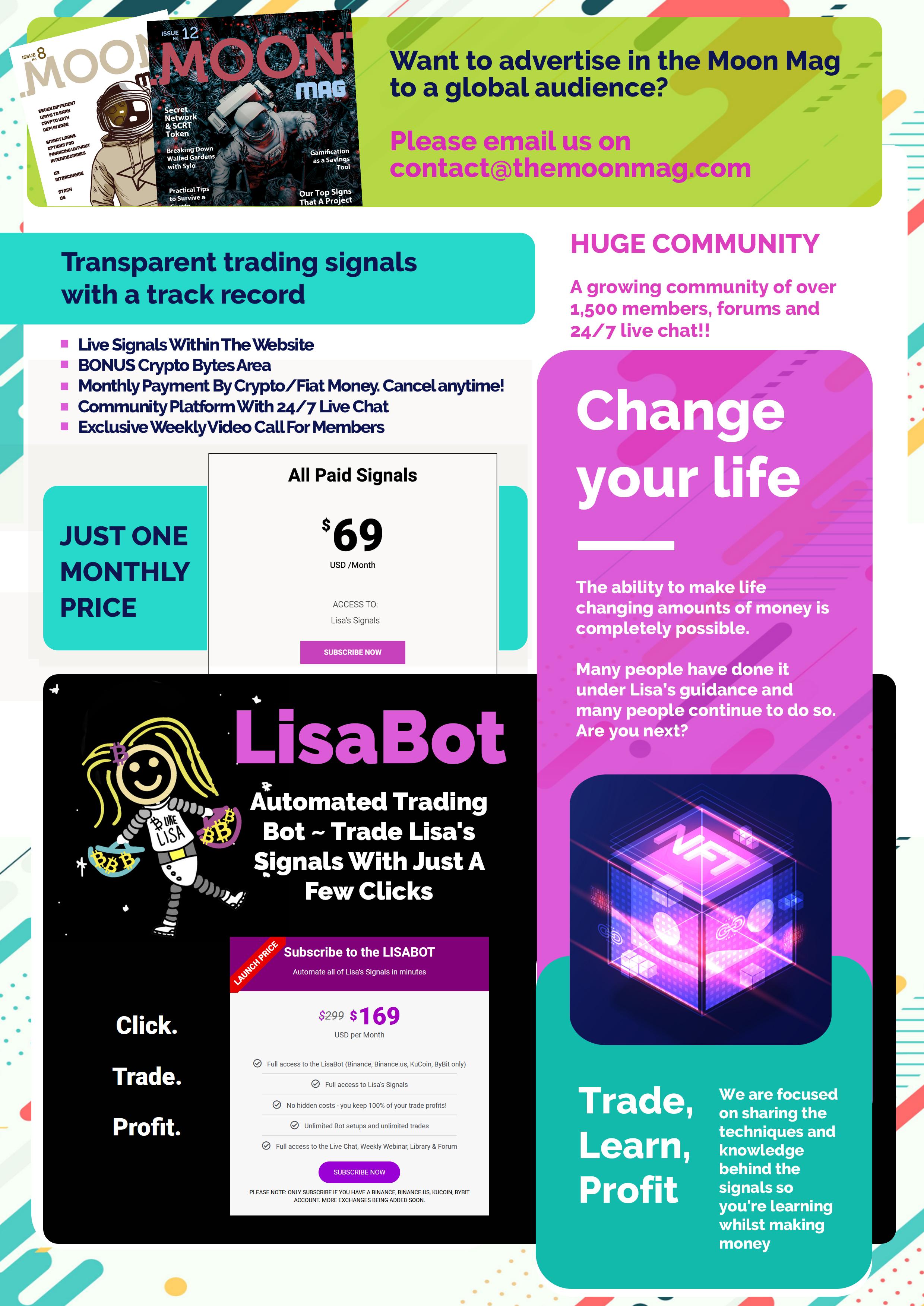

Bought To You By themoonmag.com

This past month has been interesting; if I was flicking through Netflix, I envisage the title of this documentary - “The Rise of Bitcoin: Why Banks Must Adapt or Collapse”.

As the world becomes increasingly digitised, traditional banking institutions are facing mounting challenges. In recent years, we’ve seen numerous instances of banks collapsing or being bailed out by governments. I spoke about this in my article here https://themoonmag. com/issue-13/.

Meanwhile, the popularity of cryptocurrencies like Bitcoin continues to grow, but can it grow to one million dollars in 90 days?

Balaji Srinivasan, a venture capitalist and angel investor, has stated that hyperinflation is currently occurring. He anticipates that the price of Bitcoin will reach $1 million soon and is placing million-dollar wagers on this outcome within the next 90 days. Srinivasan also recommends that investors purchase Bitcoin,

as he perceives it to be a safeguard against hyperinflation, monetary degradation, bank freezes, and the confiscation of wealth. This has reached worldwide news, not just our tiny crypto echo bubble (as my daughter tells me I live in.)

But in all reality, one of the primary drivers of the rise of Bitcoin is the growing mistrust of traditional financial institutions. Banks have been rocked by scandals, from money laundering to interest rate rigging, and many people are starting to question whether they can be trusted with their money. In contrast, Bitcoin offers a decentralised system that is not controlled by any government or corporation. Transactions are recorded on a public ledger, making it difficult for anyone to manipulate the system. In 2011 the Wall Street Journal wrote an article about Bank Runs, can this continued mistrust push Bitcoin to that magic number?

Moreover, Bitcoin has been gaining wider acceptance as a legitimate form of payment. Major companies like Tesla, Microsoft, and PayPal now accept Bitcoin as payment, while countries such as El Salvador have even adopted it as legal tender. https:// themoonmag.com/issue-16/

This growing acceptance is a clear indication that Bitcoin is here to stay and is becoming an increasingly important part of the global financial system. If you have been a long-term follower of mine, you will know I have spoken numerous times about how the financial system is about to undergo a significant transformation.

A note from Lisa…

Editorial

This concept is often attributed to economist Joseph Schumpeter, who posited that capitalism operates on a cycle of “creative destruction,” with innovation and change disrupting the status quo. Previous examples of significant financial system changes include the introduction of the gold standard in the 19th century, the Bretton Woods system in the mid-20th century, and the rise of digital finance in the early 21st century. As we approach the 40-year mark from the advent of digital finance, some experts believe that we may be on the cusp of yet another financial system shift.

The emergence of blockchain technology, decentralized finance, and the increasing adoption of cryptocurrencies suggests that we may be in the midst of a new era of financial innovation and disruption. And you are right here reading The Moon Mag on the precipice of this new era.

Happy reading, as always! And make sure you come and find me on Twitter!

Lisa

Lisa

A note from Josh…

The current global economic climate has been characterized by volatility and uncertainty. That sounds remarkably like the crypto market! And yet it is the crypto market that is so much riskier? As more individuals and institutions adopt digital currencies, it is likely that the crypto market will continue to grow and mature, offering new opportunities for investors and businesses alike. At the Moon Mag, we’ve seen a lot more hubbub from projects looking for ways to reach a new audience. Marketing is the quest but how it is undertaken is the real key to success. Many projects choose to incentivise potential investors with airdrops and we’ve got a cracking article in this issue sharing the strategy behind how you can be part of these. We also take a look at Arbitrum and talk about its airdrop, which as I write, has just opened to the market with around 600,000 wallets being able to take advantage of it. It’ll be interesting to compare our predictions within the article with the actual outcomes! Of course, airdrops are just one way of gaining an audience and getting traction in the market. There are many other ways and one of which is competitions.

Congratulations to our lucky winner of the $RFOX Apartment NFT as featured in our previous issue!

Keep your eyes peeled for more exciting competitions in the Moon Mag soon but above all, enjoy the content.

Bitcoin Ordinals Guidelines: Hunting for early-stage opportunities TRADERS PERSPECTIVE 5 Simple Ways to Make Money with Crypto in 2023 08 16 Arbitrum - Scaling Ethereum 32 SUMMARY OKX Australia Event 41

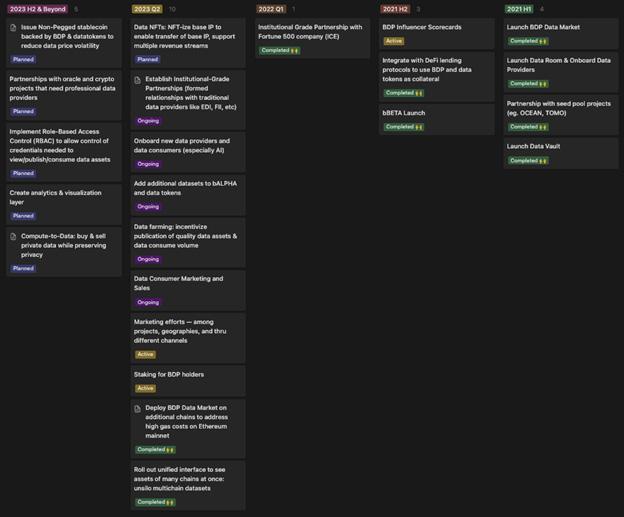

Airdrop Strategy: A Comprehensive Guide 46 Is Blockchain Just A Buzzword? 56 $BDP Big Data Protocol 64 Blockchain for Good 72 Distributed Validator Technology : The race to dominate decentralized ETH2 Staking. 76 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CONTRIBUTORS

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

Congratulations To Our Winner Of The $RFOX Apartment NFT

Kel Udeala

I’m a quantitative analyst and a mechanical engineer. I took an interest in crypto because my line of work led me down the financial trading and investment rabbit hole, and it’s only a matter of time before you reach crypto. I enjoy researching different crypto projects, and attempting to forecast their roles in the future financial and technology systems. I also find the volatility of the charts and the resulting crypto-Twitter posts very thrilling.

Daniel Jimenez

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha Jimenez

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R. Paulo Delgado

R. Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Chrom

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

TRADERS PERSPECTIVE Simple Ways to Make Money with Crypto in 2023 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. written by Lisa N. Edwards 5

Crypto has been around for over a decade now, and is becoming an integral part of our lives. With the rise of blockchain technology, cryptocurrencies have gained tremendous popularity, and we here at The Moon Mag are always finding new ways to make money with crypto.

In 2023, as we hover between Bull and Bear there will be more opportunities to make money with crypto, and it is important to keep up with the latest trends and developments in the crypto world.

Here are five simple ways to make money with crypto in 2023.

1. Play-to-Earn

Play-to-earn is a new concept that has emerged in the crypto world. It involves playing games that reward you with cryptocurrency or NFTs (non-fungible tokens) for your in-game achievements. Play-toearn games use blockchain technology to ensure transparency and fairness.

Play-to-earn can be a fun way to make money with crypto, and it requires no specialized knowledge or equipment. In 2023, play-toearn is expected to become more popular as more games adopt this model.

We have spoken about this a lot in the MoonMag, with projects like Polychain Monsters, Derace, Try Hards, UFO Gaming and more.

2. Trading

Trading is another popular way to make money with crypto. It involves buying and selling cryptocurrencies on exchanges, taking advantage of price fluctuations to make a profit. Trading requires knowledge of the market, technical analysis, and risk management, but it can be a highly profitable venture for those who are skilled at it.

In 2023, trading is expected to become even more popular as more people enter the market and more trading platforms are launched. The key to success in trading is to stay up-to-date with the latest news and trends and to have a solid trading strategy in place.

