Bought To You By themoonmag.com

As the crypto and web3 industries continue to spark a wave of excitement and innovation in the tech world, especially AI, we look at how these can help advance the crypto industry. These new technologies offer incredible opportunities for businesses and individuals to revolutionize how we interact with each other and the world around us, and TheMoonMag com aims to be at the forefront of this movement and bring you the latest blockchain technology, cryptocurrencies and other decentralized applications.

The rise of Web3 is also creating new possibilities for decentralized applications that leverage blockchain technology. Web3 is the next evolution of the internet, where users own and control their data, identities, and digital assets via NFTS. We look deeper into Web 3’s role in the metaverse with Paulo. We explore this and more with RFOX this month with an interview with their CEO - Ben Fairbank, and deep dive into this new paradigm that is leading to the development of decentralized marketplaces, social networks, and content platforms that offer greater privacy, security, and autonomy to users.

Furthermore, the emergence of NFTs and Web3 is opening up new opportunities, as we see with Xenia’s exciting article on how the International Chess Federation has entered the space with the help of Avalanche.

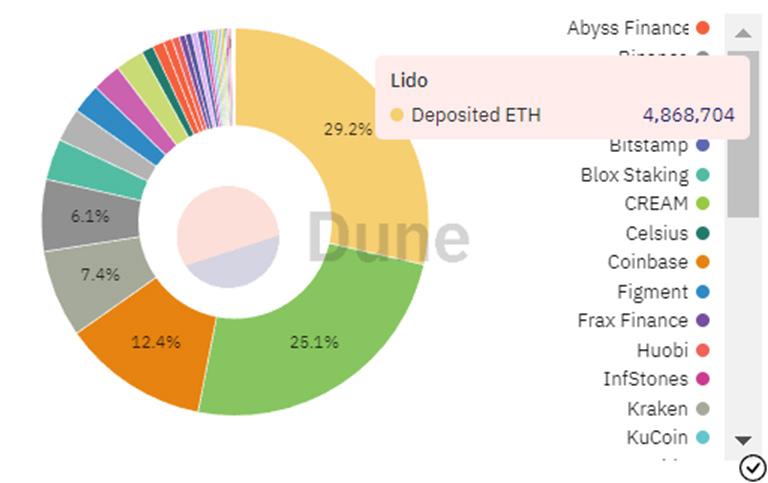

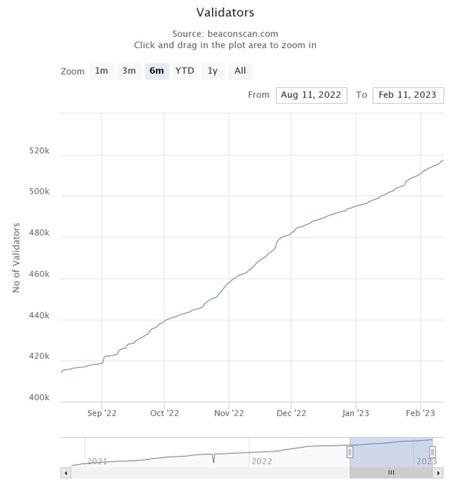

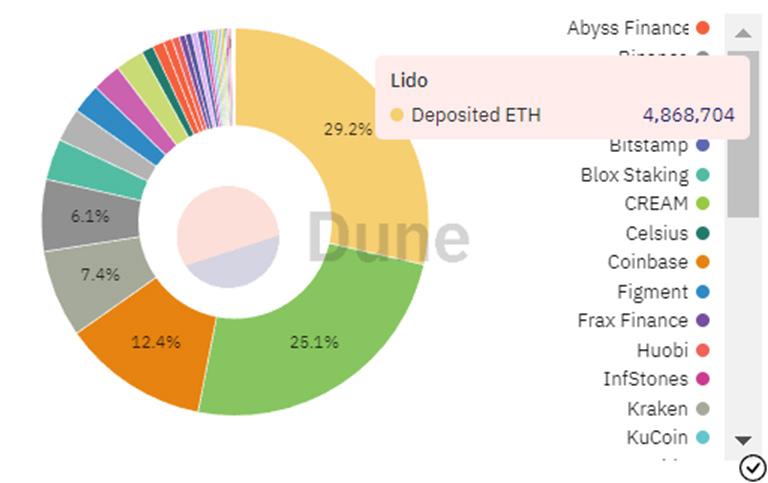

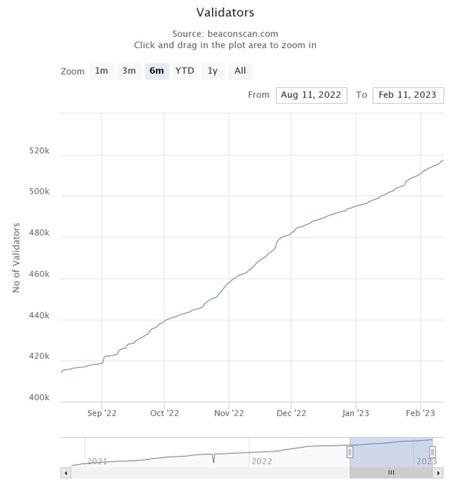

We also continue to dig deeper into layer 2 infrastructure with Cartesi and also give you what you need to know about the Shaghai ETH Upgrade (and subsequent staking unlock)

In conclusion, the crypto and web3 industries are rapidly evolving, and the possibilities for innovation and disruption are endless. These technologies are transforming the way we think about money, ownership, and identity and are creating new opportunities for businesses and individuals alike. As these industries continue to grow, we can expect to see even more exciting developments in the years to come.

A note from Lisa…

In this issue of the Moon Mag, we bring you two new features to the magazine! Our first interview AND our first competition! We had been watching $RFOX and their project for a while now and were really excited to be connected to the team to learn more about what they are doing. So the obvious thing to do was to share all that information with you too! One of the benefits of building networks within the crypto world is it allows you to get closer to the team around the projects so we encourage everyone to connect both online (Twitter is usually where you can find us!) and also offline too - there are many local meetups you can check out as well as the ever-growing list of national and international events too. Building your contacts will give you a great foot in the door and open you up to other opportunities too. So make sure you’re signed up to our mailing list at the Moon Mag to be in with a chance of winning an $RFOX Apartment NFT - more details on the competition inside this issue! Who knows what other awesome opportunities this could create over time? Enjoy and good luck!

A note from Josh…

A note from Josh…

Editorial

Revolutionizing the Crypto World: The Artificial Intelligence impact in the Cryptocurrency Industry TRADERS PERSPECTIVE THE THEORY OF TRADOLUTION! 08 14 $CTSI: What makes Cartesi unique? 26 SUMMARY

Web3’s Role in the Metaverse: Digital Democracy 36 Web3 Gets a New Player: International Chess Federation Brings Chess to the Blockchain 44 Interview: Q&A with Ben Fairbank, CEO & Co-Founder of RFOX 51 RFOX and the RFOX Token 57 Everything You Need To Know About The Ethereum Shanghai Upgrade 68 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CONTRIBUTORS

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Kel Udeala

I’m a quantitative analyst and a mechanical engineer. I took an interest in crypto because my line of work led me down the financial trading and investment rabbit hole, and it’s only a matter of time before you reach crypto. I enjoy researching different crypto projects, and attempting to forecast their roles in the future financial and technology systems. I also find the volatility of the charts and the resulting crypto-Twitter posts very thrilling.

Daniel Jimenez

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha Jimenez

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R. Paulo Delgado

R. Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Xenia Soares

Xenia is a freelance writer in the web3 niche. Her work has appeared in major crypto publications including CoinDesk, BeInCrypto, and Play-to-Earn. She has been an investor in cryptocurrency since 2017 and believes digital currency will outpace our current economy in the future.

TRADERS PERSPECTIVE

THE THEORY OF TRADOLUTION!

written by Lisa N. Edwards

written by Lisa N. Edwards

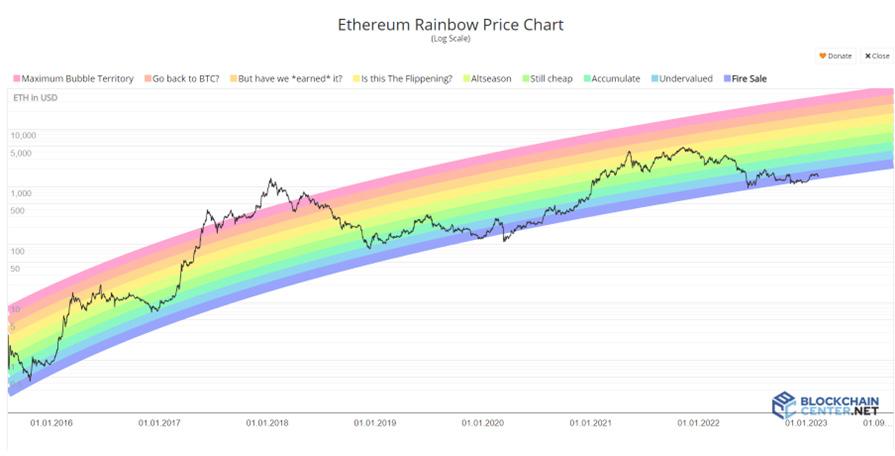

By now, you would know I like to apply psychology and history to trading. I was recently discussing how traders get stuck on one narrative, we have all been there, and it can be incredibly costly. I was there for a small while after the 69K Bitcoin high, literally still inhaling the hopium; the thrill and exhilaration of winning activate endorphins like an addict searching for the next high, and it is hard to break that feeling. The market has a way of humbling the cocky!

We see it all the time on Twitter, the excuses from the traders with hundreds of thousands of followers that refuse to give up the narrative on direction, all because they want to be RIGHT or prove a point, but most likely, they just can’t be wrong.

