A note from Lisa…

We started the Moon Mag, so you all could be as passionate about cryptocurrencies as we are, and I will explain why they are a fantastic LONG TERM investment right now.

Forget the saying sell in May and stay away…This could be one of the best times EVER to buy Cryptocurrencies and Bitcoin at superb discounts for the long-term future of money.

Money has undergone signifcant changes over the past centuries, with major transformations occurring every few decades. Here are some examples of how money has changed every 40 years:

• 1880s: The introduction of paper currency - In the late 1800s, governments began issuing paper money as a more convenient replacement for metal coins.

• 1920s: The rise of credit - In the 1920s, credit became widely available and popular, allowing people to make purchases without having money on hand.

• 1960s: The advent of electronic payments - In the 1960s, credit cards and electronic payment systems, such as the frst ATM, were introduced.

• 2000s: The proliferation of online payments - In the early 2000s, online payment systems like PayPal and online banking became commonplace, making it easier to conduct fnancial transactions anywhere in the world.

• 2040s (predicted): The rise of digital currencies - Bitcoin and other cryptocurrencies will become more mainstream and possibly replace traditional currencies altogether.

Yes, this is still 17 years away, but if BTC is still the main cryptocurrency, IMAGINE what it could be worth. Yes, I’m speculating, but as a trader, that’s what I do best

Looking to the immediate future, we can see this cycle in progress, and to look forward, we often need to look at how history has progressed us forward.

Gold Standard (Late 1800s to 1930s): Before the introduction of paper currency, money was backed by gold. Meaning that paper money could be exchanged for a fxed amount of gold. The gold standard was widely adopted in the late 1800s and early 1900s, but it was abandoned by many countries during the Great Depression in the 1930s, signifcantly changing how money worked. It wasn’t until 1976 that FIAT money fully replaced the Gold backed US dollar.

Image -Street Artist Ludo’s BTC Flower among the streets of ParisThe petrodollar system began in the 1970s when the US made an agreement with Saudi Arabia to price oil in US dollars. This agreement made the US dollar the dominant currency for global trade and allowed the US to maintain its position as a global economic power. The petrodollar system has been a signifcant part of the global monetary system for several decades, but there is debate about whether it is ending and what will replace it. If we continue to move to diferent or greener forms of power like Gold, the Petrodollar will be phased out.

Bring in DIGITAL CURRENCYcreation 2010 - as above, this is predicted to be the way of the future - we are still early and have not peaked. FIAT currency will also be phased out as money moves to digital through Apple Pay and Debit/Credit Cards. And by that time, experts believe digital currencies will be mainstream (and hopefully a lot easier to use).

As a reader of the Moon Mag, you will know this is because of Decentralisation, Security, Transparency, Accessibility and Innovation.

So grab your favourite drink, smile knowing you are 17 years early, and enjoy the rollercoaster ride that is cryptocurrency and, of course, I hope you enjoy this month’s MOON MAG!

A note from

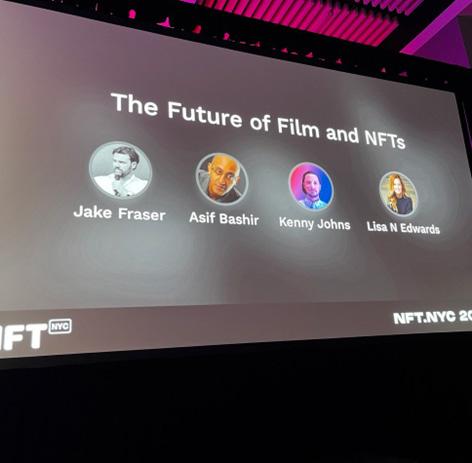

Lisa and I spent the last 3 weeks travelling, and one of our stops was in New York for the NFT.NYC conference! It was epic. It was great to fnally meet the people behind some of the awesome projects we have shared with you in the Moon Mag.

When you meet them face to face, you realise just how much building and energy is going into so many ideas in the industry. We’re so used to being updated via the Internet that it’s hard to make a tangible judgement on the eforts the workforce is actually making. Out of interest, I wonder how many of our readers have ever physically met anyone involved and working on a crypto project? We have a few more dates in our crypto calendar for other conferences and events this year, and we’re excited to meet even more inspiring people.

Enjoy the interview with Michael Sanders of Horizon Blockchain Games in this issue, and look out for more in the future! Talk to you next month (or let us know if you’re attending a crypto conference....so we can chat in person!)

http://NFT.NYC

Lisa

Lisa

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide fnancial advice. Please DYOR and above all, enjoy the content!

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R.Paulo Delgado is a crypto and fntech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and fnancial content for various businesses and news publications.

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

I can hear you now… “Yeah, you’re telling me; some of those exchanges are dodgy; they take my money!” That’s often what I hear from NEW traders, not understanding the risks involved with trading, especially on an exchange that ofers HIGH LEVERAGE trading - 100x, sometimes even 200x. It’s not actually the fault of the exchange, the onus is on the user; you press the buttons; it is very important not to let greed take over and remember - it is your money; you press the buttons, so make sure you understand what is going on. Educate yourself before making those frst trades.

a few basic pointers:

1. Two-factor authentication (2FA): Make sure the exchange supports 2FA, which provides an extra layer of security by requiring you to enter a code generated by an authentication app or sent to your phone via SMS, in addition to your username and password, to log in.

This is a MUST! No 2FA then you don’t trade - that easy! I’m not going to give you a link here; for security reasons, go to the app store on your phone and install either of these.

2. Cold storage: Check if the exchange stores the majority of its cryptocurrency in cold storage, which is an ofine storage method that is more secure than hot wallets that are connected to the internet.

Most exchanges Cold (and Hot) Wallets can be found in the Bitinfo - Rich List. A quick tip, you can guage market direction by watching some of these wallets for when they buy and sell.

3. Insurance: Find out if the exchange has insurance to cover losses due to hacking or other security breaches.

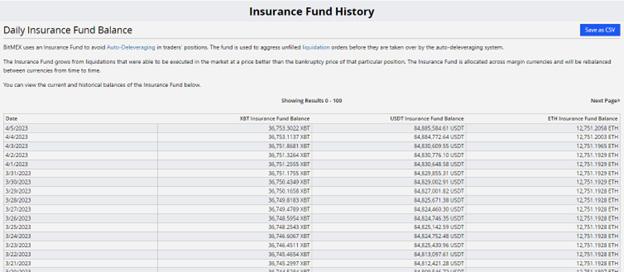

A quick Google, shows me the exchanges want you to know this! Crypto.com boasts top spot with Bitmex.com coming in at second place. Bitmex mentions “BitMEX uses an Insurance Fund to avoid AutoDeleveraging in traders’ positions.”

A bit of history, the bottom for Bitcoin in March 2020 was caused by 50 Billion being wiped from the market and several exchanges hemorrhaging after Coronavirus announcements and Bitmex Auto-deleveraging… Hence the insurance fund…which are much needed!

4. Reputation and history: Research the exchange’s reputation and history to see if they have a track record of security incidents or other issues.

This one is simple, a bit of research and reading through crypto news. If FTX popped back up tomorrow, you would know it had a serious issue(understatement, I know), but you get the gist.

5. Regulatory compliance: Ensure the exchange is compliant with relevant regulations and laws in the jurisdiction where it operates.

We have seen many exchanges face regulations, and they are only getting stricter as Governments try to work out laws for cryptocurrency and blockchain. This is a recent Press Release from ASIC, where Binance - voluntarily gave up a Derivatives Licence. They are not the frst or only exchange to face this challenge.

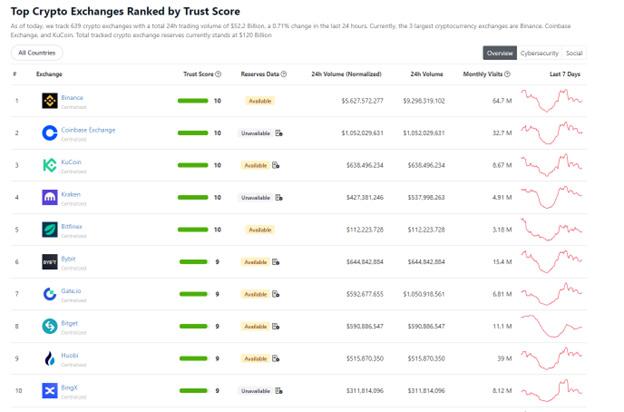

6. Transparency: Look for an exchange that is transparent about its security practices, including regular security audits and vulnerability testing.

Most exchanges are listed here, and you can check and verify their information from both Coinmarketcap. com or Coingecko.com or similar platforms. CoinGecko give a trust score and Reserves Data on this main page.

7. Customer support: Check if the exchange has a responsive customer support team that can assist you with any security-related issues.

This is usually in the form of an email address, pop up from the website of similar. This image is what we fnd on Kucoin.com exchange in the bottom corner of their website.

