A note from Lisa…

Wow, what a month we have just had! The excruciating sideways movement in the market has made Bears extremely salty, while traders turned their attention to STONKS... But it was Bitcoin that stole the show with a surge, fueled by new regulations, dodgy traders fleeing from Tether’s ability to freeze addresses, and billions rolling off the Tether printer. As a few of my Twitter followers have informed me, this doesn’t make a difference.

So, how are those SHORTS going now, boys?

On the horizon, regulatory developments pose challenges to the short-term growth of the market. However, in the longer term, this can be seen as a good thing when implemented correctly The United Kingdom seems to be leading the way!

In this issue, we explore the MiCa Framework, which can help you navigate through these new regulations and stay on the right side of the law. Governments are seeking to strike a balance between fostering innovation and protecting consumers, which is why we are seeing stricter KYC and AML measures, proposed tax regulations, and increased oversight of exchanges.

These measures aim to prevent incidents like Mt. Gox or FTX debacles. The challenge lies in finding the right balance between regulation and stifling innovation. I truly don’t envy their jobs!

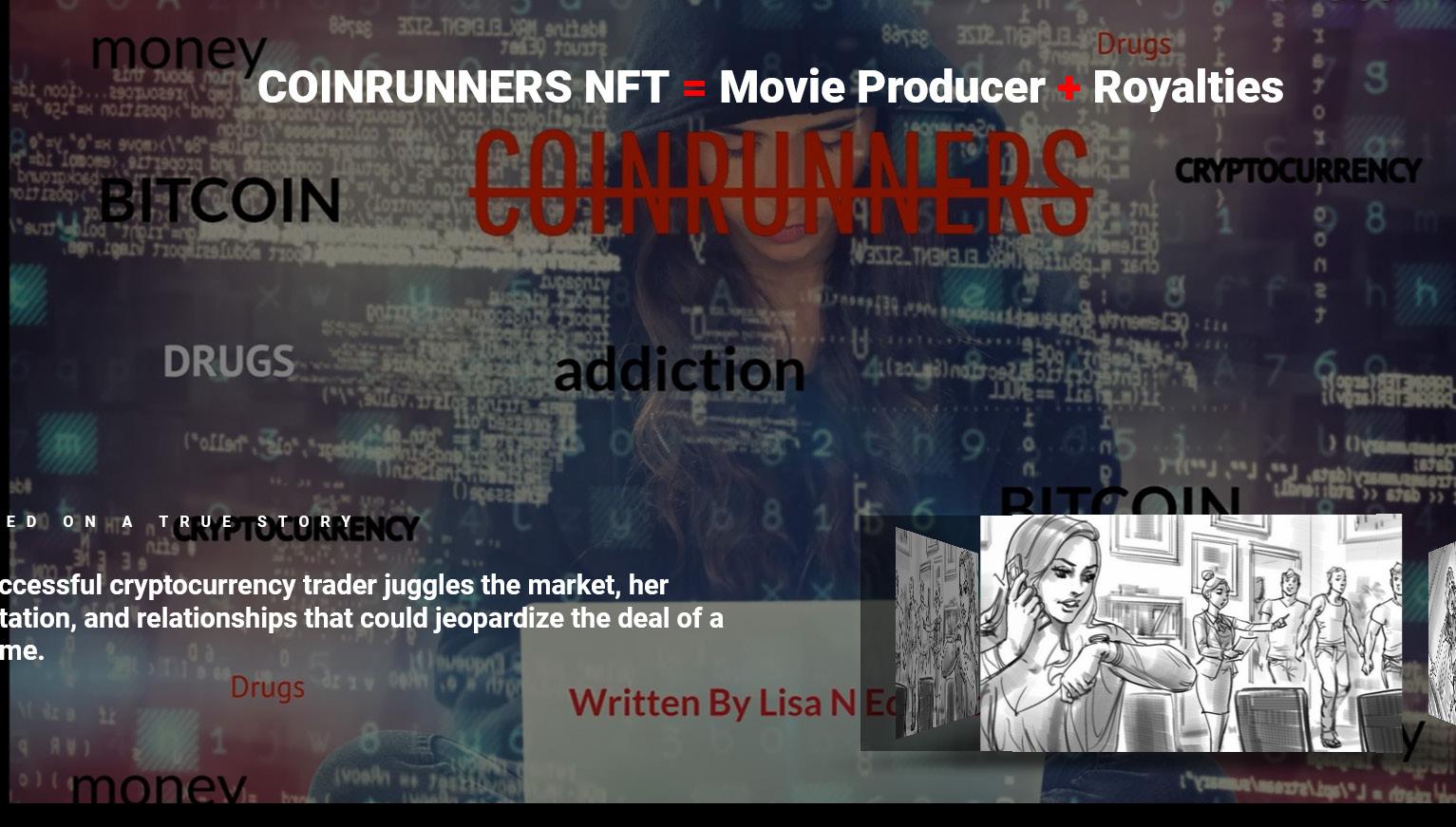

My articles discuss Choice Paralysis, explaining Hicks’ Law and how it can help you with your trading decisions. Additionally, I delve into how NFTs can disrupt the film industry, highlighting my own NFT project, COINRUNNERSMOVIE.COM. We also provide a guide on BRC-20 Tokens and explore the opportunities they present.

Furthermore, we cover payment solutions and provide comprehensive information about Exchange Tokens, especially considering the upcoming regulations.

All in all, this is another HUGE ISSUE! I hope you enjoy it as much as we have bringing it to you!

A note from Josh…

Crypto is an industry that correlates with so many other subjects, sometimes without us realising it. As Lisa demonstrates in her Traders Perspective this month, we can understand how Hick’s Law plays into trading and how you can use it to your advantage. Whether trading, investing or simply trying to understand the crypto niche a bit better, a lot of it seems to be a mental game. Investing harnesses the power of judgement, trading tests the ability to make decisions under pressure, and even just learning about crypto builds our capacity to store information for application at a later date.

Talking of crossing over into other realms, do take a read of Chrom’s article on the projects that bridge FIAT and crypto. And when you’ve finished reading and taken it all in, stop to ponder this question - is it a one-way bridge? We also have a fantastic article by Daniel on minting, creating and trading BRC-20 tokens, which is worth understanding as there seems to be a great deal of hubbub on this topic.

The whole point of the Moon Mag is to provide articles that stimulate the mind and lead to optimistic, well-informed, better thinking and thoughts around subjects. Some articles help simplify those hard-to-understand topics, some offer practical skills that you can put into action, and others offer rhetorical questions to encourage you to explore further. Everything a good magazine should contain. Enjoy!

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R.Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

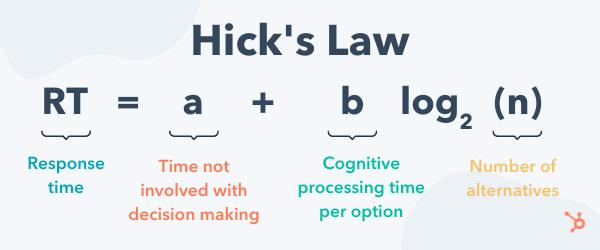

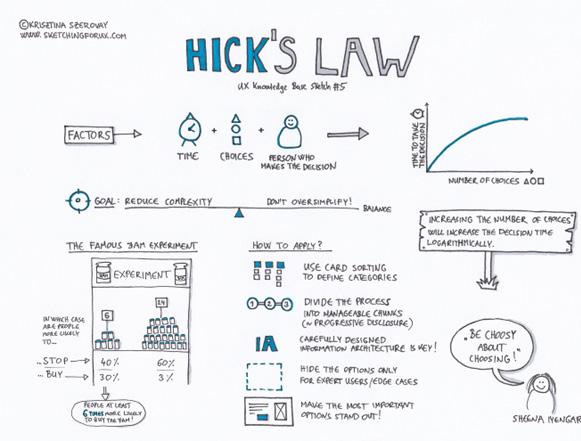

Regular readers of Traders Perspective will know I love market psychology, and one psychological principle that can significantly aid traders in this realm is Hicks Law. Initially formulated in the field of human-computer interaction, Hicks Law has found useful applications in various domains, including crypto trading. I will explore Hicks Law and its significance in optimising the decision-making processes within crypto trading.

I head straight to https://en.wikipedia.org/wiki/Hick’s_law

“Hick’s law, or the Hick–Hyman law, named after British and American psychologists William Edmund Hick and Ray Hyman, describes the time it takes for a person to make a decision as a result of the possible choices: increasing the number of choices will increase the decision time logarithmically. The Hick–Hyman law assesses cognitive information capacity in choice reaction experiments. The amount of time taken to process a certain amount of bits in the Hick–Hyman law is known as the “rate of gain of information”. The plain language implication of the finding is that increasing the number of choices does not directly increase the time to choose. In other words, twice as many choices does not result in twice as long to choose. Also, because the relationship is logarithmic, the increase in time it takes to choose becomes less and less as the number of choices increases.”

What is Hicks Law?

What is Hicks Law?

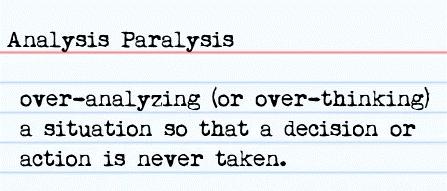

In simpler terms, as the number of choices increases, the decision-making process becomes more complex and timeconsuming. This principle is closely related to the concept of information overload, or choice paralysis, where excessive choices can overwhelm individuals and hinder their ability to make optimal decisions… especially when making a quick decision when trading short-term positions.

Author - Barry Schwartz mentions in his book ‘The Paradox of Choice - Why More is Less’ that happiness is affected by the success or failure of goal achievement. With this fact in mind, it is also a fact that 95% of traders lose money in the crypto market, usually falling prey to market forces, not reacting quickly enough and, of course, human emotion taking over, and we see panic selling and liquidations happening.

The cryptocurrency market is filled with a plethora of trading strategies, indicators, and tools. While having access to various options can be beneficial, it is crucial to avoid overwhelming oneself with too many alternatives. By simplifying trading strategies and focusing on a select few, traders can reduce decision fatigue and improve their ability to make quick and informed decisions.

This means becoming an expert on several indicators - NOT ALL OF THEM! No one can read a crowded chart. There is just too much happening for it to be clear and concise.

Cryptocurrency exchanges often provide traders with abundant trading pairs and markets. However, having too many options can lead to decision paralysis. To leverage Hicks Law, traders should streamline their trading platforms by favouring a limited number of trading pairs that align with their trading strategy and goals. By narrowing down the choices, traders can enhance their decision-making efficiency.

By narrowing down your choices, you can become familiar with how those coins move; each chart has a pattern memory as the same traders keep returning to the same charts. Even if we don’t want to admit it, we each have a favourite chart to trade that will usually make us the most profit, so we continue to return.

Defining clear and specific trading goals is essential in mitigating decision overload. Traders should establish achievable targets for profit-taking, stop-loss levels, and trade durations. This approach reduces the number of choices to be made during trading and helps maintain discipline and focus, leading to more effective decision-making.

This is why ThousandtoMillions.com as it is a clear and defined strategy that compounds not only your profits but also your discipline. (But be careful to avoid getting too sure of yourselfthis is where people lose out).

Utilise Decision-Making Frameworks: To navigate the complexities of crypto trading, traders can benefit from employing decisionmaking frameworks. Techniques such as technical analysis, fundamental analysis, and risk management strategies can be structured frameworks for evaluating opportunities and making informed decisions.

These frameworks help traders narrow their choices by considering specific criteria and reducing the cognitive load associated with decision-making. While I say here that crypto trading is complex, it’s not hard; people make it hard, and utilising Hick’s Law, removes the added layers of difficulty of excessive choice.

Embracing automation tools can alleviate the burden of decision-making. Lisabot. trade automates trades from GSIC (our major sponsor)but leaves you in total control if you want to adjust stop losses or sell sooner than the given targets. Your mindset could be every time a signal is sent, I will sell at the specified target or lower this to sell at a specified percentage giving me a certain amount of profit each time.

By utilising trading bots or setting predefined rules for executing trades, you can streamline the process, reduce the need for constant manual intervention, and get on with your life. This will also make trading more fulfilling by reducing stress levels!

It’s important to note that automated decision-making should be approached with caution and regularly monitored to ensure its effectiveness.

It will provide valuable insights into any decision-making processes. By simplifying trading strategies, streamlining platforms, setting clear goals, utilising decisionmaking frameworks, and embracing automation, YOU can effectively take control of your trading strategy and reduce decision overload by focusing on essential choices.

By applying HICK’S LAW to your decision-making, you will find improvements in your overall performance, and this will help you navigate the complex crypto market with greater confidence.

Less Choice often means less stress which leads to longer term happiness, which will mean you are more likely to stay trading and not give up!

Return to the previous issue, read my Traders Perspective, and get into the best mindset to take your trading to the next level!

• ➢Angola offers a unique ecosystem that supports NFT creation, trading, and evaluation, enabling artists and content creators to capitalise on the digital asset trend.

