More ‘operations’ planned for tax dodger crackdown

• ‘Shaking the trees’: All islands to be targeted • Business Licence filings key to spark probes

• Authorities targeting $4m Briland tax arrears

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE AUTHORITIES are planning “several operations” throughout The Bahamas targeting other suspected tax delinquents, the Ministry of Finance’s top official revealed last night, while their Harbour Island sweep is still not finished.

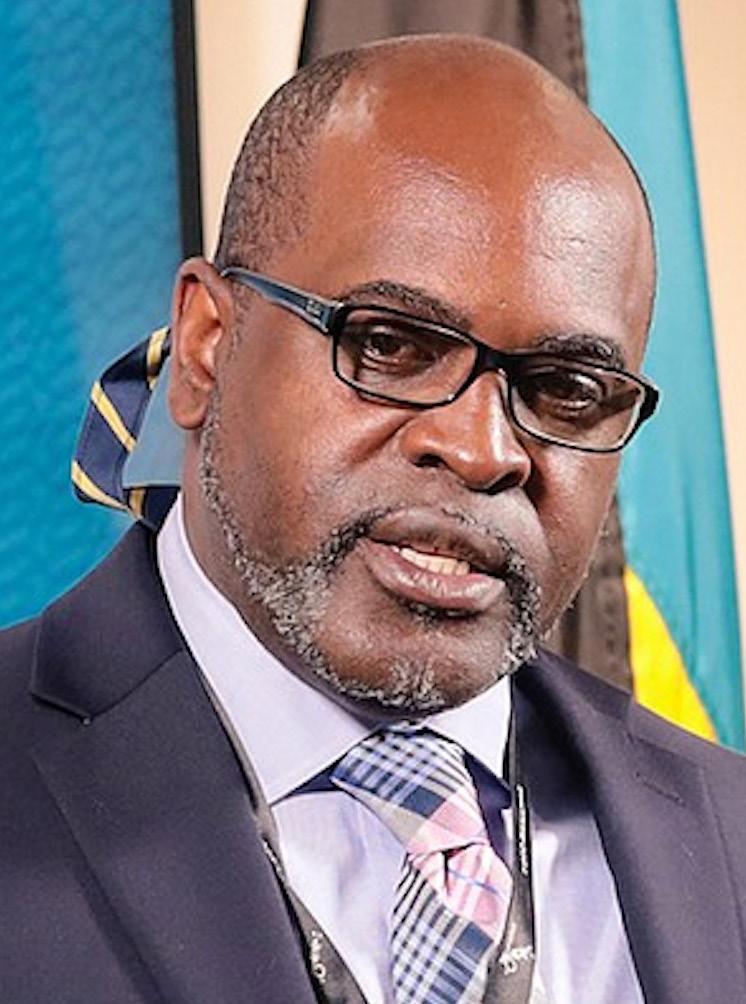

Simon Wilson, the financial secretary, confirmed to Tribune Business that further raids and asset seizures are being readied by the Department of Inland

Revenue, assisted by the police and other agencies, as a wellplaced source - speaking on condition of anonymity - suggested the Government believes it can recover $4m in outstanding tax arrears from its Harbour Island crackdown alone. While declining to confirm or provide numbers, Mr Wilson said the Ministry of Finance and Department of Inland Revenue are “shaking the trees a bit more” through a more aggressive enforcement approach against tax avoidance and evasion by

Gas retailers: ‘Never been so desperate’ due to OPEC slash

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN petroleum retailers yesterday said “it’s never been so desperate” with a surprise production cut by the major oil producing countries making their need for a margin increase even more urgent.

Vasco Bastian, the Bahamas Petroleum Retailers Association (BPRA) vice-president, told Tribune Business the sector’s plight has “become even more worrisome” after the announcement by the Organisation of Petroleum Exporting Countries (OPEC) cartel sent oil prices back above the $80

• Say oil price jump makes plight 'more worrisome'

• And resolution meeting with PM even more urgent

companies over VAT and Business Licence fee payments.

Confirming that “quite a bit” of its investigation has been triggered by suspicious Business Licence filings, with some companies reporting turnover figures that are hugely inconsistent with their known level of commercial activity, he told this newspaper that the seizure of goods, corporate records and other assets was “not a step we take lightly” and is only undertaken following the necessary probe and obtaining of a court Order.

this scenario had made a second promised meeting with Philip Davis KC and his officials to resolve their calls for a margin increase even more urgent.

Asked whether last week’s Briland raids, which targeted Conch & Coconut and Andre’s Rentals, were intended to send a warning signal to other deadbeat taxpayers, Mr Wilson replied: “It will have a demonstrative effect, but the reality is that we have to do more. We have several operations

Sir Franklyn: Quieting Titles ‘licence to thief’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

mark on the major crude indices.

And, with increased global demand set to impose further pricing pressures ahead of the summer months, when households in the US and Europe hit the roads during their annual vacations, he warned that local gas station operators will once again face the prospect of having to pay

more to purchase the same quantity of fuel.

• Consumers warned to brace for fresh pump rises SEE PAGE

This, dealers say, will result in increased overdraft and credit card fees that they must pay from price-controlled fixed margins that are already insufficient to absorb a multitude of ever-increasing costs, thus plunging many into a deeper lossmaking position. Mr Bastian and others said

Speaking after the OPEC+ group, which includes the likes of Saudi Arabia, Russia and Iraq, announced they will cut combined production by one million barrels per day or 3.7 percent of global demand, Mr Bastian told this newspaper: “That definitely, definitely would have a huge impact. It’s become even more worrisome with that type of action taken by OPEC.

“It will have a devastating impact on our industry and we cannot

Cable: URCA’s 23% budget rise ‘assault on our finances’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CABLE Bahamas has blasted the 23 percent hike in the Utilities Regulation and Competition Authority’s (URCA) 2023 budget as “an assault on the finances” of itself and other communications operators who will pay for it. The BISX-listed communications provider, in

its response to the regulator’s draft 2023 annual plan, proclaimed itself “astounded” by the magnitude of the $1.26m year-over-year increase and demanded that URCA slash this jump by more than 50 percent in percentage terms. Urging URCA to instead opt for a 5-10 percent budget increase, Cable Bahamas and its Aliv mobile affiliate said the days of communications

operators being “a ‘cash cow’” were long over yet itself and the likes of the Bahamas Telecommunications Company (BTC) are being expected to finance the rise via increased licence fees despite facing a variety of other cost and investment pressures.

Cable Bahamas suggested the situation also exposed the folly of amending the URCA Act, the regulator’s governing legislation, which

previously allowed it to retain any excess licence fees above those used to finance its budgeted operations and apply them to costs incurred in future years.

However, the Act was reformed more than a decade ago, on July 1, 2013, to require that such sums instead be transferred to the Government’s Consolidated Fund to cover its

SEE PAGE B6

Growth to ‘moderate’ as COVID revival near end

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Central Bank yesterday reaffirmed that The Bahamas’ economic growth rate will “moderate as the recovery from COVID-19 becomes more complete” with February’s air visitor arrivals just 2.5 percent off pre-pandemic pace.

Unveiling its report on February 2023’s economic

developments, the regulator said the annual gross domestic product (GDP) growth rate will start to normalise and return to more traditional levels with this nation having regained much of the economic output lost to COVID.

“The domestic economy is expected to sustain its growth trajectory in 2023, supported by a strong recovery in the tourism sector. The pace of

expansion is expected to moderate, however, as the recovery from COVID- 19 becomes more complete,” the Central Bank said, adding that unemployment levels were expected to remain above pre-pandemic numbers despite gains in construction and tourism.”

