Bought To You By themoonmag.com

Excitement is in the air as the cryptocurrency market sharply turns from bear to bull. The rise in demand for digital currencies has sparked a new wave of interest and investment, making it one of the most lucrative industries of our time.

AI is the word on the street! It was DeFi that kicked off the last Bull Run. Can AI get Bitcoin over the line and continue to head higher?

We here at theMoonMag.com think it is very possible! AI is playing a significant role in the current market and is influencing investment in many ways. With the increasing volume of data in the market, AI algorithms can analyze large amounts of information and identify patterns that would be difficult for humans to detect. This has led to the development of AIpowered trading bots designed to buy and sell digital currencies based on market conditions automatically. Check out Wewave.

AI is also helping investors make more informed decisions by providing real-time insights and predictions. With its advanced algorithms, AI can analyze market trends and provide forecasts on the future direction of the market. This information is valuable to investors as it can help them make informed decisions about when to buy and sell their investments.

In addition, AI is helping to improve the security of the cryptocurrency market. With its ability to detect and respond to unusual patterns and behaviour, AI plays a critical role in preventing fraud and hacking.

In conclusion, AI is where it is at! Watch out, as it’s likely that AI will play an even greater role in shaping the future of cryptocurrency and investment. I know it has for me!

Editorial

A note from Lisa…

A huge start to the year for cryptocurrency. The market has been reminiscent of a bull market (is it a trap!?) but the green has been a welcome sight for tired eyes who have spent the best part of last year looking for signs of life. Unless of course they have been reading the Moon Mag! In this case, there was plenty of activity and projects building in anticipation of better times.

The surge has bought renewed interest all around but it’s often easy amongst the excitement to start FOMO’ing into the latest trend of projects. AI is a good example of this. As the hype grows, curiosity and eagerness builds, which sometimes leads to an enthusiastic dive into the nearest AI project without much due diligence! We hope the Moon Mag can provide some stepping stones of perspective that allow you to make better-informed choices. Enjoy!

A note from Josh…

A note from Josh…

Sectors Capturing Attention In The Blockchain Industry TRADERS PERSPECTIVE BULL OR BEARDOES IT MATTER? 08 SUMMARY 12 Embracing The Regulatory Bugbear 5 AI Crypto Projects to Watch in 2023 26 30

Crypto Tax Havens Options: Myth Or Reality? 42 Oraichain 50 Digital Asset Technology: The Rise of a New Financial Era 63 iExec & RLC 70 Where Are They Now? Charged Particles 76 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CONTRIBUTORS

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Kel Udeala

I’m a quantitative analyst and a mechanical engineer. I took an interest in crypto because my line of work led me down the financial trading and investment rabbit hole, and it’s only a matter of time before you reach crypto. I enjoy researching different crypto projects, and attempting to forecast their roles in the future financial and technology systems. I also find the volatility of the charts and the resulting crypto-Twitter posts very thrilling.

Daniel Jimenez

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha Jimenez

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R. Paulo Delgado

R. Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Xenia Soares

Xenia is a freelance writer in the web3 niche. Her work has appeared in major crypto publications including CoinDesk, BeInCrypto, and Play-to-Earn. She has been an investor in cryptocurrency since 2017 and believes digital currency will outpace our current economy in the future.

written by Lisa N. Edwards

written by Lisa N. Edwards

TRADERS

PERSPECTIVE

BULL OR BEARDOES IT MATTER?

The January 2023 market opened with huge green dildos, 100x gems, and youtube thumbnails with what I affectionately call - COCK SUCKER MOON FACES! Take a look, and you can’t unsee it once it is seen; it’s a strange phenomenon that seems to be some sort of attention-grabbing openmouth shocked face to entice viewers into the excitement of the youtube host.

Does that mean we have reached the bottom?

Maybe or maybe not; bottoms and tops, for that matter, are only known in hindsight; we may get the feeling the market is turning, especially if you are on Twitter a lot; at the top, we had these crazy hundredto-five thousand times trades. Photos circulating with massive profits and percentages. Guaranteed only a few of these traders took the profits; they’ve probably HODLed strong while watching the zeros disappear from their portfolio. For those traders, if you were wondering maybe next time when you should sell… There is a saying to live by - the moment you show your friends, your mum/dad, your wife/husband, your Twitter followers your profits, it’s time to sell.

Bottoms are hard to guage, there are many ideas of accumulation and sideways trading being the bottom, but for me, capitulation is usually the very bottom. We got this with the FTX drama. Bitcoin also runs on a four-year cycle, and so far, we are following the cycle to a tee with this January bounce.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

FORGET TOPS AND BOTTOMS

Let’s talk about Trading psychology… mindset plays a crucial role in a trader’s success. It’s essential to be aware of your emotions and how they can impact your decision-making.

https://alternative.me/crypto/fear-and-greed-index/

Fear and greed are two emotions that can be particularly detrimental to a trader’s success. Fear can cause a trader to sell at a loss (or bottom), while greed can cause a trader to hold on to a losing position for too long (or miss the top entirely). To be successful, it’s crucial to have a clear trading plan and stick to it rather than making impulsive decisions based on emotions.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It’s also essential to take a break when emotions run high and avoid over-trading. Additionally, having a good understanding of one’s own biases and being able to manage them is crucial for maintaining a clear mindset while trading.

STOP FEAR AND GREED WITH THIS TIP

Taking regular profits is an important aspect of trading. It helps to lock in gains and reduce the risk of losing all your profits if the market suddenly turns against you. (Especially if you’re a margin/leverage trader) A common strategy is to set a profit target and a stop-loss simultaneously; this is also known as an OCOone cancels the other order. Using both a profit target and a stop-loss, you can ensure that you are taking regular profits while limiting your potential losses.

Another approach is a trailing stop, an order set at a certain percentage or dollar amount below the market price. As the market price rises, the stop-loss order will increase, locking in profits and triggering a sale if the market turns… yep, believe it or not, most (if not all) of us are here for the PROFITS!

In periods of strong wave momentum, following the market trend is often my preferred way to secure profits.

It’s important to note that taking regular profits does not mean you should sell your position every time you make a small profit. It’s a balance between maximizing gains and being mindful of risk management

A good trader will have a clear exit strategy and stick to it, regardless of how the market behaves.

In conclusion, stop thinking about TOPS and BOTTOMS; whether it’s a bull or bear market is irrelevant. As Traders, we should be aware that it’s only in hindsight that bottoms and tops can be identified and that emotions such as excitement and fear can impact decision-making. As Twitter mentions in their status updates, get out and touch some grass, the stuff under your feet, not the stuff you smoke.

TAKE THE PROFITS!

No one died taking profits!!! Drill that into your mind. Get a tattoo. Write it on your forehead if you need to. It’s important to remember that profits should be taken when they are there, and if you don’t, one of those COCK SUCKER MOON FACE guys will!

Following the money flow:

Which sectors are capturing the blockchain industry attention?

written by Daniel Jimenez

written by Daniel Jimenez

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

We are starting a new year, and the Web3 ecosystem-based sector expectations are optimistic.

After a negative outlook in 2022, marked by the collapse of large firms, low prices, and macro events that affected the industry, investors and users expect a bright 2023 for the ecosystem.

Despite the extended bear season, many projects emerged, building solutions thanks to the constant and continuous support of many investors and some venture capital firms present in the industry, which is still present despite the general loss of interest in the ecosystem for crypto winter.

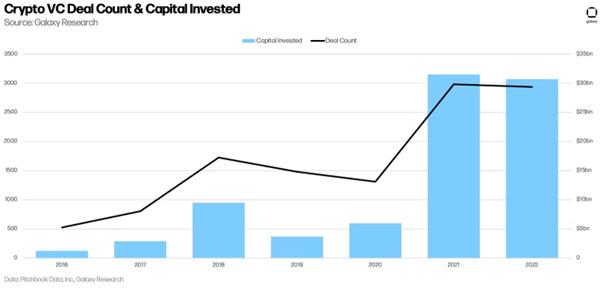

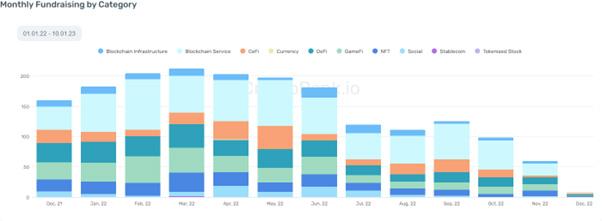

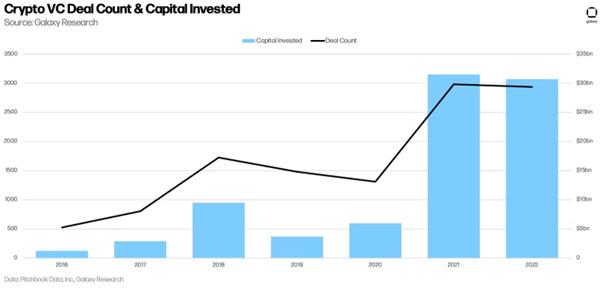

According to Cointelegraph Research, 2022 easily outperformed all other years regarding capital raised and deals completed.

While the institutional crypto investments dropped 95% to $433 million in 2022 (the lowest annual deposit seen since 2018, according to CoinShares), the Cointelegraph report notes that venture capital inflows topped $14 billion in the first two quarters of 2022 before falling back to just under $5 billion in Q3 2022. Impressive numbers despite the scandals in the industry over the sudden collapses of Celsius, 3AC, BlockFi, and FTX.

With a new industry such as blockchain, it is common to see big investor money flowing in specific directions based on market trends and hopes to capitalize on new use cases that are the gateway to the mainstream.

While venture capitalists tend to be the most active investors in blockchain-focused companies, large corporations are also paying close attention and investing in blockchain startups.

There are currently more than 800 cryptocurrency/ blockchain investment funds. Most are set up as private equity funds, while large numbers are hedge funds or hybrid funds, according to data from Crypto Fund Research.

Knowing how the investment arm is moving in the blockchain industry can mean a good practice to emulate for retail investors and the user in general on the trends that could set the tone in the development of the ecosystem.

Let’s look at which sectors are capturing attention in the industry and who its leading players intend to take advantage of their movements.

Blockchain games: Fun, first and foremost

The 2022 gaming sector has had the best investments, and the trend continues for 2023 to a large extent.

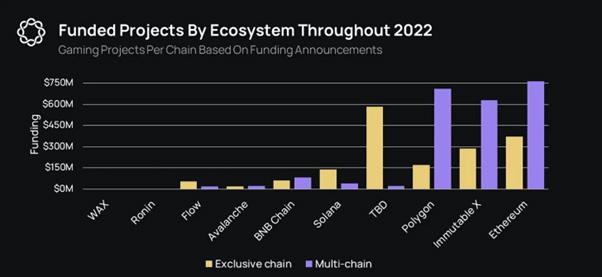

Between December 2021 and December 2022, 284 investment rounds focused on the blockchain gaming sector took place, according to Cryptorank data.

