Bought To You By themoonmag.com

With inflation increasing and prices going through the roof, there has never been a better time to learn how to make your own money and become financially independent.

In Trader’s Perspective, I touch on why this is important to me. And as always the MoonMag brings you so many ideas for new, existing and trending cryptos and tokens - and importantly we let you make your own informed decisions!

This is our 14th issue and it is COMPLETELY FREE which means if you enjoy reading the magazine, share it with at least 2 (no-coiner) friends that have NO IDEA about crypto, I feel we break it down in easy to understand and enjoyable reading as to why I believe crypto is the future!

A note from Josh…

Once you’ve delved into the world of crypto, you quickly begin to relise just how many niches within niches there are. Some projects focus on brand new ideas that have never been attempted before and others, focus on how to improve existing ideas that already have a place in traditional markets. This issue takes a look at both of these areas and, where crypto is trying to mimic or improve on existing ideas, we see a fair few alternatives! This is a great sign that the industry is bubbling away despite the somewhat uncomfortable state of the lines, candles and volume shown on a trading chart. As always, do your own research and take your time to truly understand the concepts behind the project. Enjoy issue 14!

This magazine is sole property

not

A note from Lisa…

Editorial

of themoonmag.com and is

to be redistributed in any form anywhere else.

Adult NFT Marketplace: The end of Only Fans? Inite: A ground breaking think2earn game Fan Tokens: The sports world sensation The Differences Between Tokens and Cryptocurrency 08 16 26 38 TRADERS PERSPECTIVEThe Importance of Having Your Own Money/Crypto 06 LUKSO 43 Hot Layer 2 Scaling Solutions for NFTs 50

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CONTRIBUTORS

Aldrich Shillian

Aldrich (or Rhys to those in the Signals group!) has been HODL’ing since 2017 and is proud of surviving bear markets, rug pulls and still trading successfully enough to have paid off all debts. Recently, he’s jumped head-on into NFT projects - particularly ones that combine his love of gaming.

Daniel Dudek is a data analyst and adjunct biology professor with a slight crypto addiction. He loves researching geopolitics, NFTs, real world implementation, and impacts of Blockchain technology on various industries. Follow him @jr_dudek on Twitter!

Kel Udeala

I’m a quantitative analyst and a mechanical engineer. I took an interest in crypto because my line of work led me down the financial trading and investment rabbit hole, and it’s only a matter of time before you reach crypto. I enjoy researching different crypto projects, and attempting to forecast their roles in the future financial and technology systems. I also find the volatility of the charts and the resulting crypto-Twitter posts very thrilling.

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

Mrinal B

Proud rugpull survivor since 2016; gem hunter; technophile; found asking ‘wen-moon, wen-lambo’ on Twitter; fundamentals driven asymmetric investor; making ends meet in an IT company.

Daniel Jimenez

Daniel Dudek

Samantha Jimenez

We have all heard people say money is freedom, so what does this mean? It will inherently mean something different to everyone. For one person it may mean putting food on the table for your family, to another not living on the street, or for a woman the power to leave a bad relationship if you need to. There are so many reasons having your own money is important.

THE IMPORTANCE OF HAVING YOUR OWN MONEY/CRYPTO

written by Lisa N. Edwards

From a very early age, I witnessed abusive relationships, and my mother always said to me, make sure you always have enough money to start again. To leave a relationship and be able to support yourself. I’m not talking about FINANCIAL INFIDELITY, that is a whole other topic, be open and honest, there is nothing wrong with having your own money. In any relationship the other person does not own you, you should have freedom.

What we do know about money is…It doesn’t buy happiness or any emotion for that matter, happiness is something inside us. This is why you will often hear there are no emotions in trading - it is simply a transaction, I buy here, I sell here, I (hopefully) have a stop loss if the trade doesn’t do what I anticipate it should.

Back to happiness, you can be the richest person in the world and still not be happy, or searching for inner peace. What money does buy is POWER, SECURITY, SAFETY.

TRADERS PERSPECTIVE

I’m not talking Scarface either.

I am also speaking from a female perspective, and not speaking for every female out there, but for me, power is choice, it enables me to do anything I choose, live where I want to, buy things I want to, and go anywhere I want to. This also gives me security knowing, I am financially able to support myself and be on my own should I need to, which has happened in the past. It has enabled me to stay safe and walk away from potentially dangerous situations, on the other side of the world from where I live. Not every woman in the world has the luxuries that money provides me.

Like many just coming into crypto and trading, I have not always had money, in fact as a small child we were incredibly poor, with a single mother, who worked three jobs to ensure we had everything we needed. At a very young age it became incredibly obvious that THE ONLY WAY TO MAKE MONEY IS TO MAKE YOUR OWN.

Having the ability to trade is a tool that you can carry throughout life, even in a standard everyday job, you can trade/invest some of the money that is not for your everyday essentials (like food or rent) and by trading this to hopefully enable you to lead a better quality of life - for any person whatever your gender. It is something I have always come back to, and something I have used as a tool throughout to support my dreams and goals. So now while the market is sideways, learn everything you can, so that come the next bull run you will have the necessary tools to enable you to trade and secure the gains and freedom.

What are you waiting for… take a deep dive and take control of your life and finances.

And if you want to #BeLikeLisa here is a good place to start - a free Elliott Wave Theroy Book

https://www.elliottwave.com/ free-reports/elliott-wave-princi ple?acn=19le&rcn=sma

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

I am talking Morgan Housel from the book, The Psychology of Money

I am talking Morgan Housel from the book, The Psychology of Money

Adult NFT Marketplace: The end of Only Fans?

written by Daniel Jimenez

written by Daniel Jimenez

A year ago, the world was shocked by the sale of “Everydays-The first 5000 Days” digital work by artist Beeple at Christie’s auction house for USD 69M. An event that allowed the NFT industry’s popularity to grow considerably, becoming a part of our daily lives through games, charity, event tickets, artists, musicians, etc..

Due to their intrinsic properties of traceability and uniqueness, NFTs have allowed exploring the advantages in terms of intellectual property, thus helping to avoid counterfeits and losses due to piracy of content developed by creators around the world.

And it is precisely this particular characteristic that increasingly captivates creators in the adult entertainment industry to focus on using NFTs to distribute their content and interact with fans around the world.

An infallible necessity

Adult content creation is everywhere, achieved with few clicks without much effort on the network of networks; a path to achieving personal goals for some, and a full-time job for others, in some cases providing for their relatives.

Without delving into morality issues or religious precepts, we are aware that you, dear reader, might have been tempted to ‘see’ something beyond the screens, finding a large amount of audiovisual content that comes with morality issues, viruses, fraud, sextortion, and others.

The NFT’s use in the adult entertainment industry comes with the challenge of breaking the traditional paradigms that go hand in hand with piracy, human exploitation, and human rights vulnerabilities of the thousands of people dedicated to working in this industry.

Thanks to NFTs, it is possible to achieve a fair income distribution by authorship of published materials and the tracking of original content, as well as a feasible sexual exploitation control, because of the unique decentralized fingerprint of

each of the audiovisual materials ‘coined’ within the blockchain.

A growing market

According to an InsightSLICE report, The Global Digital Content Creation Market size expects to reach USD 38.2B by 2030 at a CAGR of 12% between 2020 and 2030.

According to an InsightSLICE monthly report, The Global Digital Content Creation Market size expects to reach USD 38.2B by 2030 at a CAGR of 12% between 2020 and 2030.

And according to a monthly report from SimilarWeb, Xvideos, one of the favorite sites for solo pleasure seekers, received 3.1 billion visits during April 2021.

This phenomenon is equivalent to all Amazon + Netflix visits simultaneously.

The COVID-19 pandemic made it clear for adult content platforms such as Only Fans that the industry is experiencing its best growth season thanks to digital technologies like streaming services, that according to Bloomberg data, allowed the platform to earn almost two billion dollars.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

However, despite the resounding success of Only Fans, there are underlying problems typical of centralized platforms:

• Blocking of accounts / withdrawals of money from the platform for content creators

• Exposure to sensitive data such as names, bank card numbers, profile data from hacks or content leaks

• Traditional payment processors can sometimes prohibit the purchase of content on platforms of this type

• Exposure to chargebacks from users’ unfair claims against content creators, leaving them income deprived.

