Bought To You By themoonmag.com

Welcome to this exciting edition of Moon Mag, where we unveil the secrets of Crypto Millionaires as we enter (fingers crossed) UPTOBER! Within these pages, you’ll find a captivating narrative that explores the fascinating duality between the exhilarating tales of crypto millionaires and the journey towards mass adoption, all while delving into the intriguing psychology of HODLing. Moreover, we’re venturing into the world of side hustles. I’m particularly excited about Josh’s article, which explores the hidden opportunities in the side hustle culture which have become essential in the current economic climate.

The allure of becoming a crypto millionaire is undeniably enticing, but we mustn’t forget that these stories often have their darker aspects. That’s why we had one of our dedicated writers, Chris, embark on a deep dive into the Darker Side of Crypto.

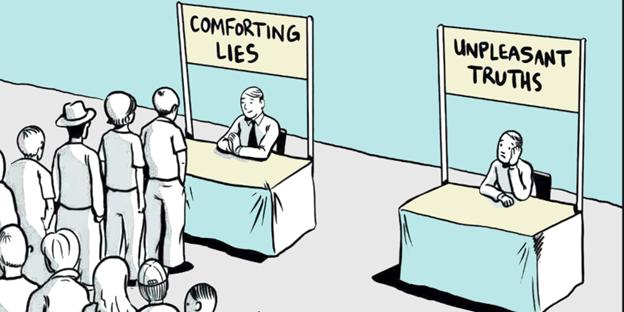

At Moon Mag, everything we do is driven by a positive mindset aimed at propelling crypto in the right direction to reach its full potential. Our ultimate goal is mass adoption, and we invite you to share this magazine with your friends who are yet to venture into the world of crypto. The No-Coiners need toget onboard! Let’s get everyone excited about the possibilities! Our positive outlook is the perfect first step! One of my fav images representing this!

We all know the journey towards mass adoption is not without its share of challenges, from regulatory complexities to technological hurdles and public perception. Bridging the gap between crypto enthusiasts and the general public requires addressing issues like scalability, security, and userfriendliness. Rest assured, this is both our mission and our aim here at Moon Mag.

A note from Lisa… Editorial

During my recent visit to Singapore for Token2049, I had the pleasure of meeting Debbie from Bitget, she’s the head of Bitget’s Regional Growth & Partnerships here in Australia. I’m excited to share what Bitget are doing in the space and as our sponsor, we are grateful to have them onboard supporting us through the Bear market and Beyond. Stay tuned over the next few issues as we bring you more updates and valuable information.

A note from Josh…

Knowledgeispower.

The Moon Mag up until this point has been 100% funded by myself and Josh and we feel to move us to the next level we are asking for your support! Please reach out https:// themoonmag.com/contact/ if you would like your name or company featured!

●Our Sponsor a Writer Campaign is as follows:

• Prominent Website Banner Ad

• ●Logo Placement on the Sponsors page

• Sponsor A Writer - $250 USD /Month Perks mentioned above

• Sponsor A Writer - For 6 Months$1,500 USD All perks and 1 Article or press release written about your project

• Sponsor A Writer For A Year - $3,000 USD All perks and 2 Articles or press releases written about your project

Enjoy this issue as much as we have bringing it to you, and if you have any feedback or suggestions, reach out to us on social media, we’d love to hear from you all!

Lisa

We’ve shifted a little with our usual Moon Mag structure to give you articles that really focus on learning and understandingareasof crypto that seem to be a common sticking point. Whilst it’s all good searching high and low for crypto gemsinthisMarket,sometimesitgets a little bit stagnant when liquidity and conidence is at its lowest. That’s not to say there aren’t any out there but it just seems sensible to us that, if you’re readying yourself for what we hope to be an epic bull run soon, then you should have as many areas of crypto covered including the knowledge and the know how. In this issue, we look at wallets, hashrate, cryptoasasidehustleand even, some crypto success stories amongst other articles!

With a bit of luck, maybe you’ll be a success story in a future issue of the Moon Mag! Enjoy the mag and be sure to cover as much ground as possible to give you the best chance at making the mostofthefutureofcrypto.

Don’t forget to get in touch with us if you want us to focus on some areas you are unsureofinthisindustryasour budding writers are happy to dig deep and search around for the best information out there,justforyou.

SUMMARY TRADERS PERSPECTIVE How Hashraste Effects Trading 8 Crypto Wallets Demystified: Securing Your Digital Assets 14 Bitget’s Five-Year Journey: Struggles, Triumphs, and Our Vision 24 Crypto Millionaires: Success Stories and Strategies for Wealth 31

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. The Psychology Of HODLing 40 The Dark Side of Crypto: Exploring Security and Scams 45 The Road To Mass Adoption In Crypto 52 Making Crypto Your Side Hustle 65

SPONSORS

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

CONTRIBUTORS

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

R.Paulo Delgado

R.Paulo Delgado is a crypto and fintech journalist, freelance writer, and ghost writer. He cut his teeth as a web and software developer for 17 years. Now he uses those skills to write tech, business, and financial content for various businesses and news publications.

Chrom

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Samantha Jimenez

Daniel Jimenez

written by Lisa N. Edwards

HASHRATE HOW IT CAN EFFECT TRADING

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. TRADERS PERSPECTIVE

There are so many factors about navigating the cryptocurrency landscape that might leave newcomers puzzled by the concept of hashrates. But for fervent cryptocurrency enthusiasts, particularly miners, hashrates are not only a familiar term but also a pivotal factor with the potential to shape their success.

Hashrates wield substantial significance within the realm of Bitcoin. They’re even embraced by cryptocurrency experts (I’d like to think I’m amongst them) to gauge the robustness of the Bitcoin network. Given this prominence, it’s worth delving into the essence of hashrates, their relevance to Bitcoin, and the insights they offer.

Decoding the Basics of Hashing

In order to unravel the significance of hashrates, let’s first grasp the concept of hashes.

A hash is a distinct alphanumeric code generated through an algorithm, representing its source word, message, or data. Various cryptocurrency projects adopt diverse hashing algorithms, which scramble numbers and words to generate hashes essential for identifying fresh data sets.

Mining in the Cryptoverse

When I first learned about mining in crypto way back in 2010 or 11, it conjured images of dirty, soot-covered, scruffed-up coal miners. I doubt that translates to crypto mining unless the miners fail to shower for long periods or are rolling in the mud…

A group of “pit boys” wait to go to work in the Sirland & Alfreton pits in Derbyshire, England, 1905.

A group of “pit boys” wait to go to work in the Sirland & Alfreton pits in Derbyshire, England, 1905.

Miners, armed with high-powered computers and mining rigs, engage in a competitive endeavour to decode and unravel these hashes. Successful decryption allows them to append new blocks to the blockchain, leading to the rewarding acquisition of cryptocurrency assets. This decryption is achieved by pinpointing a specific value within the hash, known as the nonce. The solved nonce leads to the generation of a new hash from the intricate alphanumerical arrangement.

Hashrates Unveiled What exactly is a hashrate?

It denotes the velocity at which a system can resolve hashes. A hashrate, in essence, embodies the network speed and computational might of a computer, employed to decode hashes and thereby confirm transactions within a Proof-ofWork blockchain framework.

Hashrates are gauged in units of hash per second (H/s). Other prevalent units encompass kilo hashes per second (kH/s), megahashes per second (MH/s), and beyond.

in a digital asset. This increase, according to Keiser, underscores a prevailing belief in the potential downfall of fiat currency, augmenting Bitcoin’s allure and prompting an exodus from conventional money.

The Ebb and Flow of Hashrate and Price

Fluctuating Hashrates and Public Trust

The hashrate of a network experiences shifts driven by an array of factors, including public trust in Bitcoin. Notably, an ascending hashrate is interpreted by figures like Max Keiser as indicative of heightened public faith

Historically, the hashrate and price of Bitcoin have maintained distinct trajectories. Yet, a notable convergence occurred on February 9, 2021, following Elon Musk’s substantial Bitcoin investment. (Which was reported to have recently been written down and potentially sold) This alignment was illustrated when Bitcoin’s hashrate of 183.26 EH/s matched its price of US$46,437. This synchronisation underlines the evolving dynamics between hashrates and market valuation.

Image of a home crypto miner

Image of a home crypto miner

Beyond its foundational role in network security, the hashrate also holds the power to influence the dynamic realm of crypto trading. A robust hashrate can signal heightened confidence in a cryptocurrency, fostering a favourable sentiment among traders and investors. This surge in trust can amplify demand for the cryptocurrency, potentially driving up its value. Conversely, a sudden decline in hashrate might trigger concerns about network stability, leading to cautious trading behaviour and potential market volatility. Thus, the hashrate serves as an undercurrent that intertwines with market psychology, contributing to the intricate dance of price fluctuations and trading decisions in the ever-evolving cryptocurrency landscape. (Another chart to add to your must-have list)

Bitcoin’s hashrate sits at 388.768 EH/s, close to its All Time High. This surge may suggest an accompanying surge in public trust. A pivotal role in this hashrate expansion is played by China, holding the majority share of Bitcoin mining hashrate at 65.07%, followed by the US at 7.24%, and Russia at 6.90%.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

TradingView Chart - Bitcoin: Network Hashrate 1D INTOTHEBLOCK

Hashrates: Guardians of Blockchain Security

Hashrates grow in tandem with the expansion of the blockchain. As the blockchain evolves, so does the complexity and quantity of mathematical operations. Consequently, as the rate of hashes generated and resolved surges, the Bitcoin network’s hashrate also rises. This growth fortifies network security, exemplifying the adage “strength in numbers.”

Elevated hashrates signify a substantial allocation of resources toward transaction processing, bolstering the blockchain’s defence against fraudulent activities and the manipulative control of the network. This elevated network speed erects formidable barriers against hacking attempts and concurrently intensifies the intricacy of mining by introducing more elaborate mathematical puzzles.

Intricate Challenges, Gratifying Rewards

The escalating difficulty of mining corresponds to an augmented volume of hashes miners must formulate to garner rewards. This uphill climb mirrors the evolving landscape of cryptocurrency mining, culminating in a more secure and resilient network.