The reason for the money flowing into this sector is simple: gaming remains the most popular category of blockchain-based applications and dominates the industry.

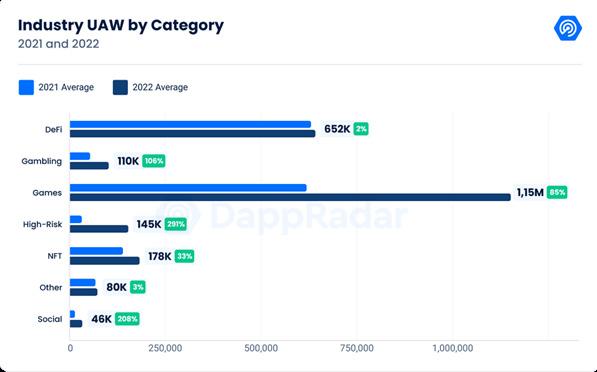

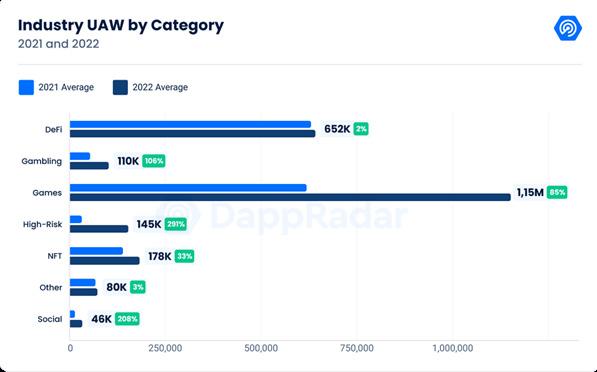

According to data from DappRadar’s latest report, in 2022, games averaged 622,620 dUAW. This number grew by 85% in 2022, reaching just over one million dUAW (unique active wallets) on average.

A report from Messari in H1-2022 notes that the gaming NFT vertical is one of a kind, raising more than four times more capital than any other NFT vertical in the first half.

With the ‘play to win’ narrative shift that dominated in 2021 and had its downfall in 2022, fun is the new focus developers are looking to capitalize on in the new era of web3 gaming based on digital property granted by NFTs.

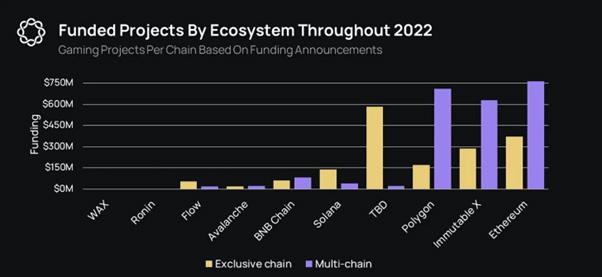

Overall, funding for web3 gaming and NFTs remained high, with $7 .2billion of capital deployed in the blockchain-based gaming industry in 2022, according to data deployed by Galaxy Research.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

These games expect to be available in a few years. Many of these projects have yet to decide on the blockchain where they will deploy, but at the moment, Polygon, ImmutableX, and Ethereum are the prevailing ones.

Who is leading the way in GameFi investment?

Growing from a $300 million industry to just over $4 billion in twelve months is nothing, especially for a young industry like blockchain.

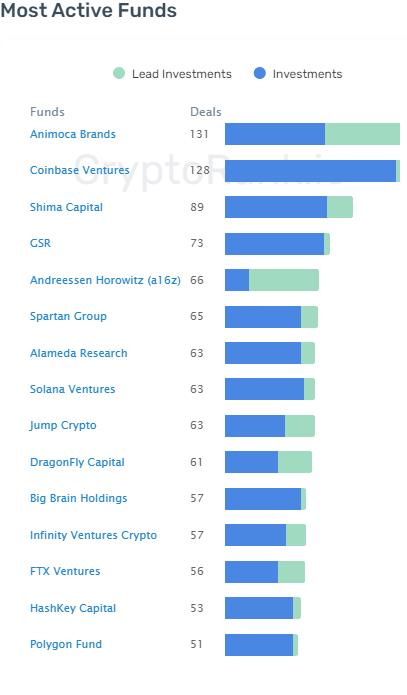

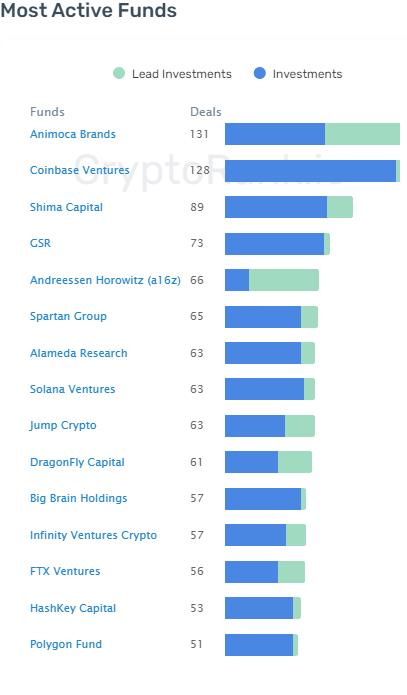

When we look at the data of the most active funds in the industry, one key player in the gaming sector stands out: Animoca Brands.

The giant company focused on digital entertainment, blockchain, and gamification based in Hong Kong was one of the leading players betting heavily on the GameFi sector.

Animoca Brands was present in 131 investment rounds, of which it led 60 during 2022, with the GameFi and NFTs sectors as the main benefactors of its money with 49.6% and 20%, respectively.

In addition, Animoca raised $544 million from investors in 2022 for its projects focused on NFTs games, coming from firms such as Temasek, Boyu Capital, and GGV Capital.

The company focuses on building the open metaverse with an investment fund that expects to reach $1 B by Q1 2023, with which it hopes to lead the sector by driving digital property rights through games and NFTs.

Axie Infinity, The Sandbox, Decentraland, and Gunzilla Games are some GameFi-focused projects on which Animoca Brands has directed its monetary efforts in 2022.

Samsung, one of the top 100 public companies, is another institutional investor that has not hesitated to support the development of web3 games through Animoca Brands. The South Korean company has been very active with projects focused on web3 games and metaverse.

Critical players supporting the GameFi sector through their investments are Shima Capital (Blocklords, Gunzilla Games, Blast Royale), Spartan Group (Fan Controlled Football, Wilder World, Metalcore), Solana Ventures (Blockstars, ELYZIO, Astro Space), among others.

What awaits us in 2023

In general, it expects that by 2023 there will be a continuous development of the sector through the rhetoric of web3 gaming, where the digital property will be present through NFTs but without interfering in the game to give continuity to the narrative focused on fun.

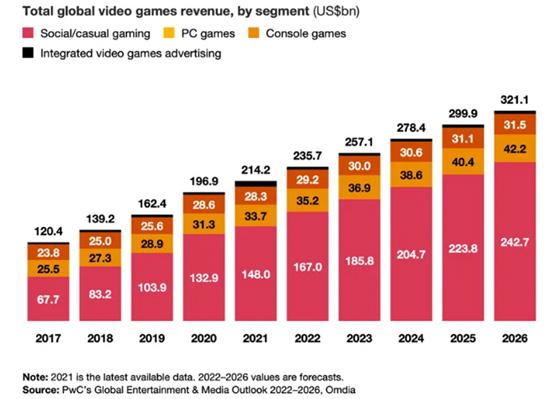

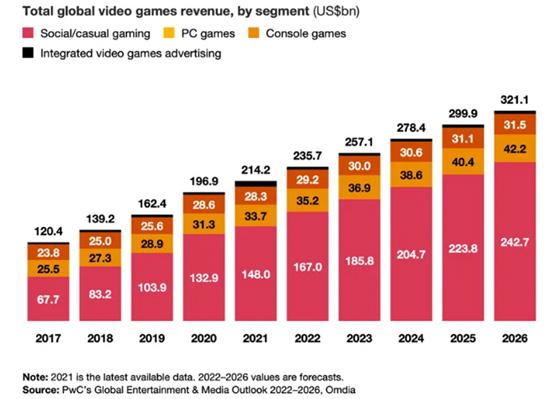

Fast industry-wide success is unlikely, even with many games launching in 2023. With the industry valued at $257.1bn for this year according to PWC data, we are sure to see many rounds of investment in the sector to continue building solutions in the field of web3 games that solve problems in the traditional sector.

Blockchain Service: Leading the way in investments

The sector focused on projects that can be categorized as an interoperability solution, thanks to its plug-and-play solution for enterprises, is another sector that has received significant funding over the last year.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

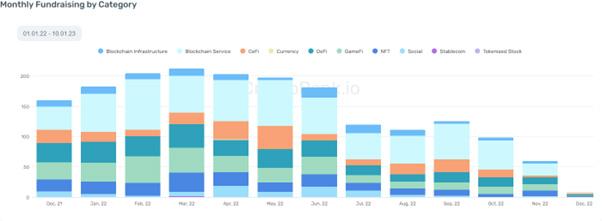

With 667 investment rounds and a marketcap currently valued at just over $9.7Bn, projects focused on this category continue to dominate investments coming from both institutional and venture capital funds, as can be seen in the graph below:

In this section, we must understand two types of investors: those coming from crypto funds, such as Coinbase Ventures, and on the other hand, public companies that are part of the top 100, such as Alphabet/ Google.

Given the blockchain technology adoption relevance in the traditional business world,many companies in the ‘Top 100 Public Companies’ ranking have been active in the industry investing through blockchain companies focused on generating solutions to activate the bridge between the traditional centralized world and the one dominated by distributed records.

From September 2021 to June 2022, at least 40 corporations invested in companies in the blockchain/ crypto space during this time. Of these 40 corporations, Samsung has been the most active with 13 investments, as reflected by Blockdata data at the end of Q3 2022.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

On the other hand, Coinbase Ventures, the investment side of the giant U.S. cryptocurrency exchange Coinbase, has been a significant player in supporting projects focused on blockchain services.

Cryptorank data indicates that Coinbase Ventures has led nine investment rounds out of 128 over the last year to become the second-largest crypto fund in the ecosystem below Animoca Brands.

Of its portfolio, 32.5% focuses on supporting the development of projects based on the sector categorized as Blockchain Service.

Cointracker, Safe, Tribal, and CoinMetrics are part of the projects Coinbase Ventures backed in 2022, following its renowned backing of major industry benchmarks such as Consensys, Alchemy, and Lido Finance, among others.

Another essential player to follow in its portfolio in this sector is Pantera Capital. The U.S. digital assets investment fund has 16.8% of its portfolio to support projects based on this line of business.

Braavos, Sender, and Unstoppable Domains are part of the projects this fund supported in 2022 within this Blockchain Service sector.

NFT : Digital property for all

Another sector that has undoubtedly garnered attention in the last year from investors is NFTs. Closely related to the blockchain gaming sector, NFTs have been expanding use cases in the industry, which has allowed them to move beyond speculative market rhetoric.

