Courier firms blocked on ‘seven figure’ tax arrears

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SEVERAL courier companies have been temporarily barred from clearing imported shipments over their failure to pay up to “seven figures” in due taxes to the Government, a top official confirmed last night.

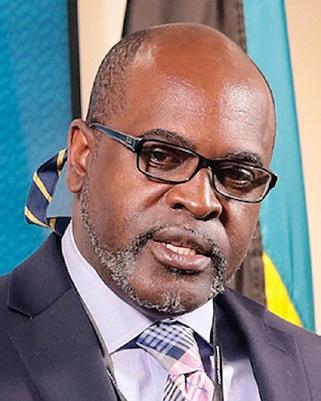

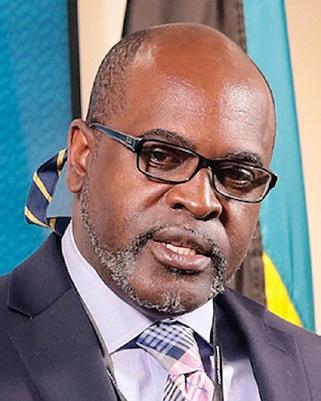

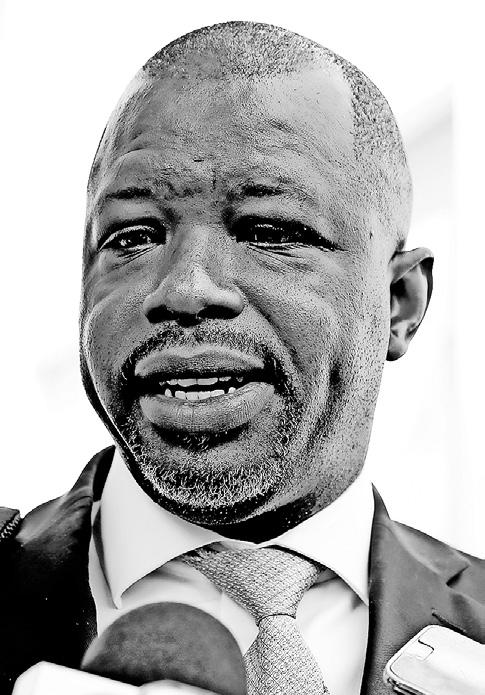

Simon Wilson, the Ministry of Finance’s financial secretary, described the situation with the industry as “an ongoing problem” given that operators can quickly build up substantial tax arrears due to the high volume of goods they are clearing on a daily basis.

Given that couriers are effectively monies provided by their clients to pay due taxes on trust, he told Tribune Business the Ministry of Finance and Department of Inland Revenue “don’t look very favourably” on those who either fail to pay in full, on time or are guilty of both offences.

Describing some firms as “repeat offenders”, Mr Wilson did not identify the culprits, or give specific

• Several suffer import halt on Treasury debt

• One confirms ‘issues’ with clearing goods

• Top official hits out over ‘repeat offenders’

figures for the sums involved, but told this newspaper the arrears accumulated by individual couriers before a block was placed on their activities has run into “seven figures” or millions of dollars. Pledging that the tax authorities will “work through it” to ensure all couriers come into compliance with their obligations, he added that the halt imposed on their activities

Esso dealers fearing rent hikes will hit all

until they become current typically never lasts more than “a day or two” because their operations are otherwise completely shut down and they stand to lose clients, their reputation and, potentially, go out of business.

Asked by Tribune Business to confirm whether several courier companies have recently suffered Customs-imposed halts to clearance of their clients’ import shipments, Mr Wilson replied: “I think that’s correct. If they owe taxes they are collecting in trust we will hold their shipments until they pay it. It’s probably a variety of things, and this is one of them.”

All courier companies were mandated by the Department of Inland Revenue to produce a Tax Compliance Certificate, showing they are current with VAT, import tariffs and other taxes, by March 13, so the recent crackdown could also be related in part to the failure of some to obtain the required paperwork by that deadline as well as pay what is owed to the Public Treasury.

SEE PAGE B6

Bahamas hurricane loss triple that of Caribbean

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS has suffered almost triple the amount of hurricanerelated losses and economic damage compared to that experienced by other Caribbean countries over the past 20 years, it was revealed yesterday.

The Inter-American Development Bank (IDB), unveiling a $160m “policy based” loan to finance improvements to this nation’s disaster risk management governance, said more frequent and intense storms have cost The Bahamas, its economy and people some $6.7bn in the

two decades leading up to 2022.

It pegged that sum as equivalent to more than 50 percent of The Bahamas’ gross domestic product (GDP), or value of its economic output, whereas the loss and damage suffered by Jamaica and Barbados over the same 20 years was estimated at 17 percent and 2 percent, respectively, of their GDPs.

“The economic damage caused by climate-related hazards in The Bahamas, as a percentage of GDP, is higher than in other countries in the Caribbean region. Thus the total damage from disasters in The Bahamas

SEE PAGE B7

Sir Franklyn ‘surprised’ at hint margin talks ending

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FOCOL’s chairman says he is “surprised” that Bahamian petroleum retailers indicated negotiations over a margin increase had ended because talks were ongoing at the Prime Minister’s Office yesterday.

Sir Franklyn Wilson, head of the BISX-listed petroleum products supplier that trades under the Shell brand, told Tribune Business he was taken aback by what he interpreted as suggestions from Raymond Jones, the Bahamas Petroleum Retailers Association (BPRA) president, that

SIR FRANKLYN WILSON

discussions with the three oil majors and the Government were over.

Confirming that executives from FOCOL, as well as Sol Petroleum Bahamas (Esso) and Rubis, were meeting with the Prime

SEE PAGE B10

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS

Petroleum Retailers Association’s vice-president yesterday said he is “very, very concerned” by a dispute that has left one Esso dealer fearing he has no choice but to “give them back their station”.

Vasco Bastian, himself an Esso dealer, told Tribune Business that all the chain’s operators were asking whether they will be hit with monthly rent increases similar to the $11,200 hike imposed on Paul Hepburn, operator of the Oakes Field gas station by the sixlegged roundabout where University and JFK Drives connect.

Mr Hepburn yesterday told Tribune Business he had received no warning about the increase, which was imposed for February’s rental payment that is due this week. Documents seen by this newspaper show the Oakes Field rental rate,

with VAT stripped out, increasing by more than one-third or 34 percent from $32,750 in January to $43,950 - an $11,200 rise.