There are definitely moments in the market when we get to certain levels, TOPS, BOTTOMS, or SUPPORT and RESISTANCE regions, that the hopium kicks in. Trading can be like natural selection. Think of trading like Darwinism…

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

What is Darwinism in simple terms?

Darwinism is the theory of the evolutionary mechanism propounded by Charles Darwin as an explanation of organic change. It denotes Darwin’s specific view that evolution is driven mainly by natural selection. Individuals with adaptive traits—traits that give them some advantage—are more likely to survive and reproduce. These individuals then pass the adaptive traits on to their offspring. Over time, these advantageous traits become more common in the population. https://www.britannica.com/science/ Darwinism

I often get asked why I don’t just trade for myself; if you’re a profitable trader, you don’t need a group to make money. Right? You can’t be profitable and run a group… that’s the mentality of Twitter trolls. What if my trading style works, and after a lifetime trading since the age of 16, I want to leave a legacy of selfsufficient people that can be in a bungalow in Ilot Maitre, swimming with turtles and have their trades set up and pay the way for their next adventure!

As a trader, it’s essential to control these emotions as if you’re a Buddhist monk. This can happen to all traders, long or short, margin or spot, and it’s imperative to adapt your style to suit the market conditions.

There are several different trading styles when it comes to trading cryptocurrencies. Here are some of the most common ones:

Day trading: Day trading involves buying and selling cryptocurrencies within the same day. Day traders often make multiple trades per day, trying to profit from short-term price movements. They usually use technical analysis and use charts, and indicators to make decisions.

Swing trading: Swing traders hold onto their positions for a longer period of time than day traders, typically a few days to a few weeks. They try to profit from medium-term price movements, using both technical and fundamental analysis to make their decisions.

HODLERS - also known as Position trading: Position traders hold their positions for a much longer period of time than day or swing traders, sometimes for several months or even years. They aim to profit from long-term trends in the cryptocurrency market and often use fundamental analysis to make their decisions.

Scalping: Scalping involves making many small trades to make small profits on each trade. Scalpers often use high-frequency trading algorithms and rely heavily on technical analysis to identify short-term price movements. Or my youtube video explaining a super simple technique using indicators.

https://www.youtube.com/ watch?v=DShobYPVaLk

Algorithmic trading: Algorithmic trading involves using computer algorithms to execute trades automatically based on pre-determined criteria. This style of trading can be used for various trading strategies, including day trading, swing trading, and scalping.

Fibonacci trading is another popular technical analysis technique used in trading. It’s based on the idea that price movements in financial markets follow specific mathematical ratios, which are

derived from the Fibonacci sequence. Here are two of the basics of Fibonacci trading:

Fibonacci retracements: This is the most commonly used Fibonacci trading technique. It involves identifying the price range of a particular cryptocurrency’s price movement and then using the Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100% to identify potential support and resistance levels. These levels can help traders identify potential entry and exit points for their trades.

Fibonacci retracements: This is the most commonly used Fibonacci trading technique. It involves identifying the price range of a particular cryptocurrency’s price movement and then using the Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100% to identify potential support and resistance levels. These levels can help traders identify potential entry and exit points for their trades.

Fibonacci extensions: This technique uses Fibonacci ratios to identify potential price targets for a cryptocurrency’s price movement. Traders can use the ratios to identify potential price targets for an uptrend or downtrend. I have a certain way of doing this I like to call Lisanacci!

Fibonacci trading can be used in various trading styles, including day trading, swing trading, and longer-term HODLs or position trading.

Elliott Wave trading is another technical analysis technique used in cryptocurrency trading. It is based on the idea that financial markets move in predictable waves and cycles, which are determined by investor psychology and market sentiment. Ralph Nelson Elliott developed the theory in the 1930s, and it has since been applied to many different financial markets, including cryptocurrencies. The theory identifies patterns of price movements, called waves, which can be used to predict future price movements. As an Elliott wave trader, I use a combination of all of the above - technical analysis, market psychology, and wave patterns to identify potential entry and exit points for my trades and signals.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It's important to note that these different trading styles can have different levels of risk and require different levels of experience and expertise. Doing your research and understanding the risks involved before you start trading is a must. And this brings me to how DARWINISM AND NATURAL SELECTION are applied to trading. It's the over-leveraged traders, those here for a quick buck or inexperienced traders with zero knowledge, who enter the market and quit just as fast.

What percentage of traders quit?

investopedia.com estimated that more than 80% of traders fail and quit. One key to success is identifying strategies that win more money than lose. Many traders fail because strategies fail to adapt to changing market conditions.

Think of trading like climbing a mountain; there are peaks, valleys, roads, or paths between the next small hill or steep mountain. If you take the emotion from the monetary aspect and place the focus on the next steps, you will be profitable and at the peak over time.

And if you want to become an Investopedia statistic, don't spend the time to learn and grow from your mistakes because every trader makes them; the difference is in these words from Vince Lombardi: WINNERS NEVER QUIT,

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

AND QUITTERS NEVER WIN.

Revolutionizing the Crypto World: The Artificial Intelligence impact in the Cryptocurrency Industry

written by Daniel Jimenez

written by Daniel Jimenez

Explore the role of artificial intelligence in the advancement of the cryptocurrency industry. Discover how AI is transforming the way we use and manage cryptocurrencies.

AI and its potential in the crypto industry

AI has been a catalyst for progress in many fields, including cryptocurrency.Thanks to its ability to quickly analyze vast amounts of data, it holds the potential to completely change our relationship with digital currencies and the underlying blockchain technology.

AI refers to computer systems development that can perform tasks that typically require human intelligence, such as understanding natural language, recognizing images, and making decisions. In recent years, AI has made significant progress in various industries, from healthcare to finance, and the crypto industry is no exception.

The integration of Artificial Intelligence (AI) and cryptocurrency can potentially change the face of the financial industry as we know it, looking forward to improved efficiency, accuracy, and security in its operations.

The crypto industry is facing a number of challenges, like a lack of security, scalability, and userfriendliness. AI has the potential to help address these challenges by providing improved security, optimized trading algorithms, and personalized user experiences. With the continued growth and development of AI technology, it’s clear that the crypto industry has a bright future ahead.

The potential benefits of AI in the cryptocurrency

world are numerous: Since revolutionizing the way we trade cryptocurrencies by providing real-time market analysis and predictions to provide faster and cheaper financial services.

This post aims to uncover the potential use cases of AI in the cryptocurrency industry and to highlight some of the projects that have implemented successful algorithms, securing their place in the market trend in recent times.

The current state of the cryptocurrency industry

The cryptocurrency sector, emphasizing Bitcoin, has seen steady growth in recent years. Most of the market’s current capitalization resulted because investors bet on the prospects of this new technology, which is likely to persist until the price level reaches stability and market recognition.

At this point, blockchain technology development has allowed cryptocurrencies such as Bitcoin to majorly impact payment systems, differentiating them from what we knew before decentralized assets’ popularity.

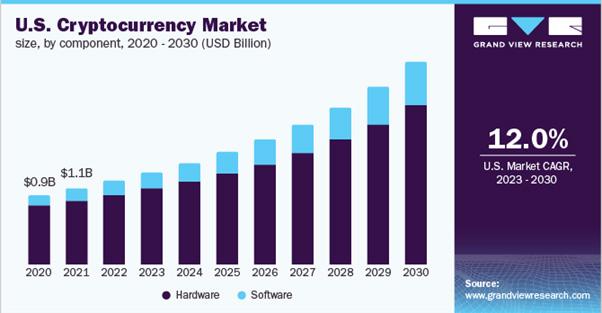

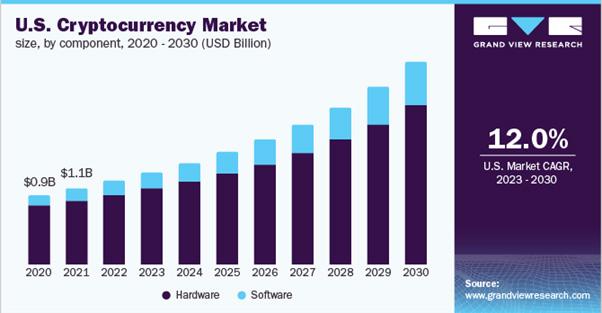

According to a report by Grand View Research, the global cryptocurrency market was valued at USD 4.67 billion in 2022 and expects to grow at a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030. The global cryptocurrency market capitalization value was over USD 800 billion in 2022.

Fields such as remittances, blockchain gaming, and finance, in general, will help further expand the cryptocurrency market. The current discussion is no longer about whether cryptocurrencies will survive but how they will evolve and when this industry will reach maturity.

Although cryptocurrencies bring decentralization and transparency to the table, there are still limitations to the current cryptocurrency systems. Scalability problems are one such issue, leading to slow transactions and high fees during peak usage. Security is another challenge, with exchanges and wallets susceptible to hacking attacks that could result in the loss of funds. The regulatory environment is yet to be fully established, making it difficult for businesses to operate in this field.

However, these limitations also present opportunities for innovation as new technologies develop to overcome these hurdles and improve the user experience.

Some of the latest innovations include using VR in blockchain games and decentralized metaverse, AI in DeFi financial protocols, and more scalable and secure platforms. These advancements are helping the industry overcome its limitations and reach maturity, making it more accessible and user-friendly.

Innovation will play a crucial role in the future of cryptocurrencies, and continued investment and development in this area will be essential for the long-term success of this rapidly growing market.

How AI is transforming the cryptocurrency industry

The cryptocurrency industry is transforming through the implementation of AI, which offers

improved methods for managing digital assets. With machine learning algorithms, AI can assist in fraud detection, risk assessment, price predictions, and others.

