Bought To You By themoonmag.com

Issue 33 is upon us, and The Moon Mag just keeps getting better, packed full of information with no bias and no bullshit!

In this issue, we get NAKED… Naked Trading, that is. I will break it down for you, explaining why you should strip back the charts to understand the wave momentum. Clothes are definitely optional for that article.

We delve into all the hype surrounding BASE Chain and Layer 3s. Samantha breaks it down into easy-to-understand information because that's what we do best!

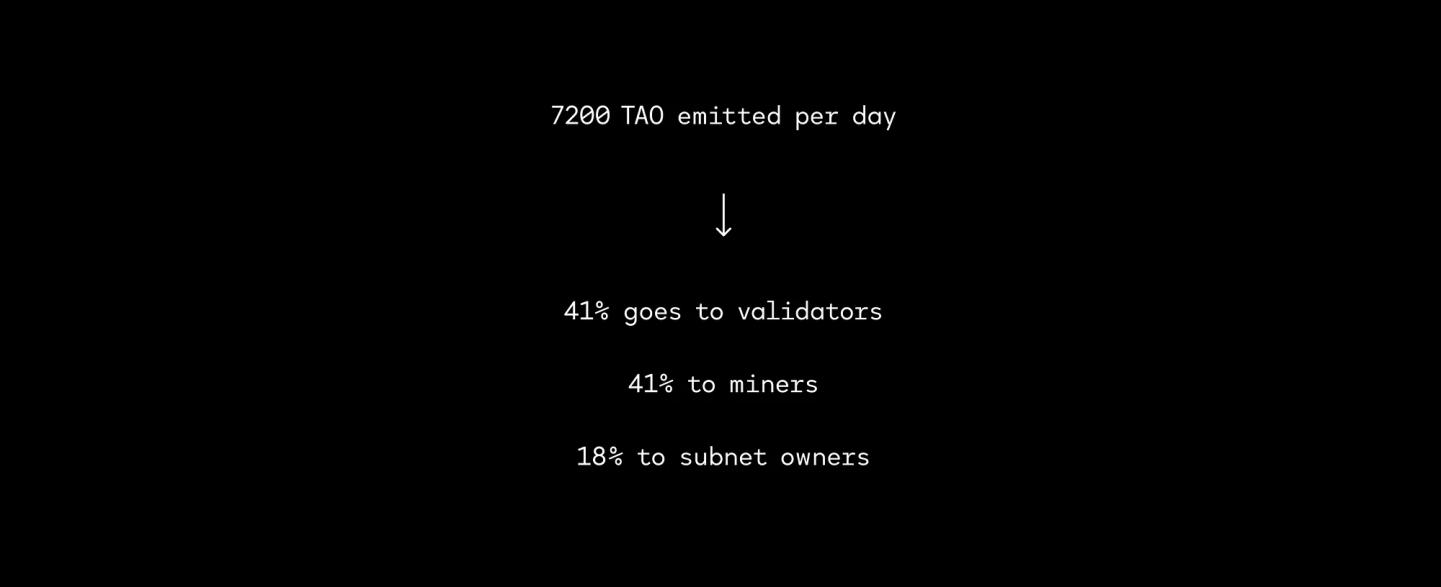

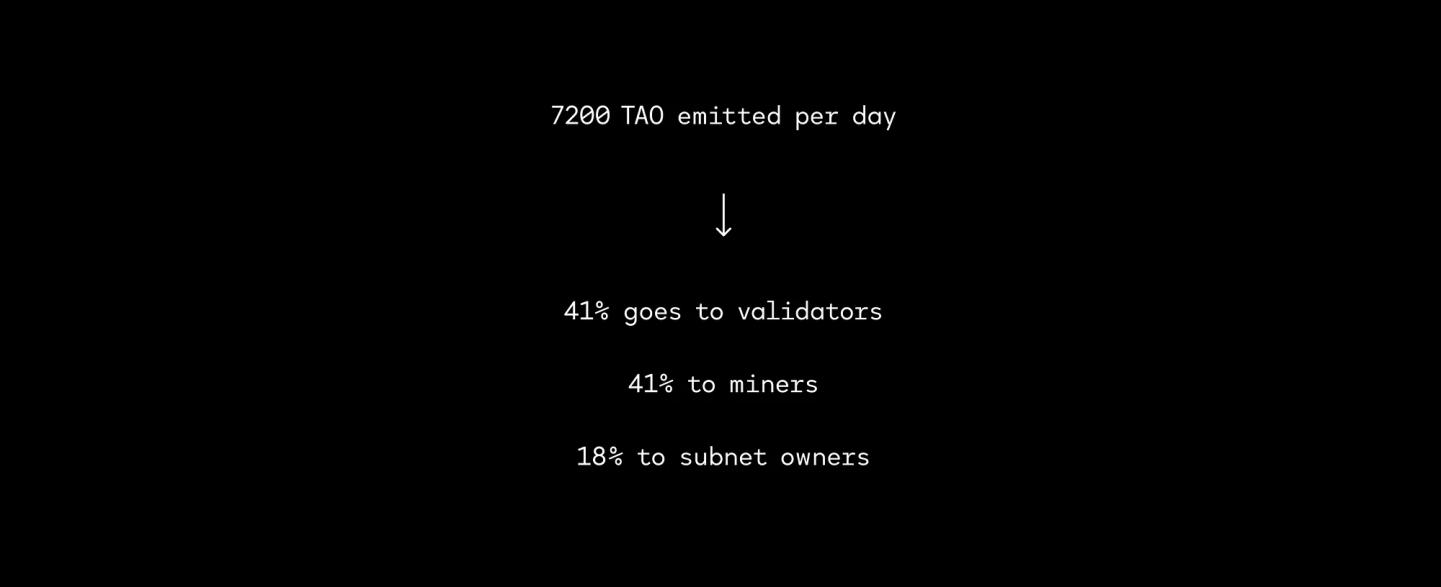

Our coins with potential this month are $DFNDR and $TAO, meticulously examined by our deep-dive specialist, Chris. He dissects the hype surrounding these projects, showcasing promising signs of becoming significant players in the decentralised finance landscape. We eagerly anticipate tracking their journey throughout this new cycle.

And don’t miss Daniel’s article on BTCFi, there’s a lot happening on BTC, and with this issue and issue to follow, we will be breaking down a lot of the new tech coming to BTC. And of course, why you need to be ahead of the curve.

At Moon Mag, we've been tracking the market for 33 months, consistently bringing you the latest and most valuable information to enhance your knowledge and education in the crypto space.

As we continue this journey together, remember that in the fast evolving world of crypto and blockchain, knowledge truly is power. Stay curious, stay informed, and never hesitate to explore new opportunities. With each issue of The Moon Mag, we aim to empower you with the insights and understanding you need to navigate the often difficult and over-polluted crypto landscape confidently.

Let's ride the waves of innovation together and reach for the stars. Happy trading, and may your investments always soar!

Lisa <3

E di t

orial

A note from Lisa

Issue 33 of the Moon Mag explores the Layer 3 narrative, BASE chain and DeFi projects in Bitcoin, and the articles are genuinely informative, allowing you to really understand the mechanics behind the tech. We also take a look at naked trading. Perhaps a clickbait title for an article, but the content is super helpful, and Lisa really pulls apart the psychological understanding in this area of trading. A fascinating read for everyone! We also deep dive into 2 potential gems - $DFNDR and $TAO. They've already had a lot of hype and are certainly paving the way to be a great success. It will be interesting to follow their journeys and see how they perform as the Market shifts and changes!

The purpose of the Moon Mag has evolved into bringing content for all audiences, with articles that make sense to everyone at all knowledge levels. There is education, information and evaluation. It's a relatively simple concept, but there is an art in translating knowledge for all. Our writers do a superb job of keeping you at the forefront of the article, and we often get some fantastic feedback from those who have learnt, understood and been fascinated by the many rabbit holes of crypto.

Happy reading!

A note from Josh

A note from Josh

SUMMARY TRADERS PERSPECTIVE NAKED TRADING UNVEILED 9 BTCfi: What potential do DeFi projects have on Bitcoin? 13 24 Introducing BASE Chain

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. 45 Crypto Narratives 2024: Layer 3's Explained 62 Bittensor and the TAO token 76 Defender Bot and the DFNDR Token

SPONSORS

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

CONTRIBUTORS

Daniel

Daniel has been a blockchain technologyevangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies MDC writer since 2018, currently writer for CryptoTrendencia.

Chris

I joined the crypto party in 2017 Worked as a DAO contributor, startup advisor, lead researcher and co-author My superpower? Translating complex blockchain concepts into clear, engaging content that resonates.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

BUY

Best Selling

Book OUT

Lisa N Edwards’

NEW

NOW!

TRADERS PERSPECTIVE

written by Lisa N. Edwards

written by Lisa N. Edwards

NAKED TRADING UNVEILED

Stripping Down Crypto Trading to the Essentials

Welcome, MoonMag readers, to a journey beyond the traditional realms of cryptocurrency trading. Today, we're getting naked! Yes, we are diving into the concept of "naked trading" – a term that might raise a few eyebrows, but fear not, it's not about stripping down to your birthday suit while staring at charts!

So, what exactly is naked trading in cryptocurrencies? Imagine shedding all the complicated indicators, fancy software, and complex strategies, leaving only you, the charts, and your instincts. That's the essence of naked trading – trading with a naked eye, relying solely on price action and market psychology.

Often, the market is cluttered with endless technical indicators and convoluted trading algorithms. Naked trading offers a refreshing approach. It's about simplicity, clarity, and getting back to basics. Instead of drowning in a sea of indicators, naked traders focus on understanding the story that price movements tell

But let's address the elephant in the room – no, naked trading does not involve sitting in front of your computer screen sans clothing while making trades. Though if that's your thing, well, we won't judge –just remember to adjust your webcam settings before joining that Zoom call!.

Now, back to business. Naked trading isn't for the faint of heart. It requires a keen eye, patience, and a deep understanding of market dynamics. By stripping away the clutter, naked traders aim to identify key support and resistance levels, spot trends and anticipate price movements based on pure market sentiment.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

One of the core principles of naked trading is the belief that all relevant information is already reflected in the price. Instead of relying on lagging indicators, naked traders trust their instincts and the raw data presented by the market.

Of course, like any trading strategy, naked trading has its pros and cons. On the bright side, it can lead to more clarity and less confusion in decision-making. Plus, it's accessible to traders of all experience levels, from beginners to seasoned veterans.

However, naked trading also comes with its challenges. It requires a significant amount of screen time and discipline to master. Without the safety net of indicators, traders must learn to trust their judgment and accept the occasional misstep.

Is naked trading the holy grail of crypto trading?

Well, it's certainly not a one-size-fits-all solution. Some traders swear by it, while others prefer a more structured approach. Ultimately, the key is to find a strategy that aligns with your personality, risk tolerance, and trading goals.

Naked trading appeals to many traders for several compelling reasons. First, it promotes a deep understanding of market dynamics and price action, fostering a more intimate connection with the market. By relying on raw price data, naked traders can develop a keen eye for spotting trends, support and resistance levels, and potential reversal points. This approach not only simplifies the trading process but also enhances traders' ability to react swiftly to changing market conditions.

Moreover, naked trading encourages selfreliance and discipline, traits that are essential for long-term success in the unpredictable cryptocurrency market. By removing the reliance on lagging indicators and complex algorithms, naked traders cultivate a sense of confidence in their own analytical skills and intuition. This self-assurance can be a powerful asset, enabling traders to make decisive and well-informed decisions even in the face of uncertainty.

Furthermore, naked trading promotes a holistic understanding of the market, encouraging traders to consider broader factors such as market sentiment, macroeconomic trends, and geopolitical events. Rather than being bogged down by the noise of countless indicators, naked traders focus on the big picture, allowing them to make more informed and nuanced trading decisions.

For these reasons, some traders swear by naked trading as their preferred approach to navigating the turbulent waters of the crypto market.

While it may not be suitable for everyone, its emphasis on simplicity, clarity, and intuition resonates with those who value a more straightforward and intuitive approach to trading. Ultimately, whether you're a staunch advocate or a sceptical observer, naked trading offers a fascinating perspective on the art and science of trading cryptocurrencies.

Do I need experience to Trade Naked?

Like any form of trading, naked trading benefits from experience, but it doesn't necessarily require prior experience to get started. One of the appealing aspects of naked trading is its simplicity and accessibility, which means that even beginners can grasp the fundamentals relatively quickly.

That said, while naked trading may seem straightforward on the surface – just looking at price charts and making decisions based on what you see – it still requires a solid understanding of market dynamics, chart patterns, and risk management principles. Experience can help traders develop the intuition and judgment needed to interpret price action accurately and make informed decisions.

For novice traders interested in exploring naked trading, starting with a solid educational foundation is essential. This might involve studying basic technical analysis concepts, learning about different chart patterns, and practising on demo accounts to hone your skills without risking real money. As you gain experience and confidence, you can gradually refine your approach and develop your own trading style.

While experience can certainly accelerate the learning process and improve trading proficiency, it's not a prerequisite for naked trading. With dedication, patience, and a willingness to learn, traders of all experience levels can embark on the journey of naked trading and potentially find success in the markets.

If you are beginning, make sure you are never trading with funds you can’t afford to lose.

In conclusion, naked trading offers a fascinating glimpse into the world of stripped-down trading –where simplicity reigns supreme and intuition takes the wheel. Just remember, when it comes to naked trading, leave the clothes off the charts, not yourself!

And there you have it, MoonMag readers, a peek into the world of naked trading in crypto. Whether you're a die-hard advocate or a curious observer, one thing's for sure – it's definitely not what you thought it was!

Happy trading, and may the charts be ever in your favour!

Introducing BASE Chain

written by Samatha

written by Samatha

What is Base Chain?

https://www.base.org/

Coinbase took a significant step into the crypto world. Over the past year, they announced the launch of Base Chain, an Ethereum Layer 2 (L2) network designed to facilitate the development of decentralised applications. Since its debut, Coinbase has made clear its purpose: to make the use of the blockchain easier and more accessible to everyone, making it attractive for billions of users to join the crypto economy.

It must be known that Base Chain has presented itself as a platform and not as another Coinbase product. It positions itself as an open ecosystem where any developer can build their applications. Its foundation is OP Stack, a set of open-source tools designed by Optimism to improve Ethereum's scalability. Base Chain has promised to be a secure, low-cost, and easyto-use alternative.

In this regard, Coinbase has been actively working since its launch to improve the platform and take it to a higher decentralisation level. This step marks a significant point in Ethereum's ecosystem expansion and crypto-economy adoption.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Why did Coinbase decide to create its layer 2?

Coinbase sought to address the limitations of Ethereum, which has been a robust platform but has also presented challenges with high gas rates and latency, thus slowing down processing and making transactions more expensive. In this sense, BASE Chain uses Ethereum as a settlement layer and offers the advantages of an open, transparent and fully auditable chain. As a layer 2, BASE Chain is designed to operate quickly and cost-effectively, allowing Coinbase to provide an enhanced experience for its users.

In addition, Base Chain intends to be a "bridge" that can connect different chains and ecosystems to make interaction possible with Ethereum L1 and other layer 2s while flowing interoperability. Since Coinbase birth, the platform's goal has been to build an open financial system that gives users true economic freedom.

For this reason, they have focused on three fundamental areas for more than ten years to achieve their principal objective. The first has been to promote protocols such as Ethereum and Bitcoin.

To this end, they created the successful crypto exchange Coinbase, which gave users access to all the digital currencies on the market. They also developed interfaces for the mass use of dapps through Coinbase Wallet.

So, bit by bit, Coinbase has now set the ultimate goal of condensing a multitude of decentralised applications that can attract a billion users to what is, in effect, the great crypto-economy.

Where is Base Chain implemented?

Base Chain is implemented in the Ethereum environment, using the OP Stack infrastructure to build its layer2 solutions. Although associated with Coinbase, it is designed as an open platform, allowing developers and users to access it from anywhere in the world.

Base aims to be interoperable with Ethereum L1, other layer 2, and other blockchain ecosystems, making it easier to connect between different networks and increasing accessibility for users and developers.