However, Valentino Hanna, general manager for Sol Petroleum Bahamas, subsequently explained that February’s rent invoice also now incorporates the monthly electricity bill - which January’s did not. With the Oakes Field station’s Bahamas Power & Light (BPL) for February standing at $5,707, this means that the actual cost increase faced by Mr Hepburn is $5,493 as he previously paid the electricity bill separately. That latter, figure, though, still represents a 16.8 percent increase on January’s rent. Mr Hanna said the extra charge was to finance Sol Petroleum Bahamas investment in the installation of solar panels at Oakes Field, and Mr Hepburn yesterday revealed his contract with the petroleum products

business@tribunemedia.net

MARCH 30, 2023

THURSDAY,

SEE PAGE B6

SIMON WILSON

$5.67 $5.67 $5.72 $5.59

How you can beat the job interview

You have finally done it. You wrote the perfect resume, nailed your application letter, and now you have the job interview in just a few days. This is exciting, but also nerve-wracking. A positive impression has to be made if you wish to land the post, but how can you do that if you have never had a successful interview?

Here are a few tips on how to win a job interview.

Practice ahead of time

Think of an interview as an audition. If you were going to audition for a role as an actor or actress, you would want to practice ahead of time, right? This is no different.

When you are practicing, try and use some of your friends or family members as props so as to feel comfortable. Remember that many employers will go “off-script” during interviews, so keep an open mind.

Dress for the Job

Common wisdom says to “dress for the job that you want”, and there is some truth to that. This does not mean that you dress too formally, but are presentable - even if the dress code is casual. You never want to show up at an interview with stained or wrinkled clothing.

Assert confidence

When you arrive at the interview, try to maintain an air of confidence even if you are feeling nervous. Hold your head up high, smile and shake the interviewer’s hand - but only if that is appropriate.

Bear in mind that your interviewer expects you to be nervous. However, they expect you to push through the nerves.

By

DEIDRE BastiaN

Eye contact For many, making eye contact is challenging. However, try to maintain eye contact as it exudes confidence, or look down at your resume sometimes.

Bring notes

Speaking of notes, always bring them as it make you seem more prepared. Use them as a strong starting point when answering questions.

Always amplify your strong suits

During interviews, it may seem as if employers ask questions that wish you speak negatively about yourself. For example, the dreaded: “What is your biggest weakness?” Do not be fooled: This is actually an opportunity for you to shine and talk about your strengths.

This does not mean that you should be inauthentic. Do not respond with phrases such as: “My biggest weakness is that I am a workaholic.” This is not what the employer wants to hear, and you will be one of hundreds of people who have responded with this answer.

You can talk about how you have learned to break down each task into smaller

tasks so that you are able to complete them with ease.

Be prepared to ask questions

Did you know that an interview is also an opportunity to interview your potential employer? Good employers love when interviewees express extra interest in their business, and you might learn something that makes the job more or less appealing.

Be sure to ask what a typical day would look like if you were to accept the position, and about the company’s culture etc, but take the answers with a grain of salt.

Follow Up

Following up after an interview is acceptable. You can send a ‘thank-you’ note the day after stating how much you appreciate getting to know more about the position.

Nonetheless, if you are unsuccessful, be sure to send a note asking for feedback as it may make you feel more comfortable, especially knowing that the interview was impressive. Ultimately, learning how to ace a job interview may take some trial and errors,but do not become discouraged if your first interview is unsuccessful.

Most successful people never made it in one go. They needed many attempts before they achieved their objective. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

• NB: Columnist welcomes feedback at deedee21bastian@gmail.com

About columnist: Deidre M. Bastian is a professionally-trained graphic designer/brand marketing analyst, author and certified life coach

PAGE 2, Thursday, March 30, 2023 THE TRIBUNE

BAHAMIANS TOLD: STOP WORK PERMIT COMPLAINTS

A CABINET minister yesterday told Bahamians to stop complaining about the number of work permits being issued for expatriate labour if they are unwilling to “step up” and fill these posts themselves.

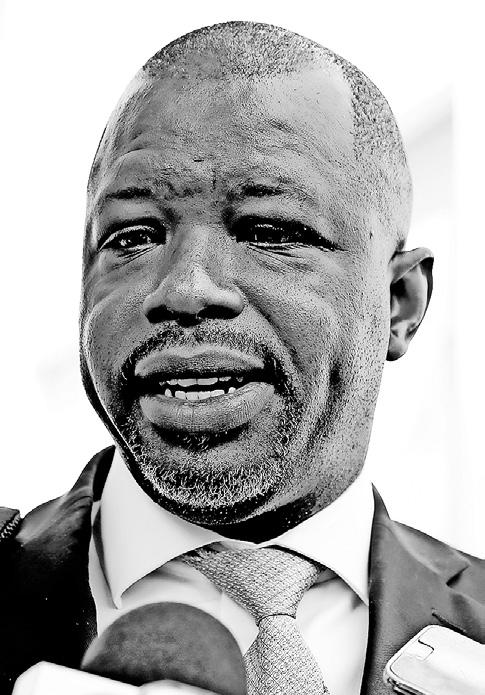

Wayne Munroe, minister of national security, asserted: “We need to stop complaining about the issuance of work permits unless we’re willing to step up and offer ourselves for these jobs.”

He gave this admonishment at the the Department of Labour’s press conference for its latest Labour on the Blocks 2.0 job fair. The event, the 12th in the series, will be held in conjunction with the Freetown Urban Renewal Programme this Saturday at Pilgrim Baptist Church, St James Road, between 9am and 3pm.

Keith Bell, minister of labour and Immigration, backed Mr Munroe’s position and encouraged Bahamians to ready themselves for employment opportunities instead of complaining and sitting on the sidelines.

He said: “Going to minister Munroe’s point, the reality is that we do give out in excess of 15,000 work permits per year in this country. And instead of complaining, sitting on the sidelines, and not having a job or not getting a job or

WAYNE MUNROE KEITH BELL

not preparing yourself for a job, the end objective is to ensure that, first of all, you work hard. Put yourself in that position. And when the opportunity is created, you’re able to get the job.”

Several major employers will be present at the job fair including Kelly’s House and Home, Family Guardian, IHOP, SMG, Sandals Royal Bahamian, ICS Security, the Department of Immigration, the Royal Bahamas Defence Force and the Bahamas Department of Corrections.

The ‘Labour on the Blocks 2.0’ initiative has held 11 job fairs on New Providence, Grand Bahama, Abaco and Eleuthera thus far, helping more than 3,000 Bahamians find employment.

Mr Bell said: “Over the past ten months, the Ministry of Labour and Immigration, in conjunction

with a number of community-based organisations, and our partners from the private sector has held 11 job fairs in three Family Islands, with over 3,000 Bahamians obtaining gainful employment.”

Persons planning to attend Saturday’s job fair should bring their resume, National Insurance Board (NIB) card and one other form of government-issued identification. They must be dressed appropriately for interviews with prospective employers. Individuals that do not have appropriate attire can request assistance at the Department of Labour’s office on Rosetta Street. Simone Thurston, acting assistant director of labour, said more than 160 persons were hired at the last job fair. She said: “Well, as for the last job fair in the community, there were

Realtor unveils crowdfund plan for property market

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN realtor yesterday described crowdfunding as a “viable alternative investment” that can provide persons with access to the real estate market.