Its assessment comes immediately after the Bahamas National Statistical Institute (BNSI) unveiled data showing

2022’s real gross domestic product (GDP) was slightly higher than that for the last COVID-free year of 2019. It added that economic activity last year expanded by 11.9 percent on a nominal basis and some 14.4 percent in real terms “as business activity returned to pre-COVID 19 levels”.

The real GDP measurement, which strips

SEE PAGE B5

ARAWAK Homes chairman yesterday urged The Bahamas to embrace a system of registered land as he warned that the Quieting Titles Act has become “a licence to thief”.

Sir Franklyn Wilson, who also heads Sunshine Holdings, told the University of The Bahamas (UOB) Business Week seminar that here is “a lot of work to do” in creating better land policy in The Bahamas. He described the “first problem” as proving proper title to a property, and the second as protecting it from people that are trying to “steal it”.

“There’s something that’s been on our books called the Quieting Titles Act that is a licence to thief,” he argued. “In our country, somewhere and at some time, we must develop some system of land registration such that people know this is my land, it’s more difficult for people to

steal it and it becomes more complicated.”

Sir Franklyn’s concerns are nothing new, but the Government and policymaker level has thus far been unwilling to enact serious reform. Tribune Business has reported on several Quieting Titles Act abuses in recent years, detailing how the law has been used as a fraudulent tool to commit real estate theft.

A typical abuse is for persons seeking a Certificate of Title from the Supreme Court not to notify others, who may have an interest in

business@tribunemedia.net TUESDAY, APRIL 4, 2023

SEE PAGE B4

SEE PAGE B4

SIR FRANKLYN WILSON

SIMON WILSON

$5.67 $5.72

B6 $5.67

$5.59

ACCESS ACCELERATOR TARGETS 200 MSMEs FOR ASSISTANCE

THE SMALL Business Development Centre (SBDC) is this year aiming to help 200 micro, small and medium-sized (MSME) enterprises access an average $100,000 in funding each through its Guaranteed Loan Programme.

Samantha Rolle, the SBDC’s executive director, addressing the University of The Bahamas (UoB) Business Week, said that while

the agency is not a direct provider of financing “we ensure seamless facilitation to access to capital for our clients through various programmes” and partner lending institutions.

“We have the Guaranteed Loan Programme, and our flagship programme offers eligible start-ups and existing MSMEs on all islands of The Bahamas access to grants, loan and equity funding,” she explained. “So with the support of our strategic partners, we will execute monthly initiatives focused on critical problems in the

local market, such as food security, affordable housing, export barriers, youth unemployment and gender inequality.

“In 2023, our goal is to identify approximately 200 MSMEs with innovative solutions to help them access an average of $100,000 in funding through the Guaranteed Loan Programme.” This funding is open to all sectors in the economy and can cover items such as equipment and facility upgrades, personnel and technological improvements as well as

sustainable development projects.

Ms Rolle added: “As pertinent issues such as climate change and resource depletion continue to impact the business world globally, Bahamian business owners must recognise the importance of assessing their sustainability risks and taking swift, decisive action to mitigate loss and environmental threats.

“So driving businesses towards sustainability requires strong leadership from leaders who are not afraid to challenge the status quo and take critical steps

in the right direction to improve the resilience of MSMEs to create a more sustainable future.”

The SBDC chief continued: “Each year the SBDC and its partners host training seminars and events to educate and inspire local entrepreneurs. During the month of March alone, we hosted what we called ‘Level Up’, and that’s a community based training workshop for start-ups and entrepreneurs that we intend to hold quarterly.

It’s essentially SBDC representatives, along with some of our strategic partners,

engaging small businesses and entrepreneurs within their environment in their community.

“We also hosted what we call the intellectual property seminar IPP, and that was part of our creative entrepreneurs initiative that was launched. Essentially what that was about is protecting your intellectual property. Again, legislative policy-based initiatives that are needed to ensure that your bright idea, your innovation, is protected.”

‘No industry more efficient’ at storm rebound than insurance

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN insurance executive yesterday said that obtaining full property coverage is critical to the ability of homeowners, businesses and the wider economy to build resilience against natural disasters.

Patrick Ward, Bahamas First’s president and chief executive, told the University of The Bahamas (UoB) Business Week that economic sustainability is directly tied to The Bahamas’ ability to recover from hurricanes and other weather-related catastrophes.

He added that this was exposed by Hurricane Dorian, and pointed to the difference in post-storm recovery pace between those who had full all-perils insurance coverage for their properties and those

that did not. The former have received financing to fully rebuild their destroyed structures, while the latter are still trying to rebound.

As a result, Mr Ward said those homeowners and businesses who had full insurance cover are “back on track,” and this is “evidence of sustainability once you have insurance kicking in and taking place. You see the recovery that’s taking place as a consequence of that… That sort of speaks

BAHAMAS TEAMS WITH CRUISE BODY FOR 800-PERSON EVENT

THE Bahamas teamed with Cruise Line International Association (CLIA) to host an event on Fort Lauderdale Beach that attracted some 800 attendees during a recent cruise industry conference.

The Ministry of Tourism, Investments and Aviation used the Seatrade Cruise Global conference to host a cultural show presenting Bahamian food, drinks and entertainment, including The Chipman Dancers and Lassie Doh Boys, at the Marriott resort.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, spoke at an event that was also attended by the ministry’s parliamentary secretary, John Pinder, its global relations consultant, Senator Randy Rolle; tourism director-general, Latia Duncombe; tourism deputy directorgeneral and director of aviation, Dr Kenneth Romer; director of investments, Phylicia Woods-Hanna; other ministry staff, government officials and Bahamas Maritime Authority representatives.

Mr Cooper is pictured giving remarks and chatting with guests. (BIS Photos/Kemuel Stubbs)

to sustainability or indemnity or the ability to recover post an event.

“So what does sustainability look like in real terms, both in a macro sense and on a day-to-day standpoint? What I’m showing you are examples of people who are individually in a position where they’ve been able to recover post an event as a result of the insurance industry kicking in and providing some kind of recovery mechanism.”

The Bahamian insurance industry paid out $1.8bn in claims as a result of Hurricane Dorian, with the ultimate industry payout likely to be as high as $2bn when external insurance claims are taken into consideration.

Mr Ward said: “The Central Bank reported in February 2020, which would have been a few months after Hurricane Dorian, that the foreign reserves in The Bahamas that actually ended the year, 2019, stood at $1.7bn and it was $500m

more than the year before at the end of 2018.

“The difference really was as a result of the inflow of reinsurance dollars coming in from the outside into the Bahamian economy to fund the claims that insurance companies” paid out. “There’s no other industry that is more efficient at getting the economy and individuals back on track following a natural disaster event than the insurance industry, and so if we do our role properly it means to restart that flow of recovery in a way that nobody else can,” Mr Ward added.

The Bahamas First chief, though, said the insurance Industry needs policy support to get over the “hurdles” to sustainability, particularly with regard to ensuring that building codes are up to standard and enforced.

Mr Ward said: “The other thing that we need to focus on, and it’s really more of a state issue, is

the modernisation of our building codes. In addition to that, the mandate from the Government to have a greater level of enforcement as it relates to whatever those new guidelines are, because having a building code that cannot be enforced is really no good.

“But there are some things that we’ve learned from Dorian, and from other storms, that we need to incorporate into some revised building codes. If we do that I think we have a better chance of being more resilient when the storm activities do occur, because they will occur with more frequency.

“Lastly, is that we just have to have an acceptance of the reality that we have to just basically reconsider what is an appropriate building code for The Bahamas as it relates to where we allow for zoning in certain areas.”

