Gas stations seek ‘pennies on gallon for liveable wage’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN petroleum retailers yesterday revealed they are seeking a “pennies on the gallon” margin increase equal to 7 percent of the landed cost of fuel to achieve their version of a “ liveable wage”.

Raymond Jones, the Bahamas Petroleum Retailers Association’s (BPRA) president, last night told Tribune Business that such an adjustment was critical “to allow us to survive as retailers” given that existing price-controlled fixed margins simply cannot cover a multitude of ever-increasing costs.

Believing that “the Bahamian public will be OK to absorb a few cents more” on the per gallon cost of gasoline, he provided several insights into the increasing hardship faced by many gas station operators due to an inflexible business model that has left many unable to break even let alone enjoy a profit.

Mr Jones said turnover-based Business Licence fees have almost doubled year-over-year due to last year’s spike in global oil prices following Russia’s invasion of Ukraine, which saw gas prices peak at around $7.20 per gallon during the 2022 first

half. Noting that his fee has increased to almost $25,000, he estimated that “99 percent” of the Association’s members will be unable to make payment by this Friday’s March 31 deadline and will be seeking to agree payment plans.

Speaking after the Association’s executive committee met yesterday to discuss their next move, after receiving no firm proposal or request for a further meeting with the Government following their first encounter two weeks ago, Mr Jones

SEE PAGE B4

Sir Franklyn ‘more confident’ than ever gas woes solved

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

• Want margin rise equal to 7% of landed fuel cost

• Feel ‘public will be OK to absorb a few cents more’

• Business Licences double; dipping into pensions

Bahamas First sees 10% motor vehicle claims rise

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMAS First’s top executive yesterday that motor vehicle claims increased “by at least 10 percent” in 2022 due to a return to pre-COVID traffic volumes combined with increased vehicle repair costs.

Patrick Ward, the BISX-listed property and casualty underwriter’s

president and chief executive, told Tribune Business that besides traffic accidents returning to typical pre-pandemic frequency it also had to deal with the “impact of inflation” on auto repair costs.

This, he explained, impacted both the cost of spare parts and new and used vehicles if the damaged auto proved a write-off and had to be fully replaced. “The cost of repairs increased, the

cost of supplies increased, and when you combine that with the frequency of accidents we expected to see an increase in the cost of claims simply because of those two factors,” Mr Ward explained. “We probably saw at least about a 10 percent increase in the outlay.

“The supply shortages are starting to abate a little bit. We are seeing parts

SEE PAGE B3

Receivables fear if VAT health claims change

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A PROMINENT doctor has voiced fears that medical practitioners will have to pay VAT if their patients cannot afford to do so should the Government persists with the changed tax treatment of

health insurance claims payouts.

Dr Duane Sands, also the Free National Movement (FNM) chairman, told Tribune Business that “not many medical practitioners can afford to do that” and carry the VAT burden for patients who simply cannot afford to pay the full 10 percent levy on their cost of care.

“We have a number of people who have private insurance who don’t have a co-pay,” he explained. “The Government will come looking for a VAT payment from the patient that the provider may not have received. They may be responsible for paying a tax they may not have collected.

“It will leave practitioners to carry an unreasonable level of accounts receivables. Once it’s on my books they don’t care if the patient has not paid. They want their money. Imagine if I’m carrying a $10,000, $30,000, $50,000 receivable that may not be collectable.

SEE PAGE B4

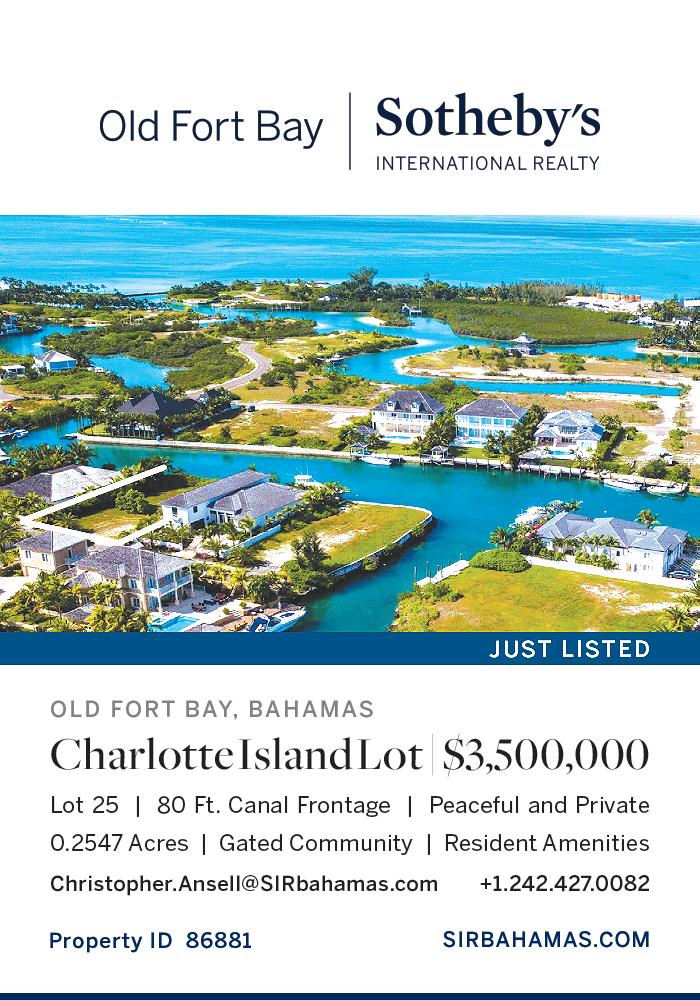

New Bay Street attraction targets 75 hires this week

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A NEW Bay Street tourist attraction is aiming to hire up to 75 persons by the end of this week following its Saturday recruitment drive, the Government’s top labour official said yesterday.

Robert Farquharson, director of labour, told Tribune Business that

135-140 persons attended, out of just over 300 who pre-registered, at last Saturday’s job fair that his department held in conjunction with I Dream of Sugar.

“The company was able to hire about 20 people on the spot,” he said. “The intention was to hire 75 people. They have about 55 people they are looking at, and second and third interviews have been

arranged for this week. I spoke to their operations manager and they are pretty pleased with the selection who showed up. They were able to hire 20 people, and are looking to hire about 55 people this coming week.”

Mr Farquharson said the Department of Labour has also partnered with a cruise line

SEE PAGE B5

FOCOL’s chairman yesterday said he is “more confident” than ever before that the push by Bahamian petroleum retailers for increased margins can be resolved “without adversely impacting the motoring public”.

Sir Franklyn Wilson, speaking as the BISX-listed petroleum products supplier and its competitors were yesterday submitting their thoughts on the issue to the Government, again reiterated to Tribune Business his belief that the Bahamas Petroleum Retailers Association and its members have made “a credible case” for a margin rise.

However, he added that there was “a lot to suggest” that the present pricecontrolled fixed margin “works” to some extent, and said there was nothing to prevent either the three oil companies - Esso, Rubis and Shell (FOCOL) - from seeking to seize market share by discounting and other commercial tactics.