Matt Sweeting, 1oak Bahamas chief executive, told Tribune Business that data provided to him by the ArawakX platform indicates there is an appetite for crowdfunding in real estate and they were in discussions with two firms interested in testing the market.

“This is going to be a real conversation and a viable alternative investment opportunity for a lot of Bahamians, whose debt service ratio may not allow for it yet, or it doesn’t allow for it any more, because they haven’t built up the

savings yet and they don’t have the kind of income that’s required yet,” Mr Sweeting said. “They may have already purchased a property that uses up a considerable amount of their debt service.

“I think, in real estate, especially as I oftentimes run into ambitious people who have already made that first purchase, but are now handicapped from doing anything else from an investment perspective, this is going to provide a tremendous opportunity for Bahamians to diversify their portfolio. This is going to be a real conversation on alternative investments that’s very sound.”

This is not a proposal aimed at enabling Bahamians to raise money to build or buy their own home via crowdfunding, but instead is an opportunity that will enable investors to buy into high-end real estate

160-plus persons hired on the spot, and those numbers are still coming in. We’re still getting feedback from employers as to how many persons they hired.”

Individuals that are not hired at the job fairs are added to the Department of Labour’s skills data bank, where there are currently some 65,000 persons registered. Ms Thurston said: “Over 65,000 persons are registered. Bear in mind, a lot of those are not unemployed persons. Some of them will be persons who are seeking a better job opportunity.”

Mr Bell said the data bank serves as a tool to ensure that labour certificates are not issued for the hiring of expatriate labour when there are qualified Bahamians available and willing to fill those posts. He added: “What happens is whenever a person applies for a labour certificate, the Department of Labour also is responsible for the issuance of labour certificates.

“And so whenever someone issues a labour certificate, the first thing that they would do is to go to that bank to determine whether or not there is any qualified Bahamian to fill that role before the certificate is issued. Then it goes over for an application for a work permit.

“And so I can say, without fear of contradiction, that in a number of instances where Bahamians have

made an application for a labour certificate, in hopes of moving towards a work permit, and the Labour Department has checked this very same bank, the applicant has been able to find a Bahamian to fill the position.”

Mr Bell also said he had been in contact with the

IHOP restaurant franchise and its opening, which was initially scheduled for February, is back on schedule. He added: “I’ve been in communication with the owner of IHOP. And the opening is imminent, I can say that, and that everything is back on schedule. We are very optimistic”

and receive dividends from those properties as income.

Mr Sweeting said: “It’s definitely an alternative investment strategy, and you want to diversify your portfolio and you want to get investments on a real estate basis. This is not for someone who is looking to buy a house and use this strategy.”

The legislative support for this is provided in the crowdfunding regulations that allowed Arawak X to operate via the Securities Industry (Business Capital) Rules 2021. Mr Sweeting said: “The legislation is there for it. It’s already supported by the legislation. It’s the same legislation that Awawak X is operating based on, and so the framework is already there.” There will be an information session hosted by 1oak to explain all the details of its plan. Mr Sweeting is expecting Jobeth

Coleby-Davis, minister for housing and transport to be in attendance, where they will “share a segment called the importance of real estate in a changing world”. He added: “We are also in partnership with FirstCaribbean International Bank. I’m going to be speaking on a topic and going through a case study on buy now or rent forever. There will also be a panel that walks people through the entire real estate process.”

THE TRIBUNE Thursday, March 30, 2023, PAGE 3

By FAY SIMMONS jsimmons@tribunemedia.com

MATT SWEETING

ALIV ‘RINGS IN’ FRESH SECURITY PARTNERSHIP

CABLE Bahamas has teamed with an Amazon subsidiary for an initiative that uses technology to improve home security.

Franklyn Butler, the BISX-listed

communications provider’s president and chief executive, speaking at the launch of the partnership between Ring and Aliv, Cable Bahamas’ mobile provider, said: “We will also collaborate on community partnerships, harnessing the power of our networks to make our neighbourhoods safer and more connected.

“This partnership between Aliv and Ring is a testament to our shared vision of a connected and secure future. We’re excited to embark on this journey together, and look forward to bringing our customers the very best in home security and smart living.”

Ring is subsidiary of multinational e-commerce giant, Amazon, and provides home security equipment that includes smart doorbells, home security cameras and alarm systems.

Todd Towey, national sales manager for Ring in the US and Canada, said:

“Ring’s mission is to make neighbourhoods safer, and we absolutely believe that the partnership that we’re establishing here with Aliv is something that tremendously advances that opportunity to make neighbourhoods safer.”

Helping to reduce crime is only one element of what

Ring proposes to develop in partnership with Aliv.

The duo are also seeking to “bring communities together” with their surveillance technology, which will allow neighbours to keep abreast of what is going on in their area and help each other.

BTC PROMISES IMPROVEMENTS IN SOUTH ANDROS BY END-APRIL

THE BAHAMAS Telecommunications Company (BTC) yesterday promised South Andros residents that they will enjoy network improvements by the end of April with a team of

technicians already sent to the area.

The communications carrier, in a statement, said its senior leadership team had visited South Andros on March 22 to view progress

We are seeking to employ the position of Shift Engineer here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience.

We offer a competitive salary and excellent benefits.

Interested persons should send their resume to: teneeshia@februarypoint

on efforts to enhance the customer experience, tour the island and meet with community leaders including local MP, Leon Lundy.

Sameer Bhatti, BTC’s chief executive, said: “Reliability is a key driver for BTC this year as we work towards delivering more resilient products and services. We have what we’ve coined a ‘dream team’ is in South Andros, and they have been working day and night on landline and mobile upgrades and repairs.

“We are ripping and replacing existing landline and broadband hardware to provide better services for our customers. We understand the importance of getting this done as quickly as possible from the commentary during our meeting with the various community leaders.”

The BTC team is also working in Mangrove Cay to identify those customers experiencing service issues, and is aiming to resolve those issues and enhance the quality of service where necessary. BTC has already upgraded wireless Internet (Wi-Fi) services in the park.

Mr Bhatti added: “It was important for me to travel with my entire leadership team. It’s a great way to demonstrate our firm commitment to building and maintaining relationships with our customers.

“In addition to upgrading our fixed network, we are also upgrading the power supply for our mobile towers to improve reliability on the island during commercial power outages. We are also conducting proactive mobile tower maintenance. We anticipate that the bulk of the maintenance and upgrade activities will be completed in another week.”

