Bought To You By themoonmag.com

Welcome to March. As of the release of this issue, there are approximately 37 days until halving, and this is where the market gets interesting, not that a New All-Time High is not something to cheer about. Today, 6th March, as I write this, Bitcoin touched this region with a strong rejection, liquidating 1 Billion Dollars in over-leveraged or margined positions from the exchange books.

https://www.nicehash.com/countdown/btchalving-2024-05-10-12-00

And I completely understand why traders (mostly new to the market) do this. Leverage and margin trading offer tantalising prospects for larger gains. Yet, these tools come with significant risks, mainly driven by greed. I often talk about knowing the risks from my Trader’s Perspective. As leverage and margin trading surge in popularity, it’s crucial to consider the dangers of excessive greed and how education is key to growth in the crypto market as a whole.

These trading methods allow investors to control larger positions with minimal upfront capital. However, the allure of greed can lead to reckless behaviour, jeopardising overall financial stability and erasing initial capital.

Greed manifests in various forms:

• Overleveraging: Borrowing beyond means amplifies both gains and losses, risking financial ruin.

• Short-Term Thinking: Greed prioritises immediate gains over long-term sustainability, disregarding risk management.

• Ignoring Warning Signs: Traders blinded by greed overlook market fundamentals and risks.

• Chasing Highs: Relentless pursuit of higher returns exposes traders to speculative assets and pump-and-dump schemes.

As my kids used to say when they were teenagers - check yourself before you reck yourself!

At TheMoonMag.com, we advocate for long-term stability in the crypto market and that means increased education and knowing what you are investing in. And with that being said, jump into $OMEGA $ONDO Layer 1s while learning how to research crypto, build a trading plan and so much more!

Happy Reading and welcome to the very beginning of the 4th Halving, bull market cycle.

Lisa

Lisa

Lisa…

A note from

Editorial

An exciting month for the crypto market as Bitcoin surges towards its all-time high. As the ringleader of the crypto world, this has created momentum for the rest of the market, and we are seeing both old and new projects burst into life.

New narratives are also taking hold in 2024. In this issue, we look at various updates, upgrades and features across the Ethereum and Solana networks and comprehensively compare some of the biggest Layer 1 coins in circulation right now. It’s vital for projects to keep building, especially as retail comes into the market.

We also have a couple of gems, $ONDO and $OMEGA, that we believe have the potential to be huge if they play their cards right and capture the interest of keen investors and excited users. Will they entice you?

It’s all good and well projects making the right moves, but it’s as important that you make the right moves too. We discuss how to research crypto with a multipage article and you can also learn about to build a trading plan to suit you. Golden knowledge that you can put into action straight away.

Josh…

A note from

As the buzz continues and crypto becomes more and more popular, set yourself up to make the most of the industry and enjoy the journey it takes you on (preferably with a copy of the Moon Mag every month to guide you on your way!).

Enjoy issue 31!

16 This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. SUMMARY How To Properly Research Crypto 10 $OMEGA Network 32 TRADERS PERSPECTIVE Building A Trading Plan

All About Ethereum Dencun 96 Token Extensions On Solana Dissected 70 $ONDO 82 Layer 1’s: The Battle For Dominance 50

SPONSORS

We are incredibly grateful to the following sponsors for their support. We run a ‘Sponsor A Writer’ campaign where crypto projects take part in an altruistic act of sponsoring our talented writers. By doing so, they play a crucial role in keeping the crypto economy alive and thriving, not only for our readership, but for the writers who provide the awesome articles.

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

CONTRIBUTORS

Daniel

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

Chrom

Chrom here, your friendly blockchain wordsmith! I joined the crypto party in 2017, have worn many hats, and I consider myself Jack of all trades. Been working as a DAO contributor, start-up advisor & research leader. Armed with a knack for turning technical jargon into engaging content. I fuse quirkiness and professionalism to deliver informative, optimistic writing that resonates with readers.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Samantha

BUY Lisa N Edwards’ Best Selling NEW Book OUT NOW!

Building A Trading Plan

The Blueprint for Consistent Success in the Crypto Markets

written by Lisa N. Edwards

written by Lisa N. Edwards

TRADERS PERSPECTIVE

With the next Crypto Bullrun just around the corner, let’s take this moment to solidify our Trading plans to surf the waves successfully!

Success isn’t just about making profitable trades; it’s about consistency. While the allure of quick wins and overnight fortunes may tantalise many, experienced traders understand that sustainable success requires a well-thought-out strategy—a trading plan.

Understanding the Essence of a Trading Plan

A trading plan is the foundation of a trader’s journey, guiding every decision and action taken in the markets. It’s a comprehensive document that encapsulates a trader’s objectives, risk tolerance, methodologies, and rules for engagement. Just as a blueprint is indispensable in constructing a sturdy building, a trading plan provides structure and direction amidst the volatility and unpredictability of the cryptocurrency markets. You likely won’t find a more volatile market, and that’s why we love it!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Setting Clear Objectives and Goals

The first step in crafting a trading plan is defining clear and achievable objectives. Whether your goal is to generate a steady income stream, grow your investment portfolio, or simply hone your trading skills, it’s essential to outline your aspirations precisely. By setting specific, measurable, attainable, relevant, and time-bound (SMART) goals, traders can stay focused and motivated throughout their journey. In my book “Become a Millionaire in One Year!” I break down how to work with SMART GOALS.

Assessing Risk Tolerance

Understanding and managing risk is the most essential part of trading. Before venturing into the markets, traders must assess their risk tolerance—the amount of risk they are willing and able to take. This involves considering financial resources, psychological resilience, and time horizon. By aligning their trading strategies with their risk tolerance, traders can mitigate potential losses and preserve capital during turbulent market conditions.

Trading without a stop loss can take quite a lot of time to reach the entrylevel if the market declines rapidly.

Developing a Methodology

A trading plan should outline the methodologies and techniques that a trader will employ to identify opportunities and execute trades. This may include technical analysis, fundamental analysis, or a combination of both. Additionally, traders should define their entry and exit criteria, position sizing strategies, and risk management techniques. By establishing clear guidelines for trading decisions, traders can maintain discipline and avoid impulsive actions driven byemotions.

Implementing Risk Management Strategies

Effective risk management is the absolute foundation of successful trading. A trading plan should incorporate robust risk management strategies to protect capital and minimise losses. This may involve setting stop-loss orders. I prefer OCO - one cancels the other orders. I also ensure a diversified portfolio and adhere to predetermined risk-reward ratios.

Furthermore, traders should regularly monitor their risk exposure and adjust their positions to adapt to changing market conditions when the market is uncertain, reducing exposure and when more strength in a bullish market increases positions for greater profits.

Reviewing and Refining

A trading plan is not static; it’s a dynamic document that evolves with experience and market dynamics. Periodic review and refinement are essential to ensure its relevance and effectiveness. Traders should regularly assess their performance, analyse their trades, and identify areas for improvement. By learning from successes and failures, traders can refine their strategies and enhance their chances of long-term market success.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

First, Check out the GSIC START-UP KIT

Here’s a checklist of information you may add to your trading plan

• Financial Situation

• Risk Tolerance

• Trading Experience

• Trading Goals and Objectives - Short-term Goals / Long-term Goals

• Specific and Measurable Targets - Timeframe for Achieving Goals

• Daily Market Analysis

• Trading Style (e.g., Day Trading, Swing Trading)

• Preferred Timeframes for Analysis

• Trading Strategy: Entry Criteria / Exit Criteria / Position Sizing / Risk Management Rules / Trade Management Techniques

• Technical Analysis Tools (e.g., Moving Averages, Fibonacci Retracement)

• Trading Platforms / Exchanges

• Trading Journal

• Risk Mitigation Strategies

• Psychological Considerations - Emotional Control / Discipline and Patience / Mental Preparation for Trading

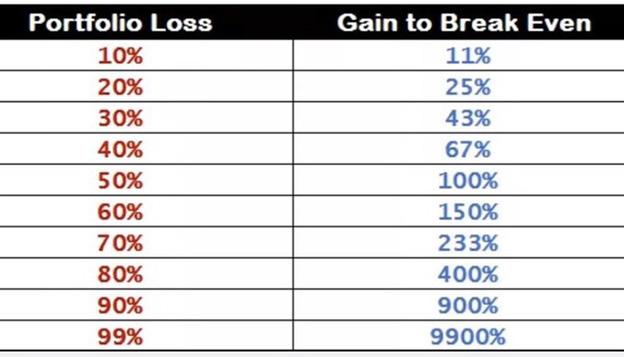

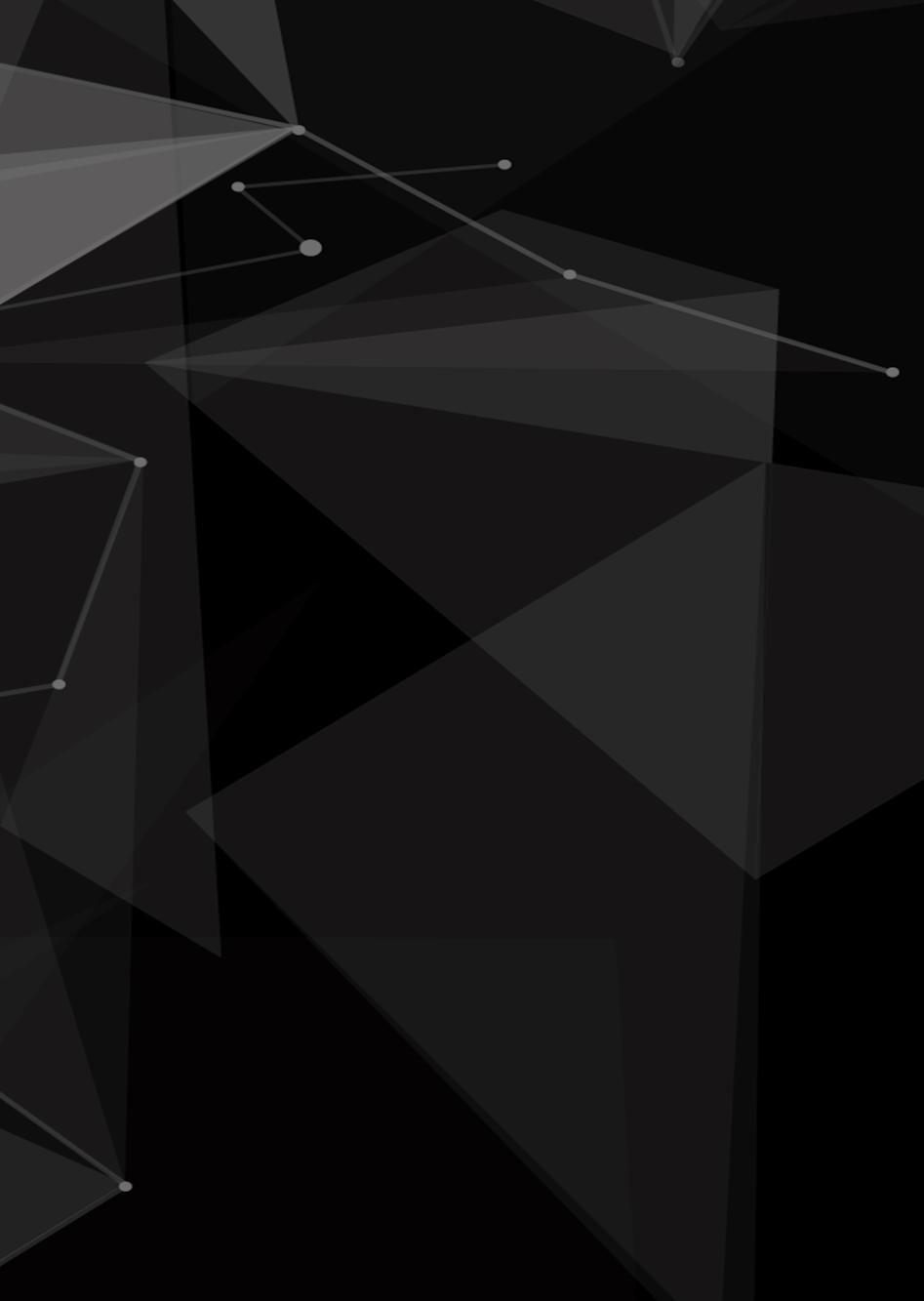

And if all else fails, keep this image by your side!

Surfing The Trading Waves

Building a trading plan is akin to learning to surf the actual waves— while the ocean of the financial markets (see what I did there) may be vast and unpredictable, mastering the fundamentals, adapting to changing conditions, and maintaining balance amidst the turbulence are all essential skills for riding the waves of success. Even when you wipe out while surfing, having a leg rope ensures you don’t lose your board; think of this as your stop loss.

Surfing the waves often demands patience, discipline, and adaptability. Just as experienced surfers navigate the ocean’s ebb and flow, traders can chart a course to success by meticulously crafting their trading plan. From setting clear objectives to implementing robust risk management strategies and continuously refining their approach, traders can create a blueprint for consistent market success.

