and the chains where you want to monitor the movement of the crypto whale. The bot will notify you of each movement of the added wallet addresses.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

In addition, telegram bots such as Whale Alert can also find you on social media platforms such as X (previously Twitter), where you can visualise large transactions between relevant assets in the ecosystem with a link to the respective block explorer for onchain details.

Final Analysis

Now that you know how easy tracking a crypto whale wallet is, you must consider some criteria for determining whales' movement within the market.

Through on-chain analysis, you can elucidate four possible scenarios and their potential consequences on the market when crypto whales act:

▪ Wallet-to-Exchange: Implies a potential sale or purchase (for a stablecoin).

▪ Exchange-to-Wallet: This shows whales are storing their crypto, possibly causing a price rise due to reduced supply.

▪ Wallet-to-Wallet: Indicates asset diversification without important market implications.

▪ Exchange-to-Exchange: This could hint at problems with an exchange or a desire for different features. (Remember when crypto whales exited the FTX before its collapse!)

In conclusion, tracking crypto whale wallets is an excellent method for the average investor to stay ahead when the information is used correctly with other methods, such as technical and fundamental analysis.

Remember not to blindly trust a crypto whale's movements. These entities can also act under the market's FOMO in times of high volatility and trigger wrong decisions that you may regret.

However, understanding their actions in the crypto market can be an excellent source of knowledge for anticipating daily trends in this crypto wild. Their movements can influence a user's trading decision and generate profitable results.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

written by Josh

written by Josh

Think & Trade Like A Crypto Whale

I love whales; I have even been to Ningaloo in Western Australia to swim with Humpback whales, but first, I wanted to know “WHAT is a Whale in Crypto,” so I turned to Investopedia.

So now that we know they are not just majestic creatures of the deep ocean, how do you spot one in crypto?

You hear about them all the time, but usually through others sharing their observations of trades that a 'whale' has undertaken. A simple screenshot of a blockchain transaction shows how a whale has casually dropped $1,000,000 on an otherwise unassuming, unknown coin, and four days later, it had turned into a whopping $4,000,000.

Or perhaps you've tracked down a whale (see Daniel's article in this issue!), and you've watched them over the last 2 months get trade after trade in 7 figs profit, and you start to wonder if your shrimp-like $247.50 is really going to make a difference….

But don't be blinded by the numbers. The real skill lies in the seemingly psychic qualities these whales possess when choosing and committing to trades. No hard and fast rules guarantee success; otherwise, we'd all be whales in a fishless ocean by now, but there are some common attributes. This article breaks down some of these traits in the hope that you can adjust your mindset to help you gain a bit more of an edge when trading.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Understanding Of Market Sentiment

The sentiment of the Market is paramount to identifying where and when to enter and exit a trade, and the trick is to either preempt a narrative or catch it early. Typically, the Market is either bullish, bearish or undecided. To simplify that further, the Market is going up, down, or sideways. A whale's goal is to identify how a large population's current sentiment aligns with the movement's outcome in the Market. There are many places to recognise this. Niche Reddit threads and Telegram groups, but X (Twitter) is famous for its ability to spread news fast and far across cyberspace. Sometimes known as the Elon effect due to tweets Elon posts about $DOGE that initially pumped the coin almost endlessly up when it first happened.

Following a wide range of accounts will give you a feel for how the Market is moving, but following accounts at varying levels of experience in the crypto Market will also give you a rounded picture. It's easy to follow and reply to all the whales, professionals and legends but remember, they are the ones looking back at you, and you (and a good percent of their numerous followers) are sharing a message that helps them decide what to do next, too! Put your feet in their shoes and look outwards to find out what the next inwards move could be.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Remember also that there are other players in the Market. It's not just all retail. You have OTC players, Exchanges and organisations. Most of the latter will certainly not reveal their intentions regarding how they play the Market since they aim to make money off you. Again, put your feet in their shoes. If you saw an incredibly bullish sentiment on the timeline, people sharing screenshots of profits they have made, euphoria and over-exposed positions, as an organisation that has enough buying power to move the Market, what do you think their next move might be to try and make some money?

Diversify Your Positions

We only tend to hear about the good trades, right? Those other trades that fall to the side, make average returns, or end in a loss are rarely talked about, but even whales have them. A whale knows that the greater the spread, the more chance of picking a winner within calculated reason. They look for the perfect line between being entirely focused on just one asset and spreading themselves too thin.

They also look at different ways of making profits. Trading is just one setup, but many other options exist, including staking, farming, airdrops, liquidity pools, and more. If your crypto is purely in stables, then it's not working for you. It's just sat there. Investigate other options and consider how delayed gratification might play into your hands. For example, trading on a new DEX might contain more risk and fewer options in the way of features, but by doing so, if the DEX does well, it might provide airdrops in the future for utilising their platform. Some of these airdrops can create very tidy sums, too!

Your Network Is Your Net Worth

Sometimes, it is not what you know but who you know. Crypto tends to move in circles, but gaining access to these circles is not as complicated as it might seem initially. One of the beauties of crypto is that it is very accessible, as transparency plays a massive role in what happens on the blockchain.

This bullet point is a whole article in itself and luckily, we have it in this very issue. Read Daniel's article to help you begin your whale networking journey!

Being part of a network can provide early access to new projects, ICOs, or token sales before they are widely publicised. This early access can present lucrative investment opportunities that may only be available to some of the public, giving networked traders a competitive advantage.

Adaptability And Agility

Knowledge is power. Good trading plays can be found not only in the aftermath of an event but also in its prediction. Stay informed about emerging trends, technological advancements, and regulatory changes so you can pivot your strategy accordingly to capitalise on new opportunities while minimising potential downsides. Remaining adaptable to changing market conditions and regulatory developments will allow you to flow with the narrative changes. Remember, don't marry your bags!

In reality, you don’t actually need to be a whale to trade like one.

Trading like a whale in the crypto world requires an approach that combines strategic thinking, market insight, diversification, and active engagement within the community. By understanding market sentiment, diversifying positions, leveraging various trading strategies, and building a solid network, traders can emulate the success of whales and, more effectively, swim the ocean of complexities in trading.

Ultimately, trading like a whale isn't just about the size of one's investments; it's about adopting a mindset prioritising informed decision-making, risk management, and continuous learning. Good luck, stay safe and trade like a whale!