Asserting that “people find a way”, as such practices have been employed in the past, Sir Franklyn told this newspaper: “The position is that the oil companies will respond to the Government in a way that they each deem appropriate. I think today was when

• Predicts ‘no adverse impact’ for motorists

• Gas station operators now ‘at our wits end’

• Willing to accept phasedin margin rises

the letter was supposed to go in. FOCOL is sending a reply, and I believe the others will be as well. “I have no doubt that the matter can be concluded without an adverse impact on the motoring public. I am more confident today than the last time I spoke to you. It’s not a crisis. It’s a desire that is creditable and reasonable, but it is not a crisis. This does not constitute a national crisis. Dorian was a crisis, Matthew was a crisis, COVID was a crisis. Everything is

SEE PAGE B2

business@tribunemedia.net TUESDAY, MARCH 28, 2023

BAHAMAS PETROLEUM RETAILERS ASSOCIATION’S (BPRA)

SIR FRANKLYN WILSON

PATRICK WARD

ROBERT FARQUHARSON

$5.67 $5.67 $5.72 $5.59

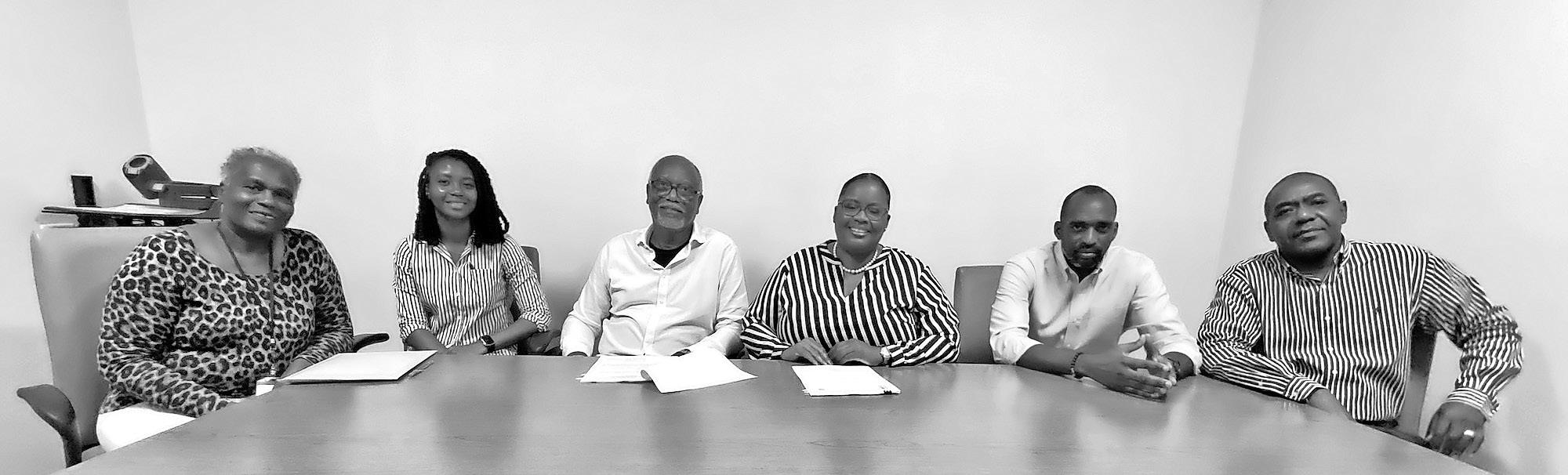

WHY BAHAMIAN CITIZENS MATTER AND NEED A VOICE

By ROBERT MYERS

AFTER many years serving as an advocacy leader for the business community, I became acutely aware of a critical representation gap among citizens who attempted to move The Bahamas forward, upward, onward, together. I realised that no matter what tax legislation was passed or incentivizing policy advances, a void existed in the day-to-day representation of the people (civil society) on issues that progressed national development. While the private sector, public sector and political parties all had a significant voice and representation in the development of the country’s future, civil society’s voice was poorly represented on a daily basis.

ROBERT MYERS

The meaningful dayto-day civil society representation for Bahamians from every walk of life, who expect progress, accountability, the equitable enforcement of the rule of law and rights from their government, needed to be improved. The people’s

right to freely obtain public information, to be heard, to hold the Government accountable for how it manages and spends the people’s tax dollars, and the right to demand higher standards from public school education, were all deficient. The business community had clout with the Government, but Bahamian citizens did not. They needed and deserved the right to matter and seek resolve. It required more than just the right to express dissatisfaction by voting for one political party or another every five years; history has proven that action to be slow and cumbersome.

So, in 2014, after six years with the Bahamas Chamber of Commerce and Employers Confederation (BCCEC), I left office

as its chairman and began laying the groundwork for the founding of the Organisation for Responsible Governance (ORG).

Having written position papers on education, economic development and responsible governance, I shared these papers and thoughts with several like-minded progressive Bahamians. I pitched the idea of forming a civil society organisation.

On July 21, 2015, ORG Bahamas Foundation - The Organisation for Responsible Governance (ORG) - was officially launched and funded by the founding councillors. The organisation had a mandate of establishing an operational executive team to grow civil society membership while focusing on advancing education,

ORG chairman stepping down

THE ORGANISATION for Responsible Governance (ORG) yesterday announced that Robert Myers, one of its founders, has stepped down as Board chairman after almost eight years in the post.

The group hailed his role in establishing ORG’s non-partisan mission, and driving its growth to become a voice for accountable governance, economic development and education reform in The Bahamas.

Mr Myers will remain on the ORG Board, while vice-chair Galen Saunders will take over as interim chairman.

Mr Myers said: “I am incredibly proud to have chaired the foundation for

over seven years, and it has been an honour and pleasure serving alongside my fellow Board members. I am also proud of the many accomplishments and works in which the ORG team, all its members, and generous donors have played a part.

“For the sustainability of any organisation, it is essential to make way for new leadership. As such, I have stepped down as chair and look forward to ORG remaining focused on the principles with which it was founded, and I look forward to supporting all that it provides the people of The Bahamas.”

Reflecting on Mr Myers’ time at ORG’s helm, Mr Saunders added: “As a

result of Mr Myers’ leadership, ORG has achieved significant progress in advancing its core issues and influencing public policy. His tireless advocacy, data-driven policy approach and personal commitment to The Bahamas have been instrumental in shaping ORG’s positive impact and legacy.

“Since his time as chairman of the Bahamas Chamber of Commerce, Mr Myers’ drive and unfettered determination have inspired me. He has spearheaded some of the most important initiatives ever taken on behalf of the Chamber and the Bahamian business community. Mr Myers did all this while

balancing geopolitical issues and their ultimate impact on the general socio-economic position of the country as it relates to the development of The Bahamas and the welfare of our people.” Matt Aubry, ORG’s executive director, said: “Robert Myers’ contribution to ORG has been invaluable, and our team is immensely grateful for his leadership, vision and unwavering dedication. His passion for responsible governance and social justice has inspired many Bahamians and impacted our society.”

Mr Myers’ decision to step down from the chairmanship comes as ORG

responsible governance and economic development, the primary pillars of growth and progress for responsible, successful and sustainable nations.

ORG recognises that these are not the only pillars of societal growth, but perhaps the foundational pedestals without which all else falters. Therefore, the explicit interconnection between these three mechanisms is essential for the growth and development of any prosperous society. The critical element to this winning formula is ensuring that citizens understand this concept’s importance and then demand it from their government. A prosperous and sustainable society cannot have responsible governance or economic development without an

prepares for a new phase of growth and development.

It is currently undergoing a strategic planning exercise to build on its achievements and expand its impact on critical issues affecting The Bahamas.

On assuming his new role, Mr Saunders shared:

“I am proud to have been one of the founding members of ORG alongside Mr Myers and other nationbuilding, like-minded business leaders and civil society stakeholders in The Bahamas. During the coming weeks and months, I will assume the interim positions of chairman of the Board and Council president as we strategise to select a new leader to fill these roles and oversee the continued development of the ORG Bahamas Foundation.

Sir Franklyn ‘more confident’ than ever gas woes solved

FROM PAGE B1

relative. I am absolutely convinced [this will be resolved] because it’s not a crisis.”

