Bought To You By themoonmag.com

Editorial

A note from Lisa…

Welcome to the June edition of The Moon Mag, where you get - FACTS, NOT HYPE!

As we head into the last month of the Australian tax year, we reflect on the first half of this year, with steep interest rate rises, which still sees the United States facing an economic crisis as central banks collapse, leaving uncertainty in their wake.

In the midst of this chaos, Bitcoin emerges as a potential game-changer. Let’s explore the crisis, crumbling banks, and the disruptive rise of Bitcoin, signalling a paradigm shift in the economy.

So what does this look like? Mounting debt, income inequality, and market volatility have rendered the USA economy fragile. Bank collapses intensify the crisis, eroding public trust in traditional banking. Is this the period going to be known as “The Banking Sector: Great Fall”?

Reckless practices, poor risk management, and speculative investments lead to bank collapses. Complex financial instruments exacerbate the situation, causing a credit crunch and further economic decline.

And what it seems to no coiners… is Bitcoin… The Ray of Hope? Will they soon be moving their hardearned dollars into this volatile asset?

Bitcoin offers an alternative to the failing banking system. Decentralised and secure, it provides financial autonomy. Limited supply attracts investors as a store of value and hedge against inflation. Its borderless payment system enables fast… and mostly low-cost transactions.

I don’t need to convince you all reading this; I am preaching to the converted… Share TheMoonMag.com with five people you know who know little to nothing about cryptocurrency!

Sharing the Moon Mag with five unaware no-coiners significantly spreads awareness and knowledge of crypto-related topics. It fosters discussions, ignites curiosity, and amplifies Moon Mag’s readership. In turn, creating a ripple effect as no-coiners may further share the Moon Mag, leading to a greater appreciation of crypto; building hype, and bringing more people and MONEY into the broader crypto ecosystem… all You need to do, is tell five friends or forward them a link on your favourite social media platform! Thanks, and enjoy this month’s, Moon Mag!

Lisa

Lisa

A note from Josh…

Memecoin mania has swept the crypto world, providing an entertaining escape from the reality of the crypto market right now, which continues to meander through the bear market. But just today as I write this, there are signs that opportunity is being leveraged in anticipation for greener days ahead. The China Central Television channel did a news report on crypto and it has the Chinese communities buzzing according to CZ, CEO of Binance. He added that moments like this have historically led to bull markets beginning.

The people I see hanging around Crypto Twitter, in our group at GSIC and occasionally, in the outside world(!) are taking moments like this into account and formulating plans but for the proactives ones amongst us, it seems to be the busiest time! We’ve recently just launched a feature within our group at Getting Started In Crypto, which allows for members to create a HODL Portfolio and automatically calculate their bags so that they can Dollar Cost Average their way into the Market. An effective stratgegy according to past results. Members can simply copy the GSIC bags at a click of a button OR create their own bags and we are seeing the latter more and more. It’s been great to see many adding a Moon Mag project or two into their bags. A powerful combination of DYOR and DCA. How many Moon Mag projects have you made the choice to invest in? And if you haven’t, perhaps this latest issue will give you some inspiring insights. Enjoy!

14 DeFi Demystified: Beyond the Basics – Unveiling “Top” Secrets 27 SUMMARY Non-Trading Routes to Crypto Generational Wealth 08 The Rise of Memes: Exploring Crypto’s Funniest Investments 34 TRADERS PERSPECTIVE THE FALLACY OF SCARCITY MINDSET The 4-Year Cycle: Unveiling the Heartbeat of Bitcoin 44

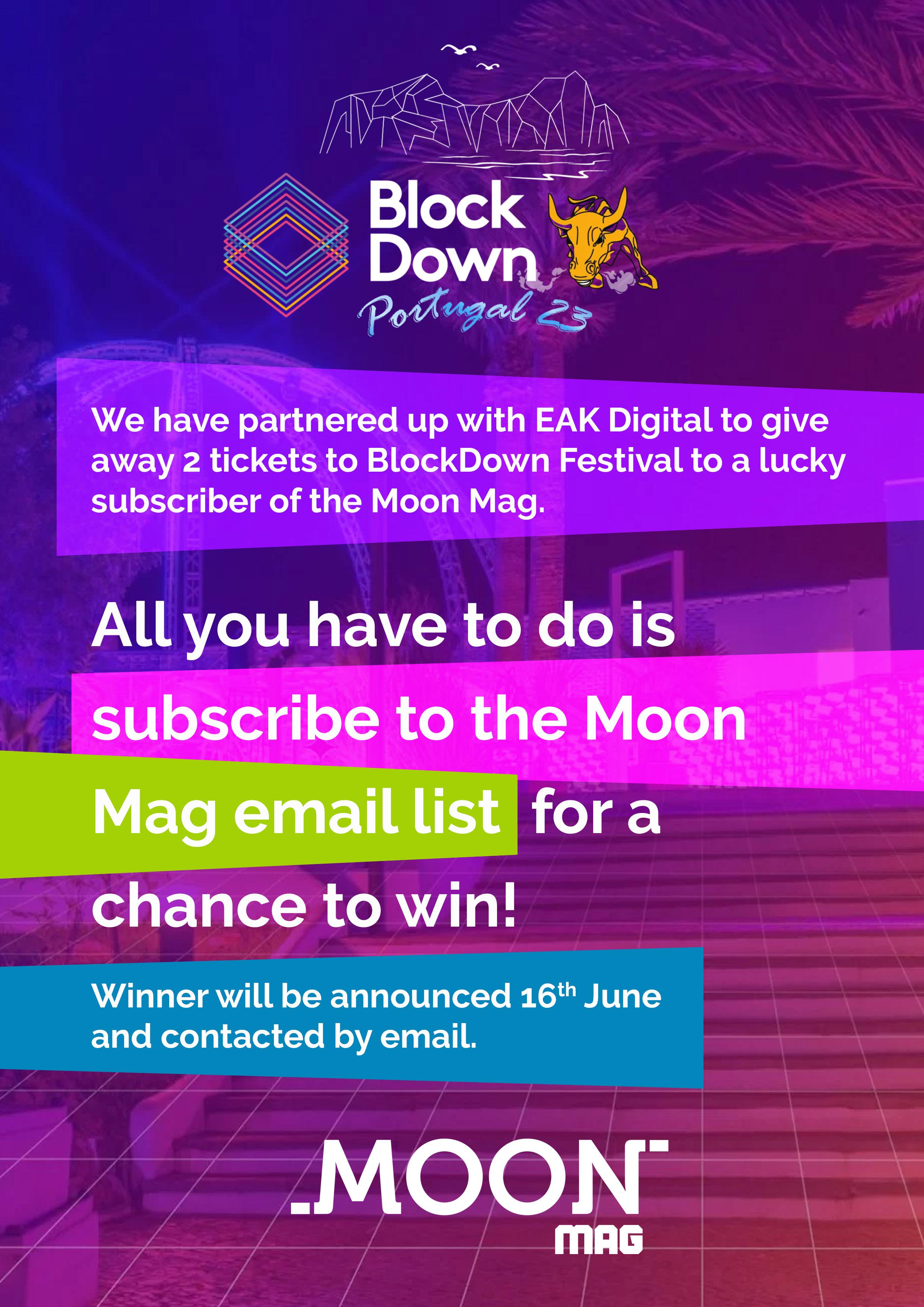

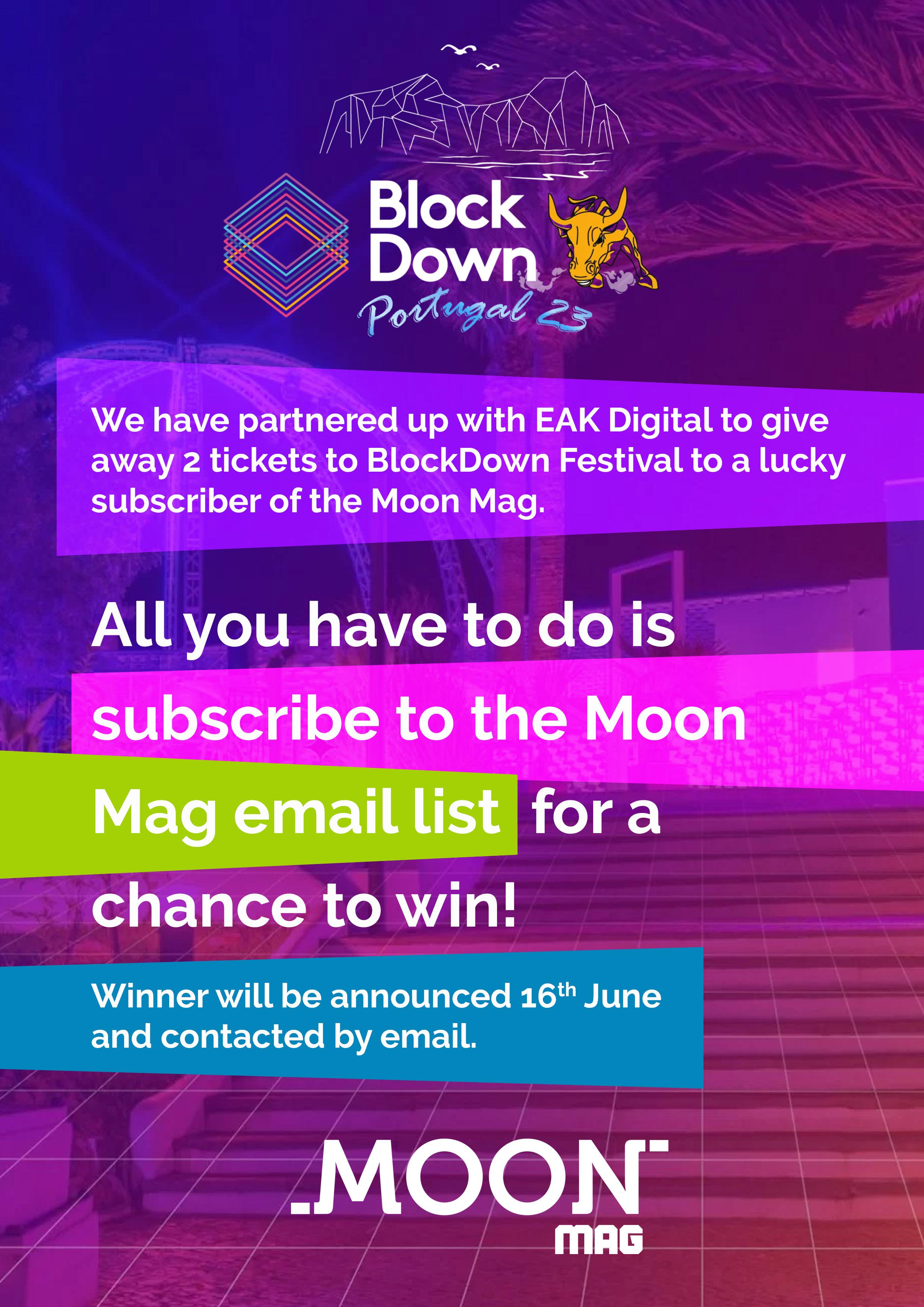

5 Countries Driving the Next Crypto Bull Run and the Benefitting Cryptocurrencies 73 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. The Rise of AI-Driven Crypto Predictions: Can Machines Outperform Humans? Sui: Build Beyond Interview at NFT.NYC with Kenny Johns of Ample 64 BlockDown Festival announces Portugal as its next location for huge Web3 culture festival 68 60 50