• Inefficient payment processing times

• Exposure of users to transactions on this type of platform on the bank statement

• OnlyFans introduced a new max tip of USD for the first four months for active users

• This limits to potential income to a creator on the platform

As you can see, the adult entertainment industry continues to expose the typical problems beyond the religious and moral precepts that add more spice to a place generally classified as ‘forbidden’.

NFT Marketplaces: A place for fair erotica

The use of NFTs and the underlying blockchain technology is changing the traditional business mode using cryptocurrencies or tokens for fair payment and income earned by artists or content creators through hard work in a sector that continues to captivate millions of hearts and fantasies every year.

The mission of these platforms is to create a secure and plagiarism-free site for adult content enthusiasts using blockchain technology, thus eliminating piracy for this industry and giving back trust, transparency, and strength to continue.

Among the benefits that the NFT Marketplace for adults are providing, we find:

• Adult content providers use NFT to manage their work on their terms and to evaluate

•

and measure their entire collection of works allowing them to benefit from their work in perpetuity.

Direct interaction with fans without third parties, receiving all income directly from their fans

•

A haven for consenting and ethical adult content providers

•

A more diverse, fair and creative art scene in one place

•

Verification of age, of the recorded content (anti-plagiarism) and a value increase of the participants of the industry

• Agile payments without chargebacks

•

Privacy and pseudo-anonymity for fans of adult entertainment

Options for users and content creators

Whether you are a user or a content creator, the advantages of using a fully decentralized NFT Marketplace for Adults are many more than the negative aspects you could find using the traditional adult content platforms.

Although the sector is still in its early stages of development and adoption, there are projects dedicated to Adult content creation that wish to bring adult content creators closer to their fans. Let’s explore some of them:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

RarePorn

RarePorn is a French-origin platform that offers a space for fans and content creators to meet based on safety, authenticity, and ethics.

RarePorn did its first-ever NFT auction that gave the rights to look at the panties of Cléa Gaultier, the latest muse of the famous house of Dorcel. This NFT sold for 2.5 ETH, about 10 thousand dollars at the time of its acquisition, showing how lucrative the market for adult entertainment is in all its facets.

It is also possible to sell your NFTs within the platform through its Binance NFT marketplace, thanks to the agreement between RarePorn and Binance.

RarePorn POKEN ($PKN) token allows the purchase of its NFTs, called NFPs, and the possibility of using it as a tip or payment to your favorite actors and actresses within the platform.

Shush Club

Shush Club is a premium online Content Creator Platform that leverages both technology and tokenization to create a pioneering infrastructure to support the rapidly growing Creator economy.

The platform wants to change the game rules usually present on platforms like Only Fans, where the top 10 creators account for 73% of all revenue from this site. Shush Club wants to empower smaller creators through SEO practices and embedded marketing for their affiliates.

Additionally, it offers an NFT Marketplace to allow content creators access to the lucrative world of NFTs powered by its native token: $SHUSH.

Earn, Create, and Affiliate are the three pillars on which this platform seeks to develop, which has among its allies the Top Earner on OnlyFans, Amouranth.

The platform is currently in its beta phase and in the process of capturing adult content creators worldwide ahead of the launch of its marketplace later this year.

Naftyart

NaftyArt is a marketplace developed by Nafty, a company dedicated to blockchain technologybased solutions for the sin industry, incorporating NFTs, tokens ($NAFTY), and APIs for payment processors on adult sites among the set of solutions for this industry.

In this marketplace, you are able to publish and sell adult NFT content from sex artists, collectors, and creators in the industry, as a part of an ambitious plan that in the future will include a Metaverse for adults and two erotic games that will allow Nafty NFT holders to generate passive income.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CumRocket

This platform offers content for people over 18 years old, ranging from streaming audiovisual material similar to Onlyfans to exchanging pornographic NFTs through its cryptocurrency called $CUMMIES.

The token displayed on BNB Chain is also used to reward content creators and access material or exclusive live sessions of creators by paying $CUMMIES.

The platform intends to help sex workers generate stable income selling adult content by bypassing traditional payment processor restrictions and increasing self-sovereignty, unlike OnlyFans.

CumRocket is a platform under the web3 concept that, since the launch of its NFT Marketplace on October 29, 2021, has incorporated more than 1,800 content creators who have sold more than 7,300 NFTs.

The platform takes a 15% commission on each transaction, unlike centralized subscription competitors like Onlyfans and JFF, who manage to take up to 30% commission from content creators.

Taboo

Taboo is an actual marketplace for adults who want to become the next blockchain playboy.

The platform also offers a streaming service for its carefully selected models, specializing in high-end content.

The great strength behind this project is the development team, with Enjin Coin Marketplace Developers, and their experience using high-

quality product development tools.

Attempting to emulate being the decentralized playboy, Taboo incorporates Super Models, who are selected to provide the highest quality and most exclusive SFW, NSFW to XXX media from adult content creators.

The platform is cross-chain (Plasma Network, Polygon, Harmony, BNB Chain), which incorporates the popular layer 2 protocols to provide a fast and cheap interface to users and content creators, allowing the different standards to develop NFT tokens such as ERC-721 and ERC-1155.

The project also includes the launch of an exclusive magazine for adults and access to private VIP parties at Taboo Mansion, events in the adult industry, and meetings with greetings from models on the platform.

The platform has about 10,000 NFTs listed, in its official OpenSea account, with a volume of 186 ETH in less than a year of its launch.

The project uses its native token TABOO, which allows commission payment to coin content, exchanges in its marketplace, and reward payment to its models.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Final Thoughts

The use of NFTs as an alternative to decentralized financial options empowered by cryptocurrencies is increasing by complementing the shortcomings of a traditional irregular income distribution system that has been the tradition in the adult entertainment industry.

Already in the past, traditional platforms such as PornHub, RedTube and Brazzer have announced the incorporation of cryptocurrencies as secure, anonymous, and decentralized forms of payment on their official sites.

Playboy has done the same by incorporating cryptocurrency wallets into its platform and recently signaling the possibility of minting (NFT) all of its adult films in a bid to fight piracy and ensure revenue from intellectual property.

As a result the future of the adult entertainment industry is reinventing itself using more and more decentralized options such as NFTs and decentralized Marketplaces for direct interaction between creators and fans.

written by Mrinal

written by Mrinal

Inite: A ground breaking think2earn game

‘X-2-earn’ mechanisms have taken the crypto world by storm. It all started with STEPN that pioneered the ‘move2earn’ economics with its innovative tokenomics, gameplay (rather walk-play), and strategy. After STEPN, there came a lot of move2earn projects, but none could replicate the success STEPN had. The ongoing bear phase also didn’t help the cause. Then there are few projects such as XCAD that are innovating in the ‘watch2earn’ space. In this article we will focus on a project that brings a unique perspective in this space by its innovative ‘think2earn’ concept.

Inite

Inite ( inite.io ) is a web3 lifestyle ideas generation app with a cool game and social mechanics to keep users engaged and rewarded. It has used best practices from leading games and technologies to merge GameFi, SocialFi, and DeFi to create think2earn game. Users are incentivized to think and create ideas on a regular basis to mine IDEA tokens.

Concept

The game concept is based on a premise that people tend to postpone picking up good habits such as jogging, meditating, exercising, or learning a new language. Inite’s game and social mechanics help stimulate users’ brains and makes achieving these goals on a daily basis an engaging and interactive experience while also allowing them to earn and gain an audience of influence.

Users need to equip themselves with NFTs in the form of devices. These NFT devices need to be purchased from their built-in marketplace and can be a PC, laptop, mobile, watch or a VR headset. Currently, only NFT mobile device collection is available and PC, laptop, and VR NFT devices are roadmap items.

Each NFT device has attributes like memory, network, battery, storage, etc. Choosing an NFT is also based on how one prefers to create new ideas (enabled through gaming mods; there are 4 gaming mods present).

A NEAR testnet wallet needs to be connected in order to make the purchase and earn IDEA tokens from the game. Other supported chains are Polygon, BSC and Aurora and users can easily switch between various testnets from within the application itself using allbridge.io.

This

magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

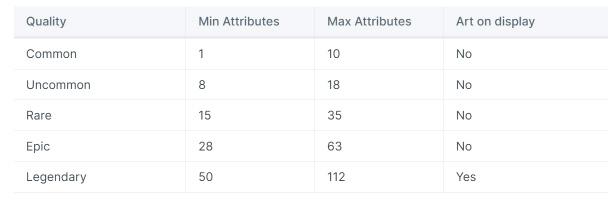

NFT device attributes change as per the device quality which ranges from Common at the lowest tier to Legendary at the highest end.