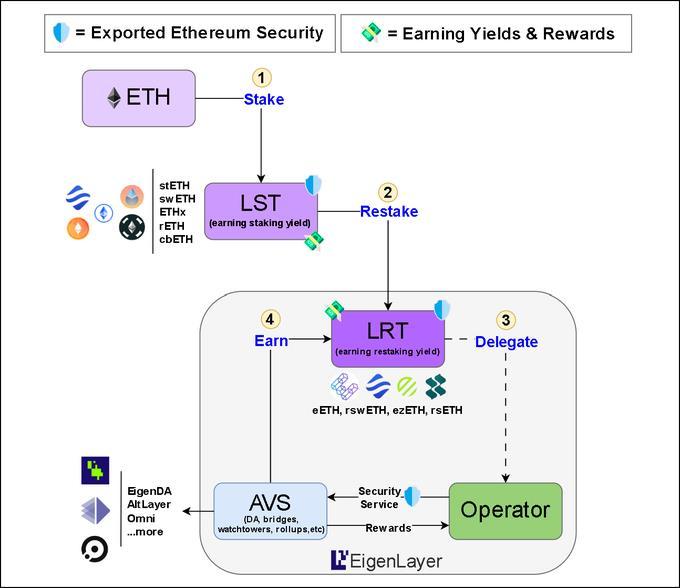

The revolution is Restaking

written by Daniel

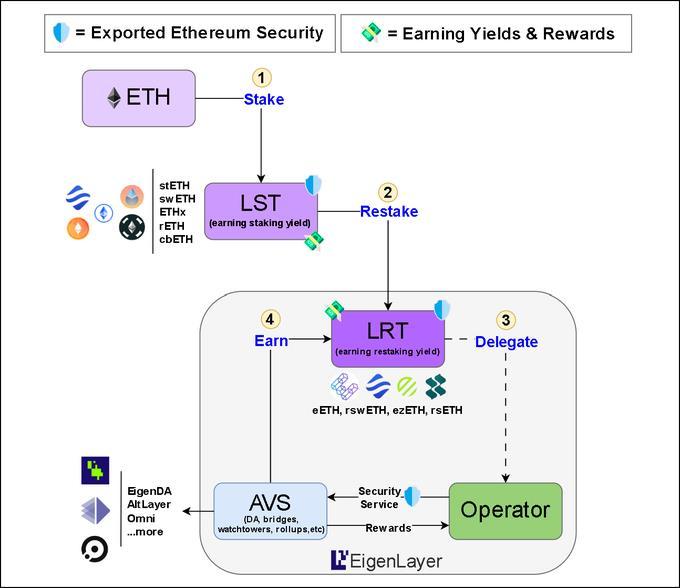

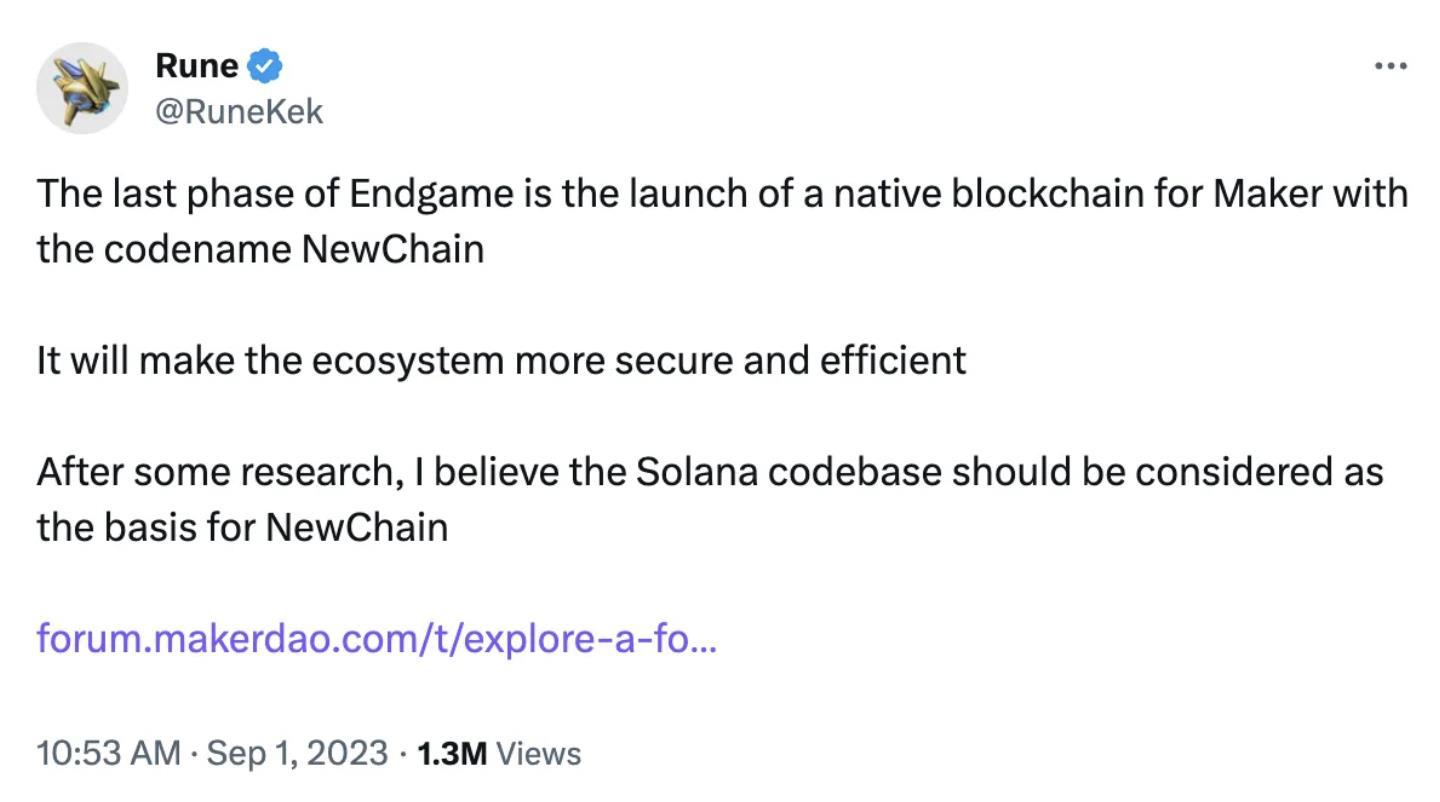

One of last year's main narratives gaining traction has been restaking. A mechanism that allows the economic security of a network to be extended beyond its borders, giving rise to a new multi-billion dollar industry.

While the narrative is not unique to Ethereum, it has the major players making a living in this market in 2024 in this ecosystem, potentially paving the way for a new industry within the web ecosystem3 to watch out for in this next bull cycle.

Given that the Ethereum blockchain consensus mechanism is one of the most secure crypto-economic systems on the blockchain, with over 31.2 billion Ether (around $107 billion) protecting the network economically, it is not unreasonable to consider using an LRT (liquid restaking) protocol to maximise your capital.

Consider extending this knowledge to other protocols, such as Cardano, where the option to 'reallocate' allows users to simultaneously participate in multiple pools, thus extending the restaking narrative beyond the boundaries of Ethereum.

What is restaking?

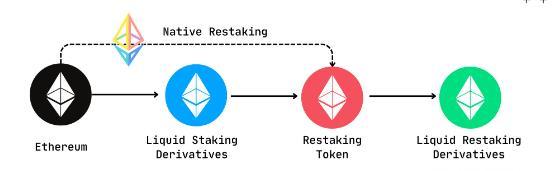

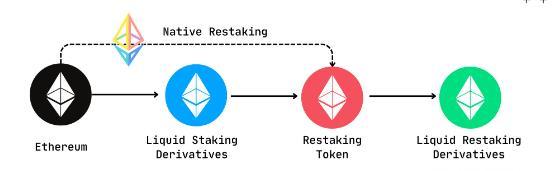

In a nutshell, restaking is:

▪ Tokens already staked on one network

▪ Staking the same tokens on a different network

▪ New slashing conditions

▪ Additional rewards

Comparable to the idea of ‘Merge Mining’ in Proof-of-Work networks, restaking allows users to secure multiple blockchains with the same hardware to earn additional rewards.

Restaking is a strategy where investors leverage their already staked assets to earn additional rewards, effectively compounding their returns by using them on a secondary platform to participate in further staking opportunities.

Furthermore, restaking is revolutionising the DeFi landscape, with Eigenlayer spearheading the movement by allowing ETH stakers to secure multiple blockchains simultaneously.

Restaking isn't limited to Ethereum alone; other protocols, like Cosmos (Persistence One) and Solana (liquid staking protocols like Jito, Marginfi, and Marinade), adopted similar mechanisms for their ecosystems.

In this opportunity, we limit ourselves to Ethereum due to the value that the main industry protocols deployed in this ecosystem represent in TVL and in addition to the fact that Ethereum is the largest decentralised network with the highest crypto-economic security in PoS networks.

Why restaking?

Simply put, restaking is when a user stakes tokens on a network they have already staked in another. Why? To earn additional rewards and maximise their return on investment (ROI).

In Ethereum, restaking is no different. It will allow users to stake ETH on Ethereum and that same ETH on other protocols, securing multiple networks simultaneously and earning additional rewards.

Restaking offers a multitude of additional benefits beyond the obvious financial rewards for validators. One of the benefits is that validators are able to provide supplementary validation services.

Validators engaging in restaking can contribute to oracles, bridges, and data availability, enhancing the ecosystem's overall functionality and reliability. This expanded role fosters a more interconnected and robust Ethereum network, where validators actively participate in various aspects of network operations and earn additional rewards for providing these ‘enhanced’ services.