BTC said it plans to replicate these activities throughout its network across The Bahamas. Its technicians are also currently completing remediation exercises in the Berry Islands to improve the level of service for customers. Mr Bhatti has committed to visiting Bimini, Eleuthera and Cat Island in the next few weeks.

PAGE 4, Thursday, March 30, 2023 THE TRIBUNE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BTC’s chief executive and technical team in South Andros. From L to R: Marlion Russell; Traves Mackey; Oran Davis; Sameer Bhatti (BTC chief executive); Rinald Rolle; Elvin Hanna.

BTC meets with community leaders in South Andros.

BTC’s leadership team visits South Andros.

BAHAMAS HITS ‘NEW LEVEL’ WITH YACHTING PROMOTION

THE BAHAMAS amplified its presence at this year’s Palm Beach International Boat Show (PBIPS) through a co-branding collaboration with Worth Avenue Yachts, a brokerage firm specialising in the sale, charter and construction of vessels.

The arrangement showcased The Bahamas’ branding inside Worth Avenue Yachts’ main tent during the show’s fourday duration, and gave the Ministry of Tourism, Investments and Aviation an unmatched opportunity to promote this nation’s product offering to high net worth super yacht owners and charter operators.

The event took place in downtown West Palm Beach from March 23 to 26, and attracted more than 55,000 attendees and 600 exhibiting brands. Some 600 boats were on display, ranging from eight-foot inflatables to super yachts nearly 300 feet in length.

“Each year the Palm Beach International Boat Show presents The Bahamas with the great opportunity to showcase the allure of our island archipelago, nestled in crystal blue water, to the international yachting community,” said John H. W. Pinder III, parliamentary secretary in the Ministry of Tourism, Investments and Aviation.

“This year, we’ve reached a new level in capturing the

imagination of thousands of yachting enthusiasts.

“Palm Beach International Boat Show also offers The Bahamas a focused opportunity to strengthen its reputation as the regional leader in yachting. This week, we’ve had a series of very productive meetings, reconnecting with longstanding business partners and engaging with new partners to generate increased tourism business for The Bahamas yachting and boating sectors, growing our economy at large.”

Mr Pinder held meetings over two days with a number of industry partners and stakeholders. He met with Eli Flint, Flexjet’s president of vertical lift, to discuss expanding private charter airlift and possible partnership with the air carrier.

The south Abaco MP also held discussions with Michael Mahan, founder of Worth Avenue Yachts, on the new partnership with The Bahamas for this year’s Palm Beach Boat Show. He also met Kwon Alexander and Justin Hardee of the New York Jets football team, and Duke Riley of the Miami Dolphins. Bahamian officials connected international event organiser, Informa, with these athletes to discuss off-season training and second home ownership.

Mr Pinder also held meetings with IGY Marinas’

senior executives, including Bert Fowles, its vice-president of sales and marketing, and Ariana Hackelson, sales and marketing executive, to discuss the yachting industry and The Bahamas’ position in the industry as well as future partnership opportunities.

A subsequent meeting was held with Randy Field, vice-president of marketing at Informa, to discuss The Bahamas’ involvement with the Palm Beach Boat Show, Fort Lauderdale International Boat Show and other opportunities to showcase this nation Staff from the Ministry of Tourism, Investments and Aviation’s yachting department were joined on Palm Beach by various Bahamian private sector partners including Odyssey, Nassau Yacht Haven and Romora Bay Club.

Boating and yachting represent one of the biggest growth sectors for the Bahamian tourism industry. The Ministry of Tourism, Investments & Aviation participates in the major boat and yachting shows annually, including the Palm Beach International Boat Show, the Fort Lauderdale Boat Show and the Monaco Yacht Show.

JOHN H. W. Pinder, the Ministry of Tourism, Investments and Aviation’s parliamentary secretary, speaks at The Bahamas’ information desk at the West Palm Beach International Boat Show.

JOHN H. W. Pinder, the Ministry of Tourism, Investments and Aviation’s parliamentary secretary, speaks with industry stakeholders and representatives from the 41st annual West Palm Beach International Boat Show.

REPRESENTATIVES from The Bahamas’ information desk at the 41st annual West Palm Beach Boat Show speak with a yacht broker on The Bahamas being the leading yachting destination.

THE TRIBUNE Thursday, March 30, 2023, PAGE 5

COURIER FIRMS BLOCKED ON ‘SEVEN FIGURE’ TAX ARREARS

Tribune Business contacted Mr Wilson after being informed that several courier companies were recently barred from importing goods into The Bahamas on their clients’ behalf. One, whose name this newspaper is withholding for legal reasons, was alleged to owe the Customs Department nearly $300,000 in unpaid taxes. It was warned by the authorities that it had to pay the full amount before it would be allowed to resume normal operations.

This directive was said to have been issued by Ralph Munroe, Customs comptroller, acting on instructions from Mr Wilson. Tribune Business was told that Mr

Munroe was in a meeting when it called for comment, and was directed to speak with Mr Wilson instead.

Meanwhile, the floor supervisor at the courier said to have owed $300,000 did confirm it had encountered “issues” with importing goods for clients over the past two weeks. However, senior management has said nothing about the matter, and the firm has resumed shipment clearance as of yesterday. Well-placed sources, speaking on condition of anonymity, said customers had been complaining they had shipments that were due and could not get them.

Mr Wilson yesterday said Customs and the Government are focused on treating tax-compliant courier companies “fairly

and quickly”. He indicated that non-payment of taxes by operators in this sector was especially egregious since it did not involve their own money but, rather, funds that have been provided to them by clients to clear shipments and pay their due obligations to the Public Treasury. “They’re not remitting taxes,” the financial secretary said of the offenders.

“Our concerns really with courier companies are that if you are collecting a sum of money from the client, and that sum of money is for Customs duty on whatever is imported, and you don’t pay the Government out of that sum......

“You have a Customs bond, and you are collecting money in trust. You’re collecting money on behalf

of the Government from a client, and you don’t pay that money to the Government in a reasonable period of time. We don’t look at that very favourably. We don’t. Then, in some cases, some companies are repeat offenders.

“It is an ongoing problem. We’ll work through it. Hopefully these companies will be in compliance pretty soon and things will work out. In some cases it can be substantial amounts and that’s a concern.” When asked whether the tax arrears owed by individual courier companies was as high as six figures, Mr Wilson replied: “Seven figures, not six. Seven figures. In some cases it can be very substantial amounts.” This implies that firms can build up tax debts

worth millions of dollars. However, while the Government’s ability to effectively shut the culprits down usually ensures it collects what is due, delayed payments impact its cash flow and also increase the possibility that some taxes may go missing or not be paid.

“These are high volume companies,” Mr Wilson told Tribune Business of the couriers, “and if they don’t focus on making timely remittances these arrears can run up pretty quickly.”

