Bought To You By themoonmag.com

A note from Lisa…

Editorial

Welcome to the 24th issue of TheMoonMag.com!

As we celebrate our two-year anniversary, we’re filled with nostalgia for traditional magazines that graced coffee tables and bookshelves. Now, you can find us on your iPad or sneak a read at your office desk. Wherever you take a moment to read, we thank you for coming back each month!

In an era dominated by pixels and screens, there’s something magical about flipping through glossy magazine pages. TheMoonMag. com embraces this nostalgia while being a beacon of positivity in the world of crypto. Each issue is curated with love and attention, capturing the essence of the crypto market with stunning visuals, engaging narratives, and thought-provoking insights.

As the Crypto and Blockchain industries rapidly move forward, our online magazine embraces the boundless opportunities of the digital era. Being free and online allows us to reach a global audience, connecting with crypto enthusiasts from all walks of life and spreading positive crypto vibes. You too can spread our vibes by sending a link to someone you think needs to know more about the positive side of crypto! I think they will love our multimedia elements, interactive infographics, and hyperlinks, as we make it easier for readers to delve deeper into the topics they find intriguing.

We aim to be a positive force in the crypto world, demystifying complex concepts and offering well-researched insights without sensationalism. Our dedicated team of writers, researchers, and designers work diligently to inform, educate, and inspire our readers.

We’re grateful for our entire team and community of readers whose support, feedback, and enthusiasm fuel our passion for promoting crypto positively.

As we raise a toast to two wonderful years of TheMoonMag.com, we look forward to the exciting journey ahead, especially as we bring you the latest and best projects for the upcoming Bull Market.

Here’s to TheMoonMag.com and to the bright future of crypto! Let’s let Leonardo raise a glass of champagne to US!

Lisa

A note from Josh…

We are 24 issues into the Moon Mag, which means a full 2 years of scouring the crypto industry, picking out greatlooking projects, understanding and explaining the jargon, following the hype and predicting where it might lead and sharing opinions that resonate (or not, sometimes!) with you, our beloved reader. It’s been an incredible journey, and I’m incredibly proud of the efforts of everyone involved. When Lisa first described the concept of the Moon Mag to me, I knew it was destined to happen, but without many other combined talents (and our sponsors!), it just wouldn’t be here today. A huge thanks to all our writers, some have been with us from Day 1, and others have popped in for just 1 or 2 articles. A special thanks to Daniel Jimenez, a fundamental part of the team and a person of many talents, for writing fab articles and helping us share the Mag through the Moon Mag Twitter handle. Behind the scenes, I want to share my gratitude to Alex, who has helped turn text articles in Google Docs into incredibly good-looking and thoughtfully designed magazine issues. The Moon Man on the cover of each Moon Mag has become an icon! I could spend hours just looking at the covers themselves. There are many more who played a part in making the Moon Mag, the Moon Mag but that’s it for my editorial! An offering of thanks, but it feels like a great time to do that.

Thank you to you, our readers, who make this venture all worthwhile. Enjoy the issue!

14 SUMMARY CBDC’s: Will They Replace Traditional Fiat? 08 Zealy.io 22 TRADERS PERSPECTIVE How to Survive Crypto Market Volatility and Join the crypto circus!

does an ETF work and what are the implications for Bitcoin? 34

How

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. Why the UK (not USA) Might be a Safer Option for Crypto HODLERS in 2023 72 Unravelling the Mystery of NFTs 60 The Role of Governance Tokens in Crypto Projects: A New Paradigm of Participation 42 Exploring & Comparing Multichain DEXs 46

CONTRIBUTORS

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Ibrahim Birima is a Freelance, Crypto and Web3 journalist. The topics he has covered for over a decade encompass politics and education, amongst others, and he is also adept in the Web3, Cryptocurrency and Blockchain domains. He is Head of Content for SMC DAO and writes for Cryptonary.

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R.Paulo Delgado

R.Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Chrom

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Ibrahim Birima

Samantha Jimenez

Daniel Jimenez

written by Lisa N. Edwards

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. TRADERS PERSPECTIVE

to Survive Crypto

Volatility and Join the crypto circus! Let’s dive straight into the world of crypto!

How

Market

The scenario - You’re new to crypto, probably from traditional markets and have seen all the high percentages in crypto and think… I want a piece of that; I only get 2-3% in Stonks and, on a good day, 10%. Or you are completely new to trading and just want to get rich quick, and crypto is going to do it for you…

Let me tell you now; these are the people that get completely REKT!

The participation of traders and investors from traditional financial markets and noobs just entering the market contributes to the volatility of the crypto market. As more traditional traders enter the crypto space, they bring their strategies and trading approaches from established markets. However,(insert dun dun dun) it’s important to note that the crypto market operates differently from traditional markets, with unique characteristics and dynamics. The influx of traditional traders can introduce both stability and volatility.

On one hand, their experience and expertise can bring liquidity and maturity to the market. On the other hand, their tendency to apply traditional market strategies without fully understanding the nuances of the crypto market can amplify volatility and lead to unexpected price swings.

Like lambs going to a slaughter… crypto whales know how traditional traders trade and how to take their money.

The interplay between traditional traders and the crypto market whales further underscores the need for education, research, and adaptation to the specific dynamics of the cryptocurrency space.

What Drives the Wild Swings in Bitcoin and Altcoins?

The crypto market has witnessed tremendous growth and popularity in recent years; if you have been here a while… you know this with cryptocurrencies like Bitcoin and altcoins capturing the attention of investors worldwide. When news coverage explodes, people in the space know the market is reaching its peak. Unfortunately, this is also when many newcomers enter and are either left to sell the bottom or HODL and forget for years to come; some of these newcomers also study and become traders like you reading this article.

If you’re a long-term crypto trader, that is exactly why you are here, the ability to make 10-50%, sometimes more, in a day! But if you don’t set your trades up properly or get greedy, it can just as easily go the other way.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Here’s a brief rundown of some different scenarios that can affect the prices of cryptocurrencies which often experience wild swings, with significant gains and losses occurring within short timeframes. Understanding the driving forces behind this volatility is crucial for investors and enthusiasts alike.

• Market Liquidity and Trading Volumes: The crypto market is relatively small compared to traditional financial markets, which means that even small trades or significant buy/sell orders can have a substantial impact on prices. Low liquidity and trading volumes make it easier for market participants to manipulate prices, creating sharp fluctuations. Cryptocurrencies with lower market capitalization are particularly susceptible to this phenomenon, as they are more prone to pumpand-dump schemes and price manipulation.

• Regulatory Environment and Government Actions: The regulatory landscape surrounding cryptocurrencies is constantly evolving and varies from country to country. Announcements of new regulations, bans, or restrictions can have a significant impact on market sentiment and price movements. For example, when China announced a crackdown on crypto mining and trading activities, the market experienced a significant downturn as it affected a large portion of the mining infrastructure.

• Market Psychology and Sentiment: Psychological factors play a crucial role in the volatility of the crypto market. Investor sentiment, fear, and greed can drive prices to extreme levels. FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt) are prevalent emotions that can lead to irrational buying or selling decisions. Social media platforms and news outlets can amplify these sentiments, causing rapid price swings.

• Technological Developments and Innovation: The crypto market is driven by technological advancements and innovations. News of significant developments, such as protocol upgrades, new partnerships, or the integration of cryptocurrencies into mainstream financial systems, can have a profound impact on prices. Positive developments often lead to price increases, while negative news can trigger sharp sell-offs.

• Market Manipulation and Whales: Market manipulation is an unfortunate reality in the crypto market. Whales, individuals or entities with substantial cryptocurrency holdings can influence prices by executing large trades. They can create buy or sell walls, trigger stop-loss orders, or engage in wash trading to manipulate the market. Such actions can result in artificial price volatility.

• Economic and Geopolitical Factors: Cryptocurrencies are not immune to broader economic and geopolitical factors. Economic indicators, such as inflation rates, interest rates, and global financial crises, can influence investor behaviour and subsequently impact crypto prices. Geopolitical events, such as regulatory decisions, political instability, or trade wars, can also contribute to market volatility.

• Lack of Fundamental Value and Price Discovery: Unlike traditional assets such as stocks or commodities, cryptocurrencies often lack clear fundamental value metrics. Valuation models used in traditional markets are not directly applicable to cryptocurrencies. The absence of fundamental analysis and price discovery mechanisms can contribute to exaggerated price movements driven solely by market speculation and sentiment.

I will leave you navigating the crypto market’s wild swings is like riding a roller coaster with no safety bar. It’s thrilling, but it can also leave you feeling queasy and wondering what just happened. So, whether you’re a traditional trader venturing into the crypto space or a wide-eyed noob dreaming of Lambos and moonshots, buckle up and prepare for a bumpy ride.

Remember, in this crypto circus, liquidity and trading volumes are the tightrope walkers. Even a small trade or a massive buy/sell order can send prices tumbling or soaring, leaving spectators in awe or panic. It’s like watching a magic show where market participants can pull rabbits out of their digital hats and make prices disappear faster than a Houdini trick.

But wait, there’s more! The regulatory environment and government actions are the unexpected plot twists in this thrilling crypto drama. Just when you thought you were safe, a government announcement can turn your dreams of crypto riches into a nightmare. It’s like a suspenseful movie where the villain shows up out of nowhere, and you’re left wondering, “Who wrote this script?”

Of course, we can’t forget the role of market psychology and sentiment, those mischievous little devils that play with our emotions. Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) are like mischievous gremlins that whisper in our ears, urging us to buy high and sell low. It’s like having a group of tiny devils and angels sitting on your shoulders, arguing about whether to HODL or panic sell.

In this crypto carnival, technological developments and innovation are the fireworks that light up the sky. Positive news about upgrades and partnerships can send prices skyrocketing, while negative news can make them plummet like a failed fireworks display. It’s like being at a Fourth of July celebration, except the fireworks are powered by blockchain and fueled by speculative frenzy.

And let’s not forget about the crypto whales, those mysterious creatures lurking in the depths of the market. They can make waves with their massive trades, creating a tsunami of price movements that leave smaller fish struggling to stay afloat. It’s like swimming with sharks, hoping you don’t get bitten by their market manipulation tactics.

So, fellow crypto enthusiasts and brave traders, as you venture into this unpredictable world of cryptocurrencies, remember to bring your sense of humour along for the ride. Embrace the roller coaster, and enjoy the show, but always stay informed, keep a cool head, and don’t forget to hold onto your crypto hats tightly. Because in this wild crypto circus, anything can happen, and the only guarantee is that it will be one heck of a ride!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Central Bank Digital Currencies

(CBDCs): Will They Replace Traditional Fiat?

written by Daniel Jimenez

Central bank digital currencies (CBDCs) have become a debate topic in the financial world as the digital revolution continues transforming various sectors, including finance, thus creating the question: Will CBDCs replace traditional fiat currencies?

