A note from Lisa

A note from Lisa

Welcome to the January 2025 edition of The Moon Mag! As the crypto world steps into a pivotal bull year, we’re here to ensure you’re equipped with the insights, stories, and strategies that matter most. From groundbreaking innovations to timeless trading principles, this issue sets the tone for what promises to be a thrilling ride in blockchain and beyond.

We check out Limewire - From piracy to pioneer, LimeWire has undergone a metamorphosis that few could have predicted. Now a leader in blockchain-based content distribution, LimeWire is carving a niche at the intersection of decentralisation and creative freedom. We explore its remarkable evolution and what it could mean for the future of digital ownership and Web3 culture.

2025 marks an inflection point in the race toward global digital currencies. As nations and corporations unveil ambitious plans, we’re unpacking the implications for traditional banking, decentralised finance, and international economic structures. Are we heading for a harmonious coexistence or a battle for supremacy? Dive into the details with our exclusive feature.

Great traders don’t just read charts—they read themselves. This month, Josh is focusing on the psychological dimension of trading. Discover practical strategies to manage emotional volatility, stay disciplined under pressure, and transform psychological challenges into competitive advantages. Trading isn’t just about the market; it’s about you.

Syntropy continues to push boundaries with its decentralised internet protocol, aiming to make the web more secure, efficient, and equitable. Our deep dive examines its latest milestones and evaluates its potential impact on both the tech and investment fronts. With industry experts' insights, you’ll better understand its trajectory.

My monthly column returns with a sharp focus on the opportunities and challenges defining crypto itself, as well as the role of macroeconomics and Trading.

This issue unpacks the industry’s hottest debates, from the rise of decentralised identity to the challenges of scaling blockchain ecosystems. We’re here to help you see the bigger picture without losing sight of the details.

January sets the stage for a transformative year in crypto. So buckle up, tune in, and let’s embark on this journey together. With The Moon Mag as your guide, the possibilities are endless. Here’s to a new year of discovery, growth, and success!

Lisa

A note from Josh

It's a brand new year and 2025 looks set to be super exciting! In this issue, we explore the ever-shifting narratives shaping the trading and blockchain industries. From the resurgence of LimeWire, now reborn as a blockchain pioneer, to the profound implications of a global digital currency race, January’s edition promises to inspire seasoned traders and curious newcomers alike.

The markets are complex ecosystems, driven as much by emotion and perception as by data. I focus on an article about Trading Emotions and how they remind us that while charts and strategies are vital, understanding our own psychology can be the key to unlocking success. We also revisit projects like Syntropy to see how they are progressing and get Lisa's trader's perspective of the month, too!

Many narratives adorn the crypto industry this year, but hopefully, we can help you break down what matters, what could matter, and what doesn't matter! It's a big world of crypto mania out there but with the help of the Moon Mag, you should start to see it with a lot more clarity. Enjoy, and Happy New Year!

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

Daniel has been a blockchain technologyevangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies MDC writer since 2018, currently writer for CryptoTrendencia.

Chris

I joined the crypto party in 2017 Worked as a DAO contributor, startup advisor, lead researcher and co-author My superpower? Translating complex blockchain concepts into clear, engaging content that resonates.

written by Lisa N. Edwards

Cryptocurrency markets are often viewed as isolated ecosystems driven primarily by technological innovation, speculative enthusiasm, and decentralisation. However, macroeconomic factors increasingly influence market movements as the crypto industry matures and integrates with the global financial system. Understanding these dynamics is essential for traders aiming to navigate the volatile waves of the cryptocurrency markets effectively.

Historically, Bitcoin and other cryptocurrencies have been touted as “digital gold,” offering a hedge against inflation.

This narrative gained significant traction in 2020 and 2021 when central banks worldwide initiated unprecedented money-printing programs to combat the economic effects of COVID-19. As fiat currencies depreciated, Bitcoin saw a meteoric rise, reinforcing its perception as a store of value. Come 2024, Bitcoin has just surpassed the magic 100K, affirming its position as “Digital Gold.”

However, the reality is nuanced. While cryptocurrencies have shown resilience during inflationary periods, their high volatility often disqualifies them as consistent inflation hedges.

Traders should monitor Consumer Price Index (CPI) reports and central bank policy announcements to anticipate how inflation trends might affect market sentiment.

Interest rates, controlled by central banks like the Federal Reserve, directly impact liquidity in the financial system. When interest rates rise, borrowing becomes more expensive, and investors often retreat from riskier assets, including cryptocurrencies. Conversely, low interest rates foster a risk-on environment, encouraging speculative investments in digital assets.

For example, the aggressive rate hikes by the Federal Reserve in 2022 and 2023 created headwinds for crypto, with Bitcoin and Ethereum experiencing significant drawdowns. Traders should pay close attention to the Federal Open Market Committee (FOMC) meetings and statements, as these can signal future rate changes and instantly impact crypto market sentiment.

Quantitative easing (QE) and tightening (QT) also play pivotal roles in this dynamic. During periods of QE, central banks inject liquidity into the economy by purchasing assets such as government bonds. This influx of liquidity often drives asset prices higher, including cryptocurrencies, as investors seek higher returns. Conversely, QT where central banks reduce their balance sheets by selling assets or allowing them to mature drains liquidity from the system, which can lead to downward pressure on risk assets. Understanding the interplay between these policies and interest rates is crucial for anticipating market conditions and positioning accordingly.

How Quantitative Easing and Tightening works in the 4-Year Bitcoin cycle. https://www.tradingview.com/chart/BLX/ndJeKVtV-UPDATED-BTC-QuantitativeChart/

Geopolitical events, such as wars, trade disputes, or sanctions, can create uncertainty in traditional markets. This uncertainty often spills over into the crypto sector. Bitcoin’s decentralised nature has occasionally positioned it as a safe-haven asset during geopolitical crises, such as the Russia-Ukraine conflict in 2022.

However, geopolitical tensions can also lead to increased regulatory scrutiny or the disruption of key infrastructure, such as mining operations or exchanges. Traders should assess how geopolitical risks may influence the adoption and liquidity of cryptocurrencies in affected regions.

While diversification within crypto portfolios is common, traders should also consider allocating capital to other asset classes, such as commodities, equities, or bonds. This multi-asset approach can help mitigate losses during extreme crypto market volatility periods driven by macroeconomic shocks.

Stablecoins like USDT, USDC, and DAI provide a haven during market turbulence. Traders can use these assets to park funds during downturns while maintaining the ability to re-enter positions quickly when conditions improve. Monitoring the stability and backing of these assets is essential, especially during macroeconomic uncertainty.

Economic indicators such as GDP growth rates, employment figures, and manufacturing data provide insights into the broader economy. For instance, a slowing economy may prompt central banks to lower interest rates, creating a more favourable environment for crypto investments. Keeping a close eye on these indicators can give traders a strategic edge.

Crypto derivatives, such as futures and options, allow traders to hedge their positions. For example, selling futures contracts or buying put options can protect against downside risks during heightened macroeconomic uncertainty. However, these instruments require a solid understanding of leverage and risk management.

While macroeconomic factors can cause short-term volatility, the long-term growth of cryptocurrencies is driven by adoption, technological advancements, and decentralisation. Traders should align their strategies with these fundamentals, avoiding the pitfalls of overreacting to temporary macroeconomic shocks.

As cryptocurrencies continue to gain mainstream acceptance, their susceptibility to macroeconomic trends will likely increase. The interplay between inflation, interest rates, and geopolitical dynamics will play a critical role in shaping market trajectories. Cryptocurrencies will become more integrated with traditional financial markets in the next decade. This evolution underscores the importance of understanding how macroeconomic factors influence crypto prices. By understanding and mastering these dynamics, traders can survive and thrive in an increasingly complex financial ecosystem.

The crypto road ahead is not without its challenges; it is also brimming with opportunity. As blockchain technology continues to revolutionise industries and redefine financial systems, traders who remain informed, adaptive, and strategic will be well-positioned to capitalise on the next wave of growth. With resilience and foresight, the crypto community can look forward to a future of innovation and unprecedented possibilities. Let’s embrace the journey with optimism and determination. We are early; pat yourself on the back for taking the risks you have so far!

written by Chris

If you were a teen or young adult in the early 2000s, the name LimeWire might evoke a rush of nostalgia. It was a time when dial-up connections gave way to broadband, and LimeWire emerged as the go-to platform for downloading music, movies, and files free of charge. With its peerto-peer (P2P) file-sharing technology powered by the BitTorrent protocol, LimeWire was more than just a software; it was a cultural phenomenon.

But this convenience came at a cost. LimeWire was rife with legal troubles and ended following a decisive legal battle with the Recording Industry Association of America (RIAA). For many, LimeWire became a cautionary tale about the growing pains of the digital age.

Fast forward to today, and LimeWire has undergone a remarkable transformation. From the ashes of its past, it has re-emerged as a platform in the blockchain space. No longer synonymous with pirated content and viruses, LimeWire is now an NFT marketplace for music and entertainment, leveraging the power of blockchain technology to support artists and creators.

At the heart of this rebirth is the LimeWire Token ($LMWR), a digital currency designed to power the platform’s ecosystem. With its sights set on revolutionising how music is created, shared, and consumed, LimeWire has also ventured into artificial intelligence, launching an AI music studio that’s capturing attention quite fast. This bold pivot reflects the company’s resilience and underscores blockchain's transformative potential in reshaping creative industries.

For those who once juggled LimeWire downloads with after-school activities, this evolution is a fascinating glimpse into how technology and the companies that drive it can adapt and thrive. LimeWire’s story is one of reinvention, blending nostalgia with innovation to carve out a new identity in the ever-changing digital landscape.

LimeWire was a hallmark of the digital revolution. Initially launched in 2000, the P2P file-sharing platform became a cultural icon, allowing users to download music, videos, and other files with unprecedented ease. It quickly amassed a loyal following, peaking with over 50 million monthly users. LimeWire wasn’t just software; it was an experience offering a treasure trove of music discovery that often came with the gamble of downloading virus-laden files.

However, LimeWire’s revolutionary approach came at a cost. Its unregulated sharing model clashed with copyright laws, triggering fierce legal battles. As mentioned in the beginning, in 2010, LimeWire was forced to shut down, marking the end of an era. Yet, even after 12 years offline, the brand’s legacy endures. It continues to be searched thousands of times daily, proving its lasting impact on digital culture.

The LimeWire of today has evolved far beyond its original incarnation. Leveraging blockchain technology, it has been reborn as a decentralised platform for music and content distribution. At its core is the LMWR token, which facilitates transactions, incentivises community engagement, and grants users governance rights. This new LimeWire empowers artists by offering a fair and transparent ecosystem where they can directly connect with fans and monetise their work.