By taking these measures into consideration, you can minimize the risks of adding money to a crypto exchange and ensure your funds are secure. And of course remember to spread your riskNothing is TOO BIG TO FAIL, as we read in Moon Mag issue 13.

Depending on how BIG your bags are, spread them over a few exchanges, I am on about 10, having learnt the lessons of MtGox, and it is unlikely all 10 would go down at the same time.

Exchanges are considered to be a HOT WALLET, do not trade your entire portfolio. Only 20% of my trading bags are actively traded. Check out Issue 12 for the breakdown.

While these are only a few tips to look for, hopefully, this makes you think before parting with your hard-earned money on the “WRONG” exchange.

Stay Safe and Vigilant at all times!

Lisa

Last month, Bitget, crypto and copy trading platform, entered into partnership with Core DAO, the organisation dedicated to developing the Satoshi Plus ecosystem. The collaboration introduced a US$200 million ecosystem fund supporting decentralised applications (DApps) built on Core Network Layer-1 blockchain.

The fund launch follows the Core network’s mainnet launch and frst airdrop of CORE tokens, which were claimed by more than 1.5 million users; and recent integrations with cross-chain messaging protocol, LayerZero and permissionless Oracle protocol Switchboard. The Ecosystem Fund, which is backed by strategic partners including Bitget and MEXC, will provide support to early-stage projects for research and development, recruiting, marketing, communitybuilding programs, and other priority growth initiatives.

Apart from the US$200 million investment, the partnership also involves the potential listing of Core projects and the opening of a new Core Trading Zone on Bitget and its integrated BitKeep wallet. Special focus will be devoted to the Core ecosystem fund and technological endeavours, giving the project support and the experience of the Bitget team in terms of security and other possible development avenues.

The Moon Mag got the inside scoop on their strategy.

1.Why did your team decide to collaborate on this ecosystem fund?

Bitget has always been committed to promoting the development and adoption of blockchain technology. We believe that blockchain has the potential to transform many industries and bring about greater fnancial freedom and empowerment for individuals.

“This investment is another example of our commitment to supporting the blockchain space from various angles. We have to keep in mind that the purpose of blockchain is to link the real world with Web3 space, and that is exactly what we are promoting with this partnership and our support to the ecosystem fund. With our help, we are confdent that Core can reach great heights and advance the real principles of decentralisation, which stand on transparency and the improvement of community members’ cross-chain experience,” Gracy Chen, Managing Director Bitget quoted.

2. How is this ecosystem fund diferent to others?

Unlike industry peers, Core DAO’s Ecosystem Fund will not utilise a grant-based system in which a project’s main criterion to receive fnancial support is a commitment to build on a given protocol. Instead, Core’s Ecosystem Fund will reward each project for hitting customised and agreed-upon benchmarks that deliver tangible value to the Core community.

“Too often, grant programs seem designed to grab headlines and generate short-term momentum rather than incubating projects aligned with the ecosystem’s long-term success,” Rich Rines, Initial Contributor at Core DAO quoted.

“Core DAO has always prioritised creating the highest quality technology versus being the ‘first’ or the ‘fastest’ to do something. That’s why our Ecosystem Fund with Bitget will incentivise projects for their ability to both deliver value and sustain success.”

3. Can you tell us more about Bitget’s intention to become one of the validators of the Core network and support Core staking on the exchange?

Bitget has extensive experience in managing and securing large volumes of assets and transactions. With more than 8 million users on our platform, Bitget can provide significant staking needs to the Core DAO ecosystem and supply it with necessary liquidity. As a validator, we will be responsible for validating transactions, participating in consensus, and helping to maintain the overall health and stability of the network. We are also interested in supporting CORE’s various financial related unit on our exchange, which will allow our users to earn rewards for supporting the network and contribute to the growth and development of the ecosystem.

This partnership comes on the heels of the recent launch of the Bitget US$100 million Web3 Fund, which is part of Bitget’s ongoing eforts to facilitate the development of the Web3 and crypto industry.

4. Can you explain Bitget’s recent launch of the Web3 Fund and its ongoing eforts to facilitate the development of the Web3 and crypto industry?

The Bitget Web3 Fund is a new initiative that we launched to support the development of the Web3 and crypto industry. The Bitget Web3 Fund will seek out VCs and projects globally that have a clear roadmap and an experienced team, and those that ofer innovative solutions to real-world problems. As of now, it has received inquiries from VCs including Foresight Ventures, Dragonfy Capital, SevenX Ventures, DAO Maker, and ABCDE Capital for potential partnerships.

“We can see that Web3 space is evolving rapidly and many projects deserve the support to further advance such development and make Web3 a truly global phenomenon, as Web2 had once become. That is why the Bitget Web3 Fund will strive to seek out projects that have the most impact on this process. We are taking a fully conscious and responsible approach in this regard and know how important accountability is when dealing with any innovative project requiring investments. We strive to support fnancial innovation in Asia and believe that our platform can act as a reliable, convenient, and secure link between the worlds of DeFi and CeFi.

Gracy Chen, Managing Director Bitget quoted.An organisation can operate automatically without any centralised authorities like governments and companies. In this article, we will introduce what exactly DAOs are, how DAOs work and some examples of DAOs.

With an advanced function smart contract, users can build decentralised applications (DApps) on the Ethereum Blockchain, an open public decentralised platform that no one person or group can control. In this article, we will introduce what exactly DApp is, common use cases of DApps today and the future of DApps.

Here are some thoughts on how web3 will change our daily lives - be it Web3 gaming, NFTs, metaverse.

Established in 2018, Bitget is the world’s leading cryptocurrency exchange with a core focus on copy trading. Serving over 8 million users in more than 100 countries and regions, the exchange is committed to helping users trade smarter by providing a secure, one-stop trading solution.

Core DAO is a Layer-1 blockchain combining the decentralisation and security of Bitcoin with the scalability and utility of Ethereum. Through its Satoshi Plus consensus mechanism, Core DAO integrates the best aspects of Proof of Stake and Proof of Work. The Core DAO is made up of a global group of contributors seeking to promote the growth of Satoshi Plus consensus and the power of blockchain technology to reshape society based on a philosophy of co-creation.

written by Daniel Jimenez

written by Daniel Jimenez

Have you ever been the victim of a message on your favorite social network asking you to help transfer funds from a supposed Bitcoin wallet with a wallet link? Or maybe you have been asked to participate in a presale of an NFT project with exclusive access from a message from some unknown contact?

If the answer is YES, you should be concerned. The popularity of cryptocurrencies in recent years has not only come with extensive adoption among individuals and public/private institutions, but it has also meant an attraction for many cybercriminals to take advantage of the FOMO around these assets to do their thing.

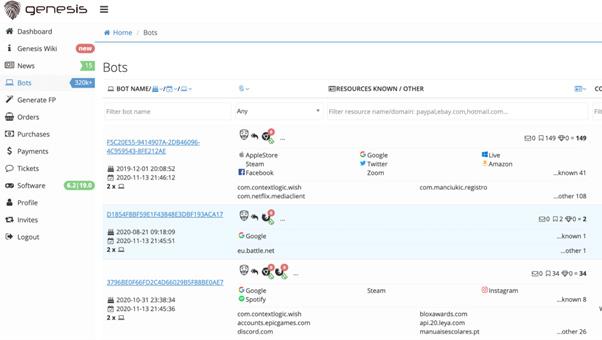

According to Cyphertrace there is a data breach on the darknet reaching nearly half a million digital identities for sale at any given time on the infamous Genesis Market site alone.

For such a reason, if you do not want your data to leak during the web3 interaction and everything concerning the cryptocurrency ecosystem, it is crucial to maintain some safe practices when interacting with any dApp or crypto wallet on your preferred smartphone or web browser.

In this article, we will explore the importance of cybersecurity when referring to cryptocurrencies and provide essential tips on ways to stay safe online.

Contrary to what many believe, the very nature of blockchain technology itself does not make it immune to the use of malicious practices by some cyber criminals.

While we have pure cryptography technology, efcient algorithms, and robust programming languages, remember: Everything is man-made and subject to the innate imperfection of the individual or organization that creates them.

Digital signatures, public key cryptography, and comprehensive security mechanisms in the form of hashes are some of the strengths of blockchain technology used as a base for nearly 7,500 cryptocurrencies today, but they are still vulnerable.

The aforementioned highlights the importance of educating yourself and understanding how the technology behind each cryptocurrency works to mitigate the potential risks when interacting with the ecosystem.

Fortunately, as was the case with the birth of the Internet in the 1990s, cybersecurity has managed to carry over into the cryptocurrency arena; there are ‘better practices’ that enthusiasts, investors, and even digital asset providers (VASPs) can use to keep the ecosystem as shielded as possible from the reach of hackers.

Security in the cryptocurrency world is paramount to safeguard digital assets and maintain privacy, integrity, and compliance. Therefore the importance of robust security measures and exercising caution in the cryptocurrency ecosystem to protect against potential threats and ensure responsible asset management.