According to the Bank International Settlements (BIS), there are more than 2 billion digital transactions worldwide, meaning that the introduction of CBDCs is undoubtedly a significant development in the traditional financial system.

In this post, we will explore CBDCs’ scope compared to traditional fiat money and analyze the implications and opportunities it presents for the banking sector.

Defining Central Bank Digital

Currencies (CBDCs)

Central bank digital currencies, as their name implies, are assets that a central bank exclusively issues and regulates, meaning they remain under its direct control and supervision when available to the general public within an economy.

Unlike traditional money, CBDCs exist only in the digital world, making them easy to transfer in a few seconds, which gives them a utility that ranges from domestic and international payments to loan guarantees, plus they can also stimulate the economy or combat inflation when regulators use them as fiscal policies.

Traditional Fiat Money vs. CBDCs

It is undeniable that traditional fiat currencies, such as the Euro or the Dollar, have played a fundamental role as foundations of the global financial system for a long time, functioning as the basis for economic transactions worldwide.

However, to fully understand the extent of the revolution that CBDCs represent, it is essential to comprehend these traditional currencies.

Traditional fiat currencies are limited because the central bank does not act as an isolated economic actor, making them possible subjects to inflation, counterfeiting, and dependence on intermediaries such as commercial banks and payment service providers (PSPs) that execute the vast majority of transactions.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

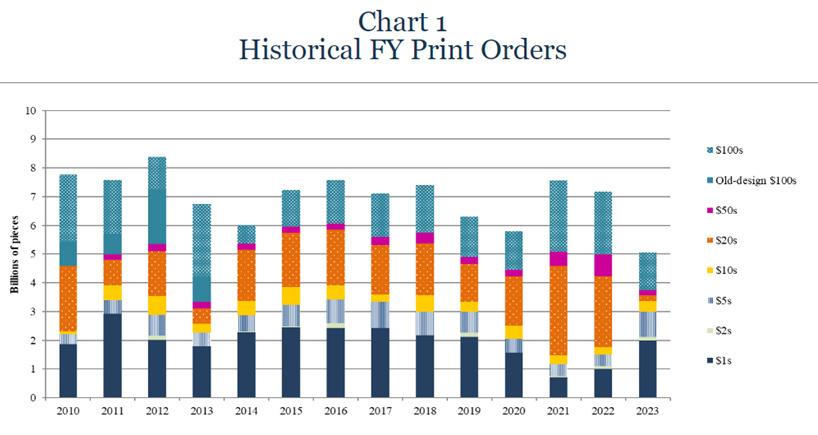

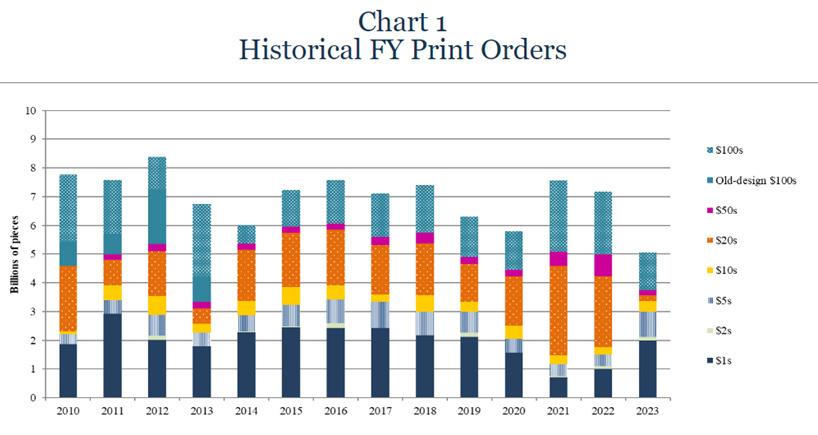

Source: FED

For this reason, costs can reflect in average transaction fees and tight control over the user during the monetary exchange consisting of the money represented by these fiat currencies and the payment systems that ‘serve society.’

With the introduction and expansion of cryptocurrencies and blockchain technology ten years ago, coupled with the interest in the use of digital assets accelerated during the COVID-19 pandemic, it is evident that governments have felt the stiff competition with the entry of decentralized finance through the use of cryptocurrencies such as Bitcoin.

While many actors such as the IMF, the BIS or the Fed itself have denied the extent of their concerns about the use of decentralized digital money by millions of users, there is no doubt that the growing adoption of Bitcoin and some stablecoins as mainstream digital payment currencies has driven the current scenario of the CBDC narrative that we are observing in various pilot projects around the world as a complement to traditional fiat money.

While I won’t try to put into context my hyperfavouritism for sovereign, decentralized digital currencies like Bitcoin over any idea of iron-fisted control over my finances by any government, there is no doubt that the traditional monetary system,

whether physical or digital, is a significant player in the world as we know it today.

Therefore, the digital future will undoubtedly remain anchored to the needs of a confluence between the two financial worlds, where CBDCs will play an important role as their use becomes widespread, proven, and successful.

In addition, it is important to highlight the potential benefits of introducing a system of digital currencies issued, backed, and controlled by governments worldwide through their central banks: read CBDCs.

CBDCs can represent a digital form of sovereign currency that seeks to harness the benefits of blockchain technology combined with fiscal policies that ‘guarantee’ the stability of traditional fiat currencies to stakeholders.

To ensure the security and stability of the system, new digital money, such as CBDCs, must fulfil the three base functions: store of value, unit of account, and medium of exchange.

But in addition to the base functions, CBDCs must be adaptable in anticipation of future developments and users’ needs, presenting some advantages to make payments more efficient.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

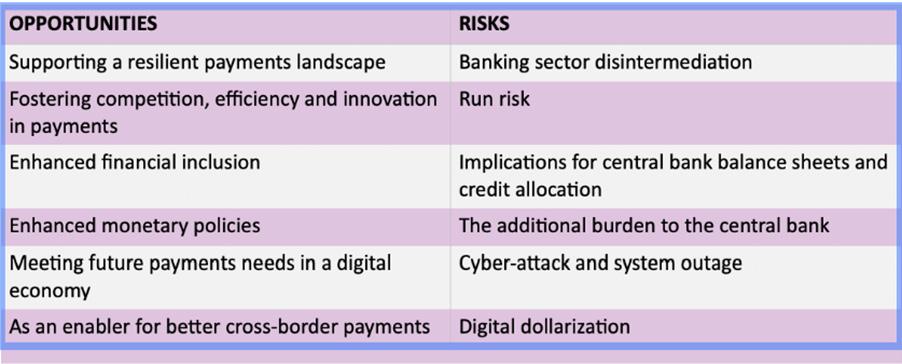

Potential Benefits of CBDCs

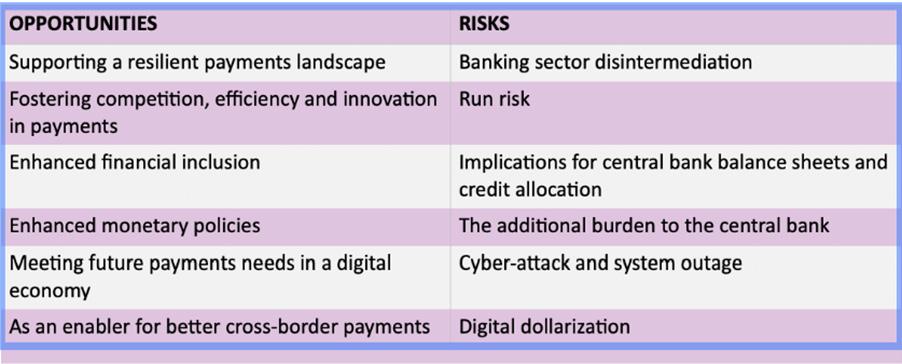

The CBDC’s potential benefits are intrinsically related to these projects’ policy objectives, with some variations depending on the jurisdiction where they are to be applied.

Generally speaking, we can point out that there are some expected benefits from a technological point of view to make payments more efficient:

1. - Speed: Primarily, they can provide faster transactions, often in real-time, thanks to the manual processing elimination and intermediaries use.

2.- The previous point connects us to the next one: cost-effectiveness. Today, the costs associated with payment transactions by PSPs or commercial banks for transaction attestation is a factor that has exposed the shortcomings of the traditional finance system compared to its peer, DeFi.

The CBDCs incorporation could reduce the costs associated with payment transactions, such as cash handling, with all the implications that this entails: custody, storage, and transport, for example.

3.- Accessibility: One of the obstacles to traditional banking is accessibility, especially in emerging economies. CBDCs can improve access to services and payment channels for millions of people worldwide, thus improving their life quality by enabling them to access the benefits of digital payment systems for goods and services purchases from their mobile phones with a digital wallet.

4.- Security: Not least, blockchain use (or a derivation of it under the premise of DLT) can provide better security for peer-to-peer transactions. With CBDCs, features such as cryptography for a digital payment infrastructure secure against fraud, counterfeiting and unauthorized access are available compared to the traditional payment system.

5.- Transparency: Finally, CBDCs implementation can lead to greater transparency thanks to the traceability offered by distributed registries as a derivation of nonpermissible blockchain. As each transaction gets immutably recorded in a distributed registry, illegal activities such as money laundering and terrorist financing can be contended due to the traceability provided by this technology.

Some disadvantages of CBDCs

While CBDCs offer more financial stability compared to cryptocurrencies due to the support they have from the central bank that issues them, which in turn is a regulated entity backed by sovereign governments, it is worth noting that they have some points of contention that some financial freedom enthusiasts oppose their implementation.

Since China’s pilot test announcement in 2016, blockchain and cryptocurrency enthusiasts have sounded the alarm about users’ financial movement control.

Control is one of the weak points that central banks will have to work hard to sell to society the idea that a government-controlled network does not defeat the inherent purpose of blockchain, which for many is synonymous with decentralisation.

However, some voices have called that even central banks can dismiss using blockchain for issuing these digital currencies, thus creating the possibility of greater government control over users’ funds.

Source: Ainslie Bullion

Source: Ainslie Bullion

On the other hand, with a single currency issued by each government central bank, it is feared that the supply of bank funds available to users will be affected.

Concerns even go beyond a single banking offer. The European Union, in its framework of understanding for the creation of a CBDC, is considering limiting a certain amount of digital currencies available to users and preventing their use for savings methods, intending to avoid collisions with commercial banking interests, thus limiting exchange difficulties between public and private institutions.

Finally, security is an issue of relevance for single points of failure. As CBDCs get controlled by a single entity, any error or cyber threat against the hosting system could be fatal for the issuing entity.