• ➢AGLA, an ERC-20 token, provides a seamless transaction system for users, fostering a vibrant economy within the platform.

• ➢Angola’s protocol plans to use innovative tokenisation methods to store activity histories, such as the Soulbound Token (SBT).

• ➢Angola’s on-chain voting and decisionmaking system demonstrates its commitment to decentralisation, ensuring community-driven governance.

• ➢Angola’s NFT marketplace has broad appeal, providing content creators with a wider audience reach and better monetisation opportunities.

• Angola’s SDK wallet ensures secure and transparent peer-to-peer transactions, fostering trust among platform users.

Introduction

Angola is an advanced platform providing a comprehensive ecosystem for creating, evaluating, and trading digital assets like Non-Fungible Tokens (NFTs). This versatile platform capitalises on the growing digital asset trend, providing a unique solution for artists and content creators to market their work.

In the heart of the Angola ecosystem lies the AGLA token, an ERC-20 token that provides the basis for transactions within the platform. Its use extends beyond simple transfers, playing a significant role in minting NFTs, securing user rights, and participating in the platform’s governance system. The AGLA token economy fuels the platform’s vibrant marketplace, where creators and collectors can interact, trade, and curate digital collections.

What truly sets Angola apart is its unwavering commitment to community governance. Angola enables community participation through an on-chain decision-making system, empowering users to shape the platform’s direction (more on that later).

So today, we delve into the intricacies of Angola, exploring its origins, team, and unique value proposition it brings to the crypto and NFT space.

With the accelerated growth of blockchain technology and NFTs, the need for an intuitive, user-friendly platform for dealing with digital assets became increasingly apparent. In response, the developers behind Angola embarked on a mission to create a robust, community-centric ecosystem designed to support the expanding NFT market.

Angola is a multifaceted platform, integrating crucial elements, from creation to evaluation to trading and so much more. The platform features the NFT Gallery, a showcase for digital content, and the NFT Marketplace, an arena for minting, buying, selling, and trading assets. These user-centric features aim to simplify the digital asset trading process, fostering accessibility for creators and collectors alike.

Moreover, Angola promotes a sense of community among its users. Services on the platform enable creators to build value and draw in community members through their NFTs. Integrated tools facilitate communication and collaboration among community members, underscoring that digital economies thrive in robust, engaged communities.

Angola’s usage of the AGLA token, an Ethereum-based (ERC-20) asset, highlights the platform’s commitment to a vibrant digital asset economy. AGLA token secures user and creator rights, and also serves as a means of purchasing NFTs in the Marketplace, reinforcing the cohesiveness of the platform’s ecosystem. But more on these later on!

As the landscape of the NFT world continues to shift and grow, Angola is poised to adapt and innovate, addressing the needs of the NFT community head-on.

At the helm of Angola’s ambitious vision is a team of seasoned professionals, It’s crucial to note that the following information is coming straight from the founding team of Angola and I am quite pleased they shared it with me.

P.S.1 - This information is not public anywhere else yet!

P.S.2 - Personally, I respect every team that works and wishes to remain anonymous. Remember that being public doesn’t always guarantee results.

Chairman WP Hong is a University of Michigan alumnus. His illustrious career includes a significant tenure as President of Samsung SDS, Korea’s IT solutions firm. In addition, he spearheaded its ICBM (IoT, Cloud, Big Data, Mobile) solutions business. Before that, as President and Chief Marketing Officer of Samsung Electronics, he played a pivotal role in solidifying Samsung’s standing as the world’s leading handset manufacturer and a global brand.

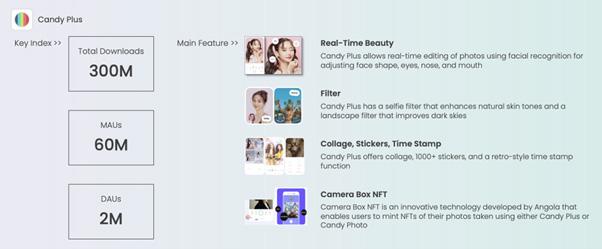

CTO JH Seo is a graduate of the Korea Educational Development Institute (KEDI) and Sungkyunkwan University. Notably, he is a co-founder and former CTO of Candy Camera and a seasoned technology leader with over 12 years of experience in the tech industry, specialising in service planning, development, and design. He has the ability to build and lead high-performing teams, ranging from fresh graduates to experienced professionals.

Sean Lee, the CMO of Angola, holds a degree from Boston University. His professional journey encompasses more than a decade in strategic investment and M&A at SK Telecom and its affiliate, Korea’s largest mobile carrier and ICT firm. Mr Lee co-founded Blockwater and Uupfi, collectively recognised as one of the largest crypto VC and asset management firms in 2020. His focus has been on real-world applications of blockchain-enabled projects, expertise that is invaluable to Angola’s market positioning and strategy.

Despite being in its early stages, Angola’s mission has a combination of factors, each playing a crucial role in its development.

The first catalyst is the explosive growth of the digital assets market, particularly NFTs, which have revolutionised how we view and engage with digital content, transforming them from ephemeral entities into unique, ownershipverifiable assets. However, this sudden expansion also emphasised the need for a structured, accessible, and comprehensive platform to support these transactions - a void Angola sought to fill.

The second catalyst is the rapid and widespread adoption of blockchain technology. As blockchain’s potential for decentralisation and transparency became more evident, it prompted a shift towards community-driven ecosystems. Angola leveraged this by creating a platform that allows NFT trading and encourages active community participation through communication and collaboration tools, creator communities, and a decisionmaking system.

The third factor driving Angola’s development is the integration of decentralised finance concepts. DeFi, with its promise of democratising finance, complemented Angola’s vision of a democratic digital asset economy. To this end, Angola incorporated tokenisation methods and decentralised trading capabilities, thus enhancing asset liquidity and enabling the exchange of AGLA tokens for other digital assets.

Lastly, Angola’s adaptability has been crucial to its growth. By recognising and promptly addressing user needs, Angola has been able to evolve with the market. An example is the platform’s initiative to tackle the high transaction costs associated with blockchain technology through Meta Transaction and off-chain signature technology, providing users with a more costeffective means to keep transaction records.

Here are the market stats of the AGLA token at the time of writing:

Price $0.0478 Market Cap $23.000.000

Trading Volume $24,000

Circulating Supply 475,450,000

Total Supply 3,000,000,000

Fully Diluted Valuation $143,940,911

AGLA Stats 09/06/23 |

Source: CoinMarketCap

OFFICIAL LINKS

Website: https://www.agla.io/

Whitepaper: https://whitepaper.agla.io/

Telegram: https://t.me/AngolaOfficial

Twitter: https://twitter.com/ANGOLA_ Official

Angola’s ecosystem cleverly integrates its primary token – AGLA – in numerous ways to sustain user engagement and ensure consistent growth. Let’s explore some key aspects of how the AGLA token works:

• Challenge Participation: The rewards level is determined by the results of a challenge, taking into account factors such as the number of picks obtained, NFT sales revenue, and the extent of challenge participation.

• Community Activities: Rewards are granted based on the liveliness of community activities, including the number of community members and registered NFTs, the number of picks obtained, and overall NFT sales revenue.

• Content Posting and Popularity: The rewards depend on the popularity of posted NFTs, the number of picks obtained, and NFT sales revenue.

• NFT Marketplace Popularity: The reward structure also accounts for a user’s level of popularity in the NFT marketplace.

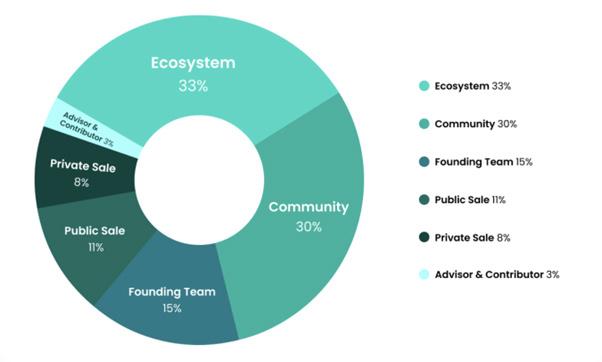

AGLA Tokenomics | Source: Angola’s DocsWe’ve seen that token distribution is focused on Angol’as ecosystem and community. Similarly, the AGLA token serves as a gateway to activities like:

• NFT Minting: You can mint relevant NFTs to qualify for using certain services within the system by burning or locking AGLA tokens or purchasing already minted NFTs.

• Open/Join a Community: You can mint or purchase NFTs to create or join an NFT community.

• Join the NFT Gallery: The more AGLA tokens are locked and the longer the lockup period, the higher the number of posts a user can register in the NFT Gallery.

• Join a Challenge: You can mint or purchase NFTs to participate in specific challenges.

• Create a Collection: You can open your digital content collection page. The more AGLA tokens are locked, the more collection space becomes available.

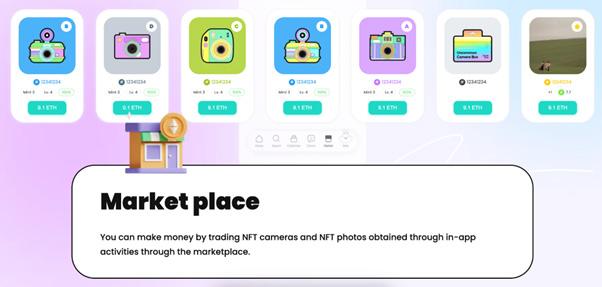

• NFT Marketplace: AGLA tokens cover NFT registration fees, sales commissions, purchase costs, and other fees in the marketplace.

• Partnerships: You can utilise AGLA tokens to mint NFTs with Angola partner’s apps and platforms.

The AGLA token is more than just a form of currency within the Angola ecosystem; it acts as a key, enabling users to unlock various features and benefits across the platform.

Simply put, AGLA redefines the entertainment market by powering the creation of iKON Photo Cards by Camera Box NFTs. These limited-edition cards, launched during the iKON 2023 World Tour, allow fans to interact with their favourite artists in a novel, digital way. By minting their own NFT Photo Cards using AGLA tokens, fans can create lasting, unique digital links with their favourite artists.

The Camera Box has three tiers - Silver, Gold, and Platinum - each offering varying levels of engagement and benefits in the Angola ecosystem. Whether minting 20 NFT Photo Cards at the Silver tier or enjoying unlimited minting and access to exclusive iKON fan signing events at the Platinum level, the AGLA token is at the heart of this rewarding fan experience.

The AGLA token plays a pivotal role in the pricing and sales strategy of the Camera Box. Each purchase of a Camera Box comes with a complimentary NFTminted Photo Card - an experience facilitated by none other than the AGLA token. The discount events and exclusive promotions tied to the iKON partnership incentivise the use of AGLA, further cementing its value within the ecosystem.

The use of AGLA extends beyond fan engagement to impacting Angola’s revenue model. By leveraging the AGLA token, Angola receives 50% of the total revenue as a tech license fee from Candy Plus’s

Camera Box NFTs.

Beyond its economic impact, the AGLA token is critical in community building and ecosystem expansion. With the iKON partnership, Angola aims to solidify its position in South Korea. The token acts as a connective thread within the community, facilitating the creation, sharing, and trading of NFTs.

The AGLA token is crucial to Angola’s vision of leading a fan culture and digital content consumption.

Angola’s journey, outlined in its roadmap, begins with a successful launch, followed by several phases of development, and expansion, leading to mainstream acceptance. Over the next few years, Angola plans to solidify its place in the NFT and entertainment space, strengthen partnerships, improve platform features, and foster a diverse and expansive ecosystem. The roadmap reveals an ambitious approach to establishing a comprehensive Web 3.0 experience in the NFT industry.

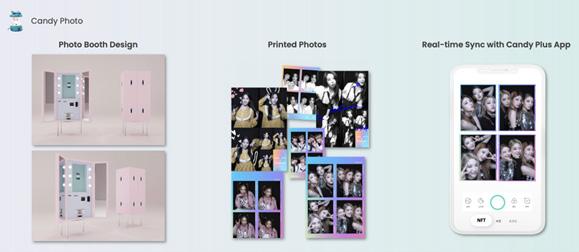

Let’s unveil the newest member of the Angola family: Candy Plus, a cutting-edge camera and photo editing app that effortlessly fits into Angola’s NFT ecosystem. I’d like to think this synergy enhances the experience, integrates advanced tools, and rolls out incentives that celebrate creativity.

CRRT tokens are the lifeblood of the Candy Plus ecosystem, driving engaging activities while incentivising user participation. Users get rewarded for their active involvement in the Candy Camera application. From taking photos, watching ads, and completing missions, to participating in challenges and minting NFTs like Camera and Camera Box, every interaction paves the way to earn CRRT tokens. This innovative approach underscores Angola’s commitment to the Take-to-Earn model.