Due to the growing infux of attacks against the crypto ecosystem, users must implement robust security measures such as strong passwords, 2FA, encryption, and verifcation of the authenticity of websites and transactions.

Given the relatively unregulated nature of cryptocurrencies, it is essential to be wary of scams and fraudulent activities. Therefore, compliance with legal requirements, including AML and KYC procedures, is becoming increasingly important. Approaching security within the cryptocurrency arena with a semi-professional tone shows the importance of safeguarding investments and mitigating risks.

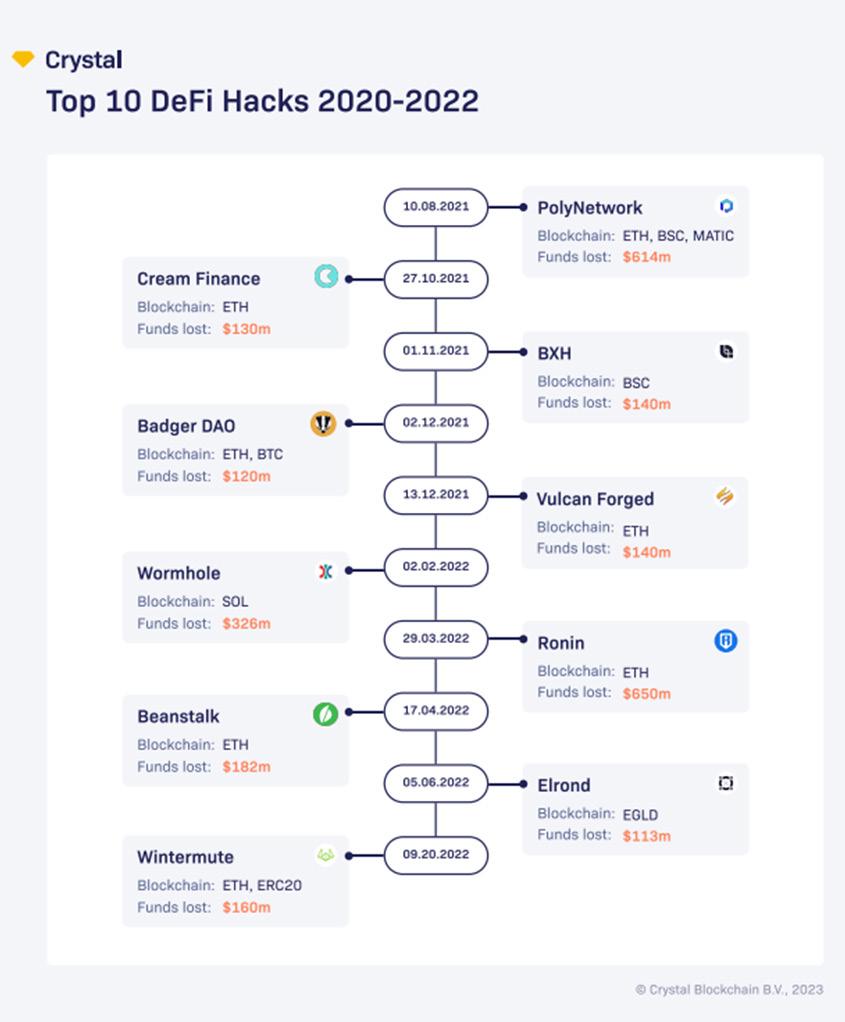

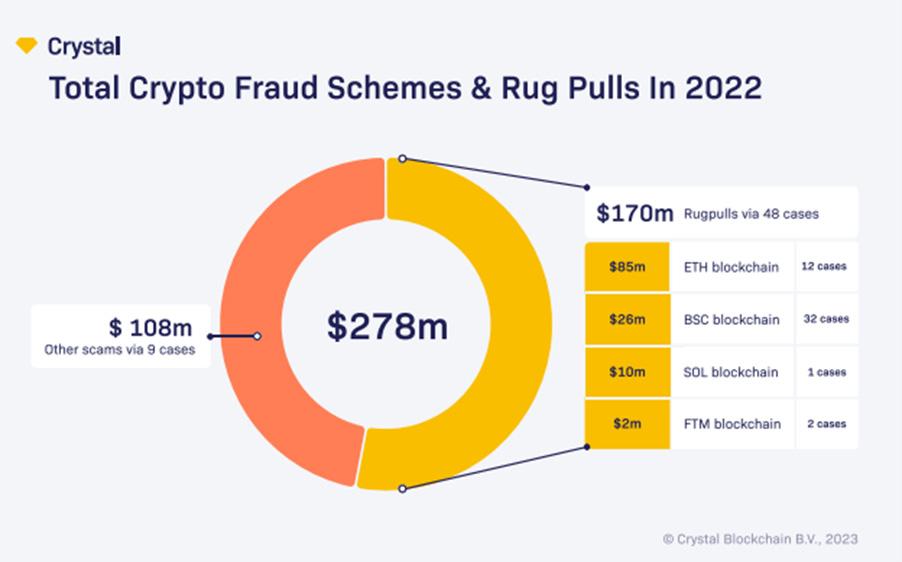

According to data from Crystal Blockchain, approximately $16.7 billion in cryptocurrencies have been stolen since 2011.

Attacks on centralized exchanges, DEXs, DeFi protocols and blockchain games have become recurrent since the mythical Mt.Gox fell from grace in 2011.

To date, the biggest hack goes to Ronin Network, the Ethereum sidechain created for the NFT Axie Infnity game, with which a lost combined value of over USD 600 million by the end of March 2022.

The most popular method of crypto theft until 2021 was the infltration of crypto exchange security systems, but currently, the tendency has moved to DeFi hacks; according to Crystal Blockchain’s Analytics Team, 231 DeFi hacks, 135 security attacks, and 95 fraudulent schemes were reported in the last 11 years.

Given the current threat landscape, it is essential to understand some of the risks when interacting with the web3 before indicating some basic guidelines for safe navigation in the ecosystem associated with cryptocurrencies.

Cryptocurrencies are decentralized and operate on a blockchain network, which makes them attractive targets for cybercriminals, with diverse cyber threats posing risks for cryptocurrency investors, including:

1. Phishing attacks: Phishing attacks are a commonly known cyber threat in which attackers attempt to trick individuals into revealing their sensitive information, such as wallet credentials, through deceptive emails, websites, or messages.

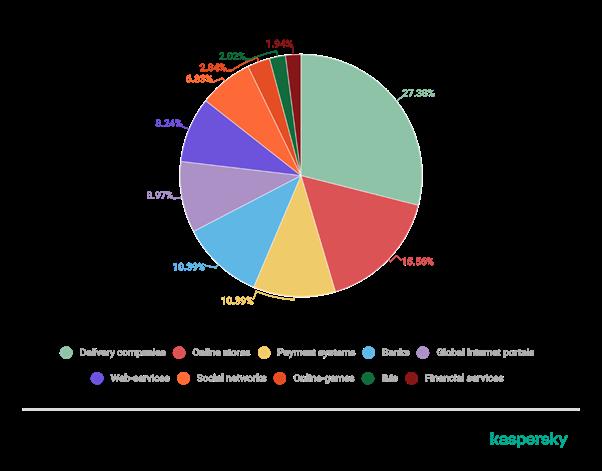

According to Kaspersky, phishing attacks doubled to over 500 million in 2022, twice more when compared to the 2021 fgures.

2. Malware and ransomware attacks: Malware and ransomware attacks involve malicious software that can infect a user’s computer or mobile device, allowing hackers to gain unauthorized access to wallets and steal funds or demand ransom for their release.

3. Social engineering attacks: Social engineering attacks involve manipulating individuals through psychological tactics to gain access to their cryptocurrency wallets, such as impersonating trustworthy entities, wielding trust relationships, or exploiting human vulnerabilities.

4. Insider attacks: involve individuals with authorized access to cryptocurrency wallets who misuse their privileges for personal gains, such as stealing funds or manipulating transactions.

5. Exchange hacks: Cryptocurrency exchanges, platforms where users trade cryptocurrencies, have been targeted by cybercriminals in the past. Exchange hacks can result in signifcant losses, as attackers may gain unauthorized access to user accounts and steal cryptocurrencies stored on the platform.

6. Ponzi schemes and investment scams: fraudulent activities that promise high returns on investments but ultimately collapse, resulting in the loss of investors’ funds. There have been cases of fraudulent investment schemes that lure unsuspecting investors with promises of high returns and disappear with their cryptocurrencies.

7. Pump-and-dump schemes: Pump-and-dump schemes involve artifcially infating the price of a cryptocurrency through coordinated eforts and then selling it at a proft, leaving other investors with losses. These schemes happen through social media or messaging platforms, and investors may fall victim to these scams by making investment decisions based on manipulated information.

8. Fake wallets and exchanges include websites or applications that mimic legitimate cryptocurrency wallets or exchanges but steal users’ private keys or login credentials. Unsuspecting investors may be tricked into using these fake platforms, resulting in the loss of their cryptocurrencies.

