Bought To You By themoonmag.com

A note from Lisa

Don’t forget to take a break!

This past month, life took an unexpected turn when I found myself on an unplanned yet necessary hiatus. A sudden bout of illness culminated in an emergency appendectomy, along with the removal of a few other bits I apparently no longer needed. The experience was gruelling, not just because of the physical pain but also due to the timing. Kind of luckily, we’re in the thick of a bear market, but managing my own trading business had left me thoroughly exhausted. It seemed my body decided that the only way I would take a break was by hitting the emergency stop button.

Running a trading business during a bear market is like navigating a ship through a storm. The constant vigilance, the strategic maneuvering, and the mental strain are unparalleled. Every dip and rise in the market demands acute attention, often leading to sleepless nights and highstress days. It's an adrenaline rush, but one that comes with a hefty toll on both mind and body. In the race to stay ahead, I’d been neglecting the very vessel that carries me through this journey my health.

The forced holiday, as I now fondly refer to my hospital stay, was a wake-up call. Lying in a sterile hospital room, detached from the chaos of the trading world, I was given a rare opportunity to reflect. The realisation was stark: I had been running on fumes, and my body finally gave out. This break, though uninvited, became a necessary reset button, reminding me of the importance of balance and, as we all know, TOUCHING GRASS!

E di

t orial

Recovery was not just about physical healing. It was a time to recalibrate my approach to life and business. I delved into books I’d been meaning to read and, most importantly, reconnected with myself. As recovery, I indulged in nature walks and heritage sites in England and Scotland while seeking some long-lost ancestors. I allowed myself the luxury of doing nothing a concept alien to most entrepreneurs.

Now, a month later, I am Bull run ready! This phrase holds more than just financial optimism; it signifies a renewed vigour and a balanced approach to my personal and professional endeavours. I’m approaching the market with a clear mind and a healthy body, ready to capitalise on opportunities with a strategic and measured perspective.

The forced holiday has been a blessing in disguise, teaching me invaluable lessons about the importance of health, balance, and resilience. As traders, we often glorify the grind, but it’s crucial to remember that success is not just about working hard but working smart. It’s about knowing when to push forward and when to step back and recharge.

I share this with my fellow traders and entrepreneurs: Take care of yourselves. The market will always be there, with its ups and downs, but your health is irreplaceable. Sometimes, life has a way of forcing us to take a break. Embrace it, learn from it, and come back stronger.

Here's to the next Bull run, fueled by ambition and a renewed sense of purpose and well-being. Stay healthy, stay balanced, and let's charge ahead with the wisdom that only a forced holiday can impart.

While you are sitting back and taking a small break, don’t forget to dive into this month’s Moon Mag!!!

Lisa x

A note from Josh

Along similar lines to Lisa's editorial, touching grass has been the theme in the last month and, as so often, we find ourselves really grateful for slowing down once we have done it. A time to reflect, re-energize, and realign.

In crypto, it's all too easy to get swept up in the non-stop action. Prices mimic a rollercoaster ride, new projects pop up left, right and center, and innovation is a constant buzz. But taking a step back to 'touch grass' – yes, literally getting outside and enjoying nature – has been a game-changer.

This little pause has given us the space to breathe, think, and get our heads straight. It’s a chance to make sure we’re not just chasing the latest hype but actually building something that lasts. It's also been essential in helping us review our strategy, modify and adjust and set ourselves up for the oncoming crypto mania we hope to see! So I'd emphasise once again to understand balance, understand when the dopamine in your body is trying to push you towards crypto and utilise it elsewhere from time to time.

Saying that, our article writers have been super busy diving into crypto, checking out new projects and bringing a layman's understanding to topics that on the face of them, seem like rocket science. There is plenty to keep you occupied but perhaps you can enjoy this issue of the Moon Mag on the sun lounger by the pool in a tropical clime rather than the rickety office chair, amongst four walls and a ceiling. Let us know if you do! Enjoy!

SUMMA R Y TRADERS PERSPECTIVE TRADING AS A BUSINESS 9 16 Runes on Bitcoin

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. 34 MONAD: A New Era for Ethereum Scaling? 48 The Neon EVM Protocol and the NEON Token 60 Crypto Trends: Modular Blockchains Crypto Curious 74

SPONSORS

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

CONTRIBUTORS

Daniel

Daniel has been a blockchain technologyevangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies MDC writer since 2018, currently writer for CryptoTrendencia.

Chris

I joined the crypto party in 2017 Worked as a DAO contributor, startup advisor, lead researcher and co-author My superpower? Translating complex blockchain concepts into clear, engaging content that resonates.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

BUY

Best Selling

Book OUT

Lisa N Edwards’

NEW

NOW!

TRADERS PERSPECTIVE

written by Lisa N. Edwards

written by Lisa N. Edwards

TRADING AS A BUSINESS

How to Determine If You're Classified as "Trading as a Business"

Coming up to tax season in Australia, I wanted to write this article to dispel a few misconceptions about trading as a business and discuss whether it may be right for you. Maybe it’s time for you to make the jump!

Ok where to start? I reached out to friend and accountant, Rony Choueiri, Director of CYPHAR ACCOUNTANTS, who specialise in cryptocurrency, blockchain and start ups, for tax and business growth, here are some key areas to watch.

Rony explained, “The rules regarding being classified as a trader are vague, so some points can be expanded. The ATO leaves it to you to build a case for it.

Below is what I'd send clients who believe they should be classified as "trading as a business" to confirm.”

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

● You engage in investment activities for commercial purposes and in a commercially feasible manner.

● You conduct activities in a business-like manner.

● You aim to make a profit and genuinely believe you will, even if it's unlikely in the short term.

● Your investment activities are consistent and repetitive.

● You maintain detailed and accurate records of all transactions

● You have a defined strategy or trading methodology, which you consistently apply

● Trading frequency: there is no secret number of trades you need to make but the higher the volume, the easier it is to prove they are trading as a business

● Business structure: do you have an ABN or corporate structure where you conduct your trading business

● Time you put into your trading business (Are you trading as a business if you work a full-time job?)

These rules can be similar worldwide, as explained below.

Is Trading as a Business Right for You?

Here's How to Decide

Trading stocks, forex, or cryptocurrencies can be a thrilling way to earn money potentially, but have you ever considered taking it to the next level and trading as a business? This decision isn't just about fancy titles or wearing suits; it has real implications for your taxes, financial management, and lifestyle. If you're wondering whether trading as a business is right, here’s a quick guide to help you decide.

Evaluate Your Trading Activity

Are You Trading Often Enough?

First things first, look at how often you trade. Are you making trades every day, week, or month? If your trading is frequent and involves a high volume of transactions, this could be a sign that transitioning to a business structure might be beneficial. Casual, occasional trades might not justify the switch.

Consistency is Key

Consistency in your trading habits is crucial. Regular, systematic trading activities indicate a professional approach. If you trade sporadically, it might be harder to justify trading as a business.

Assess Your Profit Motive

Are You In It for the Long Haul?

The ATO and other tax authorities want to see a clear intention to make a profit. Even if you aren’t raking in big bucks right now, having a long-term strategy for profitability shows you're serious. It's about genuinely believing in your potential to succeed, even if it's a slow start.

Time Commitment

Full-Time or Side Hustle?

How much time do you dedicate to trading? If it’s just a side hustle alongside your full-time job, trading as a business might not be for you. However, it's a different story if you’re clocking in significant hours researching, analysing, and trading. A full-time commitment indicates that you might be ready to leap.

Trading Methodology

What’s Your Game Plan?

Having a well-defined trading strategy is a hallmark of trading as a business. Whether you're into technical analysis, fundamental analysis, or a blend of both, consistently applying a professional strategy is key. A solid game plan helps make informed decisions and demonstrates to tax authorities that you mean business.

Financial Considerations

Do you have enough capital to sustain your trading activities and weather potential losses? Trading as a business isn’t just about making money; it’s about managing and sometimes losing it. Ensuring you have the financial cushion to support this venture is crucial.

Risk Management

What's your risk tolerance? If you're comfortable managing the financial risks associated with trading, it could be a sign you're ready to take it to the business level. Trading as a business requires a professional approach to risk management.

Show Me the Money!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Tax Implications

The Taxman ALWAYS… Cometh. One of the biggest perks of trading as a business is the ability to deduct a wide range of expenses. Office costs, technology, professional services, and even educational expenses can be written off, significantly reducing your taxable income. But remember, with great power comes great responsibility. You’ll need to keep meticulous records and possibly face more scrutiny from the tax authorities.

ALWAYS Consult a Pro. The tax landscape can be tricky. A tax professional can help you understand your jurisdiction's specific implications and requirements, ensuring you take full advantage of the benefits without stepping on any legal landmines.

Business Structure and Administration

Ready for the Admin Overload?

Are you prepared to establish and maintain a formal business structure, like an P/L in Australia or LLC in the USA or corporation? This can provide tax advantages and liability protection, but it also comes with administrative duties. The package includes bookkeeping, filing taxes as a business, and regulatory compliance.

Legal and Liability Issues

Protecting Your Assets may be advisable. Operating through a corporate structure can offer liability protection, keeping your personal assets safe from business debts and legal issues. This added layer of security might be worth the extra administrative burden.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Legal and Liability Issues

Protecting Your Assets may be advisable. Operating through a corporate structure can offer liability protection, keeping your personal assets safe from business debts and legal issues. This added layer of security might be worth the extra administrative burden.

Personal and Professional Goals

Aligning with your life plan is important! Do you know what this is? Do you have a 5/10/15-year plan?

Think about your long-term career goals. Do you dream of becoming a professional trader or running a trading-focused business? If so, structuring your activities as a business aligns perfectly with your aspirations. It’s also worth considering how this fits into your lifestyle. Are you ready to commit the time and energy required to run a trading business?

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

But most importantly… do you truly understand what you're doing?

Becoming a doctor, lawyer, or accountant takes years of study and practice. So, what makes you think you can become a professional, profitable trader overnight?

Trading as a business can offer significant benefits, from tax deductions to professional credibility, but it's not a decision to take lightly. Evaluate your trading activities, financial situation, and personal goals to make an informed choice. Remember, consulting with financial and tax professionals can provide further clarity and help you navigate the complexities of this transition.

So, is trading as a business right for you? If you're dedicated, consistent, and ready to commit fully, it might be the perfect next step. Happy trading!

Runes on Bitcoin

written by Daniel

ALL ABOUT

When Casey Rodamor introduced the Ordinal Theory in early 2023, we, like many other Bitcoin enthusiasts, perceived a before and after in the original blockchain.

While there are detractors of amplifying Bitcoin's utility beyond a secure, decentralised and fully functional network as a payment method, a store of value, in other words as the Internet of Money, there is no hiding the potential that Rodamor's proposal brought to the entire Bitcoin ecosystem.

Now, as part of these paradigm shifts and as we approach competition times and more complicated access to rewards to subsidise all the logistics needed to keep the network safe (I mean mining), Runes emerge as an alternative that can unlock the full potential of decentralised finance around Bitcoin.

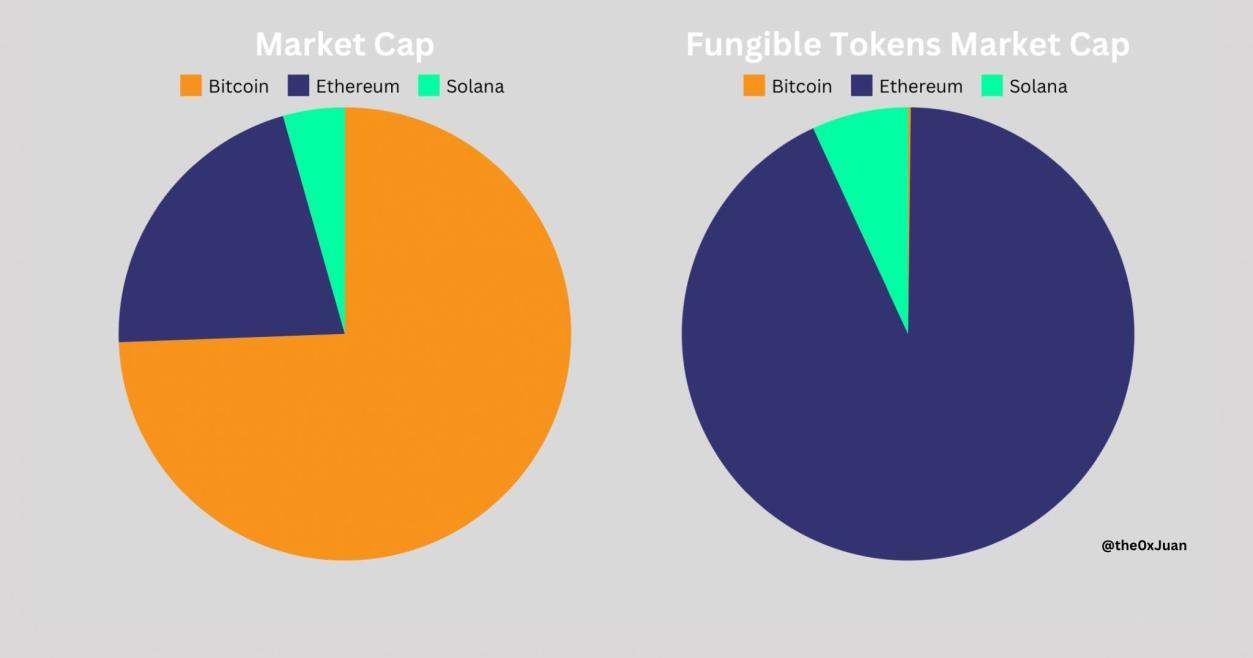

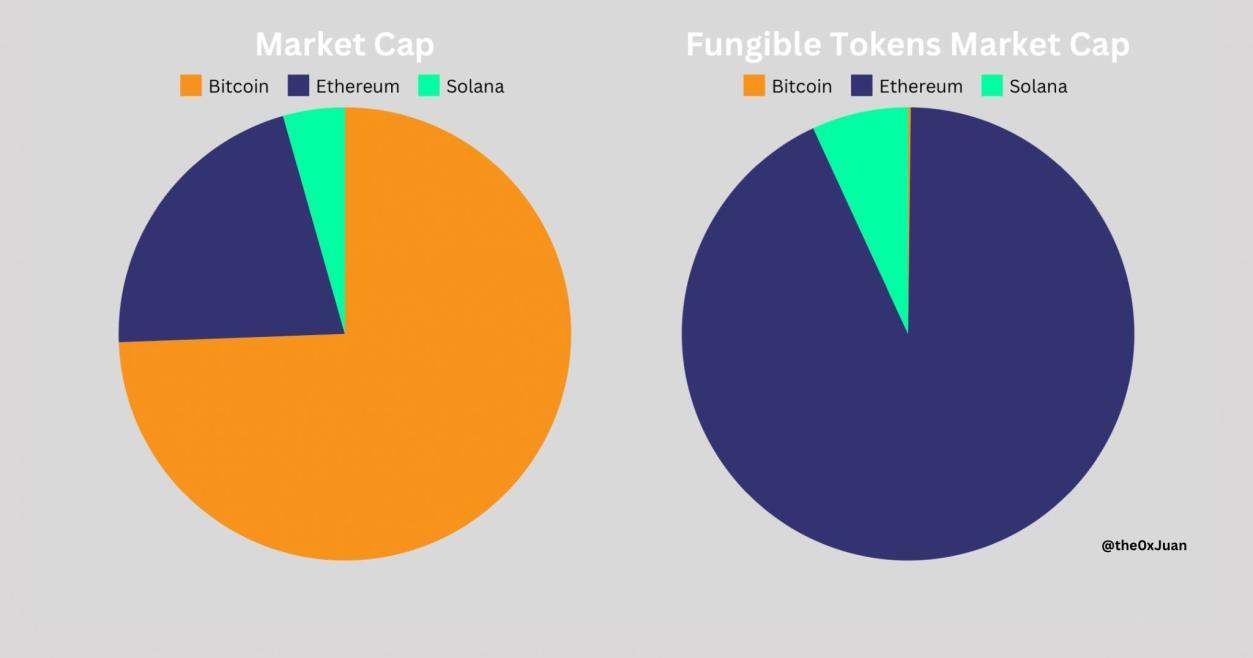

In short, Runes are Bitcoin's new fungible token standard that comes to try to capture the historically Ethereum-dominated market and other L1 networks such as Solana and BNB Chain. Beyond that, I could argue that Runes is the next significant opportunity in the next Bitcoin bull cycle.

Due to the inherent noise that its deployment has caused throughout the ecosystem, in this new instalment, we address everything you want to know about the Runes protocol in Bitcoin and what early-stage opportunities we can take advantage of to capitalise on opportunities in this emerging market.

RUNES: Tokens fungibles unrelated to Ordinals or Inscriptions

One of the key differences between the Runes protocol and its predecessor, BRC-20, is that it is issued directly on the Bitcoin network and not on a meta-protocol on top of Bitcoin.

“Runes allow Bitcoin transactions to etch, mint, and transfer Bitcoin-native digital commodities” Ordinal Theory Handbook.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

To understand the above, we must remember that the BRC-20 fungible tokens deployed as a metaprotocol on top of Ordinals, a meta-protocol on top of Bitcoin known as Ordinal Theory.

Therefore, the new fungible token standard ON Bitcoin and not ON TOP of meta-protocol makes Runes simpler, lighter and natively integrated into Bitcoin in its UTXO transactions, which translates into fewer inherent complexities when creating and managing fungible tokens on Bitcoin, which is very different from what we have been experiencing with BRC-20s on the network.

Key aspects of the Runes

● Block 840,000 is where the Runes protocol was first activated.

● Casey Rodarmor created Runes – the guy who developed Ordinals, a protocol that lets you create NFTs on Bitcoin.

● Runes was created by Casey Rodarmor – the same guy who developed Ordinals, a protocol that lets you create NFTs on Bitcoin.

● Runes natively uses the UTXO properties of the network and is not related to any external element in the chain, as its predecessor BRC-20 (Ordinal Theory) does.

● In line with the above, the Runes are more efficient and expected to have fewer complexities than the BRC-20, which could translate into lower transaction fees.

● Given the UTXO model adopted, Runes has a minimal on-chain footprint on the Bitcoin chain.

● Runes does not mean to change anything within the Bitcoin protocol or Bitcoin's consensus mechanism. Everything required to rebuild Runes exists within the Bitcoin blockchain without third-party components.

● The distribution of Runes can be diverse: pre-mints, open-mints or delayed mints as set by the issuer.