While the journey may encounter its share of challenges and uncertainties, akin to the occasional encounter with a great white shark, traders who learn to ride the waves with the whales—seeking out volume and momentum— can find themselves propelled towards financial prosperity in trading.

A well-crafted trading plan serves as a reference, offering reassurance amidst the ever-changing waves of the crypto market.

Crypto Research: Your Path to Informed Decisions

Tools, strategies, and tips for uncovering the best strategies

written by Chris

The ‘’Research’’ Mindset

The crypto market is volatile, driven as much by technical patterns as by FOMO-fueled hype. While the potential for quick profits is real, a disciplined research mindset is important for long-term success. This involves understanding the motivations behind different investment strategies – whether it’s the rush of short-term trading or your belief in the potential of blockchain technology.

Rather than relying solely on sensational headlines or impulsive reactions, true crypto fluency involves examining the market conditions, historical trends, and the underlying fundamentals that drive a crypto’s price. So, instead of seeking overnight fortunes, the informed crypto investor adopts a long-term perspective. They recognise the analogy of individual actions and broader market dynamics, understanding that sustainable growth requires a combination of education, innovation, and responsible participation from everyone within the space.

��Key Takeaway :

Informed decision-making in crypto requires moving beyond emotional reactions and embracing a strategic mindset rooted in knowledge and critical analysis.

Where Hype Ends, Fundamentals Begin

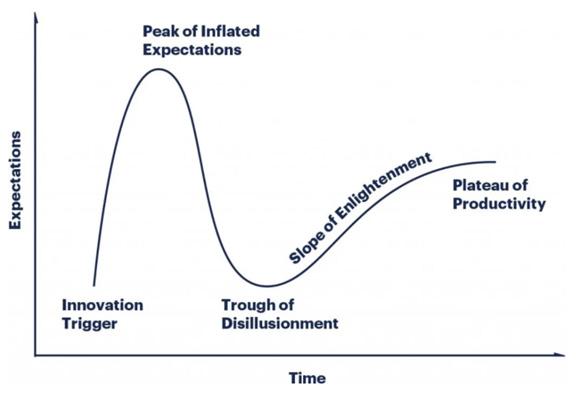

Cryptocurrencies follow a predictable cycle of hype, disillusionment, and eventual maturity. Early headlines scream about meteoric gains or catastrophic crashes. Scams, thefts and projects with empty promises further damage the industry’s reputation. It’s easy to dismiss blockchain as nothing more than buzzwords.

However, history shows this journey is typical for disruptive innovations. It’s a balancing act: on one side, hype fuels interest and investment. On the other, fundamentals determine long-term value and utility. As crypto matures, the focus naturally shifts away from sensationalism and towards the underlying technology, its potential applications, and real-world adoption.

This transition from hype to fundamentals is vital for discerning opportunities. Investors chasing unsustainable returns often lose sight of basic principles, becoming vulnerable as markets correct.

The savvy crypto investor, instead, looks for solid technological underpinnings, sustainable tokenomics, and projects solving real-world problems.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

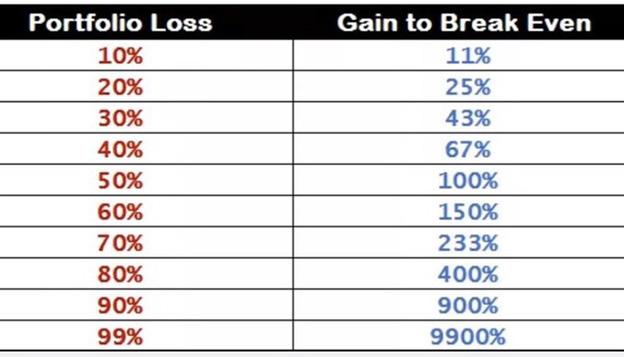

Here are the 5 descriptions of each stage of a hype cycle as outlined by Gartner:[i]

• Innovation Trigger: A breakthrough concept emerges, generating excitement and media attention. Early prototypes exist, but practical applications and long-term viability remain uncertain.

• Peak of Inflated Expectations: Initial success stories fuel unrealistic optimism, often overshadowing inevitable failures. Companies scramble to capitalise, some genuinely innovative, others opportunistic.

• Trough of Disillusionment: The hype fades as projects face challenges, limitations become apparent, and some ideas fail altogether. Investments dwindle unless those pushing the technology can adapt and demonstrate tangible value.

• Slope of Enlightenment: Practical use cases become more precise and refined. Improved iterations of the technology emerge, addressing the shortcomings of earlier attempts. Adoption grows, though cautiously, as benefits become undeniable.

• Plateau of Productivity: Widespread acceptance begins. Standards solidify, enabling comparison and evaluation of different solutions. The technology’s impact expands, proving its worth across various applications.

True potential lies beyond the headlines. A focus on fundamentals offers a more transparent lens for evaluating the long-term viability of crypto assets.

The Anatomy of Market Cycles

Bitcoin’s whitepaper by Satoshi Nakamoto in 2009 sparked a technological revolution, but its price action revealed a recurring pattern of hype, disillusionment, and eventual recovery. Understanding this cyclical nature of crypto markets is essential for navigating volatility and making informed decisions.

From Whitepaper - Wild Ride: Blockchain’s journey echoed typical hype cycles for emerging technologies. Early success fueled unrealistic expectations with the 2017 cryptocurrency mania, epitomised by Lamborghinis and overnight ‘’crypto millionaires.’’ The inevitable correction of 2018 brought widespread scepticism and plummeting prices, confirming blockchain’s place in the ‘’Trough of Disillusionment.’’

Ethereum: Fueling the ICO Boom (and Bust)

Ethereum’s emergence in 2014 became a catalyst for the crypto craze. The project introduced a new cryptocurrency and provided a revolutionary way to build and deploy decentralised applications. However, the advent of the ICO truly ignited the fires of speculation.

The ICO boom of 2014-2017 was a frenzy of project launches. Overnight, hundreds of startups and their tokens appeared, promising everything from revolutionising healthcare to...well, who knows with some of them! Billions poured into these projects, many of which had little to offer beyond a flashy website and lofty promises. The vast majority have since faded into obscurity or been exposed as outright scams.

Do you remember this guy?

Blockchain: From Hype to Hope

As the hype peaked, blockchain was hailed as the miraculous solution to every problem imaginable. Businesses scrambled to incorporate the term, with even the likes of Long Island Iced Tea Corp. seeing a stock surge by 289% simply by changing their name to include the word ‘’blockchain.’’

While the bubble eventually burst, some legitimate use cases for blockchain began to take shape. Established finance, insurance, and healthcare companies and more cautiously explored the technology, forming research consortiums and testing prototypes. While less flashy than Lambos and overnight millionaires, these efforts were crucial to separating blockchain’s potential from the hype that had previously surrounded it.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Writer Thoughts:

‘’Periods of explosive growth and speculative bubbles are inherent to emerging technologies. Therefore, the ability to research and distinguish groundbreaking potential from empty promises is an essential skill for any crypto investor.’’

The Four Phases of a Crypto Cycle

1. Accumulation: Prices bottom out. Savvy investors buy back in, seeing value, while others focus on losses. Overall, sentiment remains subdued.

2. Mark Up: The market stabilises and shows consistent growth. Early adopters are back, and positive media coverage attracts new investors. FOMO starts to build.

3. Distribution: Prices peak, and selling pressure increases. While bullish sentiment lingers, experienced investors may start offloading their holdings, recognising a shift in the tide. This phase can be short and volatile.

4. Mark Down: Prices decline sharply. Panic selling ensues as those who bought at the top, experience losses. Negative sentiment dominates until enough buyers believe the bottom is near, restarting the cycle.

Both technical innovation and human psychology drive crypto markets. Understanding cyclical patterns can offer insights into potential entry and exit points, although timing these perfectly is nearly impossible.

The Power of On-Chain Data

source: Glassnode

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Price charts tell only part of the story. To unlock the true potential of cryptocurrencies, we must examine who is transacting on-chain and the underlying reasons behind their actions. On-chain data provides this unfiltered look into the lifeblood of a crypto network.

What is On-Chain Data?

Public blockchains are giant, decentralised ledgers. They permanently record every transaction: the addresses involved, the amount transferred, and even data around smart contract usage. It’s a goldmine of information waiting to be decoded.

Why On-Chain Data Matters?

Traditional models for valuing assets often need to catch up with crypto. On-chain data unlocks the potential for more nuanced analysis. It paints a picture of a cryptocurrency’s usage, adoption patterns, and the key players in its ecosystem.

Classifying Addresses: Anonymity might be baked into blockchains, but patterns emerge when we look at addresses in the aggregate. We identify clusters with distinct behaviours: exchanges with their numerous wallets, ‘’bot’’ addresses with repetitive actions, and addresses showcasing irregular usage, often indicative of individual users. This classification gives us essential context for interpreting the data.

What This Enables:

• True Network Health: Are tokens being used for their intended purpose, or is it primarily speculative trading? We gain insights that can’t be gleaned from price action alone.

• Centralisation Watch: Are a few ‘’whales’’ dominant, or is the token distribution healthy? On-chain data helps us assess potential risks surrounding ownership concentration.

• Apples-to-Apples Comparison: Finally, we can compare projects in the same category (like decentralised exchanges or NFT marketplaces) based on real usage metrics, not just marketing promises.

Your On-chain Research Toolkit

There are a lot of on-chain data platforms, so as you progress on your crypto journey, consider exploring them. Some of the better ones:

• Messari: Detailed asset charts, address tracking, custom watchlists, and in-depth analyst reports help you grasp market dynamics on a deeper level.

• TheMoonMag: Explore a range of on-chain indicators, plus AI-powered price predictions for top assets, revealing hidden market signals.

• Glassnode: This platform caters to experienced analysts, offering sophisticated visualisations and custom metrics for truly granular research.

Social Signals as Sentiment Gauges

Classic market analysis relies heavily on company financials or technical chart patterns. But with crypto, the ‘’wisdom of the crowd’’ plays a considerable role. Sure, market sentiment can be fickle, but it can also drive surprising price swings, especially in the short term.

Social media is a wild, woolly frontier filled with crypto chatter – hype, rumours, and occasionally those rare nuggets of insight. Thankfully, there are tools to help make sense of all that noise. By using natural language processing and sophisticated algorithms, we understand the overall mood around a particular project. This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

source: A Guide for Choosing Social Sentiment Indicators

Is the community overwhelmingly excited sceptical, or are things quiet?

Read Between the ‘’Likes’’

Sentiment analysis lets us categorise posts as positive or negative, giving us a real-time temperature check on how the community feels. This can be especially useful when big news hits, letting us see how people react. Beyond sentiment, tracking engagement – likes, shares, comments – shows us what projects get people talking. Is a project building a buzz, or is it just empty hype?

The Good, the Bad, and the Bot-Fueled

• The Upside: Sentiment analysis can be like an early warning system, picking up on potential negative trends before they become full-blown crises.

• Spotting Trends: Paying attention to engagement helps us separate the projects with real staying power from those that might just be a flash in the pan.

• The Limits: Social media is just one piece of the puzzle. Over-reliance on these tools can lead to major blind spots

• Beware of Bias: Algorithms are products of their training data. Social media is full of manipulation and bots, so it’s crucial to be discerning about what we see.

source: Alternative

Key Takeaway :

Social signals can be incredibly powerful, but they’re not a crystal ball. They offer a window into the crypto community’s mood, but it’s up to the savvy investor to interpret what they see within the bigger picture.

Read Between the ‘’Likes’’

Sentiment analysis lets us categorise posts as positive or negative, giving us a real-time temperature check on how the community feels. This can be especially useful when big news hits, letting us see how people react. Beyond sentiment, tracking engagement – likes, shares, comments – shows us what projects get people talking. Is a project building a buzz, or is it just empty hype?

The Good, the Bad, and the Bot-Fueled

• The Upside: Sentiment analysis can be like an early warning system, picking up on potential negative trends before they become full-blown crises.

• Spotting Trends: Paying attention to engagement helps us separate the projects with real staying power from those that might just be a flash in the pan.

• The Limits: Social media is just one piece of the puzzle. Over-reliance on these tools can lead to major blind spots

• Beware of Bias: Algorithms are products of their training data. Social media is full of manipulation and bots, so it’s crucial to be discerning about what we see.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Tools for Gauging Social Sentiment

While your choice of tools should be tailored to your analysis style, here’s a look at some popular options:

• BittsAnalytics: This data-driven platform specialises in real-time social media analytics for the cryptocurrency market. Their APIs offer insights into both sentiment and the volume of social mentions, which is valuable for spotting buzzworthy projects and potential price drivers.

• CoinTrendz: CoinTrendz focuses its analysis on Twitter and Telegram. It’s ideal for identifying trending crypto assets across social platforms and getting granular data on community engagement and sentiment.