CONTRIBUTORS

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R.Paulo Delgado

R.Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Chrom

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Daniel Jimenez

Samantha Jimenez

TRADERS PERSPECTIVE

THE FALLACY OF SCARCITY MINDSET

written by Lisa N. Edwards

written by Lisa N. Edwards

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

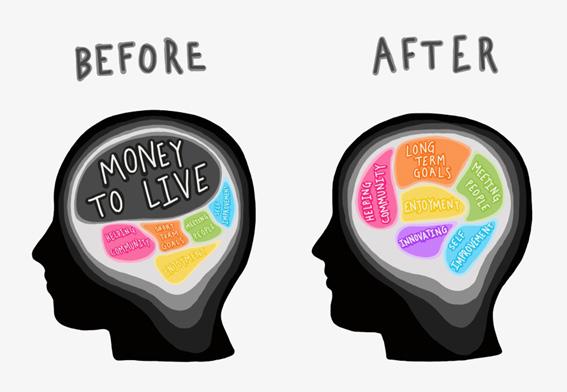

The Fallacy of Scarcity Mindset: Embracing Abundance in a World of Possibilities

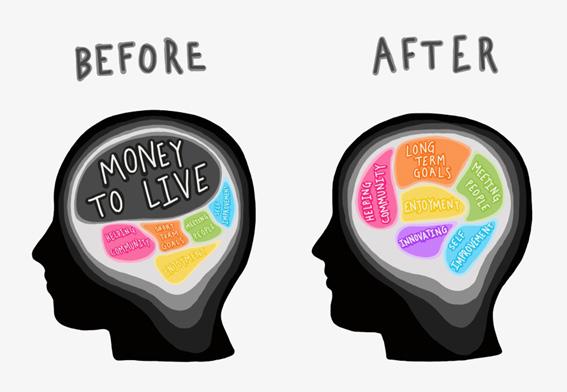

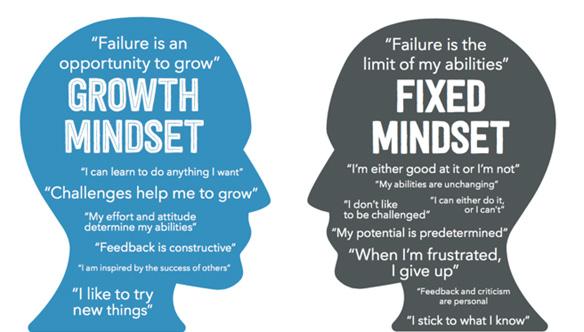

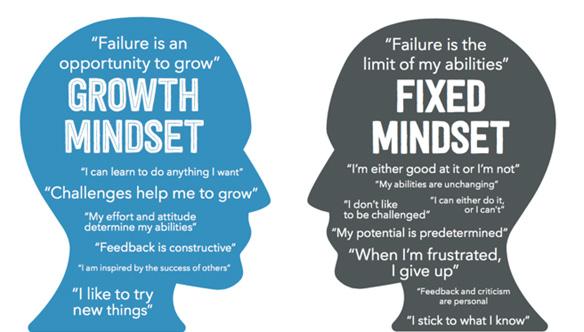

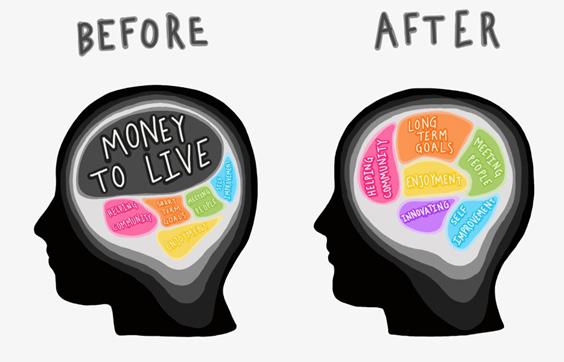

Recently I posted a THREAD (Here) on Sunken Cost Fallacy in the world of crypto; this then triggered me to write this article on the mindset behind this. Trading is predominantly psychological, and all traders must grapple with their mindset and biases to successfully navigate the volatile crypto market. The sunken cost fallacy is just one example of how psychological factors influence trading decisions. Understanding and addressing these mindset challenges is crucial for long-term success in the crypto space.

Sunken cost refers to clinging to an investment or trade simply because of the resources already committed, regardless of the potential for future gains or losses. Traders may be trapped in a cycle of holding onto failing investments, hoping for a reversal in fortunes, and unwilling to cut their losses. This mindset stems from the fear of accepting defeat or admitting mistakes, which can harm profitability.

Moving forward can be as easy as drawing a line in the sand and leaving past trades and failures where they belong in the past, but EGO can get the better of us!

The scarcity mindset has become common in today’s fast-paced and interconnected world. Many individuals believe that resources, opportunities, and success are limited, leading them to adopt a mindset of scarcity. However, this perspective is flawed and can limit personal growth, hinder innovation, and perpetuate a cycle of negativity.

I will explore the fallacy of the scarcity mindset and shed light on the importance of embracing abundance and why positivity matters not to get caught in the negative loop, which can be destructive.

Understanding the Scarcity Mindset:

The psychology behind having a scarcity mindset is deeply rooted in the belief that a finite amount of resources, opportunities, and achievements are available. I am repeating this because this part needs to sink in. People who think this way view life as a zero-sum game, where one person’s gain is another person’s loss. A deep fear of competition, perceiving success as a fixed amount and often feeling threatened by the accomplishments of others.

Fallacies of Scarcity Mindset:

Limited Resources Fallacy:

1. The scarcity mindset assumes that resources are finite and insufficient to meet everyone’s needs. History repeatedly shows that human ingenuity and innovation have created new resources, technologies (blockchain and cryptocurrencies), and opportunities. So let’s look at Bitcoin; we know there are 21 Million Bitcoins created, and once all are gone, there are no more, but looking at this as an asset that can be divided into Satoshis means there is more than enough for everyone. A scarcity mindset thinks this will create only Billionaires holding onto this digital currency when in actual fact, they are more than likely to sell to buy items they want and need enabling others to own this.

Instead of dwelling on what’s lacking, we should embrace an abundance mindset that allows us to tap into our creativity and find more innovative solutions to problems.

Zero-Sum Fallacy:

2. The zero-sum fallacy, inherent in the scarcity mindset, asserts that success or wealth obtained by one person means less for others. However, this perception disregards the potential for mutually beneficial outcomes and the creation of new opportunities. These individuals usually create opportunities for others through entrepreneurial business ventures. Success is expanded, shared, and multiplied when individuals collaborate, support each other, and foster a mindset of abundance.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Benefits of an Abundance Mindset:

Growth and Personal Development:

1. Adopting an abundance mindset opens doors to growth and personal development. When we believe opportunities are abundant, we are more likely to take risks, seek new challenges, and explore uncharted territories. This mindset allows us to expand our horizons, learn from failures, and continually strive for improvement.

Collaboration and Cooperation:

2. An abundance mindset fosters a sense of collaboration and cooperation. Rather than considering others as adversaries or rivals, we regard them as potential collaborators and allies in accomplishing shared objectives. By collaborating, exchanging our expertise and resources, and encouraging each other’s achievements, we can foster a positive and fruitful atmosphere that benefits all parties involved. It is a secure space.

Optimism and Resilience:

3. An abundance mindset instils resilience and optimism in the face of challenges. When we believe ample opportunities are available, setbacks and obstacles become temporary roadblocks rather than insurmountable barriers. This mindset allows us to have a positive outlook, look for alternative solutions, and persevere when faced with adversity.

The fallacy of scarcity mindset is a self-imposed limitation that holds individuals back from realising their full potential. Embracing an abundance mindset liberates us from the constraints of limited thinking and empowers us to see the world as a place of endless possibilities. By shifting our perspective, we unlock our creativity, foster collaboration, and build a future founded on growth, innovation, and shared success. Let us embrace the abundance surrounding us and shape a world where opportunities are plentiful for all.