FOCOL and its fellow wholesalers had previously been asked by the Government to review “some options and ideas” that were discussed previously between the parties, and respond “within a few days” with their position to the Davis administration, amid retailers’ complaints about how their survival and profitability are being squeezed by inflexible pricecontrolled margins that are

insufficient to cover everescalating operational costs. The Davis administration has engaged with the three oil major wholesalers as part of its promised strategy to review the industry’s costs and pricing at every level as it bids to square its ‘no increase in pump prices’ stance with gas station operators’ demands for relief via higher margins.

Sir Franklyn told Tribune Business that solving such disputes in a democratic system often became “messy” because all parties aired their respective viewpoints publicly and often never entirely see

LEGAL NOTICE

Flow Global Holding Fund Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that Flow Global Holding Fund Ltd. (Registration no. 204344 B is in dissolution. The date of commencement of the dissolution was the 3rd day of February, 2023. The Liquidator of the Fund is Deans Corp. and can be contacted at Winterbotham Place, Marlborough & Queen Streets, P.O. Box N-3026, Nassau, Bahamas. All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 28th day of April, 2023.

Deans Corp. Liquidator

LEGAL NOTICE

Delancy Company Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), Delancy Company Ltd. (the “Company”) is in dissolution. The date of commencement of the dissolution was the 3rd day of February, 2023. The Liquidator of the Fund is Deans Corp. and can be contacted at Winterbotham Place, Marlborough & Queen Streets, P.O. Box N-3026, Nassau, Bahamas. All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 28th day of April, 2023.

Deans Corp. Liquidator

eye-to-eye when such issues are sorted. “Because democracy is messy, the pathway to resolving differences differs, but you find a solution,” he added. “It’s messy, it’s uncomfortable but life goes on.”

Asked whether it was time to reform the petroleum industry’s fixed price-controlled margins, and switch to another system, Sir Franklyn replied that while it may not entirely be consistent with free enterprise “the fact of the matter is that it’s been in place a long time. There’s a lot to suggest it works. Every so often problems develop when

circumstances lead one party or another to do it.

“Despite the case the Association is making, there are individual wholesalers, individual retailers who seek to change all their market share by discounting. People find a way. All I’m saying to you is it’s just a matter of record that, while it’s a time when the Association is making a case for margin and price increases, and while I’m on record saying it’s a credible case, the fact of the matter is there are people discounting.”

Meanwhile, Vasco Bastian, the Bahamas Petroleum Retailers Association’s

LEGAL NOTICE

Vogue Assets Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), Vogue Assets Ltd. (the “Company”) is in dissolution. The date of commencement of the dissolution was the 3rd day of February, 2023. The Liquidator of the Fund is Deans Corp. and can be contacted at Winterbotham Place, Marlborough & Queen Streets, P.O. Box N-3026, Nassau, Bahamas. All persons having claims against the abovenamed company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 28th day of April, 2023.

Deans Corp. Liquidator

LEGAL NOTICE

Dorchester Fund Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that Dorchester Fund Ltd (Registration no. 204345 B is in dissolution. The date of commencement of the dissolution was the 3rd day of February, 2023. The Liquidator of the Fund is Deans Corp. and can be contacted at Winterbotham Place, Marlborough & Queen Streets, P.O. Box N-3026, Nassau, Bahamas. All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 28th day of April, 2023.

Deans Corp. Liquidator

(BPRA) vice-president, told Tribune Business that its gas station operator members are “at our wits end” over the inflexible 54 cent and 34 cent gasoline and diesel margins, respectively, that are no longer sufficient to cover a multitude of ever-increasing operating costs (see other article on Page 1B).

Suggesting that retailers will be receptive to a margin increase that is phased in, he said: “We are waiting patiently for the Government to respond and I hope they come back to us with something very favourable that we can all live with. We wait in limbo for the Government to get back to us, we hope with something positive. We’re willing to work with the Government on a phased-in approach with smaller margin increases.

“Something has to break. We’ve been very patient. We understand the challenges the Government faces in not wanting to pass the increased cost on to the consumer, but every other cost is being passed on to the consumer. We cannot absorb it any more. There’s nothing more we can do. We’re in a heavily regulated, fixed margin price-controlled industry. What else can we do? What else can we do?

“We’ve been very very patient with this government, and we applaud them for whatever they’re going to do. Let’s make a decision on what we need to do, and push past this last step while the price of oil is relatively low. Now’s the time to do

educated populace. They are evident in responsible families, communities and societies.

I am incredibly proud to have chaired the foundation for more than seven years, and it has been an honour and pleasure serving alongside my fellow Board members. I am also proud of the many accomplishments and works in which the ORG team, all its members and generous donors have played a part. However, for the sustainability of any organisation, it is essential to make way for new leadership. As such, I have stepped down as chairman and look forward to ORG remaining focused on the principles with which it was founded, and I look forward to supporting all that it provides the people of The Bahamas.

“Mr Myers has shined like a beacon since establishing the Organisation for Responsible governance. His vision for this country’s true and productive development and its people mirrors mine. This is why I was very pleased and proud to assist in creating and developing ORG as a founder some eight years ago, and today am just as proud to lead ORG into a new phase of success.”

“ORG has become wellpositioned to achieve its goal of promoting and ensuring, for the first time, true transparency, accountability and good governance in aspects of our country’s proper and efficient development. We endeavour to be the ever-watchful eye on behalf, and in the best interest, of the Bahamian people – now and in the future.”

it. We cannot wait until it’s summer when the price of crude oil will shoot back up. It’s a very difficult position for us all, but has to be done for the survival of the industry. We’re not asking for an astronomical amount.”

Mr Bastian said the retailers presented the Government with three different options for resolving their plight when they met with Prime Minister Philip Davis KC two weeks ago yesterday, and added: “We are united in our cause. We need to survive. All options are on the table in regards to our future. We’re not leaving anything off the table. “This is the most united that the association has been in 20 years. We’re ready and prepared. We want to work with the Government. The Government has been trying to work with us, and we want to try and work with the Government. We want to work with this government to try and bring some relief to the issue. We cannot absorb anything else. We are at our wits end. We want to get this issue behind us. It’s been 15 months....

“We just want the Government to come to our aid, take a hard look at everything and do what is right and move forward. At a stroke of a pen the Prime Minister, minister Halkitis and his colleagues can give us relief. This all goes away. We can go back to what needs to be done, working in our business, feeding our families, keep people employed, buy from the vendors we buy from, pay NIB, Business Licence fee and electricity bill.”

LEGAL NOTICE

Providence Capital Fund Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that Providence Capital Fund Ltd. (Registration no. 204346 B is in dissolution. The date of commencement of the dissolution was the 3rd day of February, 2023. The Liquidator of the Fund is Deans Corp. and can be contacted at Winterbotham Place, Marlborough & Queen Streets, P.O. Box N-3026, Nassau, Bahamas. All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 28th day of April, 2023.

Deans Corp. Liquidator

PAGE 2, Tuesday, March 28, 2023 THE TRIBUNE

TAXI INDUSTRY ‘CHAOTIC’ ON RATE RISE VACUUM

By YOURI KEMP

THE BAHAMAS Taxi Cab Union’s (BTCU) president yesterday argued that the Government has “missed a golden opportunity” to fully regulate taxi fare rates.

Wesley Ferguson told Tribune Business there is now a lack of uniformity in the industry’s pricing structure because some of his members decided to

raise rates themselves. Fees and prices now vary, with the union chief saying this has occurred because his members had growing increasingly tired of waiting on a decision by JoBeth Coleby-Davis, minister of transport and housing, to approve a rate increase. “The taxi drivers now realise that the minister is not meeting with the union. So what they are doing is what they were doing as usual; they are just charging people whatever they wanted to charge. So, essentially, what they have done

GB CHAMBER CHIEF: ‘TIME TO PUT ON BIG BOY PANTS’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

GRAND Bahama’s newly re-elected Chamber of Commerce president yesterday said it is “time to put on our big boy pants” and get to work.

