Editorial

A note from Lisa…

In this month’s Moon Mag we look at passive income and protecting your investments from market volatility.

DeFi barely existed during the 2017 bull run with a few exceptions, if you were a member of my COINRUNNERS Discord you would have invested in ICOs such as Maker Dai, FLEXACOIN now known as AMP Token and NEXO which are moving from strength to strength but there were projects like Modern Finance (MFX) that were set to reinvent the market, though didn’t survive the bear market.

The projects that did, and were able to grow and evolve in the darkest times became what was the game-changer that started this bull run from March 2020, DeFi was and has been the buzz world and as it grows and evolves. It’s important to be at the forefront of the ever-changing crypto-market, and that’s where the Moon Mag is going to be invaluable over the coming months to be ahead of the trends so you can align yourself and your portfolio accordingly.

Not everyone has time to trade, so we show you a few (COST EFFECTIVE) ways to generate passive investment and income, without the stress and tension that trading burdens those less experienced in the fast-moving crypto market.

A note from Josh…

This issue focuses on money management (as well as giving you some fascinating projects that we think will do incredible things)! We look at what you should do with that chunk of crypto that’s just sitting there. Making your crypto work for you passively is one of the surest ways to really grow your portfolio. Our writer, Daniel, explores the many ways to do this including staking. The market seems to really be focused on the metaverse and gaming at the moment too. Looking back at the projects in our previous issues fnds a few of them have really taken of! I hope you have been part of that success but if you are yet to decide where to put your crypto, at least think about staking it in the meantime. As always, do your own research and enjoy the journey!

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

CON TRI BU TORS

Aldrich Shillian

Aldrich (or Rhys to those in the Signals group!) has been HODL’ing since 2017 and is proud of surviving bear markets, rug pulls and still trading successfully enough to have paid of all debts. Recently, he’s jumped head-on into NFT projects - particularly ones that combine his love of gaming.

Shaun

Also know as XRPChillDaddy, Shaun loves researching cryptocurrencies from a technical and business strategy perspective. He spends his free time either reading, working on his business, or talking about blockchain like it’s a religion!

Daniel Jimenez

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

OPINION

How to Generate Passive Income in DeFi

written by Daniel

written by Daniel

With the arrival of Ethereum, the possibilities of programmable money have been extended to traditional felds such as fnance.

Thanks to the Ethereum blockchain’s ability to ofer smart contracts, an emerging DeFi sector has made it possible to manage money autonomously through decentralized applications that interact with smart contracts in a simple and transparent way for the user, eliminating intermediaries from the equation.

Although DeFi is today one of the most popular words in the world of cryptocurrencies, it is still an unknown feld for many. Decentralized protocols are introducing many diferent types of yield-generating opportunities, while leaving all the power and responsibility over money in the hands of the user, making traditional banks and fnancial institutions obsolete.

Growing sector

With investment opportunities in DeFi protocols that ofer annual percentage yields (APY) of between 0.5% and 1,000%, the sector attracts a large number of users every day, which is seen in the exponential growth of the sector in recent years.

According to DeFi Llama, currently more than $205 billion in value is locked in just over 500 protocols deployed on nearly 50 blockchains.

Although Ethereum is not the only blockchain network that currently ofers the ability to deploy DeFi applications which provide investors ways to obtain passive income, it is the main blockchain network that hosts the vast majority of the large protocols in the sector.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

1. Staking

Staking is one of the safest and easiest options to generate passive income in crypto. Staking can be done in a variety of ways, including for those who are inexperienced on popular platforms such as Binance.

Staking is a consensus mechanism similar to cryptocurrency mining that does not require computational power. It consists of keeping funds locked in a wallet to fulfll the function of validating and processing transactions on a Blockchain network.

Proposed by Sunny King and Scott Nadal in 2012 as an alternative to traditional mining amid the debate about the high energy consumption of Bitcoin, the idea was to block funds in a smart contract that fulflls the function of validating transactions on a network without consuming energy.

While staking, the holder of the cryptocurrencies is helping the blockchain network perform work in exchange for receiving rewards.

You should only buy the cryptocurrency of your choice. You can then stake it with a custodial or non-custodial provider from your non-custodial wallet (such as Metamask for example) to start earning interest on the fees generated from the network.

It is worth mentioning that there are diferent alternatives to staking, so there are also diferent rates that you can earn.

The quintessential website on this topic, Staking Rewards ranks the Cardano Blockchain token, ADA, as number one in terms of the percentage of annualized rewards earned for supporting this network — + 6.07% currently at the time of writing this post.

If we compare staking with the traditional method of savings in a bank account of a fnancial institution, we can see the returns are considerably higher; hence many investors wish to place their funds in staking to generate passive income while holding their favorite assets, which are always in their power and custody.

Disadvantages of staking

• Just as there are few barriers to entry, there are also few barriers to exit; therefore, if validators lose interest in one network they could switch to another at a lower cost relative to PoW.

• Validators must give up the use of their tokens.

• The period of unlocking the coins in staking is usually high, depending on the platform where they are held; a practice that often restricts the liquidity of the assets at stake, with exceptions such as the Kira Network with its Liquid Staking.

2. Loans

Lending has emerged as one of the most popular decentralized fnance use cases to migrate from the traditional fnance world. More lenders and borrowers are shifting activity from intermediaries in centralized fnance such as traditional banks to the crypto ecosystem.

Lending has become one of the most active DeFi sectorsas traditional fnance investors have observed how blockchain technology allows them to multiply their income with just a few clicks.

On the other hand, the ease of use and the elimination of entry barriers for millions of people unbanked due to lack of documentation, rigorous legislation or lack of reliable fnancial services in their countries of origin, is allowing borrowers to access fnancing in exchange for a guarantee in crypto, with no borders or consideration of race, creed or skin color.

Crypto lending is a simple concept: you lend your digital assets to a platform by locking your assets in a smart contract. Borrowers can access these assets as loans and return the interest to the platform. Smart contracts distribute accrued interest to lenders in proportion to what they lock in.

One of the great benefts of loans in DeFi is the reduction of the risk of default. Borrowers have to lock in collateral to borrow assets, and assets are subject to smart contracts that enforce repayments of collateral interest if borrowers fail to pay the interest owed.

Thus, if you have assets such as stablecoins or prestigious utility tokens in a blockchain in your non-custodial wallet, you can interact with platforms such as Aave, for example, to “lend” your assets to the platform through a smart contract and receive interest in return.

AaveLoans in DeFi are attractive because of their ease of use, not to mention that you can issue and receive them when you want, with a high APY / APR, relative to traditional interest-bearing accounts with banks.

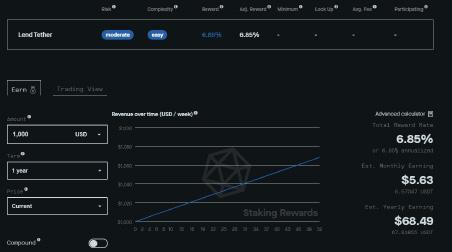

Aave, for example, a DeFi lending protocol on Ethereum, allows lenders to earn up to 6.85%APR annualized returns for Tether’s USDT stablecoin.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Source:It is worth noting that cryptocurrency loans can be applied directly by the user on DeFi or CeFi platforms; in the latter case fnancial applications such as BlockFi or Celsius can also provide the necessary (collateral?) support if required.

Some see the role of centralized fnance as good, while others consider it to go against the decentralized spirit of fnance. However, this type of CeFi platform is gaining more followers every day, with record volumes in transactions in the main cryptos in the ecosystem.