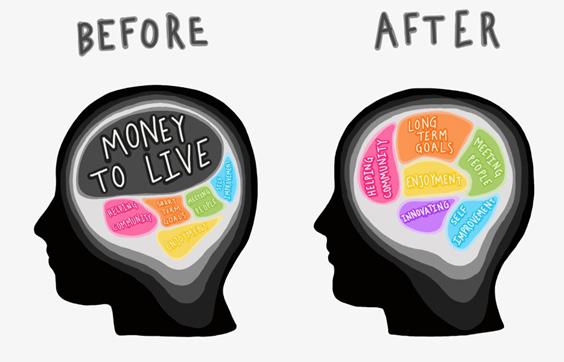

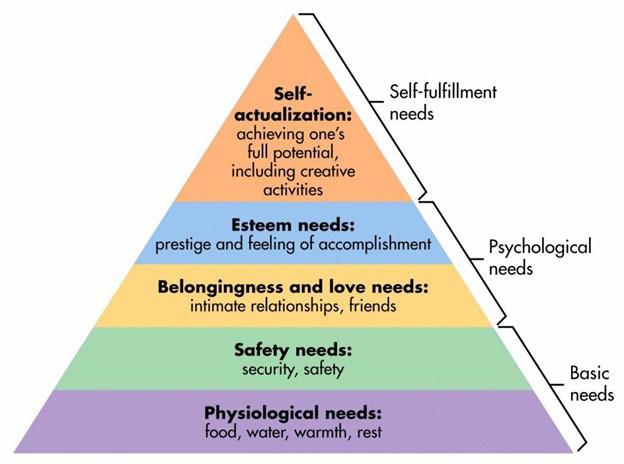

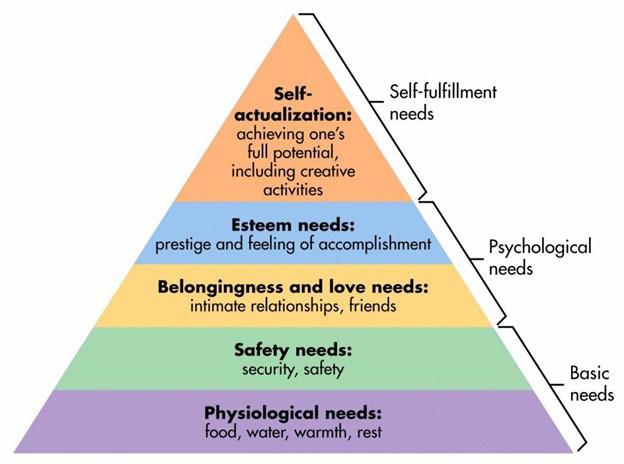

If you’re familiar with Maslow’s Hierarchy of Needs, you’d know that security and safety are human basic needs. But when viewed through a scarcity mindset, it focuses on fulfilling basic physiological and safety needs. In this perspective, individuals prioritise immediate survival and resource acquisition, often neglecting higher-level needs such as social belonging, self-esteem, and self-actualisation. The scarcity mindset can perpetuate a cycle of constant concern for scarcity, making it challenging to progress towards higher levels of personal growth and fulfilment.

Another note for Traders reading this - DON’T MARRY YOUR COINS/TOKENS - Traders must understand that the market doesn’t care about their previous investments or the emotional attachment they have developed towards certain trades.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It is essential to manage emotions effectively. FEAR AND GREED are two powerful emotions that can cloud judgment and lead to impulsive trading decisions. A disciplined trader understands the need to control these emotions and make decisions based on a rational market assessment. This may involve setting stop-loss orders, diversifying the portfolio, and practising patience to avoid making hasty decisions based on short-term fluctuations.

Building a resilient trading mindset also requires accepting that losses are a part of the game. Not every trade will be profitable, and it is crucial to learn from losses rather than dwell on them. Keeping a trading journal to track and analyse past trades can provide valuable insights into one’s trading strategy, strengths, and areas for improvement. It enables traders to adapt and refine their approach over time, increasing the likelihood of consistent profitability.

Our major sponsor GettingStartedInCrypto.com has a risk/ reward tracking sheet where you can write notes on your individual trades so that you can learn from your mistakes and successes. https://gettingstartedincrypto.com/startup-kit/

written by Chris

written by Chris

DeFi Demystified: Beyond the Basics –Unveiling “Top” Secrets

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Buckle up - this is DeFi’s deepest depths - explore the game-changers and innovations driving the future of finance.

Introduction

As we journey further into the captivating realm of DeFi, we now turn our attention to its more complex and sophisticated aspects, delving deeper into the innovations that are pushing the boundaries of traditional financial systems. We are building on the foundations established in our previous article, where we ventured through the core principles, advantages, challenges, and fundamental concepts while shedding light on key components like smart contracts, and how dApps work.

In this sequel, we navigate the uncharted territories of advanced DeFi topics such as yield optimizers, governance tokens, interoperability, and so on. We examine their roles and significance, while also investigating the burgeoning realms of insurance protocols, synthetic assets, and the integration of non-fungible tokens (NFTs) within the DeFi landscape.

Throughout our journey, I share my insights and opinions, drawn from my own experiences and observations, to help you grasp some complex topics from my perspective. Additionally, we discuss the importance of governance tokens, as well as the potential implications of future policies and regulations. By the end of this enlightening voyage, I hope to equip you with a comprehensive understanding of the current state of DeFi, its rapid growth, and the vast potential that lies ahead.

Yield Optimizers

The Definition

The emergence of yield optimizers can be traced back to the early days of yield farming when users began seeking ways to maximize their returns from liquidity pools and farming opportunities. As DeFi grew and the number of platforms offering rewards for staking assets increased, it became increasingly challenging for users to navigate this rapidly evolving space.

The first yield optimizers were born out of the need for a more efficient and user-friendly approach to yield farming. These pioneering platforms automated the process of allocating funds across various opportunities, leveraging smart contracts to execute complex strategies and optimize returns. Among the early innovators, Yearn Finance emerged as a gamechanger, introducing the concept of “vaults” to aggregate user funds and execute tailored strategies.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

So, let’s embark on the second part of our ‘’DeFi Odyssey’’, delve into the advanced applications of decentralized finance, and shed some light on the innovations that are reshaping the world of finance.

I remember how yield farming was back in the day. I was juggling numerous browser tabs, and incessantly switching between Twitter feeds and Telegram channels, all in an effort to stay informed and effectively manage my investments. Tracking exposure across various yield farms, collecting rewards, and reinvesting demands constant attention and vigilance, making the process time-consuming and overwhelming.

Yield optimizers are taking the complexity out of yield farming. Essentially, they harness data analytics and use advanced algorithms to enhance the performance of users’ investments in yield farming pools offered by various DeFi protocols, including AMMs and liquidity pools. Automation is their main key component, and that’s why we love them!

By smartly compounding rewards at the most opportune moments, yield optimizers like Beefy, and Autofarm unlock the full potential of compound interest for their users. They achieve this by employing strategy contracts within their vaults, which allocate and reinvest farm rewards collectively, reducing gas fees and sparing users the hassle of managing their investments manually. Note that there are many protocols nowadays, so do your own research and proceed according to your needs.

Strategies & Mechanisms

Let’s dive a lil deeper now! Yield optimizers employ a multitude of strategies to ensure that users get the most out of their investments, as we previously discussed. These strategies are designed to enhance returns, minimize risks, and optimize the overall yield farming experience. Let’s take a closer look at some of the mechanisms at play:

• Auto-Compounding: By automatically reinvesting earned rewards into the same liquidity pool, yield optimizers maximize the power of compound interest. No need for manual intervention, after all, compound interest is the 8th wonder of the world.

• Pooling: Yield optimizers often aggregate users’ funds into larger pools, increasing the overall efficiency of the investment process. This not only helps to reduce gas fees but also enhances the earning potential of each user’s investment.

• ❖Multi-Chain Farming: To capitalize on the diverse opportunities in the DeFi landscape, some yield optimizers extend their reach across multiple blockchain networks. This allows them to tap into a wider range of yield farming opportunities, further boosting returns for users.

• ❖Dynamic Allocation: Through continuous monitoring of market conditions and available opportunities, yield optimizers can swiftly reallocate users’ funds to the most lucrative options. This dynamic approach ensures that investments remain optimized even as market conditions change.

A Brief Overview

These are just the main points of what yield optimizers have carved out. There is much more to discuss, but I’ll probably write 10 more pages, just for yield optimizers! One thing remains certain: yield optimizers persistently evolve and adapt, simplifying our lives and significantly lowering the barrier to entry for newcomers to the world of DeFi.

The Rise of Governance in DeFi A History Lesson

The concept of governance has been integral to human societies for centuries, and its adoption in the DeFi space has profoundly impacted the way decentralized platforms operate. In the early days of DeFi, protocols were typically governed by a small group of developers or a centralized entity, which limited transparency and community involvement. However, as the DeFi ecosystem evolved, the need for a more democratic approach to decisionmaking emerged, leading to the introduction of governance tokens.

Governance tokens empower token holders to actively participate in the decision-making processes of their chosen DeFi protocols, ensuring that their development aligns with users’ best interests. By decentralizing control and fostering a community-driven approach, governance tokens create a transparent and fair environment that encourages innovation and sustainable growth.

The emergence of DAOs back in 2021 was the tipping point for user participation. Simply put, token holders can submit proposals, deliberate, and cast votes on crucial matters such as protocol upgrades, fee structures, and new feature implementations. This decentralized governance model incentivizes users to remain active and engaged while establishing a system of checks and balances to penalize or remove bad actors from the ecosystem. As a result, governance tokens have become a cornerstone of DeFi platforms, driving their evolution and long-term success.

Misconceptions & Risks

As we delve deeper, it’s crucial to acknowledge that we are still early when it comes to true decentralization. While we had many attempts to reach that goal, we are still limited on resources and insights.

However, this doesn’t guarantee the absence of significant issues affecting the protocol and user funds in the short to medium term. There are a few main problems leading to most issues in decentralized governance systems:

• ❖Perception of Tokens Among Users: Users often view tokens as a source of yield, rather than voting rights. This individualistic approach is fueled by protocols using their governance tokens as rewards for network participation. The financial incentives often outweigh governance incentives, resulting in low participation rates among token holders.

• ❖Lack of Minimum Participation: A sufficiently decentralized protocol, requires a high minimum number of token holders or participants. However, most quorum minimums focus on the number of engaged votes or tokens rather than the number of voters. This leads to supposedly decentralized systems where a small group of token holders makes decisions, understanding the token’s importance.

• ❖Private Sales to Investors: Most DAOs raise funds through private sales, where investors receive governance tokens in return. This creates a high degree of centralization at the start of token distribution, potentially disincentivizing new token holders from engaging in project governance.

Navigating Governance Challenges

As the DeFi ecosystem grows, it is essential to address the challenges and vulnerabilities associated with decentralized governance to ensure long-term sustainability and security alike.

‘’Despite acknowledging the initial centralization and high concentration of tokens within their team, some projects adhere to a strategy of gradual decentralization.’’

Addressing Knowledge Disparities and Decision-Making

In the context of decentralized governance (DeGov), a prominent issue arises from the knowledge disparity among participants. The intricate nature of DeFi protocols often necessitates specialized technical and financial expertise for participants to make informed decisions. This complexity could potentially lead to a scenario where a select group of well-informed individuals exerts disproportionate influence over the governance process, thereby compromising the principles of decentralization.