James Carey, speaking to Tribune Business after his re-election, said there is much to be done on Grand Bahama and all parties have a role to play in building a stronger partnership with the Government and the Grand Bahama Port Authority (GBPA).

He said: “My new term will be more of the same. I would love to see some things happening, and I think great opportunities are ahead of us if government works in conjunction with the GBPA. We’re going to have to put on all the big guy pants and let’s make this go. I think the opportunity is there for Grand Bahama and we want to participate in it.”

Besides the optimism, Mr Carey said there were still numerous questions that must be resolved. He asked: “What’s the plan for Freeport, and what are we seeking to do for Freeport? What are we seeking to develop, and where are we going with this thing, or are we just hoping to get some business to come in and save us?”

With work scheduled to start on the Grand Bahama International Airport’s redevelopment this week, the GB Chamber chief added: “The ground-breaking is what I am interested in and other things like the hospital.” He acknowledged that GBPA licensees have been “relatively quiet for the time being”, but said “they are very determined” to get their point across and all have a “right to speak up” on matters related to Freeport.

Last March, several Grand Bahama businesses protested outside the GBPA’s head office over the lack of economic development on the island. Mr Carey said: “I’m sure something has been resolved for them, but I think more about the process at the GBPA has been explained. I am not aware of any other particular issues right now other than those we are all familiar with. “

is give themselves a raise,”

Mr Ferguson explained.

“The minister missed a golden opportunity to regulate the taxi rates. Because she didn’t do that, it costs the taxi drivers because they are all self-employed and they are not getting a set salary. So now the industry has become chaotic.”

Mr Ferguson and his union had requested a 30 percent fare increase last year to help offset rising fuel costs and inflation, but no decision from the Government was forthcoming and relations with the

union appeared to fracture amid accusations that the Road Traffic Department had saturated the market by issuing more taxi plates than necessary.

Mr Ferguson added: “They really don’t need the minister to tell them what to charge, but we would have preferred if the minister did give the taxi drivers a raise. She might have made a mistake with granting too many taxi plates, but if she would have given the raise she would have circumvented all of the negativity

behind over-saturating the industry.”

The Ministry of Transport, meanwhile, last week met with the Bahamas Hotel and Tourism Association (BHTA) and other tourism stakeholders on ways to collaborate in improving standards in the taxi industry. The taxi cab union, though, was not invited to the meeting.

Mr Ferguson said: “The minister would not have invited me to that. I’m not that obnoxious to invite myself to a meeting that I was not invited to. They

can’t box me in because I don’t work for them. These people who the minister met with, they have a job. They work for someone and they have titles. But I don’t work for anybody. I work for the taxi cab union and myself.

“So the minute you try to box me in, I find an outlet and I’m going to bounce back and I’m going to revolt, but those people are professional people and they are not going to revolt. They go with the flow because they can’t be seen as unreasonable.”

SURVEYING CONTRACT SIGNED FOR SOLAR ENERGY MICROGRIDS

A CONTRACT for the surveying of lands on Mayaguana, Inagua, Crooked Island and Long Cay has been signed in preparation for the installation of the microgrids on those islands.

These microgrids are a part of the Government’s priorities to focus on climate change

resilience and renewable energy. The identified sites for the microgrids are on or near existing Bahamas Power & Light (BPL) power plants. The scope of works of these surveys considers the installation of various sizes of utility-scale solar photovoltaic

(PV) systems with battery energy storage. The surveys will provide an official inventory of the lands. Donald Thompson, of Donald Thompson and Associates, signed the contract with the Ministry of Finance to carry out the works on those islands.

Bahamas First sees 10% motor vehicle claims rise

FROM PAGE B1

coming out

and being more available than they were at the height of the pandemic, so we the impact of price increases and inflation to reduce. There are signs that it is starting to abate a little bit. It’s still higher than we’d like to see, but it’s starting to flat-line and reduce from the peak point which would be about a year ago.”

Bahamas First, in recently unveiling its 2022 annual unaudited results, blamed the more than $3.5m or 11 percent yearover-year fall in underwriting income to to $29.404m, as opposed to $33.031m the prior year, on higher motor vehicle claims as well as issues with its Cayman-based health insurance portfolio.

“The motor portfolio in The Bahamas experienced a reduction in underwriting profitability due mainly to a return to more normal frequency and severity of damage claims, and prior year adverse loss development. Additionally, the Cayman health business continued to perform below our expectations,” Mr Ward informed shareholders.

“The roll-out of new technology and connected systems, together with a change in key personnel within the health segment, has caused a number of operational challenges for our Cayman subsidiary, leading to negative

market perceptions about the company’s ability to fulfill its obligations to policyholders.”

Mr Ward yesterday said Bahamas First was confident that its Cayman health insurance challenges will be resolved in 2023. “We’re still at it,” he told this newspaper. “We’re making steady progress. A lot of the concerns related to the roll-out of new technology implemented in the Cayman operation, which had an impact on operations and the ability to process claims on a timely basis.

“We’re making steady progress getting back to where we were prior to the pandemic. The pandemic created issues for us from an operational standpoint. We’re well on our way to getting back to where we’d like to be, and hope in 2023 that we will achieve that objective.”

Bahamas First’s 2022 total comprehensive income rose by 39 percent year-over-year in 2022, hitting $6.6m compared to $4.8m in 2021, largely thanks to a $3.2m revaluation gain on its property assets. Mr Ward, while confirming there will be no such bounce in 2023 as the revaluation is performed once every three years, voiced optimism that Bahamas First will match or beat last year’s results from an operational standpoint hurricanes permitting.

“The Bahamian economy continues to improve, and Cayman is doing well as well,” he added. “Our expectation is that, barring any significant adverse claims activity, there is no reason why we cannot do just as well.” And Bahamas First has not given up on further Caribbean expansion opportunities beyond this nation and the Cayman Islands, although Mr Ward identified no specific targets. “We’ve still got ambitions to diversify our portfolio further in the region but nothing specific to report at this point,” he said.

The Bahamas First chief, though, warned businesses and homeowners not to expect any softening of property premium prices for up to two years due to the shortage of reinsurance capacity available to local underwriters. And any change in pricing, he added, will be up rather than down.

“I would say for, certainly the next 12 to 24 months, it’s not likely the market conditions are going to change significantly,” Mr Ward said. “The capacity scenario that currently exists in terms of shortage of capacity and hardening of pricing is something that will persist for the next 12-24 months. At best, there will be no change. In a worse case scenario there will be some level of increase.”

He added, though, that all consumers seeking property and

casualty coverage would be able to secure it. “Most people that need to have cover in place, most people should be able to find a carrier to accommodate them in one form or another,” Mr Ward said.

He added that the company’s online portal, where new and existing clients can either take out or renew coverage, and pay for it, had proven its worth with user figures increasing every month. “We’ve seen a steady growth in the use of the portal particularly because of the convenience of being able to pay and renew online,” the Bahamas First chief said.

“We expect that growth to continue as more and more people migrate to that platform to take out and renew policies. As time goes by we expect it to be a more and more significant feature for us, and more people to use it. We didn’t really set any firm expectations for it as it was a very new product on the insurance side in The Bahamas and from a regional sense. We didn’t have any great data around what the expectations would be.

“We are starting to see it grow, which is the most important dynamic. It’s definitely been worth the investment. We’ve seen it grow every quarter, having launched it just over one year ago.”

THE TRIBUNE Tuesday, March 28, 2023, PAGE 3

Tribune Business Reporter ykemp@tribunemedia.net

From L to R are: project legal counsel, Adelma Roach; Genique Kemp and Donald Thompson of Donald Thompson and Associates; project manager, Sharon Stuart; project electrical engineering specialist, Alden Austin; and procurement specialist, Don Gray.