Cryptocurrency investors face signifcant risks from various cyber threats. To safeguard their investments, investors must exercise caution, implement robust security measures, and remain vigilant within the cryptocurrency ecosystem, including employing complex passwords, enabling two-factor authentication (2FA), encrypting wallets, and verifying the authenticity of websites and transactions.

Staying informed about the latest cyber threats, being cautious of suspicious emails or messages, and avoiding unverifed sources or investment schemes can help mitigate potential risks.

By taking proactive steps to secure their investments and remaining vigilant, investors can protect their cryptocurrencies from cyber threats and minimize the risk of losses.

As we mentioned earlier, it is crucial to implement robust cybersecurity measures to safeguard your cryptocurrency investments from cyber threats. To protect their investments, users must choose the ideal cryptocurrency wallet and follow the best practices for wallet security.

Here are some essential tips to help stay safe online:

1. Use a Secure and Reliable Cryptocurrency Wallet: Choose a reputable and well-reviewed cryptocurrency wallet with advanced security features such as multi-factor authentication (MFA), strong encryption, and regular software updates. Avoid using online wallets, as they are more susceptible to cyber-attacks than ofine or hardware wallets.

Mag’s ISSUE#06

In Moon

, you will fnd some of the best and most respected Bitcoin wallets.

2.. Use a hardware wallet: Hardware wallets, such as Trezor, Ledger, or KeepKey, are physical devices that store your private keys ofine. They provide an extra layer of security by keeping your keys away from the internet, making it harder for cybercriminals to gain unauthorized access.

If you have doubts about which cold storage option is best to keep your cryptos safe, check our ISSUE#11 to learn more about the diferent types of hardware wallets.

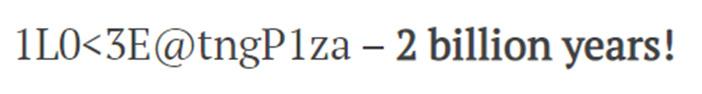

3. Create Strong and Unique Passwords for your cryptocurrency wallet by combining uppercase and lowercase letters, numbers, and special characters.Avoid using common passwords or reusing passwords across diferent accounts, as this can increase the risk of being hacked.

No password is completely uncrackable, but if you make one that takes several years and millions of dollars worth of computing power to crack, it may be near impossible to hack.

If you are not familiar with generating strong passwords, you can use tools available for all existing operating systems with which you log into the various applications of the web ecosystem3.

4. Enable Multi-Factor Authentication (MFA): Enable MFA on your cryptocurrency wallet whenever possible. MFA adds an extra layer of security by requiring a second form of verifcation, such as a fngerprint or SMS code, besides your password.

One of the most efective ways to protect against hackers gaining access to your exchange accounts is to turn on two-factor authentication (2FA) for withdrawals in your exchange app.

If you use an authenticator app, the hacker would need your phone to get the 2FA code, so that is a much stronger layer of defense than using SMS (Simjacking).

To learn more about Simjacking, check out ISSUE#15 of our magazine in the Trader Perspective by Lisa N Edwards.

5. Be Cautious of Phishing Attempts: Be cautious of unsolicited emails, messages, or websites that request your wallet credentials or personal information. Always verify the authenticity of the sender and the website before providing any sensitive information. Avoid clicking on suspicious links or downloading attachments from unknown sources.

Many scammers, for example, will ofer fake versions of the popular Ethereum wallet, MetaMask. An attacker can also create a fake website that looks just like a legitimate one but has a slightly diferent spelling in its URL. The site may lead to diferent and malicious smart contracts, stealing your crypto almost as easily as with a fake wallet.

To avoid these phishing attempts, you can use only trusted dApps from reliable sites like DappRadar. Also, use the ofcial app site by checking from other sources beyond the traditional Google or Bing search.

Last but not least, check the lock icon to the left of the URL. If the site gets hacked, you will not get an SSL certifcate (lock red).

An extra step that will help a lot is to check the smart contracts under which you interact with your wallet on the page in question (the legitimate ofcial version) available in the dApp repository.

6. Keep Your Software Updated: Regularly update your cryptocurrency wallet software, and any other software or applications related to your cryptocurrency transactions. These updates often contain critical security patches that address known vulnerabilities and protect against potential cyber threats.

A good practice here is to use a reliable, up-todate antivirus to protect yourself from security breaches or attacks by malware and viruses that can compromise your wallets.

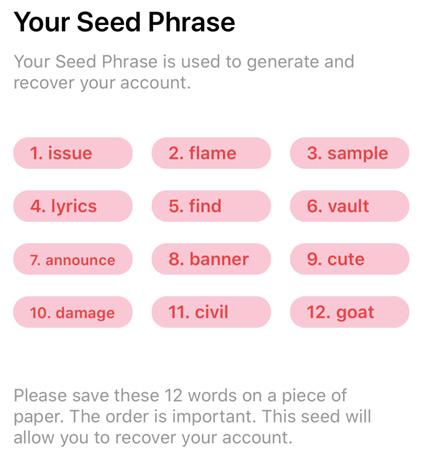

7. Backup Your Wallet Seed Phrases: Back up your wallet’s seed phrases, the series of words that serve as a backup for your cryptocurrency wallet. Store the seed phrases in a secure and ofine location, such as a hardware wallet or a physical safe, to prevent unauthorized access.

Never keep the plaintext copies or screenshots of your seed words on your PC or smartphone. Back up your seed words on a physical piece of paper.

If while browsing the web, you suddenly come across a window that looks like your wallet and asks for your seed words, then this is probably a malicious website. The safest way to deal with this is to close the tab and fush your browser’s cache.

8. Use a Virtual Private Network (VPN): Use a VPN when conducting cryptocurrency transactions online to encrypt your internet connection and protect your data from potential eavesdropping or man-in-themiddle attacks (MITM).

9. Be Wary of Public Wi-Fi Networks: Avoid using public Wi-Fi networks for cryptocurrency transactions, given that these networks are often unsecured and can get used by hackers to intercept or manipulate data.

When you use open public Wi-Fi, other people nearby can easily intercept your internet trafc using Wireshark or similar tools. With the information they receive, they can often tell if you’re visiting crypto sites. In some circumstances, they may even be able to view your transactions.

10 .Avoid downloading fles to your devices: One of the oldest practices is stealing cryptocurrencies through downloading virus-infected fles sent by e-mail or on malicious sites.

The smartest way to protect yourself is to avoid downloading fles of dubious origin. Even if it appears from a trusted source, remember to keep your device with an updated antivirus or use diferent devices for your cryptographic transactions than the one you use for daily activities.

In today’s digital world, where cryptocurrencies have gained signifcant popularity, prioritizing cybersecurity is crucial to safeguarding your investments. Cyber threats such as phishing attacks, malware, and social engineering pose real risks to your cryptocurrency holdings, and it’s essential to take proactive steps to protect your wallets and stay safe online.

By following the best practices outlined in this article, such as using hardware wallets, enabling multifactor authentication, keeping software up-to-date, using strong passwords, and backing up your wallet seed phrases, you can signifcantly reduce the risk of unauthorized access and loss of funds, that is also why it’s imperative to stay informed and educated about the latest cybersecurity threats and regularly check for updates from reputable sources.

Remember to be cautious and skeptical of unsolicited requests for sensitive information, double-check the website’s URLs, and avoid downloading suspicious fles or clicking suspicious links. Implementing these security measures and staying vigilant will go a long way in safeguarding your cryptocurrency investments and ensuring the security of your online transactions.

In conclusion, cybersecurity should be a top priority for anyone involved in cryptocurrencies. By taking proactive measures to protect your wallets and staying informed about the latest threats, you can enjoy the benefts of cryptocurrencies while minimizing the risks. Stay vigilant, stay informed, and stay safe online in the exciting and ever-evolving world of cryptocurrencies.

Are you ready to embark on the frst part of your ‘’DeFi Odyssey’’? We’ll navigate the swirling seas of decentralized fnance, revealing hidden treasures and making sense of the mystifying jargon.

As we venture further into the digital age, a new fnancial frontier is rapidly emerging, revolutionizing the global economy and the way we interact with money. Welcome to the world of Decentralized Finance, or DeFi for short. This burgeoning ecosystem is poised to transform the fnancial landscape, making it more accessible, transparent, and equitable for all. Rooted in the core principles of decentralization, trustlessness, and programmability, DeFi ofers a powerful alternative to traditional fnancial systems by leveraging the disruptive potential of blockchain technology.

Our journey begins with an exploration of what DeFi is, its core components, and how it compares to traditional fnance in terms of benefts and challenges. We’ll delve into key DeFi concepts and terminology, such as smart contracts, tokens, dApps, and liquidity, to lay a solid foundation for understanding this dynamic space. Think of it like ‘’DeFi 101’’.

We’ll examine Automated Market Makers (AMMs), lending and borrowing platforms, yield optimizers, and oracles, providing insights into their unique functions and features. Along the way, we’ll touch on DeFi governance and token economics, shedding light on their signifcance in decentralized protocols.