To address this concern, it is vital to ensure the availability of comprehensive educational resources and easily accessible communication channels for community members. By fostering active discussions and providing ample opportunities for learning, participants can be empowered to make more informed decisions. This approach nurtures a more inclusive governance process, aligning with

the ethos of decentralization.

Coordination and Efficiency

DeGov can face issues related to coordination and efficiency. As the number of participants increases, reaching a consensus can become a timeconsuming and complex process. This could slow down decision-making and limit the ability of the project to adapt and innovate quickly.

One potential solution is to implement a multitiered governance structure, with smaller working groups responsible for specific areas of the project. These groups could act as a liaison between the broader community and the core developers, streamlining decision-making and allowing for more efficient governance.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Incentive Alignment

Ensuring that token holders have aligned incentives is crucial for maintaining the integrity of any given protocol. Misaligned incentives can lead to shortterm decision-making or the concentration of power in a few hands, which could harm the project’s long-term success.

To address this challenge, protocols can design tokenomics that encourage long-term alignment by rewarding long-term holders or those who actively contribute to the governance process. Additionally, maintaining transparency regarding token distribution and vesting schedules can help deter the undue concentration of power, fostering a more balanced governance structure.

Future Potential

A critical goal for DAOs is to create a system that successfully melds algorithmic and human elements while preserving a degree of decentralization that can support a robust, functional framework.

To achieve this, DAOs need to focus on not only

defending themselves against external influences but also finding equilibrium between personal and collective agency, taking into account the necessary compromises that may arise between these participatory forms.

Concentrating on perfecting algorithmic decisionmaking, building a harmonious infrastructure consisting of both human and technological components, and encouraging a mindset of selfassessment and continuous enhancement of governance protocols, will enable participants to have a more active role in shaping the rules that govern these protocols.

Although the list of improvements for decentralized autonomous organizations (DAOs) could go on and on, what is most impressive is the willingness of users to contribute to their favorite protocols. In full transparency, I have personally contributed to various DAOs over the years. Despite this, I have also come to the realization that complete decentralization has yet to be fully achieved, regardless of how it is defined. However, I maintain a high level of optimism that this situation will improve with time.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Interoperability

Cross-Chain Communication

Efficient and secure cross-chain communication is vital for the future of DeFi. As the number of Layer-1 chains expands, seamless interaction between various ecosystems becomes increasingly essential for smooth transactions and preventing fragmentation. An effective cross-chain system allows protocols to maximize technology potential, offering users greater flexibility, accessibility, and ultimately promoting widespread adoption.

In the past, I’ve encountered many difficulties moving funds from one blockchain to another. Nowadays, the process is much easier. This process now allows for seamless participation in different ecosystems, eliminating the hassle of dealing with numerous networks, wallets, tokens, and not to mention high gas fees and the potential for your funds to be “stuck” for an extended period.

Layer-2 Solutions and Bridges

Consider them as an advanced, or ‘version 2.0’ of cross-chain communication. They enhance scalability and performance, facilitating seamless communication between different blockchain networks. Layer-2 solutions typically move transactions and computations off the main blockchain, reducing network congestion and increasing transaction speed. Remember where we discussed Arbitrum on MoonMag’s issue #20?

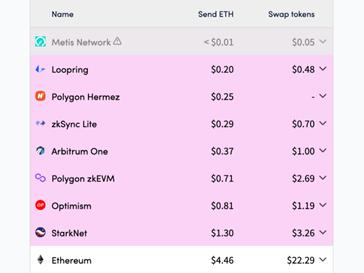

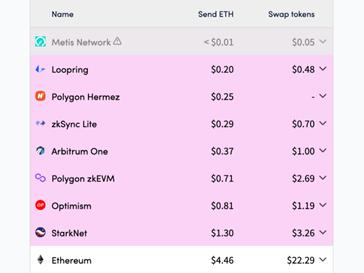

Arbitrum is a layer-2 solution for the Ethereum network. Below you can see the different L2 Ethereum solutions and the cost to send a transaction.

If I remember correctly, back in 2021, the gas fee to send ETH on Arbitrum was ~$3. It really shows the potential of layer-2 solutions. As usability increases, the fees will go even lower.

What about bridges? Bridges are a crucial element in DeFi. They connect different blockchain networks and enable seamless asset transfers between them. They promote liquidity and composability, which contributes to a more unified and efficient DeFi ecosystem.

As much as I don’t like them personally, I have to mention them. Here is a good introductory guide for bridges if you want to explore more.

Both L2 solutions and bridges have substantially improved my DeFi journey, allowing me to capitalize on opportunities across multiple chains without compromising speed or security. As a result, I’m thrilled to write about these concepts that, merely two years ago, were but whispers of ideas known only to a select few who recognized their immense potential. Let’s talk about a trustless omnichain interoperability protocol that caught my eye in 2021.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

LayerZero - The Ultimate Solution

While this isn’t necessarily a personal preference, LayerZero represents a truly innovative project focusing on secure and efficient cross-chain communication. Founded by Bryan Pelligrino, Ryan Zarick, and Caleb Bannister, LayerZero initially supported seven major blockchains, with more added subsequently. Implementing smart contracts on supported chains enables seamless communication between previously isolated networks.

Stargate, a flagship bridge & dApp built on top of LayerZero, tackles the bridging trilemma by concentrating on fast time to finality, unified liquidity venues, and native asset transactions. Stargate streamlines the bridging process and enhances security and ease of use.

LayerZero’s technology has numerous potential applications which haven’t been explored yet, such as interchain exchanges, omnichain NFT marketplaces, and cross-chain lending and borrowing.

By integrating LayerZero, DeFi protocols can achieve unified liquidity and provide users with a broader range of options without traditional bridging methods that have many limitations and vulnerabilities. Does anyone recall the BSC Token Hub hack? A staggering $570 million was drained from that cross-chain bridge, demonstrating the potential risks in this technology and one of the reasons I don’t particularly like them.

While LayerZero represents a significant advancement in interoperability, potential risks, such as centralization and oracle risk, remain. However, ongoing project development, including the expansion of its Pre-Crime technology, aims to address these concerns and improve the system’s overall robustness. As the demand for interoperable solutions grows, LayerZero is well-positioned to play a significant role in DeFi’s future.

DeFi’s Future Outlook

Insurance Protocols

The evolving DeFi ecosystem has brought about the need for new forms of protection against potential risks. Insurance protocols are emerging to meet this demand. They can potentially play a crucial role in offering coverage against smart contract failures, hacks, or other unforeseen events.

For instance, Nexus Mutual is a standout protocol that provides decentralized insurance solutions, allowing users to either purchase coverage or contribute capital to insure against potential risks.

Real-World Assets

The tokenization of real-world assets represents a bridge between the traditional financial world and decentralized finance. Assets like real estate, commodities, or even intellectual property can be tokenized and integrated into the DeFi ecosystem.

Tokenizing these assets enables fractional ownership and increased liquidity, making them accessible to a broader audience. A protocol like Centrifuge is already exploring DeFi, bringing tokenized realworld assets and facilitating their use as collateral in lending markets.

Synthetic Protocols

Synthetic assets are another rapidly growing area in DeFi. These are tokenized versions of traditional financial instruments or commodities, like stocks, bonds, and gold. By utilizing blockchain technology and smart contracts, synthetic assets allow users to gain exposure to a wide range of assets without directly owning them.

Platforms like Synthetix allow users to create and trade these synthetic assets, providing exposure to a wide range of asset classes without the need for direct ownership. As DeFi matures, the creation and adoption of synthetic assets will likely continue to expand.

Non-Fungible Tokens (NFTs) and DeFi

We are all aware of NFTs one way or the other. They gained significant attention for their use in digital art and collectibles, but did you know they can be used further within DeFi applications? NFTs can represent unique financial assets like loans, insurance policies, or yieldgenerating positions in liquidity pools.

Aavegotchi is a platform that has begun to explore this intersection, allowing users to use their NFTs as collateral for loans or even earn interest on their digital assets. As their market continues to evolve, we can expect more innovative use cases to emerge.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Current Challenges and Limitations

The future of DeFi appears promising, with new protocols and use cases emerging regularly. As more people gain access to decentralized financial services, the sector is poised to disrupt traditional finance and provide opportunities for greater financial inclusion and innovation, accessible by everyone. However, realizing this potential will require overcoming several challenges, including scalability, interoperability, and regulatory hurdles.

Scalability remains a major concern, with congested networks and high transaction fees affecting user experience, especially on platforms like Ethereum. Additionally, interoperability between various blockchains poses a challenge, as seamless crosschain transactions are essential for DeFi’s longterm success. While LayerZero solves this problem, we’re still too early. Finally, the prevalence of scams, or more colloquially known as “rugs,” perpetrated by anonymous developers and CEOs, warrants further discussion in a future article.

Regulatory Landscape and Final Thoughts

With DeFi’s growing mainstream acceptance, it’s inevitable that regulatory scrutiny will intensify. Governments worldwide are beginning

to develop clearer regulatory frameworks for cryptocurrencies and DeFi, which may affect growth and development. The implementation of these aforementioned policies is essential in cultivating a more secure environment, particularly for newcomers to the space.

Compliance with existing and emerging regulations will be essential for DeFi projects as well, in order to thrive and gain wider acceptance. In response, many protocols are proactively working to ensure compliance, engaging with regulators, and implementing measures such as Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to meet regulatory requirements.

In conclusion, while DeFi faces several challenges, its potential to transform the financial landscape is undeniable. As we come to the end of this journey together, I genuinely wish I had more “room” to delve deeper into DeFi; perhaps I’ll consider authoring a book on the subject in the future, haha! In all seriousness though, by addressing limitations, ensuring regulatory compliance, and continuing to innovate, DeFi can unlock new opportunities for financial inclusion and reshape the future of finance.

Non-Trading Routes to Crypto-Generational Wealth

written by Daniel Jimenez

written by Daniel Jimenez

The attention that cryptocurrencies have generated in recent years among millions of retail participants is undeniable, driven by the rhetoric of quick and easy wealth, often sold on social media when buying the right cryptocurrency at the right time.

