A note from Lisa

A note from Lisa

We’re turning 3 and couldn’t be more excited to celebrate with you. Our 36th issue is packed with everything you love about crypto – and then some!

We take a look back with a 10 Past Project Recap. Join us as we rewind to revisit 10 groundbreaking projects we've featured. See how these projects have evolved and shaped the crypto world.

This month, our spotlight is on Pea.Ai, which we're exploring in depth. Pea.Ai is changing the game by merging AI with blockchain. Learn how this innovative project is transforming industries and why it’s capturing everyone's attention.

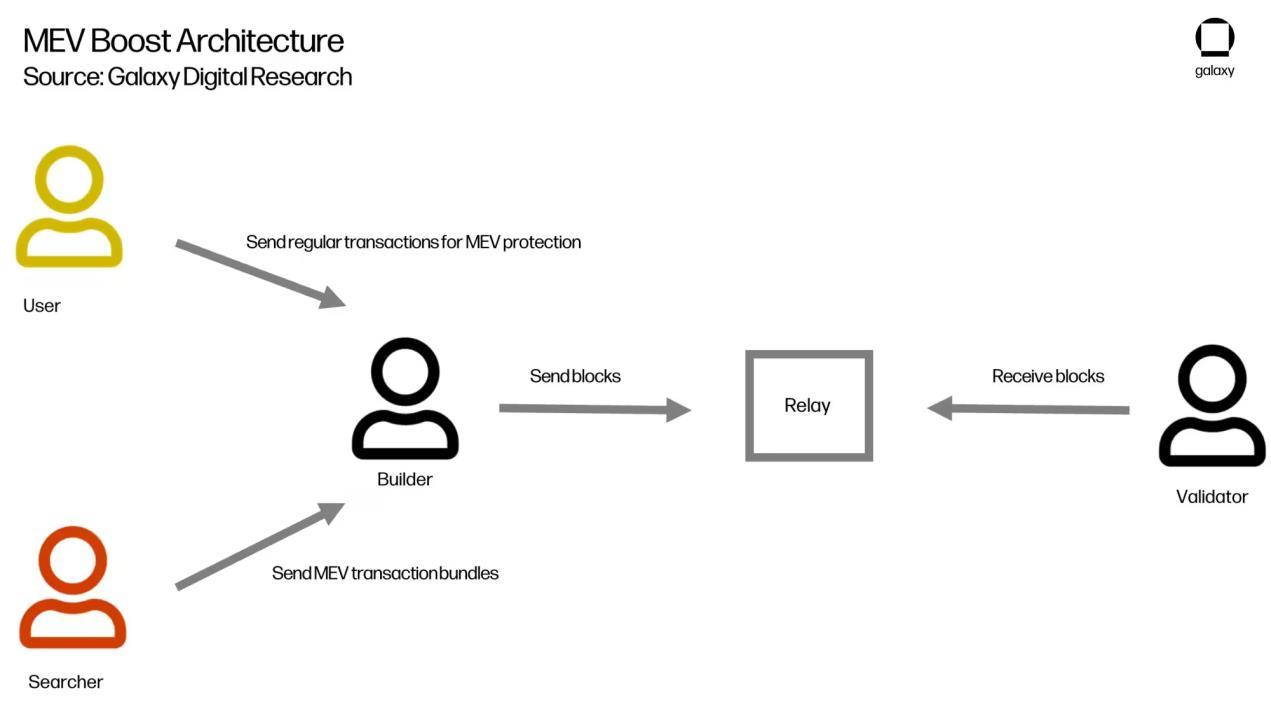

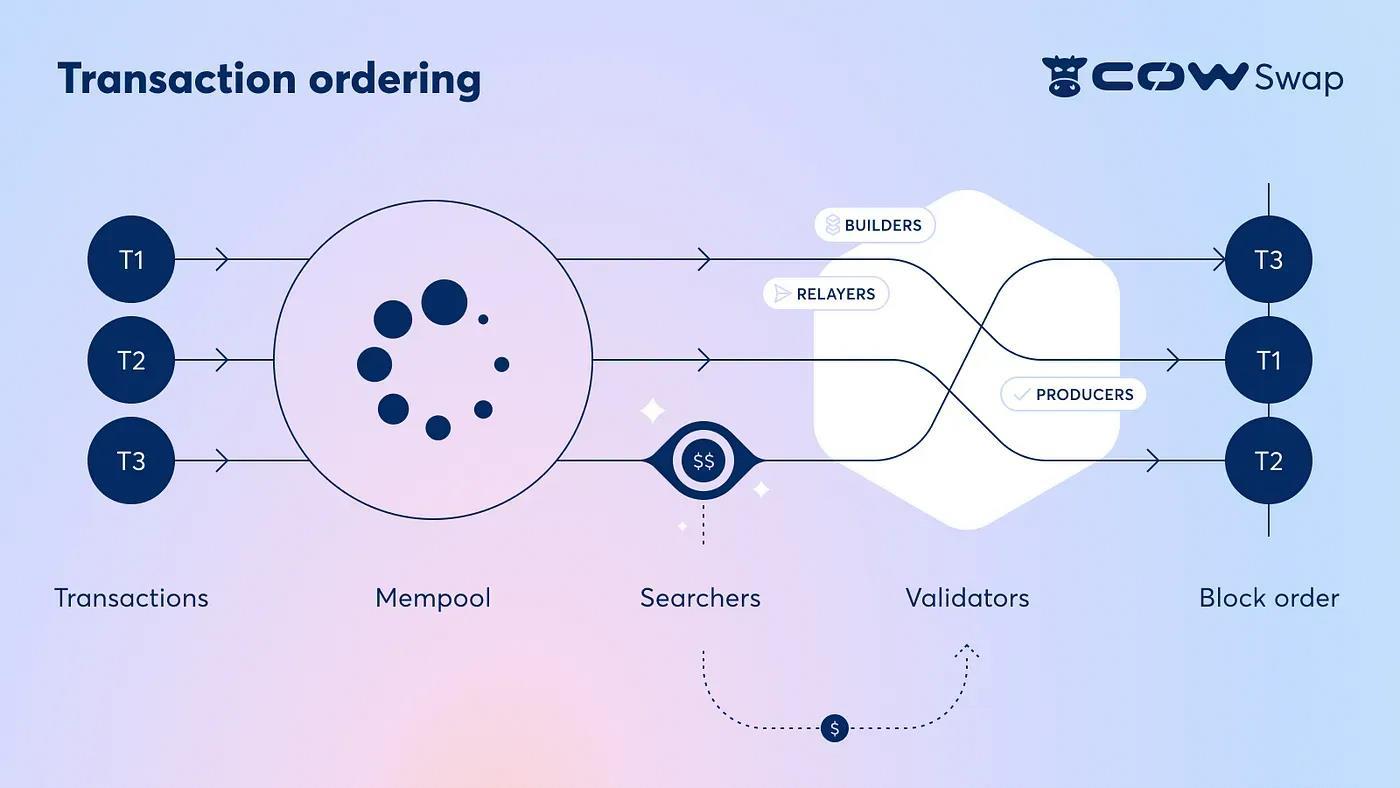

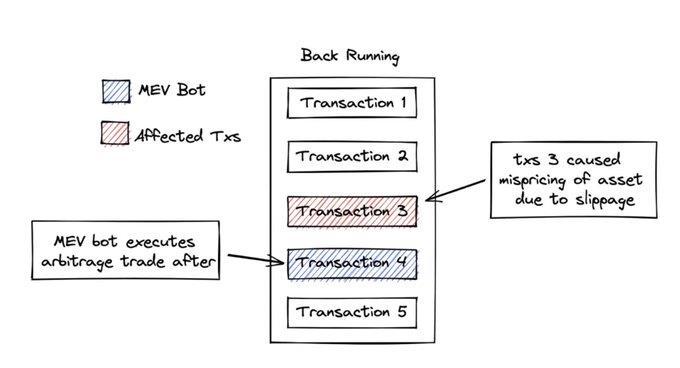

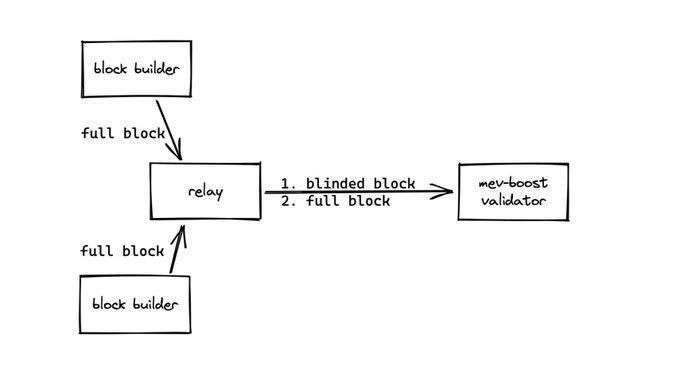

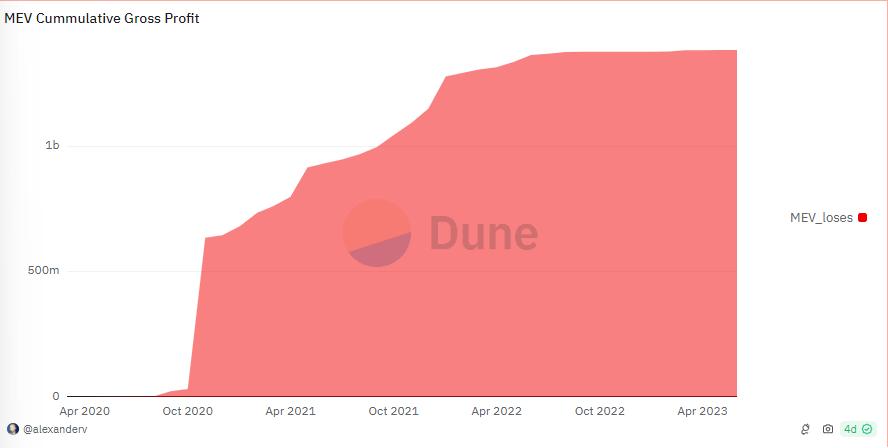

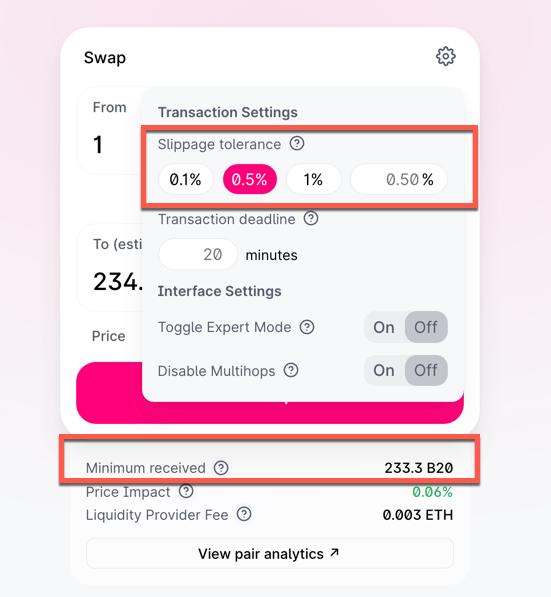

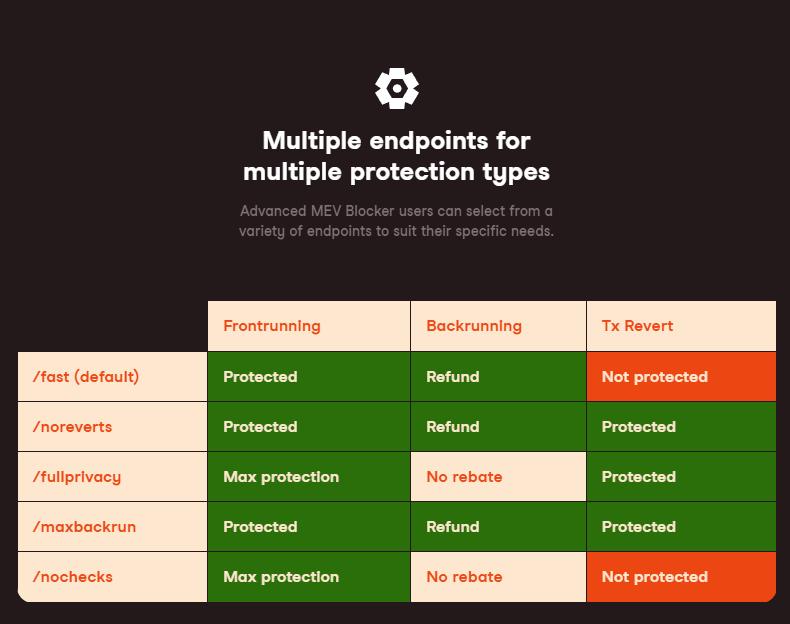

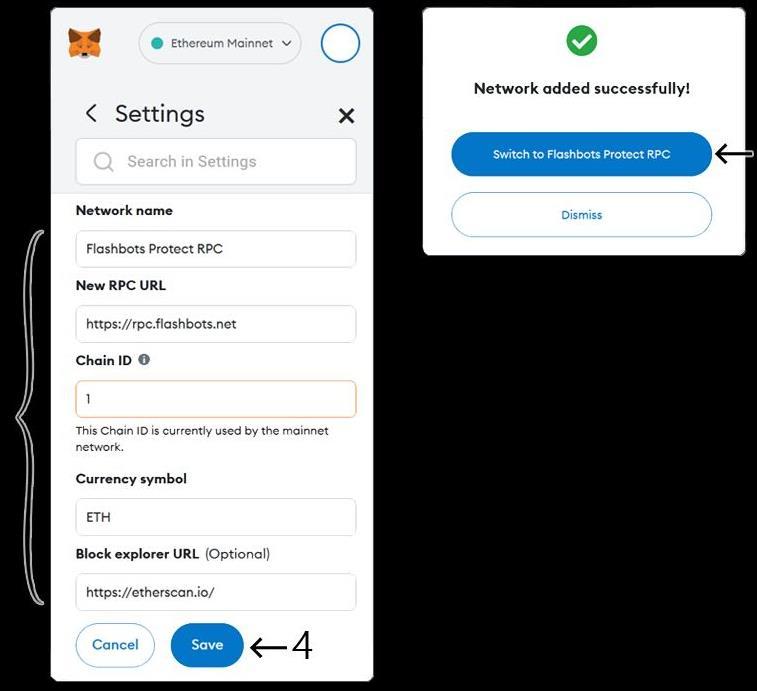

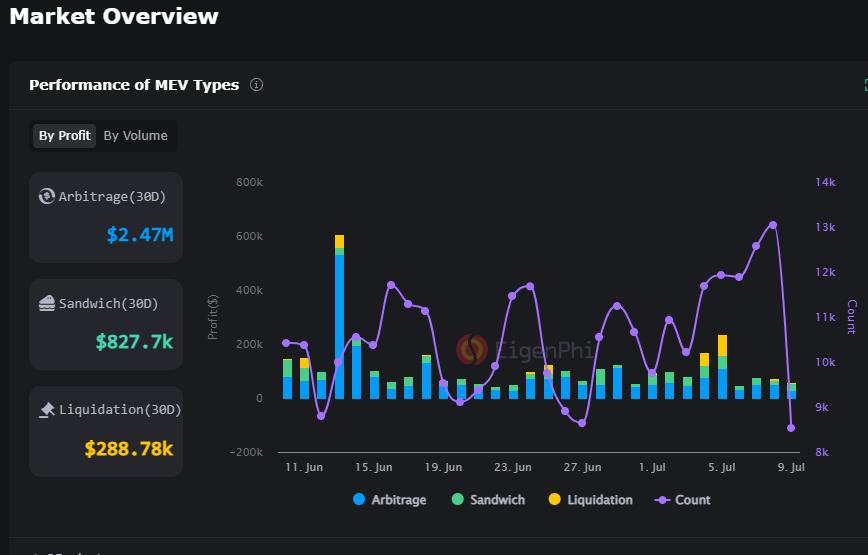

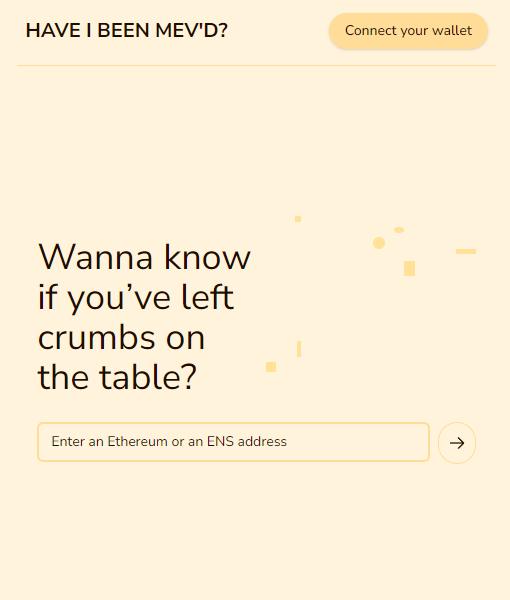

MEV: Miner/Maximum Extractable Value (MEV) might sound complex, but we’ve got you covered. We break this down so you understand the risks and how not to get scammed!

