Welcome to the Sotheby's International Realty 2023 Luxury Outlook.

We believe the reasons for prices staying strong are multifold.First, the world's seen a surge of wealth creation in recent years, and the affluent still have more money to spend. Second, many luxury purchases are made in cash, so the high-end sector remains somewhat insulated from interest-rate fluctuations.

Finally, there's a lifestyle change resulting from Covid-19 that we believe is here to stay. People are spending more of their time at home and putting more of an emphasis on their home lives, even as the world has opened up. What that means is luxury homeowners can rationalize the expenses of owning multiple properties since they are spending more time in them, and are therefore less likely to put them up for sale.

As such, inventory continues to be low, coupled with an under-supply of new construction. Fannie Mae's November 2022 forecast predicted that home sales will decline but begin to rebound in 2024. Fannie Mae economists also believe mortgage rates will steadily fall, but likely not drop below 6% any time soon.

Despite this, we have been busy working with clients who either must move or are looking to make opportunistic investments during a fluctuating market.

In the pages that follow, we'll also look beyond the real estate sector to see what consumers of luxury goods desire, from sustainable luxury items, to record-breaking auction sales, to wine investments. Now more than ever, we know that the affluent want to spend their equity wisely, and we're here to help them do just that.

#3 TEAM NAIONWIDE FORSOTHEBY'SINTERNAIONAL REALTY

JEREMY & ROBIN STEIN

Senior Global Real EstateAdvisors I Associate Brokers

+1917.854.4411 jeremy.stein@sothebys.realty

SteinNewYork.com

“My wife and I have used Robin and Jeremy Stein as our real estate brokers for the past 15 years, representing us in the sale of four apartments in New York City. We have used the Stein Team to represent us because of their professionalism, market knowledge, hard work and ability to maximize value. In every instance, they have dedicated the appropriate resources, time and effort in managing the sale process resulting in a successful transaction.”

- THOMAS

- THOMAS

“Jeremy and Robin are the only people that I would trust as my brokers. They take the time to understand precisely what I am looking for, and as a result, constantly deliver the right stuff. Whether I’m on the buy side or the sell side, Jeremy and Robin always protect my interests, yet still manage to get the deal done. Both their strategy and execution are brilliant, and there’s no one else I’d want in my corner when it comes to residential real estate.”

-ERIC“Jeremy and Robin are professional, knowledgeable and extremely effective. In addition, we always know that they will put our interests first. Twice, they have talked us out of purchasing homes, and each time something better came along later, just as they had suggested it would. We recommend Jeremy and Robin wholeheartedly.”

- ED & LAUREN

- ED & LAUREN

“Thank you for the great job you and your team did in helping to sell our home. We always felt well supported, from our earliest meetings through the final closing. The time, effort, energy and focus that you showed really made a difference, and we appreciate the high level of communication with your team throughout the process. We would highly recommend your group in the future!”

- MICHAEL & LAURIE“Your broker becomes the most important person in your life when finding a home for your family. Jeremy and Robin were trusted advisors during these times in our life. I wouldn’t trust anyone else with that responsibility.”