Incorporating AI into its framework, LimeWire enhances user experience by enabling personalised music recommendations and offering innovative tools for artists. Its AI-driven music studio provides resources for composition, mixing, and mastering, ultimately improving and decentralising the creative process. These features set LimeWire apart, making it a unique player in the NFT market.

The Vision Ahead?

LimeWire’s transformation addresses long-standing issues in the music industry, such as inadequate artist compensation and the dominance of streaming giants. By embracing NFTs, LimeWire creates a marketplace where digital collectibles, such as unique tracks or virtual concert passes, offer both artistic and monetary value. This aligns with its mission to forge closer connections between artists and fans.

LimeWire’s comeback is a bold statement of resilience and innovation. By combining blockchain, AI, and a focus on artist empowerment, it redefines its role in the music industry while staying true to its original spirit.

The once-disruptive platform is now leading a new wave of digital transformation, proving that its story is far from over.

Source: Limewire website

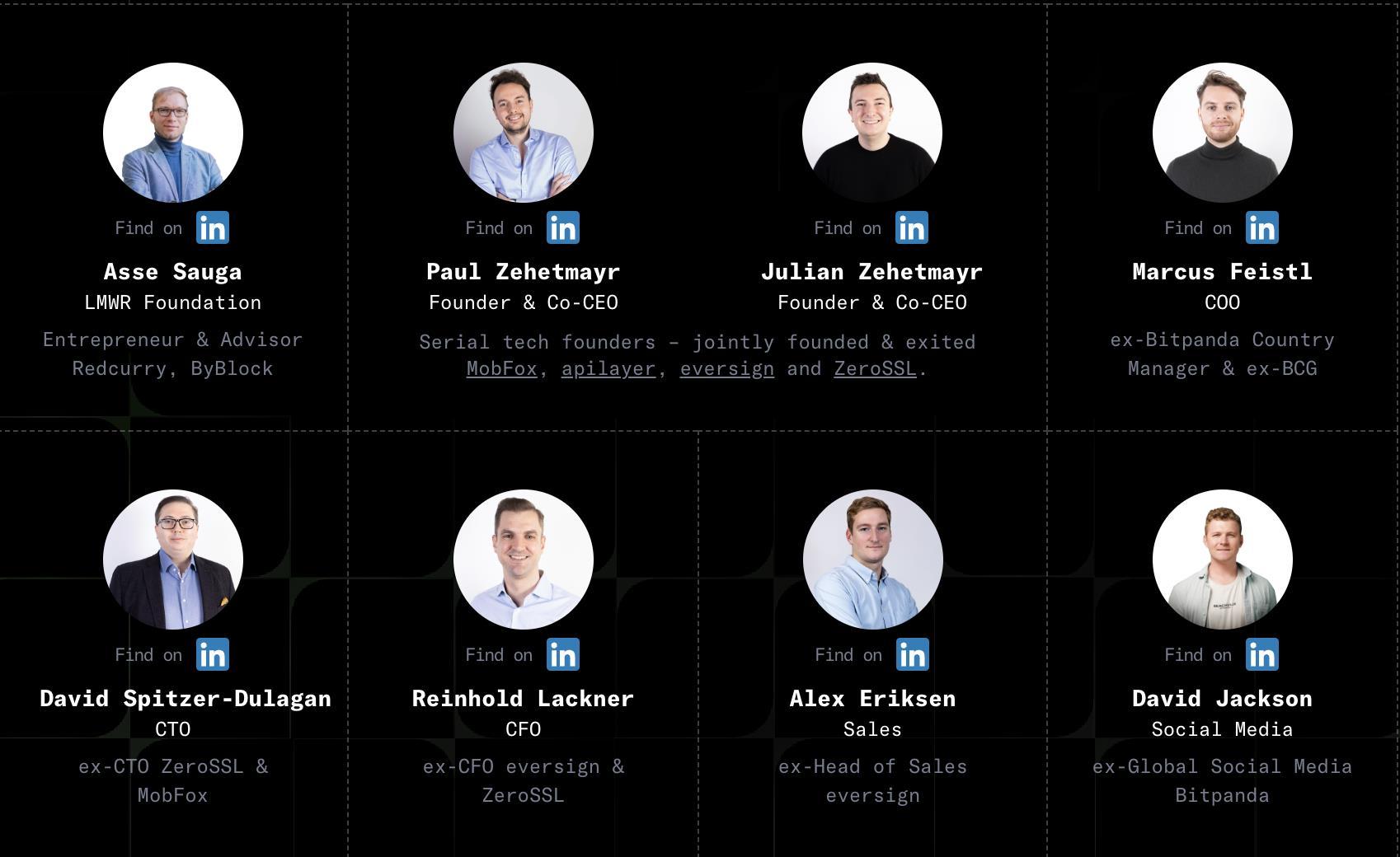

Originally the project was launched in 2000 by Mark Gorton, LimeWire revolutionised filesharing and captivated millions of users during its decade-long run.

Now, the platform has been reimagined by visionary co-founders and co-CEOs Julian and Paul Zehetmayr, who began its revival in 2021. Under their leadership, LimeWire has transformed into a blockchain-focused project, leveraging cutting-edge technology to empower creators and fans alike.

With a distributed team spanning Vienna, Berlin, and Tallinn, LimeWire brings together expertise in technology, finance, and brand development. The team is quite diverse and is committed to redefining how music and digital content are shared, owned, and monetised.

You can see the full team on Limewire’s LinkedIn page.

At the core of the LimeWire ecosystem lies the LMWR token, an ERC-20 utility token designed to fuel the platform's decentralised and AI-driven innovations. LMWR acts as a versatile payment and reward mechanism, facilitating transactions within LimeWire’s ecosystem.

1. Transactions: LMWR enables frictionless payments across the LimeWire platform.

2. Rewards: Active users of LimeWire’s generative AI and file-sharing services can earn LMWR as platform rewards, provided they hold a minimum balance.

3. Governance: Token holders gain the power to influence the LimeWire community through governance rights.

Additionally, users can stake LMWR through decentralised Web3 staking pools available on the platform. This not only provides staking rewards but also further strengthens LimeWire’s ecosystem.

source: Limewire’s Website

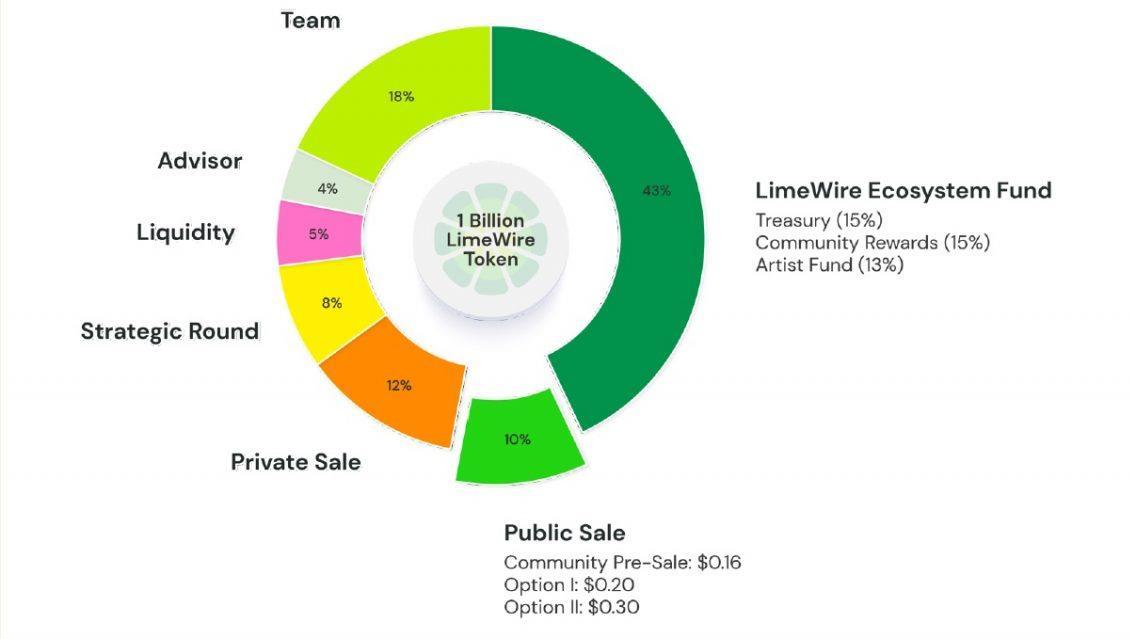

LMWR Tokenomics

Token Info

Token Name: LimeWire Token Symbol/Ticker: LMWR

Token Type: ERC-20

Smart Contract Address: 0x628A3b2E302C7e896AcC432D2d 0dD22B6cb9bc88

Minting Date: March 24, 2023

Initial Allocation

43% LimeWire ecosystem fund (15% treasury, 15% community rewards, 13% artist fund)

18% Team

12% Private sale

10% Public sale

8% Strategic round

5% Liquidity

4% Advisors

Vesting schedules ranged from 0 to 48 months, ensuring a structured and fair distribution. In addition, it's worth noting that the LMWR smart contract has been thoroughly audited by CERTIK, ranking it among the top 10% of the most secure tokens globally at spot #70

Official Links

Website: https://lmwr.com/

Docs/Whitepaper: https://lmwr.com/about https://blocknode.com/whitepaper

Linkedin: https://www.linkedin.com/company/limewire/

Discord: https://lmwr.co/discord

Twitter: https://twitter.com/limewire

LimeWire has undergone a dramatic transformation from its file-sharing origins, evolving into an innovative protocol that integrates AI and blockchain technology. By combining these two elements,

LimeWire is creating an ecosystem that caters to creators, businesses, and researchers, providing tools that are not only innovative but also decentralised and efficient. Let’s delve into the components that make LimeWire’s technology and ecosystem a project to look out for.

At the core of LimeWire’s transformation lies its AI-powered platform, which bridges the gap between traditional file-sharing and advanced AI-driven tools. The LimeWire Platform is designed to empower creators and businesses by simplifying the process of generating, sharing, and managing digital content. Its robust feature set provides unparalleled functionality for modern users.

One of the standout features of the LimeWire Platform is its generative AI capabilities. By leveraging state-of-the-art AI models, users can create, manipulate, and enhance content effortlessly. From editing multimedia files to generating entirely new content, LimeWire’s tools provide creative flexibility and efficiency that were previously unattainable for most users.

These AI tools position LimeWire as more than just a platform; it becomes a partner in creativity, enabling individuals and organisations to unlock their full potential without needing specialised technical skills.

LimeWire retains its file-sharing legacy while enhancing it with modern, collaborative features. Users can upload and transfer files of any size seamlessly across devices, making the platform ideal for teamwork. Whether it’s a business project or a creative endeavour, LimeWire ensures that collaboration is smooth and efficient.