Photo:Kristaan Ingraham/BIS

Gas stations seek ‘pennies on gallon for liveable wage’

said he had informed the Prime Minister then of how one gas station operator was using his pension money to cover operating costs and maintain staffing levels due to insufficient margins.

Vasco Bastian, the Bahamas Petroleum Retailers Association’s vice-president, told Tribune Business that gas station operators had yesterday agreed to give the Government a little more time to respond with either a formal proposal on how the industry’s concerns can be resolved or scheduling another meeting. However, failing that, he said members will vote “on whether we should continue to operate” with the present margins.

Clint Watson, the Prime Minister’s press secretary, yesterday said he would “revert” to this newspaper after inquiries were made as to the Government’s formal position on the petroleum retailers’ concerns and whether this had been communicated to the industry. However, no response was received before press time last night.

Mr Jones, meanwhile, said of the meeting: “We just discussed ways and means to reduce our operating costs. We’re hopeful that the Prime Minister and the Government would understand the plight we face with fixed margins and fixed costs and come to a mutual position that allows us to survive as retailers. We’re investors in this country.”

The last margin increase enjoyed by gas station operators occurred in 2011, some 12 years ago, under the last Ingraham administration, and operating costs and inflationary pressures have increased substantially

then. That took gasoline margins from 44 cents per gallon to 54 cents, where it has remained ever since, while diesel stands at 34 cents per gallon. Mr Jones contrasted the industry’s inflexible, pricecontrolled fixed margins with the food distribution sector. While much of the latter’s produce is price controlled, retailers and wholesalers have percentage-based - rather than fixed - margins and markups that allow them to apply for cost increases as the landed costs change.

Noting that the price of half-gallon almond milk had suddenly increased from $6 to almost $11, Mr Jones added: “The Government is not complaining about that because other retailers are allowed to adjust their price to compensate for increasing costs. In our case we’re stuck at a 54 cents fixed margin with rising costs and no ability to adjust to economic conditions. Every other business has the ability to adjust their selling price to accommodate that cost.”

Pointing to the phased increase in Bahamas Power & Light’s (BPL) fuel charge, which the Government permitted to take effect last October to allow the energy monopoly to recover increased costs, the Association president said gas retailers were only asking that they be afforded the same treatment and be granted the profit margins they “need and deserve”.

“We understand the Government’s plight, saying they do not want to push that cost to the public, but cost is cost,” Mr Jones said, adding that operators need to gain “a margin reflective of profits that allow us to survive in this industry”. The Government, though, has consistently ruled out

any margin increase on the basis that it does not want to impose a further cost increase on consumers and businesses still struggling with the wider cost of living crisis.

This was reinforced in the Government’s most recent statement, issued after it met with the petroleum retailers two weeks’ ago, in which it said: “While the government is sensitive to the plight of petroleum retailers, who have primarily asked for an increase on the currently fixed margin of 54 cents per gallon, it is also a priority of the Davis administration to act in a manner that does not impose a further financial burden on consumers.

“In light of this, the Government has agreed to explore other avenues to bring some relief to the retailers.” These other avenues were not detailed, and the statement effectively means the Government and retailers are at an impasse given that the fixed, inflexible margins are at the root of the latter’s calls for change.

Mr Jones, recalling an encounter with a lady who paid for $11 worth of gasoline with a $50 bill, and said she needed the change to help feed her children, added: “In order to serve the public we need to make a profit to pay our bills as well. We’re simply asking the Government for a 7 percent increase on the landed (imported) cost of fuel. It’s pennies on the landed cost.

“We’re simply saying treat us the same way. Allow us to make adjustments as the Government. Give us an adjustment that’s reflective of the true operating costs. We cannot make money on the current margins. We need the ability to earn a profit.

“The current 34 cents diesel margin, it’s not worth buying it at that margin we have on it, but we have to be a full service provider to the public. We have to have it, but the amount we invest for the margin, the cost to pay for it, the cost of overdraft fees, the cost of buying that fuel and having it in the tank to sell it is not very economical but it’s a necessary thing to do because it’s part of the product we offer to the public.”

Listing the ever-rising costs that fixed gasoline and diesel margins must absorb, Mr Jones pointed to the 2-3 percent “commission” or fees charged on every debit and credit card payment. On a $6 gallon of gasoline, the 3 percent charge amounts to 18 cents or one-third of the 54 cent margin, although this might be slightly less depending on the issuing bank.

With The Bahamas still largely a cash-based economy, he added that some gas station operators are being charged between $4,000 to $10,000 a month to deposit cash. With banks unwilling to accept such deposits over the counter, the industry is now incurring fees for doing this via the night deposit box.

And, with many of the petroleum industry’s 1,000plus employees earning the minimum wage, Mr Jones said their has increased by 24 percent or $50 per week due to the increase. While not opposed to the rise, he added that this has increased payroll costs for gas stations while also raising associated National Insurance Board (NIB) contributions.

And, to maintain the “spread” between minimum wage employees and others, gas stations have been forced to raise pay for cashiers as an example.

Receivables fear if VAT health claims change

FROM PAGE B1

There are not many medical practitioners I know that can afford that.”

The Davis administration has deferred the VAT treatment change, which many doctors and insurers fear will increase medical bills and treatment costs for thousands of Bahamians with private health insurance, and will not proceed prior to end-May’s Budget debate to allow time for further consultation after medical practitioners raised concerns about the impact it would have on patients, healthcare costs and their businesses. The altered VAT treatment had been due to take effect on April 1, and would have left patients/

consumers responsible for paying the full 10 percent levy on treatment, care and medicines. They are presently only covering the VAT due on the co-payment, which is typically 20 percent of the total costs, but the revision would have also left them carrying the tax burden on the remaining 80 percent of the bill that is paid by the insurers.

Dr Sands said the Government appeared to have assumed that the healthcare industry was a high margin business ripe for extracting more taxes from, but he argued this was not the case. “These sorts of medical financial decisions are clearly not thought out carefully,” he told Tribune Business

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, RASHAAD RENARDO RIDDLE of Nassau, The Bahamas, intend to change my name to RASHAAD RENARDO BOWE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

Gibson & Associates is seeking to employ an Attorney who possesses knowledge of Conveyancing and Real Estate, Probate and Estate Planning, Civil Litigation and Family Law. Applicants should be organized, self-driven, innovative, diligent, a team player and have the ability to work with minimal supervision. The successful candidate should demonstrate the following competencies:

• Excellent written and verbal communication;

• Excellent organization and prioritization skills;

• Detail oriented;

• Good client liaison skills;

• Ability to multi-task;

• Self motivated; and

• Professionally polished.

Salary will commensurate with qualifications and experience. Interested persons should email the resumes to dgibson@gibsonlawbahamas.com

“There’s no holistic conceptualisation of the impact of these decisions. It’s somebody in an ivory tower, a silo, deciding the health industry is worth ‘x’ millions of dollars and if they add 10 percent VAT they can get ‘y’ million a year. The truth is if you impose that tax now you are going to cripple the delivery of healthcare. You are going to take the public healthcare system, which is already over burdened, and bring it to its knees.

“This is clear to the persons who work in the system. All you need to do is have a technical conversation with people who work in the industry to realise this is a dumb idea. I hope that insurance experts, medical experts,

Security costs have also increased, as third-party contractors pass the minimum wage’s impact on to gas stations and their other clients.

