2 minute read

Stocks sink as bond yields rise, U.S. jobs data fuels rate hike fears

MSCI’s global index of stocks fell on Thursday, on track for its biggest one-day percentage decline since April, while Treasury yields rose as a surge in U.S. private payrolls fueled concerns that interest rates would stay higher for longer.

Payroll company ADP said June private payrolls rose 497,000, far exceeding economists’ expectations for a 228,000 increase and 267,000 in May. The Labor Department said initial claims for state unemployment benefits rose 12,000 to a seasonally adjusted 248,000 for the week ended July 1, but the prior week was revised to show 3,000 fewer applications than reported.

Advertisement

Compounding worries that this would lead to a more hawkish central bank, Federal Reserve Bank of Dallas President Lorie Logan said on Thursday that a continued above-target inflation outlook and a stronger-than-expected labor market “calls for more-restrictive monetary policy.”

U.S. Treasury yields climbed after the labor market data boosted expectations for aggressive Fed rate hikes to rein in stubbornly high inflation. The U.S. dollar had pared losses against other major currencies after the report while stock indexes were in the red across the board.

“There’s just there’s a lot of uncertainty right now in terms of how strong the economy is and what the Fed might have to do to try to deal with inflation pressures,” said James Ragan, director of wealth management research at D.A. Davidson.

While ADP’s report is not always a good guide for the government’s monthly jobs data, due out on Friday, the private payrolls data was so much higher than expected that raised concerns that Friday’s report would also bring upside surprise, Ragan said.

“Given we’d such a strong end of June the market is, at least for today, taking a more conservative view,” he said.

The Dow Jones Industrial Average fell 340.82 points, or 0.99%, to 33,947.82; the S&P 500 lost 32.11 points, or 0.72%, at 4,414.71; and the Nasdaq Composite dropped 105.76 points, or 0.77%, to 13,685.89.

The pan-European STOXX 600 index closed down 2.34% and MSCI’s gauge of stocks across the globe pared losses to 1.21%. It had fallen as much as 1.7%, which would have been its biggest one-day decline since December.

“All of it paints a picture of a market that’s concerned about the economy and a Fed that is still dead set on tightening monetary policy,” said Alex Coffey, senior trading strategist at TD Ameritrade.

With “no signs of deterioration in the labor market,” Coffey said that increasingly tight monetary policy will “all but assuredly cause some sort of economic slowdown.”

Money market traders now see an 94.9% chance of a quarter-point hike at the bank’s July 26 meeting and was betting on a 28.5% chance of another hike in September, compared with 19.1% on Wednesday, CME Group’s FedWatch tool showed.

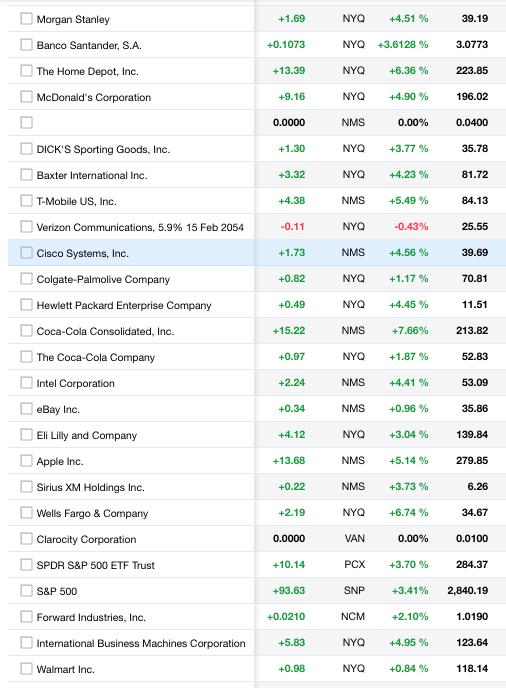

Most Assertive Stocks

Puerto Rico Stocks

And D.A. Davidson’s Ragan noted that futures indicate few bets on rate cuts until June of 2024 compared to recent bets on many as two rate cuts later in 2023.