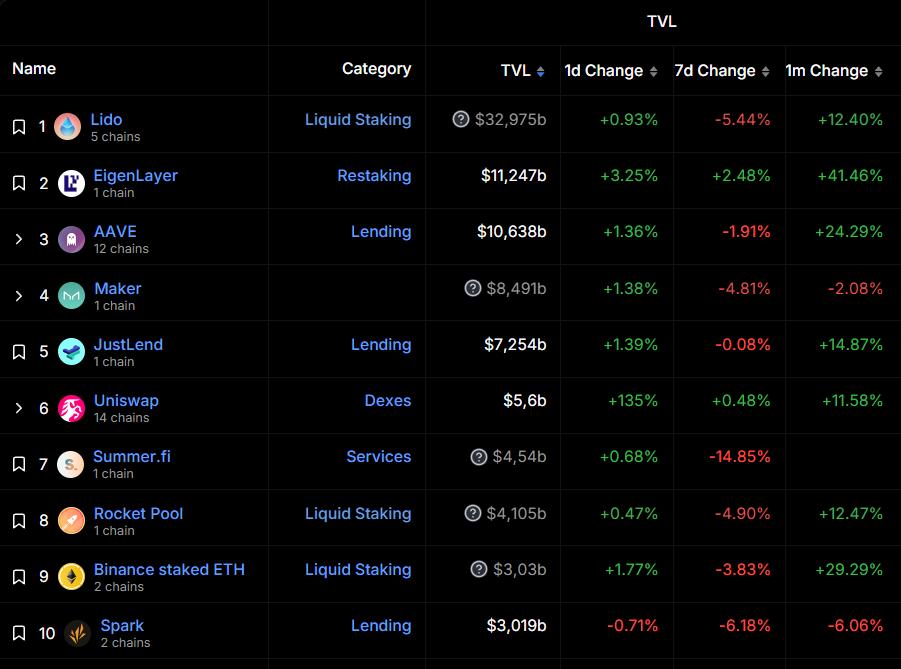

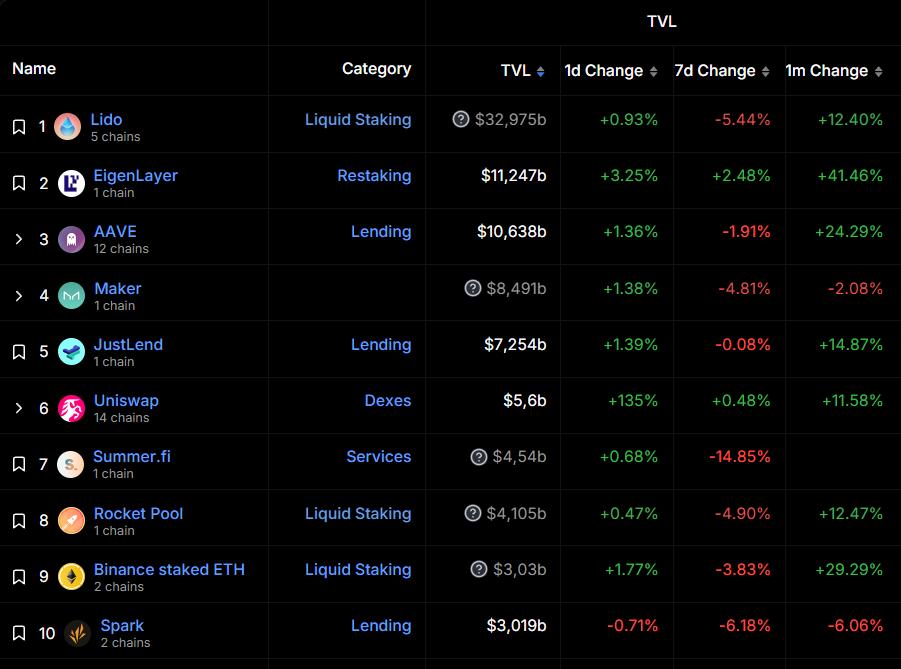

Besides, restaking promises to be one of the most important narratives of 2024. Over $11 billion has already been restaked on EigenLayer, positioning it as the second-largest application by TVL in crypto. There’s a whole ecosystem of apps designed on and around restaking on EigenLayer, and this growth is to continue.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Staking vs Restaking: How it works

To fully understand how restaking works, it is imperative that you, as a user, know how the validation process works in Ethereum PoS and, of course, the staking process.

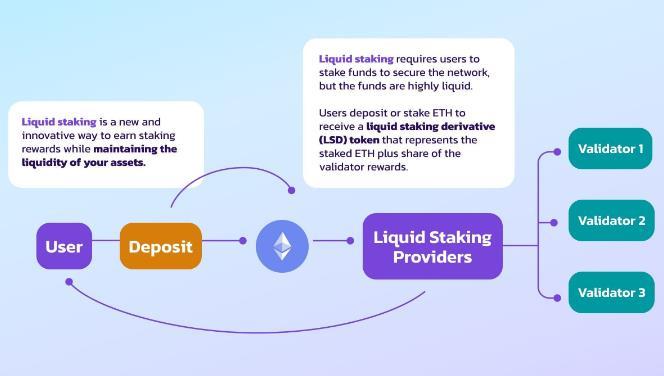

Proof-of-stake (PoS) blockchains work by consensus, a group agreement. Crypto staking lets token holders pledge their crypto to verify the correct consensus. In return, stakers get rewarded with a portion of the network's transaction fees (but also through token inflation rates), called "staking rewards."

Staking can yield between 3% to 10% annually on your original holdings. In many cases, staking is as simple as choosing how much crypto you’d like to stake and clicking a button.

There are many ways to stake, from the basic (using a centralised exchange) to the very advanced (running your validator).

Ultimately, all staked crypto ends up in the same place helping to validate the blockchain through a validator node, a computer that verifies the transactions in each block. But most staked crypto does not come from individuals running their validator nodes which can get complicated.

Most staked crypto comes from people with little technical knowledge who delegate their crypto to those who know how to run nodes. Those two parties come together thanks to various entities, such as exchanges and crypto staking pools. String it all together, and you’ve got a staking process.

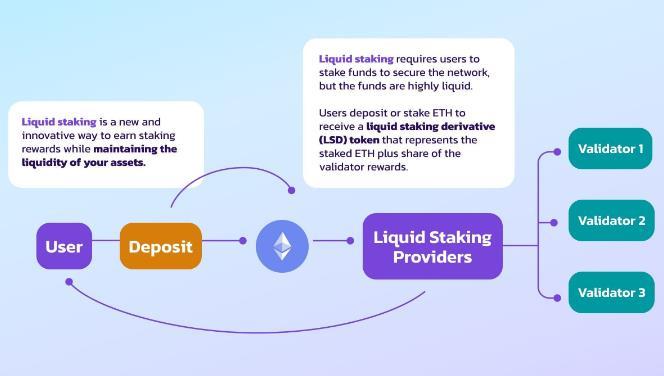

Generally, the staking process requires a period of unbounding for the user to dispose of their unstaked capital, making it illiquid and impractical for capital efficiency. From this limitation, the Liquid Staking process originated: a more flexible form of staking that allows users to earn rewards for deposited assets while maintaining the liquidity of those assets.

As noted above, tokens get locked for a set period in traditional staking, meaning users cannot trade or use them for some time. Liquid Staking changes this by issuing users a Liquid Staking Derivative (LSD) token representing the deposited asset, where users can use their LSDs whenever they wish, as the funds are highly liquid and not locked.

Therefore, users can generate multiple income streams by using the liquid versions of their assets, i.e. LSDs, in other DeFi protocols to earn more on their initial deposits. Users can also deposit and withdraw any amount of the asset without affecting the initial deposit.

But what if you can not only use these LSD tokens but also your initially locked ETH in the protocol?: Restake!

Based on this premise, EigenLayer introduced the ecosystem to restaking, which means "You take your staked ETH… and you stake it again."

Thus, restaking lets you stake your already-staked ETH for any purpose.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

From a security criterion economic point of view, applying this to Proof of Stake, restaking is when multiple networks are secured using the same equity stake.

It is important to note that proof-of-stake (PoS) consensus-based networks such as Ethereum maintain their security based on the amount of capital staked in their network, unlike networks such as Bitcoin that protect their network through intensive mining.

"Economic security" refers to the amount of capital staked in the network to prevent attacks. It is economically unattractive for an attacker to carry out such actions, given the cost of the capital required to execute them.

How to do restaking

If you are an ETH holder and want to adopt restaking early on, there are options available in the market, especially in Ethereum, to interact with restaking protocols.