3. Liquidity Provider

The liquidity provider model has revolutionized the fnance sector and propelled the growth in DeFi. In this ecosystem, popular decentralized exchange (DEX) protocols eliminate the need for order books used by traditional exchanges.

Instead automated market makers (AMM) create liquidity groups composed of pairs of tokens, which supply the liquidity for crypto or token exchanges under these protocols; thus forming the very foundation for trading markets in DEXs.

The liquidity groups are public and although they vary in performance and composition according to the DEX, the rules and operations are basically the same: anyone can provide liquidity to these groups by blocking equal values of pairs of particular tokens and receive a fee or commission per transaction proportional to the amount allocated in the pool.

For example, if you access Uniswap, the largest DEX in the crypto market, and want to provide liquidity in the ETH-USDT Pool, for example, you must contribute the same amounts of ETH and USDT in equal parts.

Source: Staking Rewards

source: Uniswap Interface (uniswaep-app.org)

Source: Staking Rewards

source: Uniswap Interface (uniswaep-app.org)

To do this, you must have both assets in your noncustodial wallet and lock these assets by signing the respective transaction in the blockchain network on which it operates (Ethereum in this case). You will then begin to earn LP tokens for your contribution to the ETHUSDT Pool for providing depth to the market.

When you desire, you can redeem those LP tokens representing your share of the total liquidity pool of the particular group in the DEX, plus the income generated by the exchanges, again, in the same value for each pair.

One of the great disadvantages of this method of generating passive income is a risk known as “impermanent loss”, which is why the APY is variable and usually higher compared to staking, for example. The impermanent loss refers to the fact that the investor can lose money compared to what would have happened if he had not joined the pool, when extreme volatility occurs in one of the tokens of the pair that afects the rebalancing of the pool’s price.

4. Yield Farming

Yield farming is a way through which an investor can obtain profts from the storage of cryptocurrencies. Yield farming involves liquidity providers and the liquidity reserve.

The former brings cryptocurrencies to the market. The second is a smart contract, responsible for validating the accumulation of funds.

The liquidity providers, in exchange for providing these funds, will obtain a reward, for example, a portion of the commissions collected by the pool.

Many DeFi platforms ofer “farms” where the investor can allocate tokens and earn income on them. It is the same principle as staking, but accessible only to liquidity providers.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Source: Fleta Connect | $0.346

The objective is simple: to place your capital in one or more investment platforms in exchange for incentives providing attractive APYs that can signifcantly grow your capital .

To yield farm, the investor deposits assets in a smart contract that, in return, will ofer a return for the mobilization of the assets. The investment can be made through various cryptocurrency platforms or exchanges and there is no single application system for this formula, as each protocol has its own features and rules.

One of the major disadvantages of yield farming is the risk assumed with this type of investment. Yield farming is complex and involves the risks of slippage and impermanent loss, which may be difcult for the average investor to manage. Even platforms that seek to simplify processes can be complicated compared to other types of cryptocurrency investment options.

Another major disadvantage is that this strategy favors those who have large amounts of capital to deploy, that is, crypto whales. Another serious problem is the security of the smart contracts of the yield farming platform. If the platform has not been properly audited, there is a risk of theft of funds or hacks that could result in partial or total loss.

5. Masternodes (MN)

Perhaps one of the less common practices in the DeFi sector due to the technical complexity of its implementation is masternodes. However, investors have the potential to generate passive income with sufcient capital and knowledge.

Masternodes are servers connected to the internet that run a wallet with a fxed number of cryptocurrencies from a particular project with a complete copy of its blockchain in real time.

A masternode is a type of full node, but its functions go beyond relaying and verifying transactions across the network. They have become popular because they area an investment providing a quick and steady source of passive income.

Among the functions of masternodes, the following stand out: increase the privacy of transactions, decrease the volatility of cryptocurrency, carry out instant transactions and allow participation in governance and voting. Regarding Masternode governance, each project has its own guidelines, although Dash was the frst project to successfully adopt the masternodes model.

The ROI of a masternode depends on multiple factors: the price at which the cryptocurrency was purchased, block reward or the incentive mechanism proposed by the project, amount of active MN, monetary cost of hosting a masternode, fnal price at which the assets are sold, among other factors.

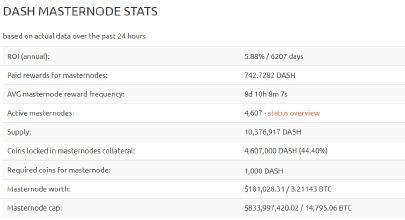

Many projects have set up a masternode to provide a reward to operators in exchange for verifying blocks of transactions for a cryptocurrency. However, DASH continues to be the main benchmark for this system due to its robustness, ROI and volume, important metrics to take into account when selecting a project for masternodes.

Source: MasterNodes.Online

Among the disadvantages is that any project with less than $100k is unreliable in the vast majority of cases, unless they are projects with a great foundation and a real utility that provides strong future potential.

Many masternode projects are used to pump and dump a particular cryptocurrency, a risky practice that can end badly for the investor. Another major disadvantage in addition to its technical complexity is the heavy investment required compared to the other passive income methods described above.

Last but not least, keeping a node requires technical skills to protect it from a hack and keep it up-to-date, although this task can be delegated.

Conclusion

The DeFi sector continues to innovate and create new opportunities to monetize the assets that investors own in their wallets. Depending on their needs and the time they are willing to wait to obtain returns, the options described can be reliable alternatives to generate passive income.

However, take our advice and do due diligence to investigate and educate yourself regarding the DeFi platforms,as well as to understand the operation of each of these yield earning activities to get the most out of your assets at stake.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Bumper and the Bump Token

written by Daniel

written by Daniel

The Bumper Protocol is a DeFi project built on the Ethereum blockchain brought to us by the same team that created Block8. It’s the frst digital asset solution designed to allow its users to mitigate downward market volatility while still benefting from positive price appreciation. If successful, this DeFi solution will undoubtedly disrupt traditional fnancial products and services.

So how is this possible?

The Bumper DeFi solution is made up of protection takers and makers. As a taker of protection, you’d connect your wallet to the Bumper Web3 fnance dApp, set the desired foor that you want protected, and then deposit your assets into the Bumper protocol. In turn, a Taker position is opened by Bumper whereby they issue a corresponding amount of feebearing tokens representing your protected position minus any accumulated fees.

Makers of the protocol provide the liquidity and this in turn opens a position in the stablecoin reserve. Being able to use $BUMP to protect your assets in the event of a market correction will allow takers to mitigate risk for the cost of a low fee. This is benefcial because unlike a stop loss in which your assets are sold, BUMP lets you hold onto your tokens until the market continues in a positive direction. The fee is paid upon cashing out your tokens.

Where To

Bumper completed a successful pre-sale on October 21, 2021, reaching a total of $3,750,256 raised during the seven days that the pre-sale lasted.

The next opportunity to purchase BUMP tokens will be in the public sale on November 23rd.

While it’s IDO will take place on Sushiswap and Uniswap on December 7, 2021. It is important to note that during the pre-sale and public sale, you will be able to acquire BUMP tokens through your web application app.bumper.f by connecting your browser wallet like Metamask or TrustWallet; or connecting directly with hardware wallets such as Ledger or Trezor, among other options.

While awaiting the public sale to arrive, you can still earn the BUMP token through farming by depositing USDC coins.