• Santiment: This platform stands out for its breadth of data sources. Santiment goes beyond social signals, offering insights into on-chain activity, developer behaviour, and project financials. This makes it a powerful tool for building a comprehensive view of a crypto project’s health.

Important Note: Remember, these are just a starting point! As the crypto analytics landscape evolves, it’s important to continually research emerging tools and find those that best align with your research goals.

Navigating the Crypto News Jungle

The world of crypto is constantly buzzing with breaking developments, exciting announcements, and sometimes, unfortunately, outright scams. Finding trustworthy sources is crucial for making informed moves in this space.

So, how to separate the good sources from the sneaky shills?

Spotting Red Flags: Trust but Verify

The crypto scene is rife with misleading or downright fake ‘’news.’’ Here’s how to avoid falling for it:

• Watch That Tone: Overly enthusiastic language? Constant promotion of a single coin? Those are warning signs.

• Where’s the Proof? Reputable sites only make claims with sources to back them up. Dodgy sites rely on hype, not facts.

• Follow the Money: Check who’s funding the site. Is there a potential conflict of interest that might bias their reporting?

• Forget the FOMO: Social media chatter is rarely a reliable news source. Those influencers often have their own agendas!

Why Bother with Crypto News Anyway?

News alerts you to scams and hacks, helping you secure your funds. You can be ‘’ahead of the curve’’ by tracking project updates, and market sentiment can help you make timely decisions with your portfolio.

It’s Not Just About Coins: Crypto news is your window into the broader world of Web3, blockchain development, and the transformative potential of this space.

News Platforms to Stay Up-To-Date

source: Givepact

Remember, variety is key! Here are some solid options:

• MoonMag Magazine: A well-regarded crypto magazine with a mix of deep-dive articles on carefully researched crypto projects, beginner guides, industry insights, narratives and trends that solely focus on informing and educating the reader. This magazine is sole property of themoonmag.com and is not to be redistributed

in any form anywhere else.

��Key Takeaway :

The best crypto news source is the one you diligently fact-check. Even reputable sites can occasionally slip up, so a critical eye is your most powerful tool!

The Narrative Hunter’s Guide

The crypto market isn’t just about charts and numbers. It’s driven by stories, by the potential people see in a project to disrupt, innovate, or even just capture the imagination. Identifying these powerful narratives early can be your key to uncovering hidden gems.

Spotting Early-Stage Potential

• The Big Idea: Does the project solve a real-world problem? Or does it offer a compelling new way to interact online? Projects without a strong, clear purpose rarely achieve long-term success.

• Beyond the Tech: Innovation is great, but even the most brilliant tech means nothing without adoption. Look for projects with a clear path to building a vibrant user base.

• Contrarian Thinking: The hottest trends aren’t always where the real opportunity lies. Sometimes, the projects quietly solving overlooked problems are poised for unexpected breakout success.

Evaluating Teams & Communities

• Who’s Building It? Look beyond flashy resumes. Are the founders doxxed (publicly known), with relevant experience? Beware of anonymous teams – they could vanish with your funds.

• Community Matters: A dedicated, engaged community can be a project’s greatest asset. Is the vibe positive and constructive, or riddled with negativity and shills?

• The Red Flags: Overly vague whitepapers, teams with no established track record, or communities driven solely by price hype are all signs to tread carefully.

��Key Takeaway :

Discovering alpha in crypto involves a blend of market analysis and storytelling. Projects that solve real problems, have strong teams and inspire genuine excitement have the highest chance of longterm success.

The Art of Due Diligence

source: Caia

source: Caia

Tokenomics: More Than Just Numbers

A project’s tokenomics are like its economic blueprint. Total supply and initial price matter, but that’s just the tip of the iceberg. To truly understand a project’s long-term health, dig deeper:

• Distribution: How are tokens allocated? Massive pre-sale stakes for VCs, the team or early investors could spell future price dumps.

• Vesting Schedules: Are there lock-up periods for those early allocations? A lack of clear vesting is a red flag.

• Utility: Does the token have a legitimate use case within the project’s ecosystem? Or is it just a speculative asset with no real function?

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Project Roadmaps: Reality vs. Promises

source: Vitalik Buterin

source: Vitalik Buterin

Ambitious roadmaps are a dime a dozen in crypto. The savvy investor separates the dreamers from the doers by looking for:

• Realistic Goals: Does the roadmap align with the team’s capabilities, or are they promising the moon with little basis in reality?

• Track Record: Has the team hit significant milestones on time? Past delivery is a decent predictor of future success.

• Adaptability: The crypto world changes fast. Rigid roadmaps can be dead on arrival. Look for teams that demonstrate flexibility.

Warning Signs

It’s never about a single factor but a pattern of concerning signs. Overreliance on buzzwords and celebrity endorsements, coupled with a lack of technical details, is a major red flag. Some teams are unwilling to engage with community questions or publish clear documentation, which could show they are hiding something. Last but not least, projects where a few whales control most of the supply or where the core team has excessive control pose long-term risks.

��Key Takeaway :

Due diligence is about separating promises from a project’s delivery ability. A healthy dose of scepticism, combined with in-depth scrutiny of token design, team track record, and realistic goals, are your best defence against disappointment.

Staying Ahead of the Curve

The crypto landscape is constantly evolving. Yesterday’s hot project could be tomorrow’s forgotten relic. Staying ahead of the curve is a matter of continuous learning and adaptation.

Developing Your Research Routine

• News & Analysis: Build a habit of checking trusted sources daily. Mix up technical updates with broader trends and thoughtful opinion pieces.

• Project Deep Dives: Set time aside each week to thoroughly explore at least one new project. Read the whitepaper, join the community, and get a sense of the overall buzz beyond the website.

• Reflection & Adaptation: Keep a research journal. Are your predictions panning out? Regular review helps you identify your strengths and biases as an investor

Critical Thinking in a Hype-Driven Space

An often bypassed advice. Crypto is full of FOMO-inducing narratives and price spikes. Maintaining critical thinking amidst the noise is crucial for longterm success.

• ➢Separate Emotion from Action: The thrill of the chase can cloud judgment. Develop clear investment criteria and stick to them even when the market grows.

• ➢Question EVERYTHING: Healthy scepticism is your friend. If a project seems too good to be true, chances are, it is.

The Importance of Continuous Learning

Crypto moves at the speed of light. New technologies, regulations, and trends emerge constantly. Continuous learning ensures your knowledge doesn’t grow stale.

• ➢Explore the Edges: Venture beyond your usual investing niche. Is DeFi catching your eye? Dig into its fundamentals, even if it’s not your focus today.

• Network: Online communities, meetups, and conferences can be treasure troves of insights. Learn from others, and you may also find yourself sharing valuable knowledge.

Final Thoughts:

The best crypto investors always continue learning. Embrace the dynamic nature of this space, build a solid research practice, and view every news cycle as an opportunity to sharpen your skills.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Omega Network: Deep Dive

written by Daniel

Introduction

The democratisation of crypto has been a fundamental objective in the evolution of this technology since Bitcoin’s entry as a pioneer in promoting financial freedoms. In this context, Omega Network stands out as an innovative proposal that seeks to simplify access and bring more people into the fascinating ecosystem of cryptocurrencies through a simple cryptocurrency mining and management system.

In contrast to the complexity associated with Bitcoin mining, which has put the opportunity to participate in cryptocurrency mining out of reach for ordinary users, the Omega network offers the possibility to mine coins through an easily accessible and intuitive mobile phone application.

Focused on building a decentralised platform to empower an efficient and easily accessible social ecosystem, Omega Network emerges as an innovative social proof-of-network, enabling users around the world to communicate, share information, make payments and develop decentralised applications, all while ensuring data privacy and security through the implementation of advanced cryptography.

Join us to explore Omega Network’s intriguing proposition in detail in this post, where we dive into the platform’s underlying technology with its token that powers its community and the milestones achieved since its founding. In doing so, we will get a comprehensive overview of this unique and promising project in the cryptocurrency world.

is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This magazine

Background and History

The project emerged in 2021 from a team of blockchain experts who wanted to create a more secure and transparent format so people could share and compare data.

Omega has since evolved to become an enhanced alternative to other mobile crypto-mining focused projects, allowing users to earn money by mining cryptocurrencies while offering the context of being a social network of networks that empowers users by monetising interaction with its platform.

This philosophy coincides with addressing structural problems centred on data breaches, lack of privacy and inefficient centralised control seen today in many social media platforms, where the user gets no compensation for the time spent interacting with these centralised platforms.

Omega Network incorporates cutting-edge cryptographic technology such as zero-knowledge proofs (zkp), a scalable consensus algorithm called Stellar Consensus Protocol (SCP) that keeps everything in sync, and a user-friendly design to enable users worldwide to make payments, create decentralised applications and ensure personal privacy and data security.

Furthermore, as stated on their website, Omega Network is designed to create and empower a

decentralised ecosystem based on blockchain technology that seeks to exploit the potential of Web 3, effortlessly combining social interactions and financial transactions.

Team & Founders

Omega Network is a project legally born on September 30th, 2022, through a limited liability company registered in the UK by James Brown (JB), founder and CEO.

As noted above, the other contributors to Omega Network, in its early stages, have been anonymous donors who initially funded the project as outlined in its whitepaper.

Despite not showing a public face of the team behind the project, it has advanced with a solid roadmap that has allowed it to partner with several cryptocurrency leaders, demonstrating that there is a team committed to Omega.

Support and Recognition

With a user base of close to three million app users, the platform has successfully attracted the participation and collaboration of several industry leaders such as CoinMarketCap, PancakeSwap, CoinGecko, OKX, Gate.io, Bybit, MEXC and KuCoin, all of which have partnered with Omega Network.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The Catalyst for Omega’s Development- Advanced Features

Omega Network focuses on two main aspects: mobile cryptocurrency mining and constructing a decentralised platform to generate a secure and efficient social ecosystem.

With the premise of becoming the gold coin, the project focuses on being functional on mobile devices and stimulating its adoption based on its simplicity, given the significant user market that uses this type of device.

To put the above into context, Statista notes that the number of smartphone owners has surpassed two billion, denoting a significant market of smartphone users. Many of these users are potential cryptocurrency enthusiasts.

With a mission to become a cryptocurrency for all, the project’s native tokens can be mined from any mobile device by downloading an app, thus activating a decentralised ecosystem of blockchain opportunities that include:

• Payments: As an open-source network, Omega intends to become a decentralised financial inclusion system for any individual by using faster and more reliable transactions than current centralised payment systems through its native OMN currency.

Statista- Number of smartphone mobile network subscriptions worldwide from 2016 to 2022, with forecasts from 2023 to 2028 (in millions)

In addition, Omega intends to establish itself as a native payment technology for institutional players to significantly reduce the costs and time required for activities such as institutional lending or asset settlement financial services.

• Cross-border payments: With an estimated USD 887 billion in remittances by 2024, according to World Bank data and an average cost of USD 12.50 per USD 200 transaction to a low- or middleincome country, the global cross-border payments market is one of the potent use cases that cryptocurrencies can address.

• Through its social interaction process empowered by blockchain technology, Omega Network can enable companies with a small budget to significantly decrease the delay and complexity of account reconciliation and validation during cross-border money transfers.

• Decentralised identity management: Through the use of state-of-the-art cryptographic techniques such as zero-knowledge proofs (ZKP) and decentralised identifiers (DID), Omega Network allows its users to securely own and control their digital identities, enabling verification across the entire web ecosystem3 when required.

• The monetisation of content by social chain interaction: An innovative proof of networking social chain, users can monetise their content through fairly distributed token rewards and transparently via smart contracts, encouraging the creation and sharing of quality content on the user-centric platform.

Privacy and Confidentiality: Advanced Features

One of the great promises in social interaction with Omega Network is the preservation of secure data and the privacy of this data when users share it in the Omega ecosystem.

To distance itself from the weaknesses demonstrated in traditional social networks where they sell the leakage and misuse of user data to the highest bidder, Omega Network uses decentralised storage solutions such as Filecoin and the InterPlanetary File System (IPFS) to ensure data resilience and prevent unauthorised access by third parties.

In addition, Omega Network claims to employ cutting-edge technologies such as zk-SNARK and zk-Rollups to enhance privacy in its ecosystem, allowing users to interact with the platform without disclosing data beyond what is necessary, enabling interaction in a secure and controlled environment with an optimal balance between performance and security.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Achievements

On May 17th, 2023, Omega Network launched its Omega Testnet. In the first few months of this launch, the platform acquired 220,000 new wallet addresses, attracted the participation of 200,000 people and facilitated transactions worth more than 2 million over the course of this phase, which lasted approximately 30 days.

The project boasts a presence in over 218 countries and a user base of 3 million after only over a year of operation. Its position has been growing within the global cryptocurrency community despite 2023 being a complicated year for the sector, attracting 2 million visits each month to its official website.