It is important to note that these are just some of the challenges to which users of CBDCs would get exposed and that there may be new questions as each jurisdiction designs new digital currencies.

Implications and Opportunities

Governments explore the adoption of CBDCs through their central banks, given that, without a doubt, these digital currencies will play a key role in shaping banking.

The adoption of CBDCs will have a potential impact beyond the user experience, offering faster, more convenient and more secure digital transactions than traditional banking. The implementation of CBDCs will have significant implications for monetary policy and the financial stability of many governments.

Governments can gain greater control over the money supply, allowing them more targeted policy intervention on objectives aligned with their interests as CBDCs get implemented.

Furthermore, CBDCs expect to transform financial innovation, enabling new use cases through programmable money, similar to how decentralized finance has revolutionized decentralized lending and automated investment platforms.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The key difference here will be that the control and backing of programmable money will reside with the central bank, i.e. the government. CBDCs will therefore be able to reshape the banking sector with programmable financial applications and impact beyond payment systems.

Commercial banks can leverage this new paradigm and exploit the benefits of operating on the CBDC infrastructure.

Last but not least, the use of CBDCs could have an impact beyond local jurisdictions and is one of the potential use cases expected to be exploited by central banks, such as the near-instant settlement of remittances and crossborder transactions.

A winding road

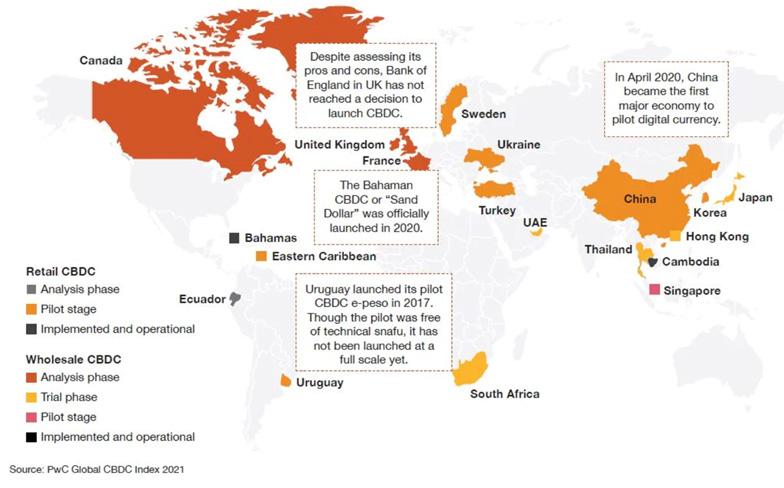

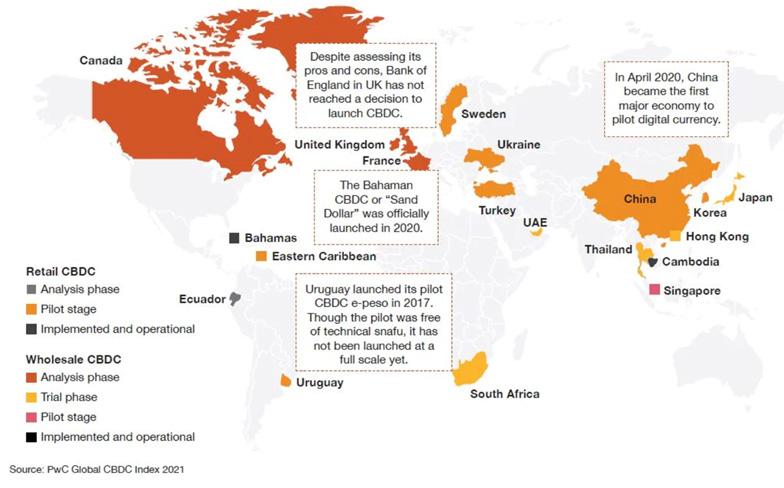

Source: BIS

While a common framework of understanding has been created in recent years among the world’s major economies to establish the necessary technological and ideological guidelines to pave the way for the future implementation of CBDCs, not all is rosy.

The transition from a current scheme governed by traditional fiat currencies to CBDCs, in my opinion, will have to wait a few years for full implementation due to the hard work involved in such a complex process that requires rigorous planning.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Beyond political will, central banks must have the necessary technological infrastructure for the CBDCs implementation, which are relatively new technology. In addition, to achieve public acceptance, the necessary regulatory frameworks are required.

While some countries’ pilot tests currently employ CBDCs, such as in Sweden, China, and the Bahamas, we must remember that the transition period merits challenges and considerations involving such sensitive issues as individual privacy, cybersecurity, and financial stability.

Source: PwC

According to data from the International Monetary Fund (IMF), only 06 cases of CBDCs in force can test the scope of implementing a digital payment system based on digital currencies backed by central banks.

It is too early to judge whether CBDCs will replace money as we know it, and for now, the two systems seem to converge and complement each other to meet the demands of the new times.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Zealy: A New Age for Web3 Communities

written by Chris

written by Chris

Key Insights

• Zealy is a platform designed to increase engagement in Web3 communities through competitive and rewarding experiences.

• he platform provides tools for blockchain games, NFTs, digital asset marketplaces, DeFi protocols and even web2 businesses.

• Zealy leverages gamified tasks and cryptocurrencies to transform superficial connections into meaningful, productive relationships within online communities.

• Zealy’s success and popularity are reflected in its 500,000 monthly active users across 180 countries, assisting 2,000 companies in engaging, analysing, and scaling their communities.

• Future plans include funding to expand its engineering, product, and design teams and leverage AI technology to maximise community-led strategies.

• Zealy actively supports community initiatives, with every member having the opportunity to make an impact.

• Users can engage with Zealy through its quest-based system, fostering learning and engagement with various cryptocurrency projects.

Meet Zealy, an innovative platform revolutionising the way Web3 communities engage, grow, and transform their members into contributors. In the digital landscape where community engagement is vital, Zealy emerges as a beacon of innovation, paving the path towards a more interactive, immersive, and rewarding Web3 community experience.

Zealy’s model is simple yet powerful – community members compete for the top spots on a leaderboard by completing quests, driving an organic increase in engagement and participation. But Zealy is more than just a competition platform. It serves as a tool for blockchain games, metaverses, digital asset marketplaces, and DeFi protocols such as zkSync, Arbitrum, Polygon, SUI, along with Web2 companies like Renault, PMU, or LVMH, to amplify their reach and boost their online presence.

By fostering a competitive, rewarding environment, Zealy encourages community members to become more than just passive participants. They transform into active contributors, directly influencing the growth and development of the community they belong to. This sense of ownership and accomplishment fuels further engagement, setting up a positive feedback loop that benefits the community and its members.

Furthermore, Zealy’s approach is not limited to Web3. As evident from their partnership with prominent Web2 companies, Zealy is positioning itself as a universal platform to engage, entertain, educate, and grow any online community, regardless of its origin or nature. This scalable and affordable solution is at the heart of Zealy’s vision - to empower every company in the world to become a community-led enterprise.

In essence, Zealy is more than a platform; it’s a paradigm shift in the way online communities are managed and grown. By harnessing the power of competition and rewards, Zealy offers an unprecedented opportunity for Web3 communities to foster growth and engagement, making it an essential tool in the arsenal of every community manager in the digital era.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Introduction

Background

The genesis of Zealy, formerly known as Crew3, reflects a distinct understanding of a significant problem in the digital age - the underutilisation of community as a valuable asset for businesses. As companies increasingly recognise the potency of community engagement in driving growth and creating joyful customer journeys, an efficient, dynamic, and engaging platform was paramount. Herein lies the birth of Crew3, the precursor to what we now know as Zealy.

Crew3 has founded on the premise that community engagement was the untapped goldmine for businesses. The digital era has provided companies with many ways to connect with their audience, but without a way to engage, analyse, and scale their community, they remained surface-level. To transform these superficial connections into meaningful, productive relationships, Crew3 focused on leveraging gamified tasks and digital assets, turning the often monotonous process of community engagement into an enjoyable, rewarding experience.

The journey from Crew3 to Zealy was marked by a milestone $3.5M pre-seed funding round led by Redalpine. This funding and the company’s rebranding signified a sharpened focus on scaling web3 communities. Other investors included Connect Ventures, Aglaé Ventures, Kima Ventures, Purple, STATION F, Founders Future, Pareto Holdings, and industry expert business angels from The Sandbox, POAP, DFNS, Starton, and Pianity. This financial backing further solidified Zealy’s position as a leading player in the web3 community engagement sphere, empowering the team to refine and expand their platform’s offerings.