Josh has you covered with Time in the Market vs. Timing the Market. Should you ride the market waves or make perfectly timed moves? We dive into this classic debate with insights and data to help you make informed decisions.

Decentralised Betting: Could this be the future of gambling? Daniel explains how this will be lucrative during this imminent bull run. Explore how blockchain is revolutionising the betting industry. Our guide covers everything from the basics to the latest platforms, making betting more transparent, secure, and accessible.

I break down “Your Guide to Cryptocurrency Exchanges.” Finding the right crypto exchange can be tricky. Our comprehensive guide outlines what to look for in an exchange, its features, security, and user experiences to help you make the best choice.

Happy Birthday to Us!

Thank you for being part of our journey. We’ve had an incredible three years and look forward to many more with you. Here’s to celebrating the past and embracing the future together!

Thank you for 3 years

Love Lisa and The Moon Mag Team

Happy Birthday to us!! The Moon Mag is 3 years old with the publishing of this issue! Wow, it's flown by, and we've had an epic journey on the way. We have a fantastic article written by Chris in this edition, which revisits some of our past deep dives and checks in with them to see what they are doing now. How many of you bought into these projects when we first talked about them? Who's still hodling?

Both Lisa and I have also written articles in this edition, and of course, Daniel, our super competent researcher and writer, has been delving into those complex topics and turning them into straightforward, clear reading for us all. We've had a range of article writers over the years, but Daniel has always been consistent and welldeserving of a piece of birthday cake!

We love hearing from you about the projects you're into, the ones you are thinking about getting into, and your stories in the crypto world. Without you reading and joining in the conversation, we wouldn't be where we are today, and I'm almost certain we're closer to the Moon than ever before!

As we look forward to the next few months and years of crypto, we endeavour to continue bringing you the best content we can in the Moon Mag from a range of diverse opinions and meticulously checked facts. For now though, we're enjoying our birthday and just take a look at the home page of the Moon Mag....all those awesome covers! A big shout out to Alex, our very talented designer and editor, for bringing it all together and making the magazines look so epic.

Happy Birthday to everyone at the Moon Mag and everyone reading the Moon Mag. Help yourself to a slice of birthday cake!

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

Daniel has been a blockchain technologyevangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies MDC writer since 2018, currently writer for CryptoTrendencia.

Chris

I joined the crypto party in 2017 Worked as a DAO contributor, startup advisor, lead researcher and co-author My superpower? Translating complex blockchain concepts into clear, engaging content that resonates.

written by Lisa N. Edwards

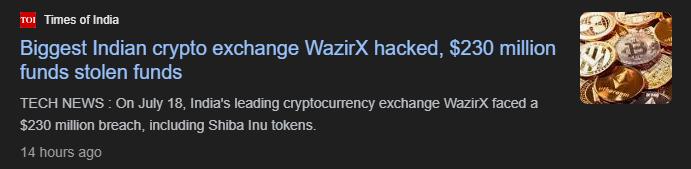

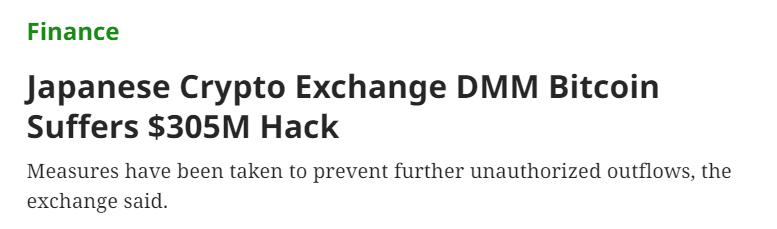

As we move into a Bull Run, hacking an exchange is the equivalent of a modern-day bank robbery and can make or break the continuation of a business. For instance, the infamous Mt. Gox exchange, which was once the world's largest Bitcoin exchange, collapsed in 2014 after losing approximately 850,000 Bitcoins to hackers. Another example is the QuadrigaCX exchange, where the mysterious death of its founder led to the loss of $190 million worth of cryptocurrencies, as he was the only one with access to the wallets. The Cryptopia exchange in New Zealand was hacked in 2019, resulting in a loss of about $30 million.

Most recently, the collapse of FTX, once a leading cryptocurrency exchange, highlights serious issues in the crypto market. In late 2022, the exchange faced a dramatic downfall due to revelations of financial mismanagement and fraud. Misuse of customer funds and deceptive practices led to a severe liquidity crisis, causing significant losses for investors.

These high-profile incidents underscore the critical need for enhanced security and transparency within the cryptocurrency ecosystem. Each of these cases—Mt. Gox, QuadrigaCX, Cryptopia, and FTX—reveal different facets of risk, from hacking to mismanagement and fraud. As the industry continues to grow, ensuring robust security measures and rigorous oversight becomes even more crucial. It’s also important for users to be diligent and informed when choosing where to invest or store their assets.

Cryptocurrency exchanges play a crucial role in the digital asset ecosystem, providing a platform for users to trade cryptocurrencies. However, the rapid growth of the crypto market has also brought significant challenges, particularly in terms of security and regulatory compliance.

This article delves into the essential aspects of cryptocurrency exchanges, including the security measures they should implement, the importance of Merkle Trees, proof of funds, and the MiCA framework. Now more than ever, it is essential to know what to look for in a cryptocurrency exchange. So, we at TheMoonMag.com break down key aspects to consider.

Cryptocurrency exchanges are platforms that facilitate the buying, selling, and trading of cryptocurrencies. They can be broadly categorised into centralised exchanges (CEXs) and decentralised exchanges (DEXs). A central authority manages centralised exchanges, whereas decentralised exchanges operate without a central entity and rely on blockchain technology to facilitate trade.

You have two main options: centralised exchanges (CEX) and decentralised exchanges (DEX). Let’s explore the differences.

Custody and Ownership: Centralised Exchanges (CEXs) hold your funds and manage your account, akin to trusting a bank with your money. However, this trust comes with significant caveats related to the key infrastructure needed to secure these funds. In this article, we delve deeper into the intricacies of this infrastructure and its implications for fund security.

User Experience: User-friendly interfaces and customer support make them accessible, especially for beginners.

Security: These exchanges are prime targets for hackers, but some offer insurance. You’re relying on their security measures.

Regulation: They nowadays require KYC and AML processes, providing accountability but reducing privacy.

Custody and Ownership: You control your private keys and funds, trading directly between wallets. It’s all about financial independence.

User Experience: DEXs can be harder to use, with a steeper learning curve. But they offer more autonomy.

Security: Reduced hacking risk since there’s no central pool of assets. You must secure your own keys and be aware of smart contract risks.

Regulation: Minimal regulatory oversight means greater privacy and fewer barriers to entry but less protection.

● Centralised Wallets: The exchange holds your private keys, providing convenience but requiring trust.

● Decentralised Wallets: You hold your private keys, giving you control and responsibility over your funds.

https://x.com/i/status/1539550790041235459

"Not Your Keys, Not Your Crypto" is a key principle in cryptocurrency security, highlighting that if you don’t control your private keys, you don’t truly own your crypto. This is similar to keeping cash under your pillow rather than in a secure vault it's convenient but vulnerable. Storing crypto on an exchange means you’re relying on their security, so while it's necessary for trading, it’s essential to choose a reputable exchange with strong security measures. Centralised exchanges offer ease of use, while decentralised ones provide more control. Balance convenience with control, keeping in mind: “Not your keys, not your coins!”

Full list of cryptocurrency exchange hacks [ 2011 – 2022 ] source: https://www.slideshare.net/slideshow/timeline-of-crypto-hacks-and-governmentactions/238149244

Cryptocurrency exchanges are pivotal to the functioning of the crypto market, but they also present significant security and regulatory challenges. By understanding and implementing robust security measures, leveraging technologies like Merkle Trees, providing proof of funds, and adhering to regulatory frameworks like MiCA, exchanges can enhance their trustworthiness and operational efficiency. Users, on the other hand, should conduct thorough research to select exchanges that prioritise security, transparency, and compliance.

Security is paramount in the cryptocurrency space, given the high risk of cyberattacks and fraud. Here are some essential security measures that exchanges should implement:

1. Two-Factor Authentication (2FA): Enhances account security by requiring users to provide two forms of identification before accessing their accounts.

2. Cold Storage: A significant portion of the exchange’s funds should be kept in cold storage, which is offline and less vulnerable to hacks.

3. Encryption: Data encryption ensures that sensitive information is protected both at rest and in transit.

4. Regular Security Audits: Conducting regular security audits helps identify and mitigate vulnerabilities in the exchange's systems.

5. DDoS Protection: Implementing measures to protect against Distributed Denial of Service (DDoS) attacks, which can disrupt exchange operations.

6. Bug Bounty Programs: Encouraging ethical hackers to identify and report security flaws by offering rewards.

A Merkle Tree is a data structure used in blockchain technology to ensure data integrity and consistency. It is particularly important for cryptocurrency exchanges for the following reasons:

1. Efficient Data Verification: Merkle Trees enable quick and efficient verification of data integrity, which is crucial for the high volume of transactions on exchanges.

2. Tamper-Proof: Merkle Trees' cryptographic nature ensures that any attempt to alter transaction data would be easily detectable.

3. Scalability: Merkle Trees facilitate the efficient scaling of blockchain networks by reducing the amount of data that needs to be processed and stored.

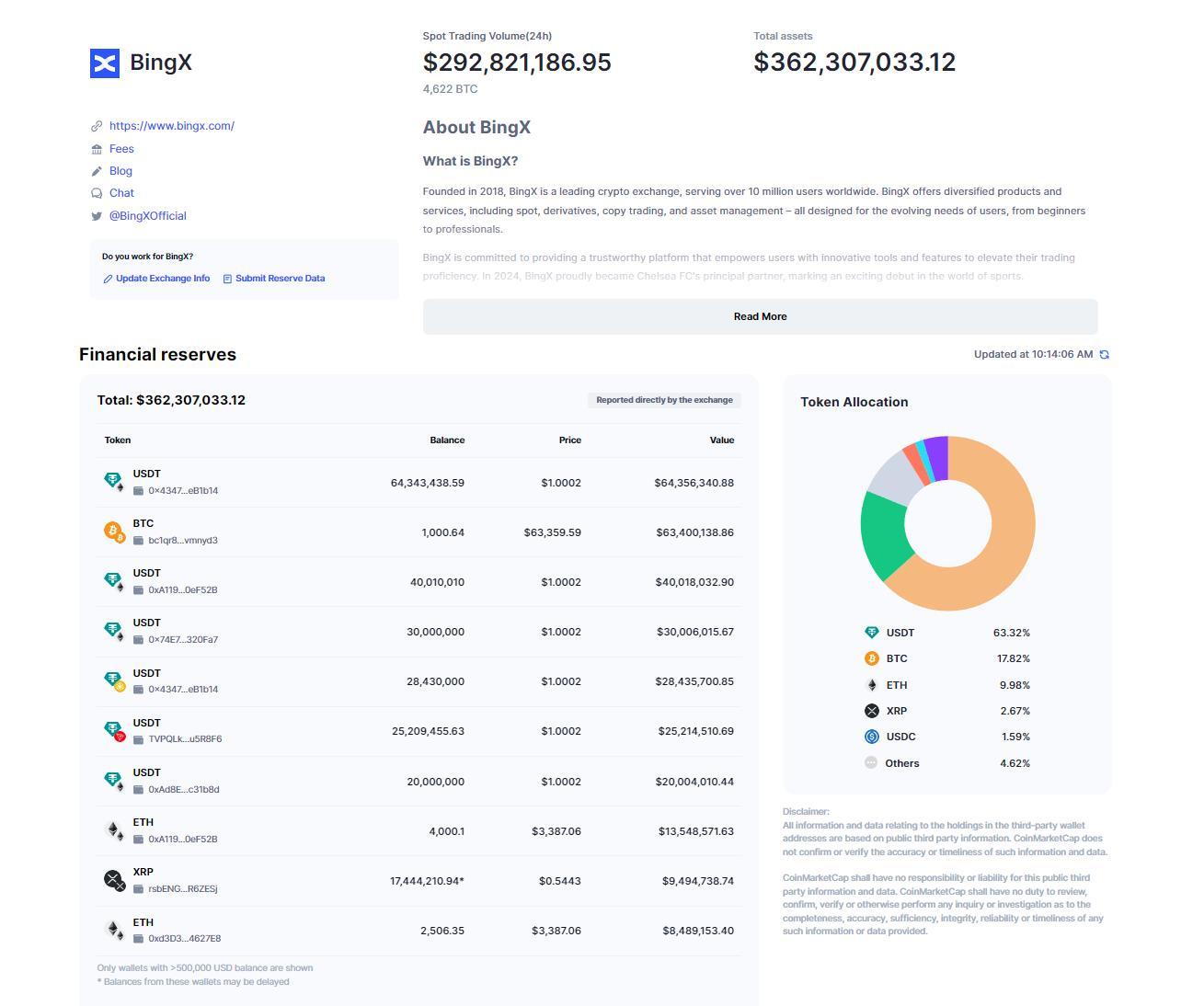

Proof of funds is a mechanism used by cryptocurrency exchanges to demonstrate their solvency and reassure users that their assets are safe. This typically involves:

1. Publishing Audits: Regularly publishing third-party audits that verify the exchange's holdings.

2. Cryptographic Proofs: Using cryptographic methods, such as Merkle Trees, to provide transparent proof of reserves without compromising user privacy.

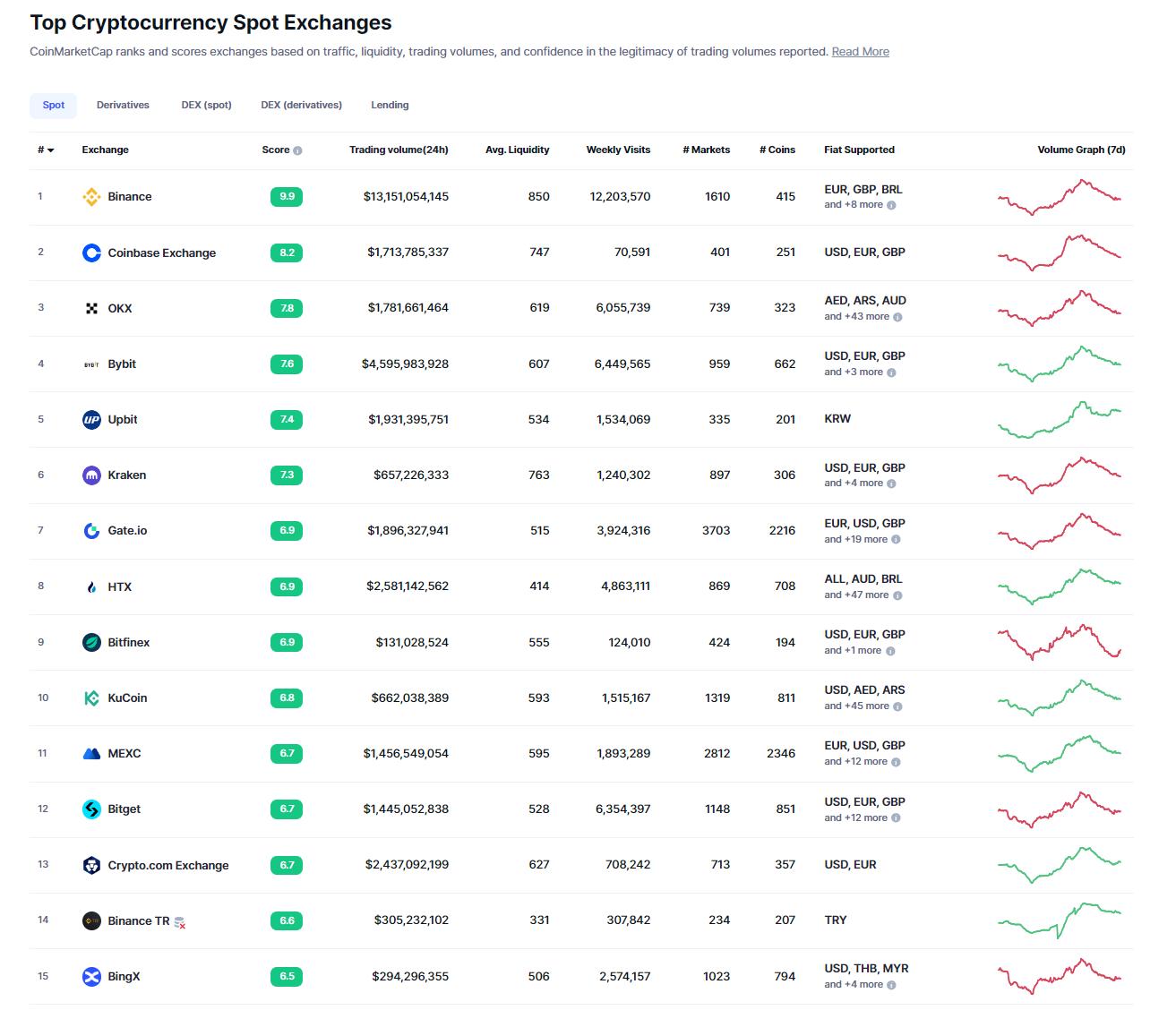

Of the TOP 15 exchanges listed https://coinmarketcap.com/rankings/exchanges/ only 1 is without reserve data.