Ready to embark on the mining journey? Check out our previous article here.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Advertise with us! Contact@themoonmag.com www.themoonmag.com

written by Chris

Crypto HOT Wallets Demystified Secure

Your Digital Assets

Introduction

So, remember those days when our wallets were chunky, filled with banknotes, some loose change, and perhaps an old cinema ticket? Yeah, those were simpler times. Now, we’re in the digital age where cryptos, DeFi, NFTs are the buzzwords. In this era, wallets have undergone a glow-up. No more leather or fabric; instead, it’s all about encrypted codes and unique keys.

In crypto, the term ‘wallet ‘is a tad misleading. You see, it doesn’t exactly store your coins like a traditional pocket wallet would hold your quid. Imagine a digital vault, keeping safe a duo of keys: one public (think of it as your postal address but for crypto) and one private (this one’s super special, like your personal autograph). When you want to do a bit of shopping or send some coins, it’s this autogra vccph that proves you’re real. Each transaction gets its special entry in this vast digital logbook, the blockchain.

Hello everyone! It’s been some time since I wrote my last article, so I’m thrilled about this one!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

To put it straight, you’re not tucking away digital coins in a pouch. Your crypto wallet is more of a bouncer, ensuring only you have a say on what’s going on inside it.

The Journey of Crypto: Why Wallets? The Evolution of Cryptocurrencies

From the early days of digital transactions (think PayPal and online bank transfers) to today’s dApps, bridging, validating blocks and so much more, we can safely assume that we made some progress over the years. Gone are the days of simple credit and debit cards. Now, we’re talking about currencies that are not tied to any nation, bank, or traditional system. Cryptocurrencies have emerged as a rebellion against controlled financial systems, putting power back into the hands of the people.

Over the past decade, digital currencies have transformed from being a hobbyist’s plaything to a serious contender on the global financial stage. Bitcoin, Ethereum, and a whole market of altcoins, NFTs and many more digital assets, have solidified their importance in today’s tech-centric world. With this rise, there was a clear need for a safe and secure way to store, transact, and manage these assets. Enter crypto wallets. But, as Uncle Ben Parker said:

The choice of choosing a wallet is entirely up to you and your specific needs. Different types of tokens can only be traded in certain wallets. For example, you can’t send native BTC on Metamask because it does not support Bitcoin’s network.

Hot Wallets: A Simple Breakdown

Who Holds the Keys?

Hot wallets, in their essence, are designed for ease and quick access. But, before choosing one, it’s crucial to understand their two primary flavours: custodial and non-custodial.

Custodial Hot Wallets:

Imagine a safety deposit box in a bank. Though it’s yours, the bank holds the key. Similarly, in custodial hot wallets, primarily found in crypto exchanges, a third party manages your private keys. They handle the heavy lifting of security for you, facilitating transactions. While they offer convenience, especially for newcomers, they’re not without risks. Entrusting your private keys to a third party means relying on their security measures. History has shown us that even the most prominent exchanges can be vulnerable to hacks or internal issues. Thus, for sizable or long-term holdings, these might not be the safest bet.

Non-Custodial Hot Wallets:

These are the DIY versions, typically found as smartphone apps or desktop software. Here, you’re in the driver’s seat. You control your private keys, and there’s no middleman. While it gives a sense of ownership and security, it comes with its challenges. If you misplace your private keys or become a victim of phishing, there’s no helpline or recovery. The responsibility rests squarely on your shoulders.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The Many Faces

Desktop Wallets: Installed directly on your computer, these offer a good balance between convenience and control. But, like all things digital, they’re susceptible to malware and hacks. Regular backups and good cyber practices are crucial.

Mobile Wallets: Tailored for the digital nomad, these are handy for on-the-go transactions. Available as smartphone apps, they streamline your crypto experience. But remember, phones can be lost or breached. Ensuring the security is top-notch and keeping backups are vital.

Online Wallets: These are cloud-based wallets that can be accessed from any device. Some even double up as browser extensions. Their biggest perk is easy access, meaning they are constantly online and more exposed to threats.

Smart Storage Tips

Always treat your hot wallet like the wallet in your back pocket, not your bank vault. You can store small amounts for daily use and keep the bulk in more secure solutions, like cold wallets (we will discuss those in a future article!).

In addition, regularly back up your wallet, keep your software updated if needed, and invest time in understanding crypto security. All I can say for now, is that ‘’be vigilant, it goes a long way.’’

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Pros

• Convenience: Access your funds anytime, anywhere, as long as you’re online.

• Versatility: Suitable for a variety of cryptocurrencies.

• User-Friendly: Ideal for beginners taking their first steps into the crypto world.

Cons

• Security Concerns: Being online means being open to cyber-attacks.

• Dependence on Third-Parties: Some hot wallets involve third-party management, which can be a potential weak link.

• Potential Losses: If you forget your access details or your device is compromised, you could lose your assets.

With these in mind, let’s analyse and compare 5 hot wallets that tick most boxes and why you should keep an eye out on them.

Top 5 Hot Wallets of Focus

MetaMask

You’ve probably known or heard about MetaMask. It’s a hot wallet primarily for tokens in the Ethereum blockchain. It operates as a mobile application and browser extension, serving as a hub to buy, sell, swap coins, and interact with Dapps. Besides its direct interaction with Ethereum’s ecosystem, you can interact with DeFi, staking, storing NFTs, combining to your cold storage wallet, and so on.

Standout Features

• Web3 Functionality: You can think of MM as a bridge surrounding ETH’s ecosystem. You can seamlessly buy, trade, and earn rewards without having to rely on a CEX. This direct interaction accentuates the decentralised ethos of the blockchain industry.

• Conversion to Cold Storage: You are not restricted to online storage. There’s an option to transfer tokens to renowned hardware wallets, including Trezor and Ledger, directly from the browser extension.

• Open Source: Transparency is key, correct? MetaMask’s open-source code means that its underpinnings are available for scrutiny by developers and users alike, fostering trust and community collaboration.

• Integration & Tools: MetaMask supports many functionalities, from facilitating token swaps to purchasing NFTs to offline storage devices. The wallet also provides staking options through third-party software integration. Additionally, for those new to the Ethereum ecosystem, MetaMask offers educational content to guide newcomers.

Security

Despite its many features, security remains a central concern. As a self-custody wallet, MetaMask offers control and autonomy, ensuring that one’s assets aren’t lost during exchange hacks. However, this also means that if you misplace your security credentials, such as the password or recovery phrase, the implications can be dire. Unlike exchanges, MetaMask is not storing your details anywhere. It’s a wallet that leans heavily on YOUR responsibility. Although MetaMask does not employ two-factor authentication or multi-signature access, its fully open-source nature allows for rigorous code security checks.

Conclusion

MetaMask is ideal for those new to crypto and DeFi. It’s user-friendly, easy to use, supports many features and has the assurance of open-source transparency. Plus, who doesn’t like a fox?

Trust Wallet

Standout Features

• Integration with Binance: If you are already a Binance user, Trust Wallet smoothens your journey even further. Whether you are trading on Binance, transactions are straightforward, and connecting to assets you hold is even easier.

• Asset Diversity: Claiming compatibility with 65 blockchains and around 4.5 million assets, Trust Wallet won’t leave you hanging dry when you are searching for your new shiny coin!

• Multi-Functional Design: Trust Wallet is not just about storing; it’s about experiencing the full suite of crypto. From staking to NFT storage, from swaps to purchases.

• Educative Initiative: Though the tools may seem rudimentary, they are potent for those embarking on their crypto journey. And for those seeking deeper insights, Binance Academy serves as the beacon of knowledge.

Security

Having a stalwart like Binance behind it lends Trust Wallet a certain gravitas. The self-custody model ensures that even if the worst befalls Binance, your assets in Trust Wallet remain untouched. However, a sword hangs over its security credentials: the absence of two-factor authentication and an unclear stance on multi-signature support. This said, much like MM, its open-source nature ensures the community can pore over every line of code, ensuring transparency and trustworthiness.

Conclusion

Trust Wallet is a robust hot wallet for everyone. However, those wishing for a direct bridge to cold storage might find it wanting. Still, it’s a comprehensive hot wallet, especially for Binance users. If you’re in the market for a versatile crypto experience, Trust Wallet might just be your best mate.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Edge

Edge Wallet was founded in 2014 and is a mobile-focused crypto wallet solution, that strikes an impeccable balance between security and user experience. Whilst being mobile-centric, it doesn’t compromise on features, putting itself a notch above other competitors in the space.

Standout Features

• Multi-Currency Support: Edge goes beyond Bitcoin. The constant innovation ensures it’s ready to accommodate over 130 different assets to 179 countries. Pretty impressive.

• Top-Notch Security: While not quite matching the impregnability of hardware (cold) wallets, Edge showcases unique security measures, many of which haven’t been observed in mobile, web-based, or desktop wallets prior.

• User-Centric Design: With an intuitive interface that prioritises ease of use, everything, from viewing your balance to dabbling with advanced settings (shielded behind a four-digit PIN), feels seamless.

• Beyond Storage: Edge is not confined to the typical ‘’store, send, and receive’’ modus operandi. The embedded exchange feature facilitates real-time crypto swaps, enabling you to hedge your assets and adapt to volatile market shifts on the go.

• OS Versatility: Whether you’re an iOS aficionado or an Android enthusiast, Edge has a universal mobile application approach ensuring that no one is left out.

Security

Edge’s commitment to security isn’t merely an afterthought – it’s foundational. Although it isn’t a hardware wallet, its robustness could very well put it atop the mobile wallet security hierarchy. The open-source nature of its code, reviewed and endorsed by security experts, stands testimony to its unyielding emphasis on user asset protection.

Conclusion

Edge Wallet is the quintessential choice for those seeking a stellar mobile crypto solution that refuses to cut corners. Its design caters to both the novice, with its simplistic interface, and the savant, thanks to its advanced features. However, you might want to supplement it with a hardware wallet due to inherent mobile wallet vulnerabilities. Still, for an on-the-go, feature-laden experience, Edge is hard to rival.

Safepal

Established with a clear vision, SafePal provides a wallet solution that resonates with users who desire more than just a storage medium. Armed with its native token, SFP, SafePal introduces a governance-based approach, which is a commendable departure from its contemporaries.

Standout Features

• Governance-Driven Token: SafePal’s SFP isn’t merely a decorative asset. Holders participate in consequential decisions, making the wallet dynamic and user-empowering.

• Security Top Notch: SafePal has a deep focus on security. All of its wallets, whether it’s the app, browser extension, or hardware wallet, come with robust security features. They’re non-custodial, meaning they don’t store your private keys, providing you with ultimate control.