Unlike traditional file-sharing platforms, LimeWire integrates blockchain technology to ensure decentralisation. Files are shared with end-to-end encryption and hosted on a decentralised network, giving users unparalleled security and control over their data. This decentralisation not only reduces the risk of data breaches but also empowers users with true ownership of their content.

In essence, LimeWire’s platform is a creatorcentric ecosystem where AI and blockchain converge to redefine content creation and sharing.

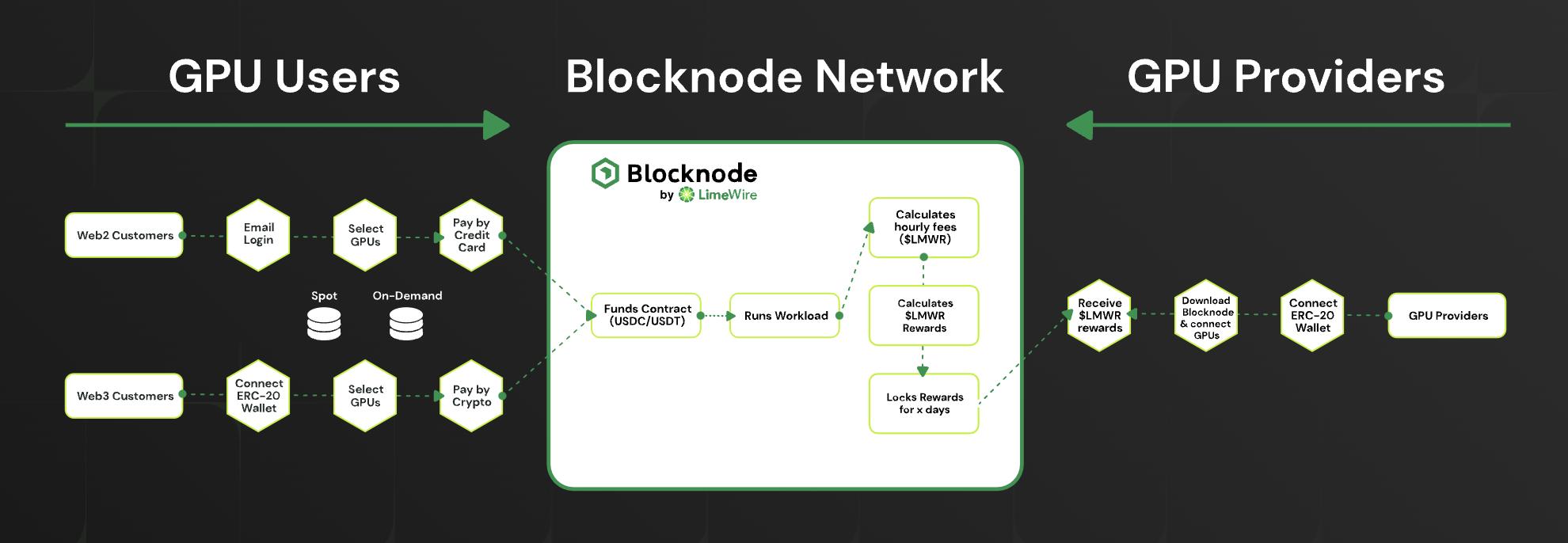

LimeWire’s innovation extends beyond file-sharing with the introduction of Blocknode, a decentralised GPU infrastructure marketplace. Blocknode addresses one of the most pressing challenges in the AI industry access to affordable and scalable computing power. By decentralising GPU resources, Blocknode creates a win-win ecosystem for both providers and users of GPU power.

Training and running AI models require immense computational resources, which are often prohibitively expensive for smaller projects. Blocknode democratises access to enterprisegrade GPU instances by connecting users with providers who have idle GPU capacity. This approach significantly lowers the cost barrier, enabling startups, researchers, and developers to access high-performance computing without compromising their budgets.

For GPU providers, Blocknode offers a unique revenue stream. Organisations and individuals with underutilised GPU resources can monetise their idle times by contributing to the Blocknode network. In return, they earn LimeWire Tokens (LMWR), creating an ecosystem where resources are efficiently utilised, and providers are incentivised to participate.

All transactions within Blocknode are powered by the LMWR token. This integration streamlines payments and rewards, ensuring that the ecosystem operates smoothly and efficiently.

The Blocknode ecosystem is meticulously designed to cater to diverse user needs while fostering decentralisation and efficiency. Its five key components highlight its versatility and scalability.

Blocknode bridges the gap between traditional and decentralised systems by offering an accessible onboarding process for Web-2 users. Companies and individuals can register using their email addresses and make payments via credit cards, ensuring that even those unfamiliar with blockchain technology can benefit from Blocknode’s services.

For users prioritising privacy and decentralisation, Blocknode offers a Web-3 onboarding process. By connecting their ERC-20 wallets, users can access GPU resources securely and anonymously. Moreover, payments made in LMWR tokens come with discounts, encouraging the adoption of decentralised finance (DeFi) tools.

This dual onboarding model ensures inclusivity, catering to both traditional and blockchain-savvy users.

Blocknode offers two types of GPU instances to cater to varying user needs:

▪ On-Demand Instances: These provide guaranteed access to GPU power, making them ideal for time-sensitive projects where reliability is crucial.

▪ Spot Instances: Available at a lower cost, these instances are perfect for users with flexible timelines, as they leverage unused GPU capacity.

This flexibility allows users to optimise their AI workloads based on budget and urgency.

The backbone of Blocknode is its Web3 network, built on the Binance Smart Chain (BNB). Payments from GPU customers are pooled to fund the Blocknode smart contract, which orchestrates the execution of AI workloads. After completing tasks, the network calculates and distributes LMWR rewards to GPU providers.

To maintain a sustainable rewards pool, Blocknode regularly buys back LMWR tokens from the open market using customer payments. This innovative mechanism aligns the interests of all participants, ensuring a vibrant and self-sustaining ecosystem.

Blocknode’s model is particularly advantageous for GPU providers. Enterprises often have idle GPU resources during non-peak hours, representing a significant sunk cost. Blocknode allows these providers to monetise their unused capacity, reducing waste and generating additional revenue.

Providers can join the network anonymously by connecting their Web3 wallets and installing the Blocknode client. Frequent LMWR reward payments incentivise providers to contribute consistently, ensuring a steady supply of GPU resources for users.

The development and deployment of Blocknode will unfold in a structured, four-phase roadmap. Each phase is designed to expand the platform’s capabilities, gradually onboarding users while enhancing the ecosystem’s functionality and scalability.

The journey of Blocknode began with a grand announcement at Token2049 2024 in Singapore, the premier Web3 conference of the year. This event marked the platform's formal introduction to the global audience. During this phase:

▪ The detailed Blocknode concept and network functionalities were unveiled.

▪ A waitlist for GPU users was launched, offering early adopters the opportunity to secure access to affordable enterprise-grade GPUs powered by Blocknode

This initial phase not only generated significant interest but also set the stage for the rollout of the platform's groundbreaking features.

In the first quarter of 2025, Blocknode will transition into its second phase with the launch of version 1 of the network. This phase will focus on:

▪ Enabling Web2 customers to access high-performance enterprise GPU instances at market-competitive prices.

▪ Offering seamless onboarding with straightforward payment methods, including credit card checkouts, to cater to non-crypto-native users.

This milestone is pivotal in demonstrating the platform’s capabilities and establishing its foothold in the AI computing market.

Later in 2025, Blocknode will evolve further by introducing Web3 capabilities, including:

▪ Anonymised logins and payment options through cryptocurrencies, offering privacy and flexibility to users.

▪ Discounts for payments made in LMWR tokens, incentivising the use of the platform’s native cryptocurrency.

Additionally, this phase will empower AI projects and enterprises to monetise their underutilised GPU resources by earning LMWR rewards. This dual benefit of cost reduction for GPU users and revenue generation for providers will enhance the network's value proposition.

In the final phase, Blocknode will broaden its reach by onboarding retail GPU providers, enabling everyday users to connect their:

▪ Gaming computers

▪ Graphic cards

This integration will:

▪ Expand the network's infrastructure with lower-cost retail GPU resources

▪ Allow retail users to earn LMWR token rewards by contributing their hardware to the network.

By including retail providers, Blocknode aims to decentralise GPU computing further, ensuring accessibility and scalability while creating a robust and diverse ecosystem.

LimeWire Originals is a limited-edition NFT collection minted on the Ethereum blockchain, comprising 5,200 unique and rare avatars. Each NFT features distinctive traits and attributes, offering more than just a digital collectible.

Owning a LimeWire Original unlocks a range of exclusive perks within the LimeWire ecosystem, creating value for holders.

1. Free LimeWire AI Studio

Holders receive a free premium subscription to LimeWire’s AI Studio, granting access to generative AI tools for creating images, videos, and music. This also includes the LimeWire Chat Assistant, enhancing their creative experience.

2. Highest APY for Activity Rewards

LimeWire Originals holders enjoy an impressive 15% APY on their locked LMWR balance for Activity Rewards, maximising token earnings on the platform.

Holders can be the first to mint or purchase new NFTs from LimeWire’s own collections or partnerships, ensuring priority access to exclusive releases.

Holders can the exclusive LimeWire Originals channel within their Discord server, offering early updates, insider news, and unique networking opportunities with other members.

A LimeWire Original NFT doubles as a ticket to exclusive events hosted by LimeWire, ranging from private parties to global gatherings. Past highlights?:

▪ Free guest list entry at Ushuaia and Hi Ibiza (during summer 2023).

▪ An exclusive Ibiza party with complimentary drinks (was on July 2023).

▪ A headline artist NFT airdrop that featured Sean Kingston, Soulja Boy, and more (2022–2023).

Therefore, someone can consider LimeWire Originals as an NFT collection. But ultimately, it’s a lifestyle and rewards ecosystem for digital creators and enthusiasts alike. With a robust historical timeline of benefits and an ever-growing list of perks, owning a LimeWire Original is a key to unlocking the best of LimeWire.

LimeWire’s transformation from a file-sharing service in 2000 to an intuitive AI-driven platform in 2022 exemplifies the power of reinvention. Today, it stands as a nostalgia hub for creators, leveraging AI tools and decentralised infrastructure to redefine how digital content is created, shared, and owned.

As LimeWire continues to evolve, its focus remains on empowering its community. With features like the LimeWire Originals, AI-powered tools, and its NFT marketplace, the platform is laying the foundation for a more inclusive and decentralised digital ecosystem. By gradually transferring governance to its users, LimeWire is fostering a model where creators and participants hold the reins of innovation.

The journey is far from over. LimeWire is poised to become a cornerstone in the creator economy, where technology and community-driven ownership converge. LimeWire’s future is one of growth, creativity, and collaboration a future that’s not just envisioned but actively built with its community at its core.