The network also boasts a large community of followers spread across its different social networks, with more than 600,000 followers across its channels.

Official Links

Website:

https://omtch.com/

Whitepaper:

https://omeganetwork.gitbook.io/omega-network-whitepaper

Play Store:

OM - Apps on Google Play

App Store: OMEGA NETWORK on the App Store

Mirror:

https://mirror.xyz/0x0ce990b52FEBAf0ee0b6ceD1eC695D0F49BF8440

Github:

https://github.com/omcoreteam

Smart Contract Audit Report:

https://sourcehat.com/audits/OmegaNetwork/

Twitter:

https://twitter.com/OMCoreTeam

Telegram:

https://t.me/OmegaNetworkTeam

Facebook:

https://www.facebook.com/OmCoreTeam/

OMN Token

Current Stats

Price Market Cap 24h Trading Volume Circulating Supply Total Supply Fully Diluted Valuation 0.007432 458,906 229,850 61,779,063 965,150,000 7,169,308 Source: Coingecko - Feb 23, 2024

Here are the market stats of the OMN token at the time of writing:

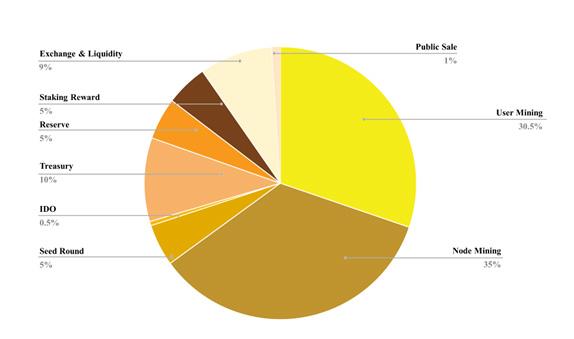

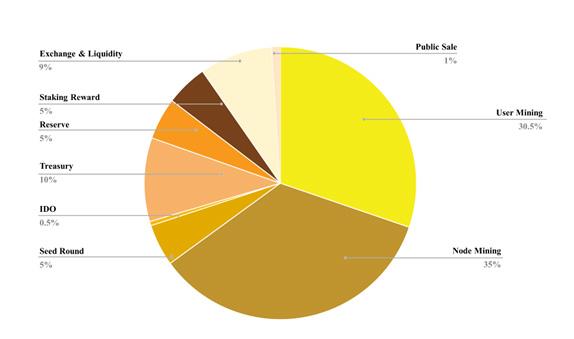

Tokenomics

Omega Network applies monetary deflation according to “Debt depositionMonetary tightening theory” (The Debt-Deflation Theory) proposed by worldfamous economist Irving Fisher.

OMN has a maximum supply of 970 million OM coins, and according to the information provided, mining of Omega Network started on September 30th, 2022. The allocation for user mining is up to 30.50% of the maximum supply.

On June 10th, 2023, Omega Network launched the Public Sale of the OM native token on its own portal, capturing the enthusiasm of a large community looking to get their hands on a share of 1% of the total supply available for this event.

The team managed to reach 151% of the target set for this phase in this Public Sale.

On the other hand, the TGE (Token Generation Event) took place on June 16th on five major exchanges such as OKX, ByBit, Gate.io, MEXC Global and KuCoin.

According to the team’s data, in the initial and private sale rounds, sales reached 330,616,546 tokens.

This move allowed the reach of OMN tokens to expand to a more significant number of users globally, which coincides with the team’s eager plans that by 2050, each of the expected 9.7 billion people worldwide will own at least 0.1 OMN.

Importantly, as a general rule, neither the team nor the initial investors have any corresponding allocation of the coins issued.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

OMN Utility

• OMN is the native token of the Omega Network and is also a governance token for the entire ecosystem.

• OMN holders can benefit from the Omega ecosystem by receiving OMN token transfers for their contribution to the network according to their corresponding role (Pioneer, Ambassador, Validator or Trainer).

• OMN can function as a reward token for contributions to the ecosystem (content creators) or simply for participating in mobile cryptocurrency.

• As a means of decentralised payments, OMN tokens can incentivise the creation of decentralised applications (Dapps) in its ecosystem or experience the potential of Web3 through DeFi properties such as OMN Staking.

Distribution and community Focus

A crucial point of Omega Network is the vehement incentive to its community, seen in its allocation for staking rewards, 5% of the Total Supply and, of course, the mobile mining rewards that dominate its tokenomics with 30.5% of the Total Supply.

In total, 344.35 million OMN are given directly to users who contribute to the strengthening and growth of the Omega Network ecosystem.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The team has even stipulated the development of programmes and grants to encourage the creation of innovative decentralised applications and solutions in its ecosystem, with a significant part of the funds coming from the Treasury (5% of Total Supply).

Key Metrics Omega Token (OMN)

Omega’s Value Proposition and Utility

Omega Network aims to become the ideal platform for social interactions and monetary transactions for cryptocurrency-friendly users, building an economic model that is sophisticated enough to achieve this priority while being universal for everyone to use.

With an easy-to-use, user-friendly interface and low barrier to entry, Omega can fit perfectly into the following use cases where it is possible to apply blockchain technology:

1.- Decentralised social networking: As mentioned earlier in this post, users on Omega Network can create and manage social profiles, connect with friends and family and engage in various online activities securely and privately when necessary, thanks to advanced cryptography.

2.-Decentralised marketplace: Through smart contracts, Omega Network supports decentralised marketplaces where users can exchange goods and services transparently and efficiently using the platform’s native token.

3.- DeFi integration: With a determined willingness to encourage the use of decentralised finance, users on Omega Network can explore the potential of DeFi with decentralised financial services such as lending, staking, borrowing and yield cultivation.

4.- Decentralised content: One of the pillars of the Omega Network ecosystem is undoubtedly empowering users who are dedicated to creating content that encourages the use of its platform. In that sense, users can publish videos and blogs and exhibit artwork and relevant content within a secure and censorship-resistant environment.

Businesses embracing Omega’s social Web3 plans

In recent months, Omega Network added new features to enhance project value and its community. These features include collaboration with other industry projects through an Airdrops program listed in the ecosystem.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The collaboration allows users to have the opportunity to increase their revenue and approach many potential projects while exposing these projects to a large community of users in more than 200 countries around the world.

Airdrop’s first project on the Omega Network was AZCoiner, which took place in the last quarter of 2023, bringing exciting opportunities to the Omega Network ecosystem user community.

Ecosystem Omega Network

While Omega’s ecosystem was planned to be launched in Testnet by Q2 2023, market conditions at that time have delayed the Omega Network team’s initial plans to complement its ecosystem.

However, it is imperative to note that the roadmap has remained the same regarding the milestones set by the team, where the Omega Mining App and Internal Omega Wallet have successfully launched.

The following decentralised applications are to arrive soon to complement the Omega Network ecosystem:

• Omega Blockchain Explorer: A block explorer to monitor the metrics associated with each transaction on the network.

• Omega DEX: A decentralised exchange where users can buy, sell, and trade native and off-chain assets, with the OMN token as the primary asset for fee payment.

• Omega Cross-Chain Bridge: Given that the industry today is multi-chain, a cross-chain bridge is essential to move assets between the different blockchains where the OMN token has deployed and to take advantage of the DeFi functionalities in the ecosystems.

OMN Mining Roles

The Omega Network ecosystem revolves primarily around the OMN Miner roles. As a user-centric platform and mobile cryptocurrency, users who decide how to contribute to the platform can choose between four roles: Pioneer, Validator, Ambassador, and Trainer.

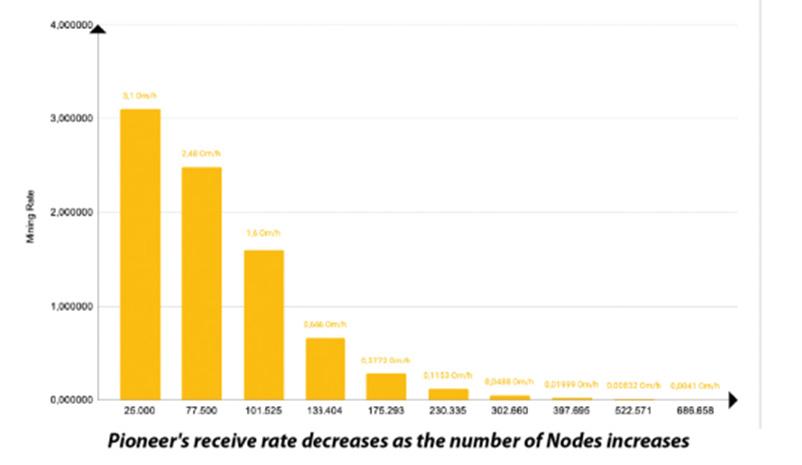

Pioneer

The basic level user in the Omega Network ecosystem receives OMN at a given rate of OMN/h by logging into the application on their mobile device every 24 hours by clicking the “Start” button.

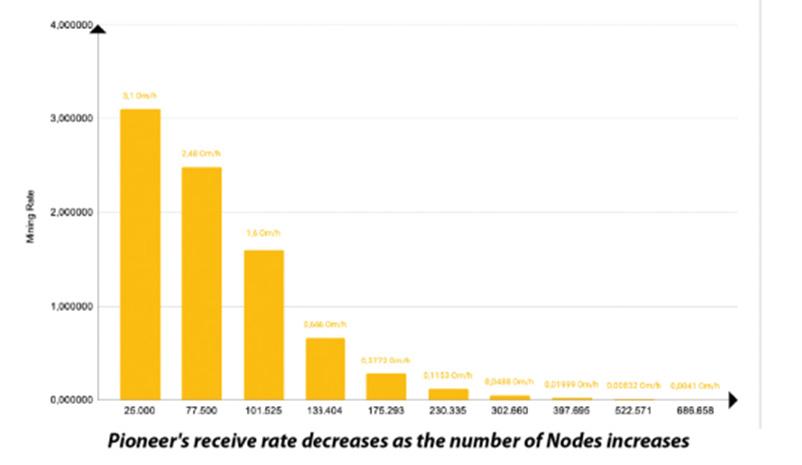

This user can also perform any transaction on Omega, such as paying other users or depositing OMN tokens. It is worth mentioning that due to Omega’s deflationary policy, the reception rate of Pioneer decreases as the number of nodes increases.

Ambassadors

As the name suggests, they are responsible for spreading the word about Omega Network by adding at least a list of 5 Pioneers they know and trust. Through this referral system, Ambassadors contribute to the growth, strengthening and worldwide assurance of the Omega Network.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Validator

In addition to using the Omega mobile app and earning OMN tokens for mobile cryptocurrency, this user runs the Omega node software to support the network.

As a validation node, it runs the SCP core algorithm, helping to validate transactions running on the network securely and transparently while receiving part of the 35% of the Total Supply OM stipulated in tokenomics as a reward for Node Mining.

Trainer

Once Omega Web3 launches, this role will become active, and its primary function will be to unite the Omega ecosystem and lead a team of collaborators, finding and exploiting NFTs.

Omega Web3 is a feature built to grow the economy in the OMN ecosystem: A platform where users interact with the real and virtual world by completing tasks and receiving rewards for completing them.

Technology: How Omega Network works

Omega Network works as a decentralised network of servers with a distributed ledger that is updated every 2 to 5 seconds between all nodes. Omega is structured on an OPoS (Optimized Proof of Stake) consensus mechanism similar to the Pi Network but uses a different hashing algorithm.

OPoS is a specialised version of PoS that introduces optimisation techniques to avoid centralisation and improve network health. Like the BNB Chain, this mechanism supports a maximum of 21 validators, allowing the network to balance decentralisation and performance.

In addition, using the OPoS consensus mechanism ensures that validators are randomly selected through a fair and transparent process, guaranteeing the basic principles of decentralisation.

To achieve the scalability necessary to compete with a traditional payment system, the consensus protocol employed by Omega Network does not rely on the entire mining network to approve transactions, given that it uses quorum slices (or part of the network) to approve and validate transactions.

Omega Network acts as a pre-SCP system, taking advantage of all the benefits of the Stellar Consensus Protocol (SCP) algorithm: energy efficiency, speed and configuration.

Stellar Consensus Protocol (SCP) is a construction of the Federated Byzantine Agreement (FBA). FBA differs from other well-known consensus mechanisms like Proof of Work (which relies on a node’s computational power) and Proof of Stake (which depends on a node’s staking power) by relying on the agreement of trusted nodes instead.

Like any Proof-of-Stake (PoS) based system, aspiring validators need a certain amount of OMN coins in collateral to become one in the network. The validator can participate in the network consensus with voting power proportional to the number of coins in the guarantee.

What is to come

According to the project roadmap, connection to the possibilities expected to develop in the new immersive Internet ecosystem will be available to Omega Network.