Since the beginning of Bitcoin and Ethereum, the stories of crypto millionaires have fascinated both insiders and outsiders, especially when hearing about the few lucky ones who have invested early in meme-coins like Doge, Shiba Inu, and recently PePe.

However, despite how fascinating these types of stories executed by a few users in the crypto ecosystem may sound, trading is a game where most lose, some win, and a few breaks even if they don’t have proper financial advice or education.

While investor trading is fascinating and a way to create wealth in crypto, it is far from the best way to generate generational wealth and participate in the cryptocurrency industry.

There is no doubt that speculation and investment, like in the rest of the real economy, must exist to bring dynamics to new technologies, and in contrast, the potential value generated by cryptocurrencies comes from building, and the value generated by people beyond trading, like the positive sum of events that can drive such a young industry as cryptocurrencies.

In this sense, there are many other possibilities besides trading to pave the way for generational crypto wealth that can determine the success of this industry. We break down each one of these options in the following paragraphs

Creating products and services that support the crypto industry

The cryptocurrency industry is booming, and its growing innovative solutions demand is creating business opportunities for entrepreneurs. Several solutions can help simplify cryptocurrency transactions, improve security, and provide users with a seamless experience.

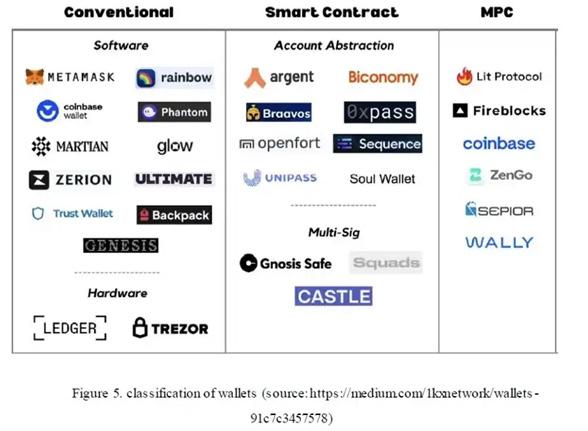

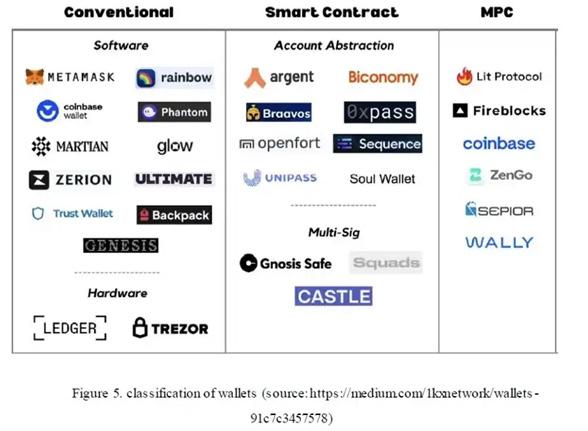

Some examples include the development of cryptocurrency wallets, which are essential for anyone involved in the industry. Wallets should be secure and easy to use and support multiple cryptocurrencies.

Cryptocurrency exchanges are another excellent example of developing products to support the crypto industry. Exchanges (CEX or DEX) allow users to buy and sell cryptocurrencies, and there is a growing demand for reliable, secure, and easy-to-use exchanges today, especially after the catastrophic events with FTX last year.

Other examples of generating generational crypto wealth with products and services include payment gateways to facilitate transactions. Payment gateways must be secure and support multiple cryptocurrencies.

Finally, cryptocurrency security is a significant concern. Security solutions include multi-factor authentication, biometric authentication, and hardware wallets.

Creating products and services that support the cryptocurrency industry is a profitable business opportunity. It is essential to stay up-to-date with the latest trends and developments in the industry to identify new opportunities. Developing secure, easy-to-use solutions that support multiple cryptocurrencies, such as wallets, exchanges, payment gateways, and trading bots, can help meet the growing demand for innovative solutions in this young industry

Working for crypto projects and companies

The cryptocurrency industry offers diverse job opportunities for those interested in being part of constantly evolving projects and companies. The most indemand roles include software development, marketing and communication, finance, operations, and management.

Developers with solid software experience are of extreme value in the industry. Blockchain technologies constantly evolve and require professionals capable of creating new platforms or applications or improving existing ones.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The opportunities for growth and excellent compensation in this type of job is quite lucrative and is among the highest paying in the various job boards.

On the other hand, marketing and communications professionals can help develop campaigns and messages that reach the right customers. Since effective communication is critical to the success of cryptocurrency companies, there is a high demand for competitive salaries to enter the cryptocurrency industry.

In the cryptocurrency industry, finance and economics knowledge is valued, with roles such as financial analysts, traders and investment managers in high demand.

With increasing innovation and development in decentralized finance, these professionals hold a privileged position within many protocols making their way into the industry.

Operations and management are essential to the success of cryptocurrency projects and businesses. In this sense, eventually, with each new project, people with organizational and strategic planning skills are needed to run the projects and ensure that operations are efficient.

In conclusion, the cryptocurrency industry constantly grows and offers diverse job opportunities for those with software skills, finance, communication, operations, and management. Success in this field requires a thorough understanding of blockchain technology’s adaptability to a constantly changing environment.

Freelancing for crypto projects

Freelancing for cryptocurrency projects has become an increasingly popular alternative for experienced professionals. The demand for talented freelancers has significantly increased, making it an excellent opportunity for those with the necessary skills and experience.

Freelancing for cryptocurrency projects has become an increasingly popular alternative for experienced professionals. The demand for talented freelancers has significantly increased, making it an excellent opportunity for those with the necessary skills and experience.

One of the main advantages of freelance work on cryptocurrency projects is the potential to earn a lot of money. The cryptocurrency industry constantly evolves and needs experts in development, marketing, and other critical areas. This high demand translates to higher pay rates for freelancers with the required skills.

However, working as a freelancer on cryptocurrency projects also comes with challenges. The lack of regulation in the cryptocurrency industry can make it difficult for freelancers to ensure fair compensation for their services.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Another challenge is the need for specialized knowledge and skills. The cryptocurrency industry is complex and constantly evolving, so freelancers must stay up-to-date with the latest developments to remain competitive, which requires significant time and effort, and those not willing to invest in their education may find it challenging to succeed.

Despite the challenges, freelancing for cryptocurrency projects can be a highly lucrative and flexible opportunity for experienced professionals. Those with the necessary experience, skills, and willingness to stay informed about the latest developments can thrive in the cryptocurrency industry and take advantage of its flexibility and high earning potential.

Working at DAOs

Working in a DAO (decentralized autonomous organization) offers a different path to generating wealth in the cryptocurrency space beyond cryptocurrency trading. As a decentralized organization operating on a blockchain, DAOs provide a transparent and consensus-driven environment where members can participate and make decisions without a central authority.

DAOs often focus on community-driven projects with a shared vision, making them an inspiring and rewarding environment for those passionate about a particular cause. Individuals can earn rewards and incentives for their work By contributing to a DAO, which can generate wealth in cryptocurrencies.

In addition, working in a DAO often involves remote work, which offers greater flexibility and the potential for better work-life balance. This lifestyle also presents opportunities to learn and develop skills in blockchain technology, which are valuable in the cryptocurrency space.

While working in a DAO may not produce the same high returns as cryptocurrency trading, it can provide a stable and sustainable approach to building wealth within the cryptocurrency space. By participating in a community-driven project, individuals can create something valuable that benefits themselves and others while earning rewards and incentives for their contributions.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The community-driven nature of DAOs provides a rewarding and motivating environment, and the flexible remote work lifestyle and opportunity to learn and develop skills in blockchain technology are additional benefits beyond the rewards and incentives for participation.

Working for grants and bug bounties

Grants offer a financial reward that individuals can convert into cryptocurrencies like Bitcoin, Ethereum, or other altcoins. By holding onto these digital assets, individuals can accumulate significant wealth as the value of these cryptocurrencies increases over time.

Software bug bounty programs are another way to earn cryptocurrencies, as companies or organizations offering these programs reward successful reporters with cryptocurrencies, some even native to their projects.

Starting your own crypto company or project

Finally, entrepreneurship is an opportunity for those willing to take risks and work in a changing environment. The possibility of creating cryptocurrency projects or working for startups can offer great rewards.

Launching a successful crypto project can provide a unique path to generating generational wealth in cryptocurrency. As a founder or team member, you can create a sustainable, long-term source of wealth that offers significant returns on your investment over time.

Beyond financial gains, launching a crypto project can offer a sense of purpose and impact. By developing new blockchain protocols, creating decentralized applications, or launching new cryptocurrencies, you can contribute to the growth and development of the crypto ecosystem, providing a sense of fulfillment beyond monetary gains.

As a founder or team member, you can obtain equity in the company or project, which can increase in value as the project grows and becomes more successful. This equity can be sold or exchanged for other cryptocurrencies or traditional assets, increasing your potential for wealth.

Launching a crypto project can offer a different route to creating generational wealth in cryptocurrencies. By contributing to the growth and development of the crypto ecosystem, you can obtain a sense of purpose and impact beyond monetary gains.

Final Thoughts

Individuals can accumulate significant amounts of cryptocurrencies over time, leading to considerable wealth by participating in these programs. Cryptocurrency investments have shown impressive returns, outperforming traditional investments such as stocks, bonds, and real estate. By diversifying their investment portfolio with cryptocurrencies, individuals can potentially benefit from the significant growth in the cryptocurrency market, creating wealth for future generations.

Therefore, working for grants and bug bounty programs can give individuals a unique opportunity to generate Generational Wealth in Cryptocurrencies by obtaining crypto rewards, and by holding onto these digital assets and diversifying their investment portfolio, individuals can accumulate significant wealth over time.

In conclusion, while trading is a popular way to generate wealth in the cryptocurrency industry, it’s not the only way. Creating products and services to support the industry and working for cryptocurrency projects and companies are viable options for generating generational wealth in the cryptocurrency space.

The industry is constantly evolving with many opportunities for entrepreneurs, developers, marketing specialists, and other professionals to contribute to its growth and success.