Asked how quickly offenders responded to being shut down, he added: “I think it would be fair to say that most companies immediately afterwards make the payment. The halt is never more than a couple of days or a day or so. It would be

Esso dealers fearing rent hikes will hit all

FROM PAGE B1

wholesaler allows it to pass the costs of “any major investment” on to gas station operators if it exceeds $50,000.

Taking out the electricity bill, the net increase in Mr Hepburn’s rent is from $32,750 in January to $38,243 in February. This, though, still represents a significant, or material, increase of greater than 10 percent and comes at a time when petroleum dealers are complaining that fixed price-controlled margins of 54 cents for gasoline and diesel, respectively, leave them unable to cover and absorb multiple cost increases.

Mr Hanna, in an e-mail exchange seen by Tribune Business, urged Mr Hepburn to meet with himself and Sol Petroleum Bahamas to resolve his concerns. “We will be happy to discuss all of the details of this matter with you, in person, at your convenience,” he wrote.

“Please contact either Earla Rahming or myself to let us know when you can be available and where you would prefer to meet. Also, please note that this is the final communication that we will respond to that includes parties external to our contractual arrangement.” When contacted by this newspaper subsequently, Mr Hanna said he was about to go into a meeting at the Prime Minister’s Office and could not talk. Efforts to reach him later were not successful.

Mr Hepburn, meanwhile, told this newspaper he was presently not in the mood to meet Mr Hanna. “I’m not ready for that yet. I’m still very angry,” he said. “I don’t think I’m going to have one in person. I don’t think I’m ready for that yet. I’m still too irate to speak to him in person. I still have to calm down some for that to happen.

“He wrote me, texted me saying I could have easily resolved this matter by calling him.... On the reverse,

he could have told me it [the rental increase] was coming and why it was coming. He could have given me that level of respect. I don’t think he did. There was no warning.”

Mr Hepburn, who also operates the Esso gas station at Blue Hill Road and Faith Avenue, also questioned the timing of the rental increase given that dealers were still trying to recover financially from the COVID-19 pandemic and are grappling with an inflexible, price-controlled model that is pushing them into loss-making territory.

“It’s so unfair,” he argued. “He [Mr Hanna] doesn’t see it that way. He thinks it’s justified. That’s why he needs to answer. Is this the right time to be doing something like that. I’m part of a BPRA (Bahamas Petroleum Retailers Association) chat group, and most of the people think it’s unconscionable and ridiculous. It’s unprecedented and ridiculously high.

“I looked at my numbers for 2022. If I don’t have any increase in the margins I will be showing a loss at the end of the year. I’d be at a loss. I will try and see how long I can manage it and see of a margin increase will help, but other than that I will have to give them back their station [Oakes Field]. Whatever is losing money will have to go back.

“Right now they’re putting Oakes Field in a losing position with that high rent. Who do you think will take a station where you have to pay $50,000 a month rent? Once you drill down, no one’s going to want that station.” Mr Hepburn said the solar panel installation was designed to reduce the Oakes Field gas station’s reliance on BPL by switching to renewables, and help Sol Petroleum to access carbon credits, but the transfer has not happened yet.

Oakes Field is the only Esso gas station where solar panels have been installed to-date, which is likely why other operators have not seen a similar increase in their rental rates. “The

other stations don’t have that issue yet because I’m the only one with solar panels,” Mr Hepburn said, adding of the rent increase: “It really makes you look at retirement. It’s very stressful.

“We’re seen to be in a position of making money. Because of all the activity they assume we’re making a ton, and they have the right to jack the rent up any time, jack the employees’ wages up any time; jack the cost of security up. BPL is going up and our margins stay fixed. You just cannot deal with that, particularly when you have the volatility of gas.

“When the price goes up, volumes contract. When it went to $7 per gallon last year business dries up. You get 50 percent of the volume you had before.

You’re in a loss position and they’re increasing the rent. It’s vexing. I think it’s unconscionable. They don’t want me to make any money. They’re putting me in a loss position and think I’m making bundles. You cannot negotiate with them. Their position has always been: Take it or leave it.”

BEHAVIOR THERAPIST NEEDED

Behavior Therapist to Teach Individuals with special needs how to talk, play, make friends and function independently while helping reduce any inappropriate behaviors.

MINIMUM REQUIREMENTS

Currently enrolled in college/university with 2 years of collage coursework completed in psychology related field.

Please send Resumes To mcandela@seahorseinstitute.org

unusual for a halt to be more than a day. Very, very unusual.”

Asked what was required to improve compliance, the financial secretary said: “Better enforcement. I think it comes down to better education and enforcement with these couriers. If you don’t pay attention it can run up very quickly. It’s a high volume business. You can be lax, and not pay attention, and before you know it you can have a pretty significant sum outstanding to the Government. Nobody intends to do it, but if you don’t pay attention it can blow right up.”

Mr Bastian told Tribune Business that he was willing to facilitate a meeting between Mr Hanna and Mr Hepburn so that the two sides can seek to resolve their differences internally away from the public spotlight. After that occurred, he said a meeting needed to be held between Sol Petroleum and all its dealers to determine if the wholesaler plans to roll-out solar energy at all the stations and seek to recover its investment from the operators - thereby adding further to their costs.

“Then we can all be abreast of what is going on and the direction that corporate wants to go,” he explained. “It opens up so many other conversations. If they make that investment and pass that investment on to the dealer using increased costs, what is the ultimate goal at the end of the day? What is the end game?

“Can the other dealers anticipate an increase? Will they have these increases across the chain? Is the timing right for it? Should it happen at all? Do they see this as the future of how this brand will look, and is this something the dealers have to absorb now or in two, three or years? Who will it benefit? Will it benefit Esso corporate alone, or will it benefit Esso dealers? Is it a project funded by Esso and we all have to pay for it? There are all sorts of questions.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 6, Thursday, March 30, 2023 THE TRIBUNE

FROM PAGE B1

Bahamas hurricane loss triple that of Caribbean

from 2002 to 2022 (over $6.7bn) is equivalent to more than 50 percent of the country’s economy in 2015. Conversely, values for Jamaica and Barbados are 17 percent and 2 percent, respectively,” the IDB report said.

The document reinforces The Bahamas’ extreme vulnerability to hurricanes, weather-related catastrophes and other climate change issues such as sea level rise. When measured in terms of GDP percentages, this nation’s loss and damages are almost three times’ higher on a relative basis when compared to Jamaica. And, in turn, $3.4bn or just over 50 percent of that $6.7bn in total losses and damage was inflicted by Hurricane Dorian in 2019.

“The vulnerability of The Bahamas to climate-related hazards is likely to be further exacerbated by climate change. An IDB report estimates that, taking climate change impact into account, a hurricane with a 100-year return period could cause up to $6bn in economic damages if it were to make landfall in The Bahamas,” the IDB added.