The CRRT tokens have a dynamic issuance model. Initially, 100 million tokens were distributed. When 90% get burned, another 100m are issued. This cycle of reward and burn gives CRRT a unique aspect. They are not just rewards, though; they can be used to unlock extended functions within the Candy Camera and to purchase NFTs. Furthermore, users can swap their CRRT tokens with AGLA tokens at a specific rate, providing flexibility and expanding the utility.

Candy Plus is the gateway to Angola’s novel NFT Camera beta service. Users can download the widely used Candy Camera app from the Apple/Google App Store and use its features. Some most notable ones:

• ➢Beyond Just Clicks: Candy Plus offers more than 200 filters and 30 editing functions to perfect each photo. Users earn ‘Carrot Points’ for each image taken. The bonuses? Real-time face correction and exclusive access to features by holding Camera NFT and Camera Box NFT.

• Minting Memories as NFTs: This app has in-app NFT minting. Users can turn their creative works into NFTs using their accrued Carrot Points. The app promotes active user engagement by offering AGLA rewards for chosen NFTs from the Gallery or NFT Challenge.

• NFT Camera: Performance varies with the Camera Stats and reward system of the NFT Camera. This camera, upgradeable based on user activity, allows collaging, buying, and selling of Camera NFTs with AGLA tokens.

• NFT Camera Box: Unlocked by collaging specific Camera NFTs, the Camera Box NFT provides access to premium functions and rewards. Users can trade these NFTs on the NFT Marketplace.

• Additional NFT Features: Candy Plus keeps things interesting with Frame NFTs and NFT Badges, mintable for extra stats and rewards. Photo collaging also offers a new level of creativity and profitability with high-grade NFTs.

• ➢Carrots for Creativity: Candy Plus rewards users for photos and active participation in challenges, referrals, and ad viewing.

Candy Plus has emerged as a force to be reckoned with, boasting an extensive global user base. It stands out for its superior photo capturing, editing tools, and innovative approach to NFT minting. The image below beautifully encapsulates the striking statistics and features Candy Plus offers to its users:

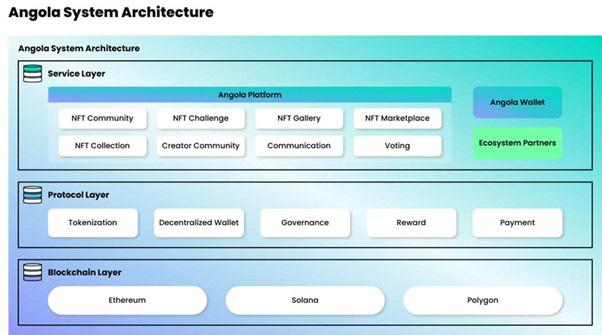

Angola has established a vibrant ecosystem that blends technology, community, and partnerships to provide a comprehensive Web 3.0 experience. Here’s a simplified view of its ecosystem:

At the heart of Angola’s ecosystem is the Take-to-Mint technology. This technology converts digital assets into unique, verifiable NFTs on the blockchain in real time. Angola integrates this technology with key ecosystem partners:

• Candy Plus: An enhanced mobile app which incorporates Angola’s technology to enhance photo-taking, editing, and NFT minting.

• Candy Photo AI Camera: An AI-based technology that enhances photos and personalises the NFT creation experience.

• Entertainment Partners: Strategic collaborations with entertainment entities amplify Angola’s reach, creating a broader NFT ecosystem.

The wallet stores AGLA tokens, NFTs, and reward points, and facilitates transactions within the network. Beyond its role as a transactional hub, the wallet supports SDK tools to integrate with Angola’s ecosystem partners.

It supports the Ethereum and Solana versions of AGLA, intending to go multi-chain soon. The Angola wallet also enables seamless swaps between ETH and Solana network, a great addition if you ask me. The Transition to Web 3.0

From minting a new NFT to participating in community challenges, each action, and each feature, boost and expands the user experience. Let us have a closer look:

• NFT Community: A place for users to connect and share NFT experiences.

• NFT Challenge: A space where members compete and showcase their creativity.

• NFT Gallery: A platform for users to display and appreciate NFT artwork.

• NFT Marketplace: A marketplace for buying, selling, and trading NFTs.

• NFT Collection: A personal space for users to manage their unique NFT collections.

Angola uses an innovative strategy to integrate blockchain and NFTs, to offer a compelling vision of fan engagement and the potential evolution of Web 3.0. The AGLA token does not just serve transactional purposes—it acts as a lynchpin, connecting these elements into a unified ecosystem. Angola has a clear ambition: to lead the way in Web 3.0 fandom culture and cultivate a thriving NFT ecosystem that aligns with the needs of digital consumers.

What truly stands out to me is the strategic aspect of these partnerships; they are not solely for the purpose of gaining visibility; they are meticulously aligned with Angola’s mission.

However, it’s all about delivering on promises and offering valuable, functional technology that appeals to the masses.

We live in a digital era, but the mass adoption of technologies like blockchain and NFTs is still an uphill climb. Therefore, questions arise:

• ➢Can Angola successfully steer this trend, developing a robust NFT ecosystem that appeals to fans, artists, and collectors alike?

• ➢Can it harness the power of Web 3.0 to reinvent fan engagement in the entertainment industry?

As we approach a new epoch in entertainment and digital interaction, I am excited to see Angola’s progress. It could significantly influence how we perceive and engage with NFTs as well.

written by Daniel Jimenez

One of the characteristics that had always differentiated Bitcoin from the rest of the ecosystem was the particularity of having only one asset on its chain: bitcoin. Unlike Ethereum for example, until January of this year, the leading blockchain by market capitalization did not host any other than its currency (BTC).

Beyond the different perspectives that this may generate, the chain was still under the original principle of its creator Satoshi Nakamoto: Magic money on the Internet resistant to censorship.

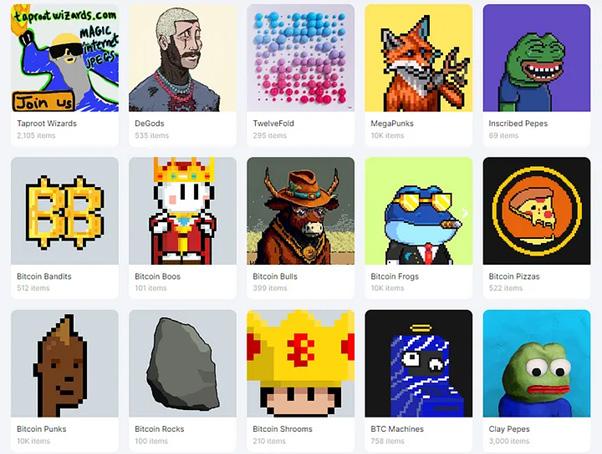

But now things changed a bit, even when still in the ‘experimental phase,’ the Ordinals introduction in January 2023 by Casey Rodarmor opened the doors for innovation and creativity from developers aiming torse expanding the use cases in the most secure and resilient blockchain network in the market such as Bitcoin.

Amidst the bubbling euphemism causing

‘programmability’ in Bitcoin, let’s explore two new use cases that gave something to talk about in the first half of 2023: BRC-20 and ORC-20.

As a prerequisite for taking early advantage of the opportunities in the industry’s principal blockchain network, we will learn the basics of such new standards and then explore the tools that will allow us to stay one step ahead of an ever-growing trend.

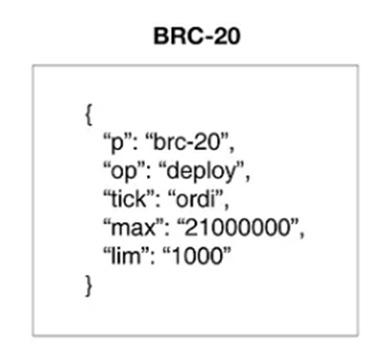

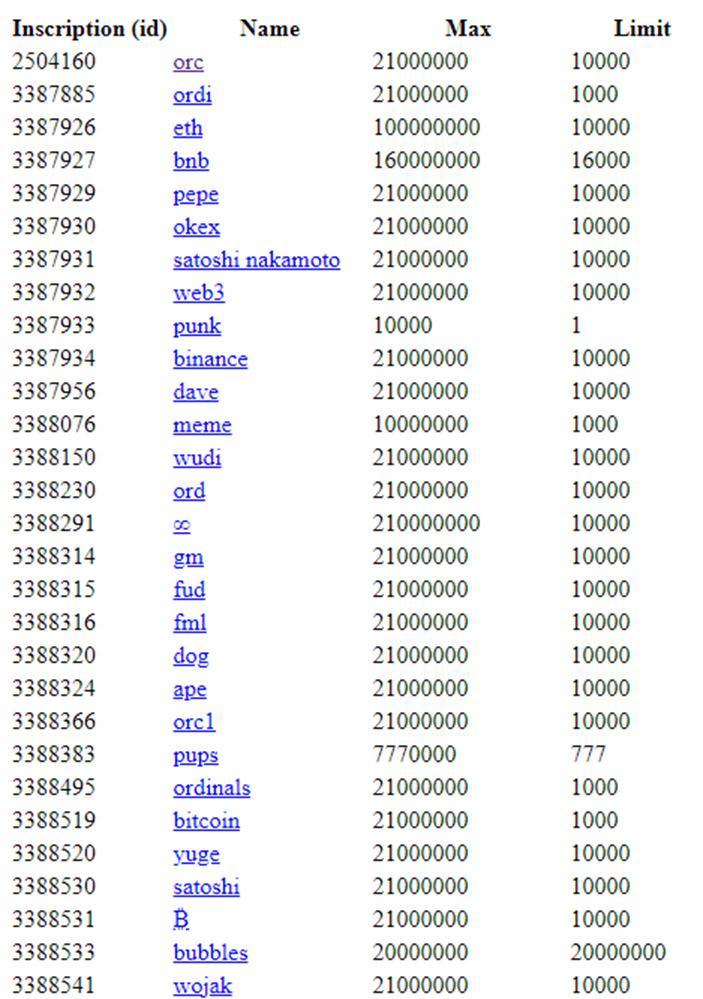

In early March 2023, the BRC-20 token standard was created on the Bitcoin network, triggering a new niche market that became the subject of mixed opinions among cryptocurrency lovers.

However, the relevant aspect is incorporating new use cases beyond non-fungible tokens through Ordinals inscriptions in satoshis.

If you want a recap on Ordinals NFT, check out our dedicated post in issue #20:

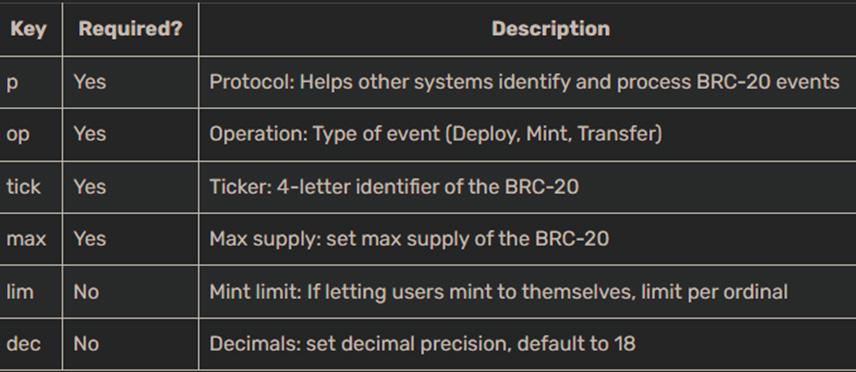

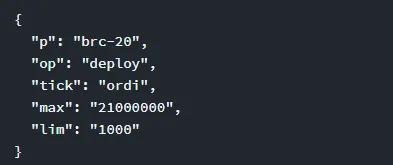

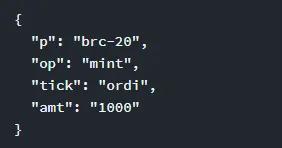

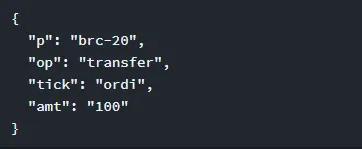

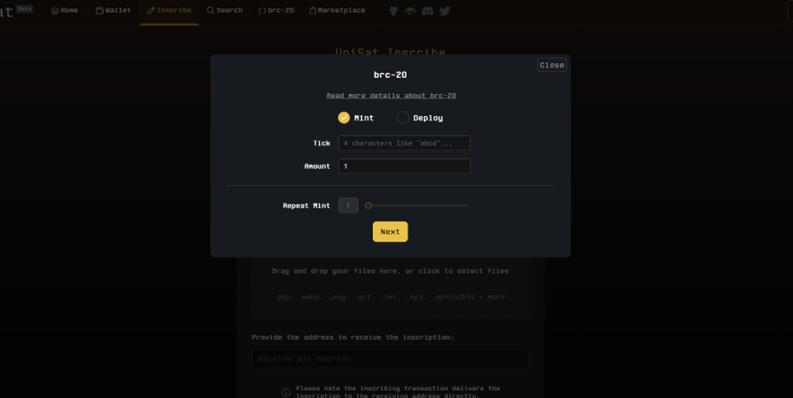

Returning to the main point of this section, the new BRC-20 token standard introduced by the enigmatic developer Domo in early March 2023 supports the creation and transfer of fungible tokens via the Ordinals protocol.