Source: Inite whitepaper

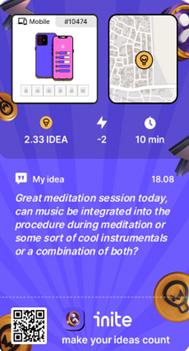

Once purchased, users feed ideas and thoughts into these NFT devices, which send them to the metaverse in return for IDEA tokens. Before submitting an idea, the user has to meditate for a period defined in the application. Only after the timer for meditation is over, can an idea be submitted. Two sample ideas are shown below:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Inite NFT device marketplace

Inite NFT device marketplace

In order to submit an idea, the device needs Energy. Post purchase of NFT device, after 12 hours user gets 1 Energy and after 24 hours, 1 more Energy is credited. So, a user can begin with 2 Energy, which means he/she can meditate for 10 minutes (1 energy = 5 minutes meditating). Players are able to increase their maximum Energy by holding more devices. The calculation is highlighted in the table below. Additional Energy is given to users for higher quality devices.

Source: Inite whitepaper

Good ideas become popular in the metaverse and earn more tokens while poor ideas gain less interest and therefore earn less. With the IDEA tokens earned, users can upgrade or level up their NFT devices so that their attributes improve leading to more earning potential. There is also a punishment system to prevent misaction like penalizing for missing a day, incentivizing users to report others’ bad ideas, etc. This brings in a unique dopamine loop into the system (neurobiology).

Inite NFT device marketplace

Inite NFT device marketplace

Users can calculate their earning potential through an earnings calculator through their Inite Guide. In a nutshell, the gameplay can be summarized into four steps.

Another very interesting aspect is the presence of an NFT Idea Marketplace where users can sell their unique and innovative ideas as NFTs. Below are some snippets from the NFT Idea Marketplace:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Tokenomics

There are two tokens in the ecosystem

INIT: The governance token with max supply 1,000,000,000

It can be received when a user buys it or swaps to INIT within the game. It can also be won in challenges and leadership battles.

It is used to vote, stake, create challenges, create clans, LVL up devices, and for device pairings.

IDEA: Utility game token with uncapped supply

It is received when a user creates an idea or receives likes on his/her idea.

It is utilized to repair device, LVL up box, use AI samples and image generation, device peering, etc. Token distribution and vesting periods

Tax and fee structure (Source: Inite whitepaper)

Cashflow

The company makes money through three avenues:

• Selling NFT collections and investing in project development and IDEA liquidity

• Selling part of INIT tokens to investors and allocate 30% to think2earn mechanics by providing running challenges, a leaderboard, a liquidity pool, and pairs of INIT/IDEA, INIT/ USDT, INIT/DAI

• Taxing in-app activities, such as NFT trading, Device peering, and NFT idea Marketplace

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

INIT token distribution (Source: Inite whitepaper and Near Insider twitter)

Partnerships

Inite is backed by Crypto Gaming United (CGU), which offers its league members an opportunity to hone their gaming skills inside of Inite’s sandbox. It has also received a grant of $50,000 from NEAR Foundation. Other partners that Inite mentions in its website:

The Graph, WOW Summit, OpenAI, Polygon, web3auth, Chrono.tech, BrightID, MetaVentures Bangkok, forklog, Binance Smart Chain, Chiko Roko, Forbes, Bitcoin Insider, Grit Daily, Block Telegraph, Coinstelegram, World Expo, Diamante Blockchain.

Roadmap

The project’s roadmap looks exciting with loads of promising milestones in future which includes strong catalysts like staking, brand collaborations etc. If the development keeps up the momentum and the various NFT devices are added as per the promised roadmap items, there could be a strong possibility of a partnership with a wearables, tech or an NFT brand.

Team

The core team is doxed and relatively young.

CTO: Andrei Ivanouski (Profile)

Developer: Bogdan Ruptash (Profile)

Advisor: Oscar Andrade (Profile)

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CEO: Mikhail Savchenko (Profile)

Developer: Myroslav Gavryliak (Profile)

Developer: Illia Havryshchuk (Profile)

CEO: Mikhail Savchenko (Profile)

Developer: Myroslav Gavryliak (Profile)

Developer: Illia Havryshchuk (Profile)

Summary

Inite’s vision is to improve users’ cognitive skills and productivity with its unique game design. It has been proven scientifically that an active brain improves longevity to keep the body active longer.

Having a strong backing from Near Foundation, Inite is an innovative and bold project which aims to combine GameFi, SocialFi, neurobiology, and quantum computing through its unique think2earn mechanism.

With think2earn mechanics, Inite aims to facilitate a healthier and more intelligent lifestyle to combat cheap addictive dopamine games. This in turn increases the longevity of the game ecosystem and attracts more users to web3 as a whole.

Fan Tokens: The sports world sensation

written by Samantha

Cryptocurrencies are a market that attracts the attention of all industries, and sports are no exception, thus the motivation to create the Fan tokens, a group of utility tokens designed to give its owners the ability to enjoy certain benefits within the crypto world.

These assets act like a digital pass that allows their owners to earn exclusive rewards or participate in unique experiences and vote and influence some of the decisions of their favorite teams. Fan Tokens are a way to acquire goods and boost user loyalty programs.

Despite being closely linked to soccer, Fan Tokens are not exclusive to this sport. Although most of the launched teams with this type of digital asset belong to the soccer world, there are also sports like basketball, tennis, Formula 1, rugby teams, and many others.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

How do fan tokens work?

The basic idea is that an organization such as a sports team mints many fungible tokens (as opposed to non-fungible tokens or NFTs), then sells or distributes them to fans or speculators.

These tokens often retail on secondary markets, just like cryptocurrencies such as Bitcoin or Ethereum, which means they are subject to conventional market forces.

Fan tokens generally confer limited rights to holders. The Paris St. Germain fan token, for example, allows holders to access exclusive VIP experiences and vote on the cover of the fan edition of the FIFA 22 soccer game.

Let’s look at an example: In this case, fans selected a message to display inside the team’s locker room for a May 2021 match: “ Together we can, together we will! Let’s take one more step towards glory and victory”.

Utility of Fan Tokens

One of the main advantages that Fan Tokens provide to their owners is the possibility of influencing some minor decisions of the teams, like the choice of a new uniform, the team’s motto, the warm-up or even the celebration music. These digital assets also offer new ways to bring fans closer to their favorite teams and players.

With more than 120 sports teams discovering the potential of blockchain technology through fan tokens and recognizing it as a way to access funding resources through their sale, the number of teams on the Socios.com platform has grown considerably of late.

Even when most of these digital assets develop in the sports and entertainment blockchain, Chiliz blockchain, others, such as Binance Chain, home to the four most capitalized tokens on the market, have started to create fan tokens for their users because of the importance gained in the last year.

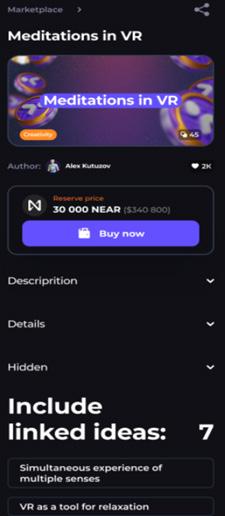

Still, Chiliz remains the leading blockchain in this niche, with hundreds of sports teams associated with its Socios.com digital platform. The current market capitalization of existing Fan Tokens is $427.310 million, according to CoinMarketCap data.

Chiliz blockchain dominates the Fan token market because most of them are soccer based, a sport in which the platform has secured deals with top teams, like FC Barcelona, where fans have opted for a locker room mural and a captain’s armband.

In August 2022, Chiliz bought a $100 million stake in FC Barcelona’s digital studio, Inter Milan, and fans voted for the first new goal celebration song in 8 years, chose the official team bus and gave their opinion on the jersey design.

Fans also chose an image that hung in the players’ area at Wembley Stadium and voted for an editorial about a memorable Man City season. By participating in many of these polls, fans entered into different contests to win prizes, such as VIP access to the teams and exclusive promotions.