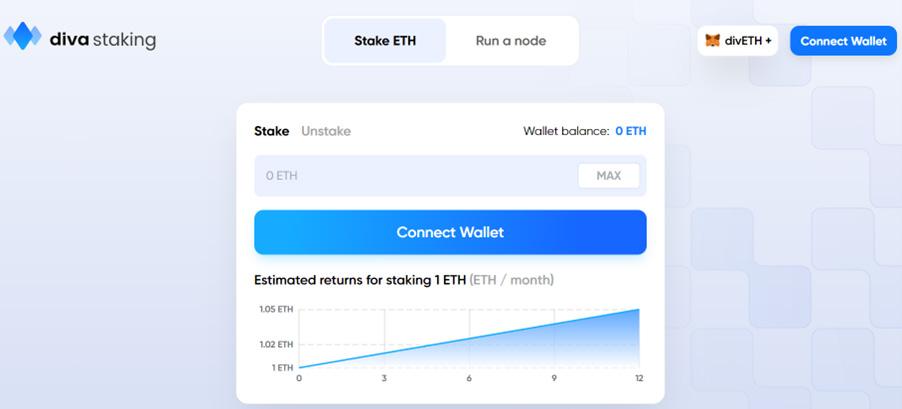

If you are a novice trader you can easily trade with AI Trading bots like LisaBot.Trade, once you API is connected to our 4 exchanges, there is no need to micro manage trades anymore.

LISABOT.TRADE have an exclusive offer for our readers - 50% off your first month! Add coupon code MoonMagLisaBot to receive the discount!

Some trading strategies can make you a LOT of CRYPTO, with some skill in trading you can also try the strategy on THOUSANDTOMILLIONS.COM. This trading strategy works by compounding your trades and very strict money management rules. Starting with $1,000 and a minimum of 234, 3% compounded trades you could be at 1 Million Dollars!

3. Staking

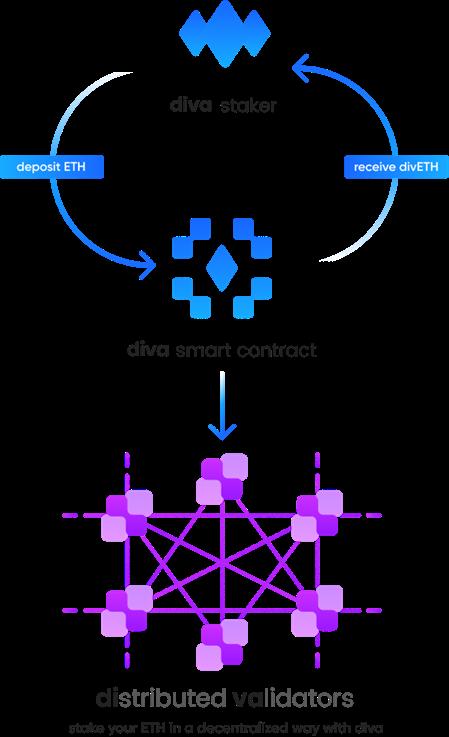

Staking is a relatively new concept in the crypto world, but its quickly gaining popularity. It involves holding a certain amount of coins in a wallet and using them to validate transactions on the blockchain. In return, stakers are rewarded with new coins or fees.

Staking requires less computing power than mining, and it can be a good way to earn passive income with your crypto holdings. In 2023, staking is expected to become more widespread as more coins adopt the proof-of-stake consensus mechanism.

The MoonMag has covered this numerous times, and would like to add after the events of 2022, it is important to go with a larger firm, sure the percentages may not be as large as those seen in 2022, but you will likely still have your crypto at the end of the staking period!

4. Yield Farming

Yield farming is a new concept that has emerged in the DeFi (decentralized finance) space. It involves providing liquidity to a decentralized exchange or lending platform in exchange for rewards. Yield farming can be a highly profitable venture, but it requires knowledge of the DeFi space and the ability to manage risk.

In 2023, yield farming is expected to become more popular as more people enter the DeFi space and more platforms are launched. However, it is important to do your research and understand the risks involved before jumping into yield farming.

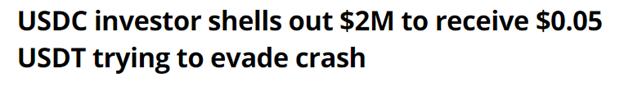

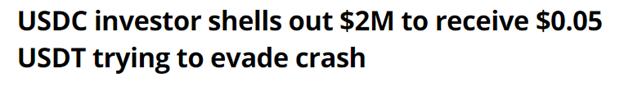

We recently saw headlines like this…

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It’s imperative you know what you are doing with crypto and yield farming, as mistakes can lose you a lot of money! Recently, while the USDC drama was in action,a hasty farmer neglected to set his slippage correctly and his 2 million dollars quickly turned into 5 cents USDT trying to evade what he thought was an imminent crypto crash, maybe this farmer had been burnt with Terra Luna?

Image Source: https://twitter.com/BowTiedPickle

5. NFTs

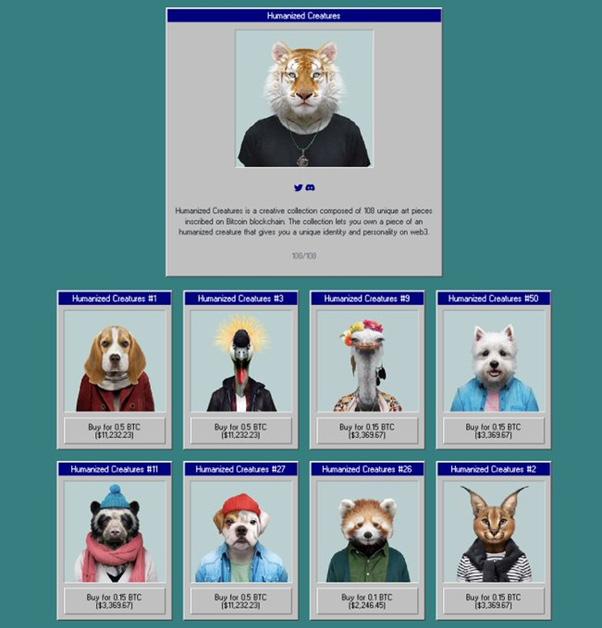

NFTs (non-fungible tokens) have taken the crypto world by storm in recent years. They are unique digital assets that can represent anything from art to music to virtual real estate, which we explored in Issue 13, Real Estate on the Blockchain. NFTs can be bought and sold on NFT marketplaces, and they can be highly valuable depending on the demand.

In 2023, NFTs are expected to continue their rise in popularity, and there will be more opportunities to make money with them. However, it is important to understand the market and to invest wisely in NFTs. Not all NFTs are the same.

Recently we saw Rihanna selling NFTs with music , Snoop Dogg has co-founded a Web3 Platform and Spotify is testing Web3 Wallet integration with the possibility of moving into NFTs for streaming royalties and perks. Film NFTs are also powering the way forward, with recent discussion in LA at the NFT conference Outreach LA, with a panel of movie experts.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

But don’t forget to support the ‘INDY’ NFT projects, like CoinRunnersMovie.com. There’s a new paradigm emerging where creators can own and monetise their content directly. Movie NFTs with royalties like COINRUNNERS are at the forefront of this shift, giving filmmakers and studios a new way to engage with audiences and generate revenue streams that are more direct, transparent, and sustainable than traditional funding models. Essentially this puts the power back with the people, to fund what they want to watch. Audience Driven Films are the way of the future.

A small selection of the 156/15000 hand drawn story board NFTs backed with movie royalties.

A small selection of the 156/15000 hand drawn story board NFTs backed with movie royalties.

MogulProductions.com describes itself as: “The future of film. Driven by its community, where all users are recognized for their contributions and get rewarded accordingly. Actors, directors, screenwriters, and moviegoers can all contribute to the next great

The Mogieland Metaverse acts as a backdrop to Tran’s animated series

Source: Mogul Productions/Chavvo Studios

Both running a similar narrative on the path to reinvent Hollywood!

There are so many ways to make money with crypto in 2023. Whether you choose to play-to-earn, trade, stake, yield farm, or invest in NFTs, it is important to do your research and understand the risks involved. With the right knowledge and strategy, you can make a good profit in the crypto world, and of course continue to follow the trends in TheMoonMag.com.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Bitcoin Ordinals Guidelines: Hunting for early-stage opportunities

written by Daniel Jimenez

written by Daniel Jimenez

If there is one thing Bitcoin has demonstrated throughout its history is the ability to surprise those who use this technology with its disruptive capacity in terms of use cases.

First, it was payments, then the store of value, and now how out of a magic hat appear the Ordinals, a kind of enhanced ‘digital artifacts’ that seeks to represent the physical world, just as the NFTs meant to do.

The key difference here is that Ordinals exist at the most primitive layer of Bitcoin and do not reside in any cross-chain or sidechain solution built on top of the most decentralized network in the ecosystem.

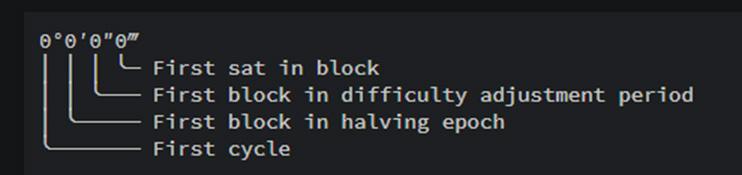

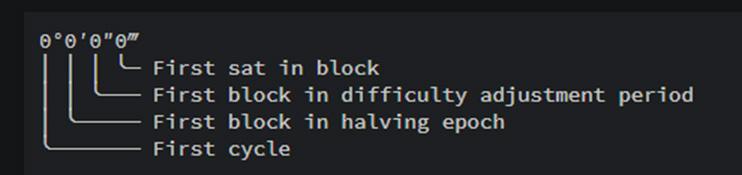

Satoshi ‘Mythic’ Ordinal -Degree Notation.

Source: Ordinal Theory Handbook

The reactions have not been long in coming, once again placing the debate over block size, transaction fees, security, and congestion (which we thought we had overcome in 2017) at the top. The noise around Ordinals should not be neglected.

According to a report published by Galaxy Research, the Bitcoin NFT market driven by Ordinals could be worth $4.5 billion by 2025.

Given this scenario, it is worth knowing a little more about what this new phenomenon, a furor in the crypto ecosystem is all about and how we could take advantage at an early stage of what seems to be a new and fast-growing market niche with great opportunities.

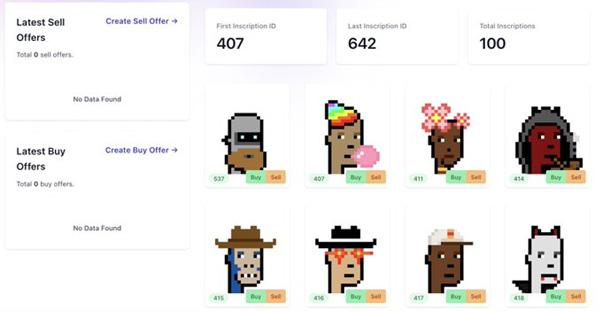

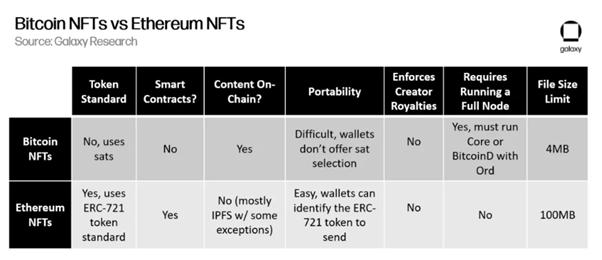

Bitcoin Ordinals or Bitcoin NFT?

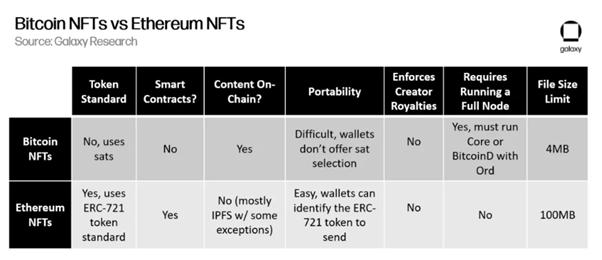

Perhaps the first question you may ask is whether or not Bitcoin Ordinals are really “Bitcoin NFTs,” as some have labeled them.