While it is true that this is nothing new in the industry, it is for Bitcoin and in a completely different way than what we were used to seeing with other standards present such as Ethereum’s ERC-20 or BNB Smart Chain’s BNB-20, for example.

The BRC-20 standard forgoes reliance on smart contracts to create, mint, and transfer tokens, performing these functions through Bitcoin ordinal inscriptions. These tokens use JavaScript object notation (JSON) data for ordinal inscriptions in satoshis to mint and transfer tokens and implement token contracts.

BRC-20s support the mint function that is transferred using the transfer function and developed with the deploy function. Like Ordinals in their early stage, creating BRC-20 tokens requires some technical knowledge, which is beyond the reach of a broad base of Bitcoin users.

However, as noted by its creator, it is an experiment to enable fungibility on the Bitcoin blockchain, subject to some experimental flaws and limitations, but also to market opportunities to capitalize on.

Although BRC-20 is still in its infancy, there are several key features that every user should be aware of before making a potential investment decision. Let’s explore the most important of them.

• Fungibility: As the term implies, BRC-20s can get exchanged easily,, opening new frontiers for token trading on the Bitcoin network.

• Security: BRC-20 tokens inherit the highsecurity level provided by the Bitcoin protocol based on the PoW consensus mechanism, giving its existence on the most secure and decentralized blockchain.

• Compatibility: They are natively compatible with the Bitcoin blockchain, facilitating integration into its ecosystem.

• Simplicity: Although in the initial stage deploying BRC-20 tokens required somewhat advanced technical knowledge, its popularity has allowed the deployment of new tools that simplify this process. In addition, natively, it does not require advanced coding since they are not dependent on smart contracts.

While BRC-20 has positive features, some shortcomings have caused a brief decline in its use: flexibility, scalability, and security.

Of all these, there is a latent risk of double spending in some BRC-20s when not implementing the methods to avoid this security deficiency. On the other hand, the ticker limitation in the naming conventions prevents BRC-20s from being extended to more complex use cases like tokenized property rights.

Not least, it is the small developer community compared to more popular token standards such as ERC-20 that limits their rate of technological progress and the big headache for many maximalist bitcoiners has been that the disproportionate increase in fees and block space due to high demand for minting BRC-20 tokens.

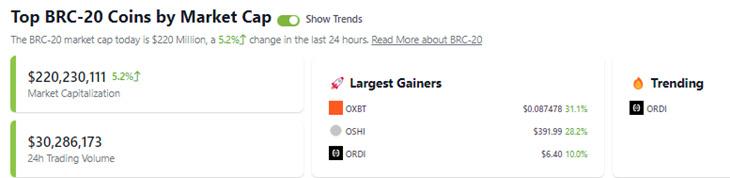

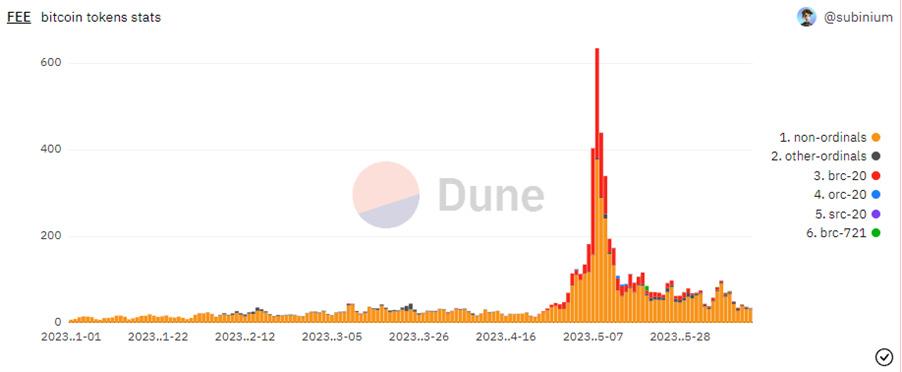

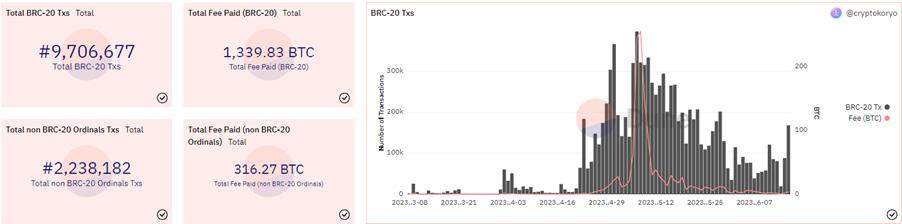

A chart reflecting the increase in average Bitcoin transaction fees by minting Ordinals due to the BRC-20 boom last May 08- Source: Glassnode.

The lack of flexibility in the design of BRC-20 tokenomics with the dependence on the Bitcoin network, which despite being secure, is rigid in terms of scalability, also limits the use of BRC-20 for massive use cases such as blockchain games.

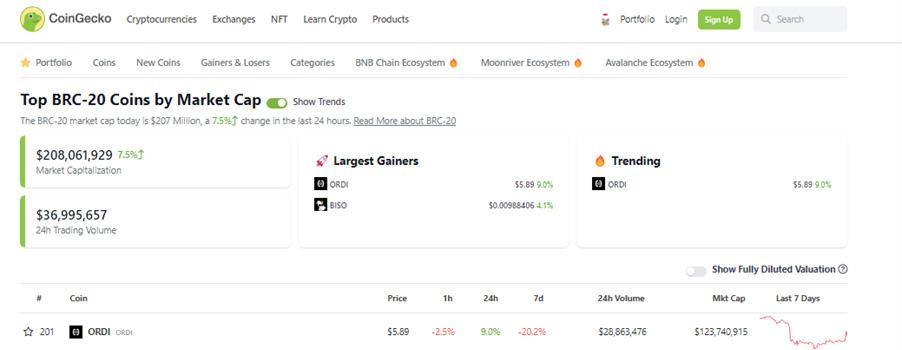

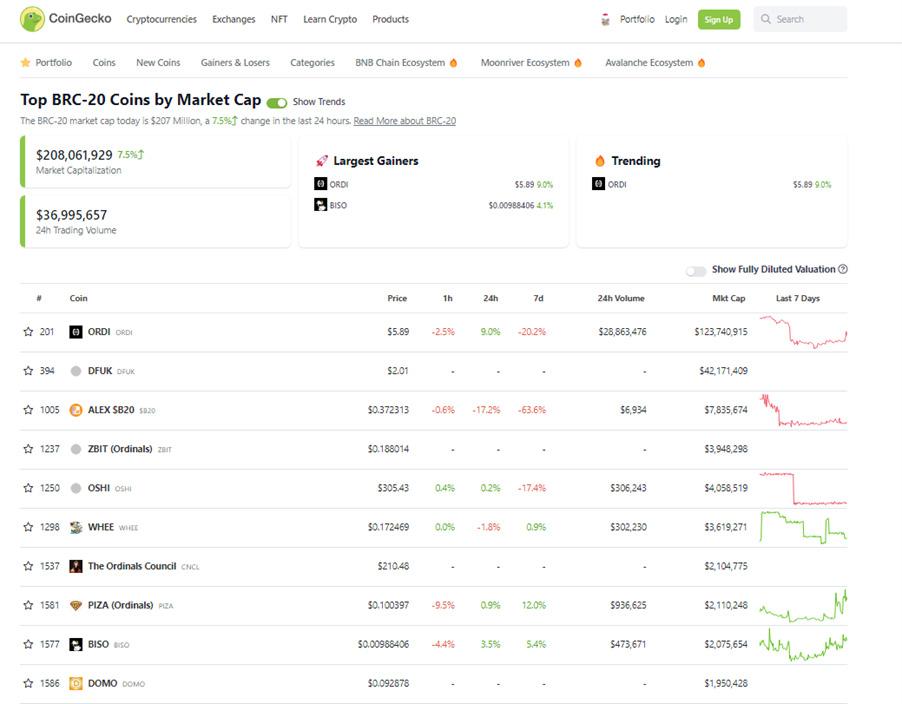

However, the rise of meme coins such as PEPE last May boosted the market cap of this growing market niche; the trend currently seems to have dissipated, with the ORDI token still being the reference in the ecosystem.

As we saw in the previous section, the BRC-20 has a series of limitations by default at the time of its implementation due to its experimental concept after the incursion of the ordinal theory in Bitcoin in the search for solutions to incorporate value to this blockchain network.

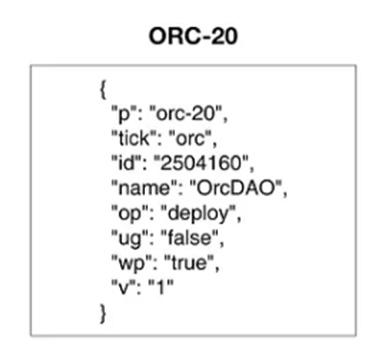

To overcome the limitations for tokenization in the Bitcoin network introduced by BRC-20, a new open standard for the Bitcoin network called ORC-20 is emerging.

• BRC-20s have a four characters limitation of token names. While initially, this may be fine, in the long run, the lack of naming options becomes an obstacle in the effective identification and branding of tokens.

• Eliminates reliance on centralized external indexers, a recurring problem in BRC-20 that has led to some cases of duplicate token tickers being by malicious actors.

• The ORC-20 standard incorporates an identifier that can recognize specific tokens to avoid external indexers from deciding in the case of identical names (ticks) token legitimacy, as is the case with BRC-20.

• It controls double spending since its base is Bitcoin’s UTXO model implementation.

• One of the great strengths of the ORC-20 is the incorporation of the UTXO concept for token transfer. Since UTXOs can only function once, it avoids, by default, the double spending presented in some BRC-20 options, thus establishing a difference from its predecessors and an extra layer of security for trading these assets.

• ORC-20s introduce the ‘Cancel’ option, a feature that allow to cancel partial transactions, enabling users to reverse or undo not fully processed transactions, offering greater flexibility and control over token transfers.

The ORC-20 is bases on both the ordinal theory and the active principle of fungibility of the BRC-20 but to eliminate the flaws present in its predecessors, such as scalability, safety, and flexibility.

For the experts, ORC-20 is an improved version of the BRC-20s that smoothes out many disadvantages present in the Domo experiment:

• Flexibility when modifying the total supply and the maximum amount of tokens minted that need to adjust for an update in the tokenomics design under certain circumstances.

• The ORC-20 standard adds the upgrade feature, which allows the total supply and maximum number of tokens per mintage to be changed, even after initial deployment, a feature not permissible in BRC-20s.

• It eliminates the limit on the length of token names, allowing a wide variety that fits perfectly with the business vision of ventures that wish to venture into this ecosystem.

Despite the substantial improvements introduced by ORC-20 compared to the first attempt at Bitcoin fungibility through BRC-20 tokens, this new update is still in an experimental phase and has received some criticism from the community for being more complex to implement than its predecessor.

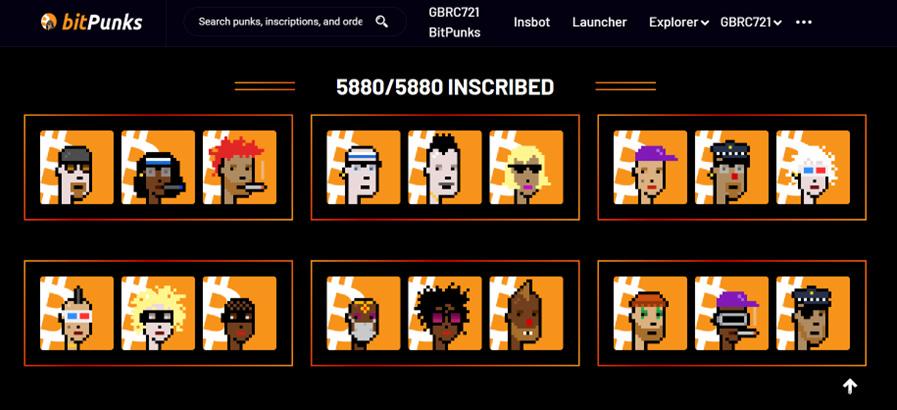

However, some community projects, like BitPunks, provide an ORC-20 explorer and OrcDAO that uses ORC tokens.

Overall, the differences between the two standards are defined and offer numerous opportunities for innovation and development that could capitalize on greater use cases in Bitcoin.