Furthermore, AI-powered bots can increase the speed and profitability of trades. As AI evolves, it plays a significant role in determining the future of the cryptocurrency industry.

A. Enhancing security in cryptocurrency transactions

AI and security are becoming increasingly important for the cryptocurrency industry as more individuals and businesses adopt digital currencies, given that Ai can enhance security measures, such as detecting and preventing fraud, improving risk assessment, and enhancing encryption techniques.

Additionally, AI can assist in monitoring and managing large amounts of transactions and complex blockchain networks. As the cryptocurrency industry continues to grow, AI will play a critical role in ensuring the security and stability of digital assets.

The algorithms application to examine smart contracts is a common approach in the sector of significant blockchain systems such as Bitcoin or Ethereum, aimed at uncovering potential fraudulent activities in the network.

The cryptocurrency industry has several instances where AI is employed to improve security, including the use of XGboost and Random Forest machine learning algorithms to detect anomalies and fraud in the Bitcoin Network, as well as the implementation of advanced AI and mathematical techniques by the Certik team to ensure the execution of contracts as intended.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

One notable project is DOCK, which provides the opportunity to create decentralized identities and verifiable credentials. You can think of DOCK as a LinkedIn without centralization, where users have full control over their information and decide who they allow to access it.

Dock offers credentialing technology that enables the creation of digital credentials that are cryptographically secure and can be instantly verified, including workforce certificates, academic accomplishments, identity documents, and KYC verifications. It is the primary utility on the Dock mainnet.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

B. Improving efficiency in cryptocurrency operations

AI can improve cryptocurrency operations efficiency through its advanced algorithms and data analysis capabilities by automating tasks, improving security, and assisting in price prediction.

AI algorithms can automate complex tasks, analyze large amounts of data, and identify new growth opportunities and improvements in cryptocurrency operations, possibly leading to more streamlined and efficient processes and potentially reducing the time and resources required to complete tasks.

However, AI implementation in cryptocurrency operations is still in its early stages, and there may be potential drawbacks and limitations.

The combination of artificial intelligence and smart contracts can revolutionize Decentralized Autonomous Organizations (DAOs), prediction markets powered by smart contracts, digital asset generation, and the advancement of secure and efficient decentralized finance (DeFi) systems.

According to a report by Gartner, by 2023, 30% of all smart contracts will be self-executing, allowing

the automation of complex business processes without the need for intermediaries.

C. Providing advanced investment opportunities

The highly unpredictable crypto market and managing cryptocurrency investments require extensive time and expertise. As technology advances, asset managers are turning to AI, machine learning (ML), and natural language processing (NLP) to simplify managing crypto investments within the fund portfolio process.

AI and blockchain are shaping the future of financial planning, offering support in investment, tax, and insurance decisions and creating new income opportunities. AI-driven crypto investing provides advantages such as more accurate predictions, sentiment analysis on crypto exchanges, automated trading, and optimized investment monetization.

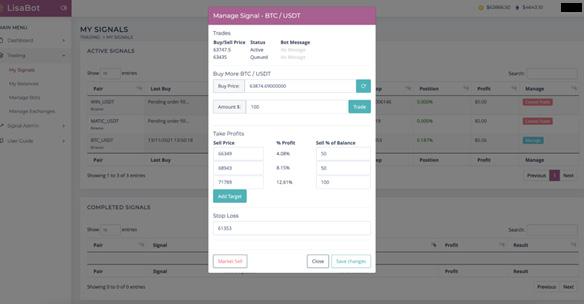

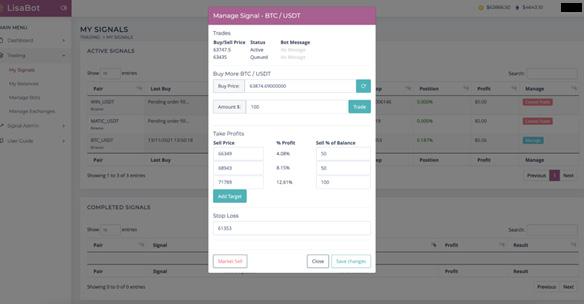

Additionally, AI-powered trading bots like the one offered by GSIC (LisaBot) can allow the average user to detect signals that move cryptocurrencies and the overall market.

Real-life examples of AI in the cryptocurrency industry

A. Case study 1: AI-powered trading bots

AI-powered trading bots are an excellent cool way for traders to level up their game! They use artificial intelligence and machine learning to analyze market data and make investment decisions for you. With these bots, you can say goodbye to the hours spent manually analyzing market trends and hello to a more efficient and potentially profitable trading experience.

Think about it, bots can analyze vast amounts of data, identify trends and patterns, and execute trades in the blink of an eye without the emotions and biases that come with human decision-making. It’s like having a super savvy, always on-the-ball trading assistant by your side. So, if you’re looking to take your trading to the next level, AI-powered trading bots might be your ticket to success!

Our LisaBot is an excellent example of this. LisaBot is our specially designed robot to enhance your trading experience. It will capture the signals we publish and execute trades based on the inputted Buy Zone, Stop Loss, and Target Profit Levels. The bot provides sufficient flexibility for you to customize the trading of our signals to your preferences, giving you control.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

B. Case study 2: AI-based risk management in crypto portfolios

Managing a crypto portfolio can be challenging, especially in a highly volatile market. Portfolio management involves deciding when to buy, sell, or hold different cryptocurrencies, requiring a thorough understanding of market trends and market conditions.

AI has the potential to help optimize portfolio management by automating rebalancing, managing risk, and generating trading signals. For example, AI-powered portfolio management platforms can use machine learning algorithms to

analyze market data and provide real-time insights and recommendations to traders.

Some notable AI-powered portfolio management platforms include Numerai, Nexo, and SingularityDAO.

Numerai is a decentralized hedge fund that utilizes artificial intelligence and machine learning algorithms for investment decision-making. With its distinct strategy, it gathers predictions from a worldwide community of data experts and incentivizes them using its Numerai token for accurate forecasting. The platform harnesses these predictions to power its trading algorithms.

Intending to bring financial freedom to the masses, SingularityDAO is developing a set of DeFi tools. To maximize Alpha generation for the community and increase the value of the AGIX token, they are utilizing Artificial Intelligence developed in-house and hosted on the SingularityNET decentralized marketplace.

The process of launch, swap, and stake at SingularityDAO leads both projects and users into DynaSets. DynaSets bring the cutting-edge risk-management techniques of AI portfolio management to the DeFi space, using advanced strategies backed by data science developed by a team of quant analysts to balance and optimize token groups.

C. Case study 3: AI-powered prediction of cryptocurrency prices

Market analysis and prediction play a crucial role in the crypto industry, providing traders with valuable insights into market trends and conditions. However, analyzing the crypto market can be complex and time-consuming, especially for novice traders.

AI has the potential to improve market prediction and analysis by identifying market trends, detecting market manipulations, and providing real-time market insights. For example, AI-powered market prediction and analysis platforms can use machine learning algorithms to analyze large amounts of market data and provide real-time insights to traders.

Some notable AI-powered market prediction and analysis platforms with exciting roadmaps include Cindicator, Gnosis, and Santiment.

Cindacator utilizes machine learning and AI to design automated crypto trading solutions. Cindicator’s model consists of two main components: human analysis and artificial intelligence.

Taken together, Cindicator’s artificial intelligence processes analysts’ predictions to provide its users with more precise event forecasts. In essence, Hybrid Intelligence harnesses man intellectual power with machine computing power learning to deliver more accurate market analytics.

Santiment (SAN) is a financial market data and content platform for crypto assets and blockchain. Santiment offers data feeds and content streams (including newswires) alongside a regularly updated database of cryptocurrency projects.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

By utilizing a mix of well-known server technologies, mobile development, machine learning, AI, and revolutionary blockchain technology, Santiment transparently stores its data, allowing for an accurate prediction of the “crowd moods” in the cryptocurrency world, providing the Santiment community with the information needed to make informed trading decisions.

Potential future advancements in the AI-cryptocurrency industry

A. Decentralized autonomous organizations (DAOs) The future of DAO may bring a new acronym: AI DAO. The merging of AI and DAO is poised to become a relevant use case in the industry in the coming years, with the capacity to support and amplify each other’s growth.

DAO activities like proposal writing, governance decision summarization, asset transactions, and member recruitment can all be improved and accelerated through AI tools. This application is already in operation and performing well within the DAO ecosystem.

The AI can review resumes, determine which individuals should become members of the DAO, and assign tasks to those with the most relevant abilities through blockchain-based reputation systems or the storage of credentials that demonstrate expertise.

With AI, the DAO can expect coherent governance summaries and a more user-friendly moderation experience in the forums.

AI can assist moderators in evaluating controversial content and determining the appropriate actions.

Incorporating AI into DAO offerings, such

as SingularityDAO’s protocol for managing cryptocurrency assets, is another way to use it.

An AI-powered solution can assist in the moderation process for content flagged as potentially problematic.

AI technology can streamline the DAO governance process by enabling automated voting instead of relying on human involvement.

Ocean Protocol and SingularityDAO are two prime examples of organizations capitalizing on the integration of AI in decentralized governance models.

B. AI-powered decentralized exchanges (DEXs)

Decentralized exchanges (DEXs) are a crucial part of the crypto industry, providing a secure and decentralized platform for buying and selling cryptocurrencies. However, the current state of DEXs is facing some challenges, such as low liquidity, slow transaction speeds, and a lack of user-friendliness.

AI has the potential to help improve DEXs by enhancing security, optimizing trading algorithms, and providing personalized experiences for users. For example, AI-powered DEXs can use machine learning algorithms to detect and prevent malicious activities, such as hacking attempts, and provide real-time market insights to traders.