• Active Ecosystem Participation: Unlike many wallets that restrict users to passive roles, SafePal encourages an active say in its evolution through token-based decisions.

• Community Emphasis: Safepal promotes discussions among community members and holders of SFP tokens. Therefore, you can vote and participate in governance decisions about the future Safepal wallet.

Security

SafePal’s security is unyielding. Although it may not compete with the fortress-like protection of hardware wallets or multi-signature wallets, it boasts features that foster trust among its users. The fact that it allows active participation in its ecosystem decisions reflects its commitment to transparency.

Conclusion

SafePal stands as an innovative choice for crypto enthusiasts who seek more than just a transactional experience. Whether you’re a casual user or a crypto enthusiast keen on actively shaping your wallet’s future, SafePal offers the tools and platform. While supplementing it with a hardware wallet might be ideal, for a dynamic, governance-based approach, SafePal remains unparalleled.

Xverse

Born out of a marriage between innovation and the unyielding power of Bitcoin, the Xverse wallet is here to redefine Bitcoin’s capabilities. As the brainchild of the Stacks ecosystem, this wallet ventures beyond the known territories of BTC, showcasing it as more than just a store of value.

Standout Features

• Advanced Bitcoin Layer: Xverse capitalises on Stacks, the ingenious smart contract layer for Bitcoin, amplifying what’s possible atop the world’s most well-known blockchain network.

• Transparent Smart Contracts: Through the Clarity programming language, smart contracts ensure phenomenal transparency, allowing anyone to review the code anytime, anywhere.

• Multiple Trading and Staking Options: From trading NFTs and DeFi protocols to earning Bitcoin rewards by staking STX, Xverse offers varied financial manoeuvres for those who are looking to more than just a hot wallet.

• No Hidden Staking Fees: Xverse’s staking pool service is free of additional costs. Users are only liable for the inherent Stacks miner “gas fe,’’ but we can never avoid those, can we?”.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Security

With the underpinnings of the robust Bitcoin blockchain and Stacks’ unique proof of transfer consensus mechanism, Xverse champions unmatched security. Clarity’s programming, focusing primarily on security, further strengthens the wallet’s defences. From its non-compilation model ensuring transparency to the ability to set contract conditions, Xverse’s commitment to user safety is crystal clear.

Conclusion

If you are looking for a BTC wallet, XVerse stands tall, proving that the most famous crypto can indeed be a playground for innovation. For enthusiasts eager to engage with DeFi, DApps, and NFTs on Bitcoin, Xverse is a beacon of modern blockchain capabilities. Available on both mobile and desktop platforms, this wallet is your window to explore and harness the burgeoning potential of Bitcoin, all while ensuring your assets are safeguarded with the best in the business.

Best Practices for Security

While cryptos and blockchain technologies in general are carving a niche for themselves, security remains paramount. But how do you ensure the safety of your digital assets amidst a sea of cyber threats, scams and shady characters?

Multi-Factor Authentication (MFA): This isn’t merely a buzzword but a bulwark against unauthorised access. MFA necessitates multiple forms of verification before granting entry, dramatically reducing the risk of breaches. Whether it’s a text message, a biometric scan, or an authenticator app, using multiple layers can dissuade even the most persistent hackers.

Routine Updates and Backups: Complacency is a cybercriminal’s best friend. Keeping your wallet software routinely updated ensures you’re equipped with the latest security patches. Simultaneously, regular backups safeguard you against unexpected data losses.

Steering Clear of Cyber Threats: Sadly, that is the most common issue between most users. A phishing link or malicious software that you downloaded to your PC or signing a transaction blindly. A piece of advice is to always double-check URLs, be wary of unsolicited communications, and educate oneself about the latest threats. Awareness and patience are the most potent antidote to deception.

Conclusion and the Path Forward

I really do hope you have a better understanding of hot (software) wallets. One salient point emerges: the onus of security, to a large extent, rests entirely up to you. The wallets we’ve covered offer robust security features, but they work best when complemented by informed and vigilant usage.

The crypto industry is more than just technology; it’s a burgeoning community that thrives on collective knowledge-sharing. As pioneers and participants of this digital revolution, we mustn’t hoard insights but disseminate them.

So, dear anon, as you step forward, arm yourself with knowledge, be extra careful of where you store your precious crypto or NFTs, and rally those around you to do the same. Our collective endeavour for a safer digital tomorrow begins with individual actions today.

Onwards and upwards!

written by Bitget

Bitget’s Five-Year Journey: Struggles, Triumphs, and Our Vision

Bitget, founded in 2018, has reached its fifth anniversary, marking a remarkable journey in the cryptocurrency industry. Over these five years, we’ve weathered the storm of volatility, experienced highs and lows, and remained steadfast in our belief in the potential of this industry.

As we celebrate this milestone, I want to share five stories that encapsulate our journey, offering insights into our past experiences. In the midst of a challenging market, we hope these stories inspire those dedicated to the industry, reminding them that our past efforts were not in vain. Together, we await the dawn of a new era.

Starting in a Bear Market: Persistence and Choices

Bitget’s founders, with backgrounds in finance, entered the world of fund investing in 2015, primarily focusing on the TMT sector. They encountered blockchain startups, often dismissed by the financial world as a “tulip bubble.” However, in the summer of 2018, Ethereum sparked a crypto boom, unveiling the innovative potential of cryptocurrencies. Recognizing this potential, our founders invested their initial capital of a few million dollars and established Bitget.

The early days were challenging, especially because we began during a bear market. We explored spot and futures trading but faced limited success with a small team of just a few dozen members. By the end of 2018, we realized the need to focus our efforts and resources on our core business. We made a tough call to halt our spot trading service as the company had been operating at a deficit for a year, and our initial capital was dwindling.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

In July 2019, we identified strong user interest in Linear Futures, becoming one of the first major platforms to launch this innovative product. Trading volumes quickly exceeded $100 million, marking a turning point. After more than a year of effort, Bitget started to generate profits. In appreciation of our employees’ dedication, we distributed bonuses and continuously improved various aspects of our operation.

Perseverance and strategic decisions were key to our success, and we remained dedicated to crypto futures trading. In 2021, confident in our futures contract business, we made the strategic move to revive our spot trading business, and now our spot trading volume has entered the top 10 among all CEXes. Our unwavering commitment to our core beliefs propelled us forward.

Secluded Training for Enhancing Copy Trading

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Bitget’s growth journey can be likened to an uphill trek, with the triumphant launch of Linear Futures in 2019 as our first significant milestone. This product provided stability to our ascent. The introduction of copy trading further aided our progress, evolving into our flagship product.

While dedicated to promoting crypto adoption through education, we observed that newcomers often struggled to understand the crypto industry and trading. Many learned through hands-on experience, facing occasional setbacks and scams. Bitget aimed to change this by allowing experienced traders to share their strategies, which newcomers could easily adopt using professional tools. In late 2019, we began developing the copy trading feature, officially launching it in May 2020, where it gained immense popularity.

However, the initial version had its share of complexities. We reached a point where the growth of our copy-trading business hit a bottleneck. While some users found value in the product, others were put off by its intricacies. We firmly believe in the mantra that “simplicity is the ultimate sophistication.” To achieve widespread adoption, a product must be user-friendly and accessible to all.

So our management team and product managers had a secluded meeting at a remote hotel over a weekend to conduct a comprehensive analysis and review of the copy trading feature. We removed some unnecessary functions, aiming at enhancing its user-friendliness, capacity, and flexibility. We continually refined and expanded this feature, extending its scope to include spot trading and introducing complementary tools like the Strategy Plaza.

Empathizing with Messi’s Growth Path

In 2022, the crypto industry saw widespread attention during the World Cup, providing an opportunity for partnerships with football teams or players. Bitget, having achieved significant growth, chose to collaborate with Lionel Messi. Messi’s journey from adversity to greatness resonated with Bitget’s startup story. Although gifted in football, Messi had barriers against him becoming the GOAT. Yet against all odds, he persevered, and with strong conviction and hard work, to become the football legend he is today, inspiring millions around the world.

His resilience, unwavering work ethic, and relentless self-improvement embody the values that Bitget holds dear and actively strives to uphold. Working with Messi not only elevated Bitget’s visibility but also provided us with a platform to convey the potential and future prospects of the crypto industry to a broader audience. It stands as a testament to Bitget’s steadfast belief that in the forthcoming crypto landscape. Interestingly, our journey to select Messi as our partner was not a solitary one. We initially considered various national football teams, all formidable contenders with a shot at World Cup glory. After meticulous evaluation and internal discussions, we arrived at the unanimous decision to join forces with Messi. In a revealing internal survey, we discovered that a significant number of our team members were avid Messi fans, eagerly anticipating his triumph.

Messi’s achievements in football, combined with his reputation as a devoted family man and team captain, aligned with our values. We saw parallels between his path and our own as a startup founded during the 2018 bear market. Both journeys required hard work, determination, and resilience. Our partnership with Messi elevated Bitget’s visibility and allowed us to convey the potential of the cryptocurrency industry to a broader audience.