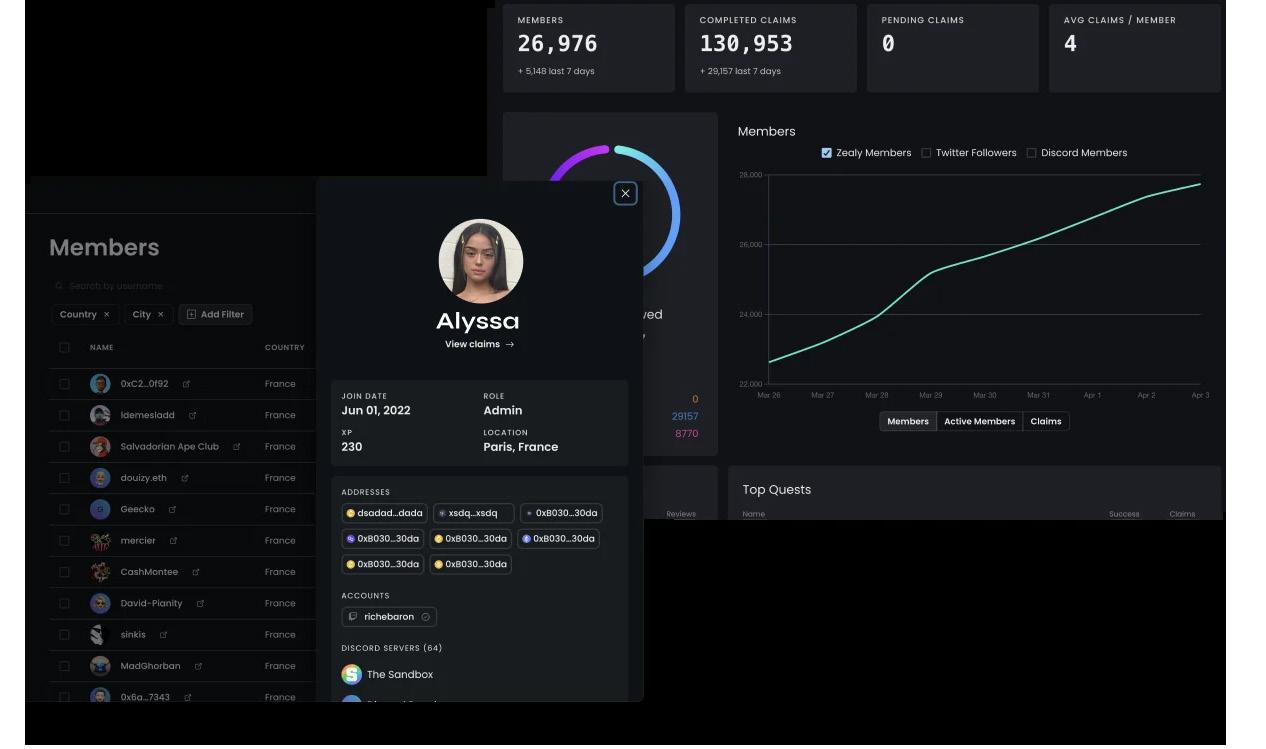

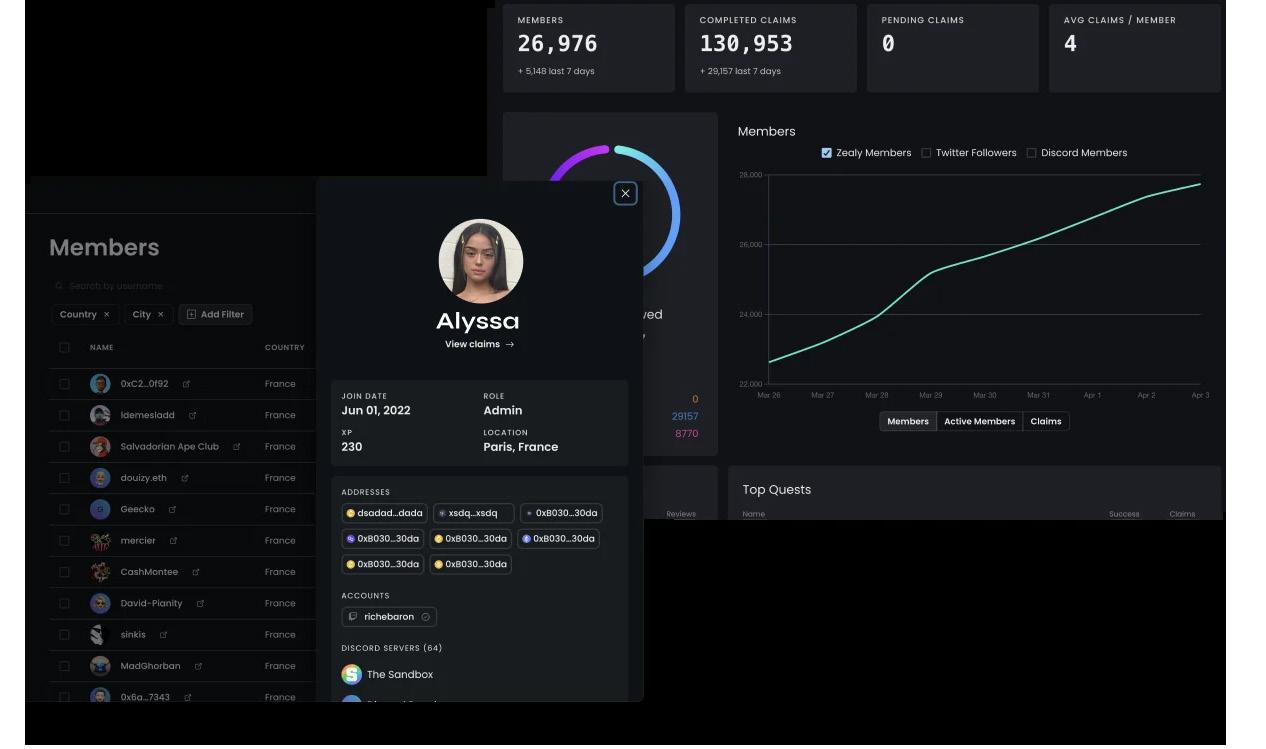

The rebranding was not merely a change in name but symbolised a broadening scope for the company. While Crew3 fostered community engagement through gamified tasks and digital assets, Zealy aimed to do more. It sought to transform how communities worked by offering detailed analytics to businesses. These analytics provided insights into which actions improved conversion rates and who the top-performing community members were. With this data, businesses could identify valuable members, such as fans, influencers, or digital asset collectors, and offer them a personalised experience, converting them into ambassadors.

Launched in 2022, Zealy quickly became the go-to-market for all web3 projects. With an impressive count of 500,000 monthly active users, who have completed 100 million tasks across 180 countries, Zealy has proved its efficacy and popularity. Today, it aids 2,000 companies, including web3 leaders and web2 corporates like Renault and Pari Mutuel Urbain (PMU), to engage, analyse, and scale their communities.

Their next goal? Zealy plans to use its funding to grow its engineering, product, and design teams. The company aims to leverage AI technology to maximise the success of community-led strategies and provide a personalised user experience. In just over a year since its inception, Zealy has firmly established itself as an essential tool for scaling community engagement. And as the Zealy journey continues, it seems the platform is just scratching the surface of its potential, promising a future where every company can become a thriving, community-led enterprise.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Team & Founders

Zealy, headquartered at 34 Avenue des Champs Elysées, Paris, was founded by an expert team in 2022, who saw the potential of community engagement tools. The founding team comprises Mathis Grosjean, Louis Demeslay, and Fredrika Lindh, each contributing unique skills and experiences that led to Zealy’s successful inception and continued growth.

To give more context on their expertise:

Mathis Grosjean - Co-Founder & CEO

• Formerly built numerous AI products.

• Expert in growing communities, having led the growth from zero to 30,000 active members.

• Follow him here.

From left to right: Fredrika Lindh, Mathis Grosjean, Louis Demeslay,

source: Zealy Notion credit image: ©Pierre Beecroft

Louis Demeslay - Co-Founder & CTO

• Full-stack developer with proficiency in React, Node.js, Solidity, #C, etc.

• His background in design enhanced Zealy’s product development.

• Follow him here.

Fredrika Lindh - Co-Founder & Product Manager

• The 2nd full-stack developer with a focus on user engagement and rapid iteration.

• Her background offered insights in the intersection of art, blockchain technology, and community management.

• Follow her here.

Jonny Quirk - Head of Community

• 15 years of experience working for startups across the globe.

• Former roles include a regional manager/marketing director position at Yelp.

• Follow him here.

Together, this team embodies Zealy’s vision of harnessing community engagement as a powerful tool for business growth. The lack of effective community tools led them to create the Zealy platform, which is now transforming community-led strategies for businesses worldwide.

Community Impact and Initiatives

On the most important topic, Zealy promotes every community initiative, therefore every member has an opportunity to make an impact. The platform’s approach to building and fostering communities is all about engagement, mutual growth, and creating value for everyone involved.

Key Developments

• In late June, Zealy’s platform saw a significant increase in activity, with 74 new communities launched, demonstrating its growing appeal across various interest groups.

• Over 3,400 quests were claimed, underscoring the engagement and commitment of the Zealy community.

• To enhance the user experience, Zealy rolled out five new features, setting a strong example of the platform’s commitment to constant improvement and innovation.

Events and Participation

Zealy’s active involvement in major events is another testament to its commitment to the web3 community. The company not only participated in the EthCC event but also organized a side event, contributing to the larger industry discourse.

Highlights

The Zealy community is home to diverse projects and initiatives. Among them, StarAtlas stood out, earning recognition as the Project of the Day. The platform also identified the rapid growth of the Retreeb community, designating it as the “upcoming star community.” New promising sprints were also launched from Abyssworld, Tyche, Cryptotanks, and Yieldmos communities, demonstrating the vibrant and dynamic nature of Zealy’s user base.

Acknowledgements

Zealy extends appreciation to its top Discord Community helpers, whose contributions reflect the supportive and collaborative ethos of the community. It’s not something entirely new by any means, nevertheless, it’s a great ‘’habit’’ on their end.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Job Opportunities and Collaborations

Zealy has also proven to be a hub for opportunities within the web3 space. For instance, Takure from UGOKI used the platform to seek a highly experienced community manager and collaborations manager, reinforcing Zealy’s role as a conduit for professional growth and partnership in the web3 ecosystem.

Official Links

Below are the official links from Zealy. Please be aware and only use these links to avoid potential scams. If you encounter a link not listed here, be sure to verify it in Zealy’s official Discord

• Website: https://zealy.io/

• Documentation: https://docs.crew3.xyz/

• Twitter: https://twitter.com/zealy_io

• Linkedin: https://www.linkedin.com/company/zealy-io

• Zealy Careers: https://zealy.io/careers

Zealy Questboards

These are the official Zealy questboards designed to keep you engaged and informed:

• Planet Zealy: https://zealy.io/c/join/questboard

• Zealy Academy: https://zealy.io/c/zealyacademy/questboard

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Understanding the Zealy Platform

Zealy offers a gamified journey through web3, where you can dive deep into various cryptocurrency projects via sequential tasks and thrilling quests. It is pretty easy to get started, and then it is up to you All you need is to:

• Connect your wallet

• Find your project

Then, you can follow a chronologically-structured task timeline on numerous platforms, accumulating points along the way and improving your Zealy rating. Earning rewards, including NFTs, privileged access to team communication, or token sale allocations.

The most interesting part, at least for me, is that can join many different projects that I am already following, accrue reward points, and compete against other people which often leads to new friendships!

Engaging with the Crypto Community

By this time I am assuming you already found your favourite project and you are already doing some juicy quests. If you didn’t notice, you often receive a retro drop reward, a token of appreciation for your activities.

Cryptocurrency startups use Zealy to display their projects, fostering an interactive environment with potential investors and community members. It is noteworthy to say that it is much easier to set this up (coming shortly), instead of organizing events on Discord and Telegram.

How to Navigate Zealy

Starting your adventure on Zealy is easy, but the grind is real, especially when you are competing with other. But at the end of the day, you should always have fun doing it.

• Link preferred wallet, or authorize your account through a Discord server.

• Browse through an extensive list of projects.

• Handpick the projects you wish to interact with.

• Unveil a roster of assignments, each promising XP credits.

• Track your progress and maintain a transparent engagement environment.

Creating a Community with Zealy

For anyone looking to build a community, Zealy can assist startups or smaller communities in showcasing their projects. The platform provides:

• An incentive-based, gamified system for users to partake in community activities.

• A quest system to create invite campaigns and encourage Twitter engagements.

• An avenue to host trivia games.

• A data collection system that offers superior insights on community engagement and growth.

Setting Up Your Community

Visit the Zealy website and click on “Create your community.” From there, you can:

• Fill out the prompts with accurate project details.

• Assign roles for your community management team.

• Share a link to invite members to your Zealy community.