Core Team

CEO

https://twitter.com/J_DeCarteret

Jonathan DeCarteret, CEO and cofounder of Bumper,holds a degree in AI and has been building and selling tech companies, most notably ‘Switch’ — the UK’s 60th fastest growing company. He is a dynamic business leader and tech entrepreneur, with substantial experience in FinTech, and driving fastgrowing disruptive digital brands and bringing innovation to market.

COO

https://twitter.com/S_Boomerang

Gareth is a Crypto Veteran and the Chief Operating Ofcer at Bumper (COO). He has worked in the commercial sector for 20 years developing extensive business knowledge in technology and fnance. Following his stint as Co-Founder and CIO of the index-linked crypto fund INDX alongside Jonathan De Carteret, this successful crypto investor joins Bumper to solve the Holy Grail of crypto by protecting the value of assets.

Following his BA in Journalism, Gareth has been involved in digital asset management since 2014 in the UK through multiple recognized investor and advisory frms.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Gareth “JauntTrooper” Ward

Jonathan “DeFi” DeCarteret

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Gareth “JauntTrooper” Ward

Jonathan “DeFi” DeCarteret

CTO

https://twitter.com/_samuelgbrooks

Samuel is an expert in Blockchain technology who has developed signifcant infuence and a reputation in the local scene of Australia, where he is from. He has independently pivoted to DeFi protocols like Synthetix. As CTO at Block8, the country’s leading blockchain product development studio, he has managed to become an industry benchmark and an active member of its community, speaking regularly at technology conferences, meetings, and podcasts.

Samuel is currently a member of the Blockchain Technical Committee of the Australian Computing Society and Working Group of the ISO Mirror Committee for Smart Contracts under Australian Standards. He has written a series of presentations and public reports on the Blockchain for both industry and government, and contributes his solid knowledge of blockchain technology to the Bumper team, where he serves as CTO.

Jason “The Pylot” Suttie CMO

https://twitter.com/CryptoPylot

This expert Marketing guru is responsible for Bumper’s communication with the community. Jason ran a marketing agency (Copper) for 12 years, where he focused on the customer experience.

Active in the crypto space since 2018, he started as a community manager and branched out into diferent sectors of the blockchain world ranging from DeFi, NFT, and DEX to becoming a successful advisor in all of these sectors.

Following his stint in Bordeaux, France where he took a wine qualifcation there, Jason started a couple of wine experience businesses that allowed him to combine his digital marketing capabilities with art and science, which he is now perfecting at Bumper to create a product that changes the face of fnance forever.

Samuel “noClip” Brooks

Samuel “noClip” Brooks

What Does BUMP Do For Investors?

The Bumper protocol has one main objective: to protect the price of crypto assets for investors. To achieve this, they have created a DeFi protocol that allows you to set the price you want to protect against price movements in the crypto asset at stake, in such a way that if the market crashes, your asset will never fall below that price.

Importantly, investor assets will not lose upside exposure to a bull market, since by not parting with them, if the market pumps, their assets also increase in value.

Being a totally disruptive platform within the DeFi sector, with a unique value proposition — “nearzero slippage” that maintains upside exposure — heretofore unseen in the ecosystem, investors who buy the native token BUMP will beneft from higher potential returns and incentives inside (and outside) of the platform.

BUMP has many layers of utility: price protection, network incentivization, staking, and governance. As can be seen, the BUMP token ofers higher proft potential than its peers within the DeFi sector.

The holders of the BUMP token will be an important part of the ecosystem, since it is used as an incentive layer to help balance the protocol, allowing them to earn profts from their holdings from the diferent loyalty programs, quota payments with BUMP, yield farming, and so on.

The BUMP token is required to use the protocol’s price protection mechanism, receive rewards from the Maker, and also for staking in the protocol. BUMP tokens are used in a “bonding” system when an insured uses the platform.

In this way, BUMP acts as the fuel of the DeFi protocol, helping investors to protect the value of their assets, while at the same time they can increase the size of their portfolio with periodic increases in BUMP tokens, and rewards for their contribution to the ecosystem.

Yield Farming/ Liquidity Pools

Bumper is fundamentally a market between buyers and sellers of liquidity. The protocol comprises four liquidity pools. The unstable assets of the protection “Takers” in one pool; stablecoin assets in another pool provided by liquidity providers, or “Makers”; and two more secondary pools that power the internal mechanisms.

Investors can act as liquidity providers (LPs) by sending USDC to the protocol to receive a return.

By using the BUMPER Dapp and sending USDC ( additions of new stablecoins expected in the future), LPs receive a corresponding amount of Bumpered USDC (bUSDC), a fungible token that generates a return which increases over time, while earning farming rewards in $BUMP.

One hundred percent of the yield earned from the Yearn USDC Vault will be distributed to eligible LPs for the epoch, a rolling two-week schedule.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

designed so that the stablecoin liquidity pool generates a yield that allows these players to maintain their positions in the pool, in exchange for increasing their yield and the TVL of the protocol. Similar to other DeFi protocols, BUMPER returns the supplied USDC plus accrued interest to the user ‘s wallet, when users withdraw the USDC from liquidity pools.

One of the great benefts of yield farming in BUMPER is that a large percentage of the liabilities can be sent to other protocols to obtain secondary performance, in addition to the premiums paid by protection Takers.

Currently 137,000 $BUMP tokens will be distributed during each 2-week epoch to USDC depositors, with a pre-sale value of nearly $150k. All USDC rewards from the Yearn vault will go to eligible LPs for that time period who will also earn BUMP rewards for staying for the whole time.

Market

Opportunity

There is great concern among investors in the crypto market over how to protect themselves from the ferce volatility their portfolios incur, due to the inherent nature of crypto assets.

The possibility of having a DeFi protocol that enables crypto invulnerability to price risk is in itself a great achievement that has never been seen in the industry before.

Add to the above the possibility of earning returns for being a DeFi Liquidity Provider (LP) in Bumper at the same time as making money from the premiums paid by users taking out protection, an attractive risk-reward proposition is created that can change the rules of the game in the ecosystem.

Bumper Finance has the necessary fundamentals to become a key player in decentralized fnance, not to mention that its token is an attractive

investment asset for those who glimpse the future growth potential of the platform once its protocol is live in December.

Add in the superior technical capabilities, whose active development is led by the top-tier team behind the protocol. Among the recent partnerships, for example, Panther will provide Bumper users with a fexible and scalable privacy infrastructure for asset protection.

Additionally, in a recent AMA, Gareth Ward announced that Bumper has a lot of new partnerships in the pipeline, including a possible enlistment and collaboration with the KuCoin Exchange for the month of December.

With a promising roadmap, and a focus on including products for institutional clients, retailers and regular DeFi users, Bumper is seeing high interest in its protocol and therefore its native $BUMP token.

To take out protection on crypto assets in the protocol, users need $BUMP tokens, which were priced at $1.07 in the pre-sale.

Taking into account that the main functionality of the protocol requires $BUMP tokens, it is not a stretch to think that investors who acquire this token at an early stage could see a fairly signifcant return after the public launch of the protocol.

In its Flashpaper, a potential market for BUMPER is described that is equal to the market capitalization of cryptocurrencies that includes all sectors:

• RETAIL: Protection via the BUMPER dApp on all ERC-20 tokens and stablecoin yield via the BUMPER dApp

• $40bn: Stablecoin yield (Premiums + 3rd party vault yields)

• INTER-PROTOCOL: Protection for unstable assets

• INSTITUTIONAL: Stablecoin yield (KYC/AML front-end) and protection for unstable assets (KYC/AML front-end)

• $15bn: bASSETS reduce over-collateralization from 150% to c.105%

• CDP ASSETS: bASSETS incur zero liquidation risk

• 3rd PARTY WALLETS: Integration with MetaMask, Coinbase & Revolut etc.