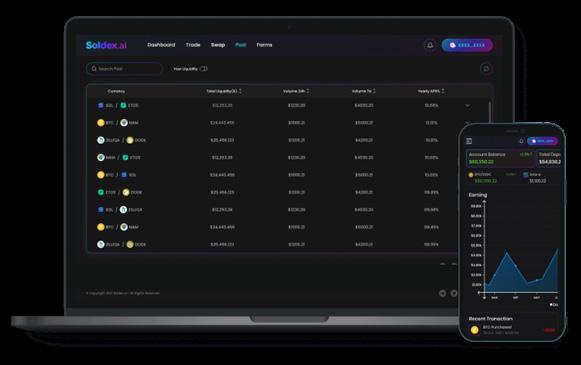

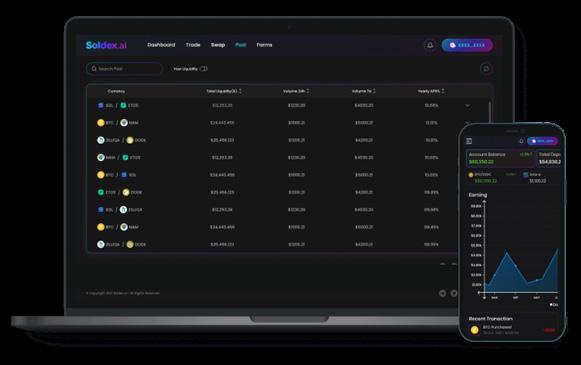

As of now, Soldex.ai is showing itself as one of the earliest DEX that employs AI-powered trading, featuring three main components: analysis of market data, prediction of market risk, and asset buying and selling.

Soldex has set its sights on using a neural network algorithm that operates in all market conditions. The algorithm will scrutinize market data, forecast risk, and handle buying and selling assets for the user. As a fully automated trading platform, it will continuously expand its knowledge base, gathering expert data.

Some of the notable DEXs like Bancor, Uniswap, and Curve maybe use AI to improve their performance.

C. AI-powered Lending and Borrowing Platforms Lending and borrowing are significant aspects of the crypto industry, allowing traders to access funds without selling their assets. However, the current state of lending and borrowing within the crypto industry is facing challenges, such as highinterest rates and a lack of loan options.

AI has the potential to transform the lending and borrowing landscape in the crypto industry by providing better interest rates, more loan options, and improved security. AI-powered lending and borrowing platforms can use machine learning algorithms to analyze market data and creditworthiness, providing lenders with real-time insights and enabling borrowers to access funds.

Some exciting AI-powered lending and borrowing platforms with interesting roadmaps include Nexo. This platform offers several loan options, including collateral-backed and stablecoin loans, and they use AI to optimize the lending and borrowing process, making it more accessible and convenient for both lenders and borrowers.

AI has the potential to revolutionize the way we think about lending and borrowing in the crypto industry. With its ability to analyze market data and creditworthiness, AI has the potential to provide better interest rates, more loan options, and improved security for both lenders and borrowers.

Fetch is a decentralized platform that can play a role in the sector by providing a means for building and deploying autonomous agents for various purposes, including supply chain management, logistics, and DeFi. Launched in June 2019, it has a wide range of applications.

Get the scoop on Fetch and other AI-powered Crypto Projects by reading our latest piece.’ 5 AI Crypto Projects to Watch in 2023’.

Conclusion

The impact of AI on the cryptocurrency industry has been significant, but it continues to evolve and mature. The use of AI algorithms for price prediction and market analysis has allowed traders to make more informed decisions, thus helping to improve overall market efficiency.

AI plays a crucial role in enhancing the security of crypto exchanges and wallets, facilitating fraudulent activity detection, and providing an added layer of protection against hacks.

Additionally, AI has a role in new cryptocurrency development, such as stablecoins, which use AI algorithms to maintain their value. AI growth could play a more important role in shaping the cryptocurrency industry, potentially leading to more sophisticated trading strategies, improved user experiences, and secure and efficient transactions.

Due to the buzz generated by ChatGPT and Microsoft’s emphasis on AI technology, several decentralized projects that either use AI or focus on developing it has come to the forefront and positively impacted the crypto market.

The AI-infused crypto projects’ potential can only become a reality if they join to tackle stability, security, and accessibility challenges. Consequently, investors must research (DYOR) before putting money into any project linked to new technologies such as Blockchain and AI

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

What makes Cartesi unique? CTSI https://cartesi.io/

Cartesi is a layer 2 infrastructure platform that aims to bring powerful computing to decentralized applications (dApps) on blockchains. It allows developers to create and execute complex computations offchain maintaining blockchain security and transparency.

A unique combination of technologies are the bases of the platform, including a Linux operating system, sidechain architecture, rollups, and verifiable computation. These components allow off-chain computations to be processed efficiently and securely and then sent to the main blockchain as a single transaction.

Cartesi allows DApp developers to use all the familiar programming languages, tools, software libraries, and services. We are facing a DApps operating system backed by a team of engineers who, since 2018, have been looking at how to implement new functions within Blockchain technology.

What motivated its creators to develop Cartesi?

The creation of Cartesi was motivated by the limitations of current blockchain platforms, especially in terms of scalability and programmability. There are millions of software developers worldwide, but only a few can overcome the barrier that characterizes the blockchain language.

In addition, scalability is an issue for many blockchain platforms, as they often have limited capacity to process transactions and execute complex calculations, which can lead to high fees, slow transaction times, and other usability issues that limit the potential of using blockchain technology in a wide range of applications.

Programmability is another major issue for many blockchain platforms with limited support for running arbitrary code or implementing complex business logic, thus, making it difficult or even impossible to create certain types of decentralized applications, or to implement more sophisticated smart contracts that can interact with off-chain systems.

Cartesi creation addresses these limitations and provides a platform for building scalable and programmable decentralized applications by allowing complex computations to perform off-chain while maintaining the security and decentralization of the underlying blockchain.

In this sense, Cartesi aims to provide a more robust and flexible platform for building decentralized applications, supporting a wide range of programming languages and tools, thus making it easier for developers to create decentralized applications that can interact with off-chain systems and support more sophisticated business logic.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Thus, easy adoption, decentralization, portability, and scalability are some of the main features of this project. One of its advantages is that it allows developers to create decentralized applications with high scalability and performance level. Based on the smart contract technology of the Ethereum blockchain, which, in turn, uses a system called “Cartesi virtual machines” (CVM). These allow dApps to perform complex calculations outside the blockchain and are autonomous and reproducible, thus offering complete transparency.

So, by using CVMs, applications can execute highly complex computations outside the Blockchain. In this way, they are not affected by the capacity limits of the blockchain. Henceforth, Cartesi apps can simultaneously handle several users and transactions seamlessly, making them attractive for online gaming, artificial intelligence, and scientific computing apps.

For its part, the platform also has decentralized storage called “Cartesi File System” (CFS) that safeguards securely and reliably the data of user applications so that they can access them without problem in a decentralized manner. In addition, they can access it from anywhere as it has a distributed storage contemplated in Blockchain technology.

CTSI Cartesi Utility Token

Cartesi has a sidechain called Noether, which optimizes ephemeral data while providing low-cost data availability for DApps. And, within this sidechain, we just mentioned the CTSI project utility token, which functions as a crypto-fuel for Noether. Here we explain its use cases in more detail.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Paying for computing resources

One of the principal use cases for the CTSI token is paying for computational resources on the Cartesi network. Developers who want to use the Cartesi infrastructure to perform off-chain computations can pay for these resources using CTSI tokens, allowing developers to build complex dApps that require significant computational power without incurring high fees or waiting for long commit times.

Governance

For their part, CTSI token holders can participate in the governance of the Cartesi network by voting on proposals that affect the development and direction of the network, making the Cartesi network a decentralized, community-driven platform where decisions go through a consensus mechanism. CTSI token holders can influence the direction of the network by proposing and voting on changes that affect the platform.

Putting into play

To participate in the Cartesi network’s consensus mechanism and earn rewards for helping to secure the network, users can stake CTSI tokens. Stakers can earn rewards in CTSI tokens for validating transactions and contributing to network security. Staking also incentivizes token holders to keep their CTSI tokens, which helps stabilize the network’s token economy.

Incentivization

Also, CTSI tokens can incentivize users to perform beneficial actions to the Cartesi network, such as validating off-chain calculations This incentivization ensures that the network is secure, reliable, and trustworthy. Developers using the Cartesi network can also offer rewards in the form of CTSI tokens to incentivize users to use their dApps and contribute to the growth of the network.

As we have detailed, the CTSI token plays a critical role in the Cartesi network by allowing developers

to create complex dApps that require significant computational power while providing governance, betting, and incentivization mechanisms to ensure the security and growth of the network.

CTSI’s pricing behavior

According to CoinMarketCap data, since its April 2020 launch, CTSI’s price has gone through several price movements, including periods of uptrends and downtrends.

In its initial trading period, CoinMarketCap describes CTSI as priced at around $0.03 per token. By the end of May 2020, CTSI’s price had risen to $0.08 per token, representing a significant increase of more than 166%.

However, at the end of June 2020 and until November 2020, the token remained in a downtrend sponsored by the general crypto market trend squeezed at that time, changing shortly after December 2020, when the price of CTSI began to rise again, reaching a new all-time high of around $0.55 per token at the end of January 2021, representing an increase of more than 2,650% since the start of trading.

But, as with many cryptocurrencies, this uptrend did not last. CTSI’s price retreated to around $0.10 per token in late February 2021 before recovering to $0.30 per token in mid-March 2021. Since then, the CTSI price has remained relatively stable, ranging between $0.10 and $0.30 per token.

Source: CoinMarketCap.