“The report also notes that while a hurricane the size of Dorian has been calculated to occur once every 50-100 years in the past, it is now estimated to occur once every 25 years due to the effects of climate change. Another report estimates that the expected coastal inundation area from a 50-year flood in New Providence will be 15 percent larger by 2050 than it is today due to increased precipitation due to climate change.”

Noting significant deficiencies and weaknesses in The Bahamas’ public policy response to disaster risk management, the IDB paper said the loan proceeds will provide the financial springboard such that this nation will enjoy a 72.7 percent improvement

against an index that measures a country’s resilience, governance and ability to cope with - and respond tocatastrophic events such as hurricanes.

The IDB said that, while The Bahamas enjoyed the second best score in the Caribbean in 2020 when benchmarked against its Index on Disaster Risk Management Governance and Public Policy (iGOPP), it still ranked below the wider Latin America average. While, from a regional perspective, The Bahamas’ 22 percent trailed only Jamaica at 25 percent, it was some way off the Western Hemisphere average at 33 percent.

“The results of the IGOPP update point out that The Bahamas has limited legal, institutional and budgetary conditions to implement effective public policies in disaster risk management, resulting in actions which are not always aligned with best international practices and generally insufficient due to scarce funding, [and which] would benefit from more robust legal mandates,” the IDB report said.

The loan initiative’s goal is to drive reforms that will see The Bahamas’ score against this index rise by 72.7 percent in percentage terms, rising from the current 22 percent to a target of 38 percent above the Latin and Caribbean average. Such an improvement, the IDB paper argued, will have a significant impact on reducing hurricane-related fatalities and reducing associated damage and economic loss.

“Once the policy reform proposed by the first operation is implemented, the iGOPP score is projected to increase to 38 percent.

Empirical evidence suggests that a disaster risk management governance improvement equivalent to an increase of one point in the iGOPP reduces, on average, by 3 percent the human fatalities caused by disasters and human economic losses by 4 percent,” the report added.

Among the targeted improvements is an overhaul of the Bahamas Building Code and planning regulations. “The Bahamas Building Code of 2003, reviewed in 2016, contains provisions for wind loads, and adopts the standards set by the American Society of Civil Engineers, while the Building Regulation Act of 1971 establishes specific penalties for noncompliance with regulations related to the construction of infrastructure,” the IDB noted.

“However, an update of this code is due. Regarding zoning, the Planning and Subdivision Act of 2010 establishes that risk zoning shall be a determining factor in land use occupation. Nevertheless, there is no legal mandate for public bodies or local governments to reduce the risk within the scope of their functions and jurisdictions, particularly for vulnerable critical infrastructure, and disaster risk analysis is not mandatory for public investment projects.”

The report revealed the Government has asked the IDB to “replenish” the $100m emergency financing it provided following Hurricane Dorian since some $80m of that sum was used in the Category Five storm’s aftermath. Just $20m of that facility remains.

“The main challenges in financial protection are the approval of legislation

establishing the formulation of a financial protection structure in the country; to establish a national emergency fund that has the capacity to accumulate resources over time and is based on the annualised loss expectancy and the disaster loss historical

records; and the establishment of a legal mandate for public bodies and local governments to cover their public assets with insurance policies or other equivalent mechanisms,” the IDB added.

The $160m loan was contingent on Parliament

passing the Disaster Risk Management Bill 2022, which became law in early December 2022. The IDB was heavily involved in preparing this legislation, supplying a senior legal adviser and legal drafter to help craft the Bill.

CALL

502-2394 TO ADVERTISE TODAY!

THE TRIBUNE Thursday, March 30, 2023, PAGE 7

FROM PAGE B1

SIR FRANKLYN ‘SURPRISED’ AT HINT MARGIN TALKS ENDING

Minister’s Office late yesterday afternoon, he said: “They’re meeting all the time. Discussions are going on. They had a meeting this afternoon. I haven’t had a briefing yet. To me, it just indicates that everybody is working hard and working in good faith.

“The Government is not ignoring the private sector, and it’s good that the political people show that they’re taking this seriously. The process is important. I noticed the statements that the president of the Association made a couple of days ago, which surprised me, because it spoke in terms as though the discussions and effort had ended.

“That was a surprise to me because I don’t think the effort has ended. It’s a messy process. Sometimes it’s possible to reconcile the interests of a particular group with the expectations of the majority, and sometimes it’s not. I think the retailers are to be commended for the fact they were measured and

tempered in making their demands, and not saying they are going to break up the country, which sometimes those seeking certain outcomes intend to do.”

Valentino Hanna, Sol Petroleum Bahamas general manager, also confirmed to Tribune Business he was attending the meeting at the Prime Minister’s Office yesterday afternoon. It came after Mr Jones, speaking to Tribune Business earlier this week, said gas station operators are seeking a margin increase equal to 7 percent of the landed cost of fuel as their equivalent of a livable wage. He added that such an adjustment was critical “to allow us to survive as retailers” given that existing price-controlled fixed margins simply cannot cover a multitude of ever-increasing costs. Believing that “the Bahamian public will be OK to absorb a few cents more” on the per gallon cost of gasoline, he provided several insights into the increasing hardship faced by many gas station operators due to an

inflexible business model that has left many unable to break even.

Mr Jones said turnoverbased Business Licence fees have almost doubled yearover-year due to last year’s spike in global oil prices following Russia’s invasion of Ukraine, which saw gas prices peak at around $7.20 per gallon during the 2022 first half. Noting that his fee has increased to almost $25,000, he estimated that “99 percent” of the Association’s members will be unable to make payment by this Friday’s March 31 deadline and will be seeking to agree payment plans.

Speaking after the Association’s executive committee met on Monday to discuss their next move, after receiving no firm proposal or request for a further meeting with the Government following their first encounter two weeks ago, Mr Jones said he had informed the Prime Minister then of how one gas station operator was using his pension money to cover operating costs and

maintain staffing levels due to insufficient margins.

The last margin increase enjoyed by gas station operators occurred in 2011, some 12 years ago, under the last Ingraham administration, and operating costs and inflationary pressures have increased substantially then. That took gasoline margins from 44 cents per gallon to 54 cents, where it has remained ever since, while diesel stands at 34 cents per gallon. Mr Jones contrasted the industry’s inflexible, pricecontrolled fixed margins with the food distribution sector. While much of the latter’s produce is price controlled, retailers and wholesalers have percentage-basedrather than fixed - margins and mark-ups that allow them to apply for cost increases as the landed costs change.