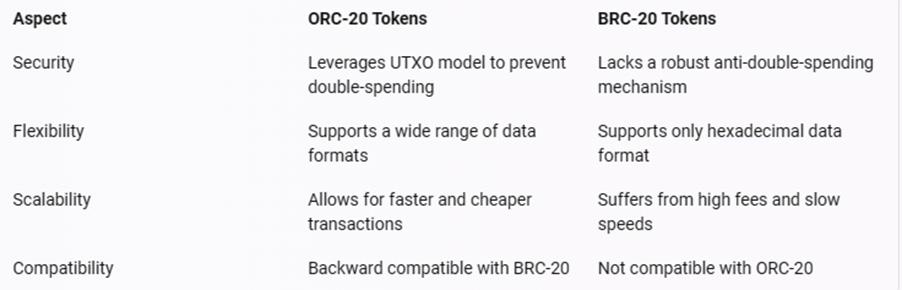

ORC-20 and BRC-20 tokens share similarities as token standards on the Bitcoin network. However, there are notable differences that set them apart. Let’s compare ORC-20 and BRC-20 tokens in the following table:

With this in mind, let’s look at some key features to explore the BRC-20 and ORC-20 markets, searching for early-stage opportunities at the discretion of your DYOR.

• BRC-20 tokens gained traction in April, causing a peak in transaction fees on the Bitcoin network on May 8, forcing some exchanges such as Binance to suspend BTC deposits and withdrawals due to the congestion of more than 400,000 pending transactions in the Bitcoin mempool.

• The first token minted under the BRC-20 standard was ORDI last March 08. $ORDI achieved a meteoric rise in the first days of May, moving its price from $0.1 per token to a 290x of $29 on May 08, giving it a temporary market capitalization of nearly $650 million, which would place it above projects such as Decentraland and Maker DAO.

• From May 13-15, ORC-20 token transactions accounted for a substantial fraction, approximately 10%, of total transactions.

• 16.5% of the fees on Bitcoin networks correspond to the BRC-20 tokens, with a value currently reaching 1,334 BTC versus 21.93 BTC in fees corresponding to the ORC-20.

• Currently, there are about 9.4M transactions related to BRC-20 tokens and 323k transactions concerning ORC-20 tokens.

• There are currently more than 11 million registrations in the Bitcoin network, including Ordinals, BRC-20, ORC-20, and other similar derivations, demonstrating the dizzying growth of this market.

• The total value of BRC-20 tokens briefly surpassed the USD 1 billion mark on May 9 but has since fallen to USD 207 million, a drop of nearly 80%.

• On May 13, a record 72,200 ORC-20 transactions were recorded, marking an alltime high. The majority of these transactions occurred predominantly within categories such as Punk, Pepe, Meme, and others.

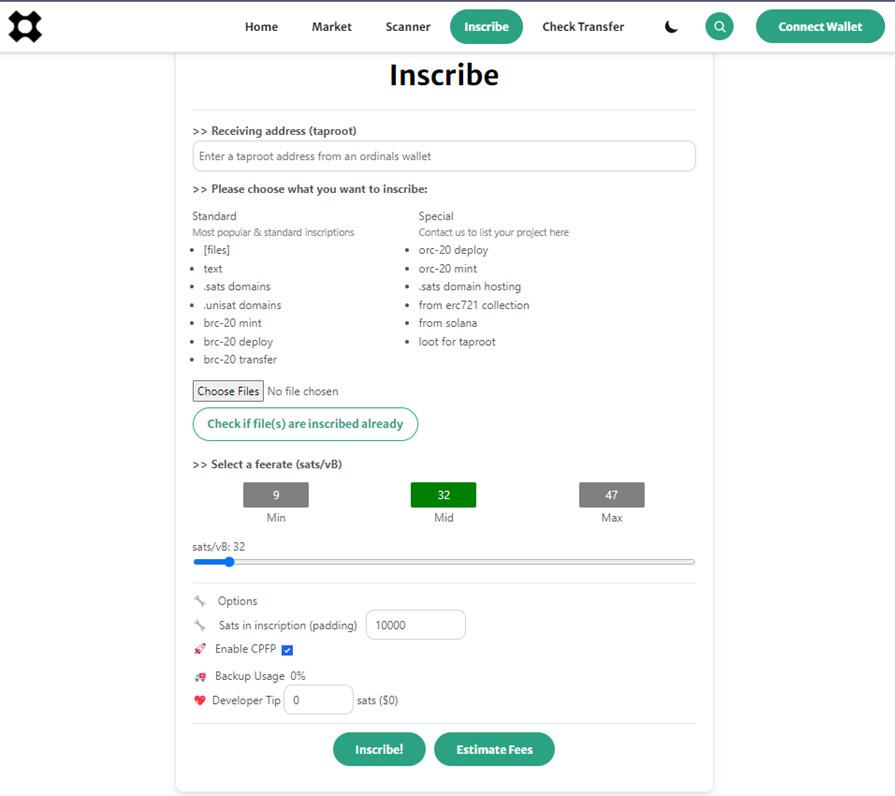

After studying the characteristics of each standard and observing the clear distinctions between them, it is logical to think about exploring the new ecosystems created under the umbrella of BRC-20 and ORC-20.

Dear reader, know that both standards (as well as the ordinals) are experimental and very recent implementations in the Bitcoin protocol, so it

is imperative to have a clear vision of the risks inherent to projects developed in them, ranging from operational failures due to unforeseen errors in their experimental phase to possible project failures due to lack of liquidity and malicious actors.

In addition, it is imperative to note that much of the reasoning for or against the new standards depends largely on perspective.

For example, for layer 2 technology creators is natural to oppose Bitcoin base layer developments such as Ordinals, BRC-20, and ORC-20. In contrast, miners are unlikely to oppose something that could increase their revenues.

This technology is hardly changing anything for holders, who probably don’t care much about transaction fees or mempool size. However, they are causing several problems for traders and other market participants, such as cryptocurrency exchanges.

Whether or not these implementations in the Bitcoin network are here to stay, the community has yet to see the full potential of the technology and its consequences. Currently, we see great potential in token issuance on the Bitcoin network, judging by the key milestones reached by each standard amid bear season with strong regulatory pressures.‘

While the BRC-20 market is broader than ORC-20, some iconic projects can mark the beginning for any user who wishes to explore and potentially invest in this niche market within the Bitcoin network.

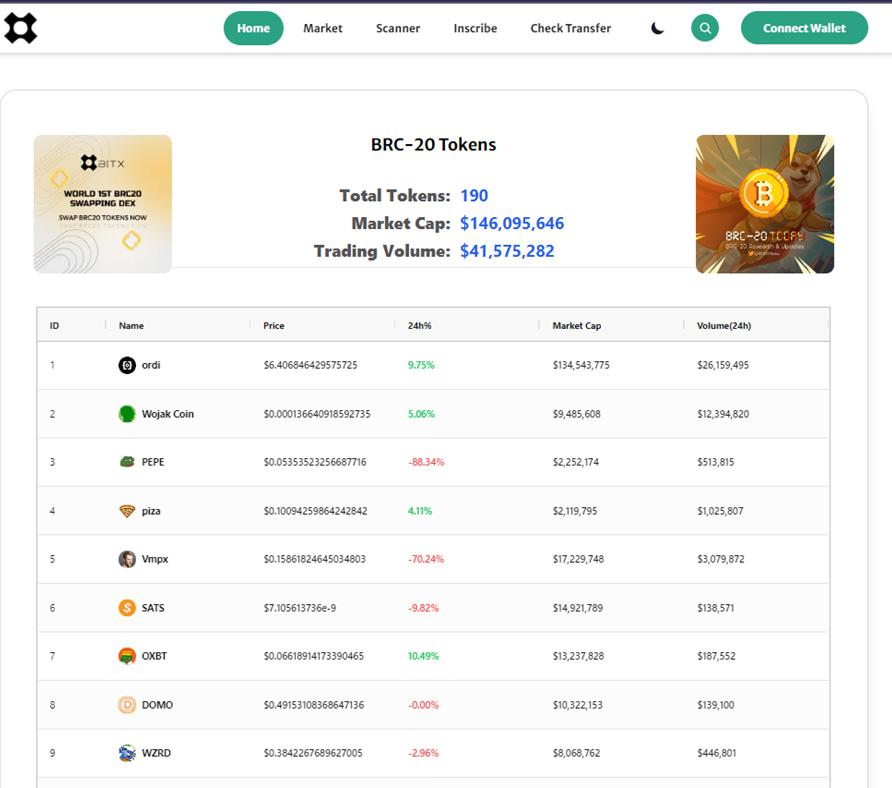

To do so, you should look at marketplace explorers such as brc-20(dot)io to locate top fungible tokens under the BRC-20 standard. In this sort of ‘marketplace,’ you could find at least 187 tokens that accumulate a large part of the BRC-20 market cap, with iconic projects such as Ordi, Pepe, and Wojak Coin.