In general, CTSI’s historical price has been marked by periods of volatility, with significant increases and decreases in value. Despite these fluctuations, CTSI has maintained a relatively stable price since mid-2021. The token’s current price is $0.163694, with a 24-hour trading volume of $8,373,554. It is ranked #264 on CoinMarketCap.

Source: CoinMarketCap.

As the Cartesi network continues to evolve and gain traction, the value and utility of the CTSI token are likely to increase, making it an attractive investment opportunity for those interested in the decentralized economy.

How Cartesi technology works

But the platform’s utility token is not the only or the main attraction of Cartesi. As we detailed above, Cartesi’s technology allows developers to build complex and scalable dApps on the blockchain, using familiar programming languages and tools so its technology is important and is what makes it really striking because it seeks to address several key limitations of blockchain technology, such as scalability, high fees, and limited programmability.

One of the main challenges of blockchain technology is its limited scalability. Most blockchains have a limited number of transactions per second, which can make it difficult to support high-demand applications. Cartesi’s off-chain computations allow developers to perform complex calculations off-chain, reducing the computational load on the blockchain and enabling faster and more scalable dApps.

Another key limitation of blockchain technology is its high fees. Many blockchains require users to pay transaction fees for each interaction with the network, which can be prohibitively expensive for some users. And, this is where Cartesi’s Layer 2 scaling solution reduces transaction fees by enabling offchain calculations, which can be performed at a lower cost than on-chain calculations.

In addition to scalability and fees, Cartesi’s technology also enables greater programmability for dApps. By allowing developers to use familiar programming languages and tools, Cartesi makes it easier to create and deploy dApps on a blockchain. This could help increase the adoption of blockchain technology by reducing the learning curve and technical knowledge required to develop dApps.

This is made possible by four important aspects of Cartesi:

Off-chain calculations: Cartesi allows developers to perform complex calculations off-chain, using a Linux environment running inside a Cartesi Node. This allows dApps to run complex calculations that are not possible on the blockchain due to its limited computing power.

Rollups: Cartesi also uses a technique called optimistic rollups to ensure that off-chain calculations are verified and secure. In a rollup, several off-chain calculations are aggregated into a single transaction that is sent to the blockchain for verification. This significantly reduces the number of transactions that need to be executed on-chain, improving scalability and reducing fees.

Verifiable calculation: Now, to ensure that offchain calculations are correct and reliable, Cartesi uses a technique called verifiable calculation. This involves generating proof that the calculation has been performed correctly and that the result is correct. The proof is then sent to the blockchain for verification.

Interoperability: Finally, Cartesi allows dApps to interact with multiple blockchains, making it possible to build cross-chain applications. This is achieved by using an open protocol called Descartes that allows dApps to communicate with different blockchains and smart contract platforms.

Cartesi’s approach to off-chain computing allows for greater scalability and flexibility in the development of dApps, making it possible to create complex applications that would not be feasible using traditional on-chain methods. In addition, Cartesi’s architecture allows for easy integration with traditional software and databases, opening up new possibilities for the adoption and integration of blockchain technology.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Why Linux?

Today, the Linux operating system is used by many technology giants mainly because of its great versatility. Among them are Amazon, Facebook, and Google, who have placed their trust in Linux. In addition to sharing its capacity to develop wellknown applications such as Airbnb and Uber.

Linux is characterized by being robust and free but without ceasing to be a highly reliable operating system. Here it is possible that its users can do many things. From setting up an application server to using office applications.

At least 96.3% of respondents to a survey conducted by the Linux Foundation in 2020 revealed that the majority of those people use this operating system within their organizations because of the multiple advantages that Linux brings them, including local, cloud-based deployments.

In this sense, and considering all that we mentioned above, it is clear that Linux is one of the most widely used server operating systems in the world, with

a significant presence in both on-premises and cloud-based deployments.

And, it is here that we can see the intimate relationship that Cartesi and blockchain have with open-source software. Linux and RISC-V (Cartesi’s virtual machine architecture) are benchmarks in the open-source world, with adoption growing steadily.

What makes Cartesi a unique platform?

Some key factors that make Cartesi unique are off-chain computing, and Linux compatibility, two factors seen above. As well as decentralized gaming.

Cartesi is uniquely positioned to provide a platform for decentralized gaming applications that can overcome the computational and storage limitations of current blockchain systems.

This is because Cartesi’s off-chain computing model allows for more complex and feature-rich games to be created and deployed on the blockchain.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Also, the Layer-2 scalability solutions make it unique. Cartesi provides Layer-2 scalability solutions that allow blockchain developers to scale their applications without compromising decentralization or security. This makes it possible to create blockchain applications that can handle large transaction volumes without sacrificing performance or reliability.

Cartesi’s technology combines the security and immutability of blockchain technology with the flexibility and power of off-chain computing. It works across multiple techniques and components to enable secure, efficient, and flexible off-chain computing on a blockchain, opening up new possibilities for innovation and technology adoption.

In addition, Cartesi can bring improvements to the crypto space. It allows developers to build complex smart contracts with ease, increasing the efficiency and flexibility of smart contract development, and enabling faster innovation and adoption of blockchain technology.

It also enables the development of decentralized applications (dApps) that can interact with traditional software and databases. This can open up new possibilities for integrating blockchain technology with existing systems, increasing the potential use cases for decentralized applications.

Overall, Cartesi’s technology can help overcome some of the key challenges facing the crypto space, such as scalability and adoption, and can bring new opportunities for innovation and integration with existing systems.

Cartesi has received backing from many investors, including some well-known names in the blockchain and cryptocurrency space. Some of its major investors include Coinbase Ventures, Binance Labs, and Digital Currency Group. In addition to its investors, Cartesi has also established partnerships and collaborations with several blockchain projects and platforms, such as Polkadot, Matic Network, and the Ethereum ecosystem.

Future projection

In the near future, Cartesis is projected to be a leading platform in the market that allows the creation of scalable and very powerful decentralized applications, but above all, it can interact efficiently with other traditional systems. Therefore, the company is developing its technology to achieve this goal very soon and also obtain strategic partnerships that allow it to join the project.

If I may mention, one of the interesting areas for Cartesi that I think could have unprecedented momentum is the potential in the games industry. On multiple occasions, we have addressed the subject in question in other editions of The Moon Mag. But I especially refer to Creepts, it is his first gaming dApp where he shows his capabilities as technology.

It basically has potential because it could give players the transparency and fairness that may be lacking in other projects. That’s not to mention the opportunities you have to take advantage of Cartesi’s off-chain computational capabilities, which henceforth benefits scalability as well as game performance while making the mechanics in question more sophisticated.

Creepts is a tower defense game in which players must defend their base from an onslaught of enemies by strategically placing towers and other defenses on a game board.

In Creepts, players can earn cryptocurrency rewards for successfully defending their base and completing various in-game objectives. This helps encourage participation in the game and can be a source of income for skilled players.

So we can say or take Creepts as an example of the potential of digital app games built on the Cartesi platform. If these capabilities are taken advantage of, developers will undoubtedly be able to create more attractive and appealing games for users, which jump to another dimension and break the traditional or “expected”. Which would also drive the adoption of decentralized applications within the industry.

Is Cartesi the same as other technologies? Why?

Cartesi’s technology is unique in several ways, although it shares some similarities with other technologies in the blockchain and cryptocurrency space.

A key difference between Cartesi and other Layer 2 solutions is its focus on off-chain computing using a full Linux operating system. Cartesi’s architecture also allows for easy integration with traditional software and databases, setting it apart from other Layer 2 solutions that focus primarily on improving scalability and transaction performance.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

That is to say, although Cartesi may share some similarities with other technologies within the crypto ecosystem, the fact of the fusion that it has between characteristics and capabilities already makes it completely unique. It is a platform with potential for innovation that not only allows the creation of decentralized applications but also gives the opportunity to interact with traditional systems.

It is as if Cartesi wanted to build a link, a bridge, that allows the connection of two worlds into one: Blockchain technology and traditional computing, together. Merging them to create new things, new possibilities for innovation in the crypto space, yes, but also beyond and that will last over time, adding value to users.

Put more simply, Cartesi aims to bridge the gap between blockchain technology and traditional computing, giving developers the opportunity to create powerful decentralized applications that can interface with existing systems while offering new possibilities for innovation and adoption in the cryptocurrency space, and even beyond.

So, when we put ourselves in front of this cluster of features and capabilities together, we find ourselves with a Cartesi that we can define as accessible, flexible, and scalable at the same time. Cartesi seeks to break down walls and obstacles for its developers so that they can put their minds to flight and create wonderful decentralized applications that steal our breath away.

So, it is not only a condensed technology, it is not only the work facilitated for developers, and not everything is summarized in what we have already seen throughout this article, it is also having the power to attract attention to initiate mass adoption. to the Blockchain space and of course an imminent growth of the industry.

written by R. Paulo Delgado

written by R. Paulo Delgado

Web3’s Role in the Metaverse: Digital Democracy

Some say Web3 is just a small dot in the upcoming metaverse. But any ethical and safe metaverse will require Web3 as its very foundation, interwoven into every aspect of it.

From Day One, the metaverse has been a challenging concept to grasp. After then-Facebook CEO Mark Zuckerberg’s announcement in October 2021 that the company was rebranding to Meta, a flurry of media articles appeared, pointing out that nobody understood what the metaverse is.

But a Delphi study titled “A Delphi study on the development of the metaverse towards 2030,” conducted recently by the Copenhagen Institute for Futures Studies (CIFS), attempts to clarify its meaning and predict where the metaverse is going.

An accompanying “Metaverse Map,” developed by CIFS in conjunction with Mandag Morgen business magazine, identifies Web3 as a small section in a much greater ecosystem of technologies, including AI, VR, AR, and Digital Twins.