By actively following the latest trends and developments in the industry, individuals can identify new opportunities and build a prosperous future in cryptocurrencies. It’s important to remember that the cryptocurrency industry is still young and has plenty of room for innovation and growth.

The Rise of Memes: Exploring Crypto’s Funniest Investments

written by Samantha Jimenez

Memecoins are meme-inspired cryptocurrencies, influenced by humor created online, that, unlike traditional cryptocurrencies such as Bitcoin or Ethereum, has emerged as a parody or satire of the conventional cryptos

The term in question became popular with the creation and success of Dogecoin in 2013. Dogecoin was created as a joke, using the meme of the Shiba Inu dog as its mascot and symbol. However, despite its initially humorous nature, Dogecoin gained popularity and adoption, becoming an actual cryptocurrency used for

Since then, numerous meme coins have come out, each with its theme and humorous approach. These are usually created with an ample initial supply and promoted in online communities, such as Reddit forums or social networking groups.

The unpredictability of these is that many meme coins emerge as a result of news stories, tweets, or jokes that capture audience attention in response to a media occurrence and a carefully planned marketing campaign involving online communities, influencers, cryptocurrency influencers, and YouTubers take place to drive the launch and promotion of the cryptocurrency.

The goal is to gain massive and viral interest in memecoin, which could subsequently lead to a rapid revaluation of its price on the market. Therefore, the virality of social networks and the internet is fundamental in this process, as it allows information to spread quickly and reach numerous people.

It is important to note that many memecoins (almost all) lack real utility or solid foundations. So their value tends to be volatile and speculative, making them a subject of debate. Some investors may see memecoins as an opportunity for quick profits, while others see them purely as online entertainment.

Presence of memecoins in the crypto market

However, its cryptocurrency market presence has been remarkable, even when it has managed to shake it up. Capturing the attention and interest of users in online communities due to its viral nature and, of course, its connection to popular memes.

Among the most popular are Dogecoin (DOGE), Shiba Inu (SHIB) Floki, and Pepe Coin. These meme coins have achieved significant market capitalization and notoriety in the cryptocurrency space, attracting investors and eager speculators wanting to take advantage of the price fluctuations and volatility associated with these coins.

But, in addition to all this, their presence in this

market is also motivated by several factors:

Meme popularity: Memecoins rely on popular memes that often flood online culture to capitalize and make them part of their identity, attracting an audience that finds it entertaining while seeing an opportunity to invest in funny content.

Online marketing and community: After initiating a marketing campaign using communication channels, like forums and social networks, users who participate generate a sense of belonging and enthusiasm for memecoins, which leads to more people migrating to this market.

Easy access: Unlike traditional cryptocurrencies, memecoins are generally easier to acquire and trade. They are available on a wide range of cryptocurrency exchange platforms and often have lower prices, making them more accessible to tokens for investors with less financial resources.

Sense of community and fun: Many memecoin investors find fun and camaraderie in these market. The humorous and lighthearted atmosphere associated with memecoins creates a sense of community among investors, which can lead to greater interest and participation in the market.

However, it is imperative to know that memecoind popularity is no guarantee of long-term stability, giving that they remain volatile and speculative assets, so investors should exercise caution and do their own due diligence before participating in this market.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Now, before we delve a little deeper into the Pepemania that has taken place over the last few days, let’s turn to the past and see how this market has been behaving with the most iconic memecoins in history.

Dogecoin (DOGE): the meme coin par excellence

Dogecoin (DOGE) is a cryptocurrency created in 2013 by Billy Markus and Jackson Palmer as a joke or parody of the more “serious” cryptocurrencies existing at the time. Inspired by the popular internet meme of the Shiba Inu dog known as “Doge.”

Although Dogecoin started as a joke, it quickly gained popularity and garnered a loyal community of followers. It is known online for its logo showing the face of the Shiba Inu dog on a cute-looking coin.

Throughout all these years, Dogecoin has experienced several remarkable moments in its history not only because of the spikes in its price but also because of the widespread adoption it has gained. In 2014, the Dogecoin community ran a fundraising campaign to send the Jamaican bobsleigh team to the Sochi Winter Olympics, achieving greater visibility because of Dogecoin.

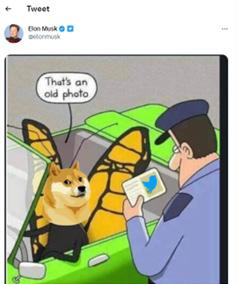

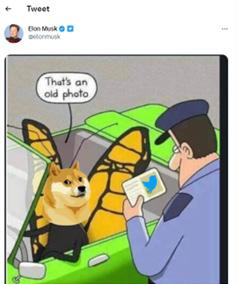

Another milestone was the sudden rise in Dogecoin’s popularity in 2021. The support of personalities such as Elon Musk, CEO of Tesla, and other social media influencers significantly increased the price of Dogecoin. Elon Musk, in particular, has tweeted about Dogecoin on several occasions, contributing to the attention and interest in the cryptocurrency.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

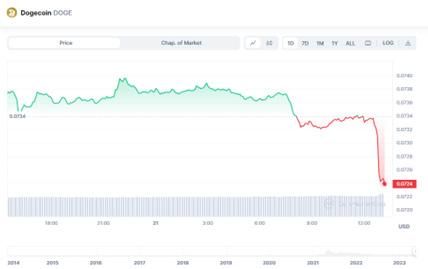

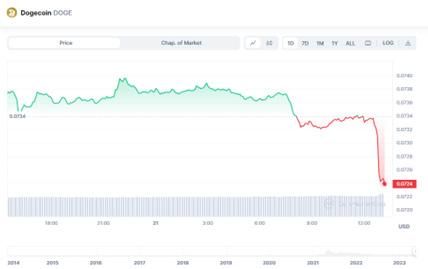

It is also true that its price behavior has been very volatile. For most of its history, Dogecoin’s price has been relatively stable and low in value. But, during the peak of the cryptocurrency market in May 2021, Dogecoin reached over $0.70 per coin.

However, according to data provided by CoinMarketCap, Dogecoin’s price at the time of writing is $0.073099 with a 24-hour trading volume of $122,737,440, obtaining a decreasing variation of -0.44% in the last 24 hours, thus occupying the #8 position within CoinMarketCap with a market capitalization of $10,192,797,658.

Dogecoin can get traded on several exchanges, including Binance, CoinW, WEEX, and OKX.

Source:Coinmarketcap

Dogecoin’s price volatility is a recurring characteristic of memecoins. Its value is driven more by emotional and market factors than because of solid fundamentals per se, which can lead to wild price swings in short periods.

In short, Dogecoin is a cryptocurrency that started as a joke and was inspired by the popular meme of the Shiba Inu dog. Throughout its history, it has experienced highlights and a significant increase in price in 2021, thanks to media attention and the support of influential personalities. However, its price remains highly volatile and speculative.

Shiba Inu: “The Dogecoin Killer”

Shiba Inu (SHIB) is a memecoin that became popular in the cryptocurrency market shortly after the popularity of Doge. It launched in August 2020, and its name comes from the Shiba Inu dog breed, also known as the main image of the Doge meme.

Shiba Inu has gained attention and followers due to its similarity to Dogecoin and its active community on social media. Like other memecoins, Shiba Inu has no definite practical use case beyond speculation and interest generated by its meme nature.

Its price has experienced significant movements with high volatility in the market. There have been times when the price rose sharply, attracting the attention of investors and speculators, such as during the peak of its bull rally in May 2021 when it traded at $0.00003791 per token, its all-time high.

However, nowadays is trading at $0.000009 per token, with a 24-hour trading volume of $67,937,557. Shiba Inu recorded a -1.64% decrease in the last 24 hours and is ranked #15 in the Coinmarketcap rankings

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Source:Coinmarketcap

However, beyond its price action, Shiba Inu has highlights such as its website describing itself as the “DOGECOIN KILLER.” It also has ShibaSwap, a decentralized exchange (DEX) launched by the Shiba Inu community (SHIB).

To clarify, ShibaSwap is not affiliated with or endorsed by Dogecoin, and the claim of being the “Dogecoin killer” is a promotional or marketing statement used by the Shiba Inu community to highlight the features and benefits of their platform.

Now, ShibaSwap allows users to exchange Ethereum network tokens, including SHIB, LEASH, BONE, or others In addition to trading, ShibaSwap also offers staking and farming features, which allow users to earn rewards by participating in the network. In addition, the Shiba Inu website (SHIB) has invited dog-inspired artists from around the world to join the “Shiba art movement” and contribute to the SHIBA INU community’s NFT (non-fungible tokens) market.

As with Dogecoin, Shiba Inu (SHIB) was endorsed and mentioned by influential figures such as Elon Musk and Vitalik Buterin.

Elon Musk, for example, has shown interest and mentioned Shiba Inu on occasion through his social media, which has generated attention and speculation around the coin. Similarly, Vitalik Buterin, co-founder of Ethereum, received a large number of SHIB tokens for free and decided to donate a significant portion of them to charities, including helping to combat the COVID-19 pandemic in India, which also increased visibility and interest in the currency.

In May 2021, the developers of Shiba Inu decided to send half of the total supply of SHIB to Vitalik Buterin’s public wallet address as a symbolic gesture to “burn” or take a part of the supply out of circulation and limit the inflation of the currency.

However, this action impacted the Shiba Inu market, given that sending several coins to Vitalik Buterin’s wallet decreased the circulating supply of SHIB and caused a price reaction.

And, although Vitalik Buterin is not directly associated with Shiba Inu, his indirect involvement through the receipt of SHIB coins undoubtedly impacted the market and generated discussions in the crypto community.

Floki Inu: The Elon Musk-inspired meme or also known as “Shiba’s sister”

Floki Inu (FLOKI) is another memecoin that has gained popularity recently, with a name inspired by the famous entrepreneur Elon Musk, who has a dog named Floki. Once the entrepreneur announced the new addition to the family, an unknown person created the memecoins inspired by Musk. Now, Floki Inu has been touted as “Shiba’s sister” and has, like Shiba and Doge, attracted the attention of investors and market enthusiasts alike.

Like other memecoins, Floki Inu initially had no established practical use case beyond speculation, interest, and investor demand. However, the team behind this project redirected what we were used to expecting from these memecoins and set out to combine the meme aspect with the real utility to create an autonomous and decentralized ecosystem. In this way, it sought to establish strategic partnerships and develop practical use cases for cryptocurrency.