The RoadMap

LP & Private Sale

During this phase, investors could deposit their holdings in USDC to earn a return on their stablecoins, as well as rewards in $BUMP and bUSDC tokens, the latter of which could be swapped up to 20% for $BUMP tokens.

Bumper’s private sale and liquidity provision program was closed early by the team, after it attracted more than $25 million, currently placing Bumper as the eighth largest DeFi derivative protocol.

In this phase, the total liquidity provided was $19,813,668 with a current APR of LP greater than 3,000%, at an average token price of $0.75.

Also, at the start of the roadmap, the Bumper team announced a technical update to the user interface, front-end and, of course, an audit of their smart contracts.

Technical updates benefted LPP (Liquidity Provider Program), allowing the ability for users to interact with smart contracts in a single transaction rather than the fow of two transactions they previously encountered.

For its part, the front-end allowed Bumper to support a whole range of hardware and software wallets beyond Metamask.

BUMP Pre-Sale

The team recently successfully completed its pre-sale, reaching in a week just over 3.5 million USD. During this phase, investors could use their USDC to buy $BUMP tokens at the pre-sale price of $1.07, without having to be a liquidity provider.

Furthermore, liquidity providers during this phase have the advantage of unlimited swapping of their holdings in bUSDC to BUMP.

From this phase, LP Farming 2.0 was started, a diferent approach to the initial LP program involving biweekly periods. In this way, if users deposit USDC before the beginning of each epoch and keep their money until the end of this period, they will receive part of the USDC rewards and part of the biweekly distribution of $BUMP tokens, prorated to their minimum holdings. During epoch, around $150k of $BUMP tokens will be distributed to USDC depositors every 15 days, at the pre-sale price.

Those LPs who deposited during the Liquidity Provisioning Program of the previous phase are the only supporters eligible to win in the frst epoch.

BUMP Public Sale

Investors can acquire the $BUMP token on November 23rd at a stipulated price of $1.40. Access is unlimited, so any investor will be able to acquire the desired amount of $BUMP tokens.

The Bumper team continues work on improving the Bumper protocol capital efciency via integrations with:

CDP lending sites (Aave/ Maker/ Compound)

Wallets (Metamask/ Coinbase)

Centralized exchanges (Binance)

Decentralized exchanges (Uniswap/ Sushi/ Balancer)

Synthetic assets (Synthetix/ Mirror)

Derivatives (Barnbridge/ Nexus/ Vesper)

IDO

In this phase, Bumper will launch its long-awaited IDO on December 7, 2021 on the decentralized exchanges SushiSwap and Uniswap. The enlistment phase on the KuCoin Exchange is also expected (according to Gareth Ward).

Protocol Goes Live

The protocol is expected to be live by the end of 2021, with the launch of the crypto asset protection system for users fully operational.

For this phase, the team expects the roadmap for the expanded asset protection whitelist to include: Major large-cap ERC-20 assets rBTC/wBTC bCOIN, e.g. (bTSLA/ bAPPLE/ bGOOG) Expanded stablecoin compatibility (BUSD/ USDT/ DAI)

As well as Interchain interoperability with BSC, ETH L2, etc.

Currently fnding a tool to protect yourself from the volatility of the cryptocurrency market beyond a stop-loss is difcult. Bumper Finance tries to fll this void for crypto lovers, who do not want to miss out to upside by losing positions when the market recovers, even to higher levels of pre-crash prices.

The protocol allows investors to establish a “foor” price where they can exchange their assets for a stablecoin whenever they want, in order to minimize losses in bear markets, but with the possibility of recovering their investments in these assets if conditions are favorable.

With this revolutionary concept, the size of the Bumper Finance market is enormous: from retail investors to institutional investors who have crypto assets on their balance sheets and want to protect themselves from the risk of volatility.

For this reason, and given its foundations with a solid roadmap combined with an experienced team within the investment sector, the path that Bumper has to travel seems to be mined with successes and a good omen within the crypto ecosystem, especially in the DeFi sector.

Its interface is easy to use, so any investor, regardless of their knowledge or size, can make use of its protocol; another point in its favor compared to other DeFi protocols. Judging by their metrics achieved in the frst two phases of $BUMP token sales, investor interest is creating a growth story in a popular new DeFi protocol.

MekaVerse mk. 2

written by Rhys

The NFT space is an exciting – but sometimes overwhelming – space to navigate. Projects pop up left, right and centre, with some going on to make huge sums of money, seemingly overnight, while others struggle to sell out their initial mints. Artists continue to improve their oferings both in the artistic/graphical sense, and in pushing the boundaries of what NFTs can do, as covered with Murat Pak last issue. More and more eyes are drawn to bigger and bigger projects, creating new audiences and markets every week. Add into the mix new blockchains creating their own NFT standards and marketplaces like we’ve seen on Solana in the last few weeks (with Aurory, Degenerate Ape Academy and SolPunks amongst others), it’s an area of investment that’s getting bigger and bigger all the time.

As the market evolves, it gets harder and harder to stand out as the standards increase week on week. But one project that has really stood out in recently is Mekaverse.

A new NFT ofering that produced beautifully rendered 3D mecha avatars for purchase, with a road map that stands out not just for being full to the brim with ideas, but also ofering some ideas that I hadn’t seen before – something that’s hard to manage in an increasingly saturated market. It has everything that I’d look for in an NFT project, particularly as an early adopter. They’ve got a huge audience (220.5k followers on Twitter, nearly 250k users in their Discord – compared to say Bored Ape Yacht Club with 190.3k followers on Twitter). We’ve had a successful initial drop with no gas war. We’ve got an art style that stands out from other projects. And we’ve already got some idea of what’s coming next for Meka holders. Let’s dive in!

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

What is Mekaverse?

Wait… What is Mecha?

Mekaverse takes signifcant inspiration from Japanese Mecha universes. For those that don’t know Mecha, this covers popular media such as Mobile Suit Gundam, Neon Genesis Evanglion, Armored Core, Xenogears and many, many others.

Mecha is so popular, in fact, that there is a lifesized Gundam in Tokyo! It’s a genre of it’s own that has a dedicated and passionate community around it, and one that artists can rif on in many, many creative ways while still creating work that is recognisably mecha. This is where Mekaverse takes design cues from and it’s a canny move. It’s an NFT project that looks to capitalise on an existing fanbase, without directly aping the existing works, and leaving room for their own inspired-by fanart down the line too.

The art style of Mekaverse sets it apart but it’s not just the inspiration from mecha that sets it apart. It’s also the full 3D rendering that elevates it when compared to other NFT projects.

Now, Mekaverse is not the frst project to produce 3D-rendered images – far from it. But it is one of the frst to do so with such intricate models. This, in theory, will take a bit longer to copy-cat, allowing Mekaverse to retain some frst-mover advantage for just that little bit longer than other generative NFT projects that are drawn, or more basic in presentation.

For early holders, that’s great because if you’re looking to fip your NFT quickly, the value should hold up a little longer than usual and possibly even get a little higher as nothing quite like it exists in the space.

The journey onwards

The short-term prospects for Mekaverse look good. The foor price spiked prereveal up to 40x the initial sale price, which shows that there are interested buyers with decent amounts of ETH circling around the project.