We’ll also showcase some of the most notable DeFi projects and platforms, highlighting their innovative features and unique selling points. Finally, we’ll briefy discuss the potential risks and challenges in the DeFi space, including security concerns, regulatory uncertainty, and scalability issues.

The Defnition

Picture a fnancial landscape where intermediaries no longer wield power, and individuals hold the keys to their fnancial destiny. Welcome to Decentralized Finance anon, a trailblazing ecosystem that leverages the transformative capabilities of blockchain technology to reshape the way we interact with money and global markets.

DeFi is a groundbreaking movement that aims to transform the fnancial industry by leveraging blockchain technology to build a new, open, transparent, and accessible fnancial infrastructure. It aspires to reimagine and improve the existing fnancial system by removing traditional intermediaries and creating a more democratized and efcient way to manage and interact with fnances.

DeFi operates on the fundamental concept of “fnancial primitives,” which are the basic building blocks that include lending, borrowing, trading, and other fnancial services. These primitives can be combined and reassembled to create complex fnancial products and services. By utilizing blockchain technology and smart contracts, DeFi enables users to interact with these fnancial primitives in a decentralized manner, without the need for banks, brokers, or other intermediaries.

A central feature of DeFi lies in the utilization of decentralized applications, or dApps for short. These applications provide an array of fnancial services through the implementation of smart contracts on blockchain networks, such as Ethereum. dApps grant users access to a diverse range of fnancial tools and services, like lending and borrowing platforms, decentralized exchanges, asset management solutions, insurance options, and even prediction markets.

DeFi holds tremendous potential, with the capacity to bring about signifcant changes in the fnancial sector. It can help increase access to fnancial services for those who are unbanked or underbanked, promote fnancial inclusion, and lower the entry barriers for new market players. Moreover, DeFi can enhance market efciency by simplifying processes, cutting transaction costs, and boosting transparency.

One of the most notable benefts of DeFi is the removal of intermediaries, which can lead to a considerable reduction in transaction fees and processing times. This change makes fnancial services more accessible, allowing both individuals and businesses to manage their fnances more efciently and with increased independence. Additionally, DeFi connects people worldwide, ofering opportunities to those who may have been previously excluded due to factors like geographical location, credit history, or limited resources.

It’s essential to recognize that DeFi goes beyond cryptocurrencies and tokens; it covers a broad spectrum of fnancial instruments and services. While cryptocurrencies have played a vital role in DeFi’s rise, the movement expands further to encompass a variety of inventive fnancial solutions.

Despite its promising advantages, DeFi also comes with its fair share of challenges and limitations. As an emerging industry, many DeFi applications have not yet reached their full potential or maturity. The ecosystem continues to develop, and users must overcome the learning curve of interacting with decentralized platforms and grasping the inherent risks involved.

Regulatory and legal issues present another signifcant obstacle for DeFi. Governments and regulators worldwide are trying to understand and address the implications of decentralized fnance, raising concerns about compliance, consumer protection, and the prevention of fraud and money laundering. To achieve widespread acceptance of DeFi, it’s crucial to overcome these regulatory hurdles and ensure the industry operates within a clearly defned legal framework.

Blockchain technology serves as the lifeblood of DeFi’s ecosystem, providing the infrastructure for secure, transparent, and programmable fnancial transactions. At the heart of this system are smart contracts, self-executing agreements whose terms are encoded directly into the blockchain. These autonomous contracts enable a wide range of DeFi applications, from lending and borrowing platforms to decentralized exchanges, ofering users a myriad of opportunities to engage with the world of fnance in new and innovative ways.

In conclusion, DeFi represents a transformative shift in the fnancial industry, with the potential to create a more open, transparent, and accessible fnancial system. However, realizing this potential requires overcoming the current limitations and challenges associated with the industry’s early stage, as well as addressing regulatory and legal concerns. Like the early days of the internet, DeFi may face skepticism and uncertainty, but with continued innovation, collaboration, and thoughtful regulation, it has the potential to fundamentally reshape the way we interact with and understand fnance. Let’s dive deeper…

In May 2020, the DeFi landscape was still in its infancy, with only $1 billion locked in DeFi protocols, as reported by DefLlama. However, by January 2021, the ‘’DeFi degens’’ had poured over $20 billion into DeFi’s smart contracts, and by the end of 2021, that fgure had skyrocketed to an astonishing $212 billion.

Despite the market fuctuations, including notable events surrounding Terra/ Luna fasco, FTX collapse, and other key players that contributed to the current bear market, DeFi has remained resilient. As of April 2023, there is still an impressive $62 billion locked in the DeFi ecosystem.

DeFi boasts several noteworthy characteristics but It’s essential to understand that while it removes the need for third-party intermediaries, it does not guarantee anonymity. Though your transactions may not include your name, they can still be traced by entities with access, such as governments, law enforcement agencies, or organizations dedicated to safeguarding fnancial interests.

But let’s have a look:

• Accessibility: DeFi is “open” in the sense that anyone can participate by creating a wallet, often without needing to provide personal information such as name and address.

• ❖Speed: Funds can be transferred almost instantaneously via blockchain, eliminating the need to wait for bank transfers to clear.

• ❖Competitive rates: At least for now, DeFi ofers better rates than traditional banks, although transaction costs may vary depending on the blockchain network utilized. Long live Ethereum!

• Composability: Often referred to as “Money Legos,” DeFi applications can seamlessly integrate with one another, enabling users to create, modify, combine, link, or build upon existing DeFi products without seeking permission.

DExs are peer-to-peer platforms that enable direct cryptocurrency transactions between individuals and protocols. In the conventional fnancial trading world, “market-making” is a widespread practice where entities or individuals provide buy and sell prices for immediate transactions. DExs tackle the issues of centralized exchanges by allowing traders to maintain control over their funds and carry out transactions directly on the blockchain.

Centralized exchanges, such as Coinbase or Binance, necessitate users to entrust their assets to the platform for every trade. In contrast, decentralized exchanges eliminate the need for an intermediary, permitting users to trade directly with each other. As mentioned in our previous piece, Uniswap currently ranks as the top DEx, allowing users to list new tokens for trading as well. While this increases risks due to a lack of screening, it ofers early investment opportunities in new assets before they become widely available.

DEXs ofer numerous advantages, including reduced counterparty risk, censorship resistance, and enhanced privacy. Since users don’t have to deposit their assets with a centralized authority, they face a signifcantly lower risk of hacks or thefts. Moreover, DEXs are less susceptible to government

intervention, as their decentralized nature makes it challenging for regulators to shut them down or control their operations.

Despite these advantages, DEXs also face certain challenges, including lower liquidity and slower transaction times compared to centralized exchanges. However, with the development of innovative solutions like Automated Market Makers (AMMs) and Layer-2 scaling solutions, the DeFi community is actively addressing these challenges and enhancing the overall user experience.

Automated Market Makers (AMMs) serve as a critical component, enabling permissionless and automatic trading of your digital assets. They accomplish this through the use of liquidity pools rather than a traditional market made up of buyers and sellers.

Imagine an AMM as a “robot” consistently prepared to quote a price between two assets. Various AMMs use diferent pricing algorithms; for example, Uniswap employs a simple formula, while others like Curve and Balancer utilize more complex ones.

In contrast to traditional exchanges that rely on order books, AMMs determine asset prices using a specifc pricing algorithm.

The formula for each protocol can difer. Uniswap’s pricing model, for instance, is based on the equation x * y = k, where x represents the amount of one token in the liquidity pool, y denotes the amount of another token, and k is a fxed constant that ensures the pool’s total liquidity remains constant.

Think of AMMs as a peer-to-contract (P2C) system. There’s no need for traditional counterparties, as trades occur directly between users and smart contracts. Since AMMs lack order books, they also do not feature order types. Instead, a smart contract determines the price at which users buy or sell assets.

While traditional counterparties are not necessary, someone still needs to create the market. This is where liquidity providers (LPs) come in. These users supply the liquidity within the smart contract, allowing the AMM to function efectively. By ofering liquidity to the pools, LPs play a vital role in maintaining the seamless and efcient operation of AMMs in the DeFi landscape.

Liquidity in the world of fnance refers to the ability to swap assets quickly and efciently without causing a signifcant impact on their market value. DExes built on the Ethereum network initially struggled with providing adequate liquidity due to a limited number of market participants.

The invention of AMMs brought forth a solution to this issue by creating liquidity pools and incentivizing users to deposit their assets as liquidity providers. A well-funded pool ensures seamless trading on DEXes and a better overall user experience.

Several prominent AMMs within the DeFi space have developed their unique approaches to address liquidity:

• Uniswap transformed the landscape by enabling the creation of liquidity pools with any two ERC-20 tokens in a fxed 50/50 ratio, becoming a widely adopted model in the Ethereum ecosystem.

• Curve Finance (often called the ‘’Backbone of DeFi’’, specifcally targets liquidity pools comprising similar assets, like stablecoins, which leads to highly competitive rates and efcient trading. This approach efectively tackles the issue of limited liquidity in DeFi.