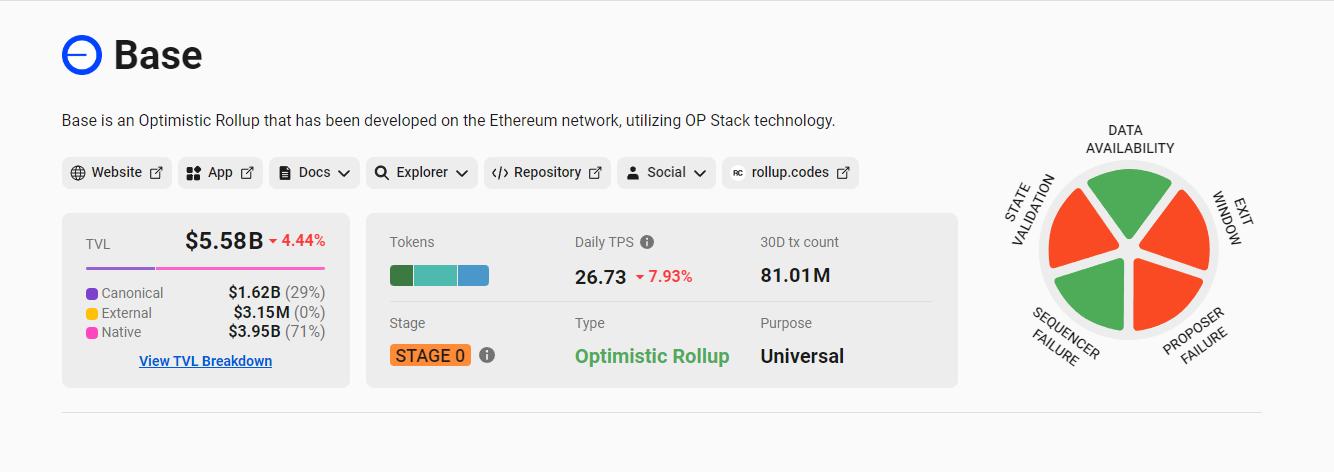

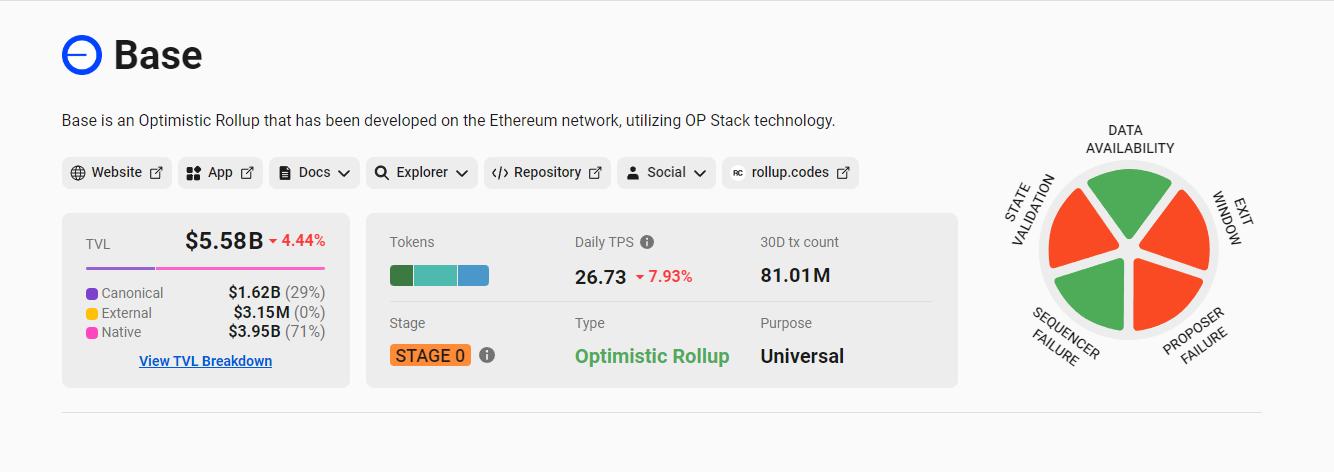

In addition, the team behind the Base blockchain has big plans to decentralise the system in the future, but they are still in an early stage called 'Stage 0' since April. L2Beat, one of the references for all this blockchain stuff, uses that term to describe when the network is in test mode.

The previous means they don't have a fully decentralised system with controlled user withdrawals and updates handled by a select group of people who 'hold the keys,' which is not unusual for rollups and layer 2 blockchains.

Often, you take things slowly so that everything works well before you let go of the reins. But most of these layer2 solutions start out being pretty centralised

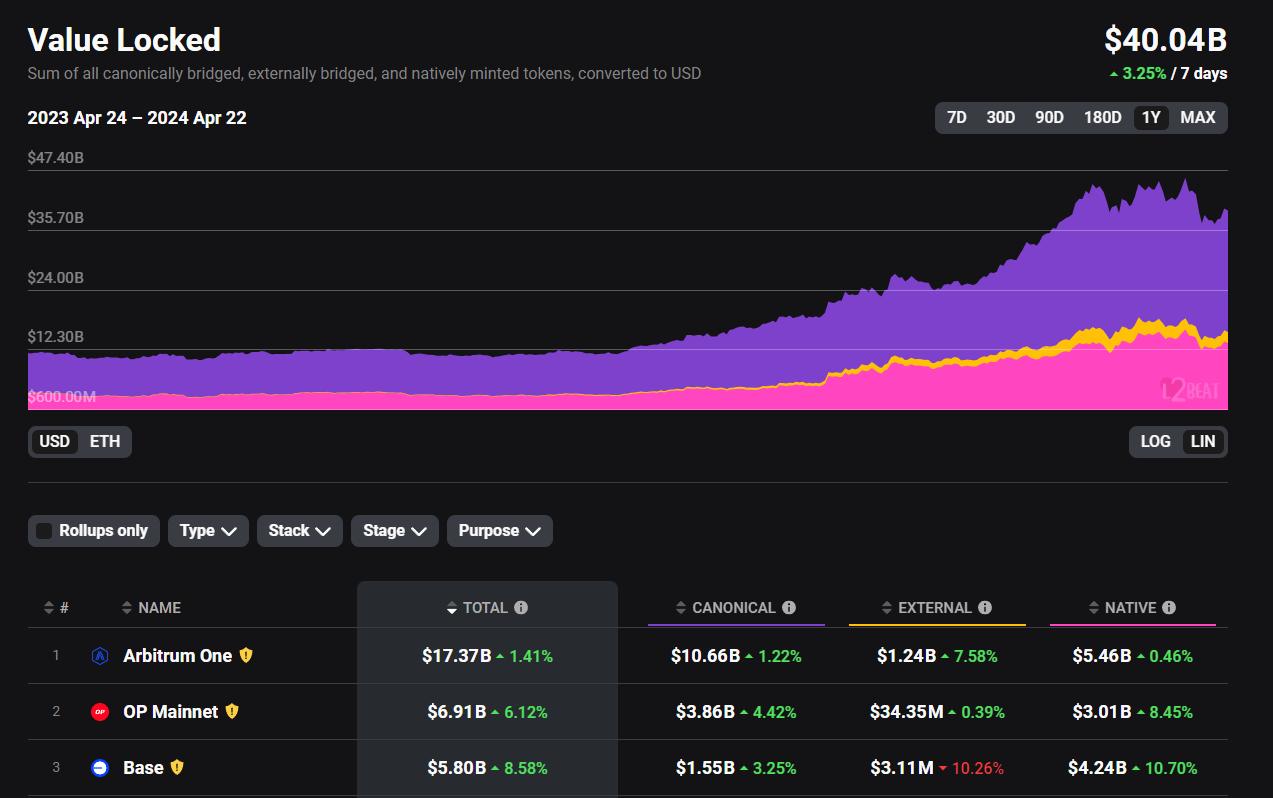

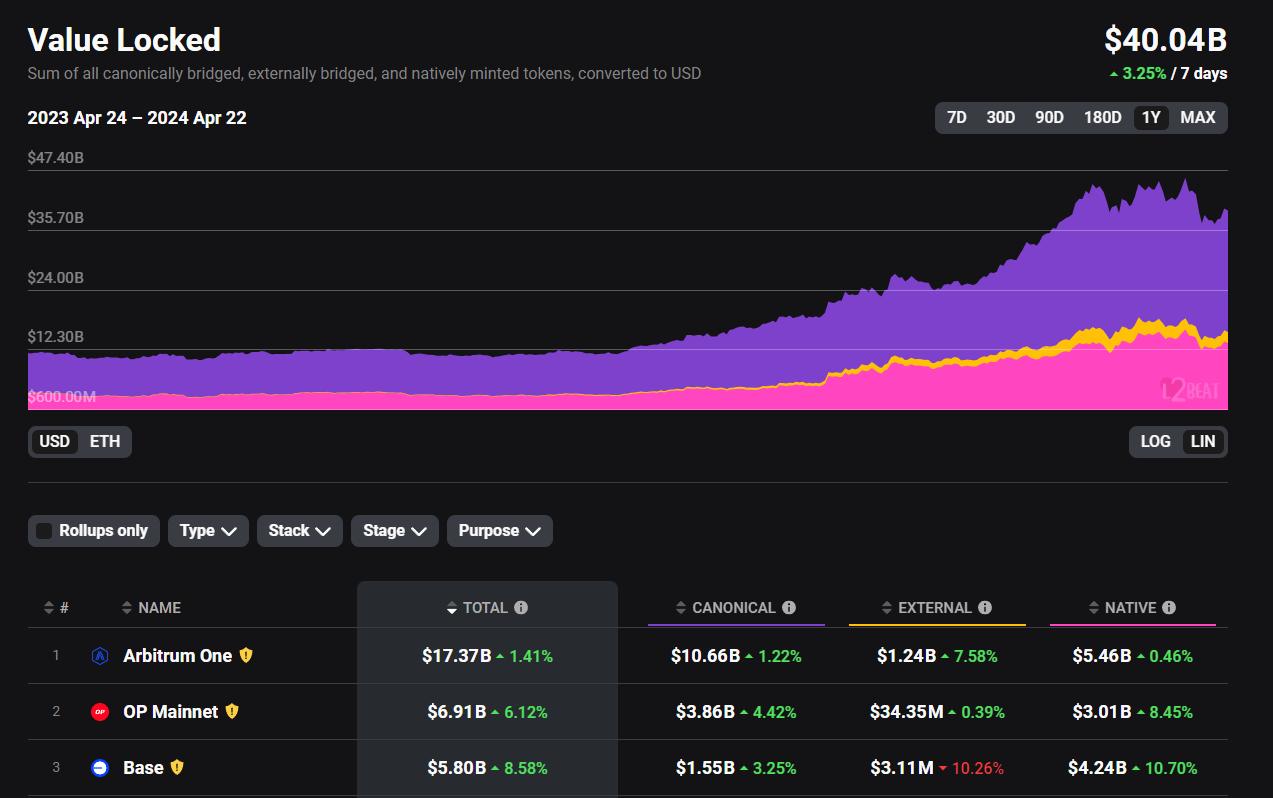

If you look at l2beat.com, an excellent site for tracking metrics, you'll see that the Base Chain has a total locked-in value (TVL) of over $5.58 billion. That puts it in third place among rollups, just behind Arbitrum and Optimism. This total locked value splits between tokens created in Base and tokens that arrive via bridges from elsewhere. Most of this value comes from tokens created in Base, especially USDC, both bridged and directly minted on the blockchain.

l2beat.com

Related to activity, as of April 2024, Base processes around 24 transactions per second and sometimes even surpasses Ethereum. This increase in activity has a lot to do with the ‘meme coin’ boom that is shaking up the crypto world. So, as Base continues to evolve, there is much to watch and expect from this ecosystem.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

How does Base Chain work?

The importance of interoperability in the ecosystem is well known For this reason, Base Chain emerges as the communication bridge we mentioned earlier, able to connect different chains and protocols

To understand how it works, let's consider the crypto-economy a big city with many avenues, streets, and access routes Some of these routes, such as Ethereum Layer 1 (L1), are the main ones, but they can be congested and expensive to navigate That's where Base comes in, acting as a kind of secondary highway, except faster and cheaper

The role of Ethereum

But, before we move on to Base, let's remember that Ethereum L1 is one of the best-known and most widely used blockchains However, that popularity has come at a cost Yes, high demand has resulted in more expensive and slower transactions For this reason, Layer 2 solutions emerge as a loophole that relieves the core network, thereby improving network efficiency.

The Base Chain

Base is a Layer2 solution with unique features built on Ethereum L1. Think of Base as an additional layer above Ethereum L1, where transactions can be faster and cheaper, and even when connected to Ethereum, it has a certain independence that allows it to operate more efficiently.