Over the last twelve months, the sector’s market volumes, while contracting at the end of the period, have seen the emergence of new players that have quickly come onto the radar of many users and, of course, thanks to the support of respected investment firms.

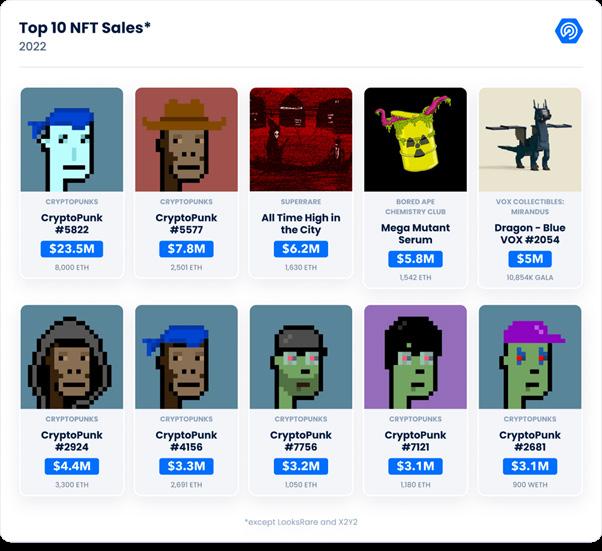

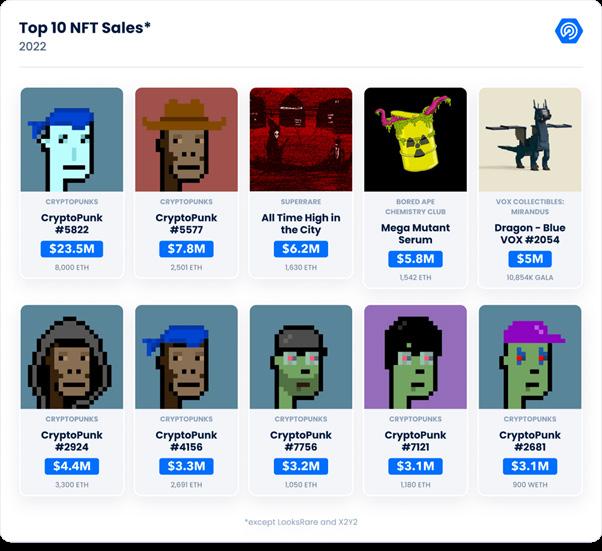

According to on-chain metrics for the NFT market, this year appeared to be positive, as NFT trading volume in 2022 increased by only 0.41% compared to 2021, according to DappRadar.

One of the major players in this sector is undoubtedly Yuga Labs, which continues to expand after announcing its acquisition of CryptoPunks, Meebits, and the NFT startup Wenew Labs.

According to DappRadar’s data on the state of the industry in 2022, Yuga Labs’ NFT collections dominated the NFT market cap in Q4, representing 55% of the top 100 most valuable NFT collections, which amount to $15 billion.

In the last twelve months, about 201 investment rounds have focused on raising funds for projects based on NFTs.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

As Messari points out, there has been sustainable growth in the last two years in investor support for projects focused on developing the NFT sector in different use cases, with gaming as the first option to support.

And the flow has again come from firms such as Animoca Brands leading the sector, along with other significant crypto funds such as Andressen Horowitz (a16z), Big Brain Holdings, and Solana Ventures.

It is worth mentioning that another industry benchmark is Dapper Labs, the company behind Cryptokitties and NBA Top Shot, which launched a $725 million fund to support the development of its Flow Blockchain.

Dapper Labs has received support from Alphabet. Other Top 100 Public Companies such as Samsung, Tencent, and LG have also appeared in the last year, supporting companies in the sector such as Immutable X, Yuga Labs, and The Sandbox, among others.

DeFi is not dead

We could only close this post by briefly pointing out one of the forerunners of crypto adoption: DeFi.

With the Terra collapse, exploits and unfavorable market conditions, and an unprecedented drop in the True Value Locked (TVL) of many industry protocols, we have seen a resurgence in the last quarter following the return of the ‘not your keys, not your cryptos’ rhetoric after the collapse of FTX.

This resurgence, dominated by DEX, has seen a significant investment influx throughout 2022 and is likely to continue the trend for 2023, following the unfortunate events after BlockFi, Celsius, and FTX.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The high expectations after The Merge of the dominant blockchain network in the DeFi sector, Ethereum, continue to generate strong traction to support the development of solutions based on this line of business.

Likewise, layer-2 solutions such as Optimism saw their LTV increase by 127.60% over the last year, demonstrating that the DeFi sector is still a diamond in the rough in the industry.

Financial support in DeFi has remained despite adverse market conditions and the prevailing trends in NFT gaming. In June, crypto exchange Huobi Global spun out a $1 billion investment fund focused on decentralized finance (DeFi) and Web3 projects.

Huobi’s fund is just a sample of money flow into the decentralized finance sector. According to Cryptorank, there were a total of 296 funding rounds directed to the sector in the last year.

GSR, Coinbase Ventures, and Shima Capital led the investment rounds towards DeFi projects with an average of 30 rounds each.

GSR is an active multi-stage investor in more than 100 leading companies and protocols building the future of finance and technology. Its portfolio (50% DeFi) includes renowned projects such as Hashflow, IQ Protocol, and Primex Finance.

In addition to crypto funds like GSR, we have seen Top Banks investing in some DeFi / CeFi protocols and related companies within the blockchain industry.

From Morgan Stanley and Goldman Sachs to CitiGroup and BNY Mellon, we have seen the heavy disbursement of money in some well-known and not-so-wellknown projects focused on different industry sectors, including DeFi.

Over the last year, projects focused on the decentralized finance (DeFi) sector have raised just over $1.4bn from the various Crypto VCs over the previous twelve months.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Final Thoughts

The blockchain market size expects to have a CAGR of 62.4% from 2022-2030, according to data from GlobalData. Blockchain as a Service (BaaS) will drive enterprise adoption, and BaaS holds the key to driving mainstream adoption of this technology.

It is for this reason that we see that the largest number of financing rounds during the last twelve months happened in the sectors categorized as Blockchain Service and Blockchain Infrastructure.

Top 100 Institutions such as Microsoft, Oracle, Visa, Mastercard, Coca-Cola, Alphabet, Toyota, CISO, Novartis, Intel, and many others are adopting this technology through third parties.

It shows that the long journey toward developing solutions that provide solid use cases in sectors such as Gaming, Finance, Logistics, and Entertainment is just beginning.

In 2023, following the financing rounds of the different investment funds, both traditional and crypto funds, can be an excellent practice to know how the money flows indoors in the trends that will set the tone in the market this year.

According to Galaxy data, 2022 was the second most crucial year for crypto VC, both in the number of deals and capital invested, just below 2021, the most vital year for crypto VC.

As noted by the investment analysis firm, of the just over $33bn invested during 2022 by the various venture capital firms, Web3/NFT/DAO/Metaverse/Gaming (“Web3”) and DeFi accounted for 31% of the capital invested in the industry ($10.3Bn). Trading startups continued to command the most capital invested.

Across jurisdictions, the arrival of crypto regulations is as certain as the rising of the sun. Here’s how industry players can prevent it from being a bad thing.

The crypto industry has matured to the point where regulations are the next logical step.

The institutional investment will flow into DeFi en masse once those institutional players know they can engage safely within the space. Banks and other regulated entities already operate within very clearly defined guardrails. Without similar guardrails in place for crypto, these institutions risk violating existing regulations by which they are already bound.

Embracing the Regulatory Bugbear

written by R. Paulo Delgado

The largest concern from the crypto community has always been that regulatory action could stifle innovation. But to continue to resist the inevitable at this stage is futile. That doesn’t mean that crypto companies need to accept the regulatory tidal wave lying down. But they do need to realize that they can either work with regulatory bodies or be mowed down by the power those bodies have.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Writing for The Washington Times, Lars Seier Christensen, Chairman of the Board of Concordium, a layer-1 blockchain for business, said, “Crypto needs to grow up.” He was referring to the fact that too much attention has been placed on the speculative aspects of crypto, which is but a drop in the ocean of the greater ecosystem of blockchain and its related technologies.

And this is how regulators see crypto — as speculation and a gamble.

As a result, proposed regulatory frameworks are so far divorced from the actualities of the industry that crypto companies understandably react against them. Regulators must be enlightened about the greater ecosystem of crypto, blockchain, web3, and the various technologies for this industry to self-police itself.

Worldwide regulations

The United States recently proposed the Digital Assets Anti-Money Laundering Act (DAAML Act), which one expert believes will cause more damage than good. Speaking to Moon Mag, Michael Fasanello, Crypto Compliance Officer for AnChain.ai, an AI-powered cybersecurity company based in San Francisco that enhances Web3 security, says, “The DAAML Act strikes directly at the heart of constitutional values of ownership and privacy. The act attacks self-custody and financial independence, shrouded by a veil of regulatory concepts that are largely already in place.”

Fasanello is also concerned about the state surveillance implications of the DAAML Act, which he calls “alarming.” He believes the legislation will end up stifling innovation.

Similar concerns about Europe’s sweeping MiCA regulations have been raised — the Markets in Crypto-Assets regulations. Speaking at a panel titled The Impact of MiCA on Cryptomarkets at Nordic Fintech Week in 2022, several panellists reacted strongly when asked if they felt the European MiCA regulations had been created in collaboration with stakeholders and significant industry players. The response was a strong No!

“Legislation always lags behind technology,” said attorney Payam Samarghandi of Samat Law in Denmark, speaking at a panel at the Fourth Nordic Blockchain Conference.

Voting on MiCA’s final approval was delayed again, meaning that the already-outdated regulations will be even more so by the time they come into force in 2023.

In Asia, crypto adoption has been immense. But from China’s outright ban to India’s recent crypto bill to Japan’s recognition of crypto as a type of money, Asia’s regulatory system is wide and varied. In Hong Kong, where stablecoin giant Tether Limited is headquartered, regulatory oversight has been primarily relaxed. But even here, signs of inching toward regulation are becoming more regular: In September 2021, a senior executive of Hong Kong’s Securities and Futures Commission (SFC) announced the need for regulating the new asset class to prevent losses for investors. And Hong Kong’s legislative council passed an amendment to its Anti-Money Laundering (AML) in December that requires virtual asset service providers to pass strict AML guidelines. It’s only a matter of time before comprehensive regulations are proposed in this sector, as they have been in the West.

Regulations were always inevitable

Targ Patience, a regulatory expert and co-founder of idclear, a Gibraltar company offering due diligence services to assist businesses with compliance, said in a recent interview with Moneyweb, “You cannot have a financial system where you have these unexpected catastrophes because even if you’re operating very sensibly, you can be affected by something that happens ‘over there’ because of interconnectedness and interoperability.”