Warning that climate change will continue to

shape the insurance industry and The Bahamas, Mr Ward said: “There are a number of other factors that we need to think about when we think about sustainability, and then making that next step in terms of building resiliency in terms of knowing what are the things we’re going to do in order to facilitate more resiliency within our economy and the different sectors that contribute to that effort.

“So one aspect.... that we need to think about is that every small increase in global average temperature results in a significantly larger increase in the probability of extreme natural events. So this is a significantly disproportionate relationship between the small changes we think will create small events. No, small changes in global average temperatures will result in significant or extreme changes on the other end of it.”

Cabinet ministers attend downtown cafe opening

TWO Cabinet ministers attended the opening of a new business on Parliament Street in downtown Nassau.

Chester Cooper, deputy prime minister and minister of tourism, investments

and aviation, and Fred Mitchell, minister of foreign affairs and the public service, were present for the opening of Olde Nassau Cafe.

Shown at the opening, from left: Senator Michela Barnett-Ellis; Mr Mitchell; Aniska Barnett, owner of Olde Nassau Cafe; Mr Cooper; Sir Michael Barnett; and April and Donald Saunders, former MP and deputy s+peaker of the House of Assembly. Mr Cooper, as daughters of the owner Anishka Barnett look on, is photographed adding his wall signature at the grand opening, and is

PAGE 2, Tuesday, April 4, 2023 THE TRIBUNE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

also pictured with artist Tamara Cargill.

PATRICK WARD

Photos:Kemuel Stubbs/BIS

DISNEY: WE’LL SPEND ‘100 PLUS YEARS IN ELEUTHERA’

DISNEY Cruise Line yesterday said it was committed to Eleuthera’s long-term growth by asserting that “we expect to be there for 100-plus years” with its Lighthouse Point destination.

Joseph Gaskins, the cruise line’s regional public affairs director for The Bahamas and Caribbean, reaffirmed that the south Eleuthera project is scheduled to open in June 2024 ahead of his presentation at the upcoming Eleuthera Business Outlook conference on April 20.

He said: “We are just over a year out of our opening of Lighthouse Point. We announced our first itineraries last week so, in June 2024, Eleutherans can expect the first Disney cruise ships to begin sailing

to Lighthouse Point. We’re very excited about that.

“Disney is committed to Eleuthera. This is not a 10-year project. This is not a 20-year project. We are putting our concrete in the ground, and we expect to be there for 100-plus years. So there is going to be growing opportunity around the development whether businesses are ready now or in the future. We are committed to helping those businesses in Eleuthera develop, take advantage of the opportunities and to grow the local economy there.”

Mr Gaskins said the upcoming Business Outlook conference will provide an opportunity for Disney Cruise Line to provide construction updates, plus announce entrepreneurial opportunities for Bahamians in food and beverage and port excursions and tours.

He said “This positions us I think in a great way to talk about the project at Eleuthera business outlook, to update the community on the progress that we’re making as it relates to our construction and as we prepare to open. But what is really important and what

I’m really excited about doing at Eleuthera business outlook is beginning

to introduce the community to the opportunities that small business ownersentrepreneurs will have as it relates to supporting our operations.”

The Disney official added: “We have a number of sub-contracting opportunities available to Bahamians as it relates to port excursions and tours, food and beverage facility

services. And we’re going to be talking a little bit about not just what those opportunities are, but also how Eleutherans and Bahamians generally can take advantage of it.

“On top of that, we’re using the Eleuthera Business Outlook to allow our team members from strategic sourcing, from our port excursions teams, from our operation integrations team, to engage with the private sector and Eleuthera. It is the first time that these teams are going to be all down together.

“And it provides us with a fantastic opportunity to use this gathering of Eleuthera’s private sector to ensure that we are shaking hands, pressing the flesh, making sure that we’re meeting the right people so that we can advance these opportunities, like I said, for Eleutherans and Bahamians. So we’re very,

very excited about this opportunity.”

Mr Gaskin reinforced that Bahamians will have first priority when it comes to providing support services to Lighthouse Point as its passengers will prefer a more culturally-rich experience provided by locals. “As it relates to port excursions and adventures, Bahamians have first priority,” he added. “As it relates to food and beverage, we have to source a minimum of 5 percent of our products from the Bahamas; from Bahamian business owners.

“We also see opportunities in facility management, vehicle maintenance, landscaping, the provision of other services that keep our operations going. So those are the kinds of things that we are looking at - authentic sauces, authentic food products, beverages, heritage tours.

Eleuthera leads Family Islands over air arrivals

By FAY SIMMONS jsimmons@tribunemedia.net

ELEUTHERA ranks second only to New Providence by leading all Family Islands for airborne visitor arrivals in 2022, it was revealed yesterday.

Dr Kenneth Romer, the Ministry of Tourism, Investments and Aviation’s deputy director-general, and director of aviation, said: “We have seen record breaking numbers at the end of 2022. When it comes to your overall numbers for foreign air arrivals, Eleuthera now ranks second behind Nassau/Paradise Island.

“But, for overall 2022 performance, Eleuthera actually edged out all of the Family Islands. So I do think when we look at the the opportunities for investment, it’s going to speak about the confidence investors have and touristic development in Eleuthera. Eleuthera has been doing exceptionally well.

“Eleuthera is targeted now for the development of three airports. We have been speaking just over the past month with airlines; foreign airlines who are going to be increasing airlift into Eleuthera. We have been advocating significantly again for foreign air arrivals. We do know that Eleuthera’s growth is constrained by capacity. So airlines want to come to Eleuthera, [but] they’re

speaking about the product deficiencies.

“They’re speaking about available capacity for additional room inventory. They’re looking at the state of the airports - North Eleuthera, Rock Sound and Governor’s Harbour. Those three airports are actually targeted for aggressive development. So we will speak about what the development template looks like. We might be able to present some concepts for airside and land side development.”

The new developments are a part of what Dr Romer refers to as the “resurrection and renaissance” of Eleuthera, which he is hopeful will attract new investors and entrepreneurs.

He will address this at the upcoming Eleuthera Business Outlook conference, and said: “I wouldn’t say Christmas is going to come early, but we’re going to call it Easter is going to come late. We’re going to speak about the resurrection and the renaissance of Eleuthera.

“And, of course, we’re going to engage with our critical stakeholders, our product partners. We’ll speak about some innovations for product. And we are really going to support the transformation and the renaissance of the Eleuthera community.

“We’re looking at the big picture. We’re going to give Eleuthera the renaissance that it needs, and it’s

going to cause there to be, I believe, new entrepreneurs, new land owners, new property owners, and we’re going to support them again as a tourism, investments and aviation family.”

Dr Romer also suggested vacation rentals as a solution to the hotel room inventory shortages that the island will eventually face as visitor arrivals numbers continue to rise. He indicated that the planned registry of vacation rental properties will ensure that units offered to guests are legitimate.

“The consensus with our international partners is that growth is constrained with capacity,” Dr Romer said, “whether we look at the airline capacity or seat capacity, which we’re dealing with. So, on the one hand, we are strongly encouraging and advocating for additional airlift into Eleuthera, both for domestic and international tourism.

“I think there has to be innovation as it relates to product. Certainly second homes. Airbnbs have to feature prominently into discussions as it relates to supplementing your traditional hotel room inventory.

I’m sure Minister [Clay] Sweeting will speak about the move to have the Airbnbs registered, so that we can know that these are legitimate places where visitors - domestic and international visitors - can stay.

Chamber president: We must lead investment discussions

By FAY SIMMONS jsimmons@tribunemedia.net

ELEUTHERA’S Chamber of Commerce president yesterday urged the Bahamian private sector to lead the discussion on the investments necessary to build a thriving national economy.