• Choose the data users need to provide before joining the community.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Setting Up Quests

Once the setup is complete, you can create quests for your community. Zealy offers templates, or you can start from scratch, tailoring the quests based on submission type, reoccurrence, XP points, and other conditions set by you.

Engagement with Zealy can be a learning curve, a community builder, or a ticket to a thriving crypto project. With its seamless integration of fun and education, Zealy proves to be a robust platform for the crypto-curious and the centhusiasts alike.

Final Remarks - My Thoughts

With Zealy, users can have a simplified yet comprehensive experience of exploring various cryptocurrency projects. It presents a unique approach to learning and engagement, providing users the chance to delve into different aspects of the crypto world. It’s an attractive platform for both newcomers and seasoned enthusiasts, offering a systematic way to engage with cryptocurrency ventures.

From my perspective, Zealy is an innovative platform that’s truly transforming how individuals interact with cryptocurrency projects. The whole

process has been an eye-opening insight into a cutting-edge platform that ingeniously simplifies a realm often seen as complex and intimidating.

The beauty of Zealy is in its ability to blend fun, learning, and practical interaction, all while promoting a sense of community. I was particularly captivated by the platform’s quest-based learning approach, which I believe could significantly encourage novice users to explore the world of crypto, without having to spend countless hours on Twitter or other social media platforms to contribute to their favourite project

To sum up, platforms like Zealy offer a beacon of accessibility and user engagement. It’s remarkable how they are leveling the playing field, allowing anyone, regardless of their technical knowledge, to be a part of the future of finance. The fact that users can earn rewards while navigating through this learning journey truly embodies the spirit of the web3 ecosystem.

I hope this piece encourages you to delve into the vibrant universe of cryptocurrency that Zealy so uniquely unravels. Whether you’re looking to grow a community, learn about crypto, or get involved in exciting projects, Zealy is your go-to platform!

How does an ETF work, and what are the implications for Bitcoin?

written by Daniel Jimenez

written by Daniel Jimenez

Since the giant BlackRock applied for a Bitcoin ETF spot approval in the middle of last month, this product type interest has notably risen among institutional investors.

As a result, the cryptocurrency market reacted positively after other asset management funds emulated BlackRock’s action with the US Securities and Exchange Commission (SEC).

While there has been no definitive announcement on the approval or denial of this new applications stream, expectations of the US regulator’s potential approval of a Bitcoin ETF spot have caused enormous anticipation among traditional cryptocurrency investors and others.

However, some Bitcoin ETF spot ETFs get approved in other latitudes, such as Canada. But due to the positioning of the United States as the dominant economy and the large number of users who own (and invest in) cryptocurrencies, a Bitcoin ETF spot approval in its territory would positively affect the market.

In the expectation of a potential medium to longterm approval of a Bitcoin ETF spot, you, my dear

reader, must understand how such a financial product works to mitigate the risks inherent in an investment that combines the best of traditional and decentralised finance.

What is a Bitcoin ETF?

It is worth clarifying that ETFs, exchange-traded funds, are a basket of various investment assets, offering investors a well-diversified portfolio, which may include commodities, stocks, or bonds, that can be bought and sold on a traditional exchange without buying each asset individually.

Based on the above, Bitcoin ETFs are financial products that allow investors to expose themselves to Bitcoin movement for profit without owning them directly.

In this way, investors do not have to worry about the technical aspects of cryptocurrencies, such as key safekeeping or virtual wallet interaction in the web ecosystem3.

To achieve this, investors do not directly buy bitcoin units but shares in the fund that manages the BTCs.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

From a financial perspective, consider spot Bitcoin ETF units as representations of actual underlying bitcoin held in custody on behalf of the ETF’s unit holders.

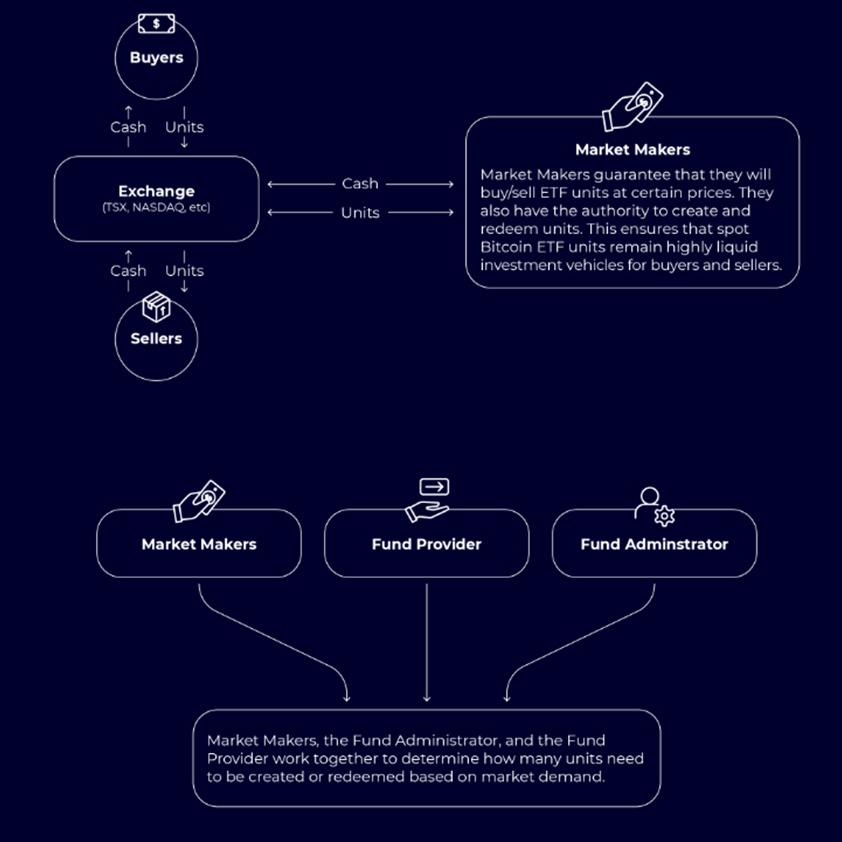

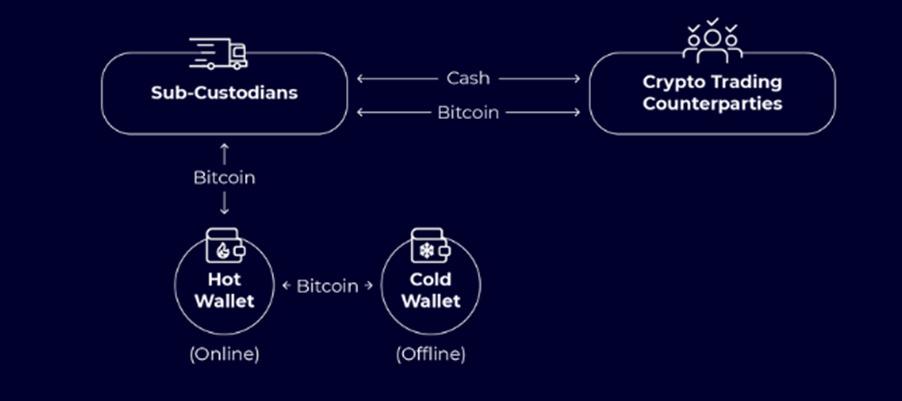

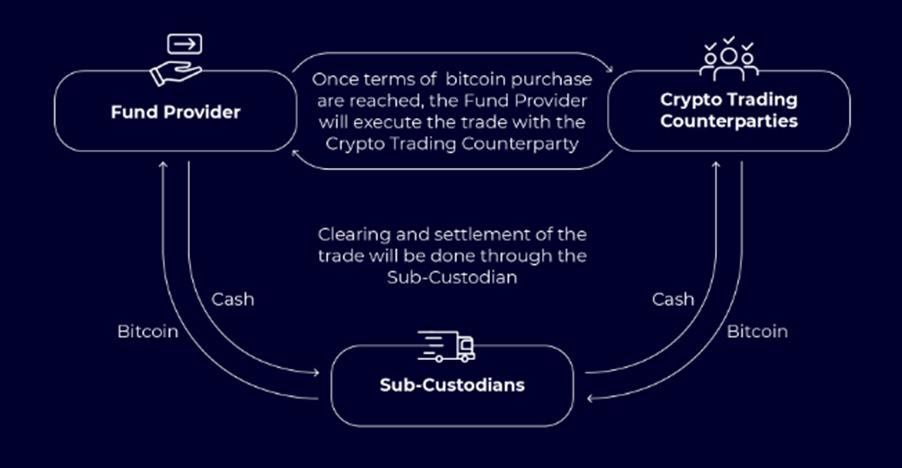

Generally, the process of a spot Bitcoin ETF is as follows.

1. A buyer purchases units of the ETF on a public exchange.

2. The ETF provider uses the money received to buy real Bitcoin.

3. This bitcoin is held securely in trust by regulated custodians on behalf of the fund provider, usually in cold storage wallets (similar to storing gold in a vault).

4. When a seller wants to redeem its ETF units, the ETF provider sells a corresponding amount of bitcoin to fund that redemption.

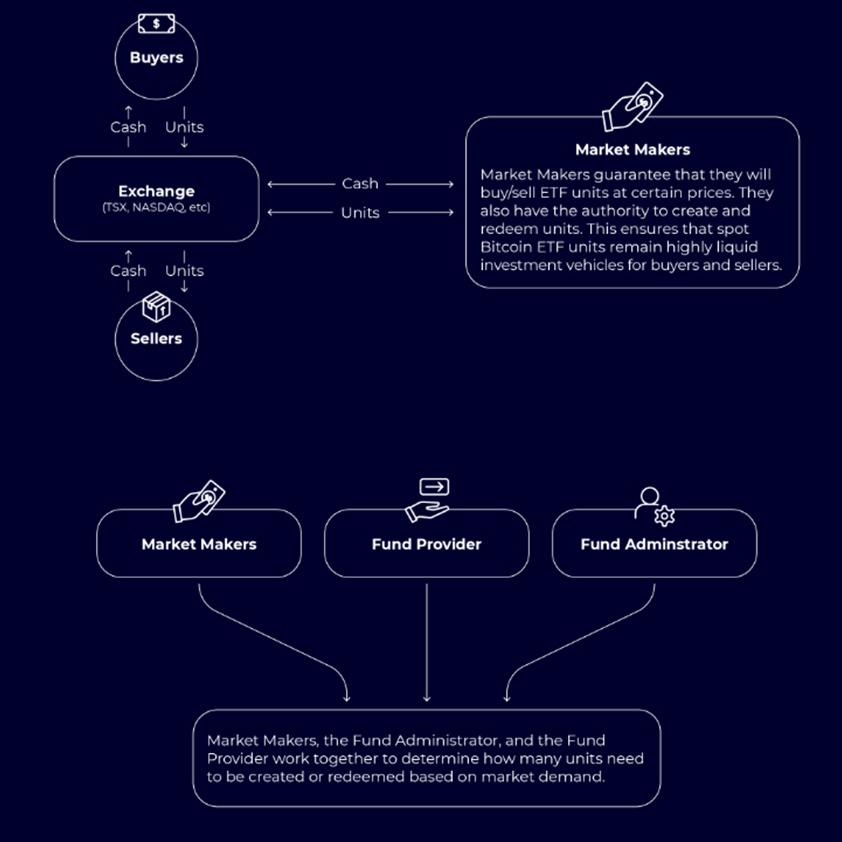

Key players in a Bitcoin ETF

Let’s explore what they are to understand the parts that work together to make a Bitcoin ETF work:

1. ETF provider: The company behind the exchange-traded fund that operates and manages this investment vehicle. If BlackRock’s spot Bitcoin ETF is approved, it would be the first provider of this type of spot product.