Listing the ever-rising costs that fixed gasoline and diesel margins must absorb, Mr Jones pointed to the 2-3 percent “commission” or fees charged on every debit and credit card payment. On

GIBSON & ASSOCIATES

Employment Opportunity Attorney

Gibson & Associates is seeking to employ an Attorney who possesses knowledge of Conveyancing and Real Estate, Probate and Estate Planning, Civil Litigation and Family Law. Applicants should be organized, self-driven, innovative, diligent, a team player and have the ability to work with minimal supervision. The successful candidate should demonstrate the following competencies:

• Excellent written and verbal communication;

• Excellent organization and prioritization skills;

• Detail oriented;

• Good client liaison skills;

• Ability to multi-task;

• Self motivated; and

• Professionally polished.

Salary will commensurate with qualifications and experience. Interested persons should email the resumes to dgibson@gibsonlawbahamas.com

a $6 gallon of gasoline, the 3 percent charge amounts to 18 cents or one-third of the 54 cent margin, although this might be slightly less depending on the issuing bank.

With The Bahamas still largely a cash-based economy, he added that some gas station operators are being charged between $4,000 to $10,000 a month to deposit cash. With banks unwilling to accept such deposits over the counter, the industry is now incurring fees for doing this via the night deposit box.

And, with many of the petroleum industry’s 1,000plus employees earning the minimum wage, Mr Jones said their has increased by 24 percent or $50 per week due to the increase. While not opposed to the rise, he added that this has increased payroll costs for gas stations while also raising associated National Insurance Board (NIB) contributions.

To maintain the “spread” between minimum wage employees and others, gas stations have been forced to raise pay for cashiers as an example. Security costs have also increased, as third-party contractors pass the minimum wage’s impact on to gas stations and their other clients.

“It’s a domino effect in all these rising costs,” Mr Jones said. “We only have 54 cents per gallon to play with. All these things take a bite out of the 54 cents. Energy costs are going up, and insurance costs have increased by 15 percent. That’s a hard cost we have to cover. You have insurance, energy costs, credit card fees, bank deposit fees, salaries and wages and operating and maintenance costs. The 54 cents has been the same for the last 12 years.

“All we’re asking the Government to do is change the margin so we can have a liveable wage. We’re asking for nothing less than an adjustment that reflects a reasonable margin that allows us to continue to invest in the business... We have to do something in the interim to reduce costs.

“Come the end of March we have to pay the Business Licence fee, and 99 percent of them said they are not in a position to do that. Some of them are going to write in and ask the Department of Inland Revenue (DIR) for a plan to pay this off. The Business Licence fee has almost doubled because of last year’s oil prices and the fact it’s based on turnover.”

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, SHEKERA CHARVERNE STUART Carroll’s Manor off Carmichael Road, Nassau, The Bahamas, Mother and legal guardian of JAYLEN MALIK JAMAL KEVON ARCHER A minor intend to change my child’s name to JAYLEN MALIK KEVON STUART If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that SASHAUNA FRAZER of P.O Box SS 19549 Garden Hills #2, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 23rd day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that LUDER CLERVOYANT of Golden Gates #2, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 10, Thursday, March 30, 2023 THE TRIBUNE

FROM PAGE B1

PUBLIC

NOTICE

Scotia Wealth Management™

JOB VACANCY Senior Manager, Fiduciary and Regulatory Controls

This role is responsible for providing expert testing support by performing operational reviews focused on key controls and based on the established guidelines and approved methodologies. Responsible for successfully performing all review testing procedures and comply with minimum operational standards, ensuring local and Enterprise-wide Policies, as well as local and global regulatory requirements are understood and met in their respective countries / region.

Stocks rally on Wall Street as bank fears ease further

By STAN CHOE

AP Business Writer

STOCKS rallied Wednesday as Wall Street shakes off more of the fear that dominated it earlier this month.

The S&P 500 rose 1.4% for its fourth gain in the last five days. The Dow Jones Industrial Average climbed 323 points, or 1%, while the Nasdaq composite jumped 1.8%.

They followed similar sized gains in other markets around the world and put the S&P 500 on track to close a tumultuous month with a modest gain. That’s despite the month being dominated by worries about banks and whether the industry is cracking under the pressure of much higher interest rates.

Forceful actions by regulators have helped to calm some of the worries about banks. By Wednesday, a measure of fear among stock investors on Wall Street fell to nearly where it was on March 8. That was the day before Silicon Valley Bank’s customers suddenly yanked out $42 billion in a panicked dash.

It became the secondlargest U.S. bank failure in history and sparked harsher scrutiny of banks around the world.

“I think the market has been very much focused on a set of extremes, like what we saw in the COVID period, where it was either:

The sky is falling, or everything is euphoric,” said Zach Hill, head of portfolio management at Horizon Investments.

While he doesn’t think fears about banks are completely gone, he says now “we’re in much more

of a middle ground environment, in terms of the economy and in terms of rate hikes flowing through to economic activity.”

Among the big actions taken by regulators was a government-brokered takeover by one Swiss banking giant of another. In that deal, UBS said Wednesday it’s bringing back former CEO Sergio Ermotti to help it absorb its troubled rival, Credit Suisse. Ermotti led the bank through its turnaround following the 2008 financial crisis.

UBS stock in Switzerland rose 3.7%. Other big banks across the continent also strengthened, which helped indexes there to rise 1% or more.

On Wall Street, nearly all of the financial stocks in the S&P 500 rose, and some of the banks that have been hit hardest in recent weeks rose sharply. First Republic Bank jumped 5.6%, and PacWest Bancorp. gained 5.1%.

The Federal Deposit Insurance Corp. announced the sale of much of Silicon Valley Bank’s assets at the start of this week. Regulators earlier this month also announced programs to help banks raise cash more easily. That, plus the implicit promise U.S. officials have seemed to make about protecting depositors at other banks, should help support the industry, analysts say.

Easing fears about the banking system have helped Treasury yields to steady in the bond market, following some historic-sized moves earlier this month.

The two-year Treasury yield, which tends to moves on expectations for the Fed and has been particularly

unsettled, ticked up to 4.09% from 4.08% late Tuesday. Earlier this month, it went from more than 5% to less than 3.80%, which is a massive move.

The path ahead for the Federal Reserve and other central banks has become much more difficult because of the banking industry’s struggles. Typically, the stillhigh inflation seen around the world would call for even higher interest rates. But that would risk more pressure on banks, which could pull back on lending and squeeze the economy.

Traders are largely betting the Fed will have to cut rates as soon as this summer, something that can act like steroids for markets. That’s helped Big Tech and other high-growth stocks in particular, which are seen as some of the biggest beneficiaries of lower rates.

It’s also why a quick glance at the index that gets the most attention on Wall Street could be deceiving, Hill said.

“Looking just at the S&P 500, you could potentially draw wrong conclusions from that,” he said. “The rotations beneath the surface, we think it makes some sense.”