Considering the definition of nonfungible tokens (NFTs), we will find a big difference between Ordinals and NFTs. Although, for practical purposes, many enthusiasts and media wish to handle the mainstream under the Bitcoin NFT concept.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

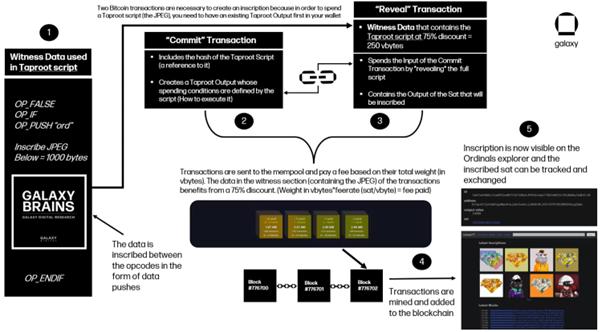

Source: Galaxy Research

Perhaps you should consider that, unlike NFTs, Ordinals are Bitcoinnative digital artifacts that do not lead to an external link where the content is as NFTs do and are unalterable, unlike the NFT works majority that flood in the market.

Ordinals can have several use cases through ‘Inscriptions’ on the Bitcoin blockchain, such as digital identity, decentralized names, money tracking, and of course, being used to deploy an NFT on the native Bitcoin network, being the most used use case currently.

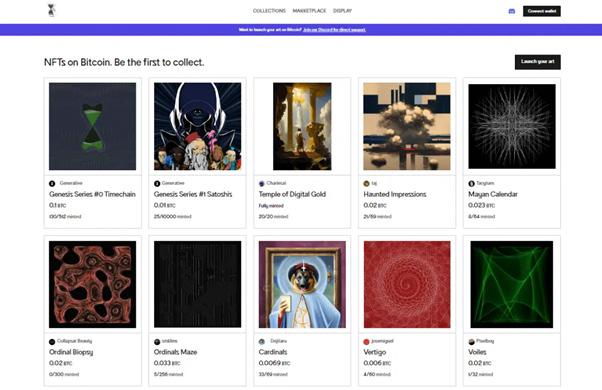

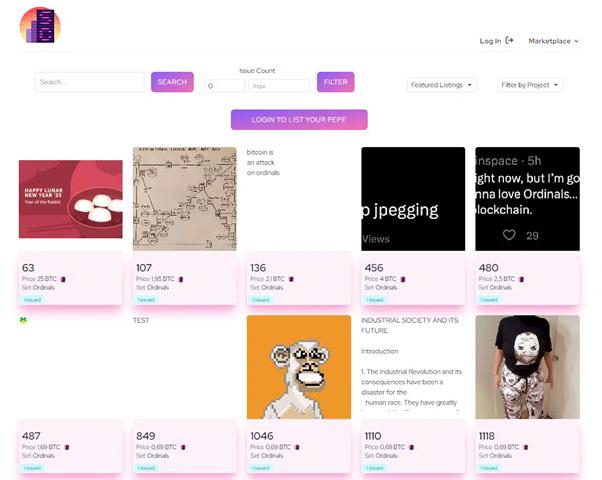

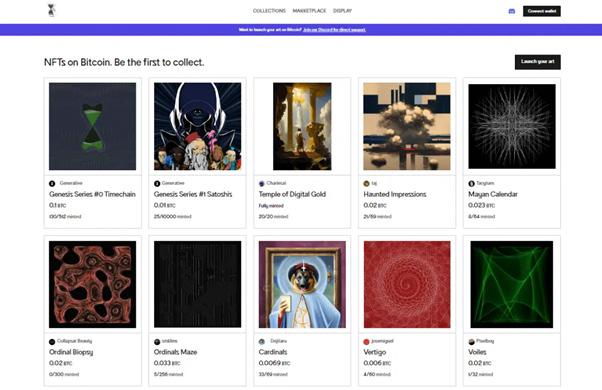

Hence the development of browsers, marketplaces, and wallets to support Bitcoin NFTs.

Inscriptions based on Ordinals Theory

Source: Ordinals.com

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Background of the Ordinals

While Ordinals are perhaps the first tangible success in bringing ordinal theory to Bitcoin, it should be noted that there have been similar attempts in the past.

Rodarmor pointed out that there have been other similar attempts and that he has ‘recreated’ something that already existed in the ancient genesis of Bitcoin’s mathematical code.

• ●August 21st, 2012: Charlie Lee proposed introducing proof-of-stake to Bitcoin in a Bitcoin Talk forum through the ordinal algorithm.

• October 8th, 2012: Jl2012 user posted a schema in the same forum that uses the decimal notation and has all the properties of ordinals, very similar to Rodamor’s Ordinals protocol.

Furthermore, given that NFTs via ‘Inscriptions’ in Bitcoin are currently the power source behind the interest in Ordinals, it is worth noting that there have been some similar attempts in the past, many of them subsequently abandoned by their developers.

Who does not remember Colored Coins or Counterparty? More recently, you can go to the RGB project and Stacks Blockchain as examples of attempts to generate digital assets in the Bitcoin network.

But unlike Ordinals, as previously mentioned, they have all been Layer-2 solution-type projects built on the Bitcoin top/side, none based on native Inscriptions in the original Bitcoin blockchain layer like Ordinals.

The Ordinals hype is such that we recently observed on March 8th the arrival of BRC-20 tokens to the Bitcoin network, an Ordinals-based experiment inspired by the Sats Names (.sats) standard, also based on Casey Rodarmor’s Theory Ordinal.

https://twitter.com/domodata/status/1633658974686855168

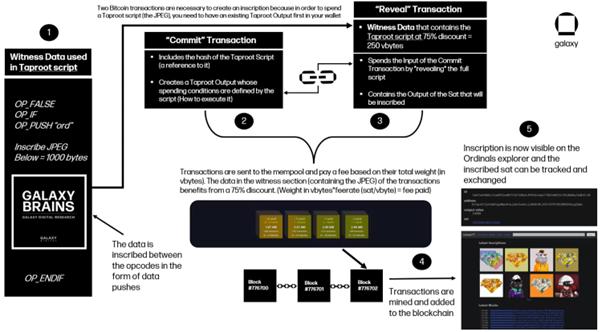

Thanks to the Sewgit and Taproot Bitcoin blockchain updates carried out in 2017 and 2021, respectively, it has now been possible to generate the inscriptions of any data in Bitcoin blocks, an indispensable precedent for the success of Ordinals.

How do Bitcoin Ordinals work?

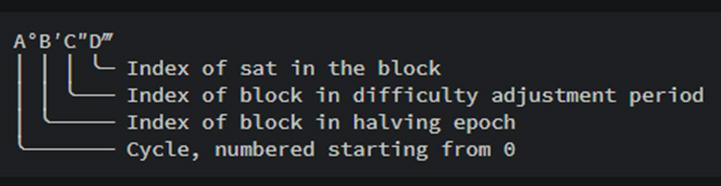

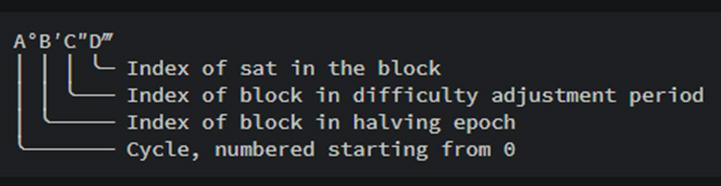

According to the Ordinals handbook created by Bitcoin engineer Casey Rodarmor, Ordinal theory is a protocol for assigning serial numbers to satoshis, the smallest subdivision of a bitcoin, and tracking those satoshis as they are spent by transactions.

Here satoshis can be inscribed with arbitrary content, creating immutable Bitcoin native digital artifacts that can be tracked, transferred, accumulated, bought, sold, lost and rediscovered.

In addition, satoshis are numbered in the order they are withdrawn with ordinal numbers and transferred from transaction entries to transaction exits, first in, first out. A similar scheme of numbering in US dollar bills, where they start at zero and are numbered serially.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Satoshi ‘Mythic’ Ordinal -Degree Notation. Source: Ordinal Theory Handbook

Thanks to the simplicity of the protocol, any bitcoiner through a simple algorithm can make a ‘Inscription’ or store data in each of the satoshis that are part of the network.

In a more philosophical approach, think of Ordinals as a simple idea with classical numismatic roots of being able to give personal identity to each satoshi present in the Bitcoin network, because each satoshi is a limited and occasionally rare supply that could experience some increase in value and also have a transcendental purpose beyond monetary value for each individual who owns it (pleasure, appreciation, collection, tradition, culture, etc).

Visualize it as your penny coin that you can attach a particular piece of information that you consider important, which can be anything from a photograph to a simple inscription of a special date that is important to you and to the community in general.

How to obtain an Ordinal?

The Theory Ordinal is a non-profit open source project, so interacting with its ORD 0.4.0 software does not require any special contribution. To generate Ordinals you only need to have the necessary BTC balance to generate transactions on the network, as well as the time and curiosity to use this technology.

The most expeditious way to obtain an Ordinal is to follow the Ordinal Inscription Guide in the project’s official Handbook. To do so, you must have the technical capabilities to deploy a Bitcoin full node.

If you want to know more about it, please click here: https://docs.ordinals.com/guides/inscriptions.html

Remember that the original conception of Ordinals is to deliver a completely decentralized and immutable algorithmic art to the masses on the Bitcoin network, where the ordinal theory manages to infuse satoshis with a numismatic value that allows them to be collected and traded as curiosities.

But if you don’t want to deal with code and programming algorithms, you can use some simpler options to own an Ordinals in your BTC wallet.

Although it is a very recent implementation, there are some options to get Ordinals without the need to deploy a Bitcoin full node.

Some solutions based on the concept of ‘Inscriptions as a Service’ have been emerging as an alternative solution for less technical users to be able to generate Ordinals in exchange for the payment of a respective fee to the platform.

Solutions like: Ordimint (a web application that allows you to mint your own Ordinals on the Bitcoin Blockchain without the need to install the Ord wallet or synchronize the blockchain hole), Gamma (a Bitcoin NFT marketplace on Stacks) or projects like Oridalsbot (from the creators of Satoshibles), can give you a good starting point to get your first Ordinal.

However, remember that like Theory Ordinal, these platforms are in very early stage technology implementation, so you should do your respective DYOR before interacting with some of these platforms.

A fundamental aspect to take into consideration is that you must have a wallet compatible with Ordinals and have a desirable knowledge of how UTXOs work in Bitcoin (depending on the type of wallet you select).

For now some options of wallets that support Ordinals are:

• ●Ord Wallet: A wallet included in the official experimental software of the open source ord 0.4.0 project written in Rust and developed on Github.

• Sparrow Wallet: An open source project powered by the community and available in Desktop versions for iOS and Windows operating systems.

• Electrum Wallet: Lightweight Bitcoin wallet, one of the most popular BTC wallet since 2011

• Hiro Wallet: A wallet for connecting apps and managing assets such as Ordinals developed for Stacks Blockchain, an L2-Bitcoin.

• Xverse: A wallet that connects to Gamma, the Bitcoin NFT marketplace that allows ordinal inscriptions without code

• Alby wallet: Browser extension for the Bitcoin and Lightning Network

• Unisat Wallet: UniSat Wallet is an first open-source browser extension wallet for Bitcoin NFTs. Store and transfer your Ordinals NFTs

• Nosft.xyz: Is a light wallet for bitcoin inscriptions, connected to your Nostr key. It is a simple open source web application to manage your ordinal inscriptions/NFTs

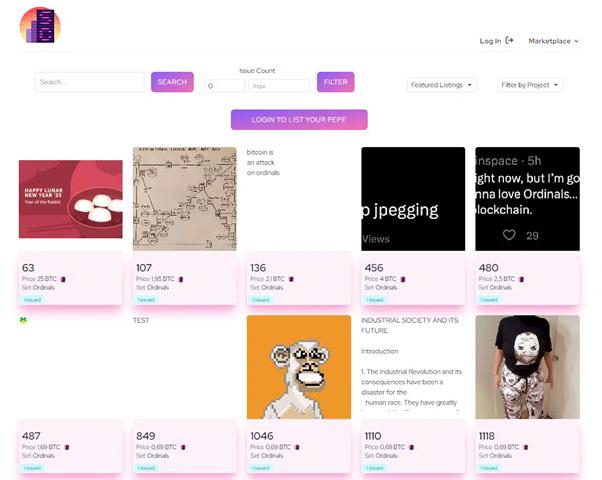

Where can I trade Ordinals?