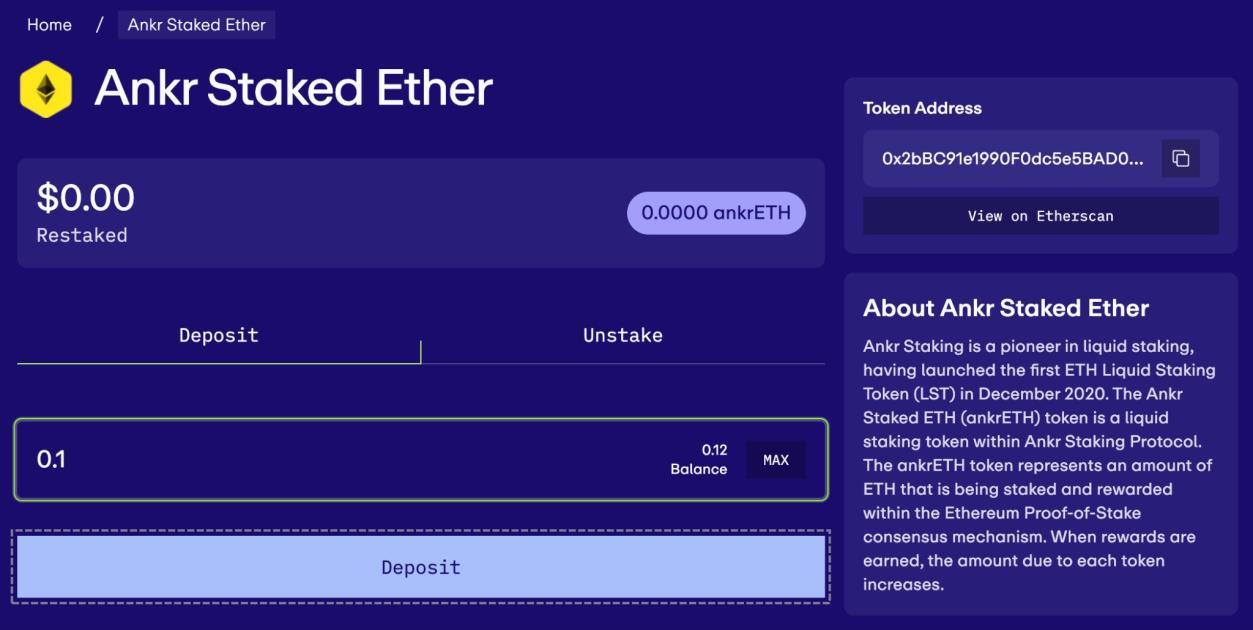

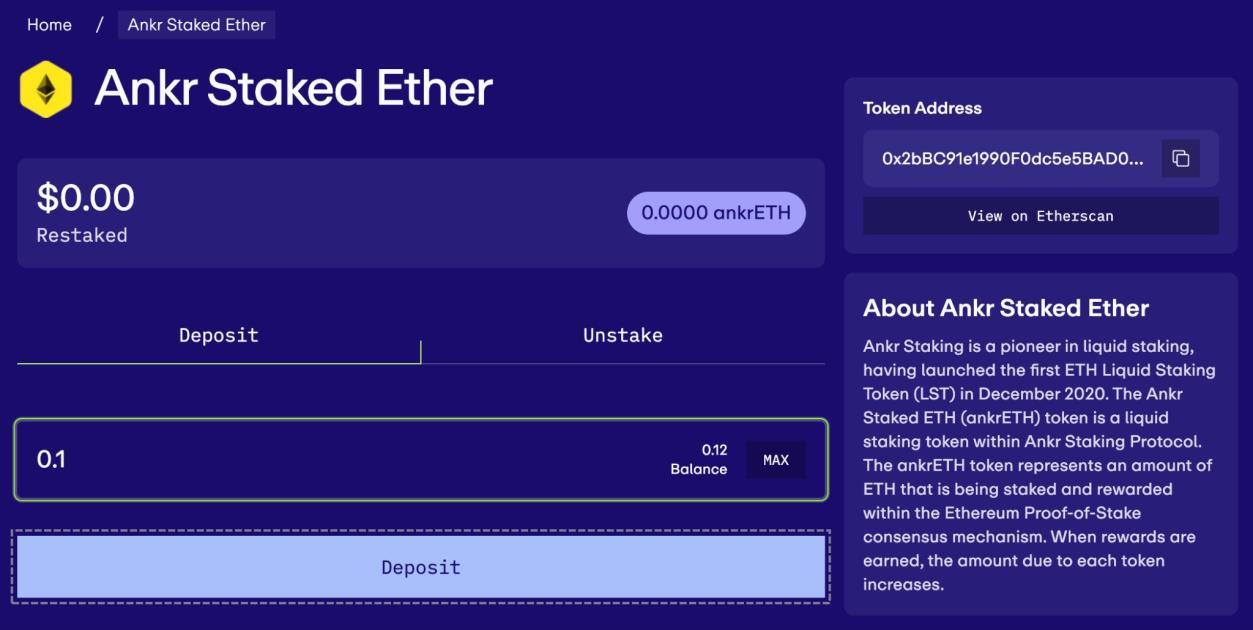

It is important to note that the process is straightforward and is nothing more than a few clicks of confirmation on your wallet. However, EigenLayer, the Ethereum forerunner of the restaking concept, achieves this mechanism in two ways: native restaking and liquid restaking

Generally speaking, native restaking is for advanced users and involves operating your validator on Ethereum and depositing regular ETH into an "EigenPod," allowing restaking to work through smart contracts that guide the management of staked assets under a validation node and the cryptoeconomic security offered by restaking protocols such as EigenLayer

On the other hand, liquid restaking is much easier. Here, the staker stakes assets with a validator and receives a token representing the stake with the validator. It then simply involves depositing liquid staking tokens such as Lido stETH, Rocket Pool rETH or Coinbase cbETH into restaking protocols such as EigenLayer

Once tokens get deposited in the restaking protocol, users can browse the available dApps to restake their tokens. In EigenLayer, the dApps are Actively Validated Services (AVS).

So, from the point of view of the average investor, who is not familiar with the technical jargon required to deploy a validation node and take part in native restaking, liquid restaking presents itself as a great, frictionless alternative for taking part in this narrative.

In a few simple steps, you can:

1.- Acquire ETH on a centralised or decentralised exchange (DEX) if you are familiar with the non-custodial process.

2.- Once you have acquired your ETH, send it to your noncustodial wallet, such as Metamask, to interact with the LST protocol of your choice.

3.- Receive the LST according to your choice, meaning you can delegate your ETH for staking to a liquid staking protocol such as Lido, Rocket Pool or Coinbase and get a derivative representing your position within these protocols, known as LST or LSD (liquid staking derivatives).

Some protocols natively offer to delegate their ETHs to generate LRTs that can be used several times in DeFi. KelpDAO is an example of this.

4.- Prepare the LST of your choice to interact with the restaking protocol in liquid form. Remember that your preferred LSTs must be in the wallet you wish to interact with during the restaking

5.- Visit the restaking protocol application and connect your wallet where you have your LST tokens. Select the asset you wish to start restaking with to continue

6.- Complete your deposit in the interface provided by entering the amount you wish to deposit into the LRT protocol. Then complete the approval transaction + final authorisation transaction with your wallet to officially start restaking

7.- Once you’re in, you can track all your deposits from the main liquid restaking protocol app page. You can also withdraw as you please using the “Unstake” button in the deposit interfaces, but keep in mind that there is a withdrawal delay period, so it will take some time for your funds to reach your wallet as things stand.

8.- As noted above, your liquid re-staked tokens (LRTs) can be used in several DeFi protocols to expose them to investment strategies that allow you to maximise your rewards. In the case of EigenLayer, AVS (Actively Validated Services) is not yet active in exposing LRTs to DeFi, but other restaking protocols, such as KelpDAO, support this feature.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This reuse of staked ETH enables users to participate in multiple ecosystems with the same assets, thereby improving stakers' capital efficiency.

Benefits of restaking

Restaking allows users to increase capital efficiency across the entire decentralised finance (DeFi) space. These primitives grant security sharing while mitigating opportunity costs for the stakers, validators, and services.

It is precisely on the premise of shared security that the restaking narrative has gained significant momentum in the industry due to the costs and difficulties that achieving elastic and sufficient security at an early stage of deployment can represent for emerging projects.

Leveraging the economic security capital of the most decentralised network with a PoS consensus mechanism such as Ethereum can promote the development of more use cases in the blockchain industry by lowering the barrier to starting a network by making the economic security provided by ETH a widely available product.

Undoubtedly, the mechanism deployed by EigenLayer on Ethereum or Persistence One on Cosmos can reduce the difficulties for networks that raise venture capital money by finding the necessary network security in these protocols to grow their security. Through restaking, early networks can more easily tap alternative sources of capital to build a critical part of their network.

In general, from an investor's perspective, restaking allows:

▪

▪ It allows users to restake their ETH and receive double staking yield from Ethereum and other protocols.