• Balancer advances the idea further by allowing users to create dynamic liquidity pools containing up to eight assets with customizable ratios, ofering greater versatility to AMMs.

The AMM model allows anyone to serve as a market maker by depositing funds into a liquidity pool. The rewards for liquidity providers vary depending on the specifc platform. For example, Uniswap v3 presents three diferent fee tiers for each pair: 0.05%, 0.30%, and 1.00%. Other platforms or forks might set diferent fee structures to entice more liquidity providers.

Ensuring ample liquidity is vital because it minimizes slippage for large orders, which encourages more trading activity on the platform. This increased volume, in turn, contributes to the growth and overall success of the DeFi ecosystem.

Oracles hold a crucial position in crypto, especially as the DeFi landscape continues to fourish. At frst glance, the term “oracle” might evoke images of ancient prophets or messengers; however, in the world of crypto, oracles serve as vital links between realworld data and blockchains.

Without oracles, blockchains resemble computers without internet access – invaluable but somewhat limited in terms of connectivity and interoperability.

Oracles essentially function as intermediaries, integrating with smart contracts to deliver a wealth of real-time information. They are crucial in establishing trust within the DeFi ecosystem.

For example, imagine an Ethereum-based betting app that operates through an escrow or smart contract. Two users, John and Bob, place a bet on the BTC/USD price over one month, locking their ETH into the smart contract. At the end of the month, the contract automatically disburses the funds to the winner. But how does the smart contract know the BTC/USD price? This is where oracles come into play.

Typically, major crypto exchanges like Coinbase or Binance provide the necessary information through APIs. The smart contract acquires this information through an oracle. Since Ethereum smart contracts are self-contained and lack access to of-chain data, they often rely on an external provider (an oracle) for such data points. This challenge is known as the “oracle problem” and poses a signifcant barrier to decentralization.

Thankfully, we have solutions. Oracles unlock the full potential of smart contracts by facilitating access to use cases that would otherwise be unattainable. By connecting the crypto world with real-world assets, oracles help bridge the gap between the two realms.

Though decentralized oracles can be slow and costly, they are also challenging to manipulate, ofering a higher level of reliability.

Some notable Oracle solutions in DeFi include:

• Chainlink: As one of the most popular decentralized oracle networks, Chainlink provides reliable and tamper-proof inputs and outputs for complex smart contracts on various blockchains. Chainlink uses a network of independent node operators that source data from multiple providers, ensuring data accuracy and minimizing the risk of manipulation.

• Band Protocol: Band Protocol is a cross-chain data oracle platform that connects real-world data and APIs to smart contracts. It provides a decentralized and scalable solution for data sourcing and aggregation, ensuring data integrity and security. Band Protocol uses a unique dual-token system and a delegated Proof-of-Stake (dPoS) mechanism for its decentralized oracle network.

Decentralizing the process of bringing of-chain data onchain can be difcult, which is why it’s often part of a “gradual decentralization” plan.

Lending and borrowing are central to the fnancial system, with most individuals engaging in these activities through mortgages, student loans, and other credit products. Traditionally, centralized platforms like banks or CeFi platforms such as Nexoi and Unchained Capital have facilitated these transactions by taking custody of depositors’ assets and ofering a modest but secure return.

DeFi on the other hand, introduces innovations in efciency, access, and transparency to the lending and borrowing process. Unlike traditional methods, it enables users to become borrowers and lenders without the need for personal information or KYC procedures.

Furthermore, DeFi allows users to maintain control of their funds at all times through the use of smart contracts on open-source blockchains. Lenders deposit assets into a lending protocol, while borrowers draw funds from the same protocol. Both parties can redeem their assets or repay their debts at any time.

To become a lender, users deposit their coins into smart contracts and receive newly minted, protocol-native tokens (e.g., aTokens for Aave, cTokens for Compound, Dai for MakerDAO) in return. These tokens represent the principal and interest accrued and can be redeemed at any time. The annual percentage yield (APY) is determined by the ratio between supplied and borrowed tokens in a specifc market.

Borrowers, on the other hand, can access loans from these protocols by providing collateral. Typically, these loans are overcollateralized, requiring borrowers to deposit more in crypto than they borrow. However, some protocols, like Maple Finance, ofer under-collateralized loans or a combination of both.

While DeFi has signifcant innovations, they are not without risks. Smart contract risk, in which public code is targeted by hackers exploiting vulnerabilities for personal gain, is a common concern. Additionally, users must exercise extreme caution when managing wallets and addresses. Errors such as sending funds to an incorrect wallet or losing a private key can result in permanent loss of funds – a risk less likely to occur under the protective umbrella of traditional CEX platforms. Although, in the past year we’ve seen that even then, your funds are not SAFU. You know what they say:

In summary, decentralized fnance ofers notable improvements in efciency, accessibility, and transparency over traditional fnance as we know it today. However, users must remain vigilant in the face of potential risks associated with smart contracts and wallet management to make the most of these innovative fnancial solutions.

Keep in mind that was only a glimpse into the vast universe of DeFi. It’s impossible to cover every single detail in a single article. Essentially, the more you explore, and engage with dApps and smart contracts, the more you’ll broaden your knowledge and experience. However, I’d like to think we addressed some fundamental aspects and ofered a starting point for beginners.

In the upcoming article of the next issue, we will dive deeper into other crucial DeFi components, such as Yield Optimizers, Governance Tokens, Interoperability, and more advanced topics. By the end of this exciting DeFi journey, I hope you’ll be buzzing with newfound insights (unlike me when I frst started ), illuminating the current state of the ecosystem, its rapid growth, and the limitless potential that awaits!

‘’Not your keys, not your coins’’.

NFT.NYC

The Moon Mag was invited to attend the NFT.NYC conference in New York and whilst we were there, we learnt more about some really exciting projects and the team behind them. In this issue, Lisa interviews Michael Sanders of Horizon Blockchain Games.

LISA: Lisa N Edwards reporting for the Moon Mag and I’m here at NFT.NYC with Michael Sanders from Horizon Blockchain Games. How are you, Michael?

MICHAEL: I’m doing wonderful. How are you, Lisa?

LISA: I’m super excited to have you here because your project is so exciting. You’re integrated with ImmutableX, you’ve got games, you’ve got wallets....so tell everyone about it!

MICHAEL: Yeah so at Horizon Blockchain Games our focus is to make web3 easy, fun and powerful for users, builders, and everyone you know and so we have Sequence, which is an all-in-one developer platform and smart wallet to make building web3 games, applications, NFT experiences easy and then we also built a game called Skyweaver, which is a premier web3 trading card game, which is really exciting.

LISA: So they go on to Skyweaver. They are NFT’s are they?

MICHAEL: They are, they’re SFT’s so ERC 1155 semi-fungible tokens. Some people collectively call them NFT’s but technically they are SFT’s.

LISA: So with Horizon, what’s the next thing on the horizon?

MICHAEL: Yeah so I’ll cover Skyweaver quickly. We have a lot of Hearthstone and Magic The Gathering and Pokemon professionals and most of our player bases have never had a crypto or web3 experience before. We’ve been building it for 5 years, it’s been in open beta for a little over a year and now we brought on a gaming director who used to work on Hearthstone and we’re focused on making it more accessible to a more casual audience and really increase the player base. Then on the Sequence side of things, we have around 65 diferent projects that have either integrated or are in the process of integrating and these range from games to marketplaces to things like loyalty programs, and even ride-sharing apps. It’s mostly games, about 70, but Sequence really enables all kinds of web3 experiences that are oriented towards the consumer and the end user.

LISA: So if you have a web3 idea and you know you don’t know where to go, can we come to Sequence and do that?

MICHAEL: Yeah, absolutely because Sequence is compatible with all EVM-compatible networks and if you need it all, we have this full stack of comprehensive tools to build your application like the smart wallet, relaying for gasless transactions, indexer to query all the data on the blockchain, marketplaces SDKs for Unity Unreal Engine, mobile web, like everything you need. We would absolutely love to help. We just love supporting great projects.

LISA: So who’s your biggest competitor in the market? Is it ImmutableX?

MICHAEL: No, I think we’re more collaborative with ImmutableX. I think our companies may have started even in like the same month, we both made a trading card game, both working on developer stuf but they’re EVM compatible. We’re friends with them, we’re all working together and we’re, you know, our team’s distributed all over the world, we’re based in Canada, so yeah, that’s the thing with web3, everyone is everywhere and it’s so easy to collaborate with everyone.

LISA: So if I had an awesome game idea and I came to you, how would I go about pitching that? Only because I know a lot of people are interested in that.

MICHAEL: Yeah so we don’t actually build games for anyone but we provide them with all the developer tools for them to make the game. If you have a concept and you need a game studio to actually build the game for you, we work with diferent partners in studios and agencies that can assist you with that. We’re more like at the infrastructure and developer tools level and if you have a project you can just reach out to us. Go to sequence.xyz, ping us on our Discord or email us and we’ll be happy to help you out.