● Runes presents a potential new revenue stream for miners, generating additional transaction fees.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: Xverse

Why Runes

One of the big questions in the community when Rodamor announced Runes was: Why Runes?

Well, the answer to this question has a particular nuance that Rodamor himself put down very well on the Hell Money Podcast::

“Runes are a form of degenerate gambling… Runes are not the future of finance… Runes are a fungible token protocol, so that people can meme…”

From a degen point of view, it is imperative to acknowledge that the Runes are merely a tool to capture the attention of the Bitcoin ecosystem. In retrospect, it is crucial to understand the pre-Runes market to understand the motives behind Rodamor's proposal: memecoins

Quite different from previous cycles, the power of memecoins has flourished beyond crypto borders thanks to their amusing way of capturing the attention of even those outside the ecosystem.

To give everything context, the marketcap of memecoins on the various blockchain networks exceeds $53.5B, with PEPE and WIF skyrocketing in the last year. Since December 2023, the trading volume of memecoins has been trending higher and skyrocketing in the first quarter of 2024 as the narrative of a new Bitcoin bull cycle consolidates, as the chart below shows.

Source: Dune Analytics

Ethereum and Solana have long been capturing the memecoin season's attention. This power encourages the native network use on which these fun coins can change lives in an instant..

Because of this 'pull' power that memecoins represent for L1s, Runes is an attempt to innovate on the initial design of the BRC-20 token to create a standard fungible token that is also accessible to more people using the Bitcoin network.

Runes are a new protocol on Bitcoin that will attempt to bring memecoins to the OG blockchain. Previous efforts to shoehorn in memecoins most recently include the well-liked but chunky BRC20s.

Memecoins on Bitcoin will almost certainly bring opportunities and fun, so Runes is not only a degenerate attempt to divert market attention to Bitcoin, but also to satisfy the growing demand for Bitcoin-native fungibility in a simpler and more native way.

How Runes Work

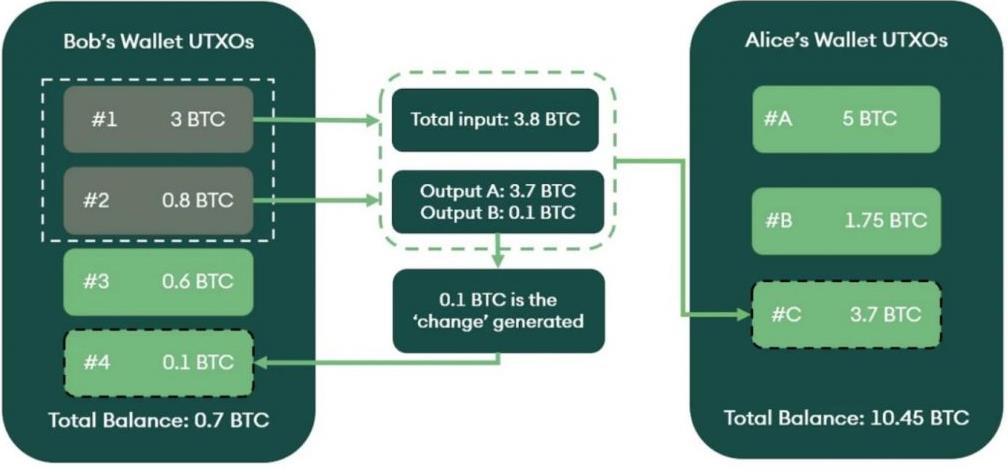

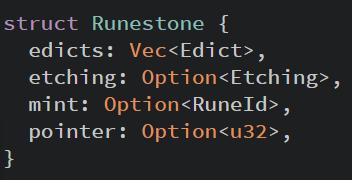

As noted, Runes does not require off-chain data or a native token to operate, given that the native UTXO model in Bitcoin transactions is its base protocol. Specifically, the data for Runes gets stored inside the OP_RETURN field of a Bitcoin transaction.

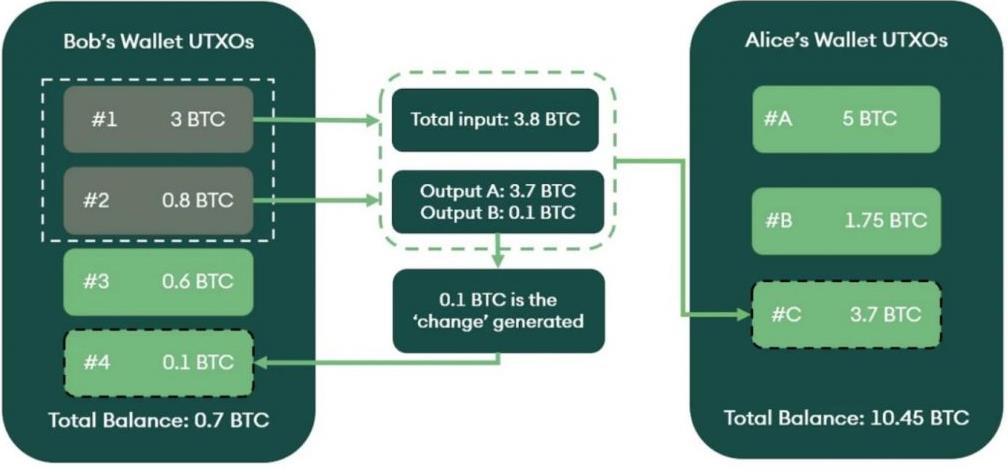

Bitcoin's UTXO models mean that when a user has a bitcoin balance in their wallet, the software counts a stack of sats across various UTXOs (unspent transaction output).

A fine example of the UTXO model is the change you receive when you purchase in a shop with cash using a banknote of a higher denomination than the bill total.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Returning to Runes, it is imperative to understand new concepts introduced in this protocol that represent the creation and operation process.

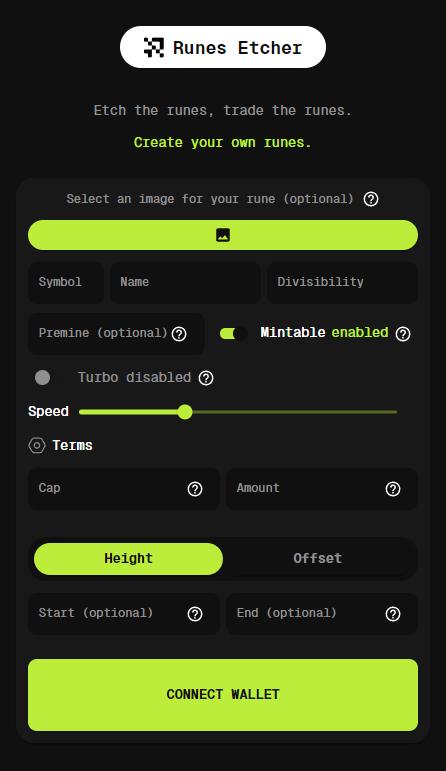

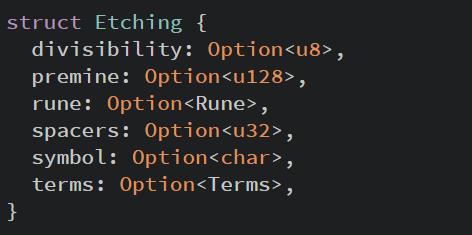

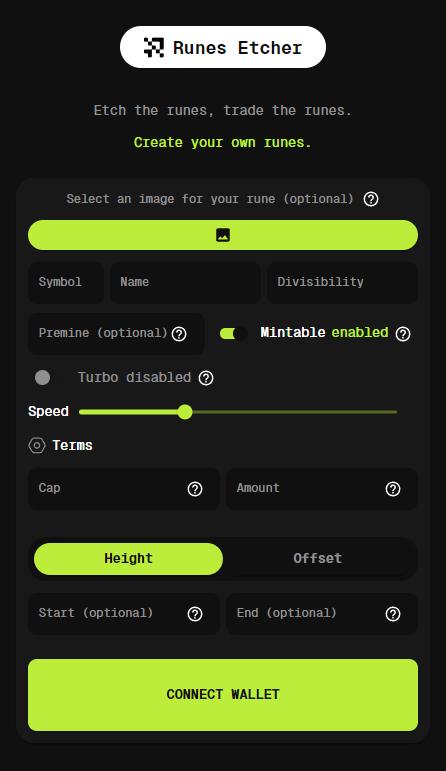

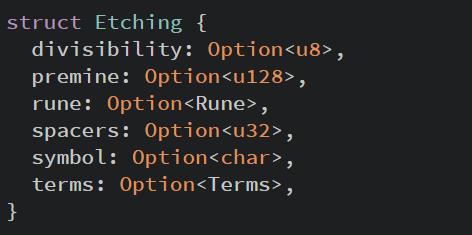

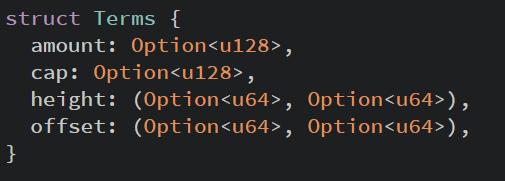

• Etching: Refers to the process of creating the Runes. During this process, token properties such as name, symbol, divisibility, terms, cap and amount, among other properties, are established.

At this point, it is important to highlight two fundamental properties of market opportunities: Name and terms.

In the first case, it is worth noting that Runes have unique names created by combining any uppercase letters from A to Z. In addition, Runes names during the first four months after their launch can only contain between 13 and 26 characters in length.

Source: SEBA Bank Research

Source: Runesterminal

The previous resulted in a crucial variation every four months until the next halving, where users could create Runes one character shorter, meaning that by August 2024, all of the 12character Rune names will unlock. Then, in December 2024, all of the 11-character Runes will unlock, and so on, allowing for continued euphemism around the Runes until the next Bitcoin Halving in 2028. Smells like a money opportunity here …

On the other hand, the 'terms' property allows a Rune to have an open mint, delayed mint or limited mint within a set of conditions pre-set in the code as a specific interval of blocks.

This property opens the door for innovations with Runes such as airdrops, lottery and gambling properties, unlocking functionality within the Bitcoin ecosystem never seen before. Will it be the next big industry airdrop in Bitcoin?

With each Rune etching unique and specific properties such as name, divisibility and tokens, these fungible tokens are ready to be transferred and exchanged in the protocol via Bitcoin transactions.

The significant thing to note is that once Runes properties get set, they remain unchanged forever.

* Minting: After establishing the properties and defined terms during etching, minting is the next natural step in the creating Runes process.

In this part, you generate the pre-defined amount of Runes according to the set terms. In short, it is the process of claiming a new Rune, similar to how you mint an NFT.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: Ordinal Theory Handbook

Source: Ordinal Theory Handbook

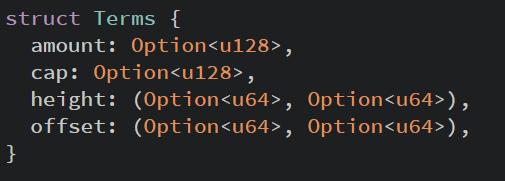

* Transferring: Runestones facilitate Runes transactions, messages stored in Bitcoin transaction outputs. Runes tokens are transferred from transaction inputs to outputs using edict messages.

Source: Ordinal Theory Handbook

These edits and scripts define the creation of new runes, minting additional units of existing runes, or transferring runes between transactions.

Source: Ordinal Theory Handbook

A key point to note here is that specific instructions are given throughout the runestones to indicate which input Runes get transferred to which outputs (pointer). If you transfer several UTXOs with different numbers of different Runes without using such specifications, all of those Runes will go to the first non-OP_RETURN output of that transaction.

The previous is crucial when a project requires, for example, token distribution (Airdrops, IDOs, private sales, etc.)

Key Point: Runestones may be malformed by empty fields, invalid variants or by including nonpushdata opcodes in the runestone OP_RETURN. In this case the runestones are termed cenotaphs.

The cenotaphs are burned, which invites us to be attentive when deploying the Runes, verifying that the 'code' is correct to prevent the loss of the funds available for token deployment.

The Potential of Runes

As the 840,000th block on the Bitcoin network strategically coincided with the latest halving activation, the FOMO around Runes became very present in the community.

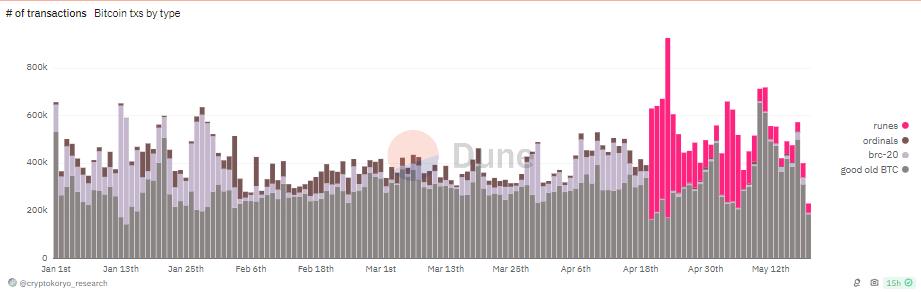

As a result, market-wide effects were not long in coming. On the one hand, transaction fees and transaction counts increased as the halving date approached. Meanwhile, sectors such as NFTs began to feel the effects of a revival that saw metrics rise, especially in Inscriptions, Ordinals and some traditional blue chips from other chains.

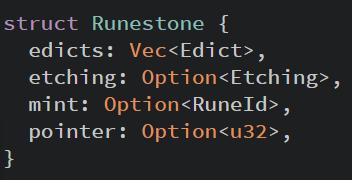

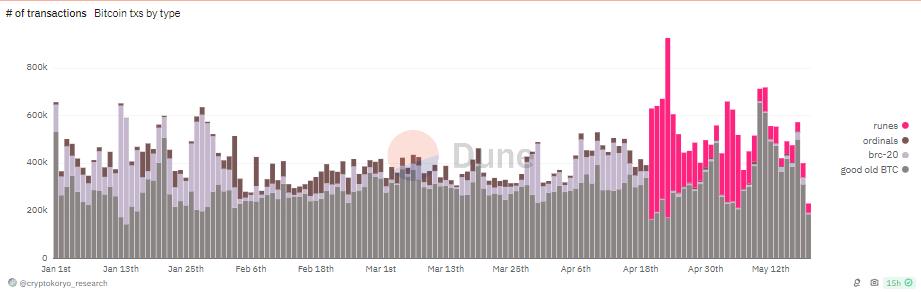

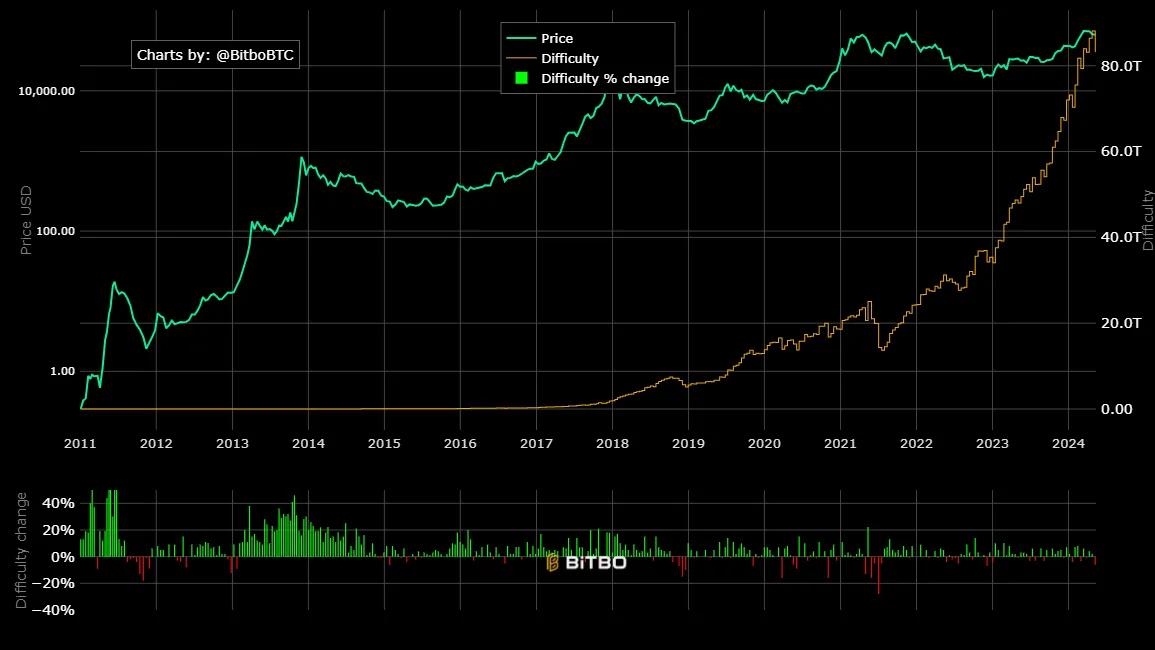

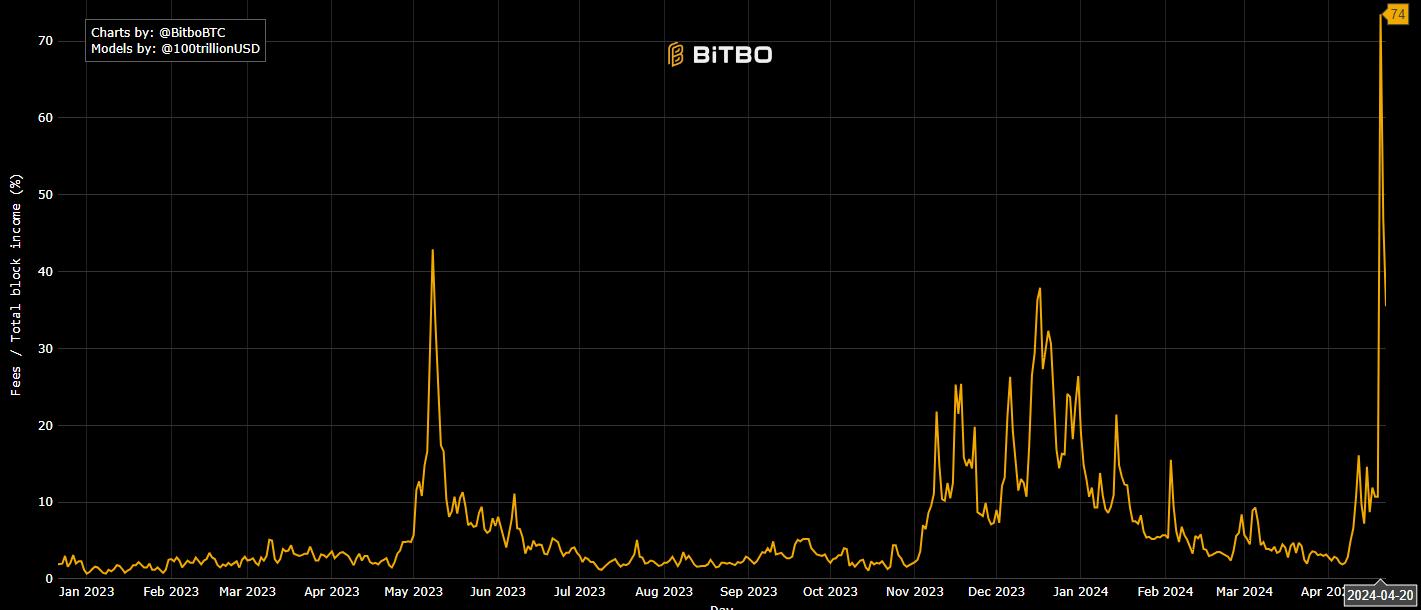

To get an idea of the effect Runes had, look at the chart of Bitcoin fees before, during and after the launch of Runes on April 20th. This day alone, transaction fees accounted for 74% of the total block reward, allowing miners to earn a considerable amount of BTC before halving to subsidise the sudden drop in inflation due to the event.