PROOF OF FUNDS - https://coinmarketcap.com/exchanges/bingx/

The Markets in Crypto-Assets (MiCA) framework is a regulatory initiative by the European Union aimed at providing a comprehensive regulatory framework for cryptocurrencies and related activities. Key aspects of MiCA include:

1. Legal Clarity: MiCA aims to provide legal certainty for crypto-assets that are not covered by existing financial services legislation.

2. Consumer Protection: Ensures that consumers have access to accurate information and that their rights are protected.

3. Market Integrity: Establishes rules to prevent market abuse and ensure the integrity of crypto-asset markets.

4. Operational Resilience: Sets requirements for operational resilience and cybersecurity for crypto-asset service providers.

When selecting a cryptocurrency exchange, users should consider the following factors:

1. Security Measures: Evaluate the exchange’s security protocols, including 2FA, cold storage, and regular audits.

2. Regulatory Compliance: Ensure the exchange complies with relevant regulations, such as MiCA in the EU or the Financial Action Task Force (FATF) guidelines.

3. Transparency: Look for exchanges that provide transparent proof of funds and regular audits.

4. Reputation: Research the exchange’s reputation, including user reviews and any past security incidents.

5. Fees: Compare trading fees, withdrawal fees, and other charges to ensure they are reasonable.

6. Customer Support: Assess the quality and availability of customer support services.

As the industry grows and evolves, the critical importance of robust security measures and regulatory compliance cannot be overstated. Whether you value privacy with decentralised exchanges or prefer the user-friendliness of centralised platforms, it’s essential to understand that the industry's growth will hinge on a heightened awareness of security practices.

Centralised exchanges, in particular, must continuously strengthen their security frameworks and embrace regulatory standards to safeguard user assets and build trust. The future of cryptocurrency trading relies on a balance of convenience and security, with an emphasis on transparency and resilience, to ensure a stable and secure environment for all participants.

With that said…make sure you check out - Too Big To Fail And What To Look For In An Exchange

I wish you all HAPPY and SAFE Trading!

A Beginner’s Look

written by Josh

This feels like a suitable topic to look at as we reach the 3 year mark of delivering the Moon Mag to crypto lovers. Some of us have been reading from issue 1, some have joined along the way but others are only just beginning! So hello and welcome to you if you are.

This article is designed to help alleviate some of the worries you might have about dipping your toes into crypto when it sometimes feels like the glory days are over (I don’t believe they are!). It has also been written to help reassure you and your reasonings for getting involved in an industry that many judge too quickly or don’t make time to understand properly.

Here’s one of the most popular phrases you will hear in finance, whether crypto or traditionaltime in the market vs. timing the market.

Let’s start with the flashy one – timing the market. This strategy is all about buying low and selling high. Sounds simple, right? But here’s the catch – it’s pretty tough to predict those highs and lows. The crypto market is volatile to say the least. You might hear stories of people who made a killing by buying Bitcoin or a memecoin at rock bottom and selling at the peak. But for every success story, there are tons of people who mistimed it and ended up with losses.

Pros:

Huge potential gains if you nail the timing: If you manage to buy during a dip and sell at a peak, the profits can be astronomical. This is the dream scenario that draws many people to the crypto market.

Can feel like a quick way to make money: The idea of making significant returns in a short period is very appealing. Who doesn’t want to double their money overnight?

Cons:

High risk if you get the timing wrong: The market is incredibly volatile, and even experts struggle to predict its movements accurately. One wrong move and you could end up buying high and selling low.

Requires constant monitoring and quick decisions: Timing the market demands a lot of time and attention. You need to stay updated with news, trends, and price movements constantly.

Can be super stressful: The pressure to make the right decision and the fear of missing out (FOMO) can be overwhelming. It’s easy to get caught in a cycle of anxiety and secondguessing.

Now, let’s talk about the “boring” strategy –time in the market. This one’s all about the long game. Instead of trying to predict market swings, you buy and hold your crypto for a length of time. The idea is that, over time, the market trends upward, and your investment grows. The other meaning behind this is that experience is invaluable, and when you’re under pressure to make a decision about how to trade a coin or where to enter and exit, experience taps you on the shoulder and offers you sound advice.

Pros:

Generally lower stress since you’re not chasing market movements: You can avoid the daily stress of monitoring the market. With a long-term strategy, you can set it and forget it, checking in occasionally rather than obsessively.

Historically, markets tend to rise over the long term: Despite the volatility, the overall trend for most major cryptocurrencies has been upward over the long term. By holding, you can ride out the lows and

benefit from the highs.

Great for beginners who don’t want to spend every waking moment watching charts: If you’re new to crypto, this strategy allows you to learn at a comfortable pace without the pressure of making quick decisions.

Cons:

Requires patience – no instant gratification here: This approach is all about the long haul. You need to be prepared to wait it out to see significant returns, which can be tough in a world that loves instant results.

You might see dips in the short term and feel tempted to sell: Watching the value of your investment drop can be disheartening, and the temptation to cut your losses can be strong. It’s essential to stick to your strategy and not panic sell.

Gains aren’t as flashy as perfect market timing: While you’re likely to see steady growth, it’s not as dramatic as the gains from perfectly timed trades. It’s more about slow and steady wins the race.

Here’s the deal – starting now is better than waiting for the “perfect” moment. Crypto is still relatively new and growing. There’s a lot of innovation happening, and we’re likely just scratching the surface. Whether you go for the long game or decide to try your hand at timing, getting skin in the game is what matters.

For beginners, I’d lean towards the time in the market approach. It’s less stressful, and you can set it and (almost) forget it. Plus, you don’t need to be a market genius to see gains over the long term. It also gives you the time to learn and the patience to let the Market teach you along the way too.

Don’t stress too much about missing out, as it can often lead to FOMO and jumping in too deep before you’ve figured out how to navigate the market. Luckily, learning happens quickly in the crypto world, so embrace it, but ensure you have a set of money management rules to abide by. Who knows, a few years from now, you might be the one telling friends they haven’t missed out yet, either! At that point, you can point them towards this very article!

What it is and how to take advantage of it!

written by Daniel

Before the blockchain era, prediction markets have existed since ancient Rome, spanning sectors beyond sports: politics, weather, science and even trading markets!

With the internet era, online gaming appeared, specifically those linked to gambling or online betting, which have inherited the old problems to this day: centralisation, security and regulation.

Stories of winners having their accounts blocked, losing access to their winnings and starting capital on centralised gambling platforms are nothing new. In addition, at centralised gambling houses, your money is earned through unfair house odds and various implicit fees on withdrawals, winnings, and administration tasks, which end up in the hands of a few and with much less than promised.

To make matters worse, regulations surrounding online gambling are vague at best, with no uniform rules around the world.

The online gambling industry was generally prosperous, but given its unfairness to players, the system quickly stagnated, resulting in more and more gamblers concluding that betting was not fun anymore.

Why? Because online gambling games often have unfair conditions for the players, the probabilities of the results get calculated with data unknown to the participants, resulting in the "system or the house" almost always winning.

Despite all of the above, the industry is showing signs of a radical change in its functioning, and this is where Blockchain can be a good entry point to achieve a total disruption in online gambling platforms.

A bet can be a prediction that a sports match, a political election, or any other event will have a specific result and not another.

With the introduction of blockchain technology, we have been observing how betting has been redefined on online platforms, giving rise to a new form of placing a bet through the use of cryptocurrencies like BTC, ETH or TRX, among others.

The use of smart contracts in each bet between the player and the bookmaker has enabled a series of benefits for both players that allows them to approach traditional problems from different angles, thus giving rise to a series of options in the industry known as Crypto iGaming.

“Crypto iGaming: online casinos, sports betting, esports wagering, virtual games, numbers games, innovative blockchain-based games and decentralised applications (DApps) is rapidly gaining traction.”

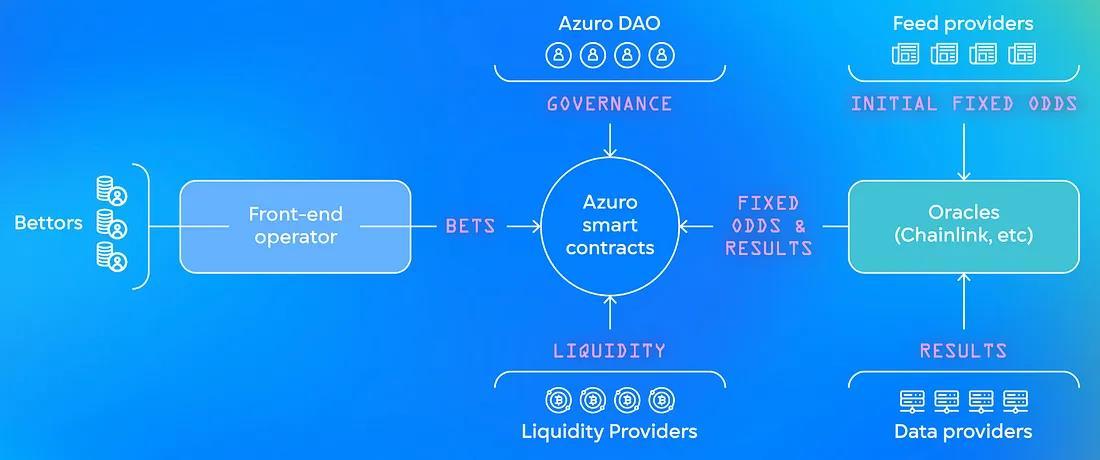

Unlike traditional betting platforms that rely on centralised authorities, decentralised protocols operate on blockchain networks. Transactions are recorded in a distributed ledger, eliminating intermediaries and ensuring that bets are executed autonomously and securely through smart contracts.

Generally, the platforms where decentralised bets happen are open source, so any user can contribute to improving the base code used for the bets. These platforms comply with the pre-defined parameters of a decentralised process characteristic of Blockchain technology, like a distributed consensus, validation based on asymmetric cryptography, and the issuance of transactions based on their sequential order on an unmodifiable chain.

With the blockchain providing the decentralised architecture, betting platforms can run without needing central operators to manage the bets, challenging the role of traditional online bookmakers.

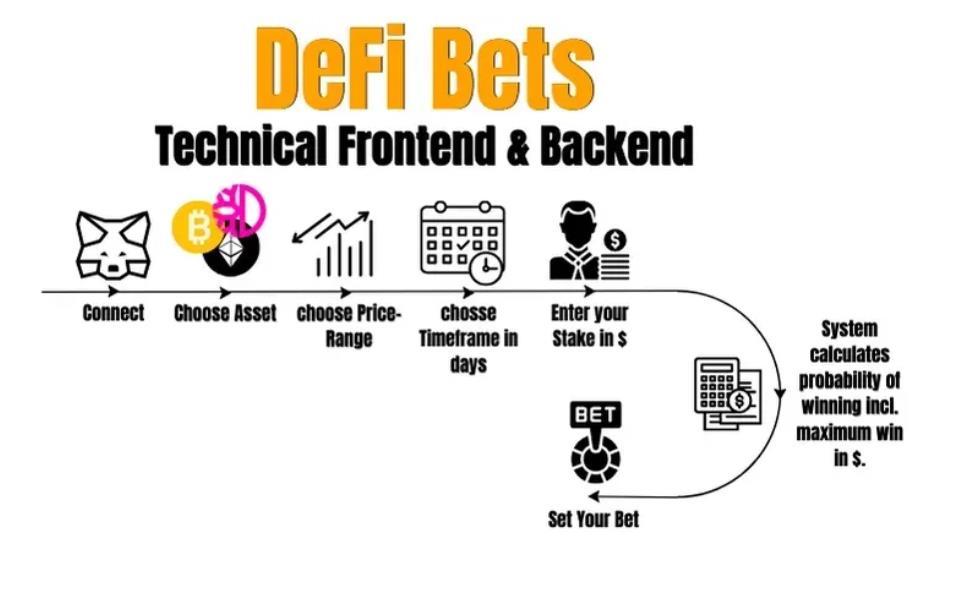

Source: DeFi-bets.com

In decentralised betting, bettors create markets and set probabilities so other players can decide to bet against the person who acts as the bookmaker.

In addition, the transaction fees in this type of platform differentiate them from their centralised peers. In a traditional online betting platform, the vig (the commission charged by the bookmaker) is 5% on average. In decentralised betting platforms, they take a smaller percentage, generally less than 1% of the betting action.

* They do not require a central authority for their operation: As we have mentioned above, the decentralised nature of blockchain technology allows for an independent betting market, where any user can bet against their peers without having to trust third parties.

* Fair rewards for everyone: Unlike traditional centralised bookmakers, where 'the house' always wins and takes the best odds, on decentralised platforms, the odds of winning are more fair and transparent to all participants.

* Access without geographical limits: One of the great advantages of decentralised systems is their accessibility to everyone, regardless of geographical location, race, or religion, and regardless of whether they are banked or not. Decentralised platforms allow the funding of accounts with

cryptocurrencies or native tokens no matter where the player is.

Fortunately, there is no need to deal with traditional -permissions required- financial institutions or restricted countries on decentralised betting platforms.

* Low Vig: With traditional bookmakers, the site takes an average of 10% of the vig from the losing side of a bet, which represents around 5% of the total bets, a large spread that a successful bettor must give up. In contrast, blockchain technology enables lowcost transactions, so the commissions of these platforms generally do not exceed 1%.

* Efficient transactions: el uso de criptomonedas permite el uso de grandes transacciones en comparación con los pagos tradicionales en línea, las cuales pueden tardar tan sólo unos minutos o horas en procesarse.

* Privacy and security: In Blockchain, cardholder identities are anonymous, so players' personal information is secure even in data breaches.

* Minimised fraud risk: unlike banking transactions, crypto transactions cannot be reversed or disputed, and transactions are fully transparent and traceable on the blockchain.

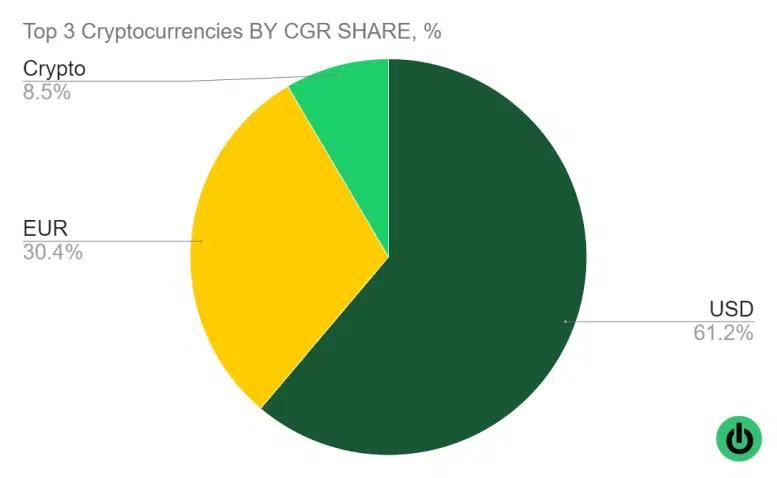

The Daily Guardian noted that in 2022, around 4% of all online gambling searches were related to cryptocurrencies. The same source found that interest in Bitcoin casinos quadrupled in less than two years.

On the other hand, forecasts from industry leaders are promising. They estimate that the revenue in the Online Gambling market could hit $100.90 billion in 2024. Sports betting accounts for 43% of the online gambling market revenue, followed by casino games with 32%.

The global iGaming market could double by 2030 at a compound annual growth rate of 11.7%. The previous data demonstrates the sustained growth that the traditional gambling sector has experienced worldwide over the past few years and how promising it will be for the foreseeable future.

Sports betting, online casinos and even traditional card games powered by blockchain technology are all part of the paradigm shift we are seeing in the gambling industry, where the decentralised sector is slowly gaining ground, with almost a quarter of a billion dollars reported in the most recent cryptocurrency gambling market statistics.