Use of Rollups

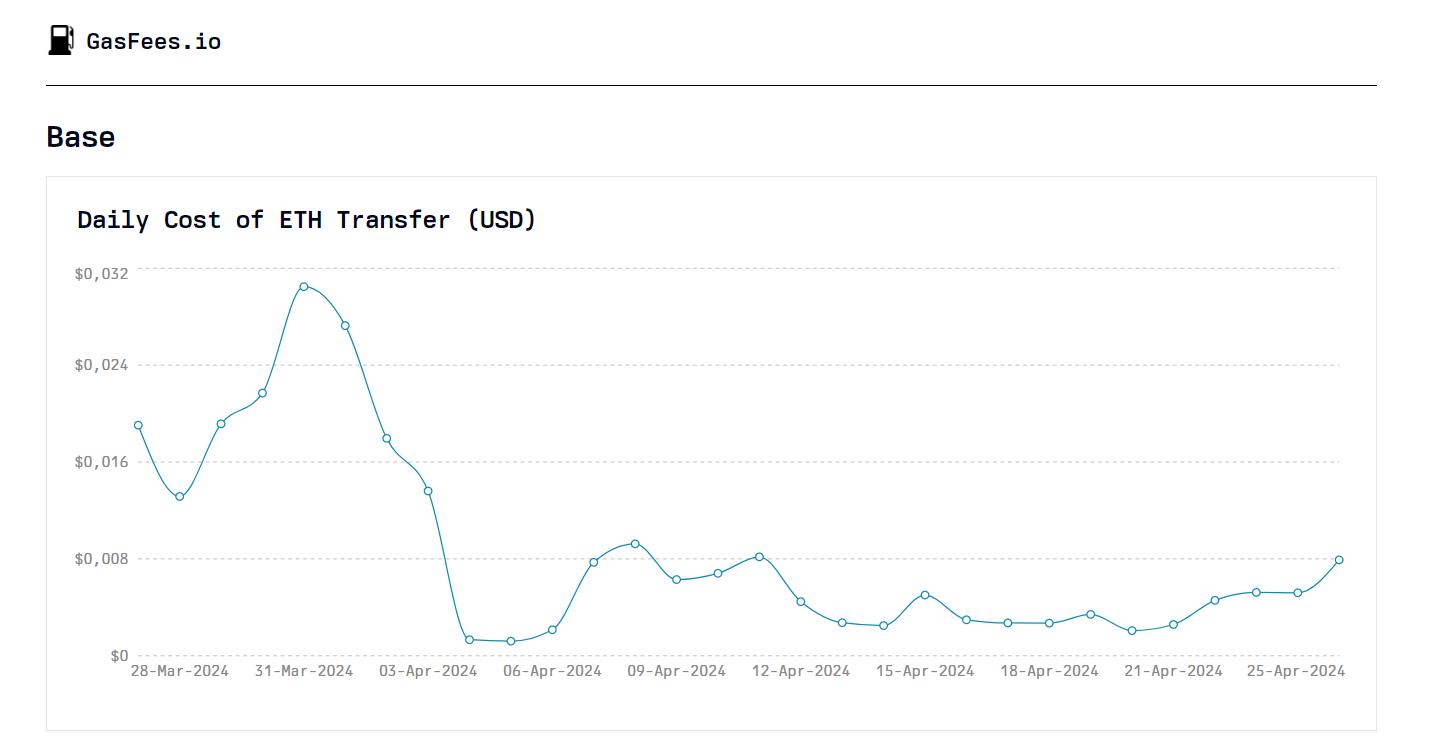

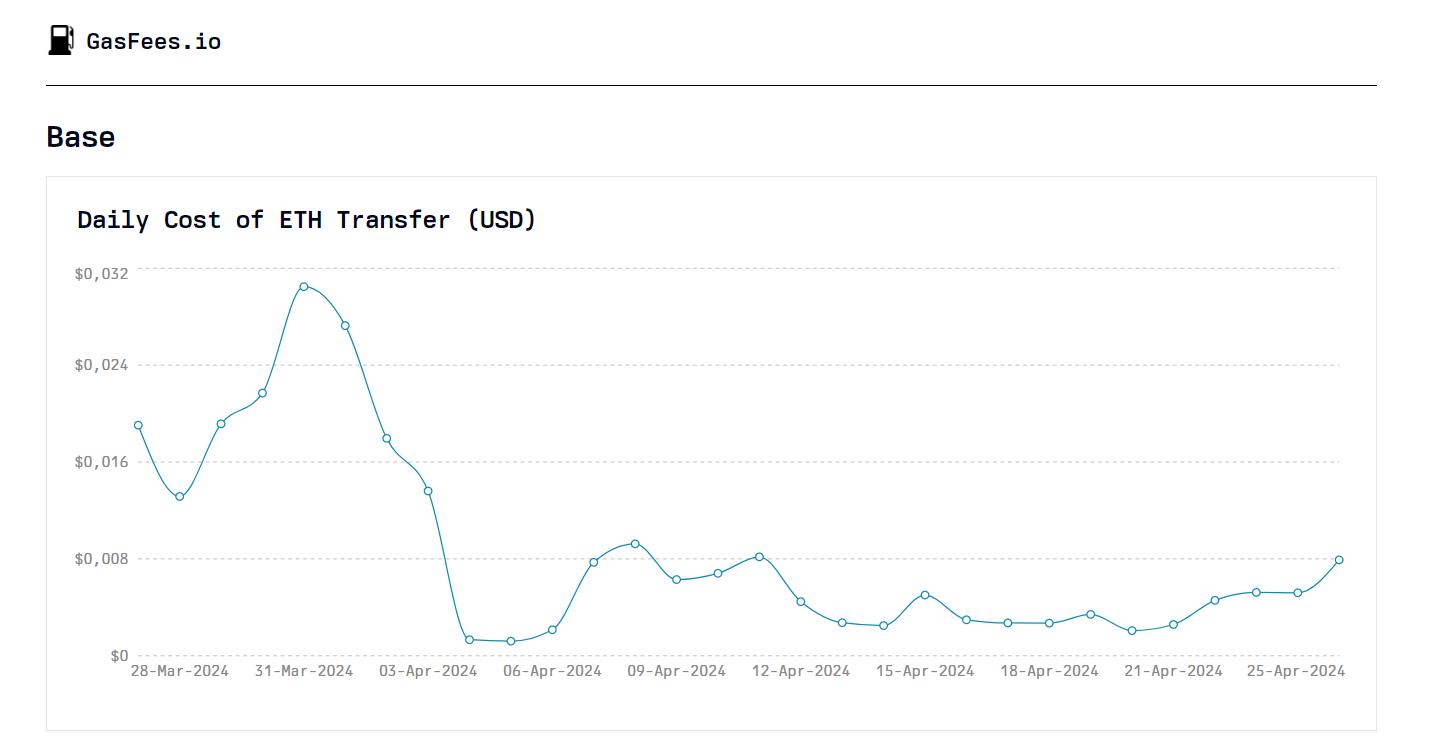

One of the keys to its operation is the use of a technology called ‘rollup’ With this technique, many small transactions are grouped (‘rolled up’) and processed as a single transaction on Ethereum's main Ethereum blockchain, which often has low fees and fast transactions Unlike Ethereum, where gas fees can be high, these secondary chains tend to have fees that are only a fraction of a dollar Base, for example, has some of the cheapest gas fees, averaging around 2 cents to make an exchange on Uniswap

https://www.gasfees.io/

Base gas tariffs after Dencun: gasfees.io

In addition, with the recent upgrade of Dencun in Base and many other cumulative packages, fees have been further reduced, now down to fractions of a cent.

Understanding fees in the Base Chain

See, the Base Chain has a clever way of handling transactions. Instead of sending them one by one to Ethereum, it batches them offchain, in batches, before making the transfer. Why is this important? By doing this, the cost of posting to Ethereum spreads across many users, meaning lower fees for everyone.

And not only is it cheaper, but it also helps reduce the burden on the Ethereum main chain. By bundling transactions and processing them off Ethereum, rollups alleviate the heavy lifting the main chain would have to do. Thus, the settlement process becomes much faster.

When you use the Base Chain, your transaction fee includes three different parts:

Rollup Fees: These are the costs of operating and maintaining the rollup, the ‘maintenance cost’ to keep the rollup running. Settlement Fees: This is where you pay to verify and commit state at the settlement layer in Ethereum.

Data Availability Fees: This covers the cost of sending compressed data to the data availability layer. Basically, it is the price for ensuring that your data is secure and accessible.

Another thing to note is that the Base Chain generates blocks every two seconds. They keep coming out every two seconds, whether full or empty, giving an approximation of how fast the whole process moves. In addition, Base allows arbitrary messages between smart contracts on its L2 layer and Ethereum's L1 layer, which is excellent for transferring tokens like ERC-20s.

And speaking of flexibility, Base has a smart contract bridge that makes it very easy to move assets between Ethereum and Base. You can deposit assets into Base and withdraw them back to Ethereum easily, giving you more freedom to move your digital assets as needed.

What makes Base Chain unique from rival chains?

Base Chain stands out from rivals like Ethereum because of diverse factors that appeal to developers and end users. For example:

The most noticeable difference between Ethereum and Base is that Ethereum is a layer 1 blockchain, while Base is a layer 2, meaning that Base's foundation builds on top of Ethereum.

Now, Ethereum does everything by itself: consensus, settlement, execution, and data management, all on one chain. So, it has to be very secure, and that security costs a lot. Instead, Base relies on Ethereum for many of those tasks. Ethereum settles and keeps the data protected, thus allowing Base to operate at much lower rates.

So, if you've ever complained about Ethereum's fees, Base could be your solution, given that thanks to this structure, fees on Base are considerably lower than on Ethereum. But Base is not only cheaper, it's also faster.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Security in the multi-signature structure: To avoid a concentration of power in a single person or identity, Base implements a multi-signature structure for smart contract updates. This means that an important decision will require the intervention of several parties involved, minimising the risk of abuse and ensuring security and trust in the network.

Tariffs: This is where Base shines. Because it relies on Ethereum for settlement and data, its fees are much lower. So, if you're looking to save on fees, it's a good option.

User and developer experience: One of the big plus points of Base is that it is compatible with the Ethereum Virtual Machine (EVM). What does this mean? As a developer, you can make the same smart contracts under the same programming language as in Ethereum, Solidity. Of course, this will make it easier to create dapps that can work on both chains without doing heavy work to make many adjustments.

Base Builders

For users, this means that the DApps and other tools they already know from Ethereum will be available in Base without too many problems. It's like moving to a new city but still finding your favourite cafes and shops.

However, this compatibility with EVM also has its tricky side, given that by sharing the same technology, Base inherits some of Ethereum's classic problems. For example, arithmetic overflows, where numbers go out of range, or re-entry attacks in which smart contracts can get hacked if not programmed carefully. These can give developers, and thus users, headaches.

While compatibility with Ethereum is beneficial for interoperability and rapid development, it's also something to keep in mind for security. As always, be cautious and informed about potential vulnerabilities. This way, you can enjoy the benefits of Base without any unpleasant surprises.

Towards a super chain: 2024 on the way to a new level

As for 2024, Base Chain aims to take the blockchain-based economy to the next level It will enable developers, companies and users to come together and take advantage of the benefits of its technology to establish an innovative, creative and free platform within its ecosystem

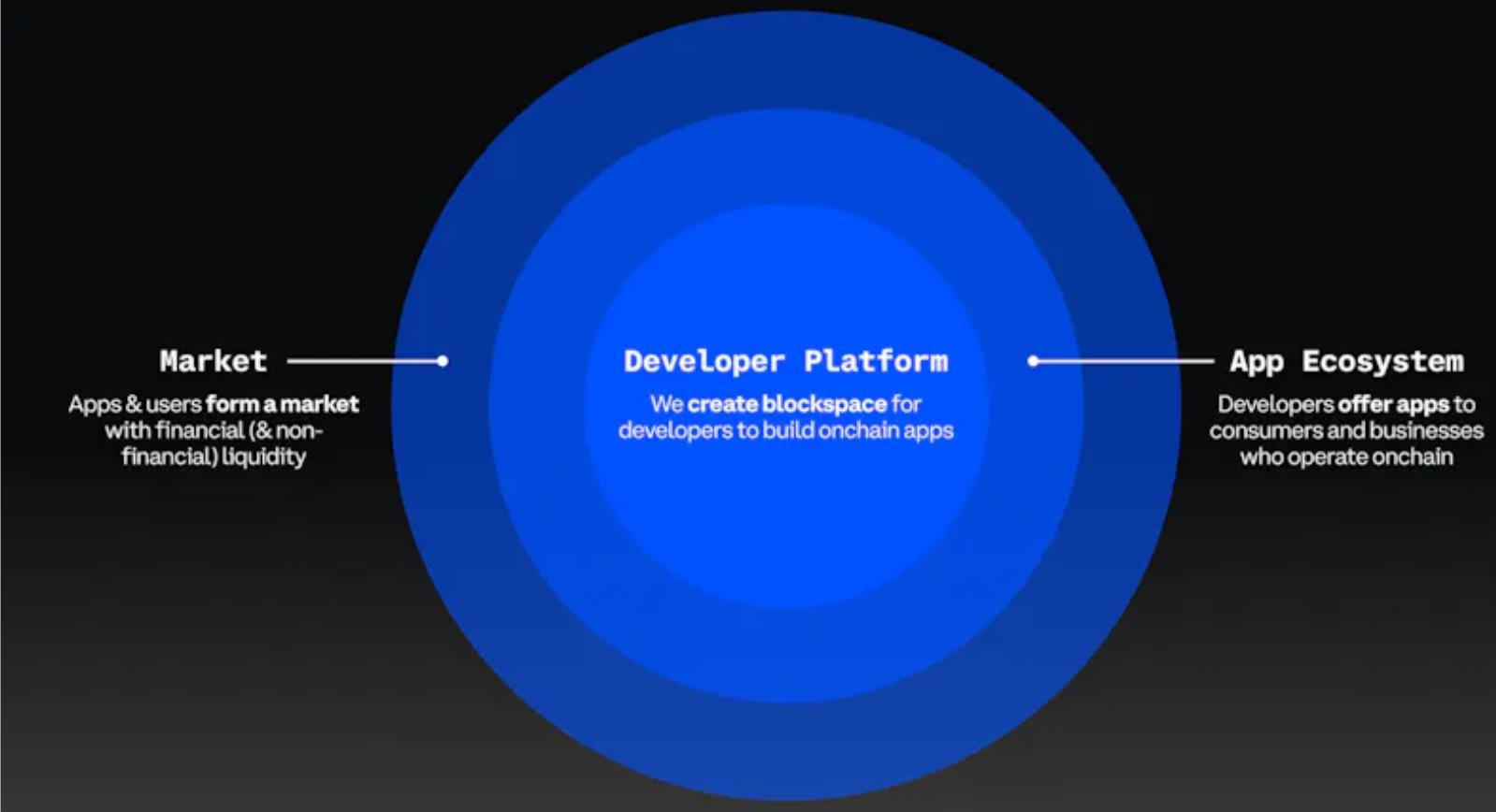

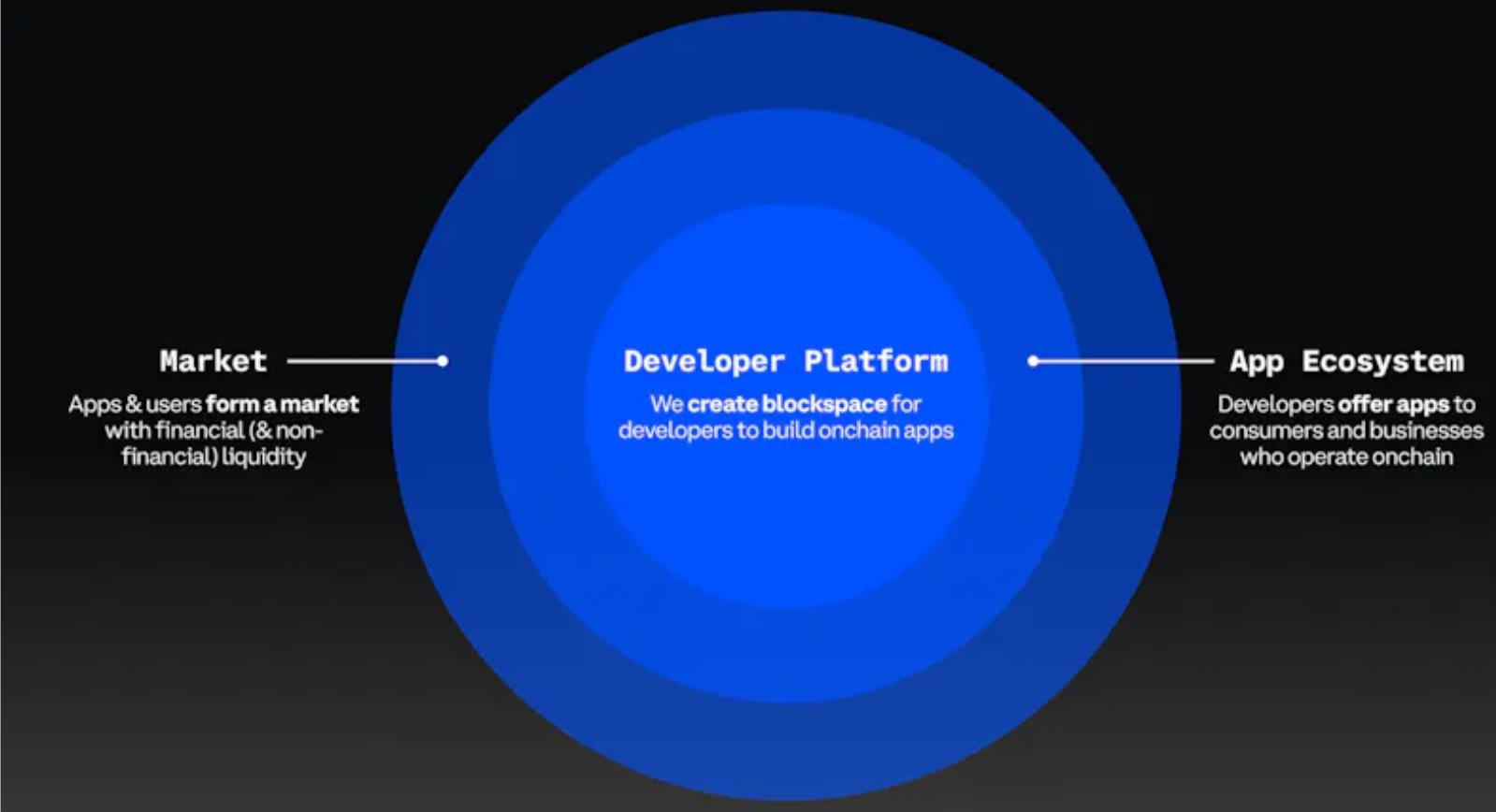

In addition, Base sees itself as an economy with three key components that combine the development platform, the application ecosystem, and the capital market. Thus, you get a complete economy and environment where you can create, interact, and do business. And that is Base Chain's vision for the future: to be the engine driving this global blockchain economy.

In other words, Base Chain wants anyone, anywhere in the world, to be able to access the chain quickly and affordably It's not just about technology but about creating an ecosystem where developers can build excellent applications that end users can access seamlessly

To complete this 'vision,' it is necessary to implement EIP-4844, which originated in 2022, as a proposal that condenses an alternative to improve transaction costs significantly while improving Ethereum's interoperability That is, seeking to make it more efficient from an economic point of view

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

But BASE Chain's mission is not just about technology. They also aim to promote a more dynamic ecosystem where Dapps flourish and become more functional for users. By 2024, Base Chain hopes to reduce fees to less than a penny and be able to standardise the use of smart wallets and streamline the chain's check-in and check-out process for users.

This year, they plan to expand the grant programme, support users and developers building on the blockchain and ensure the tools to learn and create. In addition and parallel, they are working with Coinbase to expand their services and products on the blockchain to ultimately bring a diverse range of tools and opportunities for users to choose from.

Another important aspect is the community. BASE Chain knows that the real power of blockchain technology comes from the people who use and develop it. That's why, by 2024, they want to expand their grant programme, support developers building on the blockchain and create more resources for anyone to learn and start creating. They are also working with Coinbase to bring more products and services to the blockchain, which means users will have access to more tools and opportunities.

In short, BASE Chain's mission for 2024 is to create a blockchain economy that is secure, scalable and accessible to all. With EIP-4844, they are taking significant steps to reduce costs and improve speed; with a vibrant ecosystem of applications and an active community, they are working to make blockchain use simple and more attractive for everyone. If all goes according to plan, BASE Chain will be a crucial component in the crypto-economy of the future, bringing developers, creators and users together in one place where innovation never stops.

BTCfi: What potential do DeFi projects have on Bitcoin?

written by Daniel

written by Daniel

Bitcoin's main functionality, fifteen years ago, was to serve as a transactional currency and value storage beyond the traditional governance reach.

Because of this philosophy, the base of its architecture, it has been assumed for a decade that Bitcoin could not offer the same kind of DeFi ecosystem as Ethereum.

The picture seems to have changed, as several inventions in the base layer have enabled it to have the programmability and scalability features needed to make DeFi available on Bitcoin.

BTCfi, the term denoting the application of decentralised finance natively on Bitcoin, emerges as a new narrative that hopes to take hold in 2024. It takes advantage of the FOMO around the recent halving that inspires a new bull cycle.