Thomas Sands said: “We believe that, as a group, it is very important that we, as business owners, and as an organisation, remain part of the discussion and we not only be a part but we help lead the discussion. We partner with our stakeholders, the Bahamas government, the investor, the visitor, the infrastructure that’s necessary to build an economy, and build an environment that is conducive to successful growth and participation by Bahamians as well as international investors.”

Mr Sands, a member of Campbell Shipping’s Board of Directors, said a visit to the company’s offices in Mumbai, India, led him to consider what is necessary to propel Bahamian businesses to be global players. “The level of service and innovation, the assets that The Bahamas has in relation to these locations, and understanding, you know, beginning to end analyse what is our niche, where do we best step, what are we not good at?” he said.

“What do we outsource but also, you know, as I travelled and saw all of this investment in different locations, you also measure why is that investment taking place in Eleuthera? Why are these global companies investing in The Bahamas?

What do they see as the potential here? And, in turnkey, what is the expectation? What is it that do we have to deliver? How do we compare to these locations? So, I think there is a global discussion about the world that exists today.

“There is a global discussion about why is investment taking place in The Bahamas. And I think there’s another question: What do we need to do as a people to be world players, and meet the expectations and not only making a living, thrive and be successful in our own country as this global investment takes place. But also reach out to resources that are available in other countries, that are available through connectivity, through collaboration, to better the product that we have.”

Mr Sands referenced two new developments, the Disney Lighthouse Point cruise destination and the Ritz-Carlton Reserve resort, which will provide new economic opportunities for Eleutherans. He also noted the interest that developments have in local

“It’s going to really encourage entrepreneurs. It’s going to create, I believe, a boom when it comes to ownership of smaller properties of Airbnb to supplement the major initiatives and building that’s taking place in Eleuthera.”

At a recent aviation conference in Chicago, Dr Romer said it emerged that many legacy and smaller carriers are interested in flying to Eleuthera. He has also been in discussions with cruise lines about local products, sustainable tourism and outreach programmes for the local communities. He added: “You’re going to find legacy carriers, like your American Airlines, like Delta, are eyeing Eleuthera. You’ll find the smaller carriers like a Silver, which has inter-line agreements with other large carriers, are all speaking about Eleuthera. During the airlift conference, Eleuthera was a hot topic. Airlines are saying we want to do more business in Eleuthera. But, again, this is constrained by capacity.

“We did meet with our cruise lines at Seatrade last

week, including Disney. We started back with the senior leadership, including the vice-president of government affairs at Carnival, and the whole discussion really centred around how is it that we can engage more local entrepreneurs and stakeholders.

“So we did have discussions about authentic products. We did speak to the environmental impact. We did speak about the promotion of a more sustainable tourism model. We did speak about with our cruise line partners about how they could do more and give back to our communities.”

Dr Romer discussed plans for the 14 upgraded Family Island airports, highlighting that they will be designed with sustainability and resilience against natural disasters. The maintenance of the airports will be facilitated through private-public partnerships (PPP).

He said: “So these are an additional 14 airports. The investment model is for the design, the building, the financing, operating and the maintaining of these airports. So you will be

pleased that, in our design model, we are speaking about resilience. The reality is that we are in what persons referred to as a hurricane zone. And so when we look at the design of our airports, you’re going to find there going to be some innovations around designs.

“There’s going to be best practices when it comes to sustainable airports, that we now reduce our carbon footprint, but also the design has to speak about resilience. How can they withstand a Category Five hurricane? And how is it that they can be better maintained?

“So I’m certain that when we are able to announce the private partners through our PPP model, that we are looking for partners who are going to be able to maintain these airports, who are going to help manage them. And at the end of the day, how can these airports become commercially viable entities to support the development and growth of many Family Islands, Eleuthera being one of them, three among the 14.”

products, presenting a range of opportunities for Bahamian entrepreneurs.

The Chamber chief said:

“Because of the investment that is taking place, I think there’s a broad range of opportunities. Some of it will be in the service sector, some of it will be as vendors. But there are definitely opportunities where these developments have to be serviced.

“They want authentically made, authentically grown products, or authentic manufactured products or processed products. And so I think there’s a wide audience, or a wide range of opportunities, for Bahamians, for Eleutherans, especially if there’s a way in which you could put your stamp and your name on that product and its unique offer.

“And again, that is not limited to even a food product or a craft product.

I’m sure when we look at the list of investors there’s Disney Cruise Line putting $400m into Eleuthera, Tarpum Bay Holdings coming with a Ritz-Carlton Reserve product. I’m hearing by the end of the year they are supposed to start construction. You’re talking about a very diverse opportunity over the next three to four years in the island of Eleuthera if we would just pick those two projects.”

THE TRIBUNE Tuesday, April 4, 2023, PAGE 3

By FAY SIMMONS jsimmons@tribunemedia.net

SEE PAGE B4

DISNEYS LIGHTHOUSE POINT RENDERING

More ‘operations’ planned for tax dodger crackdown

planned, and this operation in Harbour Island is not completed yet.”

Confirming that other Briland businesses, who he did not name, have also caught the attention of the Department of Inland Revenue and its audit and compliance teams, the financial secretary added: “We’re shaking the trees a bit more with our investigation. As important as the revenue is, it’s more important to ensure these companies are operating according to the law and the National Investment Policy.”

Mr Wilson also confirmed that the crackdown will extend to suspected tax dodgers on other islands, including New Providence, and cover the length and breadth of The Bahamas as part of a drive to ensure all pay their fair share to the Public Treasury. He added, though, that the steps taken on Harbour Island resulted from a formal investigation process that ended with the tax authorities obtaining a court Order allowing them to seize the assets.

“It’s a process,” Mr Wilson explained. “Once we gather information and think we have probable cause we’ll take action. We have to get a court Order. We have to go to court under the legislation and present information in order to seize equipment,

goods and records and so forth.”

The Department of Inland Revenue can employ its powers under both the VAT Act and Customs Management Act to obtain such seizure Orders, and the financial secretary said that “we’ll use both” according to the facts and circumstances of each particular case. “We get intelligence, businesses and persons come in and tell us information on a business and then, based on intelligence, we do our own investigation and if the investigation identifies a problem we’ll go ahead. It’s a process. It’s not a step we take lightly. We have a process we go through,” Mr Wilson told Tribune Business. Several companies have complained that the processing of Business Licence renewals this year was unduly delayed. However, Michael Halkitis, minister of economic affairs, said the Department of Inland Revenue and its officials have a duty to check all turnover figures submitted for accuracy, and ensure as best as possible they are consistent with the applicant’s known business activity, as means of preventing/catching firms under-declaring or reporting revenues.

Those able to get away with such practices are able to avoid/evade a portion of the due turnover-based Business Licence fee. Mr

Wilson confirmed that the extra scrutiny applied to such filings this year had helped trigger several probes, saying: “Quite a bit of it is coming because of the Department of Inland Revenue filings. Then we get intelligence.”

Turning to last week’s Harbour Island sweep, he added: “In the case of the most recent one, we were getting reports for the last couple of months for certain operations that had us thinking something is amiss here; something is not correct here. We had intelligence to indicate something is not correct, and we have to take some extra steps.”

Mr Wilson confirmed that many of the assets seized from both businesses had been returned after Conch & Coconut and Andre’s Rentals subsequently approached the Department of Inland Revenue “in good faith” to resolve the allegedly outstanding tax arrears and pay them off.

“I think they have come in and started dialogue with us,” he said of both businesses, without naming them. “It’s process. The one thing we want from businesses is transparency in operations. I think they’ve started that process of being a little more transparent.