With the foor price settling down a little now around the 2 ETH mark (10x from the initial sales), you can watch Mekas being picked up on Opensea under 2 ETH and being fipped for 2.5-3 ETH in minutes on the Mekaverse Discord server, which shows there are still buyers looking to pick up NFTs, and there are opportunities to make a little proft very quickly if you have the time and patience (and pick lowgas periods). Eventually, this distribution phase will start cooling down and the foor will have to rise as those looking to get in low realise the price isn’t coming down further.

So, opportunities for both quick fips and potentially holding for a few weeks and getting a bit more value out of doing so.

But if you’re reading the Moon Mag, you might not be here for a quick fip of an NFT. You’re looking for the long-term value proposition of a project like this, right? Well, the long-term prospects for Mekaverse are also bullish.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

That should drive prices higher and with the market already showing that there are buyers out there at 8 ETH and beyond, there’s plenty of headroom for the value of your NFT to grow and possibly exceed that over time.

If you were buying now, it’s also not just about the price you might get in the future. As with most NFT projects, it’s also about the journey you’ll go on as a community member – or “Meka Driver” as they’re termed in the Mekaverse. And this is where it starts to get really interesting. Regulars to NFT communities might not be surprised by some of the stuf in the Mekaverse roadmap –possible gamifcation, drops for holders, merchandising. But there are some unique elements in there too – in particular, 3D printing, arts toys and exploring the possibility of collaborations with famous mecha licenses for future releases. Gundam NFTs? Yes please!

As described above, they already have a uniquely large audience considering their “launch” as a project was in August, and that initial drop came in October. Also returning to the comparison above, BAYC’s launch was in April. Mekaverse has made huge ( mecha-sized?) strides in a very short time. And that audience is sticking around so far – waiting to buy Mekas on the secondary market/Opensea – hoping for the foor price to drop and drop and drop…

But much like in trading, eventually those early buyers looking to cash out their profts will be gone and then the only way to get a Meka is to buy higher. Realistically, there are still thousands of interested people who have not got a Meka yet and this makes the current foor price an interesting prospect – it’s closer to the issue price than the all-time high now, and the ratio of potential buyers to available Mekas is going to get better and better in the coming weeks.

Now whether these things come of is a diferent matter clearly and it’s always sensible to be sceptical with any investment making big promises! However, the NFT industry as a whole is getting more and more recognised for the value it creates. I keep bringing BAYC up as a comparison point but for a good reason. Just this week, BAYC’s creators signed a deal with the management company of U2 and Madonna to explore additional creative outlets for their projects – flm, TV, that sort of thing. So, when a project which hasn’t had many pre-existing links to traditional media can make that sort of an impact, it doesn’t seem like so much of a stretch that Mekaverse could tie back into the world that inspired it.

The here and now

What can you expect from holding a Meka while you wait for the possibility of huge partnerships in the future? Other projects have metaverses, token oferings, drops… What do you get as a Meka Driver? The frst drops for Meka holders have just been shared with the community giving you an insight into where the project may be going in the mid-term. The frst – “Meka-Sword” –is the frst step into a fghting system where you can battle other Mekas. Gamifcation is relatively common in NFTs, but it does provide some incentive to keep hold of your NFT and give it some utility while holding. Given the inspiration here, it would have seemed strange to not have a way to battle Mekas against each other!

The second drop – “Meka-Bots” – is a bit more abstract, purely building into the lore of the Mekaverse (as far as has been described so far). While this is something a little less tangible, getting extra NFTs purely for holding an NFT is no bad thing. For those who’ve not been able to get a full Meka, it might present an opportunity for them to get into the Mekaverse world/community at a lower price, buying the “spares’’ from holders. It also gives holders an opportunity to make some small change for practically nothing. While it remains to be seen what the Bots will look like, and what price they will go for, if they’re of similar quality, or provide some link to the original Meka through colouring or style, then I think these could be a great additional beneft to Meka Drivers. A great sign of things to come.

And that’s not all! There’s the prospect of other future drops of Meka NFTs with collaborations between artists, or exploring other characteristics and groups of mecha. There is an argument that further drops can dilute the interest in the initial ofering. But equally, a well-planned, wellexecuted, diferentiated drop could drive interest in Mekas back up and actually enhance the value of the OG Mekas.

Just like how there are many rifs on CryptoPunks now but the originals hold their value, even additional Meka drops won’t be those initial ones that will get rarer in terms of sale over time, as people leave crypto or get locked out of wallets etc – these OG Mekas should continue to increase in price over time.

Meka opportunities

Mekaverse is an ambitious project with grand ideas which just a few weeks ago I thought to be a decent NFT collection, but likely to be nothing more. But in those few weeks, the Mekaverse team has already been actively pushing the next stage of the project all the time, engaging with the community, and driving to make this better and better. The additional context of the NFT market itself becoming more interesting to those outside the crypto space suddenly gives Mekaverse huge room to grow as a project and huge prospects for early Meka Drivers.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

OP INION

Smart Investors Protect Themselves From Market Volatility with Staking

written by Daniel

written by Daniel

The cryptocurrency market is an exciting world where volatility is present in all the assets that comprise it. From the price of Bitcoin (BTC) to the price of less popular tokens, swings between all-time highs and strong sustained losses are the order of the day.

While volatile markets can be thrilling to watch, when it comes to managing investment portfolios, these types of swings can discourage some investors from investing in the crypto ecosystem, due to the high risk involved in keeping an asset with high volatility in their wallet.

However, savvy investors and those who are willing to explore the opportunities ofered by the crypto ecosystem are aware that holding cannot be so bad after all, if it is combined with ecosystem practices and some fnancial services that are emerging in the Web 3 space3.

We refer this time to staking, a fnancial term quite exclusive to the cryptocurrency markets; whereby the investor gets rewards, usually in the form of tokens, for helping a specifc network validate transactions; without having to part with the assets.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Source: INSIDER

Source: INSIDER

In this way, any investor with a well-diversifed portfolio can protect themselves from market volatility by “delegating” or “staking” their available assets in their personal wallet, increasing the size of their portfolio due to the rewards obtained as they maintain the integrity of their assets at stake.

The result is simple: in the face of a market recovery, investors end up with more coins in their wallet and, ultimately, an increase in the size of their portfolio.

Thus, intelligent investors who do not want to part with their assets in unfavorable conditions obtain a proft after a certain time, when the market conditions become suitable to execute other trading strategies that allow them to obtain a greater proft.

Understanding the Technology: Evolving from “Proof of Work (PoW)” to “Proof of Stake (PoS)”

The key to any investment is to understand how the feld in which an investor wishes to place their “golden eggs” works. For this reason, educating yourself is essential before investing in any fnancial product, and crypto is no exception. So we must frst understand how staking works before entering this fascinating world of decentralized fnance.

That said, we must add that there are many cryptocurrencies which ofer the potential to proft simply by holding them, in exchange for using them without any efort to contribute to the operation of respective the network.

As a result of the problem of energy expenditure when mining cryptocurrency in the midst of the rhetoric on climate change, blockchain networks such as Bitcoin and Ethereum based on Proof-of-Work to guarantee the operation of their networks have become an inspirational model for the emergence of more ecological alternatives that guarantee as much as possible the blockchain trilemma: decentralization, security and scalability.

That is why the Proof-of-Stake model was born as a sustainable and efcient model in energy terms, which is technologically based on the fact that each node which wants to mine has to provide as a guarantee an amount of the cryptocurrency in the network in which it is operating.