Yes, a true metaverse could exist with Web3 as a mere speck — perhaps to facilitate the occasional use of NFT concert tickets. But is that safe?

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Delphi study confirms lack of agreement on metaverse definition

The Delphi Method uses an interactive forecasting technique that relies on a structured panel of experts. The experts answer questionnaires, and then a facilitator tabulates the answers. These are sent in an anonymized form back to the experts, who can then modify their initial answers according to the anonymized responses of the others.

The theory is that experts will gravitate toward a “correct” answer after a certain number of rounds. The median or mean of the final round is then taken as the study’s final answer.

This Delphi study gathered the opinions of 72 experts, more-or-less evenly distributed across diversity attributes, continents, and spanning professional sectors from artists to entrepreneurs to regulators.

The definition of metaverse used in the study was:

“The metaverse overall is the seamless convergence of our physical and digital lives that will bring people, spaces, and things together in virtual or augmented digital worlds. This includes augmented visual layers added on top of our physical reality as well as virtual worlds.”

Nowhere does that definition cover Web3. This is curious because, at the Nordic Metaverse Summit in January, where the study’s unpublished findings were first presented, all attendees were invited to mint their first NFT — a POAP (Proof of Attendance Protocol) — that would recognize them as the first-ever attendees to this new Summit.

People somehow sense that NFTs, Web3, SelfSovereign Identity (SSI), and blockchain tech will be an integral element of a metaverse, but perhaps not quite how.

The Delphi study showed that at least 63% believe the metaverse already exists in some way or form. And 34% believe it doesn’t.

These are two starkly different opinions, revealing the great divide in agreeing on precisely what the metaverse is.

This was evident in the Summit itself where VR and AR took center stage. Companies that run centralized virtual worlds called those worlds a “metaverse.” One company described “Web3” simply as “the next iteration of the internet that is community driven.” But it was specifically referring to how it had created a community of users around a topic — much like forums currently do on the internet — rather than to any underlying technology. On the event program, that company had the terms DeFi, Web3, and DAOs next to its name. But it had implemented none of these things and only had “plans to do so.”

In stark contrast, Magnus Jones, Nordic Blockchain Lead and Head of Innovation at EY Tax and Law, drew a line in the sand and showed a slide that unequivocally divided Web2 (virtual worlds) and Web3 (metaverse).

This is what the slide said:

Structure

Property Rights

Code

Data

Access

Ownership

Identity

Content Policy

Value Accrual

User Acquisition

Social Display Systems

Product Direction

Decentralized

Cryptographically enforced

Open Source

Transparent

Permissionless

Community

Unbundled + user Controlled

User Choice

Users + Network

Grassroots + Incentives

Direct

Diverse

Bottom up

Centralized

See Terms of Service

Insider Only

Opaque

Permissioned + Limited

Corporate

Centralized Identity Provider

Platform Choice

Platform Owner

Ads

Mediated

Proprietary Hardware

Top Down

Slide presented by Magnus Jones of EY Tax and Law, dividing Web2 and Web3

By this slide’s logic, there can be no metaverse without blockchain.

Actually, there can be — theoretically speaking. But it is probably an immensely bad idea. To understand why, we need to look at a bit of blockchain history.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Metaverse (OPEN)

Virtual World (CLOSED)

The Web3 ethos, back to bitcoin

The valiant story of blockchain’s rise from nothing is the modern-day story of Robin Hood — and we shouldn’t forget it. Those “corrupt nobles” on Wall Street brought down the economic system in 2007 and 2008 and caused millions of the good people of a Worldwide Nottingham to lose their homes, jobs, and livelihoods.

But while the banks that those nobles belonged to received bailout money, and some of those nobles got away with millions in their pockets, the poorfolk adopted a new digital currency that — hurrah! — ultimately became one of the most valuable assets on Wall Street.

That was followed by Ethereum, smart contracts, and finally the DAO — an organization that cannot be corrupted or usurped by one single entity, in which the rules of the organization are built into the code itself.

Blockchain was both a technological movement and a philosophical one: By the people and for the people.

This has been the ethos of blockchain from its inception, whether it was the Bitcoin chain or Ethereum. Decentralized. No central authority. Digital democracy.

The crash of 2008 taught everyone that central authorities might not be such a great idea anymore. Every Web3 project that goes forward without this community-driven ethos fails: Porsche’s NFTs is one example, where the Teutonic bull vroomed into the china shop expecting all the awestruck commoners to hold up handkerchiefs and wipe away tears of gratitude for being in the presence of such automotive splendor. Instead, Porsche learned, like other big brands have, that succeeding in Web3 is about including the people. Its NFT project was both an embarrassment and a flop.

The time for kings ruling the roost is over. The good people paid hard when those centralized kings flouted the rules in 2008. We don’t want it to happen again.

Time was another brand that learned a lesson from the power of the Web3 community. Whereas their initial foray into Web3 was an arrogant galumph — they converted old magazine covers into NFTs and thought that was the beginning and end of an NFT collection — their TIMEPieces collection has since grown into one of the most respected in the community. Because Time learned to put the community first and let the artists do the talking in its projects. Kudos go to its VP of Web3, William Ban, who presented at the Nordic Metaverse Summit just how closely Time now works with its artists, and how deeply it respects the Web3 community.

Web3 is no place for fat kings unless those kings have been voted into kingship by governance tokens. And they can be likewise voted out by those same tokens.

In Web3, you are always a guest. Overstay your welcome, and you’ll be voted out.

In other words, Web3 digitizes democracy.

If we’re about to create a new universe that we must live in, do we really want the democratic element of it to be “tacked on” — a tiny dot in a greater map of technologies that don’t enforce any democratic principles at all?

A safe metaverse cannot exist without Web3

When a company talks about its VR universe and calls it a metaverse, that’s a misnomer. Whereas there might be disagreement on the precise definition of what a metaverse is, one element has remained constant: Seamless integration between the physical and digital world.

This concept is most fully understood by anyone who has read the book that coined the term metaverse in the first place: Snow Crash, by Neal Stephenson.

In that book, it’s sometimes hard to follow when the hero is in the physical world or when he’s in the digital world because the integration is that seamless. It’s everywhere.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Extrapolating this, we can envision several certainties that would comprise the “mature” metaverse that the Delphi Study predicts will take at least five years to achieve:

• Comfortable glasses that facilitate AR

• Connectedness everywhere we go

• Some method of authentication and identification

• Seamless payment methods, regardless of where we are

• And so on.

There can be many AR glass manufacturers, but they will all connect to the internet. Will that internet be free? Will everyone be allowed access? Will we be forced to type in new credentials or pay for access every few miles? If yes, how frustrating. How “un-seamless.”

Or will there be some central authentication process that works seamlessly between providers and which we can revoke any time we want to? Will everyone be allowed to enter virtual buildings at will? What if someone breaks digital law?

In the physical world, we need a passport to jump on a plane and fly somewhere. When entering a new country, our IDs get checked. We can’t simply walk into every building. To go to a concert, we need a ticket.

In the physical world, there are many jurisdictions. There is no central worldwide government. Why would there be one in the digital world?

For a seamless integration where we are constantly connected, and our money is as good at one establishment as it is in another, we will need that connectivity to work everywhere.

There are only two ways it can work everywhere:

• Completely centralized (worldwide governing authority)

• Completely decentralized (blockchain, web3)

The centralized version needs a chief on top who controls our access to everything and who owns our very identity. It has to be everything because the metaverse intends to be universal and seamless. You can’t have Google running half of the metaverse and then move over into the Apple part of town where nothing connects. That might be defined as a “highly technological society” but it can’t accurately be called the metaverse. So a centralized metaverse would only be possible if one entity controls everything.

Who will that entity be? Google? Our local government? Meta? North Korea? No doubt every one of those players might try to become the central player, but it’s unlikely to work.

Which leads us to the other option: Totally decentralized.

Web3 needs to form the base of this new world. Everything else can be built on top of it. Companies can implement their own authentication protocols, but people are free to move around this universe from Day One.

Self-Sovereign Identity could be used to identify us at virtual and physical buildings, and then the owners of those buildings could decide if they wanted to let us in or not. If we got tired of one part of the metaverse, we could go to another one. If we got tired of Meta receiving our private data, we could withdraw our permission from it.

Apple could create its side of the metaverse, but we could access both Apple’s side and Google’s side because our digital passport would be good at both places.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Without Web3 as a base, the metaverse will be a dystopia

Perhaps some people were initially alarmed that Meta was the driving force behind this new, connected world. The company has an atrocious data privacy record.

There are other Big Brothers and Nottingham Sheriffs in this plot, and they all have too many vested interests to be trusted with our daily lives.

A metaverse without Web3 is a dystopian novel waiting to happen.

A cohesive metaverse that spans industries and companies and sectors and jurisdictions is impossible to create safely and ethically without a permissionless, open, public blockchain underlying it.

The companies selling virtual worlds as metaverses are selling a closed system. It’s possible they haven’t fully grasped the full magnitude of what the metaverse actually means. But it might also just be that they have something to gain from a closed system. It’s up to the Web3 community to keep clamoring and shouting for more decentralization, less central control, and more power to the people of this new digital-physical world.

Web3 Gets a New Player:

International Chess Federation Brings Chess to the Blockchain

written by Xenia

written by Xenia

The world of chess has just been checkmated. By web3, that is. The International Chess Federation (FIDE) — the sport’s governing body — has recently announced a major step toward innovation by aligning with Ava Labs to bring web3 products onto the Avalanche blockchain. The goal behind this partnership is to enhance the organization’s security and trust via tamper-proof experience tracking and transparent data processing.