As mentioned in the previous section, there are few options for trading Bitcoin Ordinals at the moment. However, it is not surprising that given the growth and adoption among crypto enthusiasts of this new cultural niche, that we may see accelerated growth in the sector in the coming months.

Note, that since the creation of ORD software by Casey Rodarmor in December 2022, trades are already happening on a peer-to-peer basis facilitated by online communities in places like Discord.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

For the moment we present you with some options to trade your Ordinals, very similar to how NFT Marketplaces work, but consider first doing your due diligence (DYOR) on how each of these platforms work before trading with them:

1.- Generative XYZ: In mid-February, Generative XYZ, a marketplace on the Bitcoin network that “has the mission to bring generative art to every home” was unveiled.

The platform allows any user paying in bitcoin (BTC) or ether (ETH) to mint a Bitcoin NFT, which can be withdrawn to the user’s Ordinals-compatible wallet for storage, or to a bitcoin address generated by the platform.

However, it is worth noting that the private keys of that generated address where they are going to send their Ordinals are in Generative’s possession.

2.- Ordswap: It is a platform where you can buy and sell your Ordinals NFTs. It also offers the option to enroll new tokens in Bitcoin through a service on the platform itself.

The platform charges a 3% commission on the listing price and offers an internal wallet for the storage of your Ordinals in case you have an external one.

3.- Scarce.city: It is a new marketplace built for Ordinal NFTs. In this marketplace you don’t need to use a wallet to connect and you can log in with an email and a password.

It accepts payments in BTC with the Lightning network and also offers physical items related to the Bitcoin theme as well as Counterparty assets. They successfully executed their first auction last February 17, 2023.

4.- Ordina.ls: It is a site exclusively for buying and selling NFT Ordinals. It has a simple interface and is based on a bidding system, where each user must indicate how much he/she is willing to pay for an Ordinal from a reference value.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

5.- Ordinals Market: Ordinals Market is a marketplace for trading ordinals - a new innovation built on top of Bitcoin that is often described as NFTs for Bitcoin. Ordinals Market facilitates the trading of Bitcoin inscriptions on the Ethereum blockchain using technology created by Emblem Vault.

6.- ORDX: Ordinals Marketplace to buy and sell Inscriptions built on Bitcoin.ACurrently in beta phase and allows you to connect through a username and password.

7.- Ordsea.io: From the creators of Bitcoin name service, this marketplace intends to become the first ‘verifiable’ Ordinal marketplace. with BIP-322, where sellers must ‘prove’ ownership to list their Ordinals.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

8.- OpenOrdex: OpenOrdex is an open source zero-fee trustless Bitcoin NFT marketplace based on partially signed bitcoin transactions.

9.-bitColl:

Automated NFT marketplace on BTC made by the same team behind the legendary Punks Club, a collecting society of the Crypto Punks NFT.

Are Ordinals a bubble?

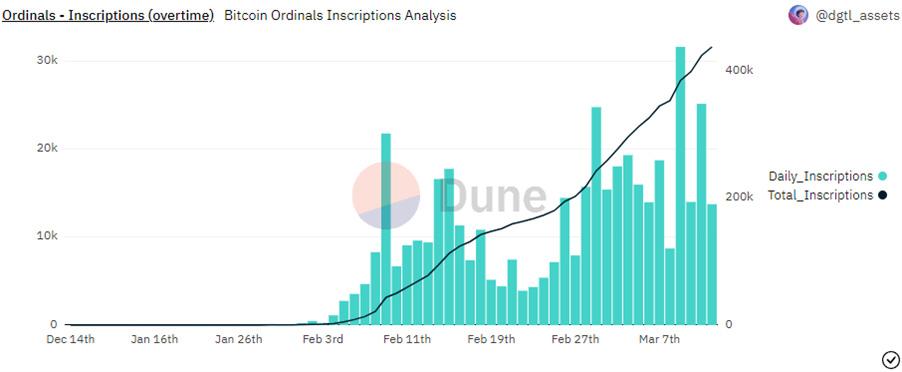

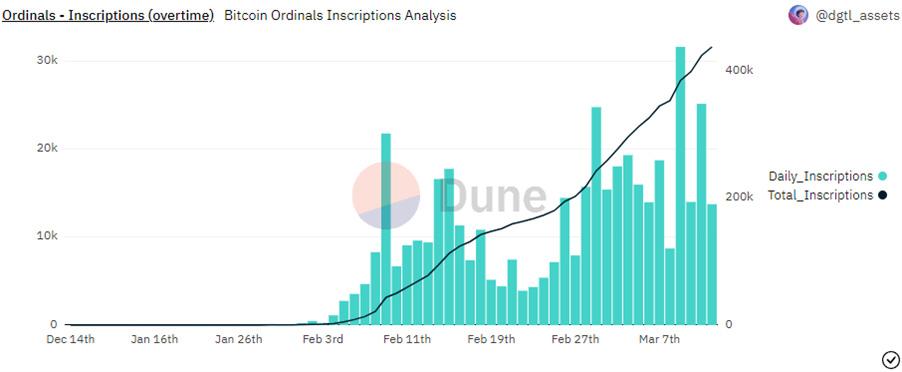

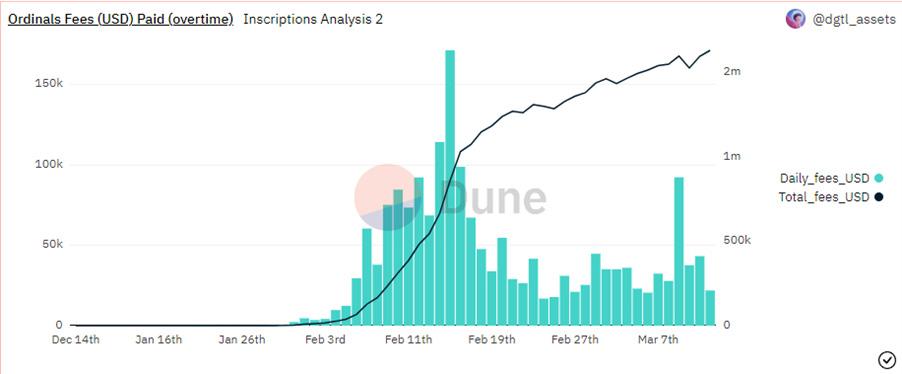

Since the emergence of Ordinals, reactions among the community have not been long in coming. Between criticism and praise, this new use case of the Bitcoin network has generated important metrics that are worth analyzing:

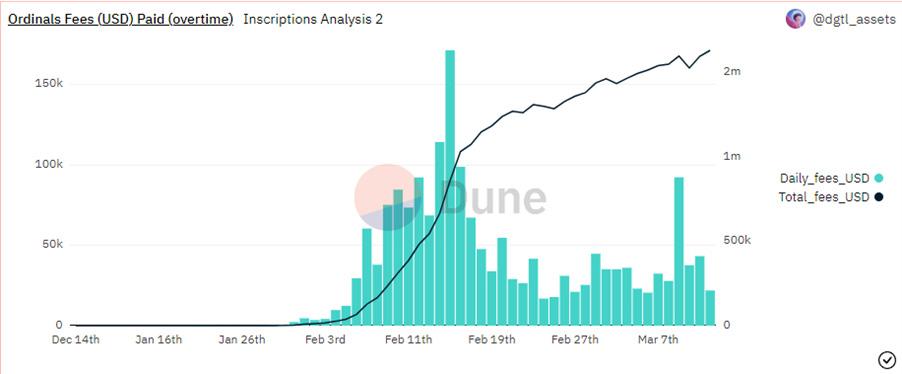

• ~$1.5M in Ordinals Fees over the last two months

• 400k + Registrations to date

• Bitcoin reached the highest transaction volume since August 2022

• Last Feb. 14 saw a surge in the creation of Bitcoin addresses with non-zero balances (44 million new wallets)

• Ordinals enrollments hit a new record of 31,700 in a single day (March 07) thanks to the launch of BRC20, an experimental way of using technology to mint and transfer tokens on the Bitcoin blockchain.

• Bitcoin reached the largest block in its history (2.52 MB) thanks to Ordinals.

Bitcoin Ordinals Inscriptions - Source: Dune Analytics

Bitcoin Ordinals Inscriptions - Source: Dune Analytics

If we take into consideration that one of the use cases that are resonating most strongly with Ordinals is the possibility of generating NFT-like ‘digital artifacts’, it seems sensible to consider Galaxy’s projected number that this new niche market could reach a marketsize of almost $5 billion by 2025.

However, let us not forget that only a few months have passed since the entry of this technology and that there is still a long way to go, where there will surely be improvements and the emergence of new players so that this sector can flourish and not be labeled as another failed attempt to generate digital assets in Bitcoin, under a new concept different from its original conception of an exclusive network of decentralized payments.

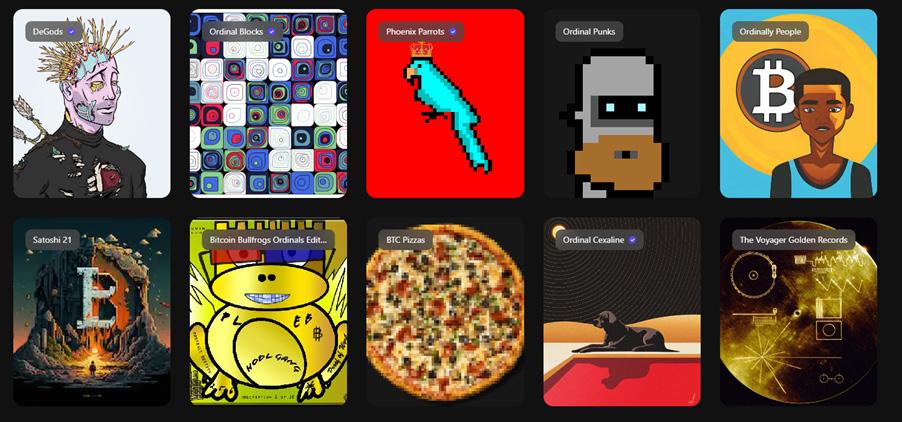

For the moment, decisions such as Yuga Labs’ TwelveFold collection on the Bitcoin blockchain thanks to inscriptions made possible by the Ordinal protocol, which sold for $16.5M USD in 24 hours, reflect possible early bets to adopt the Ordinals theory by large players within the web spectrum3.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

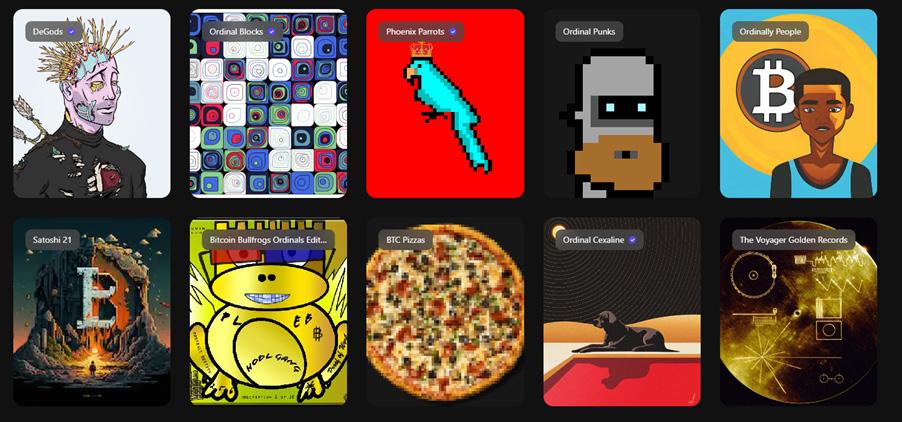

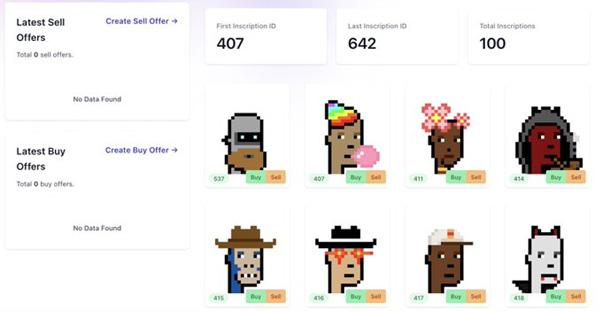

Ordinals Collections - Source: Gamma.io

Another relevant fact that indicates that the adoption of Ordinals is increasingly recurrent, is the fact of finding successful collections in other chains such as Bitcoin Punks, a version adapted to Bitcoin blockchain of the mythical NFT Crypto Punks collection.