- WILL

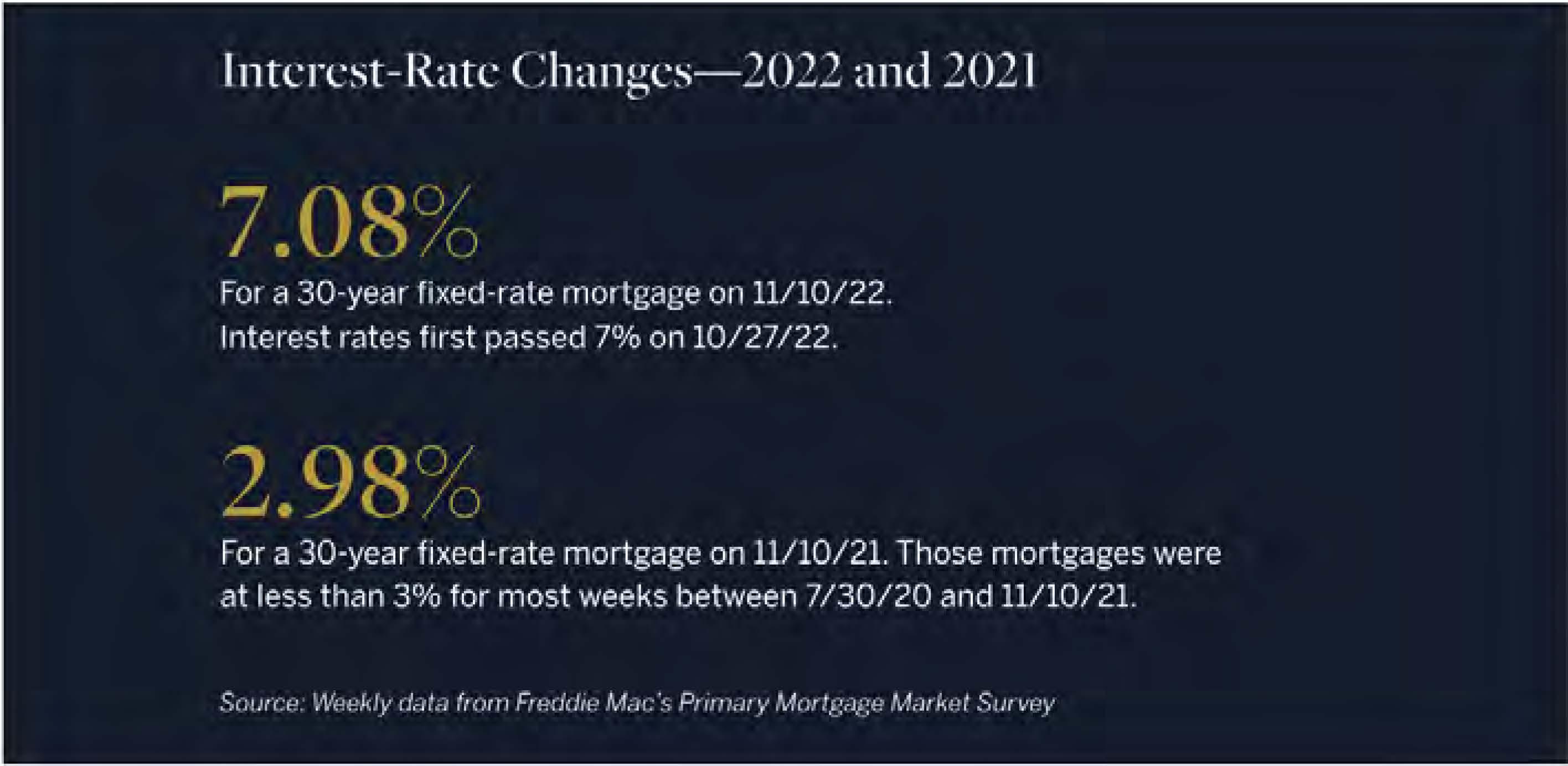

As central banks continue to increase interestrates in an efort tostave of inflation. they've also created adrag in the overallhousing market, as homeowners face higher mortgage costs. For now. though, buyers arestilleagerto gettheir hands on a prime property-especially if they feel they're getting a deal.

"If it's priced in the right range, and it's a special property, it's still moving," says Chris Klug. broker and partner, Aspen Snowmass Sotheby's International Realty. Klug says tl,at more buyers onthe ultra-high-end had been taking out mortgages in the past couple ofyears because of "incredibly advantageous rates:· now he'sseeing more cash buyers, private financing, and porfolio financing.

"Thefear of missing out that was happeninglast yearis now replaced bythe fearof paying too much," says Michael Pallier, managing director, Sydney Sotheby's International Realty. "While the rates are going up. [buyers] mayfeel they don't have to rush because. in six months'time, prices might present a better value."

Higherinterest rates are indeed causinga bitof a "lock-in efect,''according toJim Egan. Morgan Stanley's U.S. housing strategist. On an episode of Bloomberg·s Odd Lots podcast, Egan explainedthat many would-be sellers are choosingnotto selland take on new mortgages. which could end up being two tothreepercentage points higher than theonesthey 1,ave now.As such, he said. he sees listings staying tight. protecting home prices frm falling.