Alarming numbers about crypto crime don’t help ease fears. Neither does a mass media that insists on reporting the value of illicit crypto transactions instead of the percentage. In late 2022, headlines similar to “$20.3 billion of crypto was illicit” bloomed like mushrooms, but none wrote that this represents only 0.62%.of all transactions, or they only put it in the fine print.

Such numbers raise heads and make the blood boil of regulators now hungry to establish regulations swiftly and show their authority.

Still, theft is theft, and the absence of guardrails makes the space less safe than it could be.

“Illicit finance in the digital assets space skyrocketed in 2022,” says Fasanello. “Of the top 15 crypto hacks of all time by value stolen in USD, nine of them — 60% — took place in 2022. Web3 is an amazing space, full of promise. Still, regulatory gaps have allowed a plethora of financial crimes — both old and new — to permeate the space and victimize institutional investors and retail consumers alike.”

Regulations won’t stop the bad actors, but better technology might

Bernie Madoff worked within a stringent regulatory framework and was still able to swindle over $60 billion worth of funds. Enron hoodwinked regulators for years, had fake holdings, and engaged in off-the-books accounting to cause shareholders $74 billion of losses. Ivan Boesky engaged in illegal insider trading to the tune of $200 million of a personal fortune before he was caught in 1986.

Draconian regulations will make things more challenging for those who sincerely wish to comply. Those same regulations will be largely ignored by actors who never intended to follow them in the first place.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

That’s precisely why crypto stakeholders need to get involved in the regulatory process. It is the good hats that will be affected by regulations. Putting our hands up and saying, “Hey, let’s hope for the best,” will inevitably result in regulations that remain far divorced from the realities of the industry.

Gibraltar showed us the way. The British territory met with experts and professionals in the field to create one of the world’s first crypto regulatory frameworks. As a result, crypto companies swarmed to “The Rock” and now make up at least 30% of its GDP, according to one estimate.

But don’t expect regulators to bang down the door of crypto companies to learn how crypto and blockchain work. It is up to the crypto companies to make the initial offer to break bread, find common ground, and enlighten those who wield power to improve or stifle this industry.

Binance’s move to use Proof of Reserves verified by Merkle Trees is one area of tech that could help make it more difficult for bad actors to swindle victims. But Merkle Trees are legislated nowhere.

Other technological ideas could make the space safer for everyone.

The greatest danger of regulation is not the regulation itself. The greatest danger lies in the divide between those making the regulations and their lack of knowledge of crypto and blockchain technology. It is up to industry players to fill that knowledge gap and help bring about a regulatory framework where more win than lose.

5

AI Crypto Projects To Watch In 2023

written by Samantha Jimenez

written by Samantha Jimenez

Artificial intelligence integration (AI) into the world of cryptocurrencies has been one of the most exciting developments in recent years. These projects use AI to create new and innovative solutions for several industries, from finance to healthcare to gaming; In this article, we look at five AI-based cryptocurrency projects to keep an eye on in 2023.

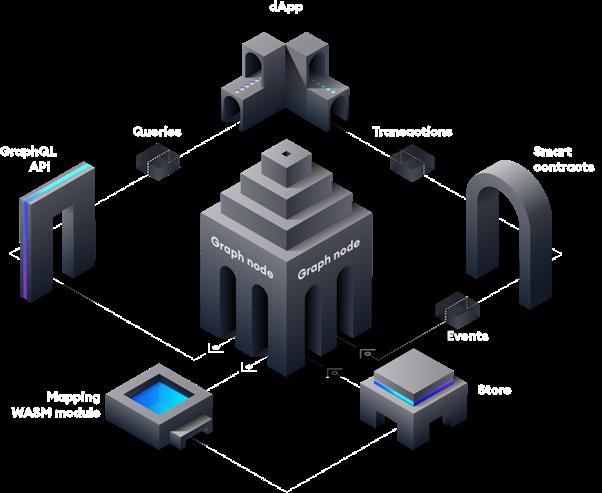

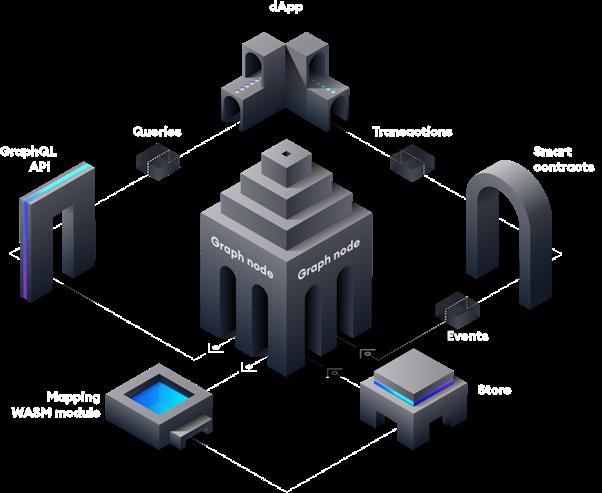

The Graph is a decentralized indexing protocol that allows querying and processing data on networks or blockchains for the first time in the history of this technology, doing it so efficiently without waiting for a centralized service provider. It functions as a query repository for web-based applications3.

With The Graph, it is possible to query networks such as Ethereum. It also allows fast, reliable, and secure data search through subgraphs facilitating data access so it can be shared globally and verified by any user on the web3.

Background.

In the past, long before The Graph came into existence, teams had to develop their indexing servers, which required extensive engineering and hardware resources. With The Graph arriving now, these processes may be unnecessary, and everything will run more smoothly easier, concluding that this protocol got to the Web3 industry to revolutionize the sector.

Thanks to the use of Blockchain technology, it is possible to create decentralized applications that have the purpose of solving the challenges imposed by the digital world. The same progress that the internet has made from its beginnings until now.

This evolution brought diverse factors and relevant attributes when immersing in a platform or protocol.

Today, we value aspects such as the power and control it gives and the fact that we own our identity, data, and even our reputation. Likewise, reliability, interoperability, privacy, security against attacks, and governance are also aspects we consider in a platform or protocol.

How does it work?

Within The Graph ecosystem, four fundamental pieces allow it to function and mesh with the data query market. In simpler terms, these four relevant pieces would be like those roles or tasks the protocol must fulfill to function correctly. At this point, we can highlight the incentives for carrying them out. We will tell you in a simple and summarised way what each one is about.

They are: “The indexers,” also known as the node operators. They compete to provide the best service at the best price.

Then there are the “curators,” who organize the data and point out which subgraphs are accurate and useful. These two are joined by “delegators,” who, as their name suggests, delegate participation to the indexers to protect the network without resorting to creating a graphs node.

And last but not least, there are the “consumers” who are nothing more than those who pay the indexers for queries, which translates into end users, which could also be web services integrated

https://thegraph.com/

The Graph

with this protocol.

What is clear from this last factor involved in the functioning of The Graph is that to be a consumer, one must pay for the use of the indexers.

The query engine allows you to check the amount of data that stores on the platform without having to do the work of calculating and storing that data yourself.

Finally, this whole structure of roles within The Graph network aims to create a decentralized data marketplace that is secure and scalable. And, to support the query marketplace, The Graph introduced a native utility token, GRT, an ERC20 token on the Ethereum blockchain that has two indispensable uses and is paramount to the protocol’s functioning.

On the one hand, indexer staking is when indexers deposit GRT tokens to be detectable in the query market and provide economic security for the work.

And secondly, curator signaling, where curators deposit GRT tokens in a curation market and get rewarded for assertively predicting which subgraphs are valuable to the network.

Furthermore, in addition to the uses we have just mentioned, having a native token within the protocol allows us to encourage certain behaviors that can benefit the network in general, such as the indexing of new subgraphs through the issuance of new tokens.

It is vital to mention that GRT, as a native token, is in the top 100 cryptocurrencies and can be purchased on most major exchanges, such as Binance, Coinbase, or others. The highest price The Graph has reached since its launch was $2.88, recorded on February 12th, 2021.

At the time of writing this article and according to CoinMarketCap ranking, GRT is ranked 58th by market capitalization. It has a price of $0.08799 and a decreasing change of -1.65% in the last 24 hours, with a market cap of $776,587,751 and a circulating supply of 8,772,718,767 GRT coins.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: CoinMarketCap.

As we have seen, it is a protocol with projection and utility for the Blockchain ecosystem and Web3. Likewise, it is a project with investors fun backing it because of the project’s clear vision as it represents a paradigm shift in the digital world and Web3.

In addition, until now, many developers have implemented Subgraphs for DApps, as was the case of Uniswap, Aragon, Livepeer, and Decentraland -to name a few- and many more. Usage of this protocol has increased by just over 50% month-on-month, reaching over 7 billion purchases in September 2020.

The Graph’s ultimate goal is to create a decentralized database that facilitates access to the information within various blockchains, and The Graph makes this information available more quickly.

The best of blockchain and AI

In addition to the web3 and all that currently represents within the crypto ecosystem, artificial intelligence is also making leaps and bounds

worth keeping an eye on because of being much more advanced than expected and is likely to bring solutions and utility to society sooner.

For this reason, markets are now turning their attention to artificial intelligence and especially to projects that may become trends in the market. Let’s continue with two projects that are among the top market capitalization projects in Blockchain technology and Artificial Intelligence.

They now want to create disruptive technology, such as blockchain, with the best of artificial technology. Let’s see.

It is a decentralized platform based on blockchain technology that can use artificial intelligence technology for automated learning. In reality, what Fetch.ai manages is data that, in turn, serves individuals or entities. But, the big plus is that instead of exposing the data to its customers through AI, the platform offers you the data you need along with several applications.

This process happens through so-called “agents,” intelligent autonomous digital entities that reproduce data, software, and others. These agents automatically learn from the AI, and when some subject needs them, they are the ones who contact these individuals or companies.

We are facing an especially useful Blockchain for developers, as this AI can provide solutions related to new DApps creation, improve efficiency, etc. The team behind this project which emerged in 2021, has been working on accelerating the research and use of emerging technologies such as blockchain and AI. It was launched in 2017 by a team from Cambridge, UK.

One of the curious things behind this project is that they used the Binance Launchpad platform to power Fetch.AI to raise capital to develop the project. The FET token that mails over the Ethereum network was created for this purpuse.

The result? They obtained 50 MILLION, which allowed them to finance this project development that brought with it a set of solutions that are a reality today, among them ones that seek to respond to problems in the organizations field and IoT. And behind these solutions is FETCH Network, a fully decentralized network that wishes to be the leading developer in a world of favorable economic activities.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Fetch.ai https://fetch.ai/

Tokenomics

The FET token in question is required for all exchanges on the network, as a refundable method for network registering, for staking, and as a mechanism for rewarding all those who work within it.

The token’s current price is $0.261857 and ranked 143rd according to CoinMarketcap’s ranking by market cap. FET had a decrease of -3.39% in the last 24 hours. It has a circulating supply of 818,912,300 FET coins and a maximum supply of 3,409,064,989 FET coins.

Source: CoinMarketCap.