▪ Maintains liquidity by providing users with an avenue to restake LPs.

▪ High flexibility: allows participation in financial activities without unstaking

What considerations should I take into account when restaking?

From the user's point of view, it is imperative to understand that, in PoS networks, the most important risk to consider when delegating your assets (ETH, in this case) is slashing.

The risk of slashing is a form of protection that PoS networks use to discourage malicious actors during the transaction validation process if users don't follow the rules of the consensus mechanism.

It is, therefore, imperative to understand that choosing the appropriate validator or a suitable Actively Validated Service (VAS) committed to following the rules in the blockchain network is critical to avoid suffering decreases in our staked balance.

While you provide capital to earn a return while directly protecting a blockchain network (staking only) or indirectly delegating your capital to a node operator, you must understand that during restaking, the risks of cuts grow as the chances of generating further returns on this capital.

In other words, the appetite to maximise your capital exposes you to taking on more risk in the restaking process, as users who restake their ETH may be subject to penalties and slashing of both Ethereum and the AVS (or dApps) they secure, depending on their restaking method and the slashing conditions of each protocol.

In addition to slashing considerations, monitoring our selected operators' fee costs, performance, and online readiness to mitigate the costs associated with delegating their tokens for validation on Ethereum is crucial.

Keep an eye on Ethereum gas fees to optimise your investment by depositing when transaction costs are lower. Use a gas tracker to make life easier!

Consider the liquidity factor and the withdrawal times provided in each protocol to get your ETH back into your wallet when you want to 'unstake'.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Not least, the consideration of using protocols focused on security and decentralisation is a significant factor in helping not to overload the consensus on Ethereum, as Buterin pointed out in his blog post on the concerns inherent in centralisation within the AVS environment and restaking in general.

More decentralised restaking is synonymous with greater security and less likelihood of the protocol failing or being subject to attacks by malicious actors that can put our ETHs at risk.

While EigenLayer is taking measures to avoid collisions due to concentrated power in a few hands, we must not neglect the constant monitoring of our ETH deployed in LRT protocols. This is a relatively new technology, meaning it is not error-free.

Where we are and where we are going with restaking

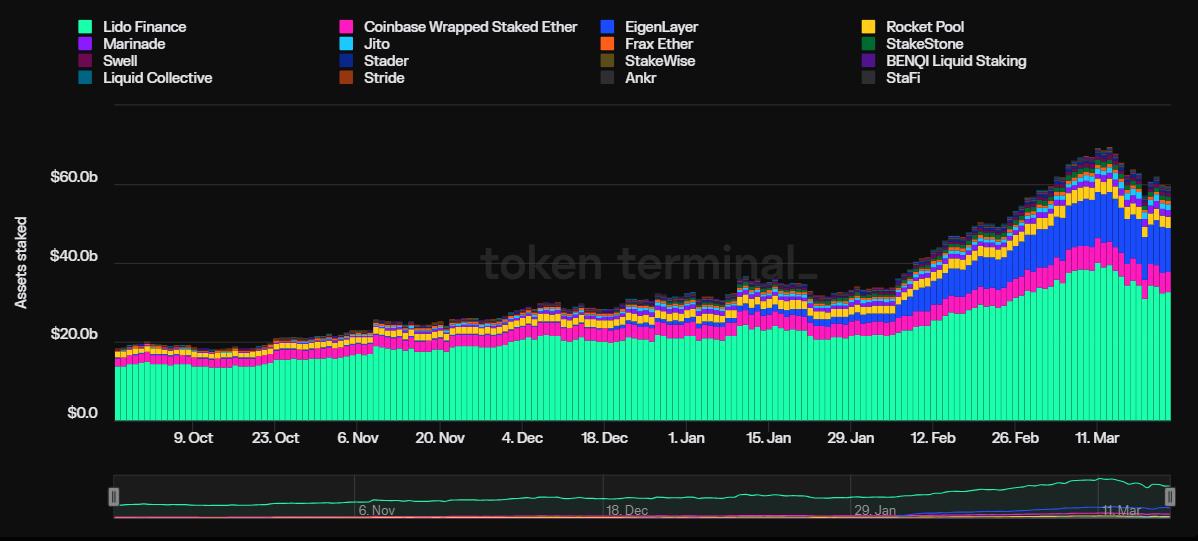

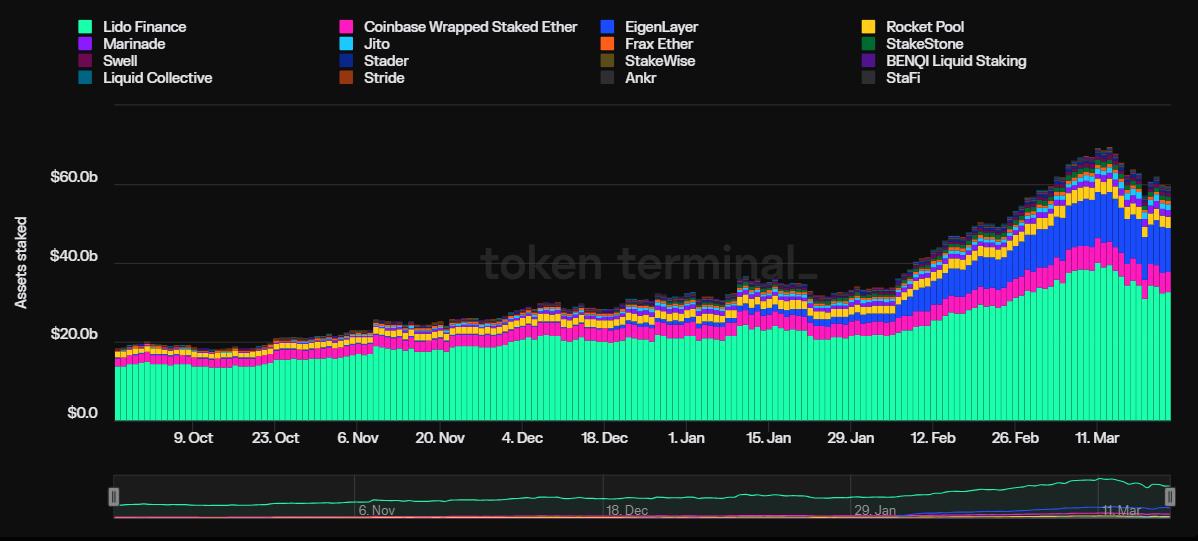

In comparing the current market state to 2021, a significant shift is evident: Dexs and lending platforms once accounted for most activity in DeFi, but liquid staking has emerged as the leading category, accounting for roughly $60B of a $107B industry.

Furthermore, restaking is revolutionising the DeFi landscape, with Eigenlayer spearheading the movement by allowing ETH to secure multiple blockchains simultaneously.

With over 26.65% of ETH staked, Ethereum is a network that offers unparalleled crypto-economic security, which is why EigenLayer has selected this blockchain network as its native home to deploy the restaking mechanism and help secure other protocols leveraging the security offered by Ethereum.