In this sense, Floki has evolved from its origin as a meme to become a project with multiple public services and utilities in the crypto industry. Its innovative ecosystem spans several areas, including a 3D NFT metaverse, DeFi (Decentralised Finance) utilities, a crypto education platform, NFT, and a product shop.

The FLOKI token plays a meaningful role in this ecosystem, given its use as a native token to access different services and manage transactions.This redirection granted by the team shows how the project has evolved beyond its meme origin and seeks to offer practical solutions and tangible benefits for its users, thus leaving an added value beyond fun.

In addition, Floki Inu (FLOKI) built a strong supporters community, self-described as the Floki Vikings, comprised of over 475,000 members who share the mission to make Floki the world’s most popular cryptocurrency. This active and engaged community has helped generate interest and promotion on social media, which has led to Floki-related hashtags trending and going viral on several occasions.

The price of this memecoin recently rose by 50% after Binance announced the opening of deposits on the exchange on April 24th, which made it to the top 100 cryptocurrencies according to coinmarket cap’s ranking. However, shortly afterward, there was a correction in its price, and it declined from 0.000046 to 0.000037. At the time of writing, Floki Inu is trading at $0.000031 per token with a 24hour trading volume of $27,587,847, thus recording a decreasing change of -4.61% in the last 24 hours. It is ranked #104 on Coinmarketcap with a market cap of $300,616,027.

Source:Coinmarketcap

It is important to note that the success of a cryptocurrency depends not only on initial popularity and partnerships but also on project execution, actual adoption, and long-term value creation. Investors and followers of Floki Inu should keep an eye on the developments and progress of the project to assess its potential as it evolves.

The memecoins trend resurfaces with PEPE Coin

Social networks such as Twitter, Instagram, and Reddit went crazy with the new trend in the crypto market: PEPE coin. A memecoin that stirred up and shook the cryptocurrency market from one moment to the next due to its incredible gains in market capitalization.

Pepe Coin came from the illustration “Pepe the Frog” and got launched without a pre-sale. The project aims to create a cryptocurrency that functions as a public domain asset without commissions and for the use and enjoyment of investors and users.

This memecoins was the cradle of new millionaires in the ecosystem. Many users shared via Twitter the chronology of how they saw their “small token investment” multiply into billions of dollars in a matter of days.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Imagine for a moment that it’s April 17th, and you’re sitting in an armchair, browsing Twitter, when you stumble upon the official launch of a memecoin worth only pennies on the dollar. You stop for a moment and think about whether it would be worth it to give up that pizza, burger, or Starbucks coffee you’re used to for a day, and instead, you get a few tokens worth $0.0000000578 per coin, do the test and the next day: Boommm!, your investment increased by 1000%, reaching $0.0000006500 per coin. Crazy, isn’t it?

Well, yes. Luck? or maybe being in the right place at the right time and not letting it slip away. Many shared stories like this, not made up, REAL like those who sold their tokens without hesitation the next day and as risky as those who decided to wait a few more weeks, trusting their intuition. A decision that also yielded even better results as PEPE continued to take off like a rocket and adapt more popularity

Many sum it up as: “The best decision of their lives”. While not everyone can replicate this success, it is cool that many have experienced it. Finally, on May 7th, 2023, PEPE Coin reached its all-time high, reaching $0.00000431 per coin. Achieving a place among the top 50 cryptocurrencies by market capitalization is considered a significant achievement.

Its price is $0.000002, with a 24-hour trading volume of $184,756,154, registering a decreasing change of -5.97% in the last 24 hours and holding a current CoinMarketCap ranking of #68.

Source:Coinmarketcap

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Pepe Coin is the latest of these meme coins that have transcended by its impact and by its stir in the crypto community through social networks. It is becoming a wanted coin because of today’s crypto market circumstances.

What might the future hold?

Memecoins have been a fun way to make money; while highly speculative, they have allowed increasing many people’s investments. We experienced this recently with the frog-inspired digital currency, PEPE, when it experienced a 1500% increase in just two weeks. This rapid growth has attracted the attention of investors and traders alike, just as the pioneering memecoins did.

However, it is important to note that memecoins such as PEPE, Dogecoin, Shiba Inu, and Floki are known for their volatility and speculative nature. While the increase in their value may be attractive to some investors, it also implies a higher risk of sharp fluctuations in price. Therefore, it is essential to conduct thorough research in order to carefully assess the associated risks before investing in this type of cryptocurrency.

In addition, its analysts expect the memecoins rally to continue in the coming weeks, albeit with potentially lower volatility, along with others emerging. However, people must know that the cryptocurrency market is highly unpredictable and subject to multiple priceinfluencing factors.

Ultimately, the evolution and future success of memecoins will depend on a combination of market demand, adoption, regulation, and public perception. As always, it is imperative to research and consider the risks before investing in any cryptocurrency, including memecoins. However, it will forever be history, the iconic way for many to make millions through a joke.

written by Lisa N Edwards

written by Lisa N Edwards

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. Unveiling the Heartbeat of Bitcoin The 4-Year Cycle:

Bitcoin has been a hot topic of speculation and analysis ever since its creation in 2009. Analysts like myself have loved to spend hours trying to work out the subsequent movements and long-term projections for BTC. And Satoshi Nakamoto had some profound foresight: creating Bitcoin in what is known as the “halving cycle” or the Bitcoin 4-year cycle.

This 4-year cycle is all about the periodic ups and downs in the price of Bitcoin. Bear and Bull markets are inbuilt, and if you’re here, we love it and can’t get enough of it. So, let’s dive into the nitty-gritty of the Bitcoin 4-year cycle and see what it means for the world of cryptocurrencies.

The Satoshi cycle in Bitcoin is where things get very interesting—named after Satoshi Nakamoto, the creator of Bitcoin. It’s quantitative genius. Just like central banks use quantitative easing to boost the economy and tightening to restrict, Bitcoin has its own inflation schedule. It’s all planned out in a 4-year cycle.

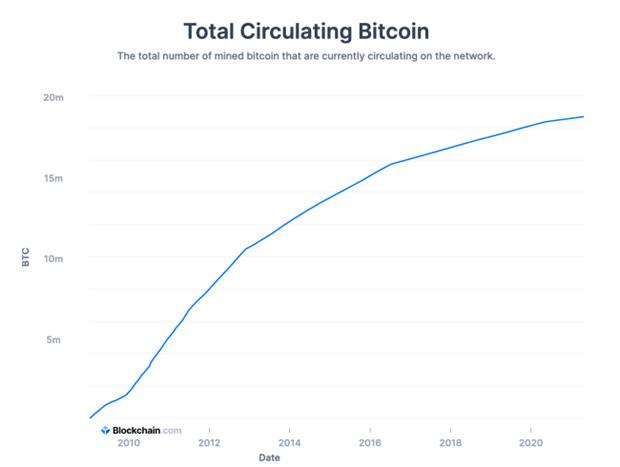

Basically, what this means is that the supply of new Bitcoins is limited to 21 million Bitcoins and follows a specific pattern. You know what happens when something becomes scarce, right? Its value goes up!

It’s like when everyone wants something, the latest fad, pokemon cards, some new item carried by the world’s biggest celeb, and it becomes more valuable, and often with more demand, there is less supply, so they’re hard to come by. Well, the same principle applies here.

So, the “Satoshi Cycle” is like this remarkable connection between supply and demand, market psychology, and the quantitative side of Bitcoin’s system. It’s like a giant puzzle; economists are digging into it to understand how this digital currency is shaking up the financial world and why I truly believe cryptocurrency is a path to the future!

The Bitcoin 4-year and Satoshi cycles are fascinating topics that keep us all on the edge of our seats and have analysts pulling their hair out. There’s so much to explore and learn from this, and it’s definitely worth keeping an eye on how they shape the future of cryptocurrencies.

The Satoshi cycle combines ideas from supply and demand, market psychology, and the quantitative aspects of Bitcoin’s system. It’s an interesting concept that gives economists a new way to explore the relationship between technology, markets, and economic theories. By studying the Satoshi cycle, we can gain valuable insights into how the Bitcoin 4-year cycle clearly works.

Understanding the Bitcoin Halving

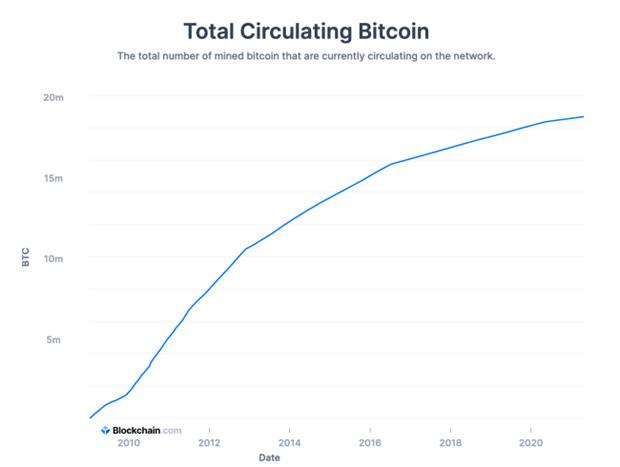

To comprehend the 4-year cycle, grasping the concept of Bitcoin halving is crucial. Every four years, the Bitcoin network undergoes a programmed event known as the “halving,” which slashes the block reward that miners receive for verifying transactions by half. The first halving occurred in 2012, reducing the reward from 50 to 25 Bitcoins per block. The subsequent halvings occurred in 2016 and 2020, bringing the reward down to 12.5 and 6.25 Bitcoins per block, respectively.

There are currently 19,384,700 bitcoins in existence. This number changes about every 10 minutes when new blocks are mined. Right now, each new block adds 6.25 bitcoins into circulation.

Source:

https://buybitcoinworldwide.com/how-manybitcoins-are-there/

The Impact on Bitcoin’s Supply and Demand

The halving is a significant event because it has a direct impact on the supply and demand dynamics of Bitcoin. With each halving, the rate at which new Bitcoins are created decreases, leading to a reduced supply. Simultaneously, the demand for Bitcoin has historically continued to grow, driven by increased institutional interest, retail adoption, and geopolitical uncertainties. This diminishing supply and growing demand set the stage for potential price appreciation.