With over 500 million global chess players, FIDE has now opened up a new era of competitive sport for its diverse tournaments. The centuries-old game of strategy is taking a bold step into the future, promising to revolutionize the industry’s standards.

Emil Sutovsky, CEO of FIDE expresses the ingenuity of the partnership as an ideal merger for unifying the chess community:

“We are excited to get into this project. Ava Labs is one of the leaders or rather driving forces behind onchain technologies, while FIDE is constantly working on improving players’ engagement and experience. Chess is a unique sport, and this cooperation will allow us to unify our community and strengthen the ties between players, clubs, federations and FIDE.”

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

And this is just the beginning.

FIDE plans to develop products that enable stronger operational efficiencies for the chess federations. Their goals are to improve game integrity, onboard a new generation of players, and most notably, empower innovation in the sport.

The influx of institutional entities entering the web3 space is growing at a rapid pace. And with GameFi making quite a splash, it was only a matter of time before the game of kings joined the arena. Yet, the question remains on every spectator’s mind: What does this mean for chess players and how will things change for the better?

Checkmate, Avalanche

Avalanche is poised to become the new frontier of international chess competition. And its merit as the world’s fastest and most reliable smart contracts platform proves why it was chosen for the task. Providing a multi-chain architecture, Avalanche is a centerpiece for customizable subnets that cater to specific use cases. Furthermore, its consensus algorithm, Avalanche-X, provides a high level

of security and decentralization. This makes the project an ideal choice for businesses and organizations looking to implement distributed ledger technology.

Avalanche’s Core, an all-in-one web3 command center wallet for all things crypto, alongside Ava Labs, will be featured as sponsors in FIDE physical chess tournaments. This includes both the World Chess Championship and Chess Olympiad. Fide handles 200 national chess associations across the globe. And now with the growing popularity of online chess, this adds an added layer to FIDE’s influence of the market since 100 million chess members participate in online chess tournaments.

Protect your king, at all costs

It’s clear that chess has come a long way since the days only a select subgroup of people were playing. Yet, in the game of chess, the main objective is to protect your king. Likewise, in sports tournaments, it becomes a top priority to protect your players. And the introduction of innovative technology may just be what FIDE and its members are missing since protection and security are the hallmarks of web3. Increased transparency

Transparency is needed to ensure trust between all people associated. This includes players, sponsors, and FIDE members themselves. Blockchain technology can ensure all the details in FIDE’s decision-making process are open to the public. This makes it easier for fans and players to keep track of important changes to the system. Furthermore, transparency helps to prevent fraud, malpractice, and corruption within the organization.

Efficient tournament management

Managing tournaments requires a lot of data processing. And with more than 300,000 active participants in FIDE tournaments specifically, blockchain can prove to be invaluable. Management done on-chain can streamline the organizational process of registering players, tracking moves or game results, and even settling prizes. And this can

be done much quicker than the standard way of running things.

Secure, tamper-proof record keeping

Moreover, the use of blockchain technology helps to secure the FIDE’s information and data while ensuring no one can tamper with the records. For example, this can be used to store player information, tournament results, and other important data on the database. This also prevents data breaching and cyber-attacks.

Fair play

Cheating and foul play will no longer be an issue with the introduction of blockchain. Chess tournaments will be provided with a secure way of recording every move made and tracking the game pieces. Therefore, nobody will be able to tamper with or manipulate the results of the games. This should assuage many chess players since these happen to be some of the top concerns in competitive chess.

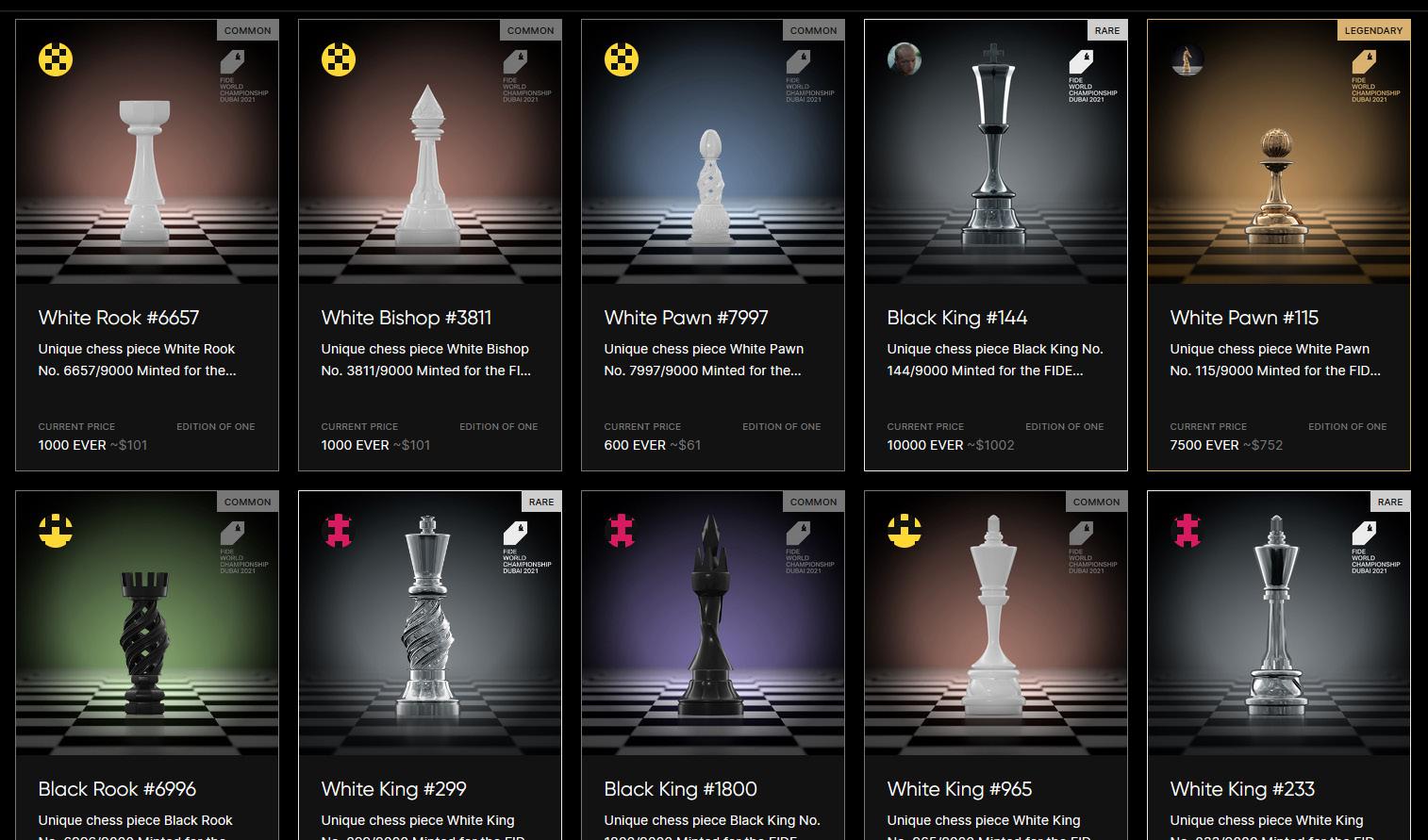

All these benefits represent a remarkable upgrade for chess players who place considerable value on trust and security. And FIDE hasn’t stopped there. In fact, the sport’s governing body had already made some legal moves of its own by being the first global sports federation to launch its own NFT marketplace.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

In a tweet, Avalanche went on to say that

“FIDE will be using Avalanche’s Subnet technology and ultra-fast transaction speed to power onchain products such as a historical game explorer, digital trophies, tournament data, and player rating management.”