2. Buyers and Sellers: Any potential investors interested in buying or selling ETF units.

3. Market Makers: Similar to traditional finance, market makers play an important role in Bitcoin ETFs. The Fund Provider authorizes market makers to create and redeem units of the ETF on its behalf. Market makers are institutions that function as wholesale buyers and sellers of ETF units, quite distinct from traditional buyers and sellers, enabling the liquidity necessary for the fund to work.

4. Exchanges: this is the public venue where Bitcoin ETF unit trading occurs on a spot basis, for example, NASDAQ, NYSE.

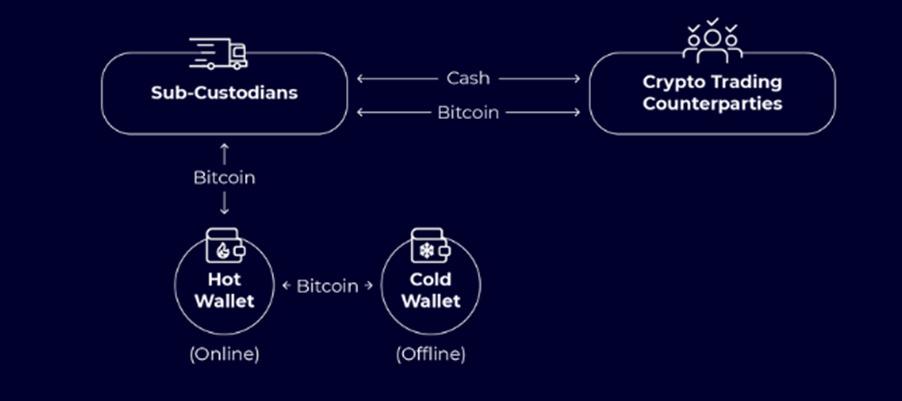

5. Custodian: Regulated financial products require a custodian authorized by the regulator to hold the fund’s assets in trust. In theory, it is a third-party entity that performs comprehensive functions for the fund provider, including clearing and settlement of money transfers.

6. Fund administrator: A third-party organisation to which the ETF provider outsources administrative tasks such as fund accounting.

7. Cryptocurrency trading counterparties: In practice, these are wholesalers for the purchase/sale of bitcoins that only trade with institutional clients.

8. Cold/hot wallets: As is well known, cold wallets are offline storage, which the custodian uses to keep bitcoins safely. Online (hot) wallets are for transfer settlement.

Inside how an ETF works

Recall that investors who buy Bitcoin ETFs buy shares or units of the fund that use Bitcoin as the underlying asset.

That is, in BlackRock’s hypothetical case with its proposed product through its iShares arm, investors would buy shares of iShares Bitcoin Trust, whose value of each of these units as a whole intends to reflect the closest performance to the price of bitcoin, allowing them exposure to the asset’s price changes for a return, without the need to hold it in a digital wallet or use a crypto exchange.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Now let’s address what happens internally in a fund during its operations.

1. The first step is the ETFs demand. Any investor wishing to acquire this product listed on any public exchange, such as the NYSE, will make the purchase management through the public exchange.

2. As mentioned above, investors purchase Fund units using Bitcoin as the underlying asset. The Market Makers provide the ETF units that get bought and sold on the exchanges to satisfy the demand, and they also determine the price for the sale and purchase of the ETF units to investors.

There is a direct correlation between the Market Makers, the Fund Manager, and the ETF Provider to identify the number of units needed to meet the purchase demand or, in the case of a sale, the ones to get redeemed.

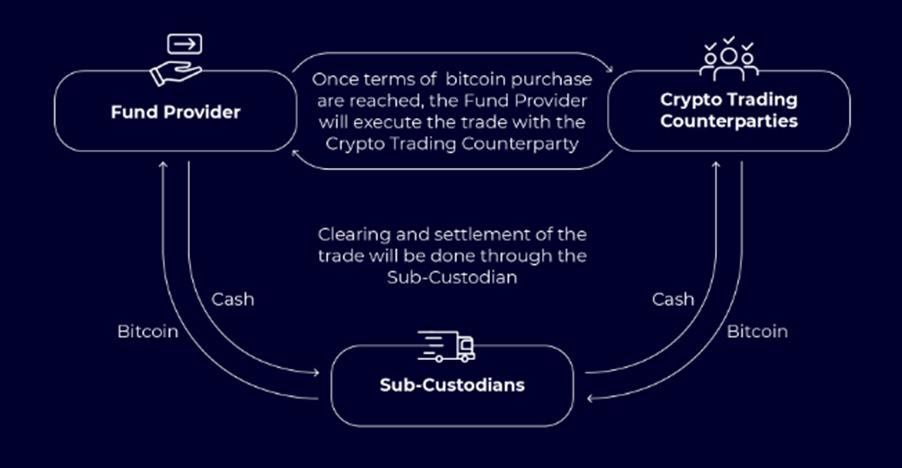

3. The previous is the point differentiating a spot Bitcoin ETF from the other available financial products. For each ETF unit to represent a real asset, in this case, bitcoin, the Fund Provider must take the money received by investors and buy real BITCOIN, which will be held in trust.

Quick note: A trust transfers tangible or intangible trust property to another person for a specified period. The trustee must exercise it for the benefit of the person established as a beneficiary by contract and transfer it to the latter, the trustee, or third parties, according to the established terms, at the end of the trust term.

Upon the current purchase of real bitcoin (in large quantities) demand, the Fund Provider communicates with cryptocurrency trading counterparties about the necessary amount to be purchased.

Once the terms between both parties (Fund Provider and Counterparty) reach an agreement, the transaction is cleared and settled through the sub-custodian and the crypto custodian, which holds the fund in trust, meaning that the acquired bitcoin must not serve any other purpose.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It is important to note that the settlement and clearing process can take from minutes to a few business days.

Implications of a spot Bitcoin ETF

Before proceeding with the ecosystem implications of approving any spot Bitcoin ETF, users should know that several Bitcoin Futures ETFs are currently on the market, which differs from the former regarding their operation and trading.

In the case of Bitcoin Futures ETFs, they have additional expenses due to their monthly rollover, ongoing management, and repositioning by portfolio managers. In addition, the contract’s accuracy in tracking the market differs from the spot market, so there is variation in tracking the bitcoin price.

Increased adoption

With a different approach to Bitcoin Futures ETFs, the likely launch of a spot Bitcoin ETF results in favourable improvements for both Fund Providers and investors, which may positively impact the performance and adoption of cryptocurrencies.

The possibility of increased interest from institutional and retail investors wishing to profit from products anchored to the price of the leading cryptocurrency without needing to interact with it would bring billions of dollars into the Bitcoin market with the approval of a spot Bitcoin ETF.

Liquidity and Market Depth

As we can see from the table above, there are almost $28 billion in assets under management by the nine funds potentially looking to implement a spot Bitcoin ETF. If BlackRock’s product, for example, gets the green light, it could significantly improve the liquidity and depth of the Bitcoin market.

Regulatory openness

Regulatory decisions around Bitcoin ETFs may provide the definitive shape and clarity needed for the cryptocurrency sector for innovation and creativity to flow, producing unprecedented development inside and outside the United States.

Because regulators must protect investors, prevent market manipulation and establish custody solutions to hold bitcoin securely, regulatory hurdles would be a thing of the past, increasing trust among investors of all sizes as the industry grows in innovation and development.

Increased volatility

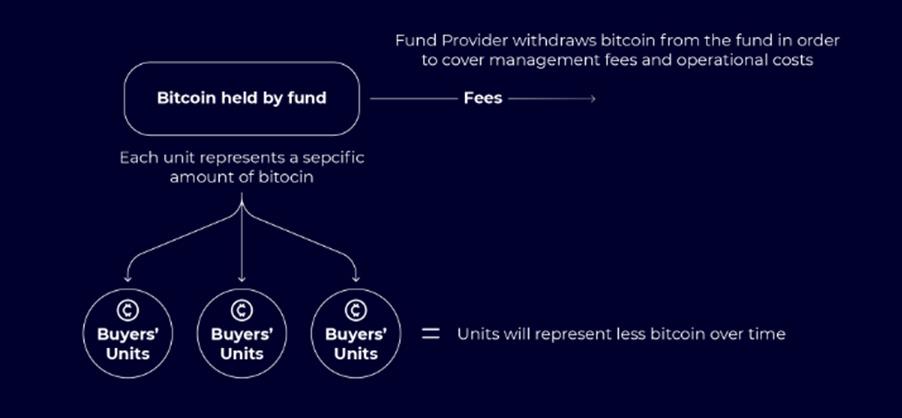

While Bitcoin is a volatile asset, Bitcoin ETF approval would increase this volatility and market risk. The asset’s price performance could be susceptible to wholesale investors’ large liquidations in the market to meet demands for ETF unit redemptions.

Increased fees and network congestion

Recently, with the introduction of Bitcoin Ordinals, we witnessed the negative network effect of increased demand for Bitcoin transactions. Similarly, these effects are likely to be repeated in the face of institutional order for large transactions, which could lead to high fees that will reduce investor returns.

Consider that each Bitcoin ETF may have a different fee, depending on the exchange-traded Fund Provider, which has a predetermined fee structure in trading the ETF units for commission expenses and management expense ratio (MER).

If the network becomes congested and transaction fees increase, the fund provider will likely implicitly charge this MER cost increase. Therefore, an investor’s unit will have slightly less bitcoin than when he bought it.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Should I Invest in a Bitcoin ETF?

Any user should consider exposure to a spot Bitcoin ETF, even when possessing limited technical knowledge about navigating the web3 Bitcoin ecosystem if they wish to capitalize on the opportunities presented by the BTC market.