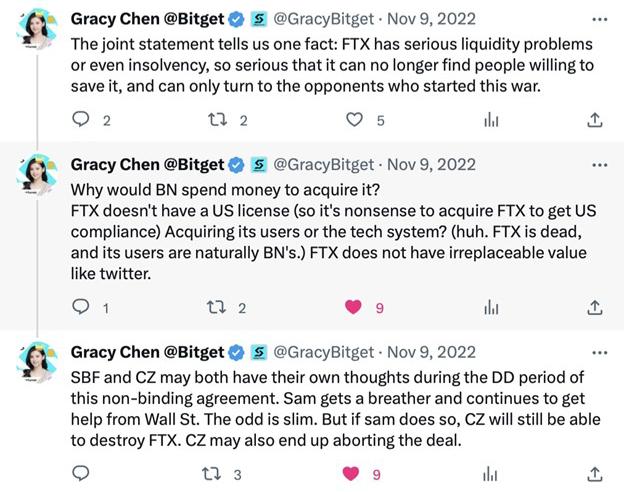

Earning Customer Trust Through Honesty After the FTX Fiasco

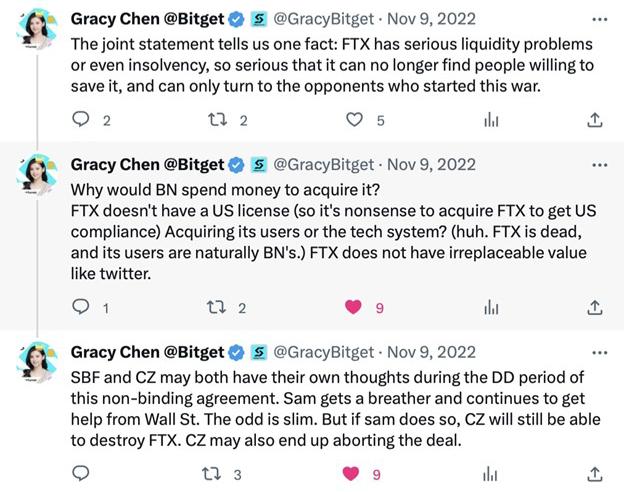

The crypto industry witnessed dramatic events in 2022, including the downfall of FTX. Still remember on November 8th, as I was getting ready for Token2049 in London, my phone alerted me to the “Binance Acquires FTX” breaking news. I quickly skimmed through Twitter posts by SBF and CZ, and their statements seemed to be at odds. SBF appeared to declare the acquisition as a done deal, while CZ did not give a confirmation. At that very moment, I realized that FTX’s problems may be much more severe than publicly perceived, given that SBF was willing to engage in discussions with CZ, who partly initiated this tumultuous saga. I immediately shared our perspective on Twitter.

https://twitter.com/GracyBitget/status/1590042346632409088?s=20

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

I asked my team to closely monitor this event, particularly focusing on our proof of reserve release. During the flight, I reflected on a crucial question: If FTX were to collapse, where would the cryptocurrency industry head, and as another centralized exchange, what steps should we take to rebuild user trust?

Amidst uncertainty, we committed to transparency by publicly pledging to publish Bitget’s reserve proof within a month. We fulfilled this promise in December, providing a detailed breakdown of our reserves. Additionally, we bolstered our Protection Fund and established a Builders Fund to support those affected by the FTX collapse. These proactive steps aimed to rebuild trust and confidence among users and the market, demonstrating our commitment to advancing the industry, even in challenging times.

Adopting a Marathoner’s Mindset to Go the Distance

In the fast-paced crypto industry, we emphasize the importance of a marathoner’s mentality. Bitget strives not only to be an exchange but to build an entire ecosystem, adapting to industry trends while maintaining a long-term perspective. Many ask me about how Bitget managed to emerge as a leading global platform. I think two things deserve careful thought: what we do and how we do it. We believe that patience, endurance, and a focus on our vision are essential for success.

At Bitget, I’ve really felt our team’s marathon mentality. Once, discussing the FTX saga with an industry veteran, he remarked: “It was a 100m sprinter - fast, flashy, but business is longer than 100m. With crypto derivatives roots too, Bitget’s more a marathon runner - not as flashy at first, but steady, patient, and persistent. Those qualities build true value over time.”

Quoting a recent trending research about happiness, directly chasing happiness often backfires, with happiness more a byproduct of effort. Just as a marathoner doesn’t pursue happiness directly but finds it in the effort, we understand that real growth comes from sustained dedication. In this dynamic landscape, we do the same in running a company. To remain steadfast, staying on the right course with mindfulness and perseverance, ready for the journey ahead.

Gracy, Managing Director at Bitget

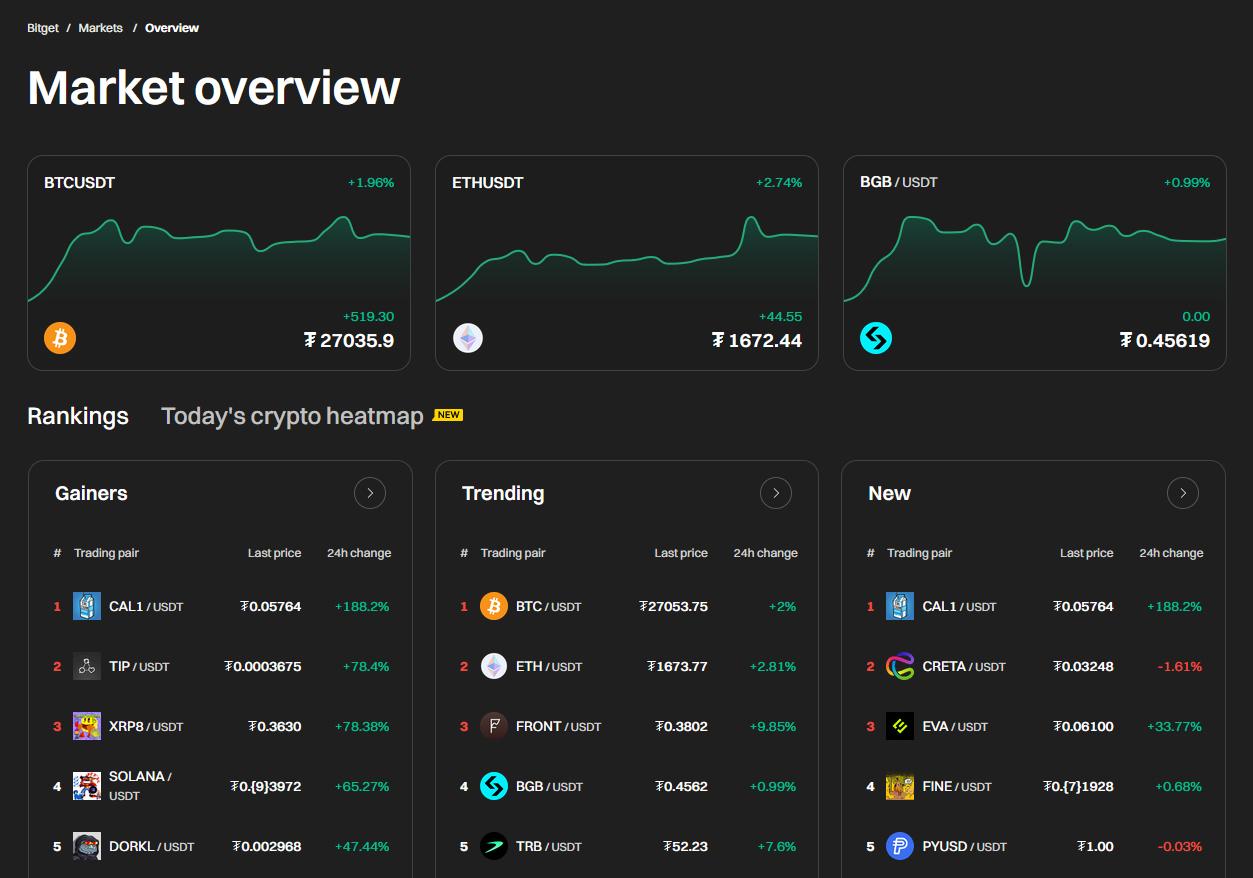

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange that offers Copy Trading services as one of its key features. Serving over 20 million users in more than 100 countries and regions, the exchange is committed to helping users trade smarter by providing a secure, one-stop trading solution. Bitget inspires individuals to embrace crypto through collaborations with credible partners, including legendary Argentinian footballer Lionel Messi and official eSports events organizer PGL.

For more information, visit:

Website | Twitter | Telegram | LinkedIn | Discord

For media inquiries, please contact: media@bitget.com

Crypto Millionaires: Success Stories and Strategies for Wealth

Writen by Daniel Jimenez

Writen by Daniel Jimenez

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It has been over a decade since Bitcoin appeared and kick-started the exciting cryptocurrency market, generating many millionaire stories now echoing worldwide.

While we are at an early stage of the technology, throughout its history, the market has offered different opportunities to capitalise on the momentum and achieve exorbitant returns that position them in the selective club of crypto-millionaires.

But is it true that you can become a millionaire with cryptocurrencies like Bitcoin? If so, is it still possible to become a crypto-billionaire under the current market conditions? More interestingly, what is the strategy for cryptocurrency enthusiasts to capitalise on a portfolio of six-figure returns with minimal investment?

It is essential to recognise that the stories of millionaires who have accumulated wealth through cryptocurrencies do not match the typical tales of sudden wealth in traditional finance.

Raising over a million dollars in cryptocurrency investments was unheard of for many traditional institutional investors, and it usually takes a considerable amount of time to achieve such goals. However, what happened with early-stage Bitcoin and meme coins in recent August reinforces the theory that anything is possible in this vibrant ecosystem and that reaching a six-figure or more portfolio is pretty far-fetched.

The existing stories about cryptocurrency millionaires encompass a mix of early Bitcoin and other cryptocurrency investments, along with risky investments made by digital pioneers who ventured into the uncharted territory of blockchain technology that allowed them to generate instant wealth by rewriting the rules of wealth accumulation.