The increase even in miners’ earnings from Ordinals may be another source of income to be seriously considered by these key players in the Bitcoin network, even serving as a source of funding once all the satoshis in the network are issued.

For now, it remains to be seen whether the diatribes around Bitcoin’s fungibility, Bitcoin block times and block size limit, beyond concerns around the carbon footprint for Bitcoin NFT and the maximalist narrative can be effectively overcome for the sector to continue to develop.

In the meantime, I recommend you educate yourself about Ordinals and make a couple of early stage satoshis registrations, either for fun, learning or investment.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Ordinals Fees Paid on USD- Source: Dune Analytics

Advertise with us! Contact@themoonmag.com

The Technology Behind Arbitrum

written by Samantha Jimenez

written by Samantha Jimenez

Arbitrum is a Layer 2 scaling solution for Ethereum, built to bring scalability improvements and to help the Ethereum network become more efficient by allowing users to accomplish secure and reliable off-chain transactions long before the final result recording on the Ethereum Maninnet.

The Optimistic Rollups technology makes this possible, presented as a layer 2 scaling solution, allowing Ethereum to process a higher transaction number per second (TPS) on what would be the Ethereum mainnet.

There are two versions of the Arbitrum Layer 2 scaling solution for Ethereum. Those versions are Arbitrum Nova and Arbitrum One. Arbitrum Nova is the initial version, launched in May 2021. It uses a federated sidechain architecture, in which a small group of trusted validators process transactions and maintain the network, allowing faster and cheaper transactions compared to the Ethereum network while maintaining full compatibility with Ethereum, being used by several decentralized applications (dapps), such as Uniswap, Balancer, and Gnosis.

Arbitrum One, on the other hand, is the upgraded and more decentralized version of Arbitrum launched in August 2021. It uses a permissionless and trustless architecture based on optimistic rollups where anyone can become a validator and participate in network security, making it more secure and decentralized than Arbitrum Nova. On Arbitrum One, dapps can easily port their code to the network thanks to being designed to be fully compatible with Ethereum.

Arbitrum Nova and Arbitrum One aim to offer faster and cheaper transactions compared to Ethereum while maintaining full compatibility with the Ethereum network. However, Arbitrum One expects to be more secure and decentralized than Arbitrum Nova due to its permissionless and trustless architecture.

In short, with Arbitrum, users can benefit from its fast transaction speeds and lower gas fees to create and trade NFTs, participate in DeFi protocols, and more.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

How does Optimistic Rollups technology work?

To guarantee system security, Artribum must use what we already know as Optimistic Rollups. The system assumes that all transactions are valid unless it is possible to prove otherwise.

In other words, if there is a false transaction within the network, any other user could challenge that transaction through a dispute resolution process involving several validating agents who will ultimately decide and verify the transaction’s credibility (as if it were a dispute within a P2P trade). If a transaction is deemed false, sanctions could befall the correspondent user.

Built The Arbitrum implementation of Optimistic Rollups is built in a programming style familiar to the Ethereum mainnet to make it easy for developers and users. The purpose and intention are to make it easier for developers to build applications on Arbitrum without stopping and learning a new system.

This way, Arbitrum Optimistic Rollups have a fast and friendly yet secure way to scale the Ethereum network and take decentralized applications to another level. That is, to a large audience.

To better understand what this technology is all about, let’s look at an example below:

Suppose Sam wants to send 1 ETH to Bob on the Ethereum network. On the principal Ethereum network, this transaction would have to be verified by all network nodes, which can be slow and expensive. However, on the Arbitrum network, the transaction can be processed using Optimistic Rollups as follows:

To better understand what this technology is all about, let’s look at an example below:

Suppose Sam wants to send 1 ETH to Bob on the Ethereum network. On the main Ethereum network, this transaction would have to be verified by all nodes on the network, which can be slow and costly. However, on the Arbitrum network, the transaction can be processed using Optimistic Rollups, as follows:

• Sam initiates the transaction by sending it to the Arbitrum Rollup contract.

• The transaction is processed off-chain,

securely and without trust, by the Arbitrum Rollup validators. The validators aggregate several transactions and generate cryptographic proof of the validity of the transactions.

• The cryptographic proof gets sent to the Ethereum mainnet as a single transaction containing the entire batch of transactions, allowing for a higher TPS rate on the Ethereum network.

• Once the batch of transactions gets confirmed on the Ethereum mainnet, the result gets transmitted to the Arbitrum Rollup contract. If the result is valid, the Rollup contract updates its status to reflect the transaction.

• Sam and Bob can now see the completed transaction in the Arbitrum Rollup contract and that the ETH has got transferred from Sam’s account to Bob’s account.

In this way, we can see how Arbitrum offers unique features which are currently proving to be one of the most exciting areas of DeFi How?

How does Arbitrum benefit DeFi?

Within the DeFi context, Arbitrum enables less expensive transactions while providing improved speed, opening several routes for users to interact with decentralized exchanges and other DeFi applications.

Because Arbitrum uses the Ethereum Virtual Machine (EVM), developers can deploy their smart contracts on Arbitrum with minimal changes to their code.

It is also possible for users of this protocol to move assets from the Ethereum mainnet to the Arbitrum network using a bridging contract. Once their assets are on Arbitrum, they can interact with DeFi applications in the same way as they could on the Ethereum mainnet. When these users want to move their assets to the Ethereum mainnet, they use that bridging contract again to make the transfer in question.

In the last few years, layer 2 scaling solutions have seen significant growth because of the objective that drives them: to relieve the enormous transaction fees that the Ethereum mainnet presents. How: by moving some transactions off the Ethereum mainnet.

So, Optimistic Rollup is one of the solutions that continues to rise in popularity thanks to several projects and protocols that have adopted it, including Uniswap and Synthetix. However, several tech giants and blockchain projects have deployed their DeFi applications on Arbitrum. Here are a few examples:

• ●Uniswap: Uniswap is a popular decentralized exchange (DEX) that has deployed its V3 protocol on Arbitrum.

• Aave: Aave is a decentralized lending platform that has deployed its protocol on Arbitrum.

• Curve Finance: Curve Finance is a decentralized exchange (DEX) that focuses on stablecoins and has deployed its platform on Arbitrum.

• SushiSwap: SushiSwap is a decentralized exchange (DEX) that has deployed its platform on Arbitrum.

• Balancer: Balancer is an automated market maker (AMM) that has deployed its platform on Arbitrum.

• Gitcoin: Gitcoin is a decentralized funding platform for open-source software development that has deployed its platform on Arbitrum.

• Gnosis: Gnosis is a decentralized prediction market platform that has deployed its platform on Arbitrum.

Another popular L2 solution is the ZK Rollup, which is similar to the Optimistic Rollup in that it aggregates off-chain transactions and settles them on-chain. However, it uses zero-knowledge proofs to ensure transaction validity, making it more secure and scalable. Several projects have also adopted ZK Rollups, including Loopring and StarkWare.

There are also other L2 solutions, such as Plasma and Validium, with their advantages and disadvantages. These are just a few examples of tech giants and blockchain projects that have deployed their DeFi applications on Arbitrum.

Arbitrum and NFTs

But, the DeFi sector is not the only one that can benefit from Arbitrum, NFTs also have a place here. NFTs, or non-fungible tokens, can also be created and traded on the Arbitrum network as it supports the same standards as Ethereum, like ERC-721 and ERC-1155, known to be used for the creation and management of NFTs.

So, many platforms are considering supporting Arbitrum, as has been the case with OpenSea. However, it is not the only one, others include:

• ●Rarible: Well-known and popular in the NFT market.

• Async Art: Async Art is an NFT platform that enables dynamic and programmable art and has taken an interest in Arbitrum to take advantage of its fast and low-cost transactions.

• SuperRare and KnownOrigin: Digital art marketplaces.

• Mintable: An NFT marketplace that allows anyone to create, buy and sell NFT.

These are some of the NFT platforms that have shown interest in the advantages that Arbitrum offers for trading digital art.

The Arbitrum ecosystem has its native token called “ARB.”

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

On the other hand, we cannot fail to mention that the Arbitum platform also has a native token called ARB which, while not directly related to NFTs (nonfungible tokens), can facilitate NFT transactions on the Arbitrum network. NFTs are unique digital assets stored on the Ethereum blockchain, often used for digital art, collectibles, and gaming items. However, high gas fees and slow transactions on the Ethereum network can make it difficult and expensive to buy and sell NFTs.v

In this regard, Arbitrum’s transaction fees can make cost savings possible. But, these are not the only use that the Arbitrum token can provide to the network.

• Transaction fees: ARB transaction fees can be paid with the $ARB token to get lower fees to those on the Ethereum network.

• Validator staking: ARB can get staked by validators on the Arbitrum network. Validators are responsible for processing

transactions and securing the network, and by staking ARB they can earn rewards in the form of more ARB.

• Governance: ARB holders have a say in the Arbitrum network governance. They can vote on proposals and decisions related to the development and management of the network.

• Liquidity: ARB can be a liquidity provider for decentralized exchanges (DEXs) on the Arbitrum network, allowing users to earn rewards by providing liquidity to trading pairs on DEXs.

• Bridging fees: users can pay bridging fees with ARB when transferring tokens between the Ethereum and Arbitrum networks.

The ARB token is important within the network. Because it incentivizes validators, pays for transactions, provides liquidity, and gives voice to incumbent users in important decisions within Arbitrum.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Arbitrum’s post-Aidrop expectations

The token launched on March 16th, 2023, was announced by the Arbitrum Foundation, who took the opportunity to communicate that, the platform would distribute ARB tokens through an Airdrop, considered a vital step for Arbitrum to become a DAO, meaning that users who receive these tokens after the Airdrop could vote on decisions within Arbitrum.

There will be 10 billion $ARB tokens, of which 12.5% will get distributed at the Airdrop event to interested users who must first go to the official Arbitrum Foundation website to ensure their eligibility for the distribution.

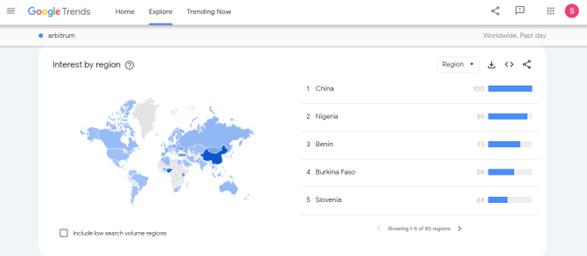

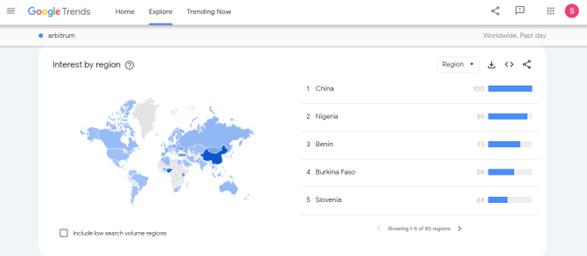

This announcement in question triggered interest among users, and Google searches immediately increased, according to Google Trends, which showed that most searches were located in China, a country that has consistently spoken out against the crypto ecosystem.

Source: GoogleTrends

Arbitrum is also looking to compete with Optimism, another popular aggregated solution that shares one of Airbitrum's core principles or objectives: to enable DeFi to be faster and more accessible, which also beat Arbitrum to the punch with the launch of its OP token in May 2022. Optimism had an advantage over Arbitrum as the latter had not yet launched a token.