This process has adapted over time...

On launch, miners received 50 BTC.

In 2012 it halved to 25 BTC.

Then in 2016 again halved to 12.5 BTC

The previous halving year on 11th May 2020, we are now down to a mere 6.25BTC.

The next upcoming halving of Bitcoin mining rewards dips to just 3.125BTC.

Bitcoin’s inflation rate is lowered effectively at the 4-year mark, and the algorithmic math difficulty increased, making it harder for the computers to “guess” or “crack” 64-digit hexadecimal number (a “hash”) this can take trillions of attempts. With this, mining difficulty increased; it is estimated that the last BITCOIN may not be mined until 2140, long after we have all left this Earth or if the network no longer exists.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The Bitcoin 4-Year Cycle

The 4-year cycle is a recurring pattern observed in Bitcoin’s price movements, linked closely to the halving events. The cycle consists of four distinct phases:

1. Accumulation Phase: This phase occurs shortly after the previous market peak and the subsequent downward trend. Bitcoin’s price gradually stabilises, and a new base forms. Savvy investors and institutions accumulate Bitcoin during this period, preparing for the next cycle.

2. Bull Run Phase: The bull run phase follows the accumulation phase and is characterised by a rapid increase in Bitcoin’s price. As demand outpaces the diminishing supply, investors flock to Bitcoin, driving its value to new all-time highs. This phase often coincides with increased media attention and general euphoria in the market.

3. Market Top Phase: As the bull run continues, speculation peaks and the market enters a phase of excessive optimism. Fueled by FOMO (fear of missing out), prices soar to unsustainable levels. This phase typically experiences a sharp correction, triggering a market downturn.

4. Bear Market Phase: The bear market phase marks a prolonged period of price decline following the market top. It is a time of pessimism and disillusionment as the market corrects itself. However, it also presents an opportunity for accumulation as prices reach attractive levels.

Historical Evidence and Observations

Analysing Bitcoin’s price history reveals fascinating patterns that align with the 4-year cycle theory. Each halving event has been followed by a significant bull run, driving Bitcoin to new heights. For instance, after the 2012 halving, Bitcoin experienced a surge, reaching its first notable peak in late 2013. Similarly, following the 2016 halving, Bitcoin soared to unprecedented levels in late 2017. The most recent cycle saw Bitcoin’s price peak in early 2021, approximately a year after the 2020 halving.

Future Implications

While the 4-year cycle is not a foolproof predictor of Bitcoin’s price movements, it provides a valuable framework for understanding market behaviour. The reduced supply resulting from each halving and sustained demand creates a favourable environment for price appreciation. Investors identifying and capitalising on the cycle’s various phases may reap significant rewards.

What Are You Waiting For?

The Bitcoin 4-year cycle, closely tied to the halving events, highlights the recurring patterns in Bitcoin’s price movements. The supply reduction and increased demand have historically driven Bitcoin’s price to new highs during each cycle. Understanding the dynamics of this cycle can help investors navigate the volatile cryptocurrency market more effectively. While it’s important to exercise caution and consider other fundamental factors, the Bitcoin 4-year cycle serves as a valuable guide for those seeking to comprehend the rhythm of this cryptocurrency known as digital gold.

https://twitter.com/bitharington/status/1655936751041658882?s=20

https://www.nicehash.com/countdown/btc-halving-2024-05-10-12-00?utm_ source=referral&utm_medium=widget&utm_campaign=crypto_countdowns_table

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

written by Chris

BUILD BEYOND

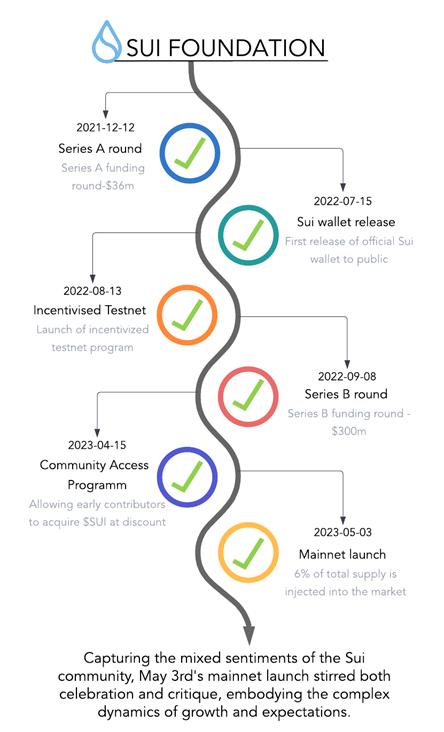

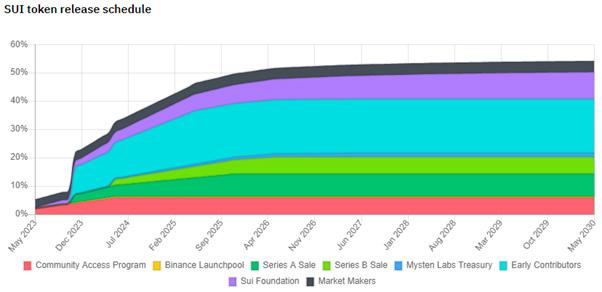

SUI Foundation and the SUI Token

Key Insights

• After its recent mainnet launch, Sui has emerged as one of the most expansive blockchain ecosystems, hosting several hundred projects under development.

• ●As a permissionless Layer-1 blockchain, Sui is designed for high throughput and low latency, offering unique user experiences.

• ●Sui facilitates around 300,000 transfers/transactions per second by bypassing consensus for simple transactions, such as P2P transfers and NFT mass mints.

• ●The Sui network’s throughput has the potential for horizontal scaling; the network throughput enhances as additional computational power is assigned to each validator.

• Sui Move, a dedicated programming language, embeds safety properties to mitigate potential hacks and exploits.

• Sui introduces a unique feature, ZK Login, in compliance with the OpenID Connect standard, enabling users to establish on-chain accounts using their existing web2 services such as Google, Apple, Facebook, etc.

Introduction

A fresh contender is making waves in the bustling realm of layer-1 blockchains, where stalwarts like Ethereum and Solana vie for dominance. Enter Sui, a permissionless layer-1 blockchain that brings a unique perspective to the current data model. As we take a deep dive into the realm of Sui, I’m intrigued by its possibilities to disrupt the status quo and emerge as the first internet-scale programmable blockchain platform.

The Sui tech stack stands out, precisely addressing three critical challenges in the blockchain arena: scalability, safe programming, and mainstream adoption. Thanks to its distinctive object-centric data model and robust consensus architecture, Sui holds the potential to scale its capacity infinitely, a feature that’s critical in the fastpaced world of blockchain technology.

And it doesn’t stop there. Sui Move, the platform’s programming language, has been developed with safety measures that shield against everyday hacks and exploits, enhancing the developer experience. Moreover, Sui is looking ahead, with plans to introduce a feature that smoothens the user experience by letting applications subsidise and remove the cost of consumer gas fees.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Background

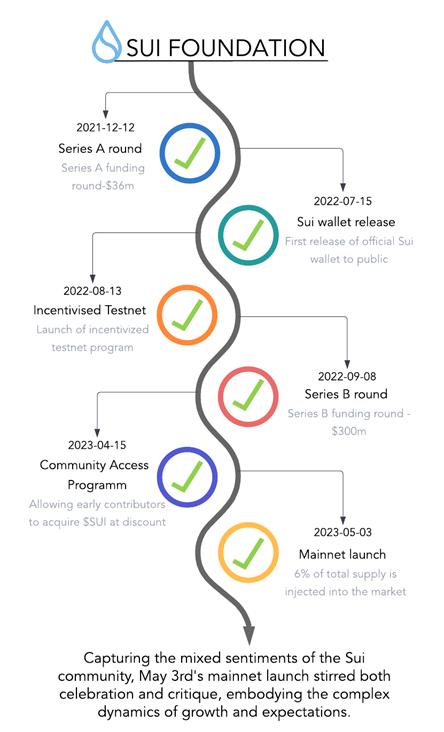

The evolution of blockchain technology is a saga marked by innovation, and at its vanguard is the Sui Network. Tracing its roots back to 2019, the ambitious vision of Meta, formerly Facebook, for a global payment network, the story took a turn when both the Diem and Novi projects faced an untimely end.

However, the setback catalysed something unique - the birth of Sui Network, a project nurtured by Mysten Labs, co-founded by former Novi leads. Mysten Labs, with its collective expertise ranging from software language compilers to cryptography, harnessed these skills to develop Sui.

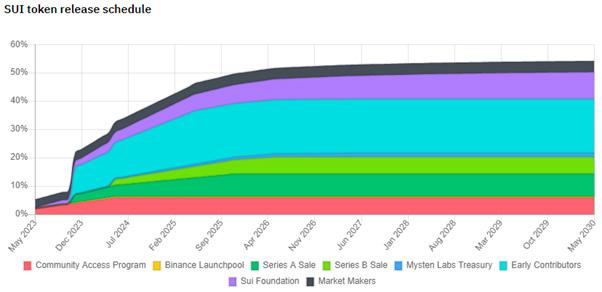

Fast-forward to 2023, Sui is primed to impact the industry significantly. Mysten Labs has secured substantial investments, adding credibility to Sui’s potential. All this while, the Sui Foundation focuses on building a robust community around Sui, supporting the creation of novel products on the platform.

Team & Founders

Mysten Labs, the driving force behind the Sui Blockchain, is led by an impressive team of co-founders with extensive experience in blockchain technology and web3. These experienced professionals have joined forces to create the fundamental infrastructure to give users and creators more significant control over their data and content.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

From left: Sam Blackshear, Evan Cheng, Adeniyi Abiodun | Source: Mysten Labs

Co-founders of Sui Blockchain:

1. Evan Cheng (CEO)

• 2012 ACM Software System Award recipient

• 10 years as a Senior Manager at Apple

• 3 years in a Director of Engineering role at Meta (previously Facebook)

• 3 years as Director of R&D for Novi Financial (a division of the Diem project)

2. Sam Blackshear (CTO)

• 3 years at Meta in Novi Labs

• Creator of the Move programming language

3. Adeniyi Abiodun (CPO)

• 3 years at Meta in Novi Labs