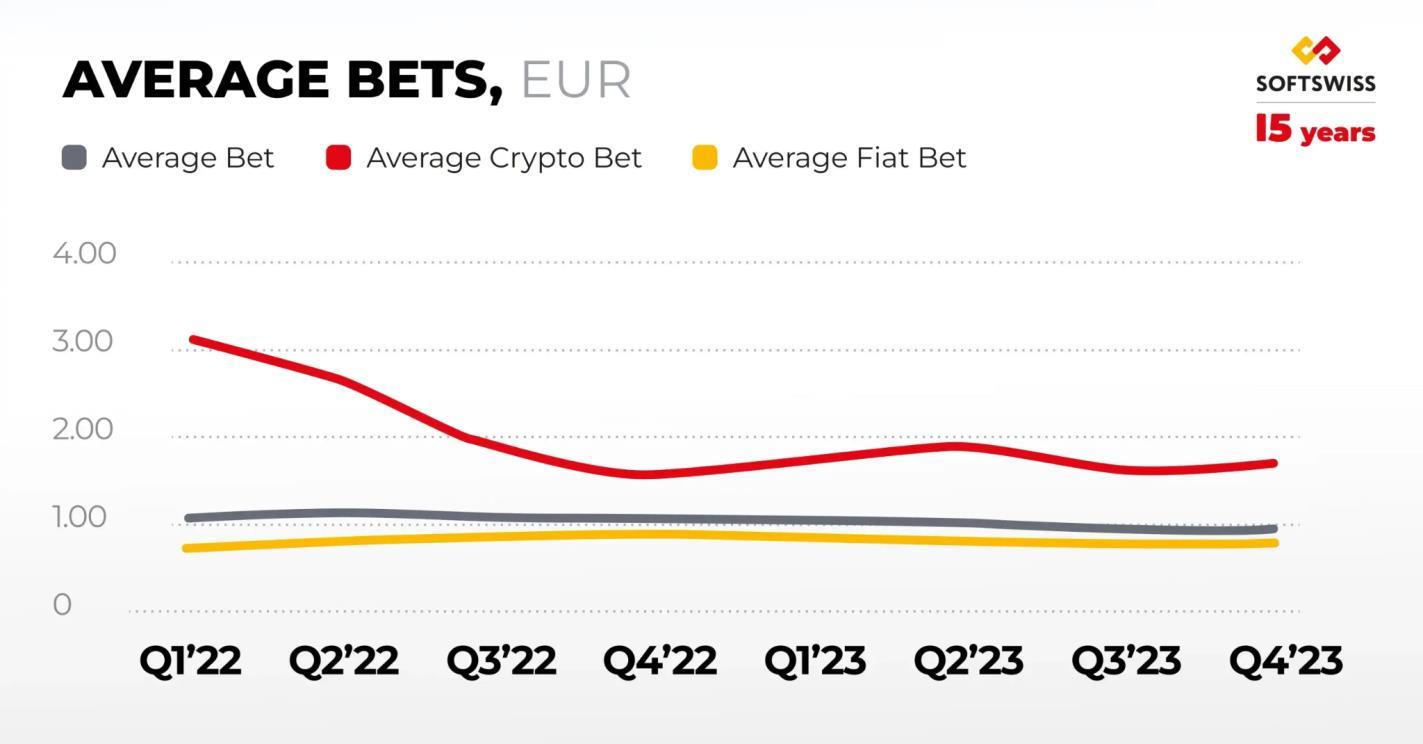

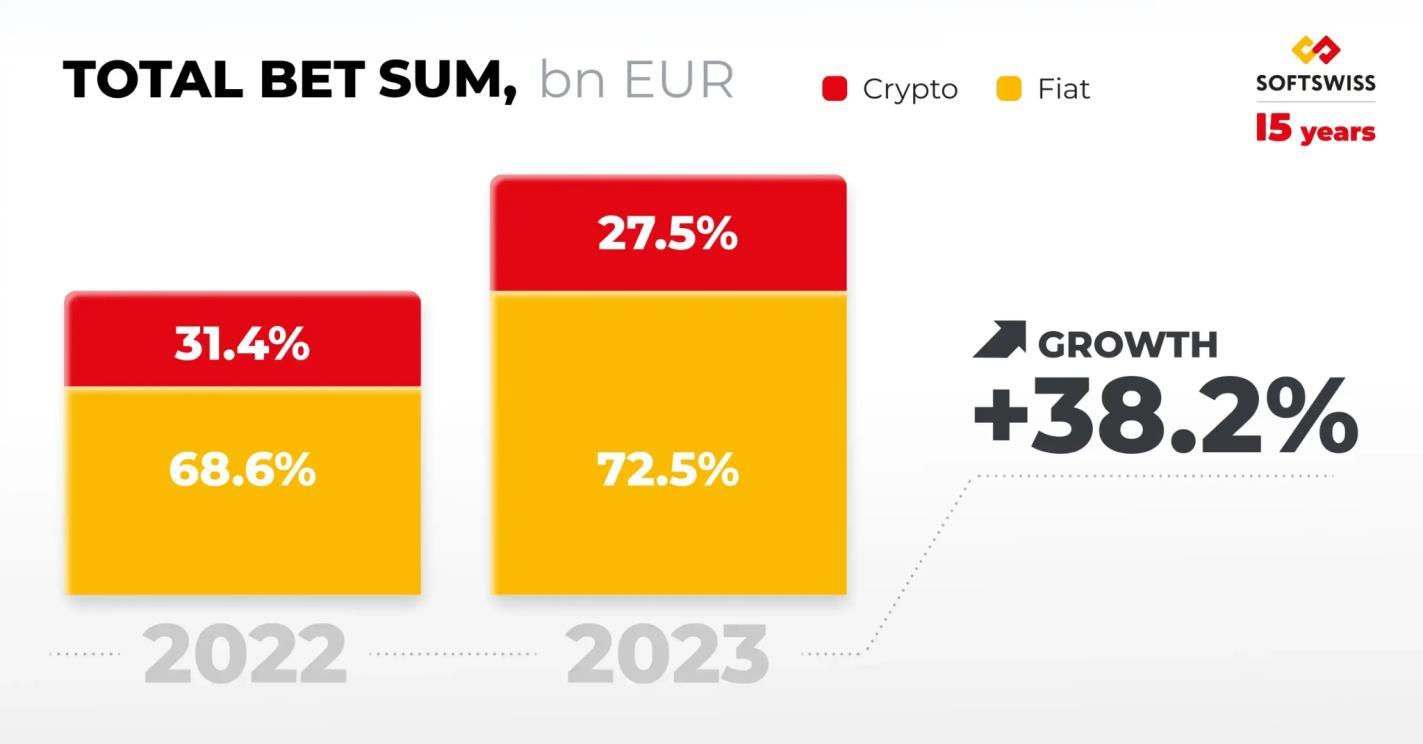

Source: SOFTWISS

While the crypto iGaming industry originated with the launch of SatoshiDice in April 2012, it wasn't until the COVID-19 pandemic that we saw a boom in these types of platforms worldwide, boosting industry metrics.

According to SOFTWISS data, the average crypto bet has stabilised somewhat throughout 2023, aligning with crypto market fluctuations.

Source: SOFTWISS

On average, the 2023 Crypto Bet Sum shows a 21.1% increase year-on-year. Simultaneously, the Crypto Bet Count increased by 50.5% year-on-year. Undoubtedly, the growing number of bets indicates an increased interest in crypto gaming, as mentioned by Softswiss in its most recent industry report.

Source: SOFTWISS

As noted above, the crypto iGaming industry encompasses some alternatives related to online platforms for decentralised betting that exist in a fairer environment than traditional methods.

The decentralised betting sector can be divided into three main groups: centralised bookmakers, prediction markets, and p2p betting protocols.

In the first case, we can place online casino games, poker or card games and lottery or bingo games that accept cryptocurrencies as a payment method (betting) and reward but do not offer a decentralised solution in betting rather than cryptocurrencies as a payment method.

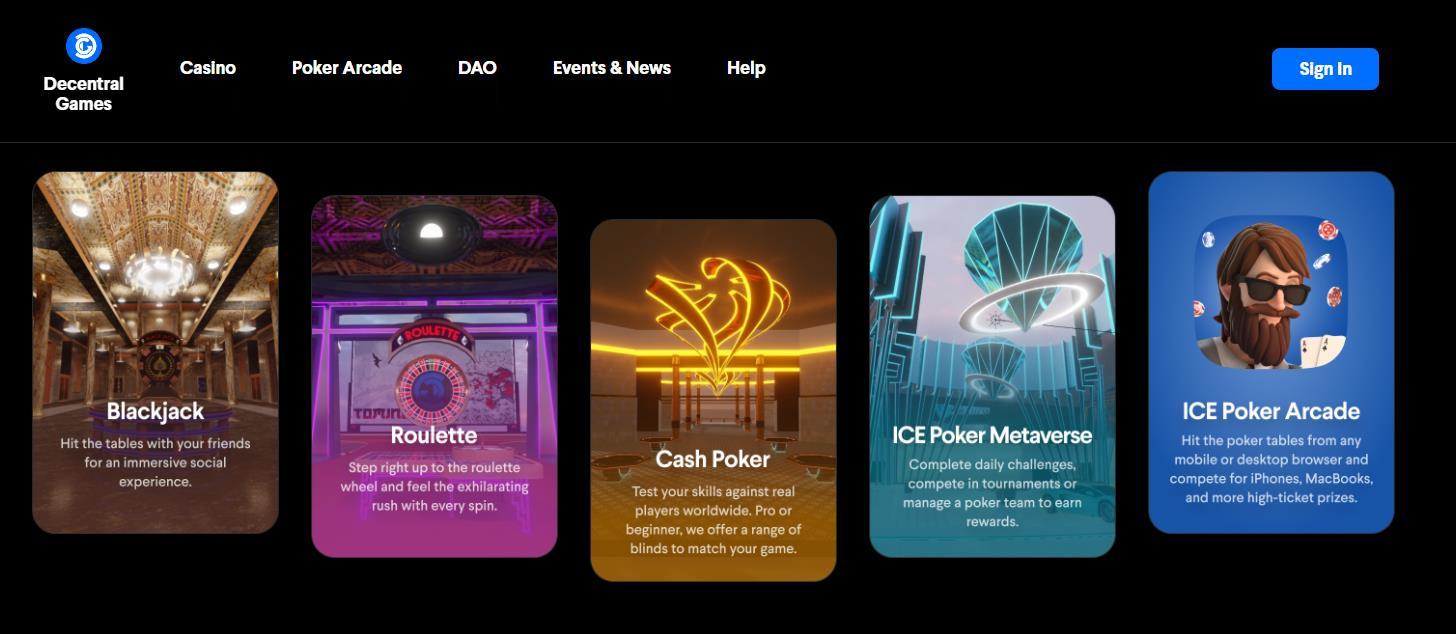

However, some decentralised casino applications attempt to evoke the general user experience of a regular gambler through a blockchain-based environment. Tron and Ethereum offer many options here.

Source: Dencentral Games

Sports betting is a growing sector that captivates users to bet on the outcome of various sporting events. With currencies such as Bitcoin or Ethereum, gamblers are betting on traditional sports such as football, basketball, and tennis and e-sports such as League of Legends and Counter-Strike.

In addition, some platforms offer real-time betting with live updates and fluctuating odds, many in a p2p environment.

In this case, p2p betting protocols link bettors together or in groups to bring the user experience closer to what bettors would expect, and the odds are clear (they do not change retroactively).

Despite the problem of liquidity for some events and poor odds according to the logic implemented on some platforms, solutions like Azuro that focus on decentralised liquidity where the betting market shares a common pool to democratise the betting business offer a more transparent, fair, fun and responsible environment.

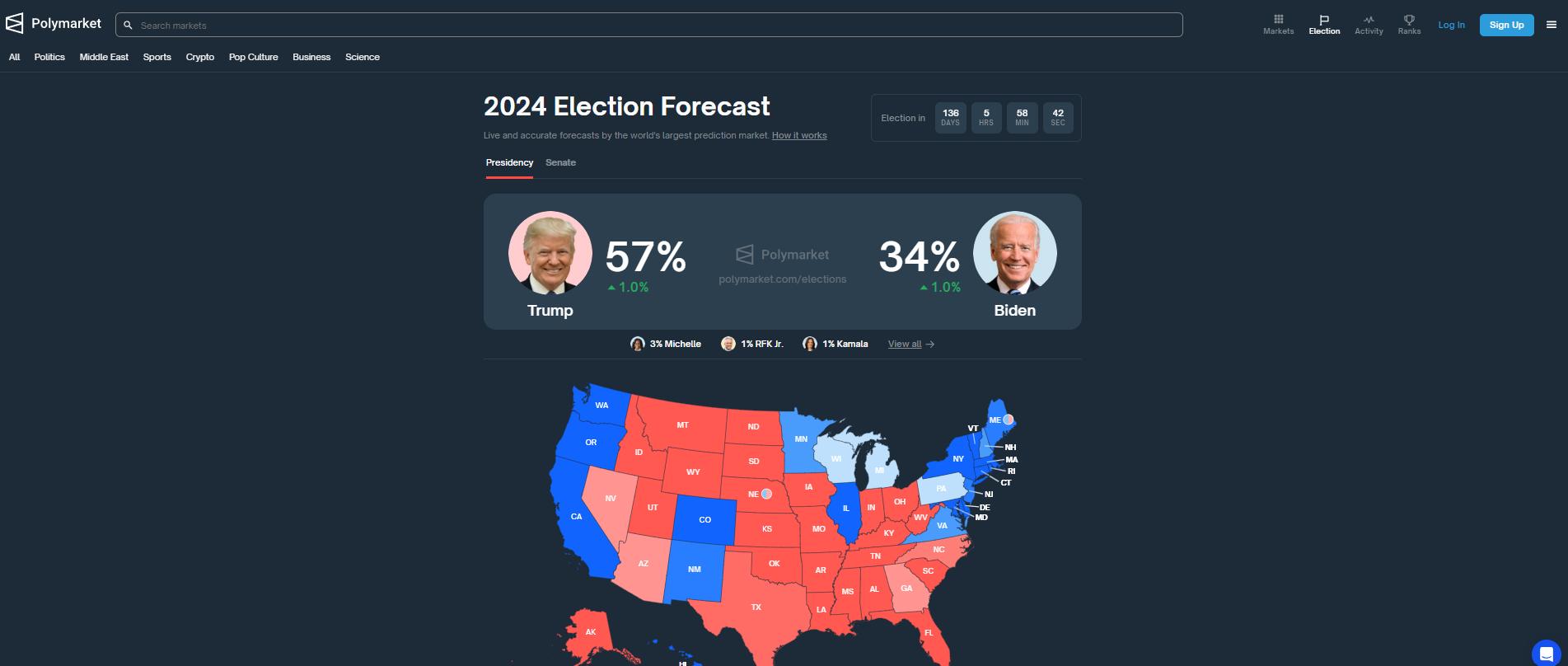

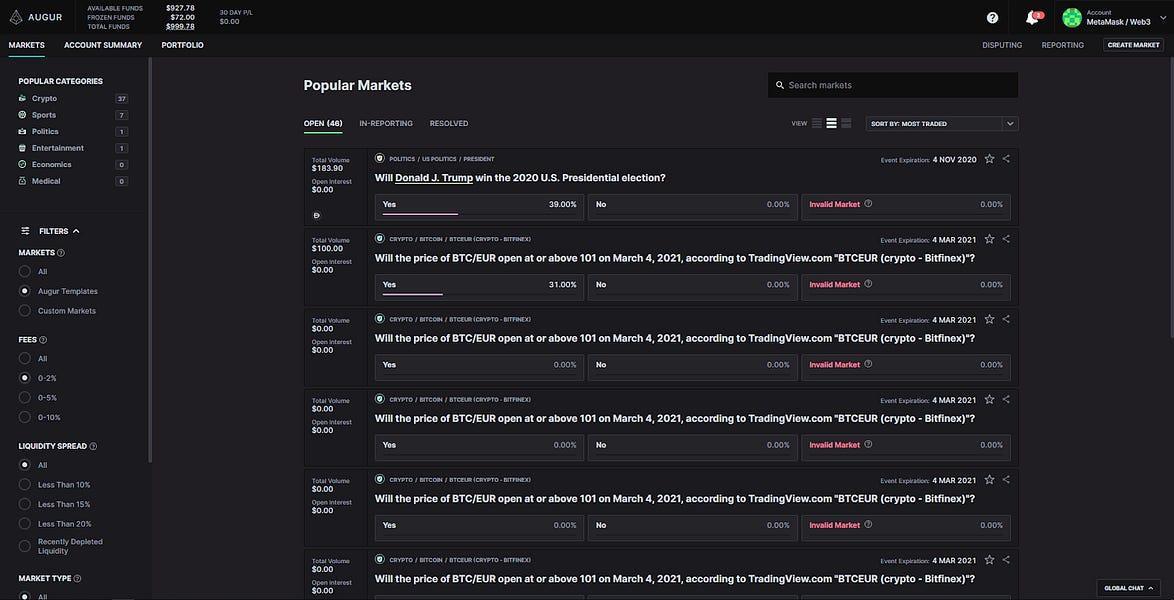

On the other hand, prediction markets are becoming very popular this year, driven mainly by political events, notably those related to the US presidential election.

Prediction markets take a broad approach to betting. Protocols such as Polymarket offer absolute freedom to create events in a decentralised manner. However, they come at a cost: The odds change retroactively, meaning that a punter cannot determine their risk/reward.

Source: Polymarket

Moreover, in prediction markets, probabilities are represented as token/share prices driven by decentralised oracles (in the case of Augur) that do not require human interaction.

Decentralised prediction markets promise to be a key player in the Crypto iGaming industry by 2024. To put the above into context, Polymarket (the important benchmark here) has achieved in the last 30 days the following impressive metrics that prove the dapp's solid traction:

● +43.1% en depósitos netos`y Total Value Locked (TVL)

● +63.4% trading volume

● +24.2% active users (daily)

Source: Tokenterminal

Whether you want to create your event and raise funds from unlucky users or participate in an event that you consider favourable to your luck, several platforms in the industry offer different options for leveraging blockchain technology in the gambling world.

However, before looking at some examples, it is crucial to take into consideration the following key aspects to consider when selecting a decentralised betting platform:

● Liquidity: Liquidity may be limited in some protocols and sometimes in specific events, especially those adopting a p2p approach where users act as LPs.