Omega City is one of the main attractions expected to be launched in 2024, a place that enables the connection between the virtual and real world, empowered by non-fungible tokens (NFTs) as a reward mechanism for performing blockchain interaction within Omega Web3, as Omega City is also known.

To this end, the team hopes to offer the public a virtual place where, in addition to meeting, interacting and earning rewards in OMN tokens, Omega Metaverse functions as a natural meeting room for social interaction and encounters between the different key players in the industry.

In addition, the Omega Network ecosystem is expected to be complemented by a native LaunchPad that will serve as a springboard to launch promising projects in the industry similar to how Omega Airdrops currently operates.

The team behind Omega has set the goal of providing a platform to develop and launch free-to-play blockchain games integrated with a native payment system powered by the OmegaPay System.

Omega expects community engagement through memberships, grants, and developer-level technical support to continue in the timeline. At the same time, launch educational campaigns to evangelise the benefits of Omega Network on the Web3.

What We See

From our perspective, the team behind Omega Network seems to have learned from their predecessors, such as Pi Network and Electroneum, by incorporating cutting-edge technology to mitigate privacy, security and scalability concerns.

Incorporating particular functionalities involving partnerships with other promising projects in the industry, such as their Airdrops strategy and referral system under the Ambassador role, they sustained growth over the last 18 months that very few projects have capitalised on.

While its price is not entirely attractive at the moment for many early-stage investors, we must not forget that we have been in a prolonged crypto winter that very few have resisted, being Omega Network a project that has been able to seek engagement with the community to stimulate their participation, due to the fundamental role it has in its vision as a project.

Doing our homework, we verified the OMN token contract address by various on-chain analysis tools, with which we discovered that there are no inherent vulnerabilities at the development level, and some scanners even gave it a perfect score of 100/100..

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

At the level of token accumulation, there is at least within its thousands of holders a significant dispersion in the distribution of OMN tokens among the different wallets that hold several amounts of OMN tokens, not exceeding, in the worst case, 33% among the large holders of the native Omega Network token, this being a fundamental point in a system that operates under a derivation of the proof-of-stake mechanism.

With the above points in mind, it is imperative to note that Omega Network’s innovative approach to making the mobile mining experience accessible to users who participate in the network and earn rewards constitutes a beneficial model. This approach, combined with a wide range of features designed to encourage social interaction by leveraging blockchain technology, including decentralised incentives and advanced cryptographic techniques, represents a paradigm shift, gaining increasing acceptance in the industry.

www.themoonmag.com Advertise with us! contact@themoonmag.com

The Epic Clash for Layer 1 Dominance in 2024

written by Samantha

written by Samantha

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Layer 1 platforms play a central role within the Blockchain and crypto ecosystem as they form the foundation of the blockchain framework. They also establish the fundamental rules defining decentralisation, security, and interoperability within the ecosystem. The importance of Layer 1 is its ability to build various decentralised applications and solutions that range from Smart Contracts to DiFi applications.

However, these platforms in question, besides being a catalyst for cryptocurrency functionality, face a blunt challenge known as the “blockchain trilemma”, which is nothing more than finding the balance between security, decentralisation and interoperability that will ensure sustaining any blockchain network in the long term.

We can find notable examples of Layer 1 platforms within the ecosystem, but the undisputed leaders looking to define the direction of the blockchain ecosystem are Ethereum, Solana, Toncoin, AVAX and DOT. These prominent platforms, each with unique strengths, not only form the base infrastructure of their respective blockchains but also shape the crypto landscape in notable ways.

In the case of Ethereum, the intelligent contracts giant has paved the way for decentralisation in blockchain development. For its part, Solana stands out for its cutting-edge approach to scalability, while Toncoin, AVAX and DOT emerge as disruptive innovators in their respective spheres. In this context, 2024 represents an inflexion point where these L1 platforms consolidate their dominance and define the game rules by solving the challenging blockchain trilemma.

Exploring the projected evolution of Ethereum, Solana, Toncoin, AVAX, and DOT reveals continued technical progress and anticipates how these platforms will shape the global crypto narrative in the coming years. In this article, dive into a detailed analysis of the impact and position of these prominent L1 platforms this year and discover how they are setting the tone for the next phase of the blockchain revolution.

https://ethereum.org/es

Ethereum leads the way in layer platforms, with a well-established and growing developers community, not to mention an ecosystem of decentralised applications (dApps) that exceeds at least 3000 active applications as its backbone, and it has continued to grow and evolve beyond its original function as a digital currency long time after its official launch by Vitalik Buterin, also becoming the epicentre of the ecosystem of dapps, Ntfs, DiFi and more.

Ethereum: A Journey from Idea to Blockchain Revolution

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

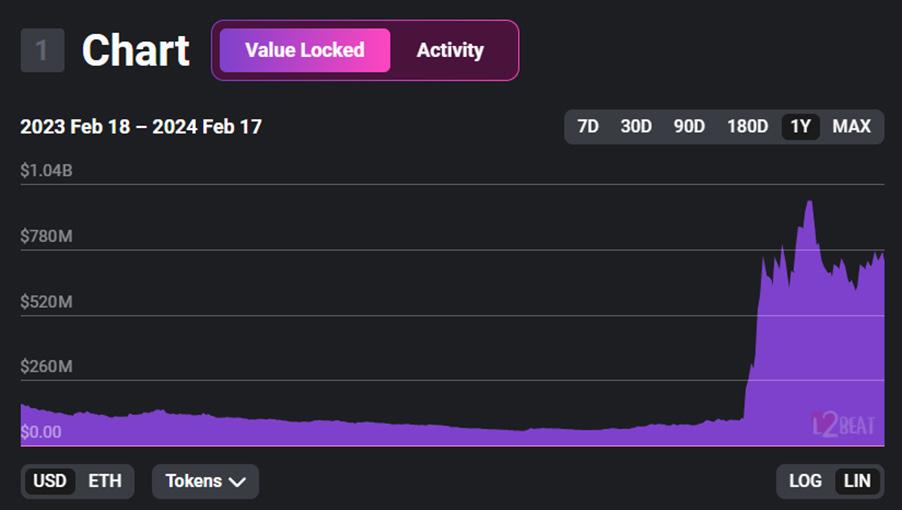

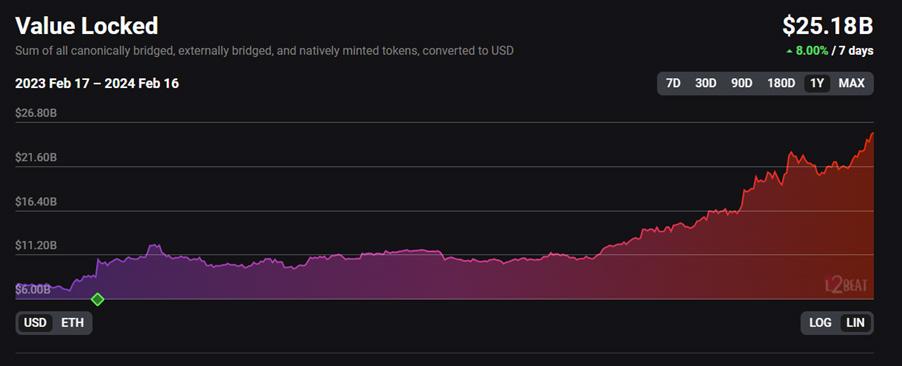

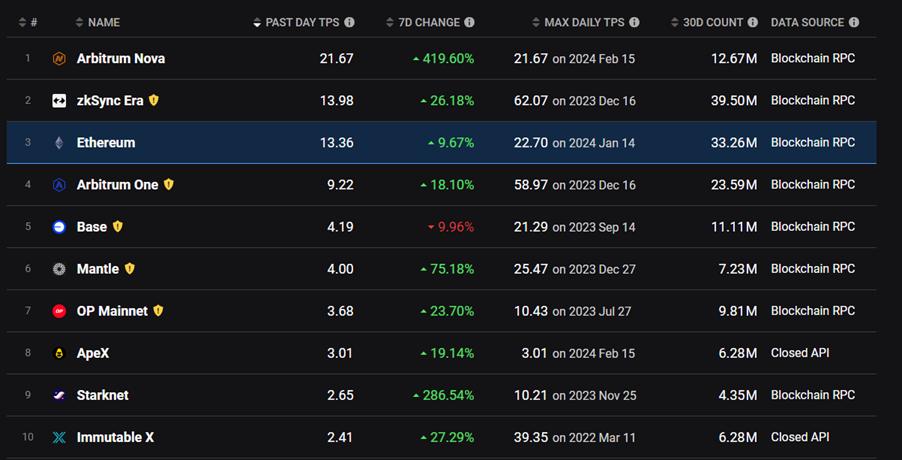

Ethereum dominates fees and total locked-in value (TVL)

Source: Artemis and Dapp Radar, data as of 1/2/2024.

While Ethereum is the leading innovative contract platform in market capitalisation and many fundamental metrics, its trajectory has also encountered significant challenges, such as network congestion and high gas tariffs. While the community has sought to address these issues with innovation and change, these challenges continue.

Triumphs and challenges over time

Ethereum has celebrated significant successes, from the ERC-20 standard introduction, which fuelled the rise of Initial Coin Offerings (ICOs), to its crucial role in the decentralised finance (DeFi) revolution. However, scalability has been a challenge motivating the constant search for solutions to improve efficiency and reduce transaction fees.

Technical features

Updates like Ethereum 2.0 have met these challenges by implementing sharding and transitioning to Proof of Stake. Prioritising security, the network uses robust cryptography and encourages decentralisation by allowing validation through staking.

Its ability to execute smart contracts has driven the development of DApps and DeFi. With token standards such as ERC-20, the Ethereum Virtual Machine and a focus on interoperability, Ethereum stands out as a versatile and pioneering platform in the blockchain space, with continuous efforts to improve its infrastructure.

Recent updates

The triad of scalability, security and decentralisation has been the constant focus in Ethereum’s development, given that as the network grew, the need to address the blockchain trilemma became pressing.

The Shapella update in April 2023 represented an important step, reducing developer gas fees and eliminating mandatory token staking. The progressive implementation of Dencun, with its proto-danksharding through EIP-4844, aims to reduce transaction fees at layer 2.

Significant Developments:

Prominent Projects Built on Ethereum

Ethereum has piloted notable projects, from DApps such as Uniswap and Compound to DeFi protocols such as Aave and MakerDAO, making its role as a leading token launch and fundraising platform crucial to blockchain innovation.

Ethereum 2.0 implementation

A crucial milestone that marked the evolution of the network is the implementation of Ethereum 2.0, also known as The Merge. The migration from PoW to PoS, with the Beacon Chain overseeing the process, eliminated mining and paved the way for further improvements in scalability and efficiency issues.

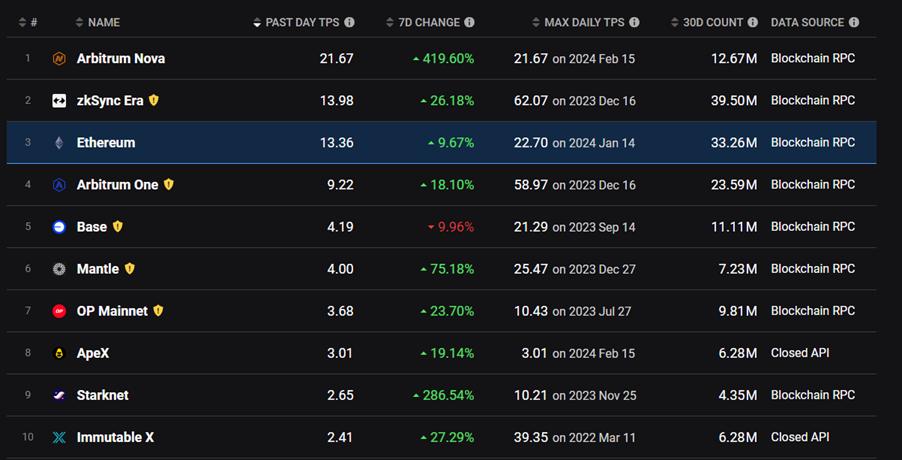

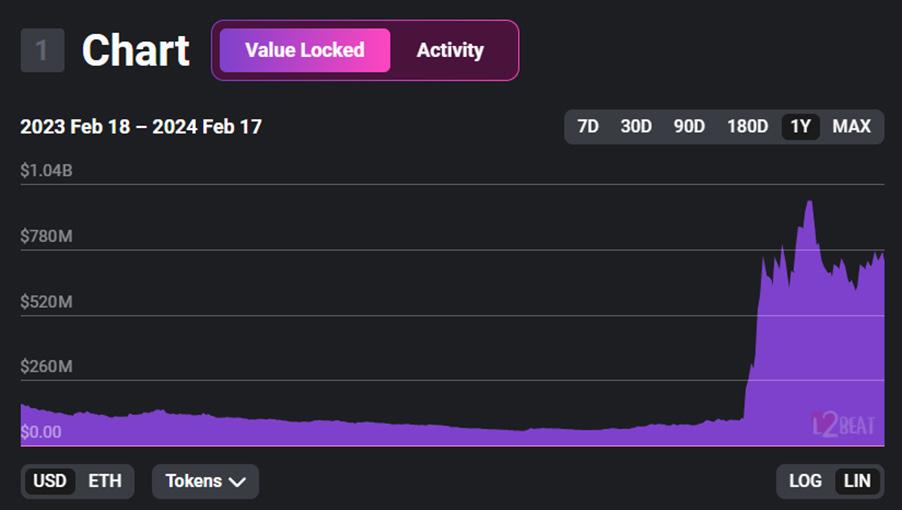

Dencun upgrade and layer 2 improvements

The Ethereum ecosystem is on the verge of experiencing lower gas rates and faster transaction speeds for Layer 2 rollups with the arrival of the Dencun update.