Source: GhostThis guarantee in the form of cryptocurrencies insures money that the miner risks losing if his transaction is fraudulent and is not fnally accepted by the network, due to the

non-concordance with the information residing in an indelible way in the rest of the nodes of his network of distributed accounting.

This is how staking was born, a diferent practice from the mining process carried out in Proof-ofwork networks. Instead of machines competing to solve a puzzle, the network assigns to a miner (node)the right to perform the validation work depending on the amount or share of tokens that node currently has.

Generally speaking, the investor uses their existing coins or tokens to make them available and contribute to the operation of a Blockchain network.

Staking from the investor’s point of view

In this investment modality, cryptocurrency holders use their digital currencies to update the blockchain; and in return, they receive a reward.

This also increases the democracy of the network: any investor of a cryptocurrency that works with Proof of Stake can delegate their cryptocurrency to a validator (not lend or deliver, but delegate), so that the validator counts it among their contributions to the participation of the system (similar to a “vote” for a particular validator).

When the validator registers a block in a PoS system, it distributes the rewards among the investors who delegated their crypto to the staking pool. Thus, the profts generated by staking basically correspond to a distribution of dividends in public limited companies.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Source: StakingTeam

Source: StakingTeam

Investors see in Staking the possibility of using their cryptocurrencies to generate additional income, an attractive proposal, which allows them to generate extraordinary income while maintaining the ownership of their crypto assets. In addition, staking rewards remain independent of a possible increase or in the price of the coin or token.

Participate in Staking: Pools

The nodes earn money by mining in a cryptocurrency network, and through Staking you can participate in that proftability.

In a similar way to miners in a Bitcoin network based on the Proof-of-Work consensus mechanism who join in a pool to increase their joint mining power on the network and thus the chances of success translating into higher rewards; in the Proof-of-Stake system, participants come together in pools to increase the chances of being selected and earn more consistent rewards.

In this way, the average investor who does not have enough coins to be a validator within a PoS system can “delegate” the amount they want based on the size of their portfolio to a recognized validator within these pools, in order to to earn rewards while protecting themselves from market volatility without shedding any assets.

Staking rewards is a good technical indicator to observe when deciding which is the best pool to delegate coins, based on the type of coin owned and the expected returns. Today, these staking providers can range from exchanges to public limited companies.

It is worth mentioning that you can also delegate your coins directly to the blockchain platforms where a particular asset is deployed, based on the PoS consensus mechanism.

In most cases, it only requires downloading the native wallet of the blockchain platform and blocking the amount of coins that you want to delegate to a validator on the network.

Remember that staking is only a technological protocol, but it will not guarantee your profts in real terms automatically if the crypto projects that generate value in the industry have not been recognized. For this, the key is to know if the currency has a useful foundation behind it based on the blockchain network under which it is deployed. If the blockchain network is not useful, it has no value, then the chances of success will be low, if not zero.

Source: Staking Rewards

Source: Staking Rewards

Staking 2.0: The Evolution of Protecting Your Investments

One of the great disadvantages of staking is that the assets in play remain ‘locked’ and unusable for the time under which your coins are delegated to a validator, or as the case may be, for the time under which you are a validator node of a particular blockchain network.

This disadvantage is tied to the inherent defciencies of the ecosystem caused by the algorithms that are used to drive this economy of smart contracts.

Considering the foregoing, although it is a point in favor when the market is bearish, since it allows us to obtain passive income without losing the exposure of our assets in a very similar way to a fxed income bond; the truth is that this practice becomes counterproductive for the opposite case.

That is, in a bull market, you would be less likely to obtain passive income and able to further capitalize your assets in games

in the various DeFi protocols in the market, due to the impossibility of use during traditional staking.

This results in a loss of income for validators who are unable to invest their holdings in more proftable opportunities.

On the other hand, the need for a solution that not only protects users from any potential downside in the market, but also ensures that they retain the same incredible upside potential characteristics of cryptocurrencies, has allowed novel protocols such as Bumper to emerge, and Liquid Staking from platforms like Kira Network.

For many experts, these are the gateways to what could be known as staking 2.0.

In the case of Liquid Staking, the goal is to allow people to monetize their staked assets and generate the highest possible returns through any of the opportunities available in the ecosystem.

Source: Kira Network

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

With this proposal it is possible for investors to integrate their tokenized staking allocations into other protocols such as Cosmos, Polkadot or BSC (in the case of Kira Network), allowing stakers to manage their risk exposure and obtain additional returns on their staked assets. at the same time that they obtain passive income on their original asset.

For its part, Bumper is an application that combines the best of staking with an asset policy to protect investments from market volatilities. In this case, investors encounter crypto price risk when the prices of the assets at stake plummet; but if the market recovers, the asset also increases.

With the Bumper platform, investors get the best of both worlds. Not only can you guarantee the price of your assets, but you can also beneft from any price improvement that occurs during your policy period, by locking your assets and activating BUMP token staking (the platform’s native token).

In this case, the BUMP tokens can be sold, exchanged or used within the broader DeFi panorama, similar to Liquid Staking, but with the particularity that your locked assets are protected with a policy that protects 100% of your holdings to up to 90% of its value in USD.

Source: Bumper

Source: Bumper

Final thoughts

Staking has succeeded in the democratization of part of the more traditional banking business, by popularizing and distributing among retailers the revenues from what until now were exclusively banking commissions and margins. Those user benefts are really the ultimate implications that underlie the essence of what “Staking” is.

This practice has become very popular today among investors of all sizes, thus the market continues to increase sharply, with a shared size between all protocols of 7.47% of the total capitalization of the cryptocurrency market.

Although like other fnancial protocols in the crypto market, staking continues to evolve along with the development of Blockchain technology, nowadays investors have diferent options to protect themselves from extreme market volatility, depending on the level of risk management they wish to assume with their portfolio.

Studying in depth the operation and risks inherent in each blockchain protocol ofered by these options is the key to a l investment while protecting your investments without parting with your assets.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Tryhards andTRYToken writtenbyShaun

Tryhards

Tryhards presents a very compelling opportunity for those of us who love crypto, gaming and play to earn mechanics.

Tryhards is a shooter game that incorporates NFTs that players own and use for battling in game, what makes it stand out other than the compelling story is the addition of layered NFTs that allow for players to own various types to augment their play style. The players initially mint a Faction character and a weapon to begin playing, along the way they will level up their NFT’s with crystals and skillsets to improve their gameplay. All of these eforts in game bring value to the NFT they hold as it will accumulate levels more so than a newly minted character. Should the player ever wish to take a break, they would be able to recapture their time by selling what they have utilized in game on the open market.

There are various levels, rarity and abilities that make each NFT unique and valuable. What’s even more exciting is the aspect of being able to battle against other players for in game currency that can be resold on the open market.

With a DAO in place for managing TRY token, staking and yield farming, not only does the game provide an interactive experience for those looking to battle, but also many ways for players to earn income for playing.

So what does having NFTs in gaming mean?

NFTs in gaming mean items, land, economies, can thrive and be worth something. As I mentioned before, if you are a gamer, how many times have you had to put down a game you spent tons of time in only to have everything you built go to waste? NFTs bring scarcity and ownership to the industry, they bring the ability to have in-game economics merged with real world monetary value, either through crypto or fat. It means being able to sell items, or accounts, or land in game on an open market

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Glossary

Non-Fungible Token (NFT)

Non-fungible tokens (NFTs) are provably scarce / unique, digital items with blockchain-managed ownership. Someexamples include collectibles (e.g. CryptoKitties), game items, digital art, event tickets, domain names, virtual realestate (e.g. Decentraland) and even ownership records for physical assets.