These coins are unique and protected by a technological “ledger” that houses all your transactions., with a cryptographic encryption that ensures that each coin is unique in the marketplace, making it nearly impossible to hack andchange account statements or steal the coins.

Historically, clubs have given Fan token users power to vote on team decisions, as if they were shareholders. However, this decisions are with minor or manageable repercussions.

A loyalty tool

Loyalty programs can use Fan tokens to boost themselves, giving those who own a fan toke rewards for participating and voting. For example, if you have a fan token for Atlético de Madrid, you can vote to decide on different aspects of the team and receive rewards for doing so.

Unlike NFTs, fan tokens are fungible, meaning they can be fractioned or exchanged for products and other tokens, making them tradable. This feature makes them particularly attractive for sports clubs, which use them to boost fan interaction and drive new business avenues.

As Fan tokes are represented by digital crypto assets and managed by ‘blockchain’ technology, there’s no way to falsify their ownership, making them easy to exchange with other people.

All these features have made fan tokens a perfect tool for sports clubs to encourage fan participation, achieving that multiple Spanish soccer teams such as Valencia, Barça or Atlético de Madrid already have their own fan tokens.

The tokens also allow fans to access discounts, promotions and limited content, test their sporting knowledge against each other and win prizes such as signed club merchandise.

Socios.com is not the only platform trading these tokens; Binance exchange launched its fan token platform, known as Binance Fan Tokens, in October 2021, to hosts tokens of the Alpine F1 team, SS Lazio, FC Porto, and Santos FC.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The 5 most capitalized fan tokens on the crypto market

Building on that, let’s take a quick look at the top five most capitalized fan tokens in the market.

The image above describes how the Società Sportiva Lazio sports club Fan Token is the most capitalized, with more than $65.09 million in market value, followed by the Santos FC and FC Porto soccer clubs Fan Tokens, in second and third place. With a market capitalization of $56.93 million and $55.52 million, respectively.

The Formula 1 team Alpine F1 Team Fan token occupies fourth place. The fifth position goes to Paris SaintGermain FC with more than $27 million. The top 5 Fan Tokens in the market by market capitalization add up to a $253 million value, representing almost 60% of the entire market capitalization of this niche crypto market.

Top Fan Token. Source: Coinmarketcap

Top Fan Token. Source: Coinmarketcap

Società Sportiva Lazio

https://www.sslazio.it/it/

Società Sportiva Lazio, for example, is a Rome sports club that teamed up with Binance to launch its Fan Token, called LAZIO, the first one on this blockchain and according to CoinMarketCap, the most capitalized Fan token in the industry.

Price of LAZIO. Source: Coinmarketcap

The price of S.S. Lazio Fan Token is USD 7.45, with a 24-hour trading volume of USD 18,127,023, thus obtaining an increasing variety of more than 718% in the last four months. Learn more details on their website.

Santos Futebol Clube

https://santosdomundo.com.br/es/santos-del-mundo/

For its part, Santos, the Fan Token of the Santos Futebol Clube sports team from São Paulo (Brazil), is the second largest capitalization Fan Token in the crypto industry, with $56.42 million currently. This token was also launched on the Binance blockchain and can provide its holders certain benefits, such as NFTs Non-fungible tokens help foster a closer relationship between the club and the public.

The current price of this Fan token is $12.29, making it the highest-priced Fan Token on the market. There 4.55 million SANTOS tokens representing 15% of the total Fan Token issuance of 30 million units.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Price of Santos FC. Source: Coinmarketcap

Santos Futebol Clube was founded in 1912 and is the team with the most goals in world soccer history, with a total of 12,833 goals to date, as indicated on its website. This team has won the Brazilian Cup, the South American Cup, the Copa Libertadores de America, and the World Interclub, among other awards.

Alpine F1 Team

https://www.f1aldia.com/

Within the top five mentioned above, a no soccer fan token, the Formula 1 team, Alpine F1 Team, enters the ranking, located in fourth place on this list with its Fan Token ALPINE.

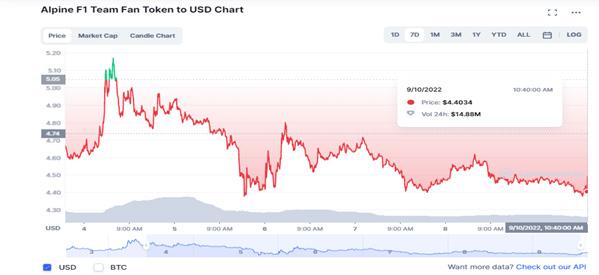

Alpine F1 Team price. Source: Coinmarketcap

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It maintains a current market capitalization of $51.07 million. At press time, the token is trading above $4.50 per unit. Its current circulation is 11.36 million tokens, representing 28% of its total issuance of 40 million units.

Alpine is the first Formula 1-related Fan Token to launch on the Binance Chain blockchain, which has seen a growth of over 250% in the last four months.

Chiliz: the world’s leading blockchain fintech provider for sports and entertainment

Another clear and benchmark example of the rise of fan tokens in this industry is Chiliz blockchain, which has shown great potential to bring cryptocurrencies to mainstream audiences worldwide. It also developed the sports fan engagement platform Socios.com, which is based on Chiliz’s blockchain infrastructure and uses $CHZ as the exclusive currency on the platform.

Teams such as Barça, Juve, Manchester City, Milan, Atlético Madrid, Roma, and PSG, among others, have already jumped on the bandwagon of Chiliz and the world of cryptocurrencies. In this sense, Chiliz is trying to tackle a different problem, helping the tokenization of entertainment platforms and the sports industry.

The idea is to be able to become the bridge between the biggest sports clubs in the world and the fans.

For soccer fans who are cryptocurrency enthusiasts, Socios.com is the best of both worlds, giving that Socios and Chiliz have the same core team, and it is usual to see Socios using the power of Chiliz. And as the CHZ token is the center of the whole ecosystem, you could also say that CHZ is the native token of Socios.com.

Amid the Qatar 2022 World Cup furor, this project closely linked to the World Cup is growing in interest, causing the price of CHZ to soar almost 40% and a projection as an investment favorite.

Due to what we mentioned earlier, it is the token of the Socios.com platform, responsible for issuing the famous fan tokens of several of the most important clubs in the world, as well as national soccer teams.

It is also the first exchange that allows fans to exchange personalized tokens and participate in club-based surveys and sweepstakes. As such, the tokens give fans voting rights, meaning the more you own, the more voting rights they have.

Atlético de Madrid players Vitolo, Koke and Adán hold up t-shirts to announce the sponsorship of Socios.com and the Chiliz cryptocurrency.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Why did investors rush to buy Chilliz?

The impetus investors felt to buy Chilliz was due to the start of the 2022-2023 European soccer seasons, the Premier League, and the 2022-2023 Liga España, generating notable gains for CHZ thanks to the different team’s Fan tokens currently participating in these leagues.

Now that the Qatar 2022 World Cup is about to start, it is worth investing in these tokens before the beginning of the sports championship, and the price rebounds strongly.

Chiliz (CHZ) shows this market growth path experienced before the World Cup in the following chart, with an upward trend in recent months, reaching 24 cents at the end of August, which represents a 100% increase from its value in July. All this is thanks to the ever-increasing interest in fan tokens ahead of Qatar 2022.

CHZ price August 2022.

Source: Coinmarketcap

CHZ is the best way to see how the fan token market is behaving, as it is necessary for trading on the internal marketplace of the Socios.com site. Despite the volatile weeks and the latest correction, the price of Chiliz is showing consolidation at around $0.20. Moreover, the scenario seems optimistic as the Qatar 2022 World Cup is approaching, and this cryptocurrency is gaining more and more media prominence.

Alexandre Dreyfus, the founder of Chiliz, announced last month the detachment of this blockchain from the Ethereum network and the launch of Chiliz 2.0, raising the investor’s anticipation.

With the imminence of the World Cup in Qatar, the increase in global sales of Fan tokens and cryptocurrencies strictly linked to the World Cup, and in the face of the problems that non-fungible tokens (NFT) have been showing lately, the spring of Fan tokens has only just begun, consequently making them an asset to watch in the coming months.

CHZ is the best way to see how the fan token market is behaving, as it is necessary for trading on the internal marketplace of the Socios.com site. Despite the volatile weeks and the latest correction, the price of Chiliz is showing consolidation at around $0.20. Moreover, the scenario seems optimistic as the Qatar 2022 World Cup is approaching, and this cryptocurrency is gaining more and more media prominence.