It’s an improvement that has been long awaited and aims to significantly reduce transaction fees on Layer 2 transactions so that they can ensure a more cost-effective user experience without compromising Ethereum’s efficiency.

In contrast, Solana continues to outperform Ethereum thanks to its lower network cost. While Ethereum struggles with high fees, Solana presents itself as a more accessible and efficient alternative.

Ethereum’s main characteristic is its constant focus on improving technical features and implementing crucial updates that help the platform address ecosystem challenges and take advantage of new opportunities as competition in this space advances. Many market enthusiasts, therefore, debate whether Ethereum is destined for oblivion if it does not effectively address the gas tariff challenge.

But, it is still too early to get ahead of these facts, so we have to wait for Ethereum’s Dencun update to materialise on 13 March 2024. As well as being a big step, it could significantly help the platform compete in terms of scalability with industry chains such as Solana.

For now, the crypto community is closely watching and following these updates that redefine the balance of power in this ecosystem.

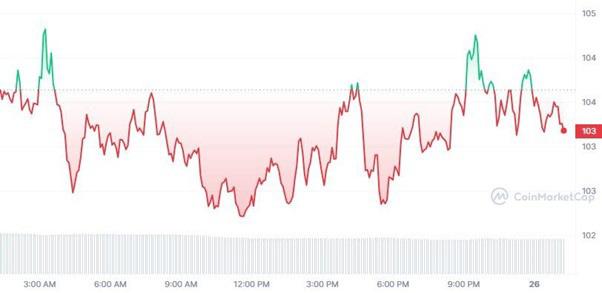

Ethereum price at the time of writing

Ethereum’s price is USD 3108.47, with a market capitalization of $373,501,306,898, according to CoinmarketCap data.

Solana:

Forging the path to Blockchain domination by 2024

https://solana.com/es

Solana, founded by Anatoly Yakovenko, a former Qualcomm engineer, in 2020, aimed to be a disruptive solution to all the existing scalability challenges affecting many blockchain networks. His focus was clear: to tackle the bottlenecks that impede the performance of other blockchains.

Relevance over time

In 2021, Solana leapt forward, implementing “Sealevel”, an upgrade that further boosts its performance. That means one contract at a time modifies the state of the blockchain, creating a runtime that can process tens of thousands of contracts in parallel, using as many cores as are available to the validator.

Subsequently, in November of the same year, a financing round led by Andreessen Horowitz raised $314 million and consolidated Solana as a leading option in the market.

Solana’s architecture and performance

Solana, the blockchain platform on the rise, quickly begins to distinguish itself through its innovative architecture. How does it achieve this? First, it bundles multiple transactions into compact blocks, a tactic that optimises network efficiency and enables faster processing.

In addition, it introduces a unique consensus mechanism called Proof-of-History or PoH that adds a temporal transactions record that reduces the wait for confirmations and boosts the network speed to impressive levels. Modularity also plays a fundamental role in its layered architecture, providing flexibility and facilitating efficient upgrades.

Performance and scalability assessment

Solana can process up to 65,000 transactions per second, setting a remarkable standard in the blockchain industry, given its combination of compact blocks and PoH, surpassing even giants such as Ethereum. In addition, its intelligent design allows for almost unlimited scalability, adapting to constant growth without losing efficiency.

But speed is not its only strength. Solana excels at keeping transaction costs to a minimum. In fact, during the recent Solana Day in Barcelona, the Solana Foundation and a great team shared first-hand valuable insights into the growing developer preference for Solana, highlighting that speed, security and efficiency are fundamental elements that make it an attractive option for users and developers seeking efficiency and cost-effectiveness.

Barcelona:

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Solana Day

Speed, safety and efficiency

In addition, it demonstrates resilience to congestion. That is, it handles significant transaction loads without sacrificing performance. However, despite Solana’s robustness, adapting database experts to its unique technology can present challenges. Building strong technology teams presents itself as a solution to overcome this obstacle.

Adoption and ecosystem

With its adoption and ecosystem, Solana has attracted over 2500 developers, backed by notable projects such as Gameshift. Moreover, the recent integration with Filecoin supports and strengthens its position in the market as it aims to improve the accessibility and usability of the blockchain.

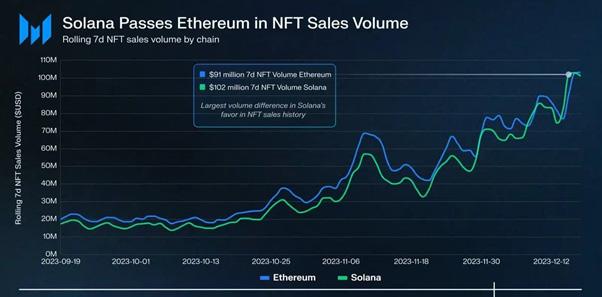

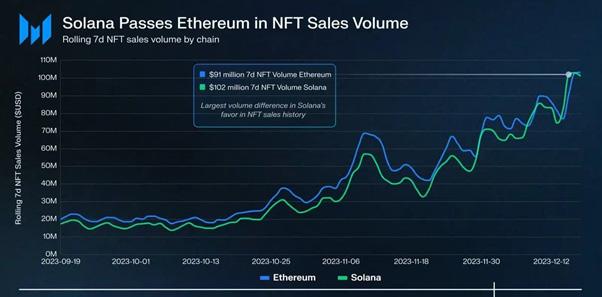

It is imperative to mention that Solana surpasses Ethereum in monthly sales volume when referring to the NFT market, demonstrating a growing interest. Solana’s recent success is evident in its substantial increase in active addresses, surpassing Ethereum three times.

Low-cost trading on Solana enables new types of products, such as profitable trading of small positions on decentralised exchanges (DEX) without high gas costs.

In fact, in terms of decentralised exchange (DEX) volumes, Solana has become the second-largest exchange, experiencing a considerable increase in non-fungible token (NFT) volumes. Even if Ethereum continues to lead the smart contract network market, Solana’s steady growth and appeal to smallerscale users and developers may pose continued challenges to Ethereum’s dominance.