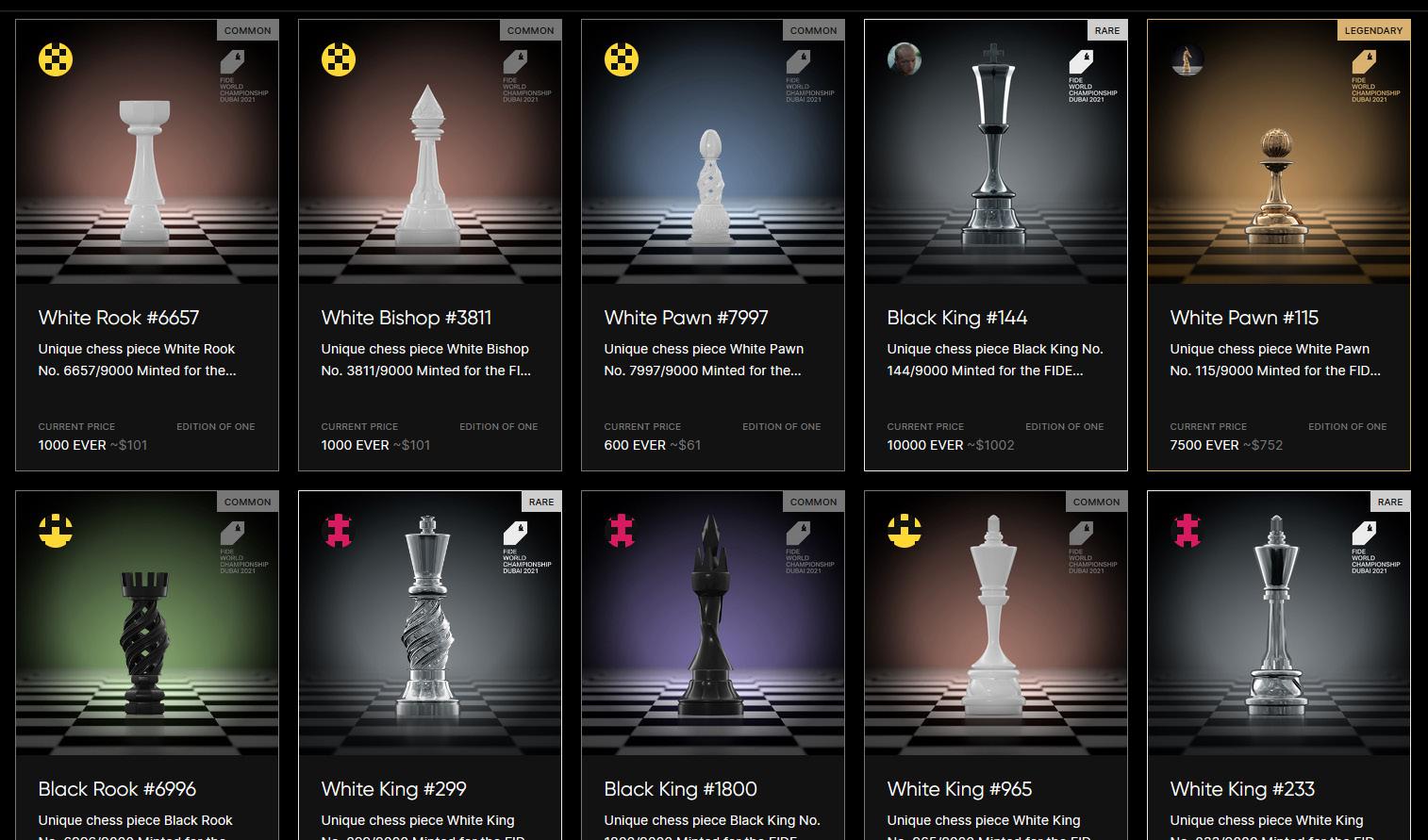

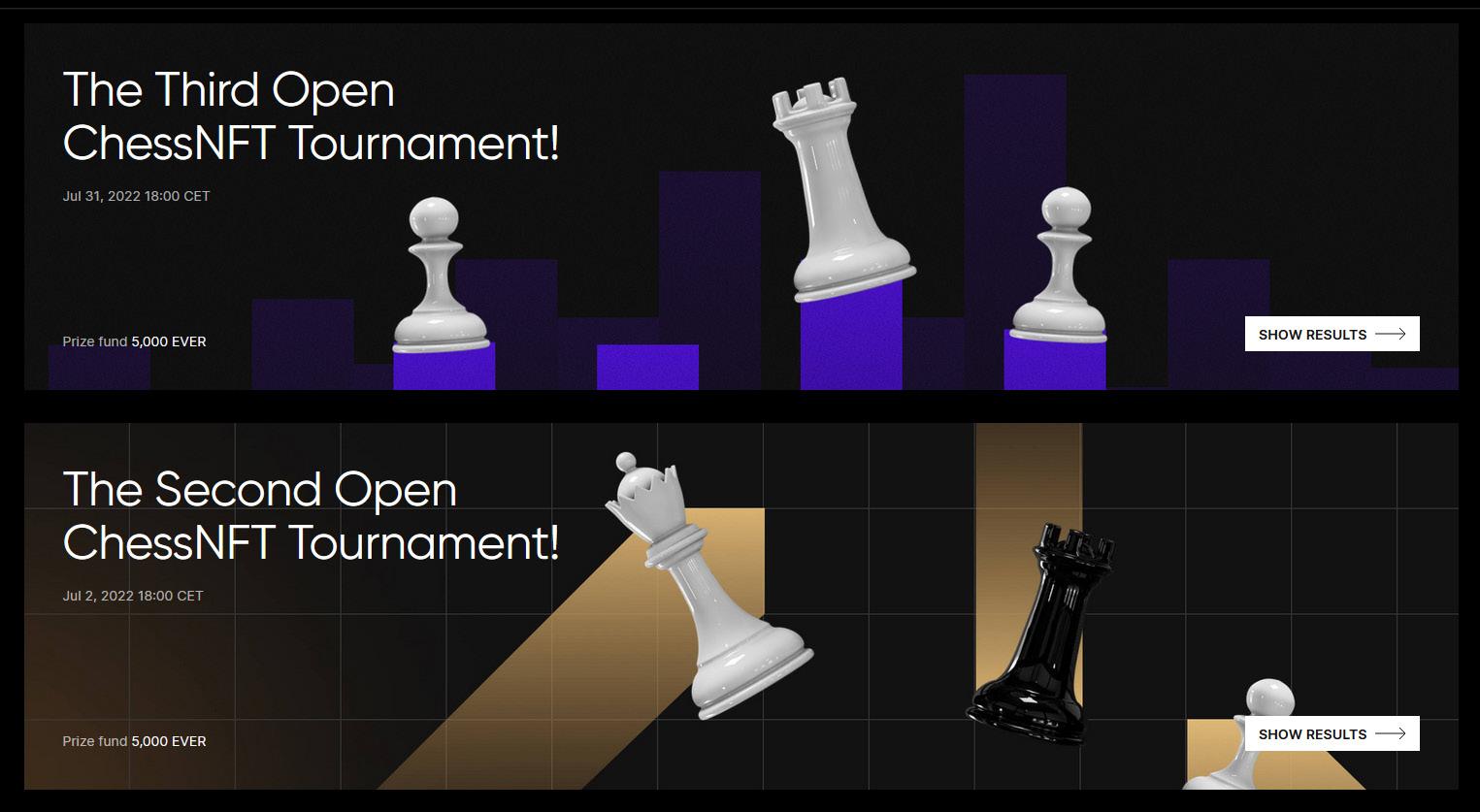

ChessNFT Marketplace

On November 3, 2021, FIDE announced that they would be partnering with TON Labs to launch ChessNFT. com, a global NFT marketplace on the Free TON Network. This transition provided chess players and fans worldwide utility for their activities. Along with chess art, iconic match moments are transformed into digital collectibles that can now be gamified and digitilized into non-fungible tokens. These can then be bid on and sold via their platform.

The Free TON Network is known for processing transactions on a global scale due to its layered work chains, providing seamless scalability for its users. This is made possible by the network’s highly efficient TON Operating System so that end-to-end decentralization can truly flourish.

Co-Founder and CEO of TON Labs Alexander Filatov believes this move will not only deliver an unprecedented experience to users today but also bring in a brand new cohort of chess players.

Chess enthusiasts around the world can now be proud owners of legendary digitized chess pieces from past FIDE tournaments. The rarer the piece, the higher the value. But this isn’t the only value derived from a web3 integration.

“By creating this platform, we are giving the wider chess community the opportunity to explore their passion in a unique, fully decentralized, digital capacity as well as experiencing true NFTs,” he says.

Every pawn is a potential queen

Every chess player has the potential to be greater. Perhaps that feeling of security that we as humans innately seek pushes us to explore our limits. Blockchain technology may just be that proverbial push in the right direction. As any chess player will tell you: chess is not just a sport, but an art as well.

Jewish-Austrian chess player and writer Rudolph Spielmann once said:

There is, indeed, a certain level of magic played in chess as the minds of players beautifully meld into the harmonic movements of their pieces like a well-orchestrated symphony. It’s this same synergy we see today with the merging of human activity and technology.

The efficiency, transparency, and security that blockchain technology provides for FIDE will undoubtedly open new doors. Doors that were once previously closed to generations who counted on their human peers to establish the foundations of trust that shouldn’t have been tampered with. This has led to a stunt in the growth of the community where the pawns remain as pawns with no hope of promotion.

Without the innovative spark that web3 lends to the chess community, players risk losing their autonomy as individuals and as a culture. This can ultimately lead to a future in which the rest of society has progressed while the classic game of chess hasn’t due to no further action being taken.

In other words, the chess community risks being stale-mated.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

“Play the opening like a book, the middlegame like a magician, and the endgame like a machine.”

Advertise with us! Contact@themoonmag.com

with Ben Fairbank, CEO & Co-Founder of RFOX

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. INTERVIEW

Q&A

Hi Ben! Welcome to the Moon Mag! When you meet people who aren’t in crypto, how do you explain what you do and describe RFOX to them?

Thanks for having me, glad to be here. Yes, that is a great question. It depends on who I am speaking to, but I describe the platform as being like Roblox in the sense it contains all the tools required for creators and users to build out worlds, brands, games, and experiences one place. I do not get into the weeds regarding the technology that underpins the products and services but more so the benefits of digital inclusion, access, and opportunity. We are making it much faster and cheaper for businesses to build or launch and to create with limited skills.

What inspired you to create RFOX and build a blockchain community?

Having been an expat and sending money through antiquated and expensive routes, Bitcoin caught my attention. When looking further into blockchain and having come from fast moving tech companies, we immediately saw the opportunity for developing apps in web3 and plugging those into a platform that becomes a one stop shop for creators, users, and brands. This is a new frontier for immersive engagement.

Our blockchain community is a passionate group of people who share our vision, and we are now working as fast as we can to get them the tools to help us build the rest together.

Your litepaper was launched in March 2021. Can you describe the journey that RFOX has been through so far?

That was an update to the first paper that was released back in 2019 and we spun the business up the year prior in 2018. It’s been an amazing journey filled with challenges, pivots.

1

2

3

Back in the early days we would spend hours in rooms with investors or partners trying to explain the concept of a metaverse and why it would be something to pay attention to. Explaining in pieces how we would start with a series of essential products and tools that would click together and underpin the platform. We ran into a lot of people who either did not understand or could not see how to make a quick buck from it and therefore dismissed the idea. We then had the fortune of meeting a couple of people and groups who said that we could be on the right track and to ignore people who do not understand the concept of a platform and get us to try and build just one product or service.

COVID expediated the need for more robust digital infrastructure and platforms and then Meta coming out and explaining their vision for the metaverse, helped to solidify our explanation but also gave us confidence that what we have been working on for years is something people now pay attention to.