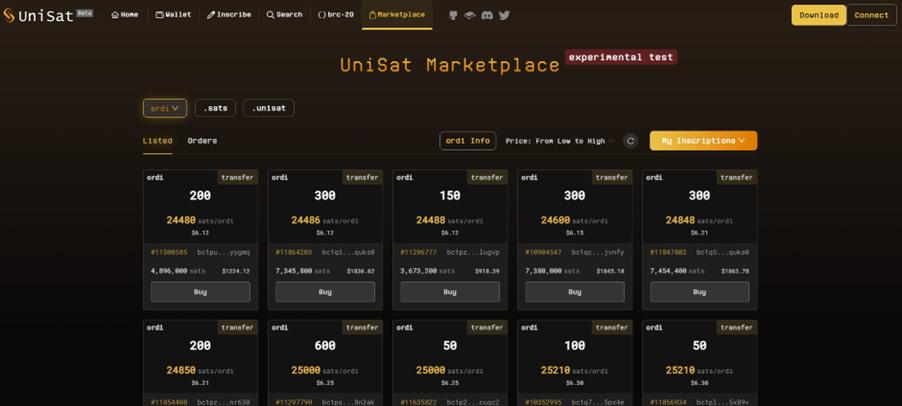

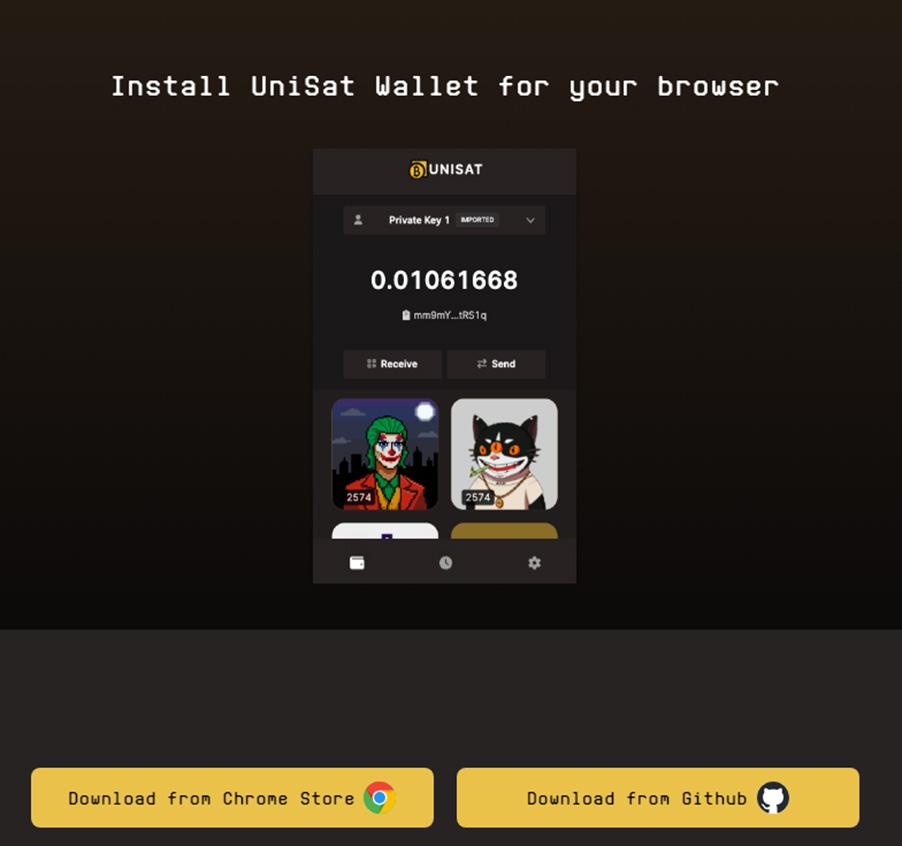

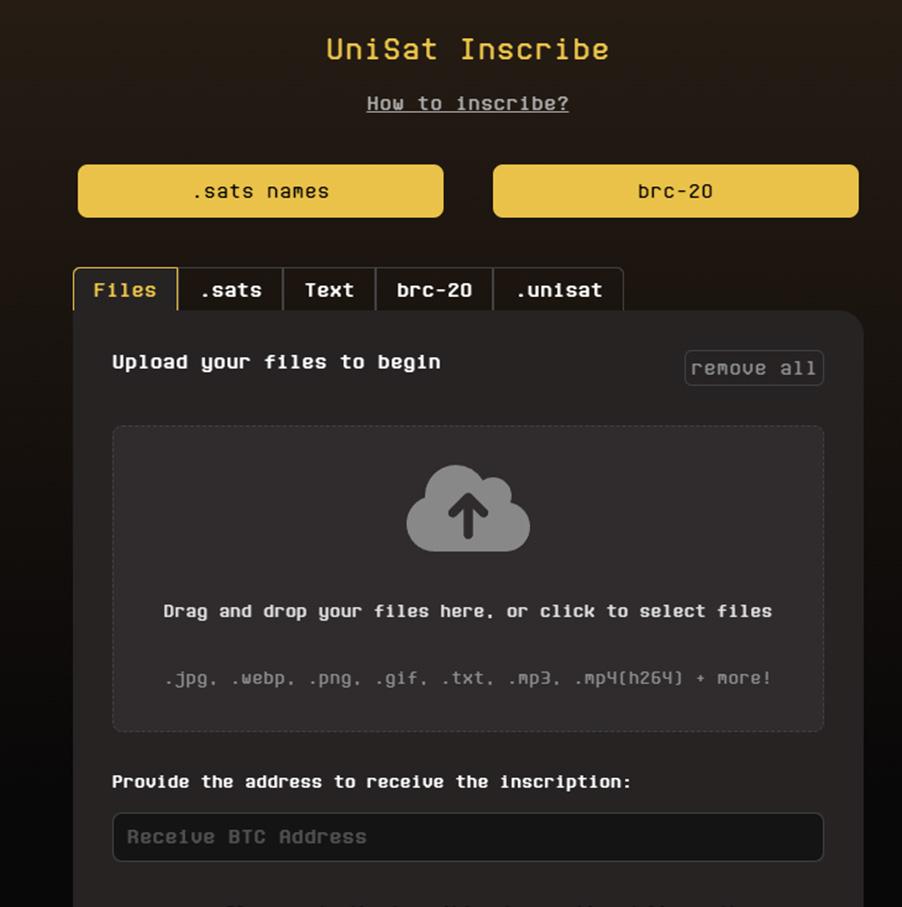

Unisat Marketplace is another option to interact with the BRC-20, offering a secondary market for several options under this standard.

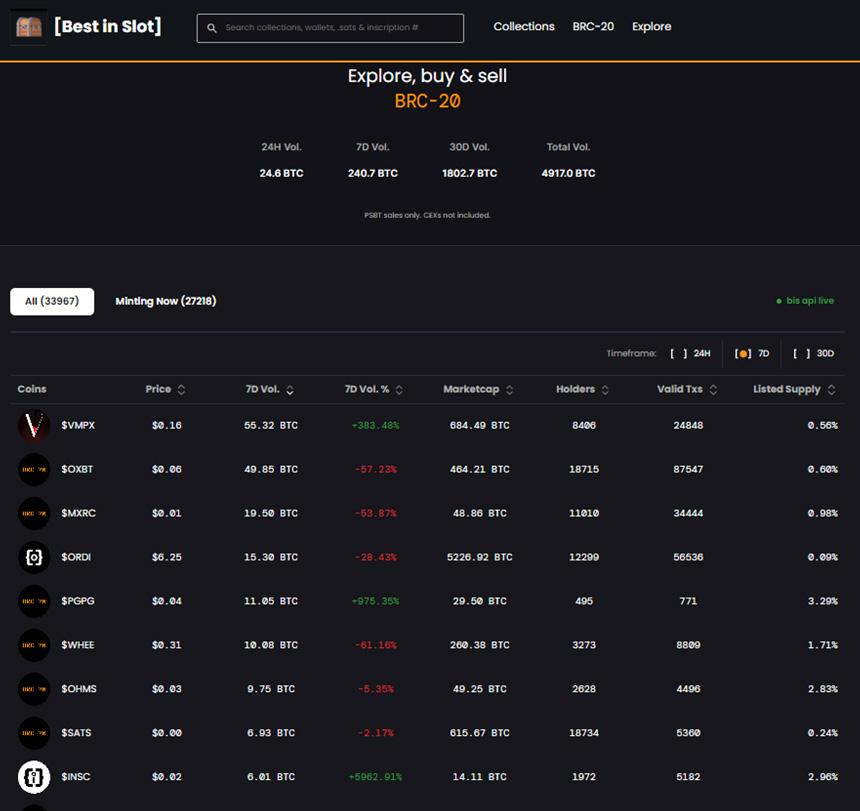

Best in Slot offers an intuitive interface for Ordinals collections and BRC-20 tokens to explore.

In addition to the options above, you can explore the market indicators Coinmarketcap and Coingecko, both offering a section for the Bitcoin ecosystem within which you can find the BRC-20s.

There you will see important metrics for each BRC-20 option and the centralized/decentralized markets where some of these tokens get traded.

In the case of ORC-20 tokens, the situation is not so simple, given their limited traction among the community. However, sites such as Loveords offer a list of at least 420 deployed ORC-20 tokens, where you can see the most representative of this ecosystem.

The artificial intelligencepowered trading assistant GeniiData provides an overview of this sector of the Bitcoin market ORC-20, its beta phase.

You can also visit early-stage projects such as BitOrcs, a collection of Ordinals driven by artists belonging to the creators of ORC-20, OrcDAO.

Another representative project besides ORC is BitPunk, a 5880 inscribed NFT marketplace that allows exploring early-stage market opportunities within the ORC-20 standard

Remember that to trade with Ordinals and standards based on this technology, such as BRC-20 and ORC-20, the user requires a compatible Bitcoin wallet. In issue number 20, you can review all about Ordinals and discover compatible Bitcoin wallets of your choice.

If you are interested in the technical aspect of each standard, you can visit the following official links of each one:

*BRC-20: brc-20 experiment

*ORC-20: ORC-20

Don’t forget that every investment carries risk, and you should do your research before committing to these new types of tokens that are in their early stage, many of them still for experimental purposes.

written by Samantha JimenezIn the cryptocurrency world, specific categories are decisive in the functioning of exchange platforms. One of them is the “Exchange Tokens.” These are native tokens or tokens specific to a particular exchange, built on an existing blockchain, such as Ethereum, which, at the same time, are designed to complete several functions within the platform.

One of the most prominent features of Exchange Tokens is their usefulness as a way to pay commissions, directly benefiting the user because they receive discounted commissions by using these tokens to pay trading fees on an exchange.

This feature helps the adoption and usage of Exchange Tokens and allows users to save on transaction costs and maximize their profits. In this article, we will explore in detail some of the most popular exchange tokens in the industry, such as Huobi Token ($HT), Binance Token ($BNB), Bitfinex Token ($LEO), KuCoin Token ($KCS) and MEXC Token ($MX).

Let’s start with the Huobi Token ($HT), the native token of the Huobi platform. Issued and managed through the blockchain by Huobi, $HT has become a cryptocurrency of great importance within the Huobi ecosystem. Its utility spans various scenarios and applications in Huobi’s global business, establishing itself as a central element in the ecosystem.

Holders of $HT tokens enjoy significant benefits across the Huobi ecosystem. In addition to earning green sub-token rewards, $HT holders benefit from the valuable promotion provided by the token’s buyback and sustained destruction program.

It can also be a payment method for transaction fees on Huobi, and by using HT to pay for transactions on the platform, users can benefit from a fee discount, providing an additional incentive to purchase and use these tokens.

In addition to its function as a way of payment, Huobi Token offers its holders additional benefits within the Huobi ecosystem. HT holders have access to special privileges, such as participating in community votes and platform-related decisions, promoting users’ active participation, and giving them a voice in the development and direction of Huobi.

A highlight of the Huobi Token is its token buyback and burning program. Huobi regularly allocates

a portion of its revenue to buy back HTs in the market and later burns them. In other words, it removes them from circulation permanently. This strategy aims to reduce the overall supply of HTs in the market, which can potentially increase their scarcity and, consequently, their value. Buying back and burning tokens is regular practice on various cryptocurrency platforms to maintain stability and balance in the token ecosystem.

Searching liquidity in the cryptocurrency market, the Huobi Token can also get traded on other exchange platforms giving users the flexibility to acquire and trade HT on different exchanges according to their preferences and trading strategies.

The current price of the Huobi token (HT) is $2.70 USD, with a 24-hour trading volume of $10,068,869 USD according to data provided by CoinMarketcap. In the last 24 hours, the price of the Huobi token has experienced a 3.47% increase. According to CoinMarketCap’s current ranking, HT is ranked #86, with a market cap of $437,292,365 USD.

Price: $HT

Source: CoinMarketCap

Huobi was founded in 2013 by Leon Li and has been a prominent player in the cryptocurrency industry ever since. The CEO and Huobi founder is known for his vision to democratize finance and make financial services more accessible to all. Under his leadership, Huobi has experienced significant growth and has become a leading platform in the cryptocurrency market.

Huobi has demonstrated its meaningful role in promoting Web 3.0 technologies adoption.Recently, it participated as a strategic partner in the highly anticipated Wiki Expo held in Singapore.

During the Wiki Expo, Huobi highlighted its commitment to empowering Web 3.0 innovations and fostering the growth of the decentralized ecosystem. The event provided a platform for Huobi to connect with industry leaders, blockchain enthusiasts, and aspiring developers, allowing them to share knowledge and explore the vast potential of blockchain technology.

Huobi’s participation in the Wiki Expo amplified its influence as a key player in the Web 3.0 revolution.

As a gateway to Web 3.0, Huobi prioritizes the security and reliability of its platform. During the event, it highlighted its robust security measures, compliance protocols, and commitment to user protection, reinforcing its position as a trusted partner for those venturing into the decentralized ecosystem.

Huobi Token (HT) is a critical element in Huobi’s vision to drive the widespread adoption of blockchain technology and decentralized applications (DApps). As it moves into the future, Huobi will continue to lead the charge in promoting Web 3.0 and enabling its users to benefit from this new technological paradigm opportunities and advantages.

Overall it has established itself as a central element in the cryptocurrency exchange community, providing incentives to users and strengthening interaction within the platform.

It is probably the best known in the crypto industry, given that it comes from the world’s largest cryptocurrency exchange, Binance. With a wide range of services and a pioneering vision, Binance has left a significant mark on the cryptocurrency ecosystem.

BNB, Binance’s native coin, has stood out in the cryptocurrency world for several reasons that make it one of a kind. Binance, as a blockchain-based decentralized network ecosystem, has experienced significant growth and has become the leading crypto exchange in multiple countries. In addition, Binance has expanded its services to various areas aiming to become the infrastructure service provider for the entire blockchain ecosystem.

One of Binance’s competitive advantages is its focus on continuous development. Although it started as a simple cryptocurrency exchange in 2017, it has evolved to encompass much more. The company constantly looks for new opportunities and has established parallel organizations, attracting considerable interest in the crypto space.

The launch of the BNB coin has been another factor in Binance’s success. As investor interest in the cryptocurrency has increased, BNB has experienced significant growth in value. In particular, in early 2021, BNB experienced a notable increase in its price, capturing the attention of corporate investors and consolidating its position in the market.

Binance has implemented strategic measures, such as BEP-95, to improve BNB’s tokenomics and make it more deflationary. Following this proposal, gas fees in the Binance Smart Chain have been reduced as the network burns a fee portion to decentralize further. This proposal was inspired by Ethereum’s well-known EIP-1559, demonstrating Binance’s ability to adopt and adapt successful concepts from other blockchain projects.

These measures have also helped Binance overcome several protocols exploits in the Binance Smart Chain. For example, Binance has faced challenges such as the $200 million exploit in Pancake Bunny and several hacks in Cream Finance. Despite these attacks, users continue to trust Binance due to its low fees and the wide availability of lucrative meme coins in its ecosystem.

Also, users can enjoy significant discounts by using BNB to pay trading fees on Binance, encouraging BNB adoption and usage while offering users a cost-effective way to trade on the platform. Binance also periodically conducts BNB token burns, permanently destroying a set amount of BNB. This token-burning strategy helps maintain the scarcity and demand for BNB, which can potentially increase its value in the long run.

In addition, various services within the Binance ecosystem function with BNB, including additional trading fees payment, participation in lending programs, subscription to Binance-backed crypto debit cards, and access to exclusive services within the platform.

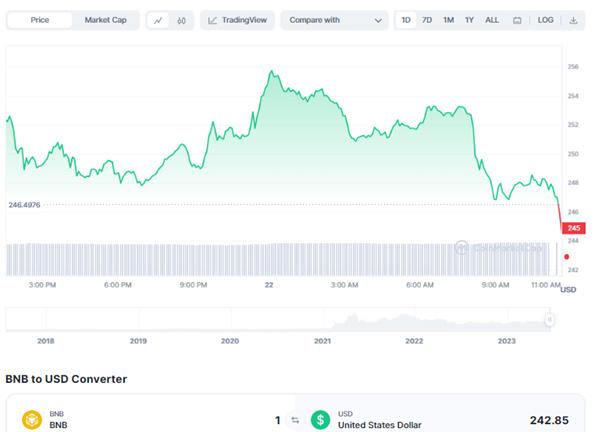

BNB’s current value is USD 248.00, and in the last 24 hours, BNB has experienced a 0.26% increase in price. In the CoinMarketCap rankings, BNB is currently ranked #4 with a live market cap of USD 38,650,982,886.