“They came in, had a discussion with us and are acting in good faith. We’re returned the assets. I think most of the assets have been returned. There’s no

reason for us to hold them. It’s moving forward.” Tribune Business sources on Harbour Island, speaking on condition of anonymity, confirmed that Conch & Coconut still appeared to be operating having seen one of its tour boat excursions leave with passengers while its golf carts are still in use on the island.

Conch & Coconut, only founded in 2018, bills itself as Harbour Island’s “leading locally-owned and operated luxury concierge and experiential travel company”. Julian Shaquille Gibson, known as ‘Shaq’, its co-founder, and who is also a realtor with Corcoran CA Christie, denied that anything was amiss when questioned by Tribune Business last week about the tax authorities’ actions and asset seizures.

Briland contacts said he had subsequently been repeating the same message to others, suggesting that it was all a mistake or misunderstanding, and was in the process of being resolved. Internet research by this newspaper also linked Conch & Coconut to a Miami-based CubanAmerican entrepreneur, Pablo Conde. One posting from 2021 said he “currently runs....... Conch & Coconut”, while also referring to the “getaway” that is Eleuthera. And a Facebook page describes him as Conch & Coconut’s co-founder, and chief

SIR FRANKLYN: QUIETING TITLES ‘LICENCE TO THIEF’

FROM PAGE B1

the same land, of the court action and their intentions.

All Quieting Titles Act applications are supposed to be made public, so rival claimants can challenge title applications, but this does not always happen.

The Supreme Court is often not made aware of the existence of rival “adverse claimants”, with applicants often lying that they have made “full and frank disclosure”. Among the most egregious examples of Quieting Titles Act fraud is the three-decade saga impacting a 156-acre tract in the Pinewood Gardens/Nassau Village area, near to Sir Lynden Pindling Estates.

As previously reported by this newspaper, a group of land speculators, assisted by some unscrupulous attorneys, obtained a Certificate of Title to the land via fraud, as they never

notified - or made the Supreme Court awarethat there was an “adverse claimant”.

They then promptly sold the land to unsuspecting Bahamians, paving the way for three decades of legal battles that have damaged the lives - and largest investments - that many ordinary persons will make in their homes. Such actions also undermine Bahamian economic activity by tying up major land tracts in legal disputes for years. The situation cries out for legislative reform by Parliament, but there has been little appetite for in a body that is typically dominated by attorneys. There is also much scepticism as to whether a land registration system will ever get off the ground. The last Ingraham administration led similar efforts more than one decade ago

to develop a three-strong package of Bills that would have overhauled the existing system.

These Bills - the Land Adjudication Bill, the Registered Land Bill and the Law of Property Bill - would have created a land registry in the Bahamas, and given commercial and residential real estate buyers greater certainty that they had good title to their properties. However, they were ultimately shelved and no subsequent administration has seen fit to revive them.

Many have referred to the present system as “a lawyer’s dream”, with attorneys earning a set fee - normally equal to 2.5 percent of the purchase price - for conducting title searches and providing “opinion on titles”. Those not employed in the legal profession find it virtually

impossible to navigate the system as structured and perform their own title searches, and Parliament tends to be dominated by the number of attorneys who are MPs and Senators by profession.

The basic current system is centred on the Registrar General’s Department and at the Department of Land and Surveys. The former only records title once it has been notarised and due taxes paid, while the latter maintains a map of all lands in the country, both private property and Crown Land, with no delineation in ownership. A land registry, though, would contain all information relating to a specific parcel of land in one database, including its location, dimensions, ownership interests and all encumbrances, such as mortgages and other liens/charges.

executive and co-founder of Pink Sands Spirits Company, the liquor brand that is being promoted on the former’s golf carts.

Asked whether The Bahamas might seek cooperation from the US federal tax authorities, such as the Internal Revenue Service (IRS), given Conch & Coconut’s US Florida connections, Mr Wilson replied to Tribune Business: “We are contemplating that.” Such co-operation is likely provided for in the various tax information exchange agreements that this nation has signed with Washington D.C.

Marc Tonis, proprietor of Andre’s Rentals, effectively confirmed that his golf carts had been confiscated when contacted by Tribune Business last Thursday. He said he was on a flight about to leave Nassau for Harbour Island, having met with his attorney, and voiced confidence that the situation will be resolved by Friday.

“Some stuff like that happened,” he said, when asked about the Department of Inland Revenue’s seizure of his golf carts and their transfer to Nassau.

“I just finished with my lawyer, and everything should be sorted out tomorrow [today]. That’s why I’m going home.” When asked what had motivated the authorities’ actions, he replied: “It’s a couple of things”, but did not elaborate.

Sir Franklyn said a proper land registry is an “issue we have to address if we are going to build a resilient economy. Registration is a part of it. Proper policies, and also proper policies related to Crown Land”.

Moving to a such a system - and registration systemwould remove the need for attorneys to conduct expensive, time consuming title searches that are sometimes prone to error, and move the Bahamian real estate market away from being based on “first to record” title deeds.

Sir Franklyn, meanwhile, yesterday also called for land policy reforms, “One of the most significant policy divides in the country revolved around land when one government said we must introduce something called the Immovable Properties Act. That was intended to take out the degree of speculation, and to make it possible for people to not just hoard

Disney: We’ll spend ‘100 plus years in Eleuthera’

FROM PAGE B3

“What we’re finding as far as the trends in tourism are concerned [is that] cultural engagement, heritage engagement, from an island that has such a rich and distinct culture, like Eleuthera, is definitely something that Disney Cruise Line passengers would be happy to be immersed in.”

Mr Gaskins said Disney’s Memorandum of Understanding (MoU) with the Eleuthera Chamber of Commerce has helped provide more than $150,000 in grant financing to local businesses. He added: “Three or four years ago, we signed a Memorandum of Understanding with

the Eleuthera Chamber of Commerce, as well as the Small Business Development Centre (SBDC) and Access Accelerator. That partnership, we invested $1m into it.

“It resulted in the buildout of the Small Business Development hub, where the Eleuthera Outlook is being held, as well as programming over the last two years for small businesses in central and south Eleuthera - business development training and grant funding.

“We’ve provided over $150,000 in grants to over 30 businesses in Eleuthera, and we are now renegotiating our support for the Eleuthera Chamber of

NOTICE

INTERNATIONAL POLO INC.

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, INTERNATIONAL POLO INC. is in dissolution as of March 30, 2023

International Liquidator Services Ltd. situated at 3rd Floor Whitfield Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator.

Commerce and SBDC as we move towards operations to ensure that we continue that support, but also do that in a strategic way that pours into the businesses in south and central Eleuthera across Eleuthera, so that they are not only able to take advantage of the opportunities that we’re providing, but also prepared to do that.”

Vendor fairs will be announced for Eleuthera and New Providence, and Mr Gaskins is welcoming all entrepreneurs to engage Disney’s team on how they can elevate their product to a level that meets the demands of global corporations.

He added: “Following the Eleuthera Business Outlook we will be hosting vendor/supplier fairs in Eleuthera and in Nassau just a few days after. We [will] launch our online vendor portal where small businesses can sign up and get one-on-one meetings with our teams.

“We’re looking at opportunities for established businesses, people who are thinking about starting a business, who may have an idea; big businesses who’ve been doing this stuff already, or folks who are looking at getting started. We’re welcoming everybody to have conversations with us to really understand

The island-wide sweep of companies in Harbour Island focused on businesses suspected of not being properly licensed, failing to pay VAT and other due taxes, and under-declaring or underreporting revenues to avoid the full Business Licence fee and other levies.

While not identifying which sums applied to which business, Mr Wilson previously told this newspaper that the two Briland businesses were suspected of owing a combined $1.3m in unpaid taxes. “With one of the businesses we (are) investigating, there is an estimated $1m in taxes (owed). The other business, our initial assessment is $300k in taxes,” he said.