“It’s a domino effect in all these rising costs,” Mr Jones said. “We only have 54 cents per gallon to play with. All these things take a bite out of the 54 cents. Energy costs are going up, and insurance costs have increased by 15 percent. That’s a hard cost we have to cover. You have insurance, energy costs, credit card fees, bank deposit fees, salaries and wages and operating and maintenance costs. The 54 cents has been the same for the last 12 years.

“All we’re asking the Government to do is change the margin so we can have a liveable wage. We’re asking for nothing less than an adjustment that reflects a reasonable margin that allows us to continue to invest in the business... We have to do something in the interim to reduce costs.

“Come the end of March we have to pay the Business Licence fee, and 99 percent of them said they are not in a position to do that. Some of them are going to write in and ask the Department of Inland Revenue (DIR) for a plan to pay this off. The Business Licence fee has almost doubled because of last year’s oil prices and the fact it’s based on turnover.”

The petroleum industry is a volume-based business, but Mr Jones said increased tourism numbers and economic activity were not translating into greater sales or market share for operators. “All we’re asking for is a reasonable margin to enable us to make a reasonable profit as investors in the Bahamian economy,” he reiterated.

“Nobody wants to reduce staffing levels. We’re a full service business. We need to be able to recover that cost, and make a small profit to allow us to survive in the industry.” Absent a resolution or failure to get the Government “back to the table”, Mr Jones said the obvious cost reduction option for retailers to employ is to reduce working hours for many staff.

“That is not the preferred solution,” he added. “We believe the Bahamian public will be OK to absorb a few cents more on the cost per gallon of fuel. That’s all we’re asking for. We’re not asking for $2 more or $1 more per gallon. There’s no expectation of that. We’re asking for 7 percent more on the cost of landed fuel, which gives us a living wage.

“We’re not aiming to disrupt the economy; that’s not our plan. Next week, Easter, will make one year since we began discussions with the Government on this. We understand the Prime Minister is very busy. There’s no threat. We want to sit down, get an agreement on what we can adjust so we can put this to bed and move on. All we’re saying is give us pennies on the gallon and that will change the look of our business long-term.

“I’ve been in this business since 2014. Some of these guys have been in the business for years, inherited it from their fathers, and are wondering how they will get a return if they can’t break even now from rising costs. Why is it difficult to ask the public to pay 20 cents extra for a gallon of gas when we are selling a drink in a hotel for $15, $20? It’s important we get the industry stabilised. No threats, let’s make a deal, but we cannot make a deal without talking.”

practitioners, hospitals, clinics, and dialysis centres be ready to take the time to talk to them [the Government]. They’d make it clear this would be a massive blow to one of the bright sparks in the economy,” he added.

“I know the Ministry of Finance feels this is an industry that has significant profit margins, but it doesn’t. This initiative has the potential to almost make it fairly impossible to survive.... They ought to retire this idea, think it through again and go back to the status quo. What we ought to be doing is making healthcare cheaper, not more expensive.

“I think the Government is going to do a quiet about face as they did with the

NOTICE

NOTICE is hereby given that ABIGALE NATASIA PERSAUD of P.O. Box SS-6542, Jean Street, Hillside Park, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

BEHAVIOR THERAPIST NEEDED

Behavior Therapist to Teach Individuals with special needs how to talk, play, make friends and function independently while helping reduce any inappropriate behaviors.

MINIMUM REQUIREMENTS

Currently enrolled in college/university with 2 years of collage coursework completed in psychology related field.

Please send Resumes To mcandela@seahorseinstitute.org

pharmacists, and some of the wholesalers and retailers in terms of groceries [on price controls]. When you have this inordinate demand for tax revenues, and you are not prepared to what impact the policy decision is likely to have on human beings, you come up with the idea where people have WTH moments. I leave it there.”

The Ministry of Finance’s position has been that it is “clearly against the VAT

Act” for insurers to claim back the 10 percent levy on medical claims payouts by netting it off against the VAT paid on the premium - a practice allegedly costing the Public Treasury millions of dollars. Its position is that VAT is payable on medical insurance claims payouts because these are being made on behalf of the end-user - the consuming patient - and thus should attract the tax.

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

NOTICE

NOTICE is hereby given that GREGORY JOHN COFFEY of P.O Box SP 63158 8C Honey Comb Suite, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000

PAPEX EXPORTERS LIMITED

(IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, PAPEX EXPORTERS LIMITED is in dissolution.

The dissolution of the said Company commenced on 23 March 2023 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The sole liquidator of the said Company is L. Michael Dean of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

L. Michael Dean Sole Liquidator

PAGE 4, Tuesday, March 28, 2023 THE TRIBUNE

FROM PAGE B1

GIBSON & ASSOCIATES Employment Opportunity Attorney

EU leaders play down bank risks as economy weakens

BRUSSELS Associated Press

EUROPEAN Union leaders Friday played down the risk of a banking crisis developing from recent global financial turbulence and hitting the economy even harder than the energy crunch tied to Russia's war in Ukraine.

After a meeting in Brussels, the EU government heads said lenders in Europe are generally in sound health and in a position to weather a combination of rising interest rates and slowing economic growth.

"The banking system is stable in Europe," German Chancellor Olaf Scholz told reporters after the summit. Dutch Prime Minister Mark Rutte said: "Generally, I think we are in good shape." The EU deliberations came in the wake of U.S. regulators' shutdown of two U.S. banks, including Silicon Valley Bank, and a Swiss-orchestrated takeover of troubled lender Credit Suisse by rival UBS.

The emergency actions on both sides of the Atlantic revived memories of the 2008 global financial meltdown and the ensuing EU sovereign debt crisis, which almost broke apart the euro currency now shared by 20 European countries.

In a sign of market jitters in Europe, shares of Deutsche Bank, Germany's largest lender, fell as much as 14% in Frankfurt on Friday. The drop, which dragged down the stocks of other European lenders, followed a steep rise in the cost of financial derivatives known as credit default swaps that

insure bondholders against the bank defaulting on its debts.

Scholz dismissed the idea of basic weaknesses at Deutsche Bank, saying it has become "very profitable" after modernizing its business.

"There is no reason to have any concerns," he said.

The European economy has been slowing rapidly since Russia invaded Ukraine 13 months ago to the day, leaving the EU flirting with recession. The war has fueled inflation by prompting cuts in supplies of previously abundant Russian oil, natural gas and coal and dented consumer and business confidence.

The European Commission, the EU's executive arm, expects economic growth in the 27-nation bloc to slow to 0.8% this year from 3.5% in 2022 and 5.4% in 2021. A projected rebound in growth to 1.6% next year depends on a sound banking sector able to lend to businesses and consumers and protect deposits.

The EU has beefed up its regulation of financial institutions since the euro debt crisis and little sign had emerged before Friday of broader contagion in Europe from Credit Suisse's dramatic rescue.

Nonetheless, financial supervision in Europe remains a patchwork of EU and national authorities pursuing common approaches rather than heeding an actual single European rulebook.

For example, the euro area still lacks a common deposit insurance system, which is widely considered a key defense against future European bank crises. A

New Bay Street attraction targets 75 hires this week

FROM PAGE B1

for the recruitment of 200 persons for one of their private island getaways in the Berry Islands, with the hiring focused on Andros. “They want to hire people for all different segments,” he explained. “They need to hire some people right now for an expansion of services they have planned later this year.

“Jobs are available. They’re looking to hire people from Andros and the Berry Islands. All those Androsians looking to be employed, I think it’s on April 3 we’re having the job fair, so we’ll be doing some advertising and public relations for that.”

On New Providence, Mr Farquharson said the Department of Labour will this Saturday take its Labour on the Blocks 2.0 initiative to the Freetown constituency from 9am to 3pm at the Pilgrim Baptist Church. Among the employers that will be present are Kelly’s House and Home; John Bull; Aquapure; Fusion Superplex; Builders Mall (FYP); McDonald’s; and Aetos Holdings (Wendy’s, Marco’s Pizza and Popeyes).