Source: CoinMarketCap

In summary, BNB stands out as a unique cryptocurrency due to Binance’s vision and development approach, its role as an infrastructure service provider for the blockchain ecosystem, and the strategic measures implemented to enhance its tokenomics and security. With its growing popularity and adoption, BNB continues to leave a significant footprint in the cryptocurrency world and positions itself as an attractive option for investors and users interested in participating in the blockchain ecosystem.

Let us also mention the Bitfinex Token ($LEO) associated with the Bitfinex exchange platform. This utility token is the heart of the iFinex ecosystem. Token holders will experience various benefits, such as discounts on exchange fees, access to premium services, and the opportunity to participate in loyalty and rewards programs.

In addition to its functional features, the $LEO can be used as a payment method within the Bitfinex ecosystem, giving users greater flexibility in their transactions. Bitfinex also conducts periodic LEO burns, removing a specific amount of LEO tokens from circulation. This practice helps reduce the circulating supply of LEO, which can potentially increase its long-term value.

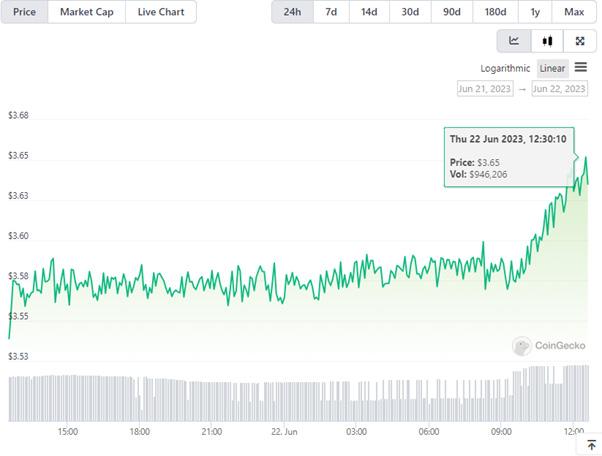

The LEO token is worth $3.64 today, up 2.7% in the last 24 hours. It is available to buy and sell on 38 different centralized crypto exchanges. LEO Token has recorded a global transaction volume of $940,315 in the past 24hrs..

LEO holders have the opportunity to participate in polls and votes related to the future of Bitfinex. This allows users to influence important decisions affecting the platform, such as feature updates, implementation of new tokens, and functionality improvements.

LEO holders can participate in polls and votes related to the Bitfinex future, thus allowing its users to influence important decisions affecting the platform, such as feature updates, implementation of new tokens, and functionality improvements.

In addition, those Bitfinex users that hold LEOs can access benefits and privileges. These may include priority access to new features and products, dedicated customer support, higher withdrawal limits, and others, providing further incentives for users to acquire and retain LEO in their accounts.

We cannot fail to mention the KuCoin Token ($KCS), the native token of KuCoin, one of the world’s leading cryptocurrency exchanges, which has gained recognition for its innovative trading platform but also for its native token.

KCS, launched in 2017, is a profit-sharing token, initially issued as an ERC-20 token on the Ethereum network, which provided compatibility with most existing Ethereum wallets. With the development of KuCoin’s decentralized trading solution, KCS expects to become the native asset of decentralized financial services and the governing token of the KuCoin community in the future.

KuCoin has expressed its commitment to “Empower KCS” and turning it into an outstanding product rather than a 55simply token. This strategy will further diversify the benefits for KCS holders. As KuCoin moves forward with implementing decentralized exchange and KuChain, KCS will become the fuel and central token for future KuCoin decentralized products.

A distinctive feature is the KCS Bonus is that it represents an excellent way to earn passive

income. Users with more than 6 KCS can receive a daily dividend from 50% of the daily revenue generated by Kucoin’s trading fees.This unique incentive mechanism benefits both KCS holders and KuCoin ecosystem builders.

In addition to receiving dividends, the KCS also has multiple use cases. As a utility token, it can pay trading fees on KuCoin Exchange, allowing users to enjoy up to 80% discounts. As the KCS serves several functions on the platform, holders can become KuCoin VIPs, giving them access to the reduced originator and taker fees without a large volume of BTC trading.

The KuCoin KCS token is a versatile asset that provides users with a wide range of benefits and opportunities within the KuCoin ecosystem. With its ongoing commitment to driving growth and innovation, KuCoin continues to cement its position as a leading platform in the cryptocurrency world.

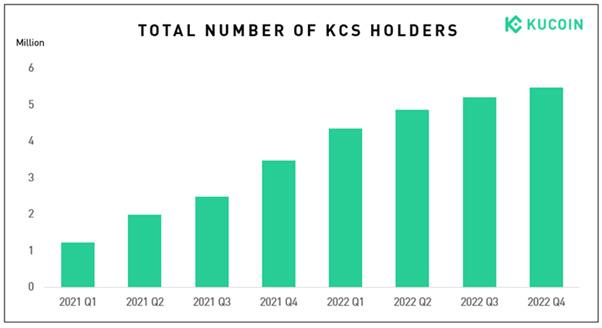

During 2022, they witnessed a significant increase in the adoption of KuCoin’s native token, the KuCoin Token (KCS). Users have discovered the value of holding KCS in their account, as it gives them access to a wide range of services on the platform. From stake and liquidity mining to lending, KCS holders enjoy discounted trading fees and participate in the growth of the KuCoin ecosystem.

The platform wishes to continue innovating and presenting new use cases for the KCS token as its utility expands.

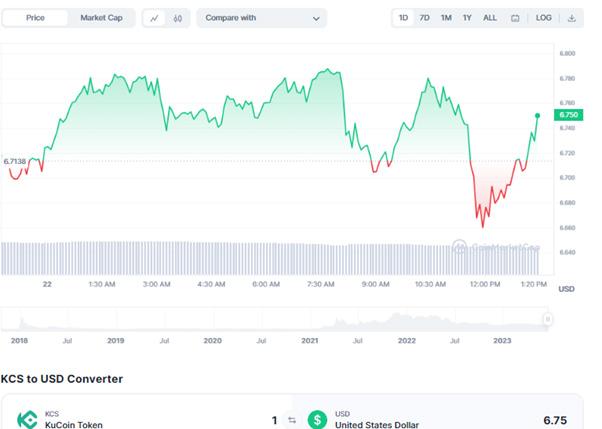

The price of the KuCoin token is USD 6.73, with a 24-hour trading volume of USD 2,270,677. KuCoin token has traded up 0.73% over the last 24 hours. The current CoinMarketCap ranking is #61, with a live market cap of USD 651,907,245.

Despite challenges and uncertainty, KuCoin has remained steadfast in its mission to be a leader in the cryptocurrency space. Their motto of being resilient and turning every challenge into an opportunity has propelled them forward and made significant strides into the future.

Last but not least is the MEXC Token ($MX). This token is associated with the MEXC exchange platform and functions as a value unit within its ecosystem.

Since its founding in 2018, MEXC has gained popularity thanks to its commitment to innovation and its ability to adapt to the changing needs of the cryptocurrency community.

One of MEXC’s most prominent features is its comprehensive product and service offering. In addition to facilitating spot, margin, and futures trading, MEXC provides access to quantitative trading, leveraged ETFs, and ETF indices, allowing users to explore various investment strategies and take advantage of emerging opportunities in the market.

Under the MEXC Earn feature, users can participate in several financial products that expand growth opportunities.From launchpad and M-day airdrops to Staking and ETH Staking 2.0, MEXC offers its users a variety of options to maximize their earnings and participate in exciting projects within the cryptocurrency ecosystem.

MEXC has simplified the process When acquiring cryptocurrencies by providing multiple funding options. Users can purchase cryptocurrencies using credit or debit cards, make global bank transfers, engage in P2P trading, and use third-party payment services such as Simplex, Banxa, and Mercuryo. This wide range of options provides convenience and accessibility to MEXC users worldwide.

By owning $MX, users can benefit from discounted transaction fees, participate in rewards programmes and have access to exclusive features and services offered by MEXC. The $MX has become an integral part of the user experience at MEXC, providing tangible benefits and encouraging greater interaction with the platform.

The current MX Token price is $2.70 per (MX/USD) with a trading volume of $6.78M in the last 24 hours, thus registering a decreasing variation of -1.28% in 24 hours.

MEXC offers a variety of options for cryptocurrency selection, with more than 180 trading pairs available. Users can access all major cryptocurrencies, such as BTC, ETH, LTC, SHIB, and XRP.

MEXC’s success reflectes its steadily growing user base, which now exceeds 6 million and spans more than 200 countries. In addition, the platform has obtained key licenses in countries such as Australia, Estonia, and the United States, reinforcing the trust and confidence of its users.

Behind the vision and leadership of MEXC is its founder and CEO, John Chen. With a strong academic background in Computer Science and a successful track record as an entrepreneur, John has led MEXC to become a major player in the cryptocurrency world. His experience and strategic vision have been instrumental to the platform’s continued growth and success.

It is important to note that while these exchange tokens offer several benefits and functionalities to users, the cryptocurrency market remains highly volatile and carries certain risks. Investors should conduct thorough research and make informed decisions before engaging or acquiring and trading these tokens.

It is also true that exchange tokens, such as Huobi Token, Binance Token, Bitfinex Token, KuCoin Token, and MEXC Token, play a key role in leading

cryptocurrency exchange ecosystems. These tokens offer unique benefits, encourage active user participation and build strong communities around the respective platforms.

In addition to their function as a means of payment, Exchange Tokens can also play a vital role in governance and decision-making within the platform. By holding these tokens, users can have the right to participate in votes and proposals that affect the future and development of the exchange. This gives them a voice and the opportunity to influence the direction and policies of the platform, which creates a sense of belonging and community among users.

Another significant advantage of Exchange Tokens is their ability to provide privileged access to exclusive features and services. Many exchanges offer membership levels or VIP programs based on the holding of these tokens. By becoming Exchange Token holders, users can access benefits such as reduced trading fees, priority customer support, and early access to new products and features, allowing them to enjoy a more complete and rewarding exchange experience.

As the ecosystem evolves, Exchange Tokens will continue to play a key role in improving the user experience and driving exchange efficiency. However, it is essential that investors are aware of the volatility inherent in the cryptocurrency market and make informed decisions based on their financial objectives and risk tolerance.

written by Chris

written by Chris

• Innovative projects have built seamless payment solutions, acting as crucial gateways between fiat and cryptocurrencies.

• ➢The regulatory landscape and inherent differences between fiat and crypto pose formidable obstacles, which these innovative projects address head-on.

• While simplifying crypto-fiat transactions, these payment solutions also grapple with issues like dependency on traditional banking systems, regulatory challenges, and cybersecurity risks.

• A significant challenge lies in reaching the unbanked population worldwide, with the potential of crypto offering universal accessibility as a solution.

• Mobile money applications, though progressive, have limited reach, necessitating the development of robust and user-friendly crypto-fiat bridge applications.

• Despite all challenges, bridging the worlds of traditional fiat and cryptocurrencies is a financial revolution.

As we stand on the precipice of a financial revolution, the dynamic world of cryptocurrencies is becoming increasingly intertwined with traditional fiat economies. This fusion is far from smooth sailing, with the decentralised nature of crypto often clashing with the regulated structures of fiat.

Despite these hurdles, there is a growing consensus on the importance of building robust ‘onramps’ and ‘offramps’ – gateways that facilitate a seamless transition between traditional financial solutions and digital assets.

Our journey into a financial future necessitates the coexistence and eventual integration of these two systems. This integration forms a bridge constructed piece by piece by pioneers and innovators who understand the indispensability of an inclusive financial ecosystem.

In this article, we spotlight some of these forwardthinking projects, delving into their unique approaches to smoothen the crypto-fiat transition, their impact on the broader crypto adoption, and what their continued evolution might mean for businesses and retail users alike.

Well, depending on how you look at it, there are always benefits and drawbacks in every situation. Payment solutions that bridge fiat and crypto have their own:

Benefits:

• ➢Simplicity: By simplifying purchases between crypto and fiat, on-ramps can appeal to more retail users.

• ➢Transparency: They can provide detailed transaction records, aiding in transparency and compliance with local regulations.

• Speed: They often offer faster transactions than traditional methods of buying crypto, like peer-to-peer exchanges.

Drawbacks:

• Dependency on traditional banking: Despite their benefits, on-ramps still depend on conventional banking systems, which can slow down transactions and lead to additional fees.

• Regulatory challenges: Since they operate

at the intersection of traditional finance and the crypto world, they often face complex and evolving regulatory requirements.

• Cybersecurity risks: Like all online financial platforms, they can be targets of cyber threats. Thus, while choosing yours, be extra diligent.