● High barrier to entry: Specialised platforms such as Augur can present a high learning curve, especially for users less familiar with cryptocurrencies.

● Regulation: The legal landscape surrounding crypto bets is still evolving, which can create uncertainty for operators and users.

● Volatility: The inherent volatility of cryptocurrencies could deter some risk-averse gamblers, but a solution is to enable Stablecoin payments.

● Maturity: The technology is relatively new, and the ecosystem is still developing, with potential security risks and technical limitations.

Let us look at some examples.

● Polymarket: The leading decentralised volume betting platform that allows users to create and participate in prediction events in diverse categories, from sports and politics to technology and entertainment.

● Augur: Following the release of its latest version, Augur promises to be a clear contender to Polymarket by incorporating decentralised oracles (unlike its competitors) to guarantee transparency in the chain. It will offer prediction markets in a secure, transparent, and highly censorship-resistant way.

Source: Augur

● Bookmaker is a decentralised sports betting platform built using Azure that offers a variety of event options. One limitation, however, is the limited liquidity it can present for some events.

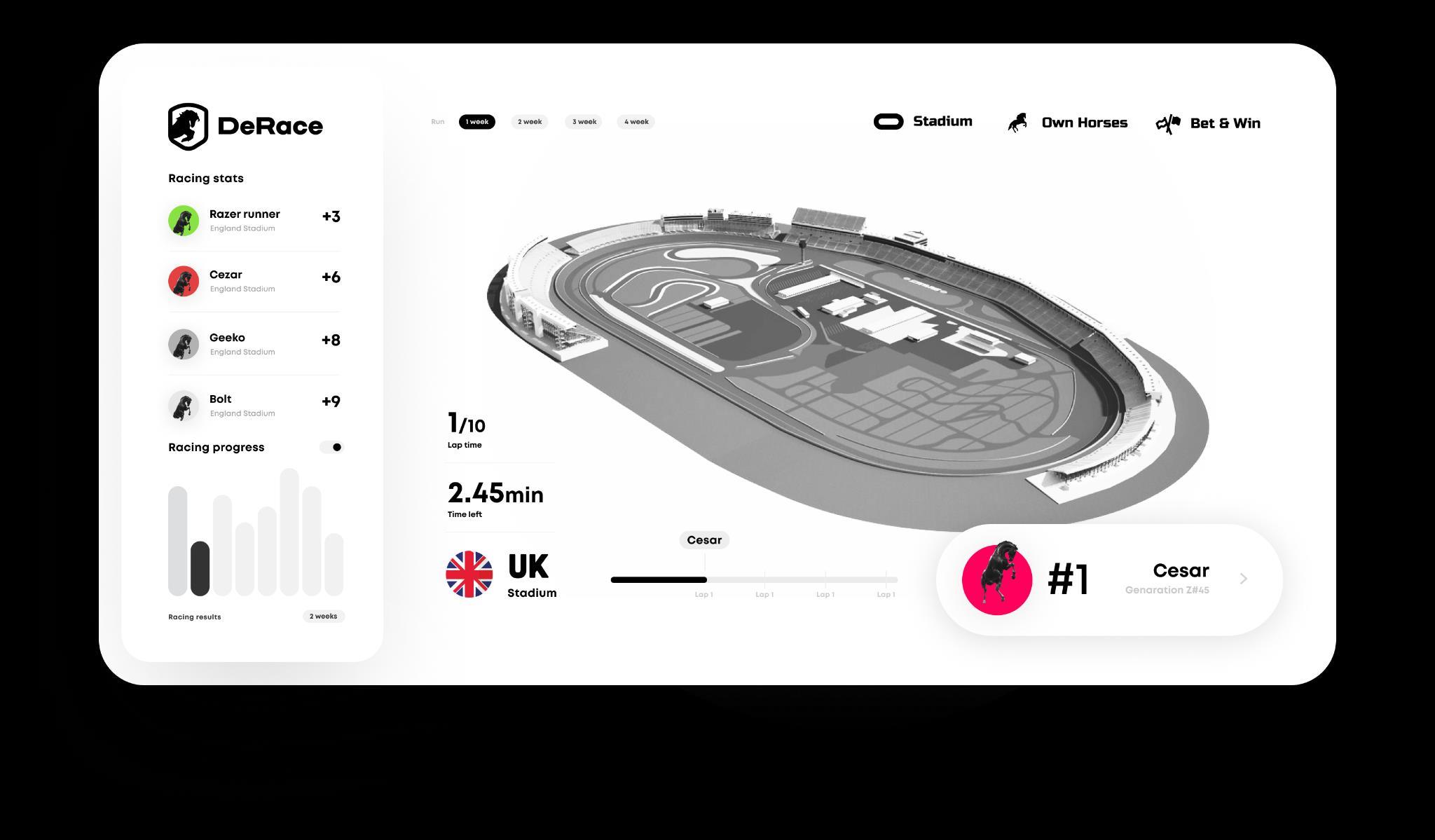

● DeRace: DeRace is an NFT gaming platform based on the Ethereum Blockchain. It is based on a customisable virtual horse racing universe where users can place sports bets.

Source: DeRace

* Earnbet: Earnbet is a decentralised application initially launched on the EOS blockchain and is one of the world's first decentralised casinos. This platform has a very advantageous house edge, one of the lowest on the market, with initial percentages of 1.5% that could go down to 0.5% if you bet with the native BET token.

* BetDex: The BetDEX Exchange is a sports betting exchange offering markets from 50+ sports leagues worldwide, with low rates, good odds and no account restrictions. The exchange is licensed and available to those who meet jurisdiction requirements. Users can access the exchange through the app and bet on different sports and competitions.

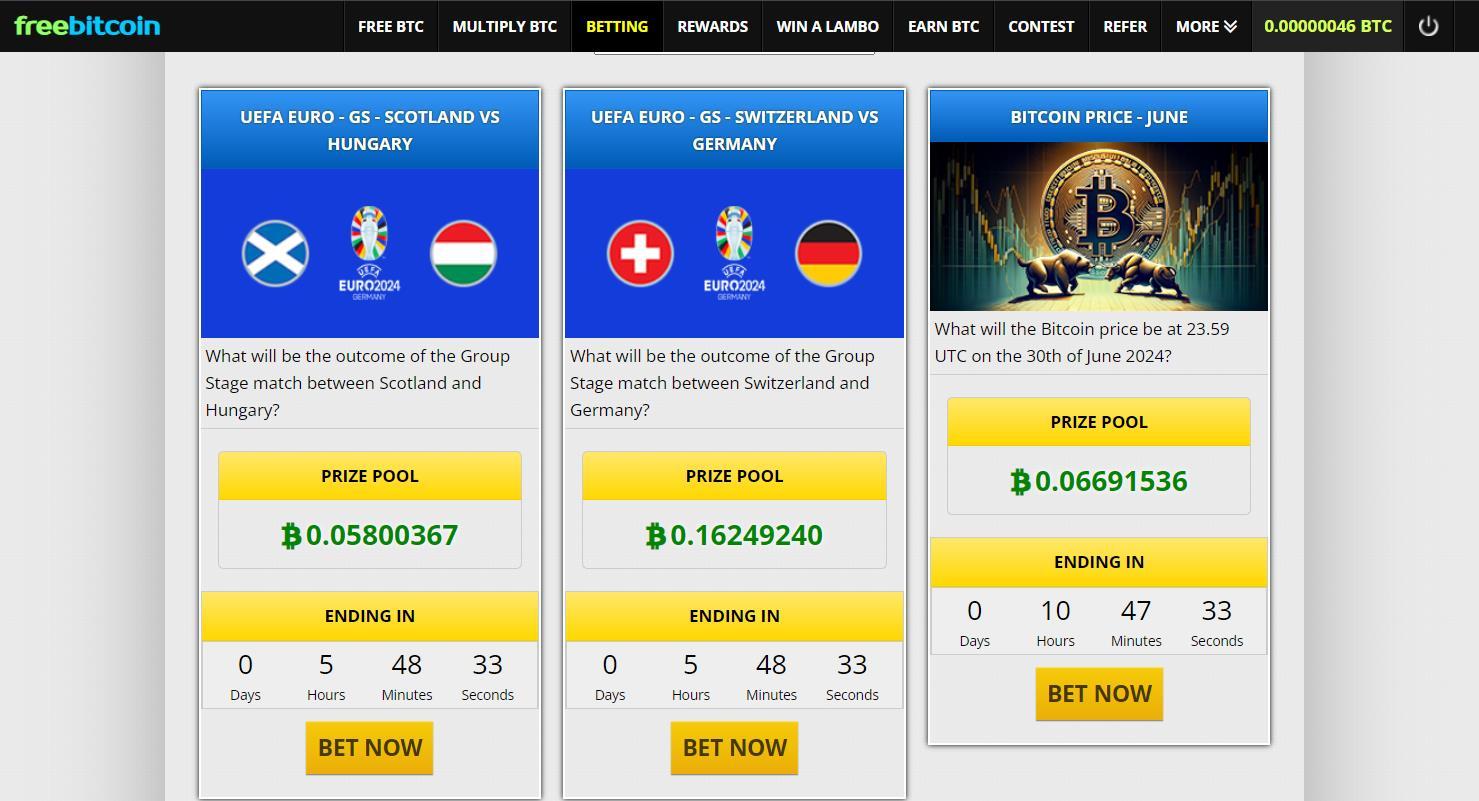

*FreeBitco.in is one of the oldest and most popular Bitcoin faucets on the market. Since its foundation in 2013, the website has offered users the opportunity to earn small amounts of Bitcoin for free through various methods, such as betting on sporting events, betting on Bitcoin price predictions, lotteries, sweepstakes and referral rewards.

Source: FreeBitco.in

With the entry into the scene of Blockchain technology in the betting sector, its growth possibilities may exceed expectations due to the properties of transparency, fair rewards, and traceability that decentralised ledgers offer.

While the crypto bet sector has a strong growth outlook in the global market driven by traditional platforms, platforms focused on decentralisation may change the game rules in the coming years and be a catalyst for crypto asset massification.

The perfect combination of game elements (gamification) and the decentralisation of blockchain technology is undoubtedly one of the monumental milestones to consider within this new digital era driven by the crypto economy.

written by Chris

Let’s Dive In!

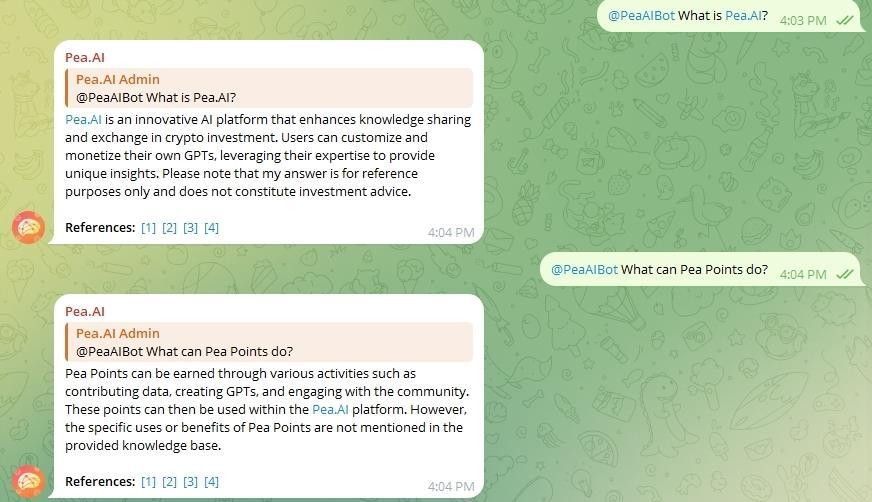

▪ Pea.AI democratises crypto investing and propers user growth with AI-enabled Telegram and Discord bots.

▪ Founded by Footprint Analytics, Pea.AI integrates expert knowledge and advanced data analysis techniques.

▪ The platform addresses user acquisition, activation, retention, and developer onboarding challenges in the Web3 space.

▪ Pea.AI supports Key Opinion Leaders (KOLs) in enhancing content output, engagement, and monetisation.

▪ Viral Quest Bot offers community managers userfriendly tools for traffic growth and user engagement through quests and rewards.

As we approach the ‘’bullrun,’’ the crypto industry has over 500 million users. However, navigating the complexities and intricacies often feels like an exclusive club for insiders and experts. The Pea.AI protocol changes that narrative, making advanced crypto insights accessible to everyone, from casual users to seasoned whales.

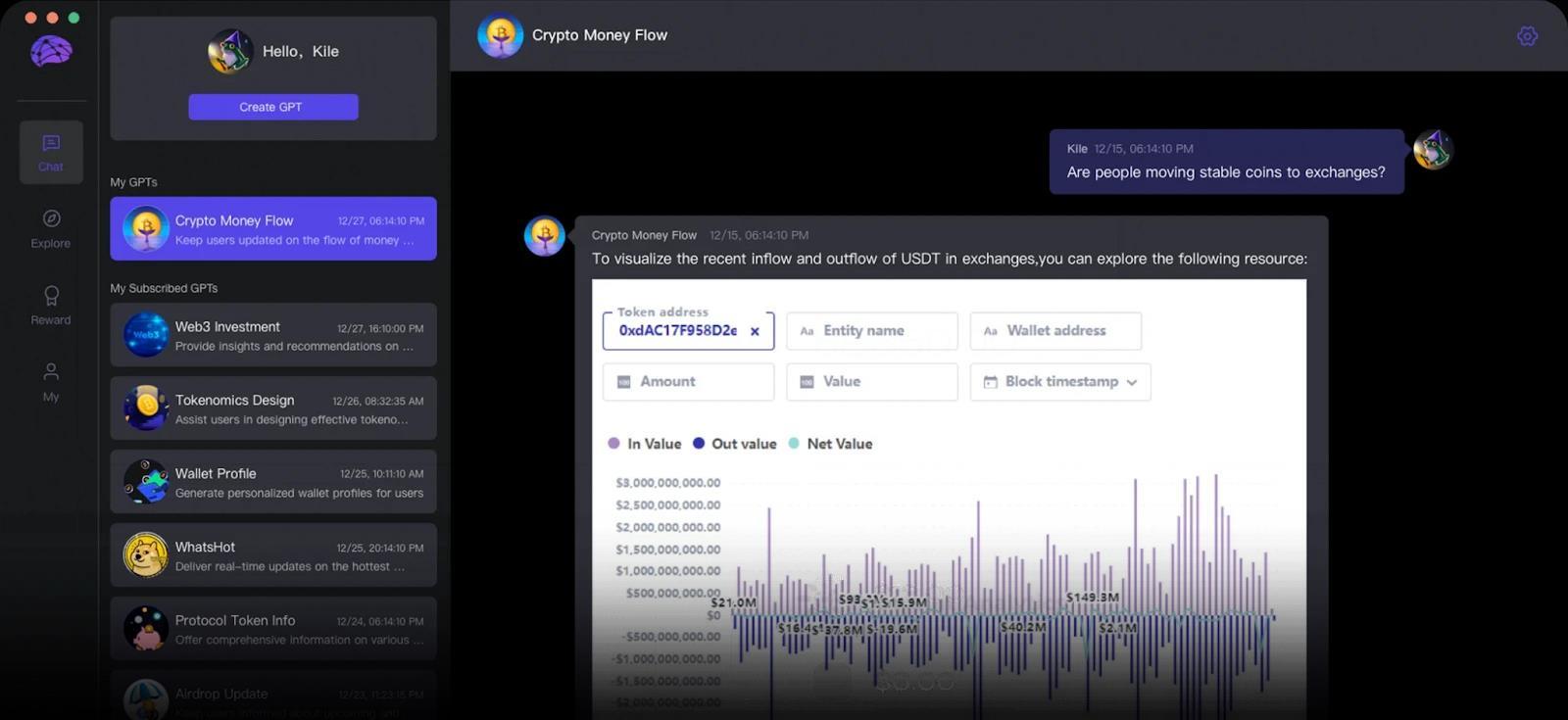

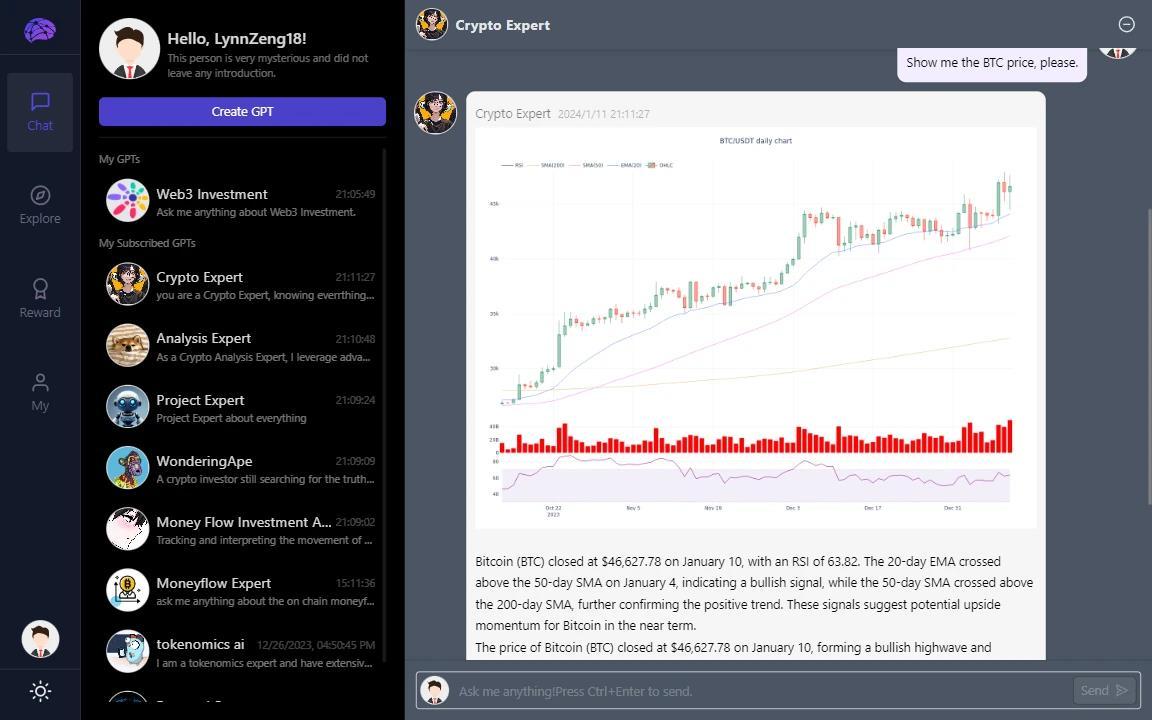

Imagine having a personal AI assistant tailored to your specific needs and goals guide you through the vast cryptocurrency landscape. Pea.AI's GPTs (Generative Pre-trained Transformers) are just that intelligent agents that can analyse blockchain data, price trends, social sentiment, and a whole host of other factors to deliver personalised insights and recommendations.