As mentioned above, these investment types are ideal for users who do not wish to deal with the technical requirements of using non-custodial wallets or exposure to centralized cryptocurrency exchanges with regulatory shortcuts, which can lead to unwanted experiences in their first attempt to venture into the world of cryptocurrencies.

In addition, one of the biggest hurdles experienced by average investors seeking exposure to Bitcoin is its price. Through a spot Bitcoin ETF, investors can gain exposure to BTC tailored to their budget, risk tolerance, and investment objectives.

For now, while there is no approved market for spot Bitcoin ETF trading within the United States, understanding how it works and what implications its approval could have for the market allows you to be one step ahead to participate in the opportunities that investing in and out of the US offers for this type of product.

For now, you can invest in Bitcoin ETFs with a different approach to the spot Bitcoin ETF through your authorized broker on exchanges such as the New York Stock Exchange and Nasdaq with the following options:

• Proshares Bitcoin Strategy ETF (BITO)

• Valkyrie Bitcoin Strategy ETF (BTF)

• VanEck Bitcoin Strategy ETF (XBTF)

• Global X Blockchain & Bitcoin Strategy ETF (XBFT)

• Global X. “Global X Blockchain & Bitcoin Strategy ETF (BITS)

In other regions of the world, like Australia and Canada, there are similar options to find, including some spot Bitcoin ETF products that are already available for trading outside the United States.

The Role of Governance Tokens in Crypto Projects: A New Paradigm of Participation

written by Paulo Delgado

Cryptocurrency arose from a belief in democracy and putting financial power back into the hands of the people.

Satoshi Nakamoto’s whitepaper emerged in a world in turmoil from the financial system’s nearcollapse due to the fiduciary irresponsibility of entities whom people had entrusted with centralised control. Bitcoin gave life and form to a concept: Financial freedom and democratisation of the financial system.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

“Community” forms part of the ethos of crypto

We’ve come a long way from the inflexibility of the Bitcoin blockchain. Smart contracts now power thousands of DeFi protocols, DAOs, and blockchain-based games. But the ethos of that basic democratic ideal continues to inform the actions of the Web3 community. Whether applied to far-reaching, strategic changes such as The Merge, or to the go-to-market strategy for a new NFT collection, the Web3 community is vociferous about any actions that reek of Central Control.

Witness: Porsche’s presumptuous stomp into NFT territory, hubristically assuming that its mere presence would suffice for Web3 denizens to roll out the red carpet and start blowing trumpets. Instead, Porsche was laughed out as “clueless,” “tone-deaf,” and engaging in “cash grab.” Porsche didn’t consider the community.

In contrast, Time Magazine actively engages with its TIMEPieces community, consults it for its next collection, and has thus gained respect in the Web3 community.

In larger, more significant contexts, Ethereum itself felt the pushback of the community when a bad actor hacked The DAO—the first-ever DAO, to all intents and purposes—in 2016 and syphoned $60 million worth of ETH because of a smart contract bug. In response, modern-day Robin Hood, Griff Green, launched a counterattack to “hack the hacker” and recover the stolen funds by stealing them himself.

But the bug remained, and the bad actor could do it again if action wasn’t taken.

The turmoil came to a head when Ethereum leadership recommended a hard fork to roll back the hacker’s transactions and essentially “reset” Ethereum to just before the hack. Some in the community didn’t like that. It went against the nature of decentralisation.

Jeffrey Wilcke, one of Ethereum’s co-founders, wrote in a blog post at the time: “The Hard Fork is a delicate topic and the way we see it, no decision

is the right one. As this is not a decision that can be made by the foundation or any other single entity, we again turn towards the community to assess its wishes in order to provide the most appropriate protocol change.”

He used a voting platform called carbonvote to determine the majority opinion, and 97% voted in favour of the hard fork. Those who dissented stayed on Ethereum Classic, which still exists today.

From manual votes to governance tokens

Using an external voting platform instead of onchain governance tokens to seek out a majority decision is like using paper ballots before electronic voting. It can work, but modern solutions suffer from fewer human errors.

Governance tokens implement the “Code is Law” paradigm. A smart contract takes over once a vote goes through and implements the decision onchain. No central human veto can override it.

We assume the smart contract running it is bugsfree, which was the unique challenge with The DAO. A smart contract bug led to the hack, and the same can occur again if developers deploy code that hasn’t been thoroughly battle-tested.

Incidents like The DAO now form the back-lore of an industry that has grown far more mature. Crypto learned from it, and thousands of DAOs exist now, many driven by governance tokens that empower that DAO’s community.

Even significant players such as Arbitrum are feeling the pressure to be more communitydriven. Arbitrum has adopted governance tokens to decide on proposals for its Arbitrum One and Arbitrum Nova chains.

Uniswap shifted to a community-led model in 2020 when it launched its UNI governance token. Decisions about the protocol now get implemented on-chain through governance token votes. When the token launched, the exchange emphasised its desire to create a free financial system, and that it owed its success to thousands of community members.

Unfortunately, token-weighted voting, also known as “coin voting,” favours wealthier voters and opens the doors to its own risks. This doesn’t invalidate the technology of governance tokens itself, but current implementations seem to pay lip service to the idea of “community” rather than genuinely implementing it. Both Uniswap and Arbitrum use a coin voting governance token.

We need a better solution than coin voting

Ethereum co-founder Vitalik Buterin has written about the risks of coin voting several times on his blog, describing how current implementations of token-weighted systems can create conflicts of interest, favour coin holder interests at the expense

of other members of the community, and that “whales” would have a greater say in community decisions.

The potential for bribery also remains an unaddressed—and dangerous—”elephant in the room,” says Buterik, when using coin voting.

It’s a question of implementation. For example, although crypto can be used to fund illicit activities (just as fiat currency can), that doesn’t make crypto inherently evil. The same applies to governance tokens. As a technological solution for empowering the crypto community, governance tokens are sound.

Developers can implement governance tokens according to whatever smart contract rules they want to. The essential concept remains inviolate: That a “Code is Law” solution exists within blockchain technology that allows protocols to be completely self-sustaining, driven entirely by the communities they serve.

Smart contract developers can implement governance tokens with One-Person, One-Vote paradigms, reputation-based systems, stakeweighting, or even other paradigms that haven’t been developed yet.

We can’t forget that Arbitrum and Uniswap Labs are for-profit organisations. Although the protocols themselves are purportedly decentralised, the primary entity paying taxes behind each one isn’t. It’s unlikely that these or any other for-profit organisations would ever relinquish full control in every possible way.

But the technology of governance tokens remains intact. Implemented in a way that accords fairness to the entire community, they represent a highly workable method to creating a truly decentralised, self-sustaining protocol governed entirely by its users.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Advertise with us! Contact@themoonmag.com www.themoonmag.com

Exploring & Comparing Multichain DEXs

written by Chris

Embracing the Shift

In the rapidly evolving space of DeFi, the concept of Multichain Decentralised Exchanges (DEXs) is gaining the spotlight. It’s not simply a trend – it represents a significant shift. DEXs operating across multiple blockchains are breaking down barriers and crafting a more accessible, borderless, and efficient crypto economy.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The Current Challenges

Swapping digital assets across different networks can feel like running a gauntlet. It’s a tricky process, where you move your tokens from one chain to a DEX, swap them through a cross-chain bridge, and then send them from the DEX onto your desired network.

However, it’s not just the complexity of the process that presents a challenge; the substantial cost is also a significant concern. The combination of conversion charges and potential high gas fees can skyrocket (yes, we love ETH), sometimes costing hundreds of dollars for a single transaction. This hefty toll means you can see a sizable chunk of your assets disappear in hefty gas fees.

Official bridges between platforms exist, but they’re usually not user-friendly. Not to mention sometimes it takes several hours for your transaction to be complete. And for our beginner friends, these bridges can be daunting, presenting a steep learning curve. For seasoned players, they can be discouragingly inefficient.

An alternative method involves using centralised exchanges (CEXs) to convert one asset into another. The problem is that they are attractive targets for hackers. It’s like leaving your front door unlocked in a neighbourhood known for break-ins. Even worse, ‘somebody else’ holds your assets, not you.

The crypto saying ‘’not your keys, not your coins’’ is spot-on.

Lately, CEXs have been grappling with the challenge of adhering to new policies, all while facing increased targeting from regulation authorities, while having to comply with KYC rules or revealing sensitive information. Multichain DEXs emerge victorious in this game. The phrase above should act as a reminder of the importance of selfsovereignty in digital asset ownership. It should encourage you to take control of your private keys and not leave your crypto assets at the mercy of third-party platforms.

Why Multichain?

Interoperability sits at the heart of this thrilling transition. Visualise an interconnected DeFi space where you are no longer restricted to a single

chain. Multichain DEXs grant access to trading opportunities spanning numerous blockchains, offering unparalleled flexibility, versatility, and prospects, whether you are the average mom & pop investor, a seasoned trader or even a liquidity provider.

Multichain DEXs stand apart from traditional DEXs due to their ability to support trading across multiple blockchain networks. At their core, they use nodes acting as intermediaries that facilitate the exchange of assets between different chains, a process that brings us closer to cross-chain composability.

The Promise of Multichain

In response to these challenges, Multichain DEXs offer a way forward. They aspire to provide seamless swaps, access more liquidity and improve token swaps between various chains with no prior experience or in-depth knowledge necessary.

In essence, these platforms evolve the traditional DEX into what can be termed an Interoperable Multichain Bridge System (IMBS). The system uses unique algorithms that make swaps via bridges, resulting in low fees and quick conversion times.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Moreover, many DEXs often come with their utility token. This token ensures lower conversion fees across all chains and offers full transparency into these fees before a transaction is finalised. This approach prevents users from getting blindsided by hidden fees.

Apart from its utility function, the token typically serves as a governance token, giving holders a say in upcoming network changes and features (like reducing transaction/gas fees or changing certain parameters).

Multifacet Fronts

Embracing a balanced investment approach is vital in DeFi, especially when navigating the constant ebb and flow of the market.

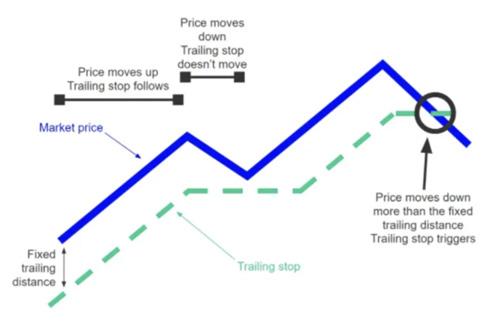

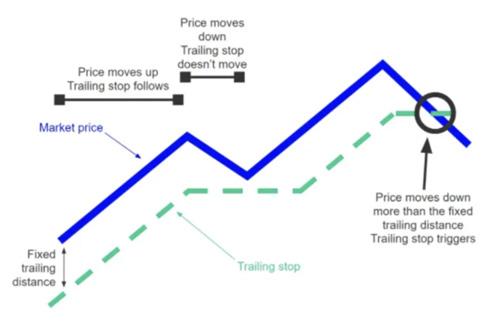

Here, ‘stop-loss’ tools become an essential part of the arsenal, enabling you to take a break from a constant market watch and keep your investments under control. To further enhance their risk management strategy, DEXs have delved into the concept of ‘Trailing Stop Loss’.