But what is the potential of DeFi projects on Bitcoin? We try to answer this and other questions in this opportunity, with the aim that you, my investor friend, regardless of your size, can understand the implications that the deployment of protocols focused on decentralised finance in Bitcoin can have for the entire industry. Yes, you read that right, IN Bitcoin.

What is DefI?

Decentralized finance (DeFi) has emerged as a transformative force in the finance world. It revolutionises traditional banking systems and enables peer-to-peer transactions with unprecedented efficiency, transparency, and accessibility.

In the current context of cryptocurrencies, where technological innovation is constant, the concept of decentralised finance (DeFi) has captured the attention of investors, developers, and industry enthusiasts.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

However, when it comes to Bitcoin, the pioneer cryptocurrency and the most valuable by market capitalisation, a question arises: Is it possible and realistic to implement DeFi in Bitcoin?

To answer this question, we must briefly review what Bitcoin is as a network and which technical fundamentals have relegated it to a store of value.

What is Bitcoin?

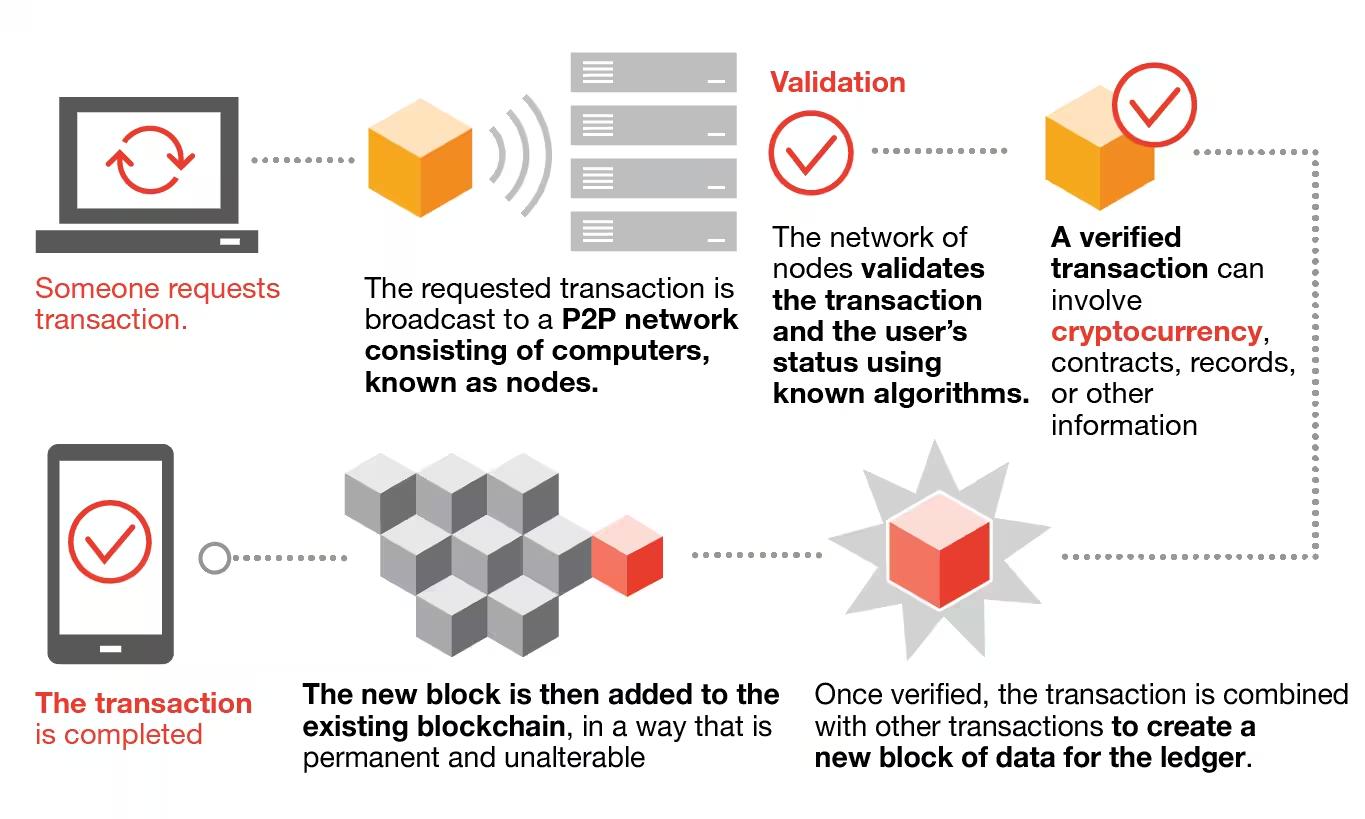

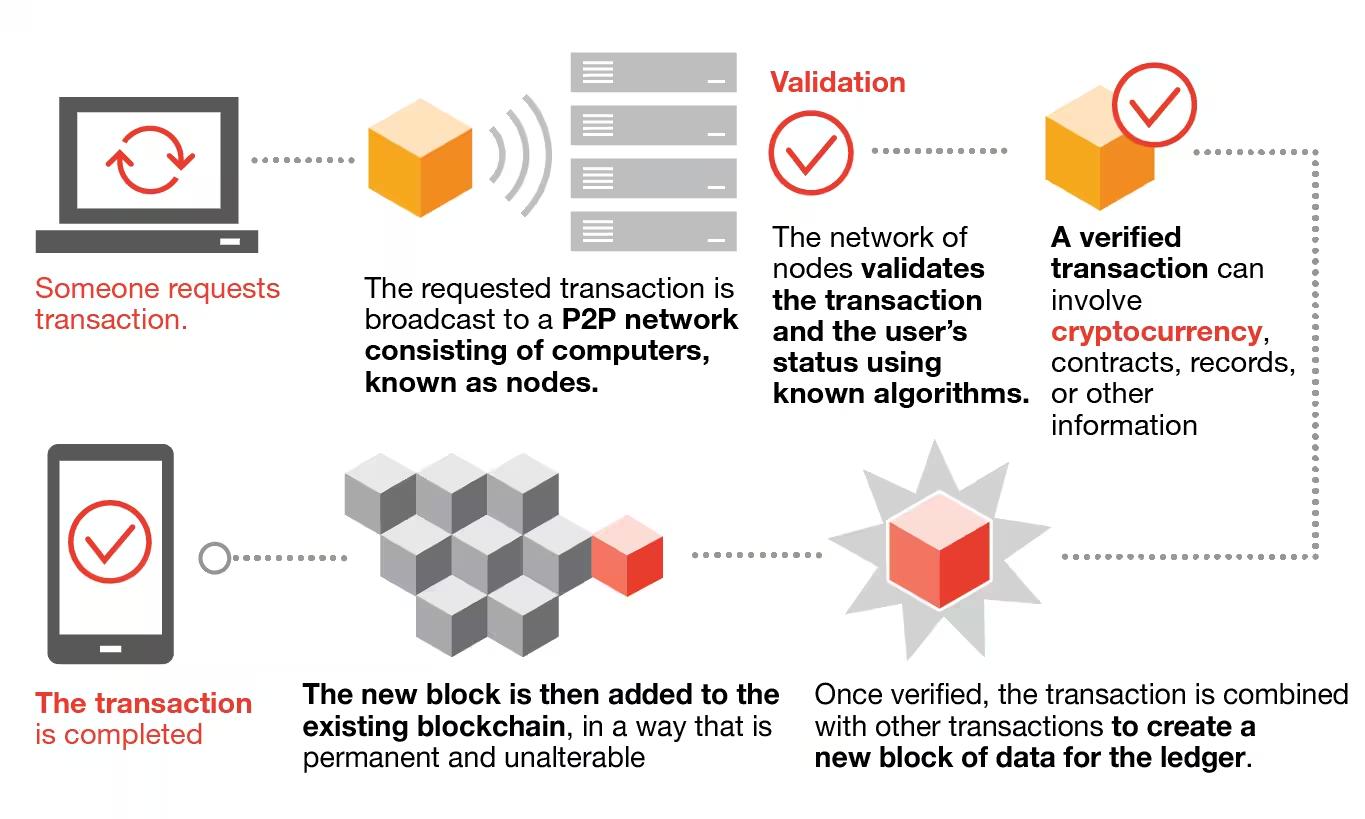

Bitcoin is a decentralised cryptocurrency that functions as a peer-to-peer network. Transactions are made directly between users without banks or governments as intermediaries.

The Bitcoin network uses a proof-of-work (PoW) consensus algorithm to validate and confirm transactions on the network. Miners compete to solve complex mathematical problems that allow them to add new blocks to the blockchain and receive bitcoins (BTC) as rewards.

Given Bitcoin's network nature, when it comes to complex DeFi applications, Bitcoin can not handle high transactions that may demand the use of DeFi applications natively on the network. In addition, Bitcoin's design did not have advanced smart contract capabilities, as Ethereum does through Solidity, which allows it to execute protocols focused on decentralised finance efficiently.

Until recently, Bitcoin was slow, expensive, and inflexible for programmers when developing DeFi applications. Now, this scenario has changed with the introduction of Ordinals and Inscriptions.

BTCfi Outlook: DeFi Summer vs BTCfi Analogy

While Ethereum has been the epicentre of DeFi's rise, a new frontier opens as DeFi finds its way to the most recognised cryptocurrency ever, Bitcoin.

As happened in the Ethereum DeFi Summer from mid-2020 to early 2021, that marked a transformative era for Ethereum, with explosive growth in investment and protocol development; in early 2023, Ordinals introduced a new way of issuing assets on the Bitcoin network, contributing to the resurgence of the Bitcoin price and in particular, innovation in the network.

Bitcoin Network

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Casey Rodamor's Ordinals drove the frenzy of hundreds of teams rushing to build fungible tokens on top of the original blockchain network for the first time, and a year later, the real value locked (TVL) of the DeFi sector in Bitcoin, driven by inscriptions and ordinals is growing significantly as the narrative becomes more popular.

But how much can BTCfi grow?

To understand the BTCfi impact, we need to go back to summer, during the COVID-19 pandemic, when the total value locked (TVL) in DeFi protocols skyrocketed as new projects driven by yield farming and liquidity mining.

LTV jumped from less than $1 billion to over $100 billion during this period, generating sector trust and greater liquidity to the ecosystem as billions of dollars inflowed into it.

To this day, Ethereum's total locked value (TVL) is close to $50 billion, representing 14% of its market cap. If we take the latter figure as a benchmark for Bitcoin (Market Cap $1.2T), BTC's TVL has the potential to reach $168 billion, based on current market conditions and sentiments.

The previous represents three times the size of DeFi on Ethereum and nearly 50% of the market capitalisation of the leading programmable network for decentralised applications in the industry's history.

Why DeFi in Bitcoin?

If you are sceptical about DeFi in Bitcoin, consider the existence of fundamentals underpinning its development and foresee gigantic growth in the coming months.

Even as I write this post, the LTV pattern on the Bitcoin network already resembles a field hockey stick, surpassing $1 billion after boasting $300 million in January 2024. Not bad, right?

For many, this chart didn't even exist and went unnoticed. Now, with halving and the whole Runes narrative, BTCfi has given reasons for innovation and capital to flow into Bitcoin on the radar:

● Network effect: DeFi projects in Bitcoin can take advantage of the considerable dominance and market cap of BTC, given that developing DeFi services on Bitcoin opens these services to a large potential market of BTC users and holders, encouraging the adoption and use of DeFi services.

• Bitcoin has a large user base. For ordinary people, cryptocurrencies are equivalent to Bitcoin, so projects developed on the network have a clear advantage over their peers on other blockchains.

● Security and reliability: The Bitcoin network stands not only as the original in the ecosystem but as the most reliable and secure distributed ledger in the industry, and if we talk about finance applications, security is a paramount factor for users.

● Censorship resistance: Unlike other blockchains, Bitcoin has the most significant number of nodes supporting the network, making it the most decentralised network in the industry today. This well-positioned distribution of nodes allows it to guarantee censorship resistance and be free of single points of failure.

● Economic stability: The fixed supply of BTC and its conception as digital gold are unique and unrepeatable attributes in the industry that Bitcoin boasts and allow it to be accepted today even within the context of traditional finance (ETFs).

● Innovation: Bitcoin is now an army of developers supporting the network worldwide. The huge Bitcoin community will flock to convenient projects implemented on its network, as has recently happened with Lightning Network, Inscriptions, and Runes.

● Bitcoin's continuous development ensures that investments flow and are in a secure environment, allowing BTCfi projects to prepare for the future.

BITCOIN Total Value Locked (TVL)

The rise of BTCfi

Until recently, DeFi restricted itself to blockchains such as Ethereum, Polygon, BNB and other Ethereum Virtual Machine (EVM) compatible networks. Even attempts like Roostock in 2018 have tried to push the development of decentralised finance on Bitcoin.

However, the frenzy with Ordinals and Runes in Bitcoin is attempting to rewrite history in what appears to be a long-term legacy of the momentum required for the Bitcoin ecosystem to be broader.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Similar to how liquidity mining was crucial to DeFi Summer, BTCfi Summer expects to have its fullest expression with the various asset classes forming an application layer for the Bitcoin ecosystem.

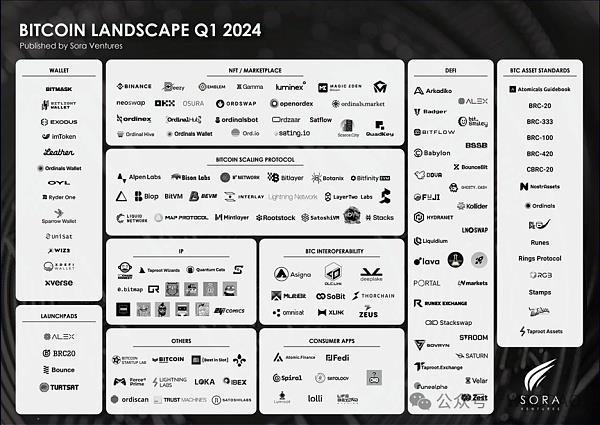

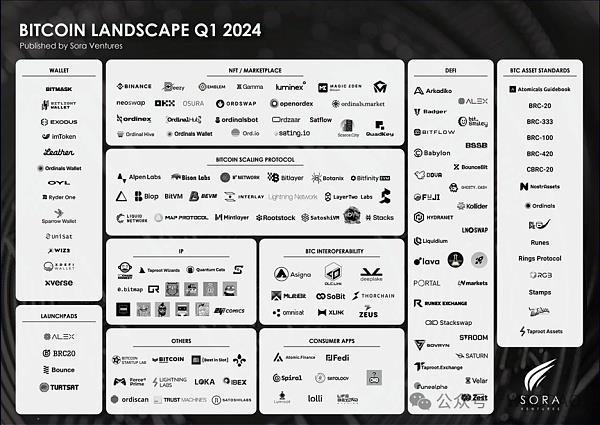

Since January 2023, many new and innovative asset types have joined Bitcoin, including TRAC Systems, Atomicals, ORC-CASH, Bitmap, BRC-100, BRC-420, Runes, Pipe, Taproot Assets, and others. These new asset types are interrelated, have been developed in tandem and are opening up new use cases and applications for the BTC network.

The path has also seen innovations around L2s in Bitcoin, similar to Ethereum. Furthermore, the Inscriptions wave drove innovations such as the Nakamoto update, the launch of Greenlight by LIquid, and a new version of RGB, which showed promise for expanding Bitcoin's network architecture.

These enhancements have enabled a variety of emerging BTC L2 protocols to arrive, such as the EVM-compatible BEVM, the zk-based BeL2 (which supports smart contracts), the Bitcoin virtual machine project MVC (MicroVisionChain), the B² Network, and the Merlin Chain launched by the Bitmap team.

The successful launch of Merlin Chain, which reached $500 million in staking volume in just 24 hours after its launch and one million users, reflects BTCfi's potential for the size of the Bitcoin network.

To put the above fact in context, the combined market cap of BRC20 tokens rose from $1 billion in 2023 to over $2.39 trillion - an increase of 239,052%.

Where is innovation taking place with BTCfi?

There is no doubt that Bitcoin eclipses the rest of the market. Its dominance currently exceeds 50%, and there is a sense that it will continue to increase in the months to come with the momentum of a more mature BTCfi-based ecosystem.

BRC-20 MarketCap

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Like the DeFi Summer in Ethereum, the drive-in infrastructure development to generate liquidity in the ecosystem will be crucial in the BTCfi startup. Let's look at some of the strands driving innovation.

BTC L2s/ Sidechains

Thanks to programmable capabilities in the network due to innovations such as Taproot, BTC L2s with smart contract capacities are also gaining traction beyond ETH rollups.

These solutions build on the core Bitcoin blockchain to provide faster transactions, reduce fees, and enhance functionality.