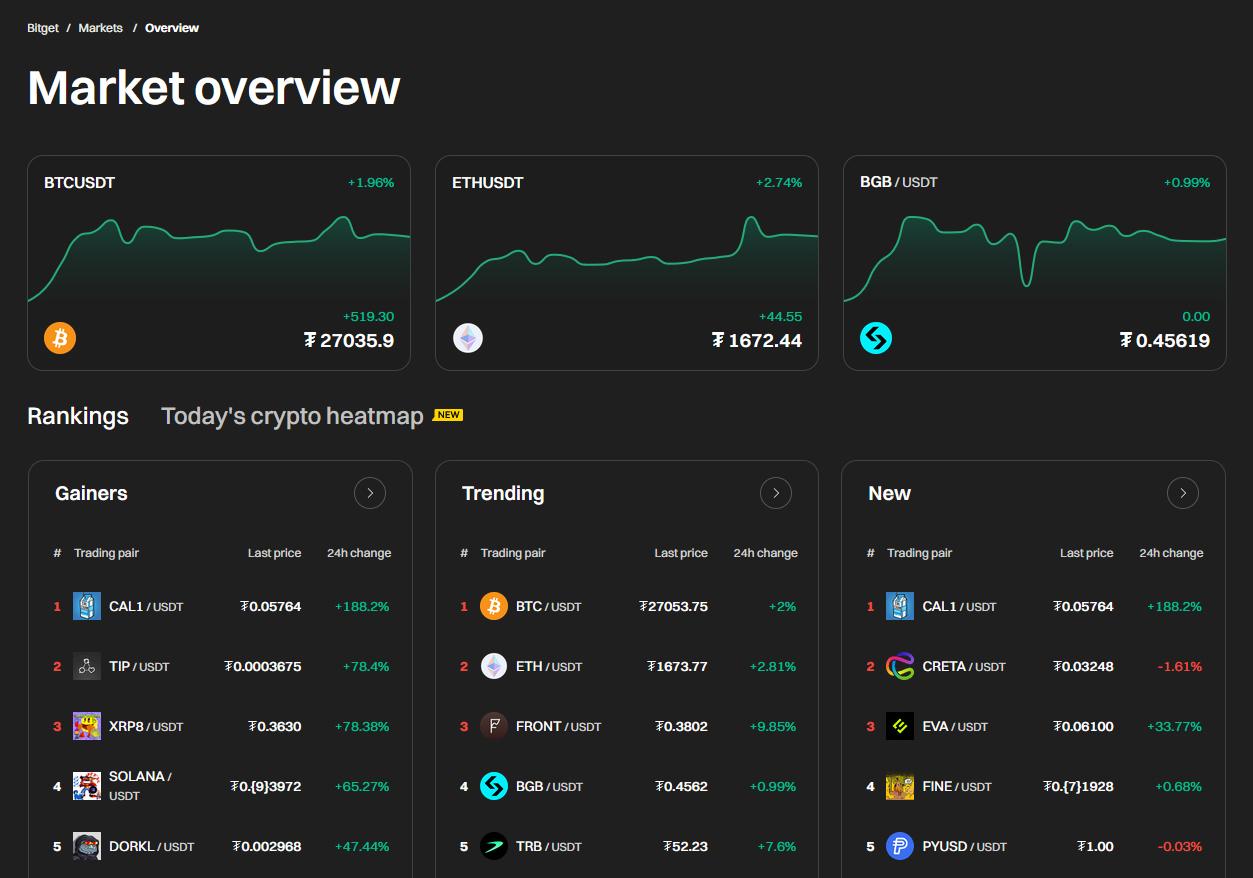

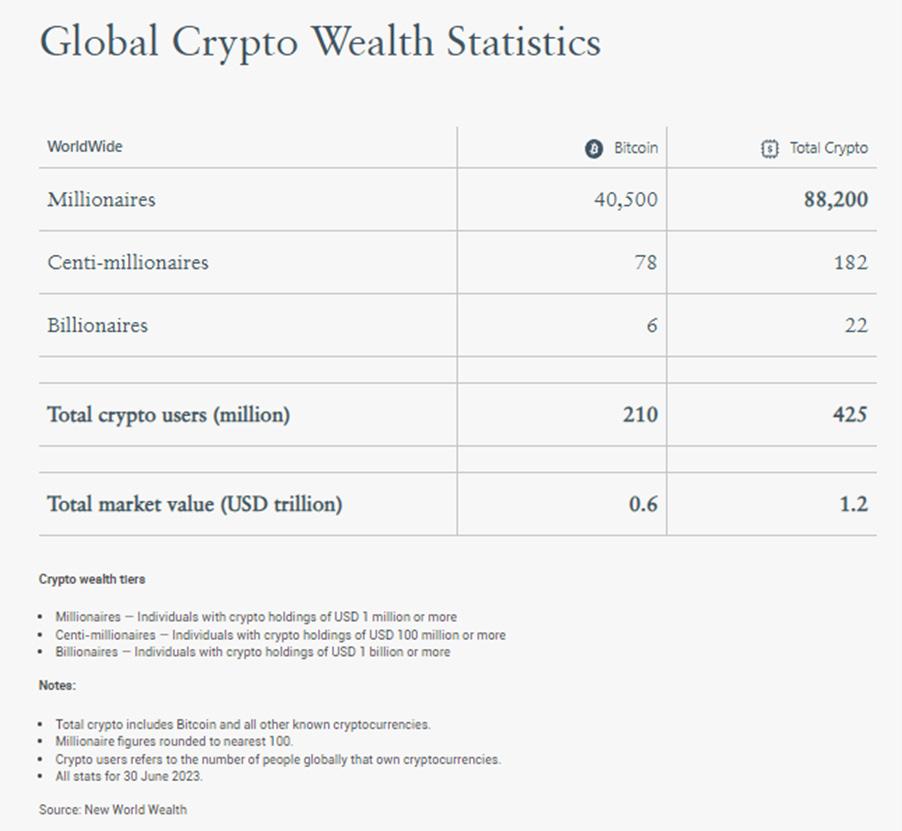

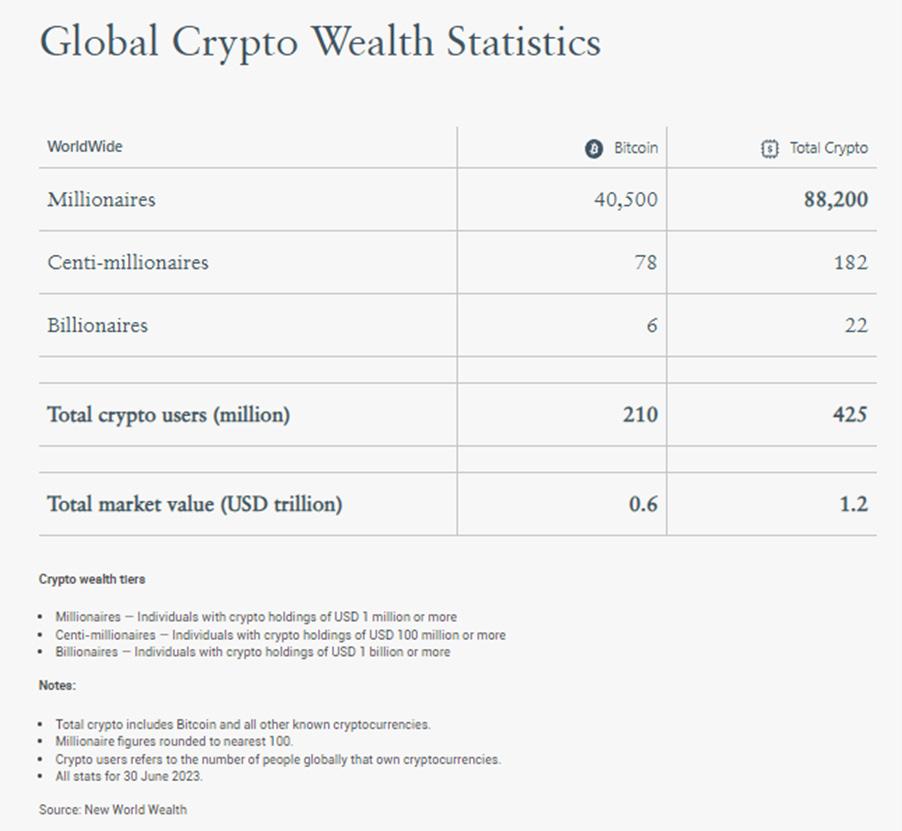

According to the Crypto Wealth Report published by Henley & Partners on September 5th, 2023, at least 88,200 individuals possess crypto holdings of USD 1 million or more, and only under half of these millionaires (40,500) hold their wealth in Bitcoin.

Fuente: Crypto Wealth Report 2023 | Henley & Partners

For this reason, in this article, we want to review some success stories of the industry’s most renowned crypto-millionaires and analyse what their strategies were - if any - or whether it was mere chance that they came along at the right time, at the right moment, to capitalise on six-figure return opportunities.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

It wasn’t all rosy.

Despite the success stories we hear in the industry, only some things were rosy from the beginning, given that the inception of new technology requires a combination of luck and cunning to gauge the exact time to dare gamble on the unknown.

Moreover, it is essential to remember that for many current crypto billionaires, these 13 years have been a captivating journey where they have managed to be pioneering visionaries who risked the potential of blockchain technology and financial assets when no one believed in it to achieve unprecedented financial success.

Therefore, understanding the disruptive potential of cryptocurrencies has been part of the common denominator among digital visionaries as we study the success stories of individuals who learned lessons along the way as they faced challenges within the turbulent seas of the crypto market before becoming crypto billionaires.

The role of luck

Before narrating some success stories to reflect, we must clarify that behind each tale, we find due diligence, persistence, and unwavering faith in blockchain technology and the potential of cryptocurrencies that have allowed these crypto billionaires to today be ‘codified’ gods.

However, the mandatory question of whether there has been luck when investing in the right cryptocurrency at the right time by these individuals has continued to hover among the various analysts of the ecosystem. In that context, there have undoubtedly been some cases where the luck factor has played a crucial role.

Some success stories to know about crypto millionaires

In this exciting journey of crypto millionaires, let’s study some nuanced examples that have inspired many cryptocurrency enthusiasts.

Erik Finman: A risky pioneer

Bitcoin’s dubbed “teenage millionaire,” Erik Finman, was a bold kid with the foresight to execute a risky strategy when he was 12 years old: he negotiated with his parents to drop out of high school and never go to college as long as he could make money by investing.

The young man managed to turn $1,000 his grandmother had given him into $1 million when Bitcoin crossed $2,700 in June 2017, after he had acquired BTC at $12 per unit at age 12, therefore becoming one of the few to be a millionaire at such a young age and to achieve financial independence after investing in Bitcoin in its early stages.

But beyond ‘luck,’ Finman stands out for two aspects beyond his pioneering vision and faith in cryptocurrencies: He had a clear strategy of investing the returns achieved on his first $1,000 investment in an online education startup (Botangle) which he then sold for an offer of 300 BTC, and maintaining a steady pace of investment in cryptocurrencies that has allowed him to estimate a net worth of more than five million dollars.

Roger Ver: Faith rather than luck

Roger Ver, popularly known as the ‘Bitcoin Jesus’, is an example for newcomers to the cryptocurrency ecosystem of the faith that some visionaries had in the early stages of Bitcoin.

Roger started accepting Bitcoin payments when the cryptocurrency was barely a dollar per unit back in the days when he was just a trader.

Thanks to his conviction about the disruptive potential of Bitcoin many years before the cryptocurrency market exploded, Roger Ver has managed to become one of the earliest and largest Bitcoin investors today, as well as one of the most prominent crypto billionaires in the industry.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Roger is an example of a mix of strategies: a unique vision and unwavering faith in the potential of blockchain technology and cryptocurrencies, even when no one believed in them, and his entrepreneurial thinking to undertake his blockchain-based project, impacting the history of cryptocurrencies with the Bitcoin fork, Bitcoin Cash (BCH).