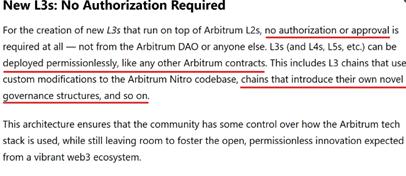

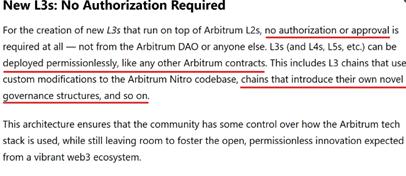

With the $ARB token launch, it is vital to know that it works for both versions of Arbitrum that we saw earlier, Arbitrum One (for DeFi/NFT) and Arbitrum Nova (for gaming/social applications). And at this point, it is worth mentioning that all this happens in the middle of the launch of Arbitrum Orbit, which is a layer 3 (L3) development solution that will allow developers to launch blockchain networks in L3 within the Arbitrum ecosystem without leaving aside the security offered and guaranteed by L2.

The technology behind Arbitrum has also been a Twitter debate, where experts are projecting the future token value after the airdrop; predicting a value of USD 1 USD to USD 2 per token; while big cryptocurrency exchanges such as Binance, Huobi, and Bybit announced that they will list their trades at $ARB on March 23rd.

Likewise, and prompted by the hype that Arbitrum’s Airdrop has caused within the community, zkSync and StarkNet are being considered promising airdrop launches in the industry, even when they do not yet have native tokenization; the recent interest in Arbitrum has led users to believe that pre-empting zkSync and StarkNet would allow them to get rewarded in the future. The suggestion stems from data shared by onchain cryptocurrency analytics firm Nansen which noted that at least 39,000 addresses transferred more than USD 871 million to zkSync last week.

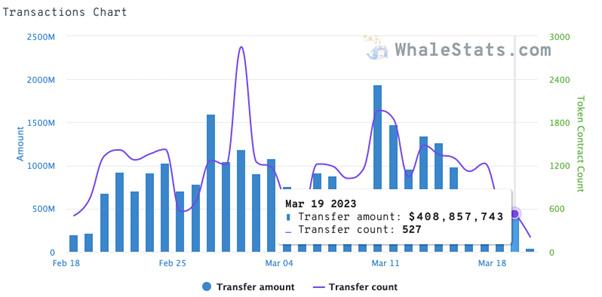

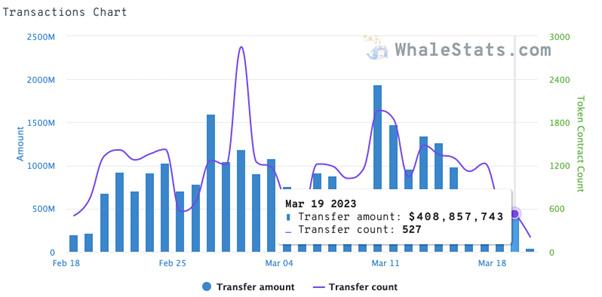

On the other hand, there exists a 120% increase in the trading volume of Ethereum whales, according to WhaleStats, just before this launch, going from $185.7 million to $408.8 million. A fact linked and related to the launch of the Arbitrum $ARB native token.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: Nansen

There is anticipation to what will happen after Arbitrum’s $ARB token launches in the wild and whether the market will benefit from a “stimulus” to the ecosystem.

What is certain is that Arbitrum intends to take a leading role in providing solutions that enable Ethereum to scale to meet the growing demand for decentralized applications and services by offering fast and affordable transactions Arbitrum can help drive Ethereum adoption and enable more people to participate in the decentralized economy.

What can we expect from Arbitrum in the future?

It is difficult to predict the future, but there are always indications that guide us a little about a project’s success, projection, or failure. And in the case of Arbitrum, some potential developments can be successful according to what we have seen in this immersion through its platform.

Improved scalability, as its growth expands, the platform is poised to deliver improvements in its transaction per second (TPS) capacity.

Further expansion in the crypto space, if Arbitrum continues to scale as it has been doing, more developers and users will want to adopt the platform, which will bring with it the creation of new DeFi projects that run on Arbitrum as well as the birth of new dApps.

Integration with other blockchains: Airbitrum’s interoperability allows it to work with other blockchains, which could lead to partnerships and integrations with other blockchain projects.

Security advancements, Airbitrum focuses on providing a secure and tamper-proof platform for its users; as the platform matures, we can expect to see continued advance in its security features.

Undoubtedly, Airbitrum’s potential for scalability, interoperability, and security makes it a project with projected success worth considering in the crypto space. Furthermore, as Arbitrum continues to expand, new innovative use cases will emerge that will impact finance and decentralized applications.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source: WhaleStats

OKX AUSTRALIA EVENT

The Moon Mag was invited to an OKX Exchange event ahead of the Australian Grand Prix! We had a fantastic time meeting new people, showing them a hard copy of our super cool Mag and learning about OKX.

Lisa sat down and spoke to Haider Rafique, the global CMO of OKX to find out more….

LISA: Haider! It’s great to meet you and welcome to Australia. How has your visit been so far?

HAIDER: Thanks for having me! First off, it’s exciting! This is my first time in Melbourne, it’s a really neat city.

LISA: So a little bit about you - you’ve had several major advertising agency roles and then you went to OKcoin and now OKX. What’s driven these career choices along the way?

HAIDER: So the fact that I’ve worked at ad agencies, I hope people don’t hold it against me! This is my second crypto firm and we are on a mission to become one of the most loved brands and I think that’s sort of our North star. One piece that we keep in mind is how can we make sure that people trust us and that they’re having a great end-to-end customer experience. I think if we do the basic things well, ultimately it will lead to people loving us and being the most loved brand in crypto.

LISA: On that note, there’s a very cool ad on OKX Twitter. Did you have anything to do with that?

HAIDER: Yes, I did, we did. Our entire team created that last year. We rebranded at the beginning

of 2022 and one of the key questions that kept coming back to us is what is OKX? Most people in the industry actually know us or knew us back then as OKEX so there came a point where we were working on an ad campaign concept and after seeing a bunch of ideas and directions one day, we just had the epiphany that really the campaign is ‘what is OKX?’ That thought manifested into the idea and then you end up seeing the final ad, which features Daniel Ricciardo, our brand ambassador, Scotty James, it’s got McLaren there, it’s got Pep Guardiola and we had a ton of fun creating it.

LISA: It’s such a cool ad!

HAIDER: Well, it’s interesting you bring up that ad. We’re probably a week away from launching yet another one and I think if you liked that, it’ll definitely indulge you! The thing I like about the ad is it’s not just crypto. It sort of sucks you in. You’re like ‘Oh, what’s going on with this? and what are they doing?’ and then they grab their phone and they’re looking down and they’re able to trade crypto and it sort of it bridges that gap as far as I’m concerned but it made it super fun. I think if we entertain people then perhaps, just perhaps, they might give us a chance and experience our product.

LISA: So that brings me to my next question. With all the negative media out there, how are you bridging that gap to bring in new people and to convert them to crypto so that they understand it’s just another, sort of, financial asset, it’s not scary, it’s not all of the things that the media keep reporting?

HAIDER: Yeah, well, I think for us our philosophy is don’t take our work or ourselves too seriously and try to have fun. In terms of making people feel comfortable, I think one of the things that we’ve done and we’ve been the pioneers of doing in the industry is we’re one of the first exchanges to react to the FTX collapse or the industry failures we all witnessed last year or even part of this year and what we ended up doing is, without any external pressure per se, we were the first exchange to rapidly go out and publish a proof of reserves, which essentially is a basic way of saying ‘Hey, we’re showing the world that we have one-to-one reserves if you deposit value on our Exchange’ and I think that became really important for people to really be able to trust the platforms they are doing their business with.

LISA: So earlier you touched on a few of the sponsorships that OKX have. So you’ve got Scotty James, you have Daniel Ricciardo….

HAIDER: Yes, we also have a few other brand

ambassadors that are going to be coming up that we’ll announce soon and then of course, we have the massive partnership with McLaren and Manchester City Football Club and of course, the Tribeca Film Festival. That’s huge.

LISA: That’s exciting! I love that you bridge the gap across everything. You’ve got football, you’ve got motorsports and then you’ve got the Arts. So where does it go from there?

HAIDER: I don’t believe that we’re going to invest a huge amount in new relationships. I think for us as a team, these are really long-term relationships that we’ve invested in so far. The focus in the first year was all about making sure that these communities really know what OKX is, what our character is and what we stand for and I think we did a pretty decent job. Now in 2023, the team is thinking about new ways to integrate our product into these properties and experiences so when people come in and experience a Grand Prix or if they go to a Premier League game or if they’re a Tribeca Film Festival, they’re actually able to touch and feel crypto and do stuff with it and realize that beyond speculation, there’s a ton of utility that’s being built in the industry and that they can interact with so I think that’s the fun part. This year is a lot about just bringing crypto closer to these communities.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

LISA: I know there’s going to be people watching this that are wondering what a CMO does. We were joking earlier that it’s the ‘Cool Man of OKX’ but it actually stands for Chief Marketing Officer, so what do you actually do?

HAIDER: Well, look, if I could say so myself, I think you can be a CMO but the cool factor is that you really have to drive yourself and I think we’ve been successful at it! I’m incredibly grateful for the team that I’ve been able to bring to OKX and they’ve really taken the vision and extended it and delivered some amazing work. Now you see a brand that I think appeals to people, it stands out. It’s not the traditional brand that you expect in crypto and that was the whole idea when we started this journey last year - let’s try to be different and have an appeal that people can relate to.

LISA: So what does the CMO do on a daily basis?

HAIDER: I think a lot of my time goes into making sure that people have a clear runway to be creative and to ultimately drive an impact and that impact starts with customers. If we can have a positive impact on customers, that naturally converts into business value but my main role is mentorship. I am making sure that the people who are here have the ability to go do some audacious things and be creative and bold and if I’m able to unblock things for them, I think they’ll be able to embrace their creativity.

LISA: Well, I am really looking forward to this new ad coming out. I loved the last one and I can’t wait to see how much creativity went into this one! Thank you so much, Haider, for spending the time talking to me and I’m so excited about everything that’s coming with OKX and bridging the gap, as that’s essentially what we are trying to do with crypto!

HAIDER: Yeah, that’s great. You guys are doing amazing work! Thanks for being here and enjoy the event!

written by

written by

Airdrop Strategy: A Comprehensive Guide Join us on the ‘’Airdrop Express’’ as we travel through time to uncover the secrets to the ultimate strategy.

Chrom This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Diving into the Past: A Historical Journey

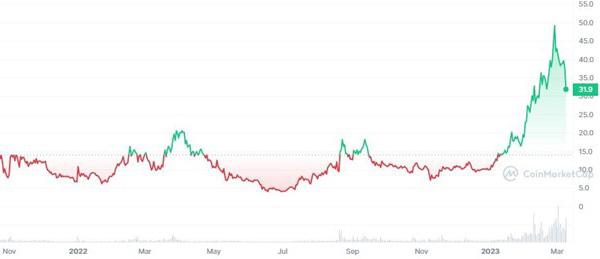

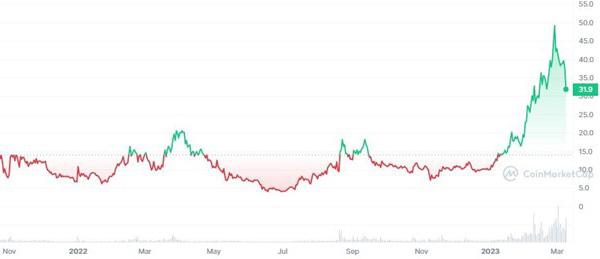

Back in February of 2014, when interest in Bitcoin was booming and alternative coins were starting to pop up, a developer with the pseudonym Baldur Friggjar Odinsson had a brilliant idea to help his fellow Icelanders escape from post-crisis capital controls. He created Auroracoin ($AUR), promising to distribute 31.8 of them to each citizen on Iceland’s national registry. All they had to do is head over to the platform to claim their tokens. It was a brand new concept that had never been tried before - an “airdrop” of free cryptocurrency for every citizen in the country!