A positive point for Fetch.ai is that almost 90% of its native FET tokens have already been issued. In other words, the token’s price will practically not change, and its inflation will be lower precisely because of the amount that remains in issue.

In this sense, and from then on, everything that rises in capitalization will reflect in the price. Likewise, the FET token is present on exchanges such as Binance, Coinbase, and Kraken, and through its use, it is possible to access the platform’s services.

SingularityNET

https://singularitynet.io

On the other hand, we have SingularityNET, a Blockchain-powered platform that aims to become a supreme artificial intelligence, offering customers the ability to create and monetize services through AI.

Through this platform, third parties can contribute their AI technologies to Singularity. Once completed, the platform can process the data they contribute and link them together to create an AI with all the knowledge.

As a decentralized platform, it removes valuable data from the hands of large centralized companies. SingularityNET also aims to be an AI technology marketplace where its creators or programmers can sell their technologies and data or exchange them for others.

To give you a little more background on the platform, the team behind it pioneered the development of the “world’s most expressive robot,” also known as “Sophia,” an AI. Sophia’s development is not complete yet, as the platform wants to continue working on it until this robot can fully understand human language.

The project that launched in 2017, and within a minute of launching its ICO in December of the same year, it raised at least $36 million.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Robot Sophia

Tokenomia

As well as the previous platforms introduced in this article, SingularityNET has a project native token called: AGIX. A little more than 50% of these tokens have been released. AGIX can appear in major exchanges such as Binance and Kucoin.

The current price of AGIX is $0.174071, had a +3.39% increase in the last 24 hours, and is currently ranked #146 on CoinMarketCap by market capitalization.

Source: CoinMarketCap.

What makes this platform unique is its Marketplace for trading AI tools by developers. It also offers a free trial that allows users or buyers to test such tools to be sure which effect suits their needs and what they are looking for.

Brief comparison for a better understanding of Fetch.ai and SingularityNET

SingularityNET and Fetch.ai are applicable and can offer value in the short term because these projects’ products are data managed by AI.

While Fetch.ai is more focused on selecting and synergizing information and data to deliver to customers or users, SIngularityNET is more focused on acquiring and absorbing AI technologies, to learning from these technologies to create an AI of its own that is supreme.

Simply put, Fetch.ai is more focused on providing data to the user, while SingularityNET aims to develop its own AI and train it to learn from other artificial bits of intelligence, which may also seem like a more longterm goal but does not detract from the essence and projection of the platform.

However, another vital comparison that allows us to understand the difference between these projects is Blockchain technology. Fetch.ai, for example, has its Blockchain and combines the proof of work and the proof of stake with the objective that the machinery in charge of the work optimizes transactions while the nodes carry out the computational work.

On the other hand, the SinglarityNET Blockchain is based on Ethereum technology, and its token can be compatible with both the Ethereum network and the Cardano network; the CEO of this project is a big fan of multi-operability, we may see the token available on more chains in the future.

There is a relevant strategy difference between these two projects. While Fetch.ai has opted to offer a more complex system where combines proof-of-work with proof-of-stake for different tasks, in the case of Singularity, it has opted more for the accessibility of its token. That is, in offering its token available for several chains.

Alethea AI. https://fetch.ai/

It is a platform pioneering intelligent iNFTs. Alethea AI creates intelligent avatars that use artificial intelligence to have conversations with people and has launched its own collectible NFT AI characters.

The company sees an underlying artificial intelligence infrastructure for iNFT as the new concept of iNFTs or non-fungible intelligent tokens on the way to the metaverse. On this platform, owners can create an iNFT by merging one of Alethea’s personality bots with an Ethereum-based NFT avatar.

Train to win

This platform aims to use this collective consciousness to build a metaverse populated by intelligent, individual, interactive characters that earn rewards for their owners by training and interacting with other iNFTs. With train-to-win, iNFT owners can train them once and then put them to work interacting with other iNFTs and users to passively earn ALI token rewards for contributing data to the Alethea.AI compatible AI engine.

ALI has a fixed supply of 10,000,000 billion tokens paid to iNFTs who provide data and participate in various initiatives to build Alethea’s shared intelligence engine. What this does is create an incentive to build Alethea’s engines. But to form a well-functioning economic structure, there must be a demand for distributed rewards.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Now, for iNFTs to engage in computationally intensive tasks that earn ALI tokens, owners must level up, using their personality bots to block ALI tokens. To possibly help strengthen Alethea’s training by allowing enterprising users to actively manage the difference between higher-level personality poods and the prices of lower-level bots, plus the number of tokens needed to upgrade them.

ALI token

Like the previous projects, Alethea also has a native token within the platform, and that is the ALI token ERC-20 which is indispensable to making decentralized operations within the platform.

It is a token characterized by incentivizing, regulating, and rewarding users who participate in this platform. It also functions as a unit of intelligence within the protocol.

ALI is currently trading at $0.033898, has had a decreasing change of -1.87% in the last 24 hours, and is ranked #235 on CoinMarketCap, with a market cap of $121,632,777.

Source: CoinMarketCap.

In addition to launching a train-to-win economy, Alethea has a more long-term goal for its iNFTs as building blocks to implement in various use cases, which could lead to creating a complete metaverse populated by individually trained iNFTs. Ultimately, developers can use the iNFT protocol to generate, train and win with their iNFTs in the world’s first intelligent metaverse known as Noah’s Ark.

Cortexlabs.AI: The first decentralized deep learning and AI network

https://cortexlabs.ai/

Our latest project to review is Cortexlabs. AI. is an open-source, public blockchain that seeks to solve one of the biggest challenges facing blockchains like Bitcoin and Ethereum today: running on-chain AI.

The current challenge for running machine learning programs on the conventional blockchain is that the virtual machine is extremely inefficient when running any nontrivial machine learning model. Therefore, most people consider it impossible to run AI on the blockchain.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

However, this platform has built a blockchain whose virtual machine (CVM) uses GPU, compatible with EVM, which can run AI programs on the blockchain. In other words, the Cortex chain can run all Ethereum Dapps and, in addition, incorporate machine learning into these Dapps

And, to continue to understand this platform, it is necessary to know that machine learning is a subfield of AI and by far the most promising one to help achieve better artificial intelligence. The basic idea of machine learning is to train machines to perform some tasks without explicitly programming them. Today, they have been used interchangeably due to the dominance of machine learning as a method of artificial intelligence.

Within this platform, there are many interesting use cases to be explored. Here we summarize the most striking ones: DeFi, gaming, global climate action, carbon credit management and trading, AI governance, and others.

Why develop in Corex?

Now, you might be wondering why you should develop on Cortex, simply: because, unlike other projects, this is the only blockchain that can realistically run AI programs.

As a DApp developer, if you want to incorporate any AI algorithms type into your DApps without resorting to off-chain AI solutions, Cortex is where you can do it.

As an AI developer, you can load AI models - currently, 23, which serve seven different purposes - into Cortex’s storage and when your model gets called, you will get rewarded with some CTXCs that come from the transaction fee. Also, unlike traditional blockchains, where all the per-block rewards go to the miners, in Cortex, a portion of the per-block reward goes to the model providers to incentivize them to optimize better models.

Finally, the reasons for running AI programs on the blockchain are the same as for running “traditional”

programs on blockchain: transparency, integrity, immutability, and resistance to censorship.

Final thoughts

Blockchain technology, Web3, and especially artificial intelligence can add value and utility to many areas of the world and in different sectors. If there is one thing they have in common, it is the power they have in themselves to add value and simplify processes and even enable the creation of others that we once imagined possible.

Although AI has been around for a long time, its potential has been growing over the years and along with its potential for applications. Now, adding value as it has become a trendy favorite for 2023. Proof of this could be seen in the market when a couple of weeks ago, cryptocurrencies related to artificial intelligence registered a rebound, in some cases over 50% - among them, the native token of Fitch.ai, AGIX, and GRT experienced gains - when leaked the possible intention that Microsoft would invest the amount of $10,000 million in OpenAI.

Even when analysts warned that the rally would fade after the revelation ceased, AI alone remains an investment option for 2023. And it doesn’t just boil down to the recent interest in AI-related cryptocurrencies and iNFTs it goes beyond that. There is a potential behind the crypto and AI ecosystem that we have not yet been able to witness and will surely start to see this year.

We have seen great platforms, each with its style, but that ultimately seeks to bring value to the ecosystem and move towards a future where we can embrace technology and all that it offers to simplify processes. Not to mention that more and more companies will be interested in including automated processes in their business and organizational models, which provides speed, efficiency, and also transparency. And this will undoubtedly be possible thanks to these new technologies.

written by Daniel Jimenez

Crypto Tax Havens Options: Myth or reality?

With the steady increase in worldwide cryptocurrency use in trade, investment, and payment is common to observe governmental fiscal adjustments in most countries toward regulating their use.

Freelancers or self-employed entrepreneurs accepting bitcoin and other cryptocurrencies as payment should consider looking for tax-friendly regions for using crypto assets, given that most countries tax with capital gains or income tax for their use.

One of the significant concerns for bitcoin and other cryptocurrency traders is undoubtedly tax liability. Many nations have implemented laws that allow investors to engage with digital assets without tax liability.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

In the ecosystem, these are the Crypto Tax Havens. While some attempt to emulate traditional tax havens, there are substantial differences in the tax treatment of crypto and traditional tax havens.

If you are a professional trader or an employee earning your salary in bitcoin and you are thinking of packing your bags to head to a crypto tax haven to minimize the positive impact on cryptocurrencies; check some of the friendly nations for 2023.

Switzerland

This country has been considered one of the tax havens of choice for traditional financiers due to its lax approach to taxation. It recently earned the nickname Crypto Valley, hinting at being a cryptocurrency tax haven.

The country has a light tax burden for cryptocurrency investors. If you trade or mine at a professional level, you must pay income tax as a wealth tax, depending on the income you generate each year.

They will not have to pay capital gains tax on their cryptocurrency gains at the investor level. However, some conditions must apply:

• Maintain assets for at least six months

• ●Turnover must be less than five times your shareholding

• Net capital gain must be less than 50% of your total revenues

Important to note: If you decide to make Switzerland your home or stay in Switzerland for at least 30 days while looking for work or at least 90 days without looking for a job, you could opt for Swiss tax residency. EU residents and non-EU citizens have distinct types of residency permits and criteria.

Puerto Rico

Despite being a United States territory, Puerto Rico is considered one of the countries without cryptocurrency taxes.

Puerto Rico residents who buy and sell cryptocurrencies are not subject to capital gains tax. The Caribbean island is a territory of the United States, so it sets its tax policy.

It is worth noting that if you move to Puerto Rico and purchase cryptocurrencies while in the territory, you will not be subject to taxation on the island.

However, if you purchased cryptocurrencies before residing in Puerto Rico, you will be subject to typical U.S. capital gains tax rates.

You’ll be considered a resident if you spend 183 days in Puerto Rico during a calendar year.

Also, if you earn revenue from services provided in Puerto Rico, you may be liable to taxation even if you have not been physically present for at least 183 days.