How the government and industry-leading businesses are boosting crypto

written by Daniel

Intro Times in crypto have changed. Nakamoto's vision to develop a reserve currency independent of any governmental authority is fulfilled daily with Bitcoin..

Paradoxically, those governmental authorities that, in the recent past, were vocal in their criticism of Bitcoin now focus on acquiring as much as possible of the limited circulating supply of the king asset in the crypto ecosystem.

Source: Forbes

And it's not just governments; we can also witness how companies and sector leaders drive the market with their appetite for the crypto narrative and beyond the technological use of blockchain that dominated in the post-DeFi Summer era.

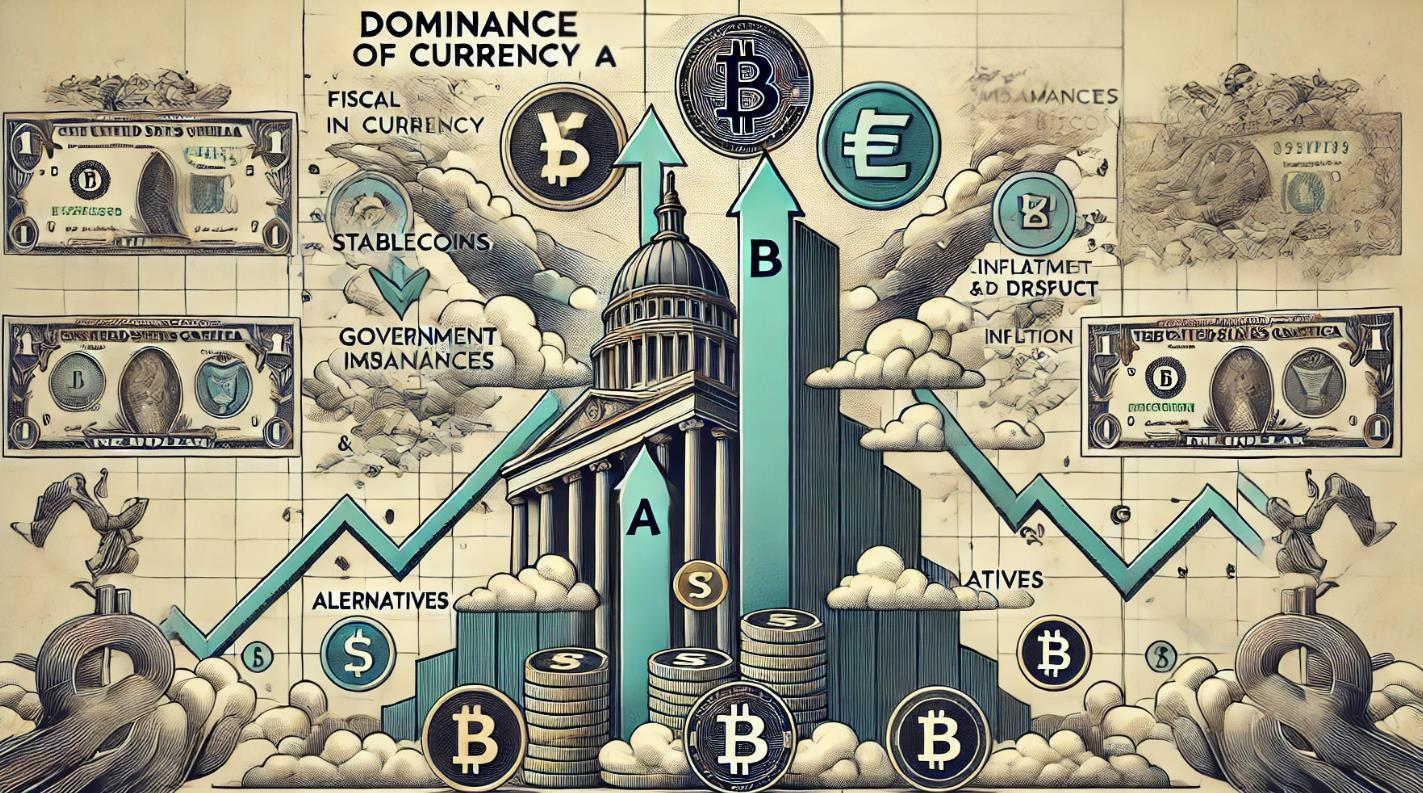

Here, we will analyse how the race for digital currencies unfolds, given that Bitcoin plays a dominant role in some of the world's leading economies, which could eventually drive the mass adoption of the crypto narrative.

“When someone tries to buy all the world's supply of a scarce asset, the more they buy, the higher the price goes ” Satoshi Nakamoto,

July 09 2010.

Before analysing how the race for digital currencies unfolds in an increasingly crypto-asset-friendly context with assets like Bitcoin or Ethereum, we must understand the key differences between ‘digital currencies’ and ‘cryptocurrencies’.

In short, digital currencies encompass a broad range of financial instruments that exist in electronic form Cryptocurrencies, a subset of digital currencies, utilise blockchain technology to secure transactions and control the creation of new units.

It is important to note that digital currencies have existed in the past, with numerous attempts at electronic currencies during the 1990s. However, these experiments failed miserably to emerge as alternative systems to traditional money, mainly due to their centralised nature.

Source: hit.bme.hu

Recently, some central banks from governments worldwide, technically supported by international bodies such as the IMF or the BIS, have been developing projects focused on digital currencies issued and controlled by central bank authorities, better known as CBDCs.

The development of CBDCs happened as a response to the growing use of crypto-assets like Bitcoin, which, in contrast to CBDCs, is based on a completely decentralised system and is not reliant on trust.

Despite what some traditional financial anarchists point to as reasons for the development of CBDCs (transaction efficiency, costs, etc.), the reality is that the conventional financial system needs to adapt to the new digital economy, increasingly embraced by citizens worldwide, thanks to the solid use case posed by Bitcoin: digital payments without doublespending

Bitcoin, created in 2009, is the first cryptocurrency on the market, developed through a decentralised peer-to-peer network and not backed by any government or bank While it is a form of digital currency, by design, Bitcoin (and some other similar cryptocurrencies) was born as an alternative to the traditional financial system, now attracting the interest of national governments and becoming a key piece in the international geopolitical chessboard.

Since the COVID-19 pandemic, governments worldwide have become aware of the potential of digital currencies, which is why we have seen them direct their efforts towards developing alternatives to traditional money, such as China, with the digital yuan, a clear example of a commitment with goals beyond payment efficiency and cash reduction: to reduce dependence on the dollar in their economy

China is not the only successful CBDC pilot project Other countries around the world have also been experimenting with these types of currencies, which is why the U.S. and the European Union authorities are also exploring CBDCs, focusing on regulatory frameworks that ensure consumer protection while fostering innovation

Source: Atlantic Council

While it is not the scope of this post to provide a detailed explanation of how CBDCs work (you can refer to Moon Mag- Issue 24 for a deeper dive on this topic), let’s take a quick look at the current state of these digital currencies:

● 134 countries and currency unions are exploring a CBDC, which represents 98% of global GDP.

● The Bahamas, Jamaica, and Nigeria are the three countries that have fully launched a CBDC.

● Every G20 country is exploring a CBDC, with 19 in the advanced stages of CBDC exploration. Of those, 13 countries are in the pilot stage, including Brazil, Japan, India, Australia, Russia, and Turkey

● All original BRICS member states Brazil, Russia, India, China, and South Africa are piloting a CBDC.

● There is a new high of 44 ongoing CBDC pilots, including the digital euro. European countries both in the euro area and beyond are increasingly testing wholesale CBDCs, domestically and across borders.

● mBridge, a cross-border CBDC project, has expanded to 13 countries since the start of the war in Ukraine This project connects banks in China, Thailand, the UAE, Hong Kong, and Saudi Arabia.

● The United States and six major central banks are involved in a cross-border wholesale CBDC project, Project Agora

As you can see, the data above demonstrates the surge in CBDC pilot development in recent years and their implementation in some countries to perfect the deployment of these types of currencies The volatility of the geopolitical landscape leaves no doubt that CBDCs will play a crucial role in the balance of economic powers in years to come.

Some analysts believe the race for CBDCs may capture a significant share of the market related to cryptocurrencies The reason is simple: as the monetary system becomes more efficient and achieves uniform parity among the different options for centralised digital currencies, cryptocurrencies could lose relevance in the areas they currently fill, such as inflation and the devaluation associated with weak fiat currencies

It's like going back to Bitcoin's origins, a group of anarchists in love with decentralisation driving a resilient, distributed payment system

However, history teaches us that geopolitical struggles have created clear distinctions between the systems of currencies issued and controlled by each country's central banks, leading to the emergence of dominant patterns such as the current dollar standard.

From this perspective, as long as currency A is dominant over currency B, governments of B will incur significant expenses and fiscal imbalances, leading to further devaluations to counteract the exchange rate differential, generating more inflation and a lack of trust from people in using that currency as a medium of exchange and store of value two fundamental principles of money

As a result, alternatives such as stablecoins or Bitcoin (cryptocurrency C) emerge to fill these gaps induced by centralised systems

“The cryptocurrency constitutes an imperfect substitute for national currencies as a store of value or medium of exchange, yet it is not associated with a centralized government and experiences fast improvements in its underlying technology relative to other currencies.” - Europe Central Bank.

Therefore, rather than suppressing the cryptocurrency market, we have noticed a shift in narrative from governments towards these types of assets. Ideas such as the “Strategic Bitcoin Reserve” are increasingly resonating in the financial environment

In addition to different governments racing to develop and implement CBDCs within their economies, we are witnessing a parallel battle, almost unimaginable just a few years ago: the accumulation of BTC by governments worldwide

Nations such as the United States, China, and Russia have recently shifted their stance towards decentralised digital currencies like Bitcoin, to the point of competing to be the nation with the largest BTC reserves.

Of course, the increase in BTC holdings has clear geopolitical value, positioning the leading cryptocurrency as a strategic asset. However, this does not diminish the relevance of CBDCs Why?

The number of global CBDC payments is stipulated to reach 7.8 billion by 2031, a 2,430% increase from 2024. Furthermore, cross-border payment systems could save around $45 billion by 2031 using CBDCs and stablecoins.

If you haven't understood the message yet, let me clarify it The state wants you to use its centralised currencies to control you while it accumulates your BTC bought at low prices.

It's no longer just a race between nations to issue their CBDC. The competition is focused on rewriting global financial power based on strategic Bitcoin reserves, demonstrating the potential of this asset

The push and development of CBDCs is an unstoppable reality, with cooperation agreements between central banks playing a key role in defining international standards for sovereign digital currencies and regulating a more digitalised global financial system.

However, the growing governmental appetite for decentralised digital currencies adds positive pressure to the crypto market.And we all know what happens when an early-stage industry gets attention: an accelerated growth cycle

Regarding The United States, a crypto-friendly cabinet and high expectations for regulatory flexibility could be the missing catalysts for the global expansion of blockchain-based use cases.