Alexandre Dreyfus, the founder of Chiliz, announced last month the detachment of this blockchain from the Ethereum network and the launch of Chiliz 2.0, raising the investor’s anticipation.

With the imminence of the World Cup in Qatar, the increase in global sales of Fan tokens and cryptocurrencies strictly linked to the World Cup, and in the face of the problems that nonfungible tokens (NFT) have been showing lately, the spring of Fan tokens has only just begun, consequently making them an asset to watch in the coming months.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

A blockchain for entertainment

In addition, Chiliz is driving blockchain use cases in several countries with these developments, as soccer has around 270 million fans, according to FIFA estimates.

Therefore, many of these people will start hearing of fan tokens, NFTs, crypto, and other industryrelated terms thanks to the involvement of figures such as Lionel Messi, global ambassador of Socios. com.

How to acquire Fans tokens?

To acquire these assets, you can purchase Fan tokens through the Socios app using Chiliz (CHZ), the native token of Socios’ parent company, or you acquire them through the app.

Once you have purchased your Fan token, you will get it in your Web3 pockets, similar to another cryptocurrency.

If your fan token comes from Partners, you can visit the Partners website or app to put your tokens to work. Sometimes, you must use these tokens to earn rewards across the platform or enter surveys. Or you can sell them on a cryptocurrency exchange if their value increases.

About CHZ https://www.chiliz.com/

Chiliz is a unique project trying to bring the blockchain world to the traditional sports and entertainment industry that is doing well, and has great partners in its pocket.

The Chiliz team is solid, with big-name partners from different backgrounds, like Juventus, FC Barcelona, Atletico Madrid, City, and PSG, global reputations soccer clubs, Binance Chain, and Chainlink that also are big names in the crypto space.

Many have seen that these tokens can be a good investment ahead of events in the world of soccer, especially with bets coming in the next few weeks to predict the winner of the World Cup.

For example, when Messi signed for PSG, many generated profits by trading the Parisian club’s fan token, taking advantage of the transfer rumors.

Something similar may happen with the Qatar 2022 World Cup. The teams that are best priced are those that are favored in the betting to win the tournament. Therefore, it will be very likely to see more such rises in the coming weeks.

Tokens, digital currencies, and cryptocurrencies are known terms in the blockchain space that are often confused, even by experts in the field.

Although it is not a sin to confuse this terminology, not knowing the key differences between these assets can pose a very high risk for those investors unaware of their basic characteristics, thus being unable to differentiate the potential gem that is hidden in the crypto space.

How many rugs pulls have not occurred in the crypto ecosystem for the sole fact of following the FUD behind a token with very concealed characteristics for users but visible to the malicious author behind the project?

To avoid this situation, if you are a newbie in the ecosystem, you should learn the key differences between these terms and avoid making common mistakes, thus not crossing the thin line that separates cryptocurrencies and digital tokens.

The Differences Between Tokens and Cryptocurrency: Why should investors know the differences between these terms?

written by Daniel Jimenez

What are cryptocurrencies?

Usually and almost by consensus, cryptocurrencies classify as assets with their particular blockchain, used as an exchange form, a value reserve, or as means of payment (currency).

According to Usman W. Chohan (MBA, University of New South Wales, Canberra), cryptocurrency “is built to function as a medium of exchange.” These exchanges are made through electronic transactions using encryption techniques with “cryptographic technology to ensure the transactional flow.”

In other words, a cryptocurrency is a digital currency with its accounting book distributed on the network, with the inability to ‘program’ it under smart contracts to generate a specific instruction other than what it was created for.

Among the most outstanding examples we have bitcoin as the greatest exponent, deployed on the same name network, Bitcoin (with a capital B).

Bitcoin is a milestone in cryptography’s modern history because of its ability to generate cryptocurrencies on a platform that records and

magazine is

validates all transactions chronologically like a public ledger.

Altcoins: The continuity of Bitcoin

Other very specific examples of cryptocurrencies are the ones that emerged after Nakamoto launched bitcoin in 2008. Some iconic examples are BCH (Bitcoin Cash), dogecoin (DOGE), and LTC (Litecoin), among others.

It is worth mentioning that “altcoins” is also a frequently used term in the crypto ecosystem to pinpoint those cryptocurrencies that come from a bitcoin fork, which were built using the original protocol and including variants in the original code (Litecoin, Dogecoin, Namecoin, etc. ).

Another group of altcoins resides on cryptocurrencies born under their own particular blockchains, such as the examples of Ethereum, Waves, Nxt, and others.

In both cases, bitcoin and altcoins work on an independent blockchain that records transactions with their native cryptocurrencies.

is not

redistributed in any form anywhere else.

This

sole property of themoonmag.com and

to be

Cryptocurrencies characteristics

• Cryptocurrencies are secured by pure cryptography through a mining process that usually uses verification methods based on consensus algorithms such as Proof-ofWork (PoW)

• Cryptocurrencies run on their particular blockchain network rather than on a different blockchain.

• The operation of cryptocurrencies does not depend on any central authority. They are decentralized and distributed in a P2P network where all transactions and activities in computing nodes function under a set of predetermined rules.

• They are distributed trustless systems.

• Requires advanced blockchain knowledge and coding skills to create.

• Blockchain development is more expensive and takes considerable time to develop.

• They can be expendable, divisible and have a limited supply.

Tokens

Tokens are another arcane term associated with the crypto ecosystem and are frequently used by users, investors, and blockchain companies. They

are often confused with cryptocurrencies and even used interchangeably as a synonym.

It is worth noting that tokens have existed for a very long time in the physical world, used by landowners to pay laborers for their work at the end of the 19th century, or used to exchange for merchandise and food within the same farm.

Another example of tokens in the physical world are those used in casinos to represent a specific amount of real money to exchange for fiat money within the same establishment.

Blockchain-based digital tokens serve a similar purpose in the digital world: a unit of value that an organization creates to govern its business model and empower its users to interact with its products.

Commonly issued by fintech companies related to blockchain use, the tokens represent assets, shares or have a specific utility in a closed ecosystem, depending on the project where it is executed.

From blockchain games to decentralized finance, tokens are issued on existing blockchain networks under the form of smart contracts that allow “programming” specific instructions for which they are created.

The above is the main difference that every investor should notice when looking at a token; programmed on open blockchain networks such as Ethereum, NEM, Waves, Solana, or Polygon, which take full advantage of the characteristics and benefits of the layer 1/layer 2 technology on which they issued.

At this point, it is worth mentioning that the great precursor of this concept of ‘programmable currencies’ is the Russian Vitalik Buterin who, thanks to his invention (Ethereum), allowing the creation of the bases for the generation of millions of programmable units (tokens) under specific standards with quite explicit attributes (ERC-20, ERC-721, ERC-1155).

Tokens, in general, are mostly issued through public or private coin offerings (and their derivatives) known as ICOs, IDOs, IGOs, etc.,

A collective financing modality where enterprises raise money to develop their business plan from interested investors.

Tokens characteristics

• They are built on top of existing blockchain protocols

• They can have a different utility than the means of payment

• They can be programmed for specific use cases such as securities, loyalties, bonds, etc.

• Tokens can leverage existing network reputation and security with customization available.

• Fairly easy to build with pre-existing tools and open source.

• Token development is faster, easier, and relatively cheap.

• They lack legal tender value.

• Its main use is to generate access within decentralized applications (Dapps)

• Although other blockchain platforms allow generating tokens as Waves, NEM, or Tron, basically Ethereum dominates the scene with more than 600 thousand ERC-20 tokens, and 128,000 ERC-721 tokens and almost 18 thousand ERC-1155 tokens.

Token Types

In addition to NFTs, it is important to mention other use cases for tokens that every investor should take into account when locating investment

opportunities:

• Utility tokens: account units used to measure any asset amount of a certain asset of a particular project. They are not investment vehicles, beyond the fact that the rise in demand and a limitation in their supply make them as appealing as these. They function more as a way of access to certain services.

• Community Tokens: Focused on autonomous organizations around a project community. They provide access to certain benefits, discounts, and rewards to specific communication channels of the community behind the project.

• Security Token: They work as an investment contract. They serve as property collateral and can even function as company shares. They are designed for financial gain and are subject to regulations.