Source: BiTBO

Source: BiTBO

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

According to Binance Research, since launch Runes has generated around 2,200 BTC in fees, approximately ~US$145M, representing almost 30% of all Bitcoin Network fees since April 20th.

On the other hand, data from Unisat indicates that demand for network blockspace and, subsequently, network fees has been driven primarily by Runes in the first week of the launch, demonstrating a positive sentiment around the Bitcoin ecosystem very similar to that experienced during Q1-2023 with Ordinals, Inscriptions and BRC-20s.

It is worth noting that the launch of Runes also involved the following network milestones:

● The achievement of over 4.8M Runes-related transactions on the Bitcoin Network, a ~45% of all Bitcoin's transactions since April 20th.

Source: Dune Analytics

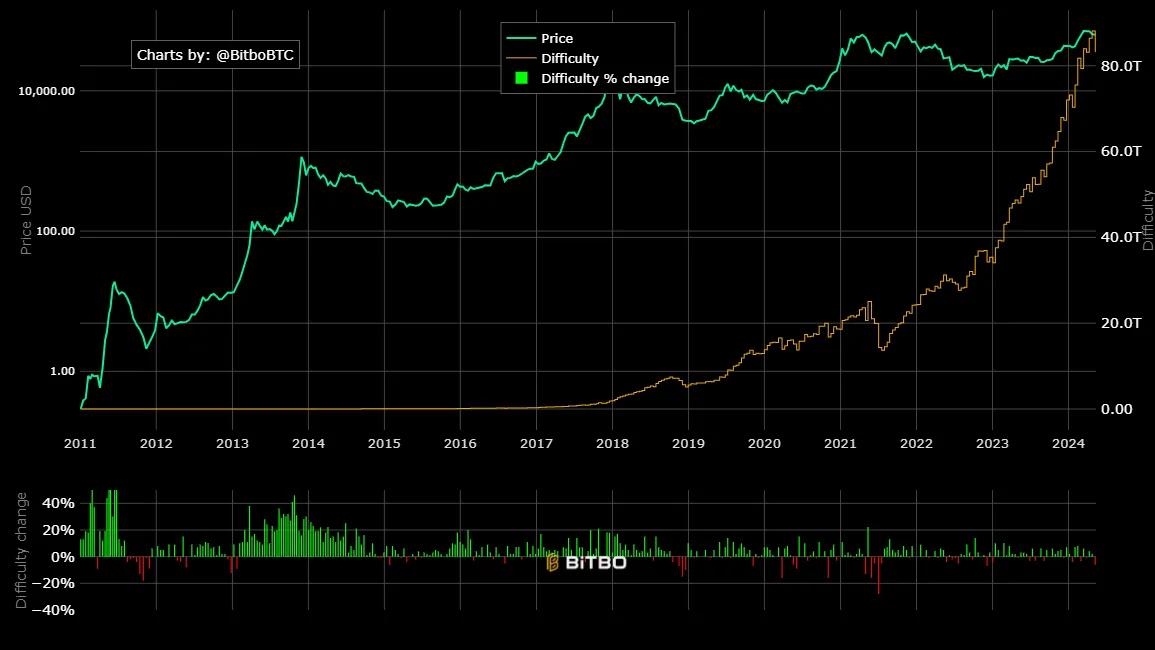

● The introduction of Runes meant a historic increase in Bitcoin mining difficulty, which rose 2% to reach a record 88.1 trillion, the first time such an increase has occurred immediately following a halving, demonstrating the hype surrounding Runes.

Source: BiTBO

• Daily active NFT traders reached a historical high on Bitcoin on April 18th at 25.6k in anticipation of the Rune launch.

Source: Nftpulse

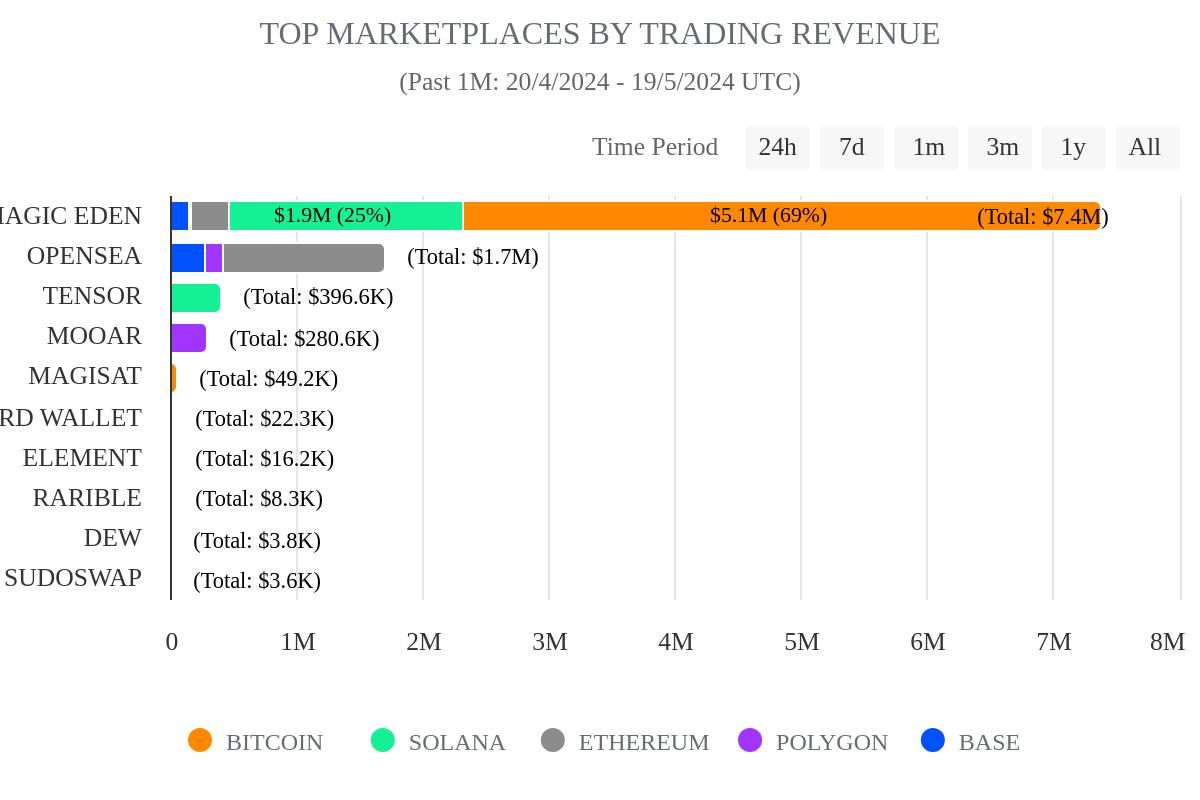

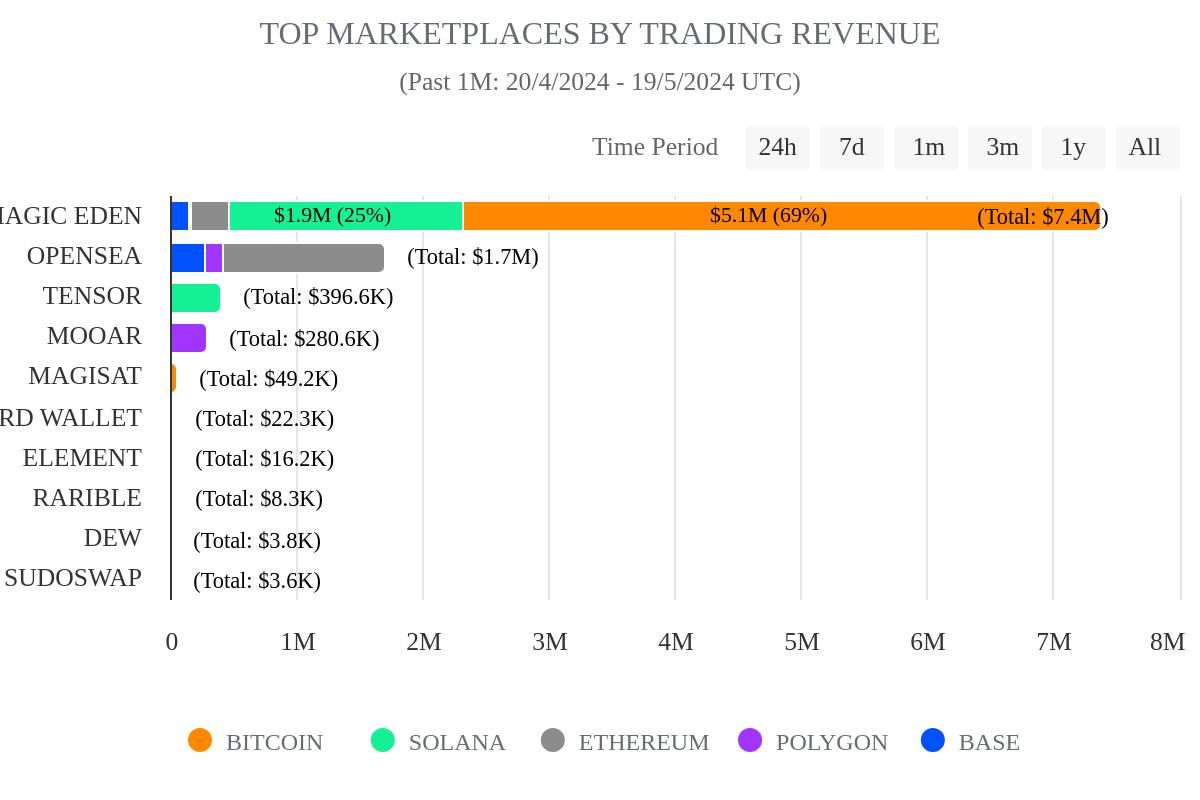

● In the first week of April, Magic Eden generated +$1.84M in revenue via Ordinals trades, more than what OpenSea and Tensor made across the Ethereum, Solana, and Polygon NFT ecosystems combined in that same span. In the first month after the halving, the figure has increased to +$5.1m in revenue, with Runes leading the way.

Source: Nftpulse

• The overall NFT market rose 27.45% in the week leading up to the launch of Runes, thanks to increased sales volume of BRC20, boosting overall industry sales to $307 million in that period.

Source: CryptoSlam

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

In addition to the impressive metrics delivered by Runes inside and outside Bitcoin, it is worth mentioning that the protocol has the potential to decrease valuable aspects, such as the storage requirements to run a full Bitcoin node that increased with the rise of the BRC-20.

On the other hand, its simplicity in creating and managing the issuance of assets directly on the Bitcoin network facilitates the issuance of various fungible tokens, expanding Bitcoin's utility and attracting a broader user base due to its native compatibility with any solution available on the network such as wallets, LNs, L2s and Bridges without the need for additional encryption.

How to invest in Runes?

If you are interested in participating in this nascent Runes market, some options support the protocol, even before halving. Be sure you have some BTC in your wallet and do your due diligence to take advantage of market opportunities.

Some of the options you can use are:

● Xverse: Bitcoin wallet that has supported Runes since before its launch on the 840,000 block of the Bitcoin network.

● Magic Eden is the most popular site for buying and trading Ordinals. It also includes support for Runes.

● RSIC: One of the forerunners of the Runer Miner Mania with a freely airdropped of Runes to early ordinal collectors

● Ord.io: One DEX to trade with Odinals and mint Runes

● OkX Wallet: Introduces support for Runes through its non-custodial wallet natively

● Runemine: A wallet to mint, transfer and manage Runes in Bitcoin

● Unisat: The ultimate wallet and marketplace for Ordinals is also available for Runes.

● Runes DEX: Launch Runes, Trade memes and experience effortless trading in the runes world

The list above can also include several protocols and services that offer Ordinals support and have now adopted Runes to capture their respective market share.

Although some DeFi protocols can use Runes for practices such as lending and yield farming, some critics point out not to lose sight of the initial purpose behind these fungible tokens: a degen way to get labelled as memecoins

However, many supporters believe this cycle is atypical and that memecoins can prove their permanence over time as Doge, Shiba, or recently, PePe, have done.

Whatever the case, remember to do your due diligence before entering this exciting market.

Runes, is this the future of Bitcoin?

To assert or deny that Runes will have a significant effect on the Bitcoin story seems to me too early to say. However, looking at the market's behaviour before, during and after its launch, there is no doubt that Runes is trying to win a space where its closest challenger (BRC-20) is already two billion reasons ahead.

Source: brc-20.io

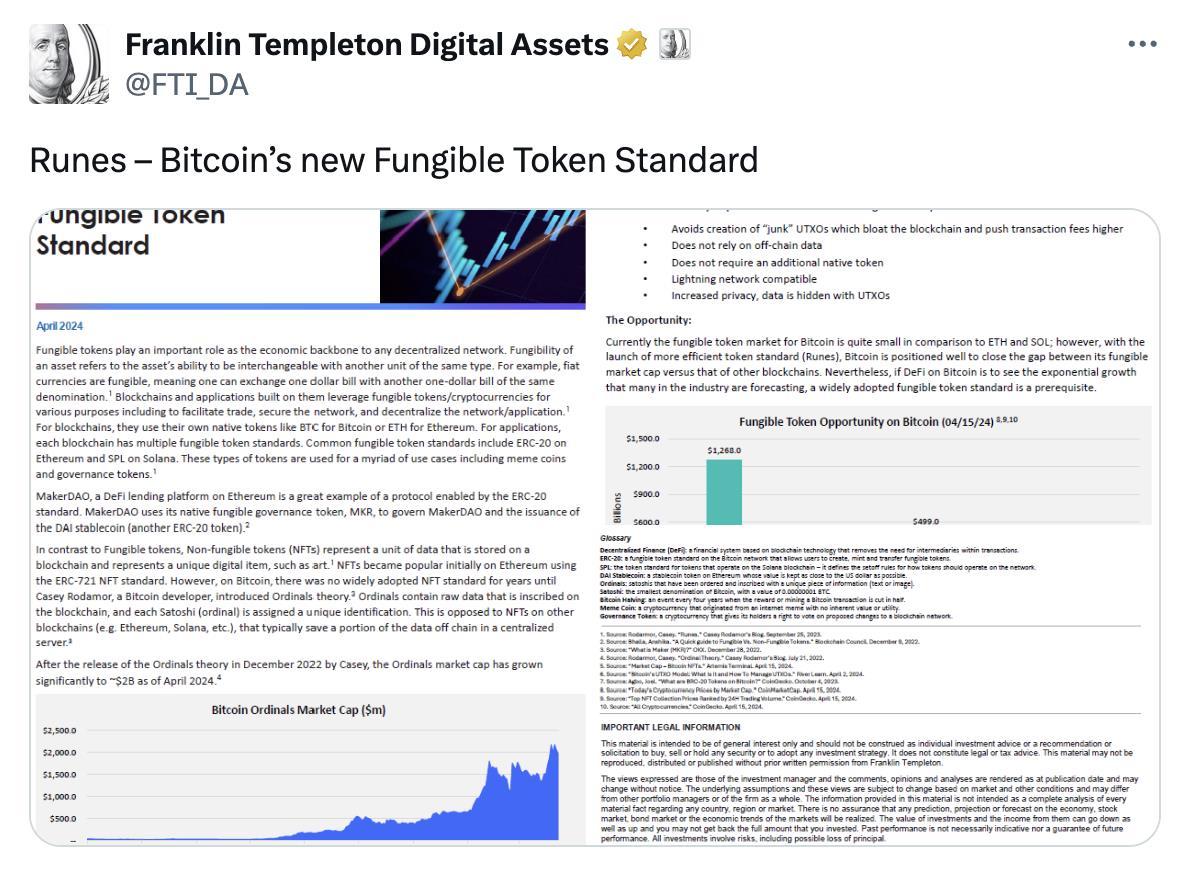

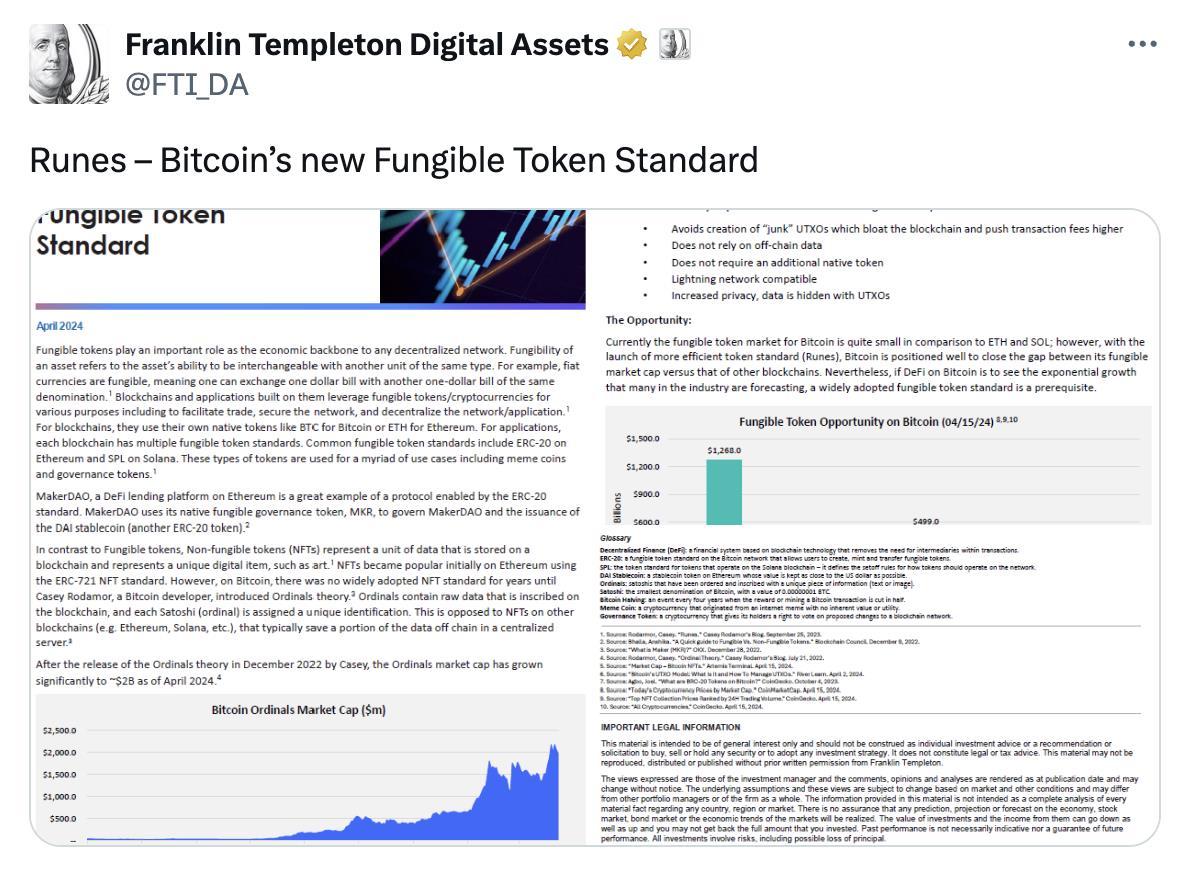

Despite the above, Runes seems to promise to close the gap not only with BRC-20 but with other dominant networks in the fungible token spectrum, such as Ethereum or Solana, as pointed out by Franklin Templeton Digital Assets, the giant fund with more than $1.5T asset manager.