But Pea.AI doesn't stop there. It's also a platform for community-driven insights. Crypto influencers and experts can publish their personalised GPTs, allowing users (like us) to tap into their knowledge and strategies.

source: Pea.AI’s blog

This revolutionary approach is about more than just convenience. It's about empowering every crypto enthusiast, regardless of experience, to make informed decisions and participate in this market's exciting potential.

Let's explore Pea.AI's unique features and capabilities and how they can transform your approach to crypto investing.

Pea.AI didn't emerge from a vacuum; it's the latest innovation from Footprint Analytics, a well-known player to uncover and visualise blockchain data. Footprint's journey began as a Web3 data solution provider, catering to analysts, builders, investors and pretty much anyone wanting a user-friendly interface for data-queries.

Footprint's expertise lies in harnessing and analysing the vast amounts of data generated by blockchain networks. The platform aggregates, cleans, and indexes raw blockchain data, transforming it into insights for users of all experience levels. From tracking NFT sales and DeFi trends to monitoring token prices and wallet activity.

The team behind Pea.AI is the same of Footprint, a diverse group of data scientists, engineers, and industry experts, all united by a passion for blockchain technology and a belief in the power of data-driven decision-making. Their collective experience and expertise have enabled them to establish themselves as a leading provider of Web3 data solutions.

With the launch of Pea.AI, they are expanding their reach even further, democratising access to sophisticated AI-powered insights and empowering individuals and communities to navigate the complexities of the crypto market with confidence.

● Navy Tse (CEO): A visionary leader passionate about empowering individual investors. Tse's quote encapsulates Pea.AI's mission: to give everyone the tools and insights they need to navigate the complex crypto world.

● Tony Zhang (Chairman): While details about Tony's background are limited, his role as Chairman suggests a solid strategic and business focus.

● Wade Deng (CTO): Wade is the driving force behind Pea.AI's technology. His machine learning and NLP expertise are essential for building a platform that can truly understand and interpret the vast amount of data within the crypto market.

The core team's long-standing partnership and shared experience in machine learning, NLP, and mathematical optimisation provide a solid foundation for Pea.AI. This collaborative spirit extends beyond the founders, with a dedicated team of experts working tirelessly to develop and refine the platform's capabilities.

This combination of vision, technical expertise, and a commitment to empowering users sets the stage for Pea.AI's continued growth and innovation. Pea.AI is poised to become a leading force in the ‘’AI-narrative that we all hear so much’’

As mentioned in the beginning, Pea.AI stands out as a unique AI platform built for the distinct challenges of the crypto market. Unlike generic language models that struggle to interpret financial data, Pea.AI's Crypto Code Interpreter thrives in this environment, transforming raw data into actionable insights for investors of all levels.

At the heart of Pea.AI is a vast amount of high-quality data. The platform integrates real-time information on prices, market capitalisation, blockchain activity, social media sentiment, news, and even fundamental data. It is comprehensive enough and ensures that users have their finger on the pulse of the crypto market at all times, empowering them with the most up-todate and relevant information.

But Pea.AI doesn't stop at simply collecting data. It leverages a sophisticated combination of traditional time-series analysis and deep learning techniques to uncover hidden patterns and correlations within this data. Think of it as a detective that can piece together the puzzle of the crypto market, revealing insights that might not be obvious to the naked eye.

One of Pea.AI's key advantages is its ability to navigate financial data's complex dimensionality and scale sensitivity. This means it can accurately analyse and interpret data from various sources, regardless of the specific units or measurement scales used. It also employs regularisation techniques to mitigate the risk of overfitting, a common pitfall in financial modelling where patterns in past data are mistaken for reliable predictors of future performance.

So is Pea.AI just ‘’crunching numbers?’’ No, not really, as it also incorporates the knowledge and expertise of seasoned crypto professionals. By integrating insights from experts, the platform ensures that its data are statistically sound, contextually relevant, and meaningful to the users. Even those new to crypto can easily understand and apply the platform's insights.

The crypto market is characterised by its volatility and the complexity of different protocols. Pea.AI addresses these challenges head-on with features designed to simplify the investment process:

▪ Cross-Sequence Reasoning: The platform can draw connections between seemingly unrelated data points, providing a more holistic view of market dynamics.

▪ Multi-Modal Signal Integration: Pea.AI offers a comprehensive understanding of market sentiment and its potential impact on prices by incorporating signals from historical news, social media, and other sources.

▪ Clear Interpretations: Pea.AI provides clear interpretations and explanations, helping users understand the reasoning behind its insights.

Pea.AI has a unique combination of powerful data analysis, expert knowledge integration, and a user-friendly interface. Is it possible to revolutionise the way people approach crypto investing? Definitely, it's a platform that empowers users to take control of their investments, armed with the knowledge and insights they need to navigate this market, which is often manipulated or controlled by experts or large entities.

Navigating the Web3 space is fraught with challenges, particularly when expanding a protocol’s user base. The high cost of acquiring new users is a significant barrier, compounded by the limited pool of user traffic. Moreover, the presence of bot and Sybil users further complicates the acquisition of genuine, valuable users. These fake users can skew data and reduce the effectiveness of marketing efforts, making it challenging to achieve sustainable growth.

Another pressing issue is the gap between acquiring users and successfully activating and retaining them. Often, there needs to be more connection between traffic acquisition and user activation, leading to fragmented processes that waste potential user engagement. Insufficient tools and content exacerbate the problem, resulting in inactive communities and low participation rates. This disjointed approach causes a high attrition rate, where users drop off before they can fully engage with the platform.

Evaluating user contributions within the ecosystem is a complex task. Many platforms lack robust systems to assess user quality and incentivise meaningful participation. The prevalence of studios, bots, and Sybil users makes it difficult to distinguish between valuable contributors and those who add little to no value. This fails to appropriately reward users who genuinely contribute to the project's success, discouraging active and positive engagement.

The onboarding process could be more efficient for developers. Critical time is wasted searching for relevant development information across public chains. Frequently answering common queries manually in community forums also consumes valuable resources. Additionally, the need for timely responses to community queries, especially across different time zones, hampers effective engagement and support for developers.

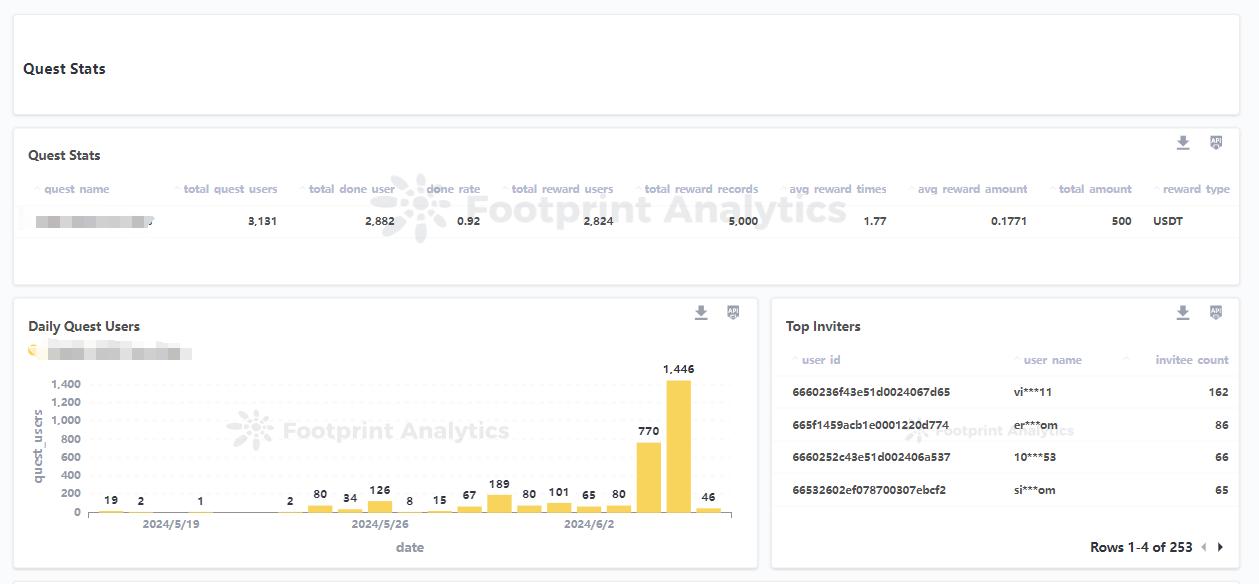

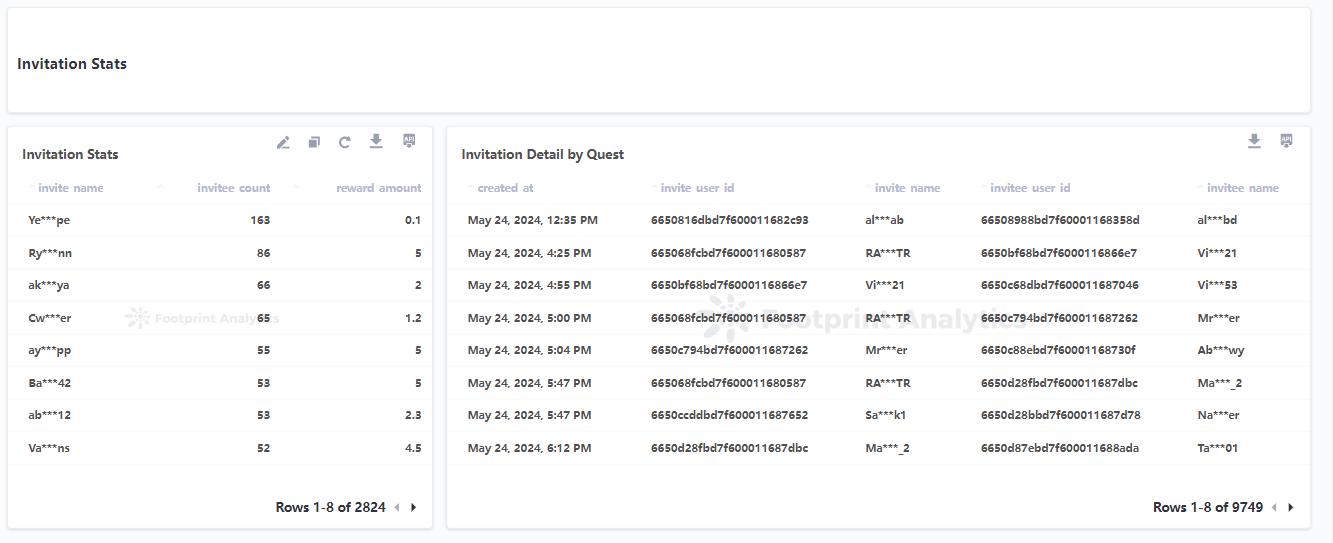

Pea.AI introduces the AI Quest Bot, designed to acquire users at significantly lower costs than competitors. The Quest Bot operates on Telegram and Discord, utilising quests and rewards to transition over 1.5 billion Web2 users into Web3. This approach leverages social fission, where invite spirals promote exponential user growth. Additionally, Pea.AI employs advanced Sybil detection methods to screen for genuine users through a combination of on-chain and off-chain tasks. The platform also offers a variety of activity templates, ranging from on-chain wallet interactions to joining Telegram communities, ensuring suitability for various user acquisition and operational scenarios.

To keep users engaged and active, Pea.AI implements several strategies:

● News Push: Daily crypto news summaries and hourly updates keep users informed and engaged.

● Custom Message Content: Product updates and project activity notifications ensure users are always aware of the latest developments.

● Regular Community Activities: Rewards based on user contributions foster a vibrant and active community.

Pea.AI provides comprehensive tools for analysing the effectiveness of activities and user contributions:

● User Quality and Contribution Analysis: Detailed insights into user behaviour, both onchain and off-chain, help evaluate individual contributions.

● User Profiling Analysis: Identifying key user characteristics aids in targeted engagement strategies.

● Community Analysis: Monitoring community activity and sentiment ensures a healthy and active user base.

The AI Developer Assistant offers round-the-clock support, fostering a learning-focused environment. It highlights frequent community queries, refining development guides and tutorials based on real user needs. This assistant ensures that developers receive timely and relevant information, enhancing the overall efficiency of the development process.

source: PeaAI’s docs

For Key Opinion Leaders (KOLs), Pea.AI provides tools to boost content output and community engagement:

● Content Output Efficiency: KOLs can upload content to the GPT knowledge base, which Pea.AI parses and trains on, eliminating the need for repeated content creation.

● Response Efficiency: The GPT bot can interact with community members, providing quick and relevant answers.

● Community Engagement: Tools like ‘’Lucky Money’’ attract attention and participation, while task-based rewards drive traffic and engagement.

Pea.AI also helps KOLs boost their income through exclusive promotional links and tracking the effectiveness of their marketing activities. Early joiners in the KOL program receive additional Pea Points rewards and traffic support, benefiting from the extensive resources provided by Footprint Analytics.

As a project or community manager, leveraging the Viral Quest Bot offers a powerful way to gain traffic and engage active users through innovative quests and Lucky Money giveaways. This tool energises your community, attracts new members, and enhances engagement through various tailored tasks and rewards.

Lucky Money giveaways are an exciting way to boost community engagement. By offering rewards through these giveaways, you can motivate members to stay active and participate more frequently.

Referral Tasks to Attract New Members

Referral tasks incentivise existing users to invite new members to join your community, organically and cost-effectively expanding your user base.

Set up quests that encourage users to engage with your community on social media, participate in onchain interactions, and complete various blockchainbased tasks. These quests help maintain a high level of activity and engagement within your community.

Supported Task Types

On-Chain Interaction Tasks

▪ Contract interactions

▪ Transactions

▪ Holding tokens/NFTs

Off-Chain Community Engagement Tasks

▪ Joining groups

▪ Subscribing to channels

▪ Speaking in groups

▪ Recruiting new members

Referral Tasks

Encouraging existing users to invite new users to join the community

USDT

Distribute stablecoin rewards to incentivise participation.

Pea Points

Award Pea Points that users can accumulate and redeem within the ecosystem.

Custom Rewards

Projects can offer unique rewards, such as tokens, NFTs, or mystery boxes, tailored to their specific needs and objectives.

1. Add PeaAIBot to Your Community

Integrate the PeaAIBot into your Telegram or Discord community.

2. Create and Distribute Lucky Money or Quest (Coming Soon)

To initiate Quests or Lucky Money campaigns, contact Pea.AI directly via their official Telegram.

3. Coordinate with Pea.AI Admins

Set up a meeting with Pea.AI admins to tailor the campaign to your community’s needs.

On-chain interaction tasks like contract interactions, transactions, and holding tokens/NFTs.

Off-chain engagement tasks include joining groups, subscribing, speaking in groups, and recruiting new members.

Referral tasks where existing users invite new members.

USDT

Pea Points

Custom rewards by the project, such as tokens, NFTs, and mystery boxes.

Pea.AI offers on-chain and off-chain task conditions, allowing for the direct setup of user registration, on-chain deposits, transactions, community engagement, and referral tasks. The Bot also provides 24/7 real-time customer service to answer community questions.

The Discord version of PeaAIBot currently supports customer service functions but does not yet support Quests and Lucky Money.

Completing Quests can significantly boost brand/project visibility and attract new users. While specific growth figures vary, regularly releasing tasks is a proven method for sustained growth. The impact of a single event depends on factors such as promotion, rewards, and the profile of participating users.