• Asset Tokens: They represent real-world objects like real estate, making it easy to buy and sell physical items without needing to move them around.

• Transaction Token: collateralized tokens such as stablecoins are regularly used as an exchange form and value store.

NFT: Non-Fungible Token

A point and aside in this post that we must do with all obligations is undoubtedly the aspect of nonfungible tokens, popularized in the current world inside and outside the blockchain industry as NFTs.

The arrival of Cryptokitties on Ethereum in 2017 generated the first use case of non-fungible tokens, which work differently from the fungible tokens known today, which introduced the blockchain ecosystem in popular areas such as gaming, art, and music.

The NFT’s key feature is that they are uniquely identifiable and distinguishable during interaction and circulation, they are non-divisible, and lack fungibility, allowing to record the ownership of indivisible and unique assets, such as a ticket to an event, a bottle of wine, or a piece of jewelry, allowing to demonstrate the originality and absolute ownership of the underlying asset.

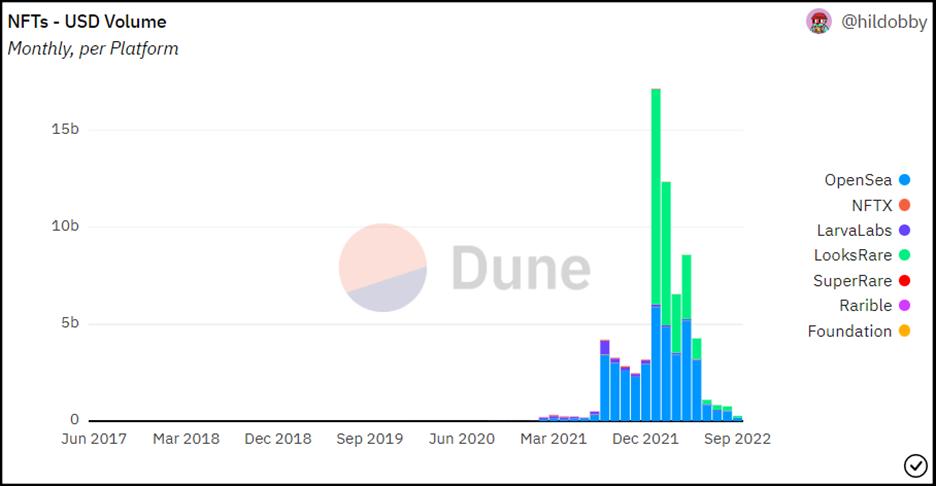

In the third quarter of 2021 alone, during the NFT craze, the market volume reached a meteoric figure of 10.7 billion dollars, demonstrating the potential that non-fungible tokens have for the industry.

Is Bitcoin a cryptocurrency or token?

Bitcoin is a cryptocurrency deployed on its own particular blockchain network, set on becoming an autonomous, decentralized payment without trust or the intervention of third parties.

Given its limited nature and support in the p2p network that supports it under the PoW consensus algorithm for its mining (creation of new bitcoin units), it has managed to classify as an asset´s safe haven beyond an exchange form.

For the reasons stated above, bitcoin is, by definition, the reference cryptocurrency in the ecosystem.

Anchored to the value of bitcoin and within the framework of decentralized finance, Wrapped Bitcoin (WBTC) has emerged, a token that allows the value of the underlying asset to be used in different DeFi protocols to obtain the advantage of the world inherent in decentralized finance.

What is better to invest in Token or Cryptocurrency?

After knowing the differences between tokens and cryptocurrencies, you may now wonder which is the best option for investment opportunities.

It is imperative to know that a cryptocurrency is more complex to build than a token, requiring not only knowledge and technical effort but also significant monetary resources for its deployment and dissemination.

With this, I clarify that it is more difficult but not impossible (Ethereum fork case) to compromise network security or to throw the entire project out the window (Terra case) by compromising the integrity of the ecosystem around the created blockchain and its main native asset: its cryptocurrency.

Not to mention the existence of tokens cataloged as ‘shitcoins’ in the ecosystem due to their low utility, null value, and dark intentions created in a few clicks by some malicious actors.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Since the tokens are easier to create and do not need more than to captivate the hearts of an army of enthusiasts who support their operation by giving value to the intangible, they have a higher risk factor when investing.

However, there are risk mitigation tools and practices to consider when locating this next ‘gem’ that everyone wants to find early on for their next million dollars.

If you want to know some tips to identify the signs that a project must have to survive in the industry, you can consult the 12th edition of our magazine.

The crypto ecosystem is full of great examples of successful projects and failures, many classified as cryptocurrencies or tokens.

Finally, its usefulness, use case and value proposition will be the fundamentals that really determine its attractiveness as an investment vehicle.

If you want to invest in real estate, you could consider a physical sector token for real estate or do it virtually through a metaverse token, but if you wish to have a value store in the future, invest in a cryptocurrency like Bitcoin, which is deflationary and has good prospects of increasing in value over time just like physical gold does.

Once again, utility is one of the fundamental aspects in which tokens differ from cryptocurrencies; both are part of the crypto ecosystem that allows users to interact with blockchain-enabled digital assets without censorship or third parties.

As noticed, having the right information is fundamental for any investor to make a profit if they understand the slight but essential differences between a token and a cryptocurrency. Until the next edition!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

written by Daniel Dudek

Unlocking web3 and the creator economy through Universal Profiles on LUKSO

One of the most critical issues in the blockchain and web3 space today is digital identity. LUKSO is building the next generation of Ethereum focusing on solving this issue and creating a network that empowers the creator by abstracting away the complexity of coding dApps, utilizing Universal Profiles (UPs) or blockchain-based accounts, and unlocking the next generation of NFTs that is more extensible and directly composable with Universal Profiles. Today, blockchain is used primarily to hold and trade tokens. The combination of fees, a lack of a more user-friendly experience, and everything you own linked to a private key and password introduce a risky environment that prohibits the practical adoption of blockchain technology. At the moment, the LUKSO testnet is live and anyone can set up a node to interact with the technology they have developed.

LYXe/LYX Token Information

All Data Is Current At Time Of Writing

Total Supply: 100,000,000 LYXe / MC: $504,820,280

Circulating Supply: 15,205,916 LYXe / MC: $76,762,546.27

Ethereum Contract Address: 0xA8b919680258d369114910511cc87595aec0be6D

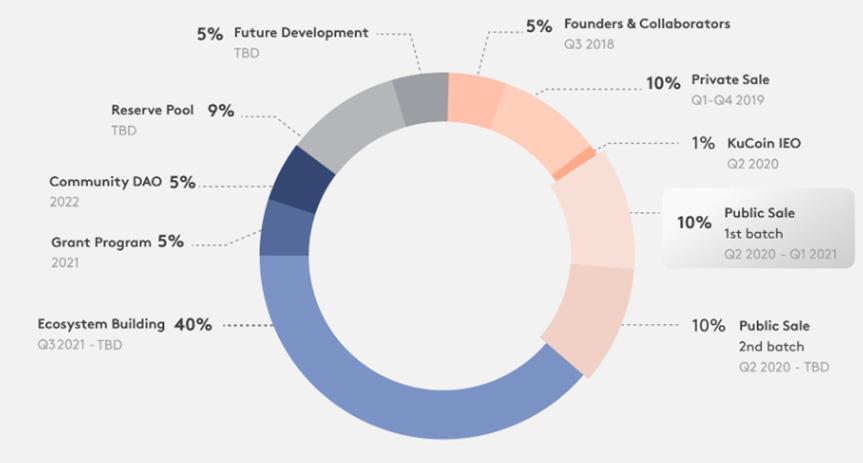

Token Allocation

5% Future Development, 5% Founders & Collaborators,

10% Private Sale, 1% KuCoin IEO, 10% Public Sale (first batch),

10% Public Sale (second batch), 40% ecosystem building, 5% grant program, 5% community DAO, 9% reserve pool

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Website https://lukso.network/

White Paper Lukso_whitepaper

Twitter https://twitter.com/lukso_io

Telegram https://t.me/LUKSO

Discord https://discord.gg/lukso

LinkedIn https://www.linkedin.com/company/lukso/

Where To

Token

• KuCoin: LYXe/USDT

• KuCoin: LYXe/ETH

• Gate.io: LYXe/USDT

• Gate.io: LYXe/ETH

• Uniswap (V2): LYXe/WETH

• Bitkub: LYXe/THB

Purchase the

Core Team

Marjorie Hernandez

• Co-Founder & Chief Product Officer

• LinkedIn & Twitter

• Marjorie is a highly experienced entrepreneur and designer having spent most of her career creating ideas and concepts for her clients. Now focusing on bringing LUKSO mainstream by merging blockchain with fashion and art. She is well-known for her ability bridge the gap in fashion and technology. A pioneer who will go down in the fashion industry for developing phygital art and bringing the largest brands into the world of crypto.