Diverse options, such as sidechains, ZK Rollups, Optimistic Rollups, and platforms like Stacks, offer unique approaches to improving Bitcoin applications.

By the way, Bitcoin has had its L2s, like Lightning Network. In addition to this innovation, we should mention solutions such as:

▪ Stacks: Layer 2 launched in 2021

▪ Roostock: Alpha play in BTCfi launched in 2018. An EVM-compatible sidechain in Bitcoin.

▪ Merlin Chain: EVM-compatible zk-rollup

Options like Bison Network, Chainway, Kasar Labs, Botanix and Liquid are also present. Some of the mentioned examples are in the Testnet phase, while the more consolidated ones, such as Roostock & Stacks, have their mainnet deployed.

NFTS- Ordinals

Ordinals was the first development that fueled the BTCfi movement, which gave the first NFT collections to the Bitcoin network. You can read all about Ordinals in Moon Mag-Issue 23 here: Issue #23 - The Moon Mag

Bitcoin NFT collections have become increasingly popular in recent months, similar to Ethereum NFT, with NodeMonkes being one of the leaders and a reference within the Ordinals. It is also referenced in marketplaces such as Ordinals. market are Bitcoin Puppets and The Wizards of Ord.

The thing to note here is the difference between Ordinals and NFTs in Ethereum: Ordinals get stored entirely on-chain, whilst NFTs only contain metadata of the associated text or artwork on the blockchain.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Metaverse

Although it is still a largely unexplored area for the Bitcoin network, the emergence of Ordinals is encouraging projects such as Darewise Entertainment, subsidised by Animoca Brands, to build a comprehensive metaverse on Bitcoin Ordinals.

This new feature will allow participation in the metaverse to BTC natives and brands that loot BTC without swapping their coins for compatible cryptocurrencies such as ETH.

Bitmap is another example to consider here. Bitmap converts Bitcoin's blockchain data into spatial land, just as The Sandbox does in Ethereum.

Top BRC-20 Tokens

BRC-20, ARC-20 & Runes

Launched by anonymous developer "domo" on March 8th, 2023, BRC-20 tokens are attempting to be Bitcoin's ERC-20. However, their limitations concerning the Ethereum standard have hindered their momentum beyond meme coins and the odd project associated with specific use cases in DeFi.

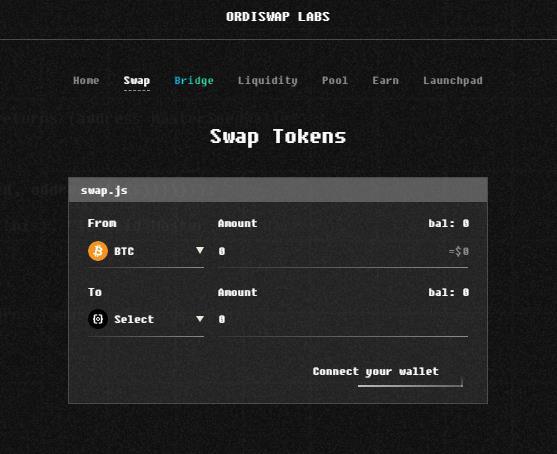

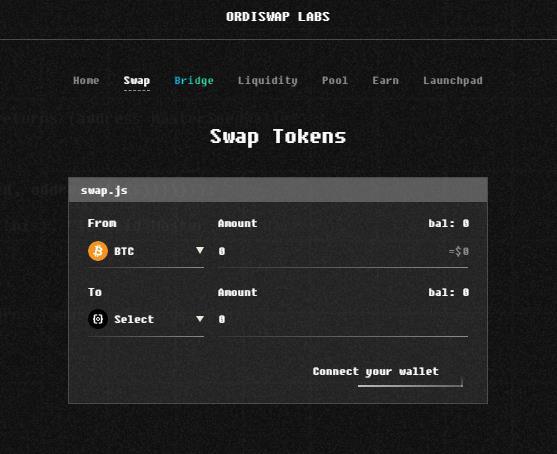

The most exemplary case is undoubtedly Ordi, which has the largest market capitalisation in this sector. Other tokens such as MUBI (Multibit), ORDS (Ordiswap), and SAVM (SatoshiVM) are referents in the BRC-20 market, a project associated with decentralised finance in Bitcoin.

It is worth mentioning that due to the limitations of the BRC-20, the Runes protocol has emerged in BTCfi, driven by the same creator of the Ordinals, Casey Rodamor. Bitcoin's UTXO technology is the base of Runes, like Atomic (ARC-20).

Bitmap

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Another anonymous developer launched the ARC20 tokens to address the limitations of Ordinary Coins using Bitcoin's UTXO model to mint tokens, where one token equals one sat.

Returning to Runes, there has been a lot of FOMO regarding this protocol. Time will tell if it will ultimately be a strong contender for ERC-20 and be able to support the growing BTCfi ecosystem.

DEXs

Decentralised exchanges, such as Uniswap and SushiSwap, were crucial pillars in bringing needed liquidity to Ethereum's burgeoning DeFi ecosystem during the start of DeFi Summer in 2020.

Runestone NFT image

A few Bitcoin projects emerged looking to drive the liquidity required for BTCfi to take off at this early stage. In addition to Ordiswap (like Uniswap but for BRC20 tokens), projects like 100Swap, B20 and COREx are players looking to capitalise on the $1T market opportunity in Bitcoin.

Lending/Borrowing

Lending protocols are crucial to the initial DeFi ecosystem in Bitcoin. It was similar to DeFi Summer on Ethereum, and BTCfi will be no different.

Just as MakerDAO created the concept and set the tone in Ethereum by playing the role of a decentralised "central bank," bitSmiley can be categorised as Bitcoin's MakerDAO

Ordiswap: A Bitcoin DEX for Ordinals

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

bitSmiley allows minting a type of over-collateralisation Stablecoin: bitUSD (based on its bitRC-20 standard), funded by OKX Ventures. The protocol seeks to launch bitLending and Credit Default Swap (CDS) in the future.

Liquidium is another player to consider in this BTCfi sector. With Liquidium, if you hold expensive Ordinary Shares, you can borrow Bitcoin or NFTs to short them.

Tonka Finance is another excellent example in this vertical. Tonka Finance follows the same playbook that worked on Ethereum for BTCFi. Its goal is to build a mature, free, and inclusive lending system for BTCFi markets and to help facilitate the initial liquidity systems necessary to power DeFi on Bitcoin.

Launchpads

Launchpads play another significant role in helping the BTCfi puzzle get off the ground. In this line, we can mention cases such as Ordify, which includes a launchpad for investors to discover the latest projects in the sector.

Image of Liquidium, a Bitcoin lending platform.

Ordify Launchpad

In addition, it offers an integrated wallet and a bridge across disparate chains to allow prospective investors to transfer the various assets that make life in the BTCfi ecosystem. The platform seamlessly bridges BRC20 with Ethereum and other bitcoin layers with EVM chains.

Staking & Restaking

One of the most significant innovations in BTCfi is undoubtedly Bitcoin's native staking. BTC holders no longer need to wrap their Bitcoin to stake it and get passive returns on their holdings.

According to DefiLlama, the TVL of Wrapped Bitcoin (WBTC) is about $10 billion, denoting the BTC holder's interest in participating in decentralised finance (DeFi) protocols.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Core Chain, Babylon, Tonka Finance, and BTCfi are examples of the new generation of protocols designed with speed and efficiency at their core. These protocols allow users to stake their Bitcoin quickly and seamlessly.

Wrapped Bitcoin (WBTC) Total Value Locked (TVL)

CoreDAO: Non-custodial BTC Staking

Additionally, the platform's self-custodial nature ensures that users have complete control over their BTC holdings, with no centralised agency in any part of user interaction. This selfcustodial approach ensures users engage without compromising their ownership and control over their Bitcoin.

In addition to native staking, one of the top narratives in 2024 is about the beginning of restaking implementation in Bitcoin. OrangeLayer is a staking infrastructure platform similar to EigenLayer, but the key difference is that it brings Bitcoin's crypto-economic security to Ethereum.

Stakers can stake their Bitcoin on the platform and earn yields for participating. BounceBit is another use case that enables earning yield on BTC in various ways, such as Liquid Staking and Restaking.

The future is bright for BTCfi- Why am I bullish on BCTfi?

After the frenzy of Ordinals and Inscriptions, it seems that finally, BTCfi is an innovation that meets the criteria needed to be a thriving ecosystem.

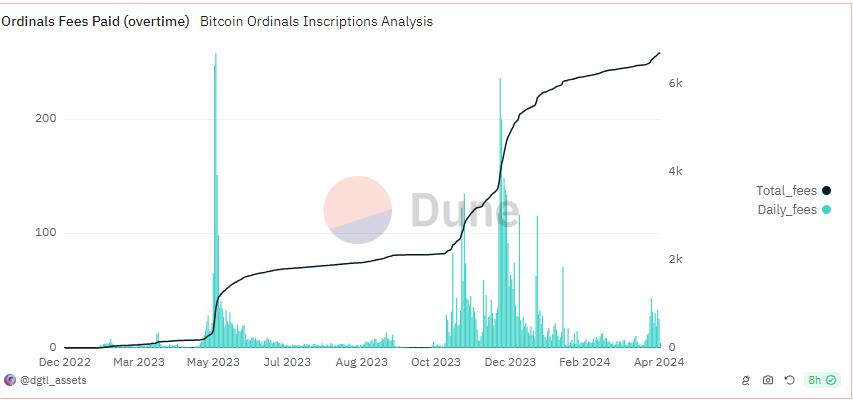

Beyond being a lifeline to the security of the Bitcoin network, with millions of dollars paid in BTC fees to miners, Ordinals seems to have carbureted enough to flow the BTCfi ecosystem, which is currently being built in different verticals as we explored in the previous segment.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

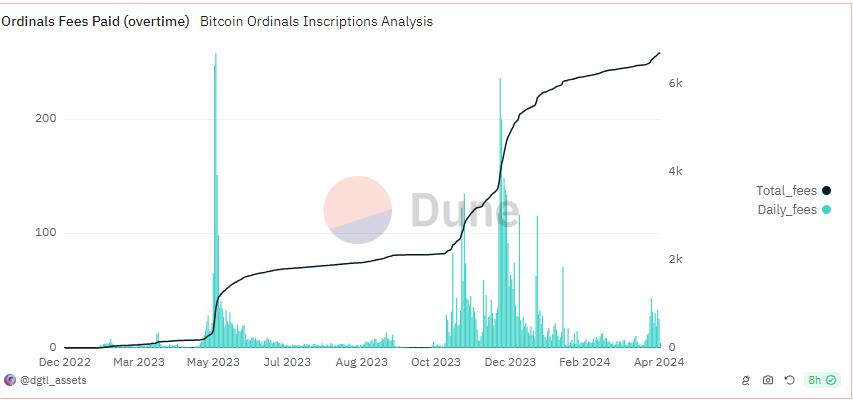

Ordinals Fees Paid according to Dune Analytics

With large CEXs like Binance and OKX investing heavily in BTCfi and truly native decentralised applications launched on Bitcoin in addition to the L2s, the various fungible token standards available on the network seem to be converging on a single path: capturing that trillion-dollar BTC market.

Looking beyond simple LTV metrics at BTCfi, the numbers indicate the potential for ecosystem growth. With a daily count of 500,000 active users and daily network fees that peaked at $17.7 million, Bitcoin reflects a solid user base and is committed to high economic activity levels and transactions that far outpace Ethereum.

Although Bitcoin's original design did not have the complexity of smart contracts and decentralised financial applications in mind, the community has demonstrated a remarkable ability to innovate, creating solutions such as sidechains, second-layer protocols and smart contract platforms built on or around the Bitcoin blockchain. These innovations have begun to open the door to DeFi services on Bitcoin, leveraging its unparalleled security, well-established network and market-leading liquidity.

Given that we are still at an embryonic stage for BTCfi, there is much more room for projects to reach billion-dollar valuations and tokens to skyrocket in these less mature ecosystems. The opportunities are out there, and it will only be a matter of time before Bitcoin dominates the decentralised finance arena as long as it stays true to its principles of decentralisation.

Bitcoin Chart Daily Fees vs Daily Active Users - Token Terminal

Defender Bot and the DFNDR Token

written by Chris

● Defender Bot revolutionises Telegram community security, replacing risky wallet connections with a user-friendly payment verification system.

● Admins gain complete control over group access, setting token holding and payment requirements to filter out unwanted users.

● Manage ‘’whale groups’’ effortlessly – Defender Bot automatically monitors member token holdings, ensuring continued exclusivity.

● The DFNDR token unlocks benefits for holders, including revenue sharing,

● advertising discounts, and loyalty rewards.

● A detailed roadmap outlines ambitious plans for Defender Bot's future, including AI integration, customisable bots, and enhanced analytics.

Intro

Defender Bot is your Telegram community's new best friend. This innovative solution reimagines how you manage members, prioritising security and ease of use. Say goodbye to risky wallet connections! Defender Bot's unique payment verification process keeps your community safe and spam-free.

You can also harness the power of customisation as Defender Bot puts you in control. Decide exactly who gets access and establish your own rules to safeguard your community against malicious bots and intruders. The DFNDR token gating is even simpler, empowering you to create the safe and exclusive space you envision.

TL;DR:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Think of Defender Bot as a digital bouncer, tirelessly filtering out unwanted visitors while streamlining entry for legitimate new members. Experience a new level of security and efficiency, leaving project owners or pretty much anyone free to focus on building a thriving Telegram community.

,

Let's dive deeper into how Defender Bot works and the benefits it offers!

Background & History

While Telegram's popularity stems from its user-friendly interface and privacy features, these same strengths can be exploited by malicious actors. Hackers are increasingly targeting the platform to spread dangerous malware, steal sensitive data, and launch targeted attacks on the crypto community.

Bots: A Growing Threat

One of the most pervasive threats is deceptive bots. These bots cleverly disguise themselves as legitimate sources, offering fake support channels or enticing rewards to trick unsuspecting users. Reports from cybersecurity firms like Q6 Cyber a few years back highlighted the alarming rise of these bots and the extensive, often hidden damage they cause.

Ease of Access for Attackers

What's especially concerning is how readily available these attack tools have become. Investigations by Intel471 revealed that individuals with minimal coding experience can purchase the code to operate a malicious bot for a small monthly fee. Some packages even include target lists, making launching attacks against specific communities frighteningly easy.

The Need for Protection

Telegram's open structure has created a pressing necessity for enhanced security measures. Crypto projects and communities need tools to safeguard themselves and their members from evolving threats. This is where Defender Bot enters the picture.

Recognising the unique challenges of the Telegram environment, Defender Bot prioritises robust security and a seamless user experience. Unlike solutions that rely on potentially risky wallet connections, Defender Bot empowers community admins to create a safeguarded space. Defender Bot acts as a vigilant gatekeeper by allowing owners to establish customised entry requirements, filtering out harmful actors while welcoming legitimate users.

Team & Founders

The Defender Bot team is relatively small compared to competitors or more significant projects. It consists of 2 lead product owners and developers, 2 designers, 2 advisors and 2 discord/tg moderators.

The core team doesn’t publicly disclose or disclose information behind the scenes, but we can assume that can change if the project gains broader acceptance in the crypto world and, therefore, in Telegram communities.