“In the case of the two businesses, one business declared $1 in revenue last year and they are making close to $1m in revenue. The next business declared $10,000 in revenue and that’s closer to $2m.”

Department of Inland Revenue officials previously confirmed around 30 golf carts, three sea craft and information from computers were seized from Andre’s Rentals, while 102 cases of Pink Sands Spirits liquor, 21 bottles of Vodka, boats, cars, two Mercedes vehicles, and three golf carts were secured from Conch & Coconut.

the land and do nothing on it, just speculating,” he recalled.

“The fact about that is that policy, as attractive as that may sound to you, the fact of the matter is it adversely affected the pace of economic activity because that speculator may be ripping the country off, but the fact of the matter is he was spending something and something is better than nothing.”

The former Immovable Properties Act is also viewed as having a “negative” impact because it drove up the cost of property in the country. Sir Franklyn said: “Some 20 years ago, you could have gotten a three-bedroom, two-bathroom, living room, dining room, kitchen and utility for under $100,000, along with the land”, but the average price for a similar home and property today starts at $300,000 in even urban areas.

the opportunities, and also understand the standard at which Disney operates as a global corporation, and look at your operations and see how we can maybe help you raise the standard

of your own operations, with the hope that by doing this, you’re not only creating the potential to partner with Disney, but also as these developments come to Eleuthera, you will be at a standard where you can supply your products and services to every other investor that is coming to Eleuthera.”

Pursuant to the provisions of Section 138 (4) of the International Business Companies Act, (as amended) NOTICE is hereby given that Nueva Viva Ltd. is in dissolution and the date of commencement of the dissolution is 17 March, 2023

PAGE 4, Tuesday, April 4, 2023 THE TRIBUNE

FROM PAGE B1

Cameron Carey and Collonna Hepburn LIQUIDATORS C/o Bamont Trust Company Limited Bahamas Financial Centre, 3rd Floor Shirley & Charlotte Streets P.O. Box SS-6373 Nassau, Bahamas NOTICE OF DISSOLUTION

L I Q U I D A T O R

Growth to ‘moderate’ as COVID revival near end

out the impact of inflation, increased by $1.614bn year-over-year to $12.854bn driven largely by the strength of the continued tourism recovery. The latter was also almost $300m higher than 2019’s $12.56m real GDP number, with these figures measuring the total value of goods and services produced within an economy during a given period. The International Monetary Fund (IMF), though, has continued to project above-average 4.1 percent real growth for The Bahamas in 2023. This assessment is shared by the Central Bank despite it identifying inflation, rising global oil prices, interest rate hikes and a COVID resurgence among the downside risks to the Bahamian economy.

“Nevertheless, new and ongoing foreign investment-led projects are anticipated to provide impetus to the construction sector, which will foster economic growth,” the regulator added yesterday.

“Tourism output continued to register strong growth, undergirded by gains in both the high value-added air segment and sea traffic, as travel restrictions related to COVID-19 remained eased, and the demand for travel in key source markets increased.

“Initial data suggested that the tourism sector continued to register robust growth during the month of February, surpassing pre-pandemic levels. The performance continued to benefit from relaxed pandemic-related conditions and heightened demand for travel in key source markets.

“Official data provided by the Ministry of Tourism showed that total passenger arrivals rose to 0.8m in February from 0.4m in the corresponding period of 2022. In particular, the dominant sea segment more than doubled to 0.7m from 0.3m visitors in the prior year. In addition, air traffic stabilised at 0.1m, exceeding pre-pandemic levels and representing 97.5 percent of the air arrivals recorded in 2019.”

Breaking these numbers down, the Central Bank said: “Disaggregated by major ports of entry, total arrivals to New Providence doubled to 0.4m from 0.2m in the previous year. Contributing to this outcome, the sea component advanced to 0.3m visitors from 0.1m in 2022, while the air segment rose to 0.1m from 79,496 in the preceding year.

“Further, traffic to the Family Islands strengthened to 0.4m visitors from 0.2m in the prior year owing to gains in the sea and air components to 0.4m and 30,112, respectively. Similarly, foreign arrivals to Grand Bahama totalled 39,467 visitors, surpassing the 13,230 registered in the previous year, as respective air and sea passengers measured 4,927 and 34,540.

“On a year-to-date basis, total arrivals recovered to 1.7m compared to 0.7m in the comparative 2022 period. Supporting this outcome, air arrivals grew to 0.3m passengers visà-vis 0.2m a year earlier, reflecting gains in all major source markets. Similarly, sea arrivals increased more than two-fold to 1.4m visitors from 0.6m in the prior year.”

As for activity at Lynden Pindling International

Airport (LPIA), the Central Bank said: “The most recent data provided by the Nassau Airport Development Company (NAD) affirmed the positive momentum in stopover business, as total departures - net of domestic passengers - increased by 51.9 percent to 121,919 in February, as compared to the corresponding period of 2022.

“Specifically, US departures moved higher by 46 percent to 101,705, while non-US departures nearly doubled to 20,214. On a year-to-date basis, outwardbound traffic expanded by 58.8 percent to 250,084 passengers. In particular, US departures rose by 54.9 percent to 208,942 visitors compared to the previous year. Likewise, non-US departures grew by 82.1 percent to 41,142 visà-vis the same period last year.”

On the vacation rental front, the Central Bank added: “Data provided by

AirDNA on the short-term vacation rental market mirrored these positive trends. Specifically, during the month of February, total room nights sold moved higher by 51.2 percent to 148,726 nights. Correspondingly, the occupancy rates for both entire place and hotel comparable listings increased to 66.3 percent and 63.6 percent, respectively, vis-à-vis 55.2 percent and 50.7 percent in the previous year.

“Further, price indicators showed that year-over-year, the average daily room rate (ADR) for entire place rose by 9.6 percent to $533.56 and, for hotel comparable listings, by 8.6 percent to $196.91.” Domestic consumer inflation for the 12 months to end-January 2023 rose to 5.7 percent, compared to 3.2 percent for the same period to January 2022, due to higher oil costs and prices for other goods and services.

The Board of Directors

Inteligo Bank Ltd.

Independent Auditor’s Report

Report on the Audit of the Financial Statements

Opinion

We have audited thefinancial statements ofInteligo Bank Ltd.(the “Bank”),which comprise thestatementoffinancial positionas at December31,2022,and thestatement ofincome, statement ofcomprehensive income,statement of changes in shareholder’s equity and statement of cash flowsfor theyear then ended,and notes to thefinancial statements, including a summary of significant accounting policies.

In our opinion, theaccompanyingfinancial statements present fairly, in all material respects, the financial position of the Bankas at December31,2022,anditsfinancial performanceand its cash flowsfor theyear then endedin accordance withInternational Financial Reporting Standards (IFRSs).

Basis for Opinion

We conducted our audit in accordancewithInternational Standards onAuditing (ISAs).Our responsibilities under those standards are further described in the Auditor’s responsibilitiesfor the audit of thefinancial statements section of our report. We are independent ofthe Bank in accordance with the International Ethics Standards Board for Accountants’ InternationalCode of Ethics for Professional Accountants (including International Independence Standards) (IESBA Code),and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code.

We believe that the audit evidence we have obtained is sufficientand appropriate to provide a basis for our opinion.

Responsibilities of Managementand the Board of Directorsfor the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRSs, and for suchinternal control as management determines is necessary to enable the preparation offinancial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Bank’s ability to continue as a going concern, disclosing, as applicable, mattersrelated to going concern and using the going concern basis of accounting unless management eitherintends to liquidatethe Bankor to cease operations, or has no realistic alternative but to do so.

The Board of Directorsisresponsible for overseeing the Bank’s financial reportingprocess.