Preparing for the future

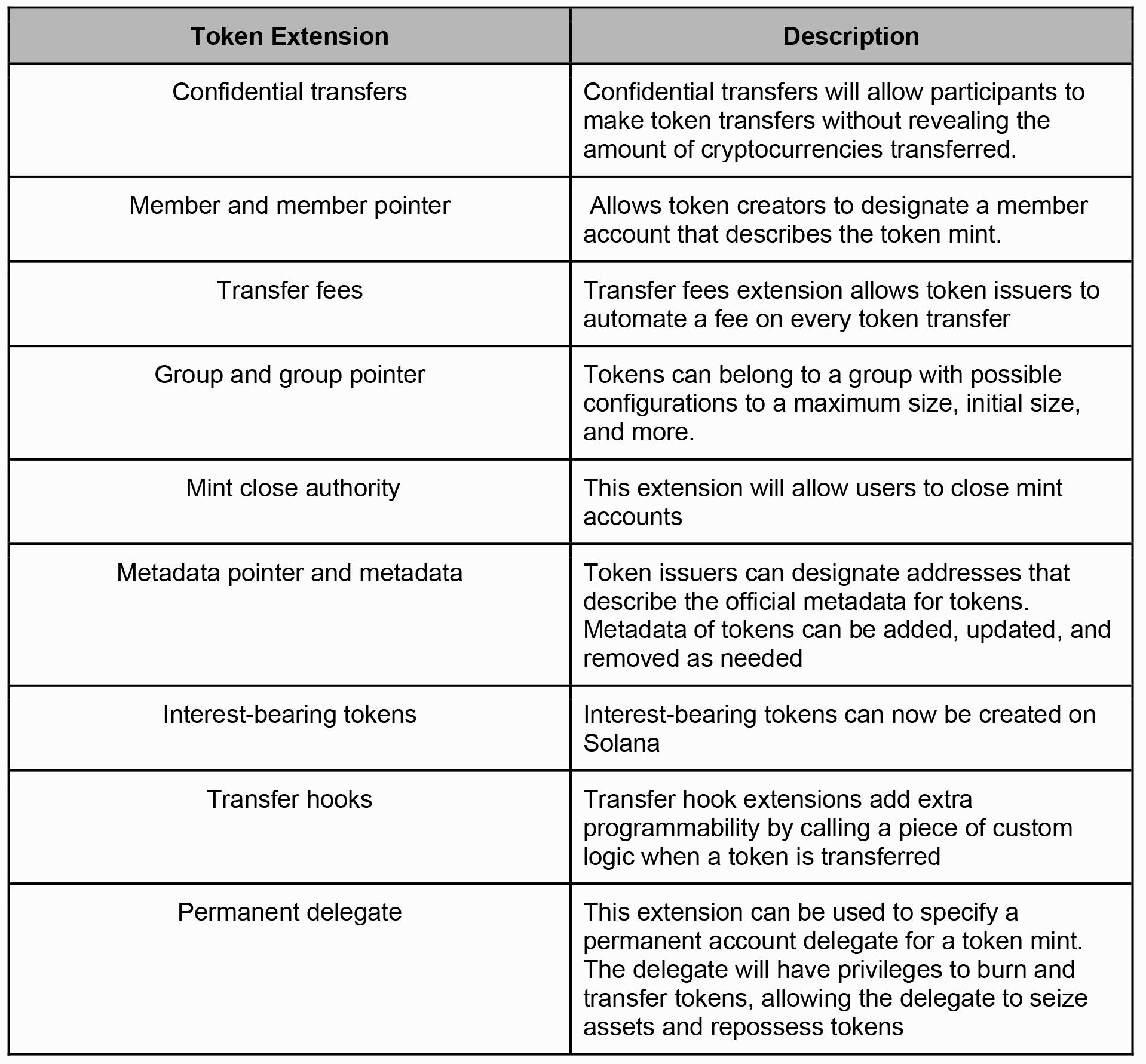

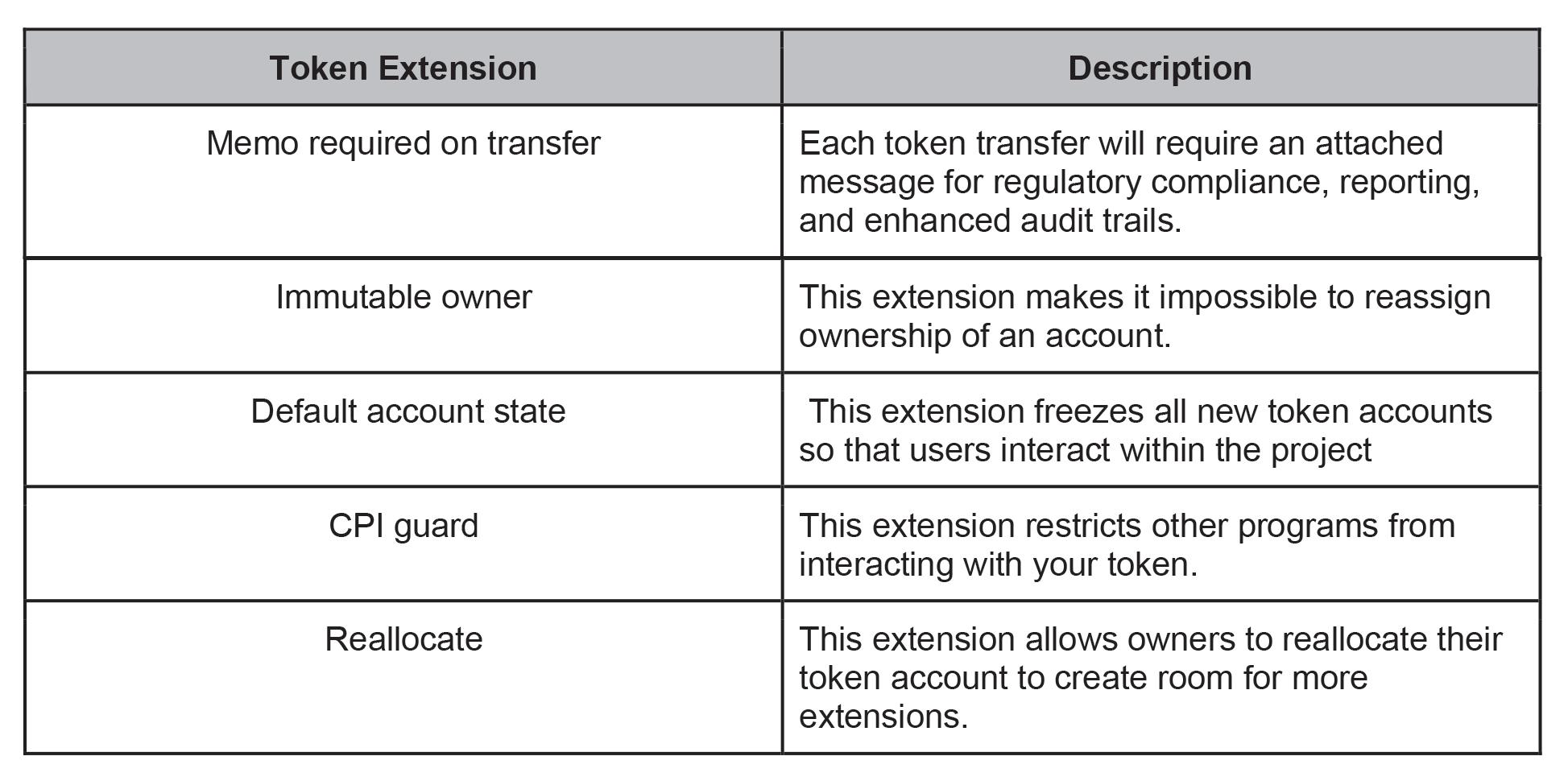

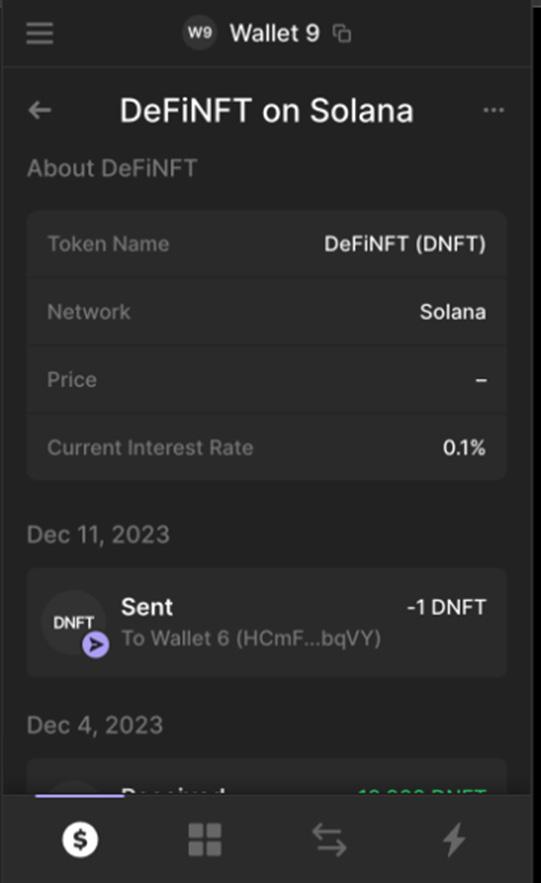

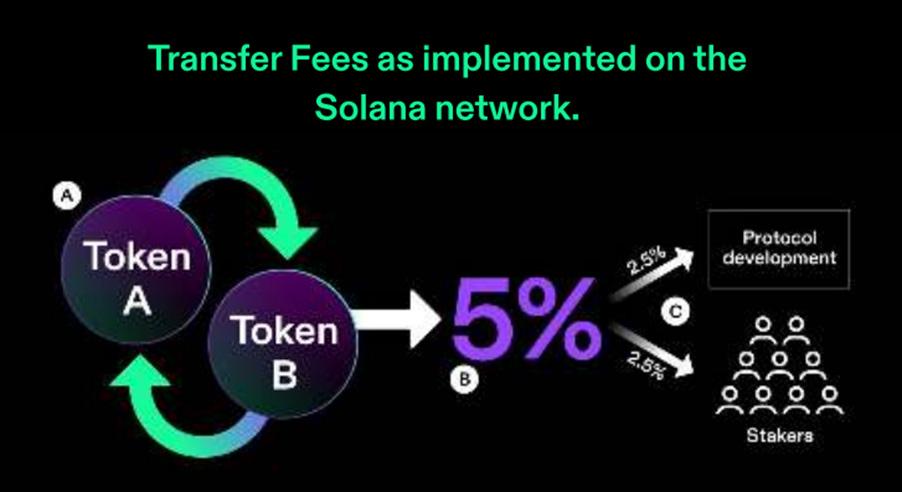

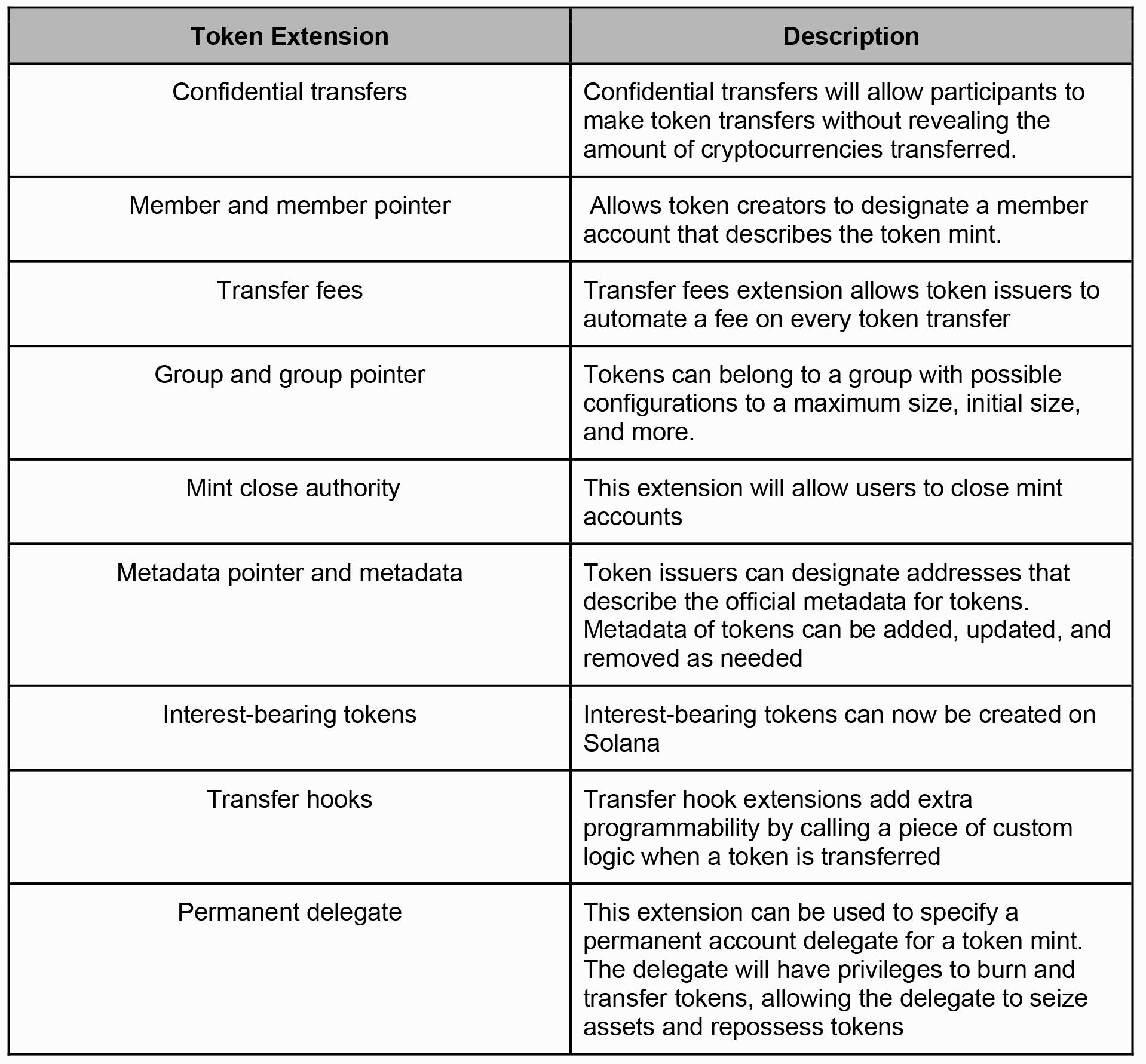

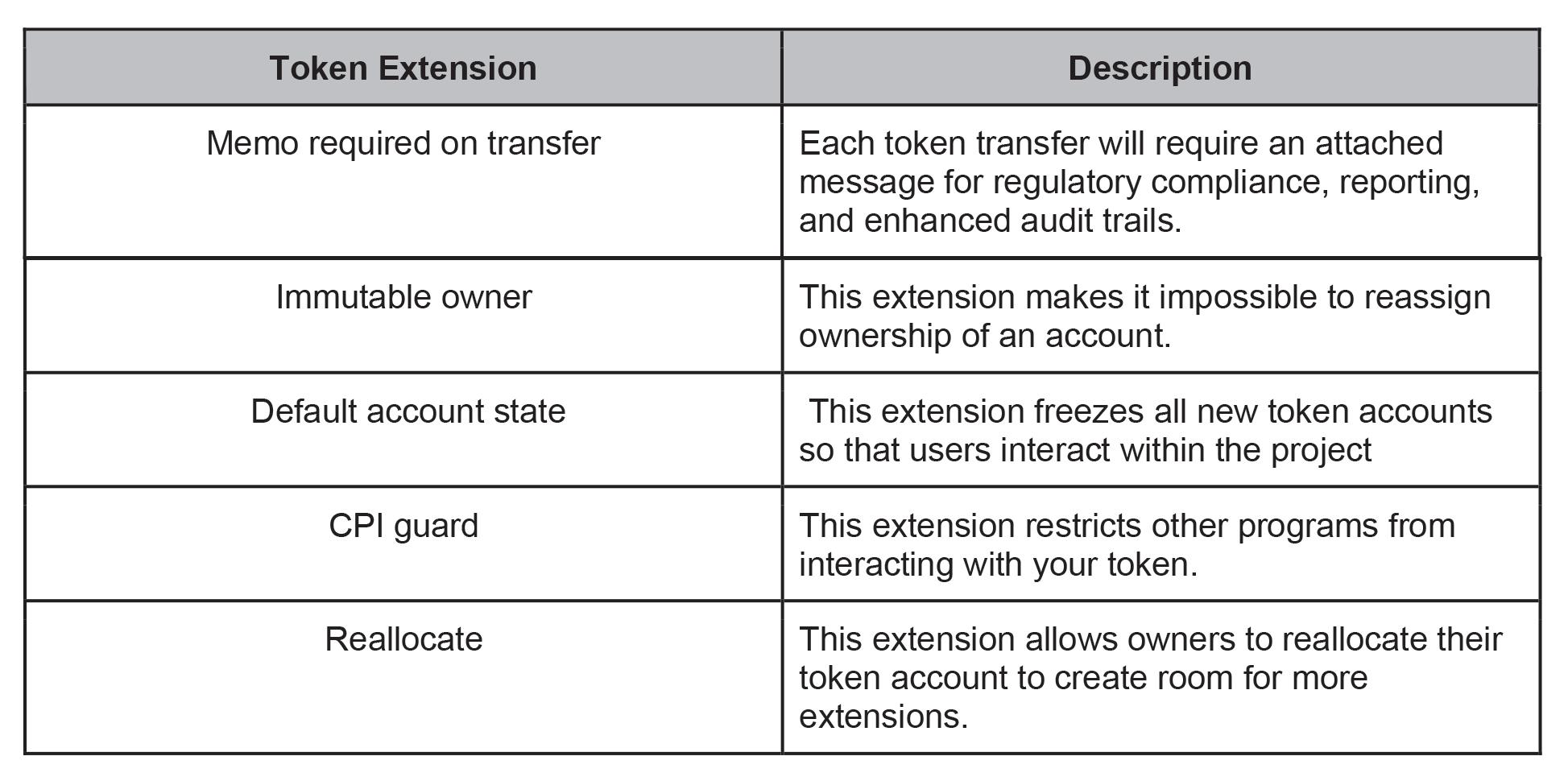

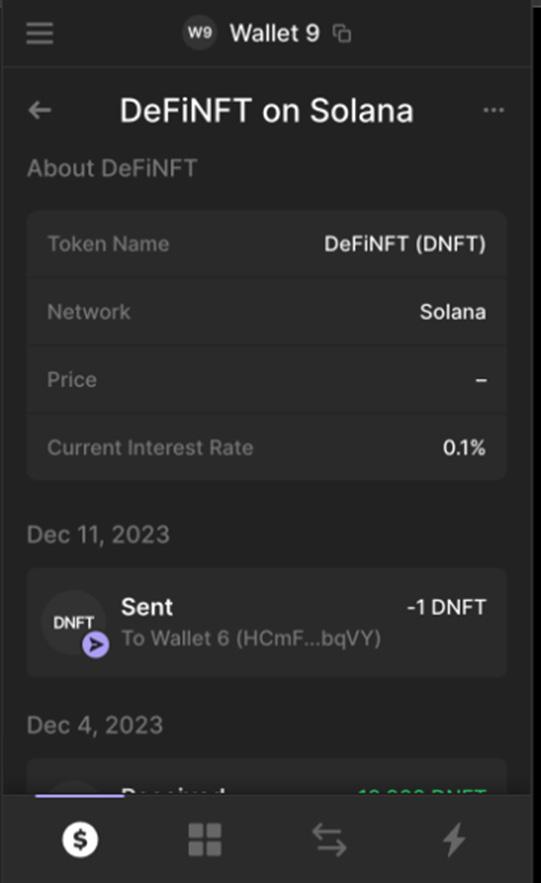

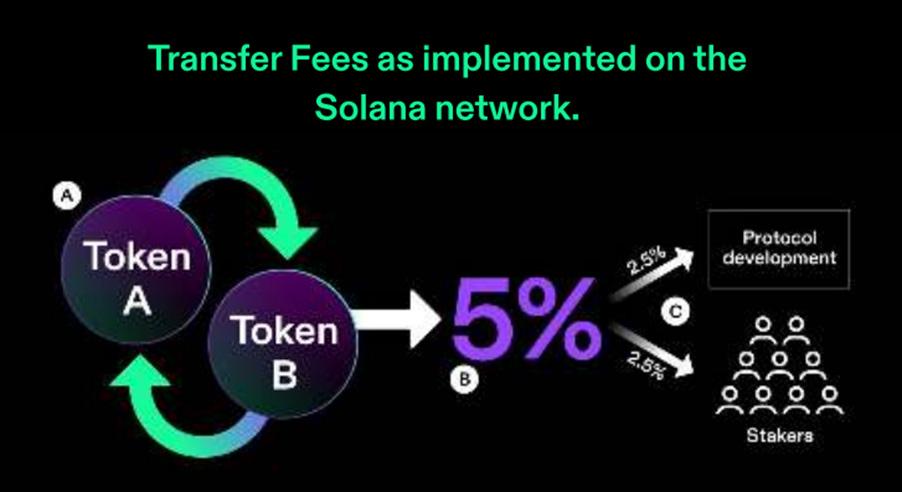

Solana is preparing for crucial developments in 2024, with token extensions that will improve creation and compatibility, a feature enabled on the Solana blockchain, to allow developers to incorporate features into their issued assets, such as confidentiality and controlled access.

Indeed, Solana’s chief strategy officer highlights the importance of token extensions, a three-year project that seeks to build the next generation of token programming on Solana. In this regard, he highlighted Solana’s fundamental difference from other blockchains, where every programme design allows it to be used by anyone on the network, allowing for efficient reuse of existing programmes.

NFT turnover, Solana and Ethereum data.

NFT turnover, Solana and Ethereum data.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Solana, meanwhile, is leading the way as the most cost-effective alternative and is rapidly gaining ground as it becomes the basis for numerous emerging projects. Its cost efficiency and the release of tokens with protocols on its Layer 1 (L1) network drive the growing demand. The community has benefited from Airdrops, such as the recent Oracle Pyth (PYTH), which distributed $77 million to early holders.

Solana is also finding success with significant collaborations in the financial arena. Visa has adopted this blockchain technology to process its payments, and Shopify has integrated USDC through SOL Pay since August 2023. These strategic partnerships position Solana as an attractive and efficient option in the blockchain landscape.

With these developments and its position in the NFT market, Solana emerges as a leading player in the blockchain world, poised for continued growth in 2024. On the horizon, developments such as Hyperledger Solang, additional token extensions and enhancements to Network Validation and Development consolidate Solana’s position as an undisputed leader in the blockchain universe.

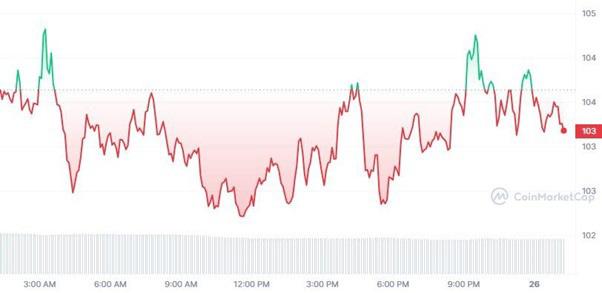

Solana’s price at the time of writing

Solana’s price is $103.18, registering a decrease of -0.59% in the last 24 hours. The current CoinMarketCap ranking is number 5, with a market cap of USD 45,511,847,155.

Toncoin

https://ton.org/

Toncoin, also known as Free TON, is an open-source, free network born as a response to the legal challenges Telegram faced with the US SEC when it tried to launch Telegram Open Network (TON) as a blockchain.

When its creators decided to close the project due to legal challenges, the community of TON developers revived it and continued with open source, creating Free TON, a decentralised network. Its original goal is to provide a fast, accessible and scalable platform for smart contracts and DApps governed by the principle of a DAO.

Key features

Toncoin stands out for its ability to process an impressive 104,715 transactions per second thanks to its multi-shard architecture, addressing common problems such as congestion and high fees on other blockchains.

Toncoin is capable of executing smart contracts, just like Ethereum, the difference being that Toncoin strives to be more efficient and economical in this regard.

The Toncoin community emphasises decentralisation, seeking to avoid concentrations of power, seeing this as a window to a more resilient and open network.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Present in the DiFi and Ntfs markets

In the competitive decentralised finance world (DeFi), Toncoin (Free TON) is a dynamic and evolving option. With DeFi platforms such as DeDust, Megaton Fi, StonFi and Optus, Toncoin allows users to participate in decentralised financial services, redefining how we interact with finance in the digital world. Its presence in the DeFi market provides investment opportunities and contributes to the overall growth and decentralisation of the Toncoin network.

Furthermore, in the non-fungible token (NFT) market, Toncoin has cultivated a creative and vibrant environment. With proprietary collections such as TON Punks and Toned Ape Club, inspired by previous successes on Ethereum, Toncoin has become a fertile ground for digital artistic expression and the exchange of unique digital assets.

Major updates or changes