Belarus

Since March 2018, this Eastern European country has adopted a friendly approach towards cryptocurrencies. Unlike the rest of the countries in the old continent that imposed significant crypto tax laws during the Bitcoin boom, the nation opted to exempt all companies and individuals from any crypto tax from 2023.

Mining and investing in cryptocurrencies are personal investments under the law and, therefore, are free of income and capital gains taxes.

In addition, activities such as staking, trading, and holding cryptocurrencies do not incur a capital gains tax or income tax.

It is important to note that all these benefits will be available until 2023, and it is still to determine how Belarus will tax cryptocurrencies in the future.

It will be considered adequate at the tax residency level if you spend more than 183 days in Belarus in a year or, more importantly, have no tax residency elsewhere.

El Salvador

Thanks to its Bitcoin 2021 adoption as legal tender, the Latin American country has been one of the pioneers and the focus of attention for cryptocurrency lovers in general.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Like any other legal tender, Bitcoin exchanges are exempt from capital gains tax.

In El Salvador, citizens can use Bitcoin to pay debts and prior obligations denominated in US dollars.

El Salvador does not tax Bitcoin income and capital gains for foreign investors to promote investment and make the country a pioneer in Bitcoin adoption.

El Salvador was the first nation to accept BTC as legal tender worldwide. It has since become a significant financial hub for driving the adoption of cryptocurrencies such as Bitcoin, making it one of the best crypto tax havens worldwide.

If you wish to obtain a tax residency in this country, you must spend more than 200 days during the year, either temporarily or permanently; or your primary source of income is in the Central American nation.

In addition, El Salvador has implemented an aggressive policy of encouragement for freelancers who earn in Bitcoin to grant them permanent residence visas with excellent facilities at the tax level.

Germany

The European country has relatively friendly cryptocurrency tax laws. In Germany, cryptocurrency classifies as a private asset, which means it is subject to personal income tax instead of capital gains tax.

The above is an encouragement to the popular HODL of Bitcoin and other cryptocurrencies in the Teutonic country, as if you keep your crypto assets for more than a year. Then when you come or spend your cryptocurrencies, you will not pay taxes on it.

Short-term cryptocurrency gains of less than €600 are not subject to tax. However, if you earn income from cryptocurrencies or make more than €600 in profits by selling your assets before 12 months of holding, you will pay normal income tax rates.

In addition, the following activities are subject to income tax:

• Receiving payments in cryptocurrencies

• Cryptocurrency trading

• ●Betting with cryptocurrencies

• ●Crypto trading with earnings over 600 euros for terms of less than one year

Residence in Germany and whether or not you have physically resided in Germany for more than six months determines tax residency in Germany.

Singapore

Singapore currently has no capital gains tax, so individual investors can dispose of their cryptocurrencies tax-free.

For this reason, exchanges such as Pemex and KuCoin have migrated their operations to their headquarters in Singapore. It doesn’t matter if you are making profits by selling or exchanging your cryptocurrencies: you will not be obliged to pay any tax on the profits generated.

Spending cryptocurrencies on goods and services is considered a barter deal rather than a payment. As a result, while the goods or services may be subject to GST, the payment token is not.

It is worth noting that the above only applies to individual investors. If you have a company whose primary function is trading cryptocurrencies, it will be subject to income tax.

Singapore is one of the best cryptocurrency tax havens at the individual investor level. Regarding tax residency, if you stay or work in Singapore for at least 183 days in a calendar year, you are considered a tax resident.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Malta

Known as one of the most cryptocurrency-friendly countries in the world and has been dubbed as ‘Blockchain Island.’

The country recognizes Bitcoin and other cryptocurrencies as a ‘unit of account, medium of exchange or store of value,’ meaning that you will not have to pay capital gains tax on long-term profits from bitcoin sales if it classifies, which is excellent for holders.

Some alternative options may be:

Malaysia: Crypto transactions are tax-free for individual investors since cryptocurrencies are not considered capital assets or legal money by Malaysian authorities.

Cayman Islands: For both crypto companies and individual investors, the Cayman Islands are a crypto tax haven. The Cayman Islands Monetary Authority does not impose corporate taxes on companies, income, or capital gains tax on residents.

Georgia: Georgia is one of the best crypto taxfree countries worldwide for individuals and corporations. The Ministry of Finance of Georgia states that individuals in Georgia are exempt from any income tax on profits from the sale of cryptocurrencies.

Bermuda: Like the Cayman Islands, Bermuda has no capital gains or income tax. However, it is essential to remember that Bermuda has a high cost of living. Also, if you own land or rent it for over three years, you may be subject to land tax.

However, cryptocurrency trading can be considered income taxed at a maximum of 35%. However, there are structuring alternatives within the Maltese tax system that allow you to lower this tax rate depending on how much you earn and where you live.

Habitual residence determines tax residency: nonEU, EEA or Swiss citizens can move to Malta, while EU, EEA or Swiss citizens cannot. The 183-day rule refers to the maximum amount of time you can physically spend in a country. After that, the income tax liability is established.

Some other options to consider

In addition to the set of nations previously described, there are other alternatives to consider that may suit you to set your tax residence if you are an active cryptocurrency investor or user.

United Arab Emirates: While there are no income or capital gains taxes for individual investors, goods and services are subject to VAT of up to 5% (including those purchased with cryptocurrencies).

Taiwán: Taiwan does not levy taxes on capital gains. On the other hand, crypto trades are treated as income from property transactions and reported as individual income for tax purposes. Therefore, consulting with a tax advisor before deciding on a new country to move to is advisable.

The Bahamas: Citizens and foreign citizens pay no personal income or capital gains taxes. The Bahamas also allows individuals to pay other taxes using cryptocurrencies instead of traditional fiat payment methods.

Slovenia: Slovenia has a flat-rate tax proposal on Crypto redemptions. It has a flat rate of just under 5% for cryptocurrency transactions and when they are sold or exchanged.

Final Thoughts

Cryptocurrency tax rules have significantly changed worldwide, with bitcoin and cryptocurrency adoption on the rise.

Some jurisdictions have presented flexible crypto tax policies that have allowed them to become the favorite place for investors, traders, and cryptocurrency users worldwide, as in El Salvador recently.

Unfortunately, these laws can often be subject to unfavorable changes to cryptocurrency lovers, as happened last year in Portugal, the once tax haven king.

The Portugal case has highlighted that depending on the political tinge in cryptocurrencyfriendly countries, laws can turn against the necessary stimulus for adopting and developing cryptocurrency-based solutions, as in El Salvador.

For this reason, traders and investors, in general, should make an in-depth analysis of the favorable conditions they may have in the other crypto tax havens present in different latitudes worldwide.

Written by Kel

Written by Kel

How can OraiChain and the ORAI token leverage the crypto AI narrative?