According to the investment firm's report,, Runes Will Help Bitcoin DeFi ‘Close the Gap’ on Ethereum and Solana in the fungible token market cap by introducing the more efficient token standard on Bitcoin.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: X

And frankly, I agree with the argument made about the role of the BRC-20 standard in the proliferation of fungible tokens on Bitcoin, given that it highlights the issue of UTXO bloat and increased fees.

Noting the above, I know that Runes can be a near-term catalyst for the Bitcoin ecosystem- just like how Ordinals caused a Bitcoin NFT rush and grew to a $2B market in under a year.

Considering that the marketcap for ERC-20 tokens on Ethereum is close to $100B, it is not unreasonable to acknowledge the potential for Runes to close the gap with its immediate rivals as more developers continue to explore its capabilities.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: X

And frankly, I agree with the argument made about the role of the BRC-20 standard in the proliferation of fungible tokens on Bitcoin, given that it highlights the issue of UTXO bloat and increased fees.

Noting the above, I know that Runes can be a near-term catalyst for the Bitcoin ecosystem- just like how Ordinals caused a Bitcoin NFT rush and grew to a $2B market in under a year.

Considering that the marketcap for ERC-20 tokens on Ethereum is close to $100B, it is not unreasonable to acknowledge the potential for Runes to close the gap with its immediate rivals as more developers continue to explore its capabilities.

Source: mempool.space

Remembering the launch of the Ordinal Theory and then the community rollout of BRC-20, there is no doubt that Runes has the technical advantages and the ideal framework in the main ecosystem network to mark its successful timeline as its predecessors did.

What I'm observing

If you consider yourself a Bitcoin and memecoins lover, Runes might be the perfect combination for you right now.

Source: X

Also, if you remember Ordi's April 2023 price of $0.4 and compare it to today's price (x10) after one year, you might find the same reasons I have for getting into early stage market experimentation, with all that it means.

In that sense, I share with you some of the options I have in sight. Of course, this is not financial or investment advice. DYOR!

• Memecoins: $DOG, $PUPS & $RSIC. They are currently leading the way in the Runes memecoins

• Launch/mintpads: Magic Runes & Runes Terminal

• Tools/ Infrastructure: Rune Bridge, Genii Data

• DAO: Runes DAO

• DeFi: Runes DEX, Runessance

• NFTs/ Pre-Rune token: Runestone, RSIC, Rune Totems & Rune Guardians.

Crypto Trends

Modular Blockchains

written by Daniel

Since the smart contract's introduction with Ethereum in 2015, the industry has experienced exponential growth due to the multiple use cases implemented with blockchain technology in a decentralised way.

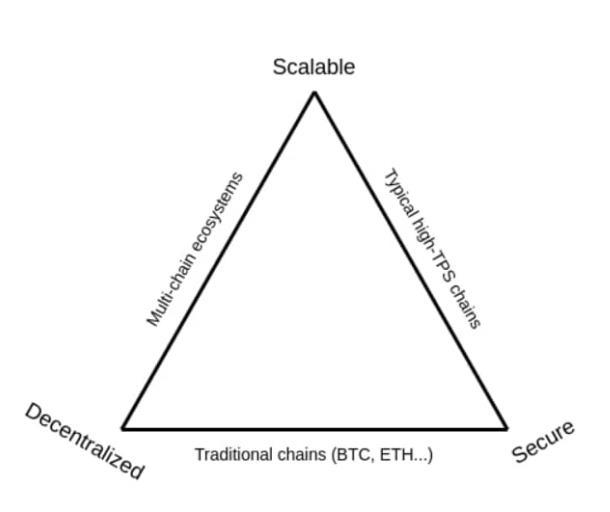

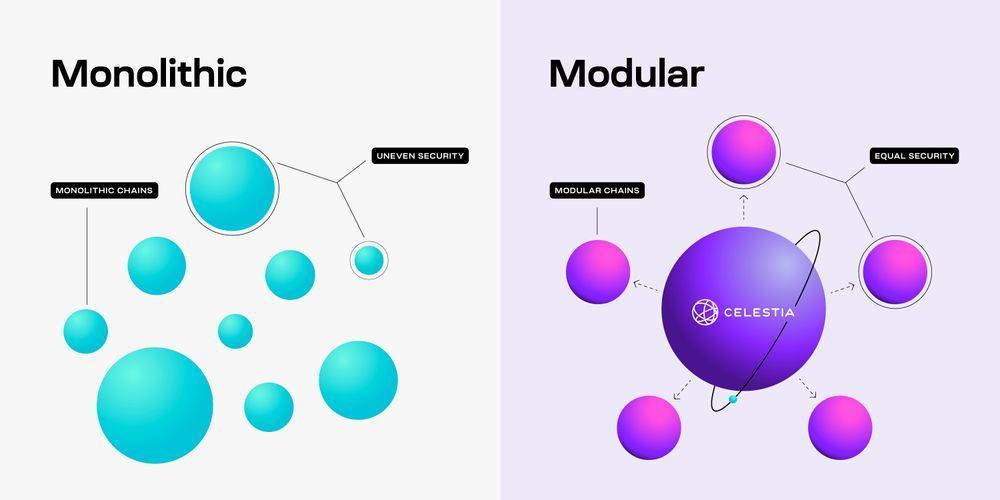

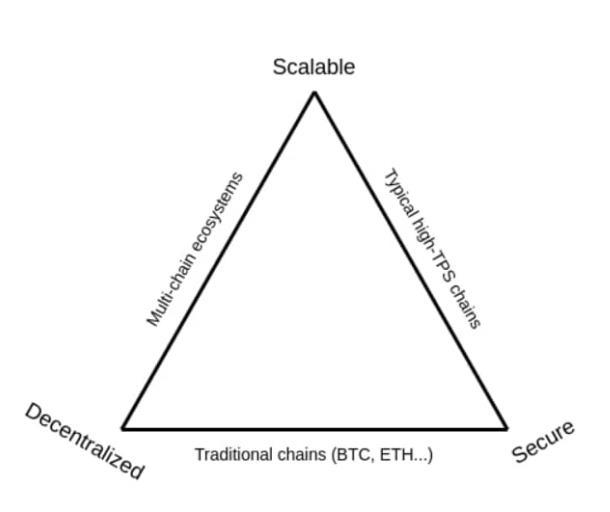

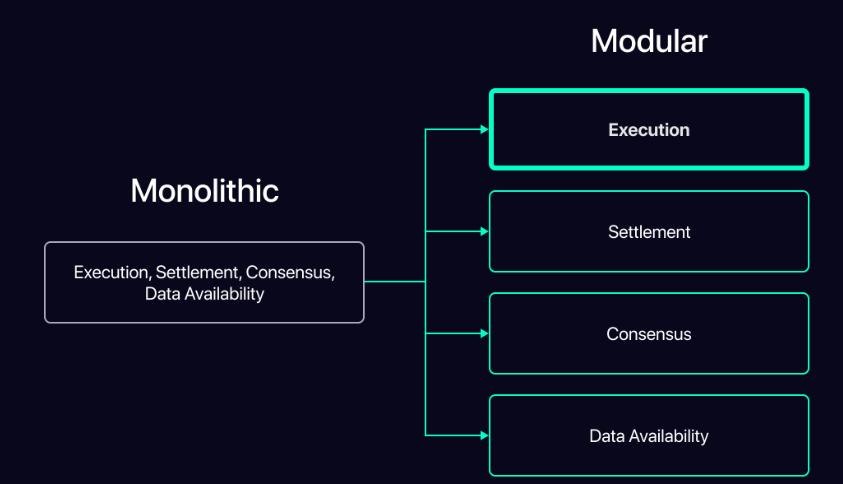

Sectors such as gaming, insurance, identity, art, music and, of course, finance, were made possible within a decentralised environment with a monolithic design approach where the blockchain 'does it all': processing transactions, verifying if they are correct and achieving consensus on them, causing scaling problems that end up hurting the average user.

Source: Forocoin

Source: Forocoin

The scalability challenges we have today in, for example, Ethereum or Bitcoin, are a product of their success under an inefficient blockchain architecture overtaken by the growing demand of users and applications deployed to satisfy the interest in the sector.

However, in 2024, the Web3 narrative known as modular blockchains expects to ease the burden of monolithic blockchains and take hold in the industry to change paradigms about the approach to building traditional blockchains.

Source: Hedera

Source: Hedera

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

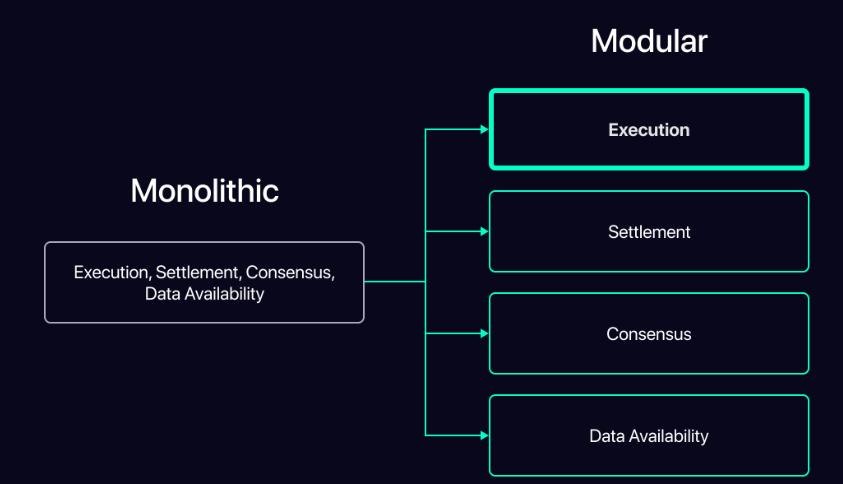

Monolithic Blockchain: Challenges

As noted above, most first-generation blockchains, such as Bitcoin, perform all functions at the same layer, which is why they are called monolithic blockchains.

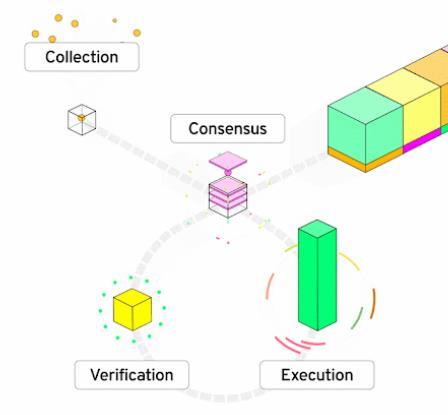

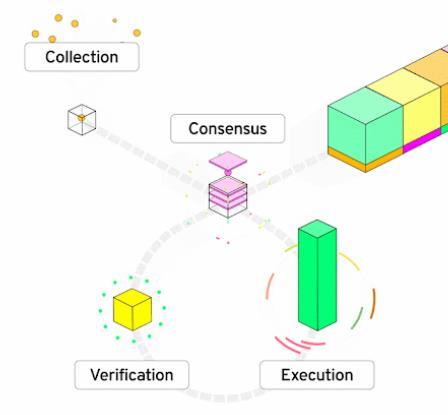

Specifically, monolithic blockchains are responsible for four different operations in a single unit: execution, data availability (DA), settlement and consensus.

Source: ResearchGate

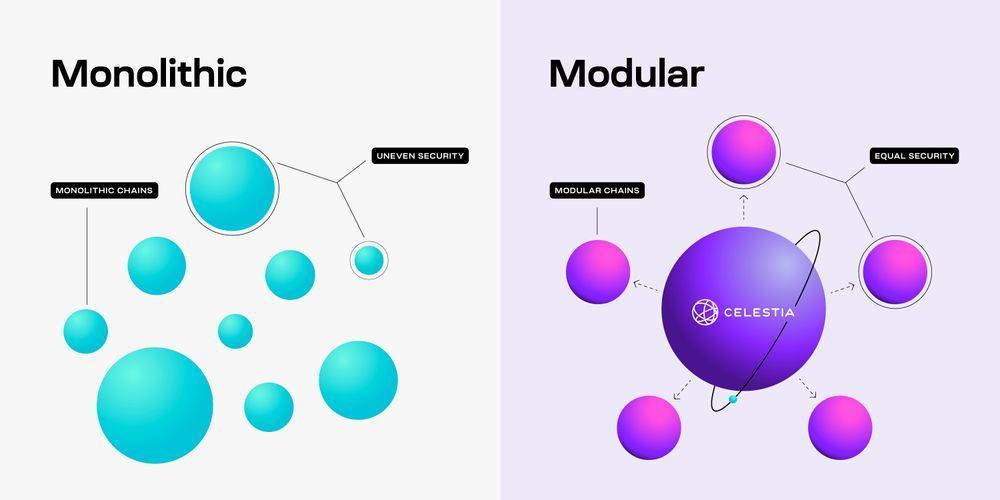

Their centralised architecture has been one of the major bottlenecks that has caused scalability issues we have seen in the past with Ethereum and Bitcoin, where block space is coveted and expensive, creating inherent scaling problems in some situations.

While it is true that monolithic blockchains are easy to integrate and understand due to their simplicity given their centralised structure, their lack of flexibility to adapt to changing needs or diverse applications leads to challenges in meeting the demand for high requirements due to their integrated nature, potentially limiting their growth and adoption.

Their reliance on the honest majority assumption makes them vulnerable to the 51% attack, which limits their scalability due to the amount of resources (and associated costs) to run full nodes. Remember, bigger/faster blocks = more computation = higher costs.

Source: Vitalik Blog

The crypto-economics around the assumption of the honest majority, in most cases of monolithic blockchains, drives up the cost of running a full node as it seeks to scale, sacrificing decentralisation and security to the detriment of performance.

On the other hand, implementing a new blockchain poses challenges, such as high hardware requirements to run the computation needed for transactions and the overhead of generating a new base of validators to enable them to validate blocks and achieve the necessary consensus on transaction statuses.

Modular blockchains to the rescue?

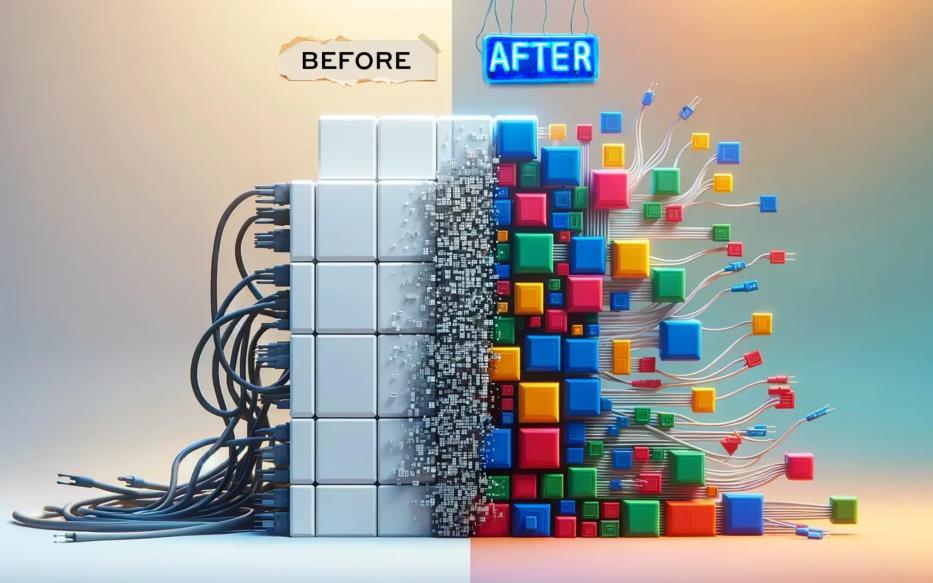

The problems currently experienced with traditional monolithic structures have spurred innovation within the industry to attempt to create blockchain networks that support the widespread global adoption in the vision of bringing 1B+ users to the Web3. Modularity is one of these innovations.