While it’s still early to know if the government’s approach to Bitcoin will be as transformative as the internet was in the 1990s, expectations are high for an industry that seeks to mature

The private sector has been a key player in the technology adoption curve. And in the race for digital currencies, this is no exception.

In recent months, we have witnessed significant expressions, signals, and actions favourable to the cryptocurrency ecosystem, with key companies such as Tesla, Square, and PayPal adopting their use on their platforms Paradoxically, payment platforms like PayPal and AliPay refused cryptocurrency adoption.

But back to the present, the new narrative that seems to dominate the private sector is undoubtedly the implementation of payment or investment methods in cryptocurrencies in the portfolios of major tech companies. While some still resist, corporate adoption by companies like MicroStrategy has legitimised the sector and encouraged consumers to engage with cryptocurrencies

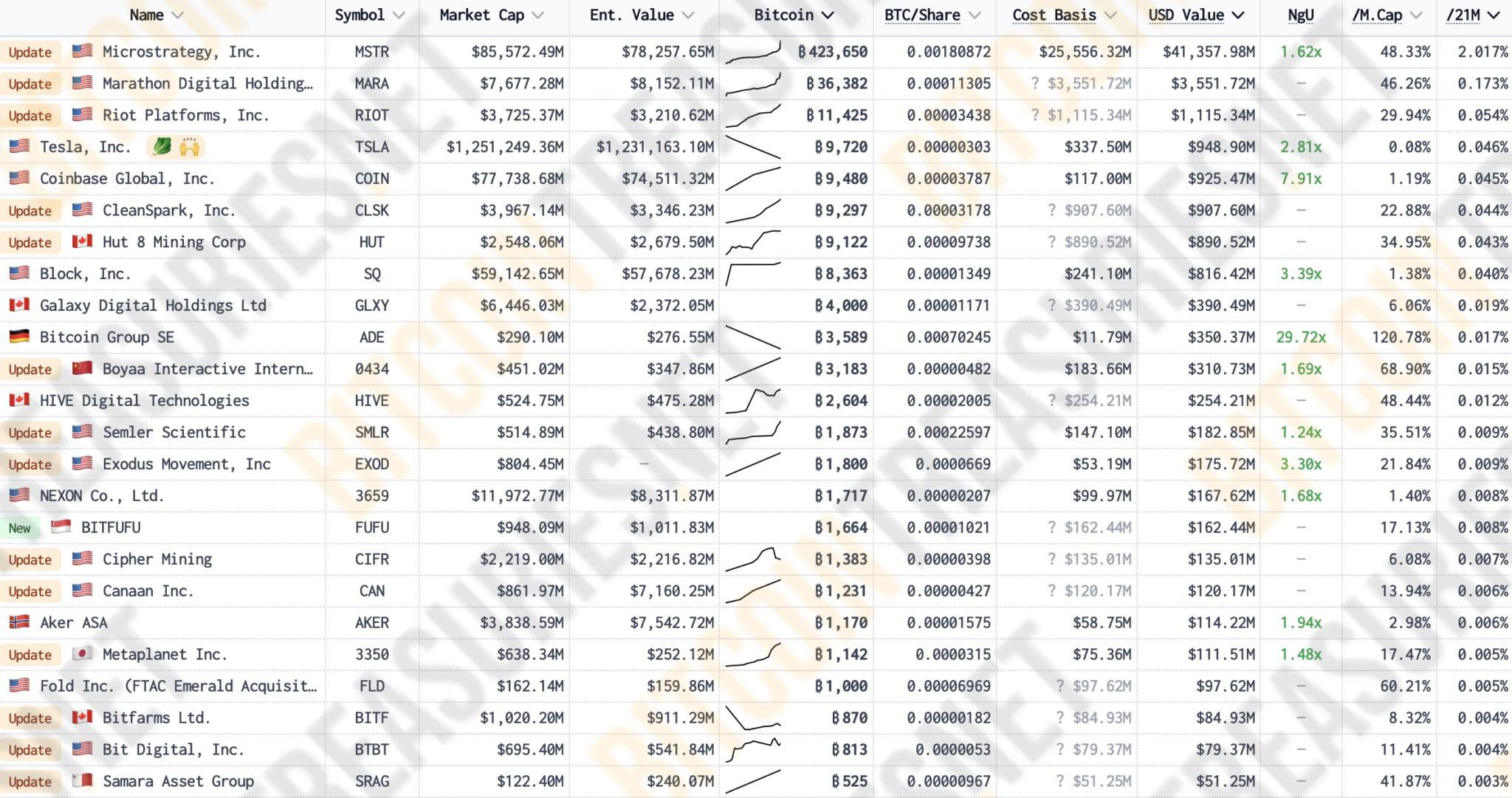

Currently, more than half a million bitcoins are in the portfolio of a group of private companies, mainly focused on technology. MicroStrategy, a software company, leads the corporate race for Bitcoin holdings with 423,650 BTC, worth approximately $43 billion

Source: Bitcoin Treasuries

MicroStrategy's accumulation is just a sign of the strong campaign that some traditional tech companies are running to keep BTC in their strategic reserves. Notable examples include Tesla with 9,720 BTC, Block Inc (Square) with 8,363 BTC, and Semler Scientific with 1,873 BTC, to name just a few of the many business models that have chosen to hold BTC in their finances

Collaborations between traditional financial institutions and cryptocurrency companies are becoming frequent as banks look to integrate digital currencies into their services.

Bitcoin was indeed born as a rebellious protest against traditional banking, which initially led to a great deal of rejection from the main actors of this financial system. However, Bitcoin and its peers are causing a digital transformation in global commerce, with more than 580 million cryptocurrency users worldwide forcing their principal detractors, such as JP Morgan, to adopt these digital currencies to evolve and adapt to the new narrative.

Source: JP Morgan

JP Morgan was one of the first traditional banks to adopt a stablecoin in 2019. Subsequently, other financial institutions such as Bank of America and Ally Bank followed suit, allowing customers to interact with these assets and cryptocurrency companies Some successful examples of this approach include:

● Goldman Sachs: Launched a cryptocurrency trading desk for Bitcoin and Ethereum options

● BBVA: Headquartered in Spain, one of the largest financial institutions in the world, introduced digital asset custody and blockchain-based loans

● UBS: Present in more than 50 countries, UBS Group AG allows its clients to trade cryptocurrency ETFs in Hong Kong. Additionally, it launched UBS Tokenize, a financial solution that helps investors, distributors, and issuers tokenise RWAs

Source: BBVA

In addition to facilitating access to crypto, both traditional companies and those focused on cryptocurrencies strive to develop new products and services, ranging from decentralised finance (DeFi) protocols to blockchain-based supply chain solutions, with the aim of bringing more users into the world of cryptocurrencies.

Predictions of digital currencies are promising Experts' projections indicate that these will become a fundamental part of the global financial system and will be widely used by corporations, governments, and users worldwide, as we see today with the internet.

The net flow of purchases of investment products like the Bitcoin Spot ETF, stocks of companies linked to the cryptocurrency tech sector, and especially the exposure large traditional banks are gaining to Bitcoin without directly acquiring it are clear signals of the acceptance digital assets are receiving in the traditional financial system

Source: SosoValue

Although there is currently widespread euphoria around digital currencies, both centralised and decentralised, amid a bull market, several challenges remain to overcome for mass adoption; hacking, fraud, and regulatory compliance stand out as the main challenges to be addressed by companies focused on developing products and services related to digital currencies

However, a collaboration between governments and industry leaders is crucial to tackling these challenges as cryptocurrencies gain ground and unlock the sector's opportunities The future of finance is undoubtedly digital, and as we navigate this new landscape, it is essential to embrace the potential of digital currencies while remaining mindful of the risks they entail

The road ahead promises to be exciting, and those who adapt to this changing environment will be well-positioned to thrive in the digital economy

written by Chris

Synternet is a blockchain platform designed to provide modular, interoperable data infrastructure across all major networks. At its core is the Data Layer, a protocol that bridges blockchains by acting as a customisable execution layer. This innovation eliminates the need for centralised services, offering developers, organisations, and users seamless access to real-time and historical on-chain data. With a focus on security, efficiency, and interoperability, Synternet is driving the future of decentralised data exchange, empowering the next generation of Web3 applications.

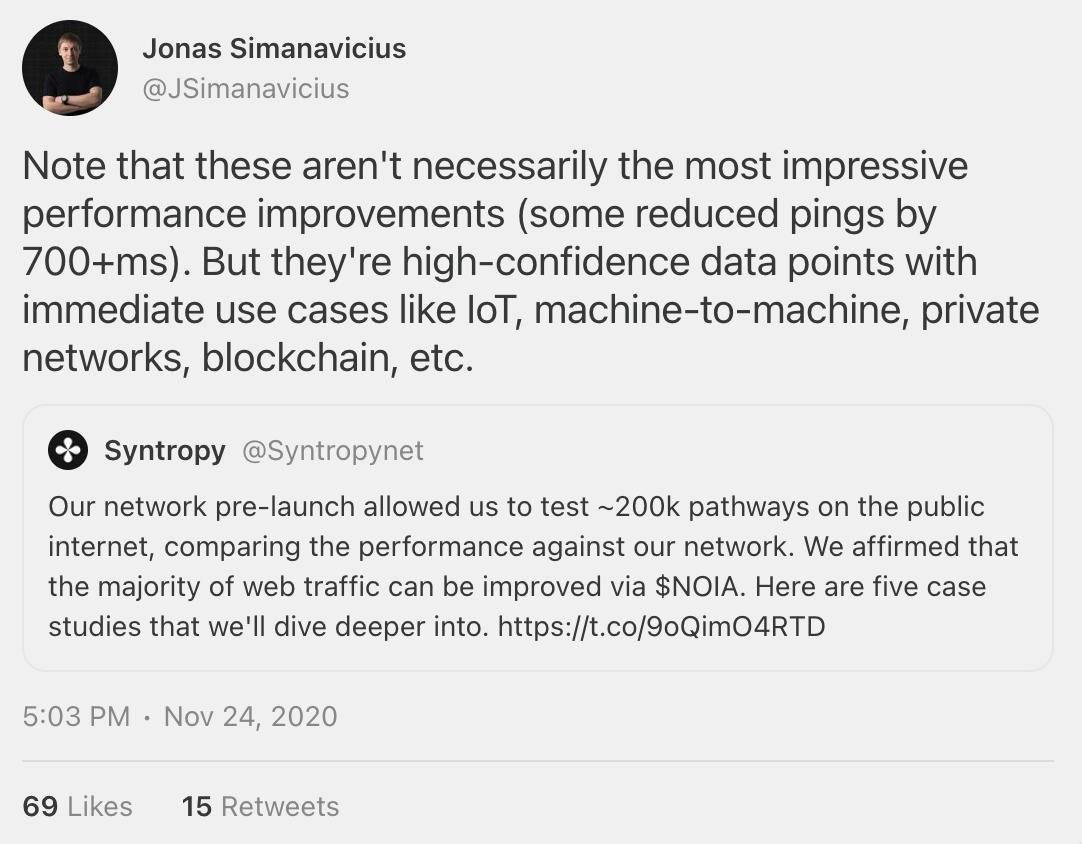

We first covered Synternet in Issue 7 of MoonMag, though, at the time, it was known as Syntropy. Since then, the platform has undergone a significant transformation, rebranding earlier this year to better align with its advanced technological vision and roadmap. This change reflects Synternet’s ambition to lead the evolution of blockchain data infrastructure, making it more accessible, scalable, and interoperable.