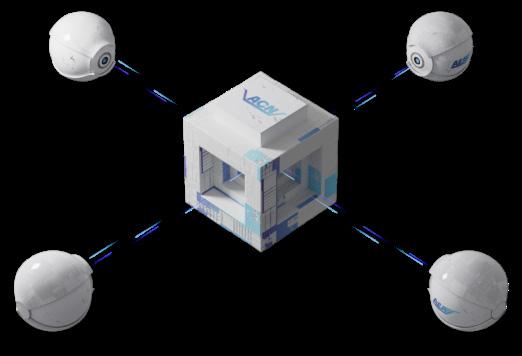

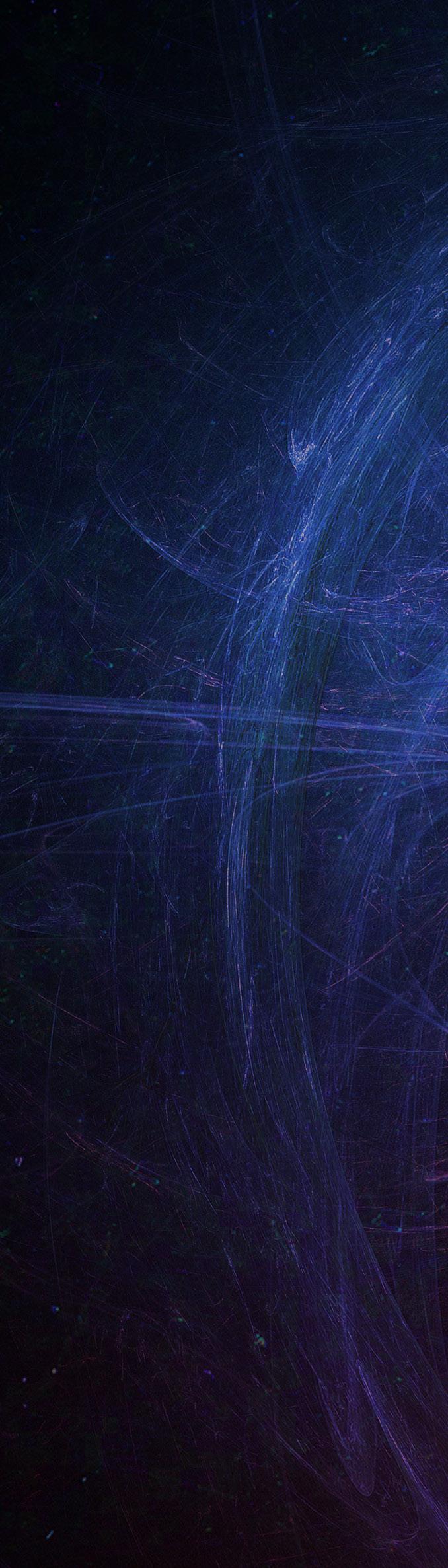

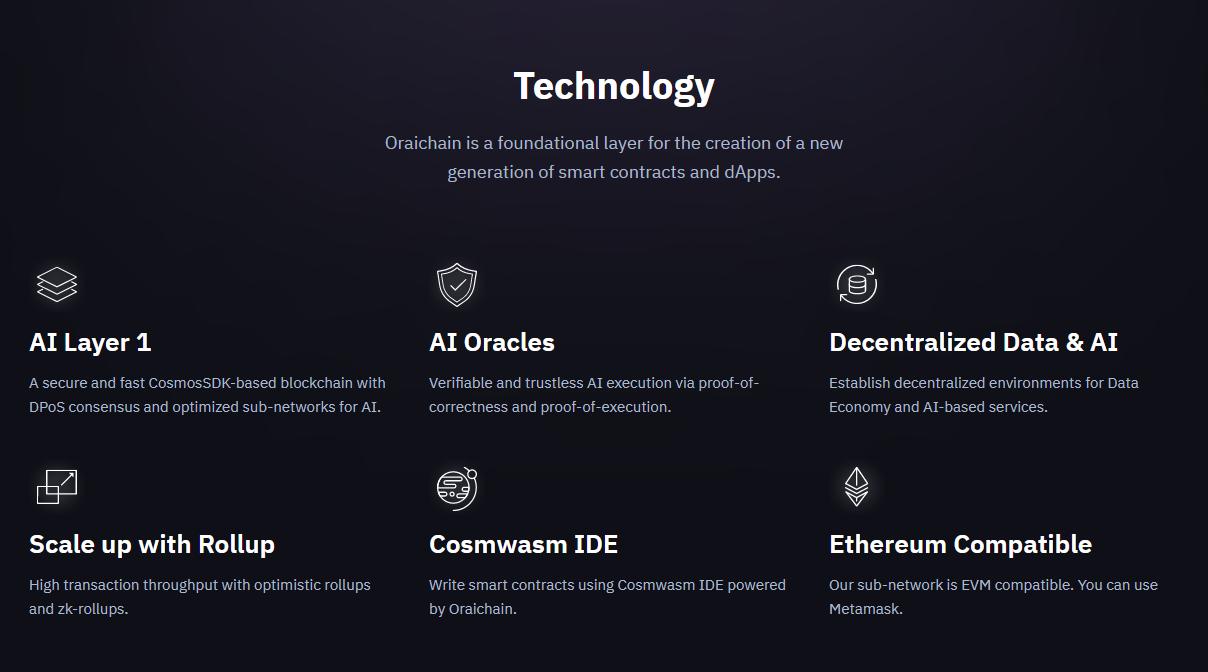

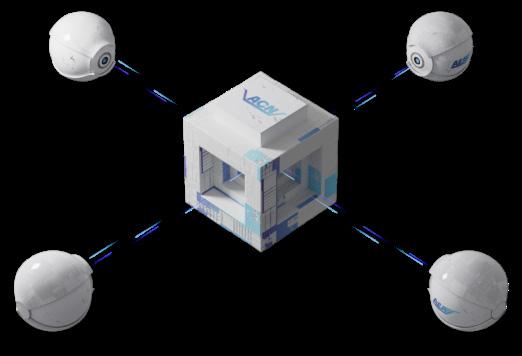

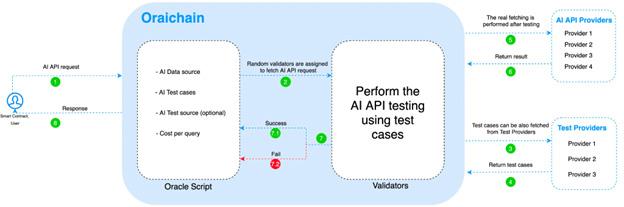

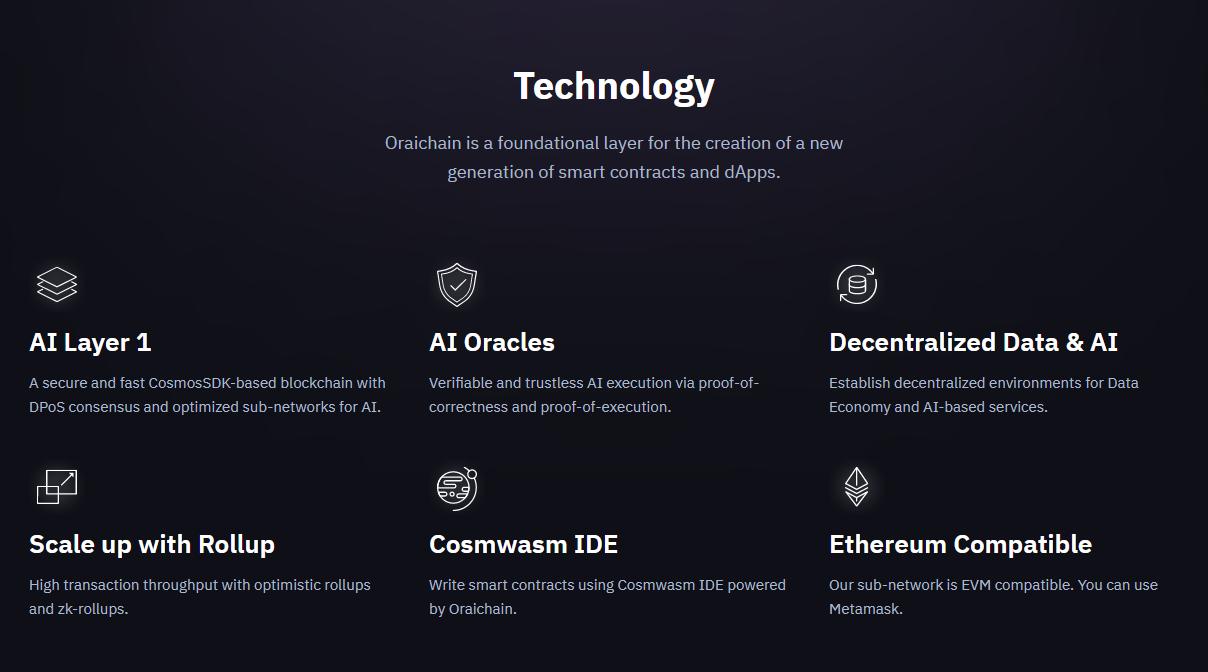

The Singapore-based software development company, also called OraiChain, developed the blockchain and its native token ORAI. OraiChain is a cryptocurrency project bringing artificial intelligence (AI) to blockchain smart contracts. It is an AI-powered oracle and Layer 1 (L1) blockchain serving as a foundational layer for building more complex smart contracts and decentralised applications (dApps). Smart contracts follow strict rules because of their nature. Hence, it is challenging incorporating AI models into smart contracts. For instance, inputs to smart contracts must be 100% accurate to generate an output, making it nearly impossible to leverage AI-based techniques such as facial recognition, which cannot provide such accuracies.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

OraiChain reduces some aspects of this strictness, thereby increasing the use cases for smart contracts. Additionally, smart contracts often use high-level programming languages like Solidity or Rust compared to typical AI models, which may use Python or Java. OraiChain bridges these two worlds, reducing the deterministic nature of blockchain ledgers and making blockchain technology and AI more compatible. More specifically, OraiChain focuses on providing platforms and standardising how AI-based data models are verified on a blockchain.

Blockchain oracles enable blockchains to call data from external APIs. OraiChain’s mechanism is similar to oracle solutions like Band Protocol or ChainLink but focuses on AI APIs and the quality of AI models.

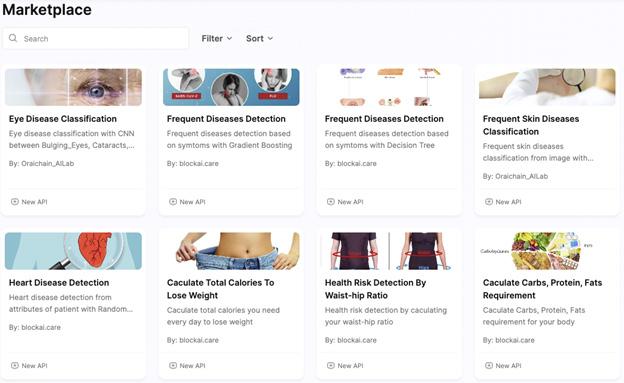

OraiChain aims to be different to other oracle and smart contract solutions by providing the following:

• AI Oracles: Allows smart contracts to access AI models via external API calls.

• AI Marketplace: Allows prospective users to assess and choose from different AI algorithms and models from various providers regardless of geographical region.

• AI Provider: Developers, individuals and software companies can create and publish AI models for different use cases, earning rewards from the use of their work.

• Users and AI Requests: Users may request AI services they cannot find anywhere else, especially if their chosen AI service provider does not have enough resources to meet the user’s service requests. OraiChain can serve as a place to purchase additional services from competent software developers.

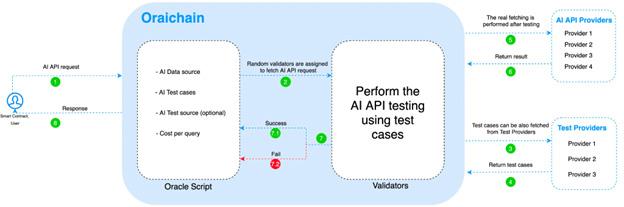

The OraiChain blockchain solution offers several use cases for the decentralisation, democratisation and monetisation of AI services in Web 2.0 and Web 3.0. They are:

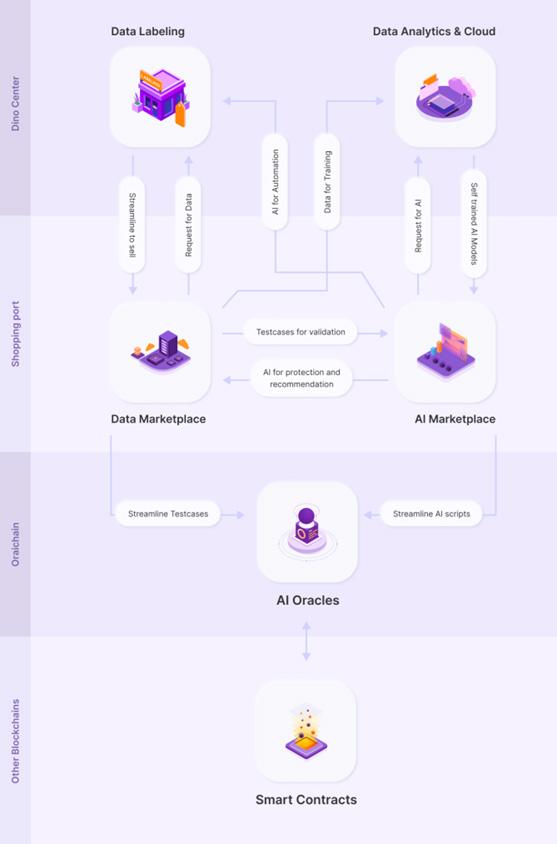

OraiChain Data Hub:

This feature provides the tools to work with, democratise and monetise data, preserving the creators’ royalties throughout the future use and resale of the data and service. With this feature, OraiChain focused on empowering a decentralised data economy using its in-house “Royalty Protocol”.