The statistics include the total number of participants, total expenditure, average cost per participant, daily user activity trends, and a detailed breakdown of invitations.

Track the invitation details for each user, including KOLs identified by the project side. The system automatically records referral relationships when users participate and share the event.

Pea.AI is committed to helping KOLs (Key Opinion Leaders) and their communities grow and monetise effectively. How?

KOLs can upload various types of content (project websites, blogs, Medium articles, research reports, guides) to the GPT knowledge base. Pea.AI will automatically parse and train on this content, eliminating the need for KOLs to rewrite and redistribute it.

By adding the GPT Bot to their community, KOLs can ensure users get quick, relevant answers, significantly enhancing the user experience.

KOLs can use the Pea.AI growth tool to send Lucky Money, activating the community and drawing attention to upcoming projects.

After obtaining the whitelist from project teams, KOLs can set tasks through Pea.AI to drive traffic and distribute rewards, promoting community growth.

Pea.AI’s growth tools allow KOLs to track the effectiveness of their promotional activities, providing proof of performance and attracting more promotional collaborations. Early joiners receive additional Pea Points rewards and traffic support, leveraging Footprint Analytics' extensive resources.

Using these tools, KOLs can significantly enhance their content output, improve community engagement, and increase their income through effective monetisation strategies.

Website: https://www.pea.ai/

Docs: https://docs.pea.ai/docs/introduction

Telegram: https://t.me/Pea_AI_News

Discord:

https://discord.gg/7ecyRmBm93

Twitter: https://twitter.com/Pea_GPTs

Blog: https://www.pea.ai/blog

Pea.AI is like a breath of fresh air in the oftenoverwhelming crypto market. It's more than just an AI tool; it's a platform designed for the community in mind. By addressing the real pain points faced by both newcomers and expert investors, Pea.AI is lowering the barriers to entry and making crypto decisions ‘’more accessible’’ in a sense.

With its unique combination of AI technology and expertdriven insights, Pea.AI is could be a game-changer. And it's not just about making predictions or providing data; it's about empowering users with the knowledge and tools to make better decisions and take control of their financial future.

So, whether you're a casual enthusiast or a dedicated trader, Pea.AI has something to offer. As the platform continues to grow and evolve, it has the potential to redefine the way we think about crypto investing and unlock new levels of transparency, collaboration, and success.

written by Chris

Welcome to a special edition of MoonMag as we celebrate our 3rd anniversary!

Over the past three years, we've published and analysed some of the most exciting and transformative projects in the blockchain space. In honour of this milestone, we're revisiting some of our past deep dives to see how these projects have evolved and what lies ahead for them. Sit back, relax and read the latest updates and plans for these protocols!

Ariva Digital (ARV) is a cryptocurrency project developed by Ariva Co., specifically designed for use in global and local tourism and travel networks. The project aims to revolutionise the digital payment system within the tourism industry, making transactions hassle-free and promoting the active use of the ARV token in one of the world economy's largest sectors. Ariva Digital was featured in the 15th issue of MoonMag, highlighting its potential to transform the tourism industry with its innovative approach.

Since our initial feature, Ariva Digital has made significant progress across its roadmap:

▪ Ariva.World

▪ Launched a desktop site with a flight module.

▪ Released B2C hotel booking and P2P yacht charter modules.

▪ Introduced additional payment methods and languages.

▪ Implemented UX/UI improvements and paid ads on search engines and social media.

▪ Ariva Wonderland

▪ Added powerful features to Ariva Creator and launched the Creator Editor.

▪ Continued land sales and improved the in-game trade system.

▪ Published the beta version with full VR support and optimised the platform.

▪ Ariva.Digital

▪ Secured partnerships with other crypto projects and attended blockchain and tourism events.

▪ Conducted meetings with hotel groups, airline, and yacht charter companies.

▪ Focused on detailed security checks and growing influencer marketing campaigns.

Ariva Digital has established itself as a comprehensive ecosystem within the tourism industry. The platform offers various services, including hotel bookings, yacht charters, and private jet hires, all integrated with cryptocurrency payments. Ariva.World has enhanced its user experience with continuous UX/UI improvements and expanded its reach through aggressive marketing campaigns. Ariva Wonderland has seen steady growth in its virtual land sales while constantly introducing new features to stay competitive.

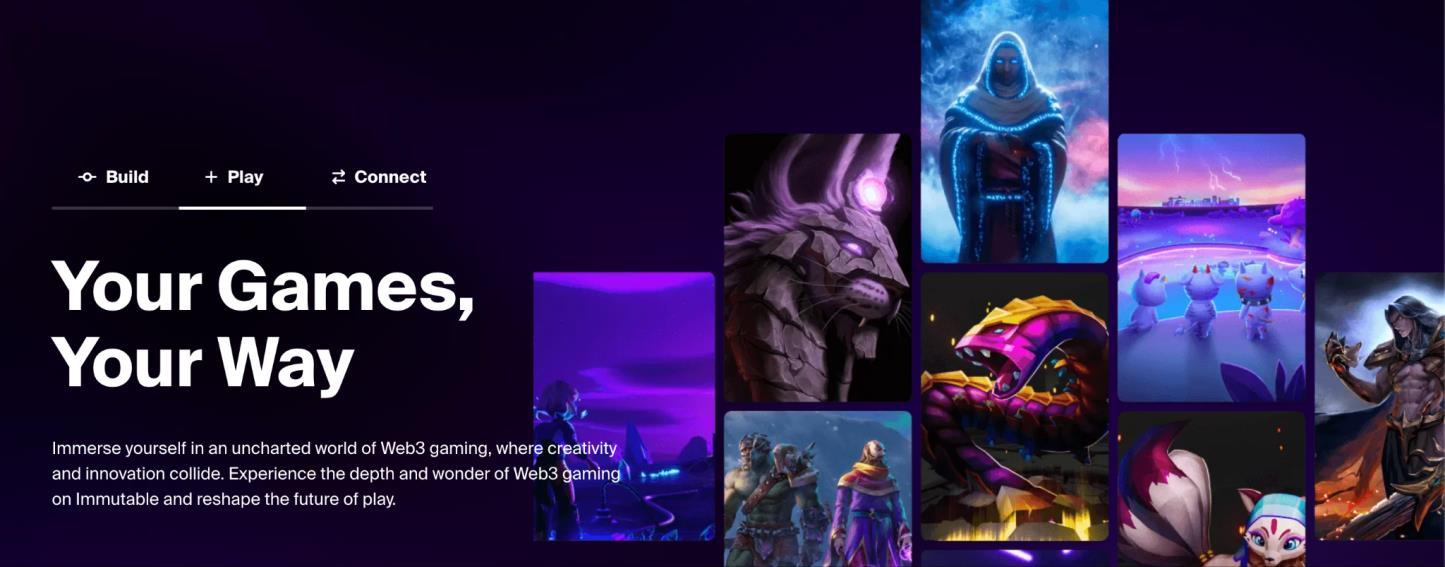

When Immutable was first featured in Issue #6th of MoonMag, it focused on its potential to address Ethereum’s high gas fees and scalability issues, particularly in the NFT space. The protocol’s use of StarkWare’s ZK-STARK technology for its ZK Rollups, combined with its developer-friendly APIs and SDKs, was highlighted as a significant advancement for blockchain gaming and the NFT landscape.

Since its initial feature, Immutable has made significant strides:

▪ In December 2023, Immutable launched Immutable Passport, simplifying the sign-up process for players and providing a universal profile to carry identity, achievements, and digital assets across different online games and marketplaces. This innovation aims to address mainstream adoption challenges in crypto-gaming by offering a seamless user experience.

▪ Five prominent web3 games and marketplaces Gods Unchained, Blocklete Golf, Bleacher Report Watch2Earn, TokenTrove, and AtomicHub have integrated Immutable Passport, demonstrating its growing influence in the industry.

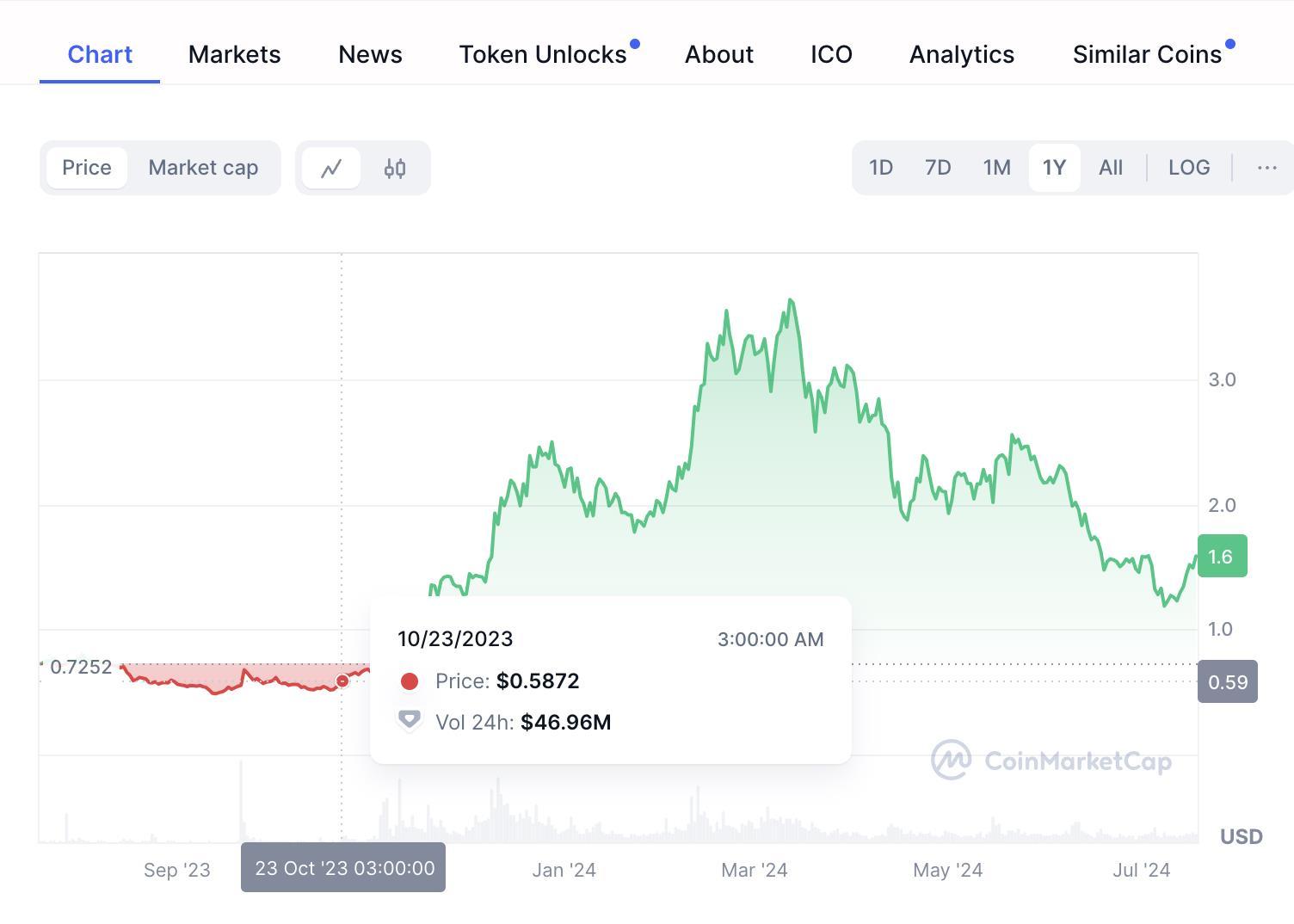

Immutable X has solidified its position as a leading layer-2 solution for Ethereum. The IMX token has seen significant growth, trading at $1.58 at the time of writing, a substantial increase from its value in October ‘23. Despite the overall downward trend in the crypto market, Immutable’s market cap stands at $2.4 billion, with a circulating supply of approximately 1.5 billion tokens

source: IMX token trading history at CMC

Looking ahead, Immutable X has several strategic plans to maintain and enhance its market position:

● Expansion of Immutable Passport: Further integration with additional games and marketplaces to broaden its user base.

● Enhancement of Developer Tools: Continuous improvement of APIs and SDKs to attract more developers and projects to the platform.

● Innovations in Scalability: Staying ahead of potential changes in Ethereum’s infrastructure, such as the anticipated rollout of Ethereum’s Consensus Layer.

Immutable X has made remarkable progress since its feature in MoonMag, showcasing its ability to innovate and expand within the NFT and blockchain gaming ecosystem. With a clear vision and robust technological foundation, Immutable X is poised to continue leading the way in solving scalability issues and enhancing user experience in the decentralised digital economy.

Immutable X has made remarkable progress since its feature in MoonMag, showcasing its ability to innovate and expand within the NFT and blockchain gaming ecosystem. With a clear vision and robust technological foundation, Immutable X is poised to continue leading the way in solving scalability issues and enhancing user experience in the decentralised digital economy.

Our deep dive summary of Core DAO is in Issue #21 of MoonMag. The focus is on its innovative approach to scaling Bitcoin and its vision to integrate DeFi functionalities with Bitcoin (BTCfi). Core’s unique position within the blockchain ecosystem and its commitment to enhancing Bitcoin’s utility were the key highlights. But how does it stand today?

Core DAO has made notable progress in recent months:

● Network Growth: In Q2 2024, the Core Chain was among the top 5 Bitcoin scaling chains. This reflects Core’s strong infrastructure in enhancing Bitcoin’s utility.

● Fast Block Times: Core maintains a consistent block time production of 3 seconds, ensuring fast transaction processing.

● Total Value Locked (TVL) Growth: The ecosystem saw explosive growth in TVL, surging from $6.75m to $74.77m, an impressive increase of 1007.41%. This growth highlights the increasing confidence and participation of its participants.

Core DAO has become a leading protocol in the BTCfi narrative. Key achievements include:

▪ User Adoption: The number of unique addresses on Core Chain increased significantly, rising from 15.5 million in Q1 to over 19 million in Q2 2024, indicating a solid growing interest.

▪ Daily Active Users (DAU): The average DAU on the Core blockchain increased by nearly 30%, demonstrating a vibrant and engaged community.

▪ Daily Transactions: The daily transaction count also grew substantially, averaging 232K daily transactions, reflecting heightened network activity and utilisation.

Core DAO has several strategic initiatives:

▪ Validator Expansion: Core plans to expand its active validator set from 21 to 31 by Q2 2025 to enhance network decentralisation and security.

▪ Staking Growth: Significant milestones in staking activities, with plans to further increase the staking of CORE tokens, BTC, and BTC hash power.

▪ Ecosystem Expansion: Continued onboarding of dApps, with a growth of 47.83%, aiming to support a diverse range of applications.

▪ Innovation Incentives: Programs like the Core Ignition Builders’ Incentive Program and BTCfi Summer Hackathon are set to drive developer innovation and ecosystem growth.

Core DAO’s recent performance and strategic initiatives underscore its commitment to advancing the BTCfi narrative. With a clear mission and a robust infrastructure, Core is wellpositioned to continue its impressive trajectory.

We featured Axelar Network in Issue #11 of MoonMag. Back then, it was recognised for creating a secure, scalable, and programmable multichain platform. The network's potential to revolutionise cross-chain interactions while having a robust infrastructure made Axelar stand out among its competitors. So what’s been happening if you haven’t been paying close attention?

Axelar Network has made substantial progress in 2024, as highlighted in its recent roadmap update:

▪ Axelar Virtual Machine (AVM): Powered by Cosmwasm, the AVM turns interoperability into a programmable layer, enabling developers to write smart contracts on Axelar and scale their interchain deployments. The AVM encompasses the Interchain Token Service (ITS), Interchain Amplifier, and Interchain Maestro, making it easier to build across multiple chains.

▪ Interchain Amplifier: This feature allows permissionless connections for arbitrary chains, exponentially increasing Axelar’s scalability. It enables new chains to connect instantly to all existing connected chains, enhancing the network's interoperability.

▪ Interchain Tokens: The ITS supports Interchain Tokens that maintain cross-chain fungibility and custom functionality. This smart contract suite simplifies managing token supply across multiple chains, making it a powerful tool for developers.

▪ Gas-Burning Mechanism: Axelar Foundation has proposed a gas-burning mechanism to reduce inflationary rewards and potentially turn the network deflationary. This mechanism aims to counteract high inflation rates by burning transaction fees, leading to a deflationary state if transaction volume grows.

Axelar Network is the largest cross-chain platform, trusted by top DeFi applications, DEXs, wallets, and enterprises integrating Web3 technologies. Key milestones include:

▪ Network Growth: In its first two years, Axelar has transferred over $7 billion in crosschain volume, supported by a dynamic set of 75 validators, making it the most secure and decentralised cross-chain network.

▪ User Adoption: Axelar has seen significant adoption from major DeFi applications and enterprises.

Axelar Network has already released its latest roadmap for 2024 and beyond:

● Integration of Diverse Consensus Approaches: The roadmap includes expanding connections to additional consensus mechanisms such as Solana, Stellar, and Movebased chains like Aptos and Sui.

● Gas Pricing Overhaul: Axelar aims to improve gas pricing accuracy, eliminate the need for overpayments and refunds, and ensure a better user experience.