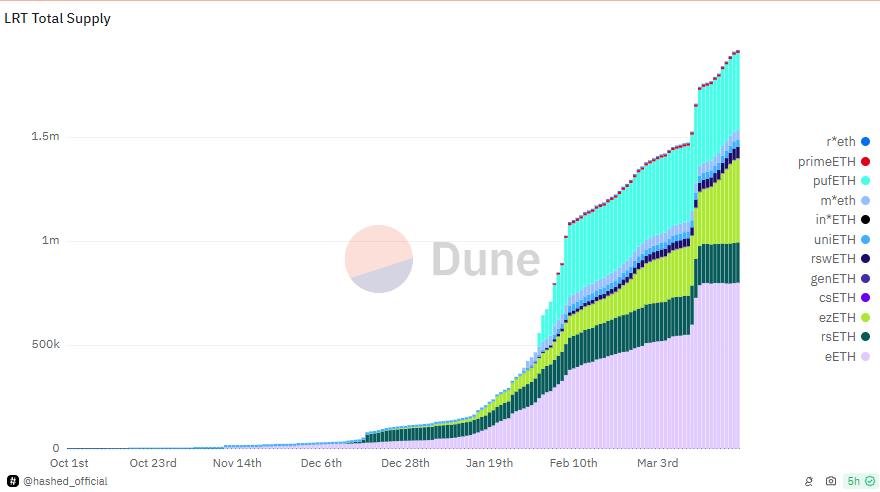

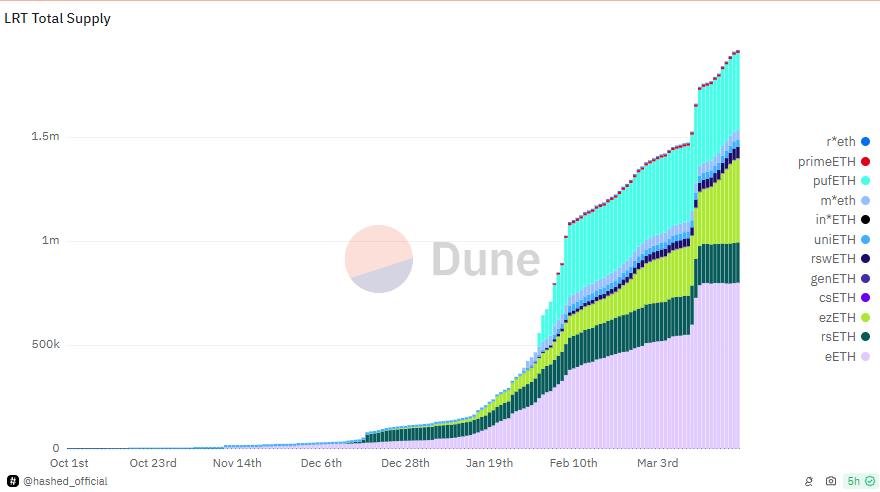

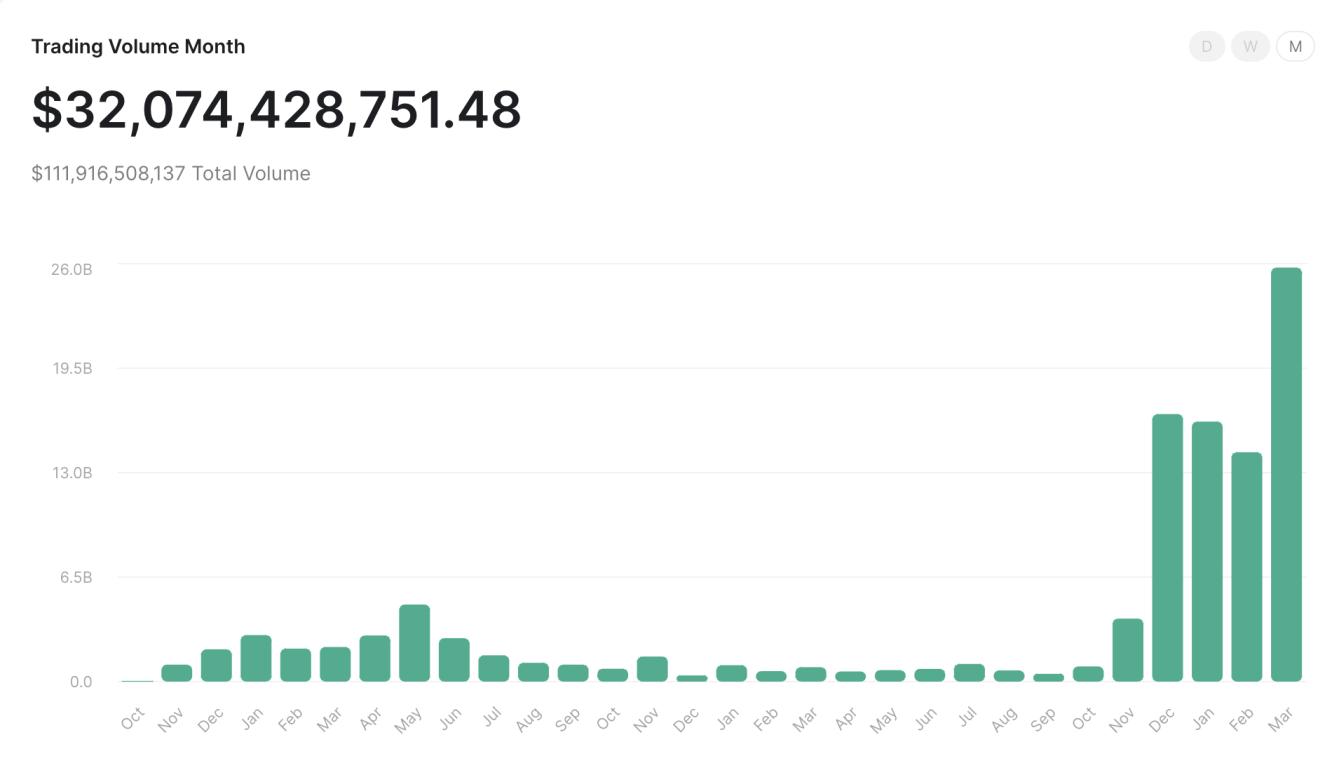

The TVL in restaking protocols has experienced a remarkable surge, skyrocketing from $1.1B to over $11.4B since the end of Q1-2024.EigenLayer is the undisputed frontrunner and innovator in the staking domain, with almost 11 billion USD in Total Value Locked (TVL).

Projects such as EigenDA, AltLayer, and Lagrange are contributing to the EigenLayer ecosystem, and other liquid reset protocols, such as Ether.fi and Puffer, have also gained traction. They have amassed close to $4 billion in FVL, demonstrating the significant potential of this industry.

As Redstone highlights in its latest report on the LRT market Q1-2024, the above metrics only represent one side of the equation: the restaking supply. It remains to see how the industry will grow on the demand side, which will be determined by Actively Validated Services (AVSes).

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Some options for restaking

Throughout this post, we have discussed EigenLayer as the industry's benchmark developing alongside restaking, as happened with FlashBots in the MEV market capture on Ethereum. EigenLayer is laying the foundations for the extensive development of protocols as demand requires, taking advantage of its primitive.

From the user's point of view, the LRTfi landscape is more diverse than AVS options or DeFi protocols for maximising the equity of restaked tokens. However, opportunities are emerging as the narrative becomes more popular. Let's look at some options to consider.

EigenLayer: The protocol went live on the mainnet in June 2023, initially supporting stETH, rETH, and cbETH. The launch was "guarded", with a cap of 3,200 tokens per asset to ensure the protocol's safety and security.

EigenLayer is pioneering the restaking movement by enabling users to restake their already staked ETH with various liquid staking providers. The restaked ETH on EigenLayer, which is later employed within its security framework, aims to extend the security guarantees of Ethereum to other applications and blockchains.

The design of a whole ecosystem of apps is happening on and around restaking on EigenLayer, and this growth is to continue. Consider EigenLayer as the base of the pyramid for building the restaking industry.

Ether.fi (eETH) is the dominant player in the LRT market, with 41.7% market capture. Its great strength is its offering of liquid staking and restaking through a non-custodial environment. Through distributed validation technology (DVT), stakers can encrypt their validation key using the public key of a selected node operator through an auction mechanism, allowing them to have control over their deposits.

Kelp DAO (rsETH) is one option that allows ETH holders to stake their ETH directly within the protocol and obtain an LRT that generates rewards. In addition, users can utilise the equivalent restaked ETH token in some of the major protocols of the DeFi spectrum. Stader Labs, the team behind the project, has successful experience in Liquid Staking.

Renzo Protocol (ezETH): Analogous to a fund manager, the Renzo protocol acts as a strategy manager for EigenLayer, allowing it to manage the repurchase of LRTs. It aims to optimise returns and reduce risks for restakers

Puffer Finance (pufETH): It is currently the third largest protocol in total LRT supply, with 19.2% of the share market. Like Ether.fi, Puffer prioritises decentralisation with a focus on single stakers and is innovative in anti-slashing measures that improve validator security and protect against the risk of cut-off due to client and operator error. Its low threshold is so attractive that it allows a trader to validate with as little as 1 ETH as collateral.

BounceBit: BounceBit's proof-of-stake Layer 1 network is a novel restaking protocol that supports assets like BTC, Binance's BTCB, and its native token. It enhances participation and chain security within the ecosystem.

BounceBit distinguishes itself by operating at the asset rather than the protocol level, offering unique solutions in the Bitcoin restaking space. The project aims to expand its ecosystem and provide users with decentralised applications and tools tailored to their needs.