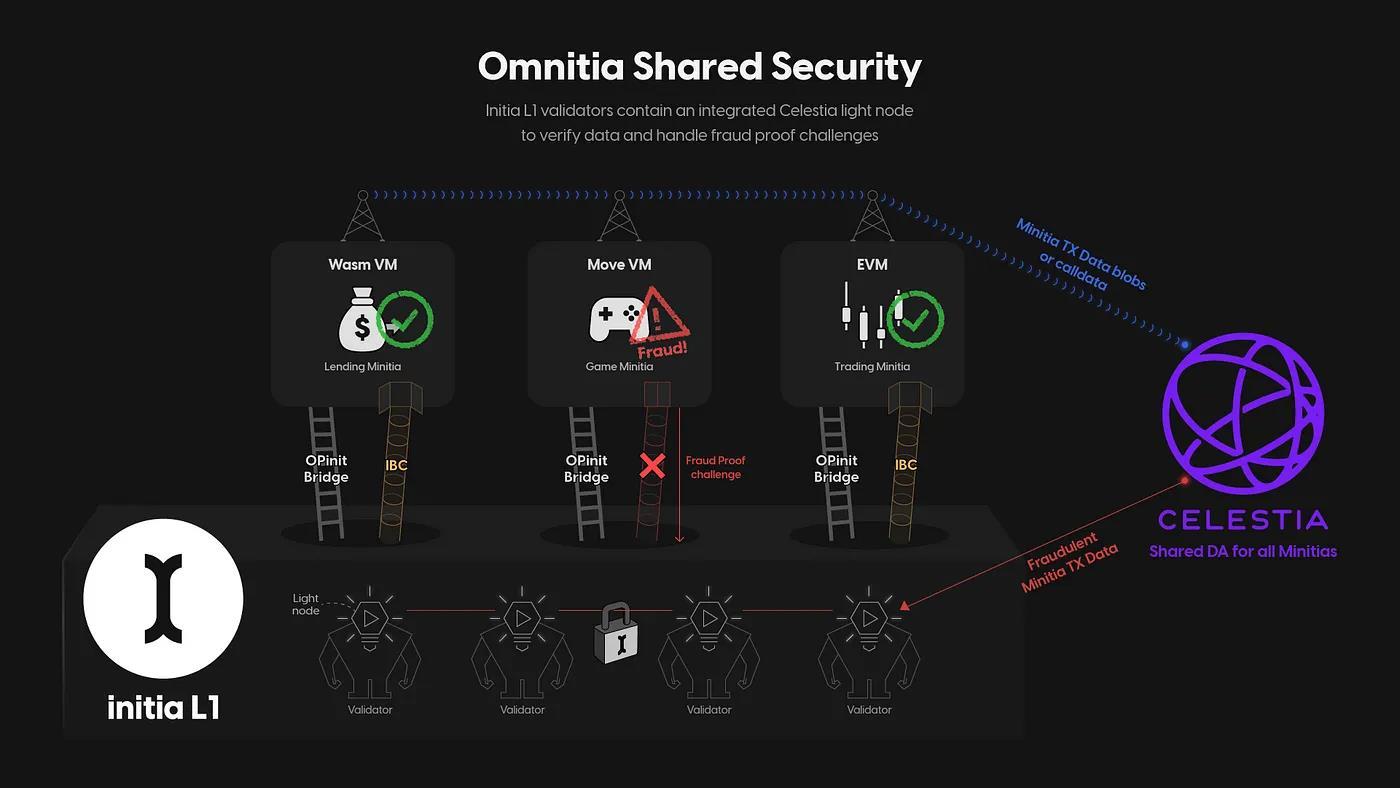

In simple terms, modular blockchains are architectures that distribute or split the fundamental functions of monolithic blockchains into separate, interoperable layers, specialising on a specific operation rather than performing at once: execution, settlement, consensus and data availability.

This distribution of functions in different layers allows modular blockchains greater flexibility and specialisation on specific market needs while effectively addressing the trilemma of traditional blockchains, such as scalability. In practice, one blockchain will be responsible for data availability (DA) while another, for example, is responsible for execution.

Source: Fuel

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Advantages of modular blockchains

Modular blockchains offer several advantages over their monolithic peers due to their flexibility to customise and optimise different blockchain components according to specific requirements. Let's take a look at some of them.

Scalability

By separating fundamental functions such as consensus, execution and data availability, modular blockchains can scale more efficiently by adding or upgrading individual modules as needed.

In the modular architecture, specialisation provides additional scalability while allowing applications to reside on separate chains so they do not have to compete with other dApps for processing computation and storage, thus improving application performance.

Customisation

Modular blockchains allow developers a great deal of flexibility, allowing the application's stakeholders to have control to modify the application according to their specific needs.

Thus, developers can, for example, choose the desired programming language, whitelist validators, hide data from the external world or choose consensus rules that align with their interests, allowing developers to adapt their applications to different use cases and implement improvements with full sovereignty without affecting the base layer.

Shared security

By being deployed on top of a base layer, modular blockchains do not have to deal with initiating their own set of validators that will support the network, meaning they can immediately leverage the security that the base layer has created, avoiding security fragmentation and saving effort and time to build its base of validators, allowing for an efficient system focused on delivering the functionality under its creation.

On the other hand, function separation contributes by improving security, and reducing the risk of systemic vulnerabilities as the layer can be independently enforced and audited. Thus, the modular architecture improves resilience by reducing the impact of failures in one module on the whole system.

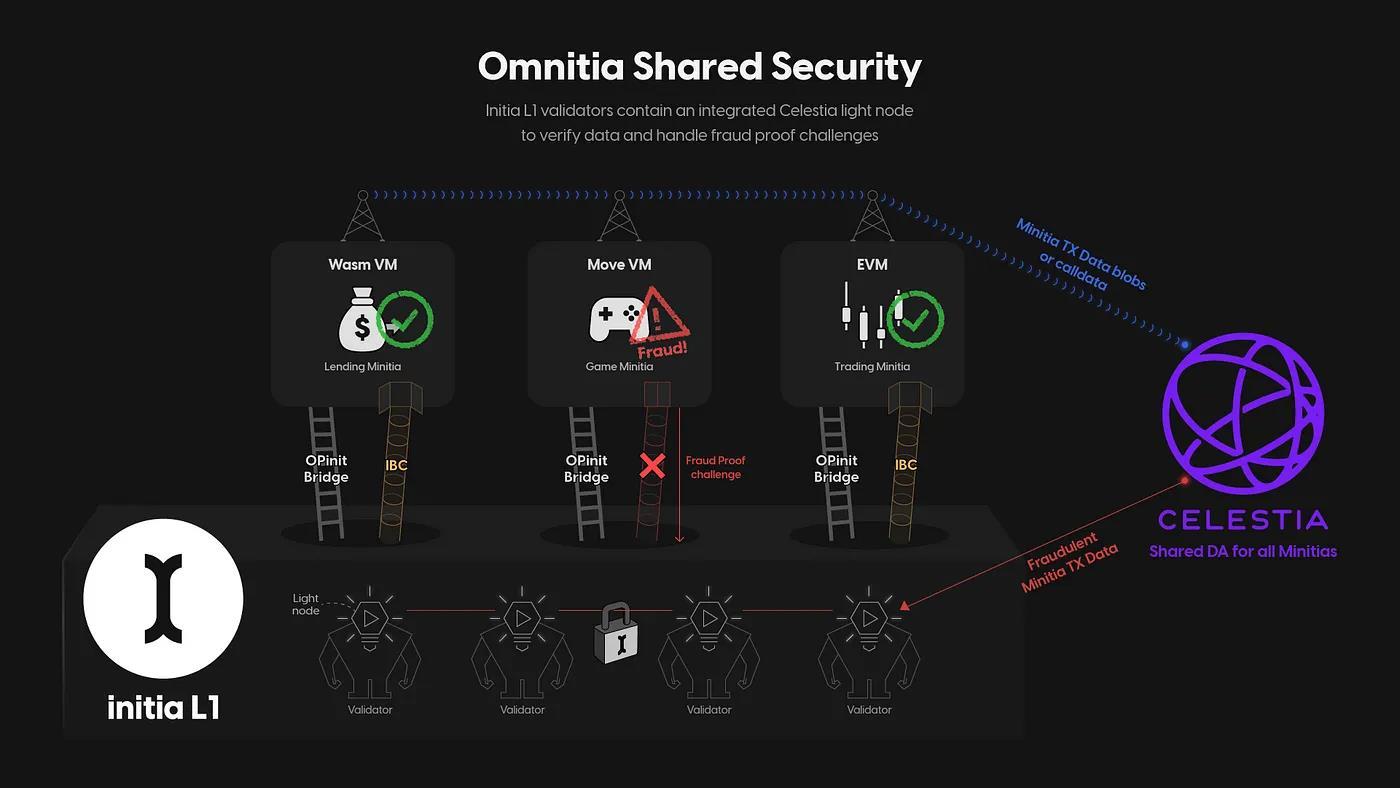

Source: Celestia

Source: Celestia

Cases like Eigen Layer are notable for leveraging the capital efficiency and security shared with the broad base of validators of its base layer: Ethereum.

Fields of use of modular blockchains

Modularity has now transcended beyond Ethereum, and we are seeing how each stack layer leads to the modular endgame. Let's look at some projects that are working to alleviate distributing key blockchain functionality in separate layers to improve scalability while preserving decentralisation and security.

Execution

Execution is how nodes process transactions and allow users to perform common operations such as staking, swaps, and trades. Modular execution layers decoupling computation and verification, allowing for much more robust security guarantees at scale and efficient computation.

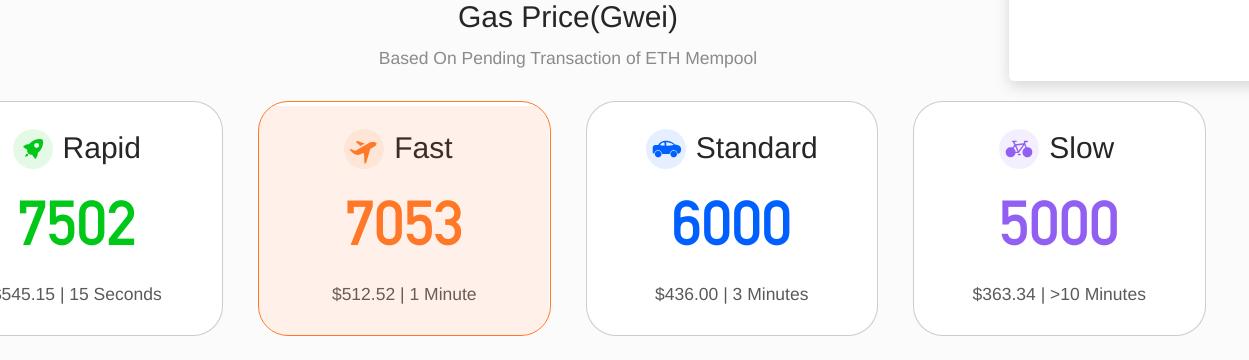

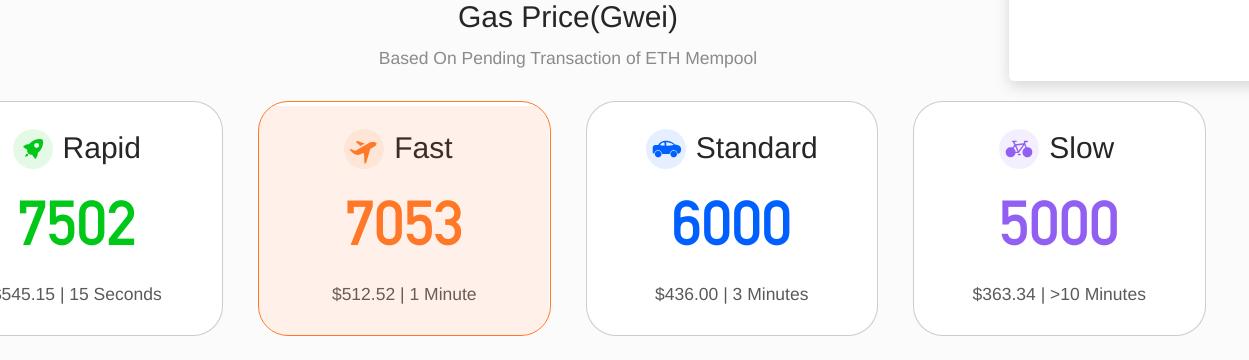

Currently, in monolithic design, there is a global marketplace of fees and serial execution, where there is a single gas fee for all types of transactions, regardless of the type of transaction or the blockchain "state" for a given transaction.

By separating the "state" that a particular transaction affects, you can have many users operating in different applications without seeing massive spikes in gas on the chain.

Cases like Fuel are a prime example of how to run a verifiable fraud or verifiable validity calculation system that leverages a modular blockchain for data availability. Unlike monolithic systems, verification does not happen at the execution layer but at the lower levels of the modular blockchain stack.

As a result, thin clients need only rely on a single complete node to guarantee the validity of the chain. Consequently, thin clients in modular execution layers have significantly higher security guarantees than their monolithic counterparts.

By adopting a design that enables high security under a single, honest minority assumption, the modular blockchain stack allows the development of blockchains with much higher performance than was previously possible with monolithic designs.

Cases like Fuel eliminate the need for modular execution layers to rely on the controversial EVM, optimising efficient and scalable computation, a superior developer experience and maximum security by achieving further advances in scalability by separating computation from verification.

In addition to Fuel, other notable examples in the modular execution layer are:

● Web Assembly (Wasm) from Fluent Labs

● MoveVM from Movement Labs and Lumio.

● LinuxVM from Cartesi

● CairoVM from StarkWare

● SolanaVM (SVM) from Eclipse

● zkVM from RiscZero

● World Engine (WE) from Argus

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Data Availability (DA)

This layer ensures that transaction data is published and available so everyone can easily calculate state and check state transitions.

DA is the guarantee that all transaction data is available to other network participants regardless of its validity. The ability of all participants to view and verify data ensures that the network is one to trust.

Source: cryptofrens

Applying modularity at this important layer means providing a fast and cost-effective data availability option, especially for those with a high volume of transactions, such as blockchain games.

Ethereum has a native DA layer, but modular blockchains such as Celestia have emerged to scale it. This modular blockchain focuses on ordering transactions and making their data available through Data Availability Sharding (DAS). The execution of smart contracts relies on the outsourcing of rollups.

Celestia separates consensus and data functions, allowing different applications to run their logic independently while sharing Celestia's security and consensus.

Source: Celestia Foundation

Eigen DA is another data availability (DA) solution powered by EigenLayer that takes the approach that protocol restakers function as DA nodes and are responsible for offloading a portion of the data to ensure credibility. EigenDA's security only scales with the introduction of new nodes without sacrificing scalability or decentralisation, achieving an average throughput of 10 MB/s with 100 nodes (~7 times more than Celestia).

Finally, you cannot overlook NEAR DA, a solution designed to provide low-cost data availability and publish it in dapps using NEAR's consensus mechanism to parallelise the network into multiple shards (parallel chains).

These fragments are aggregated to produce blocks and are only available on the network for approximately 60 hours, which does not slow down consensus. According to the NEAR DA team, its technology allows this modular layer to be 85,000 times cheaper than Ethereum for publishing data.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: NEAR DA

Source: NEAR DA

Other projects to consider in this blockchain functionality are:

● Zero Gravity from 0G Labs

● STARKEx from Starkware

● zkPorter by zkSync 2.0

● Any Trust - Arbitrum Nova from OffChain Labs

Consensus

Here, it is determined how to organise transactions and in which way to add new blocks to the chain.

A compelling project in this modular layer is Avail, which proposes an architecture that provides a base consensus layer that only creates agreement on what is the transaction data and how it is ordered, completely disassociating it from the question of validity.

Avail guarantees data availability through validation proofs, KZG commitments and erasure coding for DA mathematical guarantees, without the need for fraud proofs which run a sample of the client's data availability.

Generally, projects focused on offering modularity to the DA layer offer consensus-based solutions to decouple verification from block production. Therefore, Celestia and Ethereum Danksharding focus on scalable solutions for decoupling validity from ordering in the architecture with a modular approach.

Polkadot with its parachains, Cosmos with its network of blockchains interconnected through a central hub and Avalanche supporting multiple customised networks (subnetworks) also offer in their primitive a similar approach to the modular vision for scaling blockchain networks at the consensus layer.

Settlement

Settlemest's crucial function is to resolve transaction validation chain requirements and handle disputes by ensuring that the transaction cannot stopped and that the parties involved in the financial operation do not have their assets stolen after reaching the final settlement.

Ethereum is the dominant settlement layer for the modular stack. The network contains a wide range of rollup solutions that rely on the native security properties of the Ethereum validator set for economic security.

A great example here is Nexus, built by Neutron. Nexus leverages IBC and Hyperlane’s Modular Security stack to unleash liquidity flows between Cosmos, Ethereum and the Modular ecosystem. It enables fast and secure assets transfer to and from any rollups.

Other notable examples include Dymension, Initia, CrossFi, Hyperlane, Mitosis, Caldera, Polymer Labs and Catalyst, among other projects working on cumulative interoperability protocols that seek to solve the problem related to liquidity fragmentation.

Source: Initia

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Disadvantages of modular blockchains

As promising as modular blockchains may be, several disadvantages may hold back their mass adoption, especially in market share.

The modular narrative has resulted in a large amount of incompatible infrastructure and fractured liquidity, which places a considerable management burden on application developers and end users.

Source: Polygon Labs

As the narrative becomes more popular, we observe with concern the proliferation of blockchains and accumulative packages that try to compete with each other to capture the market liquidity available in vast ecosystems such as Ethereum, generating a degraded experience for users and developers, as well as a significant degree of complexity in the user experience.

Another major disadvantage of modular blockchains is the complexity of implementing and managing them, given that it may require more effort than monolithic blockchains to design, develop and maintain the netwo

In addition, composability is limited due to the challenges of integrating modules within a modular blockchain, which requires extensive coordination and additional testing.

Modular blockchains can pose security risks due to their blockchain model and architectural design, with potential vulnerabilities of individual modules communicating between add-ons or layers putting the whole at risk.

Source: Cross Finance

Source: Cross Finance

Applications of modular blockchains

Modular blockchains are used in traditional industry sectors and even forced many existing networks to adopt a modular approach to their design because of the scalability, flexibility and security advantages of this blockchain architecture.

Some fundamental applications where we are seeing the use of modular blockchains are:

● Decentralised Finance (DeFi): DeFi projects can benefit from scalability and flexibility, enabling faster and more efficient transactions. Cases such as Arbitrum and Optimism offer layer2 solutions to increase the speed and reduce transaction costs by leveraging the crypto-security of the base layer (Ethereum).

● Supply Chain: integrates different specialised layers to facilitate traceability and transparency in supply chains. OriginTrail is an example of connecting different supply chain systems using a modular architecture.

● Games and NFT: Blockchain games and NFT markets can handle large volumes of transactions and data more efficiently, something that modular blockchains can provide, as mentioned above. Flow is an example of the modular approach orchestrated by a holistic protocol designed for games to handle large transaction volumes efficiently.