Fabian Vogelsteller

• Co-Founder & Chief Architect

• LinkedIn & Twitter

• Fabian is an innovator, thought leader within the blockchain space, and former member of the Ethereum foundation in the early stages of 2015. For those who aren’t aware of his achievements, he is the author of the ERC20 and ERC725 standards that have revolutionized the way we create value and initiated the ICO boom, developer of the Mist browser which was the first decentralized web3 browser, was responsible for creating the web3.js library, and, most notably, developed the Ethereum wallet.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

What is the function of LYX?

The LUKSO network is the next evolution of Ethereum. In reality, it is a near mirror image of Ethereum post-merge with a focus on Universal Profiles and new smart contract standards. The token LYX is used as a utility token to secure the network via its Casper Proof-of-Stake system and to pay for gas when transacting on the network. The usage of the token varies little when compared to Ethereum.

What makes LUKSO unique?

The network Fabian Vogelsteller has developed is focused on core building blocks called the LUKSO standard proposals (LSPs). These are smart contract standards that enable interoperability and can be used by developers to create more interactable and user-friendly applications. These three core focal concepts are Universal Profiles, NFT 2.0, and Cultural Currencies.

Universal Profiles are blockchain-based accounts changing the way we interact with blockchain, made possible by the ERC725 standard. Instead of having a single private key account, UPs enable numerous devices and applications to control it with different levels of access, customizable password reset flow, and social recovery. Visuals, descriptions, and names can be added to your account. The experience of interacting with dApps will be gasless through relay services in the future with gas being subsidized at the moment for early adopters. A benefit everyone will appreciate and is necessary for mass adoption. Universal Profiles are smart contracts themselves, enabling individuals to act on incoming assets or transactions, create vaults, and track their assets.

LUKSO has created NFTs 2.0 by allowing NFTs to be identified by strings, numbers, or bytes, have unlimited amounts of metadata that can be smart contract readable, updatable metadata upon permission, and allows for batch transfers. These notable improvements on NFTs significantly improve the experience for the end user and enable new features to be conceptualized. Batch transfers enable numerous NFTs to be transferred to another account at once which will reduce the amount of gas for the user. This is a quality of life feature any digital collector would appreciate. NFTs in their current state are limited in their ability to be updated. The addition of unlimited metadata that can be smart contract readable will allow new protocolized NFTs, i.e. enabling certain traits within a specific NFT to interact with a protocol. Instead of gated access based on the token, it could potentially be gated based on the metadata such as specific traits.

LUKSO has recognized that we are moving into a world where everything is tokenized and that culture has value. As such, the team has focused heavily on Cultural Currencies allowing metadata to be added to token contracts, including descriptions, links, and icons. Function names for NFTs and fungible tokens are now unified to allow a friendlier developer experience. Lastly, senders and receivers can be notified of transfers, something simple yet an important quality of life upgrade. Using a DEX or participating in a DAO has just become more seamless.

Market Opportunity

LUKSO is setting itself up to be a contender to Ethereum. Of course, others have rivaled Ethereum in the past by touting faster transaction speeds and lower fees, but few have realized that the improvement needed to actually contend and bring more users into the network is through improving the overall experience of using blockchain. Fabian knew this and that is why he has developed a network built on smart contract standards that improve the quality of life and user experience while simultaneously improving the developer experience as well. Very few protocols are innovating at the user level. Mass adoption will never occur if developers only innovate at the technical level. The learning curve of crypto is high as it is and people don’t want to use a system that requires them to study further to participate. Removing complexities for the user and developer is what LUKSO has done. This is the market opportunity. It is the next-generation EVM blockchain based on Casper PoS and will be the foundation for the new creative economy.

The RoadMap

The LUKSO standard proposals have been developed and now the goal is to inspire application creation on the testnet through hackathons. At the time of writing, “LUKSO BUILD UP! #1” is wrapping up with over 450 par ticipants from 60+ countries building the next generation of decentralized applications. There is no specific date for the mainnet to go live and it is not emphasized. Fabian is focusing on creating a foundational layer built on standards that is resilient far into the future and can be used by anyone re gardless of technological acumen. There have been statements of mainnet going live sometime in the second half of 2022 but these deadlines, just like Ethereum deadlines, have been pushed back. When launched, LUKSO will be adoption-ready, unlike numerous others that launch to satisfy traders or investors.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Conclusion

Right now, the question you might be asking yourself is whether you should buy LYX or not. The questions you should be asking yourself after reading this and possibly doing a little more due diligence yourself should be, do you see yourself using a Universal Profile in the future, and do you recognize the importance of universal smart contract standards? If the answer is yes to these questions, then this could be a perfect time to stack considering the current market conditions. For me, I highly value Fabian Vogelsteller as a pioneer in the industry who has contributed to the most widely used features in blockchain today. I have no doubt that what LUKSO is creating will be commonplace a few years into the future. Think about how you interact on Ethereum or any smart contract blockchain today. Wouldn’t it be convenient to batch transfer tokens to other accounts to reduce possible fees, categorize tokens within your wallet based on the criteria you specify, or even be notified when a random token is transferred to your wallet? The features and standards that LUKSO is proposing are all features that are common sense upgrades but have been unable to be implemented until now. Decentralized digital identity and user experience are critical issues solved with LUKSO.

Hot Layer 2 Scaling Solutions for NFTs

Hal Finney, known for receiving the first Bitcoin transaction from Satoshi Nakamoto and contributing immensely to kickstarting the growth of the crypto space, wrote an email with the subject “Crypto trading cards”. In this email, he mentioned a more interesting way of exchanging digital cash through cryptographic trading cards. This concept was the first ideation of what the industry now calls “NFTs”.

Though the current broader market perception equates NFTs with digital art, the sector’s evolution has come to encompass music, films, social media and even DeFi. Ultimately, NFTs have become a social identifier of status in various communities, much like art and music collectables are in the physical world. Also, like in the physical art and collectable world, investors and traders are taking advantage of the industry’s growth.

written by Kel

Additionally, NFTs are now tending towards Finney’s original conception of a value exchange mechanism via “trading cards” as the crypto space incorporates NFTcollateralised lending, fractionalised ownership, and yield-bearing NFTs. For instance, 2022’s first quarter saw NFT secondary sales volume reach US$10 billion, with Ethereum having the lion’s share of this sales volume at 85% (US$8.5 billion).

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Why are NFTs experiencing such sales volumes, what is the market opportunity for NFTs, and how can investors take advantage of this explosive blockchain narrative?

NFTs are a cultural phenomenon. Even as the NFT blockchain primitive acquires more use cases, the most prolific feature that has propelled it to success and imbued it with an ‘investable asset’ status is its command of popular culture.

NFTs have experienced mainstream acceptance, with Justin Bieber, Eminem, Snoop Dogg and more buying Bored Ape Yacht Club (BAYC) NFTs. The following charts show the monthly USD volume and daily transaction count to date from the most popular NFT marketplaces.

Given the potential for NFTs to find use cases across all other sectors within the blockchain and cryptocurrency space, it is reasonable to anticipate further future growth. The current market statistics only showcase the first wave of speculation in a niche environment before broader adoption in both the Web 2.0 and Web 3.0 landscapes.

As an example, Starbucks, in Partnership with Polygon (Matic), has launched an NFT-based loyalty programme, which will let customers buy and earn digital collectable stamps in the form of NFTs that offer other various benefits and immersive experiences. Similarly, Instagram has also integrated the ability for people – creators, businesses and collectors to share digital collectables they created or own. Even international organisations such as The European Union, via its World Intellectual Property Organisation (WIPO), plans to fight the counterfeiting of real-world goods by using NFTs to show digital ownership rights and certificates of authenticity.

To further forecast the potential growth of the NFT primitive, one only has to compare the growth trajectory of the DeFi primitive, which was once a niche cryptocurrency sector that saw logarithmic growth due to high experimentation and increasing use cases.