Persistence One (XPRT) Persistence One is a purpose-built Layer 1 on a mission to maximise yield and security through Liquid Staking and Restaking. This initiative allows for the restaking of tokens from one chain to another, bolstering the Cosmos network's economic security and fostering a more resilient and collaborative blockchain infrastructure.

Through platforms like pSTAKE, Stride, Quicksilver, and Milkyway, Persistence One enables the redeployment of liquidity, introducing Liquid Restaking Tokens (LRTs) and Liquid Restaking Finance (LRTfi) to the Cosmos DeFi scene.

Octopus Network (OCT): Octopus Network introduces restaking to the NEAR Protocol, enabling $NEAR token holders to support the security of additional decentralised blockchains. This key feature of the "Octopus 2.0" upgrade aims to enhance the blockchain ecosystem's connectivity and security. Restaking boosts potential earnings for $NEAR holders and attracts app chains and middleware projects, increasing $NEAR's utility as a foundational staking asset.

Other options include Swell, EigenPie, Bedrock, Prime Staked ETH, Genesis, Inception, ClayStack, and Restake Finance. These liquid restaking protocols operate similarly to those built on the EigenLayer premise of leveraging the crypto-economic security of Ethereum and other major L1 networks on which they are deployed.

Happy restaking!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

written by Chris

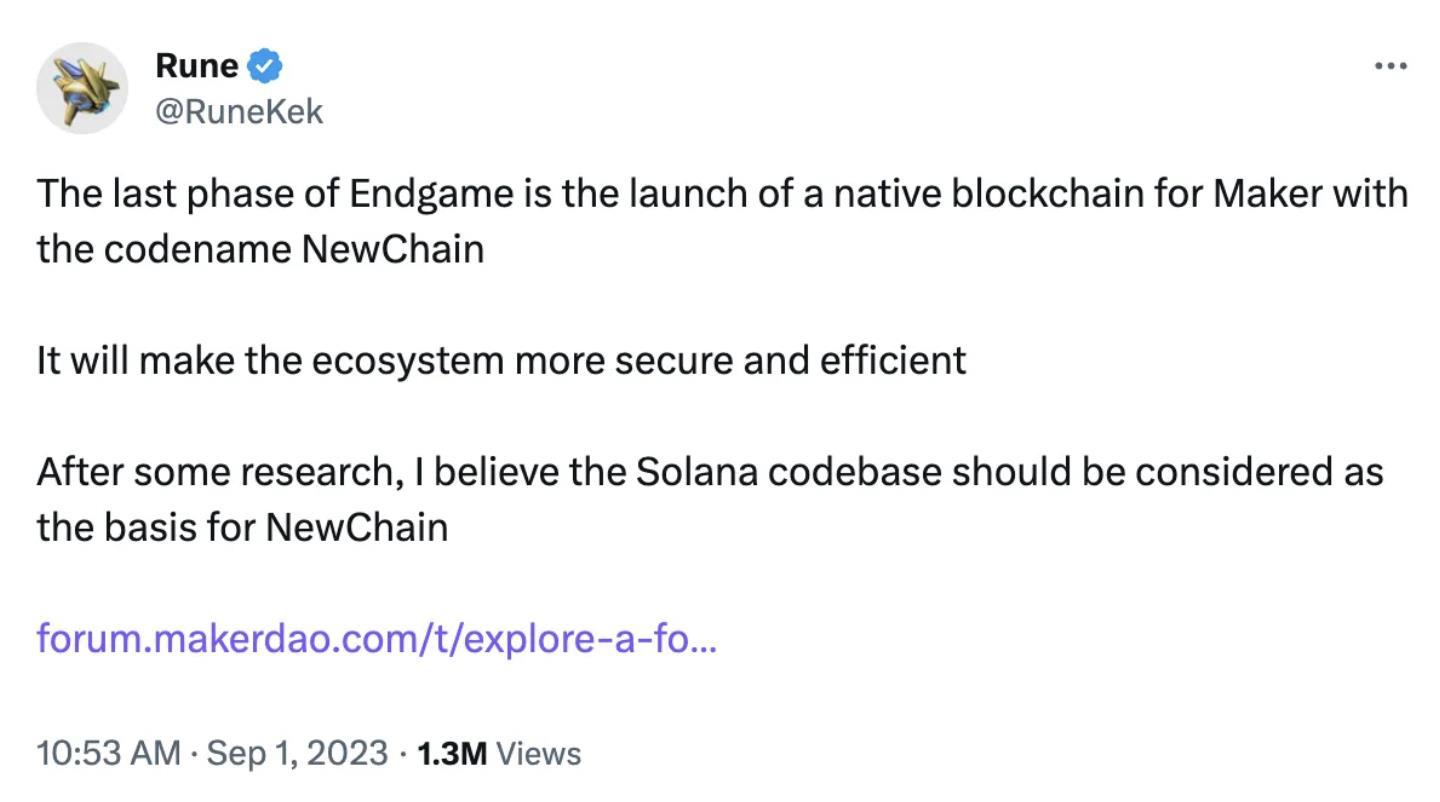

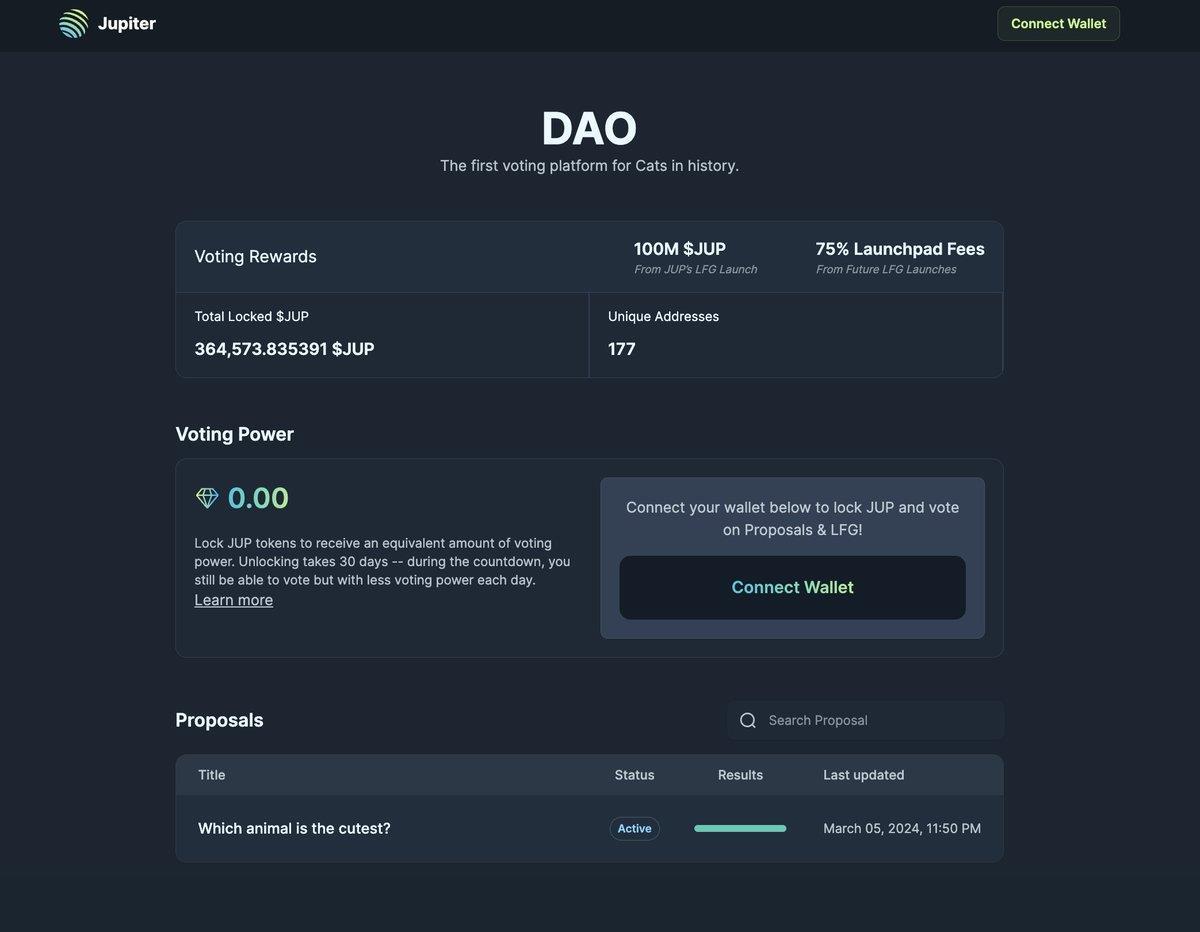

Jupiter and the JUP Token