Source: Flow Blockchain This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

A modular future

As we move towards a more interconnected digital age, modular blockchains emerge as an innovative solution to the scalability, flexibility and security issues that plagued monolithic blockchains. By separating critical functions into specialised layers, these architectures enable optimised performance and unprecedented customisation, benefiting developers and end users alike.

Projects such as Arbitrum and Optimism in DeFi, Flow in Gaming and NFT, and Celestia in blockchain infrastructure, stand out for their ability to deliver more efficient and adaptable solutions, paving the way for a wider adoption.

Modular blockchain implementation brings challenges, such as technical complexity and liquidity fragmentation, for this technology to reach its full potential. Despite these obstacles, modularity promises to revolutionise how we build and use blockchains, providing greater security and superior performance without sacrificing decentralisation.

Monad

written by Chris

written by Chris

A New Era for Ethereum Scaling?

Introduction

▪ Monad is a high-performance Layer 1 blockchain aiming to solve Ethereum's scalability challenges without sacrificing compatibility.

▪ Its innovative architecture, featuring parallel execution and pipelining, enables impressive transaction speeds and throughput.

▪ A diverse and growing ecosystem of projects is already building on Monad, focusing on DeFi and expanding into other areas.

▪ Monad’s plans will focus on community-driven initiatives and decentralised governance for protocol direction.

▪ Strategic partnerships with projects like LayerZero and Pyth Network showcase Monad's commitment to interoperability and robust data infrastructure.

▪ While the mainnet has yet to launch, Monad's potential impact on the Web3 landscape is significant. It offers a glimpse into the future of scalable, decentralised applications.

Imagine a Layer 1 blockchain that combines the familiar comforts of the Ethereum network with the speed and efficiency that rivals traditional systems. That's the bold vision behind Monad, a developer-centric platform making waves with its innovative approach to scalability.

Monad isn't just another EVM-compatible chain. It's fundamentally reimagining how Ethereum transactions are executed. By utilising pipelined and asynchronous processing, coupled with a highthroughput consensus mechanism, Monad aims to deliver an astonishing 10,000 TPS (transactions per second) – a 1000% improvement over Ethereum's current capabilities.

The result? A smart contract platform that promises the best of both worlds:

● Effortless Portability: Ethereum developers can seamlessly bring their existing applications to Monad without altering a single line of code.

● Blazing-Fast Performance: Monad's architecture allows quicker, more affordable transactions, paving the way for richer, more interactive applications.

Backed by a $19 million seed round led by Dragonfly Capital and a team boasting deep experience in highperformance systems, Monad is making a solid case for a new paradigm in blockchain scalability.

Is this the spark that ignites a new wave of Ethereum development? Let's dive deeper and explore the technology behind Monad's ambitious claims.

TL;DR

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Background & History

Monad burst onto the blockchain scene with a bold promise: to tackle Ethereum's scalability issues without sacrificing compatibility. While still in its development phase, with mainnet yet to launch, Monad has quickly gained significant attention for its innovative approach and developer-friendly environment. Early successes and strategic alliances have paved the way for rapid ecosystem growth, solidifying its position as a potential game-changer in the world of layer-1 blockchains.

Building Bridges, Building Trust

From the outset, Monad understood the importance of establishing a robust network. Its integration with LayerZero, a renowned cross-chain interoperability protocol, demonstrates a commitment to overcoming blockchain fragmentation. This partnership enables seamless connections between Monad and over 50 established blockchains, opening up vast possibilities for cross-chain applications and services.

Image: Monad and LayerZero from the partnership announcement on Monad’s Twitter

The collaboration with Pyth Network, a decentralised oracle provider, is another critical pillar in Monad's foundation. By leveraging Monad's high-performance design, Pyth aims to deliver faster and more accurate price data, a critical component for building trust and ensuring the integrity of DeFi activities on the network.

Monad's allure is evident in the increasing number of projects opting to build on its platform. As of early 2024, over 80 projects had pledged their commitment, a figure expected to reach 150 to 200 by the mainnet launch. The project's proposition is clear: compatibility with the widely used Ethereum Virtual Machine (EVM) and the promise of exceptional speed and scalability.

Currently, most projects within the Monad ecosystem focus on DeFi. Orderly Network, Pike Finance, and Switchboard Oracles are innovative protocols leveraging Monad's capabilities to create new financial instruments and services.

Beyond DeFi: A Diverse Horizon

However, Monad's ambitions extend far beyond finance. Its recent integration with the Wormhole cross-chain bridge signals an expansion into a broader range of applications, including gaming, NFTs, and even potential enterprise use cases. Adding projects like Notifi Network, Swaap Finance, Catalyst, and many others demonstrates a growing appetite for Monad's capabilities across diverse sectors.

The Wormhole partnership unlocks cross-chain interoperability for Monday, with many blockchain networks connected. (Image: $225 Million Raised in Wormhole Token Sales via Wormhole blog post)

Monad's rapid growth and expanding ecosystem testify to the demand for scalable, developer-friendly blockchain solutions. As the project matures and approaches its mainnet launch, it's well-positioned to make a lasting impact on the future of Web3.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Monad's journey has been marked by fast progress. From its inception in New York City in 2022 to securing $19m in funding in 2023 and releasing its technical documentation in September of the same year, the team has moved swiftly to establish its vision.

What's Next?

With the testnet launch slated for the latter half of 2024 and the mainnet expected to follow closely behind, Monad's future direction is coming into sharper focus. Here's what we can anticipate:

● A New Era for DEXs: As we stated before, Monad's architecture is built for speed and scalability. The team will likely leverage this advantage to explore building a genuinely decentralised limit order book exchange, which could address many of the limitations faced by current DEXs and offer traders a more efficient and robust platform.

● Expanding Possibilities: As Monad's technology gains traction, we expect to see a surge in diverse projects building on the platform. Its EVM compatibility makes it easy for Ethereum developers to port their existing applications, while the promise of increased performance opens up new opportunities for innovation.

● Community-Driven Growth: Last but not least, as the project matures, Monad envisions a future where its community plays an even more significant role in shaping its development. This could include introducing a DAO governance model and giving token holders a say in critical decisions.

While the exact trajectory remains to be seen, Monad's emphasis on performance, developer experience, and community engagement positions it well for a bright future. Whether you're a developer, investor, or simply curious about the future of blockchain, Monad is a project to keep a close eye on for sure.

Roadmap

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Comparative Analysis

Monad is a Layer-1 smart contract blockchain built with a laser focus on Ethereum’s scalability. Early projections suggest it could become one of the most high-throughput blockchains within the next two years, rivalling even industry giants like Solana.

However, unlike established networks with vast TVL and user bases, Monad has yet to launch on mainnet. While a rapid user influx is expected post-launch, achieving widespread adoption will take time.

Ethereum Compatibility as a Differentiator

Monad distinguishes itself from other highspeed chains by marrying parallel execution (similar to Aptos, Sui, and Solana) with full EVM compatibility. This allows developers to easily port existing Ethereum applications to Monad without needing to rewrite code in a different language. In contrast, while impressive in their performance, chains like Aptos and Sui present a steeper learning curve for Ethereum developers.

Monad vs. Solana

Solana is often hailed as the current scalability champion in the blockchain space. However, Monad aims to match and eventually surpass Solana's throughput. While Solana boasts impressive speed and a large user base, some critics argue its design is relatively centralised compared to Monad's approach.

Moreover, Solana's lack of native EVM compatibility could be a significant disadvantage in the long run. While Solana can support Ethereum dApps via the Wormhole bridge, the frictionless portability Monad offers to Solidity developers could be a decisive factor in attracting a broader developer community.

Monad vs. NEAR

NEAR Protocol, a PoS blockchain with its own innovative sharding technology, aims to process a remarkable 100,000 transactions per second once its Nightshade sharding is fully implemented. While NEAR is a formidable competitor, Monad's use of pipelining within an EVM-compatible framework could give it an edge in decentralisation and throughput.

The Wider Competitive Landscape

Ethereum-compatible chains like Avalanche, BNB Smart Chain, Fantom, and Injective also vied for the scalability crown. However, Monad's unique architecture and early partnerships suggest it has the potential to outperform these competitors. Other blockchains boasting impressive scalability claims include Ripple, Stellar, Algorand, and Kadena.

Monad's Potential: A Long-Term View

While still in its early stages, Monad's combination of decentralisation, extreme scalability, and EVM compatibility is a powerful trifecta. The ability to achieve 10,000 TPS initially hints at even more significant throughput potential in the future.

Challenges remain, particularly in gaining adoption against established rivals. However, the project's promising partnerships and a growing ecosystem of over 80 projects signal a strong start. It's becoming more apparent that Monad has the potential to disrupt the blockchain landscape, especially in areas like DEXs, trading platforms, and other high-performance applications.

Official Links ▪ Website ▪ Documentation ▪ Blog ▪ Twitter ▪ Discord ▪ Telegram

Why Use Monad? A User's Perspective

Monad offers a familiar yet enhanced experience for those accustomed to Ethereum's ecosystem. You can interact with Monad using your favourite Ethereum-compatible wallets like MetaMask and explore transactions on block explorers like Etherscan. Best of all, your existing Ethereum keys work seamlessly on Monad.

So, what sets Monad apart?

Monad's secret weapon is its innovative approach to transaction processing. It introduces two powerful concepts to the EVM:

● Parallel Execution: Imagine multiple cores working together to process transactions simultaneously while maintaining the correct order. This would drastically increase throughput, enabling Monad to handle far more transactions per second than current blockchains.

● Superscalar Pipelining: Picture an assembly line where different transaction stages are tackled concurrently. This pipelining technique optimises resource utilisation, squeezing out even more efficiency from the system.

This innovative architecture translates to tangible benefits for users:

● Lower Fees: Monad's enhanced efficiency means lower transaction costs, making it accessible to more users.

● Faster Transactions: No more waiting around for blocks to confirm! Monad's architecture allows for near-instant transaction finality.

● Scalable Applications: The increased throughput opens doors for more complex and interactive dApps that weren't feasible on previous monolithic blockchains.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Why Monad Matters

Monad's potential impact is huge. Imagine a world where decentralised applications can handle millions of daily active users, offering the same seamless experience we've come to expect from centralised platforms. Monad's innovations could be a major catalyst for the widespread adoption of Web3 technology.

How to Get Started

Monad's public testnet will launch soon, offering users their first chance to experience the platform's speed and user-friendly interface. Watch their official channels for updates, and get ready to add Monad to your wallet!

In summary, Monad offers:

● Familiarity: Users can use their existing Ethereum tools and wallets.

● Speed: Enjoy faster, cheaper transactions than other L1 blockchain networks.

● Scalability: Unlock the potential of next-generation dApps

Technical Concepts

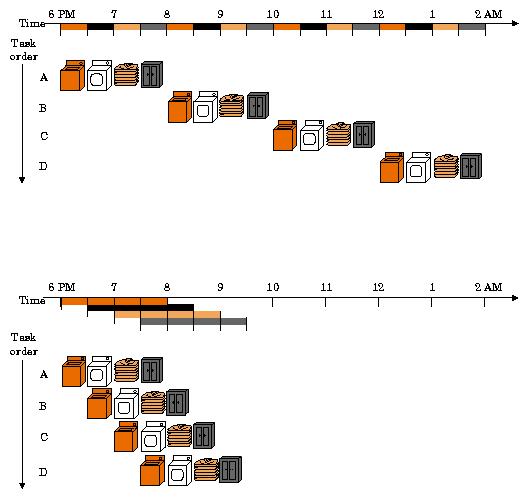

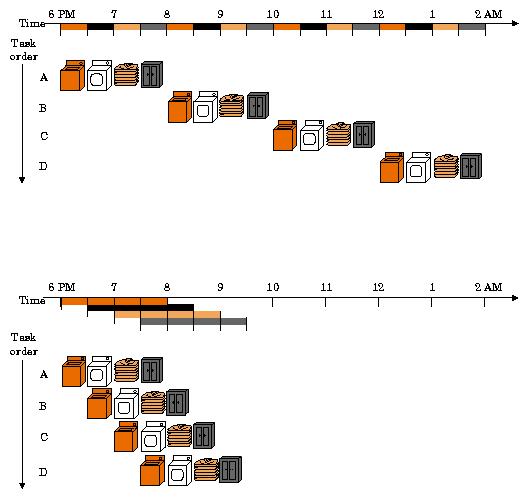

1. Pipelining: Monad's Secret Weapon for Speed

Pipelining is a core innovation behind Monad's impressive transaction finality. Imagine a factory assembly line where different workers specialise in individual tasks. One worker attaches a component, another paints it, and so on. Each worker focuses on their specific job, allowing the entire process to move much faster than if one person had to do everything themselves.

Pipelining in Monad works similarly. Instead of processing each transaction from start to finish in a single step, the process is divided into smaller, independent stages. These stages run in parallel, with different parts of the network handling various aspects of the transaction. This allows Monad to efficiently utilise its resources, dramatically boosting throughput – the number of transactions it can process per second.

Think of doing laundry. The "non-pipelined" way is to wash one load, then dry it, then fold it, and then put it away before starting the next load. A pipelined approach is much more intelligent: start the second load in the washer as soon as the first one goes into the dryer. This way, multiple loads are processed simultaneously, utilising both the washer and dryer simultaneously.

In Monad's case, the ‘’laundry loads’’ are transactions, and the ‘’washer and dryer’’ are different parts of the network specialised in specific tasks. By pipelining these tasks, Monad can process thousands of transactions concurrently, leading to faster transaction times and a more scalable blockchain.

A Simple Analogy: The Laundry Pipeline

Image: Monad’s documentation

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This isn't just about theoretical speed. Monad's pipelining architecture directly translates to a better user experience. Lower fees, faster confirmations, and the ability to build more complex applications are just some of the benefits users can expect from this innovative approach.

Asynchronous I/O: The Key to Keeping Things Moving

While Pipelining focuses on optimising individual transactions, Monad also uses another secret weapon to maintain high throughput: Asynchronous I/O (Input/Output). Think of it as a way to avoid traffic jams within your computer system.

The Bottleneck Problem

Your computer's CPU is the brain of the operation, but it relies on slower components like disk storage and network connections for data. Imagine the CPU as a lightning-fast chef while the disk and network are the tortoisepaced delivery drivers. If the chef waits for every ingredient to arrive before starting the next dish, the whole kitchen slows down.

Asynchronous I/O solves this problem by allowing the CPU to multitask. Instead of waiting idly for data from slower components, the CPU sends a request and then moves on to other tasks. When the data finally arrives, the CPU handles it without missing a beat.

Numbers

To appreciate how big of a deal this is, let's look at some numbers:

Notice the vast differences? Asynchronous I/O lets the CPU delegate slow tasks to the disk or network and then continue processing other things. When that data finally arrives, it's like a just-in-time delivery, keeping the whole system running smoothly.

Overcoming Hurdles

Even with advanced tech like memorymapped storage (which some databases use to interact with disks), Asynchronous I/O is essential. Memory-mapped storage can be surprisingly slow, often blocking the CPU's progress. Monad keeps the data flowing by making these interactions asynchronous and avoids bottlenecks that would otherwise hinder performance.

This approach is vital to Monad's efficiency. Allowing different system components to work concurrently maximises throughput and sets a new standard for blockchain performance.

The Team

The Monad Labs team comprises experienced professionals from various backgrounds, including traditional finance, fintech, and academia. They deeply understand lowlatency programming, distributed systems design, and blockchain technology. Some specific titles are software developer, blockchain researcher, systems engineer, product and tech leader, and master hacker.

You can find more information about the Monad Labs team on their website or Linkedin page: https://www.monadlabs.xyz/team, https://www.linkedin.com/company/monadl abs/people/

Conclusion

Monad's bold vision for a scalable, EVM-compatible Layer 1 blockchain represents a significant step forward in the quest for a more accessible and efficient DeFi environment. By tackling the limitations of existing blockchains head-on, Monad aims to empower developers and users alike, opening up new possibilities for decentralised applications and services. While the project is still in its early stages, its innovative technology, strategic partnerships, and rapidly growing ecosystem suggest a bright future.