What’s most impressive, though, is their list of partners and integrated projects using their bot. At the time of writing, over 40 projects are using their technology, which can all be seen here The DFNDR Token

Here are the market stats of the DFNDR token at the time of writing:

Official Links

Telegram: https://t.me/defendereth

Website: https://defenderbot.tech

Twitter: https://x.com/defendereth

Bot: https://t.me/DefenderProBot

CG: https://www.coingecko.com/en/coins/defender-bot

Documentation: https://defender-bot.gitbook.io/defender-bot-whitepaper

Price $0.1160 Market Cap24h Trading Volume $177.763 Circulating SupplyTotal Supply 100.000.000 Fully Diluted Valuation $11,586,775 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

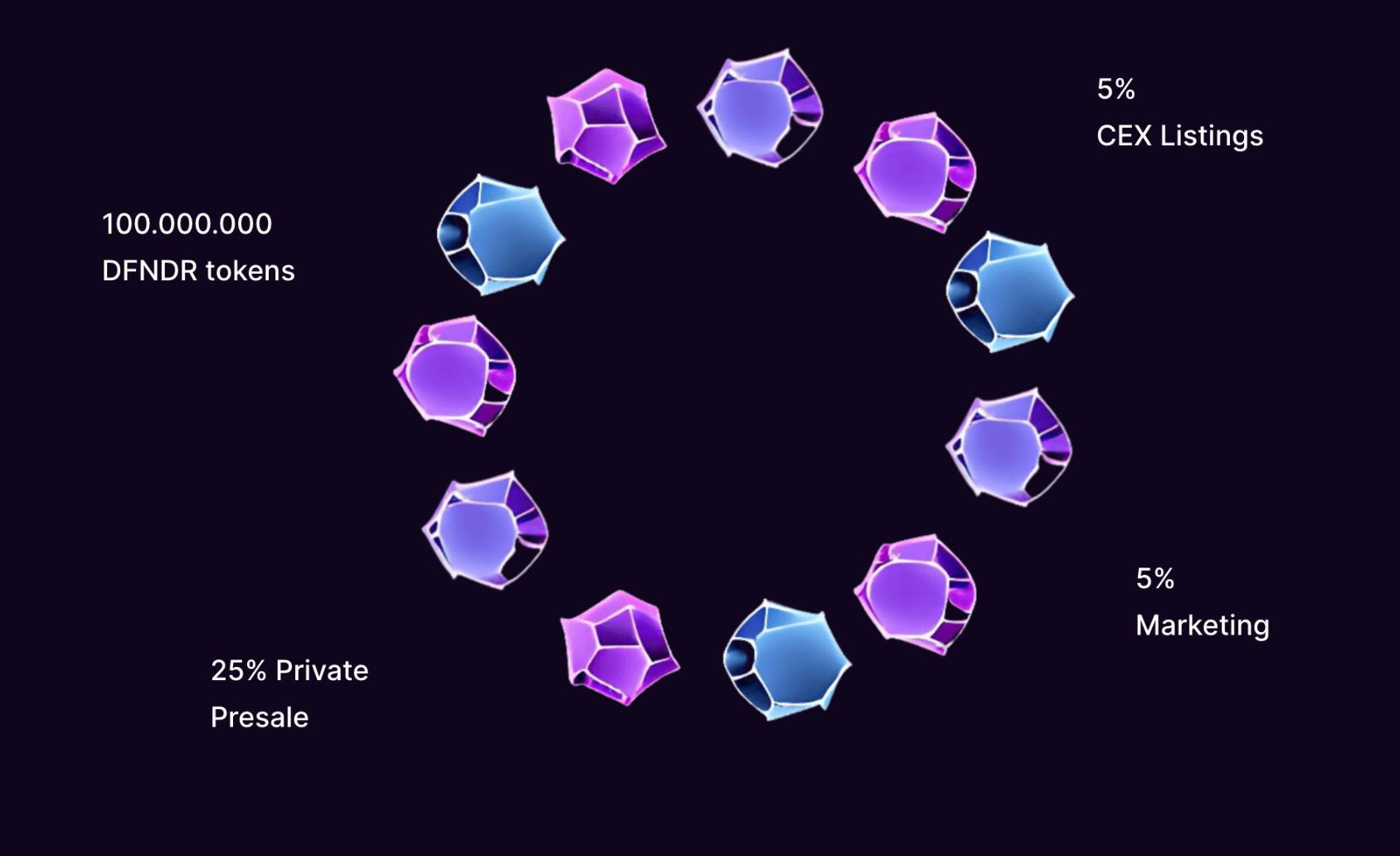

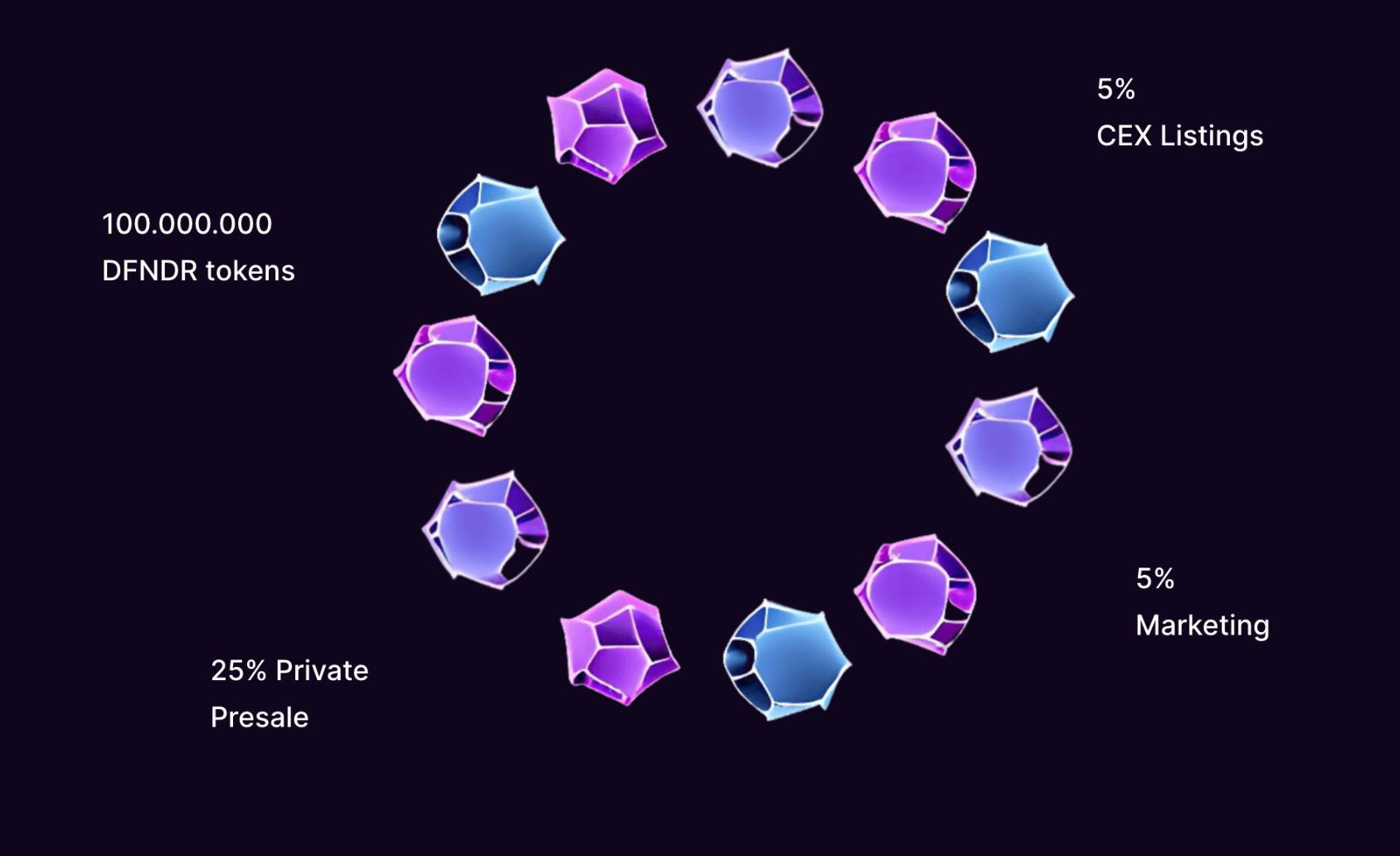

Tokenomics

The tokenomics are carefully designed to promote long-term growth and sustainability while providing rewards for community members.

Each DFNDR transaction is subject to a 5% tax. This tax isn't a burden; it's divided in a way that benefits both DFNDR holders and the future development of Defender Bot:

Revenue Share (2%): Revenue generated from transactions is used for buybacks and burns. This directly benefits holders, as it can potentially increase the value of their DFNDR tokens.

Development Fund (1%): This fund fuels continuous innovation. It ensures the Defender Bot team has the resources to keep the platform secure and add exciting new features.

Marketing (2%): This portion drives efforts to increase awareness and adoption of Defender Bot. Strategic marketing campaigns and community initiatives help bring new users to the platform.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Here's a quick overview of the key points:

▪ Token Name: Defender Bot

▪ Symbol: DFNDR

▪ Blockchain: Ethereum (ETH)

▪ Max Supply: 100,000,000 (100m)

Initial Token Distribution

▪ Marketing & Promo: 5%

▪ CEX Listings: 5%

▪ Private Sale: 25%

▪ Uniswap Liquidity Pool: 65%

▪ Initial Liquidity: 2.5 ETH

Transparency and Updates

The Defender Bot team values transparency. You can expect regular updates on revenue distribution, development progress, and marketing activities, keeping the community informed.

The DFNDR Token

The DFNDR token is a multi-purpose utility token that unlocks benefits for holders and fuels the growth of the entire Defender Bot ecosystem. But let’s break down the key ways you can put your DFNDR tokens to work:

1. Share in the Success: As a DFNDR holder, you directly benefit from the success of Defender Bot. A portion of the platform's revenue is used for buybacks and burns, potentially increasing the value of your tokens over time.

2. Discounted Advertising: Need to promote your project within the Defender Bot community? DFNDR holders get special discounts on advertising rates, making it a cost-effective way to reach a targeted audience.

3. Save on Service Fees: Paying Defender Bot service fees in DFNDR tokens instead of ETH offers a 30% discount.

4. Rewards for Loyalty: Long-term DFNDR holders can expect regular rewards, airdrops, and bonuses designed to thank them for their continued support.

Essentially, the token is cleverly designed to incentivise both the use of Defender Bot's services and long-term commitment to the platform. It also promotes a sense of community and shared ownership, transforming the token into a critical driver of Defender Bot's growth and sustainability.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

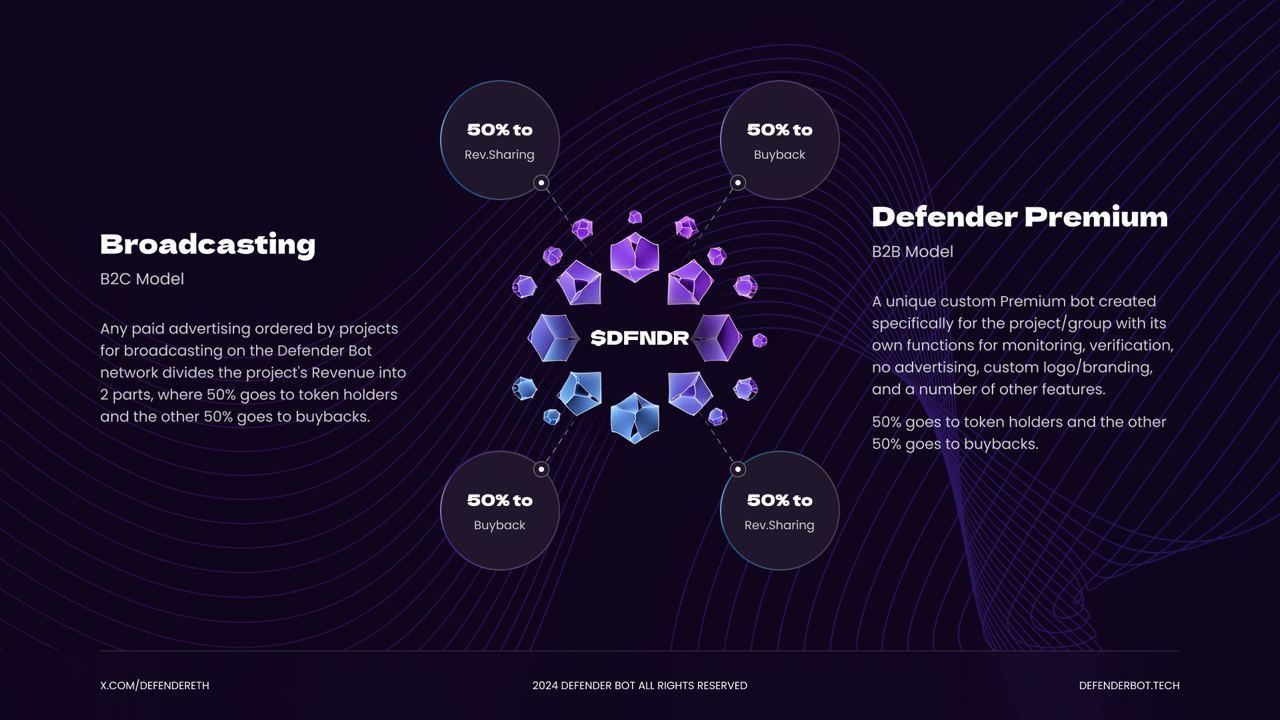

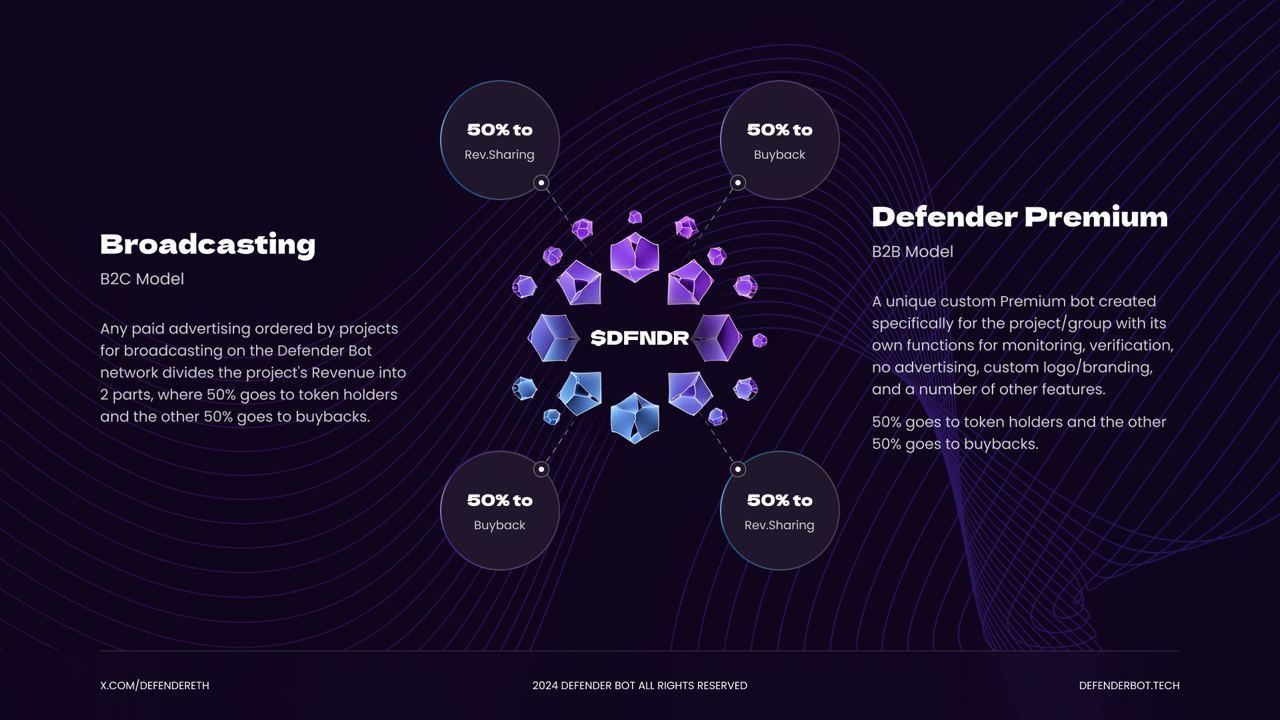

Revenue Streams

As outlined above, the DFNDR token's value is directly tied to the success of the Defender Bot platform. Let's break down the key ways Defender Bot generates revenue to benefit token holders:

▪ Revenue Sharing for Holders: A key pillar of DFNDR's value proposition is revenue sharing. DFNDR token holders receive a portion of Defender Bot's income in the form of buybacks and burns, creating the potential for token appreciation.

▪ Dedicated Advertising: Projects can gain valuable exposure within the Defender Bot community through dedicated advertising slots. The platform even offers the flexibility to broadcast custom messages across all groups where Defender Bot is active.

▪ Premium Bot Services: In the future, Defender Bot plans to introduce enhanced ‘’Custom Premium Bots.’’ These will offer features like personalised branding and unique functionalities, representing an additional source of revenue.

How the Revenue System Works

1. Income Generation: Revenue accumulates from transaction taxes, advertising fees, and potential future Premium Bot services.

2. Buyback and Burn: Periodically (every 7-10 days), the team uses accumulated revenue to buy back DFNDR tokens from the market. These tokens are then burned (permanently removed from circulation).

Details and Transparency

We’ve all heard before that details make the difference. Defender Bot’s comprehensive announcements and transparency toward community members and partners are also proof of this. Note that all this information is published in their official documentation

April 1st marked the official start date for revenue accumulation.

▪ Frequency: Buybacks and burns will occur without a fixed schedule to maximise their positive impact. Updates and transaction details will always be made publicly available.

▪ Revenue Share Percentage: 2% of all DFNDR token transactions will be dedicated to the revenuesharing program.

▪ Premium Bot Income: While not yet implemented, Premium Bots represent a potential future revenue stream.

Through the provided wallet addresses, users can track transactions and monitor the revenue cycle, ensuring trust within the community.