Cooper Turley: Ethereum Millionaire

Cooper Turley started getting involved with Bitcoin and cryptocurrencies, especially Ethereum, in 2017 when the market-leading cryptocurrency was trading at around $2,000, and ETH was just a few hundred dollars.

His interest in blockchain technology was one of the fundamental aspects that kept him hooked on the ecosystem, along with his visionary mind that anticipated the opportunities offered by the industry at the time.

This cryptocurrency investor and advisor pulled off a risky strategy for many investors: putting almost all of his money into ETH in 2018 when it was barely worth around $100.

Cooper is an example of a mix of strategies, including the typical ‘HOLD’ mantra, aka holding on to his ETH despite market fluctuations, and perseverance and hard work that has allowed him to captivate sevenfigure wealth in his portfolio.

Kristoffer Koch: Lucky billionaire?

Norwegian-born engineer Kristoffer Koch is a rare example of a story where the luck factor comes knocking at the door. Kristoffer stumbled upon Bitcoin’s core technology in 2009 while researching for his master’s thesis, which led him to experiment with the cryptocurrency by spending around $27 for more than 5,000 BTC.

According to Kristoffer himself, his investment was purely to experiment with crypto technology while developing his thesis, and he never thought it would be a move that would change his life forever.

Kristoffer’s story changed in 2013, when Bitcoin became a regular topic of discussion in many media outlets, allowing this ordinary person to stumble upon financial success when he least expected it.

His story is undoubtedly one of the examples where the “right time, right place” factor knocks on the door of some lucky people.

Kingsley Advani: Testimony to the Power of Belief

Advani is another exemplary young crypto-millionaire who relied on his intuition to recognise the potential behind Bitcoin technology. At 20 years old, he made his first investments, which allowed him to transform them into seven figures four years later.

Like Roger Ver, Kingsley Advani has capitalised on his early knowledge of technology and cryptocurrencies to make a profit that allowed him to dedicate himself as a financial advisor and become a Bitcoin success story.

Advani’s rise is an example that the story behind crypto billionaires is not just a financial story but a testament to the power of belief, innovation and the unwavering pursuit of a vision.

Kiarash Hossainpour: The Dark Side of Success

While the article mainly attempts to celebrate the achievements of Bitcoin millionaires, we cannot overlook examples that have been on the opposite side of the cryptocurrency world.

One example is Kiarash Hossainpour, a YouTuber and investor, who gained attention for the way he lost much of his fortune four years after becoming an 18-year-old Bitcoin millionaire.

Hossainpour boasted for four years about his fortune in seminars and interviews, which he managed to capitalise on his first investment in Bitcoin, and then lost overnight after the market collapse following the fall of LUNA, which made many rethink the thesis of becoming rich without the culture of entrepreneurship.

For some analysts, Hossainpour went from being a benchmark of success in the industry and an example to follow for many early-stage Bitcoin investors to a lesson in the precautions that ‘instant’ millionaires should follow about being informed about the technology, forming a mediumterm investment strategy and having an exit plan during a highly volatile market such as cryptocurrencies.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Is there still time to become a crypto millionaire?

The answer to this question depends on how you look at it. On the one hand, under existing conditions, it is unlikely that you will become a Bitcoin millionaire overnight.

You must have hundreds of thousands of dollars and enough time in the market to ensure you will become a Bitcoin millionaire this year.

However, the cryptocurrency market offers some opportunities that, although challenging to realise, recent history with PEPE and BANANA, to name a few tokens, has shown that if you have the proper knowledge, the time required and the money available to risk, you can be a lucky crypto-millionaire.

However, while we are not in the early stage of Bitcoin to be an overnight crypto-millionaire, the ecosystem still presents opportunities to save under strategies such as dollar cost averaging (DCA), offering the chance to become a crypto-millionaire in the long run.

Dollar-cost averaging (DCA) is a popular investment strategy involving investing a fixed amount at regular intervals in an asset.

This investment strategy decreases your risk of being affected by short-term price volatility and protects you from potentially allocating all your capital at a maximum price. DCA also allows you to accumulate a prominent position in the asset at a lower average price over time.

Bitcoin DCA has become a popular bitcoin investment approach because it helps mitigate the impact of bitcoin price volatility and allows anyone - even people with small amounts of capital - to build a potentially strong pot of bitcoin savings over time.

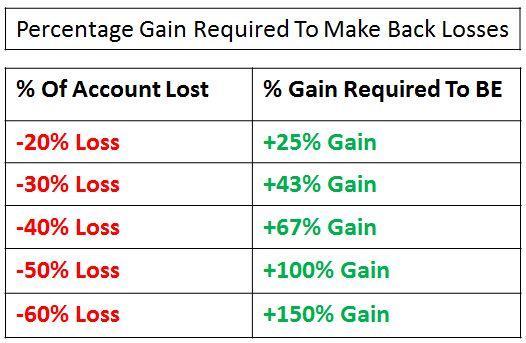

However, one must consider that the DCA strategy is a long-term investment, given that it takes years to achieve compound interest strength, and one must be mentally prepared to withstand losses of more than 20%. The key here is patience and perseverance.

Also, remember that having professional guidance to start a portfolio allows you to mitigate the risks with tools to reach your first million dollars, a common goal shared by the Getting Started on Crypto (GSIC) team.

What do crypto millionaires have in common?

From what we have explored about the history of crypto billionaires, there has been a pattern to all of these stories: They have managed to get into the ecosystem early, stay informed and educated, diversify their portfolios, and remain calm even during the stormiest times.

Thus, many crypto billionaires had the vision to invest in digital currencies when they were still a developing concept. In contrast, many keep themselves constantly educated and informed through talks, conferences, and meetups to stay abreast of the latest developments in the ecosystem.

Not least, keeping calm and learning the art of HODLing are vital aspects to mastering the FOMO and FUD that periodically occur in the cryptocurrency market and can lead us to make wrong decisions.

Of course, there are risks in the industry, especially in this new market that has yet to mature, that investors in Bitcoin and other cryptocurrencies must be willing to take. For this reason, phrases like “Do your due diligence (DYOR)” and “Don’t invest more than you are not willing to lose” are prevalent among crypto millionaires.

While there is no magic recipe for becoming a crypto millionaire, knowing their experiences allows us to learn the essentials to achieving our first million dollars!

The Psychology of HODLing: Understanding Investor Behaviour in Crypto

written by Lisa N. Edwards

written by Lisa N. Edwards

Cryptocurrencies have ushered in a new era of investment opportunities, bringing with it a unique set of challenges and behaviours. One of the most intriguing phenomena to emerge from the crypto space is the concept of “HODLing.” Coined from a misspelled word in a 2013 Bitcoin forum post, HODLing has become a defining characteristic of crypto investors. I’m going to delve into the psychology of HODLing, exploring the underlying factors that drive this behaviour and its implications for the crypto market.

The Origin of HODLing

HODLing, pronounced “hodl-ing,” is a term used in the crypto community to describe the act of holding onto cryptocurrencies for an extended period, regardless of market fluctuations. It originally surfaced in a drunken rant on the BitcoinTalk forum, where a user wrote, “I AM HODLING” instead of “I am holding.” This accidental creation has since taken on a life of its own, symbolising the steadfast determination of crypto investors.

Some of the HODL Memes.

Fear of Missing Out (FOMO)

We have all had this feeling before, and one of the primary psychological drivers behind HODLing is the fear of missing out (FOMO). Whoever wanted to be the last kid picked for a sports team at primary school? So maybe FOMO is an ingrained feeling?

Crypto markets don’t help with FOMO and are notorious for their extreme volatility, where prices can skyrocket in a matter of hours. HODLers often believe that selling their assets prematurely will result in missed opportunities for substantial gains. This fear of missing out on the next big bull run encourages them to stay invested, regardless of market conditions.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

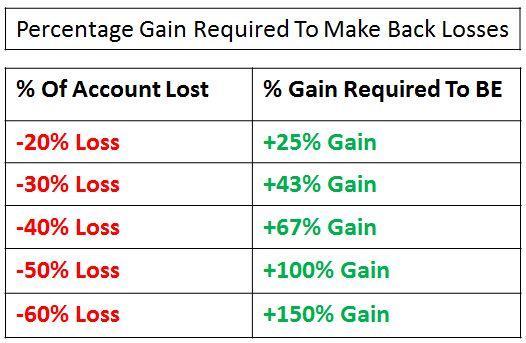

Loss Aversion

Loss aversion is another crucial psychological factor at play. Investors tend to feel the pain of losses more intensely than the joy of gains. HODLers may resist selling their assets at a loss because doing so would crystallise their losses, making them feel like they’ve failed. They hope that by holding onto their investments, they can eventually recoup their losses when the market rebounds.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Sunk Cost Fallacy

The sunk cost fallacy is a cognitive bias where individuals continue investing in a project or asset based on the resources (time, money, or effort) they have already committed, even if it no longer makes rational sense. In the context of crypto HODLing, investors may view their initial investments as sunk costs, leading them to cling to their assets in the hope of eventual profitability, even when faced with evidence suggesting otherwise.

We touch on this in-depth here https://themoonmag.com/issue-22/

Confirmation Bias

Confirmation bias is a tendency to seek out and give more weight to information that confirms one’s existing beliefs or decisions. HODLers often fall victim to this bias by selectively focusing on positive news and price predictions while ignoring or dismissing negative information. This reinforces their commitment to HODLing and bolsters their confidence in the long-term success of their investments.

Over-optimism and Cognitive Dissonance

Many HODLers exhibit over-optimism about the future of their chosen cryptocurrencies. They convince themselves that their investment choices are right, even in the face of contrary evidence. This aligns with the concept of cognitive dissonance, where individuals experience discomfort when their beliefs and actions are in conflict. They may become even more committed to their HODLing strategy to resolve this dissonance.

Implications for the Crypto Market

The psychology of HODLing has significant implications for the cryptocurrency market: Reduced Liquidity: HODLers tend to keep their assets off the market, reducing overall liquidity. This can contribute to increased price volatility when large holders decide to sell or buy.

Price Booms and Busts: The HODLing mentality can amplify price booms as investors hold onto their assets, creating scarcity. Conversely, it can intensify market crashes as HODLers resist selling during downturns, exacerbating price declines.