Whether Monad can genuinely deliver on its ambitious promises remains to be seen. However, its commitment to decentralisation, community-driven development, and a focus on realworld utility make it a project worth watching closely. As the crypto landscape continues to evolve, Monad could be a catalyst for the next wave of blockchain adoption, bringing us closer to a truly decentralised and interconnected future.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

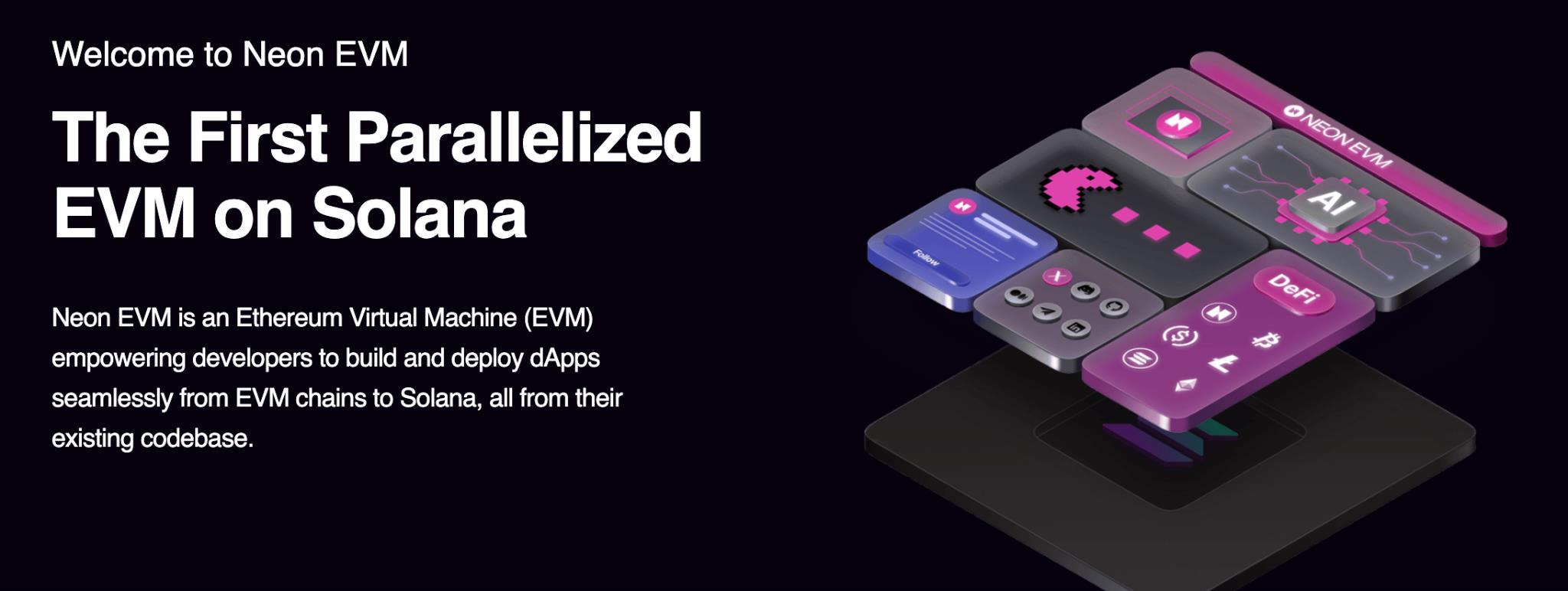

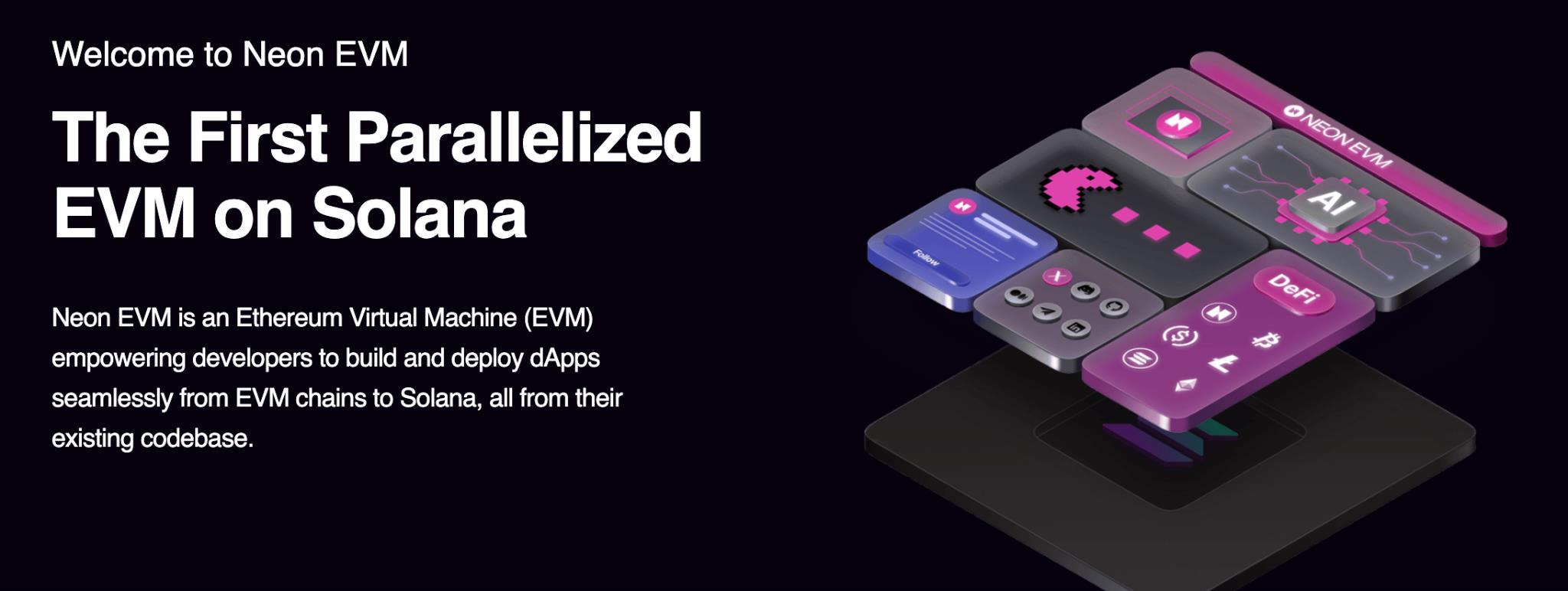

The Neon EVM Protocol and the NEON Token

written by Chris

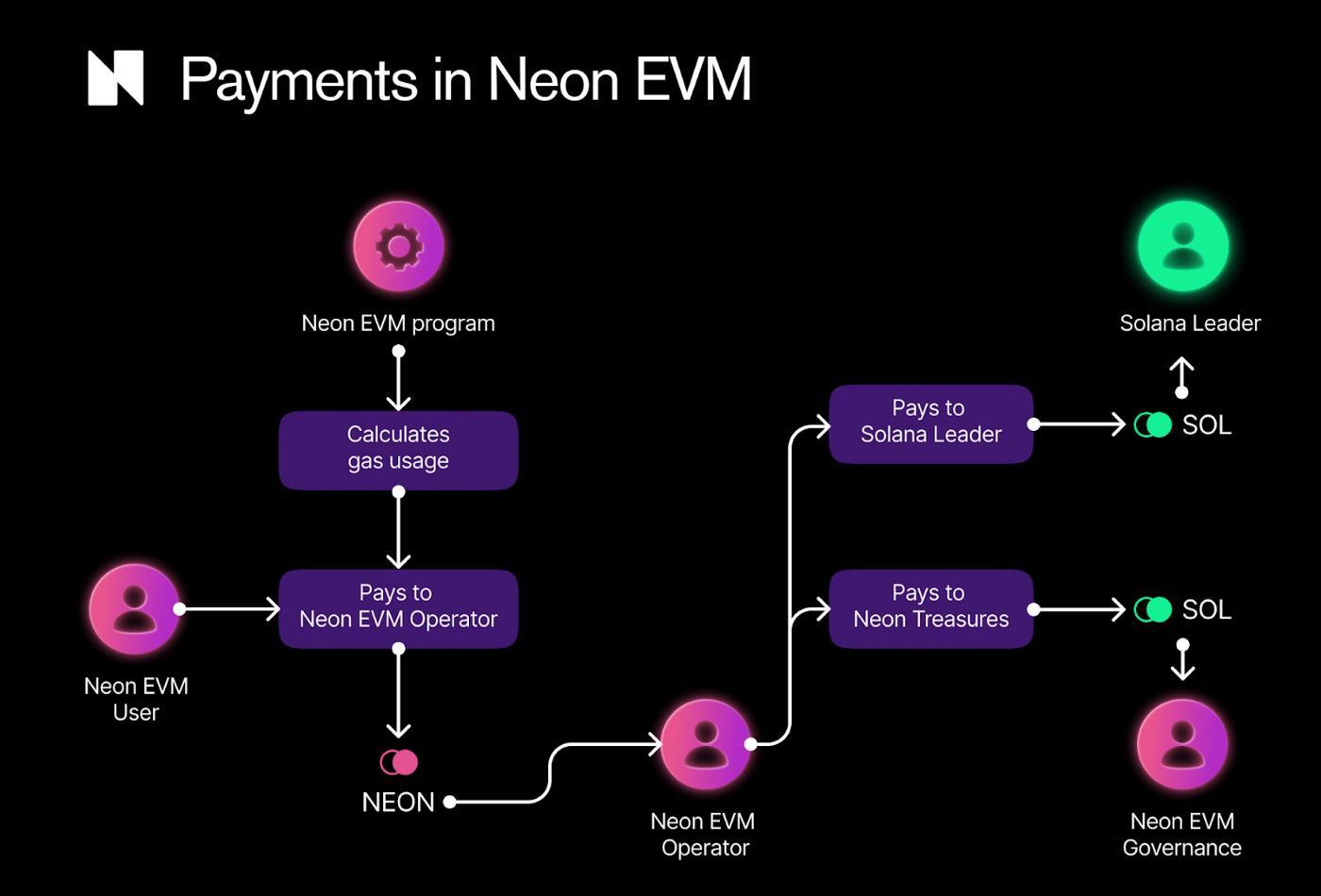

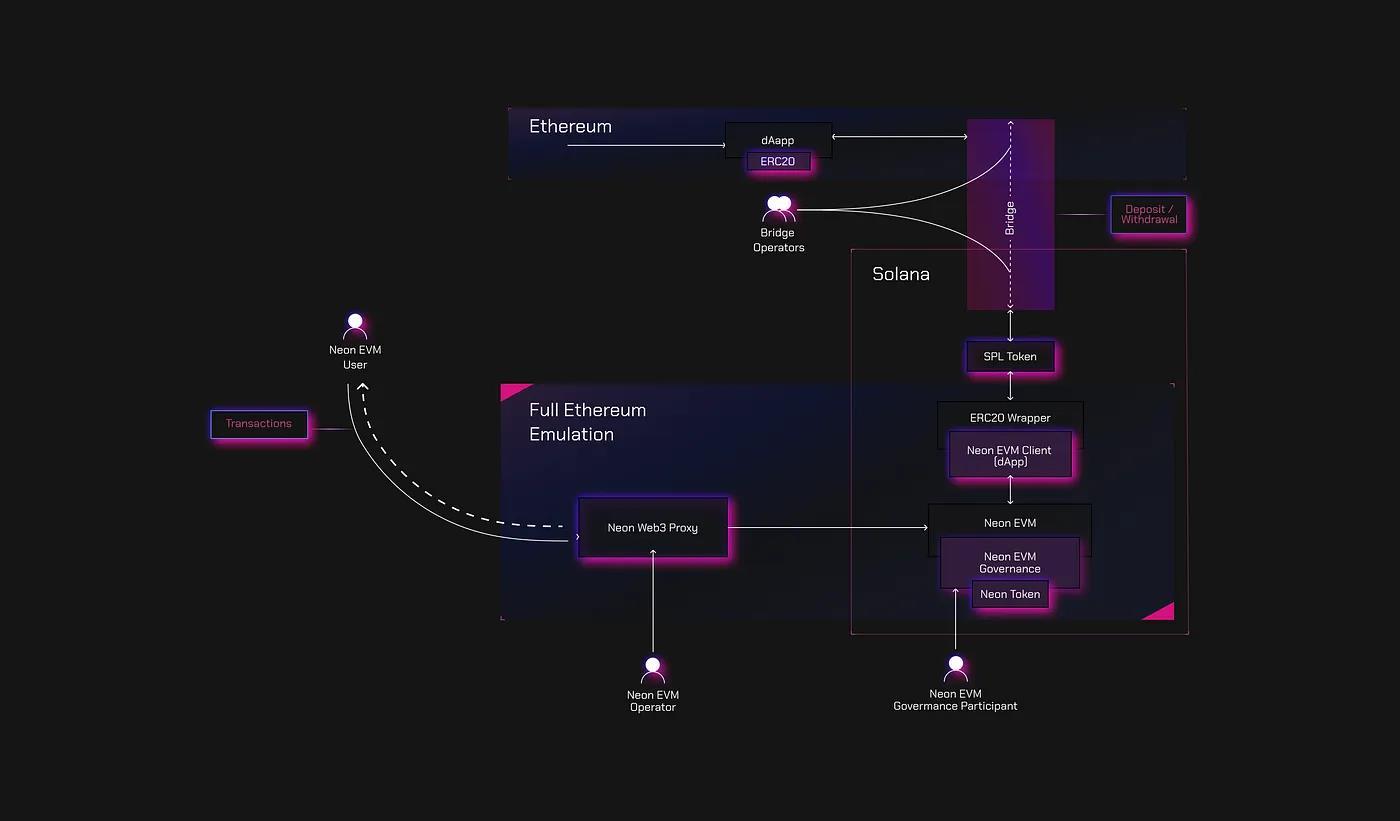

TL;DR; Neon EVM,

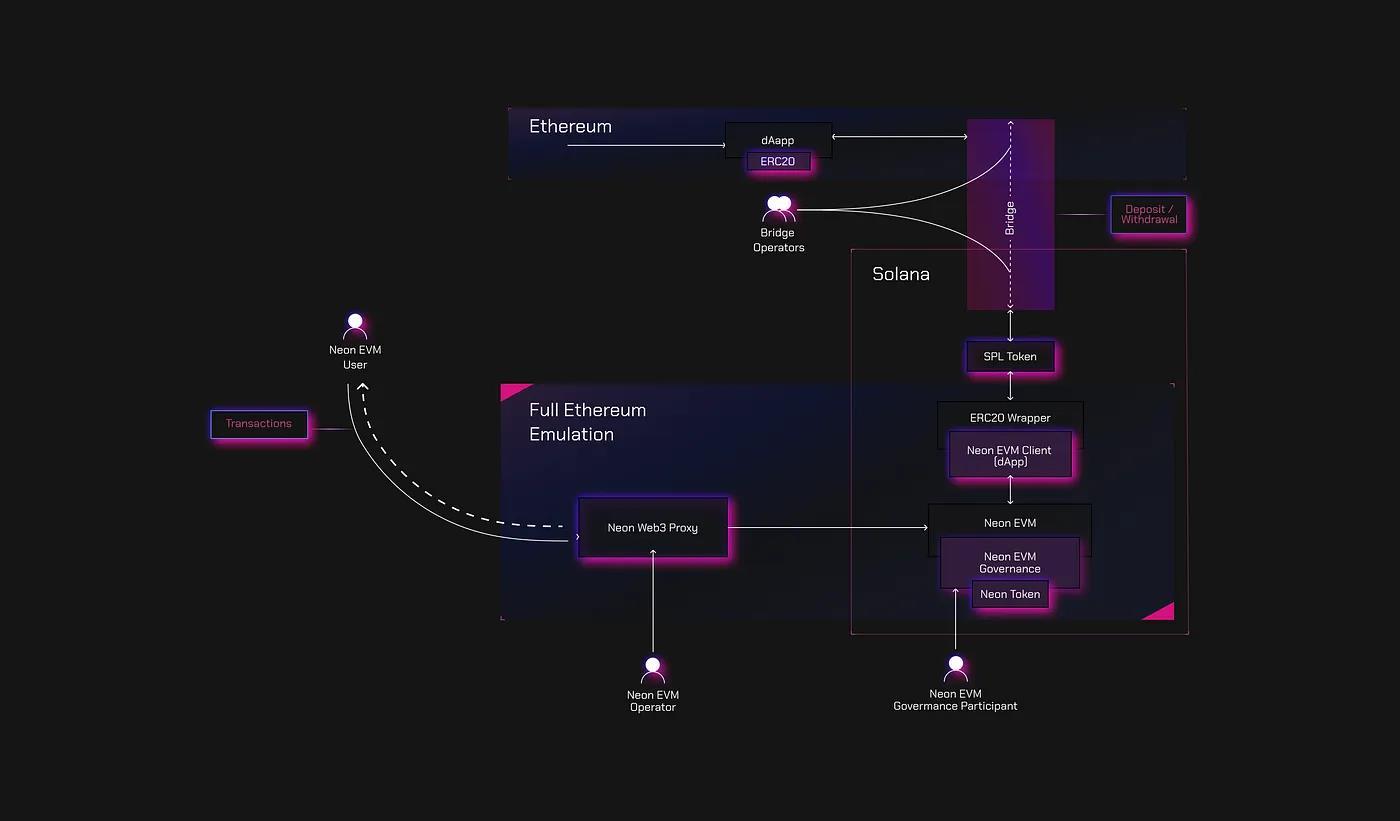

▪ Bridges Ethereum and Solana, offering the best of both worlds: Ethereum compatibility with Solana's speed and scalability.

▪ Enables Ethereum developers to easily port existing dApps or build new ones on Solana using familiar tools and languages.

▪ Employs a unique architecture with Neon EVM Program, Neon Proxy, and Neon DAO to facilitate seamless cross-chain operation.

▪ Provides a comprehensive toolkit for developers, including NeonScan, NeonPass, NeonFaucet, and Tracer API.

▪ Integrates with key service providers like Chainlink and Pyth Network oracles for secure access to realworld data.

▪ Poised for future growth, with a roadmap outlining ambitious plans for increased functionality, security, and community engagement.

Introduction

The blockchain space has long been dominated by two distinct forces, well, at least most recently, Ethereum's established innovation hub and Solana's high-speed transaction capabilities. Each boasts unique advantages, but their inherent differences have created a barrier for developers and users seeking the best of both worlds.

Neon EVM emerged as a bridge between these two ecosystems. It offers a pioneering solution that allows Ethereum-style smart contracts to run seamlessly on the Solana blockchain. Ethereum developers can tap into Solana's lightning-fast speeds and low fees without abandoning their existing tools and knowledge.

Imagine harnessing Ethereum's vast developer community, mature tooling, and established ecosystem while simultaneously unlocking Solana's performance and scalability. That's the promise of Neon EVM. It's a platform designed to empower developers, giving them the flexibility to build decentralised applications that can truly scale to meet the growing demands of the Web3 world.

Whether you're a seasoned Ethereum developer looking to expand your reach or a Solana enthusiast eager to see more innovation on your favourite chain, Neon EVM opens up a world of possibilities. By combining the best of both worlds, it aims to spark a new wave of creativity and adoption in the blockchain space.

Let's delve into how Neon EVM achieves this technological feat and explore its potential impact on the future of Web3.

Background & History

Neon EVM is positioned as a solution to bridge the capabilities of two of the most prominent blockchain networks, Ethereum and Solana. It seeks to do this by enabling Ethereum's widelyused smart contracts to function seamlessly on Solana's high-speed infrastructure.

Ethereum has solidified its place as the go-to platform for dApps. Its large community of developers, extensive tooling, and numerous successful projects like Uniswap and CryptoPunks are testaments to its dominance. However, high gas fees and scalability limitations have become growing concerns, hindering the user experience and limiting the potential of specific applications.

Solana, on the other hand, offers a compelling alternative with its exceptional transaction speed and affordability. Its innovative architecture can handle tens of thousands of transactions per second at a fraction of the cost of Ethereum. However, until now, porting Ethereum's wealth of dApps to Solana has been a complex undertaking due to fundamental technological differences.

The Best of Both Worlds

Neon EVM changes the game by enabling Ethereum-style transactions to be processed directly on the Solana blockchain. This allows developers to leverage their existing Solidity knowledge and tools to create dApps that benefit from Solana's performance advantages.

The result is a powerful combination: the established ecosystem and developer community of Ethereum, coupled with the speed and scalability of Solana. This opens up a world of possibilities where existing dApps can scale to new heights, and innovative applications previously hindered by Ethereum's limitations can finally flourish.