Metaverse

The collective term for all the elements that make up virtual worlds, including the ecosystem of people and objectsthat form economies within those worlds.

Play-to-earn

A term to describe games in which the players are able to generate real-world rewards for their in-game activities.These games are typically limited to NFT-based blockchain games as they rely on the rewards being transferable onan open market.

Treasury

Holds all funds earned by the guild that the project has earned through its direct operations.

Top Down Shooter

Applies to shooter games that are 3D in nature from a vantage point of fghting in game from a top view of allplayers.

DAO

Decentralized Autonomous Organization means that the community and investors in the project are the ones thatsteer the protocols and development initiatives in the game. Those who own the native DAO currency have a votingright that is proportionate to that of the tokens they hold.

Tryhards Team

Thriving for innovation let Mia resign from the traditional markets with an excellent experience in the corporate world. With her creative and performance-driven mindset she entered the blockchain space 5 years ago, performing all marketing activities. Excels at developing new digital promotional campaigns and coordinating creative teams.

With a passion for gaming, Thomas has worked for several years in the web and game development industries. It is now time for the next step. The idea for Tryhards was born in 2020, when he saw the immense potential of NFT’s.

Francis CTO

After many years working in a wide range of disruptive sectors, Francis recognized the potential of blockchain technology in 2013. Since then, he has been building smart contracts and leading teams. With a passion for NFT’s and his knowledge on the blockchain he will bring Tryhards to the next level.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Thomas CEO

Mia CMO

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Thomas CEO

Mia CMO

Fanatics

Currently TRY operates within 3 distinct markets that happen to all involve very high performing revenue on an annual scale.

•

DeFi Tokens NFT Markets•

•

The Gaming Industry

The NFT market has recently picked up a lot of steam. I have mentioned this before in other articles that NFTs are here to stay and will be the virtual standard for private ownership, any project being stood up with NFTs built into the foundation will have immense value over time. DeFi currently has over 70 million wallets hitting a total of $50B in funds that are in those wallets.

What Does TRY Do For Investors?

TRY token is an ERC-20 Matic token and is the native currency in game that players and investors will need to interact with the metaverse. The currency allows for the opening of loot boxes which generally holding crystals or other unique items in the game. TRY is also used for yield farming and staking, and voting on the DAO.

The Story

This shooter game actually has a very compelling story plot to the universe, unlike most other NFT games there is rarely an in depth game to draw you in to caring about the environment, or supporting a particular faction over another.

In this Story, the game starts out describing the Genesis Block and an event called the Satoshi Massacre. Beginning when Satoshi Nakamoto minted the genesis block a cataclysm of chaos was unleashed upon Earth that lead to an age of war. Factions broke out across the planet that would beget the massacre to drive humanity from Earth into the stars. As they spent centuries away from Old Earth, the Factions mutated and their bodies changed.

After 1337 years the Fanatics would learn the Old Earth, now called Planet X where the fght begins, has recovered after humanity left its surface. The fght begins with all the Factions looking to head to Planet X to reshape the planet in their image and to harness the crypto resources that it provides to power their abilities.

Currently, the game hosts four types of Fanatics with plans to include more down the line as the game evolves. Players have the option to pick which faction they would like to play as, each one having their own unique story that will likely come into play later with in-game events.

Apes:

Apes come from a jungle planet called Simios, having a troublesome history of being experimented on and forced subjugation. They eventually overthrew their captors and claimed freedom and their planet back where they have thrived since.

Robots:

Robots are the result of the Singularity bringing forth AI into the world. Satoshi Corp created the frst robot in 2011, but soon after it gained sentience and decided to leave to an uninhabited world now named Talosium, where it founded a society of equals reproduced by its own code.

Survivors:

Survivors are the descendants of humans who survived the Technological Revolutions created by Satoshi. The Satoshi Massacre led them to leaving Planet X to the planet Esperanza with hopes to rebuild society as they knew it. They now hope to reclaim Planet X for their ancestors’ dreams to be realized.

Undeads:

Undeads come from the planet Magmar, a toxic volcanic landscape that is completely uninhabitable until one day a mysterious event reanimated a lost society. Immune to pain, they now seek to spread their wrath upon other planets.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Weapons

The weapons in game start out with 3 variations to be used with more to be added on at later times. They will be NFT’s that can be upgraded and used throughout the game, or sold on the marketplace. Weapons can be upgraded in the refnery.

The three variations will be

• Electric Swift

• Rapid Blaster

• Skull Crusher

Crystals

Crystals are used as the in-game way to level up your NFT’s Fanatics and Weapons. Crystals come in diferent varieties with drop rates similar to the other NFT’s in the game like Fanatics and Weapons. They can be obtained by purchasing loot boxes, providing liquidity or buying them in the marketplace. By providing liquidity early enough in the game, market makers have a higher drop rate for crystals, as the drop rate decreases as more and more people add to the pools.

Yield Farming

Tryhard players can supply stable coins like USDC or USDT to farm crystals in game that can either be sold in the marketplace or used in game to increase the power level of their NFT’s.

Staking

Your total power is derived from how powerful your Fanatics and Weapons are in the game, which equals your universe power. You will receive rewards from the staking pool for every 100 Power Points your Universe has. This means you routinely get paid to play the game based on the rarity and expertise of the NFT’s you have in play.

The NFT’s allow users to earn TRY tokens that are mined through Proofof-Stake (POS). Players who can collect a complete set of fanatics in a faction will receive a surplus of universe power to go towards their earnings from the pool.

Guardians of the Armory (DAO)

TryHards will have a DAO in place like most projects out there that intend to give power to the community. Users who stake their TRY token will have the ability to vote on proposals to be integrated onto the platform. Only votes from staked TRY will be counted, this means you need to have your tokens actively working to help build the platform with the rest of the community to have your voice heard.

Refnery

The refnery is used to upgrade your NFT’s levels which gain more staking power. Crystals are rare minerals from Planet X that are processed in the refnery to give you the boost you need to excel in the fght for Planet X. The qualities follow the same format as the other NFT’s in terms of rarity. Crystals can either be crafted or decomposed to create more powerful ones or lesser tiered crystals.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Tryhards has been hard at work this year, they spent the initial frst 3 quarters launching the project, to include concept designs and gaming architecture that the NFT’s will connect to. This is a very tedious process because the NFT’s are 2D and have to be converted to 3D in game to represent the characters they are supposed to.

Tryhards spent a lot of time in Q3 showing the concept through fundraisers, attracting advisors to their mission and generating lore for all of the characters that represent the Fanatics. They created the smart contract that the NFT’s will run on and established many partnerships that you have seen above.

Q4 is where we currently are and is arguably in my opinion going to be the biggest one for them yet. Tryhards will be kicking of their TRY token and IDO, launching Fanatics, Weapons, and Crystal NFT Drops to the community. They will be launching the marketplace and integrating Web3 wallets to the game. Lastly, staking will go live, players will be able to get their passive income early in anticipation for Q1 of next year which is where the game begins.

Q1 of 2022 is when the Alpha begins for the game, this is basically the frst launch of the game to early players to test out. This is when game developers interact heavily with the community to fx bugs or implement needed features that were overlooked in development. Being early in this phase will give you the ability to make an impression in the game. Skills will be implemented as well as governance through TRY tokens to be able to vote on measures to direct the game.

Q2 is when the PVE battles go live to earn crystals in the game. PVE means Player Versus Environment and is usually more story-centric in most games. PVP will be launched as well and this is Player Versus Player, gamers fght on Planet X for in game rewards. There will also be land sales introducing monsters.