Auditor’s Responsibilities for the Audit of the Financial Statements

This report is made solelyto the Board of Directors, as a body. Our audit work has been undertaken so that we might state to the Board of Directorsthose matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other thanthe Bankand the Board of Directorsas a body, for our audit work, for this report, or for the opinionwe have formed.

The

1

Our objectives are to obtain reasonable assurance about whether thefinancial statements as a whole are free from material misstatement, whether due tofraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance,but is not a guarantee that an audit conducted in accordance with ISAswill always detect a materialmisstatement when it exists.Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of thesefinancial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of thefinancial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purposeof expressingan opinion on the effectiveness ofthe Bank’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

•Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Bank’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosuresare inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may causethe Bankto cease to continue as a going concern.

Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicatewiththe Board of Directorsregarding, among other matters, the planned scope and timing of the auditandsignificant audit findings,including any significant deficiencies in internal control that we identify during our audit.

The accompanying notes are an integral part of these

THE TRIBUNE Tuesday, April 4, 2023, PAGE 5

PAGE B1

FROM

2

March 28, 2023 Inteligo Bank Ltd. Statement of Financial Position December 31, 2022 (Amounts expressed in thousands of US$ dollars) The accompanying notes are an integral part of these financial statements 3 2022 2021 Notes US$ 000 US$ 000 ASSETS Cash and deposit with banks 5Cash 9 9 Deposit with banks: 5Demand deposits 278,439 288,265 5Time deposits 90,772 79,182 369,220 367,456 Financial assets: 6, 21 At fair value through profit or loss (FVPL), including $Nil pledged as collateral in 2022 (2021: $67,907) 385,393 510,976 6, 21 At fair value through other comprehensive income (FVOCI), including $30,572 pledged as collateral in 2022 (2021: $30,316) 54,808 61,849 440,201 572,825 7Loans, net 459,142 423,819 459,142 423,819 Accrued interest receivable 10,517 8,415 8Property, furniture, equipment and improvements 9,207 8,636 9Intangible assets 2,338 3,508 Securities sold pending settlement 407 906 10Other assets 8,328 8,855 30,797 30,320 TOTAL ASSETS 1,299,360 1,394,420 Inteligo Bank Ltd. Statement of Financial Position (continued) December 31, 2022 (Amounts expressed in thousands of US$ dollars)

accompanying notes are an integral part of these financial statements 5 2022 2021 Notes US$ 000 US$ 000 Liabilities Deposits: 21Demand 516,746 593,617 Time 556,797 452,479 1,073,543 1,046,096 12Borrowings 14,000 46,000 Accrued interest payable 4,242 2,804 Securities bought pending settlement 833 1,659 Other liabilities 5,430 7,531 10,505 11,994 Total liabilities 1,098,048 1,104,090 13Share capital 20,000 20,000 Other accumulated comprehensive (loss) income (4,926) (1,312) 7Regulatory reserve 2,242 2,242 Retained earnings 183,996 269,400 201,312 290,330 EQUITY 1,299,360 1,394,420 Approved on behalf of the Board of Directors on March 28, 2023 by the following: Roberto Hoyle Reynaldo Roisenvit Director Director 4 Inteligo Bank Ltd. Statement of Financial Position December 31, 2022 (Amounts expressed in thousands of US$ dollars)

The

accompanying notes are an integral part of these financial statements 3 2022 2021 Notes US$ 000 US$ 000 ASSETS Cash and deposit with banks 5Cash 9 9 Deposit with banks: 5Demand deposits 278,439 288,265 5Time deposits 90,772 79,182 369,220 367,456 Financial assets: 6, 21 At fair value through profit or loss (FVPL), including $Nil pledged as collateral in 2022 (2021: $67,907) 385,393 510,976 6, 21 At fair value through other comprehensive income (FVOCI), including $30,572 pledged as collateral in 2022 (2021: $30,316) 54,808 61,849 440,201 572,825 7Loans, net 459,142 423,819 459,142 423,819 Accrued interest receivable 10,517 8,415 8Property, furniture, equipment and improvements 9,207 8,636 9Intangible assets 2,338 3,508 Securities sold pending settlement 407 906 10Other assets 8,328 8,855 30,797 30,320 TOTAL ASSETS 1,299,360 1,394,420 Inteligo Bank Ltd. Statement of Financial Position (continued) December 31, 2022 (Amounts expressed in thousands of US$ dollars)

statements 5 2022 2021 Notes US$ 000 US$ 000 Liabilities Deposits: 21Demand 516,746 593,617 Time 556,797 452,479 1,073,543 1,046,096 12Borrowings 14,000 46,000 Accrued interest payable 4,242 2,804 Securities bought pending settlement 833 1,659 Other liabilities 5,430 7,531 10,505 11,994 Total liabilities 1,098,048 1,104,090 13Share capital 20,000 20,000 Other accumulated comprehensive (loss) income (4,926) (1,312) 7Regulatory reserve 2,242 2,242 Retained earnings 183,996 269,400 201,312 290,330 EQUITY 1,299,360 1,394,420 Approved

Directors

March 28, 2023

following: Roberto Hoyle Reynaldo Roisenvit Director Director 4

Inteligo Bank Ltd. First Floor Seventeen Shop Building Fourth Terrace Centreville P. O. Box N-3732 Nassau N.P. Bahamas T (242) 328-6846/F (242) 328-6847 Email@inteligogroup.com

financial

on behalf of the Board of

on

by the

Interested parties may obtain completed Audited Financials from the LICENSEE

Gas retailers: ‘Never been so desperate’ due to OPEC slash

wait another week. We cannot. I’ve always said we have to watch the business cycle and the oil cycle, and the US and European countries. I’ve spoken before about rising fuel costs in the summer, as people there do more driving then, and will be taking road trips they did not take for the last two to three years. All these things have an impact on crude oil prices.”

The Brent crude index’s per barrel oil price stood at $85.34 per barrel as this newspaper went to press last night, having touched $86 earlier in the day. The latter represented an $8, or 10.3 percent increase, from the $78 per barrel where the index was as recently as last Thursday, March 30. The West Texas Intermediate index, meanwhile, was slightly lower at $80.84 per barrel.

OPEC’s production cut has reversed the gradual decline, and reduced volatility, in the global oil market since prices peaked in the $130 range in early 2022 as a result of Russia’s invasion of

Ukraine. Depending on how long the cut sustains, and it is already facing push back from the US and other consuming countries, Bahamian businesses and households will likely have to brace for increased pump prices in the coming months.

It is unclear how Bahamas Power & Light (BPL) will be impacted, and to what extent, given that it has already unveiled a “glide path” of above market charges that will peak at a 163 percent increase compared to October 2022 levels this summer as it seeks to recoup some $90m in underrecovered fuel costs. With global oil prices rising, it is possible these charges may have to go even higher.

Rising oil prices, which feed into almost every aspect of the economy and Bahamians’ daily lives, especially via energy and transportation costs, will also threaten to reignite inflation and price increases that sparked a cost of living crisis for many Bahamian families in COVID’s aftermath.

Mr Bastian, meanwhile, said the prospect of further oil price rises “definitely,

definitely, definitely” makes it more urgent that their call for a margin increase equivalent to 7 percent of the landed cost of fuel be addressed. However, Sir Franklyn Wilson, FOCOL’s chairman, has suggested that more evidence needs to be provided to justify the extent of the increase they are seeking. Present retail margins are 54 cents for gasoline and 34 cents for diesel.

“I’ve been corresponding with fellow dealers on different chats and groups all day,” Mr Bastian said.