Roadmap

The Defender Bot team is committed to continuous development and innovation. Let's explore some of the exciting features and milestones planned for the future. You can see the complete roadmap here:

Phase 1

Core Bot Functionality: Launch the core Defender Bot features, including secure group access management and token-gated entry systems.

▪ Multi-Chain Support: Integration with leading blockchains to expand reach and accessibility.

▪ Community Integration: Tools and resources to empower Telegram communities to leverage Defender Bot's security features.

Phase 2

▪ Customisable Branding: Allow community owners to personalise the look and feel of Defender Bot within their groups.

▪ Advanced Analytics: Granular insights into a group activity and member behaviour for informed decisionmaking.

▪ Multi-Language Support: Broaden Defender Bot's reach by catering to a global audience.

Phase 3

▪ Customisable Bot Development Kit: Empower developers to create innovative bots that integrate seamlessly with Defender Bot.

▪ Governance Features: Introduce a DAO to allow community members to participate in key decisions.

▪ Strategic Partnerships: Collaborate with other industry leaders to enhance security and functionality.

Phase 4

▪ On-Chain Reputation System: Leverage blockchain technology to create a verifiable reputation system for users and bots.

▪ AI-Powered Threat Detection: Implement advanced AI to identify and mitigate security risks proactively.

▪ Metaverse Integration: Prepare Defender Bot for the evolving digital landscape, including potential applications in the Metaverse.

The roadmap represents a general guideline, and the Defender Bot team is flexible and adaptable from what we’ve seen so far from their roadmap. They seem to continuously evaluate the project's progress and make adjustments as needed. Regular updates and communication will ensure the community stays informed of any changes or new developments, which is better than a predefined roadmap when the crypto space is moving so fast.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Core Features

Telegram

Defender Bot offers powerful tools for Telegram group administrators and members. Let's break down the essential functions and how you can get started with a few easy steps:

Group Owner Guide

▪ Add the Bot: Invite @DefenderProBot to your group and grant it administrative rights. (Tip: Make the past chat history visible before adding it).

▪ Set Entry Rules: Customise access requirements using the "/defend" command.

○ ETH Payment: Enter your desired ETH amount (it can be zero) and your wallet address for payment.

○ Token Verification: Require members to hold a specific amount of an ERC20 token. Provide the contract address. (Setting the token quantity to 0 exempts users from this requirement).

○ NFT Verification (Coming Soon): You can utilise NFT ownership as verification. This feature is currently in development.

▪ Generate Invite Link: Defender Bot will create a unique invite link that you can share. (Tip: Use "/req" command to review your settings.)

Member Guide

▪ Follow the Invite Link: Click the link provided by the group owner.

▪

▪ Meet Requirements:

○ Token Ownership: If required, verify you hold the necessary tokens in your connected wallet.

○ ETH Payment: Send the specified ETH amount to the designated address. This confirms ownership of your wallet.

▪ Submit Payment Transaction: Click "SEND PAYMENT TX" and provide the transaction link to the bot. You'll then receive the link to join the group.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Additional Features

▪ Whitelisting: Group owners can use the "/whitelist [user id]" command to allow specific individuals to bypass requirements. This is useful for particular circumstances or troubleshooting. (Find user IDs with a dedicated bot.)

▪ Defender AI (Coming Soon): Interact with an AI conversational bot integrated directly into Defender Bot. Ask project-related questions, get quick answers, and more. This feature is currently being trained and will continue to improve over time. Use the "/defender" command to chat with the AI.

▪ Close/Open Group: Group owners can temporarily deactivate the Defender Bot link using the "/close" command and reactivate it with "/open" when ready to accept new members.

Discord

Defender Bot offers a powerful toolkit to protect Discord servers, allowing owners to establish rules and streamline the member onboarding process.

Server Owner Guide

1. Add the Bot: Invite Defender Bot to your server using the provided link: https://discord.com/oauth2/authorize?client_id=1216159157502214207&per missions=8&scope=bot

2. Set Entry Rules: Use the "/defend" command to customise access requirements. Here's how to set an example configuration:

Also, a variety of blockchains are supported. See the provided list in the context for options: (List of chains: ETH, BNB, SOL, ARB, AVAX, BONE, CRO, FTM, MATIC, CELO, GLMR, OPTI, HECO, BASE, LINEA, XDAI, AURORA, MOVR, BOBA)

▪ Get the Invite Link: Defender Bot will generate a unique invite link for your server.

Member Guide

1. Follow the Invite Link: Click the link provided by the server owner.

2. Meet Requirements:

○ Token Ownership: If needed, verify you hold the necessary tokens in your connected wallet.

○ ETH Payment: Send the specified ETH to the designated address. This confirms ownership of your wallet.

3. Verify Yourself: Follow these steps to complete the verification process:

○ Use the "/verifyme" Command: This will prompt the bot to send you a message outlining the requirements.

Important Notes

Read Instructions and Check Requirements: Before attempting to join a server, ensure you understand the specific requirements set by the owner.

Discord Privacy Settings: If the bot doesn't message you directly, check your Discord privacy settings and make sure you allow direct messages from server members.

Support: If you have any questions or need further help, contact the server owner or Defender Bot support (t.me/legendaryanubis).

Coming Soon

The initial Discord version of Defender Bot focuses on core verification features. Future updates will add features such as AI responses, statistics, and whitelisting.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

What Sets Defender Bot Apart

Defender Bot introduces innovative approaches to community management and security. Here's a look at some key features that make it stand out:

No Wallet Signatures Required:

Defender Bot prioritises convenience by streamlining the connection process. Users don't need to sign transactions with their wallets, eliminating potential friction.

Your Telegram Gatekeeper:

Defender Bot keeps your Telegram groups safe from spam bots and intrusive users by verifying user payments before granting access. This helps maintain the exclusivity and value of your community.

Automated Whale Group Management: Defender Bot makes creating and managing ‘’whale groups’’ or other groups with token holding requirements easy. The bot continuously monitors balances and automatically removes members who no longer qualify, saving you time and effort.

Customisation is Key: Easily tailor payment amounts and token ownership requirements to align perfectly with your community's structure. Defender Bot empowers you to create a highly secure and exclusive environment.

Final Thoughts

Defender Bot isn’t a big narrative that everyone talks about. Still, it is a necessary toolkit for project owners and users to navigate Discord and Telegram servers with ease and, most importantly, securely.

Their transparency regarding their financial operations, focus on growing and nocturning their community, and education truly set them apart from any competition right now. While waiting for future updates and more advanced features, you can enjoy Defender Bot's flexibility today. Simply follow the steps and dedicated videos in their documents and get started!

Crypto Narratives 2024: Layer 3’s - Explained written

by Daniel

Over time, the cryptocurrency market has proven to be a cycle of narratives. Every so often - and it does not necessarily follow a pattern - there is a new narrative that emerges to captivate the masses:

● 2017 —----------ICOs

● 2019—-----------DeFi

● 2021—-----------NFTs

Blockchain continues to evolve to meet daily challenges, given the technology maturing and the increasing demand for its application in real-world use cases.

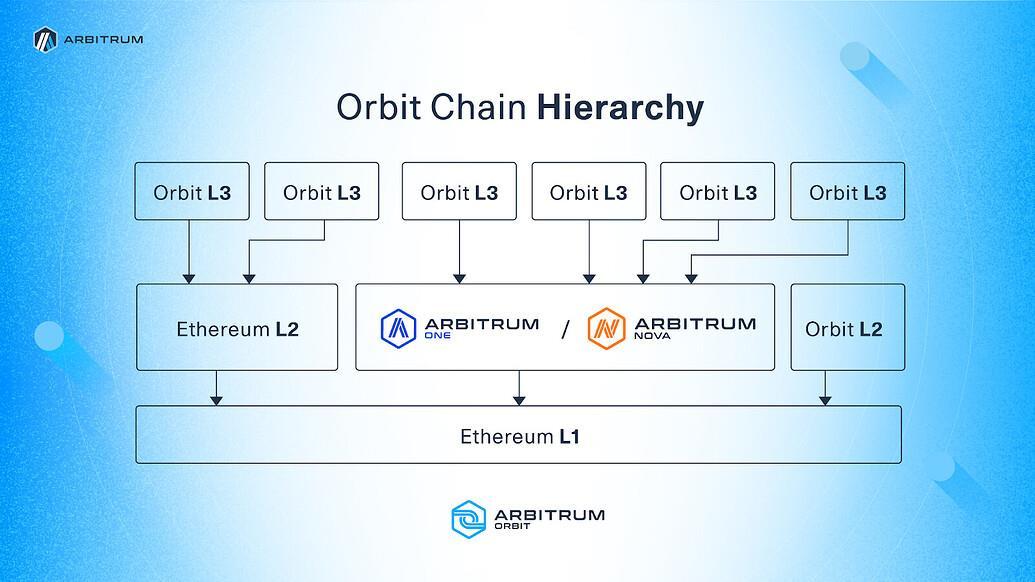

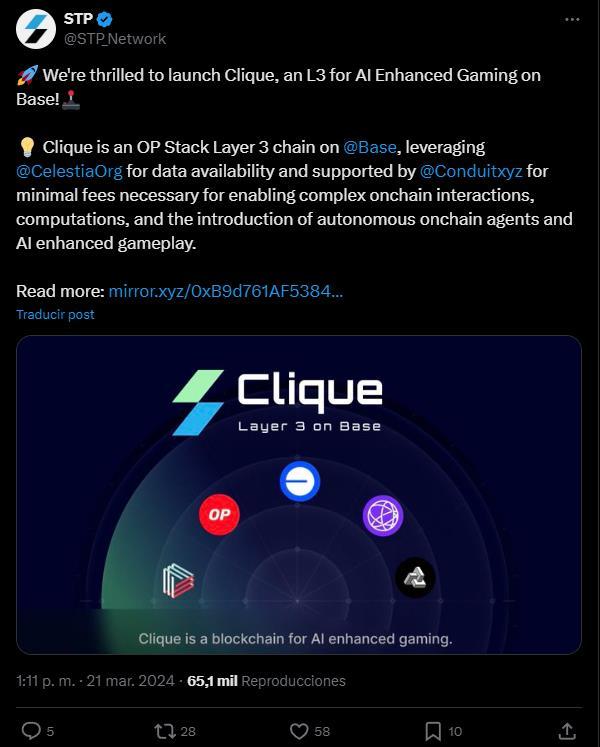

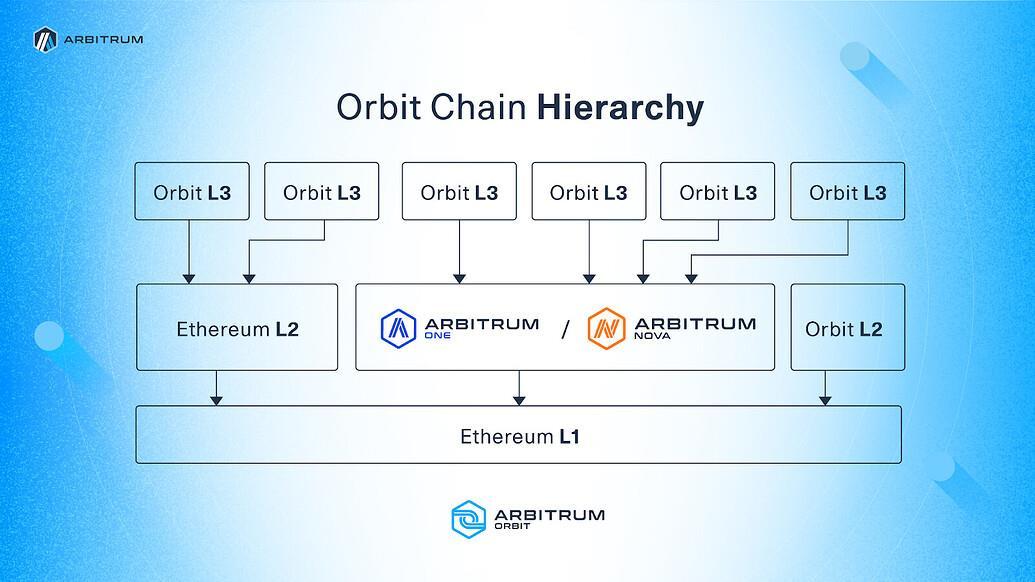

From monolithic blockchains, such as Bitcoin and Ethereum (L1), the narrative scaled in 2024 to a novel concept known as 'Layer 3' (L3). This concept seeks to position itself as a solid narrative for generating as many opportunities as ecosystems develop and as one that addresses specific use cases for particular application demands.

The increasing application of 'L3s' by many companies and projects across all sectors has brought the need to understand their characteristics and the benefits of L3s compared to Layer 2 (L2) solutions, for example.

Understanding the importance of L3s today can be a step forward for the investor in identifying unique and profitable opportunities in building a solid and diversified portfolio. Arbitrum and Optimism alone, two of the principal Layer 2s on which they built L3s, account for 60% of the Total Value Locked (TVL) relative to L2 solutions.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Understanding Layer 3s

Undoubtedly, the original monolithic designs of Layer 1 blockchains such as Bitcoin or Ethereum are tremendously inefficient. Even Ethereum proto-danksharding still has a long way to go to prove that it can be a fully functional layer for the various applications running on Web3 today.

Ethereum expects scale towards an ecosystem where Layer 2 will support the transactional load demanded by decentralised applications, allowing it to become a dedicated settlement environment focused on issuing and verifying transactions on the blockchain.

Layer 2 blockchains such as Optimism, Arbitrum and Base are experiencing significant growth this year due to their ability to execute transactions off the main chain (L1) at a better cost-performance ratio per transaction batch.

Total Value Locked (TVL) Layer 2s Solutions. Source: L2BEAT

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

L2s increase scalability with reduced gas cost per transaction and much higher transaction speeds than L1s, benefiting from the legacy security of L1s to retain the benefits of decentralisation.

In this way, L2s fulfil the primary function of 'helping Ethereum scale' while ensuring the availability of data and assets on the main chain, diversifying the computational load required.

This vision aligns with Vitalik Buterin's Ethereum roadmap upgrade presented last year. In this roadmap, Layer 2s play a crucial role in Ethereum's development towards full danksharding, with a strong focus on reducing transaction fees for L2s.

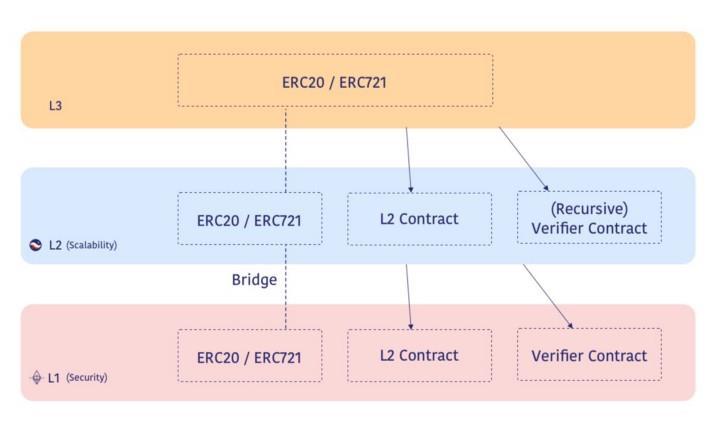

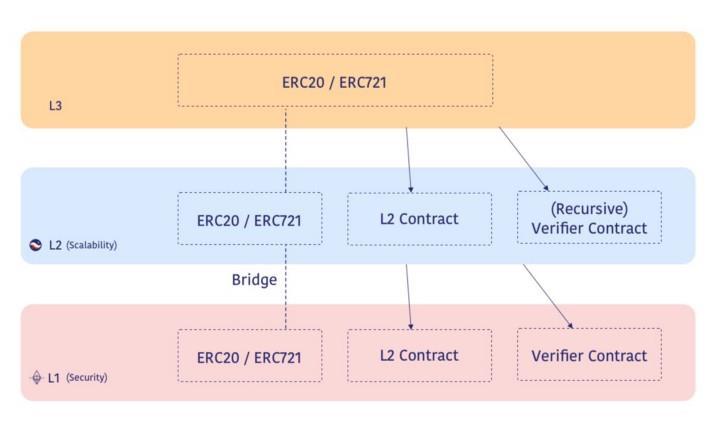

Now, the scaling in Layer 2s wants to be replicated in a concept that has emerged frequently: 'Layer 3,' which has its base on the principle of transposing the same logic applied to L1 years ago: build a Layer 2 protocol that anchors to Layer 1 for security and adds scalability.

Arbitrum L2 Data Overview. Source: Dune Analytics

In a nutshell, ‘Layer3 relates to L2 in the same way that L2 relates to L1’, as StarkWare nicely denoted in its Blogspot on this technology.

What is Layer 3?

Application layers, as Layer 3s are also known, are environments tailored to specific use cases that are built on top of L2s to ensure greater scalability and performance in the execution of these uses.