At first, the launch was a huge success, with the price skyrocketing by over 1000% in just a few weeks. It even briefly became the third-most valuable cryptocurrency!

However, the excitement didn’t last long. As early recipients cashed out their winnings, the coin’s value quickly plummeted by mid-spring, leaving many people disappointed. The notion proved to be flawed as Auroracoin did not prove to be a reliable currency in the end.

While it may not have turned out to be the next big thing, it was still a bold and innovative experiment that showed the potential for new ideas in the world of cryptocurrency. Who knows what other exciting developments are waiting just around the corner?

source: Coingecko

Lessons Learned

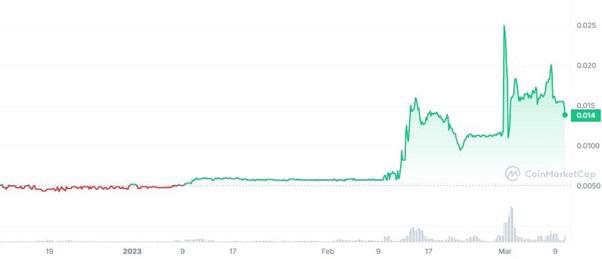

Let’s travel back to September 2020, when Uniswap, a well-known decentralized exchange (DEX), made an announcement that sparked a flurry of excitement in the crypto world.

Uniswap disclosed that its governance token, UNI, would be airdropped to users who provided liquidity to the platform. The real excitement was that holding this token would also give them governance rights.

And the very next day, Uniswap tweeted that anyone who had used its platform before September 1st, 2020, including users who failed transactions, would get 400 UNI tokens. The response was massive. Within two days, the value of UNI had skyrocketed to over $6.50 per token. This meant that the standard airdrop of 400 UNI tokens received by Uniswap users was worth a staggering $2,600 USD!

But wait, it gets better. A close acquaintance of mine kept those 400 UNI tokens and was pleasantly surprised when their value rose to $16,000 in late April 2021. And the best part? He got them all for free!

The Uniswap airdrop frenzy showed the power of community and the endless possibilities that cryptocurrency can offer. It created a sense of hype that many didn’t want to miss, and it proved that being an early adopter can lead to unexpected gains.

Thereby, welcome to the world of crypto airdrops, where we have the power to participate in our very own economies. Gone are the days when only governments could issue currencies, as now we have our beloved crypto, DeFi, and blockchain protocols to rely on.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

With these technologies, we can create the digital and physical infrastructure that is powered by a token economy. Sure, there may be challenges along the way, but the potential gains are endless.

Fast forward to 2023, and you’ve probably already heard of the stories we mentioned above. But if you’re new to the game and have never heard of an airdrop, you’re in the right place! In this guide, I’ll cover every detail you need to know about airdrops, including some tips and tricks on how to be eligible for them. So buckle up and get ready to explore the exciting world of airdrops!

What exactly is an airdrop?

Airdrops have become a popular way for DEXes, blockchain protocols, and NFT projects to incentivize their users and expand their reach. By giving away a native exchange or governance token, airdrops serve as a potential driver for growth and offer an opportunity to reward early supporters.

If you’re interested in participating in an airdrop, the good news is that they are typically easy to access. Many airdrops require completing specific tasks, such as following the project on social media, reposting a tweet, or participating in a referral campaign.

To ensure fairness in the distribution of tokens, many airdrops now utilize a process called “snapshot” on the blockchain. This process involves taking a snapshot of the blockchain at a specific time to determine who is eligible to receive tokens. This approach helps to prevent cheating and ensures that tokens are distributed to active and engaged users.

Here’s how it works

The blockchain keeps tabs on the balance and activity of a specific token across all participating wallets at a particular block height or timestamp. This creates a record of all eligible wallets at a specific point in time, and only those wallets that satisfy the required criteria at the snapshot time will qualify for the airdrop.

Once the snapshot is taken, the project team will transfer the airdropped tokens to the qualifying wallets based on predetermined criteria, such as the number of transactions at a given time or the completion of specific tasks.

Snapshots are an efficient and fair way to assess participants’ eligibility since the blockchain records all token transactions and balances in real time.

How do you become a participant?

If you are interested in participating in an upcoming airdrop, there are several ways to boost your eligibility for these promotional events. Keep in mind that requirements can vary widely (and most times you won’t know them), but here are some options to consider:

• Keep an eye out for notifications from dedicated crypto airdrop websites. These can be similar to the email promotions you receive from your favorite stores.

• Check social media for the #airdrop hashtag to stay up-to-date on new opportunities.

• Be an active user of various cryptocurrency services, products, platforms, and blockchains. The more you engage with these communities, the better your chances of qualifying for an airdrop.

• Browse cryptocurrency-related forums and news portals to find mentions of recent or upcoming airdrops.

To be eligible for a crypto airdrop, you’ll need a cryptocurrency wallet with a balance. Keep in mind that using an exchange address isn’t recommended for receiving airdrops. Instead, explore different cryptocurrency wallet solutions to find the best fit for you. While MetaMask is a popular option, there are plenty of others available to choose from.

In summary, earning eligibility for a crypto airdrop requires some effort, but it’s definitely possible to increase your chances of success. Keep up with the latest news and developments in the crypto world, and you’ll be in a great position to take advantage of future airdrop opportunities.

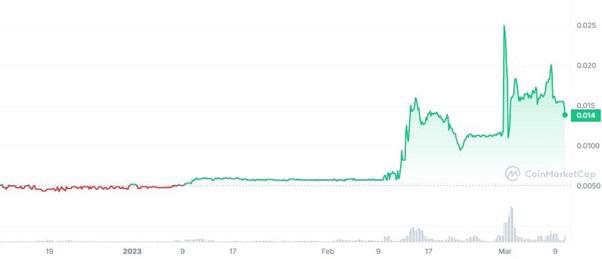

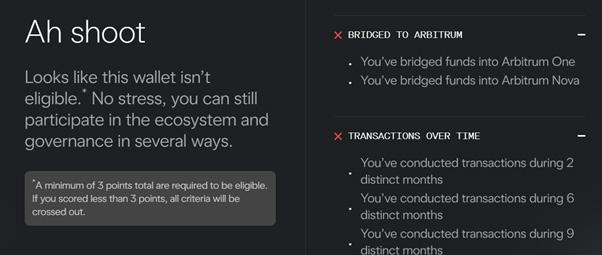

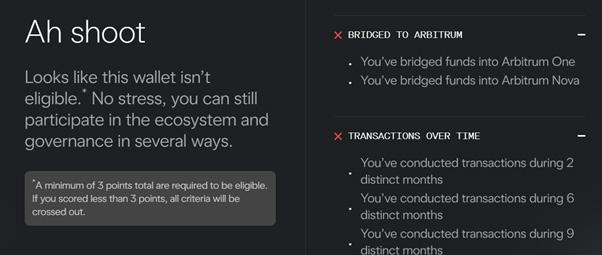

Let’s examine the most recent airdrop, Arbitrum, which generated a lot of excitement since last year, and finally happened last month. Specifics were not readily available, and fake links and scams circulated on social media platforms and Twitter.

To qualify for the airdrop, it was necessary to be an active user of Arbitrum, which involved carrying out a sequence of transactions and bridging assets into their L2 mainnet, Arbitrum One. Though the requirements, tasks, and deadlines were somewhat unclear, they were not overly complicated to complete.

To meet the eligibility criteria, users had to execute a sequence of transactions, transfer assets into Arbitrum One, their Layer 2 mainnet, and may have to spend a few hundred dollars to be considered for participation and maintain an edge over the competition. It’s important to note that these were just two of the six eligibility conditions:

Be Patient

To improve your odds of getting an airdrop, you should actively participate in the project’s ecosystem, even if the tasks required are unclear. Consistently engaging with the project increases your chances of being eligible and receiving the desired airdrop.

It’s important to keep in mind that there is no assurance that an airdrop will happen, so it’s essential to be vigilant for any potential opportunities.

Persistence and patience are vital when pursuing airdrops. Success may not be immediate, but it’s achievable. Therefore, be on the lookout for opportunities, repeat the process, and remain patient.

source: arbitrum.foundation

The Associated Risks

With every opportunity, there are always pros & cons, especially when this is on a much larger scale. While airdrops can drive growth and adoption, they can also put tokens in the hands of individuals who do not believe in the long-term viability of the project and want to maximize their short-term returns.

Sadly, airdrops can sometimes backfire. This is because a lot of protocols give governance tokens to people who may not necessarily believe in the long-term potential of the blockchain or the exchange. These individuals may just be looking to maximize their short-term profits and not necessarily interested in holding onto the tokens for the long haul.

Additionally, airdrops could unintentionally signal to the market that the tokens being distributed are of lower quality. This could, in turn, negatively affect expectations about longevity and financial prospects.

As a result, the effects of airdrops on a project’s success are an empirical question that needs to be examined closely.

While airdrops can be a useful tool in certain circumstances, it’s important for projects to consider the potential downsides before jumping in. Ultimately, a strong and loyal community of token holders is key to the success of any blockchain project, and airdrops may not always be the best way to achieve that goal.

The Debate: An Honest Effort for Adoption or Pump & Dump?

Let’s take a positive and optimistic approach to the debate around airdrops and their role in promoting cryptocurrency adoption. In order for any currency to be successful, it needs to be widely used, and that requires some level of marketing.

Even fiat currencies have a brand and require marketing efforts to promote their value as a medium of exchange or store of value. Governments indirectly promote their currencies through the strength and effectiveness of their economies, and

even welfare distributions can be seen as a form of airdrop to promote economic activity and currency adoption.

With cryptocurrencies, the responsibility for promotion falls on the community, and while it may not be an egalitarian process, it’s important to recognize that vested interests exist whether it’s an individual or a company. What matters is the size of that interest.

Early adopters of bitcoin knew that they would benefit from enticing second-, third-, and fourthround adopters, and they were willing to pay a price in foregone coins to distribute them to newcomers. The development of a passionate and engaged bitcoin community depended on a variety of marketing exercises, both organic and corporate-driven.

While it’s understandable to be wary of pumpand-dump schemes by early adopters, it’s important to approach these issues with nuance. Crypto utopianism tends to work against nuance, but it’s essential to recognize that marketing and promotion play a role in promoting the usefulness and value of a cryptocurrency.

In conclusion, let’s view airdrops as a marketing expense in the service of promoting community adoption and recognize that, one way or another, adoption requires some level of marketing. Let’s approach these issues with nuance and recognize that vested interests exist in both individuals and companies. By doing so, we can promote the success of cryptocurrency airdrops and their adoption on a wider scale.

A Potential Nuance

Crypto airdrops have several advantages, including the ability to distribute tokens in a decentralized and fair manner. Instead of selling tokens to a small group, anyone has an equal chance to receive tokens. This promotes fairness and helps avoid the concentration of wealth among a select few.

Furthermore, airdrops can help drive the adoption and usage of a project. Giving tokens away for free incentivizes users to become more involved in the community, test out the product, and provide feedback.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This creates a virtuous cycle where demand increases, which can lead to higher token prices and more attention from investors.

However, airdrops can also have some negative aspects. For instance, they can be used to artificially inflate the price of a token before dumping it, leaving airdrop recipients with worthless assets. Moreover, some projects may use airdrops to generate fake buzz and hype, leading to unsuspecting investors pouring money into a project with little real value.

Despite these drawbacks, cryptocurrency airdrops can be a powerful marketing tool for blockchain startups. They can attract new users, grow their social media following, and establish a strong community. As long as investors approach airdrops with caution and conduct their own research, they can be an excellent way to participate in the crypto world and potentially profit from promising projects.

Tips for Avoiding Airdrop Scams

Unfortunately, there are always people looking to take advantage of others, and the cryptocurrency community is not immune to scams. Airdrops, in particular, have been targeted by scammers looking to make a quick profit. They may promise free tokens, but in reality, they disappear with users’ money.