The RoadMapRoad Map

Conclusion

Tryhards is going to be a fantastic project that will incorporate ownership into gaming. I have always been a fan of these types of projects because there are so many ways to bring value into the hands of gamers that capture value for time, that is the beauty of Play-To-Earn.

While the game is currently not out yet, and we are waiting for the initial IDO of the TRY token and NFT’s given we are still early in Q4, I anticipate there to be quite a lot of interest in this project. What I hope to see happen eventually is potential tournaments that will draw interest to the project from external sources.

Given that the project is less than a year old and we understand the mission prior to their being live NFT’s to play with in game, there is signifcant opportunity to buy these NFT’s at foor pricing before the game goes live.

Tryhards has amazing lore and character creation, a plan to expand on those aspects even further, and ways for players to start earning passively before the game is live.

Gaming is an industry worth hundreds-of-billions of dollars. Crypto is now a multi-trillion-dollar industry.

The combination of the two of these two markets – at the cutting edge of technological advancement, of new experiences and wealth seems to make total sense. Even a small slice of either of these markets is now worth a huge amount, with more money pouring into both every day, particularly during the pandemic where people turned to gaming and crypto in droves.

Play-to-earn has taken of, with games like Axie Infnity now worth several billion dollars in market cap alone with a relatively limited gaming experience, and has inspired rifs on it’s formula across other blockchains and artistic styles. Axie, in a way, has proven that games can couple with crypto to tremendous efect, with early investors into their tokens, NFTs and systems richly rewarded. But the question many ask, particularly avid gamers, is when will we get experiences that match up to the games of today?

Enter Star Atlas. Star Atlas is aiming to be not just another play-to-earn game, where the ability to earn crypto and the price of tokens come frst, with the gameplay second. It aims to be a fullyfedged, AAA gaming experience that just so happens to have a blockchain market economy backing it. Being built in Unreal Engine 5 (the newest game engine being used for the latest generation of consoles and PC games), Star Atlas isn’t seeing itself as a competitor to blockchain games like Axie Infnity or My Neighbour Alice – it sees itself as competing at the sharp end of one of the most involved game genres of all – space exploration sims.

To understand a bit about why Star Atlas could be so special, let’s take a dive into space exploration games – and how Star Atlas is iterating of some time-proven concepts.

Star Man

Space exploration games are a relatively niche genre within sci-f gaming, but one that attracts hugely dedicated and passionate communities.

Thousands of players log in every day to games like EVE: Online, No Man’s Sky, Star Citizen and others, to launch amongst the stars and explore new worlds, discover new creatures, mine resources to sell on the market, dogfght in their ships, trade mapping data, buy property, play politics…

One of the things that usually stands out with space exploration games is that there are invariably multiple ways to play – and usually no wrong way to make your way. There’s no endgame everyone needs to get to except your own targets.

If you want to set up a mining corporation with your own droids or employees in-game, in some games that’s possible. If you just want to jump from system to system, mapping out the universe and selling that mapping data later, totally fne. Space pirate?

Sure, you can do that too! In some titles, you can even buy your own space stations and earn money from trade, tax, storing ships and other things. Star Atlas has in their road map that you will be able to engage in all these ways of playing – amongst other things. They really are trying to compete at the highest level.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

In these other games, everyone has their own way to play and enjoy the game and make their own mark on the universe – particularly in online titles with real-player marketplaces. If you were a miner, you might sell your resources to other players who want to build new ships to explore further or get an edge in space combat. If you’re an explorer, other players might buy mapping data so they can see which stars they’d be able to refuel from on a long journey.

And as a fghter, you could just be contributing the cash to keep the others working, selling your spoils from your latest victory to buy resources from the others in the economy.

Most games have some variation on these overarching roles – creating a supply-and-demand economy that keeps ticking along, something that Star Atlas recognises and is building into their economic models.

What only a few of these games also have is a way of linking in-game currency to dollar value –usually through an “exchange rate” of an item you can purchase for fat currency that then also has an in-game currency value, too. Probably the most notable example of this is EVE: Online –where you can use in-game money to pay for your subscription, giving in-game money a cash value (and therefore any other items in the game) – even if it’s against the rules to actually sell things in-game for real money. This is how EVE: Online hits headlines when massive battles take place. Despite not having that direct way of taking money out of a game, people spend hours carrying out their “job” in these universes… and the lack of real money trading keeps their economies relatively small (EVE’s is estimated around $55m).

So when Star Atlas is ofering players a way of converting that hard-earned in-game money into actual fat – via their two cryptocurrencies – then it’s well worth sitting up and taking notice.

The Star Atlas Economy

The Star Atlas whitepapers (available through the left-hand menu - yes, there are two of them!) are some of the most detailed I’ve seen in crypto. The standard whitepaper is 42 pages long on its own, but then a separate, economy-only whitepaper takes players and investors through the proposed Star Atlas economy - which is arguably more important to assess the value of these assets early on. Also weighing in at 38 pages, it’s a dense read – but the basics of the economy revolve around NFTs and the two cryptocurrencies ATLAS and POLIS.

ATLAS is the in-game currency that would seem familiar to any space sim player. ATLAS will be used to buy and sell resources, ships and other elements of the economy – it will be used to upgrade your ships, pay for fuel, and will also be the currency you’re likely to earn as you work your way through the universe. In crypto terms, this isn’t dissimilar to Smooth Love Potions from Axie Infnity – in that they are generated in and by playing the game, and you can sell the excess if you don’t need it immediately.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

As an infationary asset, it’s perhaps less appealing as a long-term hold but when the game launches, it could be in high demand as prospective players look to get an early foothold in the universe.

POLIS on the other hand is the Star Atlas governance token, with in-game and real-world applications. Holding POLIS allows you to vote on future Star Atlas development (after an initial centralised process while the games’ initial development takes place) such as infation rates, asset release schedules, ATLAS treasury reinvestment and game direction. In this way, POLIS represents a vote in the direction of the game and an incentive for those wanting to play (or hodl) long-term, through the Star Atlas DAO.

Additionally, POLIS will give you in-game infuence too. Holders of POLIS will be able to control some activities that can occur under their oversight, impose taxes, create laws, etcetera. While it’s not a unilateral power – you can’t impose dictatorial rule over swathes of space – POLIS holders combining with others to enact proftable changes to the in-game meta is something that already happens in games like EVE: Online, although through diferent mechanisms. While there are a couple of mechanisms that allow you to buy and earn POLIS through the game too, the token is fxed-rate, and as such, those organisations looking to wield more infuence will come looking for more POLIS on secondary markets - creating opportunity for you as an investor to capitalise, even if you’re not interested in playing the game itself.

Finally, NFTs represent “galactic assets” for players and can be traded in-game and on decentralised marketplaces based on the Solana blockchain. By connecting game assets to NFTs, Star Atlas cleverly creates a marketplace for investors who are not players, as well as protecting token price somewhat – if your only mechanism of selling an NFT was to convert to a token and then sell that of, you’d see the value of something like ATLAS reducing much more quickly through higher sell pressure. By enabling an NFT marketplace where you could exchange directly into other tokens – such as USDC – there is a mechanism to make the play-to-earn for players smoother, while also creating value in jobs that players are carrying out. If you’re a ship builder, it might be cheap enough to buy resources in-game, build a ship and sell it proftably on the secondary market, while other players without those skills will be able to buy from you to cut out some of the grind or to avoid having to carry out work they don’t enjoy.