“These are desperate times for petroleum retailers in The Bahamas. It’s never been so desperate. I hate to sound like a scorched record, but these people want help. We want to change the model, and let young Bahamian men and women move on with their lives. We need help and we need it now.”

He added that the Government, with VAT levied as a percentage, was the only party to benefit when oil prices increase. “The Government is the leading beneficiary of the industry and has no investment in it,”

Mr Bastian asserted, suggesting that if the resorts, pharmacies and food distribution industries were taxed in a similar manner to the petroleum sector then it would likely be running a Budget surplus.

The Association vicepresident also contrasted the gas station operators’ inability to adjust their prices when oil/fuel costs go up to BPL, which alters its fuel charge to cover the extra expense. “I’m going to church tomorrow to pray,”

Mr Bastian told Tribune Business. “I know Jesus always answers my prayers, but I will pray extra hard tomorrow [today].

“I’ve been speaking to someone inside the Prime Minister’s Office, and things are looking hopeful. Hopefully we can get together this week. I know it’s a short week, and it’s Holy Week, but we can have at least some chance to close this whole dialogue and what we’re trying to accomplish with the Government.”

Raymond Jones, the Bahamas Petroleum Retailers Association’s president, said multiple

CABLE: URCA’S 23% BUDGET RISE ‘ASSAULT ON OUR FINANCES’

general costs rather than being specifically used to finance communications industry regulation.

And the BISX-listed provider argued that the increased licence fees needed to finance URCA also threaten to undermine the Government’s policy of import tariff waivers on communications equipment designed to incentivise investment by itself and other operators in 5G (fifth generation) technology and Family Island networks.

It also pointed out that no progress has been made in seven years to develop a so-called Universal Service Fund to finance communications infrastructure build-out on the Family Islands and counter the low rates of return generated by these more sparsely-populated locations. And Cable

Bahamas also urged URCA to give “serious consideration” to selling its Frederick House head office in downtown Nassau because of the maintenance costs being incurred.

“The group is astounded with the presentation of this year’s draft Budget figures/amounts, both the combined electronic communications sector and electricity sector draft budgets and the individual electronic communications sector budget,” Cable Bahamas said. “URCA’s significant increase in the budget amounts for 2023, in the absence of detailed explanations or justification, is a cause for great concern to licensees.

“The days of telcos being a ‘cash cow’ are decidedly over and the mantra of the industry today is fiscal restraint and the reduction of administrative and operating costs. There are

increasing financial pressures to maintain existing networks, invest in expensive upgrades and provide new and more costly networks and services.

“Given the archipelagic nature of our country and the relatively small population, telecommunications is an expensive venture and with robust competition profits necessary for reinvestment are on the decline. URCA’s draft 2023 Budget reflects an ‘it is what it is’ approach with little consideration for the changing financial dynamics of the sector and the challenges faced by licensed operators.”

Cable Bahamas continued: “Given that this is a draft budget, and the fact that there can be no reasonable justification for a 23 percent overall increase in the combined operating budget, URCA is urged and encouraged to redraft

the 2023 combined budget with the object of reducing the $7.959m total operation expenditure to be recovered from licensees, which is $1.26m over the prior year 2022 of $6.698m and bring it more in line with 2022’s budget with, at the very most, a minimal 5 percent to 10 percent increase year-over-year.

“Indeed, the excessive budget increases being imposed on licensees, combined with increasing attempts by URCA to impose fines which are disproportionate to the alleged matter for which the fine is being applied, amounts to an assault on the finances of licensed operators in the sector.”

Noting that premises and utilities costs are forecast to increase by 48 percent year-over-year, Cable Bahamas added: “Maintaining Frederick House is not sustainable and its sale must be

factors - including when the oil companies purchase their inventories, and from which refineries and countries - will influence when local consumers see a price increase at the pumps and to what extent.

As for the impact on his members, he affirmed: “The increase in [crude oil] cost will cause us to incur more overdraft fees and the like from credit to buy the same amount of fuel at the same 54 cents margin. It doesn’t bode well for anybody because it drives the pump price up. The reason these guys cut their production is to boost profits by driving the price up. We’ll see how long that takes to translate into the local market.”

Mr Jones said some oil companies will, knowing crude prices are set to increase, seek to boost their margins at the wholesale level when they purchase from refineries. Those with wells and production assets in OPEC member countries are now especially well-placed to benefit from the new market conditions, with financial speculators and commodities traders

on the table for serious consideration.... The group, in its response last year, urged URCA to sell the Frederick House building which has been an albatross around the finances of licensees who must pay for the original poor decision to purchase such an ancient building.

“The explanation that the expenditure is for the replacement of the elevator and generator and ‘smaller scale projects’, the latter having no details, is excessive in one year and must be spread over a three-year period. The ongoing failure to secure tenants for the building, a selling pitch to licensees, in all the years since purchase - resulting in the burden being assumed by licensees - is unacceptable particularly as the building will continue to require major maintenance.”

Continuing its attack, Cable Bahamas said: “URCA must be mindful that it cannot continue year after year with budget increases without consideration for the financial pressures imposed on licensees by other forms of taxation. The budget increases diminish the effectiveness of waivers in customs duties for telecommunications equipment in the national Budget.”

Turning to the URCA Act reforms, which prevent the regulator from retaining surplus licence fees, Cable Bahamas said: “This was a shortsighted amendment, not only because it constrained URCA financially but because it also deprived licensees of credit for fees paid in good faith towards the electronic communications sector’s regulation by URCA, which were in excess of what was estimated and therefore ought rightfully and legally to have been returned to licensees by way of credit or placed into a pot/bank

also driving prices up on the futures market.

“That cut is going to affect us for the cost of purchasing fuel. It’s going to affect our business with customers. Customers are going to have to pay a higher price in future at some point,” Mr Jones said. “We don’t know when.... it could be several months down the road.

“We don’t have the luxury of being able to adjust our margins in the face of increasing costs that affect our margins, and that’s where we need to get to. We’re standing by waiting humbly for a call from the Government to come in and discuss some resolution so we can keep our businesses going as opposed to fighting day-to-day to cover costs.

“We’re really hoping that will happen in the next day or two. It’s now three weeks since the first meeting. We’re hoping that in the next day or two they will say to come back, and we will sit with the Prime Minister and his team to work out a solution so that we get the margin we so desperately need.”

account for direct benefit to the sector.

“A look at Trinidad and Tobago’s Universal Service Fund is instructive. The Fund in mid-2022 stood at $20m. The T&T 2001 Communications Act provided for all excess licence fees to be placed in said fund and, in addition, since 2015 licensees pay 1 percent on international gross revenue and half a percent on domestic gross revenue into said fund.

“To date, The Bahamas has no Universal Service Fund. Preparation work has started and stopped over the years and the data collected is now outdated. Excess licence fees and fines could have been deposited in such a fund to assist the electronic communications sector operators in the development and expansion of Family Island networks, which is of the utmost importance given the archipelagic nature of our Commonwealth,” Cable Bahamas added.

“Such forward thinking would have lessened the need for the Government to introduce duty waivers as a concession for expensive build-outs with low rates of return on investment.” URCA, in reply, pledged to investigate all the concerns and criticisms.

It said: “URCA remains committed to ensuring that the budget is fair and transparent, and that all our licensees are treated equitably. We will investigate all the suggestions and provide a detailed explanation for any increases in our budget. We also acknowledge the statement regarding the introduction of a Universal Service Fund and will analyse it further. Thank you for your input.”

NOTICE

NOTICE is hereby given that EMMANUELLA OLIBRICE of Pinewood Gardens, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of April, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that SERGE GUERRIER , of Abaco, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 6, Tuesday, April 4, 2023 THE TRIBUNE

FROM PAGE

B1

PAGE B1

FROM