Mr Farquharson earlier this month said the ‘Labour on the Blocks’ job fair series has resulted in employment for more than 3,000 Bahamian job seekers since last May. “Between New Providence and Grand Bahama, we’ve held nine ‘Labour

stalemate among national capitals over how to share risk has left the bloc without this regulatory pillar.

On the market front, officials have said European banks generally have adequate cash buffers — while still urging vigilance. "Our banking sector is resilient, with strong capital and liquidity positions," the EU leaders said in a joint statement after their meeting.

On his way into it, Paschal Donohoe, head of the group of euro-area finance ministers and Ireland's public-expenditure minister, echoed the point while saying: "We can never be complacent."

One reason for prudence is that the European

Central Bank has raised interest rates from record lows, denting the balance sheets of lenders and making it more expensive for consumers and businesses to get loans. The ECB is seeking to bring stubbornly high euro-area inflation, which was 8.5% in February, closer to a 2% target.

ECB President Christine Lagarde and Donohoe attended the EU summit to share their views about the economy.

Prime Minister Kyriakos Mitsotakis of Greece, the country that triggered the euro-area debt troubles more than a decade ago, drew a link between the current state of Greek

DENMARK

Prime Minister

Frederiksen,

on the Blocks’ since May 2022, and we estimate they’ve employed at little over 3,000 from those job fairs. That was New Providence, Grand Bahama and Abaco,” he said at the time.

“Because of the partnerships we have developed we have a pretty good idea of what type employers need, so we are seeking to align those persons in our database and encourage them to come out. The database has close to 65,000 persons registered, but it doesn’t mean they are all unemployed.”

Asked whether all Bahamians seeking work will be able to find it, Mr Farquharson replied then: “I can say without a doubt that there are a lot of employment opportunities and vacancies out there. That’s one of the reasons why we have Labour on the Blocks. We know there are opportunities out there, so we bring job seekers and employers together in one place.

“I think for most Bahamians looking for work there are opportunities, particularly in the construction field. We have a number of projects coming online in the pipeline in Grand Bahama, Abaco and Eleuthera, where additional workers are required. We’re encouraging people, whether they are semiskilled or fully skilled in the construction industry, to register with us as employment opportunities are coming up.”

speaks with Slovakia’s Prime Minister Eduard

second left, and Belgium’s Prime Minister Alexander De Croo, left, during a round table meeting at an EU summit in Brussels, Friday, March 24, 2023. European leaders gather Friday to discuss economic and financial challenges and banking rules, seeking to tamp down concerns about eventual risks for European consumers from banking troubles in the US and Switzerland.

banks and that of European financial institutions as a whole.

"The banking system in Europe is stable and

robust," Mitsotakis said. "I'm absolutely confident about the stability and the robustness of the Greek banks."

THE TRIBUNE Tuesday, March 28, 2023, PAGE 5

’s

Mette

center right,

Heger,

Photo:Geert Vanden Wijngaer/AP

Silicon Valley Bank collapse concerns founders of color

By KAT STAFFORD AND CLAIRE SAVAGE

Associated Press

IN THE hours after some of Silicon Valley Bank’s biggest customers started pulling out their money, a WhatsApp group of startup founders who are immigrants of color ballooned to more than 1,000 members.

Questions flowed as the bank’s financial status worsened. Some desperately sought advice: Could they open an account at a larger bank without a Social Security Number? Others questioned whether they had to physically be at a bank to open an account, because they’re visiting parents overseas.

One clear theme emerged: a deep concern about the broader impact on startups led by people of color.

While Wall Street struggles to contain the banking crisis after the swift demise of SVB — the nation’s 16th largest bank and the biggest to fail since the 2008 financial meltdown — industry experts predict it could become even harder for people of color to secure funding or a financial home supporting their startups.

SVB had opened its doors to such entrepreneurs, offering opportunities to form crucial relationships in the technology and financial communities that had been out of reach within larger financial institutions. But smaller players have fewer means of surviving a collapse, reflecting the perilous journey minority entrepreneurs face while attempting to navigate industries historically rife with racism.

“All these folks that have very special circumstances based on their identity, it’s not something that they can just change about themselves and that makes them unbankable by the top four (large banks),” said Asya Bradley, a board member

of numerous startups who has watched the WhatsApp group grapple with SVB’s demise.

Bradley said some investors have implored startups to switch to larger financial institutions to stymie future financial risks, but that’s not an easy transition.

“The reason why we’re going to regional and community banks is because these (large) banks don’t want our business,” Bradley said.

Banking expert Aaron Klein, a senior fellow in Economic Studies at the Brookings Institution, said SVB’s collapse could exacerbate racial disparities.

“That’s going to be more challenging for people who don’t fit the traditional credit box, including minorities,” Klein said.

“A financial system that prefers the existing holders of wealth will perpetuate the legacy of past discrimination.”

Tiffany Dufu was gutted when she couldn’t access

her SVB account and, in turn, could not pay her employees.

Dufu raised $5 million as CEO of The Cru, a New York-based career coaching platform and community for women. It was a rare feat for businesses founded by Black women, which get less than 1% of the billions of dollars in venture capital funding doled out yearly to startups. She banked with SVB because it was known for its close ties to the tech community and investors.

“In order to have raised that money, I pitched nearly 200 investors over the past few years,” said Dufu, who has since regained access to her funds and moved to Bank of America. “It’s very hard to put yourself out there and time after time — you get told this isn’t a good fit. So, the money in the bank account was very precious.”

A February Crunchbase News analysis determined funding for Black-founded startups slowed by more

than 50% last year after they received a record $5.1 billion in venture capital in 2021. Overall venture funding dropped from about $337 billion to roughly $214 billion, while Black founders were hit disproportionately hard, dropping to just $2.3 billion, or 1.1% of the total.

Entrepreneur Amy Hilliard, a professor at the University of Chicago Booth School of Business, knows how difficult it is to secure financing. It took three years to secure a loan for her cake manufacturing company, and she had to sell her home to get it started.

Banking is based on relationships and when a bank like SVB goes under, “those relationships go away, too,” said Hilliard, who is African American. Some conservative critics asserted SVB’s commitment to diversity, equity and inclusion were to blame, but banking experts say those claims were false. The bank

slid into insolvency because its larger customers pulled deposits rather than borrow at higher interest rates and the bank’s balance sheets were overexposed, forcing it to sell bonds at a loss to cover the withdrawals.

“If we’re focused on climate or communities of color or racial equity, that has nothing to do with what happened with Silicon Valley Bank,” said Valerie Red-Horse Mohl, co-founder of Known Holdings, a Black, Indigenous, Asian American-founded finance and asset management firm focused on the sustainable growth of minority-managed funds.

Red-Horse Mohl — who has raised, structured and managed over $3 billion in capital for tribal nations — said most larger banks are led by white men and majority-white boards, and “even when they do DEI programs, it’s not a really deep sort of shifting of capital.”

Smaller financial institutions, however, have worked to build relationships with people of color. “We cannot lose our regional and community banks,” she said. “It would be a travesty.”

Historically, smaller and minority-owned banks have addressed funding gaps that larger banks ignored or even created, following exclusionary laws and policies as they turned away customers because of the color of their skin.

But the ripple effects from SVB’s collapse are being felt among these banks as well, said Nicole Elam, president and CEO of the National Bankers Association, a 96-year-old trade association representing more than 175 minority-owned banks.

Some have seen customers withdraw funds and move to larger banks out of fear, even though most minority-owned banks have

a more traditional customer base, with secured loans and minimal risky investments, she said.