Toncoin has undergone several upgrades to improve the network’s scalability, security and usability. In addition, they have implemented programmes to support emerging projects, such as the TON Accelerator Programme and the introduction of Early, a platform designed for early-stage projects.

This platform represents a strategic step to close the support gap for start-up projects in the TON ecosystem to offer a lifeline to early-stage projects that seek to build communities and attract users from the earliest stages of development.

Adoption and challenges

Although it has achieved some adoption, Toncoin faces competition from more established networks such as Ethereum and Solana, and its introduction of support programmes, such as Early, reflects the effort to accelerate adoption and build engaged communities.

Toncoin shares challenges with other layer 1 projects, such as the competition to bring in new users and build engaged bases. Despite its notable technological advances, the persistent challenge lies in standing out in the competitive blockchain ecosystem.

In short, Toncoin is known for its record speed and commitment to decentralisation. However, it faces challenges in adoption and competition. Its future success will depend on its ability to consolidate its position in the market and offer attractive solutions for developers and users.

Toncoin price at the time of writing

Toncoin’s live price is $2.12, recording a 54% decrease in the last 24 hours. The current CoinMarketCap ranking is #15, with a market cap of USD 7,358,653,011.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Avalanche https://www.avax.network/

Avalanche stands out in the Layer 1 world thanks to its innovative Avalanche Consensus, which offers fast and secure transactions. Its focus on custom subnets and sidechains improves scalability and facilitates the development of specialised projects.

Its main rival, Solana, could pose a challenge, as it also stands out for its speed and scalability, competing directly in high-performance blockchain solutions.

Technical innovations

The recent “Durango” update reflects Avalanche’s commitment to technical innovation. Some of the innovations highlighted include enabling native P-Chain transfers, enabling Shanghai EIP on C-Chain to maintain smart contract compatibility with Ethereum, and integrating Avalanche Warp messages into EVM to improve native inter-chain communication in the Avalanche ecosystem.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The emphasis on improving the efficiency of native transfers and the scalability of P-Chain demonstrates Avalanche’s focus on sound technical development. In addition, constant adaptation to industry standards, such as the Ethereum Shanghai Update, demonstrates Avalanche’s ability to stay at the forefront of technology trends.

Projects in the network

Avalanche hosts several notable projects that leverage its highly scalable architecture. Among them are:

ASC-20 enrollments: With over 100 million enrollments since its inception last June, ASC-20 demonstrates the vast potential and market demand for NFT on other networks.

Developing sub-networks: Avalanche is focused on developing sub-networks, recognizing their importance for continued growth. Successful implementation of key features such as BLS drives the full use of Avalanche Warp Messaging, enabling effective communication between sub-networks and accelerating future P-Chain upgrades.

Ecosystem impact assessment

Despite recent fluctuations in price and volume, Avalanche maintains solid fundamentals. Commitment to community-driven upgrades and technical enhancements demonstrates its resilience and adaptability. The successful activation of the “Durango” upgrade reinforces Avalanche’s position as a constantly evolving network.

The impact on the ecosystem is significant, with the network facilitating the creation of diverse projects, from NFT to specialised sub-networks. Technical innovation and focus on industry standards cement Avalanche as a relevant player in the blockchain landscape, poised to meet the challenges and capitalise on future opportunities.

Avalanche’s price is $37.26 registering a decrease of -25% in the last 24 hours. The current CoinMarketCap ranking is #9, with a market cap of USD 14,053,694,464.

Polkadot (DOT): Forging an interconnected future

https://polkadot.network/

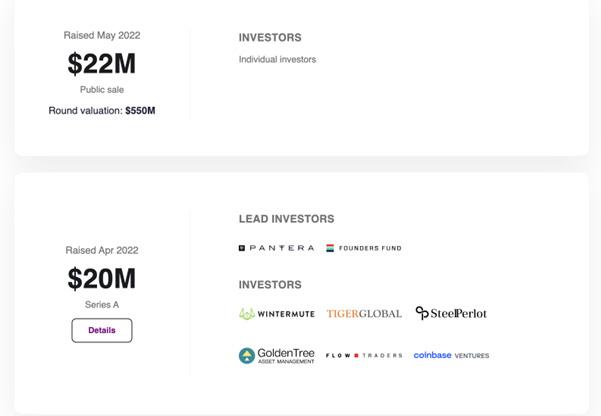

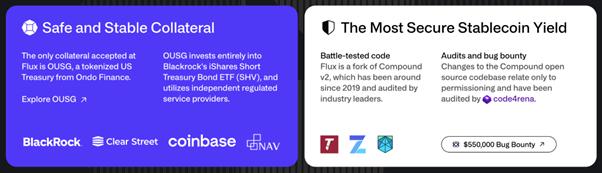

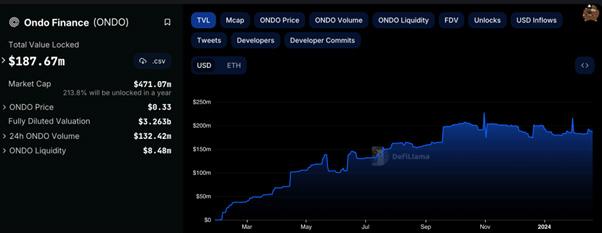

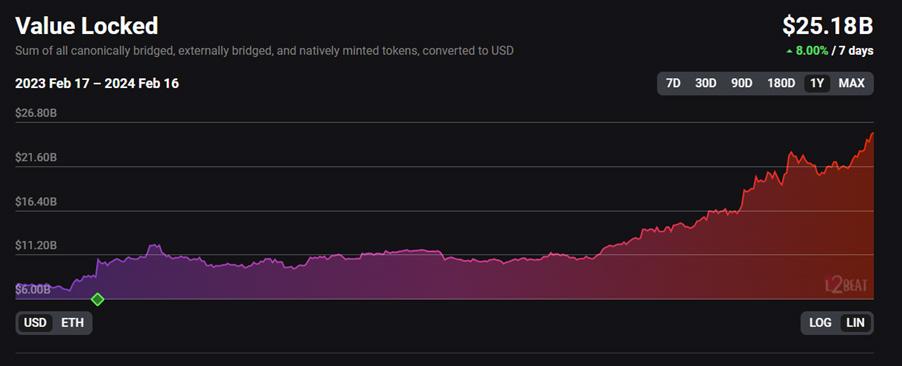

Polkadot is a multi-chain platform that facilitates the transfer of messages and value between different blockchains without requiring trust, allowing them to share their qualities and features while strengthening their security.