Long-Term Viability: While HODLing can be a successful strategy in a bull market, it may not be suitable for all cryptocurrencies. Projects with no real-world utility or value may eventually become worthless, leaving HODLers with significant losses.

The psychology of HODLing is a complex interplay of emotions, biases, and cognitive processes that shape the behaviour of crypto investors. Understanding these psychological factors is crucial for both investors and market analysts to navigate the ever-evolving crypto landscape. Remember you can be a Trader and Still HODL, but you can’t be a HODLer and still trade… two different mindsets. While HODLing can lead to substantial gains in the right circumstances (Bull markets after DCAing low), it also carries risks that should not be ignored. Balancing long-term conviction with rational decision-making remains the key to success in the crypto market.

And for anyone that has HODLed Bitcoin for ten years or more it’s really paid off… BUT you could have sold at 69K… JUST SAYING…

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The Dark Side of Crypto

Exploring Security and Scams

written by Chris

written by Chris

Ever found yourself deep in a chat about cryptocurrency lately? It seems everyone has an opinion, and for good reason. This crypto market has brought in big players but even the everyday folk like you and me. It’s clear though that crypto is not all glitter; as much as it’s a game-changer, it’s also a playground for con artists.

Remember that headline of the Ronin Network hack for $625m? It certainly sent shockwaves but it’s not always the headline acts. Beneath the surface, there’s a bunch of dodgy developers, sham exchanges and vintage Ponzi plays, and now, we even have crypto-related job scams!

Key Insights

• Crypto hacks and scams are happening every day due to a lack of proper regulations and the decentralised aspect of cryptocurrencies which make it hard to track scammers..

• Common hacks include phishing attacks, fake exchanges, ponzi schemes, honey pot projects and business opportunity tricks.

• Do your homework. DYOR, find out the who, where, what and be careful who to trust in this space.

Security Paradigm

The Blockchain Backbone

The foundation of every cryptocurrency is its underlying blockchain technology. This decentralised ledger system inherently provides security by making alterations difficult. Once a transaction is completed, it’s hard to tamper with by hackers, thanks to consensus mechanisms like PoW or PoS, and network participants. Or as you’ve probably heard it, code is law.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Security Measures

Of course, how can you trust the code? After all, the code is written by humans. The Cryptocurrency Security Standards (CCSS) is a comprehensive set of requirements designed for blockchain systems. It encompasses everything, from cryptocurrency exchanges to mobile and web applications. By adhering to these standards, projects ensure consistent security measures to inspire trust in their investors.

The CCSS comprises 10 vital steps, structured across 3 levels, and is widely accepted by many cryptocurrency exchanges. Some core steps include:

• Key/seed generation: The origin point for all cryptographic procedures.

• Wallet Creation: Facilitating secure storage of digital assets.

• Key Storage: Safeguarding the critical cryptographic keys.

• Third-party audits: Independent evaluations to ensure security compliance.

• Data Sanitisation Policy: Ensuring sensitive data is securely erased when no longer required.

Take Action

While industry standards play a crucial role, we as individuals bear the responsibility of protecting our assets. Unlike traditional banking systems, many cryptocurrency platforms lack a similar level of inherent protection. Therefore, we must exercise caution to minimise risks.

Awareness and education are pivotal. There are numerous courses and certifications available online to help you understand and mitigate these threats.

Furthermore, some actionable measures:

• Cold Wallets: Invest in a hardware wallet. These are offline and insulated from many cyber threats. Don’t forget to store somewhere safely your seed phrase!

• Multiple Wallets: It’s always a good practice to have different wallets, especially if you are serious about investing. Diversifying storage reduces the impact of a single breach.

• Routine Password Changes: This is a given but worth noting. Regular updates ensure higher security. Make sure you follow the official announcements, as many attacks were through phishing emails.

• Update Devices: Much like the previous point. Keep your devices and software updated to combat the latest threats.

• Antivirus Software/VPN: These are simple, yet effective layers of defence against malicious attacks.

Types of Crypto Scams

Typically, when there is money to be made, fraudsters and scammers aren’t far behind. Let’s delve into some of the most common crypto scams to look out for:

Probably one of the oldest crypto scams. These prey on mostly beginners, pulling upfront costs with the promise of future wealth. They might also solicit personal details, potentially gaining access to your crypto assets. Another deceptive approach includes using counterfeit celebrity endorsements with fabricated accounts and graphics, making it seem that famous individuals vouch for the venture.

1. Bitcoin Investment Schemes

1. Bitcoin Investment Schemes

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

2. Rug Pull Scams

You’ve probably heard of a too-good-to-be-true new crypto coin or project by now. After unknowing investors pour in funds, these ‘’bad actors’’ vanish, leaving investors with worthless assets. A notorious example is the Squid coin scam, drawing inspiration from the popular Netflix show. Investors were lured with the promise of significant gains, only to be left empty-handed when the developers disappeared.

3. Romance Scams

With the rise of online dating, crypto scammers have also infiltrated this space. Posing as potential romantic partners, they build trust over time and eventually manipulate victims into parting with their crypto. Once the scammer secures the funds, they ghost, leaving the victim both heartbroken and financially strained.

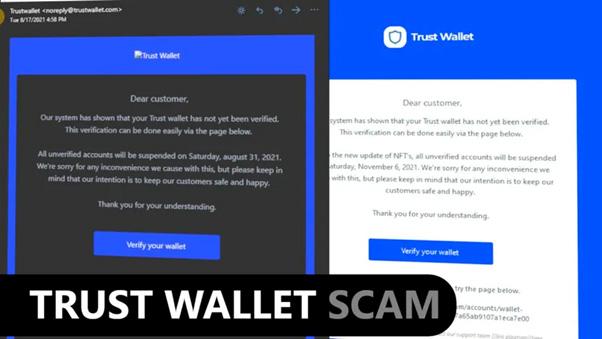

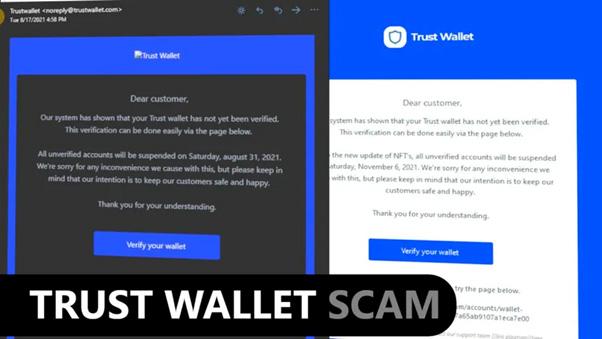

4. Phishing Scams

A classic, but still a prevalent scam. Fraudsters send malicious links via email that lead to counterfeit websites, aiming to harvest valuable personal information, especially wallet seed phrases. A good rule of thumb is to delete those emails straight away and block the sender. Another thing to watch out for is suspicious emails like this below

5. ‘’Man-in-the-Middle’’ Attacks

Imagine logging into your crypto account in a cafe. Without you knowing, a scammer might be intercepting the data you transmit, including sensitive information. They leverage public networks to perpetrate these attacks. Using a VPN ensures your data is encrypted and out of reach from these intermediaries.

6. Ponzi Schemes

Much like outside crypto, these fall in the same category. These scams revolve around a circular system— new investors fund returns for earlier ones. Essentially, it has to do with the actual tokenomics of the project. It goes back to the born of OlympusDAO and the high APR staking systems. Back then, even reputable news platforms knew it was a ponzi.

7. Deceptive Exchanges

Some scammers create counterfeit cryptocurrency exchanges. Investors might be drawn in with the promise of advantageous trades or bonuses, only to find their assets are irretrievable once deposited. Always opt for recognised and reputable exchanges.

8, Employment Scams

This one is rather old, but not many people are aware. It happened to me in the past as well. They usually offer you a job, (not a real one anyway), and they prompt you to download software of their beta game and install it. I’m not sure how they accomplish stealing funds from your wallet (cause thankfully I declined to download anything), but such scams have resulted in significant thefts, most notably to Ronin Bridge, leading to a staggering $600 million loss

9. Flash Loan Attacks

These uncollateralised loans, intended for instantaneous trades, have become scammer playgrounds. They manipulate market prices, making quick profits at the expense of other traders. The most recent Platypus Finance incident, which led to a $9 million loss, is a stark reminder of the risks.

Challenges and a Brighter Tomorrow

Crypto investments have grown rapidly, bringing both potential opportunities and challenges. Most cryptocurrencies are known for their anonymity and direct ownership but can be intimidating.

For newcomers, there’s a steep learning curve. With limited guidance from traditional financial advisors, many were left to manage their investments on their own.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The unpredictable nature of the market can sometimes lead to rushed decisions due to the FOMO. Furthermore, the increasing number of decentralised applications has its pitfalls, opening doors for those looking to exploit vulnerabilities.

Recent Stats

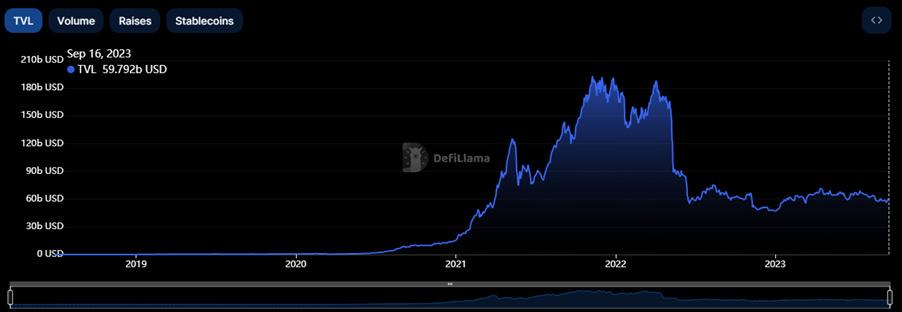

Recent figures sketch a grim narrative: 2022 saw an unwelcome pinnacle in crypto scams, with a staggering $3.8 billion drained off various platforms. An early 2023 report by ChainAnalysis, underscored $775.7 million stolen by hackers in a mere month. Most importantly, DeFi was the centre of these hacks, where DEXs, bridges and lending protocols were the victims.

A Simple Advice

Whilst mainstream adoption signifies the undeniable promise of blockchain technology and cryptos, it’s inarguable that it also beckons opportunistic scammers. It’s imperative to adopt a vigilant approach to crypto security:

1. Be sceptical of overly rosy opportunities. No investments are “guaranteed” or “risk-free,” especially in DeFi and crypto.