Governance Tokens

Think of it as a protective shadow that follows your asset’s price, while standing still during a dip. Let’s assume you’ve bought LINK at $20 each. You can set a trailing stop order at 10% to secure at least a 15% profit. As the price of LINK rises to $22, your trailing stop adjusts to $19.80, confirming some of your gains. Now, even if the price falls and the stop-loss is activated, you still walk away with a profit. So, trailing stop loss serves as your personalised market shadow, dynamically adapting to price changes, thus enabling effective risk-trade management. It looks at profits when things go right and minimises losses when the tide turns.

Revolutionising the dynamics of DeFi trading, cross-chain liquidity aggregators address the limitation we faced in the past, offering solutions beyond mere market orders on AMMs. Traders can now set precise terms for their transactions - an entry or exit price can be set, eliminating the need for constant manual market monitoring. This is made possible through tools like Limit Orders and Stop Loss functions.

Limit Orders open up opportunities to execute swaps at preferred prices. They can predetermine buy or sell orders at specific prices, providing control and the luxury of not having to monitor market fluctuations incessantly. Similarly, Stop Loss orders allow traders to curtail potential losses. When the market reaches a predetermined stop price, it triggers a market order to limit the loss on a specific holding.

Of course, all these are not new, but implementing them in Multichain DEXs, is one step forward to shaping the future of DeFi trading, making it more efficient, predictable, and less stressful.

Multichain vs. SingleChain: A Striking Contrast

The ability to facilitate trades across various blockchain networks is a game-changing feature. It offers enhanced liquidity and a broader range of assets to trade compared to single-chain DEXs. Furthermore, it fosters interoperability, allowing dApps to build upon each other instead of operating as standalone apps. This cross-chain composability unlocks immense potential and is a crucial factor in the future of DeFi. Shall we take a look at some innovators?

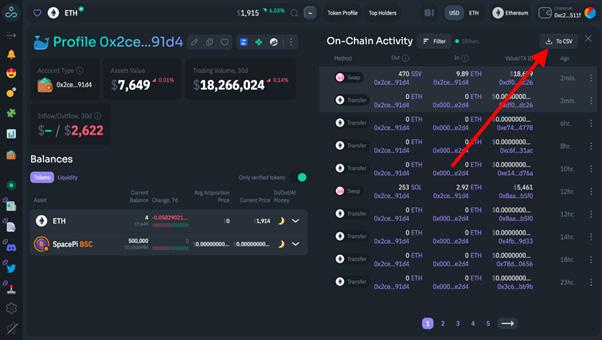

Key Players

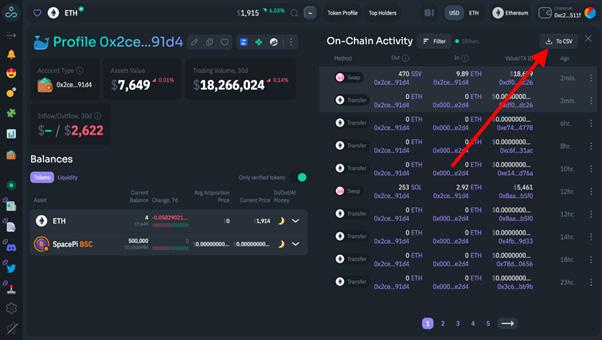

DexGuru stands out as a leading DEX aggregator that has been making strides since its launch, thanks to its comprehensive offering and continuous efforts for improvement. The platform offers real-time data and analytics across various DEXs and EVM-compatible blockchains.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

DexGuru

A major advantage DexGuru offers is enabling cross-chain swaps in collaboration with Li.Fi. This feature allows the seamless exchange of assets across different blockchain networks. Furthermore, they’ve expanded their accessibility and user experience with the launch of mobile applications on both Android and iOS, allowing for DeFi trading on the go.

I noticed several features that make DexGuru user-friendly and practical:

• Their innovative vertical layout design enhances chart readability.

• They offer the ability to download filtered on-chain transactions in a CSV format.

• Custom naming for addresses simplifies your account management.

• Real-time notifications for account activities are possible, keeping you abreast of any changes in their holdings. (Is anyone following those whales?)

On top of these, they’ve integrated with KyberSwap, a leading DEX aggregator, giving users access to more liquidity options and the best possible trade rates. Also, they’ve added support for new chains, including Canto, Arbitrum Nova, and zkSync Era, and have incorporated a straightforward open-source code integration process for adding new EVM-compatible blockchains or AMMs.

This continuous innovation and the platform’s commitment to remaining at the forefront of DeFi trading make DexGuru a noteworthy player to look out for.

dydX Exchange

dYdX launched in 2017 and offers many services, including spot, margin trading, borrowing and lending, and perpetual futures. It appeals to a diverse array of cryptocurrency traders - from beginners to professionals - providing them with more than just basic transactional capabilities.

More specifically, the platform’s recent expansion to layer-2 solutions is a significant development, ushering in several benefits like low fees and faster transaction times. One of the key changes includes a newly structured trading fee system that encourages regular users by offering them zero fees if their monthly trading volume is less than $100,000. In addition, the platform employs ZK-Rollups to move transactions off the Ethereum mainnet, leading to cheaper and faster transactions, which is always welcome.

Here are some distinctive features that set dYdX apart:

• Its commitment to full decentralisation and transparency surpasses many traditional financial services.

• There are no direct gas fees since transactions are processed off-chain.

• The fee structure is friendly towards average traders with smaller trading volumes.

• It provides superior conditions for lending and borrowing services.

• Users can earn interest from lending their assets, with rates based on market supply and demand.

Nevertheless, as a growing platform, dYdX does

face challenges, including a limited asset offering for swaps and dynamic interest rates that could be unfavourable for lenders. Additionally, there are currently a few margin trading pairs available. However, the dYdX team is improving these aspects, planning to add more trading pairs and assets.

dYdX caters to traders whose needs extend beyond basic trading tools. With features like perpetual futures contracts and leverage trading integrated into an efficient Layer 2 solution, the platform offers benefits including:

• Perpetual futures traders can trade with no expiry dates and leverage up to 25X.

• Margin traders can access up to 5X leverage on Ethereum with isolated and cross-margin trading.

The platform’s native token, DYDX, provides added utility. This token was released to the public using a set algorithm that considered both the fees paid and the open interest. In addition, users can add it to a Safety Pool or Liquidity Pool for different yield potentials.

To sum up, dYdX positions itself as a solution for the complex needs of today’s crypto traders. By offering an array of financial services akin to those in the traditional financial industry, but without the constraints of centralisation, dYdX has made itself an appealing platform for a wide range of traders. While it is still developing some features, the platform’s current offerings are likely to satisfy traders looking for more advanced trading options.

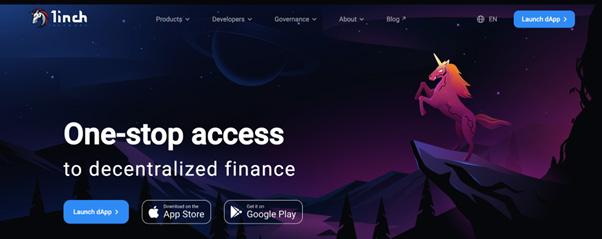

1Inch Exchange

1Inch stands out by seamlessly connecting users with multiple DEXs, ensuring the most advantageous trading rates. But that’s not where its prowess ends - it’s a holistic protocol built with innovation and user-centricity, creating a trading experience like no other.

Consider these key aspects that make 1Inch shine:

• 1inch has managed to maintain a pristine track record, free of any security breaches or hacking incidents.

• The user interface is built with the user in mind, striking a balance between functionality and user-friendliness that caters to newcomers and seasoned traders.

• 1Inch has no trading, deposit, withdrawal or hidden fees, making it a cost-effective platform for trading.

• By aggregating order books from various DEXs, 1Inch secures high liquidity and competitive rates while limiting transaction fees.

• It offers a unique approach to transaction costs. CHI GasToken can significantly reduce these costs.

• The recent addition of the Liquidity Protocol opens doors for yield farming opportunities.

The platform’s proprietary token, 1INCH, adds another layer of community engagement. It empowers holders to influence governance decisions like transaction fees and reward adjustments. The same focus on users extends to their innovative Chi Gastoken system, providing considerable savings by dynamically adapting to Ethereum’s gas prices.

The Pathfinder algorithm, an API of Liquidity Protocol V2, skillfully finds the best market prices for token swaps across different protocols. Conclusively, the swap rates are even better compared to a singlechain DEX.

This feature, alongside the commitment to constant upgrades, has powered the surge in 1inch’s transaction volume, especially since 2020. In addition, the 2021 rollout of the Aggregation Protocol v5, designed to cut transaction costs through assembly code optimisation, supports swaps using Uniswap v2 and similar forks. To this date, it has over $250b in total volume across all chains.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Finally, 1Inch’s intuitive dashboard eliminates technical barriers associated with DeFi, allowing realtime investment monitoring from anywhere, globally. It supports DEXs on Ethereum, Binance, and Polygon blockchains. With the introduction of Chi, you can enjoy lower fees, averaging around 40% less than Ethereum fees. In a nutshell, 1inch’s user focus, cost-efficiency, and relentless drive for innovation make it an indispensable choice for traders seeking a streamlined and advantageous trading experience.

Stepping Inside

Taking the first step towards understanding Multichain DEXs, I would like to take you back to a time before their advent. Remember the simplicity of single-chain DEXs? You’ve got a single blockchain, and trades happen seamlessly within that closed ecosystem. It is straightforward and efficient, provided that you are trading within that specific blockchain.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

But what happens when you want to trade tokens from different chains?

Well, single-chain DEXs can’t cater to this demand. They are confined to their parent blockchain, limiting their reach and utility. It’s akin to having a telephone that can only call numbers within your local area. Handy, but not exactly groundbreaking. That’s where multichain DEXs, similar to those discussed earlier, come into play. They are like the international calling plans to our local telephony, enabling trade across numerous blockchains, making trading and swapping simple.

How They Operate

Let’s move a little deeper. Multichain DEXs adopt various solutions with smart contracts acting as intermediaries, connecting different blockchains and enabling seamless transfers. They are like your mail courier who delivers your letters across town.