With the recent interest in NFTs (even during the recent market downturn), high gas (transaction) fees and blockchain congestion have become barriers. For instance, the NFT buying frenzy at various periods in Q1 and Q2 of 2022 severely impacted the speed of the Solana blockchain. On the other hand, while the Ethereum blockchain continued unabated, transaction fees skyrocketed. For these reasons, several blockchain projects are deploying Layer-2 scaling solutions specifically optimised for NFTs. These L2 solutions are primarily for the Ethereum blockchain, given its 85% share of the NFT market, and help scale the Ethereum blockchain by processing transactions off-chain while maintaining the same security measures and decentralisation as the mainnet. As a result, users can enjoy lower transaction fees and faster processing times while congestion on the Ethereum blockchain is kept at a minimum.

Some of the NFT-Optimised L2 scaling solutions include Arbitrum, Optimism, Loopring, Immutable X, zkSync, and zkSea, which we will further discuss below.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Arbitrum

Website: bridge.arbitrum.io

Arbitrum is an L2 scaling solution for Ethereum by Offchain Labs. The L2 uses Optimistic Rollup technology, which assumes off-chain transactions are valid and doesn’t publish validity proofs for transaction batches posted on-chain. This method separates optimistic rollups from zero-knowledge rollups, which publish cryptographic proofs of validity for off-chain transactions. Porting contracts to Arbitrum requires no code changes or downloads, as Arbitrum is fully compatible with all existing Ethereum developer tooling.

The project recently launched its ‘Arbitrum Odyssey’ initiative – a collaboration with crypto-renowned artists, offering Arbitrum-exclusive NFTs incentivising users to explore different parts of the Arbitrum ecosystem – from bridging to DeFi to NFTs and gaming. Arbitrum does not have a token, but it is worth exploring the ecosystem and using its infrastructure in case the project team decides to airdrop tokens to its users at a future time – similar to what Optimism did with the OP token.

At the time of writing, Arbitrum has about US$939 million in Total Value Locked (TVL) and has released numerous further improvements culminating in the release of Arbitrum Nitro, which has a 7x to 10x improvement in throughput.

The project is already compatible with various Ethereum Decentralised Applications (DApps) and infrastructure projects, including Uniswap, Aave, 1inch and more. With an initial US$ 120 million Series B funding round at a valuation of US$1.2 billion from Coinbase Ventures, Pantera, Alameda, Delphi Digital and more, the project is primed to succeed in its vision of scaling the Ethereum blockchain. It’s worth watching and exploring, not just for reducing the cost of your NFT mints but also in case there’s ever a future airdrop for users.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Optimism

Website: optimism.io

largest competitors, with a TVL of US$834 million at the time of writing. Similar to Arbitrum, Optimism leverages the optimistic rollup technique in its operation. Also similar to Arbitrum, Optimism is a universal Ethereum L2 scaling solution and offers optimised NFT experiences due to low gas fees and fast transactions.

Optimism raised US$3.5 million from Paradigm and IDEO to kickstart its for-profit company with a focus on building out its Optimistic Rollup scaling solution. Optimism consisted of former members of the Ethereum scaling research outfit Plasma Group.

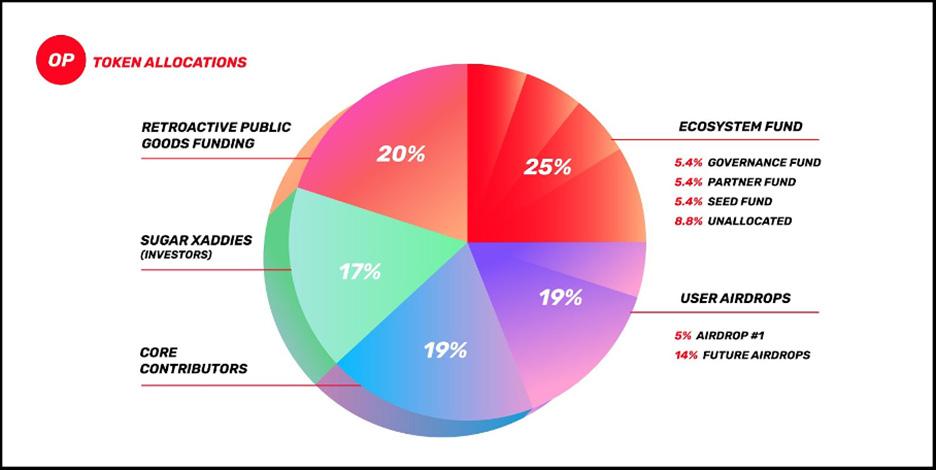

Unlike Arbitrum, Optimism has a token, which it uses as protocol revenue to fund and incentivise its ecosystem. On May 31, 2022, Optimism airdropped its OP token to its ecosystem users. The OP token gives holders participation rights in The Optimism Collective – a two-tier governance system composed of Token House and Citizens’ House, which govern technical decisions related to Optimism, such as software upgrades and public-goods funding decisions, respectively. The token has a maximum supply of 4,294,967,296, a current circulating supply of 214,748,364 and is distributed according to the following allocations:

The Optimism ecosystem has a thriving NFT ecosystem of about 33 projects and marketplaces. In the spirit of promoting the Optimism ecosystem and the proliferation of NFTs, Optimism recently launched Optimism Quests, a simple and educational means of rewarding exploration of the Optimism app ecosystem. Just by reading about different apps and completing a short quiz and task, users can mint a commemorative NFT that represents the completion of the respective quest. Season 1 of Quests will run until January 17, 2023.

With significantly increasing interest in NFTs and L2 scaling solutions, the OP token could do very well when the current adverse macroeconomic conditions and crypto market downtrend reverses. The token is available on popular centralised exchanges, including Coinbase, Binance, KuCoin, Gate.io, Huobi and Cryto.com, as well as the Optimism layer of decentralised exchanges like Uniswap.

Optimism

Websites: market.immutable.com www.immutable.com

Immutable X is the first L2 scaling solution specifically designed for NFTs on Ethereum, with instant trading, massive scalability and zero gas fees for minting and trading, all without compromising user or asset security. The project leverages StarkWare’s zk rollup technology and boasts up to 9,000 transactions per second (tps). While Arbitrum and Optimism rely on optimistic rollup technology, Immutable X relies on ZK Proofs, which ensures that new blockchain states are derived by correctly applying a series of valid user transactions to the previous states. Once the proof is processed on the Ethereum blockchain the L2 block is instantly finalised.

The project seeks to serve as the backend and liquidity platform for products, marketplaces, or games using NFTs. It aims to lower the entry barrier and provide greater access to the Immutable X wallet and its ecosystem tokens in a platform-agnostic manner for game developers and NFT designers. Immutable X also appeals to gamers on traditional gaming platforms and already boasts a commendable portfolio of games and NFT projects. Some of the most popular projects built on Immutable X are Illuvium and Gods Unchained, both of which also have their own utility tokens.

Like Optimism’s OP token, the Immutable X platform also has an IMX token. The token has three core uses – fees, staking and governance. Participants who stake IMX can receive up to 20% of Immutable’s protocol fee paid directly in IMX, or Immutable will automatically swap the actual purchase currency (e.g., ETH) for IMX on the open market. The IMX token holder is considered to have staked their tokens if they fulfil the following criteria: hold IMX on L1 or L2, have voted on a governance proposal in the last 30 days, and either hold an NFT on Immutable X or have completed a trade in the last 30 days.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Token holders will also be able to vote on token-related proposals via decentralised governance. Proposals will include topics such as how to allocate token reserves, voting on developer grants, activating daily rewards and changes in token supply. The token has a maximum supply of 2,000,000,000, a current circulating supply of 235,284,001 and is distributed according to the following allocations:

The token is available on popular centralised exchanges, including Coinbase, Binance, KuCoin, Gate.io, Huobi and Cryto.com, FTX, Kraken, Gemini, as well as decentralised exchanges like Uniswap.

Digital Worlds NFTS, the not-for-profit foundation and issuer of the IMX token, has launched a US$500 million fund to exponentially accelerate the growth and success of web 3.0 projects and games built on the platform via Ventures and Grants. Directing this US$500 million war chest towards business development could propel the project and its token to further success when the bull market returns, which makes the project one to keep an eye on.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Loopring

Website: loopring.org