In essence, Neon EVM serves as a bridge, allowing both communities to reap the rewards of each other's strengths. It's a testament to the collaborative spirit of the blockchain space, where innovation and cross-chain solutions drive us towards a more interconnected and efficient future.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

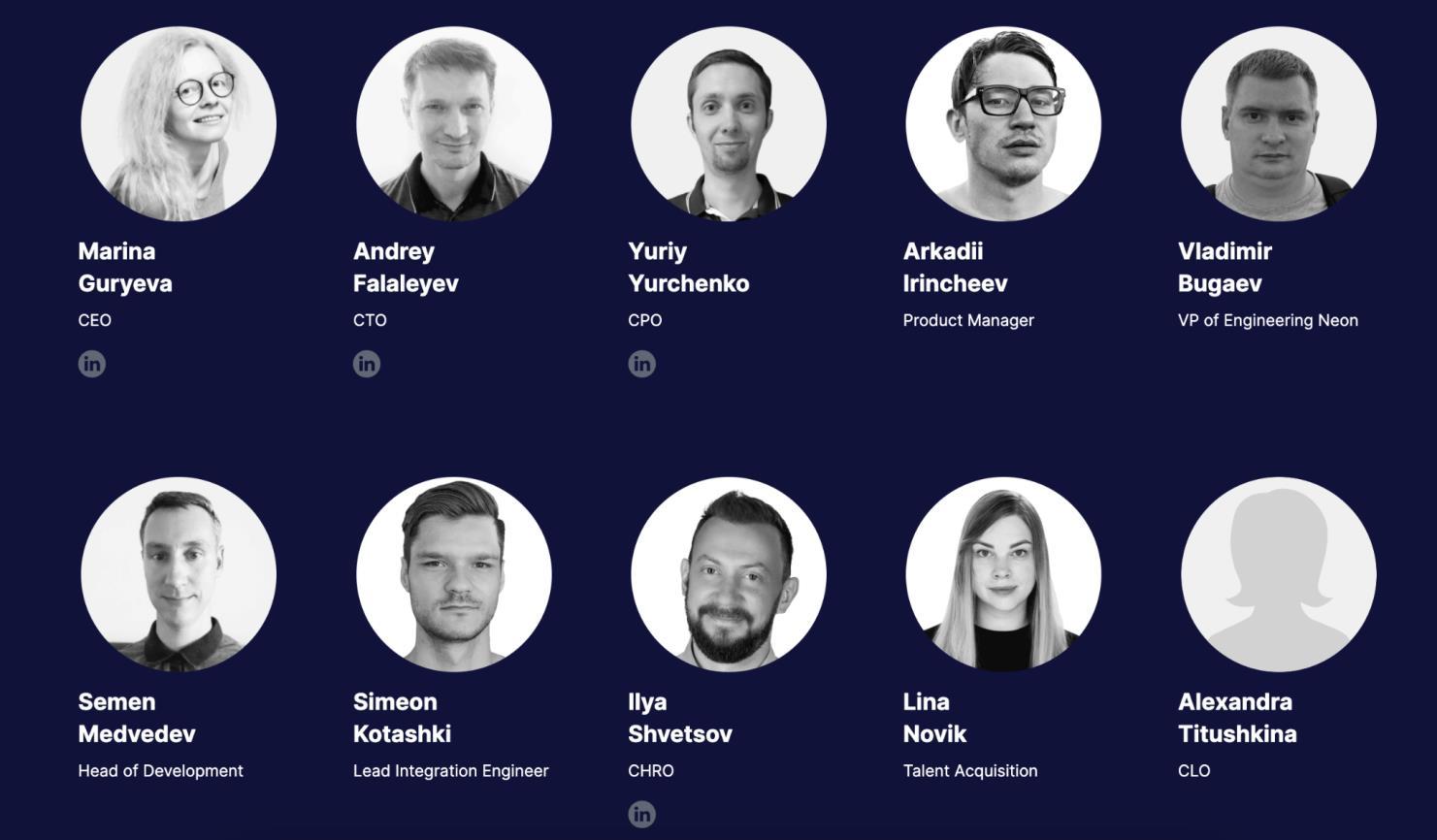

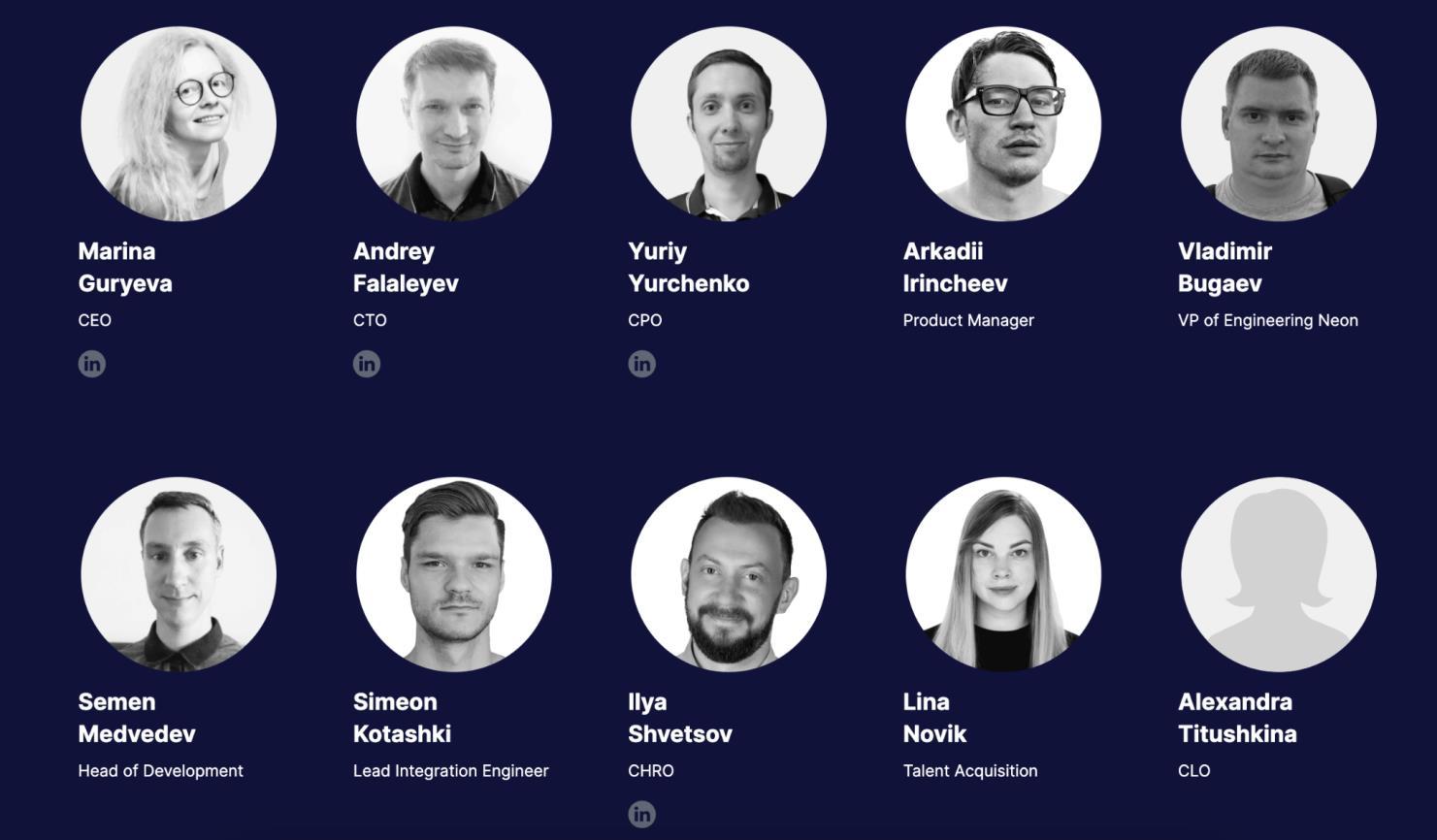

The Team and DAO

Behind the Neon EVM protocol is a dedicated team of enthusiasts and professionals who are passionate about bridging the gap between Ethereum and Solana. The team is fully remote and attracts talent from around the globe with expertise in blockchain development, smart contract engineering, and community building.

Neon Labs, the organisation behind Neon EVM, actively encourages those who share its vision to join its ranks and contribute to the project's ongoing evolution. Its commitment to a decentralised future is evident not only in its technology but also in its governance model.

Empowering the Community: The Neon DAO

The Neon DAO (Decentralized Autonomous Organization) is a testament to Neon's ethos of community-led decision-making. The DAO comprises core developers, application developers, users, and other stakeholders who collectively steer the protocol's development.

The Neon DAO operates through a system of decentralised Assemblies, each focused on a specific area:

● Ecosystem Focus Area: Responsible for promoting community initiatives and fostering longterm growth within the Neon ecosystem.

● Development Focus Area: This Assembly handles the technical aspects of the Neon EVM, ensuring continuous improvements and updates.

● Security Focus Area: Vigilantly monitoring the other two areas, the Security Focus Area works to prevent malicious activity and protect the integrity of the DAO.

The voting process is transparent and straightforward, with each NEON token equating to one vote. The community submits, discusses, and ultimately decides upon proposals, ensuring that the project's direction aligns with the collective vision of its stakeholders.

For a more comprehensive understanding of the governance structure, and the Neon DAO, you can visit the Neon Labs website and explore their detailed documentation:

▪ Neon DAO Overview: https://docs.neonevm.org/docs/gover nance/overview

This collaborative approach to governance empowers the community and strengthens Neon EVM's resilience and adaptability. It's a model that aligns with the decentralised ethos of Web3 and sets the stage for a more inclusive and sustainable future for the project.

Official Links

Website: https://neonevm.org/

Docs: https://docs.neonevm.org/docs/quick_start

Github: https://github.com/neonevm/neon-evm

Discord: https://discord.gg/neonevm

Twitter: https://twitter.com/Neon_EVM

Medium: https://medium.com/@neon_evm

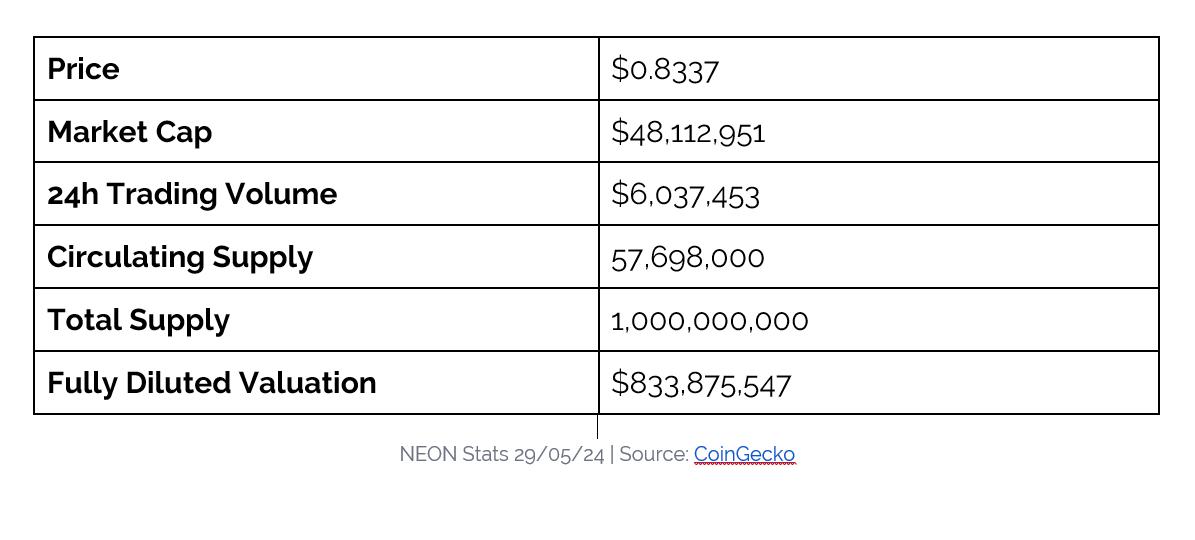

The NEON Token

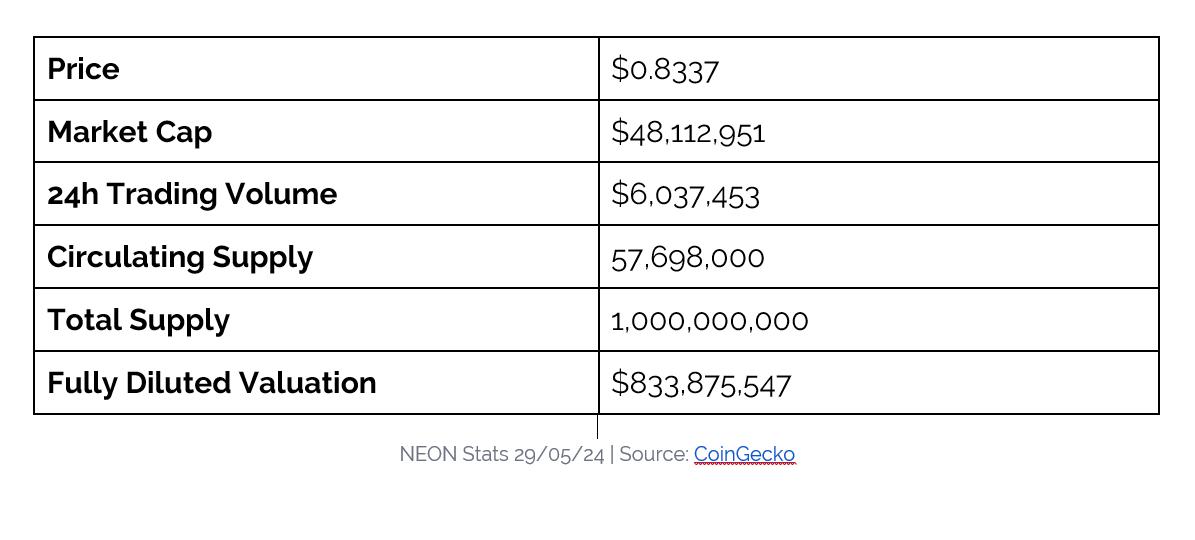

Current Stats

Here are the market stats of the NEON token at the time of writing:

Tokenomics

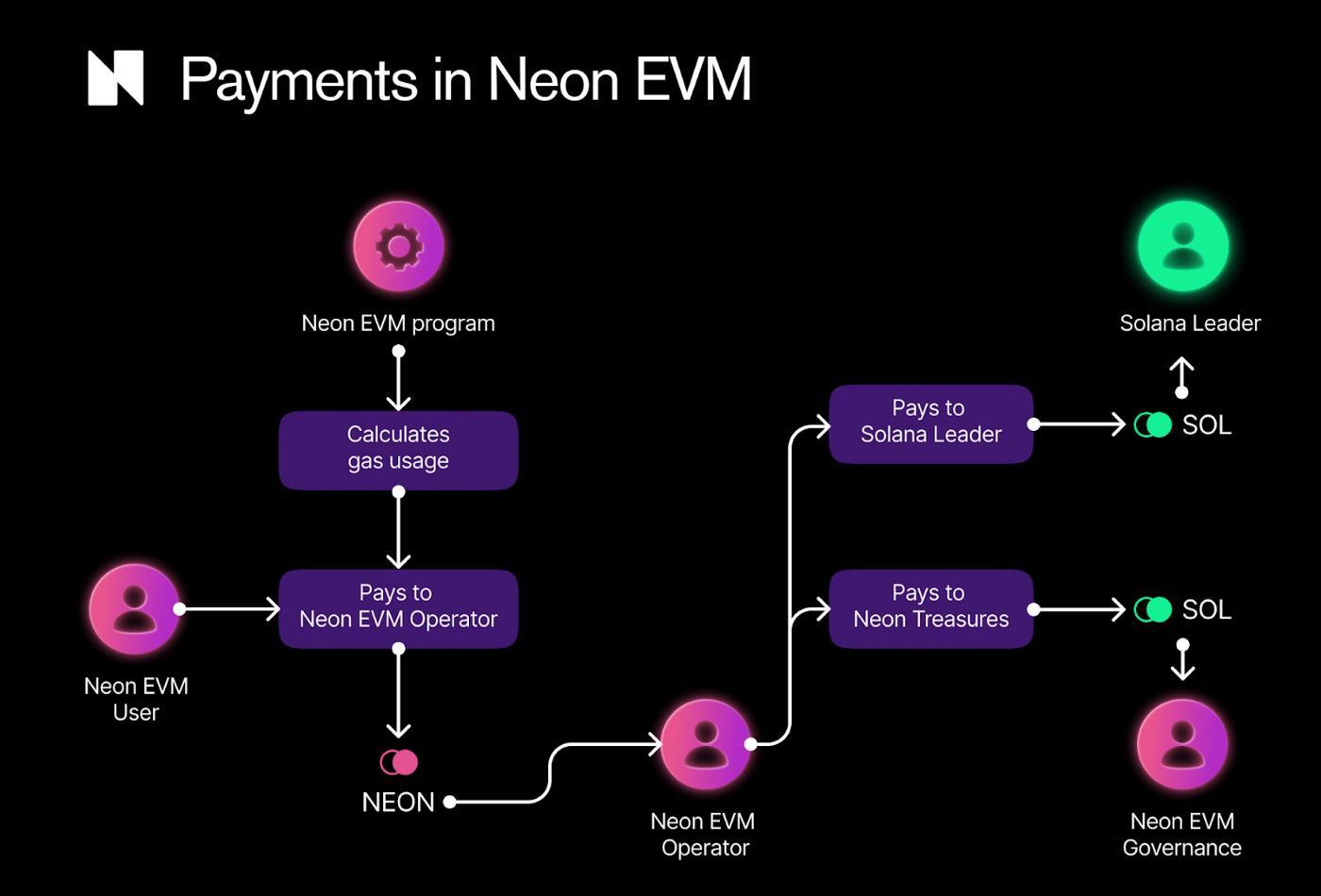

NEON, the native utility token of Neon EVM, serves two critical functions:

1. Fee Payments: NEON is used to pay for transaction fees on the Neon EVM network. This creates a consistent demand for the token and helps maintain a healthy ecosystem.

2. Governance: NEON holders participate in the Neon DAO, wielding voting power to influence decisions about the project's future direction and the use of treasury funds.

Distribution and Allocation

With a fixed supply of 1 billion NEON tokens, the allocation has been carefully structured to balance the needs of different stakeholders and promote long-term growth:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Important Considerations:

▪ Participation had KYC/AML checks and users were restricted from certain regions (USA, Canada, China, and South Korea).

▪ The vesting schedules for various allocations promoted a gradual release of tokens, aimed for stability and long-term growth.

This transparent and well-balanced token allocation strategy reflects Neon EVM's commitment to community involvement and sustainable development. The project aims to create a thriving ecosystem that benefits all stakeholders by rewarding early supporters and incentivising ongoing participation.

Neon Ecosystem