A major highlight of this transformation has been the introduction of the SYNT token (previously called NOIA). Following the launch of the Cosmos bridge on 31 July 2024, the SYNT token now serves as the native currency powering Synternet’s ecosystem. With staking live and full token utility activated, SYNT has become integral to subscribing to and paying for data services on the platform. This marked a significant step forward in Synternet’s mission, unlocking new opportunities for developers and users alike.

Syntropy's journey began in 2018 under the name NOIA, with a bold ambition to transform the internet's architecture using blockchain technology. The project's foundation was built on creating a decentralised and distributed internet infrastructure layer.

By incentivizing participants to contribute bandwidth and storage, NOIA aimed to address long-standing issues such as latency, security, and reliability.

In March 2018, NOIA presented its technological vision, emphasizing how blockchain could reshape internet connectivity. The initial goal was to develop a network of nodes that improved performance and enhanced privacy and security.

By July, the first phase of the NOIA Network Testnet launched, with over 2,000 participants across 90 countries deploying NOIA nodes. Later that year, partnerships began to take shape, starting with e-shelter, a leading data centre operator in Europe. These collaborations laid the groundwork for Syntropy's broader ecosystem.

By 2019, NOIA was gaining momentum through strategic partnerships and an expanding team. The collaboration with e-shelter evolved into the development of a software-defined network compatible with advanced internet protocols like Segment Routing and IPv6.

This technological advancement was further bolstered by partnerships with Cherry Servers and 100TB, allowing Syntropy to scale from individual servers to entire data centres.

In June, NOIA joined the prestigious Microsoft for Startups program, gaining valuable resources, mentorship, and industry connections. The same year, William B. Norton, a renowned figure in the telecommunications industry and co-founder of Equinix, joined as Syntropy's co-founder. Norton's expertise brought credibility and direction, especially as the team introduced the "Programmable Internet" concept through its whitepapers.

The transition from NOIA to Syntropy in 2020 marked a pivotal moment. This evolution reflected the project's maturation and its readiness to tackle the broader challenges of internet connectivity. Syntropy became a recognized contributor to the Internet Engineering Task Force (IETF) draft, solidifying its role in the development of Segment Routing over IPv6 (SRv6).

By mid-2020, Syntropy's Distributed Autonomous Routing Protocol (DARP) showcased tangible progress, with significant software updates and partnerships with cloud giants like Oracle and Microsoft. These partnerships allowed the protocol to scale rapidly, increasing its network nodes from a handful to over 100.

The year concluded with the pre-launch of the NOIA Network, featuring hundreds of high-performance nodes hosted on major cloud providers like AWS, Azure, and IBM. This milestone underscored Syntropy's readiness to deliver on its vision, creating a robust, decentralised internet infrastructure poised to revolutionise connectivity for businesses and individuals alike.

The launch of Syntropy in early 2021 marked a significant milestone for the project. This rebrand introduced tools like a programmable API, SDK, Network-as-Code, and integrations with Terraform and Ansible, enabling seamless creation, automation, and optimisation of encrypted connections. The developer-centric Syntropy Builders programme, initiated with a $1 million incentive fund, further accelerated adoption, laying the foundation for a self-organising community of builders.

Notable integrations followed. Microsoft included Syntropy Stack in the Azure Marketplace, Chainlink leveraged it for secure node deployment, and collaborations with gaming platforms such as Minecraft and CS:GO enhanced user experience by reducing latency and improving network stability. Partnerships with Polkadot, Elrond, and Ethereum strengthened the ecosystem, ensuring higher node performance and accessibility.

By mid-2021, Syntropy’s innovative applications spanned blockchain and gaming, while its Staking programme and Amber Chain set the stage for Syntropy Blockchain. Industry leaders from AT&T, Microsoft, and HP joined the team, reflecting Syntropy’s growing reputation.

That was the ‘brief story’ of NOIA and Syntropy. While a new chapter has begun, it’s always good to reflect on past achievements and how a project evolved over the years.

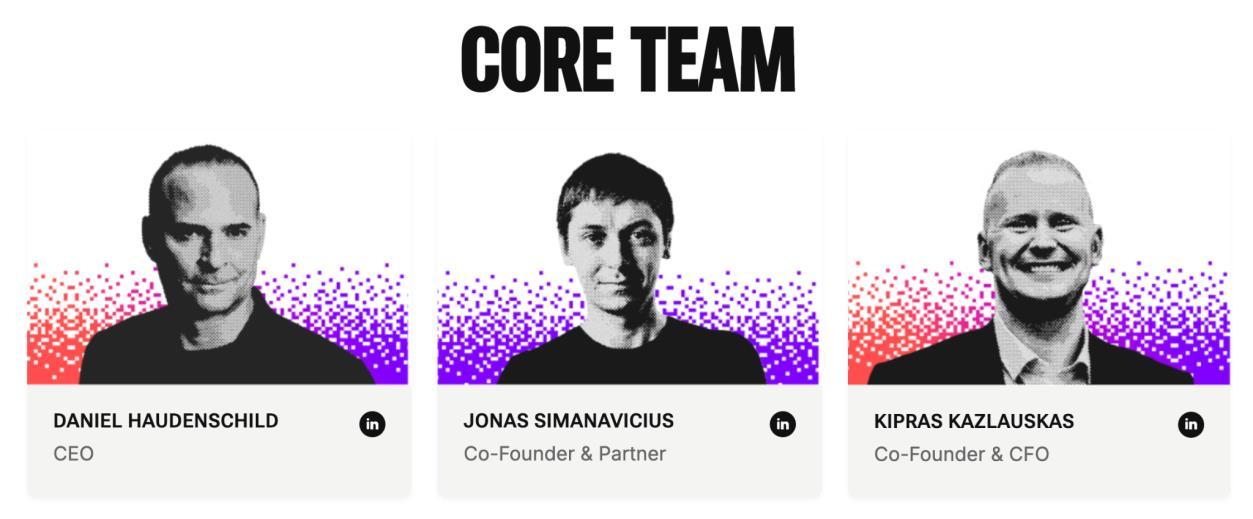

Synternet’s success is built on the shoulders of a world-class team and visionary leadership. At the helm is Daniel Haudenschild, CEO, whose experience and strategic insight have been instrumental in shaping the project's direction. Co-founders Jonas Simanavicius and Kipras Kazlauskas bring a wealth of expertise in blockchain technology and financial management, with Jonas spearheading innovation as Partner and Kipras ensuring robust financial operations as CFO. Complementing the leadership team is Paulius Gedminas, CTO, whose technical mastery ensures Synternet remains at the cutting edge of data infrastructure development.

Supporting this core team is Philippe Engels, Head of Business Development, driving growth through strategic partnerships, and Dinas Lipinskas, Head of People, who fosters a culture of collaboration and innovation. Together, this diverse group of leaders combines deep industry knowledge with a shared passion for transforming the internet through modular, interoperable data solutions.

Behind the executive team lies an extraordinary engineering and development workforce, united by their expertise in software, blockchain, and network architecture.

This talented collective is responsible for the creation and refinement of Synternet’s groundbreaking solutions, ensuring they deliver on the promise of decentralised, real-time data streaming across chains.

Synternet’s team is more than just a collection of individuals it’s a dynamic, collaborative ecosystem driven by the mission to make centralised data services obsolete. Their commitment to innovation and excellence is the driving force behind Synternet’s vision.

Curious to know more about the people behind the project?

→ Check Synternet on LinkedIn to stay connected with the team and their journey.

The SYNT Token

Synternet has officially launched its mainnet on Cosmos. This is where the SYNT token comes into play. Previously, NOIA tokens powered the ecosystem, but with the migration to ERC-20 SYNT, Synternet is laying the foundation for its future on Cosmos.

The migration from NOIA to SYNT is more than just a name change. It’s about improving security and streamlining the tokenomics. By moving to SYNT, Synternet ensures that there is a secure 1:1 ratio between NOIA and SYNT tokens while aligning the new Cosmosbased SYNT token with the platform's future. The transition allows for a hard-capped token supply of 1 billion SYNT, which will be gradually reached over time as more users migrate and bridge their tokens.

With the migration, the benefits of staking also come into play. From July 29, 2024, staking rewards are available on Cosmos, with rewards distributed on every block. This is just the beginning more features will roll out, such as token buybacks and a burn mechanism, to help manage token supply and maintain value.

The bridge to Cosmos opened on July 31, 2024, and SYNT began to slowly realise its full potential. It's now the primary means of paying for data services on the Synternet platform. Developers can subscribe to real-time data streams from across multiple blockchains, all powered by SYNT tokens.

Staking SYNT tokens offers two major advantages:

▪ It helps secure the Synternet blockchain and,

▪ Reduces the circulating supply.

As the staking process evolves, the inflation mechanism will be triggered once 100 million SYNT tokens are staked, further reinforcing the ecosystem’s stability.

For the Synternet community or any participant for that matter, whether you're staking, bridging to Cosmos, or paying for data, the utility of SYNT has just begun. As Synternet’s modular, interoperable infrastructure grows, we’re likely to see new opportunities for both developers and users.

Synternet has successfully raised capital across three funding rounds. The first two seed rounds raised $4 million and over $6 million, respectively, with backing from over ten leading institutions like Alphemy Capital, Maven11 etc.

In March 2024, Synternet completed its latest funding round, securing an undisclosed amount with investment from major firms such as CMCC Global, P2 Ventures, Moonrock Capital and many more.

As we move into 2025, Synternet has already established its tokenomics model, ensuring a balance between security, growth, and decentralisation. At the heart of this ecosystem lies the SYNT token now (formerly known as NOIA), central to both securing the chain and powering the Data Layer.