● Enhanced Developer Tools: Axelar aims to continue enhancing its developer tools, making it more straightforward to build cross-chain dApps with composable network effects.

Axelar Network's recent advancements and strategic roadmap highlight its commitment to leading the cross-chain space. With a focus on scalability, security, and interoperability, Axelar is poised to redefine the standards of cross-chain interactions and drive the next wave of Web3 development.

Sui Protocol is a Layer-1 blockchain network that has been making significant waves in DeFi since its mainnet launch in May 2023. We covered Sui in Issue #22 of Moonmag (we were on fire that month!).

Developed by Mysten Labs, Sui has quickly ascended to one of the top five non-EVM blockchains, boasting a TVL of $538 million as of July 19th, 2024. This rapid growth underscores Sui's potential to become one of DeFi star protocols.

Sui's impressive growth was fueled by a combination of developer engagement and robust community support. More specifically:

▪ Developer Engagement: Sui’s efficient design and user-friendly features have attracted many developers. This influx of talent has created a diverse array of dApps, further strengthening the network.

▪ Community Support: The expanding Sui community, comprising developers and users, validators and crypto enthusiasts, fosters an environment conducive to the fast development and enhancement of its ecosystem. This thriving community has contributed to many total network commits, reflecting active and ongoing development.

Audits and security are crucial for maintaining trust in DeFi protocols. Notably, the top DeFi protocols on Sui, NAVI protocol, and Scallop Lend have been audited by renowned entities like OtterSec, Movebit, and Cetus. These audits ensure the protocols operate securely and efficiently, bolstering user confidence.

Sui Blockchain debuted on May 3, 2023, backed by Mysten Labs. With $300 million in funding and a valuation of $2 billion by September 2022, Sui has established itself as a star player in the L1 blockchain space. Unlike its competitors, such as Ethereum, Solana, and Polkadot, Sui focuses on enhancing speed and scalability without compromising security. This unique approach positions Sui as a formidable contender in the race for blockchain supremacy and adoption.

The Sui blockchain is buzzing with activity, driven by substantial funding and a bullish crypto market. One standout project is ISSP, which is pioneering a multi-chain interoperability system for inscription protocols, primarily targeting the BTC ecosystem. ISSP’s initial steps include launching the inscription exchange protocol on both BTC and Sui chains and introducing the Sui chain’s first inscription protocol, SUI-20.

ISSP's ambitions don't stop there. They plan to develop an inscription exchange system and a cross-chain system, gradually expanding to all EVM-compatible chains and Layer 2 networks. With funding from KuCoin and integration with OKX’s Web3 ecosystem, ISSP is poised for significant achievements in 2024. Notably, the SUI-20 inscription hasn't yet

The network's continuous growth, innovative projects, and supportive community suggest a promising future. Its unique approach to scalability and security, along with a vibrant ecosystem of developers and users, sets the stage for continued success.

Zealy is a Web3 project that we covered back in Issue 25 on Moonmag. It isn’t just about tech it's a culture of innovation where everyone, regardless of their role, becomes a product creator. What sets Zealy apart is its unique approach to hackathons and events and its approach to building a vibrant community.

Initially, Zealy combined tech and business talents in their hackathon teams. It was a cool experiment, but they noticed that business folks often ended up on the sidelines, suggesting ideas or prompting AI. The essence of a hackathon is to build, not just brainstorm. So, they decided to separate the hackathons into tech and business teams to see what would happen.

The results? Nothing short of amazing. Their business team became builders, creating MVPs using no-code tools and LLMs. Flavien, a growth intern, built a feature on a React app in just one day something they’d discussed for a year. It wasn’t perfect, but it was live, functional, and beautiful. This wasn’t an isolated case. Other team members created a fully functioning marketplace using Airtable and Pory. These weren’t just side projects; they were potential game-changers for Zealy

This experiment proved that anyone can craft unique products with the right tools and mindset!

How NFT Paris Used Zealy for a 360-Campaign

NFT Paris, one of Europe’s premier Web3 events, leveraged Zealy to boost engagement and drive virality. From 800 attendees in its first edition to 20,000 in the latest, NFT Paris has consistently innovated to capture the interest of the Web3 community. Here’s how they did it:

▪ Increased both online and offline engagement from attendees.

▪ Boosted awareness through word-ofmouth.

NFT Paris crafted a 360-campaign using Zealy’s questboard to gamify the event experience.

In 2023, attendees needed a unique NFT Paris ID to access the Zealy questboard. This process verified participants and built excitement. By introducing sponsors and partners through early quests, NFT Paris provided additional value to their sponsors and boosted ticket sales.

For the 2024 edition, NFT Paris organised a Treasure Hunt via Zealy. Over two days, participants completed online and offline quests to earn experience points, with $10,000 worth of prizes for top performers.

Offline tasks included:

▪ Visiting partner booths and creating accounts on their platforms.

▪ Taking selfies with fellow participants.

▪ Providing daily feedback on the event experience.

Online tasks included:

▪ Quizzes about the event and partners.

▪ Following the event's official social media accounts.

By integrating quests with partners and sponsors, NFT Paris drove engagement and visibility, creating a memorable experience for all attendees.

Zealy is not just a platform for people to complete quests it's a catalyst for transformation. From turning business minds into builders to driving engagement at significant events like NFT Paris, Zealy is redefining what’s possible in Web3 and how communities can evolve. Stay tuned for more innovations and stories of success!

Ecoterra: A ‘’Greener’’ Blockchain Project

In the spirit of fostering a sustainable future, Ecoterra is set to launch a B2B Marketplace that will enable businesses to trade premium recycled materials such as PET granules, glass shards, and aluminium. This marketplace promotes eco-friendly supply chains by integrating these materials into various industries. Businesses can play a crucial role in promoting sustainable practices by participating in this transformative network. This is a lovely update indeed, as we featured the Ecoterra project in Issue #25 of Moobmag. But it doesn’t end there!

Ecoterra is making great progress for its token, which is now trading on BitMart, LB Bank, Uniswap, and MEXC. Its mission? To green your portfolio with eco-friendly investments. Do you want to support a platform dedicated to sustainability and innovation? Ecoterra is for you.

Starting this month, Ecoterra is upgrading its product database to make rewards more accessible for users in Romania, thanks to the newly implemented SGR system. This upgrade is part of Ecoterra’s ongoing effort to make sustainable practices more rewarding and accessible for everyone.

Ecoterra’s Beta Application is gaining significant traction, showcasing the platform's potential to revolutionise recycling. Users have collectively earned over 1.1 million Ecoterra tokens by actively recycling, proving the effectiveness of their ScanRecycle-Earn model. This model encourages recycling by rewarding users with Ecoterra tokens, which can be spent, sold, staked, or donated to support green projects globally.

Ecoterra leverages blockchain and AI to enhance global recycling efforts and combat climate change. Their platform simplifies recycling with a three-step Scan-Recycle-Earn model, ensuring transparency and reducing costs and risks by eliminating intermediaries. Additionally, Ecoterra issues NFTs as Certificates of Contribution, adding another layer of value to their platform.

Ecoterra’s Five Pillars

1. Recycling Initiatives: Ecoterra offers customised plans that reward users for engaging in green activities.

2. Recycling Marketplace: A vibrant platform that promotes product reuse and recycling, reducing landfill waste.

3. Educational Efforts: A focus on ensuring that everyone understands and practices sustainability.

4. Carbon Offset Marketplace: Users can contribute to verified, emission-curbing projects.

5. Blockchain Technology: Ensuring transparency and security while building a community of eco-minded individuals.

These elements collectively form the bedrock of Ecoterra’s approach to combating climate change. Ecoterra’s mission will become more evident as the world and our minds evolve. Discover their innovative use of blockchain technology and its impact on the recycling and carbon-offsetting industries. Whether you’re a business looking to integrate eco-friendly practices or an individual keen on contributing to a greener future, Ecoterra offers the tools and community to make it happen.

2023 marked the best year for the TON project, which achieved significant milestones in the blockchain space, cementing its role as a top 9th crypto project by market capitalisation.

Here's a concise overview of the past year’s highlights and a glimpse into their plans.

We first covered TON in Issue #28 of MoonMag, so have a read to understand the TON network better.

➢ Record-Breaking Performance: TON set a new world record by processing 104,715 transactions per second during a public performance test, audited by Certik, positioning itself as the fastest blockchain on a global scale. We co.

➢ Integration with Telegram: A significant milestone was the launch of TON Space within Telegram, making it the platform’s first self-custodial crypto wallet. This integration aims to drive mass adoption of blockchain technology among Telegram’s 800 million users.

➢ The Gateway Conference: TON hosted its first inperson conference in Dubai, "The Gateway," which showcased key projects within the ecosystem and highlighted the community’s commitment to supporting Web3 builders.

TON’s integration with Telegram has led to a significant increase in user adoption. The number of unique addresses and daily active users (DAU) on the network have surged, reflecting heightened interest and engagement. In addition, collaborations with tech giants like Amazon Web Services, Animoca Brands, and Tencent Cloud have bolstered TON’s infrastructure and broadened its reach in the space. Last but not least, DeFi and GameFi expansion can’t go unnoticed. Initiatives like the launch of Unity SDK for GameFi projects and collaborations with platforms like Trust Wallet and Alchemy Pay have expanded TON’s DeFi capabilities.

Gasless Transactions: TON is set to introduce gasless transactions, a feature that no other blockchain project has implemented yet. How? By making transactions free for users in specific cases, such as Telegram wallets and USDT transfers, TON could attract a larger user base by simplifying and reducing the cost of transactions.

Validator and Collator Separation: TON plans to separate validation and collation roles to enhance scalability. This separation could ensure efficient transaction processing even as the network scales to accommodate millions of users.

Sharding and Slashing Optimisation: TON will implement sharding tools and guidelines to improve transaction throughput and reduce fees. Additionally, slashing optimisation will enhance network security by penalising misbehaving validators more effectively.

Stablecoin Toolkit and Bridges: TON plans to introduce a stablecoin toolkit and bridges for BTC, ETH, and BNB, enhancing interoperability and enabling seamless transactions across different blockchain networks.

Record-setting achievements, strategic partnerships, and innovative technological advancements have marked TON’s 2023 journey. As it moves into 2024, TON is wellpositioned to continue its trajectory of growth and innovation, driving broader adoption of blockchain technology. Well, adoption is the plan, right? So cheers to 2024 as we eagerly await further developments for the TON network!!

MoonMag first covered Mantle back in Issue #30 (Feb 2024), but a lot has happened if you haven’t paid attention. Q2 ended and marked an outstanding period for the Mantle Network. Here’s a concise look at the latest highlights:

Restaking with $cmETH and $COOK: With the introduction of $cmETH and $COOK, Mantle launched a liquid restaking protocol. This platform provides ETH holders with yield-bearing opportunities, boosting capital efficiency within the ecosystem. For more details, check out the Mantle LSP teaser blog.

For the first half of 2024, Mantle achieved and developed the following:

● IntentX: A decentralised derivatives exchange for perpetual futures trading.

● Catizen: A cat-themed game on Telegram offering plenty of rewards.

● MetaCene: A play-to-earn mini-game on Chrome, allowing users to earn $tMAK and $MNT.

● Vertex: A cross-margined decentralised exchange protocol.

Mantle Mainnet v2 Tectonic Upgrade has brought numerous benefits. Proposals include:

● MIP-29: Authorized a $30 million capital call from Mantle Treasury.

● MIP-30: Introduced the Liquid Restaking Token ($cmETH) and governance token ($COOK).

Mantle's ecosystem continues to thrive with substantial quarterover-quarter growth. Key protocols like Pendle, INIT Capital, and Merchant Moe lead in terms of TVL. Gaming dApps such as xMetaCene and Catizen have shown impressive growth. New integrations with Fingerlabs, KyberSwap, QuickNode, Intract, Dune, Arkham, and Wormhole have expanded the ecosystem.

Bitcoin Yield: FBTC: Mantle introduced FBTC, an omnichain BTC asset designed to offer deep liquidity and diverse yield opportunities, bridging Bitcoin and Ethereum ecosystems.

▪ Mantle Network's First Anniversary Campaign: With the network turning one, exciting events and rewards are lined up for the community, so make sure you follow their socials

▪ cmETH Season 1 Metamorphosis: Starting July 1, 2024, users can earn $COOK by accumulating Powder, which will be convertible to the Mantle LSP token ($COOK) in the future.

▪ Mantle Rewards Station: More rewards, including $COOK, will be distributed over Q3.

▪ Mantle x Game7 Dungeons & Degens: Continued quests and rewards through this ongoing initiative.

▪ Mantle AI Fest Season One: CH(AI)N REACTION: A new AI campaign offering rewards for AI enthusiasts.

It is just the beginning…

As we move into the second half of 2024, Mantle is poised for continued growth and innovation, driving broader DeFi adoption. We’ve seen many integrations, new projects being developed, and continuous refinement of their services through governance. If you are serious about the next bull run, Mantle is a project to watch.

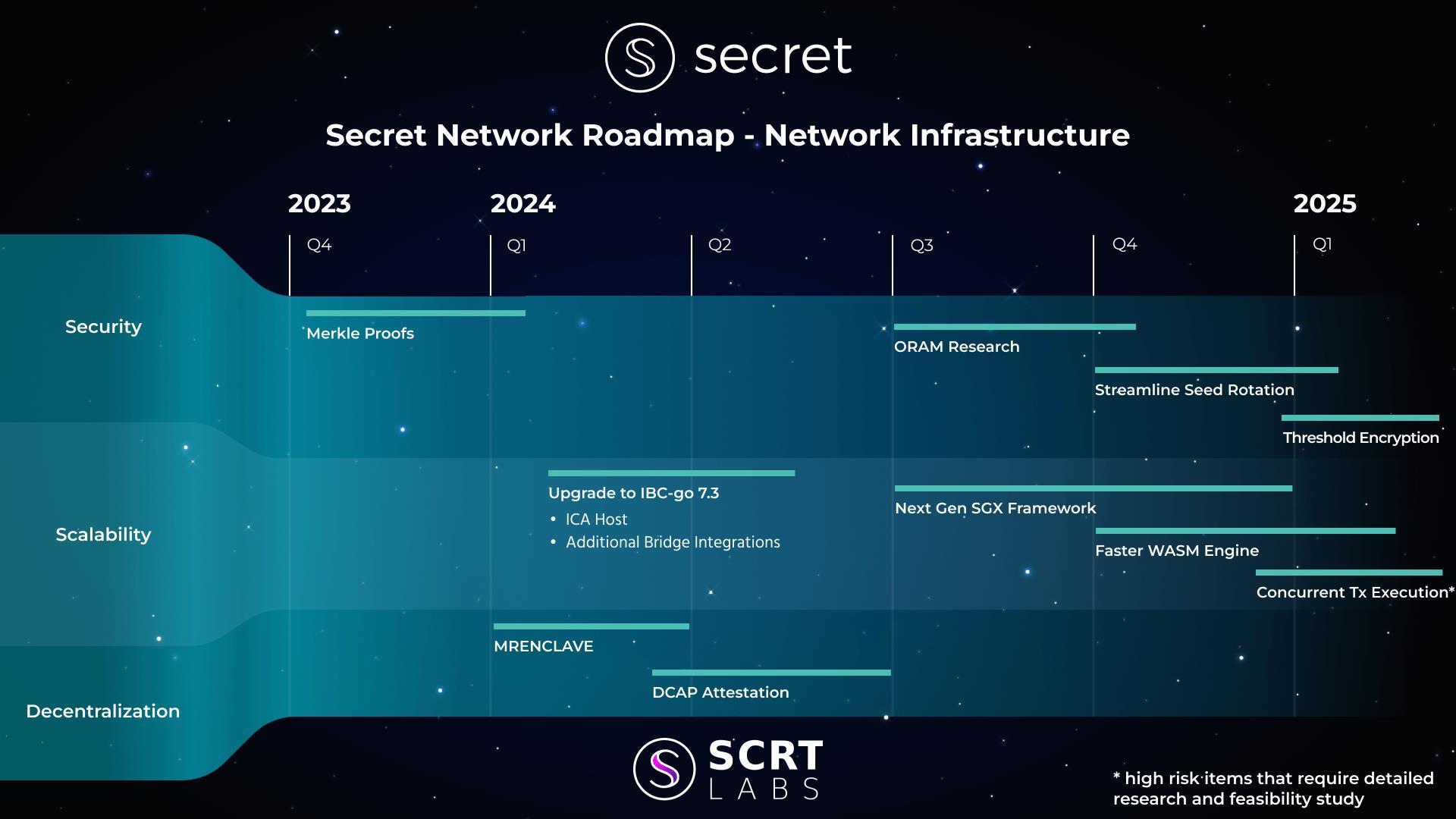

Secret Network was covered so long ago in Issue #12 of Moonmag. It feels ages, doesn’t it? Nevertheless, the team keeps building in the background while not making as much noise as its competitors.

▪ Confidential Computing Layer: Secret’s Confidential Computing Layer went live on over 20 blockchain networks, expanding its reach and utility.

▪ Leadership Changes: Recent leadership changes have brought fresh perspectives and innovative ideas, enhancing Secret’s strategic direction.