“You’re seeing customer flight of folks that we’ve been serving for a long time,” Elam said. “How many people may not come to us for a mortgage or small business loan or to do their banking business because they now have in their mind that they need to bank with a bank that is too big to fail? That’s the first impact of eroding public trust.”

Black-owned banks have been hit the hardest as the industry consolidates. Most don’t have as much capital to withstand economic downturns. At its peak, there were 134. Today, there are only 21.

But change is on the way. Within the last three years, the federal government, private sector and philanthropic community have invested heavily in minority-run depository institutions.

“In response to this national conversation around racial equity, people are really seeing minority banks are key to wealth creation and key to helping to close the wealth gap,” Elam said.

Bradley also is an angel investor, providing seed money for a number of entrepreneurs, and is seeing new opportunities as people network in the WhatsApp group to help each other remain afloat and grow.

“I’m really so hopeful,” Bradley said. “Even in the downfall of SVB, it has managed to form this incredible community of folks that are trying to help each other to succeed. They’re saying, ‘SVB was here for us, now we’re going to be here for each

Fed official: SVB itself was main cause

of

bank’s

By CHRISTOPHER RUGABER AP Economics Writer

failure

THE nation’s top financial regulator is asserting that Silicon Valley Bank’s own management was largely to blame for the bank’s failure earlier this month and says the Federal Reserve will review whether a 2018 law that weakened stricter bank rules also contributed to its collapse. “SVB’s failure is a textbook case of mismanagement,” Michael Barr, the Fed’s vice chair for supervision, said in written testimony that will be delivered Tuesday at a hearing of the Senate Banking Committee.

Barr pointed to the bank’s “concentrated business model,” in which its customers were overwhelmingly venture capital and high-tech firms in Silicon Valley. He also contends that the bank failed to manage the risk of its bond holdings, which lost value as the Fed raised interest rates.

Silicon Valley was seized by the Federal Deposit Insurance Corp. on March 10 in the second-largest bank failure in U.S. history.

Late Sunday, the FDIC said that First Citizens Bank, based in Raleigh, North Carolina, had agreed to buy about one third of Silicon Valley’s assets — about $72 billion — at a discount of about $16.5 billion. The FDIC said its deposit insurance fund would take a $20 billion hit from its rescue of SVB, a record amount, in part because it agreed to backstop all deposits at the bank, including those above a $250,000 cap.

The Senate Banking Committee will hold the first formal congressional hearing on the failures of

FEDERAL Reserve Board Vice Chair for Supervision Michael Barr listens to participants at a hearing at the Federal Reserve building, Friday, Sept. 23, 2022, in Washington.

/AP

Silicon Valley Bank and New York-based Signature Bank and the shortcomings of supervision and regulation, by the Fed and other agencies, that preceded them. The committee will also likely question Barr and other officials about the government’s response, including its emergency decision to insure all the deposits at both banks, even as the vast majority exceeded the $250,000 limit.

Martin Gruenberg, chairman of the FDIC, and Nellie Liang, the Treasury undersecretary for domestic finance, will also testify at the Senate hearing. On Wednesday, all three will testify to a House committee.

Gruenberg said in his prepared testimony that the FDIC, which insures bank deposits, will investigate and potentially impose financial penalties on executives and board members of the two failed banks. The FDIC can also seek to bar them from working in the financial industry again.

PAGE 6, Tuesday, March 28, 2023 THE TRIBUNE

SECURITY guards let individuals enter the Silicon Valley Bank’s headquarters in Santa Clara, Calif., March 13, 2023. While Wall Street struggles to contain the banking crisis after the swift demise of SVB — the nation’s 16th largest bank and the biggest to fail since the 2008 financial meltdown — industry experts predict it could become even harder for people of color to secure funding or a financial home that supports their startups.

Photo:Benjamin Fanjoy/AP

MONDAY, 27 MARCH 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2393.870.480.02-251.19-9.50 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.35 AML Foods Limited AML 6.90 6.900.00 0.2390.17028.92.46% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.762.04Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.652.35Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 3.652.25Bank of Bahamas BOB 3.10 3.100.00 0.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.503.25Cable Bahamas CAB 4.50 4.500.00 -0.4380.000-10.3 0.00% 11.507.50Commonwealth Brewery CBB 11.00 11.000.00 0.1400.00078.60.00% 3.652.65Commonwealth Bank CBL 3.58 3.580.00151,5200.1840.12019.53.35% 9.307.16Colina Holdings CHL 8.53 8.530.00 0.4490.22019.02.58% 17.5010.65CIBC FirstCaribbean Bank CIB 10.65 10.650.00 1850.7220.72014.86.76% 3.252.05Consolidated Water BDRs CWCB 2.86 2.980.12 0.1020.43429.214.56% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.73 10.060.33 0.6460.32815.63.26% 11.5010.75Famguard FAM 11.20 11.220.02 2,6950.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.00 18.000.00 0.8160.54022.13.00% 4.053.55Focol FCL 4.05 4.050.00 0.2030.12020.02.96% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.000 0.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.000 0.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.000 0.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.000 0.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 90.8890.34BGRS FX BGR131249 BSBGR1312499 90.8890.880.00 90.9890.89BGRS FX BGR132249 BSBGR1322498 90.8990.890.00 100.2499.95BGRS FL BGRS91026 BSBGRS910266 100.24100.240.00 100.09100.03BGRS FL BGRS99031 BSBGRS990318 100.03100.030.00 100.14100.14BGRS FL BGRS79027 03/28/2027BSBGRS790270 100.14100.140.00 100.33100.33BGRS FL BGRS80027 05/09/2027BSBGRS800277 100.82100.820.00 100.66100.66BGRS FL BGRS81027 07/26/2027BSBGRS810276 100.52100.520.00 100.79100.79BGRS FL BGRS81036 07/26/2036BSBGRS810367 100.79100.790.00 100.41100.41BGRS FL BGRS83027 11/28/2027BSBGRS830274 100.41100.410.00 100.12100.12BGRS FL BGRS84032 09/22/2032BSBGRS840323 100.12100.120.00 100.12100.12BGRS FL BGRS84033 09/22/2033BSBGRS840331 100.12100.120.00 100.00100.00BGRS FL BGRS86036 08/27/2036BSBGRS860362 100.32100.320.00 99.6999.69BGRS FX BGRS94029 07/16/2029BSBGRS940297 99.6999.690.00 100.77100.77BGRS FL BGRS81035 07/26/2035BSBGRS810359 100.77100.770.00 92.0592.00BGRS FX BGR125238 10/15/2038BSBGR1252380 100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.602.11 2.600.36%3.89% 4.903.30 4.900.11%5.06% 2.271.68 2.270.18%2.94% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.791.72 1.780.60%3.09% 2.031.82 2.032.93%11.13% 1.901.81 1.900.87%4.76% 1.010.93 0.950.04%-5.20% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 22-Sep-2033 4.56% 4.84% 4.68% 28-Nov-2027 22-Sep-2032 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.81% 5.00% 5.60% 4.30% 4.32% 4.56% 4.50% 4.65% 15-Oct-2049 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund 15-Aug-2026 4.56% 5.65% 9-May-2027 27-Aug-2036 4.30% 4.56% 23-Sep-2031 28-Mar-2027 26-Jul-2027 26-Jul-2036 CFAL Global Bond Fund 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 27-Jan-2023 15-Oct-2038 15-Jul-2049 26-Jul-2035 16-Jul-2029 31-Dec-2021 31-Dec-2022 31-Dec-2022 28-Feb-2023 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 28-Feb-2023 28-Feb-2023 INTEREST Prime + 1.75%

REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jan-2023 31-Jan-2023 6.95% 4.50% 31-Dec-2022 28-Feb-2023 4.50% 6.25% Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com

Photo:Manuel Balce Ceneta

MARKET

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net