Token Info:

Token Symbol: SYNT (formerly NOIA)

Token Type: ERC-20

Issuance/Burn Mechanism: Dynamic mechanism

Contract Address: https://etherscan.io/token/0xDA987c655ebC38C801DB64A8608bc1AA56Cd9a31

Token Distribution: Finance 35%, Sales 20%, Team 15%, Community 10%, Node Rewards 10%, Advisors 10%.

source: Synternet’s docs

Synternet’s security relies on Validators, who are incentivised through a reward pool. This pool, dedicated to block formation rewards, encourages Validators to stake tokens, with the target stake rate ranging from 50-67% of the circulating supply. The reward rate will fluctuate based on how much is staked, ensuring that it remains sustainable.

For Validators, the rewards will be tied to the staking amount, with annual rates starting at 12-20% in the early years and stabilising at 5-12% in the long run.

Over time, these rewards will increasingly depend on the amount of gas fees collected, which will grow as more data flows through the Data Layer.

The Data Layer will also have its own set of incentives, designed to attract the ‘’key players’’ – Brokers and Observers. These actors must lock a required amount of tokens on-chain to participate, with a dynamic subsidy rate that adjusts depending on the amount of tokens credited.

The crediting rate for Brokers, for instance, influences the number of entities within the system. If the rate is too low, subsidies will increase to encourage more participation. Once the crediting rate exceeds the target, the subsidy rate will decrease, ensuring that the system remains balanced and sustainable.

Brokers and Observers can expect APRs between 20-30%, higher than the Validator rewards due to the specialised nature of their roles and the greater level of involvement required.

A portion of the total token supply will be allocated to the community pool, which will be managed by the Synternet governance The primary purpose of this pool is to support the Publisher infrastructure, ensuring that Web3 data remains affordable and accessible.

Publishers who offer valuable data streams at low cost could receive subsidies from the community pool, helping them continue providing essential services to the network.

These subsidies will be decided through proposals submitted on-chain, with Validators likely to approve them if the data generates gas fees and benefits the wider ecosystem.

Synternet’s tokenomics are designed to foster long-term growth, with rewards and incentives structured to attract active participants across the ecosystem. By balancing security, participation, and community-driven governance, Synternet has been already setting the stage to advance.

Website: https://www.synternet.com/

Docs: https://docs.synternet.com/docs

Github: https://github.com/synternet

Discord: https://discord.gg/synternet

Twitter: https://twitter.com/synternet_com

Synternet Data Layer protocol creates a fully decentralized, incentivized framework for the exchange of blockchain data. In its core design, the protocol facilitates access to Web3 data, offering a unique solution for developers looking to build dApps

Synternet’s approach addresses a key challenge in blockchain ecosystems: the lack of true decentralisation in current data access models.

At the moment, most decentralised applications rely on centralised infrastructures, especially when it comes to accessing blockchain data. This centralisation undermines the promise of decentralised networks, as data flows through proprietary APIs controlled by single entities. These APIs act as gatekeepers, leading to vulnerabilities and a lack of transparency, making these so-called decentralised applications ultimately reliant on Web2 solutions.

The Synternet Data Layer protocol solves this problem by decentralising access to blockchain data. By allowing anyone to become a data provider and consumer within a distributed network, Synternet ensures that data flows through a truly decentralised channel. This is achieved through the protocol's on-chain consensus system, which governs the authentication of participants and tracks data usage, creating an incentive-driven environment for data sharing.

The protocol’s key advantages include:

● Decentralisation: Anyone can provide or consume blockchain data, ensuring a more distributed and democratized approach to data access.

● Usability: Staking and incentivisation mechanisms, powered by Synternet’s utility token, help reduce costs and improve the quality of service.

● Scalability: By leveraging the PubSub (Publish-Subscribe) messaging model, Synternet eliminates the need for computation at the data source, making the network highly scalable and efficient.

Synternet's decentralised approach ensures that data access is no longer controlled by a single entity, but instead managed by a distributed network that prioritises fairness and transparency.

At the heart of Synternet's Data Layer is the Publish-Subscribe (PubSub) protocol, a messaging framework that facilitates communication between Publishers, Brokers, and Subscribers and Clients. This is built on a wire-compatible fork of NATS, a well-known messaging system, and ensures that data flows smoothly from origin to end user.

● Publishers: These entities provide data to the network. They only need to compute the data once and send it to Brokers, reducing the computational load at the data source.

● Brokers: These act as intermediaries, distributing data to Subscribers. Brokers are incentivised through a fixed protocol fee, regardless of whether the data is provided for free or at a cost.

● Subscribers & Clients: These are the end users or applications that consume the data. Subscribers pay for the data they access, incentivising the entire system to maintain highquality service.

The core advantage of the PubSub model is its scalability. By allowing data to be computed only once at the source, it avoids the inefficiencies of traditional request-reply models, where every query requires computation at the data source.

Synternet employs this to synchronise and facilitate the interaction between all parties. The blockchain acts as a registry for all entities and services, storing essential data on-chain for transparency and accountability. This ensures that all participants are authenticated, authorised, and held accountable for their actions.

● Registry: The blockchain stores records of all entities and data streams, ensuring transparency.

● Authentication: Each participant's public key is stored on-chain, ensuring secure identification.

● Authorization: Only Subscribers who have shown interest in a particular data stream are authorised to access it.

● Accounting: All data streams are tracked on-chain, allowing for accurate reward distribution to Publishers, Brokers, and Observers.

● Payments: Payments for data consumption are made using Synternet’s utility token, ensuring seamless transactions within the ecosystem.

This system also incorporates staking and incentivisation mechanisms to ensure the best behaviour from all parties. Participants must bond utility tokens to their services, ensuring that they act in good faith. If any malicious behaviour is detected, a portion of the stake is slashed, helping to maintain the integrity of the system.

source: Synternet’s docs

The value in the Synternet Data Layer system is driven by the Subscribers. As the primary consumers of data, Subscribers are directly responsible for rewarding the other participants in the network. Publishers, who provide data, compete with each other based on price, quality, and efficiency. The competition helps drive down the cost of data, making it more affordable for developers to build decentralised applications.

Brokers, while not competing on price, earn a fixed protocol fee for distributing data. This creates a stable incentive for Brokers to maintain the flow of data, ensuring the system remains functional and efficient. To further safeguard the network, an additional layer of accountability is provided by Observers, who monitor and attest to the actions of Brokers. Observers ensure that data is properly delivered and that the off-chain accounting is accurate, adding another layer of trust to the system.

The dynamic between Publishers, Brokers, Subscribers, and Observers creates a balanced ecosystem where data access is incentivised, high-quality service is prioritised, and costs are driven down over time. This makes the Synternet Data Layer an attractive solution for anyone seeking a more decentralised and efficient way to access blockchain data.

As this year comes to an end, Synternet continues to build on its momentum, delivering meaningful progress. From unveiling the Graphling Chain to updating the Pikes Peak roadmap and celebrating milestones like the Osmosis LP and Uniswap V3 launches, this year has been a testament to Synternet’s commitment to progress and growth. Insights gained at Devcon 2024 and collaborations forged during the journey have further solidified Synternet’s vision.

Synternet remains focused on pushing boundaries and creating opportunities for its growing community. With a firm foundation in place, the future is bright, and the possibilities are endless for Synternet’s role in shaping the future of decentralized data services.

written by Daniel

A new year is about to come, and the market is heating up, as expected, but the latest year also brings new challenges for the ever-changing and innovative world of cryptocurrencies. If there’s one thing we’ve learned in recent years, the ecosystem always thrives on captivating narratives that drive innovation, adoption, and market enthusiasm.

But how can we predict the coming big narrative for this new year? While we’re not space gurus with supernatural powers to foresee the future, the market provides valuable tools to conduct analyses to shed light on the crypto narratives that might dominate the scene during this year full of high expectations Let’s dive in!

One concept that has become increasingly popular in the crypto sphere is narratives. While they are not unique to this industry (they have always existed in traditional finance), the trends emerging year after year in the crypto ecosystem have led market participants to seek out, identify, and better understand the trending ideas, stories, or beliefs that shape how people perceive and value digital assets.

The narratives about cryptocurrencies built during each cycle allow investors to gain early exposure to the assets framed within these narratives, enabling them to harness their potential to construct a profitable portfolio.However, it’s also important to note that some narratives turn out to be misleading and fail to meet the expectations of the average investor Hence, it’s crucial to evaluate them critically, separating market hype from the actual substance of the narrative at the time.

Whether successful or not, market narratives are important because they play a central role in shaping public perception and market movements For this reason, if we look at the short history of crypto space, the narratives that have emerged (or been constructed?) have significantly influenced the performance of the assets tied to them. After all, significant venture capital (VC) firms need to recover their investments.

If you don’t believe me, look at the narratives that have historically driven the cryptocurrency market:

● DeFi in 2020

● Altcoins 2021

● NTFs 2021

● AI and Big Data 2023

● Meme tokens 2024

Here is the corrected and translated text in British English:

One of the most complicated questions to answer in crypto is when? To figure it out, we must first know where to look: the smart money flow.

That’s right, dear reader The flow of smart money is undoubtedly the most logical trail to follow if you want to capture opportunities in crypto or any industry. Why? Simple: major investors “turn on the money printer” and are responsible for ensuring liquidity flows into the financial system

Once liquidity from the big smart money begins to flow, the sun starts to shine, and the major bets made by venture capital (VC) firms on projects whether newly launched or renewed begin to materialise.

Although it’s not an exact science or a theory to follow to the letter, studying the movements of large capital holders can give you a clearer idea of which sectors to pay attention to in the upcoming cryptocurrency cycles

Remember, these investors get access to privileged information, and their perspectives and investments are typically well-founded. Therefore, global macroeconomic variables and technological changes influence the potential narratives in the crypto market.

For this reason, some tools allow you to track where money is moving, whether by sector or blockchain These tools can be a valuable resource for your financial analysis when investing

Based on on-chain information about the latest funding rounds, we can gather the following key insights:

● About 156 funding rounds were completed over the past month, raising $2.0023 billion.

● The Blockchain infrastructure and services received the most funding in the latest rounds, making GameFi, DeFi, CeFi, and Web3 stand out

● Animoca Brands and OKX Ventures lead industry investments, with nearly 200 successful deals in the past 30 days alone.

● The United States is the country that has received the most VC investment

Source: CoinCarp.com

Now that we have a clearer idea of where the money is flowing, we can delve into what we believe could be some of the dominant narratives for 2025.

Consider that many of these narratives are extensions of existing trends in the industry Other narratives emerged during the second half of last year and seem poised to continue consolidating at least during the first half of 2025 due to the positive momentum in the industry, bolstered by the inclusion of pro-crypto officials in the new administration of the dominant economy in the sector: the United States

Towards the end of 2023 and the beginning of 2024, two narratives emerged that drew users' attention to decentralised finance: tokenisation of real-world assets (commonly known as RWAs) and Decentralised Physical Infrastructure Networks (DePIN).