Building blocks of an L3.

Source: StarkWare

Fractal Scaling From L2 to L3. Source: StarkWare

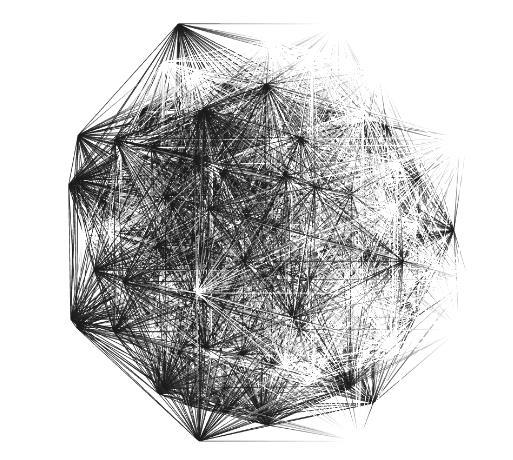

The key is that while Layer 2 and Layer 3 solutions aim to scale the blockchain, Layer 3 solutions emphasise connecting the different networks (Layer 1 and Layer 2), facilitating seamless interoperability between them, and creating a more costeffective solution.

Think of application layers as virtual worlds in Roblox, where users play in specific worlds within the metaverse under a dedicated disk space to leverage the platform's technology without worrying about settling assets between the actual world and the metaverse. This results in fast, scalable, low transaction-cost games (apps) with near-zero fees.

Layer 3s simulates an interconnected world of L2 apps that leverage their technological bounties and user base with sufficient liquidity without worrying about publishing updates to the main L1 layer.

Novel Layer 3 concept by ZK.Link. Source: zk.LINK

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

L3s present considerable advantages in improved scalability, interoperability, and costeffectiveness, which are leveraged by blockchain L2s such as Polygon, Arbitrum, and Optimism to deploy their own L3 ecosystems for particular use cases in an isolated state environment and fee market.

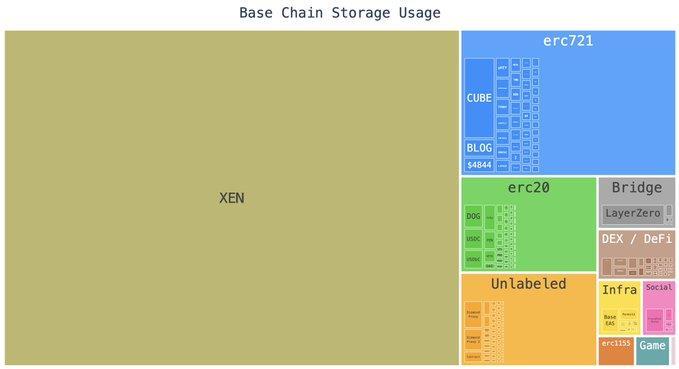

Furthermore, through application layers, the projects take better advantage of the block space. The next generation of computing is already active in monolithic blockchains such as Ethereum, and it uses the novel concept of blobs.

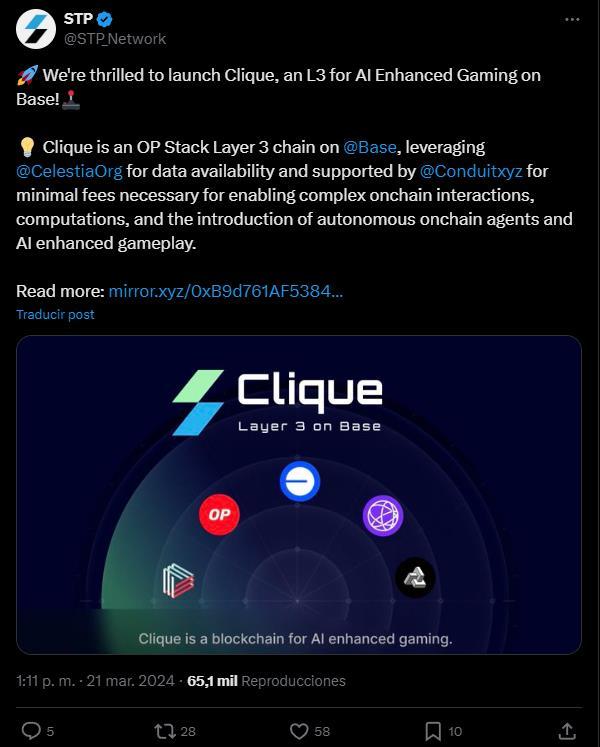

Degen Chain on Base or XAI on Arbitrum are perfect examples of the growing supply of application layers actively developing on L2s.

Why Layer 3’s?

The expansion that is taking place in blockchain technology from L2s to adapt existing technology to specific user demands through L3s is undoubtedly a breakthrough in extending the reach of the decentralised marketplace and bringing it to the masses.

The ecosystems built by the various established L2s in the industry through L3s will likely be an extension of their established reputations, namely for these application layers to inherit the vibrancy, liquidity, and capacity of the L2 they have chosen to further extend their brand.

Popular Game

Crypto Unicorns deployed in Arbitrum Orbit. Source: XAI GAMES.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

By offering extensive customisation and inheriting the trusted L2 infrastructure, application layers have strong arguments supporting their deployment:

● More deterministic performance and costs

L3s make it cheaper and faster to add users and assets via L2, meaning that if a project launches an L2, it will be more expensive to move assets/users from a CEX to Ethereum L1 to its L2, as it involves two L1 transactions, which given current market conditions, is sometimes stupidly expensive.

On the contrary, if the specific use case launches on an L3, users can go from a CEX to a primary L2 with direct exchange to their L3. This scenario denotes double transactions at L2s rates. Irresistibly cheap after Dencun Upgrade.

● Interoperability at a lower cost

Publishing data and updates at layer 1 involves much lower costs through L2s for any established projects, but for a new project wishing to run on L2, the costs of publishing at the core layer can be up to 21000 L1 gas per batch in the case of rollups (~$1200) and up to 400,000 gas for ZK rollups (~$23000).

● Greater scope for experimentation

Projects can innovate without necessarily deploying on the main chain with the costs of doing so. The customisation of L3 offers the potential for experiments that can not happen on L2 or L1.

Similar to how developers use Kusama in Polkadot, L3s allow for innovations to run before deploying them to the general public. There are many ways to set up an L3 with several resources available in the Rollups-as-a-Service (RaaS) and Modular Blockchains verticals.

● Privacy

L3s can turn into privacy-centric applications. By applying zero-knowledge proofs to transactions, L3s focused on use cases such as Digital Identity can preserve the privacy of a public L2.

● Network effect

L3s can allow projects to leverage the extensive user base, reputation, liquidity and assets in the underlying L2, thus allowing developers to leverage L2 distribution channels, helping to evolve and forge layer 2.

● New economic models

Since each L3 has its own dedicated block space, it offers fee isolation that projects can use to establish their economics. In addition, as mentioned above, block space is a new economic model gaining more and more traction within Ethereum.

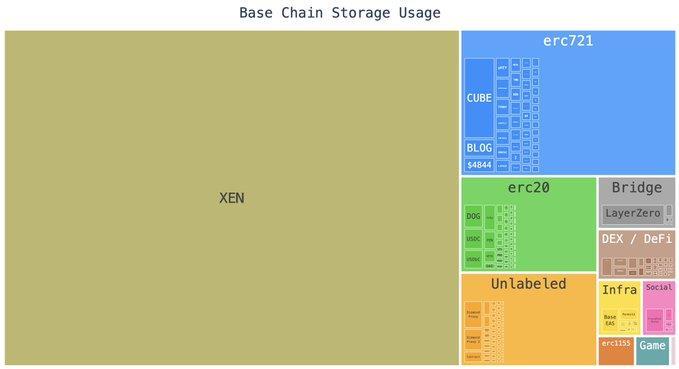

Base Chain Storage Usage. Source: user Storm in X

The previous arguments reflect the potential that L3s can have to deal with the scalability costs of monolithic blockchain networks and to leverage the resources available in L2s to customise specific use cases without using unnecessary resources.

Of course, this ‘optimisation’ of technological resources in the application layers ultimately translates into a significant improvement in the performance of the various decentralised applications that we are beginning to see built in the L3s, where the end user gets the best benefit, driving them to use blockchain technology more and more every day.

Case Studies and Examples

Layer 3 is revolutionising the industry's construction, especially how blockchain technology has been harnessed for specific use cases, allowing them to adapt to legitimate project needs without sacrificing security.

As it gains traction and becomes more popular, especially in the traditional industry, we will increasingly see the launch of custom projects as an application layer in the various L2s that offer a tech stack (SDK) to implement it.

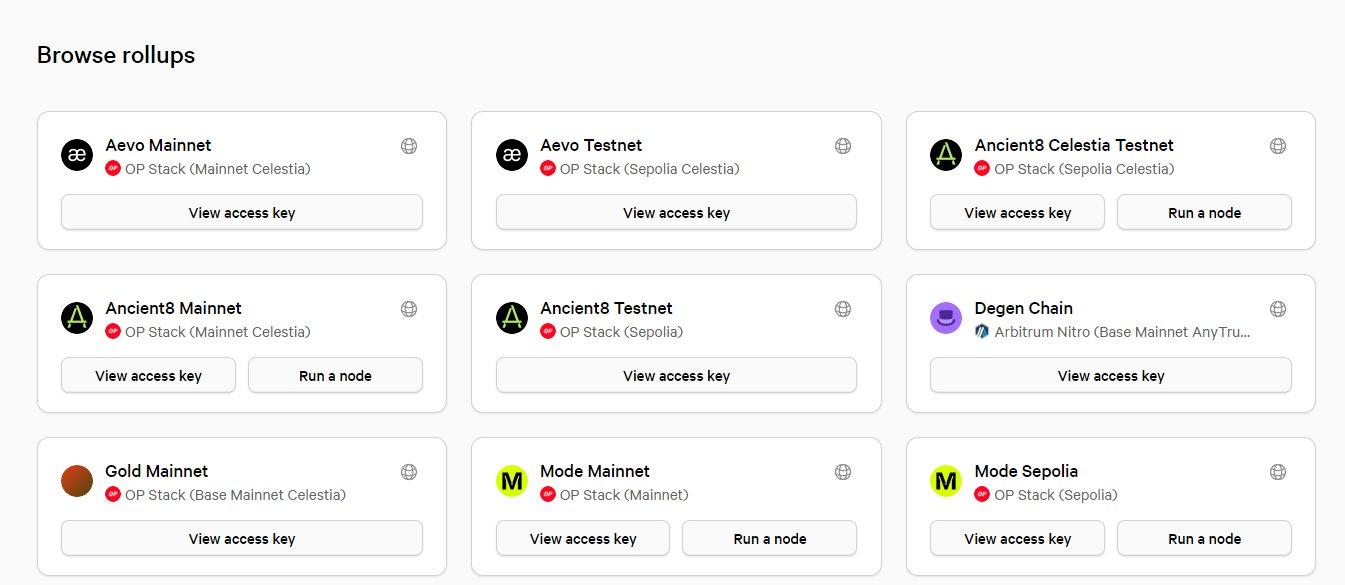

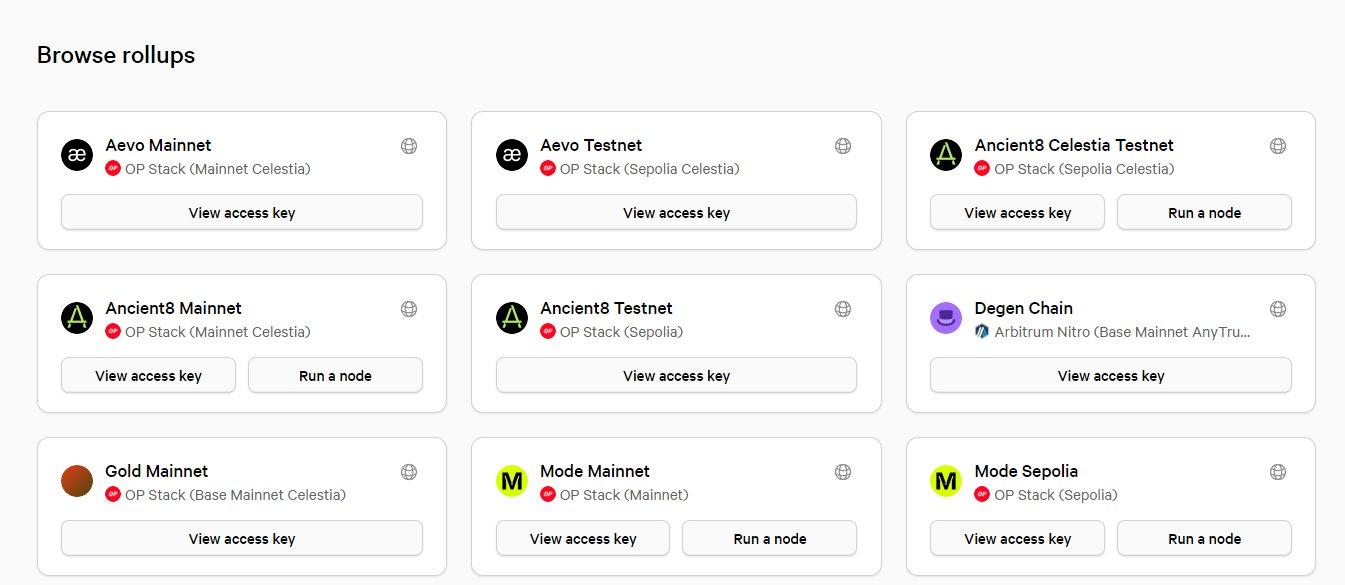

Projects can choose from several options, such as Optimism's Op Stack or Arbitrum Orbit as a rollup framework with Ethereum, Base, Zora or Mode as the settlement layer where the rollup transactions are verified. Projects can also have roll-up transaction data posted to either Ethereum or Celestia.

From an investor's point of view, it is convenient to be aware of who are the principal L2 players evolving towards a standardised framework for Layer 3 adoption, generating a whole ecosystem of opportunities with extensions of specific use cases such as gaming, SocialFi, and NFTs, among others.

Let's look at the leading solutions for Layer 3 in the industry.

● StarkNet is one of the forerunners driving the use of the Layer 3 concept in the industry since 2021. It offers an SDK that is highly customisable, fast, costeffective and suits any use case. Madara is the framework that simplifies the development of modular app chains on Starknet

● Arbitrum Orbit: Arbitrum is currently the L2 with the best track record on L2 metrics. Focused on the gaming sector, Arbitrum wants to leverage its growing ecosystem and extend it through its Orbit chains to create highly customisable Layer 3 blockchains. Orbit blockchains are highly customisable and offer an excellent scalability ratio to suit specific demands.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Orbit chains. Source: Arbitrum Foundation

● OP Stack: Optimism's OP Stack offers tools for building economic and fast Ethereumcompatible blockchains. The advantages of building with OP Stack come from its standardised framework and out-of-the-box interoperability with other OP Stack-based blockchains.

● zkLink Nova: This is the cumulative multi-chain Layer 3 infrastructure based on zeroknowledge technology, offering the first multi-chain Zk-Rollup infrastructure as zkLink With zkLink Nova, implementing high-performance, low-cost Rollup apps is possible.

● ZK Stack: A technology stack introduced by zkSync to create an ecosystem of customisable and trustless linked blockchains powered by zkEVM called 'Hyperchains', based on the zkSync Era code.

● Taiko/Loopring: Loopring is an application-specific Layer 2 and Layer 3 ZK-Rollup protocol that allows for high throughput, low-cost trading, and payments on Ethereum. Loopring announced its Layer 3 will go live on Taiko’s Alpha-3 testnet to showcase a new possibility by deploying a highly optimised, application-specific ZK-Rollup on top of a generalisable Layer 2.

● Kakarot: Kakarot is a zkEVM implementation written in Cairo (Starknet). Layer 3 zkEVMs Kakarot and Madara will combine to create unified stacks for Layer 3 zkEVMs where teams can deploy zkEVM appchains and utilise validity proofs to settle transactions on Starknet

In addition to the previous offerings, you can deploy an L3 today in just a few clicks with existing RaaS platforms such as Conduit, Caldera, Gelato, AltLayer, Lumoz, Snapchain, Ankr y Zeeve, and others.

Arbitrum

RPCs and web sockets for public Conduit rollups. Source: Conduit

Examples of Layer 3s

Some of the examples given in the industry in terms of the application layer include:

● Paradex (Starknet): A crypto derivative exchange launched on Starknet’s first Appchain

● GRVT: a hybrid decentralised exchange in the zkSync ecosystem, being the first to utilise zkSync’s Layer 3 Hyperchain technology.

● XAI Foundation: a gaming-focused, permissionless Layer 3 blockchain launched on Arbitrum.