2. DYOR. You’ve probably heard that already, but taking matters at face value can be costly.

3. It’s best not to be in the spotlight when investing in crypto. Keep the successes for yourself. Scam artists can and will find you through your social media.

4. Upgrade your account security, never share or use the same passwords, activate 2FA, get a solid Antivirus/VPN, and avoid using public networks. Also, avoid using the same PC/laptop for crypto and entertainment.

5. Last but not least, diversify your holdings – akin to not hoarding all cash under one’s mattress, crypto assets should be spread accordingly.

Conclusion

I really do hope you read the whole article. Security is paramount these days, not only for our investments but for our sanity as well. Always be diligent. Being first in an ICO or an IDO means two things. You’ll either be lucky and gain some $, or most likely lose your investment.

Therefore, take your time and read the actual value proposition, and whitepaper, research the team behind the project and make sure you invest only what you afford to lose. Till next time, stay SAFU!

written by Daniel Jimenez

Unlocking Cryptocurrency’s Potential: Road to Mass Adoption

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

From blockchain complexity to regulatory challenges, delve into the journey of cryptocurrencies towards mass acceptance.

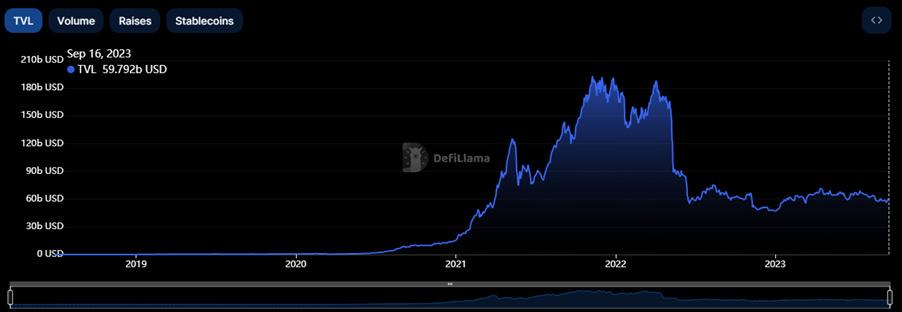

There is no doubt about the potential of cryptocurrencies in today’s financial landscape. Their adoption has witnessed significant growth across various sectors of society in such a short period, a phenomenon deemed unimaginable a decade ago by many crypto enthusiasts.

Cryptocurrencies have entered numerous regions, managing to transcend geographical boundaries, racial divides, and societal distinctions, unequivocally highlighting that Bitcoin, and all it embodies, is here to stay.

In stark contrast to the predictions made by decentralised finance detractors a few years ago, the path toward mass adoption of this ecosystem appears closer as technical, regulatory, and security challenges within the industry continue to improve.

Reaching the following billion users in the cryptocurrency world is a milestone that no longer seems far-fetched, especially when we consider the growing on-chain transaction numbers, the burgeoning count of active unique wallets (Weekly Active Users or WAU), and the expanding array of decentralised application options that are being developed, even in the face of a bearish price market.

Source: Bitcoin Magazine/Glassnode

However, as with any emerging technology, we must surpass some challenges to achieve widespread cryptocurrency adoption and integration into various facets of our lives.

. In this article, we delve into these challenges and elucidate the progress made on the path to adoption by the next billion crypto users, who will contribute to the decentralised technology’s forthcoming mass dissemination.

Understanding Mass Adoption in Cryptocurrency Defining Mass Adoption in Cryptocurrency

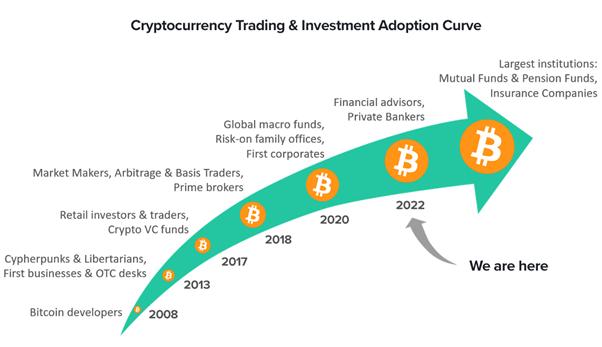

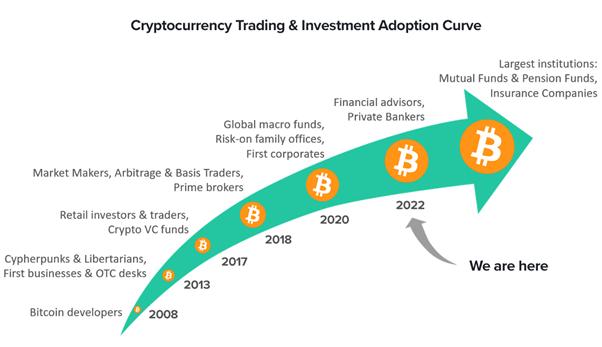

Cryptocurrency mass adoption marks a pivotal moment in their journey where crypto assets shift from a specialised realm of a few cypherpunks to an integral global economic and financial system component.

To achieve this, we must first traverse diverse cycles during the cryptocurrency adoption trajectory, much like what occurred with other technologies such as the Internet or the telephone.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The diffusion of innovations, according to Rogers.

Source: Diffusion of innovations - Wikipedia

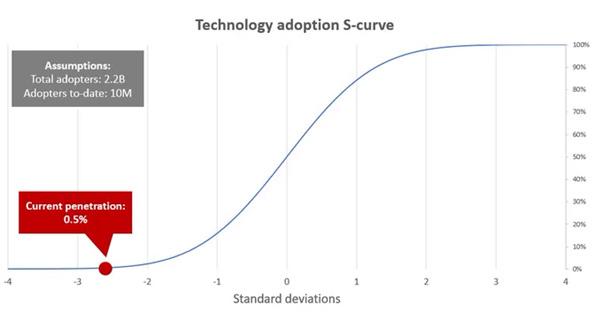

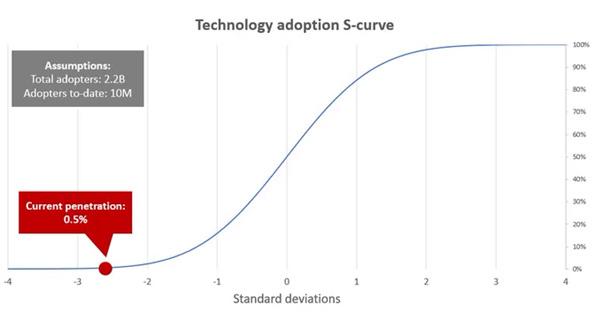

As Roger’s diffusion of innovations curve suggests, new technologies like Bitcoin undergo an S-curve cycle as they gain market share. Conversely, adoption by the general population follows a typical statistical bell curve.

According to the chart above and analyses conducted by various studies, such as Crypto.com, where approximately 300 million people likely owned some form of cryptocurrency by December 2021, we find ourselves in the ‘Early Adopters’ stage of cryptocurrency-related technology like blockchain.

‘The 2023 Global Crypto Adoption Index,’ which is Chainalysis’s latest report, indicates a decrease in worldwide grassroots crypto adoption across 154 countries, supporting the notion that we are still in an early stage for Bitcoin.

Source: Chainalysis

Chainalysis data demonstrates that Bitcoin will not spread rapidly like Facebook, the Internet, or the iPhone because it needs to overcome various obstacles, reinvent itself, and, much like the clock in the 17th and 18th centuries, simplify individuals’ financial needs before the masses can adopt it.

This premise is also rooted in an analysis conducted by Jesse Myers in 2020, later endorsed by Bitcoin Magazine this year, suggesting that Bitcoin adoption by ‘heavy users’ stands at a penetration rate of 0.01% of the world’s population, placing it on the left edge of the technology adoption S-curve.

Source: X

Factors Driving Widespread Adoption

The catalysts propelling the journey towards widespread adoption are multifaceted, and despite being in the nascent stage of Bitcoin, we must acknowledge that numerous advancements have occurred within the industry to enhance cryptocurrency adoption and popularisation.

However, undoubtedly, one of the biggest challenges confronting the crypto ecosystem’s adoption is the education concerning the underlying technology: blockchain. The blockchain technology underpinning cryptocurrencies is often perceived as intricate and challenging to grasp due to its terminology encompassing cryptographic algorithms, digital wallets, and public and private keys, among other components.

A concerted effort from various industry stakeholders is requisite to educate individuals about blockchain mechanics to generate awareness of this technology’s utility and advantages to attain the following billion crypto users.

Part of the endeavour at Moon Mag to educate about this technology’s functioning, usage, and practical tips to harness its potential is a result of a large-scale industry initiative to provide comprehensible guides elucidating the intricacies of the technology and potential risks.

User-Friendly Tools and Interfaces

On another note, it is imperative to highlight that the path to mass adoption in crypto necessitates that cryptographic protocols and platforms become more accessible and user-friendly to the average user.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

One of the significant entry barriers within the crypto ecosystem, particularly in the so-called web3 realm, remains the complexity and non-intuitive user interface presented by many protocols and platforms offering cryptocurrency-based use cases.

In comparison with the adoption timeline of the mobile phone, Bitcoin remains relatively intricate and enigmatic for the average user, given that aspects such as cold storage solutions, mnemonic seed phrases, and cross-chain bridges continue to pose challenges for the most novice crypto enthusiasts, even when we have more simple solutions than those available to early adopters on the BitcoinTalk Forum when Nakamoto introduced his invention.

Nevertheless, it is vital to acknowledge the significant progress made by web3 developers in different sectors, such as blockchain gaming and crypto wallets, in recent years as part of a collective effort towards mass adoption of the technology.

This reality is evident in the integration between functional web2 products widely accepted by the average user, such as PayPal, and their linkage with decentralised options like Bitcoin and cryptocurrencies, demonstrating the existing opportunity for innovation and tool development between non-web3 developers and traditional systems.

The recent case of PayPal illustrates that Bitcoin integration (and all it represents) with traditional financial systems is currently a reality spreading across big economies worldwide, which was inconceivable a decade ago.

Of course, we must recognise potential milestones, such as the approval of a spot Bitcoin ETF, the availability of trading stocks of sector-related companies in the complex financial stock market, and Bitcoin recognition as legal tender in visionary countries like El Salvador.