Gains for Big Tech stocks, which dominate the top of the S&P 500, have helped buoy that index. But smaller stocks are still down sharply for the month, as are financial stocks.

The Fed has hinted it sees one more hike before holding rates steady through this year. Many professionals on Wall Street take the Fed at its word, saying rate cuts would likely come more quickly only if the economy is in serious trouble.

The incumbent is responsible for the review and monitoring of the effectiveness of fiduciary controls as well as being responsible for supporting the governance framework, providing support to business lines through escalations, monitoring, program breaches or gaps; reviewing controls as required and reporting the effectiveness of the Trust Field Review Program in the country.

The incumbent will serve as the regulatory expert, reviewing local legal and regulatory laws, guidelines, rules and regulations that are applicable to the business and ensuring that relevant procedures and controls are implemented which are aligned with the laws, guidelines, rules and regulations.

The incumbent will also be responsible for ensuring that Fiduciary controls and procedures are comprehensively and accurately documents in the applicable guidelines / manuals which are approved and operational.

MAJOR ACCOUNTABILITIES

• Provide support to ensure alignment, effectiveness and compliance of local and global testing programs including AML/ATF, Sanctions, On Boarding Practices and other Operational testing programs.

• Provide support and guidance to Business Lines.

• Support by identifying issues through testing reviews of Business Lines.

• Provide proactive recommendations and clarifications related to reviews and participate in control alignment and optimization of procedures.

• Identify control gaps and provide /assist with remediation action plans in coordination with the local Compliance officer for any process breaches.

• Continuously assess inherent risks and mitigating controls in the execution of established procedures.

• Conduct monitoring and testing to ensure the effective and compliant execution and sustainability of the Field Review Program.

• Assist in developing and maintaining metrics and reporting of findings.

• Conduct training programs geared towards improving the internal controls and testing mechanism within the Business Lines.

• The incumbent must have superior working knowledge and establish a database of all existing and new legal and regulatory laws, guidelines, rules and regulations that impact the Businesses.

• Create reports and track training on outstanding legal, regulatory and control issues.

• Act as champion performing a comprehensive review of all Fiduciary guidelines and manuals

• identify gaps and deficiencies in the guidelines/manuals

• Provide responses to senior management, regulators, auditors and staff on queries relating to the content and interpretation of the guidelines/manuals.

EDUCATIONAL/COMPETENCY REQUIREMENT

University degree in a business or legal related field. Relevant Master's degree is desirable, together with:

• A minimum of 5 years' experience with control testing or audit experience in an operations, regulatory or compliance capacity within a financial institution setting.

• 7 – 10 years experience in the Trust / banking sector.

• Compliance designation (ACAMS / ICA) is required.

• Legal qualification would be an asset.

• Compliance, monitoring and testing background required.

• Prior experience in examinations/auditing roles, and an understanding of testing methodology and risk and controls analysis.

• Possess strong communication (verbal and written), listening, presentation and facilitation skills.

• The incumbent must be a strong leader with excellent interpersonal, communication and influencing skills in order to build consensus and collaboration with stakeholders.

• Ability to suggest appropriate recommendations to senior/executive management and effectively support those recommendations by applying critical thinking skills and decision making.

• Excellent organizational and time management skills, including ability to work well under pressure and constantly adjust priorities for self and the team.

• Working knowledge of MS Office (Word, Excel, and PowerPoint).

• Ability to work and travel independently at various locations both locally and internationally when needed.

Qualified candidates should submit C.V via email to: hrbahamas@scotiawealth.com on or before April 3rd, 2023

Please note that only those individuals short - listed for an interview will be contacted.

Please send your resume no later than April 3rd, 2023 to: hrbahamas@scotiawealth.com

THE TRIBUNE Thursday, March 30, 2023, PAGE 11

TRADERS work on the floor at the New York Stock Exchange in New York, Tuesday, March 28, 2023.

Photo:Seth Wenig/AP

Kindly put the job title in the subject line when applying.

Scotia Wealth Management™

JOB VACANCY Associate, Fiduciary Services

This role contributes to the overall success of the Fiduciary Services Department / International Trust Unit / Bahamas / Northern Region ensuring specific individual goals, plans, initiatives conducted are in compliance with governing regulations, internal policies and procedures.

To maintain high quality administration of a straightforward portfolio of trust, foundation, insurance, fund, company and agency solutions in a manner that deepens relationships and enhances profitability, and contributes to the effective operation of Relationship Management through the maintenance of effective risk management controls.

MAJOR ACCOUNTABILITIES

• Communicate with Designated Persons and their advisors in a prompt and efficient manner, with regard to the operation of wealth structures serviced by the Team.

• Ensure that regular and routine administration aspects are diarized and achieved promptly, e.g., preparation of annual financial statements, payments/distributions to designated persons, renewal of insurance policies and that all statements and reports are supplied in a timely manner.

• Have acquired a detailed understanding of and acting in accordance with the Founding and Ancillary Documentation of all cases under administration, assets held, the Designated Persons, and associated tax, legal, and regulatory impact

• Invest funds in accordance with documentation requirements or guidance/instructions from Designated Persons or their advisors, if appropriate or if directed by Team Leader, in a timely and accurate manner.

• Prepare and check computer input relating to transactions and to ensure current and correct financial records for each case and approving same within prescribed limits.

• Prepare company minutes and annual returns and updating statutory records.

• Review financial statements after preparation by accounting department and before dispatching to Designated Persons

• Comply with internal systems of reporting and authorization as evidenced in the Policy and Procedures Manual, and the Trust Services Administration Manual.

• Conduct reviews of each case promptly, as the Annual Review forms are issued and raising appropriate queries.

• Check all files and wallets for each case regularly to ensure that filing is in chronological order and that all documents and correspondence have been correctly filed in safe, statutory wallet or correspondence file.

EDUCATIONAL/COMPETENCY REQUIREMENTS:

• Basic knowledge of fiduciary principles and practices.

• Strong knowledge and understanding of trust and corporate administration, fiduciary principles and regulatory requirements.

• A good understanding of local laws with a legal background.

• Basic Accounting knowledge.

• Professional Trust qualifications or Society of Trust and Estate Practitioners accreditation.

• 5 years progressive related experience within the finance industry.

• Proficiency in organizational and basic analytical and numeracy skills must be evidenced.

• Foreign language capabilities are desirable, especially Spanish and European languages

Qualified candidates should submit C.V via email to: hrbahamas@scotiawealth.com on or before April 3rd, 2023

Please note that only those individuals short - listed for an interview will be contacted.

Please send your resume no later than April 3rd, 2023 to : hrbahamas@scotiawealth.com

Kindly put the job title in the subject line when applying.

PAGE 12, Thursday, March 30, 2023 THE TRIBUNE