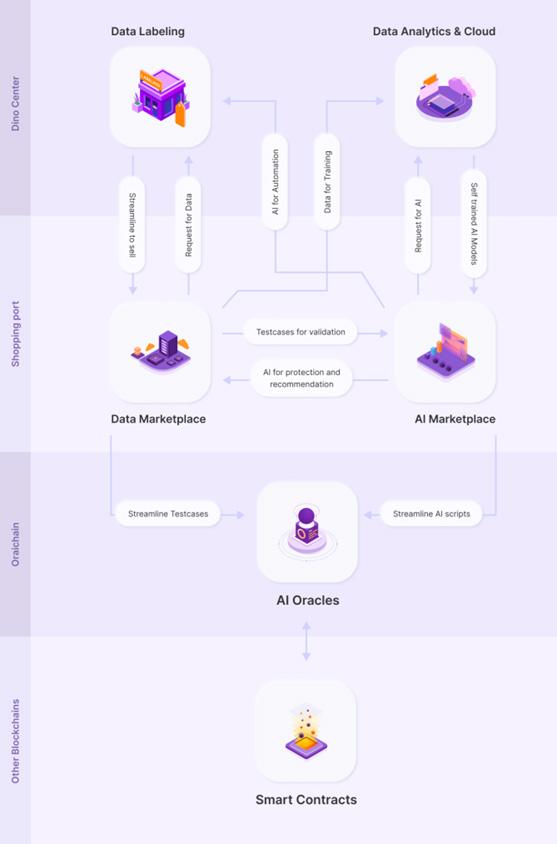

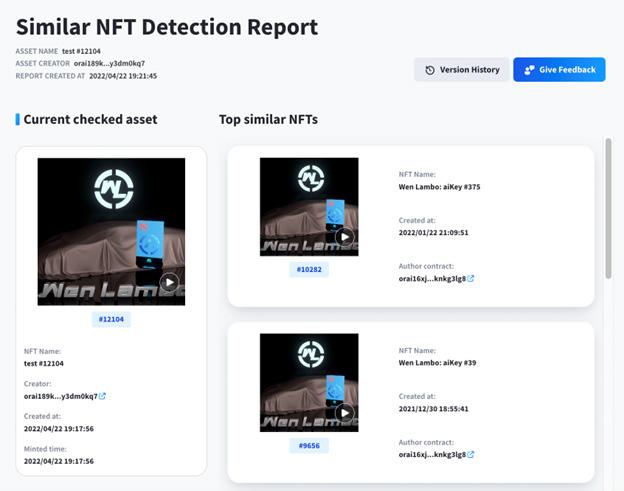

aiRight NFT Audit & Copyright Management: OraiChain developed aiRight, a platform leveraging the power of AI to determine the authenticity and point of origin of NFTs minted on-chain. OraiChain stated that, with this feature, they were the first movers to provide an AI-powered oracle service for NFTs. The project team has built several multichain databases for authenticity evaluation. The databases comprise off-chain data collected from public sources for artwork, music and films and on-chain sources from NFT marketplaces.

AI Marketplace:

OraiChain’s AI Marketplace is a platform where developers can provide AI-powered services, products, and APIs, and users can purchase these services for their computational needs. At the time of writing, the marketplace boasts 81 APIs, 13 categories and 1201 types of API calls, and developers can create and list more services, earning rewards and royalties. Example products and services include but are not limited to, sentiment classification based on audio recognition, facial emotion classification, pneumonia prediction from chest x-ray images, text-to-image generation, licence plate detection and recognition, and many more.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

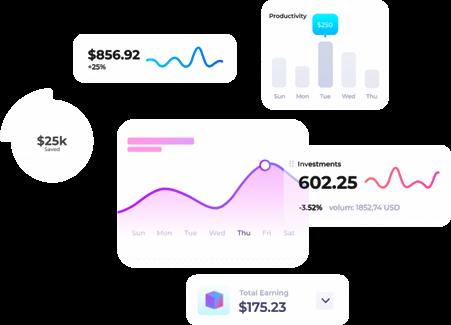

Yield Farming Using AI Services:

OraiChain’s yield farming protocol is called yai.finance (or yAI). With inspiration from yearn.finance (YFI), OraiChain’s solution seeks to further reduce the complexities of yield trading by using AI-based strategies compared to YFI’s crowdsourced DAO voting strategies.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Another feature that showcases how the OraiChain blockchain empowers developers and users to improve the user experience (UX) of dApps includes the use of facial recognition to access vault balances instead of private keys, using facial recognition to reset one’s private/public key pair, and using one’s private key in combination with facial recognition to execute smart contracts.

Data

All Data Is Current at Time of Writing

Circulating Supply: 3,927,435

Max Supply: 19,779,269

Total Supply: 19,779,269

Ethereum Network Contract Address:

0x4c11249814f11b9346808179cf06e71ac328c1b5

BNB Smart Chain Contract Address:

0xa325ad6d9c92b55a3fc5ad7e412b1518f96441c0

Seed Sale: 0.65%

Marketing: 6.13%

Ecosystem: 37.51%

Team: 20.22%

Advisors: 7.58%

Foundation: 27.90%

Website https://orai.io/

Twitter

https://twitter.com/oraichain

Telegram https://t.me/oraichain

Discord https://discord.com/invite/wwjg2ddfzd

Medium https://blog.orai.io/

Whitepaper

https://docs.orai.io/

Where To Purchase The ORAI Token

ORAI is available from centralised exchanges such as KuCoin, Bilaxy and Gate.io and decentralised exchanges (DEXs) such as PancakeSwap, Uniswap and, OraiChain’s DEX, OraiDEX.

Core Team

The project team comprises highly competent and experienced individuals from various professional backgrounds, from game and blockchain development to academia.

Duc Le Pham

Chief Product Officer and Co-Founder

LinkedIn

Duc is OraiChain’s Chief Product Officer and also a Co-Founder. He has a degree in Information Technology from the Hanoi University of Science and Technology and a Master’s degree in Computer Science from Seattle University. Before launching OraiChain, he was a Blockchain Developer at CO-WELL, a Java Software Engineer at NEO and a Researcher and Blockchain Developer at the Hanoi University of Science and Technology.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Diep Nguyen AI Lead and Co-Founder

LinkedIn

Diep is the AI Lead and a Co-Founder of OraiChain. She has a PhD and Master’s degree in Media and Governance and a Bachelor’s degree in Information and Environment Studies from Keio University in Tokyo, Japan. In addition to helping launch OraiChain, Diep is also a Lecturer at the University of Engineering and Technology, VNU Hanoi. She has also held various research and academic roles, including as a Research Consultant and a Research Associate at the Keio University Media Centre in Japan.

Pham Thanh Tu Chief Technology Officer LinkedIn

Pham is the Co-Founder and CTO of OraiChain. He has also founded several business ventures, including Novalex Technologies, an IT services and consulting company, and AgileTech, a company developing IT applications for outsourcing big data services. Before helping to launch OraiChain, he was a Technical Advisor for Icetea.io (re-branded to Firebird), a gamespecialised chain that allows developers to build scalable and frictionless Web3 gaming and metaverse applications without compromising security, and Summoners Arena, a franchise flagship game where players collect, upgrade, evolve characters, and forge Items to compete in different game modes. He has a degree in Information Technology Engineering from the Hanoi University of Science and Technology.

Phan

Mai Linh

Head of Business Development LinkedIn

Phan is the Head of Business Development at OraiChain. She has a Bachelor’s degree in Banking and Finance from the Foreign Trade University in Hanoi, Vietnam. Before joining OraiChain, she also was the Head of Business Development at Datochain JSC, an International Finance Teacher at FRC, a department of the Foreign Trade University, and a Business Customer Service Manager at Techcombank, a Vietnamese joint-stock commercial bank.

What Does ORAI Do For Investors?

OraiChain’s native utility token, ORAI, serves three main uses: staking for validators, transaction fees, and network governance. All OraiChain validators require ORAI tokens to create blocks and fulfil data requests on-chain. The token is ‘gas’ for transacting onchain, including payment to request-executing validators and AI-API providers. Finally, the OraiChain network has a DAO structure where token holders must vote on all protocol upgrades and parameter changes.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Market Opportunity

The current narrative surrounding AI development is powerful and has been brewing for some years. OraiChain, as well as other projects such as Cardano-based SingularityNET, Ethereum-based The Graph, Cosmos’s Fetch.ai, Ethereum’s iExec and many more, have been building the foundation for leveraging AI in the blockchain industry. It took the proliferation of ChatGPT to showcase the power of AI and its potential to disrupt various industries.

To showcase the potential for current AI technology to disrupt various industries, we asked ChatGPT the question. The answer presented below is interesting and amusing:

“AI can disrupt various industries in several ways, including:

1. Automation of tasks: AI can automate repetitive and mundane tasks, leading to increased efficiency and cost savings for businesses.

2. Predictive modelling: AI can analyse large amounts of data to make predictions about future trends and patterns, which can help businesses make better decisions and improve their operations.

3. Improved customer service: AI-powered chatbots and virtual assistants can provide 24/7 customer service, helping businesses to improve customer satisfaction and loyalty.

4. Personalization: AI can be used to personalise products, services, and marketing efforts, which can help businesses to increase sales and customer engagement.

5. Healthcare: AI can be used in the medical field to analyse medical images, assist in drug discovery, and support medical diagnoses.

6. Self-driving cars: Self-driving cars, which are powered by AI, have the potential to revolutionise transportation and logistics industries.

7. Robotics: AI-powered robots can automate industrial processes, improve safety and efficiency in manufacturing, and help with tasks in dangerous or inaccessible environments.

These are just a few examples of how AI can disrupt various industries. The potential for AI to transform businesses and industries is enormous, and it is likely that many more uses for AI will be discovered in the future.”

Imagine building not only a language model like ChatGPT but other models and putting these to work on a marketplace to earn rewards for the services rendered. This concept is one of the core value propositions of OraiChain. Then, add another layer where you can democratise and decentralise the creation of these AI models - imagine OpenAI’s ChatGPT but developed by many individuals and not just a venture-capital-funded company.

One of the areas ChatGPT mentioned above where OraiChain is already making contributions via its marketplace is in the area of “Healthcare: AI can be used in the medical field to analyse medical images, assist in drug discovery, and support medical diagnoses”.

By 2025, revenues from the AI software market could reach US$126 billion, and many sectors, including the financial services industry, are increasingly relying on AI models to assess risk. If OraiChain can tap into 1% of this potential revenue stream, that would give the project a potential revenue of US$1.2 billion by 2025 - and this is just revenue. Obviously, this speculative back-of-envelope mathematics depends on the project team realising its vision and succeeding in bringing its product to the mass market.

The Roadmap

The OraiChain network seeks to implement new use cases. For example, some upcoming use cases for the blockchain and its dApps cover areas of the supply chain where smart contracts can help verify the authenticity of various products, provide validity and data for DeFi lending and pricing GameFi primitives based on their attributes. The network aims to implement multichain compatibility. Currently, there is a live proposal to create an InterWasm DAO, seeking to develop a general tool for developers to tap into the Cosmos ecosystem.

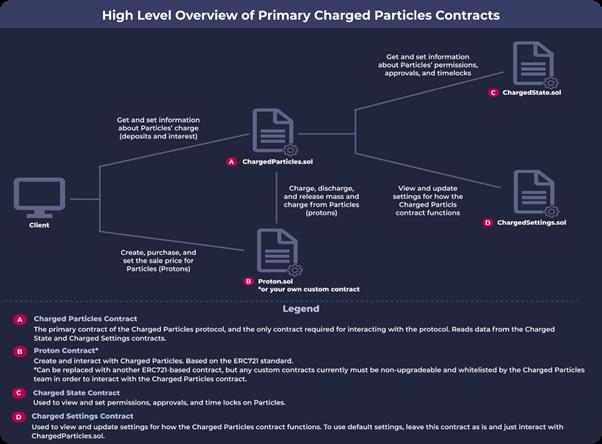

Conclusion