Nearly a year later, these sectors are mature enough to address the next generation of decentralised finance, moving beyond the traditional yield farming trend of the 2020 DeFi summer.

During 2025, DeFi 3.0 might focus on turning real-world assets (RWAs) such as real estate, bonds, and commodities into tokens. This trend bridges traditional finance with blockchain, delivering unprecedented transparency and liquidity

In Moon Mag 29, you can find an in-depth explanation of this crypto narrative and its potential in an increasingly tokenised world. Now, with a government that is supportive of the crypto industry, it is likely that RWA tokens will begin gaining momentum throughout much of 2025.

As of 2024, the tokenised RWA market is valued at nearly $13.5 billion, with tokenised treasuries dominating the real-world asset (RWA) space, making up 62% of the market. Data from Messari suggests that the tokenisation market could reach between $3.5 trillion and $9 trillion, with the potential to represent a $16 trillion business opportunity by 2030, accounting for 10% of global GDP.

On the other hand, Decentralised Physical Infrastructure Networks (DePIN) are ready to gain traction as blockchain innovation continues to expand in the Internet of Things (IoT) sector, particularly in mobility, mobile networks, and GPU rendering, driven by the increasing demand for artificial intelligence (AI) models

The DePIN market has seen significant growth, with its total market capitalisation increasing by 400% to $20 billion over the past year. The AI narrative has driven substantial growth in the DePIN market, particularly in the Compute and Storage sectors, which have seen over 50% growth in recent months (Messari report).

According to Messari, the DePIN sector has attracted significant investment, with early-stage fundraising up 296% year-over-year. Notable fundraising rounds include IoTeX raising $50 million and Peaq raising $30 million to support DePIN projects

Among the tokens I am closely tracking in these segments are:

● Karrier One: it provides wireless access and banking services to the unbanked through a phone number. The project is built on the Sui blockchain.

● Nexera Finance: Facilitates the legal handling of digital and realworld assets via blockchain.

● Chirp Wireless: A global decentralised telecommunications and IoT network built on Sui.

● Syntropynet: Revolutionising data management for fairness, with $NOIA as its primary currency.

● Render: Render Network continues cementing itself as a leader in this sector as demand for computational power to support data availability in AI models grows.

● Filecoin: A leader in decentralised storage solutions with the potential to revolutionise the segment

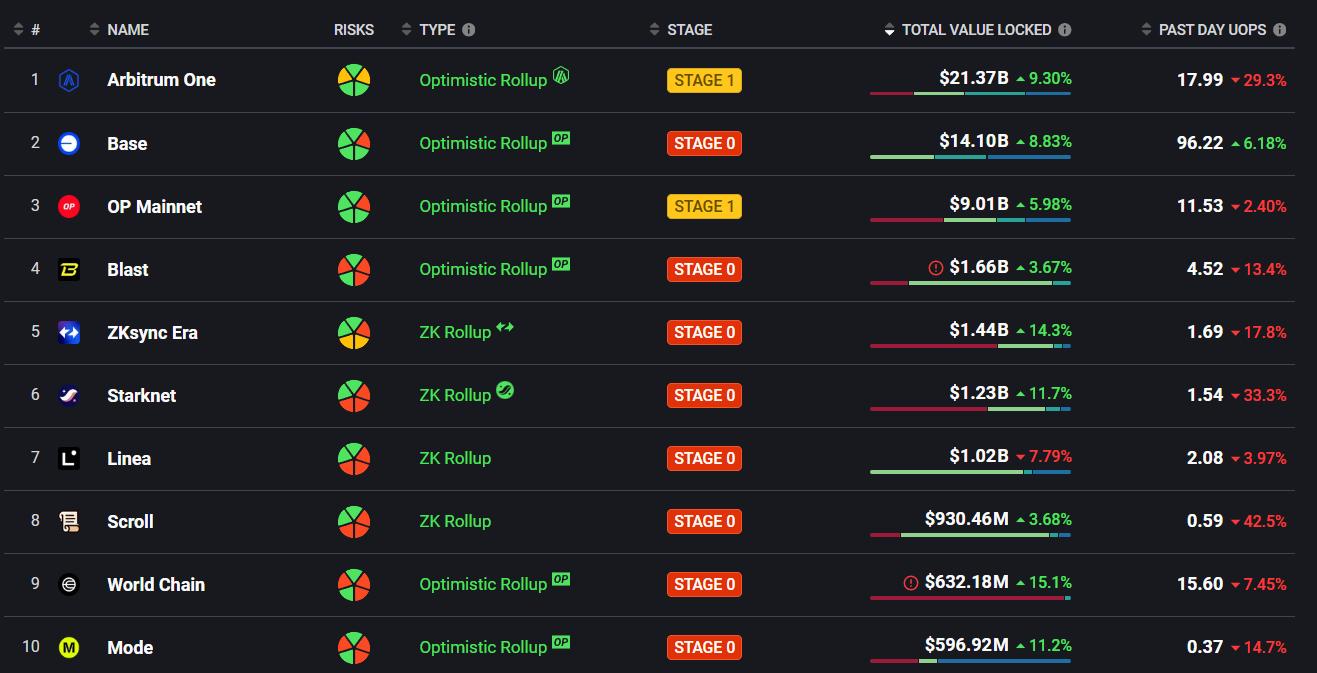

Without a doubt, we know that for much of 2025, the dominant narrative will remain focused on L1 and L2 projects aimed at providing solutions to the key components of blockchain infrastructure

Four major players stand out: Solana, Sui, Bitcoin, and Ethereum. Each, due to its vision and design for the complete decentralisation of blockchain technology, is set to play a central role in this narrative. Let's delve into the arguments supporting this theory.

Bitcoin will continue to be the dominant digital asset in the industry due to its role as a store of value for those seeking financial stability, especially in emerging markets.

The institutional adoption and advancements in Bitcoin's Lightning Network protocol will strengthen its utility as a value store and an exchange medium. In this regard, the solutions around the Bitcoin ecosystem (L2s), such as Rootstock and Stacks, could propel the network beyond its role as "digital gold."

A particularly noteworthy project in this context is Satoshi Virtual Machine (Satoshi VM), a ZK Rollup Layer 2 for Bitcoin.

Despite criticism towards Ethereum for its extensive roadmap to implement scaling solutions that enhance efficiency, the development of its ecosystem, anchored by Layer 2 solutions such as Arbitrum, Base, and Optimism, continues to demonstrate that the network has much to offer in 2025.

The Pectra Upgrade, a major network enhancement expected to bring significant protocol-level improvements in the first quarter of the year, could incentivise more use cases and innovation within Ethereum's ecosystem This includes advancements in validator infrastructure, off-chain processing, and blockchain services focused on attracting more users to a highly decentralised and secure environment

The crypto space has evolved, and the emergence of several new Layer 1 blockchains gaining prominence in unique ways during this cycle is proof of that Two L1 networks worth noting for their achievements in scalability and efficiency are Sui and Solana.

Sui is leveraging its ecosystem by attracting projects focused on GameFi, memecoins, SocialFi, and DePIN Its ability to offer realtime, secure, and scalable interactions without the bottlenecks typical of first-generation blockchain solutions sets it apart

Meanwhile, after reaching a new ATH, Solana continues to position itself as an L1 network capable of achieving 1 million TPS following its Firedancer upgrade This foundation positions Solana to directly compete with Ethereum on total value locked (TVL). Native projects such as Jupiter DEX are strong competitors to the once-dominant Uniswap, offering insight into Solana's trajectory in 2025.

In recent months, there has been much discussion about a resurgence in the NFT market, particularly regarding the natural evolution of established projects in this sector. These efforts wish to retain their loyal audience and attract new users while avoiding a repeat of the unchecked frenzy the sector experienced in 2021.

Nowadays, NFTs are shifting from art-based collectables to applications with tangible utility Games, metaverse integrations, and memberships now take centre stage

The native token by Pudgy Penguins launch is a clear example of how blue-chip NFT projects innovate to become more accessible and attract new community members, even from mainstream circles beyond the project's original NFT base.

Source: Crypto Slam

The convergence of AI and blockchain technology is a trend we have been discussing in Moon Mag since late 2023.The exciting possibilities that the union of these two technologies presents are undeniable, ranging from optimising smart contracts to AI agents now managing blockchain applications

After the debacle the AI sector experienced once the frenzy driven by the rise of ChatGPT and its counterparts had ended, developers in this field appear to have found the necessary synergy to enable new use cases within the crypto ecosystem, focusing on the use of decentralised resources to enhance new AI models in the cryptocurrency industry

However, ethical concerns regarding transparency and biases in AI systems must be addressed to ensure sustainable growth.

2025 could be the year when regulatory clarity fosters institutional confidence in cryptocurrencies. With the entry of a new government favourable to the sector in the United States, there is a strong sense of optimism for new developments in the industry to proceed without the concerns of the past over the rigid regulatory blows that, in some cases, were imposed by the SEC in the United States

Frameworks that balance innovation with regulatory compliance will shape the adoption curve. However, opportunities abound, and overly restrictive policies may also arise, making engagement with regulators crucial. Only time will tell whether the remedy is worse than the disease

The current narratives of the crypto ecosystem include real-world assets (RWAs), Artificial Intelligence (AI), Layer 2 solutions (L2s), and decentralised physical infrastructure networks (DePIN), in addition to emerging memecoins and, of course, the established GameFi sector.

As 2025 progresses, these narratives promise to consolidate the crypto industry in a macroeconomic environment that seems favourable for innovation and the development of new use cases.

From the evolution of decentralised finance (DeFi) to the resurgence of NFTs and the synergy between AI and blockchain, the stories emerging from this dynamic space highlight its resilience and adaptability. Whether you are a developer, investor, or enthusiast, staying informed will be key to navigating the ever-changing world of cryptocurrencies

written by Josh

I’ve been following Lisa’s posts and columns for a while now, and let me just say she makes trading look effortless. I’ve had the chance to sit beside her and watch her in action, too. Seeing her trade live is something else she’s calm, focused, and totally locked in like she’s solving a puzzle. What’s wild is how she owns her emotions. She’s open about being fiery in her personal life, but when it comes to trading, it’s like she flips a switch and everything’s under control.

Naturally, I thought, “I can do that too.”

ALERT!!

I couldn’t.

Trading your own money is a completely different beast. The stakes feel sky-high, and mistakes happen fast.

When I first jumped into margin trading, I thought I was ready I wasn’t. The lessons hit hard and fast. If you want to experience every emotion rage, hope, panic, greed all at once, just start overtrading. Toss in some lofty goals, and you’re on the express train to Rekt City.

Yeah, guys have emotions too, and I was feeling all of them. Full tilt. Trading drags you into this raw, primal state where the real fight isn’t with the market it’s with yourself. But here’s the thing: trading is also a mirror. It shows you your limits, your flaws, and where you need to grow.