LISA: That’s awesome. So what’s next for you guys? You’ve been speaking here at the conference and it’s been an epic conference with literally thousands of people and they’re so into all the NFTs, all the gaming, all the brands, all the diferent stages and I sat in on one of your talks earlier and it’s just so epic.

MICHAEL: Awesome! Yeah, thank you! For us it’s just really about supporting as many projects as we can, like just scaling adoption you know, getting more developers and builders using our tools so that we can grow this ecosystem and yeah, again it ranges from games to loyalty programs, NFT tokens games experiences, like all sorts of consumer-oriented stuf and being here is really special because like you said, you know you can hop on Zoom calls or Google or whatever but just being in person with someone, there’s a diferent energy to it. Defnitely a little more opportunity for serendipity and just human connection and conversations that aren’t restricted to the 30-minute mark ending on your calendar! So it’s really special and just being exposed to new ideas that perhaps you wouldn’t take the time to schedule a call about but then you realise like oh wow, there’s actually a lot of synergy here and I’m super curious about, for example, where web3 music is or where web3 is going to help music. I don’t think anyone’s fully fgured it out but lots of great, great ideas and then gaming, I think is pretty obvious this is the future of gaming. I mean it’s tremendous because I’ve been in crypto since 2010, like nearly as long as you I think, so that’s like 13 years and, you know, it originated with Bitcoin and now we have all these incredible decentralized applications to the point that I think in four or fve years from now, no one’s even gonna talk about web3, it should be like of course, it’s ubiquitous, that’s what we all use and it’s been a magical evolution and a wonderful journey to participate in.

On November 1st, 2018, a groundbreaking event took place in New York City that brought together innovators, creators, and enthusiasts from all corners of the world. The NFT NYC Conference was the frst-ever conference solely dedicated to non-fungible tokens (NFTs), and it was a resounding success.

Flash forward to April 12-14, 2023, and TheMoonMag.com attended the latest NFT.NYC conference!

The NFT NYC Conference was a three-day event this year that featured a wide variety of speakers, panels, and workshops on all things NFT-related. Attendees were treated to insights from some of the biggest names in the industry, including one of our favourite YouTubers - Tom Bilyeu.

The major sponsor this year was IMMUTABLE X which we have covered in both issues 6 and 17.

https://themoonmag.com/ issue-17/

https://themoonmag.com/ issue-6/

Non-fungible tokens are unique digital assets that can represent anything from art and music to virtual real estate and rare collectibles. They are created and stored on a blockchain, which ensures their authenticity and scarcity. NFTs have exploded in popularity in recent years, with artists, musicians, and other creators using them as a new way to monetize their work and build a community around their brand.

One of the key themes of the conference was the potential for NFTs to disrupt traditional industries, such as art, music and, of course, flm, and that is why I was there, for CoinrunnersMovie.com.

Speakers discussed how NFTs can give artists, musicians, flmmakers and writers greater control over their work and create new revenue streams. They also talked about the importance of building a community around NFTs and using them to create a more democratic and decentralized art world.

Another important theme of the conference was the environmental impact of NFTs. Because NFTs are created and stored on a blockchain, they require a signifcant amount of energy to produce and maintain. This has led to concerns about their carbon footprint and sustainability.

Many speakers addressed these concerns and discussed potential solutions, such as using renewable energy sources to power blockchain networks.

The NFT NYC Conference this year was beamed onto the billboards in Times Square and was a landmark event that showcased the potential of NFTs and brought together some of the brightest minds in the industry at the new conference centre at Hudson Yards.

It was a testament to the growing interest in NFTs and their potential to transform the way we think about art, music, flm and other forms of creative expression. As the NFT ecosystem continues to evolve, events like this will be crucial for bringing together innovators and creators to shape the future of this exciting new technology.

RejuveAI is a pioneering, decentralized, worldwide network that unifes longevity research with artifcial intelligence, focusing on giving people longer live spams. It is a brand-new project in the industry, ofcially launched on March 16th, 2023, to extend its users’ life in a healthy way.

This project has developed a mobile application called “Longevity” to monetize users’ data access. That is, to give information about their diet, lifestyle, and sports they practice, among other aspects, and once this data gets emptied, people will obtain Rejuve.AI tokens ($RJV) as a reward; The application monitors people’s lifestyles intending to give its users advice to help them increase their longevity.

The previous is possible because the customer-provided data gets sent to the company, then goes through an artifcial intelligence model, which analyses statistics showing the shared characteristics among those who live the longest. This data is kept secure and private through Blockchain technology.

Singlarity.Net, a leading AI project, supports Rejuve. AI and some of the developers of Rejuve.AI previously worked at SingularityNET, among them its founders, Jasmine Smith, Deborah Duong, and Ben Goertzel (the latter CEO of SingularityNET). Let’s get to know a little more about her team:

Jasmine Smith, with a Health Information Management degree and a specialization in Informatics and previous experience working as Community Manager at Singulaity.Net, is the projects’ executive director; her worldwide travels and experience at SingularityNET led her to Rejuve.AI inspiring her to attack the challenges in human longevity area, research relying on AI and making them afordable and accessible to many people.

Deborah Doung, who was also part of Singulariny.Net in the AI department, is now the director of AI development at Rejuve and has extensive experience in complex adaptive systems and a philosophy background. She has also developed social simulations based on intelligent agents to study selforganization and the appearance of complicated social patterns. Her research lies between artifcial intelligence and computational social science.

Last but not least is the great Ben Goertzel, an American mathematician, and programmer known for coining the “general artifcial intelligence” term, is the founder and CEO of SingularityNET, and is also known for the magic behind humanoid robots.

More than 15 passionate experts in relevant areas complement this team, striving to make the company’s mission a reality. People trained in AI, medicine, international business, bioinformatics, and others, seek to develop an efective platform that meets the goal of helping people achieve a better quality of life, thus making longevity a fact.

Now then, the project has a native token within the Rejuve.AI network known as $RJV and customer data-linked NFTs that can get exchanged for Rejuve.AI products and services. In other words, each NFT represents user data, which will receive profts from Rejuve.AI in perpetuity, meaning that whenever Rejuve.AI makes profts, it will get shared among all NFT owners.

Rejuve.AI’s mission is to fnd advanced longevity therapies and solutions to make them available and afordable to all who want them while fairly compensating the data scientists who have made these discoveries possible. Let’s start with our detailed dive.

Currently, in the longevity market, the frst products have been targeted at those with the purchasing power, given their high acquisition costs. And the data leading to these products have come from the general population through the frequently used technology devices, often without knowing. But these users do not immediately receive benefts for their contributions.

Motivated by this problem, the Rejuve.AI project wants to solve it by rewarding credit for the contribution ofered by users with their data to advance longevity research.

Users will receive tangible benefts, such as early access to health-related therapies at reduced

prices, by incentivizing people to contribute their data to the company’s research.

Rejuve is a SingularityNET spin-of, a decentralized marketplace for AI, and an ecosystem for creating artifcial general intelligence (AGI), and Rejuve’s incubator in 2018 and now serving as a channel for Bio-AI research. Longevity is a natural ft for futurism/AI, with many tech enthusiasts desiring a longer life to witness the achievements they aspire to.

The principal tool behind this technology is the Longevity mobile app, through which all data collection is possible, ofering customers diferent ways to volunteer information, such as surveys, lab tests, and the use of the technology behind wearables or multitasking devices, all in exchange for $RJV tokens.

This personal health record will function as an electronic personal health record (ePHR), giving Rejuve.AI and collaborating laboratories a better time performing measurements and interventions to help with research.

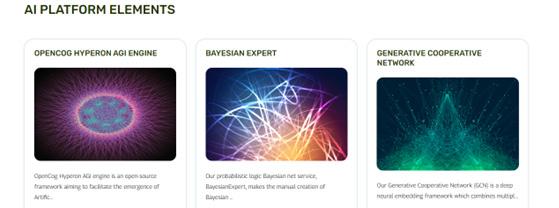

For the whole process to work, the AI in the Rejuve network is essential, as it is responsible for analyzing data that helps fnd previously impossible solutions. It is an AI that aims to create dynamic and multiresolution models of the human body, all in the company of precision medicine, the AI integrated with Rejuve.

In this way, they resort to neural and Bayesian networks, which, although diferent, are powerful machine learning models. Neural networks, for example, have proven to be very efective in learning complex patterns and have also been fundamental in advancing the feld of artifcial intelligence. Bayesian networks, on the other hand, are generally used for tasks such as prediction, classifcation, and decision-making under uncertainty.

But the use of these networks is not all; they also resort to simulations as a powerful tool to develop and test artifcial general intelligence (AGI) engines such as OpenCog Hyperon, which, through the creation of simulated environments and scenarios, developers can test and improve the system’s ability to learn, reason and resolve conficts in a wide range of situations.

And at this point, we add the Cooperative Generative Network (GCN), similar to the Generative Adversarial Network (GAN). Both generate new data similar to a training set.