To protect yourself from falling prey to an airdrop

scam, it’s important to take some precautions. Here are some tips to keep in mind:

• Conduct thorough research before participating in any airdrop. Verify the project’s legitimacy, check the credibility of the team, read the whitepaper, and look for reviews from trustworthy sources.

• Be wary of any airdrop that requests personal information or private keys. A legitimate airdrop will never ask for sensitive information or your seed phrase.

• Don’t be lured by promises of guaranteed profits or high returns. Airdrops are a promotional tool and a way to get some free coins/tokens, but they are not a getrich-quick scheme.

• Be cautious of airdrops that require you to send crypto or pay a fee to participate. Genuine airdrops should never ask for payment.

• Your Ultimate Handbook: zkSync ‘’Potential’’ Airdrop

• The following guide is based on our research and analysis. While nothing has been officially confirmed by the zkSync team, I’ve combined my knowledge and insights on previous airdrops to provide you with valuable information. If you missed out on the recent $ARB airdrop from Arbitrum, you’ll definitely want to keep an eye out for the possibility of an airdrop from zkSync.

What is a Zero-Knowledge (ZK) Rollup?

• ZK-rollup is a key component of zkSync.

• It employs cryptographic proofs to validate transactions while preserving privacy and security.

• Transaction details like token amounts are kept anonymous.

• It ensures a genuinely safe and trustless environment for DeFi.

Here’s what you need to know:

• Your best bet is to interact with zkSync Lite, which gives you the highest chance of being eligible for the airdrop.

• Additionally, participating in dApps within the zkSync ecosystem may qualify you for potential airdrops from both zkSync and ecosystem projects.

Then, follow these steps:

• Add zkSync Era Alpha Testnet on MetaMask.

• Obtain Testnet Tokens.

• Interact with zkSync Lite.

• Bridge Funds to zkSync.

• Interact with the zkSync ecosystem.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

To get the Testnet tokens, here’s what you need to do:

• The best way to get Testnet Tokens is by visiting: https://goerli.portal.zksync.io/faucet

• You’ll need a Twitter account to claim Testnet Tokens, and it must not be new and must have a profile picture.

• Testnet Tokens include Goerli ETH, DAI, LINK, USDC, and wBTC.

• These tokens have no real value and are only used for testing purposes.

Tips for using zkSync Lite:

• Using zkSync Lite does not require a whitelisted address unlike interacting with the zkSync mainnet.

• To get started with zkSync Lite, you need to connect your L1 ETH wallet and pay a small one-time account activation fee.

• After activating your account, you can deposit your ETH or USDT balances from L1 to zkSync Lite.

• You have the option to withdraw your funds from zkSync Lite back to L1 anytime.

How to transfer funds to zkSync using a bridge:

• Visit the bridge portal at https://goerli.portal. zksync.io/bridge

• Ensure that you have enough Goerli ETH in your wallet to initiate the transfer.

• You can acquire Goerli ETH from various faucets such as https://goerlifaucet.com/

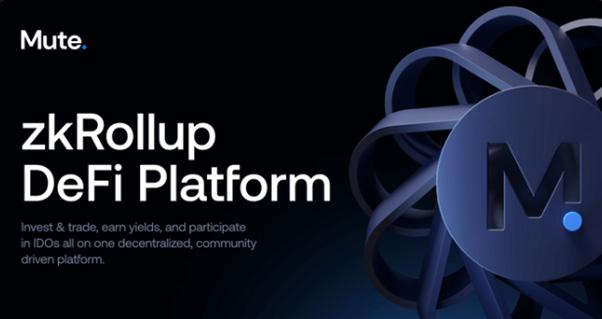

Interact with the Mute Platform:

• Mute DEX is a decentralized exchange platform that allows users to swap tokens, buy $MUTE, add liquidity, and stake.

• To interact with the platform, you will need testnet tokens and connect your wallet to https://app.mute.io on the zkSync network.

• Once connected, you can easily access the platform’s features and participate.

The Verdict

• Crypto airdrops are a great way for startups to distribute tokens in a decentralized and democratic way.

• They give everyone an equal opportunity to receive tokens, which can help create a more level playing field.

• Airdrops can also increase the adoption and usage of a project, creating a virtuous cycle of more users leading to more demand, higher token prices, and more attention from investors.

• However, there are some potential downsides, including the risk of “pump and dump” schemes and generating fake buzz.

• Despite these concerns, airdrops can be a powerful marketing tool for blockchain startups to attract new users, increase their social media following, and build a strong community around their projects.

• As long as investors approach airdrops with a healthy dose of skepticism and do their due diligence, they can be a great way to get involved in the crypto world and potentially profit from the success of promising projects.

Overall, cryptocurrency airdrops can be an exciting opportunity with risks, but with careful consideration and research, they can be a valuable way to engage with the crypto community, grow your portfolio and benefit from promising projects.

Is Blockchain Just A Buzzword?

written by Daniel Jimenez

written by Daniel Jimenez

In simple terms, blockchain is not just a fancy buzzword. It’s a technology that allows for secure transactions between parties without the need for intermediaries like banks. It does this by using a distributed ledger that records transactions on a network of computers in a transparent, secure, and unalterable way.

Blockchain has the potential to revolutionize many industries, including healthcare, supply chain management, and voting systems, among others. Its unique features make it an attractive solution for situations where trust and transparency are crucial.

While there has been a lot of hype surrounding blockchain, it’s not just a passing trend. It has already been implemented in real-world applications and is expected to continue to grow and evolve in the coming years.

Removing the noise

As technology continues to evolve, buzzwords like blockchain, non-fungible tokens (NFTs), and artificial intelligence (AI) have become increasingly popular.

Much like the dot-com boom of the 1990s, unfortunately, this popularity has also led to some companies using these buzzwords for the sake of marketing, without actually utilizing the technologies in a meaningful way.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Here are some tips and techniques to help you make informed decisions:

1. Research the Technology

Before investing in any project, it’s important to understand the technology behind it. For example, if a company claims to be utilizing blockchain, research the technology to understand how it works and how it can be applied. This will help you identify companies that are truly utilizing the technology, rather than just using buzzwords for marketing.

Look into the company’s background, team, and track record. Check if they have a working product or if they’re just in the idea stage.

Blockchain projects are typically divided into tokenization projects, such as Business Model, which aim to focus on the creation of a digital product or services and use an existing blockchain platform to automate economic aspects through the issuance of tokens or any other similar asset.

Others simply add advanced features to an existing blockchain, such as the case of L2-Ethereum which seeks to solve specific problems such as Ethereum’s scalability in this case.

In more ambitious cases, and often observed in the industry a couple of years ago, some claimed to build a new blockchain platform, which is far from the reality in many cases of projects that only seek to use the buzzword for marketing purposes.

In this case, it is worth asking yourself some of the following questions depending on the type of project being analyzed: Is the token essential or just a fundraising tool? How does the token model integrate with the Business Model? Is it decentralized enough? How does it compare to similar projects?

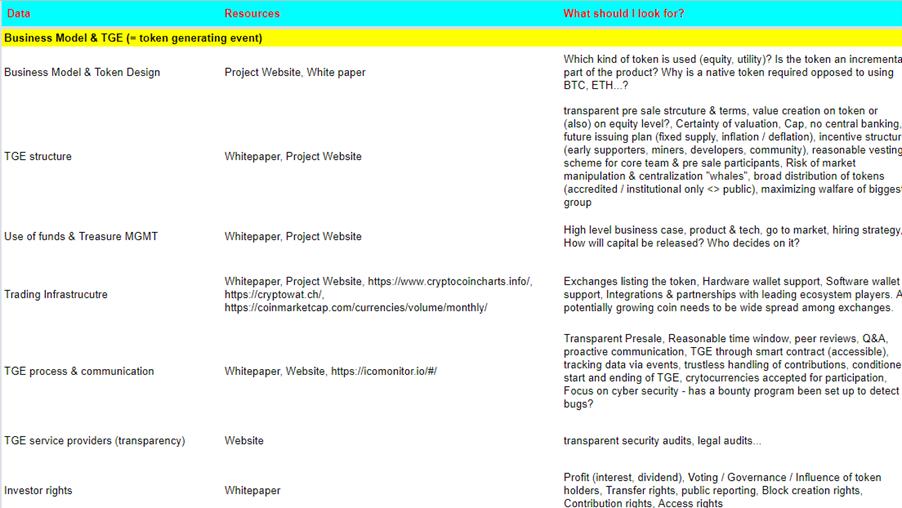

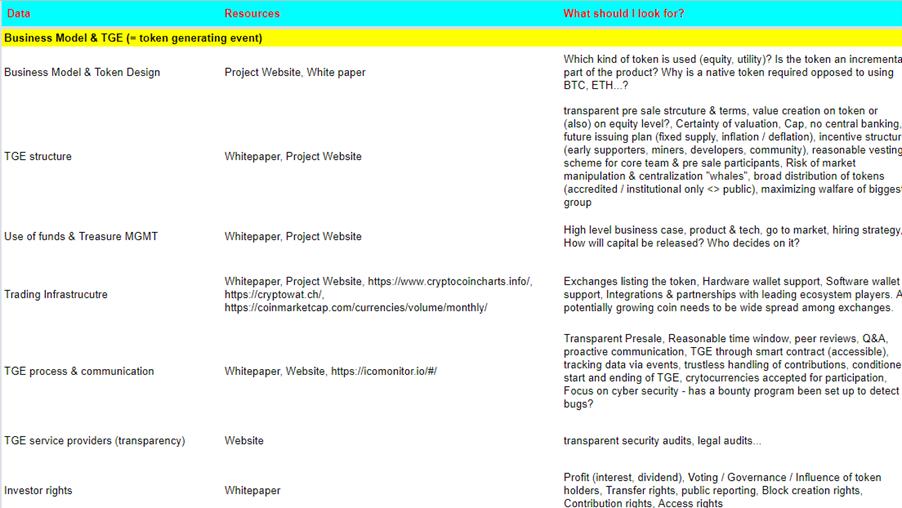

To complete this analysis, consider unifying the criteria in a table in a spreadsheet and assigning it a weighted value like this:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

2. Evaluate the Team

The team behind a project can provide valuable insight into whether or not it’s legitimate. Look for team members with experience and expertise in the technology they claim to be using. If the team lacks this expertise, it could be a sign that they are just using buzzwords to attract attention.

A good starting point for analyzing the project team members is a qualitative analysis of their Linkedin profiles and verifying if they have had previous experience in the technology they are ‘selling’, published articles, social connections, etc.

Another crucial aspect to look at is the advisors who provide knowledge and support to the project. If these advisors lack relevant training in blockchain or in the project’s field and do not have an interesting success story, this should rise alarm bells about the legitimacy of the project that claims to be involved with the technology.

3. Look for Real Use Cases

Real projects that utilize these technologies will have clear use cases and applications. Look for companies that can demonstrate how their technology is being used in a practical way, rather than just making bold claims about its potential.

If a company claims to use blockchain, NFTs, or AI, check if they’re actually utilizing these technologies in their products or services. For instance, if they’re using blockchain, check if they have a decentralized system that provides transparency and security.

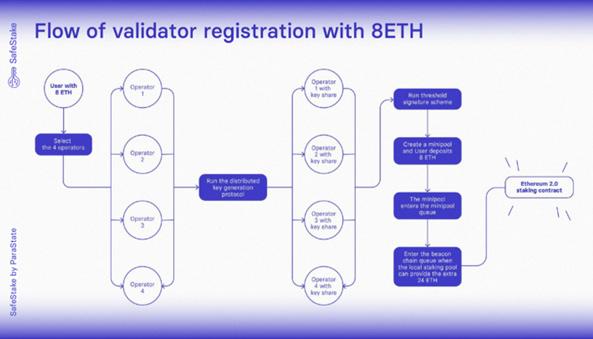

Verify the technological stack on which the project is built: Do they rely on an existing platform or build a new one?