The endeavour to intertwine cryptocurrencies and fiat presents challenges, each more intricate than the last. On one hand, cryptocurrencies promise decentralisation, transparency, and global accessibility. Conversely, fiat currencies, ensconced in centuries-old structures, present a tried and tested method of wealth storage and transaction. Bridging these contrasting financial landscapes necessitates understanding their unique obstacles and the innovative solutions to overcome them.

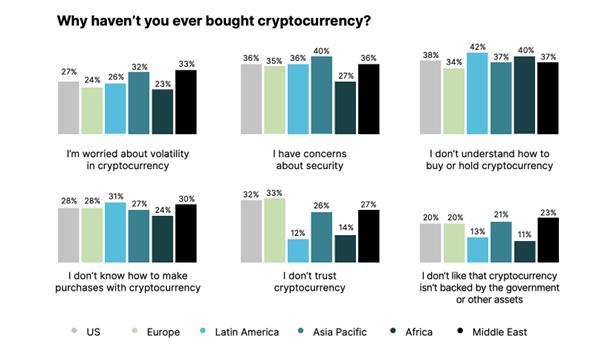

One of the foremost challenges lies in reaching the unbanked retail users of the world. Global Findex’s 2021 report, underscores the global predicament, indicating that approximately 1.4 billion individuals worldwide continue to lack access to essential banking services due to geographical barriers, economic circumstances, or lack of necessary documentation. Adding to the complexity, the latest research paper from Gemini on cryptocurrency reveals that a higher percentage of individuals express significant uncertainty about acquiring and maintaining crypto assets, along with concerns over their security.

Despite some regions making strides with mobile money applications, their scope of influence remains limited. This is where the potential of crypto comes into play, promising universal accessibility and the possibility to bypass traditional banking prerequisites. Yet, embracing such a radical shift in finance comes with its hurdles, notably the need for digital literacy and infrastructure for usage.

Even so, these challenges underscore the importance of developing robust and user-friendly crypto-fiat bridge applications that can be accessed

globally.

Then, there is the notorious regulatory quagmire that crypto has to contend with. Authorities worldwide have struggled to fit this disruptive technology into existing regulatory frameworks, often leading to unclear or inconsistent guidelines. The ambiguous regulatory landscape, alongside the perceived intricacies and instability of crypto, might discourage retail users and institutions from adopting these digital assets.

Last but not least, the integration is thwarted by the inherent differences between the two currencies - the centralisation and regulatory oversight of traditional finance clashes with the decentralisation and autonomy championed by the crypto industry.

As we proceed, I’ll delve deeper into the best projects that are meeting these challenges head-on, opening new doors to the global financial future.

MetalPay, a pioneering project in the crypto-fiat integration space, is redefining the conventional banking experience by introducing blockchain’s innovative elements into everyday financial operations. With its unique offering, MetalPay aims to seamlessly blend traditional finance and cryptocurrency for a holistic monetary experience.

The unique selling point of MetalPay is its comprehensive and user-friendly app that treats fiat and crypto equally. Every MetalPay account comes with a routing and account number, much like a conventional bank, enabling users to conduct routine financial activities, from receiving salary deposits to paying for utilities. This familiar framework fosters a comfortable transition for those taking their first steps into the crypto world.

MetalPay’s platform goes beyond being a mere ‘gateway’ for crypto transactions. It allows users to send cash and crypto for free, underscoring its commitment to affordability and accessibility. The forthcoming savings account feature could broaden its service offerings.

On the cryptocurrency front, MetalPay offers a straightforward and secure method for users to manage their existing crypto portfolios or to initiate a new one, facilitating purchases, sales, and savings with ease. The platform’s round-the-clock service offers convenience, which is rarely seen in traditional banking.

In summary, MetalPay’s efforts to bridge the fiat-crypto gap foster financial inclusivity and expand the adoption of digital assets in everyday life. Its innovative solutions are helping pave the way for a more integrated financial future.

MoonPay, a financial technology company, is devoted to simplifying the process of buying cryptocurrency. By building an efficient payment infrastructure, MoonPay offers a seamless experience for converting between fiat currencies and crypto, acquiring digital assets much more accessible.

MoonPay stands out with its broad range of on-and-off-ramp products that cater to all kinds of payment methods, whether debit and credit cards, local bank transfers, or even mobile payment solutions such as Apple Pay, Google Pay, and Samsung Pay. With operations spanning over 160 countries and partnerships with more than 300 leading wallets, websites, and applications, MoonPay truly showcases its extensive global reach and credibility.

Adding to its accomplishments, Moonpay uses energy from renewable sources and pledges to become carbon neutral by 2030. Simultaneously, the company commits to ESG practices, promoting quality education, a decent working environment and sustainable economic growth.

These features combined with an easy-to-use platform, reinforce MoonPay’s commitment to offering a safe, accessible, and simple fiat-to-crypto bridge, making them a significant player in this field.

Onramper is establishing itself as the preferred orchestrator for fiat-to-crypto transitions, offering a comprehensive solution that effectively bridges the chasm between traditional and digital currencies. It simplifies the onboarding process for users, improving success rates while minimising the hassles of integration and maintenance.

Onramper’s unique selling point revolves around its advanced routing engine and data insights, allowing it to pair users with their ideal onramp. With a swift integration process, businesses can provide a consistent fiat-to-crypto solution, customising the platform to align with their brand and preferences in displaying fiat currencies, cryptocurrencies, crypto networks, and wallet behaviours.

Moreover, Onramper offers rich insights into customer behaviour, the performance of various onramps, and dropout causes. These insights empower businesses to iterate and optimise their onboarding flow, enhancing user experience and success rates.

At the core of Onramper’s service is its dynamic transaction routing system. It intelligently matches users with the most suitable onramp based on multiple inputs, like user location, fiat currency used, and available KYC documentation. Onramper offers global access and integrates a wide range of payment methods. It aims to build a robust and seamless bridge between traditional and digital currencies.

A pioneer in the digital payment gateway scene, CoinPayments is revolutionising the eCommerce landscape with cryptocurrency. Established in 2013, the company initially gained traction as the first payment processor to support altcoins at a time when Bitcoin was the sole focus.

CoinPayments offers an extensive array of services tailored to businesses and individual users. For businesses, it provides ready-made plugins for major eCommerce platforms, payment buttons for quick website integration, and custom APIs. Its Invoice Builder allows businesses to send crypto payment links to customers and even offers a Point

For individual users, CoinPayments’ features are equally robust. It offers a multi-coin wallet supporting over 2,310 cryptocurrencies, auto coin conversion to avoid volatility, global payment facilities, a crypto vault for securing coins, and an auto-forward feature to send payments to any desired crypto wallet.

The platform boasts an impressive global reach, serving over 100,000 merchants worldwide and hosting over 1,000,000 wallet users. It assists businesses in accepting cryptocurrencies at minimal processing fees and provides users with a unified platform to store, exchange, and make transactions with cryptocurrencies.

At its core, CoinPayments is about fostering the global adoption of crypto. While it doesn’t offer credit cards to crypto, it continues to adapt and evolve based on user feedback and industry trends.

As the grand theatre of cryptocurrency and blockchain technology continues to unfold, many potential new users still need to catch up, daunted

by the complexities these innovative platforms present. The major roadblocks? For starters, a lack of comprehensive guidance and the seemingly esoteric lexicon of the crypto universe often lead to confusion. Additionally, the intimidating volatility and uncertainty about the security of assets further add to the apprehension.

However, the projects mentioned above reframe the narrative, offering bridges between the traditional fiat-based world and the emerging crypto-economy. These projects, designed with user-friendliness at their core, offer comprehensive guidance and simplify the crypto terminologies, thus bringing down the first barrier. Their robust security measures and mechanisms to handle volatility help address the common concerns around safety and uncertainty. By offering an integrative solution, they are progressively shattering the barriers to entry and democratising access to crypto assets.

The role of cryptocurrency as a payment solution extends beyond overcoming the hurdles of traditional banking systems. Its inherent design philosophy of decentralisation, transparency, and efficiency is appealing to people across the globe, regardless of geographical boundaries or access to traditional financial services. For individuals in regions underserved by conventional banking, crypto-based payments offer a unique opportunity to participate in the global economy, thereby fostering financial inclusion.

Furthermore, crypto-payment solutions offer convenience and speed that surpasses traditional methods. Transactions are processed in real time and are not affected by the typical banking hours or interbank delays.

The beauty of crypto? It knows no borders. Meaning it’s possible to shoot off international transactions faster than a ‘reply all’ mail, without the hassle of currency conversion or those dreaded sky-high fees. These projects have set the stage for a new era, simplifying the integration between fiat and crypto.

In conclusion, the transition into this new era of finance requires innovation and continued learning, acceptance, and adaptation from users. As such, the narrative is not just about cryptocurrencies and the tech behind them but about us actively participating in redefining a better financial future and mass adoption.

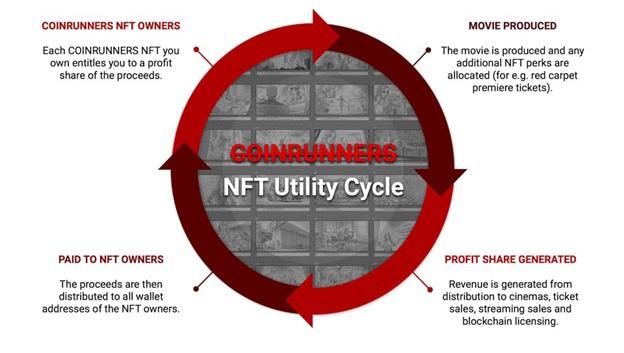

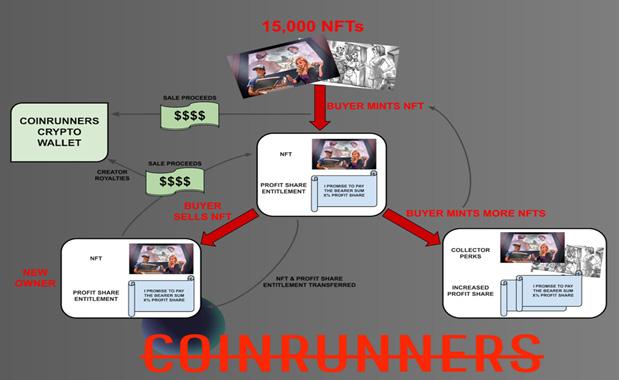

What if an NFT project could successfully create a model streamlining ownership and facilitating the transfer and sale of stakes in a film? It WOULD revolutionise the way films are financed.

Such a model could enable investors and supporters to easily buy, sell, and trade their ownership shares in a film project, fostering a more liquid and dynamic market. This liquidity could attract a broader range of investors, including those who may have previously been deterred by the complexities and illiquidity of traditional film funding.

By providing a seamless platform for fractional ownership and transferability, NFTs could democratise the film financing process, empowering individual investors and fostering a more inclusive

ecosystem for filmmakers and audiences alike. This would enable a market where new stories have the opportunity to secure funding rather than relying on rehashed ideas.

By diversifying film financing options with NFTs and embracing innovative approaches for equity financing, the industry can break free from the cycle of repetitive narratives. This would create an environment where fresh and original stories can thrive, attracting investors who are eager to support bold and unique creative visions. Ultimately, this shift in funding dynamics would enable filmmakers to bring fresh perspectives and narratives to the forefront, injecting vitality and excitement into the film industry. It’s the defibrillator to bring INDY FILM back to the forefront!

However, it’s crucial to thoroughly consider the legal and regulatory implications associated with transferring ownership stakes in films. Existing contracts and rights agreements may require revisions to accommodate this new model, which COINRUNNERSMOVIE.COM has successfully implemented.

To address this, COINRUNNERSMOVIE.COM engaged the expertise of entertainment lawyers to develop new contracts integrated into the blockchain. These contracts serve as binding agreements for equity funding combined with profit sharing. In the traditional film investment model, if unforeseen circumstances arose, investors’ funds would remain tied up with limited options. However, through the innovative implementation of NFT ownership, these rights can be resold, allowing NFT owners to recoup their investment and potentially even profit from the NFT sale.

This pioneering approach empowers investors by providing liquidity and flexibility, enabling them to navigate unexpected situations more effectively. Utilising blockchain technology and NFT ownership introduces a transformative element to film financing, opening up new avenues for financial stability and growth within the industry.

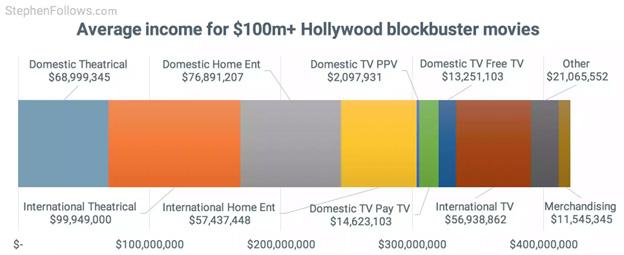

Traditionally Film financing can be achieved through three main avenues:

• Equity financing: Involves securing capital from investors who contribute funds in exchange for a share in the film’s ownership or future profits. It provides investors with an opportunity to become stakeholders in the production of the film.