However, while GANs use two competing neural networks to generate new data, GCNs use multiple neural networks that cooperate to create new data, allowing crowdsourcing of AI models from other scientists to develop a simulation based on the principles of consensus in complex adaptive systems.

As for the channel used to test the wonders promised by this technology: The Longevity app has recently closed its beta version and expects to launch during the second quarter of 2023; let’s see how it works.

The beta version of Rejuve.AI’s Longevity application was frst launched in July 2022 for the community to test the project opportunities and the app functionality itself.

The Longevity installation (now closed and completed) was a simulation of the fnal iteration, scheduled for release in the second quarter of the year; it did not ofer real RJV tokens, and any longevity research took data provided by users, deleting all the data at the end of the Longevity beta version.

However, they would retain basic information such as emails, bug reports, and comments to validate any Beta Tester rewards, but not health data). The beta version gathered approximately 1500 Beta testers from more than 60 countries worldwide.

The application displays a system that lists the score, which indicates the users’ general health level and allows them to compete with others in the network. For that, the system has several evaluation criteria, like, as measuring blood pressure, cholesterol levels, sleep hours, personalized diets, nutritional interviews, lab reports, and more.

Next, the AI will take collaborative AI models from the scientifc community to build a dynamic, multiresolution mechanical model of the human body, used by members of the AI and medical researcher network to develop new drugs, therapies, and treatments exclusively for longevity; If necessary, biological user data and DNA analysis will get uploaded to the app through photographs.

In addition, to achieve further goals, all user data provided is intended to be used in the future. Hence its engagement with other organizations, including supplement and test providers, research organizations, biopharmaceutical companies, and others focused on longevity and health.

As we highlighted above, within the Rejuve.AI technology, there is the native token of the network, which has several functions and purposes, such as rewarding users through their contribution to the Longevity project. Supplements, medical tests, personalized plans to live longer, and more can be purchased at afordable prices using the app’s tokens.

Rejuve is an ERC-20 utility token, a fungible token used for transactions between network members and to reward data contributions, that works over the Cardano network and the AGIX (SingularityNET) network. When the network formation is complete, a fxed token number will get minted, ensuring a stable token supply and potentially increasing its value. It is also a token

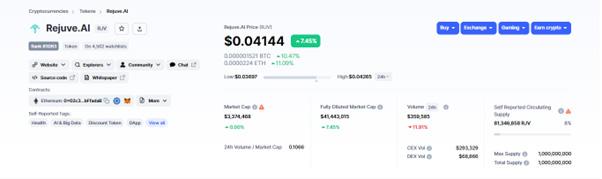

Rejuve.AI $RJV token data.

Source: CoinMarketCap

The top cryptocurrency exchanges to trade shares of Rejuve.AI are Bitget, BingX, Gate.io, MEXC, and Uniswap v3 (Ethereum). The current price of the token is $0.04144, with a 7.45% increase in the last 24 hours; This is according to the data provided by CoinMarketCap shown in the image.

Price chart of $RJV

Source: CoinMarketCap

Furthermore, the data also details that the token in question has already bottomed, which could suggest a rebound from this level. The current market cap of $0 USD. The 24-hour trading volume is $ 359,585.79 USD.

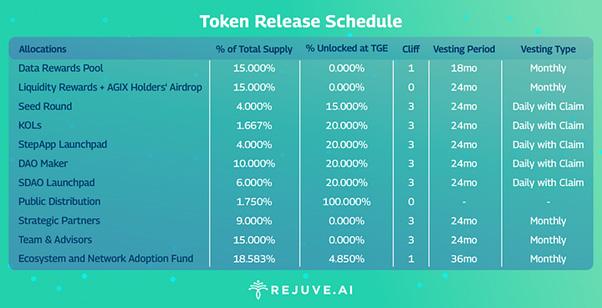

The token ofcially launched on March 16th on three launch pads and four blockchains, completing the public round in a 72 seconds record. They also shared with the community the token allocation categories and structure.

Source: REJUVE.AI

In general, these categories of token allocation in the Rejuve network aim to grow the development of the platform and the ecosystem of this technology. Prominent among them are:

• Liquidity Rewards + AGIX Holder Airdrop aimed at incentivizing users to maintain AGIX.

• Data Rewards Group which is designed to incentivize users to contribute their health data to the Rejuve.AI platform.

• TGE Launch and Distribution, designed to support the launch and distribution of Rejuve. AI tokens, among others detailed in the image above.

So, as it provides transparency and clarity regarding token allocations, Rejuve gains users’ trust, something critical to pursue long-term success.

However, the $RJV utility token is not the only protagonist in this network. There are more tokens linked to NFTs or non-fungible tokens; We will quickly summarize their participation in this economy.

• Rejuve ID/Data NFT: This is a unique identity token associated with each member of the Rejuve network that contributes data, which tracks permissions to use data through a permissions hash.

• The Rejuve Product NFT: An ERC-721 NFT fragmented into ERC-20 utility tokens, representing data contributors’ ownership stake in a product. These tokens are distributed to data owners in proportion to their contribution to a generated product, and product revenue is distributed in the form of RJV tokens to pNFT shard holders in proportion to the number of shards they own.

• The Rejuve Product NFT coupon: An ERC1155 token that is given as a prize to stakers in an NFT challenge stakes pool at the time the community solves a challenge. It provides a discount on the product that NFT manufactured for the winning idea of the challenge.

A curious fact to note is that network members who do not contribute data can buy pNFT tokens from members who contribute data, join research groups, and get discounts on the application if they have RJV tokens.

In addition, this project values the participation of its network members, so it wants to involve them

in decision-making, especially when managing member data. Rejuve is committed to implementing a decentralized autonomous organization (DAO) structure to achieve this goal.

A DAO is an organization that operates autonomously, where decisions go through consensus mechanisms rather than a centralized authority. In this model, network members would have ownership and decision-making power over the Rejuve network. This type of structure aligns with the ideals of the SingularityNET ecosystem, which values decentralization and community governance.

The transition to a DAO will happen through progressive decentralization, which involves gradually shifting power and decision-making to network members. This approach allows for a measured and intentional transition, from a traditional organization to a community-governed self-organized entity.

Overall, it appears that Rejuve is committed to creating a network that values its members and operates in a transparent and decentralized manner, with decision-making power distributed among network members through a DAO structure.

As we saw in our introduction, Rejuve.AI allows users to share their data for research, which will subsequently bring a double beneft: Achieving a healthier, longer life and getting rewards for following these tips. In addition, researchers who contribute resulting discoveries can get rewarded like the users.

The Longevity app achieved a positive reception from the users who participated in the beta test, generating feedback from the general public and experts in the health sector, especially doctors. The team behind this project intends to continue to build on its momentum after its ofcial launch in response to market demands, considering user feedback. For the time being, they will continue with their development plans in three phases:

The frst is the mobile application Google Play Store and Apple Appstore launch. The second phase plans to spend $RJV tokens in the in-app rewards store and close with tokens for data contribution. All aim to culminate before the end of the year. Let’s take a look at their roadmap.

At this stage, the project could include several features that will improve the existing application, for example, the inclusion of wearable devices and the incorporation of biomarkers that give more accurate health monitoring to the user.

It is also hoped that the inclusion of these new features will help customers to more accurately estimate their biological age, which in turn will help to improve overall health.

Another foreseen addition in this stage is the incorporation of RJV tokens rewards, to be given after completing diferent tasks within the Longevity application, intended to motivate users to contribute to the project by providing more information and data of interest to help advance longevity-related research.

Another relevant point is the special partner ofers available (expected to be renowned in the health and longevity feld) that the app plans to launch for all those who download the application in a limited period, helping to increase the app’s interest and visibility.

The second stage expects to include features related to gamifcation and rewards to users, where they will contribute health data to help research and develop future features within the app while maintaining anonymity. However, those who lead a healthy and active life will also be able to receive rewards. What they are looking for through this is for customers to acquire healthy and sustained habits over time.

At this point, it will also be possible for Longevity app users to spend their RJVs in the in-app rewards shop. This rewards shop will ofer several options that can get exchanged with RJV tokens and which will have to do with services or products linked to longevity. These include discounts on premium subscriptions.

This stage will be activated months after RJV spending gets enabled in the rewards shop.

In this last stage, the project foresees the creation of a social network within the Lonvegity application where users can connect and interact with other community members with similar interests to discuss, compare, and measure their progress. It also starts rewarding tokens for data contribution, initiating Data Commons, i.e. a centralized database where all the collected data from users who have given their consent to participate is stored, and users receive RJV tokens in return.

The project has the purpose and priority of safeguarding the security of user data, which is why these new features will work to shield its privacy with the latest security generation. If the wish to stop sharing data appears, customers could remove it from the system.

However, to become a contributing member of the data-sharing network, it will be necessary to complete a series of steps such as Completing identity verifcation (KYC lite), signing a data consent form as well as beginning the minting of unique NFT data, which will serve as an identity token for Rejuve Network.

Once completed, customers can submit data regularly in exchange for RJV tokens.