Intro

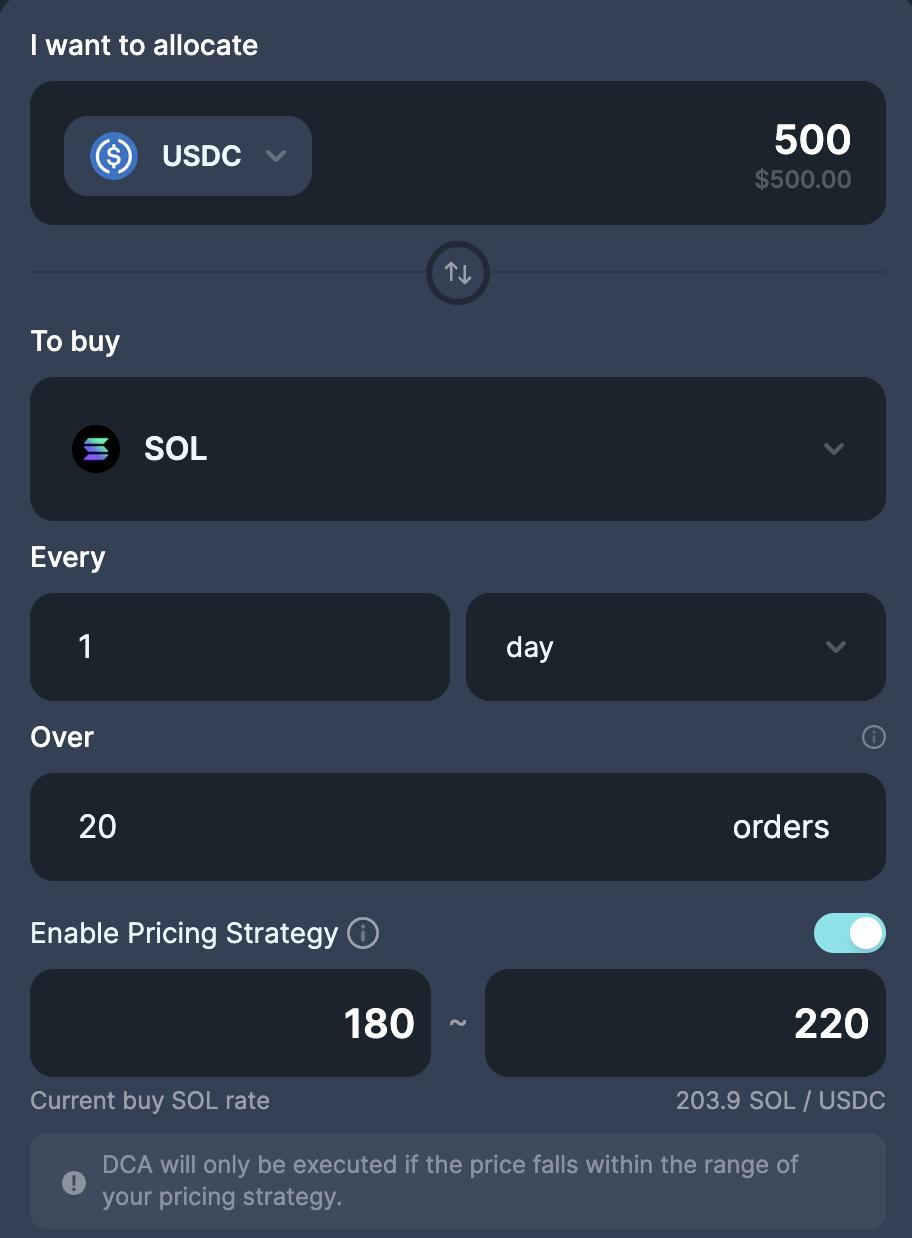

We know that the Solana blockchain offers lightning-fast transactions and a growing array of decentralised exchanges (DEXs) However, finding the best swap rates can be a headache Jupiter is a DEX aggregator and solves this by pooling liquidity from multiple sources With its constant scans of top Solana DEXs, it seeks to uncover the most favourable routes for your trades, ensuring you get the most bang for your buck

Fueled by its native token, JUP, Jupiter combines efficiency with a user-friendly interface, lowering the barrier to entry within the Solana DeFi ecosystem Its Metis routing algorithm sets it apart, promising superior trade execution optimised for minimal slippage and fees

Jupiter's ambitions don't stop at simple swaps The team envisions a comprehensive trading platform on Solana With features like limit orders, perpetual futures offering up to 100x leverage, and even a proposed decentralised stablecoin (SUSD), they aim to cater to a wide range of trader needs Whether Jupiter can successfully achieve this ambitious goal remains to be seen

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: DefiCalendar

Background & History

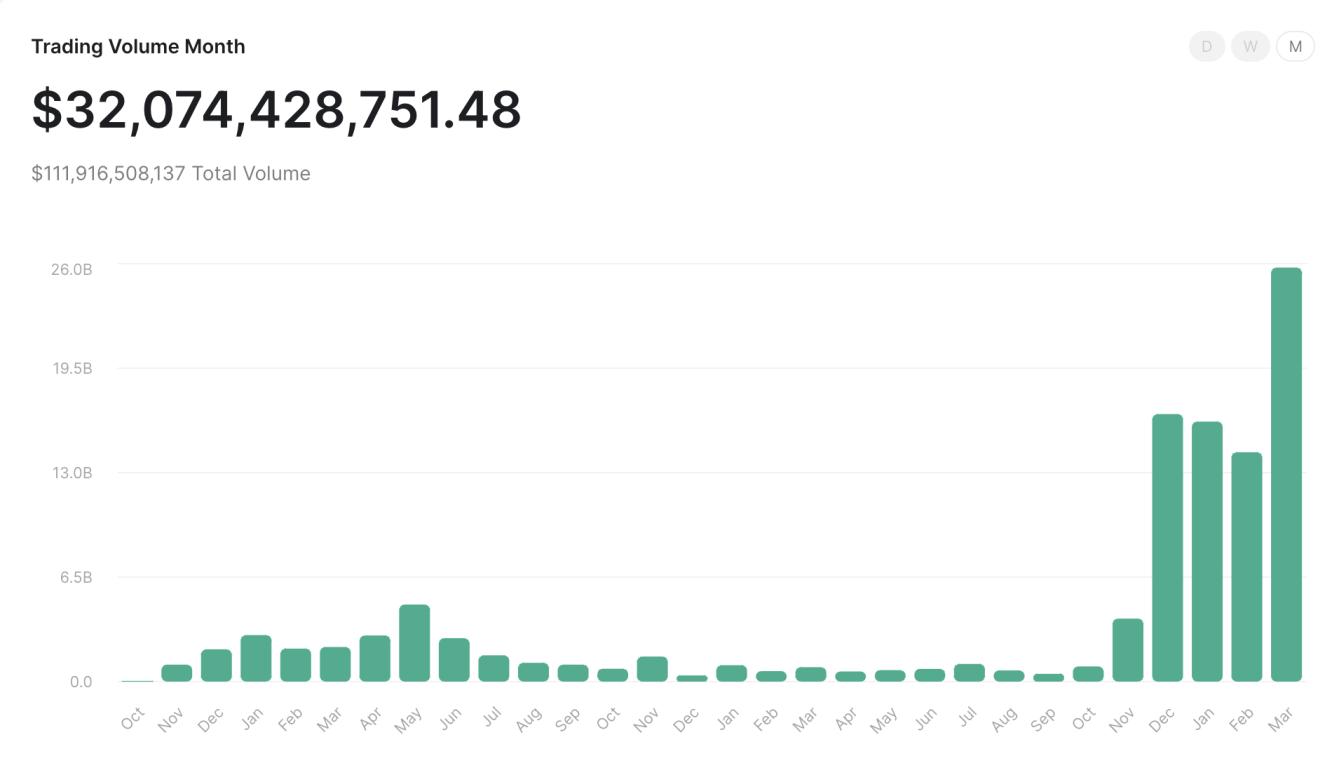

Jupiter began as an experiment within the Solana ecosystem, aiming to enhance stablecoin utility and explore cross-protocol liquidity solutions. Its success led to its launch as a standalone project in November 2021, quickly gaining recognition for its efficiency and user-friendly approach